RAPID NUTRITION PLC

CORPORATE GOVERNANCE

CONTENTS

ACCOUNTING PRINCIPLES |

BUSINESS OF THE GROUP - Company Information - Board of Directors and Management - Shareholders and Related Party Transactions - Description of the share capital and the shares |

TAXATION |

GLOSSARY OF TERMS |

Accounting Principles

The financial information of the Company contained in this document is prepared in accordance with the International Financial Reporting Standards (IFRS) as adopted by the European Union and with those parts of the Companies Act 2006 of the United Kingdom applicable to companies reporting under IFRS.

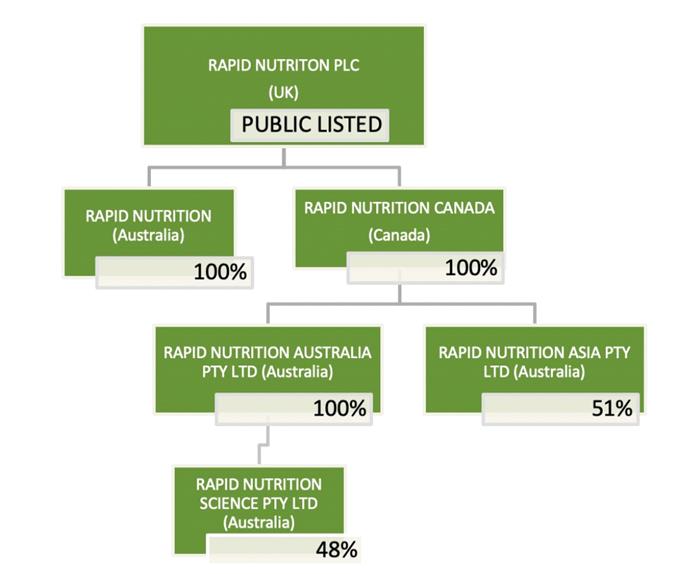

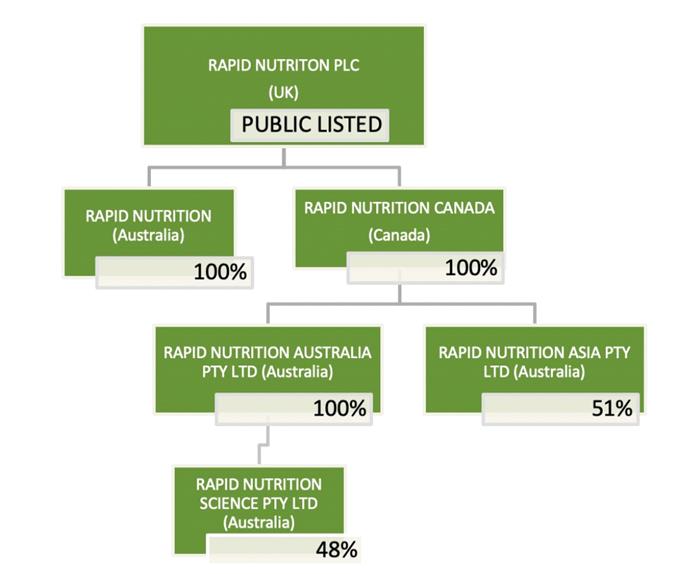

The Company is the holding company of Rapid Nutrition Pty Ltd, Australia (Rapid Nutrition Pty Ltd and Rapid Nutrition Canada). Rapid Nutrition Pty Ltd holds 100% of the shares in Rapid Nutrition Australia Pty Ltd, and 51% of the shares in Rapid Nutrition Asia Pty Ltd. Rapid Nutrition Australia Pty Ltd holds 48% in Rapid Nutrition Science Pty Ltd. Rapid Nutrition Pty Ltd together with Rapid Nutrition Australia Pty Ltd, Rapid Nutrition Asia Pty Ltd, Rapid Nutrition Science Pty Ltd and Rapid Nutrition Canada “the Subsidiaries). Rapid Nutrition Pty Ltd was incorporated in 2001 in Australia. In 2012 the Company was incorporated in the United Kingdom and absorbed Rapid Nutrition Pty Ltd.

Rapid Nutrition Australia Pty Ltd, Australia was incorporated on 23 Februray 2018 with the sole purpose to specifically hold the GNC Master Distribution License and anything directly related to the GNC rollout and activities in Australia

Rapid Nutrition Asia Pty Ltd, Australia was incorporated on 17 April 2018 with the goal to focus on Asia related trading activities for the group. It is expected that this vehicle will be used specifically to source Australian-made nutritional supplements to the Chinese market expected to start in the second half of 2018. The development of business through this vehicle is part of the Group's current growth strategy.

Rapid Nutrition Canada In, was incorporated on 12 June 2019 enabling the group to obtain electronic eligbility on CDS.

Rapid Nutrition Science Pty Ltd was incorporated 28 April 2020 to hold any new intellectual property developed by Ruth Kendon.

The Group business is based on research and development (R&D), manufacturing and distributions of weight-loss and diet management products, sports nutrition and vitamins and dietary supplements.

COMPANY INFORMATION

1.2.1 Name, Registered Office, Location

The name of the Company is Rapid Nutrition PLC. The Company's the registered address is 20-27 Gloucester Street, London WC1N 3AX, United Kingdom and the Company's head office is located at 40-46 Nestor Drive, Meadowbrook QLD 4131, Australia.

The whole business of the Company is operated through its subsidiary Rapid Nutrition Pty Ltd, 40-46 Nestor Drive, Meadowbrook QLD 4131, Australia.

