Table of Contents

As filed with the Securities and Exchange Commission on February 26, 2021.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM F-10

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Cresco Labs Inc.

(Exact name of Registrant as specified in its charter)

| British Columbia, Canada | 2833 | 98-1505364 | ||

(Province or other Jurisdiction of Incorporation or Organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number, if applicable) |

400 W Erie St Suite 110

Chicago, IL 60654

United States

(312) 929-0993

(Address and telephone number of Registrant’s principal executive offices)

John Schetz, General Counsel

Cresco Labs Inc.

400 W Erie St Suite 110

Chicago, IL 60654

United States

(312) 929-0993

(Name, address (including zip code) and telephone number (including area code) of agent for service in the United States)

Copies to:

Heidi Steele

McDermott Will & Emery LLP

444 West Lake Street Suite 4000

Chicago, IL 60606

Telephone: (312) 372-2000

Approximate date of commencement of proposed sale of the securities to the public:

As soon as practicable after this registration statement becomes effective

British Columbia, Canada

(Principal jurisdiction regulating this offering)

It is proposed that this filing shall become effective (check appropriate box below):

| A. | ☐ upon filing with the Commission, pursuant to Rule 467(a) (if in connection with an offering being made contemporaneously in the United States and Canada). |

| B. | ☒ at some future date (check the appropriate box below) |

| 1. | ☐ pursuant to Rule 467(b) on ( ) at ( ) (designate a time not sooner than 7 calendar days after filing). |

| 2. | ☐ pursuant to Rule 467(b) on ( ) at ( ) (designate a time 7 calendar days or sooner after filing) because the securities regulatory authority in the review jurisdiction has issued a receipt or notification of clearance on ( ). |

| 3. | ☐ pursuant to Rule 467(b) as soon as practicable after notification of the Commission by the Registrant or the Canadian securities regulatory authority of the review jurisdiction that a receipt or notification of clearance has been issued with respect hereto. |

| 4. | ☒ after the filing of the next amendment to this Form (if preliminary material is being filed). |

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to the home jurisdiction’s shelf prospectus offering procedures, check the following box. ☒

CALCULATION OF REGISTRATION FEE

| ||||||

Title of Each Class of Securities to be Registered | Amount to be Registered(1) | Proposed Maximum Aggregate Offering Price(1)(2) | Amount of Registration Fee(2) | |||

Subordinate Voting Shares | ||||||

Debt Securities | ||||||

Subscription Receipts | ||||||

Warrants | ||||||

Units | ||||||

Total | US$1,000,000,000 | US$1,000,000,000 | US$109,100 | |||

| ||||||

| ||||||

| (1) | There are being registered under this registration statement such indeterminate number of Subordinate Voting Shares, Debt Securities, Subscription Receipts, Warrants and Units of the Registrant as shall have an aggregate initial offering price of US$1,000,000,000. Any securities registered by this registration statement may be sold separately or as units with other securities registered under this registration statement. The proposed maximum initial offering price per security will be determined, from time to time, by the Registrant in connection with the sale of the securities under this registration statement. |

| (2) | Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457 of the Securities Act of 1933, as amended (the “U.S. Securities Act”). |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registration statement shall become effective as provided in Rule 467 under the Securities Act of 1933 or on such date as the Commission, acting pursuant to Section 8(a) of the Act, may determine.

Table of Contents

PART I

INFORMATION REQUIRED TO BE DELIVERED TO OFFEREES OR PURCHASERS

Table of Contents

A copy of this preliminary short form base shelf prospectus has been filed with securities regulatory authorities in each of the provinces of Canada but has not yet become final for the purpose of the sale of securities. A registration statement relating to these securities has also been filed with the U.S. Securities and Exchange Commission. Information contained in this preliminary short form base shelf prospectus may not be complete and may have to be amended. The securities may not be sold nor may offers to buy be accepted until a receipt for the short form base shelf prospectus is obtained from the applicable securities regulatory authorities. This short form base shelf prospectus does not constitute an offer to sell or a solicitation of an offer to buy, nor shall there be any sales of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

This preliminary short form base shelf prospectus has been filed under legislation in each of the provinces of Canada that permits certain information about these securities to be determined after this prospectus has become final and that permits the omission from this prospectus of that information. The legislation requires the delivery to purchasers of a prospectus supplement containing the omitted information within a specified period of time after agreeing to purchase any of these securities.

No securities regulatory authority has expressed an opinion about these securities and it is an offence to claim otherwise. This short form base shelf prospectus constitutes a public offering of these securities only in those jurisdictions where they may be lawfully offered for sale and therein only by persons permitted to sell such securities.

Information has been incorporated by reference in this short form base shelf prospectus from documents filed with securities commissions or similar authorities in Canada. Copies of the documents incorporated herein by reference may be obtained on request without charge from Cresco Labs Inc., at 400 W Erie St. #110, Chicago, IL, 60654, telephone 312-929-0993, and are also available electronically at www.sedar.com.

PRELIMINARY SHORT FORM BASE SHELF PROSPECTUS

| New Issue and Secondary Offering | February 26, 2021 |

CRESCO LABS INC.

US$1,000,000,000

Subordinate Voting Shares

Debt Securities

Subscription Receipts

Warrants

Units

Cresco Labs Inc. (“Cresco” or the “Corporation”) may from time to time offer and issue the following securities: (i) subordinate voting shares of the Corporation (“Subordinate Voting Shares”); (ii) debt securities of the Corporation (“Debt Securities”); (iii) subscription receipts (“Subscription Receipts”) exchangeable for Subordinate Voting Shares and/or other securities of the Corporation; (iv) warrants exercisable to acquire Subordinate Voting Shares and/or other securities of the Corporation (“Warrants”); and (v) securities comprised of more than one of Subordinate Voting Shares, Debt Securities, Subscription Receipts and/or Warrants offered together as a unit (“Units”), or any combination thereof having an offer price of up to US$1,000,000,000 in aggregate (or the equivalent thereof, at the date of issue, in any other currency or currencies, as the case may be) at any time during the 25-month period that this short form base shelf prospectus (including any amendments hereto, the “Prospectus”) remains valid. The Subordinate Voting Shares, Debt Securities, Subscription Receipts, Warrants and Units (collectively, the “Securities”) offered hereby may be offered in one or more offerings, separately or together, in separate series, in amounts, at prices and on terms to be set forth in one or more prospectus supplements (collectively or individually, as the case may be, “Prospectus Supplements”). In addition, one or more securityholders (each, a “Selling Securityholder”) of the Corporation may also offer and sell Securities under this Prospectus. See “Selling Securityholders”.

The Securities may be sold, from time to time in one or more transactions at a fixed price or prices which may be changed or at market prices prevailing at the time of sale, at prices related to such prevailing market prices or at negotiated prices, including sales made directly on the Canadian Securities Exchange (the “CSE”) or other existing trading markets for the Securities, and as set forth in an accompanying Prospectus Supplement. See “Plan of Distribution”.

