- VWESQ Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Vintage Wine Estates (VWESQ) DEF 14ADefinitive proxy

Filed: 23 Dec 21, 4:02pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________

SCHEDULE 14A

_____________________________________________

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

VINTAGE WINE ESTATES, INC.

(Name of Registrant as Specified In Its Charter)

___________________________________________________

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

__________________________________________________________________________________________________

(2) Aggregate number of securities to which transaction applies:

__________________________________________________________________________________________________

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

__________________________________________________________________________________________________

(4) Proposed maximum aggregate value of transaction:

__________________________________________________________________________________________________

(5) Total fee paid:

__________________________________________________________________________________________________

☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

__________________________________________________________________________________________________

(2) Form, Schedule or Registration Statement No.:

__________________________________________________________________________________________________

(3) Filing Party:

__________________________________________________________________________________________________

(4) Date Filed:

__________________________________________________________________________________________________

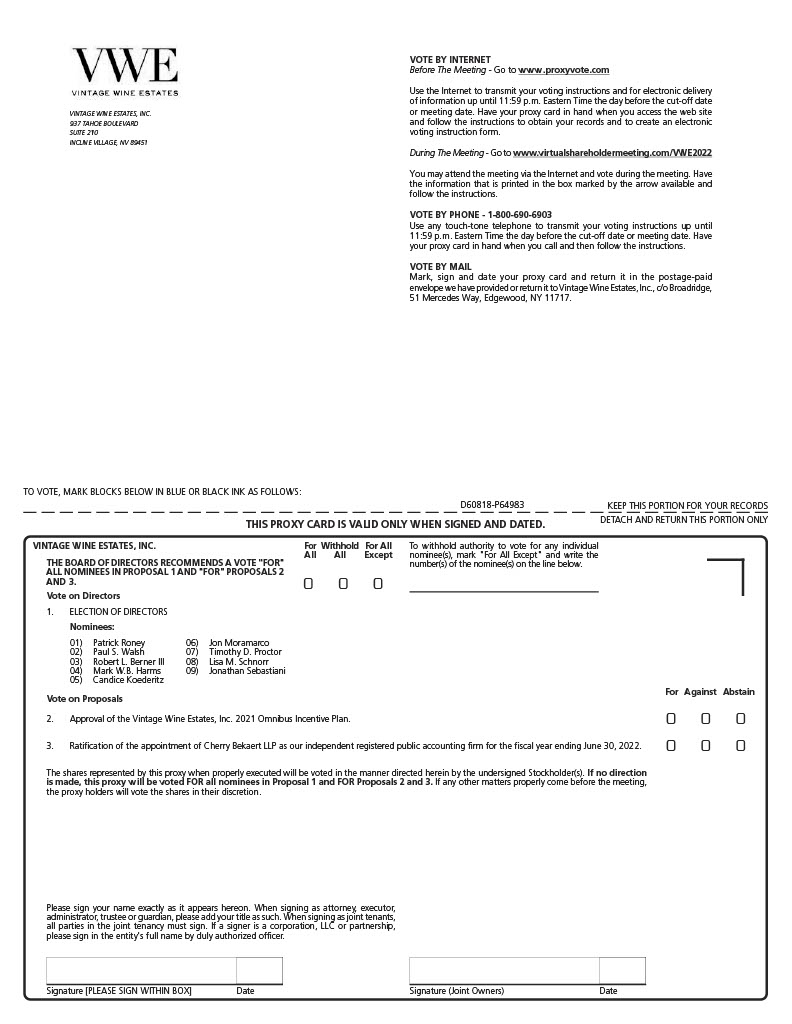

937 Tahoe Boulevard, Suite 210 | Incline Village, Nevada 89451

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

You are cordially invited to attend the Annual Meeting of Stockholders of Vintage Wine Estates, Inc.

Date & Time: | Wednesday, February 2, 2022 at 9:00 A.M., Pacific Time |

Location: | Virtual meeting at www.virtualshareholdermeeting.com/VWE2022 |

Record Date: | Vintage Wine Estates, Inc. stockholders of record on the books of the Company at the close of business on December 6, 2021, the record date, are entitled to notice of, and to vote at, the Annual Meeting or at any postponement or adjournment thereof. |

Mail Date: | We intend to mail the Notice Regarding the Availability of Proxy Materials, or the proxy statement and proxy card, as applicable, on or about December 23, 2021 to our stockholders of record on the record date. |

Stockholders will vote regarding: | 1. Election of nine director nominees named in the proxy statement to serve until our next annual meeting of stockholders and until their respective successors have been duly elected and qualified; 2. Approval of the Vintage Wine Estates, Inc. 2021 Omnibus Incentive Plan; 3. Ratification of the appointment of Cherry Bekaert LLP as our independent registered public accounting firm for the fiscal year ending June 30, 2022; and 4. The transaction of any other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

Voting: | It is important that your shares be represented and voted. Please vote your shares either electronically over the Internet or by telephone, or if you receive a paper proxy card by mail, by completing and returning the proxy card mailed to you. Voting instructions are provided in the accompanying proxy statement and in the Notice of Internet Availability of Proxy Materials. By submitting your proxy promptly, you will save us the expense of further proxy solicitation. We encourage you to submit your proxy as soon as possible by Internet, by telephone or by signing, dating and returning all proxy cards or instruction forms provided to you. |

By order of the Board of Directors,

Patrick Roney

Chief Executive Officer

December 23, 2021

Incline Village, Nevada

Important Notice Regarding Availability of Proxy Materials for the Stockholder Meeting

to be Held on February 2, 2022

The proxy materials for the Annual Meeting, including the Annual Report and the Proxy Statement, are available at www.proxyvote.com

PROXY STATEMENT

for the

ANNUAL MEETING OF STOCKHOLDERS

to be held on Wednesday, February 2, 2022

The Annual Meeting of Stockholders (the "Annual Meeting") of Vintage Wine Estates, Inc., a Nevada corporation (the “Company,” “VWE,” “we,” “our” or “us”) will be held virtually at 9:00 a.m., Pacific Time, on Wednesday, February 2, 2022.

Due to the continuing public health impact of the coronavirus disease 2019 (“COVID-19”) pandemic and to support the health and well-being of our directors, employees and stockholders, we are pleased to provide stockholders with the opportunity to participate in the Annual Meeting online via the Internet in a virtual-only meeting format to facilitate shareholder attendance and provide a consistent experience to all stockholders regardless of location. We will provide a live webcast of the Annual Meeting at www.virtualshareholdermeeting.com/VWE 2022, where you will also be able to submit questions and vote online. You will not be able to attend the meeting at a physical location.

This proxy statement and accompanying form of proxy are being furnished to you as a stockholder of the Company and the form of proxy is being solicited by and on behalf of our Board of Directors (the “Board”) for use at the Annual Meeting, and at any adjournments or postponements thereof. This proxy statement and the enclosed form of proxy are being first mailed to stockholders on or about December 23, 2021.

What Are You Voting On?

You will be entitled to vote on the following proposals at the Annual Meeting:

Stockholders also will transact any other business that properly comes before the Annual Meeting or any adjournment or postponement thereof.

Who Can Vote

The Board has set December 6, 2021 as the record date for the Annual Meeting. You are entitled to notice and to vote if you were a stockholder of record of our common stock, no par value per share (“common stock”), as of the close of business on the record date. You are entitled to one vote on each proposal for each share of common stock you held on the record date. Your shares may be voted by telephone or electronically via the internet, or if you receive a paper proxy card by mail, by completing and returning the proxy card mailed to you.

Shares Outstanding and Quorum

At the close of business on the record date, there were 60,461,611 shares of our common stock outstanding and entitled to vote at the Annual Meeting. The presence, in person or by proxy of the holders of a majority of the outstanding shares of our common stock entitled to vote constitutes a quorum, which is required to hold and conduct business at the Annual Meeting.

