1 Earnings Release July 18, 2024 Second Quarter 2024 Results Exhibit 99.3

2 This slide presentation and certain of our other filings with the Securities and Exchange Commission contain statements that constitute "forward-looking statements" within the meaning of, and subject to the protections of, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact are forward-looking statements. You can identify these forward-looking statements through Synovus' use of words such as "believes," "anticipates," "expects," "may," "will," "assumes," "predicts," "could," "should," "would," "intends," "targets," "estimates," "projects," "plans," "potential" and other similar words and expressions of the future or otherwise regarding the outlook for Synovus' future business and financial performance and/or the performance of the banking industry and economy in general. These forward-looking statements include, among others, statements on our expectations related to (1) loan growth; (2) deposit growth and deposit costs; (3) net interest income and net interest margin; (4) revenue growth; (5) non-interest expense; (6) credit trends and key credit performance metrics; (7) our future operating and financial performance; (8) our strategy and initiatives for future revenue growth, balance sheet optimization, capital management, and expense management; (9) our effective tax rate; and (10) our assumptions underlying these expectations. Prospective investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve known and unknown risks and uncertainties which may cause the actual results, performance or achievements of Synovus to be materially different from the future results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements are based on the information known to, and current beliefs and expectations of, Synovus' management and are subject to significant risks and uncertainties. Actual results may differ materially from those contemplated by such forward-looking statements. A number of factors could cause actual results to differ materially from those contemplated by the forward-looking statements in this presentation. Many of these factors are beyond Synovus' ability to control or predict. These forward-looking statements are based upon information presently known to Synovus' management and are inherently subjective, uncertain and subject to change due to any number of risks and uncertainties, including, without limitation, the risks and other factors set forth in Synovus' filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the year ended December 31, 2023 under the captions "Cautionary Notice Regarding Forward-Looking Statements" and "Risk Factors" and in Synovus' quarterly reports on Form 10-Q and current reports on Form 8-K. We believe these forward- looking statements are reasonable; however, undue reliance should not be placed on any forward-looking statements, which are based on current expectations and speak only as of the date that they are made. We do not assume any obligation to update any forward-looking statements as a result of new information, future developments or otherwise, except as otherwise may be required by law. This slide presentation contains certain non-GAAP financial measures determined by methods other than in accordance with generally accepted accounting principles. Such non-GAAP financial measures include the following: adjusted net income available to common shareholders; adjusted diluted earnings per share; adjusted return on average assets; return on average tangible common equity; adjusted return on average tangible common equity; adjusted non-interest revenue; adjusted revenue; adjusted non-interest expense; adjusted tangible efficiency ratio; tangible common equity ratio; and adjusted pre-provision net revenue (PPNR). The most comparable GAAP measures to these measures are net income (loss) available to common shareholders; diluted earnings (loss) per share; return on average assets; return on average common equity; total non-interest revenue; total revenue; total non-interest expense; efficiency ratio-TE; total Synovus Financial Corp. shareholders' equity to total assets ratio; and PPNR, respectively. Management believes that these non-GAAP financial measures provide meaningful additional information about Synovus to assist management and investors in evaluating Synovus' operating results, financial strength, the performance of its business and the strength of its capital position. However, these non-GAAP financial measures have inherent limitations as analytical tools and should not be considered in isolation or as a substitute for analyses of operating results or capital position as reported under GAAP. The non-GAAP financial measures should be considered as additional views of the way our financial measures are affected by significant items and other factors, and since they are not required to be uniformly applied, they may not be comparable to other similarly titled measures at other companies. Adjusted net income available to common shareholders, adjusted diluted earnings per share and adjusted return on average assets are measures used by management to evaluate operating results exclusive of items that are not indicative of ongoing operations and impact period- to-period comparisons. Return on average tangible common equity and adjusted return on average tangible common equity are measures used by management to compare Synovus' performance with other financial institutions because it calculates the return available to common shareholders without the impact of intangible assets and their related amortization, thereby allowing management to evaluate the performance of the business consistently. Adjusted non-interest revenue and adjusted revenue are measures used by management to evaluate non-interest revenue and total revenue exclusive of net investment securities gains (losses), fair value adjustments on non-qualified deferred compensation, and other items not indicative of ongoing operations that could impact period-to-period comparisons. Adjusted non-interest expense and the adjusted tangible efficiency ratio are measures utilized by management to measure the success of expense management initiatives focused on reducing recurring controllable operating costs. The tangible common equity ratio is used by stakeholders to assess our capital position. Adjusted PPNR is used by management to evaluate PPNR exclusive of items that management believes are not indicative of ongoing operations and impact period-to-period comparisons. The computations of the non-GAAP financial measures used in this slide presentation are set forth in the appendix to this slide presentation. Management does not provide a reconciliation for forward-looking non-GAAP financial measures where it is unable to provide a meaningful or accurate calculation or estimation of reconciling items and the information is not available without unreasonable effort. This is due to the inherent difficulty of forecasting the occurrence and the financial impact of various items that have not yet occurred, are out of Synovus’ control, or cannot be reasonably predicted. For the same reasons, Synovus’ management is unable to address the probable significance of the unavailable information. Forward-looking non-GAAP financial measures provided without the most directly comparable GAAP financial measures may vary materially from the corresponding GAAP financial measures. Forward-Looking Statements Use of Non-GAAP Financial Measures

3 • Reported 2Q24 EPS of $(0.16) impacted by a securities loss, while adjusted EPS was $1.16 • Net interest income up 4% QoQ, with the NIM(3) expanding 16 bps to 3.20% • Non-interest revenue of $(129) million was negatively impacted by a $257 million securities loss • Adjusted non-interest revenue of $127 million rose 9% QoQ and 15% YoY • Non-interest expense declined 6% QoQ and was down 2% YoY • Loans and core deposits(4) were relatively stable QoQ • NCOs/average loans were 0.32% compared to 0.41% in 1Q24 • CET1 ratio(5) increased 24 bps QoQ to 10.62%, inclusive of $91 million in share repurchases Balance Sheet (Period-end, $ in millions) Total Loans, Net of Unearned $43,093 Deposits $50,196 Key Performance Metrics Reported Adjusted(1) Net Income (Loss) Available to Common Shareholders(2) $(23,741) $169,617 Diluted Earnings (Loss) Per Share $(0.16) $1.16 Return on Average Assets (0.10)% 1.21% Return on Average Tangible Common Equity (2.2)% 17.6% Efficiency Ratio-TE(3) 98.1% 53.1% (1) Non-GAAP financial measure; see appendix for applicable reconciliation; (2) $ In thousands; (3) Taxable equivalent; (4) Excludes brokered; (5) 2Q24 capital ratios are preliminary Second Quarter 2024 Financial Highlights

