UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-23621

| Name of Fund: | | BlackRock 2037 Municipal Target Term Trust (BMN) |

| Fund Address: | | 100 Bellevue Parkway, Wilmington, DE 19809 |

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock 2037

Municipal Target Term Trust, 50 Hudson Yards, New York, NY 10001

Registrant’s telephone number, including area code: (800) 882-0052, Option 4

Date of fiscal year end: 12/31/2022

Date of reporting period: 12/31/2022

Item 1 – Report to Stockholders

(a) The Report to Shareholders is attached herewith.

| | |

| | DECEMBER 31, 2022 |

BlackRock 2037 Municipal Target Term Trust (BMN)

|

| Not FDIC Insured • May Lose Value • No Bank Guarantee |

The Markets in Review

Dear Shareholder,

Significant economic headwinds emerged during the 12-month reporting period ended December 31, 2022, as investors navigated changing economic conditions and volatile markets. The U.S. economy shrank in the first half of 2022 before returning to modest growth in the third quarter, marking a shift to a more challenging post-reopening economic environment. Changes in consumer spending patterns and a tight labor market led to elevated inflation, which reached a 40-year high before beginning to moderate. Moreover, while the foremost effect of Russia’s invasion of Ukraine has been a severe humanitarian crisis, the ongoing war continued to present challenges for both investors and policymakers.

Equity prices fell as interest rates rose, particularly during the first half of the reporting period. Both large- and small-capitalization U.S. stocks fell, although equities began to recover in the second half of the year as inflation eased and economic growth resumed. Emerging market stocks and international equities from developed markets declined overall, pressured by rising interest rates and a strengthening U.S. dollar.

The 10-year U.S. Treasury yield rose notably during the reporting period, driving its price down, as investors reacted to fluctuating inflation data and attempted to anticipate its impact on future interest rate changes. The corporate bond market also faced inflationary headwinds, and heightened uncertainty led to higher corporate bond spreads (the difference in yield between U.S. Treasuries and similarly-dated corporate bonds).

The U.S. Federal Reserve (the “Fed”), acknowledging that inflation has been more persistent than expected, raised interest rates seven times. Furthermore, the Fed wound down its bond-buying programs and is accelerating the reduction of its balance sheet. While the Fed suggested that additional rate hikes were likely, it also gave indications that the pace of increases would slow if inflation continued to subside.

The pandemic’s restructuring of the economy brought an ongoing mismatch between supply and demand, contributing to the current inflationary regime. While growth slowed in 2022, we believe that taming inflation requires a more dramatic economic decline to bring demand back to a level more in line with the economy’s capacity. The Fed has been raising interest rates at the fastest pace in decades, and seems set to overtighten in its effort to get inflation back to target. With this in mind, we believe the possibility of a U.S. recession in the near-term is high, but this prospect has not yet been fully priced in by markets. Investors should expect a period of higher volatility as markets adjust to the new economic reality and policymakers attempt to adapt to rapidly changing conditions.

In this environment, while we favor an overweight to equities in the long-term, the market’s concerns over excessive rate hikes from central banks moderate our outlook. Rising input costs and a deteriorating economic backdrop are likely to challenge corporate earnings, so we are underweight equities overall in the near term. However, we see better opportunities in credit, where valuations are attractive and higher yields provide income opportunities. We believe that global investment-grade corporates, global inflation-linked bonds, and U.S. mortgage-backed securities offer strong opportunities for a six- to twelve-month horizon.

Overall, our view is that investors need to think globally, position themselves to be prepared for a decarbonizing economy, and be nimble as market conditions change. We encourage you to talk with your financial advisor and visit blackrock.com for further insight about investing in today’s markets.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

Rob Kapito

President, BlackRock Advisors, LLC

| | | | |

Total Returns as of December 31, 2022 |

| | | |

| | | 6-Month | | 12-Month |

| | |

U.S. large cap equities (S&P 500® Index) | | 2.31% | | (18.11)% |

| | |

U.S. small cap equities

(Russell 2000® Index) | | 3.91 | | (20.44) |

| | |

International equities

(MSCI Europe, Australasia, Far East Index) | | 6.36 | | (14.45) |

| | |

Emerging market equities

(MSCI Emerging Markets Index) | | (2.99) | | (20.09) |

| | |

3-month Treasury bills

(ICE BofA 3-Month U.S. Treasury Bill Index) | | 1.32 | | 1.47 |

| | |

U.S. Treasury securities

(ICE BofA 10-Year U.S. Treasury Index) | | (5.58) | | (16.28) |

| | |

U.S. investment grade bonds

(Bloomberg U.S. Aggregate Bond Index) | | (2.97) | | (13.01) |

| | |

Tax-exempt municipal bonds

(Bloomberg Municipal Bond Index) | | 0.50 | | (8.53) |

| | |

U.S. high yield bonds

(Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index) | | 3.50 | | (11.18) |

|

| Past performance is not an indication of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. |

| | |

| 2 | | THIS PAGE IS NOT PART OF YOUR FUND REPORT |

Table of Contents

Municipal Market Overview For the Reporting Period Ended December 31, 2022

Municipal Market Conditions

Municipal bonds posted negative total returns during the period alongside rising interest rates spurred by surging inflation and aggressive U.S. Federal Reserve policy tightening. The market experienced a drawdown on par with some of the worst on record as the U.S. central bank delivered 425bps of rate hikes at the fastest pace in history. However, growing expectations for a pause in policy tightening later in the period offered a reprieve. Strong credit fundamentals, bolstered by robust revenue growth and elevated fund balances, drove positive excess returns versus comparable U.S. Treasuries. Shorter-duration (i.e., less sensitive to interest rates) and higher-rated bonds outperformed.

| | | | |

| | |

During the 12 months ended December 31, 2022, municipal bond funds experienced net outflows totaling $145 billion (based on data from the Investment Company Institute), marking the largest outflow cycle on record. As a result, elevated bid-wanted activity weighed on the market as investors raised cash to meet redemptions. At the same time, the market absorbed $351 billion in issuance, below the $452 billion issued during the prior 12-months. New issue oversubscriptions waned as sentiment turned less constructive. | | | | Bloomberg Municipal Bond Index Total Returns as of December 31, 2022 6 months: 0.50% 12 months: (8.53)% |

|

|

|

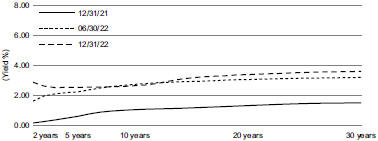

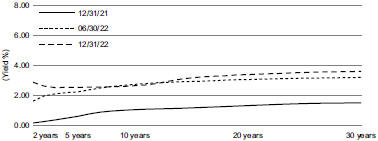

A Closer Look at Yields

AAA Municipal Yield Curves

| | |

| | From December 31, 2021, to December 31, 2022, yields on AAA-rated 30-year municipal bonds increased by 209 basis points (“bps”) from 1.49% to 3.58%, while ten-year rates increased by 160 bps from 1.03% to 2.63% and five-year rates increased by 193 bps from 0.59% to 2.52% (as measured by Thomson Municipal Market Data). As a result, the municipal yield curve flattened over the 12-month period with the spread between two- and 30-year maturities flattening by 27 bps. However, the curve remained relatively steep compared to the deeply inverted U.S. Treasury curve, which flattened by 163 bps. |

Source: Thomson Municipal Market Data. | | The selloff experienced in early 2022 helped restore value to the asset class before outperformance in the latter half of the year stretched valuations across the curve. Municipal-to-Treasury ratios now sit below their 5-year averages, most notably in the front end of the curve. |

Financial Conditions of Municipal Issuers

Buoyed by successive federal aid injections, vaccine distribution, and the re-opening of the economy, states and many local governments experienced revenue growth above forecasts in 2021 and 2022. While revenue collections, particularly sales and personal income tax receipts, continue to be robust in an environment of higher inflation, growth may subside as inflation declines or the economy slows. In the meantime, prevailing higher wages, energy costs, and interest rates in the post-Covid recovery will pressure state and local government costs. However, overall credit fundamentals are expected to remain sturdy. At this point, tax receipts could come under pressure although states with significant oil and gas production would benefit should prices remain elevated or rise. While municipal utilities typically benefit from autonomous rate-setting that allows them to adjust for rising fuel costs, rising commodity prices over a prolonged period could test affordability and the political will to raise rates to balance operations. State housing authority bonds, flagship universities, and strong national and regional health systems may also be pressured but are better poised to absorb the impact of the economic shock. Critical providers (safety net hospitals, mass transit systems, airports) with limited resources may still experience fiscal strain from the economic fallout from rising inflation, but aid and the re-opening of the economy will continue to support operating results through 2023. Work-from-home policies remain headwinds for mass transit farebox revenue and commercial real estate values. BlackRock anticipates that a small subset of the market, mainly non-rated stand-alone projects, will remain susceptible to credit deterioration.