Shares that are voted “FOR,” “AGAINST,” or “ABSTAIN” are treated as being present at the Annual Meeting for the purposes of establishing a quorum. Broker non-votes will also be considered present and entitled to vote for purposes of determining the presence or absence of a quorum for the transaction of business, but such broker non-votes will not be included in the tabulation of the voting results with respect to the election of directors and other non-routine matters.

| -1- |

|

If your shares are held in “street name,” your shares are counted as present for purposes of determining a quorum if your broker, bank, trust or other nominee submits a proxy covering your shares. Your broker, bank, trust or other nominee is entitled to submit a proxy covering your shares as to certain “routine” matters, even if you have not instructed your broker, bank, trust or other nominee on how to vote on those matters. Please see the subsection “If You Do Not Specify How You Want Your Shares Voted” below. In the absence of a quorum, the Annual Meeting may be adjourned, from time to time, by the chairman of the meeting or by the vote of the holders of a majority of the shares represented thereat, but no other business may be transacted at such meeting.

How to Vote Your Shares

Stockholders can vote their shares using one of the following methods:

You may vote by attending the Annual Meeting or by submitting a proxy. The method of voting by proxy differs (1) depending on whether you are viewing this proxy statement on the Internet or receiving a paper copy and (2) for shares held as a record holder and shares held in “street name.”

If your shares are registered directly in your name in the records of the Company’s transfer agent, TSX Trust Company, you are considered the stockholder of record with respect to those shares.

If your shares are held in a stock brokerage account or by a bank, trust or other nominee, then the broker, bank, trust or other nominee is considered to be the stockholder of record with respect to those shares. However, you are still considered to be the beneficial owner of those shares, and your shares are said to be held in “street name.” Street name holders generally cannot submit a proxy or vote their shares directly and must instead instruct their broker, bank, trust or other nominee how to vote their shares using the methods described below.

Shares Held as a Record Holder. If you hold your shares of common stock as a record holder and you are viewing this proxy statement on the Internet, you may submit a proxy over the Internet by following the instructions on the website referred to in the Notice previously mailed to you. You may request paper copies of the proxy statement and proxy card by following the instructions in the Notice. If you hold your shares of common stock as a record holder and you are reviewing a paper copy of this proxy statement, you may submit a proxy over the Internet or by telephone by following the instructions on the proxy card, or by completing, dating and signing the proxy card that was included with this proxy statement and promptly returning it in the pre-addressed, postage-paid envelope provided to you.

Shares Held in Street Name. If you hold your shares of common stock in street name, you will receive a notice from your broker, bank, trust or other nominee that includes instructions on how to vote your shares. Your broker, bank, trust or other nominee may allow you to deliver your voting instructions over the Internet and may also permit you to submit your voting instructions by telephone. In addition, you may request paper copies of this proxy statement and accompanying proxy card from your broker by following the instructions on the notice provided by your broker, bank, trust or other nominee.

The Internet and telephone voting facilities will close at 11:59 P.M., Eastern Time on February 1, 2022. Stockholders who submit a proxy through the Internet or by telephone should be aware that they may incur costs to access the Internet or telephone, such as usage charges from telephone companies or Internet service providers and that these costs must be borne by the stockholder.

| -2- |

|

YOUR VOTE IS VERY IMPORTANT Whether or not you plan to attend the Annual Meeting, please vote as promptly as possible in order to ensure that your shares are represented at the Annual Meeting. |

Changing Your Vote

As a stockholder of record, if you submit a proxy, you may revoke that proxy at any time before it is voted at the Annual Meeting. Stockholders of record may revoke a proxy by (i) delivering a written notice of revocation to the attention of the Secretary of the Company at our principal executive offices at 937 Tahoe Boulevard, Suite 210, Incline Village, Nevada 89451 or (ii) duly submitting a later-dated proxy by mail that is received prior to the Annual Meeting or over the Internet, or by telephone by 11:59 P.M., Eastern Time, on February 1, 2022. Attendance at the Annual Meeting will not, by itself, revoke a proxy. If your shares are held in the name of a broker, bank, trust or other nominee, you may change your voting instructions by following the instructions of your broker, bank, trust or other nominee.

If You Receive More Than One Proxy Card or Notice

If you receive more than one proxy card or notice, it means you hold shares that are registered in more than one account. To ensure that all of your shares are voted, you should sign and return each proxy card or, if you submit a proxy by telephone or the Internet, you should submit one proxy for each proxy card or notice you receive.

How Will Your Shares Be Voted

Stockholders of record as of the close of business on December 6, 2021 are entitled to one vote for each share of our common stock held on all matters to be voted upon at the Annual Meeting. All shares entitled to vote and represented by properly submitted proxies received before the polls are closed at the Annual Meeting, and not revoked or superseded, will be voted at the Annual Meeting in accordance with the instructions indicated on those proxies.

If You Do Not Specify How You Want Your Shares Voted

As a stockholder of record, if you submit a signed proxy card or submit your proxy by telephone or Internet and do not specify how you want your shares voted, the proxy holder will vote your shares:

If you hold your shares in street name and do not provide voting instructions to your broker or other nominee, your shares will be considered to be “broker non-votes” and will not be voted on any proposal on which your broker or other nominee does not have discretionary authority to vote. A “broker non-vote” occurs when a nominee holding shares for a beneficial owner has not received voting instructions from the beneficial owner and the nominee does not have discretionary authority to vote the shares. Shares that constitute broker non-votes will be counted as present at the Annual Meeting for the purpose of determining a quorum, but will not be considered entitled to vote on the proposal in question. Brokers generally have discretionary authority to vote on the ratification of the appointment of Cherry Bekaert LLP as our independent registered public accounting firm. Brokers, however, do not have discretionary authority to vote on the election of directors to serve on our Board or the approval of the Vintage Wine Estates, Inc. 2021 Omnibus Incentive Plan.

In their discretion, the proxy holders named in the proxy are authorized to vote on any other matters that may properly come before the Annual Meeting and at any continuation, postponement or adjournment thereof. The Board is not aware of any other items of business that will be presented for consideration at the Annual Meeting other than those described in this proxy statement. In

| -3- |

|

addition, no stockholder proposal or nomination was received on a timely basis, so no such matters may be brought to a vote at the Annual Meeting.

Votes Required and Recommendations of the Board

Proposal 1 – Election of Directors

The stockholders will vote to elect nine directors to serve until our next annual meeting of stockholders and until their respective successors are duly elected and qualified or until their earlier death, resignation or removal. The election of directors requires a plurality of the votes cast by the holders of common stock present and voting at the Annual Meeting, with the nine nominees receiving the highest vote totals to be elected. Stockholders may vote “FOR” or “WITHHOLD.” Votes indicating “WITHHOLD” will not be counted as a vote “FOR” that nominee. Abstentions and broker non-votes will not be counted as votes cast and will have no effect on the outcome of the vote of Proposal 1. If your shares are held by your broker in “street name,” and you do not furnish voting instructions to your broker, your brokerage firm may not vote your shares on Proposal 1.

Pursuant to the Company’s Majority Voting Policy, any nominee for director who receives a greater number of “WITHHOLD” votes than “FOR” votes with respect to their election in an uncontested election is required to tender their resignation as a director to the Chairman of the Board, to be effective upon acceptance by the Board. The Nominating and Governance Committee of the Board will consider the director’s offer to resign and then make a recommendation to the Board whether to accept it. The Board will make its decision within 90 days following the Annual Meeting and will accept the resignation absent exceptional circumstances and will announce its decision via press release, including the reasons for rejecting the resignation, if applicable.

Each nominee has agreed to serve if elected and the Board has no reason to believe that any nominee will be unable to serve. However, if any nominee should become unavailable for election prior to the Annual Meeting, the proxies will be voted in favor of the election of a substitute nominee or nominees proposed by the Board or, alternatively, the number of directors may be reduced accordingly by the Board.