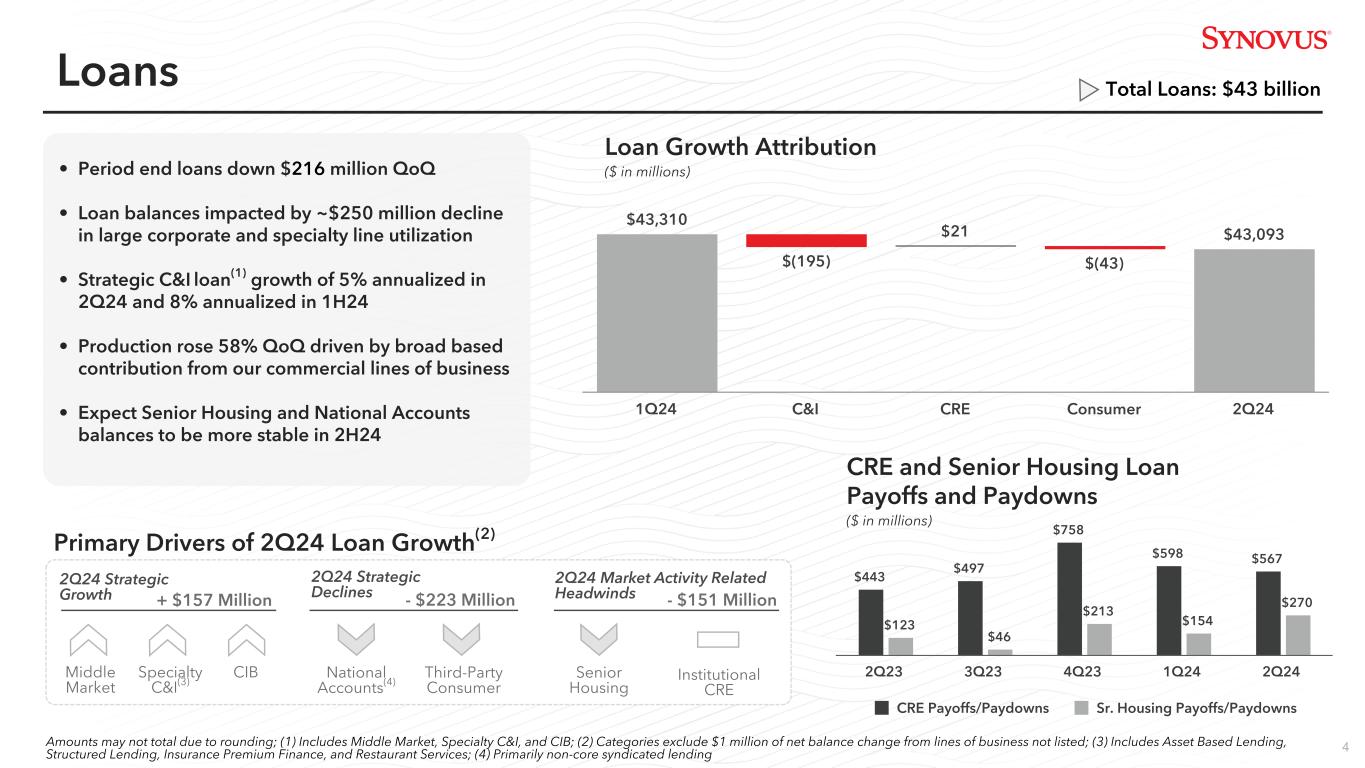

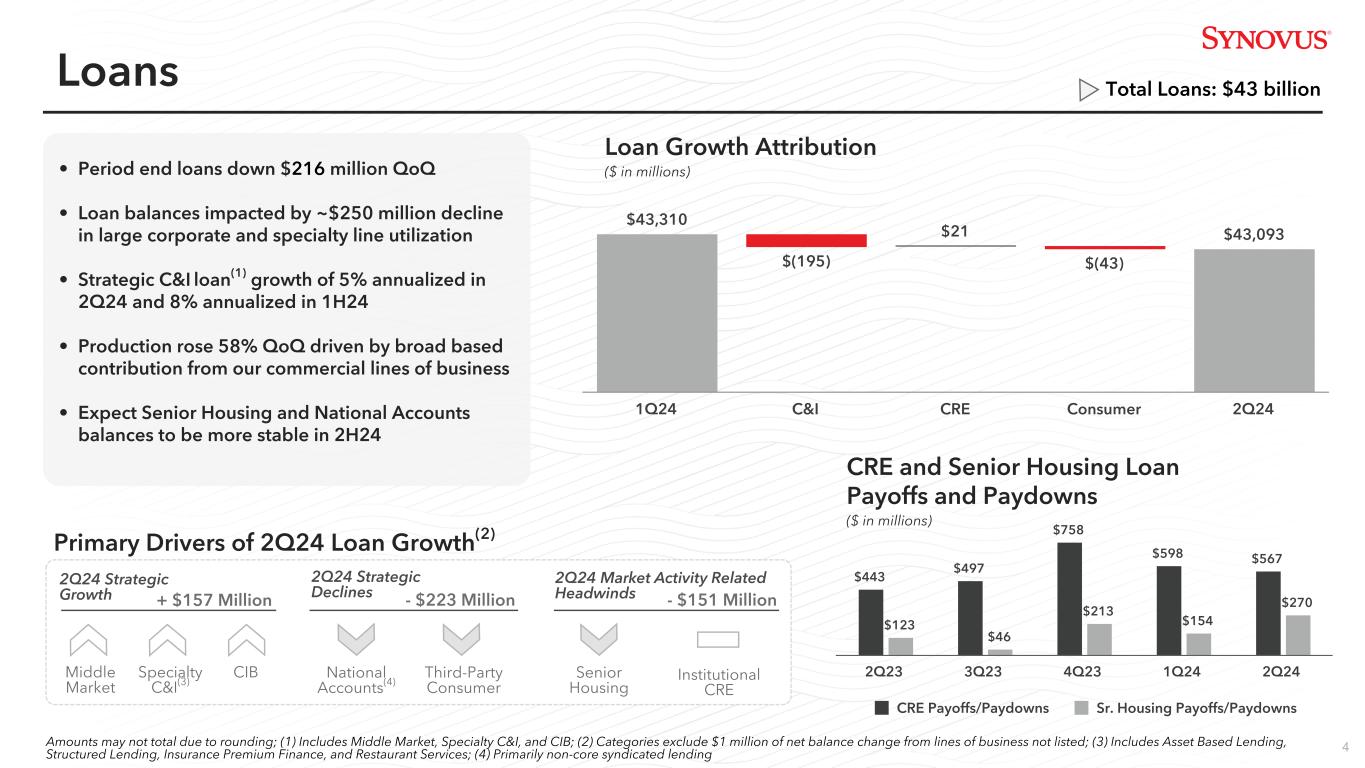

4 • Period end loans down $216 million QoQ • Loan balances impacted by ~$250 million decline in large corporate and specialty line utilization • Strategic C&I loan(1) growth of 5% annualized in 2Q24 and 8% annualized in 1H24 • Production rose 58% QoQ driven by broad based contribution from our commercial lines of business • Expect Senior Housing and National Accounts balances to be more stable in 2H24 Loans $43,310 $(195) $21 $(43) $43,093 1Q24 C&I CRE Consumer 2Q24 Loan Growth Attribution ($ in millions) Total Loans: $43 billion Amounts may not total due to rounding; (1) Includes Middle Market, Specialty C&I, and CIB; (2) Categories exclude $1 million of net balance change from lines of business not listed; (3) Includes Asset Based Lending, Structured Lending, Insurance Premium Finance, and Restaurant Services; (4) Primarily non-core syndicated lending 2Q24 Strategic Growth CIBSpecialty C&I(3) Middle Market 2Q24 Strategic Declines Third-Party Consumer National Accounts(4) - $223 Million Primary Drivers of 2Q24 Loan Growth(2) $443 $497 $758 $598 $567 $123 $46 $213 $154 $270 CRE Payoffs/Paydowns Sr. Housing Payoffs/Paydowns 2Q23 3Q23 4Q23 1Q24 2Q24 CRE and Senior Housing Loan Payoffs and Paydowns ($ in millions) 2Q24 Market Activity Related Headwinds - $151 Million Senior Housing + $157 Million Institutional CRE

