COMFORT CARE HOME HEALTH SERVICES, LLC AND SUBSIDIARIES AND AFFILIATES

CONSOLIDATED AND COMBINED FINANCIAL STATEMENTS

SEPTEMBER 30, 2021

COMFORT CARE HOME HEALTH SERVICES, LLC

AND SUBSIDIARIES AND AFFILIATES

TABLE OF CONTENTS

SEPTEMBER 30, 2021

INDEPENDENT ACCOUNTANTS’ REVIEW REPORT 1

CONSOLIDATED AND COMBINED FINANCIAL STATEMENTS

Consolidated and Combined Balance Sheet 2

Consolidated and Combined Statement of Operations and Members’ Capital 3

Consolidated and Combined Statement of Cash Flows 4

Notes to the Consolidated and Combined Financial Statements 5

INDEPENDENT ACCOUNTANTS’ REVIEW REPORT

To the Board of Directors

Comfort Care Home Health Services, LLC and Subsidiaries and Affiliates

We have reviewed the accompanying consolidated and combined financial statements of Comfort Care Home Health Services, LLC and Subsidiaries and Affiliates, which comprise the consolidated and combined balance sheet as of September 30, 2021, and the related consolidated and combined statements of operations and members’ capital and cash flows for the nine months then ended, and the related notes to the consolidated and combined financial statements. A review includes primarily applying analytical procedures to management’s financial data and making inquiries of company management. A review is substantially less in scope than an audit, the objective of which is the expression of an opinion regarding the financial statements as a whole. Accordingly, we do not express such an opinion.

Management’s Responsibility for the Financial Statements

Management is responsible for the preparation and fair presentation of these consolidated and combined financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation and maintenance of internal control relevant to the preparation and fair presentation of consolidated and combined financial statements that are free from material misstatement, whether due to fraud or error.

Auditors’ Responsibility

Our responsibility is to conduct the review engagement in accordance with Statements on Standards for Accounting and Review Services promulgated by the Accounting and Review Services Committee of the AICPA. Those standards require us to perform procedures to obtain limited assurance as a basis for reporting whether we are aware of any material modifications that should be made to the financial statements for them to be in accordance with accounting principles generally accepted in the United States of America. We believe that the results of our procedures provide a reasonable basis for our conclusion.

Accountant’s Conclusion

Based on our review, we are not aware of any material modifications that should be made to the accompanying consolidated and combined financial statements in order for them to be in accordance with accounting principles generally accepted in the United States of America.

