1 Medicare Advantage Done Right A NEW ERA OF AGING © 2025 Alignment Healthcare USA, LLC. All Rights Reserved. Alignment Healthcare is a registered trademark with the U.S. Patent and Trademark Office.

2 Legal Disclaimer Forward Looking Statements This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995, as amended. Forward-looking statements are subject to risks and uncertainties and are based on assumptions that may prove to be inaccurate, which could cause actual results to differ materially from those expected or implied by the forward-looking statements. Actual results may differ materially from the results predicted, and reported results should not be considered as an indication of future performance. Important risks and uncertainties that could cause the Company’s actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others, the following: the Company's ability to attract new members and enter new markets, including the need for certain governmental approvals; its ability to maintain a high rating for its plans on the Five Star Quality Rating System; our ability to develop and maintain satisfactory relationships with care providers that service our members; risks associated with being a government contractor; changes in laws and regulations applicable to its business model; risks related to its indebtedness, including the potential for rising interest rates; changes in market or industry conditions and receptivity to its technology and services; results of litigation or a security incident; and the impact of shortages of qualified personnel and related increases in its labor costs. For a detailed discussion of the risk factors that could affect the Company's actual results, please refer to the risk factors identified in its Annual Report on Form 10-K for the year ended December 31, 2023, and the other periodic reports it files with the SEC. All information provided in this Current Report on Form 8-K is as of the date hereof, and the Company undertakes no duty to update or revise this information unless required by law. This presentation includes certain market and industry data and statistics, which are based on publicly available information, industry publications and surveys, reports from government agencies, reports by market research firms and our own estimates based on our management’s knowledge of, and experience in, the industry and market in which we compete. Third-party industry publications and forecasts have been obtained from sources we generally believe to be reliable. In addition, certain information contained in this presentation represents management estimates. While we believe our internal estimates to be reasonable, they have not been verified by any independent sources. Such data involve risks and uncertainties and are subject to change. This presentation contains certain “non-GAAP” financial measures within the meaning of Item 10 of Regulation S-K promulgated by the SEC. We believe that non-GAAP financial measures provide an additional way of viewing aspects of our operations that, when viewed with the GAAP results, provide a more complete understanding of our results of operations and the factors and trends affecting our business. These non-GAAP financial measures are also used by our management to evaluate financial results and to plan and forecast future periods. However, non-GAAP financial measures should be considered as a supplement to, and not as a substitute for, or superior to, the corresponding measures calculated in accordance with GAAP. Non-GAAP financial measures used by us may differ from the non-GAAP measures used by other companies, including our competitors. To supplement our consolidated financial statements presented on a GAAP basis, we disclose the following non-GAAP measures: Medical Benefits Ratio, Adjusted EBITDA and Adjusted Gross Profit, as these are performance measures that our management uses to assess our operating performance. Because these measures facilitate internal comparisons of our historical operating performance on a more consistent basis, we use these measures for business planning purposes and in evaluating acquisition opportunities.

3 Breakout 2024 Execution Creates Foundation to Scale in 2025 & Beyond 2024 Scale and Momentum • 185,000 members implying 55% membership growth YoY1 • 340 basis point improvement in adj. SG&A ratio1,2 • $33M adj. EBITDA improvement YoY1 • Achieved 98% of members in plans rated 4 stars or above for rating year 2025 2025 Steady Growth & Margin Expansion • 209,900 members as of Jan. 1, implying 35% membership growth YoY • Anticipated improvement in both MBR and SG&A ratios • Confidence in achieving $40 million of adj. EBITDA • Widening stars and v28 relative payment advantages in 2025 and 2026 Notes: 1. Based on full-year 2024 guidance midpoint provided as of Oct. 29, 2024 2. Adjusted SG&A divided by revenue excluding ACO REACH. Adjusted SG&A defined as adjusted gross profit minus adjusted EBITDA

4 Founded through Personal Experience & Built through Lessons Learned • John’s mother suffered a heart attack and was hospitalized • He witnessed firsthand how difficult it was to navigate the health care system and its impact on patient health and recovery • This led John to found Alignment with the goal of treating each member as if they were family • Founding principles: put the senior first, support the doctor, use data and technology to improve senior life and do everything with a serving heart • A strong calling of responsibility to improve the healthcare system for seniors Personal Experience FHP International Vertical Integration, One of the First MA Contracts Provider Partnerships, 1 million MA Seniors Core Systems, Technology and Supply Chain Operations Chronic Care Management Lessons Learned in Healthcare

5 A Differentiated Approach to Medicare Advantage Commitment to clinical excellence: investing in employed clinical resources to provide more care to high-risk seniors Managing risk and caring for seniors is our core competency: preference to assume financial risk and upside instead of globally capping Actionable data to empower clinical decisions: Operate with daily visibility into key utilization & clinical metrics Business model designed to scale: capital-efficient home and virtual care model focuses on 20% of members that represent 80% of institutional costs Approach MA as a care management business: not an actuarial pricing business Alignment Principles of Success in Medicare Advantage: Transparency, Visibility, Control, Durability ~4% of medical expenses for at-risk members invested in employed clinical model, including >400 employed clinical staff comprising ~25% of full-time employees. 64% of members in at-risk contracts. AVA technology: 200+ unique data sources, 250+ dashboards, 40+ workflow and engagement applications, 200+ AI models. Not dependent on owned brick and mortar clinics. Empower, instead of compete with, existing community doctors. Allows for capital-efficient replicability. Daily clinical meetings, joint operating sessions with providers, emphasis on clinical gap closures, care delivery though home- based health and senior advocacy.

