As filed with the Securities and Exchange Commission on June 2, 2023

Registration No. 333-253037

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 10 to

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

IMPACT BIOMEDICAL INC.

(Exact name of registrant as specified in its charter)

| Nevada | | 8731 | | 85-3926944 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

275 Wiregrass Pkwy

West Henrietta, NY 14586

+1-585-325-3610

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Frank D. Heuszel

Chief Executive Officer

Impact BioMedical Inc.

275 Wiregrass Pkwy

West Henrietta, NY 14586

+1-585-325-3610

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With a copy to:

Darrin M. Ocasio, Esq.

Sichenzia Ross Ference LLP

1185 Avenue of the Americas

New York, NY 10036

Telephone: +1-212-930-9700

As soon as practicable after the effective date of this registration statement.

(Approximate date of commencement of proposed sale to the public)

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated filer | ☐ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | | Smaller reporting company | ☒ |

| | | | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not issue these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION

PRELIMINARY PROSPECTUS DATED JUNE 2, 2023

IMPACT BIOMEDICAL INC.

486,706,712 shares of Common Stock

(par value $0.001 per share)

This prospectus is being furnished to you as a stockholder of DSS, Inc. (“DSS”), in connection with the planned distribution to its stockholders of shares of common stock, par value $0.001 per share (the “Common Stock”) of Impact BioMedical Inc. (the “Company,” “Impact,” “we,” “our” or “us” as applicable) beneficially held by DSS, through its wholly-owned subsidiary, DSS BioHealth Security, Inc. (the “Distribution”).

DSS’s long-term plans for the Company include taking the Company public through an initial public offering. In concert with this planned public offering, DSS, through its wholly-owned subsidiary DSS BioHealth Security, Inc. plans to distribute an aggregate of approximately 486,706,712 shares of our Common Stock (the “Impact Shares”) beneficially held by DSS BioHealth Security, Inc. in a distribution to holders of DSS common stock, par value $0.02 per share (“DSS Common Stock”) as of June 30, 2023 (the “Record Date”), except DSS will not cause to be distributed by DSS BioHealth Security, Inc. any Impact Shares to the Chairman of the Board of DSS, Mr. Chan Heng Fai Ambrose, or any of his affiliates that hold shares of DSS Common Stock. As of the Record Date, Mr. Chan, individually and through affiliates, beneficially held 18,587,572 shares of DSS Common Stock (the “Affiliate Shares”). Except for the Affiliate Shares, each share of DSS Common Stock outstanding as of 5:00 p.m., New York City time, held on a Record Date, will entitle the holder thereof to receive four (4) Impact Shares.

Immediately prior to the Distribution, DSS, through its wholly-owned subsidiary Impact BioMedical Inc., will beneficially hold 100%, or 3,877,282,251 of the issued and outstanding shares of our Common Stock. The Distribution will be effective as of 5:00 p.m., New York City time, on July 14, 2023 (“Distribution Date”).

The Distribution will not occur until this Registration Statement becomes effective under the Securities Act of 1933, as amended (the “Securities Act”). The Distribution will be made in book-entry form by a distribution agent. Each Impact Share distributed as part of the Distribution will be not be eligible for resale until 180 days from the date of the Company’s initial public offering becomes effective under the Securities Act, subject to the discretion of the Company to lift the restriction sooner.

All of our outstanding shares of Common Stock are currently beneficially owned by DSS, through its wholly-owned subsidiary DSS BioHealth Security, Inc. Accordingly, there currently is no public trading market for our Common Stock. Our Common Stock is currently not listed for trading on any stock exchange or market. The Impact Shares may be illiquid as we cannot predict whether any trading market will develop. We currently plan to apply for listing of our Common Stock on the over-the-counter board upon the effectiveness of the registration statement, of which this prospectus forms a part. However, we can provide no assurance that our shares will be traded on the bulletin board or, if traded, that a public market will materialize. If no market is ever developed for our shares, it will be difficult for shareholders to sell their stock.

DSS stockholders are not required to vote on or take any other action in connection with the Distribution. We are not asking you for a proxy, and we request that you do not send us a proxy. DSS stockholders will not be required to pay any consideration for the Impact Shares that they receive in the Distribution, and they will not be required to surrender or exchange their shares of DSS Common Stock or take any other action in connection with the Distribution.

We are an “emerging growth company,” as defined under the federal securities laws, and have elected to comply with certain reduced public company reporting requirements for this prospectus and for future filings.

Investing in our securities involve a high degree of risk. Before buying any securities, you should carefully consider the matters described in the section titled “Risk Factors” beginning on page 11 of this Prospectus.

You should rely only on the information contained in this prospectus or any prospectus supplement or amendment hereto. We have not authorized anyone to provide you with different information.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or determined if this Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This Prospectus is not an offer to sell, or a solicitation of an offer to buy, any securities.

The date of this Prospectus is ________ ___, 2023.

TABLE OF CONTENTS

QUESTIONS AND ANSWERS ABOUT THE DISTRIBUTION

The following questions and answers briefly address some commonly asked questions about the Distribution. They may not include all the information that is important to you. We encourage you to read carefully this entire Prospectus and the other documents to which we have referred you. We have included references in certain parts of this section to direct you to a more detailed discussion of each topic presented in this section.

| Q: | What is the Distribution? |

| | |

| A: | The Distribution is a method by which we will begin to separate from DSS. DSS currently beneficially owns through its wholly-owned subsidiary, DSS BioHealth Security, Inc., 3,877,282,251 shares of our Common Stock, representing 100% of our issued and outstanding capital stock. In connection with the Distribution, DSS, through its wholly-owned subsidiary DSS BioHealth Security, Inc., will distribute to holders of DSS Common Stock an aggregate of 486,706,712 Impact Shares. Following the Distribution DSS, through its wholly-owned subsidiary DSS BioHealth Security, Inc., will retain approximately an 87% ownership interest in the Company or otherwise possess control over us. |

| | |

| Q: | Will the number of shares of DSS Common Stock I own change as a result of a Distribution? |

| | |

| A: | No, the number of shares of DSS Common Stock you own will not change as a result of a Distribution. |

| | |

| Q: | What are the reasons for the Distribution? |

| | |

| A: | The Distribution is a method by which DSS will begin to carry out the intention of management and the board of directors of DSS (“DSS Board”) to take the Company public and to reward DSS stockholders via the issuance of the Impact Shares. |

| | |

| Q: | What will I receive in a Distribution? |

| | |

| A: | As a holder of DSS Common Stock, you will receive a dividend of four Impact BioMedical Shares for every share of DSS Common Stock you hold on the Record Date. The distribution agent will distribute only whole Impact Shares in the Distribution. Your proportionate interest in DSS will not change as a result of the Distribution. For a more detailed description, see “The Distribution.” |

| | |

| Q: | What is being distributed to holders of DSS Common Stock in the Distribution? |

| | |

| A: | DSS will cause its wholly-owned subsidiary DSS BioHealth Security, Inc. to distribute 486,706,712 Impact BioMedical Shares in the Distribution. Subsequent to the Distribution DSS will maintain through its wholly-owned subsidiary DSS BioHealth Security, Inc. approximately 87% of our issued and outstanding shares of Common Stock. For more information on the shares being distributed in the Distribution, see “Description of Our Capital Stock—Common Stock.” |

| Q: | What is the record date for the Distribution? |

| | |

| A: | The DSS Board has designated 5:00 p.m., New York City time, on June 30, 2023 as the record ownership date for the Distribution. |

| | |

| Q: | When will the Distribution to holders of DSS Common Stock occur? |

| | |

| A: | The Distribution will be effective as of 5:00 p.m., New York City time on July 14, 2023 (the “Distribution Date”). On or shortly after the Distribution Date, the Impact Shares will be credited in book-entry accounts for stockholders entitled to receive those shares in the Distribution. We expect that it may take the distribution agent up to two weeks after each Distribution Date to fully distribute the Impact Shares to DSS stockholders. See “Questions and Answers About the Distribution—How will DSS distribute the Impact Shares?” for more information on how to access your book-entry account or your bank, brokerage or other account holding Impact Shares that you will receive in the Distribution. |

| | |

| Q: | What do I have to do to participate in the Distribution? |

| | |

| A: | You are not required to take any action, but we urge you to read this Prospectus carefully. Holders of DSS Common Stock on the Record Date will not need to pay any cash or deliver any other consideration, including any shares of DSS Common Stock, in order to receive Impact Shares in the Distribution. No stockholder approval of the Distribution is required. We are not asking you for a vote, and we request that you do not send us a proxy card. |

| | |

| Q: | If I sell my shares of DSS Common Stock on or before the Distribution Date, will I still be entitled to receive shares of Common Stock in the Distribution? |

| | |

| A: | If you hold shares of DSS Common Stock as of the Record Date and decide to sell them on or before the relevant Distribution Date, you will not be entitled to receive Impact Shares. You should discuss these alternatives with your bank, broker or other nominee. Each Impact Share distributed as part of the Distribution will be not be eligible for resale until 180 days from the date of the Company’s initial public offering becomes effective under the Securities Act, subject to the discretion of the Company to lift the restriction sooner. |