/s/ Warren Averett, LLC

Birmingham, Alabama

January 7, 2022

1

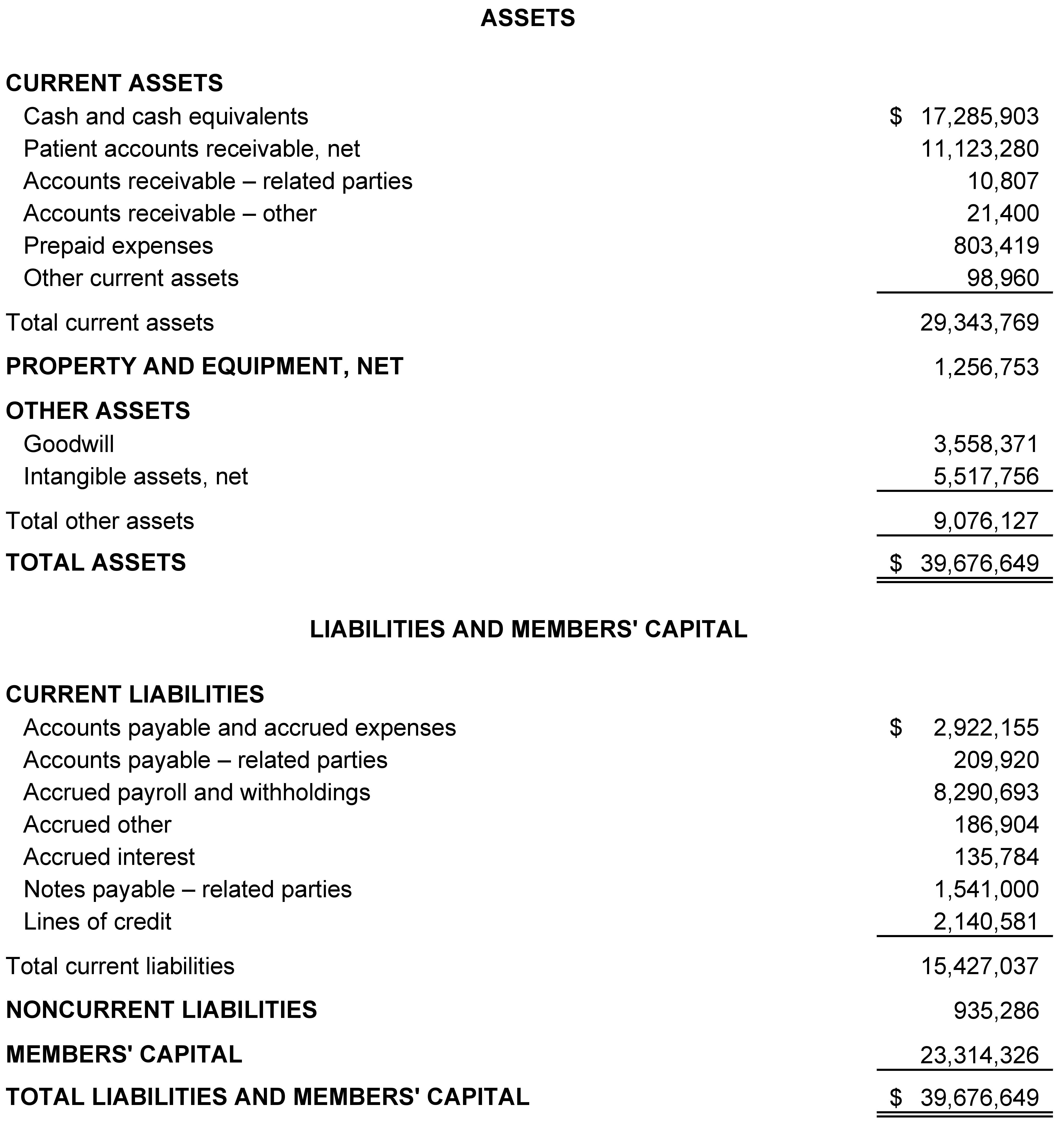

COMFORT CARE HOME HEALTH SERVICES, LLC

AND SUBSIDIARIES AND AFFILIATES

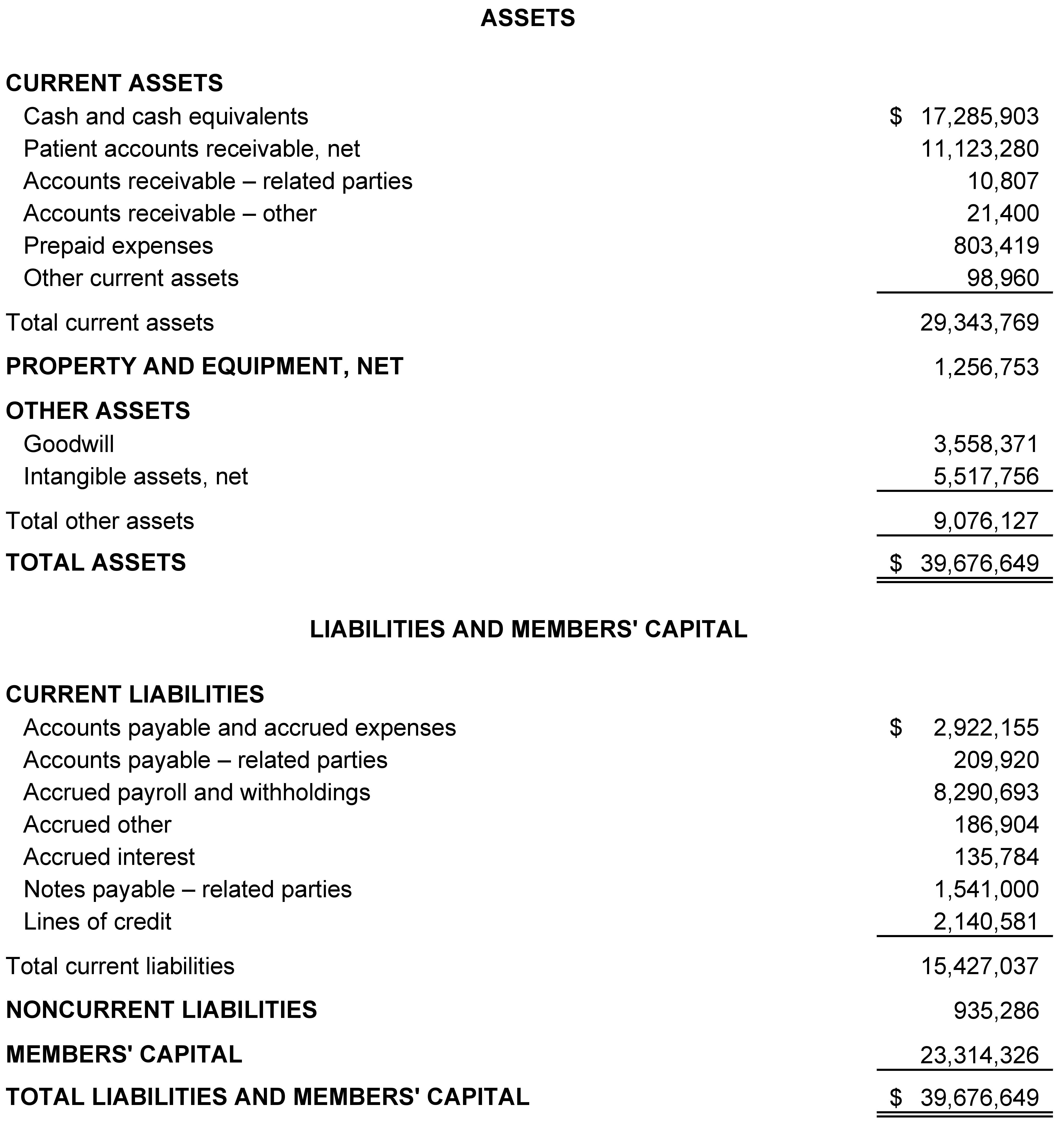

CONSOLIDATED AND COMBINED BALANCE SHEET

SEPTEMBER 30, 2021

See independent accountants’ review report and notes to the

consolidated and combined financial statements.