Table of Contents

The specific terms of any offering of Securities will be set forth in the applicable Prospectus Supplement and may include, without limitation, where applicable: (i) in the case of Subordinate Voting Shares, the number of Subordinate Voting Shares being offered, the offering price, whether the Subordinate Voting Shares are being offered for cash, the person offering the Subordinate Voting Shares (the Corporation and/or the Selling Securityholder) and any other terms specific to the Subordinate Voting Shares being offered; (ii) in the case of Debt Securities, the specific designation, aggregate principal amount, the currency or the currency unit for which the Debt Securities may be purchased, maturity, interest provisions, authorized denominations, offering price, whether the Debt Securities are being offered for cash, the covenants, the events of default, any terms for redemption or retraction, any exchange or conversion rights attached to the Debt Securities, the person offering the Debt Securities (the Corporation and/or the Selling Securityholder) and any other terms specific to the Debt Securities being offered; (iii) in the case of Subscription Receipts, the number of Subscription Receipts being offered, the offering price, whether the Subscription Receipts are being offered for cash, the terms, conditions and procedures for the exchange of the Subscription Receipts into or for Subordinate Voting Shares and/or other securities of the Corporation, the person offering the Subscription Receipts (the Corporation and/or the Selling Securityholder) and any other terms specific to the Subscription Receipts being offered; (iv) in the case of Warrants, the number of such Warrants offered, the offering price, whether the Warrants are being offered for cash, the terms, conditions and procedures for the exercise of such Warrants into or for Subordinate Voting Shares and/or other securities of the Corporation, the person offering the Warrants (the Corporation and/or the Selling Securityholder) and any other specific terms; and (v) in the case of Units, the number of Units being offered, the offering price, the terms of the Subordinate Voting Shares, Debt Securities, Subscription Receipts and/or Warrants underlying the Units, the person offering the Units (the Corporation and/or the Selling Securityholder) and any other specific terms.

All shelf information permitted under applicable securities legislation to be omitted from this Prospectus will be contained in one or more Prospectus Supplements that will be delivered to purchasers together with this Prospectus. Each Prospectus Supplement will be incorporated by reference into this Prospectus as of the date of such Prospectus Supplement and only for the purposes of the distribution of the Securities covered by that Prospectus Supplement. The offerings are subject to approval of certain legal matters on behalf of the Corporation by Bennett Jones LLP.

This Prospectus does not qualify for issuance Debt Securities, or Securities convertible or exchangeable into Debt Securities, in respect of which the payment of principal and/or interest may be determined, in whole or in part, by reference to one or more underlying interests including, for example, an equity or debt security, a statistical measure of economic or financial performance including, without limitation, any currency, consumer price or mortgage index, or the price or value of one or more commodities, indices or other items, or any other item or formula, or any combination or basket of the foregoing items. This Prospectus may qualify for issuance Debt Securities, or Securities convertible or exchangeable into Debt Securities, in respect of which the payment of principal and/or interest may be determined, in whole or in part, by reference to published rates of a central banking authority or one or more financial institutions, such as a prime rate or bankers’ acceptance rate, or to recognized market benchmark interest rates such as CDOR (the Canadian Dollar Offered Rate) or LIBOR (the London Interbank Offered Rate), and/or convertible into or exchangeable for Subordinate Voting Shares and/or other securities of the Corporation.

The Corporation and the Selling Securityholders may sell the Securities, separately or together: (i) to one or more underwriters or dealers; (ii) through one or more agents; or (iii) directly to one or more purchasers. The Prospectus Supplement relating to a particular offering of Securities will describe the terms of such offering of Securities, including: (i) the terms of the Securities to which the Prospectus Supplement relates, including the type of Security being offered, and the method of distribution; (ii) the name or names of any underwriters, dealers or agents involved in such offering of Securities; (iii) the purchase price of the Securities offered thereby and the proceeds to, and the expenses borne by, the Corporation or the Selling Securityholder from the sale of such Securities; (iv) any commission, underwriting discounts and other items constituting compensation payable to underwriters, dealers or agents; (v) any discounts or concessions allowed or re-allowed or paid to underwriters, dealers or agents; and (vi) the identity of the Selling Securityholder, if any. See “Plan of Distribution”.

In connection with any offering of the Securities, subject to applicable laws (unless otherwise specified in the relevant Prospectus Supplement), the underwriters or agents may over-allot or effect transactions that stabilize or maintain the market price of the offered Securities at a level above that which might otherwise prevail on the open market. Such transactions, if commenced, may be interrupted or discontinued at any time. See “Plan of Distribution”.

- ii -

Table of Contents

The issued and outstanding Subordinate Voting Shares are listed and posted for trading on the CSE under the symbol “CL”. On February 25, 2021, the last trading day prior to the date of this Prospectus, the closing price per Subordinate Voting Share on the CSE was $18.19. Unless otherwise specified in the applicable Prospectus Supplement, the Debt Securities, Subscription Receipts, Warrants and Units will not be listed on any securities exchange. There is no market through which these Securities may be sold and purchasers may not be able to resell such Securities purchased under this Prospectus. This may affect the pricing of the Securities in the secondary market, the transparency and availability of trading prices, the liquidity of the Securities, and the extent of issuer regulation.

Investing in Securities is speculative and involves a high degree of risk and should only be made by persons who can afford the total loss of their investment. A prospective purchaser should therefore review this Prospectus and the documents incorporated by reference herein in their entirety and carefully consider the risk factors described or referenced under “Risk Factors” prior to investing in such Securities.

No underwriter, dealer or agent has been involved in the preparation of this Prospectus or performed any review of the contents of this Prospectus.

Note to U.S. Holders:

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE U.S. SECURITIES AND EXCHANGE COMMISSION (THE “SEC”) NOR HAS THE SEC PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The Corporation is permitted, under a multijurisdictional disclosure system adopted in the United States and Canada, to prepare this Prospectus in accordance with Canadian disclosure requirements. Prospective investors should be aware that such requirements are different from those of the United States. The Corporation prepares its annual financial statements and its interim financial statements, which have been included or incorporated by reference herein, in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board, and thus may not be comparable to financial statements of United States companies prepared under United States generally accepted accounting principles.

Purchasers of Securities should be aware that the acquisition of Securities may have tax consequences both in the United States and in Canada. This Prospectus does not discuss U.S. or Canadian tax consequences and any such tax consequences may not be described fully in any applicable Prospectus Supplement with respect to a particular offering of Securities. Prospective investors should consult their own tax advisors prior to deciding to purchase any of the Securities.

The enforcement by investors of civil liabilities under U.S. federal securities laws may be affected adversely by the fact that the Corporation is incorporated under the laws of British Columbia, Canada.

The Corporation has four classes of issued and outstanding shares: the Subordinate Voting Shares, the Proportionate Voting Shares of the Corporation (the “Proportionate Voting Shares”), the Super Voting Shares of the Corporation (the “Super Voting Shares”) and the Special Subordinate Voting Shares of the Corporation (the “Special Subordinate Voting Shares”). The Subordinate Voting Shares are “restricted securities” within the meaning of such term under applicable Canadian securities laws. Each Subordinate Voting Share is entitled to one vote per Subordinate Voting Share, each Proportionate Voting Share is entitled to one vote in respect of each Subordinate Voting Share into which such Proportionate Voting Share could ultimately then be converted, which is currently equal to 200 votes per Proportionate Voting Share, each Super Voting Share is currently entitled to 2,000 votes per Super Voting Share, and each Special Subordinate Voting Share is entitled to one vote in respect of each Subordinate Voting Share into which such Special Subordinate Voting Share could ultimately be converted, which is currently equal to 0.00001 of a vote per Special Subordinate Voting Share, in each case, on all matters upon which the holders of shares of the Corporation are entitled to vote, and holders of Subordinate Voting Shares, Proportionate Voting Shares, Super Voting Shares and Special Subordinate Voting Shares will vote together on all matters subject to a vote of holders of those