The opinions expressed are those of BlackRock as of December 31, 2022 and are subject to change at any time due to changes in market or economic conditions. The comments should not be construed as a recommendation of any individual holdings or market sectors. Investing involves risk including loss of principal. Bond values fluctuate in price so the value of your investment can go down depending on market conditions. Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in bond values. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments. There may be less information on the financial condition of municipal issuers than for public corporations. The market for municipal bonds may be less liquid than for taxable bonds. Some investors may be subject to Alternative Minimum Tax (“AMT”). Capital gains distributions, if any, are taxable.

The Bloomberg Municipal Bond Index, a broad, market value-weighted index, seeks to measure the performance of the U.S. municipal bond market. All bonds in the index are exempt from U.S. federal income taxes or subject to the AMT. Past performance is not an indication of future results. Index performance is shown for illustrative purposes only. It is not possible to invest directly in an index.

| | |

| 4 | | 2 0 2 2 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

The Benefits and Risks of Leveraging

The Trust may utilize leverage to seek to enhance the distribution rate on, and net asset value (“NAV”) of, their common shares (“Common Shares”). However, there is no guarantee that these objectives can be achieved in all interest rate environments.

In general, the concept of leveraging is based on the premise that the financing cost of leverage, which is based on short-term interest rates, is normally lower than the income earned by the Trust on its longer-term portfolio investments purchased with the proceeds from leverage. To the extent that the total assets of the Trust (including the assets obtained from leverage) are invested in higher-yielding portfolio investments, the Trust’s shareholders benefit from the incremental net income. The interest earned on securities purchased with the proceeds from leverage (after paying the leverage costs) is paid to shareholders in the form of dividends, and the value of these portfolio holdings (less the leverage liability) is reflected in the per share NAV.

To illustrate these concepts, assume the Trust’s capitalization is $100 million and it utilizes leverage for an additional $30 million, creating a total value of $130 million available for investment in longer-term income securities. If prevailing short-term interest rates are 3% and longer-term interest rates are 6%, the yield curve has a strongly positive slope. In this case, the Trust’s financing costs on the $30 million of proceeds obtained from leverage are based on the lower short-term interest rates. At the same time, the securities purchased by the Trust with the proceeds from leverage earn income based on longer-term interest rates. In this case, the Trust’s financing cost of leverage is significantly lower than the income earned on the Trust’s longer-term investments acquired from such leverage proceeds, and therefore the holders of Common Shares (“Common Shareholders”) are the beneficiaries of the incremental net income.

However, in order to benefit shareholders, the return on assets purchased with leverage proceeds must exceed the ongoing costs associated with the leverage. If interest and other costs of leverage exceed the Trust’s return on assets purchased with leverage proceeds, income to shareholders is lower than if the Trust had not used leverage. Furthermore, the value of the Trust’s portfolio investments generally varies inversely with the direction of long-term interest rates, although other factors can influence the value of portfolio investments. In contrast, the amount of the Trust’s obligations under its leverage arrangement generally does not fluctuate in relation to interest rates. As a result, changes in interest rates can influence the Trust’s NAVs positively or negatively. Changes in the future direction of interest rates are very difficult to predict accurately, and there is no assurance that the Trust’s intended leveraging strategy will be successful.

The use of leverage also generally causes greater changes in the Trust’s NAV, market price and dividend rates than comparable portfolios without leverage. In a declining market, leverage is likely to cause a greater decline in the NAV and market price of the Trust’s shares than if the Trust were not leveraged. In addition, the Trust may be required to sell portfolio securities at inopportune times or at distressed values in order to comply with regulatory requirements applicable to the use of leverage or as required by the terms of leverage instruments, which may cause the Trust to incur losses. The use of leverage may limit the Trust’s ability to invest in certain types of securities or use certain types of hedging strategies. The Trust incurs expenses in connection with the use of leverage, all of which are borne by shareholders and may reduce income to the shareholders. Moreover, to the extent the calculation of the Trust’s investment advisory fees includes assets purchased with the proceeds of leverage, the investment advisory fees payable to the Trust’s investment adviser will be higher than if the Trust did not use leverage.

The Trust may utilize leverage through TOB Trusts as described in the Notes to Financial Statements, if applicable.

Under the Investment Company Act of 1940, as amended (the “1940 Act”), the Trust is permitted to issue debt up to 33 1/3% of its total managed assets. The Trust may voluntarily elect to limit its leverage to less than the maximum amount permitted under the 1940 Act.

| | |

THE BENEFITS AND RISKS OF LEVERAGING | | 5 |

| | |

| Trust Summary as of December 31, 2022 | | BlackRock 2037 Municipal Target Term Trust (BMN) |

Investment Objective

BlackRock 2037 Municipal Target Term Trust’s (BMN) (the “Trust”) investment objectives are to provide current income that is exempt from regular federal income tax (but which may be subject to the federal alternative minimum tax in certain circumstances) and to return $25.00 per common share (the initial public offering price per common share) to holders of common shares on or about September 30, 2037. Under normal market conditions, the Trust invests at least 80% of its Managed Assets in municipal securities. The Trust invests primarily in investment grade quality securities or securities that are unrated but judged to be of comparable quality by the investment adviser.

There is no assurance that the Trust will achieve its investment objectives, including its investment objective of returning $25.00 per share.

Trust Information

| | |

| | |

Symbol on New York Stock Exchange | | BMN |

Initial Offering Date | | October 28, 2022 |

Termination Date | | September 30, 2037 |

Market Price and Net Asset Value Per Share Summary

| | | | | | | | | | | | | | | | | | | | |

| | | | 12/31/22 | | | | 10/28/22 | (a) | | | Change | | | | High | | | | Low | |

| | | | | |

Closing Market Price | | $ | 24.44 | | | $ | 25.00 | | | | (2.24 | )% | | $ | 25.55 | | | $ | 24.40 | |

Net Asset Value | | | 25.42 | | | | 25.00 | | | | 1.68 | | | | 25.60 | | | | 25.00 | |

| | (a) | Commencement of operations. | |

Overview of the Trust’s Total Investments

SECTOR ALLOCATION

| | | | |

| | |

| Sector(a)(b) | | 12/31/22 | |

| |

Transportation | | | 25.1 | % |

Health | | | 20.8 | |

Housing | | | 14.3 | |

County/City/Special District/School District | | | 14.1 | |

Education | | | 9.0 | |

Utilities | | | 7.9 | |

State | | | 5.9 | |

Corporate | | | 2.9 | |

CALL/MATURITY SCHEDULE

| | | | |

| | |

| Calendar Year Ended December 31,(a)(c) | | Percentage | |

| |

2023 | | | 6.9 | % |

2024 | | | 12.0 | |

2025 | | | 10.5 | |

2026 | | | 4.7 | |

2027 | | | 8.8 | |

CREDIT QUALITY ALLOCATION

| | | | |

| | |

| Credit Rating(a)(d) | | 12/31/22 | |

| |

AAA/Aaa | | | 5.7 | % |

AA/Aa | | | 37.9 | |

A | | | 21.6 | |

BBB/Baa | | | 19.2 | |

BB/Ba | | | 3.2 | |

B | | | 1.1 | |

N/R(e) | | | 11.3 | |

| (a) | Excludes short-term securities. |

| (b) | For Trust compliance purposes, the Trust’s sector classifications refer to one or more of the sector sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease. |

| (c) | Scheduled maturity dates and/or bonds that are subject to potential calls by issuers over the next five years. |

| (d) | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| (e) | The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors and individual investments. Using this approach, the investment adviser has deemed certain of these unrated securities as investment grade quality. As of December 31, 2022, the market value of unrated securities deemed by the investment adviser to be investment grade represents 1.9% of the Trust’s total investments. |

| | |

| 6 | | 2 0 2 2 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

| | |

Schedule of Investments December 31, 2022 | | BlackRock 2037 Municipal Target Term Trust (BMN) (Percentages shown are based on Net Assets) |

| | | | | | | | |

| Security | | Par

(000) | | | Value | |

| | |

Municipal Bonds | | | | | | | | |

| | |

| Arizona — 1.3% | | | | | | |

Salt Verde Financial Corp., RB, 5.00%, 12/01/37 | | $ | 2,000 | | | $ | 2,042,170 | |

| | | | | | | | |

| | |

| California — 1.6% | | | | | | |

California Statewide Communities Development Authority, SAB, Series A, RB, 5.00%, 12/01/41(a) | | | 2,500 | | | | 2,426,765 | |

| | | | | | | | |

| | |

| Colorado — 6.2% | | | | | | |

City & County of Denver Colorado Airport System Revenue, Refunding ARB, Series D, AMT, 5.00%, 11/15/42 | | | 4,000 | | | | 4,137,816 | |