2

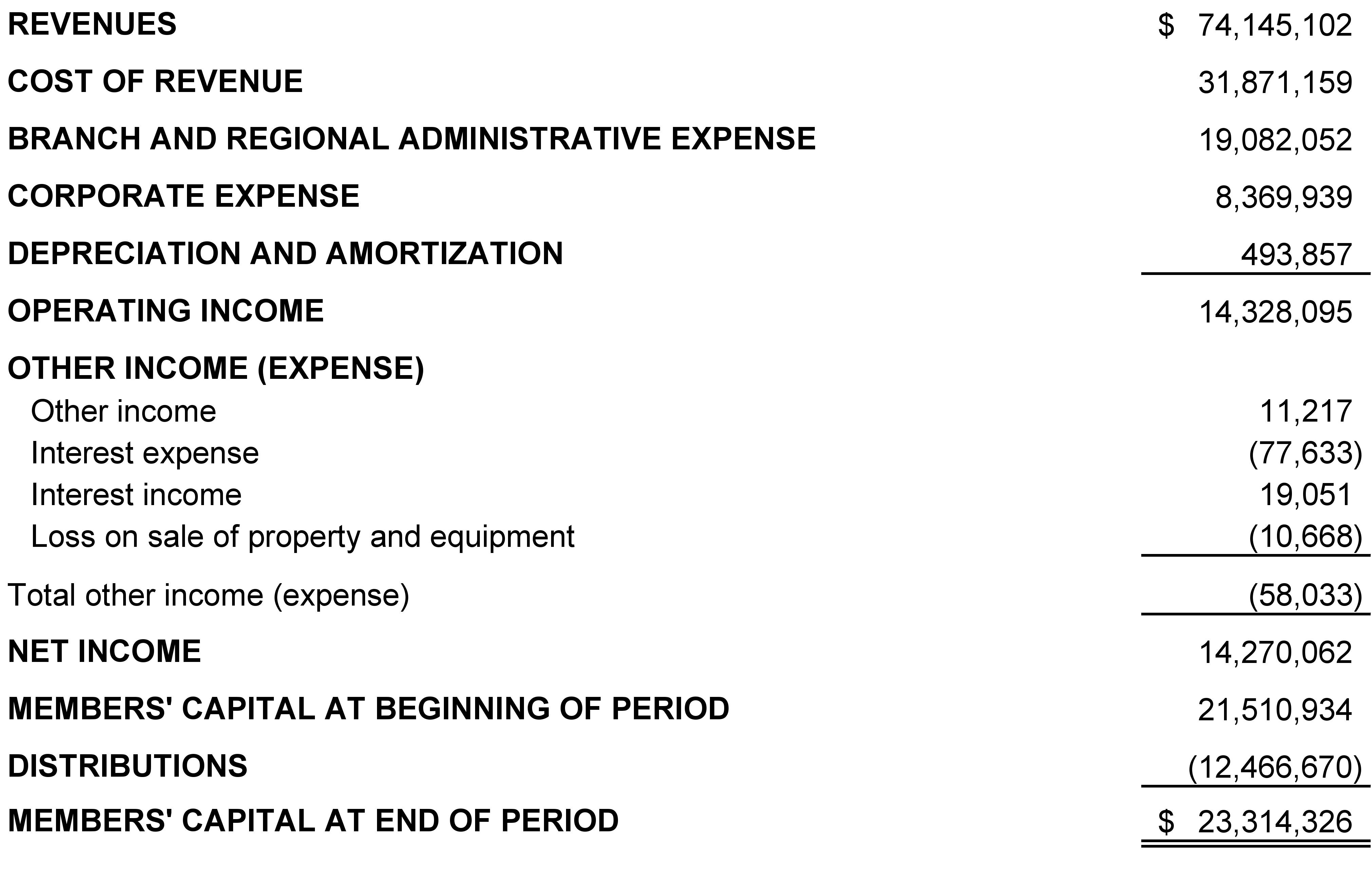

COMFORT CARE HOME HEALTH SERVICES, LLC

AND SUBSIDIARIES AND AFFILIATES

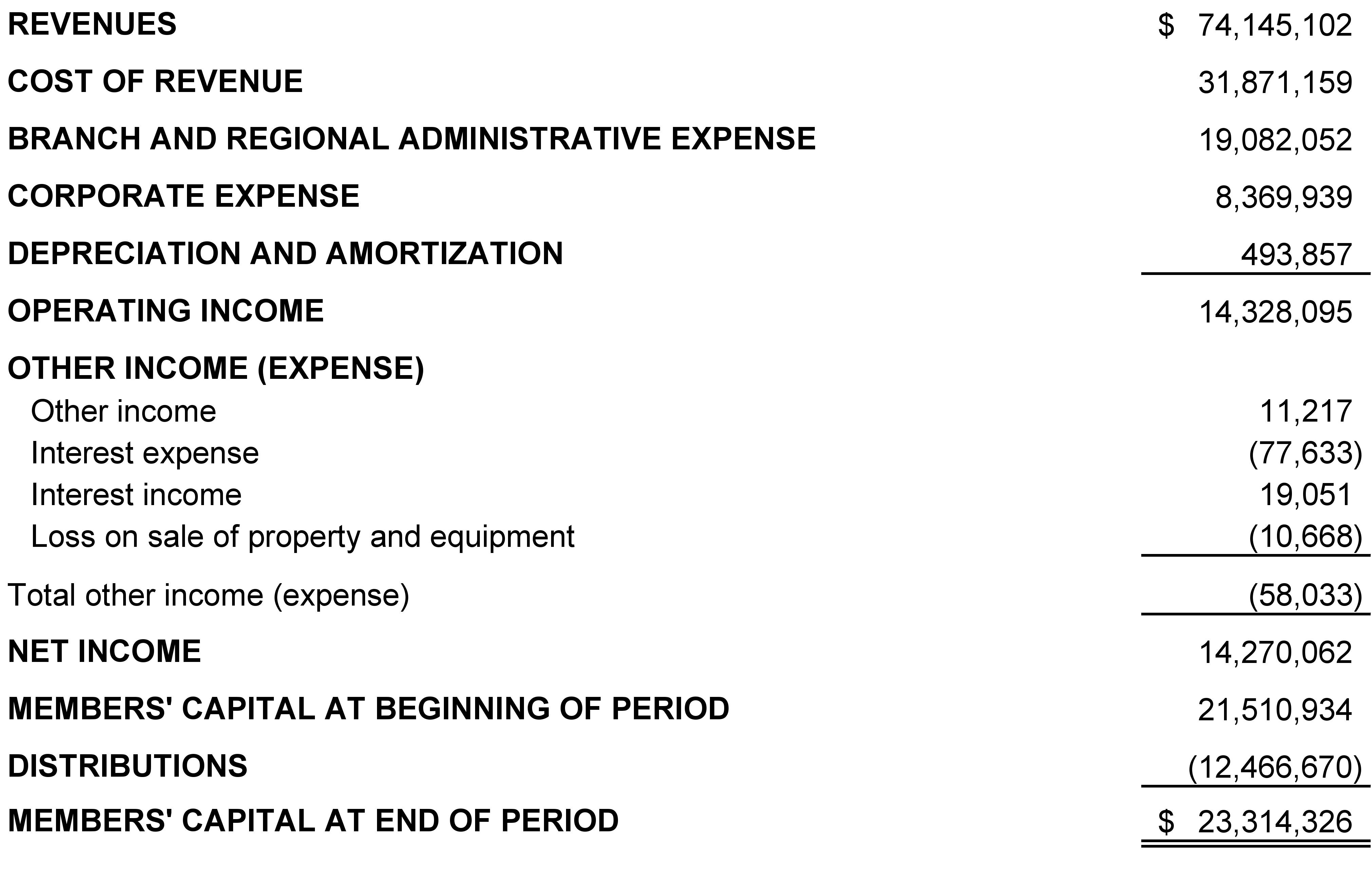

CONSOLIDATED AND COMBINED STATEMENT OF

OPERATIONS AND MEMBERS’ CAPITAL

FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2021

See independent accountants’ review report and notes to the

consolidated and combined financial statements.