6 This is How We Win: The Virtuous Cycle – Doing Well by Doing Good High Quality and Low Cost Create Durable Competitive Advantages S E R VI CE DELIVERY & RETENTION S U S TA IN A B L E G R O W TH H IG H Q U A L IT Y, LO W C O S T ACTIONABLE D ATA COMPETITIVE BENEFITS • Alignment Virtual Application (AVA): Purpose-built technology platform • Real time member data to support health plan operations • Actionable insights enables timely medical intervention by our Care Anywhere clinical teams • Care Anywhere (CAW): Employed clinical teams who act on AVA medical insights • Engage with our highest-risk seniors to improve member health • Agile teams deployed at the home and virtually • Richer benefits and differentiated products • Funded through reinvestment of savings derived from medical cost management • Curated Products tailored to fit senior lifestyles • Disciplined bids balance growth and margin objectives • Competitive moat established through superior care management and CMS star ratings advantages vs competitors • Concierge-level member support provide members with a premium Medicare Advantage experience • Insourced call center and disciplined supplemental benefit vendor management provide consistently high quality 1 2 3 4 5

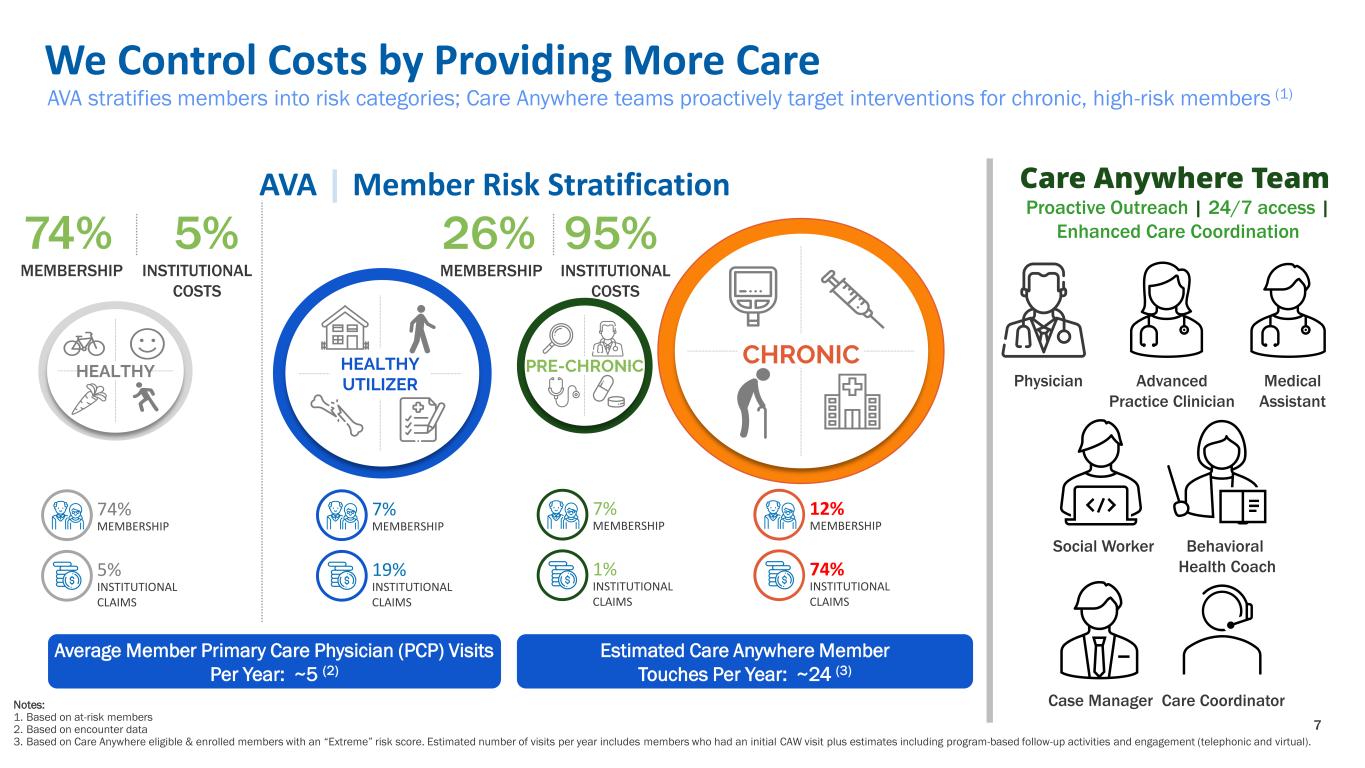

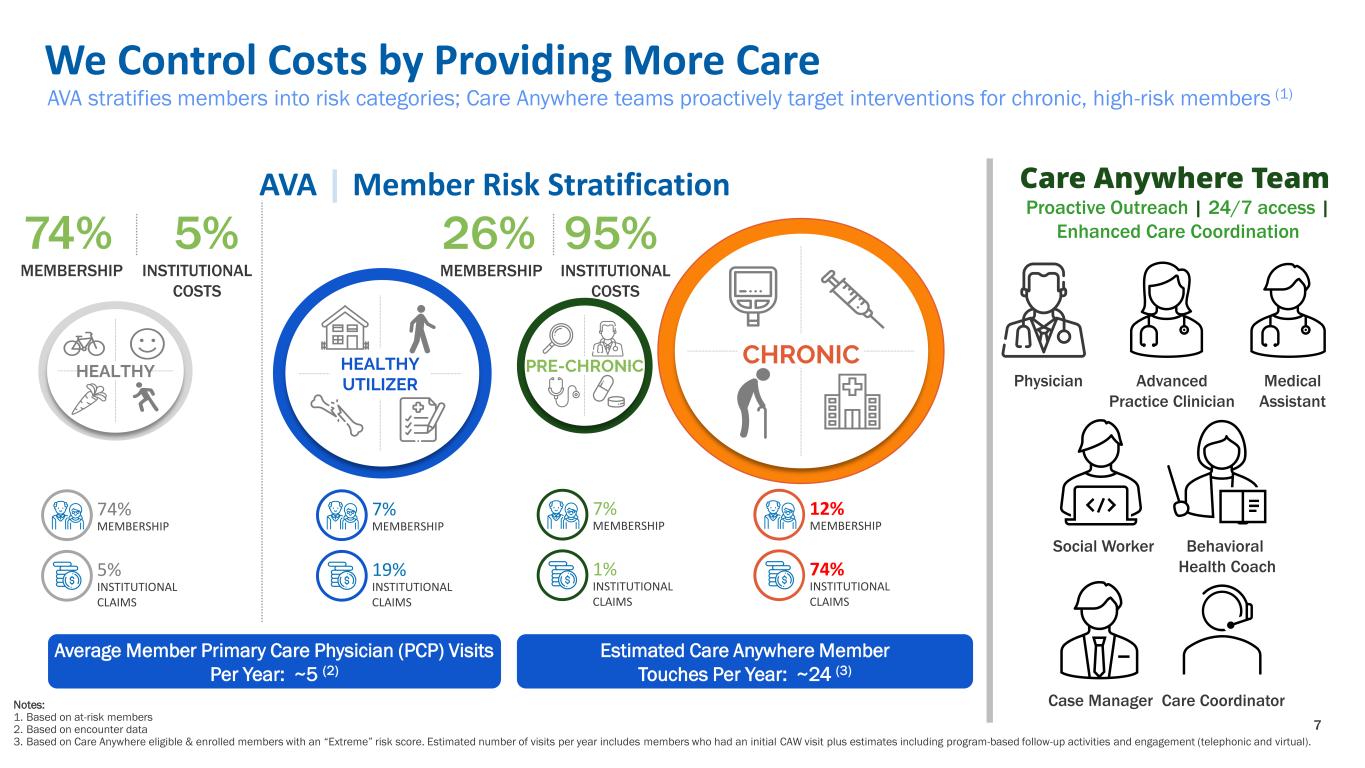

7 74% MEMBERSHIP 5% INSTITUTIONAL CLAIMS 7% MEMBERSHIP 19% INSTITUTIONAL CLAIMS 7% MEMBERSHIP 1% INSTITUTIONAL CLAIMS HEALTHY PRE-CHRONICHEALTHY UTILIZER Notes: 1. Based on at-risk members 2. Based on encounter data 3. Based on Care Anywhere eligible & enrolled members with an “Extreme” risk score. Estimated number of visits per year includes members who had an initial CAW visit plus estimates including program-based follow-up activities and engagement (telephonic and virtual). 