- iii -

Table of Contents

classes of shares as if they were one class of shares, except to the extent that a separate vote of holders as a separate class is required by law or provided by the articles of the Corporation. Other than the return of the issue price for their Super Voting Shares, the holders of Super Voting Shares are not entitled to receive, directly or indirectly, as holders of Super Voting Shares, any other assets or property of the Corporation. Holders of Subordinate Voting Shares, Proportionate Voting Shares and Special Subordinate Voting Shares are entitled to receive, as and when declared by the board of directors of the Corporation, dividends in cash or property of the Corporation. In the event of the liquidation, dissolution or winding-up of the Corporation, whether voluntary or involuntary, or in the event of any other distribution of assets of the Corporation among its shareholders for the purpose of winding up its affairs, the holders of Subordinate Voting Shares are, subject to the prior rights of the holders of any shares of the Corporation ranking in priority to the Subordinate Voting Shares (including, without restriction, the Super Voting Shares as to the issue price paid in respect thereof), entitled to participate rateably along with all other holders of Subordinate Voting Shares. In the event that a take-over bid is made for the Super Voting Shares, the holders of Subordinate Voting Shares will not be entitled to participate in such offer and may not tender their shares into any such offer, whether under the terms of the Subordinate Voting Shares or under any coattail trust or similar agreement. Notwithstanding this, any take-over bid for solely the Super Voting Shares is unlikely given that by the terms of the investment agreement entered into by the Corporation and the Founders (as defined herein) in connection with the issuance to the Founders of the Super Voting Shares, upon any sale of Super Voting Shares to an unrelated third party purchaser, such Super Voting Shares will be redeemed by the Corporation for their issue price. See “Description of Share Capital of the Corporation” for further details.

The directors, chief executive officer and chief financial officer of the Corporation reside outside of Canada and each has appointed Bennett Jones LLP, 3400 One First Canadian Place, Toronto, Ontario, M5X 1A4, as his or her agent for service of process in Canada. Marcum LLP, the auditor in respect of the audited financial statements of the Corporation, as at and for the years ended December 31, 2020 and 2019, is incorporated, continued or otherwise organized under the laws of a foreign jurisdiction. Purchasers are advised that it may not be possible for investors to enforce judgments obtained in Canada against any person or company that resides outside of Canada or is incorporated, continued or otherwise organized under the laws of a foreign jurisdiction, even if the party has appointed an agent for service of process.

The Corporation’s head office is located at 400 W Erie St. #110, Chicago, IL, 60654 and registered office is located at Suite 2500, 666 Burrard Street, Vancouver, BC, V6C 2X8.

This Prospectus qualifies the distribution of securities of an entity that currently directly derives a substantial portion of its revenues from the cannabis industry in certain U.S. states, which industry is illegal under U.S. federal law. The Corporation is directly involved (through its licensed subsidiaries) in both the adult-use and medical cannabis industry in the States of Illinois, Pennsylvania, Ohio, Nevada, Arizona and California, as permitted within such states under applicable state law which states have regulated such industries, and is in the process of acquiring businesses which would allow the Corporation to directly participate in the adult-use and medical cannabis industry in the States of New York, Massachusetts, Florida and Maryland, as permitted within such states under applicable state law and which states have regulated such industries.

The cultivation, sale and use of cannabis is illegal under United States federal law pursuant to the Controlled Substance Act (21 U.S.C. §811) (the “CSA”). The United States federal government regulates drugs through the CSA, which places controlled substances, including cannabis, in a schedule. Other than industrial hemp, cannabis is classified as a Schedule I drug. Under United States federal law, a Schedule I drug or substance has a high potential for abuse, no accepted medical use in the United States, and a lack of accepted safety for the use of the drug under medical supervision. Under the CSA, the policies and regulations of the United States federal government and its agencies are that cannabis has no medical benefit and a range of activities including cultivation and the personal use of cannabis is prohibited. The United States Food and Drug Administration (“FDA”) has not approved cannabis for the treatment of any disease or condition. The agency has, however, approved one cannabis-derived drug product, Epidiolex, for the treatment of seizures associated with Lennos-Gastaut syndrome or Dravet syndrome.

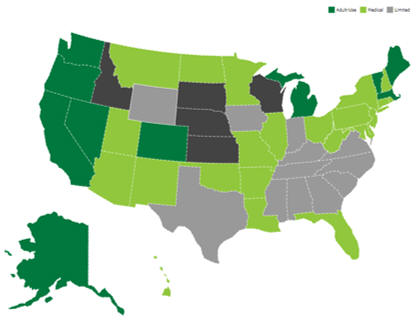

Despite the current state of the federal law and the CSA, 35 U.S. states, Washington D.C., and the territories of Puerto Rico, the U.S. Virgin Islands, the Northern Mariana Islands and Guam have laws and/or regulations that recognize, in one form or another, legitimate medical uses for cannabis and consumer use of cannabis in

- iv -

Table of Contents

connection with medical treatment for patients with certain qualifying conditions. The States of Alaska, Arizona, California, Colorado, Illinois, Maine, Massachusetts, Michigan, Montana, Nevada, New Jersey, Oregon, South Dakota, Vermont, Washington, and the District of Columbia, have legalized recreational use of cannabis, although the District of Columbia has not legalized commercial sale of cannabis. In early 2018, Vermont became the first state to legalize recreational cannabis by passage in a state legislature, but does not yet allow commercial sales of recreational cannabis.

Over half of the U.S. states have enacted legislation to legalize and regulate the sale and use of medical cannabis, provided that there are strict limits on the levels of THC. However, there is no guarantee that state laws legalizing and regulating the sale and use of cannabis will not be repealed or overturned, or that local governmental authorities will not limit the applicability of state laws within their respective jurisdictions.

Accordingly, in the U.S., cannabis is largely regulated at the state level. State laws that permit and regulate the production, distribution and use of cannabis for adult-use or medical purposes are in direct conflict with the CSA. Although certain states authorize medical or adult-use cannabis production and distribution by licensed or registered entities, under United States federal law, the possession, use, cultivation, and transfer of cannabis and any related drug paraphernalia is illegal and any such acts are criminal acts. The Supremacy Clause of the United States Constitution establishes that the United States Constitution and federal laws made pursuant to it are paramount and in case of conflict between federal and state law, the federal law shall apply.

On January 4, 2018, former U.S. Attorney General Jeff Sessions issued a memorandum to U.S. district attorneys which rescinded previous guidance from the U.S. Department of Justice (“DOJ”) specific to cannabis enforcement in the United States, including the Cole Memorandum (as defined herein). With the Cole Memorandum rescinded, U.S. federal prosecutors have been given discretion in determining whether to prosecute cannabis related violations of U.S. federal law. Mr. Sessions resigned on November 7, 2018. Following the brief tenure of Matthew Whitaker as the acting United States Attorney General, on December 7, 2018, President Donald Trump announced the nomination of William Barr and, on February 14, 2019, Mr. Barr was confirmed as Attorney General. The DOJ under Mr. Barr did not take a formal position on federal enforcement of laws relating to cannabis. On December 14, 2020, President Trump announced that Mr. Barr would be resigning from his post as Attorney General, effective December 23, 2020. President Joseph Biden has nominated Merrick Garland to succeed Mr. Barr as the U.S. Attorney General. It is unclear what impact, if any, the new administration will have on U.S. federal government enforcement policy on cannabis. If the DOJ policy shifts to aggressively pursue financiers or equity owners of cannabis-related business, and United States Attorneys followed such policies through pursuing prosecutions, then the Corporation could face (i) seizure of its cash and other assets used to support or derived from its cannabis subsidiaries, and (ii) the arrest of its employees, directors, officers, managers and investors, who could face charges of ancillary criminal violations of the CSA for aiding and abetting and conspiring to violate the CSA by virtue of providing financial support to state-licensed or permitted cultivators, processors, distributors, and/or retailers of cannabis. Additionally, as has recently been affirmed by the U.S. Customs and Border Protection, employees, directors, officers, managers and investors of the Corporation who are not U.S. citizens face the risk of being barred from entry into the United States for life.