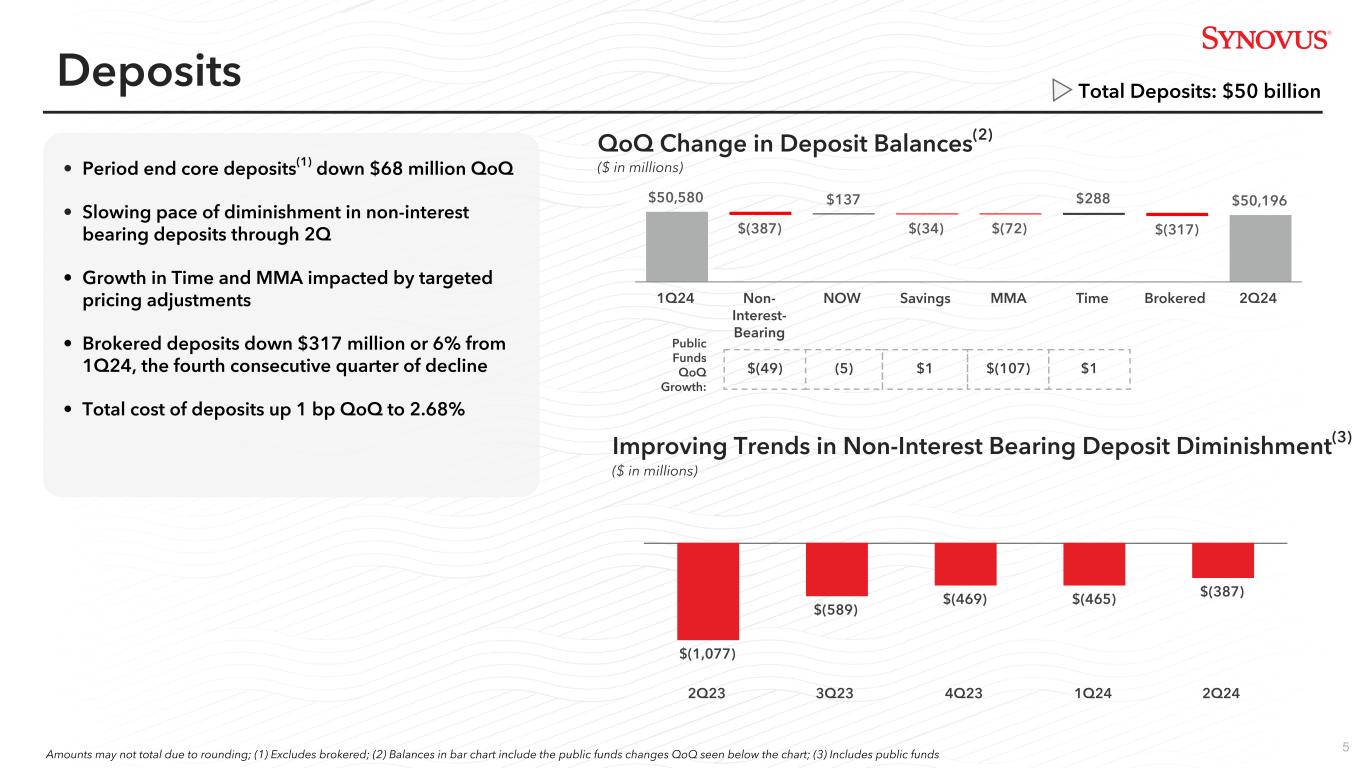

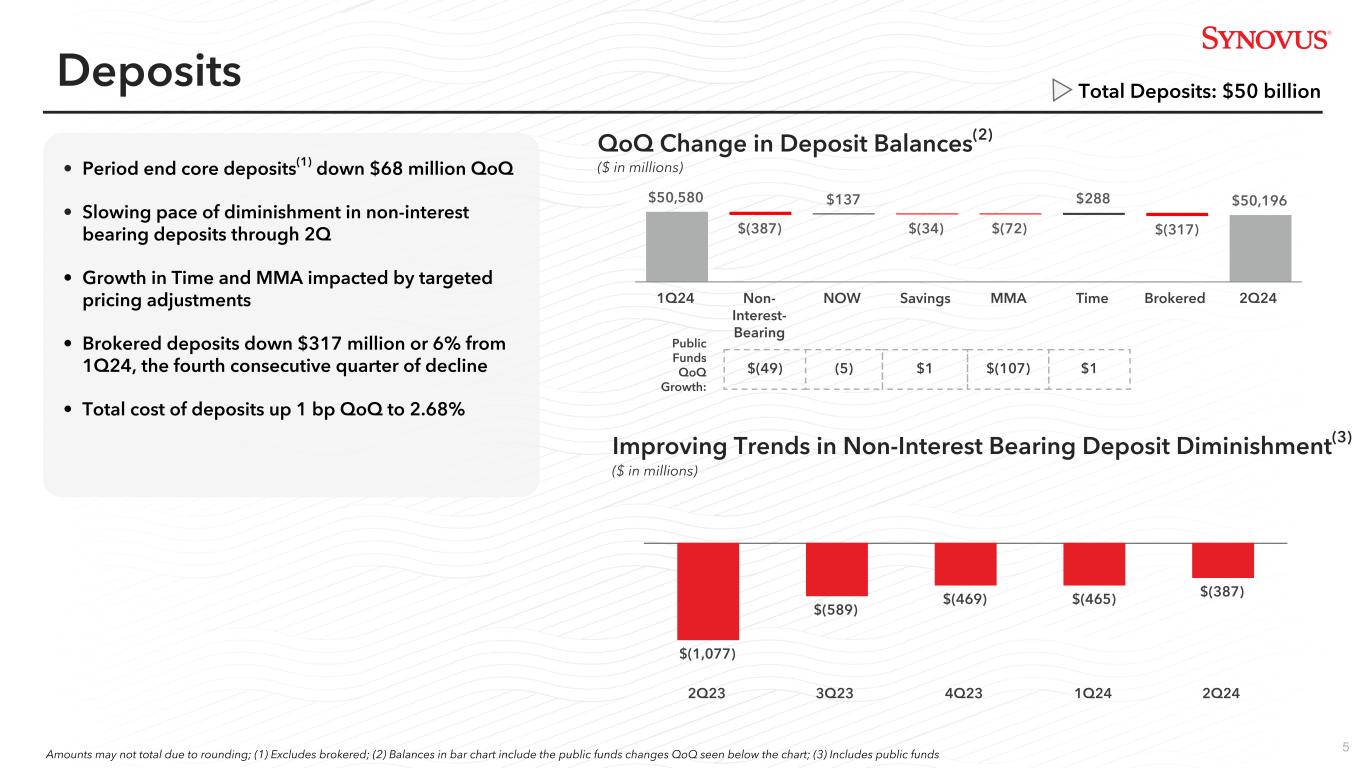

5 $50,580 $(387) $137 $(34) $(72) $288 $(317) $50,196 1Q24 Non- Interest- Bearing NOW Savings MMA Time Brokered 2Q24 Deposits • Period end core deposits(1) down $68 million QoQ • Slowing pace of diminishment in non-interest bearing deposits through 2Q • Growth in Time and MMA impacted by targeted pricing adjustments • Brokered deposits down $317 million or 6% from 1Q24, the fourth consecutive quarter of decline • Total cost of deposits up 1 bp QoQ to 2.68% QoQ Change in Deposit Balances(2) ($ in millions) Amounts may not total due to rounding; (1) Excludes brokered; (2) Balances in bar chart include the public funds changes QoQ seen below the chart; (3) Includes public funds Public Funds QoQ Growth: $(49) (5) $1 $(107) Total Deposits: $50 billion $1 $(1,077) $(589) $(469) $(465) $(387) 2Q23 3Q23 4Q23 1Q24 2Q24 Improving Trends in Non-Interest Bearing Deposit Diminishment(3) ($ in millions)

6 $456 $443 $437 $419 $435 3.20% 3.11% 3.11% 3.04% 3.20% Net Interest Income Net Interest Margin 2Q23 3Q23 4Q23 1Q24 2Q24 Amounts may not total due to rounding; NIM Attribution reflects estimates and includes both attributed and unattributed items; Note: All references to NIM are are taxable equivalent Net Interest Income Net Interest Income and Net Interest Margin Trends ($ in millions)• Net interest income increased $16 million or 4% QoQ • NIM expansion of 16 bps, supported by stronger loan and securities yields, as well as stable deposit cost • Expect 2H24 NIM expansion to be supported by continued fixed-rate asset repricing and relative stability in deposit cost Net Interest Income: $435 million 1Q24 NIM 3.04% bps difference QoQ Loan Yield +0.07% Deposit Rate -0.01% Deposit Mix +0.01% 2Q24 Securities Repositioning +0.05% Impact of HTM Reclassification +0.04% 2Q24 NIM 3.20% Net Interest Margin Attribution

7 $293 $345 $374 $413 2020 2021 2022 2023 2024E ($ in millions) 2Q24 QoQ Δ YoY Δ Core Banking Fees(2) $48 2% 4% Wealth Revenue(3) $41 (3)% (5)% Capital Markets Income $15 128% 59% Net Mortgage Revenue $4 15% (14)% Other Income(4)(5) $19 13% 166% Total Adjusted Non-Interest Revenue(6) $127 9% 15% Total Non-Interest Revenue $(129) (208)% (215)% Amounts may not total due to rounding; (1) Commercial Sponsorship income includes GreenSky income (within other income) and ISO sponsorship NIR (within service charges on deposit accounts and card fees in core banking fees and other income); (2) Includes service charges on deposit accounts, card fees, and several other non-interest revenue components including line of credit non-usage fees, letter of credit fees, ATM fee income, and miscellaneous other service charges; (3) Consists of fiduciary/asset management, brokerage, and insurance revenues; (4) Includes earnings on equity method investments, income from BOLI, Commercial Sponsorship, and other miscellaneous income; (5) Excludes adjusted NIR items. See appendix for adjusted NIR non-GAAP reconciliation; (6) Non-GAAP financial measure; see appendix for applicable reconciliation; (7) Core Client NIR (ex. Mortgage) primarily includes Core Banking Fees, Wealth Revenue, Capital Markets income, Commercial Sponsorship, and other miscellaneous income; (8) Reclassification of Core Client NIR performed in 1Q24 Non-Interest Revenue Growth and Stability in Core Client Non-Interest Revenue(7)(8) ($ in millions) Non-Interest Revenue ~12% CAGR Non-Interest Revenue: $(129) million $435M - $445M • Sequential growth primarily attributable to robust syndication and debt capital markets fees • Year over year growth driven by higher Treasury and Payment Solutions, Capital Markets and Commercial Sponsorship income(1) • Wealth revenue declined YoY from lower repo revenue and divestiture of GLOBALT in 2023 • Recorded $257 million loss on the securities repositioning