Our Board recommends that you vote FOR the

election of each of the nine nominees for election to the Board

Proposal 2 – Approval of the Vintage Wine Estates, Inc. 2021 Omnibus Incentive Plan

The approval of the Vintage Wine Estates, Inc. 2021 Omnibus Incentive Plan requires the affirmative vote of at least a majority of the votes cast on Proposal 2 by holders of common stock present and voting at the Annual Meeting. For Proposal 2, a stockholder may indicate “FOR,” “AGAINST” or “ABSTAIN” on the proxy card. For purposes of determining the number of votes cast with respect to Proposal 2, only those votes cast “FOR” or “AGAINST” are included. Abstentions and broker non-votes are counted only for purposes of determining whether a quorum is present at the meeting and therefore will have no effect on the outcome of the vote for this proposal. Brokerage firms and nominees will not have the authority to vote their customers’ unvoted shares on Proposal 2 or to vote their customers’ shares if their customers have not furnished voting instructions within a specified period of time prior to the Annual Meeting.

Our Board recommends that you vote FOR the proposal to approve

the Vintage Wine Estates, Inc. 2021 Omnibus Incentive Plan

Proposal 3 – Ratification of Appointment of Independent Registered Public Accounting Firm

The ratification of the appointment of Cherry Bekaert LLP as our independent registered public accounting firm for the fiscal year ending June 30, 2022 requires the affirmative vote of at least a majority of the votes cast on Proposal 3 by holders of common stock present and voting at the Annual Meeting. For Proposal 3, a stockholder may indicate “FOR,” “AGAINST,” OR “ABSTAIN” on the proxy card. For purposes of determining the number of votes cast with respect to this proposal, only those votes cast “FOR” OR “AGAINST” are included. Abstentions and broker non-votes are counted only for purposes of determining whether a quorum is present at the meeting and therefore will have no effect on the outcome of the vote for this proposal. Brokerage firms and nominees have the authority to vote their customers’ unvoted shares on Proposal 3 as well as to vote their customers’ shares on

| -4- |

|

this proposal where the customers have not furnished voting instructions within a specified period of time prior to the Annual Meeting.

Our Board recommends that you vote FOR the ratification of the appointment of

Cherry Bekaert LLP as our independent registered public accounting firm

Any other matter submitted to the stockholders will require the affirmative vote of a majority of the shares represented and entitled to vote, online or by proxy, at the Annual Meeting, unless a greater percentage is required either by law or by our articles of incorporation or bylaws. In addition, the proxy confers discretionary authority to the persons named in the proxy authorizing those persons to vote, in their discretion, on any other matters properly presented at the Annual Meeting. The Board is not currently aware of any such other matters. If any other matter does properly come before the Annual Meeting, the Board intends that the persons named in the enclosed form of proxy will vote on such matter as directed by the Board or, in the absence of such direction, in accordance with their judgment.

Rules of the Meeting

The Chairman of the Board (the “Chairman”), or in the Chairman’s absence, our Chief Executive Officer (the “Chief Executive Officer”), will call to order and preside over meetings of stockholders. Our Board of Directors may adopt rules, regulations and procedures for the conduct of any meeting of stockholders as it deems appropriate. Except to the extent inconsistent with such rules, regulations and procedures, the presiding officer of any meeting of stockholders will also determine the order of business and have the authority in his or her sole discretion to determine the rules of procedure and regulate the conduct of the meeting, including without limitation by: (a) imposing restrictions on the persons (other than stockholders of the Company or their duly appointed proxy holders) that may attend the meeting; (b) ascertaining whether any stockholder or his or her proxy holder may be excluded from the meeting based upon any determination by the presiding officer, in his or her sole discretion, that any such person has disrupted or is likely to disrupt the proceedings thereat; (c) determining the circumstances in which any person may make a statement or ask questions at the meeting; (d) ruling on all procedural questions that may arise during or in connection with the meeting; (e) determining whether any nomination or business proposed to be brought before the meeting has been properly brought before the meeting; (f) determining the time or times at which the polls for voting at the meeting will be opened and closed; and (g) recessing or adjourning the meeting in accordance with our bylaws.

Tabulation of Votes and Inspector of Elections

All votes will be tabulated by the inspector of election appointed for the Annual Meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes. Shares held by persons attending the Annual Meeting but not voting, shares represented by proxies that reflect abstentions as to one or more proposals, and broker non-votes will be counted as present for purposes of determining a quorum.

Solicitation of Proxies

We will bear the entire cost of solicitation of proxies, including preparation, assembly and mailing of this proxy statement, the proxy, the notice and any additional information furnished to stockholders. Copies of solicitation materials will be furnished to banks, brokerage houses, fiduciaries and custodians holding shares of our common stock in their names that are beneficially owned by others to forward to those beneficial owners. We may reimburse persons representing beneficial owners for their costs of forwarding the solicitation materials to the beneficial owners. Original solicitation of proxies may be supplemented by telephone, facsimile, electronic mail or personal solicitation by our directors, officers or staff members. No additional compensation will be paid to our directors, officers or staff members for such services.

| -5- |

|

PROPOSAL 1 – ELECTION OF DIRECTORS

Under our governing documents, and subject to the terms of the Investor Rights Agreement (as further described below under the section titled “Corporate Governance – Investor Rights Agreement”), our Board will consist of not fewer than five nor more than eleven members. Our Board has the power to set the number of authorized directors within those specified limits from time to time by resolution. We currently have nine authorized directors serving on our Board; each is elected for a term expiring at the next annual meeting of stockholders and until their successors are duly elected and qualified or until his or her earlier death, disability, resignation, disqualification or removal.

Based on the recommendation of our Nominating and Governance Committee, and pursuant to the terms of the Investor Rights Agreement, our Board has nominated each of the nine director nominees set forth below to stand for re-election by our stockholders at the Annual Meeting. If re-elected, each such director will hold office until our annual meeting of stockholders to be held in 2022 and until his or her successor is elected and qualified, or until his or her earlier death, disability, resignation, disqualification or removal. The following table contains information regarding each of the nominees for election to our Board (ages are as of December 1, 2021):

Director Nominee | Age | Director Since (4) | Audit Committee | Compensation Committee | Nominating and Governance Committee |

Patrick Roney (1) | 65 | 2021 |

|

|

|

Paul S. Walsh (2) | 66 | 2019 |

|

| X |

Robert L. Berner III (1) | 60 | 2019 |

| X |

|

Mark W.B. Harms (2) | 60 | 2019 | X |

|

|

Candice Koederitz (3) | 65 | 2021 | X |

|

|

Jon Moramarco (1) | 65 | 2021 | X |

|

|

Timothy D. Proctor (3) | 71 | 2019 |

| X |

|

Lisa M. Schnorr (1) | 56 | 2021 | X |

|

|

Jonathan Sebastiani (1) | 51 | 2021 |

|

| X |

________________

(1) These individuals are Roney Nominees, as defined below under the section titled “Corporate Governance – Investor Rights Agreement.”

(2) These individuals are Sponsor Nominees, as defined below under the section titled “Corporate Governance – Investor Rights Agreement.”

(3) These individuals are Nominating Committee Nominees, as defined below under the section titled “Corporate Governance – Investor Rights Agreement.”

(4) Indicates the year the respective individual became a director of Vintage Wine Estates, Inc., a Nevada corporation, or Bespoke Capital Acquisition Corp, a British Columbia corporation, as applicable. See "Our Director Nominees" below for more details.

Each nominee has agreed to serve if elected and the Board has no reason to believe that any nominee will be unable to serve. However, if any nominee should become unavailable for election prior to the Annual Meeting, the proxies will be voted in favor of the election of a substitute nominee or nominees proposed by the Nominating and Governance Committee or, alternatively, the number of directors may be reduced accordingly by the Board.

Pursuant to the Company’s Majority Voting Policy, any nominee for director who receives a greater number of “WITHHOLD” votes than “FOR” votes with respect to their election in an uncontested election is required to tender their resignation as a director to the

| -6- |

|

Chairman of the Board, to be effective upon acceptance by the Board. The Nominating and Governance Committee of the Board will consider the director’s offer to resign and then make a recommendation to the Board whether to accept it. The Board will make its decision within 90 days following the Annual Meeting and will accept the resignation absent exceptional circumstances and will announce its decision via press release, including the reasons for rejecting the resignation, if applicable.