1.2.2 Incorporation, Duration

The Company was incorporated in England and Wales on 11 January 2012 under the name Rapid Nutrition PLC. The Company exists since its incorporation and its duration is not limited.

1.2.3 System of Law, Legal Form

The Company is a public limited company (PLC) incorporated under the laws of England and Wales and operating pursuant to the UK Companies Act 1985 (as amended) and the Companies Act 2006 (Act).

1.2.4 Purpose

The laws of England and Wales require companies to specify their nature of business according to the standard industrial classification of economic activities (UK SIC Code) when filing with Companies House, which is the United Kingdom's registrar of companies.

The Company business purpose and activities are included under the UK SIC Code 21100 "Manufacture of basic pharmaceutical products" which includes provitamins, vitamins and their derivatives (manufacture) as well as mineral and pharmaceutical nutritional ingredients for food and feeding stuff (manufacture).

1.2.5 Register

The Company is registered through Companies House, United Kingdom since its incorporation under the company number 7905640.

1.2.6 Group Structure

The Company was incorporated to act as a holding company for Rapid Nutrition Pty Ltd and the Rapid Nutrition business. Rapid Nutrition Pty Ltd, Australia became a wholly owned subsidiary of the Company on 24 July 2012 and is the operating entity in the Group. Addtionally, Rapid Nutrition Pty has incorporated Rapid Nutrition Australia Pty Ltd as a wholly owned subsidiary on 23 February 2018, for the purpose of holding the GNC Australian Distirbution Agreement as well as any related activities to GNC in the Australia market. Furthermore Rapid Nutrition Pty Ltd is a majority shareholder of Rapid Nutrition Asia Pty Ltd, since 17 April 2018. It is expected that this vehicle will be used specifically to source Australian-made nutritional supplements to the Chinese market starting in the second half of 2018. The development of business through this vehicle is part of the Group's current growth strategy. The group recently incorporated a non-operating subsidiary in Canada in 2019 under the name Rapid Nutrition Canada Inc. The purpose of this was to obtain CDS Eligibility for its Common Shares. CDS Clearing offers the New York Link and DTC Direct Link services to transact Canada-U.S. cross-border settlements and to provide custody services for U.S.-based securities via DTC. Shares that are CDS eligible often increase trading volume. In addition, CDS eligibility addresses the issue that many US firms have that prohibit trading in shares that are not either CDS or DTC eligible. As Rapid Nutrition moves forward with its business plans, CDS eligibility will extend its reach to a broader audience of investors, both in North America and internationally and further support its shareholders. The group lastly incorporate Rapid Nutrition Science Pty Ltd on the 28 April 2020 to hold any new intellectual property developed by Ruth Kendon.

BOARD OF DIRECTORS AND MANAGEMENT

The Company is a public limited company (PLC) incorporated under the laws of England and Wales.

The corporate bodies of a PLC under the laws of England and Wales consist of a Board of Directors and any committees to which the Board of Directors choose to delegate their powers.

The respective rights and responsibilities of these bodies are set forth in the Companies Act 2006, the Company’s Articles of Association and any terms of reference of the committees.

The board of directors of a PLC is responsible for the management of the company's business. Each director, and the board of directors as a whole, owes duties to the company. These duties are: To act within their powers; to promote the success of the company; to exercise independent judgment; to exercise reasonable care, skill and diligence; to avoid conflicts of interest; not to accept benefits from third parties; and to declare interests in any proposed transactions or arrangements with the Company.

English company law does not distinguish between a management board and a supervisory board. The directors can either be executive or non-executive members but all owe the same statutory duties to the company.

1.4.1 General

According to Articles 82 and 83 of the Company's Articles, Directors are appointed by ordinary resolution of the shareholders or by a decision of the directors. As a matter of best practice, the directors of the Company rotate for re-election at each Annual General Meeting of the Company, although this is not required under the Company’s articles of association. The Company is required to have a minimum of two directors. There is no distinction drawn between executive and non-executive directors under the laws of England and Wales. Any person occupying the position of director, by whatever name called, will considered to be a director.

Currently, the Company's Board of Directors consists of three members.

1.4.2 Members of the Board of Directors

Simon St Ledger, executive Director and CEO (Nationality: Australian): Simon St Ledger has been a personal trainer and dietary consultant, and an advisor to numerous health clubs and organisations. In the two decades that he has been in the industry, Simon St Ledger has amongst other things managed national fitness equipment suppliers, and was chiefly responsible for the establishment of the Australian National Weight Loss Clinic.

Simon St Ledger was named a finalist for the 2012 Brisbane Young Entrepreneur Award. Simon St Ledger also made the Subsidiary worthy of the 2013 Premier of Queensland’s Export Award in the Health and Biotechnology category. This recognition earned the Subsidiary a place in the national finals of the 51st Australian Government Export Awards, representing Queensland in the small business category.

Shayne Kellow, non-executive Director (Nationality: Australian): Shayne Kellow has over twenty-five years of experience in institutional and business development, corporate finance and international sales. He has experience, establishing global distribution networks within the healthcare industry, in particular in South-East Asia, Middle East and the Americas. Previous roles of Shayne Kellow include Business Operations Manager of the Australian Business Development Centre which involved mentoring and advising Business Startup for over 250 new businesses. Further, he was the Founding Director of Elmore Oil, a successful healthcare company manufacturing and distributing natural lotions with therapeutic benefits to over 12 countries.

Vesta Vanderbeken, non-executive Director (Nationality: Australian): Ms Vanderbeken has had over two decades of investment banking and corporate finance experience across various industries, including diversified industrials, consumer services, infrastructure, power, utilities, telecommunications, entertainment and agriculture. Vesta has held senior roles in Investment, Institutional and Corporate Banking with the Australia and New Zealand Banking Group Limited, ANZ Investment Bank and worked on some of the largest institutional and project finance deals in Australia.