Colorado Health Facilities Authority, Refunding RB, Series A, 4.00%, 08/01/39 | | | 750 | | | | 676,180 | |

E-470 Public Highway Authority, Refunding RB, Series A, 5.00%, 09/01/40 | | | 3,800 | | | | 3,840,987 | |

Eagle County Airport Terminal Corp., RB, Series B, AMT, 5.00%, 05/01/41 | | | 1,000 | | | | 1,018,814 | |

| | | | | | | | |

| | |

| | | | | | | 9,673,797 | |

| | |

| District of Columbia — 0.7% | | | | | | |

District of Columbia, RB, Class A, AMT, 5.50%, 02/28/37 | | | 1,000 | | | | 1,068,643 | |

| | | | | | | | |

| | |

| Illinois — 11.0% | | | | | | |

Chicago Board of Education, GO, Series C, 5.25%, 12/01/39 | | | 2,650 | | | | 2,655,509 | |

Chicago Midway International Airport, Refunding ARB, Series A, AMT, 2nd Lien, 5.00%, 01/01/34 | | | 1,500 | | | | 1,505,402 | |

City of Chicago Illinois Waterworks Revenue, Refunding RB, 2nd Lien, 5.00%, 11/01/42 | | | 2,000 | | | | 2,000,094 | |

City of Chicago Illinois, Refunding GO, Series A, 5.50%, 01/01/41 | | | 1,855 | | | | 1,930,550 | |

Illinois Finance Authority, Refunding RB, 4.00%, 08/15/41 | | | 1,170 | | | | 1,115,175 | |

Illinois Housing Development Authority, RB, Series G, (FHLMC, FNMA, GNMA), 4.85%, 10/01/42 | | | 5,000 | | | | 5,074,800 | |

Metropolitan Pier & Exposition Authority, RB, Series A, (NPFGC), 0.00%, 06/15/37(b) | | | 2,000 | | | | 1,013,260 | |

State of Illinois, GO, 5.00%, 02/01/39 | | | 1,850 | | | | 1,850,472 | |

| | | | | | | | |

| | |

| | | | | | | 17,145,262 | |

| | |

| Kansas — 0.2% | | | | | | |

City of Manhattan Kansas, Refunding RB, Series A, 4.00%, 06/01/26 | | | 315 | | | | 304,476 | |

| | | | | | | | |

| | |

| Louisiana — 0.6% | | | | | | |

Louisiana Housing Corp., RB, Series B, (FHLMC, FNMA, GNMA), 4.60%, 12/01/42 | | | 1,000 | | | | 1,003,395 | |

| | | | | | | | |

| | |

| Maryland — 3.6% | | | | | | |

Maryland Community Development Administration, RB, (FHLMC, FNMA, GNMA), 4.95%, 09/01/42 | | | 4,000 | | | | 4,114,476 | |

Maryland Economic Development Corp., RB, AMT, 5.00%, 12/31/40 | | | 1,500 | | | | 1,543,974 | |

| | | | | | | | |

| | |

| | | | | | | 5,658,450 | |

| | |

| Massachusetts — 0.6% | | | | | | |

Massachusetts Development Finance Agency, RB, 5.00%, 07/01/42 | | | 1,000 | | | | 997,802 | |

| | | | | | | | |

| | |

| Michigan — 8.0% | | | | | | |

Michigan Finance Authority, Refunding RB | | | | | | | | |

5.00%, 11/15/41 | | | 1,000 | | | | 1,022,255 | |

5.00%, 12/01/42 | | | 4,865 | | | | 5,007,165 | |

| | | | | | | | |

| Security | | Par (000) | | | Value | |

| | |

Michigan (continued) | | | | | | | | |

Michigan State Housing Development Authority, RB | | | | | | | | |

Series D, 5.10%, 12/01/37 | | $ | 2,250 | | | $ | 2,359,429 | |

Series D, 5.20%, 12/01/40 | | | 2,750 | | | | 2,882,352 | |

Wayne County Airport Authority, RB, Series D, 5.00%, 12/01/40 | | | 1,230 | | | | 1,262,388 | |

| | | | | | | | |

| | |

| | | | | | | 12,533,589 | |

| | |

| Minnesota — 1.0% | | | | | | |

Minnesota Housing Finance Agency, RB, S/F Housing, Series N, (FHLMC, FNMA, GNMA), 5.10%, 07/01/42 | | | 1,500 | | | | 1,556,535 | |

| | | | | | | | |

| | |

| Mississippi(c) — 2.9% | | | | | | |

County of Jackson Mississippi, Refunding RB, 3.55%, 06/01/23 | | | 4,000 | | | | 4,000,000 | |

Mississippi Business Finance Corp., RB, AMT, 7.75%, 07/15/47 | | | 500 | | | | 504,860 | |

| | | | | | | | |

| | |

| | | | | | | 4,504,860 | |

| | |

| Nevada(a) — 0.6% | | | | | | |

City of North Las Vegas Nevada, GO, BAB | | | | | | | | |

5.50%, 06/01/37 | | | 500 | | | | 497,015 | |

5.75%, 06/01/42 | | | 500 | | | | 498,184 | |

| | | | | | | | |

| | |

| | | | | | | 995,199 | |

| | |

| New Jersey — 8.8% | | | | | | |

New Jersey Economic Development Authority, RB, Series A, 5.00%, 06/15/42 | | | 1,500 | | | | 1,532,663 | |

New Jersey Transportation Trust Fund Authority, RB, 5.00%, 06/15/42 | | | 2,700 | | | | 2,806,466 | |

South Jersey Port Corp. Refunding RB, Series S, 5.00%, 01/01/39 | | | 1,350 | | | | 1,372,078 | |

South Jersey Transportation Authority, Refunding RB, Series A, 5.00%, 11/01/39 | | | 3,000 | | | | 2,954,331 | |

Triborough Bridge & Tunnel Authority Refunding RB, 3.50%, 01/01/32(c) | | | 5,000 | | | | 5,000,000 | |

| | | | | | | | |

| | |

| | | | | | | 13,665,538 | |

| | |

| New York — 14.5% | | | | | | |

Build NYC Resource Corp., RB, 5.00%, 06/01/32(a) | | | 400 | | | | 402,401 | |

City of New York GO, 3.49%, 09/01/49(c) | | | 5,000 | | | | 5,000,000 | |

Metropolitan Transportation Authority, RB, Series B, 5.25%, 11/15/37 | | | 1,000 | | | | 1,006,566 | |

Metropolitan Transportation Authority, Refunding RB | | | | | | | | |

Series B, 5.00%, 11/15/40 | | | 1,000 | | | | 1,002,897 | |

Series C, 5.00%, 11/15/42 | | | 500 | | | | 501,862 | |

Monroe County Industrial Development Corp., RB, Series A, 5.00%, 12/01/37 | | | 1,670 | | | | 1,670,242 | |

New York City Housing Development Corp., RB, M/F Housing, 4.60%, 11/01/42 | | | 1,500 | | | | 1,501,954 | |

New York City Municipal Water Finance Authority, Refunding RB, Refunding RB, VRDN, 3.85%, 01/04/23(c) | | | 5,000 | | | | 5,000,000 | |

New York Convention Center Development Corp., Refunding RB, 5.00%, 11/15/40 | | | 2,500 | | | | 2,521,520 | |

New York Transportation Development Corp., ARB, AMT, 5.00%, 01/01/36 | | | 1,500 | | | | 1,495,749 | |