| | |

| Q: | How will DSS distribute the Impact Shares? |

| | |

| A: | Registered stockholders: If you are a registered stockholder (meaning you own your shares of DSS Common Stock directly through DSS’s transfer agent, American Stock Transfer & Trust Company, LLC), V Stock Transfer LLC our transfer agent, which is serving as the distribution agent in connection with the Distribution, will credit the Impact Shares you receive in the Distribution to a new book-entry account on or shortly after the Distribution Date. Our distribution agent will mail you a book-entry account statement that reflects the number of Impact Shares you own. You will be able to access information regarding your book-entry account holding the Impact Shares at V Stock Transfer LLC. |

| | |

| | “Street name” or beneficial stockholders: If you own your shares of DSS Common Stock beneficially through a bank, broker or other nominee, your bank, broker or other nominee will credit your account with the Impact Shares you receive in the Distribution on or shortly after the Distribution Date. Please contact your bank, broker or other nominee for further information about your account. |

| | |

| | We will not issue any physical stock certificates to any stockholders, even if requested. See “The Distribution—When and How You Will Receive Company Shares” for a more detailed explanation. |

| Q: | What is the U.S. federal income tax consequences to me of the Distribution? |

| | |

| A: | DSS shareholders will be subject to being taxed on the distribution of the Impact Shares. |

| | |

| | See “Material U.S. Federal Income Tax Consequences of the Distribution” for more information regarding the potential tax consequences to you from the Distribution. |

| | |

| | You should consult your own tax advisors regarding the particular tax consequences of the Distribution to you, including the applicability and effect of any U.S. federal, state, local and non-U.S. tax laws. |

| | |

| Q: | Does the Company intend to pay cash dividends? |

| | |

| A: | Following the Distribution, we do not anticipate paying any dividends on Impact Shares in the foreseeable future. See “Dividend Policy” for more information. |

| | |

| Q: | How will our Common Stock trade? |

| | |

| A: | Our shares of Common Stock are not listed on any securities exchange and the Impact Shares may be illiquid as we cannot predict whether any trading market will develop. |

| | |

| Q: | Will my shares of DSS Common Stock continue to trade on the NYSE American LLC exchange (“NYSE Amex”) following the Distribution? |

| | |

| A: | Yes. Following the Distribution, DSS Common Stock will continue to trade on the NYSE Amex under the symbol “DSS” through and after the Distribution Date. |

| | |

| Q: | Will the Distribution affect the trading price of my DSS Common Stock? |

| | |

| A: | We do not expect the trading price of shares of DSS Common Stock immediately following the Distribution to be materially lower or higher than immediately prior to the Distribution. However, until the market has fully analyzed the value of DSS without its ownership of the Impact Shares, the trading price of shares of DSS Common Stock may fluctuate. We cannot assure you that, following the Distribution, the combined trading prices of the DSS Common Stock and Impact Shares will equal or exceed what the trading price of DSS Common Stock would have been in the absence of the Distribution. It is possible that after the Distribution, the combined equity value of DSS and the Impact Shares will be less than DSS’s equity value before the Distribution. |

| Q: | Do I have appraisal rights in connection with the Distribution? |

| | |

| A: | No. Holders of DSS Common Stock are not entitled to appraisal rights in connection with the Distribution. |

| Q: | What will the relationship be between DSS and the Company after the Distribution? |

| | |

| A: | Following the Distribution, DSS, through its wholly-owned subsidiary DSS BioHealth Security, Inc., will still have a continuing stock ownership interest in and is expected to possess control over the Company, until and if the proposed public offering of the Company is completed. |

| | |

| Q: | Who is the transfer agent and registrar for our Common Stock? Who is the distribution agent in connection with the Distribution? |

| | |

| A: | V Stock Transfer LLC is the transfer agent and registrar for our Common Stock and is serving as the distribution agent in connection with the Distribution. |

| | |

| Q: | Are there risks associated with owning shares of our Common Stock? |

| | |

| A: | Yes. Our business faces both general and specific risks and uncertainties. Our business also faces risks relating to the Distribution. Accordingly, you should read carefully the information set forth in the section titled “Risk Factors” in this Prospectus. |

| | |

| Q: | Are there any conditions to completing the Distribution? |

| | |

| A: | Yes. The Distribution is conditional upon a number of matters, including but not limited to the authorization and approval of the DSS Board (which has been obtained) and the declaration of effectiveness of our Registration Statement on Form S-1, of which this Prospectus is a part, by the Securities and Exchange Commission. See “Summary—Summary of the Distribution— Conditions to the Distribution” for a more detailed explanation of the conditions to completing the Distribution. |

| | |

| Q: | Can DSS decide to not proceed with the Distribution even if all the conditions to the Distribution have been met? |

| | |

| A: | Yes. Until the Distribution has occurred, the DSS Board has the right to not proceed with the Distribution, even if all the conditions are satisfied. |

| | |

| Q: | Could there be any other classes of capital stock of the Company outstanding after the Distribution? |

| | |

| A: | No. After giving effect to the Distribution, the only class of our capital stock then outstanding is expected to be our Common Stock. |

| | |

| Q: | Where can I get more information? |

| | |

| A: | If you have any questions relating to the mechanics of the Distribution, you should contact the distribution agent, V Stock Transfer LLC, at: |

V Stock Transfer LLC 18 Lafayette Place

Woodmere, NY 11598

+1 212-828-8435

info@vstocktransfer.com

www.vstocktransfer.com

SUMMARY

This summary highlights certain information contained elsewhere in this Prospectus and may not contain all the information that is important to you. To understand fully and for a more complete description of the terms and conditions of the Distribution, you should read this Prospectus in its entirety, including the information presented under the section titled “Risk Factors” and the consolidated financial statements and related notes, and the documents to which you are referred. See “Where You Can Find More Information.”

Except where the context otherwise requires, or where otherwise indicated, references to the “Company,” “we,” “us,” or “our” are to are to Impact BioMedical Inc. and its subsidiaries.