Vesta has a Bachelor of Applied Economics degree from the University of South Australia, a Graduate Diploma in Applied Finance and Investments from the Financial Services Institute of Australia and completed studies in entrepreneurship at Stanford University.

1.4.3 Committees

As envisaged by the UK Corporate Governance Code, which is not statutory law but a set of principles that represent good corporate governance practice and has been widely adopted by UK companies, the Board has established Audit, Remuneration, Nomination and Disclosure Committees.

Audit Committee: The Audit Committee has responsibility for, among other things, the monitoring of the financial integrity of the financial statements of the Group and the involvement of the Group’s auditors in that process. It focuses in particular on compliance with accounting policies and ensuring that an effective system of internal financial controls is maintained. The ultimate responsibility for reviewing and approving the annual report and accounts and the half-yearly reports remains with the Board. The Audit Committee will normally meet at least three times a year at the appropriate times in the reporting and audit cycle.

The terms of reference of the Audit Committee cover such issues as membership and the frequency of meetings, together with requirements for quorum and notice procedure and the right to attend meetings. The responsibilities of the Audit Committee covered in the terms of reference are: external audit, internal audit, financial reporting and internal controls and risk management. The terms of reference also set out the authority of the committee to carry out its responsibilities. The Audit Committee’s terms of reference require that it comprise two or more independent non-executive Directors, and at least one person who is to have significant, recent and relevant financial experience.

The Audit Committee currently comprises two members being independent non-executive Director, and independent non-executive adviser. The committee is chaired by the non-executive director.

The ultimate responsibility for reviewing and approving the annual report and accounts and the half-yearly reports will remain with the Board.

Remuneration Committee: The Remuneration and Nomination Committee has responsibility for considering and making recommendations to the Board in respect of appointments to the Board, the Board committees and the chairmanship of the Board committees. It is also responsible for keeping the structure, size and composition of the Board under regular review, and for making recommendations to the Board with regard to any changes necessary.

The responsibilities of the Remuneration and Nomination Committee covered in its terms of ref-erence include: review of the Board composition; appointing new Directors; reappointment and re-election of existing Directors; succession planning, taking into account the skills and exper-tise that will be needed on the Board in the future; reviewing time required from non-executive directors; determining membership of other Board committees; and ensuring external facilitation of the evaluation of the Board.

The Committee is further responsible for the determination of the terms and conditions of em-ployment, remuneration and benefits of each of the Chairman, executive Directors, members of the executive and the company secretary, including pension rights and any compensation pay-ments, and recommending and monitoring the level and structure of remuneration for senior management and the implementation of share option or other performance-related schemes. The Remuneration and Nomination Committee will meet at least twice a year.

The terms of reference of the Remuneration and Nomination Committee also cover such issues as membership and frequency of meetings, together with the requirements for quorum and no-tice procedure and the right to attend meetings. The responsibilities of the Remuneration and Nomination Committee covered in its terms of reference are: determining and monitoring policy on and setting levels of remuneration; early termination, performance-related pay and pension arrangements; reporting and disclosure of remuneration policy; share schemes (including the annual level of awards); obtaining information on remuneration in other companies; and select-ing, appointing and terminating remuneration consultants. The terms of reference also set out the reporting responsibilities and the authority of the committee to carry out its responsibilities.

The Remuneration and Nomination Committee comprises 2 members; non-executive director and and an independent non-executive adviser. The committee is chaired by non-executive adviser.

Disclosure Committee: The Disclosure Committee is responsible for, among other things, helping the Company make timely and accurate disclosure of all information that it is required to disclose under its legal and regulatory obligations. The Disclosure Committee will meet at such times as shall be necessary or appropriate.

The Disclosure Committee’s terms of reference deal with such issues as membership and frequency of meetings, together with the requirements for quorum and notice procedure and the right to attend meetings. The responsibilities in the terms of reference of the Disclosure Committee relate to the following: determining the disclosure treatment of material information; identifying insider information; assisting in the design, implementation and periodic evaluation of disclosure controls and procedures; monitoring compliance with the Company’s disclosure procedures and share dealing policies; resolving questions about the materiality of information; insider lists; reviewing announcements dealing with significant developments in the Company’s business; and considering the requirements for announcements in case of rumors relating to the Company.

The Disclosure Committee comprises the non-executive Director, the independent non-executive corporate advisor and the independent non- executive advisor. The Committee is chaired by non-executive corporate advisor

1.4.4 Appointed Executive Officers

English law does not distinguish between a management board and a board of directors with a supervisory function. The directors are responsible for the management of the company's business. There are executive and non-executive directors. Directors may delegate certain powers and tasks to third parties.

The Company's directors have appointed Michael Zhu as Chief Financial Officer. Michael Zhu has experience working with business of all sizes and industries; he operates his own accounting practice and consulting firm where he specializes in business services and operations, policies and procedures, business planning, financial modeling and valuation, and raising capital. Likewise, Michael Zhu has a wealth of experience using cloud platforms to evolve and customize his accounting and consulting services with the latest technology.

1.4.5 Company Secretary

Public companies governed by the Companies Act are required to appoint a Company Secretary according to section 271 of the Companies Act 2006.

The Company Secretary of the Company is Elemental Company Secretary Limited with its business address at 27 Old Gloucester Street, London WC1N 3AX, United Kingdom.