On December 27, 2020, President Donald Trump signed the Consolidated Appropriations Act of 2021, which included the Rohrabacher-Farr Amendment (as defined herein), which prohibits the funding of federal prosecutions with respect to medical cannabis activities that are legal under state law. The Consolidated Appropriations Act of 2021 makes appropriations for the fiscal year ending September 30, 2021. There can be no assurances that the Rohrabacher- Farr Amendment will be included in future appropriations bills or budget resolutions. See “United States Regulatory Environment” for additional information.

The Corporation’s objective is to capitalize on the opportunities presented as a result of the changing regulatory environment governing the cannabis industry in the United States. Accordingly, there are a number of significant risks associated with the business of the Corporation. Unless and until the United States Congress amends the CSA with respect to medical and/or adult-use cannabis (and as to the timing or scope of any such potential amendments there can be no assurance), there is a significant risk that federal authorities may enforce current U.S. federal law, and the business of the Corporation may be deemed to be producing, cultivating, extracting, or dispensing cannabis or aiding or abetting or otherwise engaging in a conspiracy to commit such

- v -

Table of Contents

acts in violation of federal law in the United States. If the U.S. federal government begins to enforce U.S. federal laws relating to cannabis in states where the sale and use of cannabis is currently legal, or if existing applicable state laws are repealed or curtailed, the Corporation’s business, results of operations, financial condition and prospects would be materially adversely affected.

In light of the political and regulatory uncertainty surrounding the treatment of United States cannabis-related activities, on February 8, 2018, the Canadian Securities Administrators published CSA Staff Notice 51-352 – (Revised) Issuers with U.S. Marijuana-Related Activities (“Staff Notice 51-352”) setting out the Canadian Securities Administrator’s disclosure expectations for specific risks facing issuers with cannabis-related activities in the United States. Staff Notice 51-352 includes additional disclosure expectations that apply to all issuers with United States cannabis-related activities, including those with direct and indirect involvement in the cultivation and distribution of cannabis, as well as issuers that provide goods and services to third parties involved in the United States cannabis industry.

For these reasons, the Corporation’s investments in the United States cannabis market may subject the Corporation to heightened scrutiny by regulators, stock exchanges, clearing agencies and other United States and Canadian authorities. There are a number of risks associated with the business of the Corporation. See the section entitled “Risk Factors” herein and within the AIF (as defined herein).

- vi -

Table of Contents

| 10 | ||||

| 10 | ||||

| 10 | ||||

| 11 | ||||

| 11 | ||||

| 11 | ||||

| 13 | ||||

| 15 | ||||

| 18 | ||||

| 24 | ||||

| 25 | ||||

| 26 | ||||

| 27 | ||||

| 27 | ||||

| 27 | ||||

| 28 | ||||

| 28 | ||||

| 29 | ||||

| 30 | ||||

| 30 | ||||

| 30 | ||||

| 38 | ||||

| 38 | ||||

| 38 | ||||

| 43 | ||||

| 43 | ||||

| 43 | ||||

| 43 | ||||

| 43 | ||||

| 44 | ||||

Table of Contents

ABOUT THIS SHORT FORM BASE SHELF PROSPECTUS

An investor should rely only on the information contained in this Prospectus (including the documents incorporated by reference herein) and is not entitled to rely on parts of the information contained in this Prospectus (including the documents incorporated by reference herein) to the exclusion of others. The Corporation has not authorized anyone to provide investors with additional or different information. The Corporation takes no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give readers of this Prospectus. Information contained on, or otherwise accessed through, the Corporation’s website shall not be deemed to be a part of this Prospectus and such information is not incorporated by reference herein.

The Corporation is not offering to sell the Securities in any jurisdictions where the offer or sale of the Securities is not permitted. The information contained in this Prospectus (including the documents incorporated by reference herein) is accurate only as of the date of this Prospectus or as of the date as otherwise set out herein (or as of the date of the document incorporated by reference herein or as of the date as otherwise set out in the document incorporated by reference herein, as applicable), regardless of the time of delivery of this Prospectus or any sale of the Subordinate Voting Shares, Debt Securities, Subscription Receipts, Warrants and/or Units. The business, financial condition, capital, results of operations and prospects of the Corporation may have changed since those dates. The Corporation does not undertake to update the information contained or incorporated by reference herein, except as required by applicable Canadian securities laws.

This Prospectus shall not be used by anyone for any purpose other than in connection with an offering of Securities as described in one or more Prospectus Supplements.

The documents incorporated or deemed to be incorporated by reference herein contain meaningful and material information relating to the Corporation and readers of this Prospectus should review all information contained in this Prospectus, the applicable Prospectus Supplement and the documents incorporated or deemed to be incorporated by reference herein and therein.

ENFORCEMENT OF CIVIL LIABILITIES

Cresco is incorporated under and governed by the Business Corporations Act (British Columbia). The Corporation has appointed an agent for service of process in the United States; however it may nevertheless be difficult for investors who reside in the United States to effect service of process in the United States upon the Corporation or to enforce a U.S. court judgment predicated upon the civil liability provisions of the U.S. federal securities laws against the Corporation. There is substantial doubt whether an action could be brought in Canada in the first instance predicated solely upon U.S. federal securities laws.

The Corporation filed with the SEC, concurrently with the Registration Statement (as defined herein), an appointment of agent for service of process on Form F-X. Under the Form F-X, the Corporation appointed Cresco Labs, LLC (the “LLC”) as its agent for service of process in the United States in connection with any investigation or administrative proceeding conducted by the SEC and any civil suit or action brought against or involving the Corporation in a U.S. court arising out of or related to or concerning the offering of Securities under this Prospectus.

MEANING OF CERTAIN REFERENCES AND CURRENCY PRESENTATION

References to dollars or “$” are to Canadian currency unless otherwise indicated. All references to “US$” refer to United States dollars. On February 25, 2021, the daily exchange rate for the United States dollar in terms of Canadian dollars, as quoted by the Bank of Canada, was US$1.00 = $1.2530.

Unless the context otherwise requires, all references in this Prospectus to the “Corporation” refer to the Corporation and its subsidiary entities on a consolidated basis.

Table of Contents

WHERE YOU CAN FIND MORE INFORMATION

The Corporation files certain reports with, and furnishes other information to, each of the SEC and certain securities regulatory authorities of Canada. Under a multijurisdictional disclosure system adopted by the United States and Canada, such reports and other information may be prepared in accordance with the disclosure requirements of the provincial and territorial securities regulatory authorities of Canada, which requirements are different from those of the United States. As a foreign private issuer, the Corporation is exempt from the rules under the U.S. Securities Exchange Act of 1934, as amended (the “U.S. Exchange Act”), prescribing the furnishing and content of proxy statements, and the Corporation’s officers and directors are exempt from the reporting and short swing profit recovery provisions contained in Section 16 of the U.S. Exchange Act. The Corporation’s reports and other information filed or furnished with or to the SEC are available, from EDGAR at www.sec.gov, as well as from commercial document retrieval services. The Corporation’s Canadian filings are available on SEDAR at www.sedar.com.

The Corporation has filed with the SEC under the U.S. Securities Act of 1933, as amended (the “U.S. Securities Act”) the Registration Statement (as defined herein) relating to the Securities being offered hereunder, of which this Prospectus forms a part. This Prospectus does not contain all of the information set forth in the Registration Statement, certain items of which are contained in the exhibits to the Registration Statement as permitted or required by the rules and regulations of the SEC. Items of information omitted from this Prospectus but contained in the Registration Statement will be available on the SEC’s website at www.sec.gov.

Unless otherwise indicated, the market and industry data contained or incorporated by reference in this Prospectus is based upon information from independent industry publications, market research, analyst reports and surveys and other publicly available sources. Although the Corporation believes these sources to be generally reliable, market and industry data is subject to interpretation and cannot be verified with complete certainty due to limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties inherent in any survey. The Corporation has not independently verified any of the data from third party sources referred to or incorporated by reference herein, and accordingly the accuracy and completeness of such data is not guaranteed.