12% MEMBERSHIP 74% INSTITUTIONAL CLAIMS 74% MEMBERSHIP 5% INSTITUTIONAL COSTS 26% MEMBERSHIP 95% INSTITUTIONAL COSTS Average Member Primary Care Physician (PCP) Visits Per Year: ~5 (2) CHRONIC Estimated Care Anywhere Member Touches Per Year: ~24 (3) Care Anywhere Team Physician Social Worker Advanced Practice Clinician Case Manager Proactive Outreach | 24/7 access | Enhanced Care Coordination Behavioral Health Coach Care Coordinator Medical Assistant We Control Costs by Providing More Care AVA | Member Risk Stratification AVA stratifies members into risk categories; Care Anywhere teams proactively target interventions for chronic, high-risk members (1)

8 Quality >80 Care Anywhere NPS 4.9 Google Rating1 98% of Members in 4+ Star Rated Plans2 1.9% Auth. Denial Rate3: Providing Care & Preventing Fraud, Waste, Abuse Alignment Delivers Industry-Leading Results Sales 30% 5-Year Membership CAGR5 >80% of Gross Sales Through Plan Switchers Retention 47% Lower Voluntary Turnover vs Industry Avg.4 Clinical Consistency & Replicability 6 153 Inpatient Admissions / K 39% better than MFFS CA Admissions / K: 152 Ex-CA Admissions / K: 148 150-165 Admission / K over past 7 years Notes: 1. Google Rating based on Alignment Health Corporate HQ rating; composite of more than 7,000 ratings as of Dec. 2024 2. Plan membership as of Dec. 2024 3. Based on full-year 2023 authorization data. Includes full and partial authorization denials 4. Voluntary disenrollment based on CY23 CMS Stars reporting for H3815 and national avg. 5. Growth CAGR based on the midpoint of 2024 year-end membership guidance provided as of October 29, 2024 6. Medicare FFS data represents 2019 Medicare FFS; ALHC data represents YTD 3Q 2024 At-Risk member utilization metrics