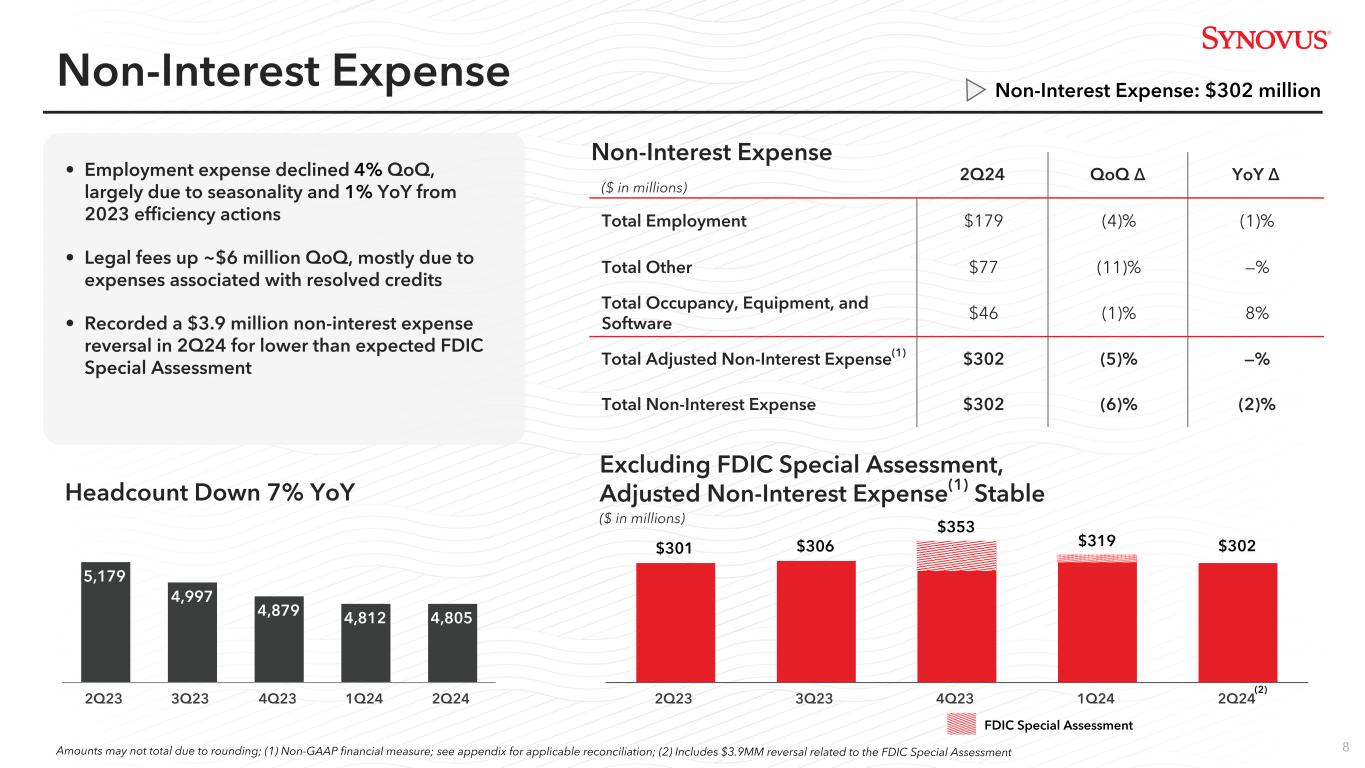

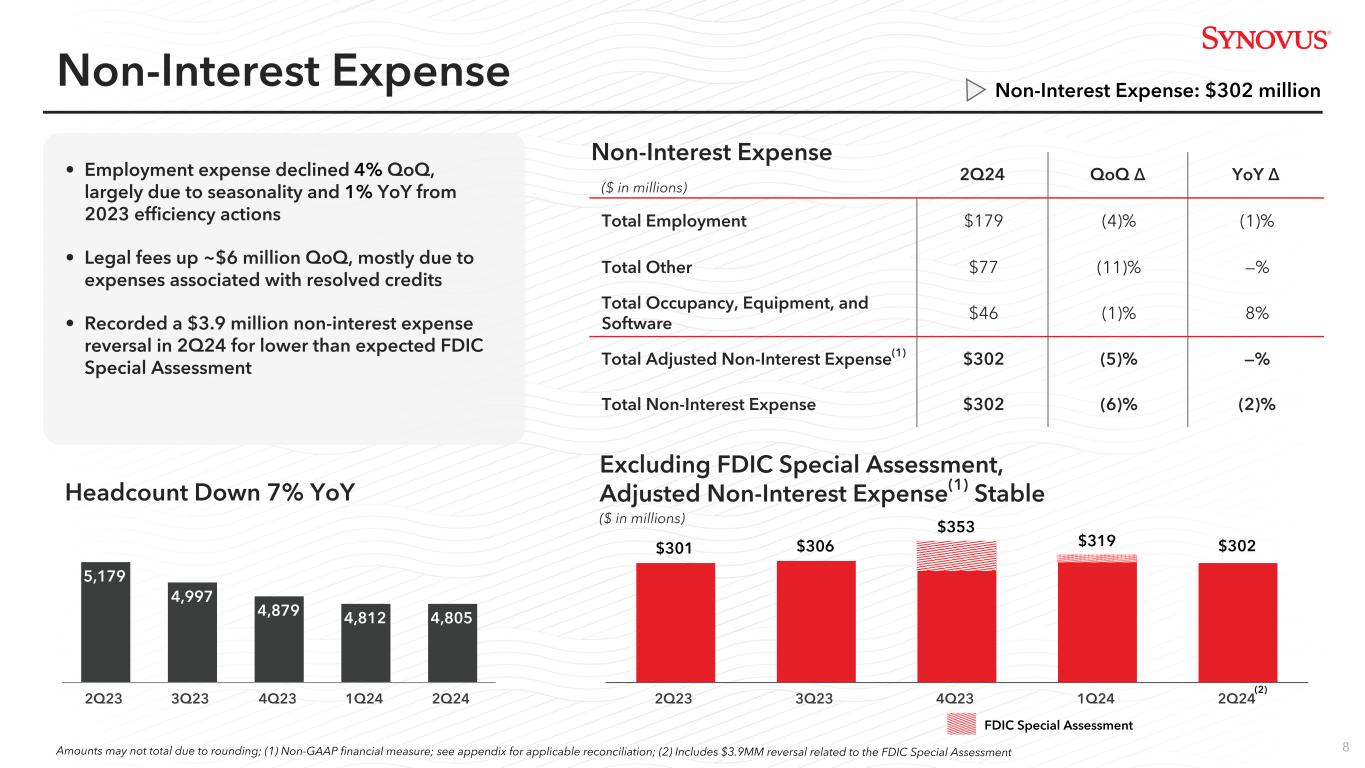

8 Non-Interest Expense ($ in millions) 2Q24 QoQ Δ YoY Δ Total Employment $179 (4)% (1)% Total Other $77 (11)% —% Total Occupancy, Equipment, and Software $46 (1)% 8% Total Adjusted Non-Interest Expense(1) $302 (5)% —% Total Non-Interest Expense $302 (6)% (2)% Non-Interest Expense Non-Interest Expense: $302 million • Employment expense declined 4% QoQ, largely due to seasonality and 1% YoY from 2023 efficiency actions • Legal fees up ~$6 million QoQ, mostly due to expenses associated with resolved credits • Recorded a $3.9 million non-interest expense reversal in 2Q24 for lower than expected FDIC Special Assessment 5,179 4,997 4,879 4,812 4,805 2Q23 3Q23 4Q23 1Q24 2Q24 Headcount Down 7% YoY Amounts may not total due to rounding; (1) Non-GAAP financial measure; see appendix for applicable reconciliation; (2) Includes $3.9MM reversal related to the FDIC Special Assessment Excluding FDIC Special Assessment, Adjusted Non-Interest Expense(1) Stable ($ in millions) $301 $306 $353 $319 2Q23 3Q23 4Q23 1Q24 2Q24 $302 FDIC Special Assessment (2)