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

This Prospectus includes “forward-looking information” and “forward-looking statements” within the meaning of Canadian securities laws and United States securities laws. In addition to the following cautionary statement, with respect to forward-looking information contained in the documents incorporated by reference herein, prospective purchasers should refer to “Cautionary Statement Regarding Forward-Looking Information” in the AIF (as defined herein) or any subsequently filed annual information form of the Corporation, as well as the advisories section of any documents incorporated or deemed to be by reference herein, including those that are filed after the date hereof.

All information, other than statements of historical facts, included in this Prospectus that address activities, events or developments that the Corporation expects or anticipates will or may occur in the future is forward-looking information. Forward-looking information is often identified by the words “may”, “would”, “could”, “should”, “will”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “expect” or similar expressions and includes, among others, information regarding: the Corporation’s intention regarding cash flows from operating activities in future periods, the expected timing of the closing of the Arrangement (as defined herein), statements relating to the business and future activities of, and developments related to, the Corporation after the date of this Prospectus, including but not limited to, such things as future business strategy, competitive strengths, goals, expansion and growth of the Corporation’s business, operations and plans, including new revenue streams, the completion of contemplated acquisitions by the Corporation, the application for additional licenses and the grant of licenses that have been applied for, the expansion of existing cultivation and production facilities, the completion of cultivation and production facilities that are under construction, the construction of additional cultivation and production facilities, the expansion into additional States within the United States, international markets and Canada, any potential future legalization of adult-use and/or medical marijuana under U.S. federal law; expectations of market size and growth in the United States and the States in which the Corporation operates; expectations for other economic, business, regulatory and/or competitive factors related to the Corporation or the cannabis industry generally; and other events or conditions that may occur in the future.

- 2 -

Table of Contents

Readers are cautioned that forward-looking information and statements are not based on historical facts but instead are based on reasonable assumptions, estimates, analysis and opinions of management of the Corporation at the time they were provided or made, in light of its experience and its perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, and involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Corporation, as applicable, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information and statements.

Forward-looking information and statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management at the date the statements are made including, among other things, assumptions about: the contemplated acquisitions and dispositions being completed on the current terms and current contemplated timeline, including that all conditions to the completion of the Arrangement will be satisfied in a timely manner; development costs remaining consistent with budgets; ability to manage anticipated and unanticipated costs; favorable equity and debt capital markets; the ability to raise sufficient capital to advance the business of the Corporation; favorable operating and economic conditions; political and regulatory stability; obtaining and maintaining all required licenses and permits; receipt of governmental approvals and permits; sustained labor stability; stability in financial and capital goods markets; favourable production levels and costs from the Corporation’s operations; the pricing of various cannabis products; the level of demand for cannabis products; the availability of third party service providers and other inputs for the Corporation’s operations; and the Corporation’s ability to conduct operations in a safe, efficient and effective manner. While the Corporation considers these assumptions to be reasonable, the assumptions are inherently subject to significant business, social, economic, political, regulatory, competitive and other risks and uncertainties, contingencies and other factors that could cause actual performance, achievements, actions, events, results or conditions to be materially different from those projected in the forward-looking information and statements. Many assumptions are based on factors and events that are not within the control of the Corporation and there is no assurance they will prove to be correct.

Risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Corporation, as applicable, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information and statements include, among others, risks relating to the availability of future financing; the use of proceeds of future financings; the accuracy of forward-looking information; regulatory uncertainty; money laundering laws and access to banking; heightened scrutiny of cannabis companies in Canada; proceedings against the Corporation; significant ongoing costs and obligations related to the Corporation’s investment in infrastructure; regulatory compliance and operations; availability of favourable locations; unfavorable tax treatment of cannabis businesses; the tax classification of the Corporation; the Corporation being a holding corporation; enforcement of contracts; competition; limitations on owners of licenses; difficulty in forecasting; the concentrated voting control of the Corporation and the unpredictability caused by the existing capital structure; dilution; volatility of market price; negative cash flows; U.S. regulatory landscape and enforcement related to cannabis, including political risks; risks relating to anti-money laundering laws and regulation; other governmental and environmental regulation; public opinion and perception of the cannabis industry; risks related to the ability to consummate the proposed acquisitions and the ability to obtain requisite regulatory approvals and third party consents and the satisfaction of other conditions to the consummation of the Arrangement and other proposed acquisitions on the proposed terms and schedule; the potential impact of the announcement or consummation of the proposed acquisitions on relationships, including with regulatory bodies, employees, suppliers, customers and competitors; the diversion of management time on the proposed acquisitions; risks related to contracts with third party service providers; risks related to the enforceability of contracts; the limited operating history of the Corporation; reliance on the expertise and judgment of senior management of the Corporation; risks inherent in an agricultural business; risks related to co-investment with parties with different interests to the Corporation; risks related to proprietary intellectual property and potential infringement by third parties; risks relating to financing activities including leverage; risks relating to the management of growth; increased costs associated with the Corporation becoming a publicly traded company; increasing competition in the industry; risks relating to energy costs; risks associated to cannabis products manufactured for human consumption including potential product recalls; reliance on key inputs, suppliers and skilled labour (the availability and retention of which is subject to uncertainty); cybersecurity risks; ability and constraints on marketing products; fraudulent activity by employees, contractors and consultants; tax and insurance related risks;

- 3 -

Table of Contents

risks related to the economy generally; risk of litigation; conflicts of interest; risks relating to certain remedies being limited and the difficulty of enforcement of judgments and effecting service outside of Canada; risks related to future acquisitions or dispositions; sales by existing shareholders; the limited market for securities of the Corporation; limited research and data relating to cannabis; the effects of the COVID-19 pandemic; as well as those risk factors discussed elsewhere herein and in the documents incorporated by reference herein, including the AIF.

Readers are cautioned that the foregoing lists are not exhaustive of all factors and assumptions that may have been used. Although the Corporation has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such forward-looking information and statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such information and statements. Accordingly, readers should not place undue reliance on forward-looking information and statements. The forward-looking information and statements contained herein are presented for the purposes of assisting readers in understanding the Corporation’s expected financial and operating performance and the Corporation’s plans and objectives and may not be appropriate for other purposes.

The forward-looking information and statements contained in this Prospectus represent the Corporation’s views and expectations as of the date of this Prospectus and forward-looking information and statements contained in the documents incorporated by reference herein represent the Corporation’s views and expectations as of the date of such documents, unless otherwise indicated in such documents. The Corporation anticipates that subsequent events and developments may cause its views and expectations to change. However, while the Corporation may elect to update such forward- looking information and statements at a future time, it has no current intention of and assumes no obligation for doing so except to the extent required by applicable law.

DOCUMENTS INCORPORATED BY REFERENCE

Information has been incorporated by reference in this Prospectus from documents filed with the securities commissions or similar regulatory authorities in Canada. Copies of the documents incorporated herein by reference may be obtained on request without charge from the General Counsel of the Corporation, at 400 W Erie St. #110, Chicago, IL, 60654, 312-929-0993, and are also available electronically at www.sedar.com.

