Division of Corporation Finance

Office of Manufacturing

Securities and Exchange Commission

100 F Street, NE

Washington, D.C. 20549

Attn: Eric Atallah and Mary Mast

| | Re: | Impact BioMedical Inc. |

| | | Amendment No. 11 to Registration Statement on Form S-1 Filed June 21, 2023 |

| | | File No. 333-253037 |

Dear Mr. Atallah and Ms. Mast:

On behalf of Impact BioMedical Inc. (the “Company”), this letter responds to comments provided by the staff of the Division of Corporation Finance (the “Staff”), of the Securities and Exchange Commission (the “Commission”) provided to the undersigned on June 27, 2023 regarding the Company’s Registration Statement on Form S-1.

For convenience, the Staff’s comments have been restated below and the Company’s responses are set out immediately under the restated comments. Unless otherwise indicated, defined terms used herein have the meanings set forth in the S-1.

Amendment No. 11 to Registration Statement on Form S-1

Capitalization, page 17

| 1. | We note your response and revised disclosures to prior comment 1. It does not appear as though you have included your notes payable in your total capitalization. Please explain why notes payable is not included in your total capitalization or revise your filing accordingly. Also, please tell us why Non-controlling interest in subsidiary is included in Total capitalization or remove the line item. |

Response: The capitalization table has been updated to include the note payable to the related party. Also, the capitalization table has been updated to illustrate the retained earnings associated with Impact BioMedical as well as the non-controlling interest of the Company’s subsidiaries.

| 2. | As a related matter please update your capitalization table to be consistent with the most recent balance sheet included in your filing (i.e., March 31, 2023) |

Response: The capitalization table has been updated to reflect March 31, 2023.

Note 8. Goodwill, page F-12

| 3. | We note your response and revised disclosures in response to prior comment 3. Regarding your valuation under the income approach, please tell us why you believe the material assumptions you used including future sales, operating margins, discount rates, and growth rates are reasonably supportable given the current stage of development. |

Response: Under AICPA guidelines, we believe the Company is currently in stage 4 of development described as “Enterprise has met additional key development milestones (for example, first customer orders or first revenue shipments) and has some product revenue, but it is still operating at a loss. Typically, mezzanine rounds of financing occur during this stage. Also, it is frequently in this stage that discussions would start with investment banks for an initial public offering (IPO).” This determination is supported by an independent third party that performed their quantitative analysis of the Company’s goodwill.

There have been several developments to its acquiring the business in 2020 to support our assumptions around future sales margins and growth rates. Those include but are not limited to:

| i. | The biotechnology industry in which we operate per the IBISWorld Industry Report NN001 Biotechnology in the U.S., dated January of 2022, estimates the current market size at approximately $137.6 billion. Growth over the 2016 through 2021 period is estimated at a rate of negative 0.4% per annum. Over the next five years, industry growth is projected at 2.2% per annum. |

| | | |

| ii. | In line with the Company’s research, discovery and license business model, the Company has executed licensing agreements on four of its discovery assets, i.e. Equivir, Equivir-G, Linebacker 1 and Linebacker 2, with an experienced publicly traded biotech pharmaceutical company. That partner is conducting next stage studies and development of those licensed technologies, with immediate plans to market, distribute and sell the technology. These third-party licensing agreements provide for third-party funding for the continued testing, development, and advancement of these next generation technologies. This business model of discovery and then licensing significantly reduces, or eliminates, the company’s cost to bring these products to market and generate revenue and shifts that cost responsibility to its licensing partner. |

| | | |

| iii. | Since acquiring the company in 2020, the management team have discovered at least 6 new biohealth based discoveries which it has added to its portfolio; each with significant research support and licensing interest. Several of the previously acquired other technologies, and the newer discoveries, that are not currently under a licensing agreement, are, or are slated to be, in validation testing and development by multiple third-party partners seriously interested in the technologies. If those validation tests go as planned, then there is a high likelihood that future agreements for licensing and royalties will be negotiated. |

| | | |

| iv. | For certain technologies, we have been in active adaptation testing with existing qualified manufacturing partners to incorporate our advanced technologies into their existing international marketed products which if comes to fruition will generate significant, potential future revenues for the company. |

| | | |

| | v. | Our research and development partners continue to identify new, patentable technologies that we believe are unique in the industry and will provide us with material new revenue streams. |

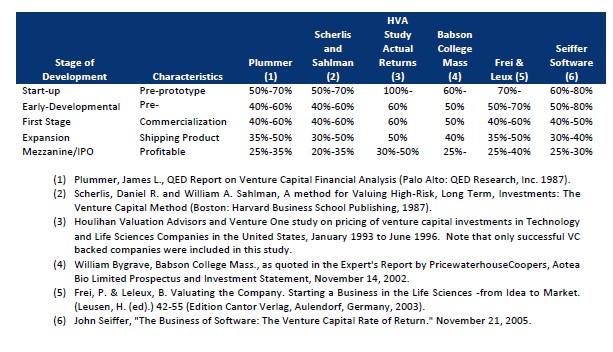

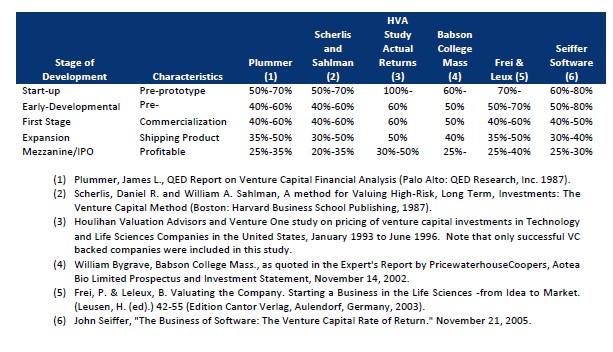

Regarding the discount rate used by the independent third party that performed the valuation of our goodwill balance as of June 1, 2022, the stage 4 of development that we are currently in. In order to support the discount rate determined, multiple venture capital studies were reviewed which disclose a range of returns required depending on the stage of development for the subject company. This stage of development translates into discount rates in the 35% to 50% range. Based upon this range, we feel our discount rate is reasonable. The studies reviewed are summarized below:

| 4. | As a related matter, we note your disclosures on page F-25 that during the year ended December 31, 2022, you used qualitative factors to determine whether it was more likely than not that the fair value of a reporting unit exceeded its carrying amount. Please reconcile the disclosure on page F-25 to your disclosure in this footnote which indicates that you performed quantitative goodwill testing during the year ended December 31, 2022. |

Response: The related footnotes have been updated for the correct terminology.

| 5. | We note from your response and revised disclosures in response to prior comment 4 that you may use internal discounted cash flow estimates, quoted market prices, when available, and independent appraisals, as appropriate, to determine fair value. However it does not appear as though you have discussed the valuation methodology and key assumptions used in your most recent impairment analysis, as previously requested. Please advise us or revise your filing accordingly |

Response: Footnote 9 has been updated to identify the methodology used as qualitative and the key factors considered.

Should you have any questions regarding the foregoing, please do not hesitate to contact the Company’s counsel, Darrin Ocasio, of Sichenzia Ross Ference LLP at (212) 930-9700.

| Sincerely, | |

| | |

| Frank D. Heuszel | |

| Chief Executive Officer | |

| cc: | Darrin M. Ocasio, Esq. |