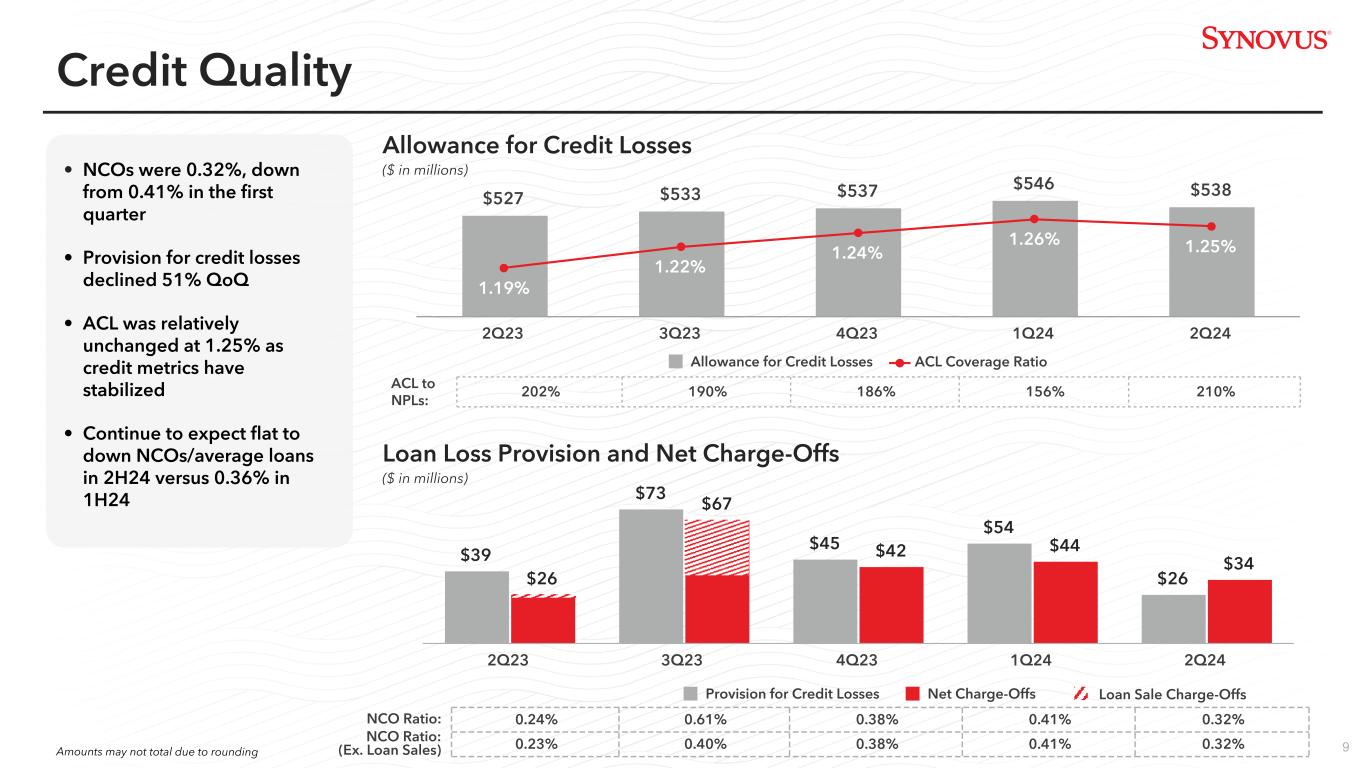

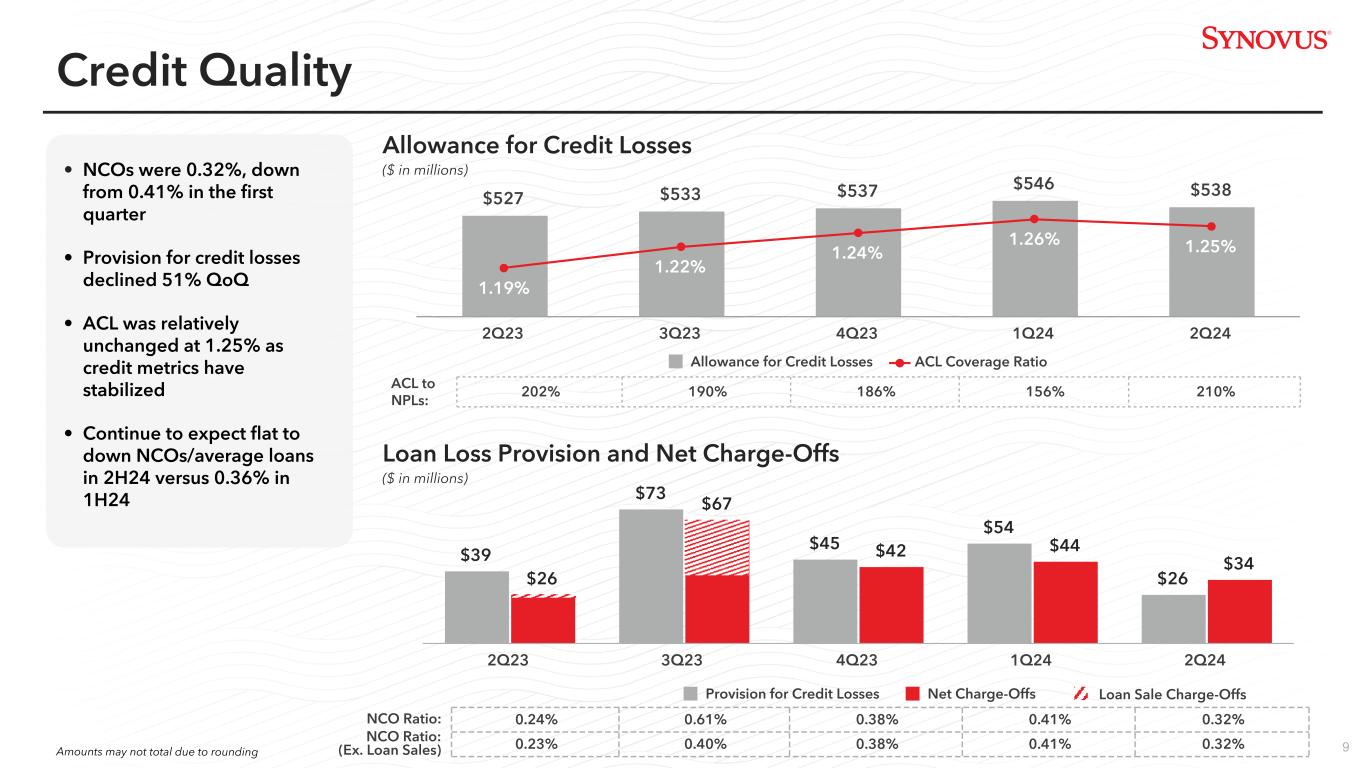

9 Credit Quality • NCOs were 0.32%, down from 0.41% in the first quarter • Provision for credit losses declined 51% QoQ • ACL was relatively unchanged at 1.25% as credit metrics have stabilized • Continue to expect flat to down NCOs/average loans in 2H24 versus 0.36% in 1H24 $39 $73 $45 $54 $26$26 $67 $42 $44 $34 Provision for Credit Losses Net Charge-Offs 2Q23 3Q23 4Q23 1Q24 2Q24 0.24% 0.61% 0.38% 0.41% 0.32% 0.23% 0.40% 0.38% 0.41% 0.32% NCO Ratio: Loan Loss Provision and Net Charge-Offs ($ in millions) NCO Ratio: (Ex. Loan Sales) Loan Sale Charge-Offs Amounts may not total due to rounding $527 $533 $537 $546 $538 1.19% 1.22% 1.24% 1.26% 1.25% Allowance for Credit Losses ACL Coverage Ratio 2Q23 3Q23 4Q23 1Q24 2Q24 202% 190% 186% 156% 210%ACL to NPLs: Allowance for Credit Losses ($ in millions)

10 $110,803 $94,784 $70,294 $151,828 $61,601 C&I CRE Consumer 2Q23 3Q23 4Q23 1Q24 2Q24 Credit Quality Credit Metric Trends 0.59% 0.64% 0.66% 0.81% 0.59% 3.0% 3.4% 3.5% 3.8% 3.7% Non Performing Loan Ratio Criticized & Classified Loans as a % of Total Loans 2Q23 3Q23 4Q23 1Q24 2Q24 • Non-performing loan ratio declined to 0.59% of loans, down from 0.81% in 1Q24 • NPL inflows improved from the prior quarter • Criticized and classified loans declined slightly Non-Performing Loan Inflows ($ in thousands)