Introduction

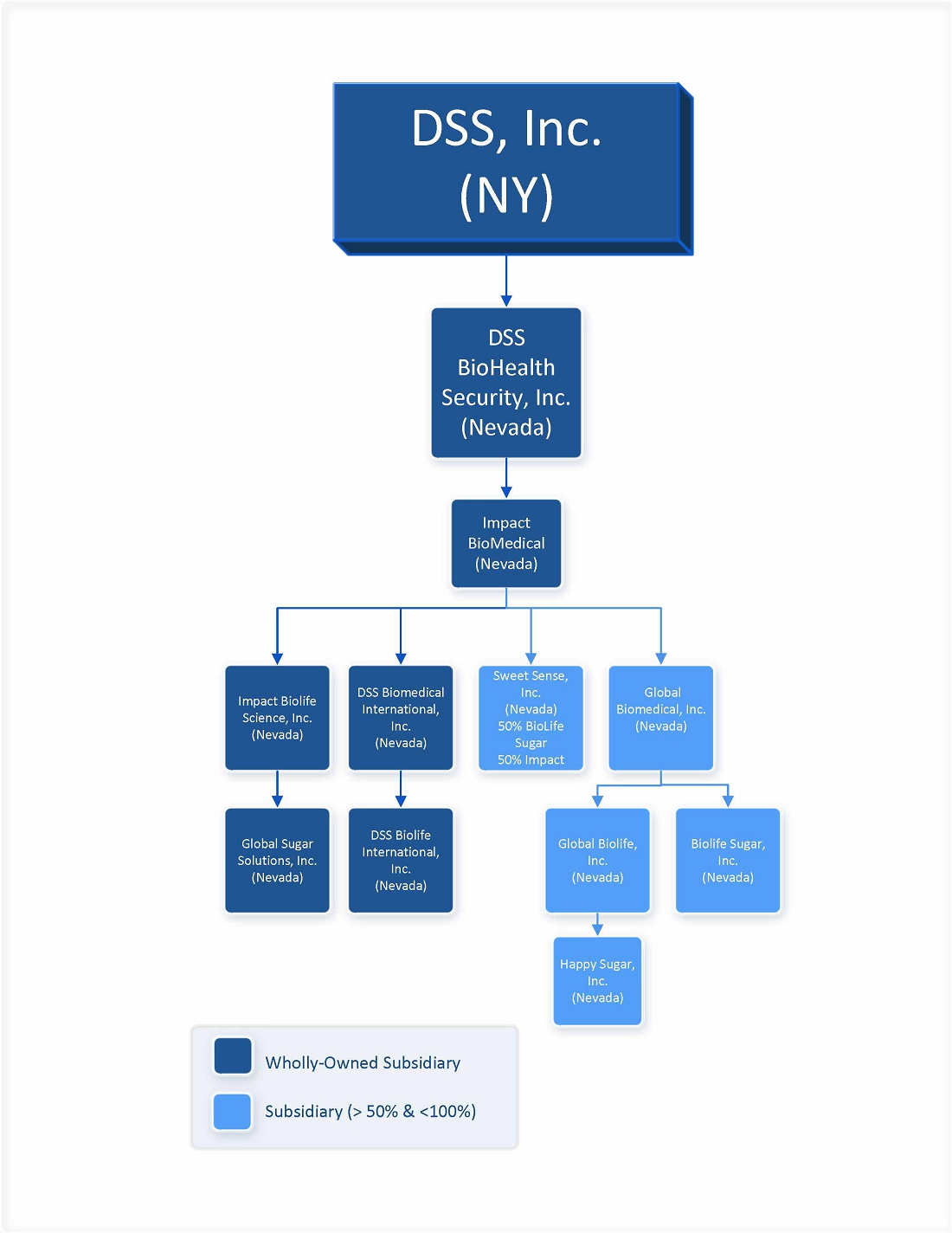

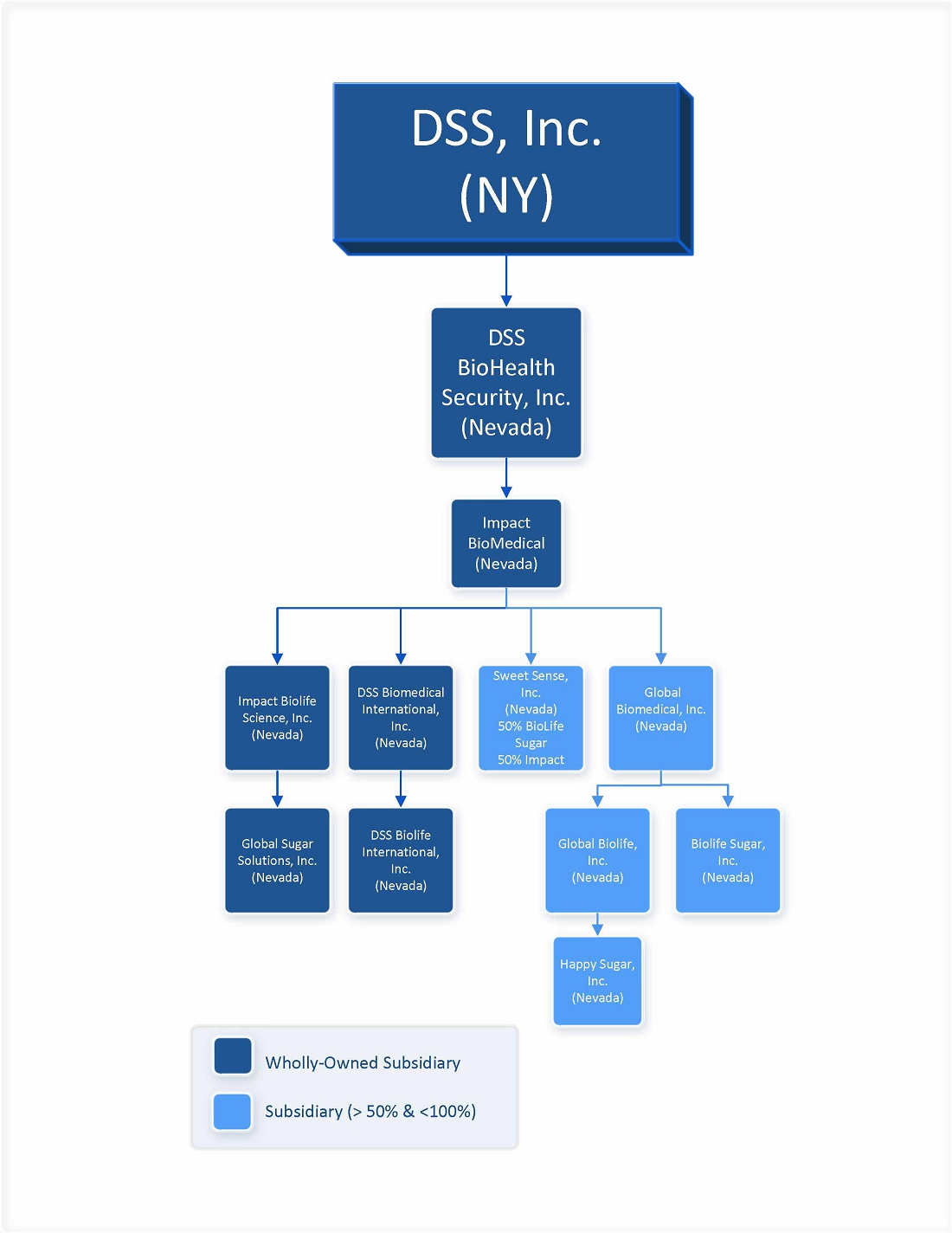

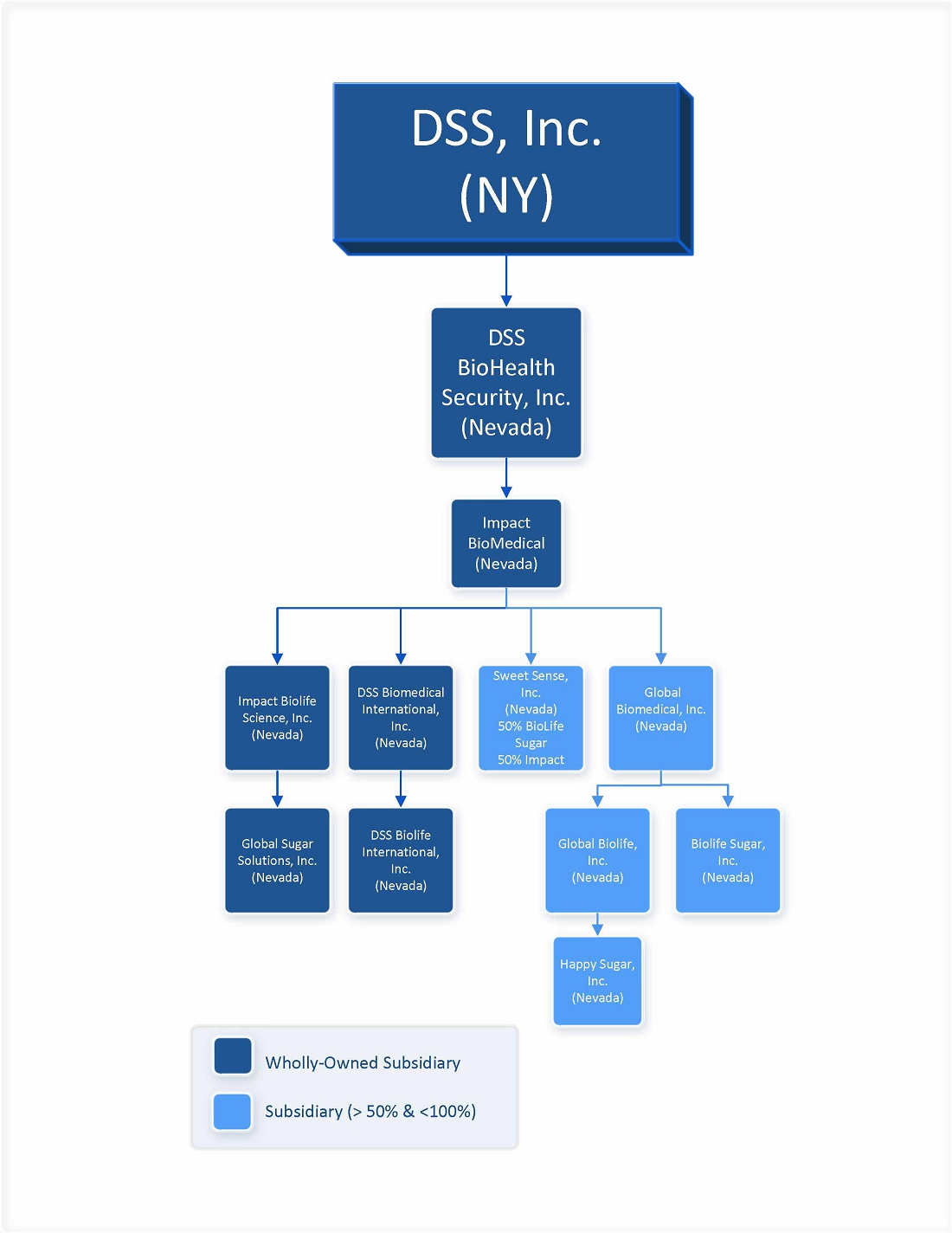

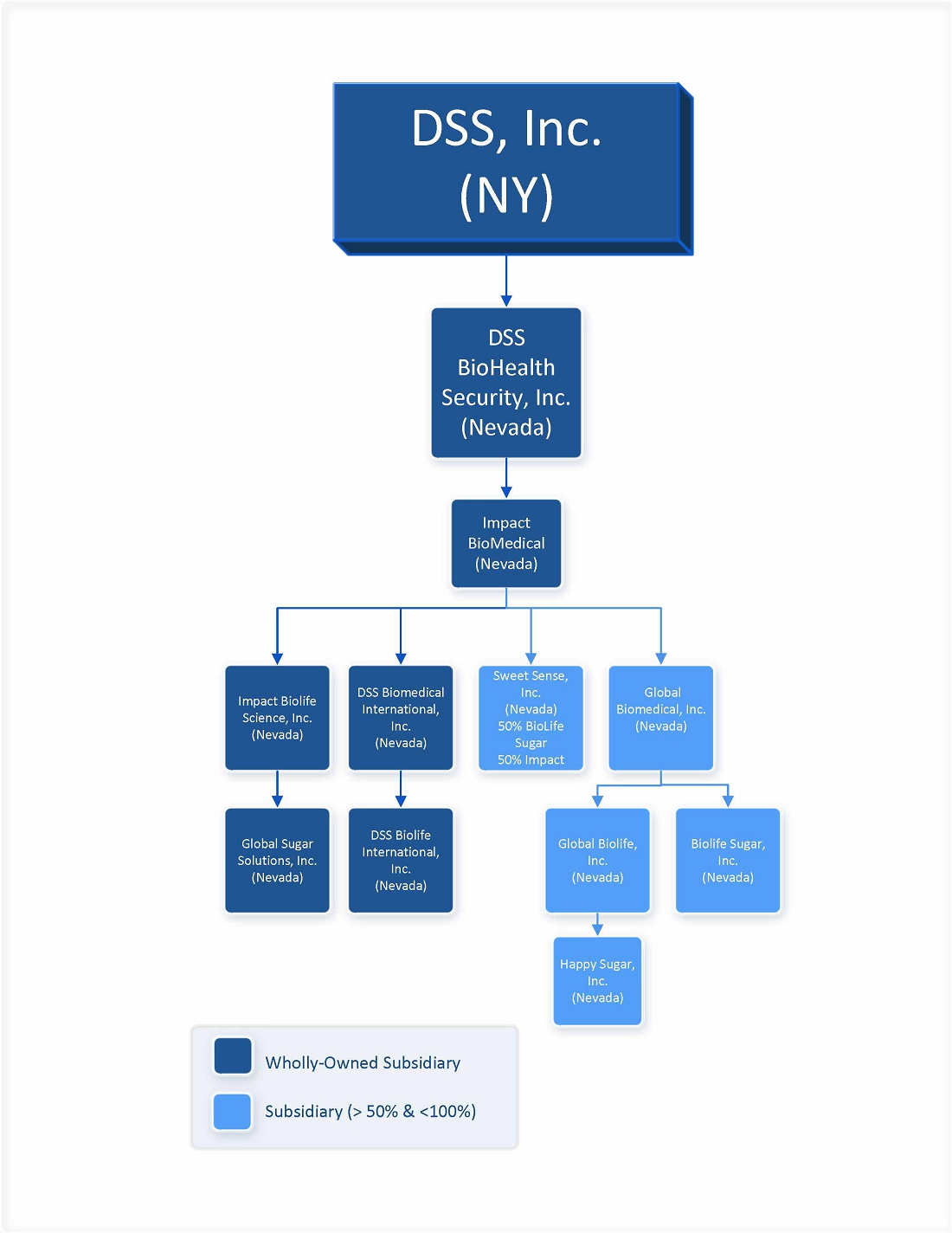

Impact BioMedical is the developer of unique and differentiated technologies to address unmet healthcare and wellness needs. Our activities range from the discovery of technologies and leveraging those technologies to create and commercialize product candidates. Currently, our operations are conducted, and our assets are owned primarily through our principal subsidiaries: (i) Global BioLife, Inc. (“Global BioLife”), which was incorporated on April 14, 2017, (ii) Impact BioLife Science (“Impact BioLife”), which was incorporated on August 28, 2020, Global BioMedical, Inc. (“Global BioMedical”), which was incorporated on April 18, 2017, and (iii) Sweet Sense, Inc. (“Sweet Sense”), which was incorporated on April 30, 2018.

Risks Associated with Our Business

Our business is subject to numerous risks described in the section entitled “Risk Factors” and elsewhere in this prospectus. You should carefully consider these risks. Some of these risks include, but are not limited to that:

| | ● | we cannot guarantee that we will find third-parties or customers that are interested in purchasing, licensing, or co-developing our products; |

| | ● | even if we are able to establish licensing arrangements, we cannot guarantee that licensors will be successful in their development efforts of products; |

| | ● | we cannot guarantee that our products will ever be approved for clinical testing or commercialization by the FDA; |

| | ● | we have not yet generated any revenue from our operations; |

| | ● | we have a history of net losses, negative cash flows, and accumulated deficits over the last two years; and |

| | ● | an occurrence of an uncontrolled event such as the Covid-19 pandemic, is likely to negatively affect our operations. |

Implications of Being an Emerging Growth Company and a Smaller Reporting Company

As a company with less than $1.235 billion in revenue during our last fiscal year, we qualify as an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act (the “JOBS Act”). Section 107 of the JOBS Act provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended (or the “Securities Act”), for complying with new or revised accounting standards. Thus, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies.

An emerging growth company may also take advantage of reduced reporting requirements that are otherwise applicable to public companies. These provisions include, but are not limited to:

| | ● | we may present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations; |

| | | |

| | ● | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended, or the Sarbanes-Oxley Act; |

| | | |

| | ● | reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements; and |

| | | |

| | ● | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval |

We may take advantage of these provisions until the last day of our fiscal year following the fifth anniversary of the date of the first sale of our common equity securities pursuant to an effective registration statement under the Securities Act, which such fifth anniversary will occur in 2026. However, if certain events occur prior to the end of such five-year period, including if we become a “large accelerated filer,” our annual gross revenues exceed $1.235 billion or we issue more than $1.0 billion of non-convertible debt in any three-year period, we will cease to be an emerging growth company prior to the end of such five-year period.