New York Transportation Development Corp., RB, AMT, 5.00%, 10/01/40 | | | 1,500 | | | | 1,442,936 | |

Onondaga Civic Development Corp., RB, 5.00%, 07/01/40 | | | 1,075 | | | | 1,082,221 | |

| | | | | | | | |

| | |

| | | | | | | 22,628,348 | |

| | |

SCHEDULE OF INVESTMENTS | | 7 |

| | |

Schedule of Investments (continued) December 31, 2022 | | BlackRock 2037 Municipal Target Term Trust (BMN) (Percentages shown are based on Net Assets) |

| | | | | | | | |

| Security | | Par (000) | | | Value | |

| | |

| North Carolina — 1.0% | | | | | | |

North Carolina Medical Care Commission, Refunding RB, 5.00%, 10/01/30 | | $ | 500 | | | $ | 496,993 | |

North Carolina Turnpike Authority, Refunding RB, Series A, 5.00%, 07/01/42 | | | 995 | | | | 1,002,427 | |

| | | | | | | | |

| | |

| | | | | | | 1,499,420 | |

| | |

| Ohio — 3.1% | | | | | | |

County of Franklin Ohio, RB, 5.00%, 05/15/40 | | | 3,140 | | | | 3,221,213 | |

State of Ohio, RB, AMT, 5.00%, 12/31/39 | | | 1,680 | | | | 1,692,059 | |

| | | | | | | | |

| | |

| | | | | | | 4,913,272 | |

| | |

| Oklahoma — 0.6% | | | | | | |

Tulsa County Industrial Authority, Refunding RB, 5.25%, 11/15/37 | | | 1,000 | | | | 1,000,150 | |

| | | | | | | | |

| | |

| Oregon — 1.2% | | | | | | |

Port of Portland Oregon Airport Revenue, ARB, Series 24B, AMT, 5.00%, 07/01/42 | | | 1,835 | | | | 1,862,048 | |

| | | | | | | | |

| | |

| Pennsylvania — 11.3% | | | | | | |

Allentown Neighborhood Improvement Zone Development Authority, Refunding RB, 5.00%, 05/01/42 | | | 2,580 | | | | 2,540,167 | |

General Authority of Southcentral Pennsylvania, Refunding RB, 5.00%, 06/01/39 | | | 5,000 | | | | 5,228,100 | |

Montgomery County Industrial Development Authority, Refunding RB, 5.00%, 11/15/36 | | | 350 | | | | 351,014 | |

Pennsylvania Economic Development Financing Authority, Refunding RB, AMT, 5.50%, 06/30/43 | | | 5,000 | | | | 5,171,270 | |

Pennsylvania Higher Educational Facilities Authority, Refunding RB, 5.00%, 05/01/41 | | | 1,500 | | | | 1,557,713 | |

Pennsylvania Turnpike Commission, RB, Sub-Series B-1, 5.00%, 06/01/42 | | | 1,500 | | | | 1,543,373 | |

Philadelphia Gas Works Co., Refunding RB, 5.00%, 08/01/42 | | | 1,170 | | | | 1,204,979 | |

| | | | | | | | |

| | |

| | | | | | | 17,596,616 | |

| | |

| Puerto Rico — 5.8% | | | | | | |

Commonwealth of Puerto Rico, GO, Series A1, Restructured, 5.75%, 07/01/31 | | | 3,447 | | | | 3,552,065 | |

Puerto Rico Commonwealth Aqueduct & Sewer Authority, Refunding RB | | | | | | | | |

Series A, 5.00%, 07/01/29(a) | | | 1,785 | | | | 1,765,847 | |

Series B, 0.00%, 07/01/32(b) | | | 1,500 | | | | 889,578 | |

Puerto Rico Sales Tax Financing Corp. Sales Tax Revenue, RB | | | | | | | | |

Series A-2, Convertiable, Restructured, 4.33%, 07/01/40 . | | | 1,500 | | | | 1,331,791 | |

Series A-1, RB, 4.55%, 07/01/40 | | | 1,750 | | | | 1,592,187 | |

| | | | | | | | |

| | |

| | | | | | | 9,131,468 | |

| | |

| South Carolina — 1.1% | | | | | | |

South Carolina Public Service Authority, Refunding RB, Series E, 5.50%, 12/01/42 | | | 1,500 | | | | 1,632,828 | |

| | | | | | | | |

| | |

| Tennessee — 2.3% | | | | | | |

Metropolitan Government Nashville & Davidson County Health & Educational Facilities Board, RB, 5.00%, 10/01/41 | | | 1,000 | | | | 961,325 | |

Tennergy Corp., RB, Series A, 5.50%, 10/01/53(c) | | | 1,500 | | | | 1,580,715 | |

Tennessee Energy Acquisition Corp., RB, Series A, 5.00%, 05/01/52(c) | | | 925 | | | | 973,479 | |

| | | | | | | | |

| | |

| | | | | | | 3,515,519 | |

| | | | | | | | |

| Security | | Par (000) | | | Value | |

| | |

| Texas — 5.9% | | | | | | |

Central Texas Turnpike System, RB, Series C, 5.00%, 08/15/42 | | $ | 1,500 | | | $ | 1,523,005 | |

City of Austin Texas Electric Utility Revenue, Refunding RB, 5.00%, 11/15/40 | | | 1,600 | | | | 1,601,693 | |

Harris County Cultural Education Facilities Finance Corp., Refunding RB, 5.00%, 01/01/27 | | | 895 | | | | 887,482 | |

San Antonio Water System, Refunding RB, Series A, Junior Lien, 4.00%, 05/15/40 | | | 810 | | | | 813,422 | |

Tarrant County Cultural Education Facilities Finance Corp., Refunding RB | | | | | | | | |

5.00%, 11/15/40 | | | 1,500 | | | | 1,418,429 | |

Series A-1, 5.00%, 10/01/44 | | | 3,020 | | | | 2,945,451 | |

| | | | | | | | |

| | |

| | | | | | | 9,189,482 | |

| | |

| Vermont — 0.8% | | | | | | |

Vermont Economic Development Authority, RB, AMT, 4.63%, 04/01/36(a)(c) | | | 1,300 | | | | 1,265,425 | |

| | | | | | | | |

| | |

| Washington — 1.6% | | | | | | |

University of Washington, Refunding RB, Series C, 4.00%, 12/01/40 | | | 2,500 | | | | 2,443,042 | |

Washington State Housing Finance Commission, Refunding RB, 5.00%, 07/01/33 | | | 105 | | | | 105,328 | |

| | | | | | | | |

| | |

| | | | | | | 2,548,370 | |

| | |

| Wisconsin — 4.1% | | | | | | |

Public Finance Authority, Refunding RB, Series B, AMT, 5.00%, 07/01/42 | | | 1,500 | | | | 1,467,292 | |

University of Wisconsin Hospitals & Clinics, Refunding RB, Series B, 3.60%, 04/01/48(c) | | | 5,000 | | | | 5,000,000 | |

| | | | | | | | |

| | |

| | | | | | | 6,467,292 | |

| | | | | | | | |

| | |

Total Long-Term Investments — 100.4%

(Cost: $154,913,872) | | | | | | | 156,826,719 | |

| | | | | | | | |

| | |

| | | Shares | | | | |

| | |

Short-Term Securities | | | | | | | | |

| | |

| Money Market Funds — 0.0% | | | | | | |

BlackRock Liquidity Funds, MuniCash, Institutional Class, 3.09%(d)(e) | | | 95,796 | | | | 95,787 | |

| | | | | | | | |

| |

Total Short-Term Securities — 0.0%

(Cost: $95,787) | | | | 95,787 | |

| | | | | | | | |

| |

Total Investments — 100.4%

(Cost: $155,009,659) | | | | 156,922,506 | |

| |

Liabilities in Excess of Other Assets — (0.4)% | | | | (675,901 | ) |

| | | | | | | | |

| |

Net Assets — 100.0% | | | $ | 156,246,605 | |

| | | | | | | | |

| (a) | Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration to qualified institutional investors. |

| (c) | Variable rate security. Interest rate resets periodically. The rate shown is the effective interest rate as of period end. Security description also includes the reference rate and spread if published and available. |

| (d) | Affiliate of the Trust. |

| (e) | Annualized 7-day yield as of period end. |

For Trust compliance purposes, the Trust’s industry classifications refer to one or more of the industry sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease.