3

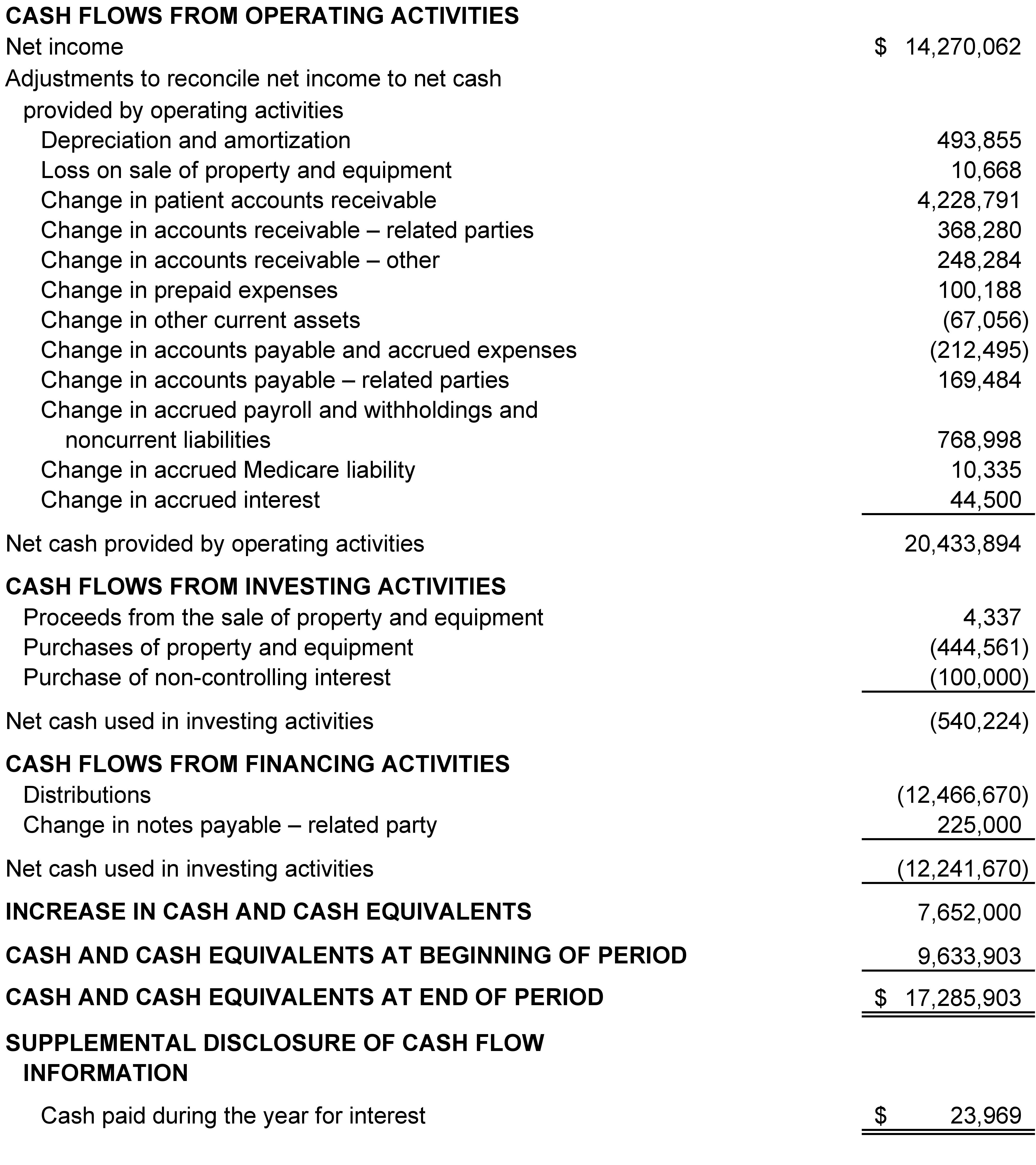

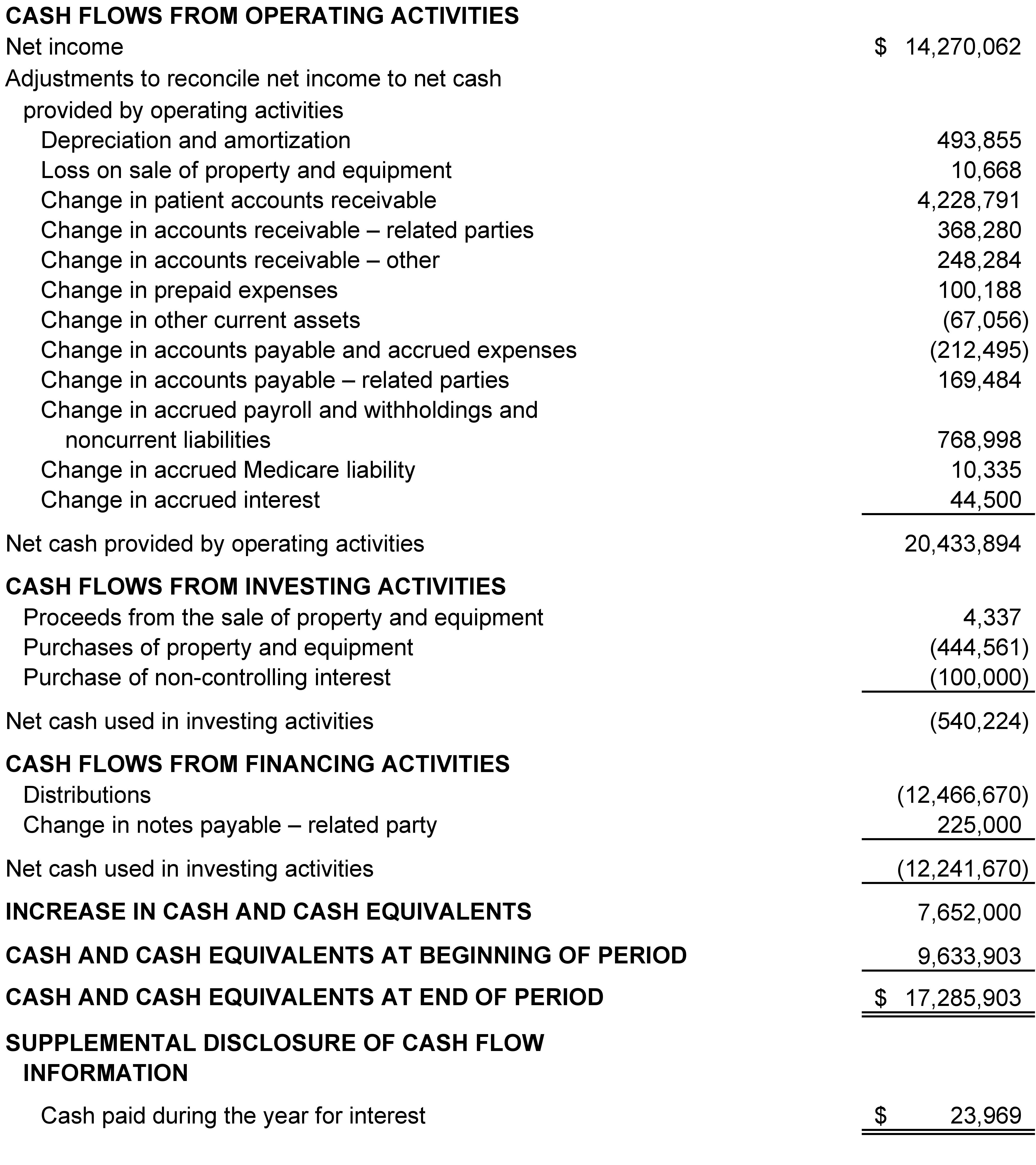

COMFORT CARE HOME HEALTH SERVICES, LLC

AND SUBSIDIARIES AND AFFILIATES

CONSOLIDATED AND COMBINED STATEMENT OF CASH FLOWS

FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2021

See independent accountants’ review report and notes to the

consolidated and combined financial statements.