9 Case Study: Virtuous Cycle in Action 2 Product Investment $0 $50 $100 $150 $200 $250 $300 2018 2019 2020 2021 2022 2023 2024 Average Rebate Value ($ pmpm) 3 Membership Growth 1 Medical Outcomes • Initial Entry: Members who were paneled to doctors affiliated with the IPA were extremely complex (70% dually-eligible) but received only basic case management services that were insufficient for their health profile. • Market Improvement: Care Anywhere deployment leveraged greater use of health coaches and social workers to address the social and clinical issues in this population. AVA insights jointly used by Alignment and IPA’s case management teams to coordinate on chronic care management and member outreach. Financial alignment created by shared-upside risk pool arrangement supported collaborative efforts to improve member health. • Results: AVA insights and market actions resulted in visibility into and management of member chronic conditions, social issues, and inpatient admission reductions. A portion of medical cost savings were reinvested in product benefits which resulted in high-margin growth. 80 100 120 140 160 180 200 220 60% 65% 70% 75% 80% 85% 90% 95% 2018 2019 2020 2021 2022 2023 MBR (%) and Inpatient Admissions per Thousand MBR (%) Inpatient APK 0 500 1,000 1,500 2,000 2,500 3,000 2018 2019 2020 2021 2022 2023 Average Medicare Advantage Enrollment

10 Our Model Enables Us to Manage Costs while Growing Quickly Notes: 1. Alignment MBR reflects adj. MBR excluding ACO REACH. MBR metrics for peers represent the most comparable reported measure to an individual MA MBR. YoY membership comparisons exclude the impact of acquired membership. • Alignment has differentiated itself by achieving superior growth while leveraging its care model and AVA to manage medical costs • In comparison to a peer group of national publicly traded health plans, Alignment was the fastest growing MA plan, growing at 58% vs the peer set avg. of 0.9% • MBR for the peer set increased an average of 250bps year-over-year, with higher growth health plans among the peer set showing even greater MBR increases Alignment Healthcare Peer 1 Peer 2 Peer 6 Peer 4 Peer 3 Peer 5 -3.0% -2.0% -1.0% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% -30% -20% -10% 0% 10% 20% 30% 40% 50% 60% 70% Y o Y C h a n g e i n Y T D Q 3 M B R ( % ) YoY Change in Q3 MA Membership (%) YTD 3Q24 YoY Change in MBR (%) vs Change in Membership (%) Better B e tt e r