| | |

| 8 | | 2 0 2 2 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

| | |

Schedule of Investments (continued) December 31, 2022 | | BlackRock 2037 Municipal Target Term Trust (BMN) |

Affiliates

Investments in issuers considered to be affiliate(s) of the Trust during the period ended December 31, 2022 for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Affiliated Issuer | |

| Value at

10/28/22 |

(a) | |

| Purchases

at Cost |

| |

| Proceeds

from Sales |

| |

| Net

Realized Gain (Loss) |

| |

| Change in

Unrealized Appreciation (Depreciation) |

| |

| Value at

12/31/22 |

| |

| Shares

Held at 12/31/22 |

| | | Income | | |

| Capital Gain

Distributions from Underlying Funds |

|

| |

| | | | | | | | | | | | |

BlackRock Liquidity Funds, MuniCash, Institutional Class | | $ | — | | | $ | 83,861 | (b) | | $ | — | | | $ | 11,926 | | | $ | — | | | | | | | $ | 95,787 | | | | 95,796 | | | $ | 180,901 | | | | | | | $ | — | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | (a) | Commencement of operations. | |

| | (b) | Represents net amount purchased (sold). | |

Fair Value Hierarchy as of Period End

Various inputs are used in determining the fair value of financial instruments. For a description of the input levels and information about the Trust’s policy regarding valuation of financial instruments, refer to the Notes to Financial Statements.

The following table summarizes the Trust’s financial instruments categorized in the fair value hierarchy. The breakdown of the Trust’s financial instruments into major categories is disclosed in the Schedule of Investments above.

| | | | | | | | | | | | | | | | |

| |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| |

| | | | |

Assets | | | | | | | | | | | | | | | | |

Investments | | | | | | | | | | | | | | | | |

Long-Term Investments | | | | | | | | | | | | | | | | |

Municipal Bonds | | $ | — | | | $ | 156,826,719 | | | $ | — | | | $ | 156,826,719 | |

Short-Term Securities | | | | | | | | | | | | | | | | |

Money Market Funds | | | 95,787 | | | | — | | | | — | | | | 95,787 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | $ | 95,787 | | | $ | 156,826,719 | | | $ | — | | | $ | 156,922,506 | |

| | | | | | | | | | | | | | | | |

See notes to financial statements.

| | | | |

SCHEDULE OF INVESTMENTS | | | 9 | |

Statement of Assets and Liabilities

December 31, 2022

| | | | |

| | | BMN | |

| |

| |

ASSETS | | | | |

Investments, at value — unaffiliated(a) | | $ | 156,826,719 | |

Investments, at value — affiliated(b) | | | 95,787 | |

Receivables: | | | | |

Dividends — affiliated | | | 53,602 | |

Interest — unaffiliated | | | 1,335,318 | |

| | | | |

| |

Total assets | | | 158,311,426 | |

| | | | |

| |

LIABILITIES | | | | |

Payables: | | | | |

Investments purchased | | | 1,938,594 | |

Accounting services fees | | | 4,413 | |

Custodian fees | | | 934 | |

Investment advisory fees | | | 67,212 | |

Trustees’ and Officer’s fees | | | 618 | |

Other accrued expenses | | | 3,756 | |

Professional fees | | | 46,746 | |

Transfer agent fees | | | 2,548 | |

| | | | |

| |

Total liabilities | | | 2,064,821 | |

| | | | |

| |

NET ASSETS | | $ | 156,246,605 | |

| | | | |

| |

NET ASSETS APPLICABLE TO COMMON SHAREHOLDERS CONSIST OF | | | | |

Paid-in capital(c)(d)(e) | | $ | 153,691,325 | |

Accumulated earnings | | | 2,555,280 | |

| | | | |

| |

NET ASSETS | | $ | 156,246,605 | |

| | | | |

| |

Net asset value | | $ | 25.42 | |

| | | | |

| |

(a) Investments, at cost — unaffiliated | | $ | 154,913,872 | |

(b) Investments, at cost — affiliated | | $ | 95,787 | |

(c) Shares outstanding | | | 6,147,653 | |

(d) Shares authorized | | | Unlimited | |

(e) Par value | | $ | 0.001 | |

See notes to financial statements.

| | |

| 10 | | 2 0 2 2 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

Statement of Operations

Period Ended December 31, 2022

| | | | |

| | | BMN(a) | |

| |

| |

INVESTMENT INCOME | | | | |

Dividends — affiliated | | $ | 180,901 | |

Interest — unaffiliated | | | 634,676 | |

| | | | |

| |

Total investment income | | | 815,577 | |

| | | | |

| |

EXPENSES | | | | |

Investment advisory | | | 133,205 | |

Professional | | | 46,746 | |

Accounting services | | | 4,413 | |

Trustees and Officer | | | 2,750 | |

Transfer agent | | | 2,548 | |

Printing and postage | | | 1,726 | |

Custodian | | | 934 | |

Miscellaneous | | | 2,124 | |

| | | | |

| |

Total expenses | | | 194,446 | |

Less: | | | | |

Fees waived and/or reimbursed by the Manager | | | (9,376 | ) |

| | | | |

| |

Total expenses after fees waived and/or reimbursed | | | 185,070 | |

| | | | |

| |

Net investment income | | | 630,507 | |

| | | | |

| |

REALIZED AND UNREALIZED GAIN (LOSS) | | | | |

Net realized gain from: | | | | |

Investments — affiliated | | | 11,926 | |

Net change in unrealized appreciation (depreciation) on: | | | | |

Investments — unaffiliated | | | 1,912,847 | |

| | | | |

Net realized and unrealized gain | | | 1,924,773 | |

| | | | |

| |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 2,555,280 | |

| | | | |

| (a) | For the period from October 28, 2022 (commencement of operations) to December 31, 2022. |

See notes to financial statements.

Statement of Changes in Net Assets

| | | | |

| | | BMN | |

| |

| |

| Period from

10/28/22to 12/31/22 |

(a) |

| |

| |

INCREASE (DECREASE) IN NET ASSETS | | | | |

| |

OPERATIONS | | | | |

Net investment income | | $ | 630,507 | |

Net realized gain | | | 11,926 | |

Net change in unrealized appreciation (depreciation) | | | 1,912,847 | |

| | | | |

| |

Net increase in net assets resulting from operations | | | 2,555,280 | |

| | | | |

| |

CAPITAL SHARE TRANSACTIONS | | | | |

Net proceeds from the issuance of shares | | | 153,691,325 | |

| | | | |

| |

NET ASSETS | | | | |

Total increase in net assets | | | 156,246,605 | |

Beginning of period | | | — | |

| | | | |

| |

End of period | | $ | 156,246,605 | |

| | | | |

| (a) | Commencement of operations. |

See notes to financial statements.

| | |

| 12 | | 2 0 2 2 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

Financial Highlights

(For a share outstanding throughout each period)

| | | | | | | | |

| | | BMN | |

| | | Period from | |

| | | | | | | 10/28/22 | (a) |

| | | | to 12/31/22 | |

| | | |

Net asset value, beginning of period | | | | | | $ | 25.00 | |

| | | | | | | | |

| | |

Net investment income(b) | | | | | | | 0.11 | |

Net realized and unrealized gain | | | | | | | 0.31 | |

| | | | | | | | |

| | |

Net increase from investment operations | | | | | | | 0.42 | |

| | | | | | | | |

| | |

Net asset value, end of period | | | | | | $ | 25.42 | |

| | | | | | | | |

| | |

Market price, end of period | | | | | | $ | 24.44 | |

| | | | | | | | |

| | |

Total Return(c) | | | | | | | | |

Based on net asset value | | | | | | | 1.68 | %(d) |

| | | | | | | | |

Based on market price | | | | | | | (2.24 | )%(d) |

| | | | | | | | |

| | |

Ratios to Average Net Assets(e) | | | | | | | | |

Total expenses | | | | | | | 0.65 | %(f)(g) |

| | | | | | | | |

| | |

Total expenses after fees waived and/or reimbursed | | | | | | | 0.61 | %(f)(g) |

| | | | | | | | |

| | |

Net investment income | | | | | | | 2.60 | %(g) |

| | | | | | | | |

| | |

Supplemental Data | | | | | | | | |

Net assets, end of period (000) | | | | | | $ | 156,247 | |

| | | | | | | | |

| | |

Portfolio turnover rate | | | | | | | 38 | % |

| | | | | | | | |

| (a) | Commencement of operations. |

| (b) | Based on average shares outstanding. |

| (c) | Total returns based on market price, which can be significantly greater or less than the net asset value, may result in substantially different returns. Where applicable, excludes the effects of any sales charges and assumes the reinvestment of distributions at actual reinvestment prices. |

| (e) | Excludes fees and expenses incurred indirectly as a result of investments in underlying funds. |

| (f) | Audit and printing costs were not annualized in the calculation of the expense ratios. If these expenses were annualized, the total expenses and total expenses after fees waived and/or reimbursed would have been 0.80% and 0.76%. |

See notes to financial statements.