4

COMFORT CARE HOME HEALTH SERVICES, LLC

AND SUBSIDIARIES AND AFFILIATES

NOTES TO THE CONSOLIDATED AND COMBINED FINANCIAL STATEMENTS

SEPTEMBER 30, 2021

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Nature of Operations

Comfort Care Home Health Services, LLC and Subsidiaries is a limited liability company formed under the laws of the state of Alabama to provide various in-home therapy and nursing services in Alabama. Comfort Care Hospice, LLC and Subsidiaries (Affiliate) is a limited liability company formed under the laws of the state of Alabama to provide hospice services in Alabama and Tennessee. Premier Medical Housecall, LLC (Affiliate) is a limited liability company formed under the laws of the state of Alabama to provide various in-home medical services in Alabama. Collectively these entities are referred to as Comfort Care Home Health Services, LLC and Subsidiaries and Affiliates (the Company).

Principles of Consolidation and Combination

The accompanying consolidated and combined financial statements include the accounts of Comfort Care Home Health Services, LLC and its wholly owned subsidiaries, Comfort Care Coastal Home Health, LLC, Comfort Care Home Health of North Alabama, LLC, Comfort Care Home Health of Northeast Alabama, LLC, and Comfort Care Home Health of West Alabama, LLC; and its 75%-owned subsidiary, Woodland Home Health Services – CRMC, LLC, and its Affiliates, Comfort Care Hospice, LLC and its wholly-owned subsidiaries, Comfort Care Coastal Hospice, LLC and Comfort Care Hospice of Middle Tennessee, LLC and Premier Medical Housecall, LLC. All material intercompany balances and transactions have been eliminated upon consolidation and combination.

On February 3, 2021, Comfort Care Home Health Services, LLC entered into an agreement to purchase the interest of the noncontrolling member of Woodland Home Health Services – CRMC for $100,000. Per the terms of the agreement, Woodland Home Health Services – CRMC will continue to be operated by Comfort Care Home Health Services, LLC for not less than six years. Comfort Care Home Health Services, LLC also assumes the assets and liabilities of Woodland Home Health Services – CRMC and indemnifies the noncontrolling interest holder of any liability.

Use of Estimates

The preparation of the consolidated and combined financial statements in conformity with generally accepted accounting principles in the United States of America (GAAP) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the consolidated and combined financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Cash and Cash Equivalents

The Company includes cash equivalents (defined as investments having a maturity of three months or less) in cash flows for each period. The Company maintains cash on deposit at a bank, which, at times, may exceed federally insured limits. The Company has not experienced any losses in such accounts.

Fiscal Year-End

The Company’s fiscal year ends on December 31.

5

COMFORT CARE HOME HEALTH SERVICES, LLC

AND SUBSIDIARIES AND AFFILIATES

NOTES TO THE CONSOLIDATED AND COMBINED FINANCIAL STATEMENTS

SEPTEMBER 30, 2021

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES – CONTINUED

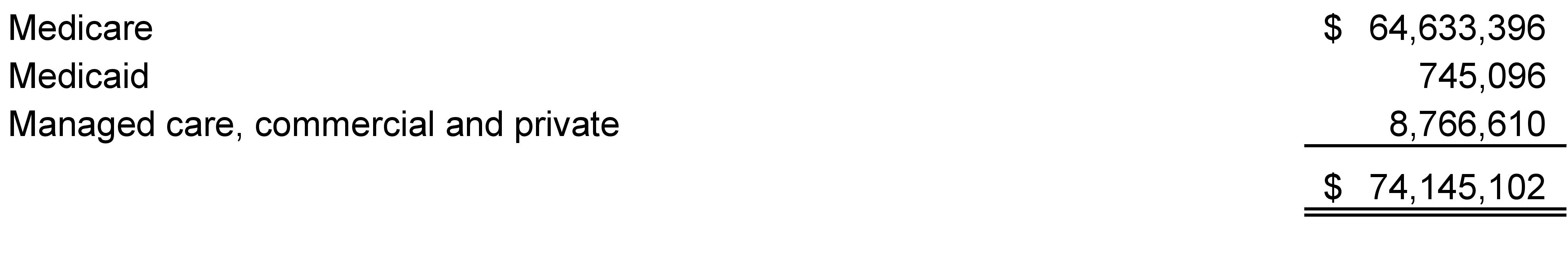

Revenue Recognition and Accounts Receivable

Net patient service revenue is reported at the amount that reflects the consideration the Company expects to receive in exchange for providing services. Receipts are from Medicare, Medicaid, Managed Care, Commercial, and others for services rendered, and they include implicit price concessions for retroactive revenue adjustments due to actual receipts from third-party payors, settlements of audits and reviews. The estimated uncollectible amounts due from these payors are considered implicit price concessions that are a direct reduction to net patient service revenue. The Company assesses the patient's ability to pay for their healthcare services at the time of patient admission based on the Company's verification of the patient's insurance coverage under the Medicare, Medicaid and other commercial or managed care insurance programs. The promise to provide quality care is accounted for as a single performance obligation. The Company satisfies its performance obligation by providing quality of care services to its patients and residents on a daily basis until termination of the contract.

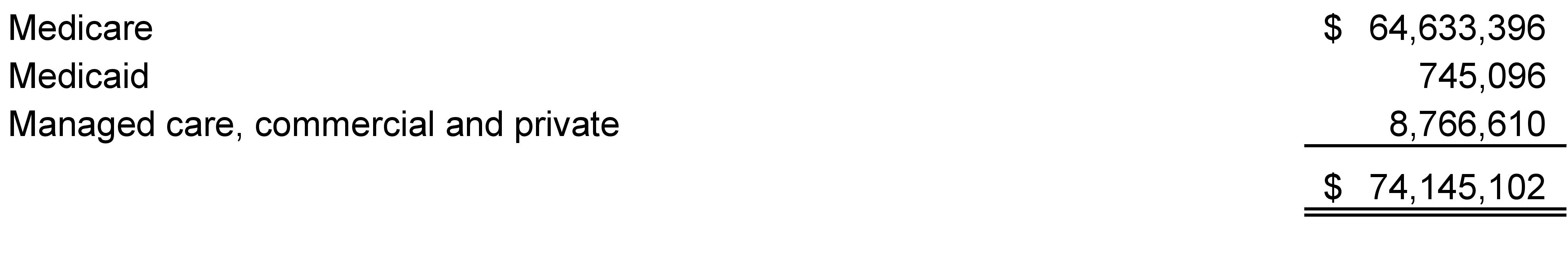

The following tables summarizes revenue from contracts with customers by payor source for the nine months ended September 30, 2021:

Property and Equipment

Property and equipment is carried at cost less accumulated depreciation and includes expenditures,

which substantially increase the useful lives of property and equipment. Maintenance, repairs and minor renovations are charged to income as incurred. When property and equipment is retired or otherwise disposed of, the related costs and accumulated depreciation are removed from their respective accounts, and any gain or loss on the disposition is credited or charged to operations.