Subject to the terms of the Investor Rights Agreement, vacancies on the Board (including any vacancy created by an increase in the size of the Board) will be filled solely by the affirmative vote of a majority of the remaining directors then in office, even though less than a quorum of the Board, or by a sole remaining director. A director so elected to fill a vacancy will hold office until the next annual meeting of stockholders and until such director’s successor is elected and qualified, or until such director’s earlier death, disability, resignation, disqualification or removal.

Our Director Nominees

The following provides certain biographical information for each nominee and a summary of the specific qualifications, attributes, skills and experiences which led our Board to conclude that each nominee should serve on the Board at this time. There are no family relationships among any of our directors or among any of our directors and our executive officers.

Prior to the June 2021 consummation of our business combination, which we refer to as the “Business Combination,” certain of our director nominees served on the board of directors of Vintage Wine Estates, Inc., a California corporation. We refer to this entity as “Legacy VWE.”

Patrick Roney has served as our Chief Executive Officer and a director since June 2021. Mr. Roney served as the Chief Executive Officer of Legacy VWE since its inception, having co-founded Legacy VWE in 2007 with the late Leslie Rudd. Mr. Roney has spent his 30-plus year career in the wine, spirits, and food industries, beginning with his first job as a young sommelier at the legendary Pump Room in Chicago. He has been hands-on in every aspect of the wine and spirits business—from production to sales and marketing, to finance and senior management, at some of the industry’s most important brands, including Seagram’s, Chateau St. Jean, Dean & Deluca and the Kunde Family Winery. Mr. Roney’s idea to bring fine wine brand Girard together with a direct-to-consumer brand Windsor Vineyards, to form Vintage Wine Estates, illustrates his deep knowledge of market trends and consumer behaviors. Mr. Roney models an entrepreneurial spirit and is dedicated to preserving the heritage of iconic wine brands while maintaining focus on the customer and innovative ideas. He holds a B.S. degree from Northwestern University and an M.B.A. degree from Southern Illinois University. He is well-qualified to serve as a director because of his manifold roles in operations, finance, sales and marketing throughout his career in food and beverage companies, including leadership of Legacy VWE from its very beginning.

Paul S. Walsh is our Chairman of the Board and has served as a director since July 2019. Mr. Walsh brings with him a wealth of experience as Chief Executive Officer of a large multinational branded consumer products corporation operating in highly regulated markets. Mr. Walsh previously served as Chairman of Compass Group PLC from February 2014 to December 2020. He also previously served as the Lead Operating Partner of Bespoke Capital Partners, LLC (“Bespoke”) from August 2016 to June 2020. Mr. Walsh was the Chief Executive Officer of Diageo, the world’s largest spirits company, from 2000 to 2013. Prior to that, Mr. Walsh was the Chairman and President of The Pillsbury Company from 1996 to 1999. Under Mr. Walsh’s leadership, Diageo was transformed from a multi-national conglomerate into a focused global market leading spirits business via a combination of organic growth and significant acquisitions. Mr. Walsh and his management team created over $80 billion of shareholder value while in leadership at Diageo. Mr. Walsh brings with him substantial corporate leadership experience, knowledge of consumer-centric companies, international operations expertise, and experience with regulated industries. He has also held executive-level finance positions, including as Chief Financial Officer of Grand Metropolitan Foods and Intercontinental Hotels. Throughout his career, Mr. Walsh has built success and growth at his companies through the deployment of effective brand development and marketing strategies, which brings added perspective to our Board. Notable successes include the creation of the Johnnie Walker family of Scotch Whiskey brands. He also currently serves as Executive Chairman of McLaren Group. He is a non-executive director of McDonald’s Corporation (NYSE: MCD) and FedEx Corporation (NYSE: FDX).

Robert L. Berner III has served as a director since July 2019. Mr. Berner is a founder, Joint Managing Partner and Chief Investment Officer of Bespoke and Chairman of Bespoke’s Investment Committee. He has been active in the private equity industry for over 30 years. Mr. Berner has sat on numerous boards and is currently Chairman of, Johnnie-O LLC (men’s lifestyle brand). Mr. Berner also was a principal investor in, and Chairman of Diversified Distribution Systems, LLC (DDS), the largest specialty retail distribution and services business in the United States, which was recently successfully sold to Bunzl Plc. Mr. Berner was previously a Partner at CVC Capital Partners, a global private equity firm with over $100 billion of assets under management, and assisted in the opening and development of the firm’s US efforts, including serving as Chairman of CVC US. Prior to CVC, he served as a Managing Director at Ripplewood Holdings and was a member of the firm’s Investment Committee. Prior thereto, Mr. Berner was

| -7- |

|

a Partner and member of the Investment Committee of Charterhouse International. Mr. Berner began his career in the investment banking division of Morgan Stanley where he was a Principal in the mergers and acquisitions department. Mr. Berner also serves on the board of Bespoke’s portfolio companies. In addition, Mr. Berner has acted as a non-executive director on the boards of numerous private equity portfolio companies during his private equity career and has sat on the board of several charitable and not for profit organizations. Mr. Berner has an MBA from Northwestern University and a BBA in Finance from the University of Notre Dame.

Mark W.B. Harms has served as a director since July 2019. He previously served as the Chief Executive Officer of BCAC from December 2020 to June 2021. Mr. Harms is a founder and Joint Managing Partner of Bespoke. Prior to Bespoke, Mr. Harms founded Global Leisure Partners (“GLP”) in 2004, where he is the Chairman and Chief Executive Officer. GLP has advised on over $60 billion of transactions to date, deploying over $500 million of capital into a number of investments and developed an industry leading operating executive network with 75+ members. Mr. Harms has completed over 130 advisory and principal transactions in North and South America, Europe and Australia. Mr. Harms has extensive experience with regard to leveraged debt, mezzanine and equity financing techniques in Europe and the U.S. with over $100 billion in completed transactions. Prior to founding GLP, Mr. Harms worked at Oppenheimer as a Managing Director and at CIBC World Markets as the founder and head of the Consumer Growth Group. Mr. Harms built within Consumer Growth Group strong industry verticals in branded consumer products and services, gaming, health and fitness, specialty retail and travel and tourism. Mr. Harms also serves on the board of Bespoke’s portfolio company, World Fitness Services. Mr. Harms was a non-executive director of 24 Hour Fitness, a Bespoke portfolio company, from 2014 to 2020. Mr. Harms was a Vice Chairman of the World Travel & Tourism Council from 2009 to 2014 and is a member and on the board of the International Association of Gaming Advisors. He was also a non-executive director on a number of other charitable, educational and non for profit boards. Mr. Harms has an MBA from the University of Chicago and a BA from the University of Michigan.

Candice Koederitz has served as a director since June 2021. She previously served as a director of BCAC from July 2019 to November 2019. Ms. Koederitz brings capital markets, due diligence, financial market product development, international and risk management experience, which she gained as a Managing Director at Morgan Stanley where she spent over 30 years. At Morgan Stanley, Ms. Koederitz worked with companies and governments globally to raise over $30 billion in capital. Ms. Koederitz held various senior management roles, including head of Capital, head of Regulatory Implementation, Chief Executive Officer of Morgan Stanley Asia (S) Ltd in Singapore and head of Capital Markets Execution. She co-chaired the Capital Commitment Committee, Equity Underwriting Committees, Americas Franchise Committee and was a member of the Firm and Securities Risk Committees. Ms. Koederitz is currently an independent, non-executive director of TEAM, Inc. (Nasdaq: TEAM) and ICE Benchmark Administration Ltd, a financial benchmark administrator, and of Scotia Holdings (US) Inc., whose parent company is The Bank of Nova Scotia. She is also active in several non-profit organizations. Ms. Koederitz has an M.B.A. degree from Harvard Business School and a B.S. degree in Civil Engineering from the University of Texas at Austin. She is qualified to serve on the Company’s board of directors because of her financial acumen and executive skills.

