Exhibit 99.2

GOLD ROYALTY CORP.

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE THREE AND NINE MONTHS ENDED JUNE 30, 2022

August 15, 2022

Gold Royalty Corp.

Management’s Discussion and Analysis

For the three and nine months ended June 30, 2022

General

This management’s discussion and analysis (“MD&A”) of the financial condition and results of operations of Gold Royalty Corp. (“Gold Royalty” or the "Company") should be read in conjunction with its unaudited condensed interim consolidated financial statements and the notes thereto for the three and nine months ended June 30, 2022, and its Annual Report on Form 20-F (the “Annual Report”), including the Company’s audited consolidated financial statements and the notes thereto, for the year ended September 30, 2021, copies of which are available on SEDAR at www.sedar.com and on EDGAR at www.sec.gov.

The Company’s unaudited condensed interim consolidated financial statements for the three and nine months ended June 30, 2022, have been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”) applicable to the presentation of interim financial statements including International Accounting Standard 34, Interim Financial Reporting. This MD&A refers to various non-IFRS measures. Non-IFRS measures do not have standardized meanings under IFRS. Accordingly, non-IFRS measures should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. To facilitate a better understanding of these measures as calculated by the Company, additional information has been provided in this MD&A. Please refer to section “Non-IFRS Measures” of this MD&A for detailed descriptions and reconciliations.

Unless otherwise stated, all information contained in this MD&A is as of August 15, 2022. Unless otherwise stated, references herein to “$” or “dollars” are to United States dollars and references to “C$” are to Canadian dollars. References in this MD&A to the “Company”, “Gold Royalty” and “GRC” mean Gold Royalty Corp., together with its subsidiaries unless the context otherwise requires.

Business Overview

Gold Royalty is a precious metals-focused royalty company offering creative financing solutions to the metals and mining industry. The Company’s diversified portfolio includes 198 royalties across producing, developing, advanced-exploration and early-exploration staged properties.

The head office and principal address of the Company is located at 1030 West Georgia Street, Suite 1830, Vancouver, British Columbia, V6E 2Y3, Canada. The Company’s common share (the “GRC Shares”) and certain of its outstanding common share purchase warrant are listed on the NYSE American under the symbols “GROY” and “GROY.WS”, respectively.

Business Strategy

The Company’s mission is to acquire royalties, streams and similar interests at varying stages of the mine life cycle to build a balanced portfolio offering near, medium and longer-term returns for its investors.

In carrying out its long-term growth strategy, the Company seeks out and continually reviews opportunities to expand its portfolio through the acquisition of existing or newly created royalty, stream or similar interests and through accretive acquisitions of companies that hold such assets. In acquiring newly created interests, the Company acts as a source of financing to mining companies for the development and exploration of projects.

The Company’s “royalty generator model” is focused on mineral properties held by the Company and its subsidiaries and additional properties they may acquire from time to time, with the aim of subsequently optioning or selling them to third-party mining companies in transactions where the Company would retain a royalty, carried interest or other similar interest. The Company believes the royalty generator model provides increased volume of potential royalty opportunities, targeting opportunities with potential exploration upside.

The Company generally does not conduct development or mining operations on the properties in which it holds interests and it is not required to contribute capital costs for these properties. The Company may, from time to time, conduct non-material exploration related activities to advance its royalty generator model.

1

Gold Royalty Corp.

Management’s Discussion and Analysis

For the three and nine months ended June 30, 2022

Highlights for the three and nine months ended June 30, 2022

For the three and nine months ended June 30, 2022, highlights include:

Select royalty portfolio highlights for the three months ended June 30, 2022 include:

2

Gold Royalty Corp.

Management’s Discussion and Analysis

For the three and nine months ended June 30, 2022

See “Selected Asset Updates” for further information.

Recent Developments

The following is a description of selected recent business developments for the nine months ended June 30, 2022. See also “Selected Asset Updates” for information regarding recent developments respecting the selected projects in which the Company holds royalty interests.

At-the-Market Program

On August 15, 2022, the Company entered into an equity distribution agreement (the "Distribution Agreement") with a syndicate of agents led by BMO Nesbitt Burns Inc., and including BMO Capital Markets Corp., H.C. Wainwright & Co. LLC, Haywood Securities Inc., Laurentian Bank Securities Inc., Laurentian Capital (USA) Inc., Raymond James Ltd. and Raymond James & Associates Inc. (collectively, the "Agents"), providing for the issuance of up to $50 million of GRC Shares from treasury to the public from time to time pursuant to an "at the market" equity program (the "ATM Program").

The Company does not currently have any plans to use the ATM Program. The Company currently intends to use the net proceeds, if any, from the ATM Program to implement its growth and acquisition strategy, including the direct and indirect acquisition of additional royalties, streams and similar interests, and for working capital.

The volume and timing of distributions under the ATM Program, if any, will be determined at the Company’s sole discretion, subject to applicable regulatory limitations. Any sales of GRC Shares under the ATM Program will be made by the Agents through the facilities of the NYSE American LLC, or any other marketplace on which the GRC Shares are listed, quoted or otherwise traded, at the prevailing market prices.

Unless earlier terminated by the Company or the Agents as permitted therein, the Distribution Agreement will terminate upon the earlier of: (a) the date that the aggregate gross sales proceeds of the GRC Shares sold under the ATM Program reaches the aggregate amount of $50 million; or (b) September 1, 2023.

The ATM Program will become effective upon the filing of a prospectus supplement to the Company's short form base shelf prospectus dated July 15, 2022, and U.S. registration statement on Form F-3 filed on June 13, 2022, as amended on July 6, 2022. This foregoing does not constitute an offer to sell or the solicitation of an offer to buy securities, nor will there be any sale of, the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

3

Gold Royalty Corp.

Management’s Discussion and Analysis

For the three and nine months ended June 30, 2022

Monarch Royalty Financing

On April 6, 2022, the Company completed a royalty financing transaction with Monarch. Pursuant to the definitive agreement, the Company provided approximately $3.6 million (C$4.5 million) in additional royalty financing to Monarch in exchange for increasing the percentage of the Company’s existing royalties and provided an additional $0.8 million (C$1 million) in equity financing to Monarch by participating in its marketed private placement. Pursuant to the transaction, among other things:

Pursuant to the private placement, the Company acquired 1,666,667 units of Monarch at a price of C$0.60 per unit. Each unit consists of one common share of Monarch and one transferable common share purchase warrant, with each warrant entitling the holder to acquire an additional common share for C$0.95 for a period of 60 months following the date of issuance thereof.

Acquisition of Royalty on Côté Gold Project

On March 1, 2022, the Company completed the acquisition of an existing 0.75% NSR royalty on a portion of the Côté Gold Project, located in Ontario Canada operated by IAMGOLD. The Company paid total consideration to a third-party holder of $15.8 million for the royalty at closing, which comprised of $15 million in cash and the issuance of 207,449 GRC Shares. An additional 50,000 GRC Shares were issued in connection with the transaction as consideration for certain third-party acknowledgements.

Revolving Credit Facility

On January 24, 2022, the Company entered into a definitive credit agreement with Bank of Montreal providing for a $10 million secured revolving credit facility (the “Facility”) that includes the Accordion.

The Facility, secured against the assets of the Company, is available for general corporate purposes, acquisitions and investments subject to certain limitations. Amounts drawn on the Facility bear interest at a rate determined by reference to the U.S. dollar Base Rate plus a margin of 3.00% per annum or Adjusted Term SOFR Rate plus a margin of 4.00% per annum, as applicable. It matures on March 31, 2023. The exercise of the Accordion is subject to certain additional conditions and the satisfaction of financial covenants.

As of the date hereof, the Company has drawn $10 million under the Facility, which matures in March 2023.

Inaugural Quarterly Cash Dividend Program

On January 18, 2022, the Company announced that its board of directors approved the initiation of a quarterly dividend program and declared an inaugural quarterly cash dividend of $0.01 per GRC Share. The Company paid dividends of $1.3 million on each of March 31, 2022 and June 30, 2022 to shareholders of record as of the close of business on March 15, 2022 and June 20, 2022, respectively.