Notes to Financial Statements

BlackRock 2037 Municipal Target Term Trust (the “Trust”) is registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Trust is registered as a non-diversified, closed-end management investment company. The Trust is organized as a Maryland statutory trust. The Trust determines and makes available for publication the net asset value (“NAV”) of its Common Shares on a daily basis.

Prior to commencement of operations on October 28, 2022, the Trust had no operations other than those relating to organizational matters and the sale of 4,000 Common Shares on August 1, 2022 to BlackRock Financial Management, Inc., an affiliate of the Trust, for $100,000. Investment operations for the Trust commenced on October 28, 2022.

The Trust, together with certain other registered investment companies advised by BlackRock Advisors, LLC (the “Manager”) or its affiliates, is included in a complex of funds referred to as the BlackRock Fixed-Income Complex.

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

The financial statements are prepared in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”), which may require management to make estimates and assumptions that affect the reported amounts of assets and liabilities in the financial statements, disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. The Trust is considered an investment company under U.S. GAAP and follows the accounting and reporting guidance applicable to investment companies. Below is a summary of significant accounting policies:

Investment Transactions and Income Recognition: For financial reporting purposes, investment transactions are recorded on the dates the transactions are executed. Realized gains and losses on investment transactions are determined using the specific identification method. Dividend income and capital gain distributions, if any, are recorded on the ex-dividend dates. Non-cash dividends, if any, are recorded on the ex-dividend dates at fair value. Interest income, including amortization and accretion of premiums and discounts on debt securities, is recognized daily on an accrual basis.

Collateralization: If required by an exchange or counterparty agreement, the Trust may be required to deliver/deposit cash and/or securities to/with an exchange, or broker-dealer or custodian as collateral for certain investments.

Distributions: Distributions from net investment income are declared and paid monthly. Distributions of capital gains are recorded on the ex-dividend dates and made at least annually. The character and timing of distributions are determined in accordance with U.S. federal income tax regulations, which may differ from U.S. GAAP.

Deferred Compensation Plan: Under the Deferred Compensation Plan (the “Plan”) approved by the Board of Trustees of the Trust (the “Board”), the trustees who are not “interested persons” of the Trust, as defined in the 1940 Act (“Independent Trustees”), may defer a portion of their annual complex-wide compensation. Deferred amounts earn an approximate return as though equivalent dollar amounts had been invested in common shares of certain funds in the BlackRock Fixed-Income Complex selected by the Independent Trustees. This has the same economic effect for the Independent Trustees as if the Independent Trustees had invested the deferred amounts directly in certain funds in the BlackRock Fixed-Income Complex.

The Plan is not funded and obligations thereunder represent general unsecured claims against the general assets of the Trust, as applicable. Deferred compensation liabilities, if any, are included in the Trustees’ and Officer’s fees payable in the Statement of Assets and Liabilities and will remain as a liability of the Trust until such amounts are distributed in accordance with the Plan. Net appreciation (depreciation) in the value of participants’ deferral accounts is allocated among the participating funds in the BlackRock Fixed-Income Complex and reflected as Trustees and Officer expense on the Statement of Operations. The Trustees and Officer expense may be negative as a result of a decrease in value of the deferred accounts.

Organization and Offering Costs: Organization costs associated with the establishment of the Trust and offering expenses of the Trust with respect to the issuance of shares in the amount of $83,000 and $682,675, respectively, were paid by the Manager. The Trust is not obligated to repay any such organizational costs or offering expenses paid by the Manager.

Indemnifications: In the normal course of business, the Trust enters into contracts that contain a variety of representations that provide general indemnification. The Trust’s maximum exposure under these arrangements is unknown because it involves future potential claims against the Trust, which cannot be predicted with any certainty.

Other: Expenses directly related to the Trust are charged to the Trust. Other operating expenses shared by several funds, including other funds managed by the Manager, are prorated among those funds on the basis of relative net assets or other appropriate methods.

| 3. | INVESTMENT VALUATION AND FAIR VALUE MEASUREMENTS |

Investment Valuation Policies: The Trust’s investments are valued at fair value (also referred to as “market value” within the financial statements) each day that the Trust is open for business and, for financial reporting purposes, as of the report date. U.S. GAAP defines fair value as the price a fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. The Board has approved the designation of the Trust’s Manager as the valuation designee for the Trust. The Trust determines the fair values of its financial instruments using various independent dealers or pricing services under the Manager’s policies. If a security’s market price is not readily available or does not otherwise accurately represent the fair value of the security, the security will be valued in accordance with the Manager’s policies and procedures as reflecting fair value. The Manager has formed a committee (the “Valuation Committee”) to develop pricing policies and procedures and to oversee the pricing function for all financial instruments, with assistance from other BlackRock pricing committees.

| | |

| 14 | | 2 0 2 2 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

Notes to Financial Statements (continued)

Fair Value Inputs and Methodologies: The following methods and inputs are used to establish the fair value of the Trust’s assets and liabilities:

| | • | | Fixed-income investments for which market quotations are readily available are generally valued using the last available bid price or current market quotations provided by independent dealers or third-party pricing services. Floating rate loan interests are valued at the mean of the bid prices from one or more independent brokers or dealers as obtained from a third-party pricing service. Pricing services generally value fixed-income securities assuming orderly transactions of an institutional round lot size, but a fund may hold or transact in such securities in smaller, odd lot sizes. Odd lots may trade at lower prices than institutional round lots. The pricing services may use matrix pricing or valuation models that utilize certain inputs and assumptions to derive values, including transaction data (e.g., recent representative bids and offers), market data, credit quality information, perceived market movements, news, and other relevant information. Certain fixed-income securities, including asset- backed and mortgage related securities may be valued based on valuation models that consider the estimated cash flows of each tranche of the entity, establish a benchmark yield and develop an estimated tranche specific spread to the benchmark yield based on the unique attributes of the tranche. The amortized cost method of valuation may be used with respect to debt obligations with sixty days or less remaining to maturity unless the Manager determines such method does not represent fair value. |

| | • | | Investments in open-end U.S. mutual funds (including money market funds) are valued at that day’s published NAV. |

If events (e.g., market volatility, company announcement or a natural disaster) occur that are expected to materially affect the value of such investment, or in the event that application of these methods of valuation results in a price for an investment that is deemed not to be representative of the market value of such investment, or if a price is not available, the investment will be valued by the Valuation Committee in accordance with the Manager’s policies and procedures as reflecting fair value (“Fair Valued Investments”). The fair valuation approaches that may be used by the Valuation Committee include market approach, income approach and cost approach. Valuation techniques such as discounted cash flow, use of market comparables and matrix pricing are types of valuation approaches and are typically used in determining fair value. When determining the price for Fair Valued Investments, the Valuation Committee seeks to determine the price that the Trust might reasonably expect to receive or pay from the current sale or purchase of that asset or liability in an arm’s-length transaction. Fair value determinations shall be based upon all available factors that the Valuation Committee deems relevant and consistent with the principles of fair value measurement.