As of the date hereof, the following documents (or the sections or sub-sections thereof set out below), filed with the various securities commissions or similar authorities in each of the provinces of Canada, are specifically incorporated by reference into, and form an integral part of, this Prospectus:

| 1. | the annual information form of the Corporation dated April 28, 2020 (the “AIF”); |

| 2. | the unaudited condensed interim financial statements of the Corporation for the three and nine month periods ended September 30, 2020 and 2019, together with the notes thereon filed on November 18, 2020; |

| 3. | the management’s discussion and analysis of financial condition and results of operations of the Corporation for the three months and nine month periods ended September 30, 2020 and 2019, filed on November 18, 2020; |

| 4. | the audited financial statements of the Corporation for the years ended December 31, 2019 and 2018, together with the notes thereto and the auditor’s report for the year ended December 31, 2019 attached thereto, filed on April 28, 2020; |

| 5. | the management’s discussion and analysis of financial condition and results of operations of the Corporation for the three and twelve month periods ended December 31, 2019 and 2018, filed on April 28, 2020; |

| 6. | the sub-section entitled “Summary of the Equity Plan” of Section 9 (Options to Purchase Securities) of the listing statement of the Corporation dated November 30, 2018; |

- 4 -

Table of Contents

| 7. | the management information circular of the Corporation dated June 3, 2020, prepared in connection with an annual general and special meeting of shareholders held on June 29, 2020, filed on June 8, 2020; |

| 8. | the material change report dated January 13, 2020, in connection with the completion of the court approved plan of arrangement pursuant to which the Corporation acquired all of the issued and outstanding shares of CannaRoyalty Corp. d/b/a Origin House (“Origin House”); |

| 9. | the material change report of the Corporation dated February 3, 2020, in connection with the Corporation’s entry into a credit agreement for a senior secured term loan (the “Senior Secured Loan”) in an initial aggregate principal amount of US$100 million; |

| 10. | the material change report of the Corporation dated March 12, 2020, in connection with the resignation of Joseph Caltabiano from his former position as the Corporation’s President; |

| 11. | the material change report of the Corporation dated January 19, 2021, in connection with the Corporation’s entry into an arrangement agreement with Bluma Wellness Inc. (“Bluma”), pursuant to which the Corporation will acquire all of the issued and outstanding shares of Bluma; and |

| 12. | the material change report of the Corporation dated February 1, 2021, in connection with the closing of the Corporation’s overnight marketed offering of Subordinate Voting Shares. |

Any document of the type required by National Instrument 44-101 — Short Form Prospectus Distributions to be incorporated by reference into a short form prospectus, including any annual information forms, material change reports (except confidential material change reports), business acquisition reports, interim financial statements, annual financial statements and the auditor’s report thereon, management’s discussion and analysis and information circulars of the Corporation filed by the Corporation with securities commissions or similar authorities in Canada after the date of this Prospectus and prior to the completion or withdrawal of any offering under this Prospectus shall be deemed to be incorporated by reference into this Prospectus. In addition, all documents filed on Form 6-K or Form 40-F by the Corporation with the SEC on or after the date of this Prospectus shall be deemed to be incorporated by reference into the registration statement on Form F-10 (the “Registration Statement”) of which this Prospectus forms a part, if and to the extent, in the case of any report on Form 6-K, expressly provided in such document.

Upon a new interim financial report and related management’s discussion and analysis of the Corporation being filed with the applicable securities regulatory authorities during the currency of this Prospectus, the previous interim financial report and related management’s discussion and analysis of the Corporation most recently filed shall be deemed no longer to be incorporated by reference into this Prospectus for purposes of future offers and sales of Securities hereunder. Upon new annual financial statements and related management’s discussion and analysis of the Corporation being filed with the applicable securities regulatory authorities during the currency of this Prospectus, the previous annual financial statements and related management’s discussion and analysis and the previous interim financial report and related management’s discussion and analysis of the Corporation most recently filed shall be deemed no longer to be incorporated by reference into this Prospectus for purposes of future offers and sales of Securities hereunder. Upon a new annual information form of the Corporation being filed with the applicable securities regulatory authorities during the currency of this Prospectus, the following documents shall be deemed no longer to be incorporated by reference into this Prospectus for purposes of future offers and sales of Securities hereunder: (i) the previous annual information form, if any; (ii) material change reports filed by the Corporation prior to the end of the financial year in respect of which the new annual information form is filed; (iii) business acquisition reports filed by the Corporation for acquisitions completed prior to the beginning of the financial year in respect of which the new annual information form is filed; and (iv) any information circular of the Corporation filed by the Corporation prior to the beginning of the financial year in respect of which the new annual information form is filed. Upon a new information circular of the Corporation prepared in connection with an annual general meeting of the Corporation being filed with the applicable securities regulatory authorities during the currency of this Prospectus, the previous information circular of the Corporation prepared in connection with an annual general meeting of the Corporation shall be deemed no longer to be incorporated by reference into this Prospectus for purposes of future offers and sales of Securities hereunder.

- 5 -

Table of Contents

A Prospectus Supplement to this Prospectus containing the specific variable terms in respect of an offering of the Securities will be delivered to purchasers of such Securities together with this Prospectus, unless an exemption from the prospectus delivery requirements has been granted or is otherwise available, and will be deemed to be incorporated by reference into this Prospectus as of the date of such Prospectus Supplement only for the purposes of the offering of the Securities covered by such Prospectus Supplement.

Notwithstanding anything herein to the contrary, any statement contained in this Prospectus or in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded, for purposes of this Prospectus, to the extent that a statement contained herein or in any other subsequently filed document incorporated or deemed to be incorporated by reference herein modifies or supersedes such prior statement. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. The making of a modifying or superseding statement shall not be deemed an admission for any purpose that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary to make a statement not misleading in light of the circumstances in which it was made. Any statement so modified or superseded shall thereafter neither constitute, nor be deemed to constitute, a part of this Prospectus, except as so modified or superseded.

Corporate Structure

The Corporation was incorporated in the Province of British Columbia under the Business Corporations Act (British Columbia) on July 6, 1990. On December 30, 1997, the Corporation changed its name from Randsburg Gold Corporation to Randsburg International Gold Corp. (“Randsburg”), and consolidated its outstanding common shares on a five old for one new basis. On November 30, 2018, in connection with the Business Combination (as defined herein), the Corporation (i) consolidated its outstanding Randsburg common shares on a 812.63 old for one new basis by way of resolution of its board of directors (without any corporate filings being necessary), and (ii) filed an alteration to its Notice of Articles with the British Columbia Registrar of Companies to change its name from Randsburg International Gold Corp. to Cresco Labs Inc. and to amend the rights and restrictions of its existing class of common shares, redesignate such class as the class of Subordinate Voting Shares and create the Proportionate Voting Shares and the Super Voting Shares (collectively, the “Share Terms Amendment”). On June 29, 2020, the Corporation filed an alteration to its Notice of Articles with the British Columbia Registrar of Companies to create a class of Special Subordinate Voting Shares and amend the rights and restrictions of the Subordinate Voting Shares, the Super Voting Shares and the Proportionate Voting Shares.

The Corporation’s head office is located at 400 W Erie St #110, Chicago, IL 60654 and the Corporation’s registered office is located at Suite 2500, 666 Burrard Street, Vancouver, BC V6C 2X8.

On November 30, 2018, a series of transactions were completed among the Corporation (then Randsburg) and Cresco resulting in a reorganization of Cresco and Randsburg and pursuant to which Randsburg became the indirect parent and sole voting unitholder of Cresco (the “Business Combination”). The Business Combination constituted a reverse takeover of Randsburg by Cresco under applicable securities laws.

Cresco Labs LLC was formed as a limited liability company under the laws of the state of Illinois on October 8, 2013 and is governed by the Cresco limited liability company agreement dated October 8, 2013, as amended and restated as of March 28, 2015 and as further amended and restated as of March 17, 2018 and as of July 1, 2018 (the “Pre-Combination LLC Agreement”). The Pre-Combination LLC Agreement was further amended and restated in connection with the completion of the Business Combination.