We have elected to take advantage of certain of the reduced disclosure obligations regarding executive compensation in this prospectus and, as long as we continue to qualify as an emerging growth company, we may elect to take advantage of this and other reduced burdens in future filings. As a result, the information that we provide to our stockholders may be different than you might receive from other public reporting companies in which you hold equity interests.

We are also a “smaller reporting company,” as defined under SEC Regulation S-K. As such, we also are exempt from the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act and also are subject to less extensive disclosure requirements regarding executive compensation in our periodic reports and proxy statements. We will continue to be deemed a smaller reporting company until our public float exceeds $75 million on the last day of our second fiscal quarter in the preceding fiscal year.

Business Overview

Impact BioMedical Inc. (“Impact”) targets urgent medical needs and expands the borders of medical and pharmaceutical science. Impact drives mission-oriented research and development, and commercialization of solutions for medical advances in human wellness and healthcare. By leveraging technology and new science with strategic partnerships, Impact BioMedical provides advances in drug discovery for the prevention, inhibition, and treatment of neurological, oncology and immuno-related diseases. Other exciting technologies include a breakthrough alternative sugar aimed to combat diabetes and functional fragrance formulations aimed at the industrial and medical industry. The research and development efforts have been primarily conducted in collaboration with GRDG Sciences, LLC (“GRDG”) and with the expertise of Mr. Daryl Thompson as its Director of Scientific Initiatives. We have initiated research regarding universal therapeutics as part of an attempt to help address some of the world’s deadliest diseases.

The business model of Impact BioMedical revolves around two methodologies – Licensing and Sales Distribution. Impact BioMedical develops valuable and unique patented technologies which will be licensed to pharmaceutical, large consumer package goods companies and venture capitalists in exchange for usage licensing and royalties. Impact also utilizes the DSS ecosystem to leverage distribution networks on a global scale. Impact will engage in branded and private labelling of certain products for sales generation through these channels. This global distribution model will give direct access to end users of Impact’s nutraceutical and health related products.

Below is a list of our principal subsidiaries:

| | ● | Impact BioLife Science, Inc.; |

| | ● | Global BioMedical, Inc.; |

| | ● | Global BioLife, Inc.; and |

| | ● | Sweet Sense, Inc. |

Impact BioLife Science, Inc. We are the sole owner of the outstanding equity of Impact BioLife Science, Inc.

Global Biomedical, Inc. We own 90.91% of Global Biomedical, Inc. outstanding equity, and the balance minority equity owner is Peggy Tang.

Global BioLife, Inc. Through our majority owned subsidiary Global Biomedical, Inc., we own 90% of the outstanding equity of Global BioLife, Inc. The other equity owner is Holista CollTech Limited (“Holista”) (10%).

Sweet Sense, Inc. We are the owner of 50% of the outstanding equity of Sweet Sense. The other equity owner is BioLife Sugar, Inc. (“BioLife Sugar”).

Below is an organization chart showing our ownership structure and ownership interests.

Impact BioMedical and our majority-owned subsidiaries own or have rights to a portfolio of biomedical intellectual property and leverages its scientific know-how and intellectual property rights to develop various emerging technologies, including biopharmaceuticals, antivirals, antimicrobials, sugar alternatives, insect repellents, fragrances, bioplastics and natural preservatives.

