the costs of enforcement of the provisions of the indemnity) without negligence, bad faith or willful misconduct on its part, arising out of or in connection with the administration of the issuing entity. In certain instances, this indemnification will be higher in priority than payments to noteholders. See “The Indenture—Events of Default Remedies.”

The indenture trustee may resign at any time by giving at least (30) days’ written notice thereof to the issuing entity. The indenture trustee may be removed with (30) days’ written notice from any series, class or tranche of notes at any time by not less than 66 2/3% of the holders of that series, class or tranche. The issuing entity may also remove the indenture trustee if, among other things, the indenture trustee is no longer eligible to act as trustee under the indenture or if the indenture trustee becomes insolvent. In all circumstances, the issuing entity must appoint a successor indenture trustee for the notes. Any resignation or removal of the indenture trustee and appointment of a successor indenture trustee will not become effective until the successor indenture trustee accepts the appointment.

Any successor indenture trustee will execute and deliver to the issuing entity and its predecessor indenture trustee an instrument accepting such appointment. The successor trustee must (1) be a corporation organized and doing business under the laws of the United States of America or of any state, (2) be authorized under such laws to exercise corporate trust powers, (3) have a combined capital surplus, and undivided profits of at least $50,000,000, subject to supervision or examination by federal or state authority, and (4) have at the time of appointment, a long term senior, unsecured debt or issuer rating of “Baa3” or better by Moody’s, if rated by Moody’s, “BBB-” or better by S&P Global Ratings, if rated by S&P Global Ratings, and “BBB” or better by Fitch, if rated by Fitch (or, if not rated by Moody’s, S&P Global Ratings or Fitch, a comparable rating by another statistical rating agency). The issuing entity may not, nor may any person directly or indirectly controlling, controlled by, or under common control with the issuing entity, serve as indenture trustee. The indenture trustee shall not offer or provide credit or credit enhancement to the Issuer or be affiliated, as such term is defined in Rule 405 under the Securities Act of 1933, as amended, with the Issuer.

The issuing entity or its affiliates may maintain accounts and other banking or trustee relationships with the indenture trustee and its affiliates.

Owner Trustee

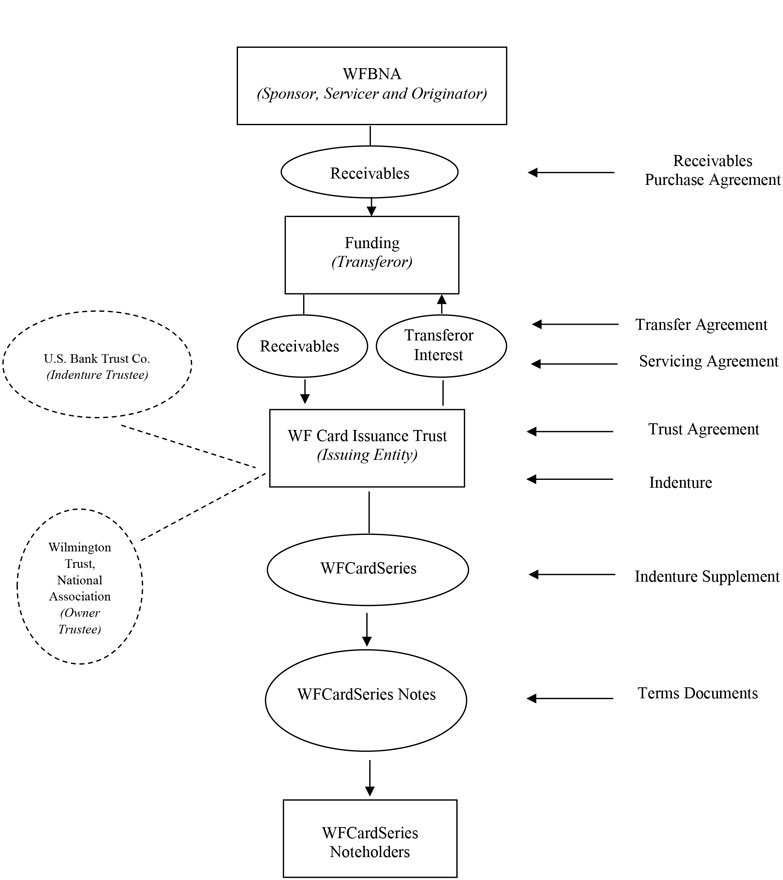

Wilmington Trust, National Association, a national banking association organized and existing under the laws of the United States of America with trust powers, is the owner trustee for the issuing entity. See “Transaction Parties; Legal Proceedings; Affiliations, Relationships and Related Transactions—WF Card Issuance Trust” for a description of the ministerial nature of the owner trustee’s duties and “Transaction Parties; Legal Proceedings; Affiliations, Relationships and Related Transactions—Wilmington Trust, National Association” for a description of Wilmington Trust, National Association.

The owner trustee will be indemnified from and against all liabilities, obligations, losses, damages, penalties, taxes, claims, actions, investigations, proceedings, costs, expenses or disbursements of any kind arising out of, among other things, the trust agreement or any other related documents (or the enforcement thereof), the administration of the issuing entity’s assets or the action or inaction of the owner trustee under the trust agreement, except for (1) its own willful misconduct, bad faith or gross negligence, or (2) the inaccuracy of certain of its representations and warranties in the trust agreement.

The owner trustee may resign at any time by giving 30 days’ prior written notice to the beneficiary. The owner trustee may also be removed as owner trustee if it becomes insolvent, it is no longer eligible to act as owner trustee under the trust agreement or by a written instrument delivered by the beneficiary to the owner trustee. The beneficiary must appoint a successor owner trustee. If a successor owner trustee has

124