Security Ownership of Certain Beneficial Owners and Management

* Represents less than 1% of our ordinary shares outstanding.

(1) The number of shares beneficially owned includes ordinary shares issuable upon the vesting within 60 days of September 11, 2023 of restricted stock units awarded pursuant to the Non-Employee Director Incentive Plan 2022, as follows: Ms. Baker 485, Ms. Halligan 485, Ms. Shouraboura 485, Ms. Wood 485, and Messrs. Drabble 454, May 454, Metcalf 232, Murray 485, and Schmitt 485.

(2) The number of shares beneficially owned includes ordinary shares issuable upon the vesting within 60 days of September 11, 2023 of conditional shares awarded pursuant to the Performance Ordinary Share Plan 2019, as follows: Ms. Long 8,825 and Messrs. Graham 8,763 and Thees 7,966. The number of shares beneficially owned also includes ordinary shares issuable upon the vesting within 60 days of September 11, 2023 of conditional shares awarded pursuant to the Ordinary Share Plan 2019, as follows: Ms. Long 1,891 and Messrs. Graham 1,877 and Thees 1,707. The number of shares beneficially owned also includes ordinary shares issuable upon the vesting within 60 days of September 11, 2023 of conditional shares awarded pursuant to the Long Term Incentive Plan 2019, as follows: Ms. Long 1,370 and Messrs. Brundage 14,329, Graham 1,360 and Murphy 37,900.

(3) The number of shares beneficially owned includes ordinary shares issuable upon the vesting within 60 days of September 11, 2023 of 39,869 conditional shares awarded pursuant to the Performance Ordinary Share Plan 2019. The number of shares beneficially owned also includes ordinary shares issuable upon the vesting within 60 days of September 11, 2023 of 8,542 conditional shares awarded pursuant to the Ordinary Share Plan 2019. The number of shares beneficially owned also includes ordinary shares issuable upon the vesting within 60 days of September 11, 2023 of 54,959 conditional shares awarded pursuant to the Long Term Incentive Plan 2019. The number of shares beneficially owned includes ordinary shares issuable upon the vesting within 60 days of September 11, 2023 of 4,050 restricted stock units awarded pursuant to the Non-Employee Director Incentive Plan 2022.

(4) Based on the Schedule 13G filed by BlackRock, Inc. with the SEC on February 14, 2023, BlackRock, Inc. and its subsidiaries beneficially owned an aggregate of 11,370,273 ordinary shares as of February 14, 2023, and BlackRock, Inc. had sole voting power over 10,184,350 ordinary shares, shared voting power over 0 ordinary shares, sole dispositive power over 11,370,273 ordinary shares and shared dispositive power over 0 ordinary shares. The address for BlackRock, Inc. is 55 East 52nd Street, New York, NY 10055. Ferguson plc has also received a TR-1 notification (Standard Form for Notification of Major Holdings, also referred to as Voting Rights Attached to Shares—Article 12(1) of Directive 2004/109/EC, Financial Instruments—Article 11(3) of the Commission Directive 2007/14/EC) pursuant to the Disclosure Guidance and Transparency Rules of the U.K. FCA (“Form TR-1”) from BlackRock, Inc. reporting a change in voting rights attached to Ferguson plc ordinary shares. The Form TR-1 reports that, as of June 23, 2023, BlackRock, Inc. and certain of its wholly owned subsidiaries held voting rights attached to 13,099,715 Ferguson plc ordinary shares implying ownership of 6.4%. Because the “voting rights attached to shares” reported on Form TR-1 are not necessarily equivalent to “beneficial ownership” interests as defined under Rule 13d-3 of the Exchange Act, the table does not reflect the information reported in the Form TR-1.

