Certain events affecting or involving other parties to the transactions could result in accelerated, delayed, or reduced payments to you.

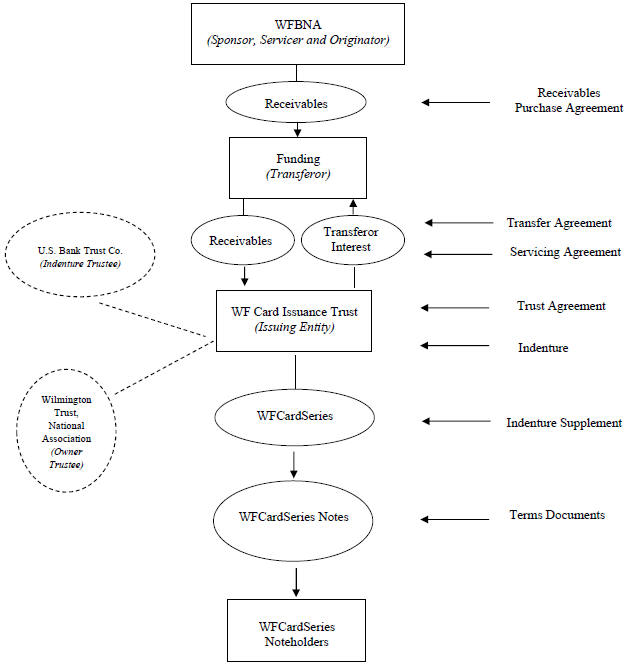

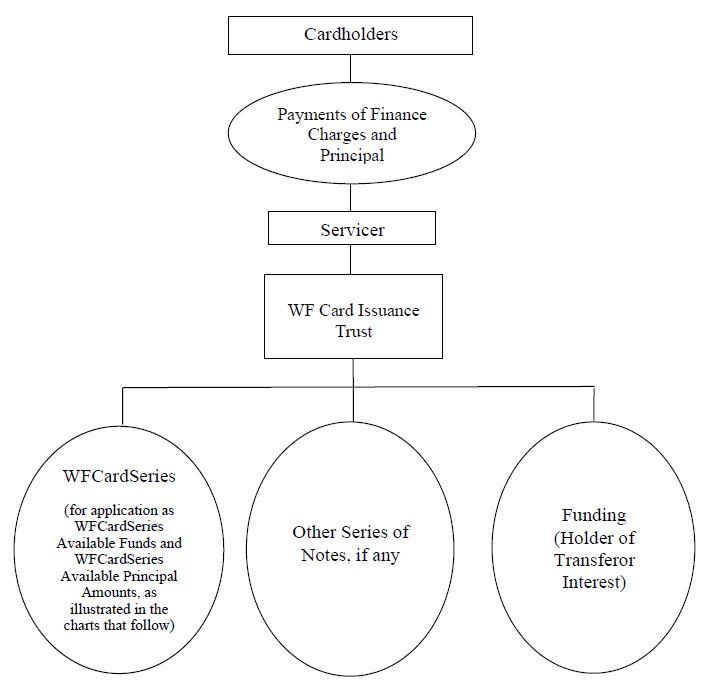

Parties in addition to WFBNA, Funding and the issuing entity may have material roles in WFCIT notes transactions. Pursuant to the servicing agreement, WFBNA, as servicer, has the right to delegate or outsource its duties as servicer to a subservicer who agrees to act in accordance with the servicing agreement and WFBNA’s lending guidelines. In addition, the trust accounts established by the indenture trustee are maintained with U.S. Bank N.A. and in certain circumstances may be maintained with another eligible institution. Additionally, if so specified in the related prospectus, funds to make payments on the notes offered thereby may be supplied by derivative counterparties, supplemental enhancement providers, or supplemental liquidity providers. If any of these parties were to enter conservatorship, receivership, or bankruptcy or were to become insolvent or otherwise experience an adverse event, payments to you could be accelerated, delayed, or reduced.

Some interests could have priority over the indenture trustee’s interest in the receivables, which could cause delayed or reduced payments to you.

Representations and warranties are made that the indenture trustee has a perfected interest in the receivables. If any of these representations and warranties were found not to be true, however, payments to you could be delayed or reduced.

The transaction documents permit liens for municipal or other local taxes to have priority over the indenture trustee’s perfected interest in the receivables. If any of these tax liens were to arise, or if other interests in the receivables were found to have priority over those of the indenture trustee, you could suffer a loss on your investment.

If a conservator, a receiver, or a bankruptcy trustee were appointed for WFBNA, the transferor, or the issuing entity, and if the administrative expenses of the conservator, the receiver, or the bankruptcy trustee were found to relate to the receivables or the transaction documents, those expenses could be paid from collections on the receivables before the indenture trustee receives any payments, which could result in losses on your investment. See “—The conservatorship, receivership, bankruptcy, or insolvency of WFBNA, Funding, the issuing entity, or any of their affiliates could result in accelerated, delayed, or reduced payments to you” in this prospectus.

The indenture trustee may not have a perfected interest in collections and interchange commingled by each of, respectively, the servicer and WFBNA with its own funds, which could cause delayed or reduced payments to you.

Each of the servicer and WFBNA is obligated to deposit, respectively, collections and interchange into the collection account no later than the second business day after the date of processing for such collections and interchange. See “Sources of Funds to Pay the Notes—Application of Collections” and “WFBNA’s Credit Card Activities.”

All collections and interchange that each of the servicer and WFBNA, respectively, is permitted to hold may be commingled with its other funds and used for its own benefit for the time, not to exceed two business days, necessary to clear any payments received. The indenture trustee may not have a perfected interest in these amounts, and thus payments to you could be delayed or reduced if the servicer or WFBNA were to enter conservatorship or receivership, were to become insolvent, or were to fail to perform its obligations under the transaction documents.

39