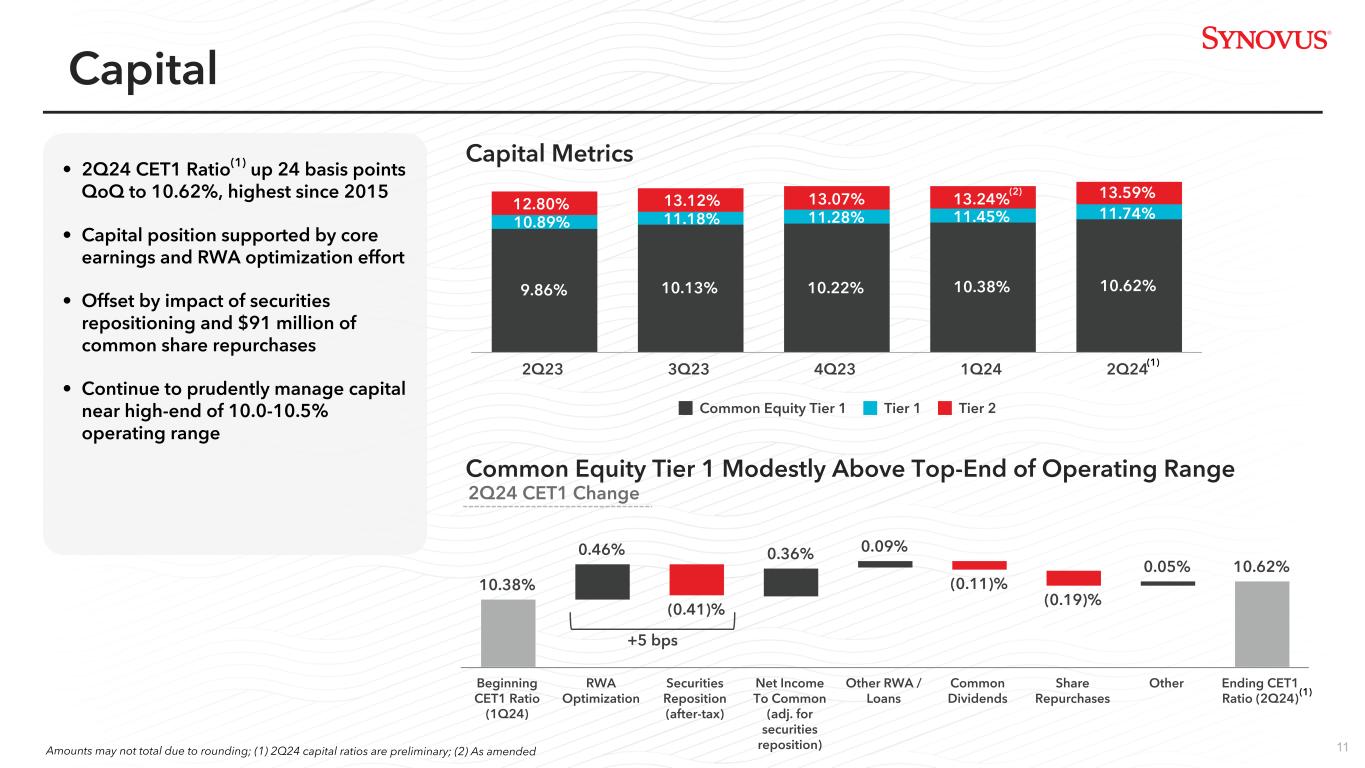

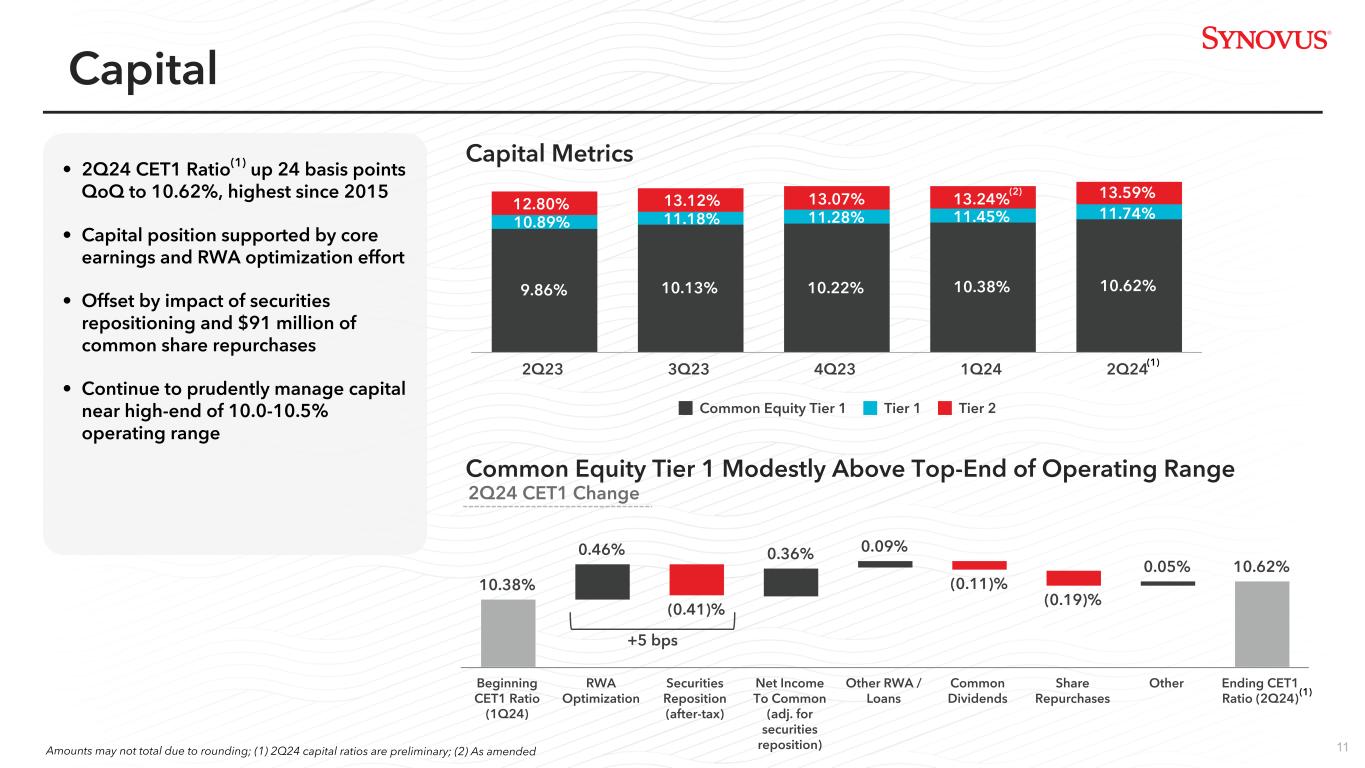

11 9.86% 10.13% 10.22% 10.38% 10.62% Common Equity Tier 1 Tier 1 Tier 2 2Q23 3Q23 4Q23 1Q24 2Q24 • 2Q24 CET1 Ratio(1) up 24 basis points QoQ to 10.62%, highest since 2015 • Capital position supported by core earnings and RWA optimization effort • Offset by impact of securities repositioning and $91 million of common share repurchases • Continue to prudently manage capital near high-end of 10.0-10.5% operating range Amounts may not total due to rounding; (1) 2Q24 capital ratios are preliminary; (2) As amended (1) 11.45% 13.24% 13.59% 11.74% Capital Capital Metrics 10.89% 12.80% 13.12% 11.18% Common Equity Tier 1 Modestly Above Top-End of Operating Range 10.38% 0.46% (0.41)% 0.36% 0.09% (0.11)% (0.19)% 0.05% 10.62% Beginning CET1 Ratio (1Q24) RWA Optimization Securities Reposition (after-tax) Net Income To Common (adj. for securities reposition) Other RWA / Loans Common Dividends Share Repurchases Other Ending CET1 Ratio (2Q24) 2Q24 CET1 Change (1) 13.07% 11.28% +5 bps (2)