Impact BioMedical has had several important and valuable products, technology, or compounds that are in continuing development and/or licensing stages. The Company has not conducted and has no current plans to conduct any preclinical testing for these products, technology, or compounds:

| | ● | LineBacker: Multi-faceted therapeutic platform intended for metabolic, neurologic, cancer, and infectious diseases. |

| | | |

| | ● | Equivir: A compound intended for antiviral infection treatments. Equivir/Nemovir is a novel blend of FDA Generally Recognized as Safe (“GRAS”) eligible natural compounds. These compounds are generally sourced from fruits, vegetables, and other natural substances. Please note, the FDA has not approved this product, GRAS designation means that the FDA does not question the basis for a notifier’s GRAS determination, and GRAS determination does not increase the likelihood that product candidates will receive marketing approval. |

| | | |

| | ● | Laetose: Laetose technology is derived from a unique combination of sugar and other naturally occurring compounds which demonstrate the ability to inhibit the inflammatory and metabolic response of sugar alone. This compound is a sugar alternative aimed to combat diabetes. |

| | | |

| | ● | 3F: A botanical compound intended to serve as an insect repellent and anti-microbial agent. 3F is a unique formulation of specialized ingredients from naturally occurring botanical sources. |

| | | |

| | ● | 3F Mosquito Repellent: 3F repellent contains botanical ingredients that mosquitos avoid. These ingredients affect the mosquito’s receptors, essentially making the insect blind to a human’s presence. This can be utilized as a stand-alone repellent or as an additive in detergents, lotions, shampoo, and other substances to provide mosquito protection. |

| | | |

| | ● | 3F Antimicrobial: 3F antimicrobial contains botanical ingredients known to kill viruses. These ingredients are intended to inhibit viral replication. This can be utilized as a stand-alone antimicrobial or as an additive in detergents, lotions, shampoo, fabrics, and other substances. |

Commercialization Business Strategies

Our business model revolves mainly around two approaches – Licensing and Sales Distribution.

1. Licensing

The licensing strategy includes developing unique patented technologies which would then be licensed to external partners for developing, registration, and commercialization as appropriate. We believe that interest in licensing certain projects may rise over time as validating data becomes available.

In June of 2022, Impact BioMedical signed a License Agreement with ProPhase Labs to produce and distribute compound Equivir, which has shown potential as a treatment to limit the occurrence of or reduce the risk or severity of viral outbreaks.

In July of 2022, Global BioLife, Inc., a subsidiary of Impact, executed a license agreement with ProPhase BioPharma, Inc. (“PBIO”), a subsidiary of ProPhase Labs, Inc., a rapidly growing and diversified diagnostics, genomics and biotech company, for Global BioLife’s Linebacker portfolio (LB-1 and LB-2), two patented small molecule PIM kinase inhibitors with significant potential across multiple therapeutic indications.

2. Sales Distribution

We are intending to pursue 3rd party partnerships specifically with large manufactures in the pharmaceutical, food, health and beauty, and nutraceutical industries to commercialize our products, ideas and intellectual property. We will leverage their product development, commercialization and distribution capabilities to take products to market through a licensing and/or private label sales model.

3. Research and Development

We have secured arrangements with certain affiliates to undertake activities to improve existing product candidates and develop new ones. We believe the timely development of new, and the enhancement of our existing products, is essential to our success. Although we intend to invest a substantial amount of our resources in research and development, there is no guarantee that our investment will translate into improvements of existing products or the development of new products.

Stockholders Agreement between Global BioLife and the Global BioLife Stockholders

On April 26, 2017, Global BioLife entered into a stockholders’ agreement with its stockholders Global BioMedical, GRDG and Holista (the “Global BioLife Stockholders’ Agreement”). Pursuant to the Global BioLife Stockholder’s Agreement, GRDG has agreed to contribute to Global BioLife any and all right, title, interest and ownership held by GRDG in any patent related to the uses of the “Linebacker Patents” as defined in the Global BioLife Stockholders’ Agreement. Further, pursuant to the Global BioLife Stockholders Agreement, GRDG has agreed to contribute to Global BioLife the advice and services of Daryl Thompson as a scientist during the term of the agreement in connection with the development of the Linebacker Patents and all projects associated therewith, as well as such other projects as Global BioLife may from time to time pursue. In addition, Global BioLife agreed to contract with GRDG for the needed research in order to develop the Linebacker Patents as well as new intellectual property. Compensation paid by Global BioLife for this work, if any, shall be provided for in Global BioLife’ budget

Pursuant to the Global BioLife Stockholders’ Agreement, Global Biomedical has agreed to contribute to Global BioLife the funds set forth in the Global BioLife budget and such reasonable amounts as the Global BioLife board of directors shall in future annual periods authorize as Global BioLife’s business plan and budget. Such budget shall include (i) a payment of $20,994 per month to GRDG and (ii) such other amounts as shall be necessary to fund the scientific operations that the Global BioLife board shall agree to pursue. The monthly payments were adjusted for the increase in rent of GRDG office and general inflation. Current monthly payments approximate to $43,000. For the years ended December 31, 2022 and 2021, the Company incurred expenses of $546,000 and $509,176, respectively. On December 31, 2022 and 2021, the Company owed this related party $0, and had prepaid monthly fees approximating $43,000.

Under the Global BioLife Stockholders’ Agreement, Holista has agreed to (i) assist in the global commercialization of Global BioLife’s intellectual property, (ii) assist in the initiation and development of joint venture opportunities for Global BioLife, and (iii) provide the expertise of Dr. Rajen M. Dato to Global BioLife as strategic director.

The Global BioLife Stockholders’ Agreement shall terminate (a) upon the dissolution and winding up of Global BioLife or (b) on the date the parties terminate the agreement by unanimous written consent.

On May 22, 2018, the parties to the Global BioLife Stockholders’ Agreement entered into Amendment No. 1 to the agreement (“Amendment No. 1 to the Global BioLife Stockholders Agreement”), and in August of 2020 the parties entered into Amendment No. 2 to the agreement (“Amendment No. 2 to the Global BioLife Stockholders Agreement”). Pursuant to Amendment No. 2, the parties to the Global BioLife Stockholders Agreement agreed to waive the obligations of GRDG to contribute any further inventions, discoveries or other items of intellectual property developed by GRDG during the term of the Stockholders’ Agreement subsequent to the date of Amendment No. 2, except for any invention, discovery or other items of intellectual property which is directly related to, or necessary for the sale, licensing or further development of intellectual property owned by Global BioLife.

Licensing Proceeds Distribution Agreement

In May 2022, Impact entered into a new licensing proceeds distribution agreement whereas GRDG will continue to invent and develop Improvements and Discoveries for and on behalf Impact and agree to assign any such Discoveries/Improvements/advances to Impact generated by its efforts and through the resources funded by Impact, directly or indirectly. Any such Discoveries assigned to Impact would be considered Intellectual Property under this Agreement such that GRDG would receive 20% of the gross licensing or sale proceeds received by Impact from the licensing of such discoveries. Under the same agreement, GRDG transferred all of its right, title, and interest that GRDG has, if any, in Global as set forth in the Global Agreement back to Global, and all right, title and interest that GRDG has, if any, in Impact back to Impact, and hereinafter having no further ownership, control, or interest in either Global or Impact.

Stockholders Agreement between Impact BioLife and the Impact BioLife Stockholders

In December 2020, Impact BioLife entered into a stockholder’s agreement with its stockholders Impact BioMedical and GRDG (the “Impact BioLife Stockholders’ Agreement”). Pursuant to the Impact BioLife Stockholders’ Agreement, GRDG agreed to (i) transfer certain intellectual property as identified in the Stockholders’ Agreement to Impact BioLife, (ii) present all suitable technologies developed by GRDG to Impact BioLife, so as to provide Impact BioLife with the opportunity to fund, own and develop any intellectual property developed by GRDG and (iii) retain the advice and services of Mr. Daryl Thompson as a scientist during the term of the Impact BioLife Stockholders’ Agreement in connection with all projects as Impact BioLife may from time to time pursue. Further, pursuant to the Impact BioLife Stockholders’ Agreement, GRDG also agreed that Daryl Thompson will devote most of his professional time and efforts to the business of Impact BioLife, including but not limited to, the development of new intellectual property for Impact BioLife.

In addition, pursuant to the Impact BioLife Stockholder’s Agreement, the Company has agreed to contribute to Impact BioLife such reasonable amounts as the board of directors of Impact BioLife shall in future annual periods authorize as Impact BioLife’s business plan and budget (the “Impact BioLife Budget”). The Impact BioLife Budget shall include (i) a payment approximating $43,000 per month to GRDG and (ii) such other amounts as shall be necessary to fund the research, development and other scientific operations that the Impact BioLife board of directors shall agree to pursue. For the years ended December 31, 2022 and 2021, the Company incurred expenses of $546,000 and $509,176, respectively. On December 31, 2022 and 2021, the Company owed this related party $0, and had prepaid monthly fees approximating $43,000.

Pursuant to the Impact BioLife Stockholders’ Agreement, the board of directors of Impact BioLife shall never be less than one nor more than five directors. GRDG shall be entitled to nominate one director to the Impact BioLife board of directors so long as it shall remain a stockholder of Impact BioLife. The Company shall be entitled to nominate the remaining directors of the Impact BioLife. In addition, pursuant to the Impact BioLife Stockholders’ Agreement, so long as it is a stockholder of Impact BioLife, the Company is entitled to appoint Impact BioLife’s chief executive officer, who, at the discretion of the Company, may also serve as a director of the Impact BioLife board of directors. The parties to the Impact BioLife Stockholders’ Agreement have agreed that the initial directors of the Impact BioLife board of directors shall be Heng Fai Ambrose Chan, Frank D. Heuszel and Daryl Thompson. The Company shall appoint the chairman of the Impact BioLife board of directors.