The dividend program contemplates quarterly dividends, the declaration, timing, amount and payment of which will be subject to the discretion and approval of the board of directors of the Company based on relevant factors, including, among others, the Company’s financial condition and capital allocation plans.

4

Gold Royalty Corp.

Management’s Discussion and Analysis

For the three and nine months ended June 30, 2022

Option Agreement on Eldorado Project

On January 14, 2022, Nevada Select Royalty, Inc., a wholly-owned subsidiary of the Company, granted an option to a third party to purchase 100% of its right, title, and interest in its Eldorado Project for a 3.0% NSR and aggregate cash payments of $2.0 million, of which $0.08 million has been received. The balance of the cash payments is due as follows:

Acquisition of Golden Valley and Abitibi

On November 5, 2021, the Company completed the acquisition of all of the outstanding shares of each of Golden Valley and Abitibi pursuant to statutory plans of arrangement for consideration consisting of:

The total consideration paid by the Company to holders of Golden Valley and Abitibi shares under the transaction consisted of an aggregate of 61,104,200 GRC Shares. Additionally, pursuant to the plan of arrangement with Golden Valley, each of Golden Valley’s 1,166,389 share purchase options that were outstanding immediately prior to closing were exchanged for options to purchase 2,498,045 GRC Shares.

Based on the share price of the GRC Shares, and the estimated fair value of Gold Royalty options issued in exchange for Golden Valley options, the total consideration for the acquisition was approximately $306 million. The Company began consolidating the operating results, cash flows and net assets of Golden Valley and Abitibi from November 5, 2021.

The royalties indirectly acquired by the Company through this transaction, included, among others:

Selected Asset Updates

The following is a summary of selected recent developments as announced by the operators of the underlying projects. Readers should refer to the disclosure documents of the applicable operators referenced below for further information regarding such developments. Unless otherwise stated, the operators of such projects have prepared their respective disclosures under Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101") and the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") – CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended.

Please see the Company’s Annual Report for additional information regarding the Company’s material properties and descriptions of the royalties on such properties and its other key royalty interests.

Canadian Malartic

The Company holds four royalties on portions of the Canadian Malartic Property, including a 3.0% NSR royalty on portions of the Canadian Malartic mine. This royalty currently applies to a portion of the open pit areas (the eastern end of the Barnat Extension) where a majority of production to date has occurred. The royalty also applies to portions

5

Gold Royalty Corp.

Management’s Discussion and Analysis

For the three and nine months ended June 30, 2022

of the Odyssey, East Malartic, Sladen and Sheehan zones, and all of the Jeffrey zone within the Canadian Malartic Mine Property. The Canadian Malartic Mine is a 50/50 partnership between Agnico Eagle and Yamana.

The Company also holds 2.0% NSR royalties on the Charlie Zone and the eastern portion of the Gouldie zone, a 1.5% NSR royalty on the Midway Project (1.0% NSR can be bought back for $1.0 million plus an additional 0.5% NSR for $1.0 million) and a 15% NPI on the Radium Property.

In a news release dated April 27, 2022, Yamana reiterated its 10-year outlook for the project, stating that Yamana’s exploration efforts are expected to lead to more mining areas allowing it to take advantage of available plant capacity, ore processing that will exceed 20,000 tonnes per day, and sustainable production that will exceed the initial production plan of 500,000 to 600,000 ounces per year.

In a news release dated July 7, 2022, Yamana announced that production was ahead of plan at the project, with first production from Odyssey South expected in the first quarter of 2023. On July 27, 2022, Yamana announced positive exploration results, stating that drilling is expected to significantly expand the inferred resource envelope which would provide the basis for updated technical studies in 2023, which are expected to allow definition of mineral reserves for the Odyssey underground project over the next few years, starting at the end of 2022.

For more information, refer to Yamana’s news releases dated July 27, 2022, July 7, 2022, and April 27, 2022, available under Yamana’s profile on www.sedar.com.

Côté Gold Project

The Company holds a 0.75% NSR royalty over the southern portion of the Côté Gold Project in Ontario.

In a news release dated August 3, 2022, IAMGOLD announced update on the Côté Gold Project, including updated costs to complete, project economics and LOM plan to be included in a new technical report for the Côté Gold Project expected to be filed by it on SEDAR on or before September 17, 2022. IAMGOLD disclosed that the Côté Gold Project is over 57% complete and the updated project costs and schedule gives greatly improved visibility towards completion.

Highlights of the project update disclosed by IAMGOLD include:

The foregoing project update relates to the entirety of the Côté Gold Project, with the Company's royalty interest applying to portions thereof. For further information, readers should refer to IAMGOLD's news release dated August 3, 2022, available under IAMGOLD’s profile on www.sedar.com.

REN Project

The Company holds a 1.5% NSR and a 3.5% NPI over the REN project.

On August 8, 2022, Barrick disclosed in its presentation the second quarter of 2022 that, resources at REN are expected to grow in 2022 as the project advances to feasibility. The western side of the project contains the new +1.5 kilometres (“km”) Corona Corridor which shows continuity of mineralization 250 m from existing infrastructure. It further

6

Gold Royalty Corp.

Management’s Discussion and Analysis

For the three and nine months ended June 30, 2022

disclosed that mineralization remains open at both JB and Corona Corridors and that it has initiated various mining studies on the geotechnical, ventilation, dewatering parameters to optimally design this part of the mine.

Barrick had previously noted it is targeting to bring REN into the Goldstrike mine plan in the short term. Its second quarter drilling highlights related to the Corona Corridor which is expected to support the growth of the current 1.2 million ounce maiden inferred resource (5.2 Mt at 7.3 g/t Au) includes significant intercepts from MRC-22001: 27.7 m at 11.49 g/t Au.

For further information, readers should refer to Barrick’s news release dated August 8, 2022, available under Barrick’s profile on www.sedar.com, and presentation for quarterly report on the second quarter of 2022, available on Barrick’s website.

Beaufor Mine

The Company holds a 1.0% NSR royalty over the Beaufor Mine and a C$3.75 PTR royalty over the Beacon Mill operated by Monarch in Québec.

In a news release dated July 27, 2022, Monarch announced the production of its first gold bar from its wholly-owned Beaufor Mine and Beacon Mill representing a major milestone. It disclosed that as of July 27, 2022, a total of 23,914 tonnes averaging 4.76 g/t Au have been stockpiled, ready to be processed at the Beacon Mill. Monarch disclosed that it will continue to ramp up production at the Beacon Mill and expects to reach commercial production in the coming months.

For more information, refer to Monarch’s news release dated July 27, 2022, available under Monarch’s profile on www.sedar.com.

Fenelon Gold Project

The Company holds a 2.0% NSR royalty over the Fenelon Gold Project in Québec.

In a news release dated July 26, 2022, Wallbridge announced positive assay results from its drilling campaign at the Fenelon Gold Project, which further expanded the lateral footprint of the deposit. The western and eastern extensions of mineralization are exemplified by drill holes FA-22-401 (3.01 g/t Au over 17.95 m) in the west and FA-22-420A (25.14 g/t Au over 3.27 m) in the east, both of which intersected gold mineralization outside existing estimates at approximately 795 to 865 m below surface. Furthermore, the areas directly surrounding these intercepts remain untested with further room to expand the mineralization.

In a news release dated June 7, 2022, Wallbridge announced positive assay results from its in-fill sampling program, which aims to analyze previously unsampled intervals of drill core with the objective of adding new gold mineralization within the known footprint of the deposit. Wallbridge identified more than 50,000 m of previously unsampled drill core and prioritized approximately 30,000 m for sampling by the third calendar quarter of 2022, focusing on intervals that occur within or adjacent to known mineralized zones.

For more information, refer to Wallbridge’s news release dated July 26, 2022, and its technical report titled "Technical Report on for the Detour-Fenelon Gold Trend Property, Quebec, Canada" with an effective date of December 23, 2021, each available under Wallbridge’s profile on www.sedar.com.

Jerritt Canyon Mine

The Company holds a 0.5% NSR royalty over the Jerritt Canyon Mine operated by First Majestic. The Company also holds an incremental per ton royalty interest on the Jerritt Canyon processing facility.