The Company Secretary's general responsibilities are:

-

annual compliance services;

-

support for the general meeting of the Company;

-

drafting of the notice of general meeting;

-

drafting of the proxy form, board minutes calling the meeting, chairman’s script and ancillary documents;

-

ad hoc advice on the proposed resolutions;

-

attendance at the meeting in person or by telephone conference;

-

drafting of the minutes of the meeting; and

-

filing any relevant resolutions with Companies House.

1.4.6 Positions held by the Members of the Board of Directors in the last five years

The members of the Board of Directors of the Company have not been, during the last five years or currently are, members of the administrative, management or supervisory bodies under company law, or partners, of any other listed and major companies.

1.4.7 Business Address

The business address of all three members of the Board of Directors and the Chief Financial Officer is 40-46 Nester Drive, Meadowbrook Qld 4131, Australia.

1.5.

Ownership of Shares and Option Rights in the Company

The following table shows the number of Shares and option rights in the Company held directly or indirectly by individual members of the Board of Directors and the Chief Financial Officer of the Company. The applicable percentage ownership is based on 34,374,674 Shares outstanding.

| | No. of Shares1 | Voting Rights (%) | Number of options1 |

| Simon St Ledger | 2,448,458 | 7.54% | 0 |

| Vesta Vanderbeken | 0 | - | 0 |

| Shayne Kellow | 272,022 | 0.84% | 0 |

| Michael Zhu (Chief Financial Officer) | 0 | - | 0 |

| Total | 2,720,480 | 8.38% | 0 |

1.6.

Employee Participation Program

The Company has no employee participation programs in place.

1.7.

Statutory and Group Auditor

The existing auditing mandate was assumed by Greenwich & Co UK (previously under the name of KSI (WA)) Level 2, 35 Outram Street, West Perth WA 6005, Australia. Greenwich & Co UK was the Company's auditor for the last three financial years. Greenwich & Co UK is also the auditor of the Company's Subsidiary.

SHAREHOLDERS AND RELATED PARTY TRANSACTIONS

Since its Listing at SIX Swiss Exchange on 29 March 2017, the Company has been subject to article 120 of the Swiss Federal Act on Financial Market Infrastructures and Market Conduct in Securities and Derivatives Trading (FMIA) which reads as follows:

"1 Anyone who directly or indirectly or acting in concert with third parties acquires or disposes of shares or acquisition or sale rights relating to shares of a company with its registered office in Switzerland whose equity securities are listed in whole or in part in Switzerland, or of a company with its registered office abroad whose equity securities are mainly listed in whole or in part in Switzerland, and thereby reaches, falls below or exceeds the thresholds of 3%, 5%, 10%, 15%, 20%, 25%, 33⅓%, 50% or 66⅔% of the voting rights, whether exercisable or not, must notify this to the company and to the stock exchanges on which the equity securities are listed.

2 Financial intermediaries who acquire or dispose of shares or acquisition or sale rights on behalf of third parties are not subject to this notification duty.

3 Anyone who has the discretionary power to exercise the voting rights associated with equity securities in accordance with paragraph 1 is also subject to the notification duty.

4 The following shall be deemed equivalent to an acquisition or disposal:

a.

the initial listing of equity securities;

b.

the conversion of participation certificates or profit-sharing certificates into shares;

c.

the exercise of conversion or acquisition rights;

d.

changes in the share capital; and

e.

the exercise of sale rights.

5 All procedures that can ultimately confer the voting right to equity securities also constitute an indirect acquisition. This does not apply in the case of powers of attorney granted solely for the purposes of representation at a general meeting."

As of 30 June 2019, the shareholder base notified to the Company and disclosed on the disclosure platform of SIX Swiss Exchange in compliance with the disclosure requirements of article 120 FMIA consists of the following persons and entities (percentage figures refer to a percentage of voting rights in relation to the voting rights of the Shares published in accordance with article 115 paragraph 3 of the Ordinance on Financial Market Infrastructures and Market Conduct in Securities and Derivatives Trading at the time of notification):

| Major Shareholders | No. of Shares/No. of voting rights | Proportion of voting rights |

JBG Corp Pty Ltd, Nestor Drive, Meadowbrook 4131, Australia Beneficial Owner: Leisa St Ledger, Rochedale, Queensland 4123, Australia1 | 3'666'592 | 9.43 % |

Cayman Emerging Manager Platform SPC, Jenepe IPO Capital Fund SP, Governors Square, Unit 5-202, West Bay Road, Grand Cayman KY1-1001, Cayman Islands Beneficial Owner: Peter Hughes, St. George, Bermuda | 5'021'503 | 12.93% |

| IPO CAPITAL PLC, E1W1 YW, London, United Kingdom | 1,611,049 | 4.69% |

| Whetstone Capital Group PLC, EC2M 1QS, London, United Kingdom | 1,514,687 | 4.41% |

| Lewnis Boudaui, 1020 Vienna, Austria | 1,217,520 | 3.75% |

| Motivate Health Technologies Inc, Reno NV 89509, United States | 1,405,004 | 4.33% |

| Simon St Ledger, 4131, Meadowbrook, Australia | 2,448,458 | 7.54% |

| ABK Investments Limited, Kowloon Bay, Hong Kong | 1,850,000 | 4.76% |

| Alternative Gestion S.A, Hermance, Geneva, Switzerland | 2,000,000 | 5.81% |

| The CCK Superannuation Fund, 2250, Holgate, NSW Australia | 1,203,281 | 3.71% |

1 Leisa St Ledger, Rochedale, Qld, Australia is the sole director and shareholder of JBG Corp Pty Ltd and the wife of Simon St Ledger, Director and CEO of the Company.