The Impact BioLife Stockholders’ Agreement will terminate (a) upon the dissolution and winding up of Impact BioLife, (b) on the date the parties terminate the agreement by unanimous written, (c) on the fifth anniversary of the date of the Impact BioLife Stockholders’ Agreement, unless the parties mutually agree to an extension, or (d) upon three months’ written notice by either party.

Licensing Proceeds Distribution Agreement between GRDG Sciences, LLC, Global BioLife, Inc., and Impact BioLife Sciences, Inc., to include Impact Biomedical Inc.

On February 15, 2022, the Company and Impact BioLife Sciences, Inc. (together, “Impact”), entered into a Licensing Proceeds Distribution Agreement (the “LPDA”) with the Company’s subsidiary, Global BioLife, Inc. (“Global,” and together with Impact BioLife Sciences, Inc. and the Company, the “Impact Parties”), and GRDG Sciences, LLC (“GRDG”), pursuant to which the parties clarified the consideration due to GRDG under pre-existing agreements by and between GRDG and the Impact Parties. Pursuant to the LPDA, GRDG will receive 20% of the gross licensing or sale proceeds from any of its developed improvements for and on behalf of Global and the Impact Parties. Further, Impact agreed to provide periodic payments to GRDG for the purpose of paying or reimbursing certain salaries, overhead, office rent reimbursements, and other operating costs. As compensation, GRDG will receive 20% of the gross licensing or sale proceeds received by the Impact Parties for any intellectual property generated. Pursuant to the GRDG, Impact retroactively acknowledged that GDRG (1) is not a shareholder in any company or subsidiary of the Impact Parties, and (2) that GDRG’s full consideration for the improvement developments which it has or will develop is/was (a) monthly operating cash flow payments, and (2) 20% of the gross proceeds from any licensing or sale of such improvements and discoveries. In addition, GRDG agreed to transfer all of its right, title and interest in Global to Global, and all right, title and interest in Impact to Impact. Global has agreed to provide GRDG a financial interest in revenue received directed to the licensing of the Global intellectual property, and Impact has agreed to provide GRDG an interest in revenue received directed to the licensing of the impact intellectual property.

Share Exchange Transaction

On August 21, 2020, we closed on a Share Exchange Agreement by and among DSS, DSS BioHealth Security, Inc., Alset International Ltd. (formerly Singapore eDevelopment Ltd.), and Global Biomedical Pte Ltd. (“GBM”), pursuant to which we became a wholly-owned subsidiary of DSS BioHealth Security, Inc. Shortly after closing, Frank D. Heuszel, Jason Grady, and John Thatch were appointed directors, and Mr. Heng Fai Ambrose Chan remained on the Board of Directors and appointed Chief Executive Officer, Mr. Heuszel was appointed President, Mr. Grady was appointed Chief Operating Officer and Todd Macko was appointed Secretary and Treasurer, replacing the officers and directors who resigned in connection with the share exchange.

Mr. Chan is the Chief Executive Officer and largest shareholder of Alset International Ltd., as well as the Chairman of the Board and largest shareholder of the DSS.

Corporate Information

Impact BioMedical Inc. is a Nevada corporation and was incorporated in October 2018. Our principal executive offices are located at 275 Wiregrass Parkway, West Henrietta, NY 14586. Our telephone number is +1-585-325-3610. Our website address is https://www.impbio.com. Our website and the information contained thereon, or connected thereto, does not and will not constitute part of this Prospectus or the Registration Statement on Form S-1 of which this Prospectus is a part.

Summary of the Distribution

| Distributing Company | | |

| | | DSS, Inc., a New York corporation, which beneficially owns through its wholly-owned subsidiary DSS BioHealth Security, Inc. 3,877,282,251 shares of our Common Stock, representing 100% of our outstanding shares of our Common Stock prior to the Distribution. After the Distribution, DSS will own approximately 87% of our Common Stock. |

| | | |

| Distributed Company | | |

| | | Impact BioMedical Inc., a Nevada corporation and a subsidiary of DSS. At the time of the Distribution, we operate primarily through our principal subsidiaries, Impact BioLife, Global Biomedical, Global BioLife and Sweet Sense. Through our principal subsidiaries, we are committed to both funding research, developing and commercializing new offerings in pharmaceuticals, consumer and wellness products, including, but not limited to, a focus on: (i) the development of a universal therapeutic drug platform; (ii) a new sugar substitute; and (iii) a multi-use fragrance developed for industrial and medical applications, including an insect repellant, and (iv) an OTC medication with broad antiviral activity. Impact. |

| Distributed Securities in the Distribution | | |

| | | 486,706,712 shares of our Common Stock indirectly owned by DSS, which represent approximately 12% of our Common Stock issued and outstanding immediately prior to the Distribution. Based on 140,264,250 shares of DSS Common Stock outstanding as of the close of business on the Record Date, not including the Affiliate Shares, this reflects a distribution ratio of four (4) Impact Shares for every one (1) share of DSS Common Stock. |

| | | |

| Record Date | | The Record Date is 5:00 p.m., New York City time, on June 30, 2023. |

| | | |

| Distribution Date | | The Distribution Date is July 14, 2023, and we expect that the Distribution will be effective as of 5:00 p.m., New York City time. |

| | | |

| | | |

| Distribution Ratio | | Each holder of DSS Common Stock will receive four (4) shares of our Common Stock for every one (1) share of DSS Common Stock it holds on the Record Date. The distribution agent will distribute only whole shares of our Common Stock in the Distribution. |

| | | |

| | | Please note that if you sell your shares of DSS Common Stock on or before the Distribution Date, the buyer of those shares will in most circumstances be entitled to receive the shares of our Common Stock to be distributed in respect of the DSS shares that you sold. |

| | | |

| | | |

| The Distribution | | On the Distribution Date, DSS will release the shares of our Common Stock to the distribution agent to distribute to DSS stockholders. DSS will distribute our shares in book-entry form, and thus we will not issue any physical stock certificates. We expect that it will take the distribution agent up to two weeks to electronically issue shares of our Common Stock to you or your bank or brokerage firm on your behalf by way of direct registration in book-entry form. If you own your shares of DSS Common Stock through a bank, broker or other nominee, your bank, broker or other nominee will credit your account with the whole shares of our Common Stock that you receive in the Distribution on or shortly after the Distribution Date. You will not be required to make any payment, surrender or exchange your shares of DSS Common Stock or take any other action to receive your shares of our Common Stock. |

| | | |

| Conditions to the Distribution | | The Distribution is subject to the satisfaction, or the DSS Board’s waiver, of the following conditions: |

| | | ● | the DSS Board shall have authorized and approved the Distribution by its wholly-owned subsidiary DSS BioHealth Security, Inc. and not withdrawn such authorization and approval, and shall have declared the dividend of our Common Stock to DSS stockholders; |

| | | ● | the SEC shall have declared effective our Registration Statement on Form S-1, of which this Prospectus is a part, under the Securities Act of 1933, as amended (the “Securities Act”), and no stop order suspending the effectiveness of our Registration Statement shall be in effect and no proceedings for that purpose shall be pending before or threatened by the SEC; |

| | | ● | no order, injunction or decree issued by any governmental authority of competent jurisdiction or other legal restraint or prohibition preventing consummation of the Distribution shall be in effect, and no other event outside the control of DSS shall have occurred or failed to occur that prevents the consummation of the Distribution; and |

| | | | |

| | | ● | no other events or developments shall have occurred prior to the Distribution Date that, in the sole judgment of the DSS Board, would result in the Distribution having a material adverse effect on DSS or its stockholders; and |

| | | | |

| | | ● | Each Impact Share distributed as part of the Distribution will be not be eligible for resale until 180 days from the date of the Company’s initial public offering becomes effective under the Securities Act, subject to the discretion of the Company to lift the restriction sooner. |

| | | The fulfillment of the foregoing conditions will not create any obligation on the part of DSS to effect the Distribution. We are not aware of any material federal, foreign or state regulatory requirements with which we must comply, other than SEC rules and regulations, or any material approvals that we must obtain, other than the SEC’s declaration of the effectiveness of the Registration Statement, in connection with the Distribution. DSS has the right not to complete the Distribution if, at any time, the DSS Board determines, in its sole and absolute discretion, that the Distribution is not in the best interests of DSS or its stockholders or is otherwise not advisable. For a more detailed description, see “The Distribution—Conditions to the Distribution.” |

| | | |

| Trading Market | | All of our outstanding shares of Common Stock are currently beneficially owned by DSS through its wholly-owned subsidiary DSS BioHealth Security, Inc. Accordingly, there currently is no public trading market for the Common Stock. The Common Stock is currently not listed for trading on any stock exchange or market. The Common Stock may be illiquid as we cannot predict whether any trading market will develop. |

| Tax Consequences to DS Stockholders | | DSS shareholders will be subject to a taxable event on the distribution of the Impact Shares. See “Material U.S. Federal Income Tax Consequences of the Distribution” for more information regarding the potential tax consequences to you of the Distribution. |

| | | |

| | | You should consult your own tax advisors regarding the particular tax consequences of the Distribution to you, including the applicability and effect of any U.S. federal, state, local and non-U.S. tax laws. |

| | | |

| Dividend Policy | | Following the Distribution, we do not anticipate paying any cash dividends on our Common Stock in the foreseeable future. See “Dividend Policy” for more information. |

| | | |

| Transfer Agent and Distribution Agent | | V Stock Transfer LLC, the transfer agent and registrar for our Common Stock, will serve as distribution agent in connection with the Distribution. |

| | | |

| Risk Factors | | Our business faces both general and specific risks and uncertainties. Our business also faces risks relating to the Distribution. Accordingly, you should read carefully the information set forth under the section titled “Risk Factors.” |

RISK FACTORS

You should carefully consider all the information in this Prospectus and each of the risks described below, which we believe are the principal risks that we face. Some of the risks relate to our business, others to the Distribution. Some risks relate principally to the securities markets and ownership of our Common Stock. The risks and uncertainties described below are not the only ones faced by us. Additional risks and uncertainties not presently known or that are currently deemed immaterial also may impair our business operations. If any of the following risks occur, our business, financial condition, operating results and cash flows and the trading price of our Common Stock could be materially adversely affected.