The Company provides for depreciation of property and equipment using the straight-line method over estimated useful lives as follows:

| |

Item | Estimated Useful Life |

| |

Computers and equipment | 3 - 5 years |

Furniture and fixtures | 5 - 7 years |

Leasehold improvements | 7 - 15 years |

Auto and vehicles | 5 years |

| |

6

COMFORT CARE HOME HEALTH SERVICES, LLC

AND SUBSIDIARIES AND AFFILIATES

NOTES TO THE CONSOLIDATED AND COMBINED FINANCIAL STATEMENTS

SEPTEMBER 30, 2021

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES – CONTINUED

Goodwill

Goodwill represents, at the time of an acquisition, the amount of purchase price paid in excess of the fair value of net assets acquired. Goodwill is tested for impairment at the reporting unit level on an annual basis and between annual tests if an event occurs or circumstances change that would more likely than not reduce the fair value of a reporting unit below its carrying value. No indications of impairment were identified at September 30, 2021.

Intangible Assets

Included in intangible assets are the costs of acquiring rights related to various certificates of need from prior acquisitions and a non-compete agreement. The rights to the certificates of need are being amortized over a period of 15 or 40 years. The non-compete agreement is being amortized over 3 years. Amortization expense totaled $126,036 for the nine months ended September 30, 2021.

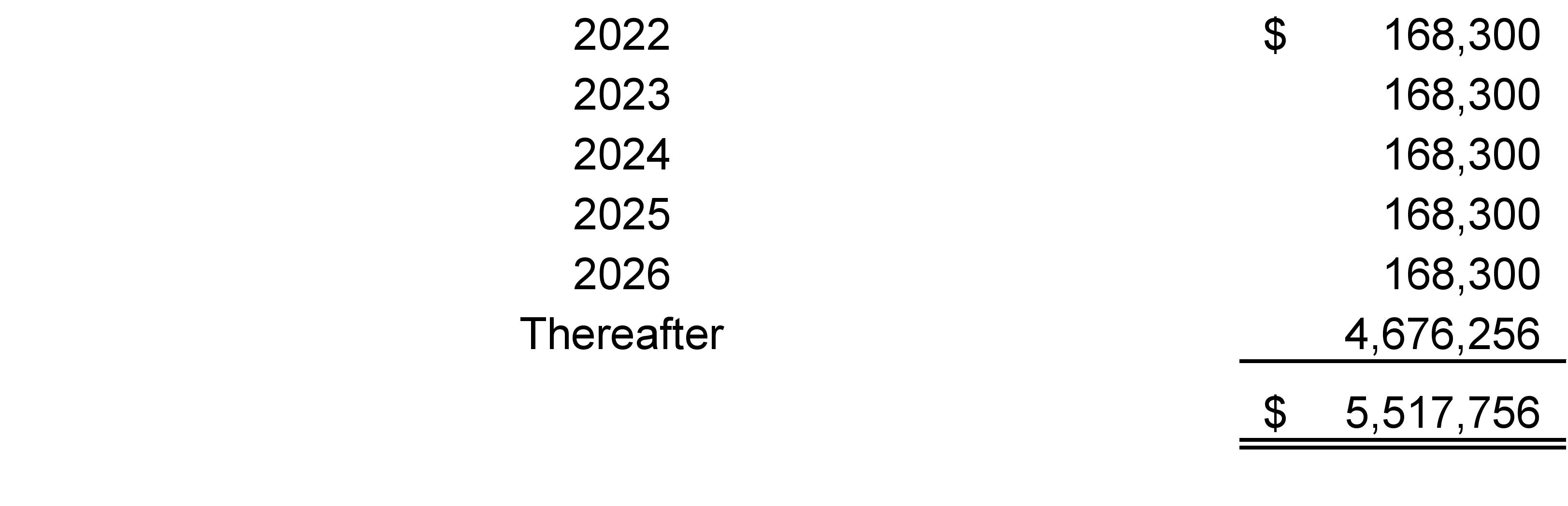

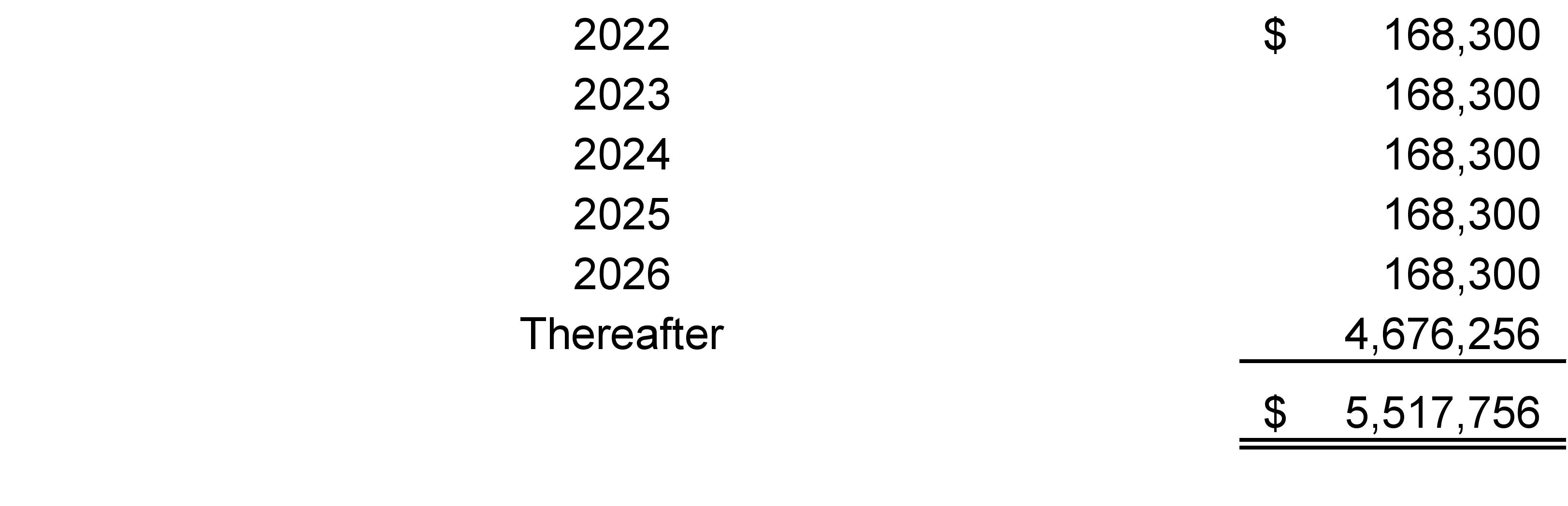

The estimated aggregate amortization expense for each of the five succeeding years, thereafter, and in the aggregate for intangible assets subject to amortization is as follows:

Advertising Costs

Advertising costs, which are other than direct-response advertising, are charged to operations when incurred. Total advertising costs were $1,556,617 for the nine months ended September 30, 2021.