Fair Value Hierarchy: Various inputs are used in determining the fair value of financial instruments. These inputs to valuation techniques are categorized into a fair value hierarchy consisting of three broad levels for financial reporting purposes as follows:

| | • | | Level 1 – Unadjusted price quotations in active markets/exchanges for identical assets or liabilities that the Trust has the ability to access; |

| | • | | Level 2 – Other observable inputs (including, but not limited to, quoted prices for similar assets or liabilities in markets that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the assets or liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates) or other market–corroborated inputs); and |

| | • | | Level 3 – Unobservable inputs based on the best information available in the circumstances, to the extent observable inputs are not available (including the Valuation Committee’s assumptions used in determining the fair value of financial instruments). |

The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the fair value hierarchy classification is determined based on the lowest level input that is significant to the fair value measurement in its entirety. Investments classified within Level 3 have significant unobservable inputs used by the Valuation Committee in determining the price for Fair Valued Investments. Level 3 investments include equity or debt issued by privately held companies or funds that may not have a secondary market and/or may have a limited number of investors. The categorization of a value determined for financial instruments is based on the pricing transparency of the financial instruments and is not necessarily an indication of the risks associated with investing in those securities.

| 4. | SECURITIES AND OTHER INVESTMENTS |

Zero-Coupon Bonds: Zero-coupon bonds are normally issued at a significant discount from face value and do not provide for periodic interest payments. These bonds may experience greater volatility in market value than other debt obligations of similar maturity which provide for regular interest payments.

| 5. | INVESTMENT ADVISORY AGREEMENT AND OTHER TRANSACTIONS WITH AFFILIATES |

Investment Advisory: The Trust entered into an Investment Advisory Agreement with the Manager, the Trust’s investment adviser and an indirect, wholly-owned subsidiary of BlackRock, Inc. (“BlackRock”), to provide investment advisory and administrative services. The Manager is responsible for the management of the Trust’s portfolio and provides the personnel, facilities, equipment and certain other services necessary to the operations of the Trust.

For such services, the Trust pays the Manager a monthly fee at an annual rate equal to 0.55% of the average daily value of the Trust’s managed assets.

For purposes of calculating this fee, “managed assets” are determined as total assets of the Trust (including any assets attributable to money borrowed for investment purposes) less the sum of its accrued liabilities (other than money borrowed for investment purposes).

Expense Waivers: The Manager contractually agreed to waive its investment advisory fees by the amount of investment advisory fees the Trust pays to the Manager indirectly through its investment in affiliated money market funds (the “affiliated money market fund waiver”) through June 30, 2024. The contractual agreement may be terminated upon 90 days’ notice by a majority of the Independent Trustees, or by a vote of a majority of the outstanding voting securities of the Trust. This amount is included in fees waived and/or reimbursed by the Manager in the Statement of Operations. For the period ended December 31, 2022, the amount waived was $9,376.

| | | | |

NOTES TO FINANCIAL STATEMENTS | | | 15 | |

Notes to Financial Statements (continued)

The Manager contractually agreed to waive its investment advisory fee with respect to any portion of the Trust’s assets invested in affiliated equity and fixed-income mutual funds and affiliated exchange-traded funds that have a contractual management fee through June 30, 2024. The agreement can be renewed for annual periods thereafter, and may be terminated on 90 days’ notice, each subject to approval by a majority of the Trust’s Independent Trustees. For the period ended December 31, 2022, there were no fees waived by the Manager pursuant to this arrangement.

Trustees and Officers: Certain trustees and/or officers of the Trust are directors and/or officers of BlackRock or its affiliates. The Trust reimburses the Manager for a portion of the compensation paid to the Trust’s Chief Compliance Officer, which is included in Trustees and Officer in the Statement of Operations.

For the period ended December 31, 2022, purchases and sales of investments, excluding short-term securities, were $180,904,583 and $30,000,000, respectively.

It is the Trust’s policy to comply with the requirements of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies, and to distribute substantially all of its taxable income to its shareholders. Therefore, no U.S. federal income tax provision is required.

The Trust files U.S. federal and various state and local tax returns. No income tax returns are currently under examination. The statute of limitations on the Trust’s U.S. federal tax returns generally remains open for a period of three years after they are filed. The statutes of limitations on the Trust’s state and local tax returns may remain open for an additional year depending upon the jurisdiction.

Management has analyzed tax laws and regulations and their application to the Trust as of December 31, 2022, inclusive of the open tax return years, and does not believe that there are any uncertain tax positions that require recognition of a tax liability in the Trust’s financial statements.

As of December 31, 2022, the tax components of accumulated earnings (loss) were as follows:

| | | | | | | | | | | | | | | | |

| |

| Trust Name | | Undistributed

Tax-Exempt Income | | | Undistributed

Ordinary Income | | | Net Unrealized

Gains (Losses)(a) | | | Total | |

| |

| | | | |

BMN | | $ | 626,493 | | | $ | 13,333 | | | $ | 1,915,454 | | | $ | 2,555,280 | |

| |

| | (a) | The difference between book-basis and tax-basis net unrealized gains was attributable primarily to the tax deferral of losses on wash sales and amortization methods for premiums and discounts on fixed income securities. | |

As of December 31, 2022, gross unrealized appreciation and depreciation based on cost of investments (including short positions and derivatives, if any) for U.S. federal income tax purposes were as follows:

| | | | | | | | | | | | | | | | |

| |

| Trust Name | | Tax Cost | | | Gross Unrealized

Appreciation | | | Gross Unrealized Depreciation | | | Net Unrealized

Appreciation

(Depreciation) | |

| |

| | | | |

BMN | | $ | 155,007,052 | | | $ | 2,513,508 | | | $ | (598,054 | ) | | $ | 1,915,454 | |

| |

In the normal course of business, the Trust invests in securities or other instruments and may enter into certain transactions, and such activities subject the Trust to various risks, including among others, fluctuations in the market (market risk) or failure of an issuer to meet all of its obligations. The value of securities or other instruments may also be affected by various factors, including, without limitation: (i) the general economy; (ii) the overall market as well as local, regional or global political and/or social instability; (iii) regulation, taxation or international tax treaties between various countries; or (iv) currency, interest rate and price fluctuations. Local, regional or global events such as war, acts of terrorism, the spread of infectious illness or other public health issues, recessions, or other events could have a significant impact on the Trust and its investments.

The Trust may hold a significant amount of bonds subject to calls by the issuers at defined dates and prices. When bonds are called by issuers and the Trust reinvest the proceeds received, such investments may be in securities with lower yields than the bonds originally held, and correspondingly, could adversely impact the yield and total return performance of the Trust.

The Trust may invest without limitation in illiquid or less liquid investments or investments in which no secondary market is readily available or which are otherwise illiquid, including private placement securities. The Trust may not be able to readily dispose of such investments at prices that approximate those at which the Trust could sell such investments if they were more widely traded and, as a result of such illiquidity, the Trust may have to sell other investments or engage in borrowing transactions if necessary to raise funds to meet its obligations. Limited liquidity can also affect the market price of investments, thereby adversely affecting the Trust’s NAV and ability to make dividend distributions. Privately issued debt securities are often of below investment grade quality, frequently are unrated and present many of the same risks as investing in below investment grade public debt securities.

Market Risk: The Trust may be exposed to prepayment risk, which is the risk that borrowers may exercise their option to prepay principal earlier than scheduled during periods of declining interest rates, which would force the Trust to reinvest in lower yielding securities. The Trust may also be exposed to reinvestment risk, which is the risk that income from the Trust’s portfolio will decline if the Trust invests the proceeds from matured, traded or called fixed-income securities at market interest rates that are below the Trust portfolio’s current earnings rate.

| | |

| 16 | | 2 0 2 2 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

Notes to Financial Statements (continued)

Municipal securities are subject to the risk that litigation, legislation or other political events, local business or economic conditions, credit rating downgrades, or the bankruptcy of the issuer could have a significant effect on an issuer’s ability to make payments of principal and/or interest or otherwise affect the value of such securities. Municipal securities can be significantly affected by political or economic changes, including changes made in the law after issuance of the securities, as well as uncertainties in the municipal market related to, taxation, legislative changes or the rights of municipal security holders, including in connection with an issuer insolvency. Municipal securities backed by current or anticipated revenues from a specific project or specific assets can be negatively affected by the discontinuance of the tax benefits supporting the project or assets or the inability to collect revenues for the project or from the assets. Municipal securities may be less liquid than taxable bonds, and there may be less publicly available information on the financial condition of municipal security issuers than for issuers of other securities.

Infectious Illness Risk: An outbreak of an infectious illness, such as the COVID-19 pandemic, may adversely impact the economies of many nations and the global economy, and may impact individual issuers and capital markets in ways that cannot be foreseen. An infectious illness outbreak may result in, among other things, closed international borders, prolonged quarantines, supply chain disruptions, market volatility or disruptions and other significant economic, social and political impacts.