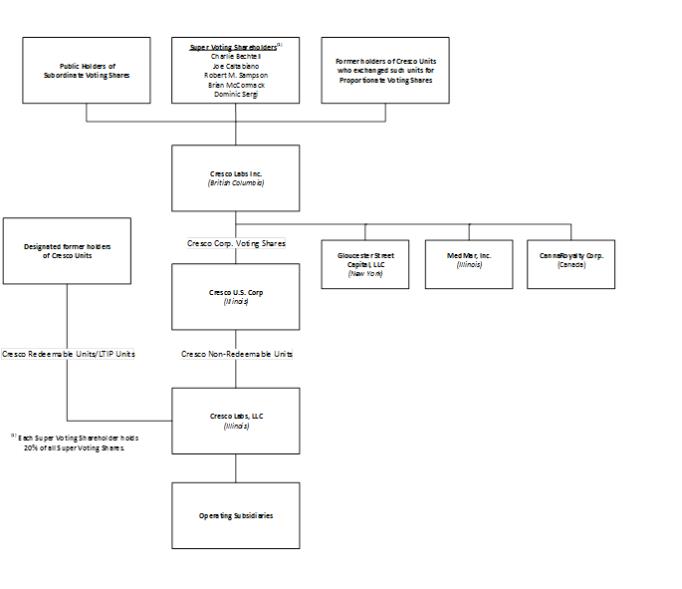

Set forth below is the condensed organization chart of the Corporation. The material subsidiaries of Cresco did not change in connection with the Business Combination.

- 6 -

Table of Contents

Note: See “Description of Share Capital of the Corporation” herein, “Description of Share Capital of Cresco Corp.” in the AIF and “Description of Unit Capital of Cresco” in the AIF for additional details as to the share and unit capital of the Corporation, Cresco U.S. Corp. (“Cresco Corp.”) and the LLC, respectively.

Summary Description of the Business

Cresco exists to provide high-quality and consistent cannabis-based products to consumers. Cresco blends regulatory compliance expertise with best practices from the agricultural, pharmaceutical and consumer packaged goods industries. Cresco (either directly or indirectly through subsidiaries) has been awarded three licenses to cultivate and manufacture medicinal cannabis in the State of Illinois. Cresco was awarded a cultivation license in Pennsylvania and was one of only five cultivators that was initially also awarded a dispensary license which allows for up to three dispensaries, with a second license granted in December of 2018 for up to three additional dispensaries. Cresco was awarded a cultivation license in Ohio and a dispensary license in Ohio and was the first approved dispensary to begin dispensary operations in Ohio in December 2018. Cresco received prequalification from the State of Michigan, which will allow Cresco to operate growing, processing and provisioning center facilities in Michigan. Cresco also has an interest in a cultivation, processing, and dispensary license in Nevada, an ownership interest in cultivation and processing licenses in California, owns and operates five dispensaries in Illinois and owns and operates two cultivation centers and one dispensary location in Arizona. Cresco acquired one medical cannabis cultivation center license and

- 7 -

Table of Contents

four dispensary locations in New York. Most recently, Cresco was the first cultivator in Illinois to receive approvals to grow adult-use cannabis; all three cultivation facilities were granted approvals in the state. Additionally, Cresco’s five Illinois dispensary locations were approved for dispensing adult-use cannabis in the state upon legalization, effective January 1, 2020. Cresco has completed an agreement to acquire assets in Massachusetts, including state registration and licensing that will allow for cultivation, manufacturing, processing, and the establishment and operation of a medical marijuana dispensary, with the ability to obtain up to three medical marijuana dispensary licenses and three adult-use dispensary licenses. Cresco has also completed its acquisition of operations in California, via the acquisition of Origin House (as defined herein). Additionally, Cresco has entered into an agreement to acquire operations in Florida, via Bluma. See “Recent Developments”.

Cresco plans to leverage the success in these markets to expand into legalized cannabis markets in other states, while focusing on compliance, control, efficiency, and product performance in the medicinal or adult-use cannabis industry.

Cresco owns and operates cultivation, manufacturing and retail dispensary businesses. The manufacturing and retail businesses are operational today and vertically integrated across eight highly regulated and/or limited licenses, and therefore limited legal supply markets: Illinois, Nevada, Ohio, Arizona, Pennsylvania, California, New York and Massachusetts, with processing operations in Maryland, and is expected to commence cultivation, manufacturing and retail dispensary operations in Michigan. These markets, where supply and demand can be reasonably predicted and forecasted, create the foundation upon which Cresco has created the opportunity for sustainable growth. Importantly, Cresco is not yet active in markets popularized by mainstream media like Washington, Oregon and Colorado where loose regulatory frameworks create unpredictable supply-demand market dynamics.

This ownership of wholesale and retail businesses supports Cresco’s strategy of distributing brands at scale by enabling Cresco to capture market share, generate brand awareness, and earn customer loyalty in its operating markets by guaranteeing share-of-shelf in its own retail stores and its ability to foster mutually beneficial relationships with its third-party dispensary customers as a large supplier of a portfolio of distinct and trusted cannabis brands. More detailed information regarding the business of the Corporation as well as its operations, assets, and properties can be found in the AIF and other documents incorporated by reference herein, as supplemented by the disclosure herein. See “Documents Incorporated by Reference” and “Recent Developments”.

Recent Developments

Increase and Extension of Credit Facility

On December 14, 2020, the Corporation announced an increase in its Senior Secured Loan from US$100 million to US$200 million. Also, as part of the agreement with the Corporation’s lenders, the Senior Secured Loan was extended to January 23, 2023 at a reduced interest rate of 12% per annum and the Corporation was provided with greater prepayment optionality.

Bluma Wellness Inc.

On January 14, 2021, the Corporation announced that it had entered into an arrangement agreement with Bluma, a publicly traded company, to acquire all of the issued and outstanding shares of Bluma (the “Arrangement”) on the basis of 0.0859 of a Subordinate Voting Share for each common share of Bluma, subject to certain adjustments as described in the arrangement agreement. On the date of announcement, total consideration for the Arrangement was equal to US$213 million, or US$1.12 per Bluma share. The Arrangement is proposed to be effected by way of a plan of arrangement under the Business Corporations Act (British Columbia). Bluma, under its operating subsidiary, One Plant Florida, has seven strategically located dispensaries with eight more locations under legal control and planned to open.

The Arrangement is subject to, among other things, the approval of Bluma shareholders at a special meeting, and receipt of all required CSE, regulatory and court approvals, including clearance under the U.S. Hart-Scott-Rodino Antitrust Improvements Act.

- 8 -

Table of Contents

Chief Operating Officer

On January 19, 2021, the Corporation announced that it had hired Ty Gent as its new chief operating officer, replacing David Ellis who became regional president of operations for emerging markets in Massachusetts, New York, Pennsylvania, Ohio and Maryland. As chief operating officer, Mr. Gent is responsible for operational consistency and efficiency across markets and implementation of structural enhancements to facilitate scaling.

Equity Offering

On January 21, 2021, the Corporation announced the closing of an overnight marketed offering of Subordinate Voting Shares at a price of $16.00 per share for total gross proceeds of approximately US$125 million.

DESCRIPTION OF SHARE CAPITAL OF THE CORPORATION

The authorized share capital of the Corporation consists of an unlimited number of Subordinate Voting Shares, of which 216,851,695 were issued and outstanding as of February 25, 2021, an unlimited number of Proportionate Voting Shares, of which 138,204 (which are convertible on a 1:200 basis into 27,640,896 Subordinate Voting Shares) were issued and outstanding as of February 25, 2021, an unlimited number of Super Voting Shares, of which 500,000 were issued and outstanding as of February 25, 2021, and an unlimited number of Special Subordinate Voting Shares, of which 63,868,296 (which are convertible on a 100,000:1 basis into 639 Subordinate Voting Shares) were issued and outstanding as of February 25, 2021. All of the issued and outstanding Super Voting Shares are held by the Corporation’s founders, Charlie Bachtell, Joe Caltabiano, Robert Sampson, Dominic Sergi and Brian McCormack (together, the “Founders”). In addition, members of the LLC hold 120,907,764 redeemable units that are convertible into Proportionate Voting Shares on a 200:1 basis.