Taxes on Income

As a limited liability company, the Company is generally not subject to federal or state income taxes as the liability flows to the members. Accordingly, the accompanying consolidated and combined financial statements contain no provision or liability for income taxes.

Uncertain Tax Positions

The Company applies guidance issued by the FASB relating to uncertainty in income taxes. This guidance requires entities to assess their tax positions for the likelihood that they would be overturned upon Internal Revenue Service (IRS) examination or upon examination by state taxing authorities. In accordance with this guidance, the Company has assessed its tax positions and determined that it does not have any positions at September 30, 2021, that it would be unable to substantiate.

7

COMFORT CARE HOME HEALTH SERVICES, LLC

AND SUBSIDIARIES AND AFFILIATES

NOTES TO THE CONSOLIDATED AND COMBINED FINANCIAL STATEMENTS

SEPTEMBER 30, 2021

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES – CONTINUED

Subsequent Events

Management has evaluated subsequent events and their potential effects on these consolidated and combined financial statements through January 7, 2022.

Recent Accounting Pronouncements

In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842). The purpose of this ASU is to increase transparency and comparability among organizations by recognizing lease assets and lease liabilities on the balance sheet and disclosing key information about leasing arrangements. The amendments in this ASU require that lessees recognize the rights and obligations resulting from leases as assets and liabilities on their balance sheets, initially measured at the present value of the lease payments over the term of the lease, including payments to be made in optional periods to extend the lease and payments to purchase the underlying assets if the lessee is reasonably certain of exercising those options. Topic 842 requires recognition of lease assets and lease liabilities by lessees for those leases classified as operating leases under previous generally accepted accounting principles (GAAP). This guidance is effective for fiscal years beginning after December 15, 2021. Management is currently evaluating the impact of this document to the Company’s consolidated and combined financial statements.

2. CONCENTRATION OF CREDIT RISK

The Company grants credit without collateral to its patients, most of whom are local residents and are insured under third-party payor agreements. The mix of receivables from patients and third-party payors was as follows at September 30, 2021:

8

COMFORT CARE HOME HEALTH SERVICES, LLC

AND SUBSIDIARIES AND AFFILIATES

NOTES TO THE CONSOLIDATED AND COMBINED FINANCIAL STATEMENTS

SEPTEMBER 30, 2021

3. PROPERTY AND EQUIPMENT

At September 30, 2021, property and equipment consisted of the following:

Depreciation expense totaled $367,819 for the year ended September 30, 2021.

4. LINES OF CREDIT

Comfort Care Home Health Services, LLC maintains a line of credit with a maximum limit of $3,000,000. The line bears interest at the Wall Street Journal Prime Rate minus 1% (2.25% at September 30, 2021). The line of credit is secured by the personal guarantee of certain members and all assets of Comfort Care Home Health Services, LLC. The line of credit matures in November 2021. At September 30, 2021, there was no balance outstanding. The credit agreement requires Comfort Care Home Health Services, LLC to maintain certain financial and affirmative covenants. At September 30, 2021, Comfort Care Home Health Services, LLC was in compliance with its financial covenants.

Comfort Care Hospice, LLC maintains a line of credit with a maximum limit of $5,150,000. The line bears interest at the Wall Street Journal Prime Rate minus 1% (2.25% at September 30, 2021). The line of credit is secured by the personal guarantee of certain members and all assets of Comfort Care Hospice, LLC. The line of credit matures in November 2021. At September 30, 2021, there was $2,140,581 outstanding. The credit agreement requires Comfort Care Hospice, LLC to maintain certain financial and affirmative covenants. At September 30, 2021, Comfort Care Hospice, LLC was in compliance with its financial covenants.

5. OPERATING LEASES

The Company leases office space from a related party through common ownership. Rent expense under these operating leases were $164,367 for the nine months ended September 30, 2021. Minimum facility lease payments are $16,763 and $1,500 per month. The lease terms expire on April 14, 2022 and August 31, 2026.

9

COMFORT CARE HOME HEALTH SERVICES, LLC

AND SUBSIDIARIES AND AFFILIATES

NOTES TO THE CONSOLIDATED AND COMBINED FINANCIAL STATEMENTS

SEPTEMBER 30, 2021

5. OPERATING LEASES – CONTINUED

The Company leases additional office spaces from a separate related party through common ownership. Rent expense under these operating leases was $78,446 for the nine months ended September 30, 2021. Minimum facility lease payments are $8,716 per month. The lease terms renew month to month.

The Company also leases various other facilities, automobiles and equipment from unrelated parties under operating leases expiring at various dates through 2030. Rent expense under these operating leases was $1,430,338 for the nine months ended September 30, 2021. Minimum facility lease payments range from $21 to $10,048 per month.