The information above is derived from the website of SIX Exchange Regulation as per 1 June 2020 and is therefore based on disclosures SIX Exhange Regulation and the Company received from third parties. The information presented in the table above is to the best of the Company's knowledge accurate and up to date.

Motivate Health Technology Inc. holds 4.33% of the Shares of the Company and the Company owns currently 15% of shares of Motivate Health Technology Inc.

1.10.

Public Purchase Offers

Swiss Law: Pursuant to the FMIA anyone who directly, indirectly or acting in concert with third parties acquires equity securities which, added to the equity securities already owned, exceed the threshold of 33⅓% of the voting rights of a listed target company, whether exercisable or not, must make an offer to acquire all listed equity securities of the company. Target companies may raise this threshold to 49% of voting rights (opting-up) in their articles of incorporation. The price offered must be at least as high as the higher of the following two amounts: the stock exchange price or the highest price that the offeror has paid for equity securities of the target company in the preceding twelve months. Companies may, prior to their equity securities being admitted to official listing on a stock exchange, state in their articles of incorporation that an offeror shall not be bound by the obligation to make a public takeover offer (opting-out).

The Swiss law on public purchase offers also applies to companies with registered seat outside of Switzerland if their equities are at least partly listed at a Swiss stock exchange (article 125 (1) (b) FMIA). In case a foreign law would also be applicable to the public offering the applications of Swiss law may be waived to the extent that the foreign law conflicts with the Swiss law and the investors protections under the foreign law would be deemed as equivalent to the Swiss rules (Article 125 (2) FMIA).

Laws of England and Wales: The Company has been advised that the provisions of the City Code on Takeovers and Mergers (UK Takeover Code) do not apply to the Company as at the date of this document since the directors do not consider that the Company has its place of central management and control in the United Kingdom, the Channel Islands or the Isle of Man. In the event that this changed in the future, the UK Takeover Code would apply to the Company.

Articles of Association: The Articles of Association of the Company do not contain any provisions regarding offer obligations. The Company's 'Articles of Association' can be viewed here: Search Path: rnplc.com>Investor Relations>Corporate Governance

DESCRIPTION OF THE SHARE CAPITAL AND THE SHARES

1.11.1 Issued Capital

As of 30 June 2019, the Company's statutory ordinary share capital amounted to nominally GBP 32,459,824. The Shares are fully paid and rank pari passu with each other.

1.11.2 Authorized Capital / Authority to allot shares / Pre-emption rights

Under the law of England and Wales the concepts of authorized capital as known under Swiss law is not applicable. English law, however, provides for an authorization to allot shares and to disapply pre-emption rights as set out below.

Pursuant to section 551 Companies Act 2006, the directors of a company may by ordinary resolution of the shareholders exercise the power to allot shares in the company or grant rights to subscribe for or to convert any security into shares in the company.

Pursuant to section 571 Companies Act 2006, a company may by a special resolution of the shareholders resolve that section 561 Companies Act 2006 (existing shareholders’ right of pre-emption) does not apply to a specified allotment of equity securities (as defined by section 560 Companies Act 2006) to be made pursuant to that authorization or applies to such an allotment with such modifications as may be specified in the resolution.

On 14 November 2017 at the annual general meeting of the Company the following resolutions were passed and have effect until the earlier of 31 December 2018 and the conclusion of the next Annual General Meeting:

●

The Directors authority to allot securities up to an aggregated nominal amount of GBP 500,000 in accordance with Section 551 of the Companies Act 2006.

●

The Directors authority to allot securities up to an aggregated nominal amount of GBP 25,000 in accordance with Section 551 of the Companies Act 2006.

●

The Directors authority to allot securities up to an aggregated nominl amount of GBP 250,000 in accordance with Section 551 of the Companies Act 2006.

1.11.3 Conditional Capital

As of the date of this document the Company has no conditional share capital. For the authorizations of the directors to allot additional shares pursuant ot the law of England and Wales, seesection 1.11.2 above.

The Swiss Security Number (Valorennummer) of the New Shares is 24217339, the ISIN is GB00BLG2TX24 and the SIX Swiss Exchange Ticker Symbol is RAP.

1.13.

Type of Shares, Certification and Form of Shares

The Company has in issue 38,849,541 ordinary registered Shares with a nominal value of GBP 0.01 each and 388495.41.

The Shares have been validly created under the Companies Act 2006.

The Shares are partially represented by individual certificates and partially as uncertificated securities. Shares in the form of uncertificated securities are held with CREST and Clearstream. Clearing and settlement with respect to such Shares traded over SIX Swiss Exchange occurs typically through SIX x-clear and SIX SIS, respectively. CREST is a paperless settlement procedure operated by Euroclear UK & Ireland Limited enabling securities to be evidenced otherwise than by a certificate and transferred otherwise than by a written instrument. CREST is a voluntary system, therefore shareholders of uncertificated Shares have the right under English law to receive and retain physical share certificates from the Company. However, Shares in certificated form cannot be held or traded in CREST. Shareholders who wish to hold their Shares in certificated form would need to withdraw their Shares from CREST and would not be able to trade such Shares over SIX Swiss Exchange and to clear and settle such Shares through SIX x-clear and SIX SIS, respectively.

A corporate shareholder can hold Shares in CREST directly, provided that it has become a direct CREST member and has the hardware and software to connect directly with CREST, or via a sponsor, a CREST member who offers such services to other companies. An individual shareholder can open an account in his or her name with a stockbroker who is a CREST member, in which case the individual’s name remains on the company’s register and the individual is the legal and beneficial owner of the securities. Accordingly, the individual receives dividends, corporate action notifications and other documentation directly from the company’s registrar and will be able to attend and vote at the meetings of shareholders.