Jon Moramarco has served as a director since June 2021. Mr. Moramarco has nearly 40 years of uninterrupted involvement in the wine industry. Since 2009, he has been Managing Partner of BW166 LLC, a consultancy to the beverage alcohol industry and provider of beverage alcohol industry data. Industry reports published by BW166 LLC include the bw166 Total Beverage Alcohol Overview and The Gomberg & Frederiksen Report. From 2010 to 2014, Mr. Moramarco was President and Chief Executive Officer of Winebow Inc., a significant importer of table wines into the U.S. market and a wholesaler of fine wines and craft spirits. From 1999 to 2009, was an executive with Constellation Brands, holding positions such as President and Chief Executive Officer of Canandaigua Wine Co. (1999-2003), President and Chief Executive Officer of Icon Estates (2003-2005), President and Chief Executive Officer of Constellation Europe (2007-2007) and Chief Executive Officer of Constellation International (2007-2009). In his final role at Constellation Brands leading to his recruitment to Winebow Inc., he served on the Executive Management Committee of the parent company and participated in all board meetings. From 1982 to 1999, Mr. Moramarco held a series of positions with Allied Domecq and its predecessor companies. He holds a B.S. degree in Agricultural Science & Management from the University of California at Davis and a certificate in Organizational Change from Stanford Business School. Mr. Moramarco’s professional affiliations include the Executive Leadership Board for Viticulture and Enology of the University of California at Davis and former board positions with the Wine Institute of California, the American Vintners Association and the Wine Market Council. He is qualified to serve on the Company’s board of directors because of his deep understanding of the wine industry and his financial and managerial skills relating directly to the industry.

Timothy D. Proctor has served as a director since August 2019. He has 38 years of experience in the practice of law, primarily in the highly regulated industries of pharmaceuticals and drinks. After five years at Union Carbide Corporation, Mr. Proctor spent 13 years at Merck supporting pharmaceutical marketing and research activities worldwide. At Glaxo (now GlaxoSmithKline) Mr. Proctor was US general counsel with responsibility for the full range of legal activities in support of marketing, manufacturing, and

| -8- |

|

research, including intellectual property, as well as corporate compliance. He moved with Glaxo to the head office in London to be global head of human resources, and while in London joined Diageo plc as global general counsel. His thirteen years at Diageo involved managing a worldwide team of lawyers in support of a number of marketing, M&A, regulatory, and compliance challenges, during a period of strong growth for the company. Mr. Proctor’s previous board service included the Northwestern Mutual, Wachovia Bank and Allergan, Inc. Mr. Proctor has MBA and JD degrees from the University of Chicago, earned in a joint program.

Lisa M. Schnorr has served as a director since June 2021. She retired in May 2021 from Constellation Brands (NYSE: STZ), a Fortune 500 company and a leading international producer of beer, wine and spirits with operations in the U.S., Mexico, New Zealand and Italy. Ms. Schnorr joined Constellation Brands in 2004 and earned promotions through a series of positions with increasing responsibility, including Vice President of Compensation and HRIS (2011-2013), Senior Vice President of Total Rewards (2014-2015), Corporate Controller (2015-2017) and Chief Financial Officer of the Wine & Spirits Division (2017-2019). Before joining Constellation Brands, Ms. Schnorr held financial and accounting positions at various public and private companies and she began her career in 1987 at PricewaterhouseCoopers (formerly Price Waterhouse), all in Rochester, New York. Since 2014, Ms. Schnorr has been a member of the board of directors of Graham Corporation (NYSE: GHM), where she serves as an Audit Committee member and Compensation Committee chair. She holds a B.S. degree in Accounting from the State University of New York at Oswego. Ms. Schnorr’s experience in VWE’s industry is a valuable contribution to the Company’s board of directors, as is her experience in strategic planning, audit, financial planning and analysis, capital allocation, public company corporate governance and risk management, among other functions and roles.

Jonathan Sebastiani has served as a director since June 2021. He previously served as a director of Legacy VWE from October 2018 to June 2021. He founded Sonoma Brands in January 2016 to invest in high-growth, emerging consumer brands and selectively incubate new concepts. Mr. Sebastiani currently leads all aspects of Sonoma Brands’ investment strategy and portfolio company management. Prior to founding Sonoma Brands, he was the Founder and Chief Executive Officer of KRAVE Pure Foods, acquired by The Hershey Company in 2015. Prior to KRAVE, he was the President of Viansa Winery. Mr. Sebastiani holds a B.S. degree from Santa Clara University and a dual M.B.A. degree from the Haas School of Business, University of California at Berkeley, and Columbia Business School. Mr. Sebastiani is qualified to serve on the Company’s board of directors because of his success as an entrepreneur and investor with respect to consumer products companies, particularly in the wine industry.

Our Board recommends a vote FOR each of the Board nominees named in

Proposal 1 in this proxy statement.

CORPORATE GOVERNANCE

Board Leadership and Structure

The Board has appointed Paul Walsh, an independent member of the Board, to serve as Chairman of the Board. The Chairman’s duties include presiding at all meetings of the stockholders and all meetings of the Board. The Chairman also performs such other duties and may exercise such other powers as may from time to time be assigned by the Board, including approving the agenda and meeting schedules for each meeting of the Board, taking into account suggestions of other directors. All directors have input into the preparation of agendas for Board meetings and topics of Board discussion and oversight. The independent members of our Board also regularly meet in executive session, without members of management present. Our Board believes this structure allows all of the directors to participate in the full range of the Board’s responsibilities with respect to its oversight of the Company’s management. Our Board has determined that this leadership structure is appropriate given the size of the Company, the number of directors overseeing the Company and the Board’s oversight responsibilities.

Investor Rights Agreement

In connection with the consummation of our Business Combination, the Company and certain holders of VWE capital stock entered into an investor rights agreement dated June 7, 2021 (the “Investor Rights Agreement”), which provides for, among other things, (i) certain rights with respect to the nomination and election of members of our Board and (ii) certain voting agreements relating to all other stockholder matters with respect to shares of common stock owned by the parties thereto. These features of the Investor Rights Agreement are explained further below.

| -9- |

|

Director Nominee Designation Rights

The Investor Rights Agreement provides that, until our 2028 annual meeting of stockholders, Patrick Roney (the “Roney Representative”) will have, so long as the size of the Board remains nine directors, the right to designate five nominees for election to the Board (each, a “Roney Nominee”), at least two of whom will qualify as independent directors under Nasdaq listing requirements. The Investor Rights Agreement further provides that, until our 2028 annual meeting of stockholders, Bespoke Sponsor Capital LP (the “Sponsor”) will have, so long as the size of the Board remains nine directors and the common stock remains listed on the Toronto Stock Exchange (“TSX”), the right to designate two nominees for election to the Board (and, if the common stock is no longer listed on the TSX, four nominees for election to the Board) (each, a “Sponsor Nominee”), at least one of whom will qualify as an independent director under Nasdaq listing requirements.

In furtherance of the designation rights described above, whenever directors are to be elected, the Board (including any committee thereof) will nominate, and the stockholders party to the Investor Rights Agreement (other than Casing & Co. f/b/o Wasatch Microcap Fund) (the "Specified Investors") will vote for each Roney Nominee and each Sponsor Nominee.

The Roney Representative will have the right to remove Roney Nominees and the Sponsor will have the right to remove Sponsor Nominees. Vacancies created by resignation, removal, death or otherwise will be filled by the Roney Representative if the predecessor director was a Roney Nominee or by the Sponsor if the predecessor director was a Sponsor Nominee. Vacancies created by increases in Board size will be filled proportionally (rounded up or down to the nearest whole number) such that, following such increase in Board size, the number of Roney Nominees or Sponsor Nominees, as a percentage of the total number of directors, remains the same.

Any director nominees not nominated pursuant to the designation rights of the Roney Representative or the Sponsor will qualify as independent directors under Nasdaq listing requirements and will be recommended to the Board by the Nominating and Governance Committee (each, a “Nominating Committee Nominee”).