The Subordinate Voting Shares are “restricted securities” within the meaning of such term under applicable Canadian securities laws. The Corporation has complied with the requirements of Part 12 of National Instrument 41- 101 — General Prospectus Requirements (“NI 41-101”) to be able to file a prospectus under which the Subordinate Voting Shares or securities that are, directly or indirectly, convertible into, or exercisable or exchangeable for, the Subordinate Voting Shares are distributed, as the Corporation received the requisite prior majority approval of shareholders of the Corporation, at the annual and special meeting of shareholders held on November 14, 2018, in accordance with applicable law, including Section 12.3 of NI 41-101, for the Share Terms Amendment. The Share Terms Amendment constituted a “restricted security reorganization” within the meaning of such term under applicable Canadian securities laws.

As of February 25, 2021, the Subordinate Voting Shares represent approximately 17% of the voting rights attached to outstanding securities of the Corporation, the Proportionate Voting Shares represent approximately 2%, the Super Voting Shares represent approximately 80%, and the Special Subordinate Voting Shares represent approximately 0.0001% of the voting rights attached to outstanding securities of the Corporation.

The following is a summary of the rights, privileges, restrictions and conditions attached to the Subordinate Voting Shares, the Proportionate Voting Shares, the Super Voting Shares, and the Special Subordinate Voting Shares but does not purport to be complete. Reference should be made to the articles of the Corporation and the full text of their provisions for a complete description thereof, which are available under the Corporation’s profile on SEDAR at www.sedar.com.

Subordinate Voting Shares

Right to Notice and Vote | Holders of Subordinate Voting Shares will be entitled to notice of and to attend at any meeting of the shareholders of the Corporation, except a meeting of which only holders of another particular class or series of shares of the Corporation will have the right to vote. At each such meeting, holders of Subordinate Voting Shares will be entitled to one vote in respect of each Subordinate Voting Share held. |

- 9 -

Table of Contents

Class Rights & Right of First Refusal | As long as any Subordinate Voting Shares remain outstanding, the Corporation will not, without the consent of the holders of the Subordinate Voting Shares by separate special resolution, prejudice or interfere with any right attached to the Subordinate Voting Shares. Holders of Subordinate Voting Shares will not be entitled to a right of first refusal to subscribe for, purchase or receive any part of any issue of Subordinate Voting Shares, or bonds, debentures or other securities of the Corporation. | |

Dividends | Holders of Subordinate Voting Shares will be entitled to receive as and when declared by the directors of the Corporation, dividends in cash or property of the Corporation. | |

Participation | In the event of the liquidation, dissolution or winding-up of the Corporation, whether voluntary or involuntary, or in the event of any other distribution of assets of the Corporation among its shareholders for the purpose of winding up its affairs, the holders of Subordinate Voting Shares shall, subject to the prior rights of the holders of any shares of the Corporation ranking in priority to the Subordinate Voting Shares (including, without restriction, the Super Voting Shares) be entitled to participate ratably along with all other holders of Subordinate Voting Shares, Special Subordinate Voting Shares (on an as converted to Subordinate Voting Shares basis) and the Proportionate Voting Shares (on an as converted to Subordinate Voting Shares basis). | |

Changes | No subdivision or consolidation of the Subordinate Voting Shares shall occur unless, simultaneously, the Subordinate Voting Shares, the Special Subordinate Voting Shares, the Proportionate Voting Shares and the Super Voting Shares are subdivided or consolidated in the same manner or such other adjustment is made so as to maintain and preserve the relative rights of the holders of the shares of each of the said classes. | |

Conversion | In the event that an offer is made to purchase Proportionate Voting Shares and the offer is one which is required, pursuant to applicable securities legislation or the rules or conditions of listing of a stock exchange on which the Proportionate Voting Shares are then listed, to be made to all or substantially all the holders of Proportionate Voting Shares in a given province or territory of Canada to which these requirements apply, each Subordinate Voting Share shall become convertible at the option of the holder into Proportionate Voting Shares at the inverse of the Conversion Ratio then in effect at any time while the offer is in effect until one day after the time prescribed by applicable securities legislation for the offeror to take up and pay for such shares as are to be acquired pursuant to the offer. The conversion right may only be exercised in respect of Subordinate Voting Shares for the purpose of depositing the resulting Proportionate Voting Shares pursuant to the offer, and for no other reason. In such event, the Corporation’s transfer agent shall deposit the resulting Proportionate Voting Shares on behalf of the holder. Should the Proportionate Voting Shares issued upon conversion and tendered in response to the offer be withdrawn by shareholders or not taken up by the offeror, or should the offer be abandoned or withdrawn, the Proportionate Voting Shares resulting from the conversion shall be automatically reconverted, without further intervention on the part of the Corporation or on the part of the holder, into Subordinate Voting Shares at the Conversion Ratio then in effect. | |

Take-Over Bid Protection

The Super Voting Shares are transferable only among the Founders and their respective affiliates for planning and similar purposes. The Founders have entered into an investment agreement with the Corporation whereby, upon any sale of Super Voting Shares to a third party purchaser not listed above, such Super Voting Shares will immediately be redeemed by the Corporation for their issue price. See “Super Voting Shares – Investment Agreement” below.

Additionally, as noted above, the Corporation’s articles entitle the holders of Subordinate Voting Shares to convert to Proportionate Voting Shares and tender to any take-over bid made solely to the holders of Proportionate Voting Shares.

- 10 -

Table of Contents

Proportionate Voting Shares

Right to Vote | Holders of Proportionate Voting Shares will be entitled to notice of and to attend at any meeting of the shareholders of the Corporation, except a meeting of which only holders of another particular class or series of shares of the Corporation will have the right to vote. At each such meeting, holders of Proportionate Voting Shares will be entitled to one vote in respect of each Subordinate Voting Share into which such Proportionate Voting Share could ultimately then be converted, which for greater certainty, shall initially be equal to 200 votes per Proportionate Voting Share (subject to adjustment at the discretion of the board of directors of the Corporation, depending upon the ratios necessary to preserve foreign private issuer status). | |

Class Rights | As long as any Proportionate Voting Shares remain outstanding, the Corporation will not, without the consent of the holders of the Proportionate Voting Shares and Super Voting Shares by separate special resolution, prejudice or interfere with any right or special right attached to the Proportionate Voting Shares. Consent of the holders of a majority of the outstanding Proportionate Voting Shares and Super Voting Shares shall be required for any action that authorizes or creates shares of any class having preferences superior to or on a parity with the Proportionate Voting Shares. In connection with the exercise of the voting rights for the foregoing only, each holder of Proportionate Voting Shares will have one vote in respect of each Proportionate Voting Share held. | |

Dividends | The holder of Proportionate Voting Shares shall have the right to receive dividends, out of any cash or other assets legally available therefor, pari passu (on an as converted basis, assuming conversion of all Proportionate Voting Shares into Subordinate Voting Shares) as to dividends and any declaration or payment of any dividend on the Subordinate Voting Shares. No dividend will be declared or paid on the Proportionate Voting Shares unless the Corporation simultaneously declares or pays, as applicable, equivalent dividends (on an as-converted to Subordinate Voting Share basis) on the Subordinate Voting Shares and the Special Subordinate Voting Shares. | |