More commonly, the individual transfers his or her securities into a nominee account with a stockbroker or custodian bank acting as nominee for the beneficial owners of the shares. Such a stockbroker or custodian bank is either a direct member of CREST or relies on services of a CREST member. The nominee holds the Shares on behalf of the individual and is the legal owner of the shares, and the shares are registered in the name of the nominee in the company's register. The individual retains beneficial ownership and will receive dividends, corporate action notifications and other documentation via the nominee. Underlying beneficial owners of Shares who wish to obtain a confirmation of their shareholding need to contact their broker or custodian bank.

1.14.

Dividends and Dividend Policy

1.14.1 Dividend Policy and Restrictions

The Company has no dividend policy at the date of this document. The Board will determine – pursuant to the Company's Articles - what, if any, dividends are to be distributed to shareholders from time to time taking into account the profitability and strategic direction of the Company, and such other matters as the Board may consider relevant. The Board has no restrictions on its ability to determine a dividend policy and there are no restrictions in place relating to the payment of dividends.

The Company has not paid any dividends since its incorporation on 11 January 2012.

The Company will maintain a paying agent in Switzerland for the distribution of any dividends for as long as its Shares are listed on the SIX Swiss Exchange. The Company's paying agent in Switzerland is currently Banque Cramer & Cie SA.

Subject to limitations of electronic trading platforms and custodian arrangements, each shareholder of the Company who holds fully paid Shares has the following rights as determined by the Articles of Association and the laws of England and Wales:

(a) Right to attend and speak at general meetings;

(b) Right to vote at a general meeting;

(c) Right to receive dividends.

The rights attached to the Shares only apply to the shareholders listed in the company register For Shares in the form of uncertificated securities, the nominee will be registered in the company register and not the underlying beneficial owner. Therefore, only the nominee has the right to vote, attend meetings and receive dividends. The rights of the beneficial owners are thus derivative in nature. In practice, the underlying beneficial owners of Shares would normally be contacted by their broker or custodian bank with regard to matters communicated by the Company to its shareholders, such as with respect to shareholder meetings, dividends, etc.

The Company has only issued ordinary shares, and as such there are no preferences or restrictions that distinguish the shares in the company.

According to section 41 of the Company's Articles no voting rights attached to a share may be exercised at any general meeting unless all amounts payable to the Company in respect of that share have been paid. There are no additional voting restrictions applicable to the Shares under the laws of England and Wales.

Shareholders are entitled to appoint a proxy to exercise all or any of their rights to attend and to speak and vote on their behalf at the general meeting. A shareholder may appoint more than one proxy in relation to the general meeting provided that each proxy is appointed to exercise the rights attached to a different share or shares held by that shareholder. A proxy does not need to be a shareholder of the Company.

Subject to some specific cases where notice periods may vary including provisions of the Companies Act 2006 which require “special notice”, the Directors may call a general meeting to obtain a vote of the members in the following circumstances with the requisite amount of notice:

(a) for an annual general meeting at least 21 clear days' notice;

(b) for any other general meeting other than an adjourned meeting, the directors must give shareholders at least 14 clear days' notice.

In the case where there are less than two directors, or one or more of the directors are unable or unwilling to call a general meeting, two shareholders may call such a meeting for the purpose of appointing one or more directors.

Ordinary Resolutions require a simple voting majority to be passed and Special Resolutions a voting majority of 75%, in each case with respect to votes cast at a shareholder's meeting.

1.16.

Restriction of Transfer of Shares and Lock-up

As per the date of this document, there are no transfer restrictions or lock-up periods in the Company's Articles of Association or under the laws of England and Wales applicable with regard to the Shares.

Special Provisions

As per the date of this document, there are no special provisions pursuant to the Company's Articles that differ from the laws of England and Wales in respect of changes to capital and the rights attached to the individual types of shares, other than as set out above.

2.1.

Taxation in Switzerland

The following summary does not purport to be a comprehensive description of all the tax consequences of the acquisition, ownership and disposal of the New Shares, and does not take into account the specific circumstances of any particular holder. The summary is based on a residence and effective management of the Company outside Switzerland and Liechtenstein. The summary is based, as applicable, on the tax laws, regulations, decrees, rulings, income tax conventions (treaties), administrative practice and judicial decisions of Switzerland as in effect on the date of this summary which are subject to change (or subject to changes in interpretations), possibly with retrospective effect. This is not a complete analysis of the potential tax effects relevant to owning New Shares, nor does the following summary take into account or discuss the tax laws of any jurisdiction other than Switzerland. It also does not take into account investors' individual circumstances. This summary does not purport to be a legal opinion or to address all tax aspects that may be relevant to a holder of New Shares. Holders are advised to consult their own tax adviser in light of their particular circumstances as to the Swiss and foreign tax laws, tax regulations and regulatory practices that could be relevant for them in connection with the New Shares. Tax consequences may differ according to the provisions of different double taxation treaties and the investor's particular circumstances. The statements and discussion of Swiss taxes set out below are of a general nature and do not relate to persons in the business of buying and selling shares or other securities.

2.1.1 Federal Withholding Tax

Dividend payments and similar cash or in-kind distributions on New Shares are not subject to Swiss federal withholding tax (Verrechnungssteuer).