Voting Agreements

The Investor Rights Agreement also provides for voting agreements with respect to all other stockholder matters. Pursuant thereto, each of the Major Investors (as defined below) appointed the Roney Representative as such stockholder’s attorney-in-fact and proxy to vote the common stock owned by such stockholder at each annual or special meeting of stockholders on all matters other than, in the case of the Sponsor, certain “Reserved Matters.” The Reserved Matters include, among other things, (a) the issuance of equity by the Company or the adoption of any equity plan, (b) any business combination transaction to which the Company is a party, and (c) any amendment of the Company’s articles of incorporation or bylaws (other than an amendment that does not discriminate by its terms against any class, series or group of stockholders or any particular stockholder or adversely affect stockholder rights in a significant respect). The proxy period began on June 7, 2021 and ends on the earlier of (i) June 6, 2028 and (ii) when the Roney Investors (as defined below) cease to own at least 10% of the outstanding common stock.

As defined in the Investor Rights Agreement, the “Major Investors” are the Sponsor, the Sebastiani Investors, the Roney Investors and the Rudd Investors. The “Sebastiani Investors” are Sonoma Brands II, L.P., Sonoma Brands II Select, L.P. and Sonoma Brands VWE Co-Invest, L.P. The “Roney Investors” are the Patrick A. Roney and Laura G. Roney Trust and Sean Roney. The “Rudd Investors” are Marital Trust D under the Leslie G. Rudd Living Trust U/A/D 3/31/1999, as amended, the SLR Non-Exempt Trust U/A/D 4/21/2018 and the Rudd Foundation.

The above description of the Investor Rights Agreement is only a summary and is qualified in its entirety by reference to the full text of the Investor Rights Agreement, which is filed as Exhibit 10.3 to the Company’s Current Report on Form 8-K filed with the SEC on June 11, 2021.

Director Independence

Nasdaq listing standards require that a majority of the members of our Board be “independent,” as such term is defined by the Nasdaq listing standards, and to disclose in the proxy statement for each annual meeting those directors that our Board has determined to be independent. Based on such definition, our Board has determined that each of Messrs. Walsh, Berner, Moramarco, Proctor and Sebastiani, and Mses. Koederitz and Schnorr, are independent.

Board Diversity

In August 2021, the SEC approved a Nasdaq proposal to adopt new listing rules relating to board diversity and disclosure. As approved by the SEC, the new Nasdaq listing rules will require all Nasdaq listed companies to disclose consistent, transparent

| -10- |

|

diversity statistics regarding their boards of directors. The rules also will require most Nasdaq listed companies to have, or explain why they do not have, at least two diverse directors, including one who self-identifies as female and one who self-identifies as either an under-represented minority or LGBTQ+. In this regard, Mses. Koederitz and Schnorr are female and Mr. Proctor is African-American. Accordingly, the Company would be in compliance with Nasdaq’s diversity requirement.

The Board Diversity Matrix below presents the Board’s diversity statistics in the format prescribed by the pending Nasdaq rules.

Board Diversity Matrix (as of December 1, 2021) | ||||

Total Number of Directors | 9 | |||

| Female | Male | Non- Binary | Did Not Disclose Gender |

Part I: Gender Identity |

| |||

Directors | 2 | 7 | — | — |

Part II: Demographic Background |

|

| ||

African American or Black | — | 1 | — | — |

Alaskan Native or Native American | — | — | — | — |

Asian | — | — | — | — |

Hispanic or Latinx | — | — | — | — |

Native Hawaiian or Pacific Islander | — | — | — | — |

White | 2 | 6 | — | — |

Two or More Races or Ethnicities | — | — | — | — |

LGBTQ+ | — | |||

Did Not Disclose Demographic Background | — | |||

Meetings of the Board of Directors

We became a public company upon the closing of the Business Combination on June 7, 2021. During the fiscal year ended June 30, 2021 (“fiscal 2021”), our Board held one meeting. No director attended less than 75% of the aggregate of the total number of meetings of the Board or of a committee on which such director served during fiscal 2021.

Committees of the Board

Our Board has three standing committees, which were constituted following the consummation of our Business Combination: the Audit Committee, the Compensation Committee, and the Nominating and Governance Committee. Each of the committees reports to the Board as it deems appropriate and as the Board may request. Each committee operates under a written charter adopted by the Board, which charters are available on our website at www.vintagewineestates.com. A general description of the duties and responsibilities of these committees, their members and the number of times each committee met is set forth below.

Audit Committee. The Audit Committee did not meet in fiscal 2021. In accordance with its charter, the Audit Committee assists the Board in fulfilling its legal and fiduciary obligations in matters involving our accounting, auditing, financial reporting and legal compliance functions by approving the services performed by our independent registered public accounting firm and reviewing their reports regarding our accounting practices and systems of internal accounting controls. The Audit Committee also oversees the audit efforts of our independent registered public accounting firm and takes those actions as it deems necessary to satisfy itself that the independent registered public accounting firm is independent of management. The members of the Audit Committee are Lisa Schnorr (Chair), Candice Koederitz and Jon Moramarco, all of whom satisfy the requirements for financial literacy under applicable rules and regulations. The Board has determined that each member of the Audit Committee is independent under applicable Nasdaq and SEC rules, including the additional independence criteria set forth in Rule 10A-3 under the Securities Exchange Act of 1934 (the “Exchange Act”). In addition, the Board has determined that Ms. Schnorr qualifies as an “audit committee financial expert” as such term is defined in Item 407 of Regulation S-K.

Compensation Committee. The Compensation Committee did not meet in fiscal 2021. In accordance with its charter, the Compensation Committee determines the general compensation policies and the compensation provided to officers of the

| -11- |

|

Company. The Compensation Committee also make recommendations to the Board regarding director compensation. In addition, the Compensation Committee reviews and determines security-based compensation for directors, officers, employees and consultants of the Company and will administer the Company’s equity incentive plans. The Compensation Committee also oversees corporate compensation programs. The members of the Compensation Committee are Robert Berner (Chair) and Timothy Proctor. The Board has determined that each member of the Compensation Committee is independent under applicable Nasdaq rules.

Nominating and Governance Committee. The Nominating and Governance Committee did not meet in fiscal 2021. In accordance with its charter, the Nominating and Governance Committee is responsible for making recommendations to the Board regarding candidates for directorships and the size and composition of the Board and its committees, subject at all times to the rights and responsibilities of the Roney Representative and of the Sponsor under the Investor Rights Agreement. The Nominating and Governance Committee also identifies and nominates any directors not nominated as Roney Nominees or Sponsor Nominees pursuant to the Investor Rights Agreement. In addition, the Nominating and Governance Committee is responsible for overseeing the Company’s governance and for making recommendations to the Board concerning governance matters. The members of the Nominating and Governance Committee are Paul Walsh (Chair) and Jonathan Sebastiani. The Board has determined that each member of the Nominating and Governance Committee is independent under applicable Nasdaq rules.

Nomination of Directors

Subject to the nominee designation rights of the Roney Representative and the Sponsor pursuant to the Investor Rights Agreement, the process followed by the Nominating and Governance Committee to identify and evaluate director candidates includes requests to the members of our Board and others for recommendations, meetings to evaluate biographical information and background material relating to potential candidates and interviews of selected candidates by members of the Nominating and Governance Committee and our Board.

In recommending candidates to the Board for nomination as directors, the Nominating and Governance Committee will strive to identify individuals who bring a unique perspective to the Company’s leadership and contribute to the overall diversity of our Board. Although the Nominating and Governance Committee has not adopted a specific written diversity policy for nominations, we believe that a diversity of experience, gender, race, ethnicity and age contributes to effective governance for the benefit of our stockholders. The Nominating and Governance Committee considers such characteristics together with the other qualities considered necessary or appropriate by the Nominating and Governance Committee, such as requisite judgment, skill, integrity and experience. The Nominating and Governance Committee does not assign a particular weight to these individual factors. Rather, the Nominating and Governance Committee looks for a mix of factors that, when considered along with the experience and credentials of the other candidates and existing directors, will provide stockholders with a diverse and experienced Board.