Investment Objective Risk: There is no assurance that BMN will achieve its investment objectives, including its investment objective of returning $25.00 per share. As BMN approaches its scheduled termination date, it is expected that the maturity of BMN’s portfolio securities will shorten, which is likely to reduce BMN’s income and distributions to shareholders.

Counterparty Credit Risk: The Trust may be exposed to counterparty credit risk, or the risk that an entity may fail to or be unable to perform on its commitments related to unsettled or open transactions, including making timely interest and/or principal payments or otherwise honoring its obligations. The Trust manages counterparty credit risk by entering into transactions only with counterparties that the Manager believes have the financial resources to honor their obligations and by monitoring the financial stability of those counterparties. Financial assets, which potentially expose the Trust to market, issuer and counterparty credit risks, consist principally of financial instruments and receivables due from counterparties. The extent of the Trust’s exposure to market, issuer and counterparty credit risks with respect to these financial assets is approximately their value recorded in the Statement of Assets and Liabilities, less any collateral held by the Trust.

Concentration Risk: A diversified portfolio, where this is appropriate and consistent with a fund’s objectives, minimizes the risk that a price change of a particular investment will have a material impact on the NAV of a fund. The investment concentrations within the Trust’s portfolio are disclosed in its Schedule of Investments.

The Trust invests a significant portion of its assets in fixed-income securities and/or uses derivatives tied to the fixed-income markets. Changes in market interest rates or economic conditions may affect the value and/or liquidity of such investments. Interest rate risk is the risk that prices of bonds and other fixed-income securities will decrease as interest rates rise and increase as interest rates fall. The Trust may be subject to a greater risk of rising interest rates due to the recent period of historically low interest rates. The Federal Reserve has recently begun to raise the federal funds rate as part of its efforts to address inflation. There is a risk that interest rates will continue to rise, which will likely drive down the prices of bonds and other fixed-income securities, and could negatively impact the Trust’s performance.

LIBOR Transition Risk: The United Kingdom’s Financial Conduct Authority announced a phase out of the London Interbank Offered Rate (“LIBOR”). Although many LIBOR rates ceased to be published or no longer are representative of the underlying market they seek to measure after December 31, 2021, a selection of widely used USD LIBOR rates will continue to be published through June 2023 in order to assist with the transition. The Trust may be exposed to financial instruments tied to LIBOR to determine payment obligations, financing terms, hedging strategies or investment value. The transition process away from LIBOR might lead to increased volatility and illiquidity in markets for, and reduce the effectiveness of new hedges placed against instruments whose terms currently include LIBOR. The ultimate effect of the LIBOR transition process on the Trust is uncertain.

| 9. | CAPITAL SHARE TRANSACTIONS |

The Trust is authorized to issue an unlimited number of shares, all of which were initially classified as Common Shares. The Board is authorized, however, to reclassify any unissued Common Shares to Preferred Shares without the approval of Common Shareholders.

For the period October 28, 2022 to December 31, 2022, shares issued and outstanding increased by 5,380,000 from the initial public offering and 763,653 from the underwriters’ exercising the over-allotment option.

As of December 31, 2022, BlackRock Financial Management, Inc., an affiliate of the Trust, owned 4,000 shares of BMN.

Management’s evaluation of the impact of all subsequent events on the Trust’s financial statements was completed through the date the financial statements were issued and the following items were noted:

The Trust declared and paid or will pay distributions to Common Shareholders as follows:

| | | | | | | | | | | | | | | | |

| |

| Trust Name | | Declaration

Date | | | Record

Date | | | Payable/

Paid Date | | | Dividend Per

Common Share | |

| |

| | | | |

BMN | | | 01/03/23 | | | | 01/13/23 | | | | 02/01/23 | | | $ | 0.093750 | |

| | | 02/01/23 | | | | 02/15/23 | | | | 03/01/23 | | | | 0.093750 | |

| |

| | | | |

NOTES TO FINANCIAL STATEMENTS | | | 17 | |

Report of Independent Registered Public Accounting Firm

To the Shareholders and the Board of Trustees of BlackRock 2037 Municipal Target Term Trust:

Opinion on the Financial Statements and Financial Highlights

We have audited the accompanying statement of assets and liabilities of BlackRock 2037 Municipal Target Term Trust (the “Fund”), including the schedule of investments, as of December 31, 2022, the related statements of operations and changes in net assets, and the financial highlights for the period from October 28, 2022 (commencement of operations) through December 31, 2022, and the related notes. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of the Fund as of December 31, 2022, and the results of its operations, the changes in its net assets, and the financial highlights for the period from October 28, 2022 (commencement of operations) through December 31, 2022, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements and financial highlights based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audit we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. Our procedures included confirmation of securities owned as of December 31, 2022, by correspondence with custodians or counterparties; when replies were not received, we performed other auditing procedures. We believe that our audit provides a reasonable basis for our opinion.

Deloitte & Touche LLP

Boston, Massachusetts

February 23, 2023

We have served as the auditor of one or more BlackRock investment companies since 1992.

| | |

| 18 | | 2 0 2 2 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

Important Tax Information (unaudited)

The following amount, or maximum amount allowable by law, is hereby designated as tax-exempt interest dividends for the fiscal year ended December 31, 2022:

| | | | |

| |

| Trust Name | | Exempt-Interest Dividends | |

| |

| |

BMN | | $ | 626,493 | |

| |

| | |

IMPORTANT TAX INFORMATION | | 19 |

Disclosure of Investment Advisory Agreement

The Board of Trustees (the “Board,” the members of which are referred to as “Board Members”) of BlackRock 2037 Municipal Target Term Trust (the “Fund”) met on May 20, 2022 (the “Meeting”) to consider the approval of the proposed investment advisory agreement (the “Agreement”) between the Fund and BlackRock Advisors, LLC (the “Manager” or “BlackRock”), the Fund’s investment advisor.

The Approval Process

Pursuant to the Investment Company Act of 1940 (the “1940 Act”), the Board is required to consider the initial approval of the Agreement. The Board members who are not “interested persons” of the Fund, as defined in the 1940 Act, are considered independent Board members (the “Independent Board Members”). In connection with this process, the Board assessed, among other things, the nature, extent and quality of the services to be provided to the Fund by BlackRock, BlackRock’s personnel and affiliates, including (as applicable): investment management services; accounting oversight; administrative and shareholder services; oversight of the Fund’s service providers; risk management and oversight; and legal, regulatory and compliance services.

At the Meeting, the Board reviewed materials relating to its consideration of the Agreement. The Board considered all factors it believed relevant with respect to the Fund, including, among other factors: (a) the nature, extent and quality of the services to be provided by BlackRock; (b) the investment performance of BlackRock portfolio management; (c) the advisory fee and the estimated cost of the services to be provided and estimated profits to be realized by BlackRock and its affiliates from their relationship with the Fund; (d) the sharing of potential economies of scale; (e) potential fall-out benefits to BlackRock and its affiliates as a result of BlackRock’s relationship with the Fund; and (f) other factors deemed relevant by the Board Members.

In considering approval of the Agreement, the Board met with the relevant investment advisory personnel from BlackRock and considered all information it deemed reasonably necessary to evaluate the terms of the Agreement. The Board received materials in advance of the Meeting relating to its consideration of the Agreement, including, among other things, (a) fees and estimated expense ratios of the Fund in comparison to the fees and expense ratios of a peer group of funds as determined by Broadridge Financial Solutions, Inc. (“Broadridge”) and other metrics, as applicable; (b) information on the composition of the peer group of funds and a description of Broadridge’s methodology; (c) information regarding BlackRock’s economic outlook for the Fund and its general investment outlook for the markets; (d) information regarding fees paid to service providers that are affiliates of BlackRock; and (e) information outlining the legal duties of the Board under the 1940 Act with respect to the consideration and approval of the Agreement. The Board also noted information received at prior Board meetings concerning compliance records and regulatory matters relating to BlackRock.

The Board also considered other matters it deemed important to the approval process, such as other payments to be made to BlackRock or its affiliates relating to securities lending and cash management, and BlackRock’s services related to the valuation and pricing of Fund portfolio holdings. The Board noted the willingness of BlackRock’s personnel to engage in open, candid discussions with the Board. The Board did not identify any particular information as determinative, and each Board Member may have attributed different weights to the various items considered.

A. Nature, Extent and Quality of the Services to be Provided by BlackRock