Risks Relating to the Distribution

The Distribution may not be completed on the terms or timeline currently contemplated, if at all.

While we are actively engaged in planning for the Distribution, unanticipated developments could delay or negatively affect the Distribution, including, but not limited to, those related to the filing and effectiveness of appropriate filings with the SEC and receiving any required regulatory approvals. In addition, until a Distribution has occurred, the DSS Board, in its sole discretion, has the right to not proceed with the Distribution, even if all the conditions are satisfied. Therefore, the Distribution may not be completed on the terms or timeline currently contemplated, if at all.

DSS expects the Distribution to be treated as a taxable non-liquidating distribution to its stockholders. As a result, a U.S. stockholder of DSS may have a U.S. Federal income tax liability in respect of the Distribution without the receipt of cash from DSS or Impact.

DSS expects the Distribution to be treated as a taxable, non-liquidating distribution to its stockholders. As such, for U.S. federal income tax purposes, each U.S. stockholder of DSS receiving shares of Impact Common Stock in the Distribution would be treated as if such stockholder had received a distribution in an amount equal to the fair market value of Impact Common Stock received, which would result in (1) a taxable dividend to the extent of such stockholder’s pro rata share of DSS’s current and accumulated earnings and profits, (2) a reduction in such stockholder’s basis (but not below zero) in DSS common stock to the extent the amount received exceeds such stockholder’s share of earnings and profits and (3) a taxable gain to the extent the amount received exceeds the sum of the amount treated as a dividend and the stockholder’s basis in the DSS Common Stock. Accordingly, such stockholder may have a U.S. federal income tax liability in respect of the Distribution without the receipt of cash from DSS or Impact.

For a more detailed discussion, see the section entitled “The Distribution – U.S. Federal Income Tax Consequences of the Distribution” below.

We have a limited operating history, and our historical financial information may not be a reliable indicator of our future results.

There is no historical financial information about us upon which to base an evaluation of our performance. As of the date of this report, we have not generated any revenues from operations. We cannot guarantee we will be successful in our business operations. Our business is subject to risks inherent in the establishment of a new business enterprise, including limited capital resources, possible delays our research, testing and marketing efforts or wider economic downturns. For additional information about our past financial performance and the basis of presentation of our financial statements, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our historical financial statements and the notes thereto included elsewhere in this Prospectus.

Risks Relating to Our Business

If we do not adequately protect our intellectual property rights, our operations may be materially harmed.

We rely on and expect to continue to rely on agreements with parties with whom we have relationships, as well as patent, trademark and trade secret protection laws, to protect our intellectual property and proprietary rights. We cannot assure you that we can adequately protect our intellectual property or successfully prosecute potential infringement of its intellectual property rights. Also, we cannot assure you that others will not assert rights in, or ownership of, trademarks and other proprietary rights of ours or that we will be able to successfully resolve these types of conflicts to our satisfaction. Our failure to protect our intellectual property rights may result in a loss in potential revenue and could materially harm our operations and financial condition

New legislation, regulations or rules related to obtaining patents or enforcing patents could significantly increase our operating costs and decrease any potential revenue we might otherwise make.

We spend a significant amount of resources on its patent assets. If new legislation, regulations or rules are implemented either by Congress, the U.S. Patent and Trademark Office (the “USPTO”) or the courts that impact the patent application process, the patent enforcement process or the rights of patent holders, these changes could negatively affect its expenses, potential revenue and could negatively impact the value of its assets.

Safety and effectiveness concerns can have significant negative impacts on sales and results of operations, lead to litigation and cause reputational damage.

Concerns about product safety, whether raised internally or by litigants, regulators or consumer advocates, and whether or not based on scientific evidence, can result in safety alerts, product recalls, governmental investigations, regulatory action on the part of the FDA (or its counterpart in other countries), private claims and lawsuits, payment of fines and settlements, declining sales and reputational damage. These circumstances can also result in damage to brand image, brand equity and consumer trust in products. Product recalls could in the future prompt government investigations and inspections, the shutdown of manufacturing facilities, continued product shortages and related sales declines, significant remediation costs, reputational damage, possible civil penalties and criminal prosecution.

Significant challenges or delays in our innovation and development of new products, technologies and indications could have an adverse impact on our long-term success.

Our continued growth and success depend on our ability to innovate and develop new and differentiated products and services that address the evolving health care needs of patients, providers and consumers. Development of successful products and technologies may also be necessary to offset revenue losses should our products lose market share due to various factors such as competition and loss of patent exclusivity. We cannot be certain when or whether we will be able to develop, license or otherwise acquire companies, products and technologies, whether particular product candidates will be granted regulatory approval, and, if approved, whether the products will be commercially successful. We pursue product development through internal research and development as well as through collaborations, acquisitions, joint ventures and licensing or other arrangements with third parties. In all of these contexts, developing new products, particularly biotechnology products, requires a significant commitment of resources over many years. Only a very few biopharmaceutical research and development programs result in commercially viable products. The process depends on many factors, including the ability to discern patients’ and healthcare providers’ future needs; develop new compounds, strategies and technologies; achieve successful clinical trial results; secure effective intellectual property protection; obtain regulatory approvals on a timely basis; and, if and when they reach the market, successfully differentiate its products from competing products and approaches to treatment. New products or enhancements to existing products may not be accepted quickly or significantly in the marketplace for healthcare providers, and there may be uncertainty over third-party reimbursement. Even following initial regulatory approval, the success of a product can be adversely impacted by safety and efficacy findings in larger patient populations, as well as market entry of competitive products.

We are subject to risks related to corporate social responsibility and reputational matters.

Our reputation and the reputation of our brands, including the perception held by our customers, end-users, business partners, investors, other key stakeholders and the communities in which we do business are influenced by various factors. There is an increased focus from our stakeholders on ESG practices and disclosure - and if we fail, or are perceived to have failed, in any number of ESG matters, such as environmental stewardship, inclusion and diversity, workplace conduct and support for local communities, or to effectively respond to changes in, or new, legal or regulatory requirements concerning climate change or other sustainability concerns, our reputation or the reputation of our brands may suffer. Such damage to our reputation and the reputation of our brands may negatively impact our business, financial condition and results of operations. In addition, negative or inaccurate postings or comments on social media or networking websites about the Company or our brands could generate adverse publicity that could damage our reputation or the reputation of our brands. If we are unable to effectively manage real or perceived issues, including concerns about product quality, safety, corporate social responsibility or other matters, sentiments toward the Company or our products could be negatively impacted, and our financial results could suffer.

We may not have adequate funds to implement our business plan.

Although we have received capital from our parent companies to meet our working capital and financing needs in the past, additional financing may be required in order to meet our current and projected cash requirements for operations. We cannot assure that we will secure all or any of the funding we anticipate. If our entire original capital is fully expended and additional costs cannot be funded from borrowings or capital from other sources, then our financial condition, results of operations and business performance would be materially adversely affected. We cannot assure that we will have adequate capital or financing to conduct our business or to grow.

Risks Related to Our Common Stock

Currently, there is no public market for our securities, and there can be no assurances that any public market will ever develop.

Currently, our Common Stock is not listed or quoted on any public market, exchange, or quotation system. Although we plan to take steps to have our Common Stock publicly traded, a market for our Common Stock may never develop. Even if we are successful in developing a public market, there may not be enough liquidity in such market to enable stockholders to sell their stock. If a public market for our Common Stock does not develop, DSS stockholders may not be able to re-sell the shares of our Common Stock that they have received, rendering their shares effectively worthless.

Future sales of our Common Stock in the public market could lower our stock price, and any additional capital raised by us through the sale of equity or convertible securities may dilute our stockholders’ ownership in us.

We may sell additional shares of our Common Stock in public or private offerings. We also may issue convertible debt or equity securities. No prediction can be made as to the effect, if any, that future sales or distributions of our Common Stock will have on the market price of our Common Stock from time to time. Sales or distributions of substantial amounts of our Common Stock, or the perception that such sales or distributions are likely to occur, could adversely affect the prevailing fair market price for our Common Stock.

We do not intend to pay any cash dividends in the foreseeable future and, therefore, any return on your investment in our Common Stock must come from increases in the fair market value of our Common Stock.