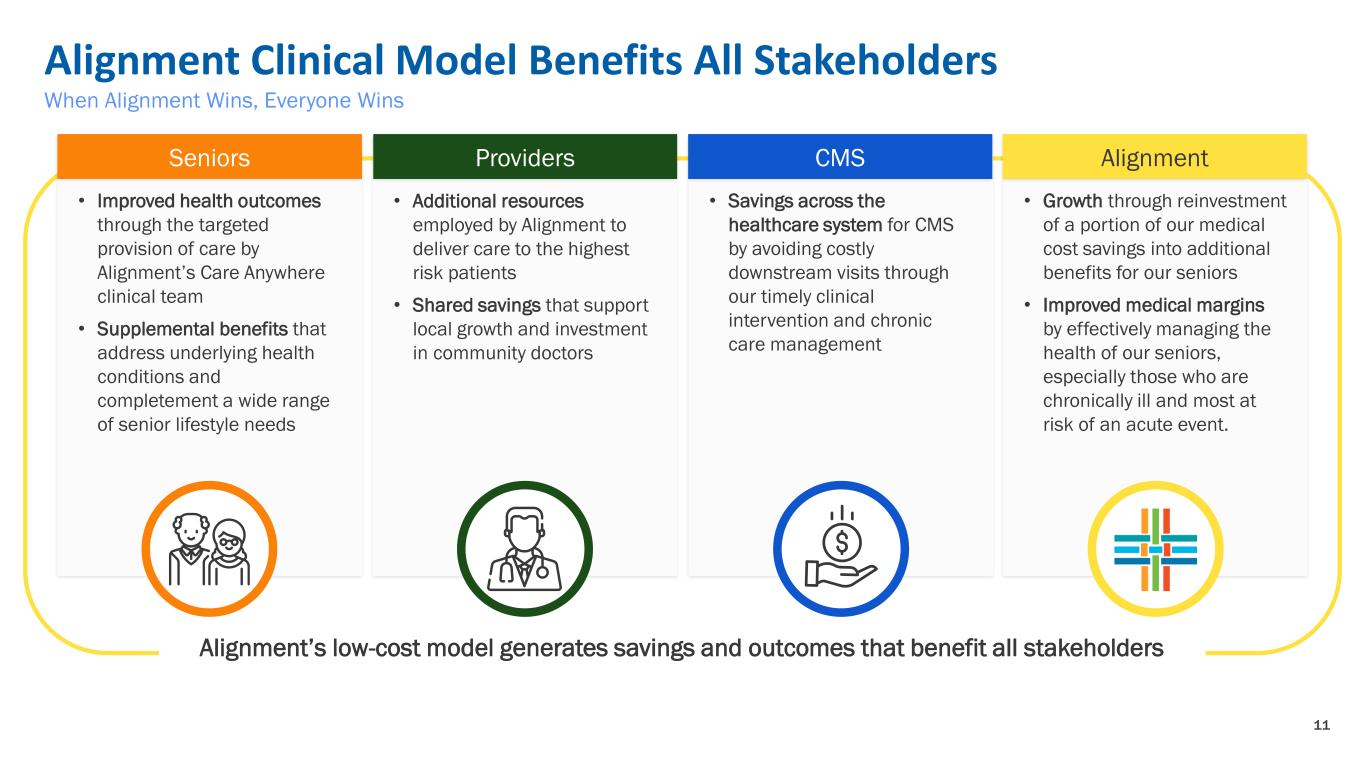

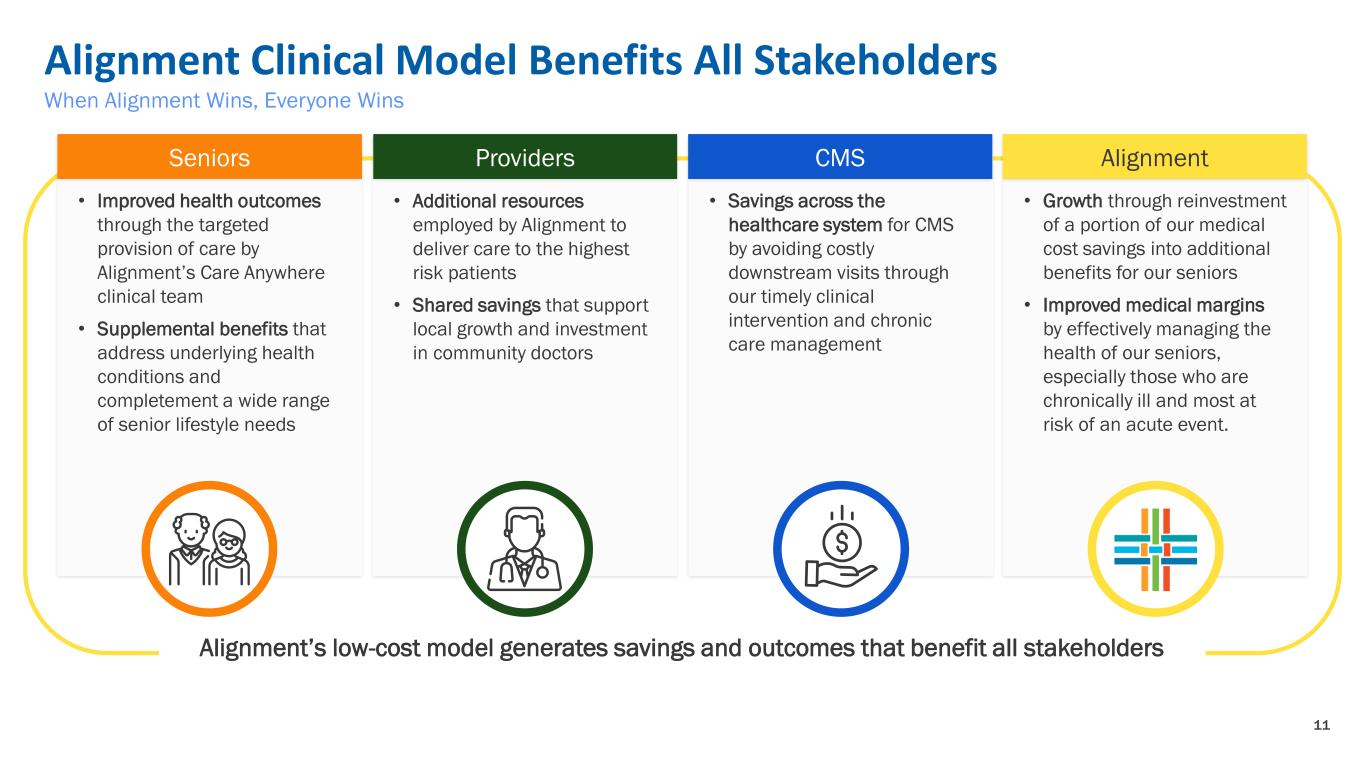

11 Alignment Clinical Model Benefits All Stakeholders • Improved health outcomes through the targeted provision of care by Alignment’s Care Anywhere clinical team • Supplemental benefits that address underlying health conditions and completement a wide range of senior lifestyle needs • Additional resources employed by Alignment to deliver care to the highest risk patients • Shared savings that support local growth and investment in community doctors • Savings across the healthcare system for CMS by avoiding costly downstream visits through our timely clinical intervention and chronic care management CMSProvidersSeniors • Growth through reinvestment of a portion of our medical cost savings into additional benefits for our seniors • Improved medical margins by effectively managing the health of our seniors, especially those who are chronically ill and most at risk of an acute event. Alignment Alignment’s low-cost model generates savings and outcomes that benefit all stakeholders When Alignment Wins, Everyone Wins