In a news release dated July 20, 2022, First Majestic announced, among others, the following results and updates for its Jerritt Canyon Mine:

7

Gold Royalty Corp.

Management’s Discussion and Analysis

For the three and nine months ended June 30, 2022

For more information, refer to First Majestic’s news release dated July 20, 2022, available under First Majestic’s profile on www.sedar.com.

Other Assets

In a news release dated January 18, 2022, Calibre disclosed previously unreleased results from nine drillholes of an exploration drill program at the Gold Rock Project. The Company holds a 0.5% NSR royalty over the Gold Rock Project in Nevada.

8

Gold Royalty Corp.

Management’s Discussion and Analysis

For the three and nine months ended June 30, 2022

COVID-19 Pandemic and Current Economic Environment

The Company continues to closely monitor the ongoing COVID-19 pandemic. Given the nature of the Company's operations, the pandemic has had relatively little direct impact on the Company's day-to-day operations.

To date, most of the operators of the projects underlying the Company's interests have not disclosed any material impact from the COVID-19 pandemic on the projects underlying such interests. However, many of such operators have disclosed operational changes to protect employees, with many operators enacting remote working protocols.

Summary of Quarterly Results

The following table sets forth selected financial results of the Company for each of the quarterly periods indicated.

|

| June 30, |

|

| March 31, |

|

| December 31, 2021 |

|

| September 30, 2021 |

| ||||

(in thousands of dollars, except per share amounts) |

| ($) |

|

| ($) |

|

| ($) |

|

| ($) |

| ||||

Statement of Loss and Comprehensive Loss |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Royalty and option income |

|

| 1,907 |

|

|

| 638 |

|

|

| 533 |

|

|

| 192 |

|

Net loss |

|

| (3,438 | ) |

|

| (2,388 | ) |

|

| (6,841 | ) |

|

| (9,216 | ) |

Net loss per share, basic and diluted |

|

| (0.03 | ) |

|

| (0.02 | ) |

|

| (0.06 | ) |

|

| (0.17 | ) |

Dividends declared per share |

|

| 0.01 |

|

|

| 0.01 |

|

|

| — |

|

|

| — |

|

Non-IFRS and Other Measures |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Adjusted Net Loss* |

|

| (2,153 | ) |

|

| (3,269 | ) |

|

| (3,540 | ) |

|

| (4,423 | ) |

Adjusted Net Loss Per Share, basic and diluted* |

|

| (0.02 | ) |

|

| (0.02 | ) |

|

| (0.03 | ) |

|

| (0.08 | ) |

Total Gold Equivalent Ounces (“GEOs”)* |

|

| 1,031 |

|

|

| 345 |

|

|

| 288 |

|

|

| 104 |

|

Cash flow used in operating activities, excluding changes in non-cash working capital* |

|

| (603 | ) |

|

| (3,177 | ) |

|

| (5,894 | ) |

|

| (6,341 | ) |

Statement of Financial Position |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Total assets |

|

| 671,148 |

|

|

| 678,035 |

|

|

| 677,364 |

|

|

| 279,499 |

|

Total non-current liabilities |

|

| 135,298 |

|

|

| 138,779 |

|

|

| 141,450 |

|

|

| 47,260 |

|

9

Gold Royalty Corp.

Management’s Discussion and Analysis

For the three and nine months ended June 30, 2022

|

| June 30, |

|

| March 31, |

|

| December 31, 2020 |

|

| September 30, 2020 |

| ||||

(in thousands of dollars, except per share amounts) |

| ($) |

|

| ($) |

|

| ($) |

|

| ($) |

| ||||

Statement of Loss and Comprehensive Loss |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Royalty and option income |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

Net loss |

|

| (3,035 | ) |

|

| (2,256 | ) |

|

| (500 | ) |

|

| (137 | ) |

Net loss per share, basic and diluted |

|

| (0.07 | ) |

|

| (0.08 | ) |

|

| (0.04 | ) |

|

| (136,837 | ) |

Dividends declared per share |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

Non-IFRS and Other Measures |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Adjusted Net Loss* |

|

| (2,260 | ) |

|

| (2,227 | ) |

|

| (431 | ) |

|

| (137 | ) |

Adjusted Net Loss Per Share, basic and diluted* |

|

| (0.05 | ) |

|

| (0.08 | ) |

|

| (0.04 | ) |

|

| (136,837 | ) |

Cash flow used in operating activities, excluding changes in non-cash working capital* |

|

| (2,249 | ) |

|

| (1,249 | ) |

|

| (421 | ) |

|

| (137 | ) |

Statement of Financial Position |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Total assets |

|

| 101,368 |

|

|

| 103,303 |

|

|

| 15,928 |

|

|

| 55 |

|

Total non-current liabilities |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

* See “Non-IFRS Measures”.

Changes in net loss from quarter to quarter for the period from incorporation to date have been affected primarily by increased corporate activity following the Company’s initial public offering (the “IPO”), professional and consulting fees incurred in connection with acquisition of Ely, the business combinations with Golden Valley and Abitibi, and professional fees incurred in connection with corporate activities conducted during the respective periods, offset by royalty and option income earned.

The decrease in net loss in the three months ended June 30, 2022, compared to three months ended June 30, 2021, is primarily attributed to the recognition of royalty and option income of $1.9 million, gain on disposition of marketable securities of $0.9 million and a gain on change in fair value of derivative liabilities of $2.8 million in the current quarter in 2022, partially offset by an increase in salaries due to the addition of employees to support the growth of the Company's business, interest expense incurred on the Facility, and loss on the change in fair value of marketable securities of $4.5 million as a result of general market conditions.

10

Gold Royalty Corp.