Our Board does not currently prescribe any minimum qualifications for director candidates; however, the Nominating and Governance Committee will take into account a potential candidate’s experience, areas of expertise and other factors relevant to the overall composition of our Board.

Our bylaws provide that nominations by stockholders of persons for election to the Board may be made by timely notice to the Corporate Secretary of the Company and otherwise complying with the requirements set forth in our bylaws. The Nominating and Governance Committee will consider persons properly nominated by stockholders and recommend to the full Board whether any such nominees should be included with the Board’s nominees for election by stockholders. The Nominating and Governance Committee will evaluate properly nominated stockholder-recommended candidates by following substantially the same process, and applying substantially the same criteria, as it follows for candidates submitted by others. To be adequate, the nomination notice must set forth certain information specified in our bylaws about each stockholder submitting a nomination and each person being nominated. Our bylaws are available in our SEC filings which can be accessed on our website at www.vintagewineestates.com under the “Governance” tab and will be provided to any stockholder upon written request to Vintage Wine Estates, Inc., 937 Tahoe Boulevard, Suite 210, Incline Village, Nevada 89451, Attn: Corporate Secretary. A stockholder is not entitled to have its nominees included in our proxy statement solely as a result of such stockholder’s compliance with the foregoing provisions. If a stockholder (or other qualified representative of the stockholder) does not appear at the annual or special meeting to present its nomination, such nomination will be disregarded (notwithstanding that proxies in respect of such nomination may have been solicited, obtained or delivered).

Communications with Directors

Our annual meeting of stockholders provides an opportunity each year for stockholders to ask questions of, or otherwise communicate directly with, members of our Board on appropriate matters. In addition, stockholders may communicate in writing

| -12- |

|

with any particular director, any committee of our Board, or the directors as a group, by sending such written communication to our Corporate Secretary at 937 Tahoe Boulevard, Suite 210, Incline Village, Nevada 89451 or via email to CorporateSecretary@vintagewineestates.com. Our Corporate Secretary will provide copies of written communications received at such addresses to the Board, relevant committee or the relevant director unless such communications are considered, in the reasonable judgment of our Corporate Secretary, to be inappropriate for submission to the intended recipient(s). The Corporate Secretary will not forward to the Board, any committee or any director communications that are not related to the duties and responsibilities of the Board, including, without limitation, customer complaints, solicitations, communications that do not relate directly or indirectly to our business or communications that relate to improper or irrelevant topics. The Corporate Secretary or their designee may analyze and prepare a response to the information contained in communications received and may deliver a copy of the communication to other Company staff members or agents who are responsible for analyzing or responding to complaints or requests. The Corporate Secretary will share all proper communications with the Board, the appropriate committee or the appropriate director(s) on at least a quarterly basis. From time to time, our Board may change the process by which stockholders may communicate with the Board or its members. We will post any changes in this process on our website or otherwise make a public disclosure.

Risk Oversight

One of the key functions of the Board is informed oversight over the Company’s risk management process. The Board administers this oversight function directly through the Board as a whole, as well as through the standing committees of the Board as they address risks inherent in their respective areas of oversight. In particular, the entire Board is responsible for monitoring and assessing strategic risk exposure, and the Audit Committee has the responsibility to consider and discuss major financial risk exposures and the steps that management has taken to monitor and control such exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. The Audit Committee also has the responsibility to review with management the process by which risk assessment and management is undertaken, monitor compliance with legal and regulatory requirements and review the adequacy and effectiveness of the Company’s internal controls over financial reporting and (in coordination with the Nominating and Governance committee) its disclosure controls and processes. The Nominating and Governance Committee is responsible for monitoring the Company’s corporate governance policies and systems in light of the governance risks that the Company faces and the adequacy of the Company’s policies and procedures designed to address such risks. The Compensation Committee assesses and monitors whether any of our compensation plans, policies and programs comply with applicable legal and regulatory requirements.

Board Attendance at Annual Meetings of Stockholders

Directors are encouraged, but not required, to attend our annual meetings of stockholders.

Code of Business Conduct and Ethics

We have adopted a Code of Business Conduct and Ethics that applies to all of our employees, directors and officers, including our Chief Executive Officer, President, Chief Financial Officer, Chief Operating Officer and other executive and senior financial officers. We have made the Code of Business Conduct and Ethics available on our website at www.vintagewineestates.com. Any amendments to the Code of Business Conduct and Ethics, or any waivers of its requirements, are expected to be disclosed on that website to the extent required by applicable SEC and Nasdaq rules.

Anti-Hedging Policy

Our Board has adopted an Insider Trading Policy, which applies to all directors, officers and employees of the Company, including any entities that any of such persons control and their family members (collectively, “Insiders”). Among other things, the policy prohibits hedging transactions by any Insider or any of their designees. Such prohibited hedging transactions may include, without limitation, the use of financial instruments such as prepaid variable forwards, equity swaps, short sale instruments, puts, collars and exchange funds or other transactions that hedge or offset, or are designed to hedge or offset, any decrease in the market value of the Company’s securities.

Audit Committee Report

Management is responsible for our financial reporting process, including our system of internal control, and for the preparation of our consolidated financial statements in accordance with accounting principles generally accepted in the United States ("GAAP"). Our independent auditors are responsible for auditing those financial statements. The Audit Committee’s responsibility is to monitor and review these processes. It is not the Audit Committee’s duty or responsibility to conduct audit or accounting reviews or

| -13- |

|

procedures. The members of the Audit Committee are not employees of the Company and may not be, and may not represent themselves to be or to serve as, accountants or auditors by profession or experts in the fields of accounting or auditing. Therefore, the Audit Committee has relied, without independent verification, on management’s representation that the financial statements have been prepared with integrity and objectivity and in conformity with GAAP and on the representations of the independent registered public accounting firm included in its report on our financial statements. The Audit Committee’s oversight does not provide it with an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or policies, or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, the Audit Committee’s considerations and discussions with management and the independent registered public accounting firm do not assure that our financial statements are presented in accordance with GAAP, that the audit of our financial statements has been carried out in accordance with generally accepted auditing standards, or that our independent registered public accounting firm is in fact “independent”.

In accordance with its written charter, the Audit Committee assists our Board in fulfilling its responsibility to oversee the integrity of the accounting and financial reporting processes of the Company. Typically, for each fiscal year, the Audit Committee selects the independent registered public accounting firm to audit our financial statements and such selection is subsequently presented to our stockholders for ratification.

The Audit Committee has reviewed and discussed the audited financial statements contained in our Annual Report on Form 10-K for the fiscal year ended June 30, 2021 with our management and has discussed with the independent registered public accounting firm the matters required to be discussed by the statement on Auditing Standards No. 1301 “Communications With Audit Committees” as adopted by the Public Company Accounting Oversight Board. The Audit Committee has also discussed with the independent registered public accounting firm matters relating to its independence, including a review of audit and non-audit fees and the written disclosures and letter from the independent registered public accounting firm to the Audit Committee pursuant to the applicable requirements of the Public Company Accounting Oversight Board regarding the independent registered public accounting firm’s communications with the Audit Committee concerning independence.

Based on the reviews and discussions referred to above, the Audit Committee recommended to the Board, and the Board approved, that the audited financial statements be included in our Annual Report on Form 10-K for the fiscal year ended June 30, 2021 for filing with the SEC.