We do not intend to pay cash dividends on our Common Stock in the foreseeable future. We expect to retain future earnings, if any, for reinvestment in our business. Also, any credit agreements, which we may enter into, may restrict our ability to pay dividends. Whether we pay cash dividends in the future will be at the discretion of our Board and will be dependent upon our financial condition, results of operations, cash requirements, future prospects and any other factors our Board deems relevant. Therefore, any return on your investment in our Common Stock must come from increases in the fair market value of our Common Stock. For more information, see “Dividend Policy.”

Your percentage ownership in the Company may be diluted in the future.

Your percentage ownership in the Company may be diluted in the future because of equity awards that we may grant to our directors, officers and other employees. In addition, we may issue equity as all or part of the consideration paid for acquisitions and strategic investments that we may make in the future or as necessary to finance our ongoing operations.

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

This Prospectus contains “forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements give our current expectations or forecasts of future events. You can identify these statements because they do not relate strictly to historical or current facts. In some cases, these forward-looking statements can be identified by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “potential,” “continue,” “is/are likely to” or other similar expressions. They also appear in any discussion of future operating or financial performance. In particular, these include statements relating to future actions, future performance of our products, level of expenses and anticipated expense reductions, the outcome of any legal proceedings, and financial results. Although we believe that we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know about our business and operations, there can be no assurance that our actual results will not differ materially from what we expect or believe. The following factors could cause our actual results to differ from our expectations or beliefs:

| | ● | the potential adverse impact on our business resulting from the Distribution; |

| | ● | the adverse effect from a decline in the securities markets or from catastrophic, unpredictable events like a global health pandemic; |

| | ● | a decline in the performance of our products; |

| | ● | a general downturn in the economy; |

| | ● | changes in government policy or regulation; |

| | ● | changes in our ability to attract or retain key employees; |

| | ● | unforeseen costs and other effects related to legal proceedings or investigations of governmental and self-regulatory organizations; and |

| | ● | other factors (including the risks contained in the section titled “Risk Factors”) relating to our industry, our operations and results of operations. |

The preceding list is not intended to be an exhaustive list of all of our forward-looking statements. Forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. Accordingly, you are cautioned that any forward-looking statements are not guarantees of future performance and are subject to certain risks, uncertainties and assumptions that are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable as of the date made, expectations may prove to have been materially different from the results expressed or implied by such forward-looking statements. Unless otherwise required by law, we also disclaim any obligation to update our view of any such risks or uncertainties or to announce publicly the result of any revisions to the forward-looking statements made in this Prospectus.

THE DISTRIBUTION

Background

DSS currently beneficially owns through its wholly owned subsidiary, DSS BioHealth Security, Inc., 3,877,282,251 shares of our Common Stock, which represents 100% of the shares outstanding. These shares were acquired on August 21, 2020, upon closing of the Share Exchange Agreement. DSS is deemed to be a beneficial owner of the shares of our Common Stock covered by this Prospectus because it has voting and dispositive power over such shares.

On August 27, 2020, the DSS Board approved the Distribution. DSS will distribute part of its equity interest that it holds in us, consisting of 486,706,712 shares of our Common Stock, to DSS stockholders, except for the holders of the Affiliate Shares. Following the Distribution, DSS will own an equity interest in us of approximately 87%, giving DSS effective control over us. No approval of DSS Common Stockholders is required in connection with the Distribution, and DSS stockholders will not have any appraisal rights in connection with the Distribution.

The Distribution is subject to the satisfaction, or the DSS Board’s waiver, of a number of conditions. In addition, DSS has the right not to complete the Distribution if, at any time, the DSS Board determines, in its sole and absolute discretion, that the Distribution is not in the best interests of DSS or its stockholders or is otherwise not advisable. For a more detailed description, see “The Distribution—Conditions to the Distribution.”

Reasons for the Distribution

The Distribution is the method by which DSS will begin to carry out the intention of management of DSS and the DSS Board to take the Company public and to reward DSS stockholders via the issuance of our shares of Common Stock.

When and How You Will Receive Company Shares

DSS will distribute to its stockholders, as a dividend, 4 shares of our Common Stock for every share of DSS Common Stock outstanding, except for the Affiliate Shares, as of 5:00 p.m., New York City time, June 30, 2023, the Record Date of the Distribution.

Prior to the Distribution, DSS will deliver the Common Stock to the distribution agent. V Stock Transfer LLC, the transfer agent and registrar for our Common Stock, will serve as distribution agent in connection with the Distribution.

Each Impact Share distributed as part of the Distribution will be not be eligible for resale until 180 days from the date of the Company’s initial public offering becomes effective under the Securities Act, subject to the discretion of the Company to lift the restriction sooner.

If you own DSS common stock on the Record Date, the shares of our Common Stock that you are entitled to receive in the Distribution will be issued to your account as follows:

| | ● | Registered stockholders. If you own your shares of DSS Common Stock directly through DSS’s transfer agent, American Stock Transfer & Trust Company, you are a registered stockholder. In this case, our transfer agent, V Stock Transfer LLC, which is serving as the distribution agent in connection with the Distribution, will credit the whole shares of our Common Stock you receive in the Distribution to a new book-entry account established on or shortly after the Distribution Date. Registration in book-entry form refers to a method of recording share ownership where no physical stock certificates are issued to stockholders, as is the case in the Distribution. You will be able to access information regarding your book-entry account holding our shares of Common Stock at V Stock Transfer LLC. Commencing on or shortly after the Distribution Date, the distribution agent will mail to you an account statement that indicates the number of whole shares of our Common Stock that have been registered in book-entry form in your name. We expect it will take the distribution agent up to two weeks after the Distribution Date to complete the distribution of the shares of our Common Stock and mail statements of holding to all registered stockholders. |

| | ● | “Street name” or beneficial stockholders. If you own your shares of DSS Common Stock beneficially through a bank, broker or other nominee, the bank, broker or other nominee holds the shares in “street name” and records your ownership on its books. If you own your shares of DSS Common Stock through a bank, broker or other nominee, your bank, broker or other nominee will credit your account with the whole Impact Shares that you receive in the Distribution on or shortly after the Distribution Date. We encourage you to contact your bank, broker or other nominee if you have any questions concerning the mechanics of having shares held in “street name.” |

We will not issue any physical stock certificates to any stockholders, even if requested.

If you sell any of your shares of DSS Common Stock on or before a Distribution Date, the buyer of those shares will in most circumstances be entitled to receive the Impact Shares to be distributed in respect of the shares of DSS Common Stock you sold.

We are not asking DSS stockholders to take any action in connection with the Distribution. No approval of the holders of DSS Common Stock is required for the Distribution. We are not asking you for a proxy and request that you not send us a proxy. We are also not asking you to make any payment or surrender or exchange any of your shares of DSS Common Stock for Impact Shares. The number of outstanding shares of DSS Common Stock will not change as a result of the Distribution.

Number of Shares You Will Receive

On the Distribution Date, you will receive four Impact Shares for every share of DSS Common Stock you held on the Record Date, unless you sell any of your shares of DSS Common Stock on or before a Distribution Date, in which case the buyer of those shares may be entitled to receive the Impact Shares.

Results of the Distribution

After the Distribution, we expect to have approximately [•] holders of shares of our Common Stock, based on the number of DSS stockholders and shares of DSS Common Stock outstanding. The actual number of holders of shares of our Common Stock will depend on the actual number of holders of shares of DSS Common Stock outstanding on the Record Date. The Distribution will not affect the number of outstanding shares of DSS Common Stock or any rights of DSS stockholders, although it is possible that the trading price of shares of DSS Common Stock immediately following the Distribution may be lower than immediately prior to the Distribution because the trading price of DSS Common Stock will no longer reflect the value of DSS ownership stake immediately before the Distribution. Nevertheless, we do not expect the trading price of shares of DSS Common Stock immediately following the Distribution to be materially lower. However, until the market has fully analyzed the value of DSS without the value represented by the Impact Shares distributed to DSS stockholders, the trading price of shares of DSS Common Stock may fluctuate.

Listing and Trading of our Common Stock

All of our outstanding shares of Common Stock are currently beneficially owned by DSS. Accordingly, there currently is no public trading market for the Impact Shares. Our Common Stock is currently not listed for trading on any stock exchange or market. The Impact Shares may be illiquid as we cannot predict whether any trading market will develop.

Conditions to the Distribution

We expect that each Distribution will be effective on the Distribution Date, provided that the following conditions shall have been satisfied or waived by DSS:

| | ● | the DSS Board shall have authorized and approved the Distribution and not withdrawn such authorization and approval, and shall have declared the dividend of our Common Stock to DSS stockholders; |

| | ● | the SEC shall have declared effective our Registration Statement on Form S-1, of which this Prospectus is a part, under the Securities Act, and no stop order suspending the effectiveness of our Registration Statement shall be in effect and no proceedings for that purpose shall be pending before or threatened by the SEC; |

| | ● | no order, injunction or decree issued by any governmental authority of competent jurisdiction or other legal restraint or prohibition preventing consummation of the Distribution shall be in effect, and no other event outside the control of DSS shall have occurred or failed to occur that prevents the consummation of the Distribution; and |

| | ● | no other events or developments shall have occurred prior to the Distribution Date that, in the judgment of the DSS Board, would result in the Distribution having a material adverse effect on DSS or its stockholders. |