Management’s Discussion and Analysis

For the three and nine months ended June 30, 2022

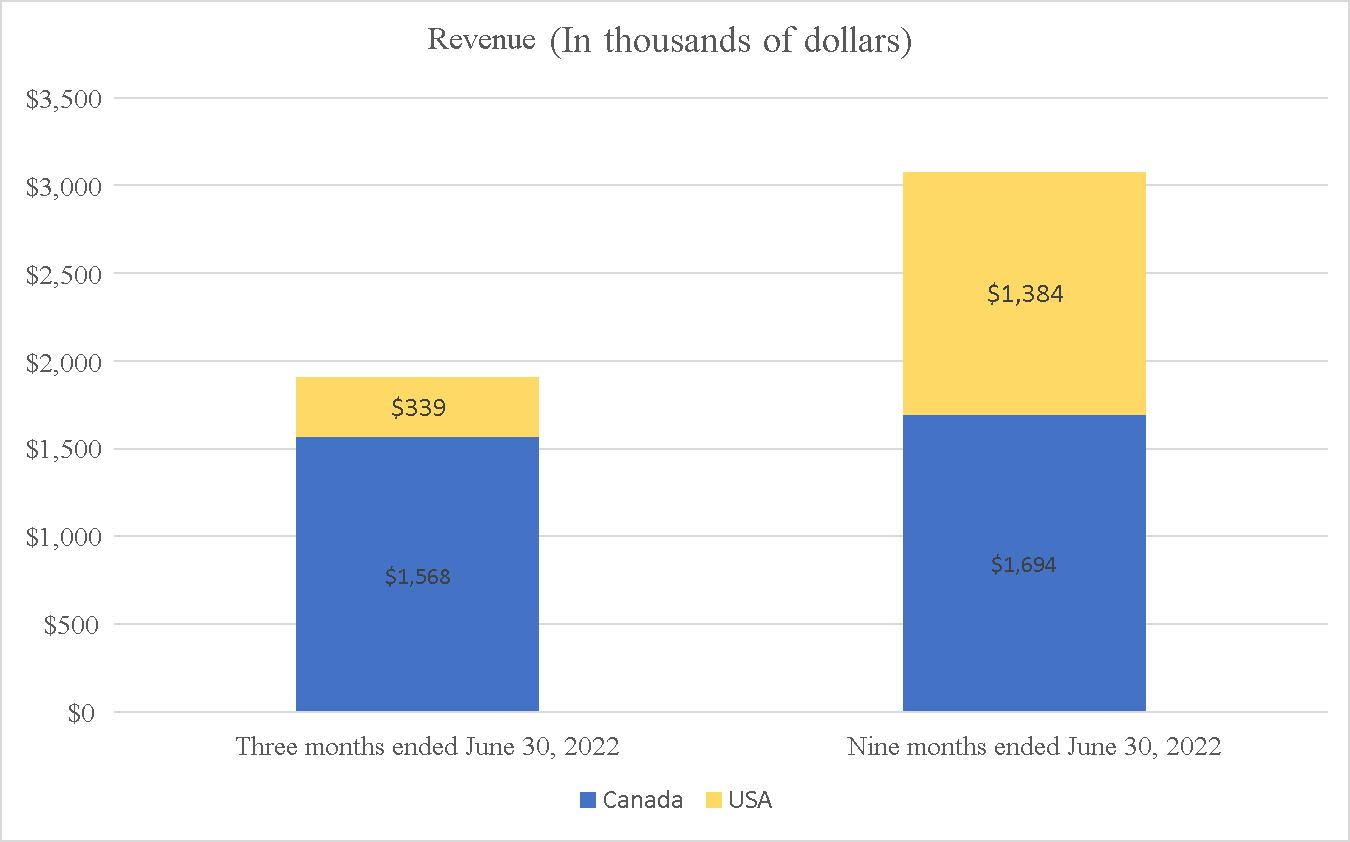

For the three and nine months ended June 30, 2022, the Company generated revenue of $1.9 million and $3.1 million, respectively, from the portfolio of royalties and optioned mineral properties that were acquired in August 2021 and November 2021 through the acquisitions of Ely, Golden Valley and Abitibi. The following provides a breakdown of the Company’s revenue by country for the periods indicated:

The Company did not generate revenues in the comparative period of 2021.

During the three and nine months ended June 30, 2022, the Company incurred a net loss of $3.4 million and $12.7 million, respectively, compared to $3.0 million and $5.8 million for the corresponding periods of 2021. The decrease in the loss for the three months ended June 30, 2022 compared to the three months ended June 30, 2021 is primarily attributed to the recognition of royalty and option income, gain on disposition of marketable securities and change in fair value of derivative liabilities, partially offset by an increase in salaries due to the addition of employees to support the growth of the Company’s business, interest expense incurred on the Facility, and loss on the change in fair value of marketable securities as a result of general market conditions

The increase in net loss for nine months ended June 30, 2022 compared to the nine months ended June 30, 2021 was primarily the result of increased corporate activity and included transaction costs specific to the acquisitions of Ely, Golden Valley and Abitibi and the offer to acquire Elemental Royalties Corp. (the “Elemental Offer”) of approximately $5.6 million, an impairment loss of $3.8 million, partially offset by royalty and option income, and gain on derivative and marketable securities.

Trends, events and uncertainties that are reasonably likely to have an effect on the business of the Company include developments in the gold markets, general financial market conditions, and the ongoing effects of the COVID-19 pandemic on owners and operators of the properties underlying the Company’s interests, as discussed elsewhere in this MD&A.

11

Gold Royalty Corp.

Management’s Discussion and Analysis

For the three and nine months ended June 30, 2022

Outlook

Based on the production guidance published to date by the operators of the producing properties underlying the Company’s existing royalties and a forecasted gold price ranging from $1,700 per ounce to $2,000 per ounce, the Company currently expects revenues to be in the range between $4.6 million and $5 million for the fiscal year ending September 30, 2022. Also See “Non-IFRS Measures”.

The foregoing projected outlook constitutes forward-looking information and is intended to provide information about management’s current expectations for the Company’s 2022 fiscal year. Although considered reasonable as of the date hereof, such outlook and the underlying assumptions may prove to be inaccurate. Accordingly, actual results could differ materially from the Company’s expectations as set forth herein. See “Forward-Looking Statements”.

In preparing the above outlook, the Company assumed, among other things, that the operators of the projects underlying royalties will meet expected production milestones and forecasts for the applicable period. This section includes forward-looking statements. See “Forward-Looking Statements”.

Non-IFRS Measures

The Company has included, in this MD&A, certain performance measures, including: (i) Adjusted Net Loss; (ii) Adjusted Net Loss Per Share; (iii) cash flows used in operating activities, excluding changes in non-cash working capital; and (iv) GEOs, which are each non-IFRS measures. The presentation of such non-IFRS measures is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. These non-IFRS measures do not have any standardized meaning prescribed by IFRS, and other companies may calculate these measures differently.

Adjusted Net Loss is calculated by deducting the following from net loss: transaction-related expenses, share of loss and dilution gain in associate, impairment, changes in fair value of derivative liabilities and short-term investments, gain on disposition of short-term investments, foreign exchange gain/(loss) and other income. Adjusted Net Loss Per Share, basic and diluted per share have been determined by dividing the Adjusted Net Loss by the weighted average number of GRC Shares for the applicable period. The Company has included this information as management believes that they are useful measures of the performance measurement as they adjust for items which are not always reflective of the underlying operating performance of our business and/or are not necessarily indicative of future operating results. The table below provides a reconciliation of net loss to Adjusted Net Loss and Adjusted Net Loss Per Share, basic and diluted for the periods indicated:

|

| June 30, 2022 |

|

| March 31, 2022 |

|

| December 31, 2021 |

|

| September 30, 2021 |

| ||||

(in thousands of dollars, except per share amounts) |

| ($) |

|

| ($) |

|

| ($) |

|

| ($) |

| ||||

Net loss |

|

| (3,438 | ) |

|

| (2,388 | ) |

|

| (6,841 | ) |

|

| (9,216 | ) |

Transaction-related expenses |

|

| 575 |

|

|

| 960 |

|

|

| 4,058 |

|

|

| 2,425 |

|

Share of loss in associate |

|

| 47 |

|

|

| 108 |

|

|

| 143 |

|

|

| — |

|

Dilution gain in associate |

|

| (20 | ) |

|

| (80 | ) |

|

| — |

|

|

| — |

|

Impairment of royalty |

|

| — |

|

|

| 3,821 |

|

|

| — |

|

|

| — |

|

Change in fair value of derivative liabilities |

|

| (2,836 | ) | �� |

| (1,798 | ) |

|

| (90 | ) |

|

| 1,511 |

|

Change in fair value of short-term investments |

|

| 4,542 |

|

|

| (2,707 | ) |

|

| (542 | ) |

|

| 168 |

|

Gain on disposition of short-term investments |

|

| (915 | ) |

|

| (1,168 | ) |

|

| — |

|

|

| — |

|

Foreign exchange (gain)/loss |

|

| 3 |

|

|

| (13 | ) |

|

| (23 | ) |

|

| 705 |

|

Other income |

|

| (111 | ) |

|

| (4 | ) |

|

| (245 | ) |

|

| (16 | ) |

Adjusted Net Loss |

|

| (2,153 | ) |

|

| (3,269 | ) |

|

| (3,540 | ) |

|

| (4,423 | ) |

Weighted average number of common shares |

|

| 134,372,502 |

|

|

| 134,019,359 |

|

|

| 109,907,519 |

|

|

| 54,387,749 |

|

Adjusted Net Loss Per Share, basic and diluted |

|

| (0.02 | ) |

|

| (0.02 | ) |

|

| (0.03 | ) |

|

| (0.08 | ) |

12

Gold Royalty Corp.

Management’s Discussion and Analysis

For the three and nine months ended June 30, 2022

|

| June 30, 2021 |

|

| March 31, |

|

| December 31, 2020 |

|

| September 30, 2020 |

| ||||

(in thousands of dollars, except per share amounts) |

| ($) |

|

| ($) |

|

| ($) |

|

| ($) |

| ||||

Net loss |

|

| (3,035 | ) |

|

| (2,256 | ) |

|

| (500 | ) |

|

| (137 | ) |

Transaction-related expenses |

|

| 810 |

|

|

| — |

|

|

| — |

|

|

| — |

|

Foreign exchange loss |

|

| 9 |

|

|

| 29 |

|

|

| 69 |

|

|

| — |

|

Other income |

|

| (44 | ) |

|

| — |

|

|

| — |

|

|

| — |

|

Adjusted Net Loss |

|

| (2,260 | ) |

|

| (2,227 | ) |

|

| (431 | ) |

|

| (137 | ) |

Weighted average number of common shares |

|

| 41,602,391 |

|

|

| 26,921,180 |

|

|

| 11,252,989 |

|

|

| 1 |

|

Adjusted Net Loss Per Share, basic and diluted |

|

| (0.05 | ) |

|

| (0.08 | ) |

|

| (0.04 | ) |

|

| (136,837 | ) |

Total GEOs are determined by dividing revenue by $1,850/ounce (average of $1,700/ounce and $2,000/ounce). The Company has included this information as management believes certain investors use this information to evaluate the Company’s performance in comparison to other gold royalty companies.