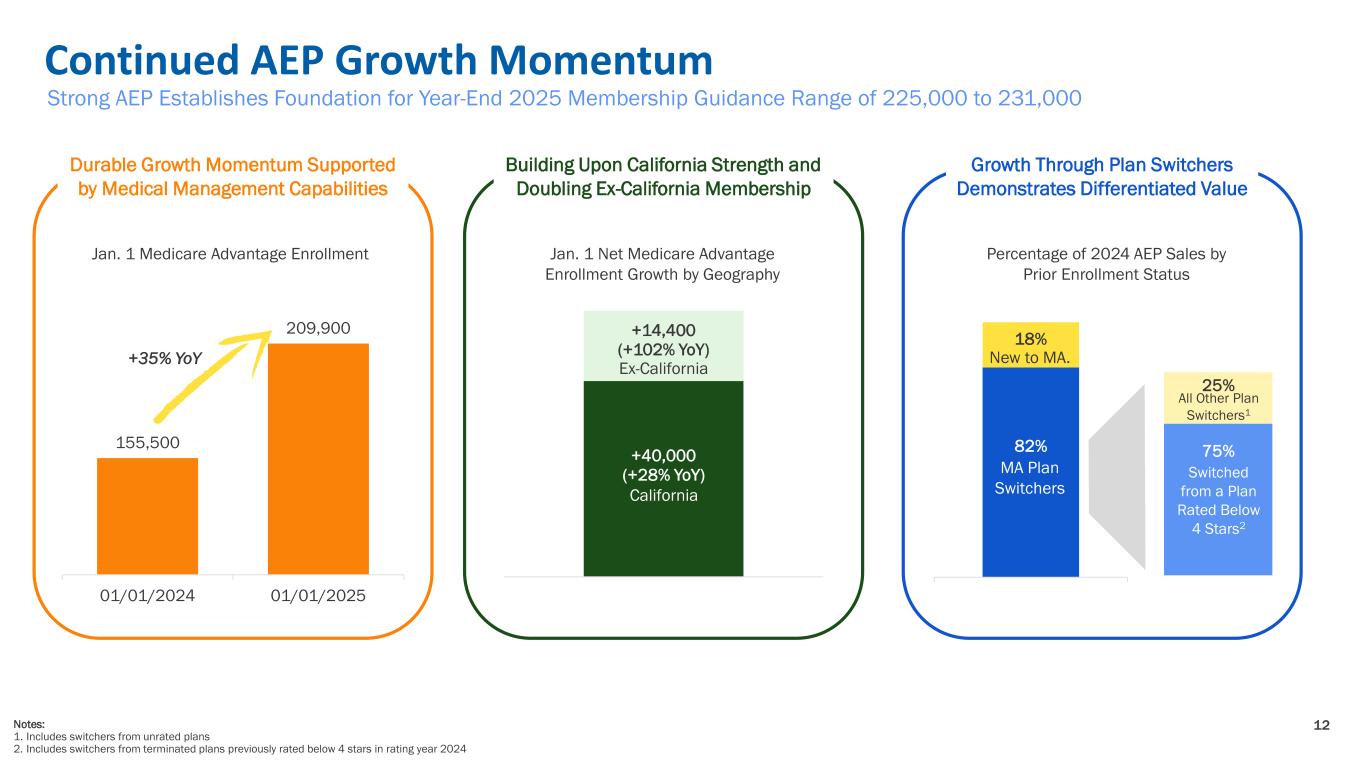

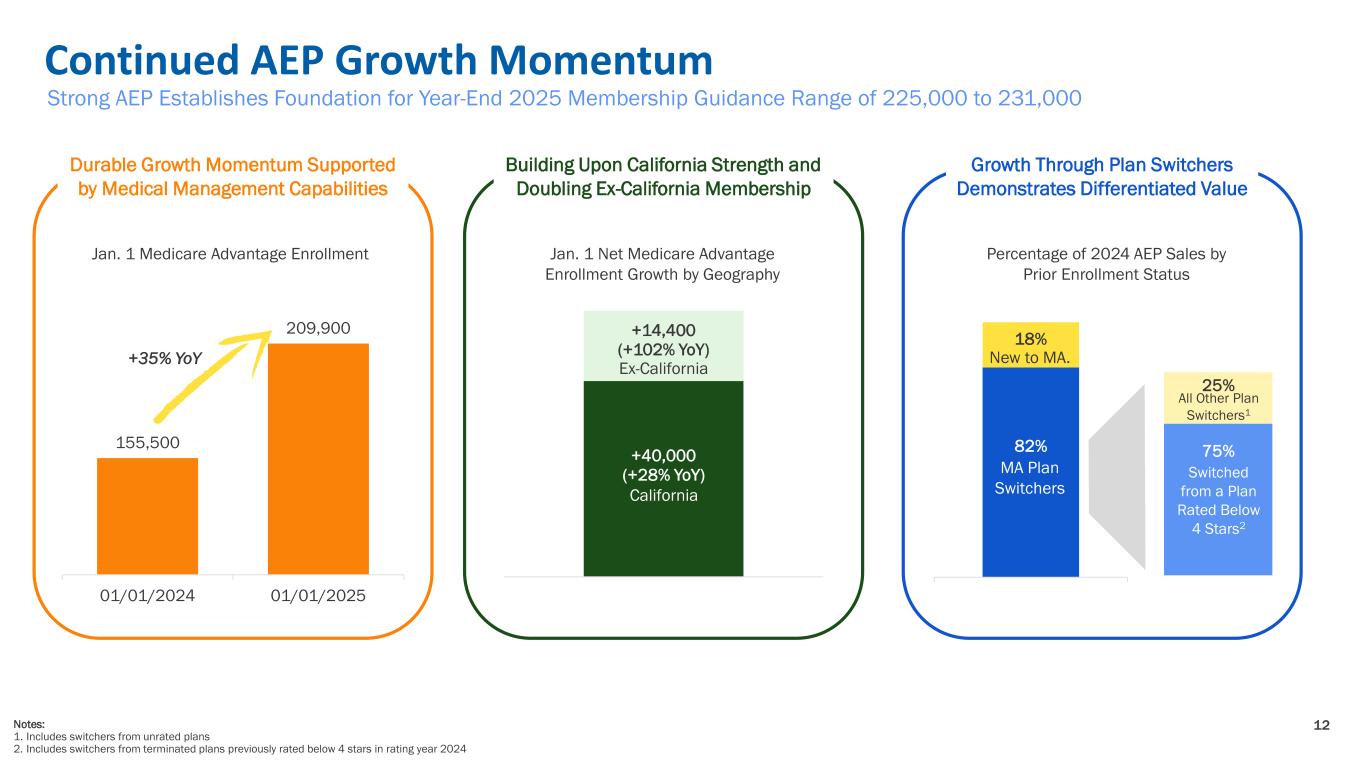

12 Continued AEP Growth Momentum Strong AEP Establishes Foundation for Year-End 2025 Membership Guidance Range of 225,000 to 231,000 155,500 209,900 01/01/2024 01/01/2025 Durable Growth Momentum Supported by Medical Management Capabilities Growth Through Plan Switchers Demonstrates Differentiated Value Jan. 1 Medicare Advantage Enrollment Percentage of 2024 AEP Sales by Prior Enrollment Status 82% 18% 1 New to MA. MA Plan Switchers +35% YoY Notes: 1. Includes switchers from unrated plans 2. Includes switchers from terminated plans previously rated below 4 stars in rating year 2024 Building Upon California Strength and Doubling Ex-California Membership Jan. 1 Net Medicare Advantage Enrollment Growth by Geography +40,000 (+28% YoY) +14,400 (+102% YoY) 1 California Ex-California 75% 25% Switched from a Plan Rated Below 4 Stars2 All Other Plan Switchers1

13 100% 94% 92% 98% 89% 74% 79% 64% 2022 2023 2024 2025 ALHC Industry Increasing Stars Advantages Extends Strong Growth Position Alignment members in 4+ star plans is increasing from 92% to 98% while the industry is declining from 79% to 64% in PY 2026 ALHC California Performance 100% 96% 95% 100% 90% 80% 68% 61% 2022 2023 2024 2025 ALHC Industry ALHC National Performance 2022 2023 2024 2025 2023 2024 2025 2026 Rating Year Payment Year 2022 2023 2024 2025 2023 2024 2025 2026 Percentage of Membership in Plans Rated 4 Stars or Greater 1Percentage of Membership in Plans Rated 4 Stars or Greater 1 100% of CA members in plans rated 4 stars or above 4+ star rating CA HMO plan for 8 consecutive years Widening CA star ratings advantages in payment year 2026 98% of all Alignment members in plans rated 4 stars or above 4 star HMO and 4.5 star PPO in CA; 5 star rated HMO in NC and NV Widening national star ratings advantages in payment year 2026 +27% +32% +39% +13% Notes: 1. Based on December membership data of each rating year. 2025 based on December 2024 membership data