2.1.2 Federal, Cantonal and Communal Income Taxes and Wealth Tax

Individuals who are Swiss residents for tax purposes and hold New Shares as part of their private assets (Privatvermögen) are required to include dividend payments and similar cash or in-kind distributions or liquidating distributions in excess of the repayment of the nominal amount and capital contribution reserves in terms of Swiss tax law (Kapitaleinlageprinzip) in their personal income tax return and are liable to federal, cantonal and communal income tax on any net taxable income for the relevant tax period. Their capital gains resulting from the sale of Shares are generally not subject to income tax and their capital losses are not deductible for income tax purposes. In case such individuals are qualified as professional securities dealers (Wertschriftenhändler) for income tax purposes, their share sale proceeds may be recharacterized into taxable investment income. Furthermore, upon a repurchase of Shares by the Company, the portion of the repurchase price in excess of the nominal amount and capital contribution reserves in terms of Swiss tax law may be classified as taxable investment income. Individuals who are Swiss residents for tax purposes and hold Shares as part of their business assets (Geschäftsvermögen) and legal entities who are Swiss residents for tax purposes and non-resident taxpayers that hold Shares in connection with the conduct of a trade or business in Switzerland through a permanent establishment or fixed place of business situated in Switzerland, who receive dividend payments and similar cash or in-kind distributions or liquidating distributions or realize a capital gain or loss on the disposition of Shares have to include such distributions, gains or losses in their income statement for the relevant tax period (Buchwertprinzip) and are liable to federal, cantonal and communal individual or corporate income tax, as the case may be, on any net taxable earnings for such tax period. The same tax treatment applies to Swiss resident individuals who, for income tax purposes, are classified as "professional securities dealers" for reasons of, inter alia, frequent dealing and debt-financed purchases so that the New Shares are qualified as business assets. Swiss resident corporate taxpayers, and foreign corporate taxpayers which hold New Shares in connection with the conduct of a trade or business in Switzerland through a permanent establishment, may qualify for participation relief (Beteiligungsabzug) in respect of dividends received and capital gains (Gestehungskostenprinzip), if their holding of Shares is considered substantial for tax purposes.

Any holder of New Shares who is not a Swiss resident for tax purposes and who during the current taxation year has not engaged in a trade or business in Switzerland through a permanent establishment or fixed place of business and who is not subject to taxation in Switzerland for any other reason will generally not be liable to any federal, cantonal or communal income tax on dividend payments and similar cash or in-kind distributions or liquidating distributions or on a realized gain on the sale of Shares. Such a holder will also not be liable to any cantonal/communal wealth tax on the New Shares.

2.1.3 Gift and Inheritance Taxes

The transfer of Shares may be subject to cantonal and/or communal gift, estate or inheritance taxes if the donor is, or the deceased was, resident for tax purposes in a canton levying such taxes.

2.1.4 Federal Stamp Taxes

The transfer of shares in the secondary market is generally subject to federal stamp turnover tax (Umsatzabgabe) where a bank or a securities dealer in Switzerland or Liechtenstein as defined in the Federal Stamp Tax Act acts as an intermediary or is a party to the sale of Shares currently at a rate of 0.3 percent (full rate for foreign shares) of the price paid for the Shares.

2.2.

Taxation in the United Kingdom

The following summary includes a description of the current tax position of Shareholders who are resident or ordinarily resident in the United Kingdom for tax purposes and holding ordinary Shares beneficially as investments. The statements below are intended only as a general guide and do not constitute advice to any shareholder on his personal tax position and may not apply to certain classes of investor who may be subject to special rules (such as dealers in securities, insurance companies, charities, collective investment schemes or pension providers). The comments are based on current legislation and H.M. Revenue & Customs, the department responsible for the collection of taxes in the United Kingdom, practice at the date of this document.

Any investor who is in doubt as to their tax position or who is subject to taxation in a jurisdiction other than the United Kingdom, should consult his or her own professional advisers immediately.

Shareholders should note that the levels and bases of, and relief from, taxation may change and that changes may affect benefits of investment in the Company. This summary is not exhaustive and does not generally consider tax relief or exemptions.

2.2.1 Taxation of Dividends

The Company will not be required to withhold tax at source when paying a dividend to UK tax resident individuals or companies.

A United Kingdom resident individual shareholder will not generally pay tax on the first GBP 5,000 of dividends that they receive in a tax year. Above this allowance the tax a United Kingdom resident individual shareholder will pay depends on which Income Tax band they are in. The current dividend tax rates for the year end 5 April 2018 are as follows:

Subject to certain exceptions, a Shareholder which is a company resident for tax purposes in the United Kingdom and which receives a dividend paid by another company resident for tax purposes in the United Kingdom will not generally have to pay corporation tax in respect of it.

Persons who are not resident in the United Kingdom should consult their own tax advisers concerning their tax liabilities on dividends received from the Company.

2.2.2 Taxation of Capital Gains

If a Shareholder disposes of any or all of his ordinary Shares in the Company he may incur a liability to tax on chargeable gains depending upon the Shareholder's particular circumstances and subject to any available exemptions and reliefs. Companies are entitled to indexation allowance which may also reduce the chargeable gain.

2.2.3 Other Taxes

The transfer of shares in the secondary market is generally subject to UK Stamp Duty Reserve Tax (SDRT). A purchase on SIX Swiss Exchange of Shares in the form of uncertificated securities that are held with CREST and Clearstream and that are cleared and settled through SIX x-clear and SIX SIS, respectively, currently triggers SDRT of 0.5 percent. This stamp tax is charged fully to the buyer of the Shares, and the buyer is liable for the payment. The buyer's bank (SIX Swiss Exchange member) normally assumes the responsibility for the required registration with the HM Revenue and Customs (HMRC), the tax, payments and customs authority of the United Kingdom and the correct deduction and reporting of the tax on behalf of its customer. Certain transfers and purchases are normally exempt from SDRT, such as qualifying transfers between recognized intermediaries and clearing houses or purchases by UK registered charities. Transfers of certificated Shares are subject to a stamp duty of 0.5 per cent, when the transaction value exceeds GBP 1,000.