Cash flow used in operating activities, excluding changes in non-cash working capital is determined by excluding the impact of changes in non-cash working capital items to or from cash used in operating activities. The Company has included this information as management believes certain investors use this information to evaluate the Company’s performance in comparison to other gold royalty companies in the precious metal mining industry. The table below provides a reconciliation of operating cash flows to operating cash flows, excluding changes in non-cash working capital:

|

| June 30, 2022 |

|

| March 31, 2022 |

|

| December 31, 2021 |

|

| September 30, 2021 |

| ||||

(in thousands of dollars) |

| ($) |

|

| ($) |

|

| ($) |

|

| ($) |

| ||||

Net loss |

|

| (3,438 | ) |

|

| (2,388 | ) |

|

| (6,841 | ) |

|

| (9,216 | ) |

Items not involving cash: |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Depreciation |

|

| 21 |

|

|

| 15 |

|

|

| 9 |

|

|

| 5 |

|

Depletion |

|

| 1,037 |

|

|

| 488 |

|

|

| 287 |

|

|

| 164 |

|

Interest expense |

|

| 269 |

|

|

| 105 |

|

|

| — |

|

|

| — |

|

Interest income |

|

| (3 | ) |

|

| (1 | ) |

|

| (2 | ) |

|

| (12 | ) |

Share-based compensation |

|

| 705 |

|

|

| 1,146 |

|

|

| 901 |

|

|

| 1,068 |

|

Change in fair value of short-term investments |

|

| 4,542 |

|

|

| (2,707 | ) |

|

| (542 | ) |

|

| 168 |

|

Gain on disposition of short-term investments |

|

| (915 | ) |

|

| (1,168 | ) |

|

| — |

|

|

| — |

|

Change in fair value of derivative liabilities |

|

| (2,836 | ) |

|

| (1,798 | ) |

|

| (90 | ) |

|

| 1,511 |

|

Impairment of royalty |

|

| — |

|

|

| 3,821 |

|

|

| — |

|

|

| — |

|

Share of loss in associate |

|

| 47 |

|

|

| 108 |

|

|

| 143 |

|

|

| — |

|

Dilution gain in associate |

|

| (20 | ) |

|

| (80 | ) |

|

| — |

|

|

| — |

|

Deferred tax expense (tax recovery) |

|

| (15 | ) |

|

| (652 | ) |

|

| 167 |

|

|

| — |

|

Foreign exchange (gain)/loss |

|

| 3 |

|

|

| (66 | ) |

|

| 74 |

|

|

| (29 | ) |

Cash flow used in operating activities, excluding changes in non-cash working capital |

|

| (603 | ) |

|

| (3,177 | ) |

|

| (5,894 | ) |

|

| (6,341 | ) |

13

Gold Royalty Corp.

Management’s Discussion and Analysis

For the three and nine months ended June 30, 2022

|

| June 30, 2021 |

|

| March 31, 2021 |

|

| December 31, 2020 |

|

| September 30, 2020 |

| ||||

(in thousands of dollars) |

| ($) |

|

| ($) |

|

| ($) |

|

| ($) |

| ||||

Net loss |

|

| (3,035 | ) |

|

| (2,256 | ) |

|

| (500 | ) |

|

| (137 | ) |

Items not involving cash: |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Interest income |

|

| (44 | ) |

|

| (8 | ) |

|

| — |

|

|

| — |

|

Share-based compensation |

|

| 830 |

|

|

| 1,018 |

|

|

| 79 |

|

|

| — |

|

Cash flow used in operating activities, excluding changes in non-cash working capital |

|

| (2,249 | ) |

|

| (1,246 | ) |

|

| (421 | ) |

|

| (137 | ) |

Discussion of Operations

Three months ended June 30, 2022, compared to three months ended June 30, 2021

During the three months ended June 30, 2022, the Company had revenue of $1.9 million. No revenue was earned in the comparative period of 2021. The revenue primarily consists of revenues relating to royalties and optioned mineral properties acquired in August 2021 and November 2021 through the Company’s acquisitions of Ely, Golden Valley, and Abitibi.

During the three months ended June 30, 2022, the Company recognized depletion expense of $1.0 million. No such expenses were incurred during the three months ended June 30, 2021 since no revenue was earned during the same period.

During the three months ended June 30, 2022, the Company incurred management and directors’ fees of $0.4 million. Management and directors’ fees primarily consisted of salaries paid or payable to members of senior management and fees paid to the directors of the Company. The increase compared to the same period in 2021 is due to the addition of management employees hired to support the growth of the business.

During the three months ended June 30, 2022 and 2021, the Company incurred general and administrative costs of approximately $1.3 million and $0.9 million, respectively. General and administrative costs comprise of salaries, wages, and benefits, investor communications and marketing expenses, office and technology expenses, transfer agent and regulatory fees and insurance fees. The increase in general and administrative costs was primarily the result of increased post-IPO activities, the commencement of the royalty generator business and the consolidation of administrative expenses incurred by Ely, Golden Valley and Abitibi after their respective acquisitions.

During the three months ended June 30, 2022, the Company incurred professional fees of approximately $0.5 million. Professional fees primarily consisted of transaction-related expenses for completed transactions (including the Company’s acquisition of Golden Valley and Abitibi) and those in process or under evaluation, audit and quarterly review fees, and legal fees for general corporate and securities matters. Excluding costs related to acquisition transactions and the Elemental Offer, professional fees totaled $0.1 million for the three months ended June 30, 2022.

During the three months ended June 30, 2022, the Company recognized share-based compensation expense of $0.7 million as compared to $0.8 million in the same period in 2021. Share-based compensation expense represented the vesting of share options, restricted shares and restricted share units granted by the Company to management, directors, employees and consultants. The share-based compensation expense also included the amortization the fair value of shares issued by the Company to contractors for marketing services of $0.3 million for the three months ended June 30, 2022. The decrease in share-based compensation expense from $0.8 million in 2021 to $0.7 million in 2022 is primarily due to a decrease in the share option expense of $0.4 million, offset by an increase in share-based compensation expense for marketing services of $0.3 million.

During the three months ended June 30, 2022, the Company incurred mining claims maintenance expense of $0.1 million. No such expenses were incurred in the three months ended June 30, 2021.

During the three months ended June 30, 2022, the Company recognized a fair value gain on its derivative liabilities of $2.8 million. The change is primarily as a result of the remeasurement of the fair value of 8,849,251 warrants to

14

Gold Royalty Corp.

Management’s Discussion and Analysis

For the three and nine months ended June 30, 2022

purchase common shares of Ely (“Ely Warrant”) that were outstanding as at June 30, 2022. The Ely Warrants represent the right to acquire, on valid exercise thereof (include payment of the applicable exercise price), 0.2450 of a GRC Share plus C$0.0001. The fair value of the Ely Warrants has been estimated based on the Black-Scholes option pricing model and the change in fair value is recognized in the condensed consolidated statements of comprehensive loss.

During the three months ended June 30, 2022, the Company recognized a fair value loss on its short-term investments of $4.5 million resulting from the decrease in the fair value of marketable securities held by it. Short-term investments are measured at fair value with references to closing foreign exchange rates and the quoted share price in the market. The Company had a gain of $0.9 million from disposition of marketable securities during the period.

The Company incurred interest expense of $0.3 million on the Facility in the three months ended June 30, 2022. No interest expense was incurred by the Company in the same period in the previous year as the Facility was drawn down in February 2022.