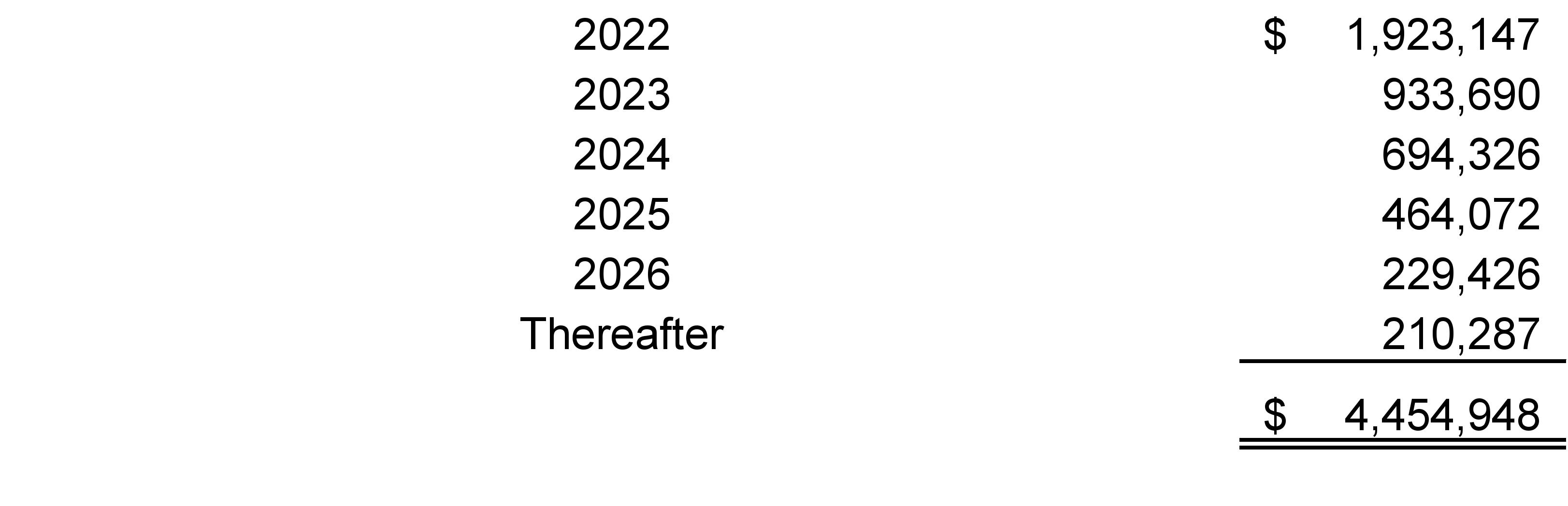

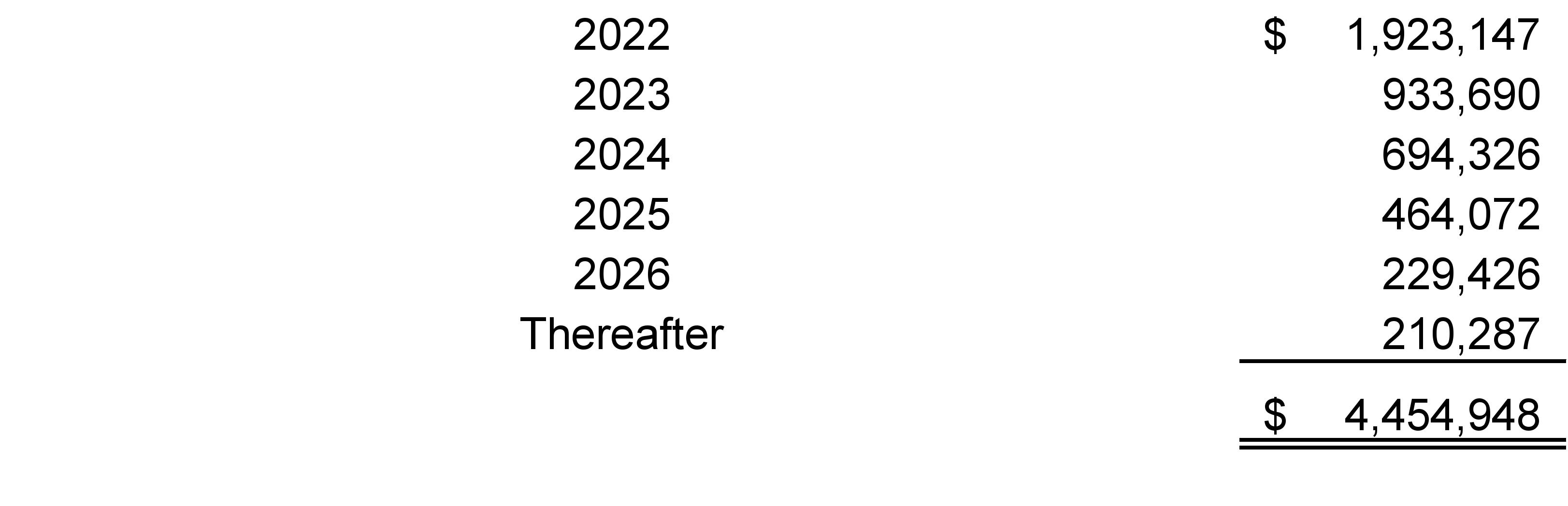

The following is a schedule of future minimum lease payments under all operating leases having initial or remaining noncancelable lease terms in excess of one year:

6. RELATED PARTY TRANSACTIONS

The Company was charged for management fees from a related party through common ownership totaling $1,368,000 in 2021. At September 30, 2021, the Company had no accounts payable to related parties related to the management fees.

The Company shares expenses with and leases employees to and from related parties through common ownership. At September 30, 2021, the Company had $10,807 in accounts receivable from related parties and $209,920 in accounts payable to related parties related to shared expenses and leased employees.

The Company has various notes payable to a related party through common ownership. The amount to be repaid under these notes at September 30, 2021 was $1,541,000. The notes accrue interest at a rate of 2.75% to 5.00%. Interest expense totaled $42,653 for the nine months ended September 30, 2020.

The Company leases various office space from a related company (see Note 5).

10

COMFORT CARE HOME HEALTH SERVICES, LLC

AND SUBSIDIARIES AND AFFILIATES

NOTES TO THE CONSOLIDATED AND COMBINED FINANCIAL STATEMENTS

SEPTEMBER 30, 2021

7. EMPLOYEE BENEFIT PLANS

The Company sponsors a profit-sharing plan for its employees pursuant to Section 401(k) of the Internal Revenue Code. Contributions are made at the discretion of the Company’s Board of Directors. The Company matched $177,457 in employee contributions to the plan in 2021. Generally, the plan is available to all employees after certain eligibility requirements have been satisfied. The Company may amend or terminate this plan at its sole discretion.

8. LITIGATION

The Company is subject to lawsuits from time to time. Management believes that the ultimate liability resulting from unexpected claims, if any, will not have a material adverse effect on the accompanying consolidated and combined financial statements.

9. MEDICAL MALPRACTICE INSURANCE

The professional liability coverage is on claims-made basis for the nine months ended September 30, 2021. Per claim coverage for the nine months ended September 30, 2021, was $1,000,000 with an aggregate maximum annual coverage of $3,000,000.

10. EMPLOYEE GROUP HEALTH INSURANCE PLAN

The Company has a self-insured health insurance plan for its employees’ medical care and assumed liability for employees’ group health costs. The plan includes “excess loss” insurance, which limits claims liability to $125,000 per individual. The Company and related parties are responsible for claims costs in excess of the reinsurer’s individual limit of liability. The Company has recorded its estimate liability for unpaid claims in the accompanying consolidated and combined financial statements.

11. SUBSEQUENT EVENT

On December 9, 2021, the owners of Comfort Care Home Health Services, LLC and Subsidiaries and Affiliates sold their membership interests to Aveanna Healthcare Senior Services, LLC for $345,000,000.

11