(5) Based on the Schedule 13G/A filed with the SEC on February 14, 2023, as of February 14, 2023: (i) Nelson Peltz beneficially owned an aggregate of 11,267,446 ordinary shares, had sole voting power over 49,265 ordinary shares, shared voting power over 11,218,181 ordinary shares, sole dispositive power over 49,265 ordinary shares and shared dispositive power over 11,218,181 ordinary shares; (ii) Peter W. May beneficially owned an aggregate of 11,228,818 ordinary shares, had sole voting power over 10,637 ordinary shares, shared voting power over 11,218,181 ordinary shares, sole dispositive power over 10,637 ordinary shares and shared dispositive power over 11,218,181 ordinary shares; (iii) Edward P. Garden beneficially owned an aggregate of 11,240,663 ordinary shares, had sole voting power over 22,482 ordinary shares, shared voting power over 11,218,181 ordinary shares, sole dispositive power over 22,482 ordinary shares and shared dispositive power over 11,218,181 ordinary shares; (iv) Trian Fund Management, L.P. beneficially owned an aggregate of 11,218,181 ordinary shares, had sole voting power over 0 ordinary shares, shared voting power over 11,218,181 ordinary shares, sole dispositive power over 0 ordinary shares and shared dispositive power over 11,218,181 ordinary shares; (v) Trian Fund Management GP, LLC beneficially owned an aggregate of 11,218,181 ordinary shares, had sole voting power over 0 ordinary shares, shared voting power over 11,218,181 ordinary shares, sole dispositive power over 0 ordinary shares and shared dispositive power over 11,218,181 ordinary shares; (vi) Trian Investors Management, LLC beneficially owned an aggregate of 4,377,875 ordinary shares, had sole voting power over 0 ordinary shares, shared voting power over 4,377,875 ordinary shares, sole dispositive power over 0 ordinary shares and shared dispositive power over 4,377,875 ordinary shares; (vii) Trian Investors 1, L.P. beneficially owned an aggregate of 4,377,875 ordinary shares, had sole voting power over 0 ordinary shares, shared voting power over 4,377,875 ordinary shares, sole dispositive power over 0 ordinary shares and shared dispositive power over 4,377,875 ordinary shares; (viii) Trian Partners, L.P. beneficially owned an aggregate of 1,196,330 ordinary shares, had sole voting power over 0 ordinary shares, shared voting power over 1,196,330 ordinary shares, sole dispositive power over 0 ordinary shares and shared dispositive power over 1,196,330 ordinary shares; (ix) Trian Partners Master Fund, L.P. beneficially owned an aggregate of 1,489,123 ordinary shares, had sole voting power over 0 ordinary shares, shared voting power over 1,489,123 ordinary shares, sole dispositive power over 0 ordinary shares and shared dispositive power over 1,489,123 ordinary shares; (x) Trian Partners Parallel Fund I, L.P. beneficially owned an aggregate of 291,517 ordinary shares, had sole voting power over 0 ordinary shares, shared voting power over 291,517 ordinary shares, sole dispositive power over 0 ordinary shares and shared dispositive power over 291,517 ordinary shares; (xi) Trian Partners Strategic Investment Fund-A, L.P. beneficially owned an aggregate of 710,468 ordinary shares, had sole voting power over 0 ordinary shares, shared voting power over 710,468 ordinary shares, sole dispositive power over 0 ordinary shares and shared dispositive power over 710,468 ordinary shares; (xii) Trian Partners Strategic Investment Fund-N, L.P. beneficially owned an aggregate of 1,743,340 ordinary shares, had sole voting power over 0 ordinary shares, shared voting power over 1,743,340 ordinary shares, sole dispositive power over 0 ordinary shares and shared dispositive power over 1,743,340 ordinary shares; (xiii) Trian Partners Fund (Sub)-G, L.P. beneficially owned an aggregate of 155,800 ordinary shares, had sole voting power over 0 ordinary shares, shared voting power over 155,800 ordinary shares, sole dispositive power over 0 ordinary shares and shared dispositive power over 155,800 ordinary shares; (xiv) Trian Partners Strategic Fund-G II, L.P. beneficially owned an aggregate of 408,364 ordinary shares, had sole voting power over 0 ordinary shares, shared voting power over 408,364 ordinary shares, sole dispositive power over 0 ordinary shares and shared dispositive power over 408,364 ordinary shares; (xv) Trian Partners Strategic Fund-G III, L.P. beneficially owned an aggregate of 198,892 ordinary shares, had sole voting power over 0 ordinary shares, shared voting power over 198,892 ordinary shares, sole dispositive power over 0 ordinary shares and shared dispositive power over 198,892 ordinary shares; (xvi) Trian Partners Strategic Fund-K, L.P. beneficially owned an aggregate of 496,470 ordinary shares, had sole voting power over 0 ordinary shares, shared voting power over 496,470 ordinary shares, sole dispositive power over 0 ordinary shares and shared dispositive power over 496,470 ordinary shares; and (xvii) Trian Partners Co-Investment Opportunities Fund, Ltd. beneficially owned an aggregate of 150,002 ordinary shares, had sole voting power over 0 ordinary shares, shared voting power over 150,002 ordinary shares, sole dispositive power over 0 ordinary shares and shared dispositive power over 150,002 ordinary shares. Messrs. Peltz, May and Garden, by virtue of their relationships to certain of the entities named under (iii) through (xvii), may be deemed to beneficially own (as that term is defined in Rule 13d-3 of the Exchange Act) the ordinary shares that are owned by such entities. Messrs. Peltz, May and Garden disclaim ownership of such shares for all other purposes. The principal business address of each of Messrs. Peltz, May and Garden is 223 Sunset Avenue, Suite 223, Palm Beach, Florida 33480. The principal business address of the entities named in (iv) to (vi), (viii), (x) to (xvi) is 280 Park Avenue, 41st Floor, New York, NY 10017. The principal business address of the entity named in (vii) is PO Box 286, Floor 2, Trafalgar Court, Les Banques, St. Peter Port, Guernsey, GY1 4LY and the principal business address of the entities named in (ix) and (xvii) is c/o DE (Cayman) Limited, Landmark Square, West Bay Road, PO Box 775, Grand Cayman, Cayman Islands, KY1-9006.

(6) Based on Amendment Number 1 to Form 13F filed with the SEC on August 15, 2023 by Trian Fund Management, L.P. (“Trian”), as of August 14, 2023, Trian and certain affiliates exercise investment discretion with respect to 5,494,700 ordinary shares, implying beneficial ownership of approximately 2.7%.

(7) Based on the Schedule 13G filed by The Vanguard Group, Inc. with the SEC on January 10, 2023, The Vanguard Group, Inc. beneficially owned an aggregate of 25,853,710 ordinary shares, had sole voting power over 0 ordinary shares, shared voting power over 1,582,500 ordinary shares, sole dispositive power over 23,940,553 ordinary shares and shared dispositive power over 1,913,157 ordinary shares as of January 10, 2023. The principal business office address for The Vanguard Group is 100 Vanguard Blvd. Malvern, PA 19355.

| | | | |

| | | |

| 92 | | 2023 PROXY STATEMENT, FERGUSON PLC | | |

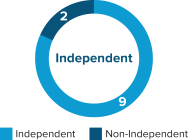

All Independent

All Independent