The following table provides a breakdown of selected expenses, which comprise of recurring and transaction specific expenses, for the three months ended June 30, 2022:

|

| Recurring |

|

| Transaction - related expenses |

|

| Total |

| |||

(in thousands of dollars) |

| ($) |

|

| ($) |

|

| ($) |

| |||

Consulting fees |

|

| 192 |

|

|

| 160 |

|

|

| 352 |

|

Professional fees |

|

| 62 |

|

|

| 415 |

|

|

| 477 |

|

|

|

| 254 |

|

|

| 575 |

|

|

| 829 |

|

Nine months ended June 30, 2022, compared to nine months ended June 30, 2021

During the nine months ended June 30, 2022, the Company earned revenue of approximately $3.1 million. No revenue was earned by the Company for the comparative period of 2021. The revenue primarily consists of revenues relating to royalties and optioned mineral properties acquired in August 2021 and November 2021 through the Company’s acquisitions of Ely, Golden Valley, and Abitibi.

During the nine months ended June 30, 2022, the Company recognized depletion expense of $1.8 million. No such expenses were incurred during the nine months ended June 30, 2021 since no revenue was earned during the same period.

The Company incurred consulting fees of $4.1 million during the nine months ended June 30, 2022, compared to $0.7 million for the same period in 2021. The increase in consulting fees consist of transaction specific expenses related to corporate development and advisory services in connection with the Company’s acquisitions during the period.

During the nine months ended June 30, 2022, the Company incurred management and directors’ fees of $0.9 million compared to $0.3 million for the same period in 2021. Management and directors’ fees primarily consisted of salaries paid or payable to members of senior management and fees paid to the directors of the Company. The Company's directors did not receive directors’ fees before the completion of the Company’s IPO in March 2021.

During the nine months ended June 30, 2022, the Company incurred general and administrative costs of approximately $4.3 million compared to $1.2 million for the same period 2021. General and administrative costs comprise of salaries, wages, and benefits, investor communications and marketing expenses, office and technology expenses, transfer agent and regulatory fees and insurance fees. The increase in general and administrative costs was primarily the result of increased post-IPO activities, the commencement of the royalty generator business and the consolidation of administrative expenses incurred by Ely, Golden Valley and Abitibi after their respective acquisitions. A major component of the insurance fees is related to the directors and officers liability insurance which the Company put in place upon the completion of the IPO.

15

Gold Royalty Corp.

Management’s Discussion and Analysis

For the three and nine months ended June 30, 2022

During the nine months ended June 30, 2022, the Company incurred professional fees of approximately $3.7 million compared to $1.5 million for the same period in 2021. Professional fees primarily consisted of transaction-related expenses for completed transactions (including the Company’s acquisition of Golden Valley and Abitibi) and those in process or under evaluation, audit and quarterly review fees, and legal fees for general corporate and securities matters. Excluding costs related to the acquisitions of Ely, Golden Valley and Abitibi and the Elemental Offer, total professional fees totaled $1.6 million for the nine months ended June 30, 2022.

During the nine months ended June 30, 2022, the Company recognized share-based compensation expense of $2.8 million compared to $1.9 million for the same period in 2021. Share-based compensation expense represented the vesting of share options, restricted shares and restricted share units granted by the Company to management, directors, employees and consultants. The share-based compensation expense also included the amortization the fair value of shares issued by the Company to contractors for marketing services of $0.9 million for the nine months ended June 30, 2022.

During the nine months ended June 30, 2022, the Company incurred mining claims maintenance expense of $0.2 million. No such expenses were incurred in the nine months ended June 30, 2021.

During the nine months ended June 30, 2022, mining operations at the Rawhide Mine were suspended due to working capital constraints. Rawhide’s management are evaluating strategic options to address the constraint including outright sale. The Company has reviewed the underlying circumstances and has recognized an impairment charge of $3.8 million on its Rawhide royalty during the period June 30, 2022.

During the nine months ended June 30, 2022, the Company recognized a fair value gain on its derivative liabilities of $4.7 million. The change is primarily as a result of the remeasurement of the fair value of 8,849,251 Ely Warrants that were outstanding as at June 30, 2022.

During the nine months ended June 30, 2022, the Company recognized a fair value loss on its short-term investments of $1.3 million resulting from the decrease in the fair value of marketable securities held by it. Short-term investments are measured at fair value with references to closing foreign exchange rates and the quoted share price in the market. The Company had a gain of $2.1 million from disposition of marketable securities during the period.

The Company incurred interest expenses of $0.4 million on the Facility during the nine months ended June 30, 2022. No interest expense was incurred by the Company in the same period in the previous year as the Facility was drawn down in February 2022.

The following table provides a breakdown of the selected expenses, which comprise of recurring and transaction specific expenses, for the nine months ended June 30, 2022:

|

| Recurring |

|

| Transaction -related expenses |

|

| Total |

| |||

(in thousands of dollars) |

| ($) |

|

| ($) |

|

| ($) |

| |||

Consulting fees |

|

| 546 |

|

|

| 3,535 |

|

|

| 4,081 |

|

Professional fees |

|

| 1,600 |

|

|

| 2,058 |

|

|

| 3,658 |

|

|

|

| 2,146 |

|

|

| 5,593 |

|

|

| 7,739 |

|

16

Gold Royalty Corp.

Management’s Discussion and Analysis

For the three and nine months ended June 30, 2022

Liquidity and Capital Resources

|

| As at June 30, |

|

| As at September 30, |

| ||

|

| 2022 |

|

| 2021 |

| ||

(in thousands of dollars) |

| ($) |

|

| ($) |

| ||

Cash and cash equivalents |

|

| 6,024 |

|

|

| 9,905 |

|

Working capital (current assets less current liabilities) |

|

| 6,326 |

|

|

| 6,380 |

|

Total assets |

|

| 671,148 |

|

|

| 279,499 |

|

Total current liabilities |

|

| 15,440 |

|

|

| 6,921 |

|

Accounts payable and accrued liabilities |

|

| 5,751 |

|

|

| 6,921 |

|

Bank loan |

|

| 9,689 |

|

|

| — |

|

Total non-current liabilities |

|

| 135,298 |

|

|

| 47,260 |

|

Shareholders’ equity |

|

| 520,410 |

|

|

| 225,318 |

|

As at June 30, 2022, the Company had cash and cash equivalents of $6.0 million compared to $9.9 million at September 30, 2021, royalty and other mineral interests with a carrying value of $646.1 million which were acquired through issuances of the Company’s common shares and cash, and accounts payable and accrued liabilities of $5.8 million compared to $6.9 million at September 30, 2021. The increase in current liabilities from $6.9 million as of September 30, 2021 to $15.4 million as of June 30, 2022 was primarily attributed to the drawdown of $10 million from the Facility which matures in March 2023. As at June 30, 2022, the Company had working capital (current assets less current liabilities) of $6.3 million as compared to $6.4 million as at September 30, 2021. The increase in short term investments during the nine months ended June 30, 2022 is primary attributable to marketable securities acquired in the merger with Golden Valley and Abitibi. Increase in accounts receivable during the nine months ended June 30, 2022 is consistent with the increase in revenue during the nine months ended June 30, 2022. Prepaids and other receivable consist of prepaid insurance expense and tax receivable as at June 30, 2022.

As at June 30, 2022, the Company had cash, cash equivalents and marketable securities of approximately $17.1 million, compared to $11.0 million as at September 30, 2021.

The Company’s principal sources of financing to date have been the prior issuance of shares, by way of private placement, and the IPO, the Facility and revenue generated by the Company’s interests. The Company also acquired cash and marketable securities of approximately $35.6 million in connection with its acquisition of Golden Valley and Abitibi in the nine months ended June 30, 2022. The Company believes that it has sufficient cash and cash equivalents to meet its obligations and to finance its planned activities over the next 12 months. Over the long term, the Company expects to meet its obligations and finance its growth plan through revenue generating from its royalty interests, issuance of securities pursuant to equity financings and short-term or long-term loans. Capital markets may not be receptive to offerings of new equity from treasury or debt, whether by way of private placements or public offerings. The Company’s growth and future success is dependent on external sources of financing which may not be available on acceptable terms, or at all.