Schellenberg Wittmer AG, Löwenstrasse 19, 8001 Zurich, Switzerland, being recognized as a representative by SIX Exchange Regulation according to article 43 of the Listing Rules, has filed on behalf of the Company an application for the listing of the Shares according to the International Reporting Standard of SIX Swiss Exchange.

As long as the Shares are listed on the SIX Swiss Exchange, the Company will maintain a principal paying agent (Hauptzahlstelle) in Switzerland. The Company's paying agent in Switzerland is Banque Cramer & Cie SA.

Copies of the Company's Articles of Association as well as the Company's annual reports for the past three years are available at the offices of Rapid Nutrition PLC at 27 Gloucester Street , London, United Kingdom, WC1N 3AX (telephone number: +44 20 3239 2561; e-mail: info@rnplc.com) during regular business hours.

According to the Company's Articles of Association and the statutory law of England and Wales, notices to Shareholders are validly made via registered mail to the nominee registered address in the United Kingdom.

Publications in connection with the listing of the Shares are made in compliance with the applicable Listing Rules of SIX Swiss Exchange. Significant changes to the information contained in this document occurring until the first trading day of the New Shars at SIX Swiss Exchange will be published via an official notice with SIX Swiss Exchange. The Company publishes financial information and press releases in the electronic media and on its website at http://www.rnplc.com/.

3.

GLOSSARY OF DEFINED TERMS

| Act | means the Companies Act 1985 (as amended) and the Companies Act 2006 of the United Kingdom to the extent in force. |

| Articles | means the Company's articles of association as amended. |

| ASIC | Australian Securities and Investments Commission. |

| AUD | means the lawful currency of Australia. |

| Australian Corporations Act | means Corporations Act 2001 of the Commonwealth of Australia. |

| Board | means the Board of Directors of the Company. |

| CHF | means the lawful currency of Switzerland. |

| Company | means Rapid Nutrition PLC. |

| CREST | means the settlement system and central securities depository for the UK operated by Euroclear UK & Ireland Limited. |

| DCF | means discounted cash flow. |

| Director | means a member of the Board of Directors of the Company. |

| EEA | means the European Economic Area. |

| EMEA | means Europe, the Middle East and Africa. |

| EUR | means the lawful currency of the Member States of the European Communities that have adopted the Euro as its lawful currency in accordance with legislation of the European Community relating to the Economic and Monetary Union. |

| Exempt Investors | means an investors who fall within one or more of the categories of investors under section 708 of the Australian Corporations Act to whom an offer may be made without disclosure under Part 6D.2 of the Australian Corporations Act and are "wholesale clients" for the purpose of section 761G of the Australian Corporations Act. |

| FDA | means US Food and Drug Administration. |

| FMIA | means Swiss Federal Act on Financial Market Infrastructures and Market Conduct in Securities and Derivatives Trading dated 19 June 2015, as amended. |

| FSMA | means Financial Services and Markets Act 2000 of the United Kingdom. |

| GMP | means Good Manufacturing Practice. |

| Group | means the Company and its wholly owned subsidiary Rapid Nutrition Pty Ltd, Australia. |

| Group Companies | means the companies of the Group. |

| IFRS | means International Financial Reporting Standards. |

| Initial Price | means the initial trading price for the Shares. |

| Listing | means the listing the New Shares of the Company according to the International Reporting Standard of SIX Swiss Exchange. |

| Listing Rules | means the Listing Rules of SIX Swiss Exchange dated 1 January 2016. |

| Order | means Financial Services and Markets Act 2000 (Financial Promotion) Order 2005. |

| PLC | mean a public limited company incorporated under the laws of England and Wales. |

| Prospectus Directive | means Directive 2003/71/EC and amendments thereto, including the 2014 Amending Directive. |

| PSC Register | means register of people with significant control pursuant to the Companies Act 2006. |

| Rapid Nutrition Pty | means the Company's subsidiary Rapid Nutrition Pty Ltd, Australia. |

| Relevant Member State | means the Member States of the European Economic Area which have implemented the Prospectus Directive. |

| R&D | means research and development. |

| SDRT | means UK Stamp Duty Reserve Tax. |

| SESTA | means the Swiss Federal Act on Stock Exchange and Securities Trading dated 24 March 1995, as amended. |

| SFA | means the Securities and Futures Act of Singapore. |

| Shareholders | means the shareholders of the Company. |

| Shares | means the ordinary shares with a nominal value of GBP 1.00 per share of the Company. |

| SIX SIS | means SIX SIS Ltd, Olten, Switzerland. |

| SIX Swiss Exchange | means SIX Swiss Exchange Ltd, Zurich, Switzerland. |

| SIX x-clear | means SIX x-clear AG, Zurich, Switzerland |

| Subsidiary | means Rapid Nutrition Pty Ltd, Australia. |

| Swiss Codeof Obligations | means the Swiss Code of Obligations (Schweizerisches Obligationenrecht), as amended. |

| Swiss FederalIntermediatedSecurities Act | means the Swiss Federal Intermediated Securities Act (Bundesgesetz über die Bucheffekten), as amended. |

| USD | means the lawful currency of the United States of America. |

| VDS | Vitamin and dietary supplements. |

| 1933 Act | means the U.S. Securities Act of 1933, as amended. |

| 2014 Amending Directive | means Directive 2014/51/EU of 16 April 2014. |