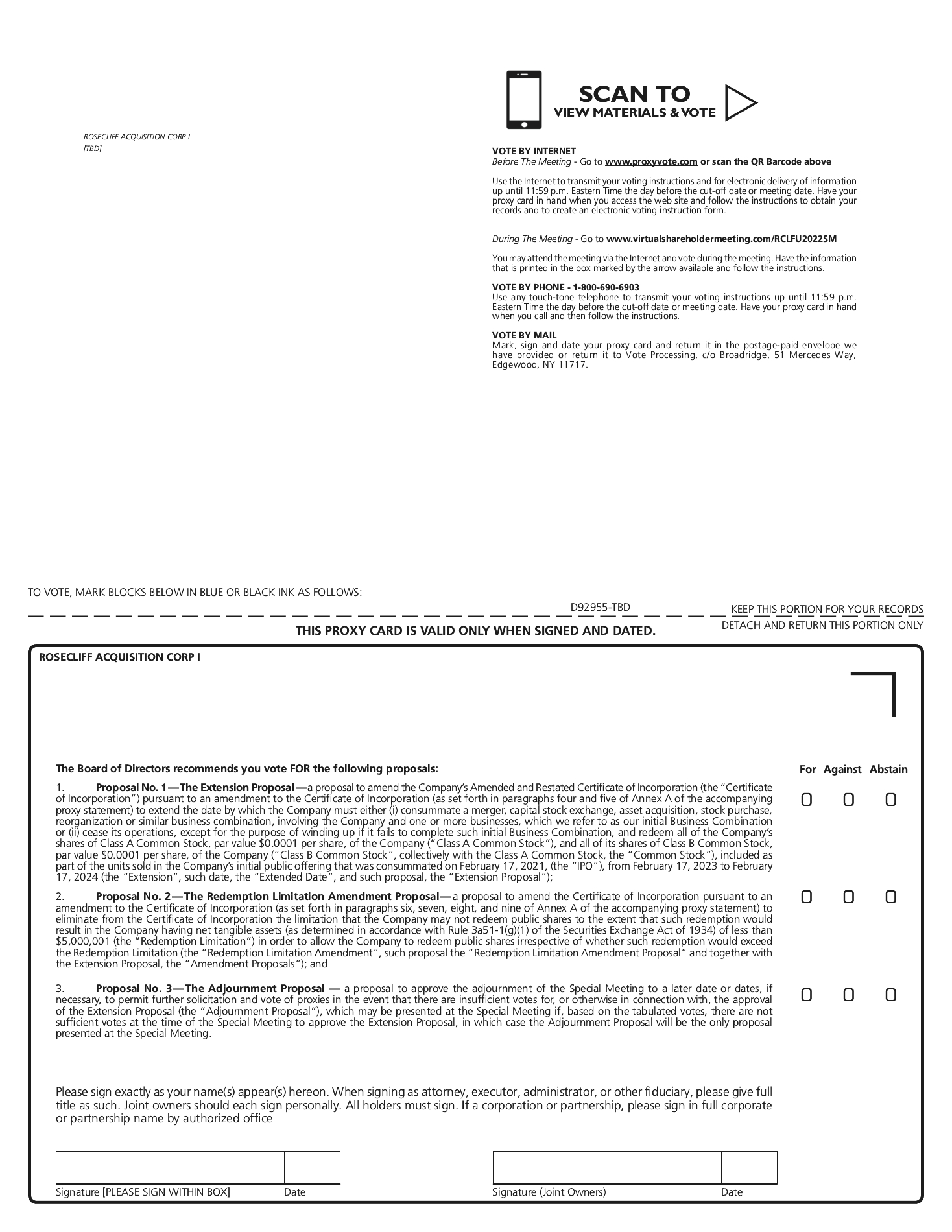

PROPOSAL NO. 1 — THE EXTENSION PROPOSAL

Background

We are a blank check company, incorporated on November 17, 2020, as a Delaware corporation for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses.

On February 17, 2021, the Company consummated its IPO of its units, with each unit consisting of one share of Class A Common Stock and one-third of one redeemable warrant, which included the full exercise by the underwriters of their over-allotment option in the amount of 3,300,000 units. Each whole warrant entitles the holder thereof to purchase one share of Class A Common Stock at a price of $11.50 per share. Only whole warrants are exercisable. Simultaneously with the closing of the IPO, the Company completed the private sale of 4,706,667 private placement warrants at a purchase price of $1.50 per private placement warrant to the Sponsor, generating gross proceeds to us of $7,060,000. Following the closing of the IPO, a total of $253,000,000 (approximately $10.00 per unit) of the net proceeds from the IPO and the sale of the private placement warrants was placed in the Trust Account, with Continental Stock Transfer & Trust Company acting as trustee. The Company’s Certificate of Incorporation provides for the return of the IPO proceeds held in the Trust Account to the holders of shares of Class A Common Stock if it does not complete an initial Business Combination by February 17, 2023.

Reasons for the Extension Proposal

The Certificate of Incorporation provides that we have until February 17, 2023 to complete an initial Business Combination. The Board has determined that there may not be sufficient time before February 17, 2023, to hold a special meeting to obtain stockholder approval of and consummate an initial Business Combination. Accordingly, the Board believes that in order to be able to successfully complete an initial Business Combination, it is appropriate to continue the Company’s existence until the Extended Date. The Board believes that an initial Business Combination is in the best interests of the Company and our stockholders. Therefore, the Board has determined that it is in the best interests of our stockholders to extend the date by which the Company must complete an initial Business Combination to the Extended Date.

If the Extension Proposal is not approved or not implemented and we do not consummate an initial Business Combination by February 17, 2023, the Certificate of Incorporation provides that we will (i) cease all operations except for the purpose of winding up; (ii) as promptly as reasonably possible but not more than ten business days thereafter, redeem our public shares, at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the Trust Account, including interest (less up to $100,000 of interest to pay dissolution expenses and which interest shall be net of taxes payable), divided by the number of then issued and outstanding public shares, which redemption will completely extinguish public stockholders’ rights as stockholders (including the right to receive further liquidating distributions, if any); and (iii) as promptly as reasonably possible following such redemption, subject to the approval of our remaining stockholders and the Board, liquidate and dissolve, subject, in each case, to the Company’s obligations under the DGCL to provide for claims of creditors and the requirements of other applicable law. There will be no redemption rights or liquidating distributions with respect to our warrants, which will expire worthless if we fail to complete our initial Business Combination by February 17, 2023 or, if the Extension Proposal is approved and implemented, the Extended Date.

We believe that the provisions of the Certificate of Incorporation described in the preceding paragraph were included to protect the Company’s stockholders from having to sustain their investments for an unreasonably long period if the Company failed to find a suitable initial Business Combination in the timeframe contemplated by the Certificate of Incorporation. We also believe, however, that given the Company’s expenditure of time, effort and money on pursuing an initial Business Combination, and our belief that an initial Business Combination is in the best interest of the Company and our stockholders, the Extension is warranted.

The sole purpose of the Extension Proposal is to provide the Company with additional time to complete an initial Business Combination, which the Board believes is in the best interests of the Company and our stockholders. A copy of the proposed amendment to the Certificate of Incorporation is attached to this proxy statement as Annex A.

You are not being asked to vote on an initial Business Combination at this time. If either of the Amendment Proposals is approved and implemented and you do not elect to redeem your public shares in