See “Financial Instruments and Risk Management” for more information regarding liquidity risks associated with financial instruments.

Cash Flows and Capital Resources

Three months ended June 30, 2022

Operating Activities

Net cash used in operating activities during the three months ended June 30, 2022, which reflected a net loss of $3.4 million offset by non-cash items including the Company’s share-based compensation of $0.7 million and deduction of the non-cash change in fair value of short-term investments and derivative liabilities. Non-cash working capital changes includes an increase in accounts receivable of $2.0 million, a decrease in prepaids and other receivables of $0.9 million and a decrease in accounts payable and accrued liabilities of $1.8 million. Significant operating

17

Gold Royalty Corp.

Management’s Discussion and Analysis

For the three and nine months ended June 30, 2022

expenditures during the period included consulting fees, management salaries and directors’ fees, general and administrative costs and professional fees of approximately $2.5 million.

Investing Activities

During the three months ended June 30, 2022, the Company made an investment in royalty and other mineral interests of $3.6 million, acquired marketable securities of 0.8 million and received cash proceeds from disposal of marketable securities of $5.6 million. The Company received option payments of approximately $0.1 million.

Financing Activities

During the three months ended June 30, 2022, net cash used in financing activities was $1.5 million which primarily represented dividend payment of $1.3 million made on June 30, 2022 and interest payment of $0.1 million.

Nine months ended June 30, 2022

Operating Activities

Net cash used in operating activities during the nine months ended June 30, 2022 was $19.9 million, which reflected a net loss of $12.7 million offset by non-cash items including the Company’s share-based compensation of $2.8 million and non-cash change in fair value of short-term investments and derivative liabilities. Non-cash working capital changes includes an increase in accounts receivable of $1.9 million, a decrease in prepaids and other receivables of $2.0 million and a decrease in accounts payable and accrued liabilities of $9.5 million. Significant operating expenditures during the period included consulting fees, management salaries and directors’ fees, general and administrative costs and professional fees of approximately $12.9 million.

Investing Activities

During the nine months ended June 30, 2022, the Company made an investment in royalty and other mineral interests of $19.0 million and acquired cash and restricted cash for a total amount of $12.2 million from the business combination with Golden Valley and Abitibi. The Company also received cash proceeds from disposal of marketable securities of $15.1 million and option payments of approximately $1.6 million.

Financing Activities

During the nine months ended June 30, 2022, net cash provided by financing activities was $7.3 million which primarily represented net proceeds from drawing down the Facility of $9.5 million and proceeds from the exercise of Ely Warrants of $0.7 million.

On January 18, 2022, the Company announced the initiation of a quarterly dividend program and declared an inaugural quarterly cash dividend of $0.01 per common share. The Company paid dividends of $1.3 million and $1.3 million on March 31, 2022 and June 30, 2022, respectively.

Contractual Obligations

As at June 30, 2022, the Company has the following contractual obligations, including payments due for each of the next five years and thereafter:

|

| Payments Due by Period |

| |||||||||||||||||

(in thousands of dollars) |

| Total |

|

| Less than 1 year |

|

| 1 – 3 years |

|

| 4 – 5 years |

|

| After 5 years |

| |||||

Lease obligation |

| $ | 108 |

|

| $ | 30 |

|

| $ | 37 |

|

| $ | 41 |

|

|

| — |

|

Revolving credit facility |

| $ | 9,689 |

|

| $ | 9,689 |

|

|

| — |

|

|

| — |

|

|

| — |

|

Government loan |

| $ | 47 |

|

|

| — |

|

| $ | 47 |

|

|

| — |

|

|

| — |

|

Total |

| $ | 9,844 |

|

| $ | 9,719 |

|

| $ | 84 |

|

| $ | 41 |

|

| $ | — |

|

18

Gold Royalty Corp.

Management’s Discussion and Analysis

For the three and nine months ended June 30, 2022

Off-Balance Sheet Arrangements

As at June 30, 2022, the Company did not have any off-balance sheet arrangements.

Transactions with Related Parties

Related Party Transactions

During the three and nine months ended June 30, 2022, the Company incurred $0.2 million and $0.7 million in office and technology expenses for website design, hosting and maintenance services provided by Blender Media Inc. (“Blender”), a company controlled by a family member of Amir Adnani, a director of the Company and which is in the business of providing such services to public companies. On October 12, 2021, the Company issued 120,000 GRC Shares to Blender as compensation for the expanded scope of digital marketing services for a contract term ended on June 27, 2022. During the three and nine months ended June 30, 2022, the Company recognized share-based compensation expense of $0.2 million and $0.6 million, respectively, in respect of this contract.

Related party transactions are based on the amounts agreed to by the parties. During the nine months ended June 30, 2022, the Company did not enter into any contracts or undertake any commitment with any related parties other than as described herein.

Transactions with Key Management Personnel

Key management personnel are persons responsible for planning, directing and controlling the activities of an entity. Total management salaries and directors’ fees incurred for services provided by key management personnel of the Company for the three and nine months ended June 30, 2022 and 2021 are as follows:

|

| For the three months ended |

|

| For the nine months ended |

| ||||||||||

|

| June 30 |

|

| June 30 |

| ||||||||||

|

| 2022 |

|

| 2021 |

|

| 2022 |

|

| 2021 |

| ||||

(in thousands of dollars) |

| ($) |

|

| ($) |

|

| ($) |

|

| ($) |

| ||||

Management salaries |

|

| 290 |

|

|

| 157 |

|

|

| 755 |

|

|

| 286 |

|

Directors’ fees |

|

| 63 |

|

|

| 24 |

|

|

| 160 |

|

|

| 47 |

|

Share-based compensation |

|

| 310 |

|

|

| 558 |

|

|

| 1,440 |

|

|

| 1,583 |

|

|

|

| 663 |

|

|

| 739 |

|

|

| 2,355 |

|

|

| 1,916 |

|

19

Gold Royalty Corp.

Management’s Discussion and Analysis

For the three and nine months ended June 30, 2022

Critical Accounting Estimates and Judgments

The preparation of financial statements requires management to make judgments and estimates and form assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and reported amounts of income and expenses during the reporting period. On an ongoing basis, management evaluates its judgments and estimates in relation to assets, liabilities, income and expenses. Management uses historical experience and various other factors it believes to be reasonable under the given circumstances as the basis for its judgments and estimates. Actual outcomes may differ from these estimates under different assumptions and conditions.

Information about significant sources of estimation uncertainty and judgments made by management in preparing the consolidated financial statements are described below.

20

Gold Royalty Corp.

Management’s Discussion and Analysis

For the three and nine months ended June 30, 2022

Financial Instruments and Risk Management

The Company’s financial instruments consist of cash and cash equivalents, short-term and long-term investments, accounts receivable, accounts payable and accrued liabilities, lease obligation, bank loan and derivative liabilities. The Company’s short and long-term investments are initially recorded at fair value and subsequently revalued to their fair market value at each period end based on inputs such as equity prices. The fair value of the Company’s other financial instruments, which include cash and cash equivalents, accounts receivable, and accounts payable and accrued liabilities approximate their carrying values due to their short term to maturity.

Financial risk management objectives and policies

The financial risk arising from the Company’s operations are credit risk, liquidity risk, equity price risk and currency risk. These risks arise from the normal course of operations and all transactions undertaken are to support the Company’s ability to continue as a going concern. The risks associated with financial instruments and the policies on how the Company mitigates these risks are set out below. Management manages and monitors these exposures to ensure appropriate measures are implemented in a timely and effective manner.

Credit risk

Credit risk is the risk of an unexpected loss if a customer or third-party to a financial instrument fails to meet its contractual obligations. Credit risk for the Company is primarily associated with the Company’s bank balances and accounts receivable. The Company mitigates credit risk associated with its bank balance by holding cash with large reputable financial institutions. The Company’s maximum exposure to credit risk is equivalent to the carrying value of its cash and cash equivalents and accounts receivable.

Liquidity risk

Liquidity risk is the risk that the Company will not be able to settle or manage its obligations associated with financial liabilities. To manage liquidity risk, the Company closely monitors its liquidity position and ensures it has adequate sources of funding to finance its projects and operations. The Company’s working capital (current assets less current liabilities) as at June 30, 2022 was $6.3 million compared to $6.4 million as at September 30, 2021. The Company’s accounts payable and accrued liabilities and bank loan are expected to be realized or settled, respectively, within a one-year period.