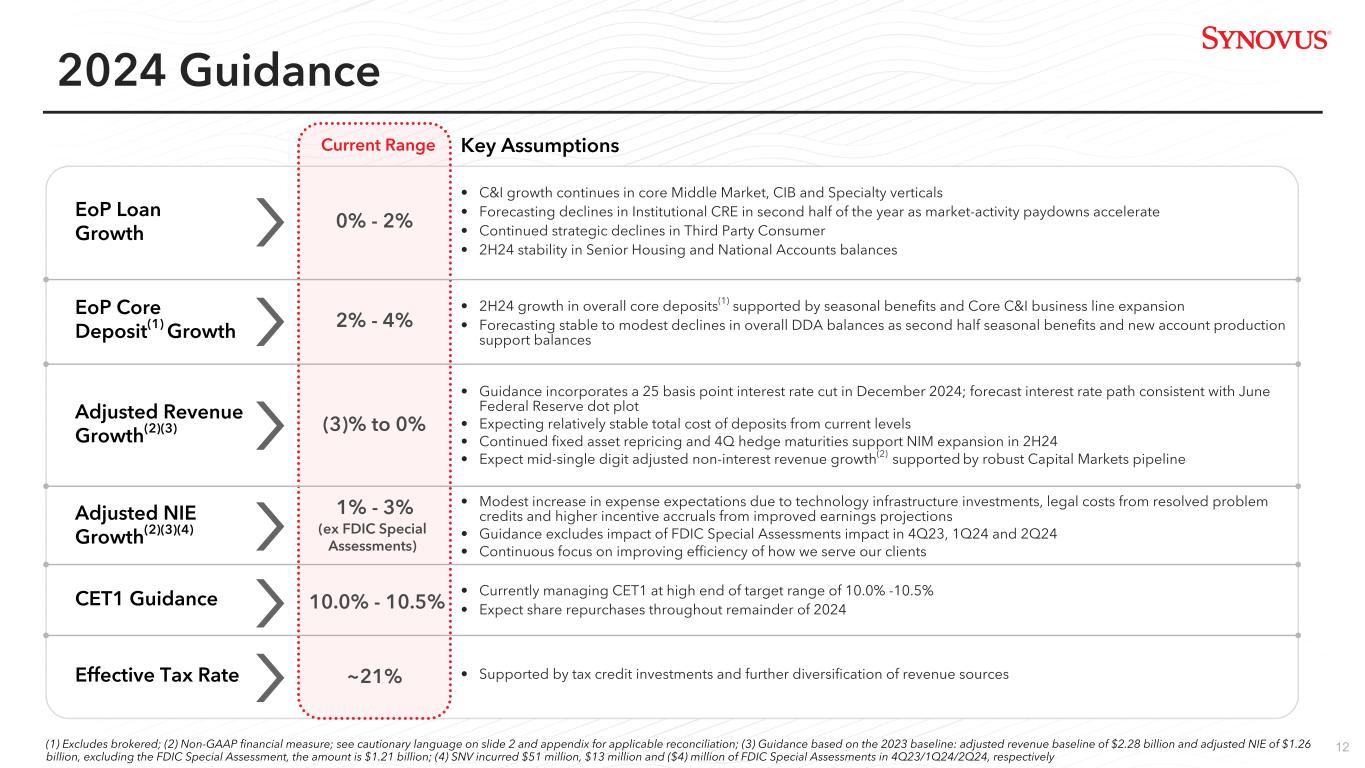

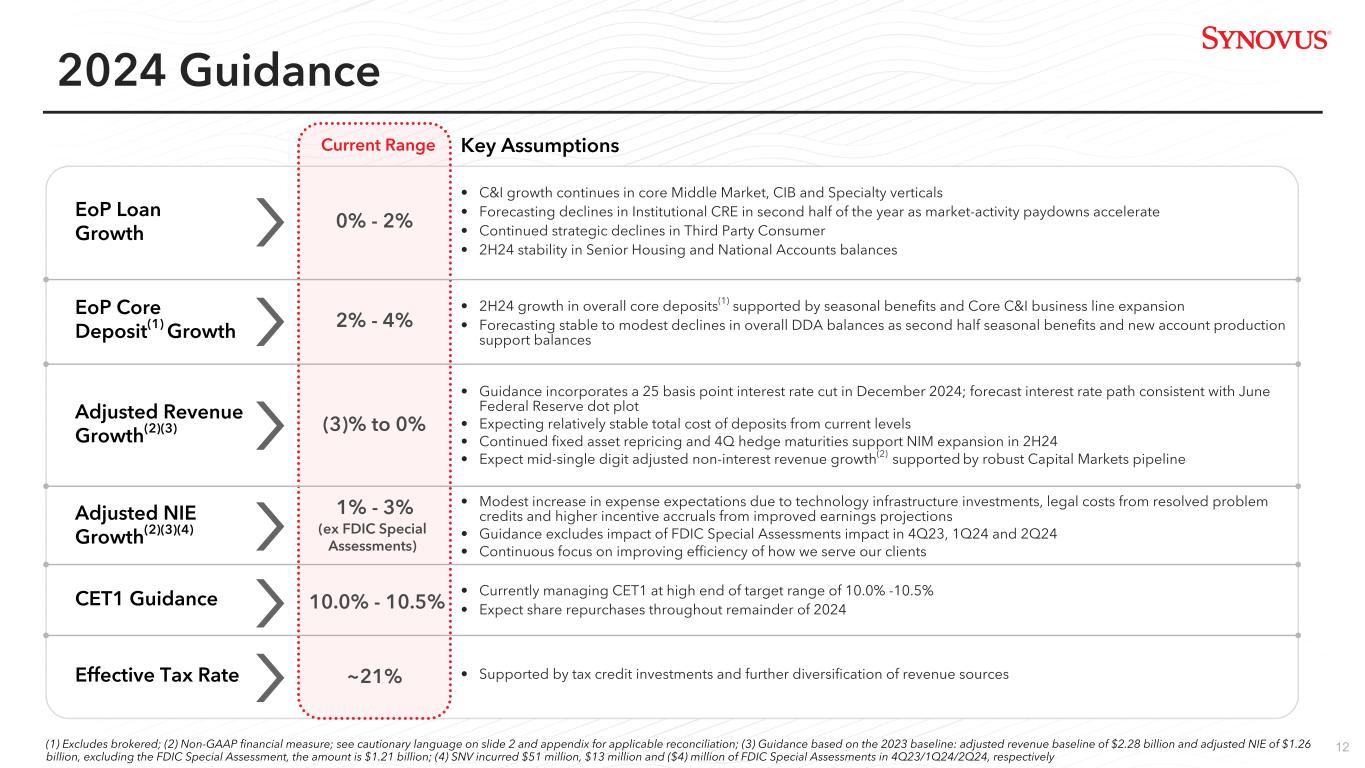

12 2024 Guidance Key Assumptions EoP Loan Growth EoP Core Deposit(1) Growth Adjusted Revenue Growth(2)(3) Adjusted NIE Growth(2)(3)(4) Effective Tax Rate CET1 Guidance Current Range 0% - 2% 2% - 4% (3)% to 0% 1% - 3% (ex FDIC Special Assessments) ~21% 10.0% - 10.5% • C&I growth continues in core Middle Market, CIB and Specialty verticals • Forecasting declines in Institutional CRE in second half of the year as market-activity paydowns accelerate • Continued strategic declines in Third Party Consumer • 2H24 stability in Senior Housing and National Accounts balances • 2H24 growth in overall core deposits(1) supported by seasonal benefits and Core C&I business line expansion • Forecasting stable to modest declines in overall DDA balances as second half seasonal benefits and new account production support balances • Currently managing CET1 at high end of target range of 10.0% -10.5% • Expect share repurchases throughout remainder of 2024 • Supported by tax credit investments and further diversification of revenue sources • Guidance incorporates a 25 basis point interest rate cut in December 2024; forecast interest rate path consistent with June Federal Reserve dot plot • Expecting relatively stable total cost of deposits from current levels • Continued fixed asset repricing and 4Q hedge maturities support NIM expansion in 2H24 • Expect mid-single digit adjusted non-interest revenue growth(2) supported by robust Capital Markets pipeline • Modest increase in expense expectations due to technology infrastructure investments, legal costs from resolved problem credits and higher incentive accruals from improved earnings projections • Guidance excludes impact of FDIC Special Assessments impact in 4Q23, 1Q24 and 2Q24 • Continuous focus on improving efficiency of how we serve our clients (1) Excludes brokered; (2) Non-GAAP financial measure; see cautionary language on slide 2 and appendix for applicable reconciliation; (3) Guidance based on the 2023 baseline: adjusted revenue baseline of $2.28 billion and adjusted NIE of $1.26 billion, excluding the FDIC Special Assessment, the amount is $1.21 billion; (4) SNV incurred $51 million, $13 million and ($4) million of FDIC Special Assessments in 4Q23/1Q24/2Q24, respectively