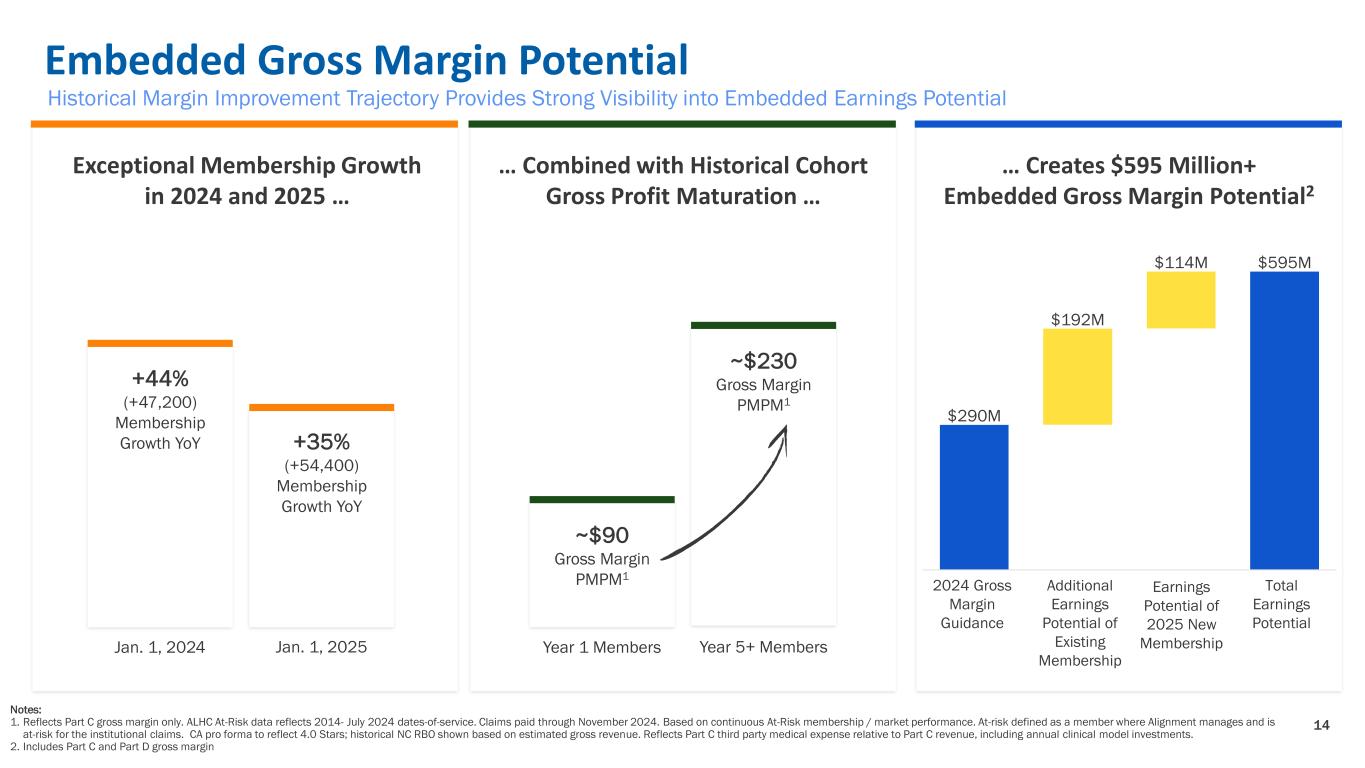

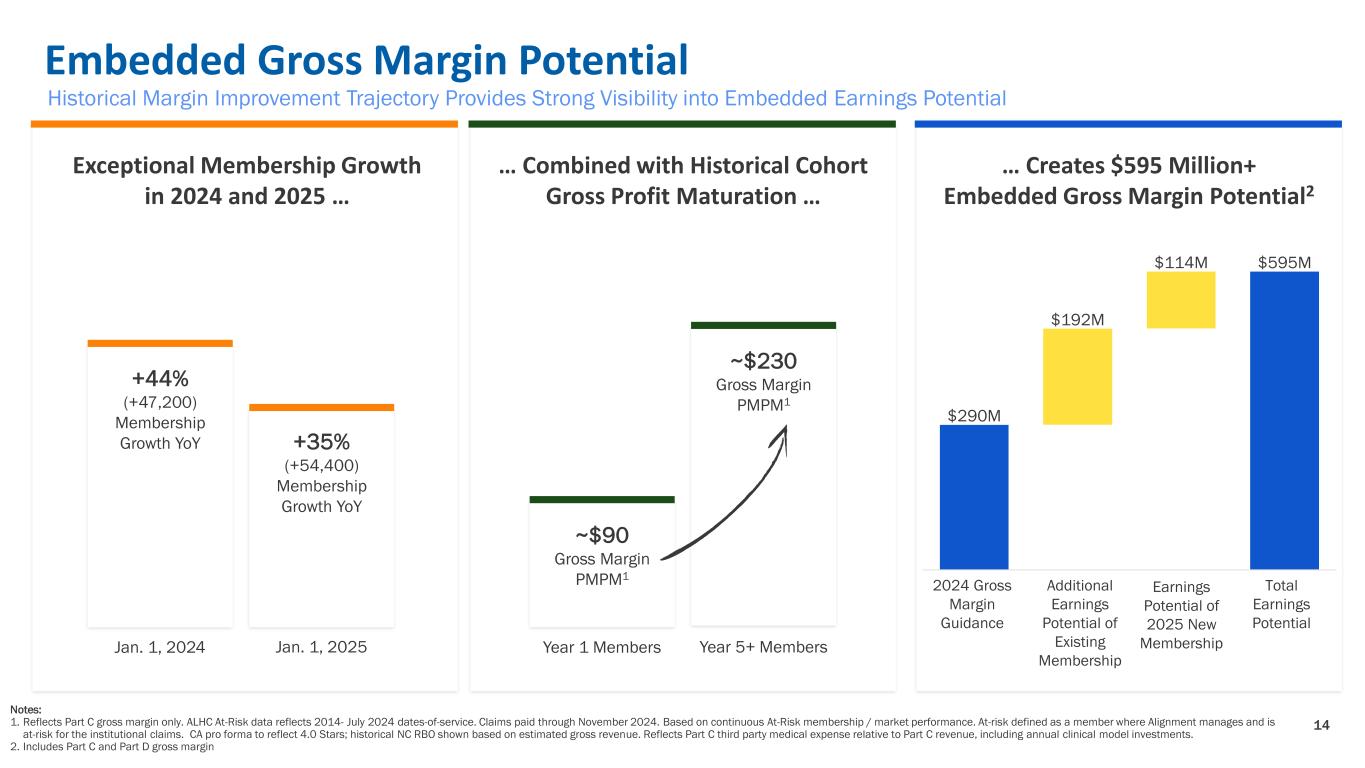

14 Embedded Gross Margin Potential Historical Margin Improvement Trajectory Provides Strong Visibility into Embedded Earnings Potential Notes: 1. Reflects Part C gross margin only. ALHC At-Risk data reflects 2014- July 2024 dates-of-service. Claims paid through November 2024. Based on continuous At-Risk membership / market performance. At-risk defined as a member where Alignment manages and is at-risk for the institutional claims. CA pro forma to reflect 4.0 Stars; historical NC RBO shown based on estimated gross revenue. Reflects Part C third party medical expense relative to Part C revenue, including annual clinical model investments. 2. Includes Part C and Part D gross margin ~$90 Gross Margin PMPM1 ~$230 Gross Margin PMPM1 Year 1 Members Year 5+ Members … Combined with Historical Cohort Gross Profit Maturation … +44% (+47,200) Membership Growth YoY +35% (+54,400) Membership Growth YoY Jan. 1, 2024 Jan. 1, 2025 Exceptional Membership Growth in 2024 and 2025 … … Creates $595 Million+ Embedded Gross Margin Potential2 0 1 11 0 Guidance 0 Existing embership 0 ew embership Total Earnings Potential2024 Gross Margin Guidance Additional Earnings Potential of Existing Membership Earnings Potential of 2025 New Membership Total Earnings Potential

15 Strong 2024 and 2025 growth adds enterprise scale and operating leverage Multi-Year Runway of Opportunity Disciplined bids lays foundation for margin expansion in 2025 Widening competitive advantage versus incumbents heading into 2026 (stars, final phase-in of risk model changes) Continue to invest in ex-California markets and fund organic growth using internally-generated cash flows Favorable 2027 growth and margin outlook supported by CAHPS star measure weighting reductions for rating year 2026 / payment year 2027 Strategic Decisions and Execution Converging to Drive Long-Term Success