The Company’s future profitability will be dependent on the royalty income to be received from mine operators. Royalties are based on a percentage of the minerals or the products produced, or revenue or profits generated from the property which is typically dependent on the prices of the minerals the property operators are able to realize. Mineral prices are affected by numerous factors such as interest rates, exchange rates, inflation or deflation and global and regional supply and demand. The Company has the required liquidity to meet its obligations and to finance its planned activities.

Currency risk

The Company is exposed to foreign exchange risk when the Company undertakes transactions and holds assets and liabilities in currencies other than its functional currency. The Company currently does not engage in foreign exchange

21

Gold Royalty Corp.

Management’s Discussion and Analysis

For the three and nine months ended June 30, 2022

currency hedging. The currency risk on the Company’s cash and cash equivalents, short-term investments, accounts payable and accrued liabilities and derivative liabilities are minimal.

Equity price risk

The Company is exposed to equity price risk associated with its investment in other mining companies. The Company’s short-term investments consisting of common shares are exposed to significant equity price risk due to the potentially volatile and speculative nature of the businesses in which the investments are held. Based on the Company’s short-term investments held as at June 30, 2022, a 10% change in the market price of these investments would have an impact of approximately $0.8 million on net loss.

Interest rate risk

The Company’s exposure to interest rate risk arises from the impact of interest rates on its cash and secured revolving credit facility, which bear interest at fixed or variable rates. The interest rate risks on the Company's cash balances are minimal. The Company's secured revolving credit facility bears interest at a rate determined by reference to the U.S. dollar Base Rate plus a margin of 3.00% or Adjusted Term SOFR plus a margin of 4.00%, as applicable and an increase (decrease) of 10 basis point in the applicable rate of interest would not have a significant impact on the net loss for nine months ended June 30, 2022. The Company's lease liability is determined using the interest rate implicit in the lease and an increase (decrease) of 10 basis point would not have a significant impact on the net loss for the nine months ended June 30, 2022.

Outstanding Share Data

As at the date hereof, the Company has134,519,388 common shares, 10,350,000 common share purchase warrants, 166,812 restricted share units and 6,085,076 share options outstanding. In addition, there are 13,518,252 Ely Warrants outstanding as at the date hereof, representing the right to acquire, on valid exercise thereof (including payment of the applicable exercise price), 0.2450 of a GRC Share plus C$0.0001. Accordingly, the Ely Warrants are exercisable into 3,311,971 GRC Shares.

Disclosure Controls and Procedures and Internal Control over Financial Reporting

Disclosure Controls and Procedures

The Chief Executive Officer (the “CEO”) and the Chief Financial Officer (the “CFO”) of the Company are responsible for establishing and maintaining the Company’s disclosure controls and procedures (“DCP”). The Company maintains DCP designed to ensure that information required to be disclosed in reports filed under applicable Canadian securities laws and the U.S. Securities Exchange Act of 1934, as amended, is recorded, processed, summarized and reported within the appropriate time periods and that such information is accumulated and communicated to the Company’s management, including the CEO and CFO, to allow for timely decisions regarding required disclosure.

In designing and evaluating DCP, the Company recognizes that any disclosure controls and procedures, no matter how well conceived or operated, can only provide reasonable, not absolute, assurance that the objectives of the control system are met, and management is required to exercise its judgment in evaluating the cost-benefit relationship of possible controls and procedures.

The CEO and CFO have evaluated whether there were changes to the DCP during the nine months ended June 30, 2022 that have materially affected, or are reasonably likely to materially affect, the DCP. No such changes were identified through their evaluation.

Internal Control over Financial Reporting

The Company’s management, including the CEO and the CFO, are responsible for establishing and maintaining adequate internal control over financial reporting (“ICFR”) for the Company to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with IFRS. The fundamental issue is ensuring all transactions are properly authorized and identified and

22

Gold Royalty Corp.

Management’s Discussion and Analysis

For the three and nine months ended June 30, 2022

entered into a well-designed, robust and clearly understood accounting system on a timely basis to minimize risk of inaccuracy, failure to fairly reflect transactions, failure to fairly record transactions necessary to present financial statements in accordance with IFRS, unauthorized receipts and expenditures, or the inability to provide assurance that unauthorized acquisitions or dispositions of assets can be detected.

The Company’s ICFR may not prevent or detect all misstatements because of inherent limitations. Additionally, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions or deterioration in the degree of compliance with the Company’s policies and procedures.

The CEO and CFO have evaluated whether there were changes to the ICFR during the nine months ended June 30, 2022 that have materially affected, or are reasonably likely to materially affect, the ICFR. No such changes were identified through their evaluation.

Forward-looking Statements

Certain statements contained in this MD&A constitute “forward-looking information” within the meaning of Canadian securities laws and “forward-looking statements” within the meaning of securities laws in the United States (collectively, “Forward-Looking Statements”). These statements relate to the expectations of management about future events, results of operations and the Company’s future performance (both operational and financial) and business prospects. All statements other than statements of historical fact are Forward-Looking Statements. The use of any of the words “anticipate”, “plan”, “contemplate”, “continue”, “estimate”, “expect”, “intend”, “propose”, “might”, “may”, “will”, “shall”, “project”, “should”, “could”, “would”, “believe”, “predict”, “forecast”, “target”, “aim”, “pursue”, “potential”, “objective” and “capable” and the negative of these terms or other similar expressions are generally indicative of Forward-Looking Statements. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such Forward-Looking Statements. No assurance can be given that these expectations will prove to be correct and such Forward-Looking Statements should not be unduly relied on. These statements speak only as of the date of this MD&A. In addition, this MD&A may contain Forward-Looking Statements attributed to third-party industry sources. Without limitation, this MD&A contains Forward-Looking Statements pertaining to the following:

These Forward-Looking Statements are based on opinions, estimates and assumptions in light of the Company’s experience and perception of historical trends, current conditions and expected future developments, as well as other factors that the Company currently believes are appropriate and reasonable in the circumstances, including that:

23

Gold Royalty Corp.

Management’s Discussion and Analysis

For the three and nine months ended June 30, 2022

Actual results could differ materially from those anticipated in these Forward-Looking Statements as a result of the following risk factors, among others:

This list of factors should not be construed as exhaustive. The Company does not intend to and does not assume any obligations to update Forward-Looking Statements, except as required by applicable law.

Please see “Item 3. Key Information – D. Risk Factors” in the Annual Report for further information regarding key risks faced by the Company.

Technical Information

Except where otherwise stated, the disclosure herein relating to the properties underlying the Company’s royalty and other interests is based on information publicly disclosed by the owners and operators of such properties. Specifically, as a royalty holder, the Company has limited, if any, access to properties included in its asset portfolio. Additionally, the Company may from time to time receive operating information from the owners and operators of the properties, which the Company is not permitted to disclose to the public. The Company is dependent on the operators of the properties and their qualified persons to provide information to the Company or on publicly available information to prepare disclosure pertaining to properties and operations on the properties on which the Company holds interests and

24

Gold Royalty Corp.

Management’s Discussion and Analysis

For the three and nine months ended June 30, 2022

generally will have limited or no ability to independently verify such information. Although the Company does not currently have any knowledge that such information may not be accurate, there can be no assurance that such third-party information is complete or accurate.

The scientific and technical information contained in this MD&A relating to the Company’s royalty and other interests, exclusive of properties in Québec, has been reviewed and approved by Alastair Still, P.Geo., who is the Director of Technical Services of the Company, a qualified person as such term is defined under NI 43-101 and a member of Professional Geoscientists Ontario and Engineers and Geoscientists British Columbia. Glenn Mullan, P.Geo., a director of the Company, is a "qualified person" as such term is defined under NI 43-101 and has reviewed and approved the technical information pertaining to projects located in Québec, Canada, disclosed in this MD&A.

Additional Information

Additional information concerning the Company is available under the Company’s profile at www.sedar.com and www.sec.gov.

25