The Audit Committee

Lisa M. Schnorr, Chair

Candice Koederitz

Jon Moramarco

EXECUTIVE OFFICERS

Executive Officers of VWE

The following sets forth the names, ages, positions and biographical information regarding each of our executive officers as of December 1, 2021 (Mr. Roney’s biographical information is presented under “Proposal 1 – Election of Directors – Our Director Nominees”):

Name |

| Age |

| Title |

Executive Officers |

|

|

|

|

Patrick Roney |

| 65 |

| Chief Executive Officer and Director |

Terry Wheatley |

| 68 |

| President |

Katherine DeVillers |

| 59 |

| Chief Financial Officer |

Russell G. Joy |

| 58 |

| Chief Operating Officer |

| -14- |

|

Terry Wheatley has served as our President since June 2021. Prior to that, she had served as the President of Legacy VWE since 2018, overseeing all commerce channels and marketing for the company, having joined Legacy VWE in 2014 when Canopy Management was acquired by Legacy VWE. Ms. Wheatley began her 30-plus year career in the wine and spirits industry at E.&J. Gallo. After 17 years at Gallo, Ms. Wheatley took over sales and marketing positions at Sutter Home/Trinchero Family Estate, ultimately becoming the Senior Vice President of Marketing. In 2008, Ms. Wheatley founded her own wine brand creation, sales and marketing company, Canopy Management, leveraging her long-term relationships with the wine industry’s top buyers to bring a portfolio of innovative wine brands to market. Ms. Wheatley has also served as Chairwoman of CannaCraft, a large-scale cannabis manufacturer, since December 2019.

Katherine DeVillers has served as our Chief Financial Officer since June 2021. Prior to that, she had served as Legacy VWE’s Chief Financial Officer since August 2018. From January 2014 until joining Legacy VWE, Ms. DeVillers served as Chief Financial Officer at C. Mondavi Family and before then, held finance positions at other wine businesses, including Allied Domecq, The Vincraft Group and Ascentia Wine Estates, LLC. Ms. DeVillers also collaborates on acquisition strategy and implementation and oversees the Finance and Accounting departments of VWE. She holds a B.S. degree from California Polytechnic State University at San Luis Obispo.

Russell G. Joy has served as our Chief Operating Officer since November 1, 2021. Mr. Joy has over 15 years of extensive experience in the wine industry. Prior to joining the Company, Mr. Joy most recently served as General Manager of Napa Wine Company from May 2020 to September 2021. Prior to that, he was Vice President-Director of Strategy-CA from March 2017 to February 2020 and Vice President of California Operations from April 2016 to April 2019 at Ste. Michelle Wine Estates.

Executive officers are elected annually by, and serve at the discretion of, the Board.

EXECUTIVE COMPENSATION

Overview

We were originally formed in 2019 as Bespoke Capital Acquisition Corp. (“BCAC”), a special purpose acquisition corporation incorporated under the laws of the Province of British Columbia. BCAC was organized for the purpose of effecting an acquisition of one or more businesses or assets by way of a merger, amalgamation, share exchange, asset acquisition, share purchase, reorganization or any other similar business combination involving BCAC.

On June 7, 2021, BCAC consummated the transactions with Legacy VWE, pursuant to a transaction agreement dated February 3, 2021. As a result of the transactions, BCAC changed its jurisdiction of incorporation from the Province of British Columbia to the State of Nevada, BCAC changed its name to “Vintage Wine Estates, Inc.” and Legacy VWE became our wholly owned subsidiary.

Effective upon consummation of the Business Combination, Mark Harms resigned as Chief Executive Officer of the Company, Patrick Roney was appointed as Chief Executive Officer of the Company, Terry Wheatley was appointed as President of the Company, and Jeff Nicholson was appointed as Chief Operating Officer of the Company, among other management changes.

This section discusses the material components of the executive compensation for the executive officers who were our “named executive officers” for fiscal year 2021. This discussion may contain forward-looking statements that are based on our current plans, considerations, expectations and determinations regarding future compensation programs.

For fiscal year 2021, our named executive officers (“NEOs”) were:

2021 Summary Compensation Table

The following table provides information regarding the compensation of our NEOs for fiscal year 2021 (other than Mr. Harms, who did not receive any compensation during fiscal year 2021).

| -15- |

|

Name and Principal Position |

| Fiscal Year |

| Salary |

|

| Bonus |

|

| Stock Awards |

|

| Option Awards |

|

| Non-Equity Incentive Plan Compensation ($) |

|

| All Other Compensation ($)(4) |

|

| Total ($) |

| |||||||

Patrick Roney |

| 2021 |

| $ | 406,603 |

|

| $ | 124,373 |

|

| $ | - |

|

| $ | - |

|

| $ | - |

|

| $ | - |

|

| $ | 530,976 |

|

Chief Executive Officer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

Terry Wheatley |

| 2021 |

| $ | 407,808 |

|

| $ | 123,291 |

|

| $ | - |

|

| $ | 1,917,645 |

|

| $ | - |

|

| $ | 18,000 |

|

| $ | 2,466,744 |

|

President |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

Jeff Nicholson (5) |

| 2021 |

| $ | 334,750 |

|

| $ | 100,200 |

|

| $ | - |

|

| $ | 654,605 |

|

| $ | - |

|

| $ | 33,996 |

|

| $ | 1,123,551 |

|

Former Chief Operating Officer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

________________________

(1) Amounts in this column represent base salary earned during fiscal year 2021.

(2) Although Mr. Roney, Ms. Wheatley and Mr. Nicholson received grants to purchase common stock on June 7, 2021, such grants are contingent upon stockholder approval of the Vintage Wine Estates, Inc. 2021 Omnibus Incentive Plan, as further described below under “— Fiscal Year 2021 Equity-Based Compensation — June 2021 Option Grants.” Because the grants are contingent upon stockholder approval, the grant date fair value for these stock options is not yet determinable.

(3) Upon the consummation of the business combination, each option to purchase shares of Legacy VWE capital stock outstanding immediately prior to the consummation of the business combination, whether vested or unvested, was cancelled in exchange for a cash payment, as further described below under “— Fiscal Year 2021 Equity-Based Compensation.” Amounts in this column reflect the excess of the fair value of the consideration issued (the cash payments net of the exercise price of the options) over the fair value of the settled options at the cancellation date, which the Company recognized as incremental compensation expense. Ms. Wheatley received a total of $1,917,645 and Mr. Nicholson received a total of $654,605 in cash in exchange for the cancelled options to purchase shares of Legacy VWE capital stock.

(4) Amounts in this column represent a car allowance of $18,000 for Mrs. Wheatley and the cost of a company-paid apartment sometimes used by Mr. Nicholson.

(5) Mr. Nicholson resigned from the Company effective October 31, 2021.

Employment Agreements with the NEOs

In fiscal year 2021, the Company entered into new employment agreements with each of its post-transaction executive officers, including the NEOs, that became effective upon the consummation of the transaction.

Roney Employment Agreement

The employment agreement with Mr. Roney specifies that he will serve as the Company’s Chief Executive Officer and that his annual base salary is $500,000, subject to review and adjustment by the Board from time to time. Mr. Roney is eligible for a discretionary bonus of up to 40% of his base salary. Upon a termination of employment by the Company without cause or by Mr. Roney with good reason, Mr. Roney would be entitled to accrued benefits and a severance payment equal to three years’ base salary, payable over 36 months. For purposes of the employment agreements, “cause” is defined generally as a conviction or certain pleas to, a felony or certain other crimes, commission of a fraudulent or illegal act in respect of the Company, failure to perform duties under the employment agreement that was, or reasonably could be expected to be, materially injurious to the business, operations or reputation of the Company, a material violation of the Company’s written policies or procedures or a material breach of the executive’s obligations under the employment agreement. For purposes of the employment agreements, “good reason” is defined generally as a material reduction in the executive’s base salary, a material diminution of the executive’s title, duties, authorities or responsibilities or a material breach of the Company’s obligations under the employment agreement.

Wheatley and Nicholson Employment Agreements

The employment agreements with Mrs. Wheatley and Mr. Nicholson specify their titles as President and Chief Operating Officer, respectively, and entitle them to annual base salaries of $413,822 and $334,750, respectively, in each case subject to review and adjustment by the Board from time to time. Mrs. Wheatley’s and Mr. Nicholson’s employment agreements also provide for discretionary annual bonuses of up to 30% of their respective annual base salaries. The employment agreements also entitle them

| -16- |

|