Appendix

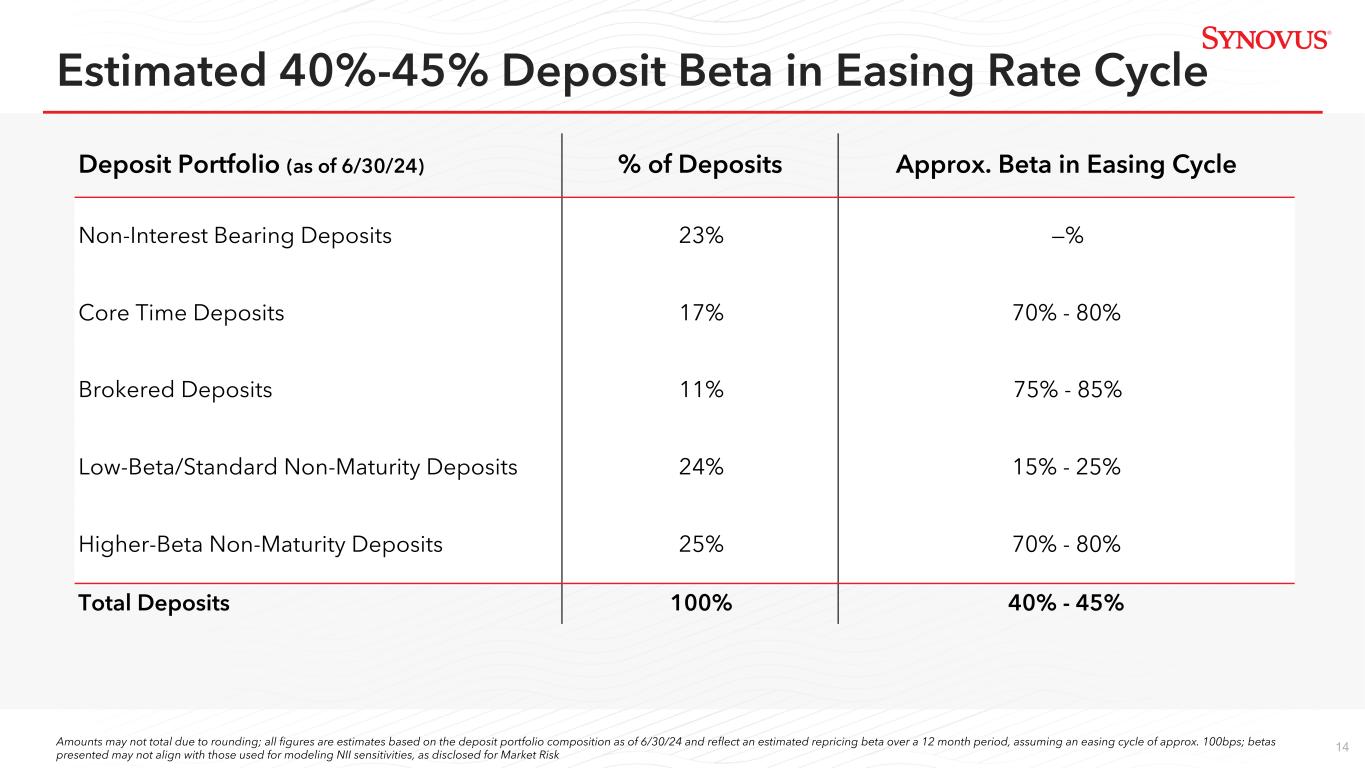

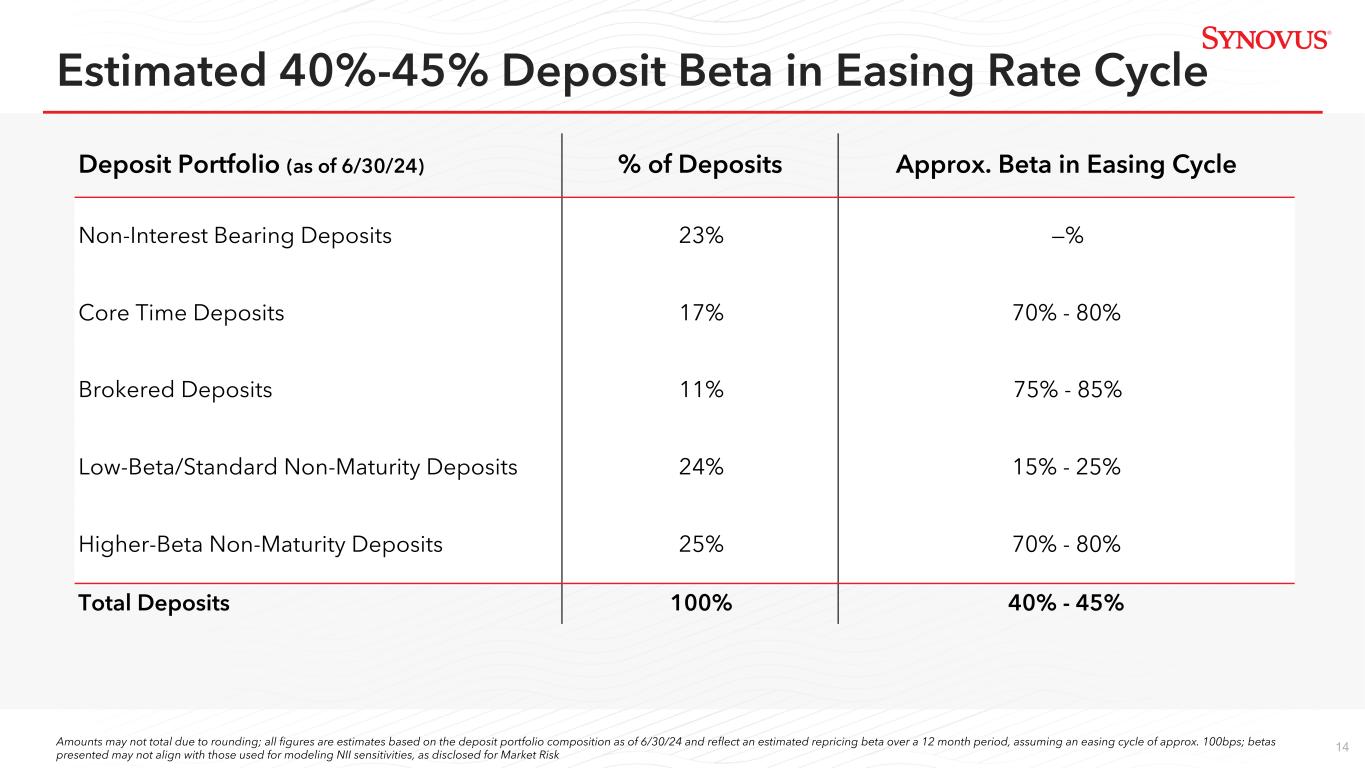

14 Deposit Portfolio (as of 6/30/24) % of Deposits Approx. Beta in Easing Cycle Non-Interest Bearing Deposits 23% —% Core Time Deposits 17% 70% - 80% Brokered Deposits 11% 75% - 85% Low-Beta/Standard Non-Maturity Deposits 24% 15% - 25% Higher-Beta Non-Maturity Deposits 25% 70% - 80% Total Deposits 100% 40% - 45% Estimated 40%-45% Deposit Beta in Easing Rate Cycle Amounts may not total due to rounding; all figures are estimates based on the deposit portfolio composition as of 6/30/24 and reflect an estimated repricing beta over a 12 month period, assuming an easing cycle of approx. 100bps; betas presented may not align with those used for modeling NII sensitivities, as disclosed for Market Risk

15 Loan Trends $44,353 $43,680 $43,404 $43,310 $43,093 $35,825 $35,176 $34,915 $34,925 $34,752 $8,528 $8,504 $8,489 $8,385 $8,341 Commercial Consumer 2Q23 3Q23 4Q23 1Q24 2Q24 Period End Loans ($ in millions) $44,099 $43,500 $43,597 $43,378 $43,365 $35,629 $34,990 $35,106 $34,944 $35,006 $8,470 $8,510 $8,491 $8,434 $8,358 Commercial Consumer 2Q23 3Q23 4Q23 1Q24 2Q24 Average Loans ($ in millions) Amounts may not total due to rounding

16 $50,080 $50,204 $50,739 $50,580 $50,196 $13,566 $12,977 $12,508 $12,042 $11,656 $10,082 $10,051 $10,681 $10,644 $10,781 $13,094 $12,989 $12,902 $12,925 $12,854 $1,230 $1,140 $1,071 $1,055 $1,021 $5,579 $6,825 $7,534 $8,195 $8,482 $6,530 $6,222 $6,043 $5,719 $5,402 NIB DDA IB DDA MMA Savings Time Brokered 2Q23 3Q23 4Q23 1Q24 2Q24 Deposit Trends Period End Deposits ($ in millions) Average Deposits ($ in millions) $49,719 $50,113 $50,587 $50,186 $50,408 $13,874 $13,049 $12,744 $12,072 $12,099 $9,891 $10,114 $10,422 $10,590 $10,789 $13,468 $13,147 $13,054 $12,826 $12,617 $1,276 $1,178 $1,099 $1,057 $1,036 $4,866 $6,181 $7,198 $7,903 $8,383 $6,343 $6,443 $6,069 $5,737 $5,483 NIB DDA IB DDA MMA Savings Time Brokered 2Q23 3Q23 4Q23 1Q24 2Q24 Amounts may not total due to rounding

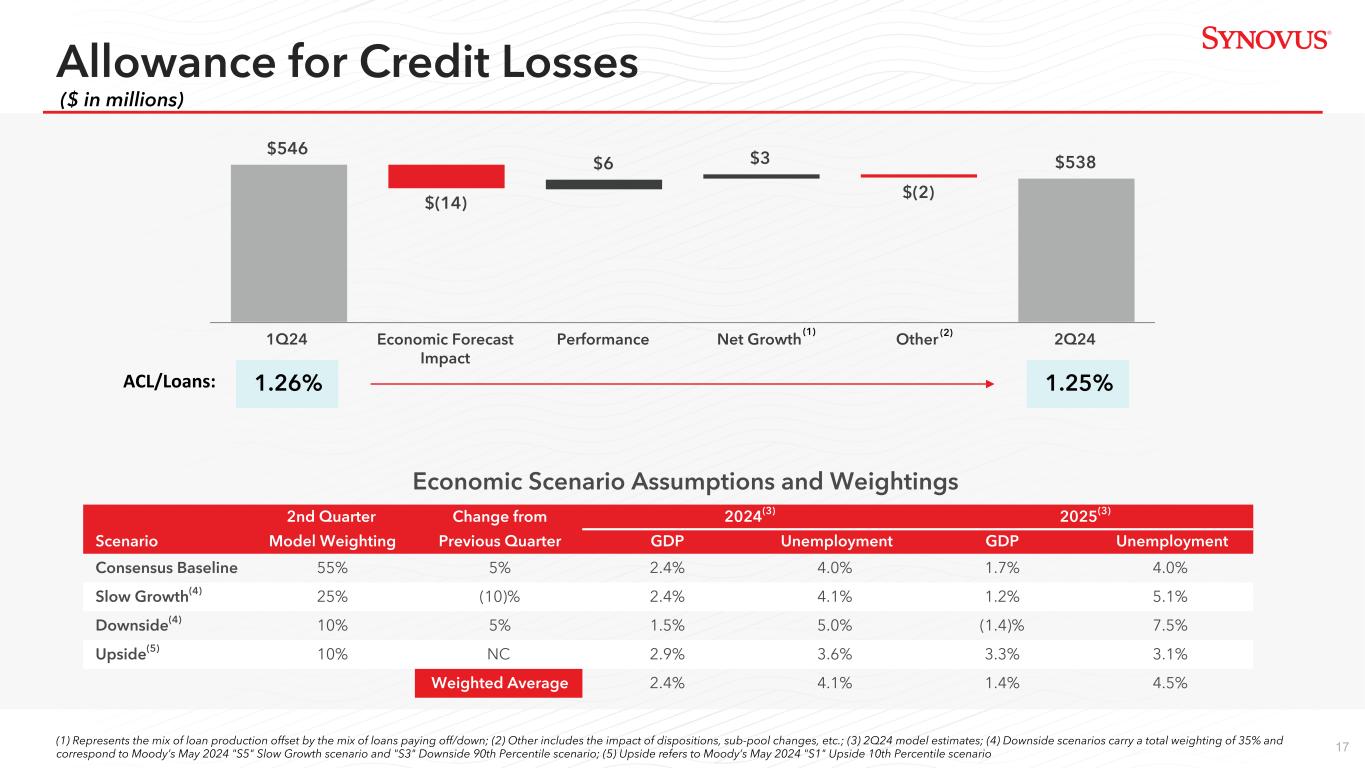

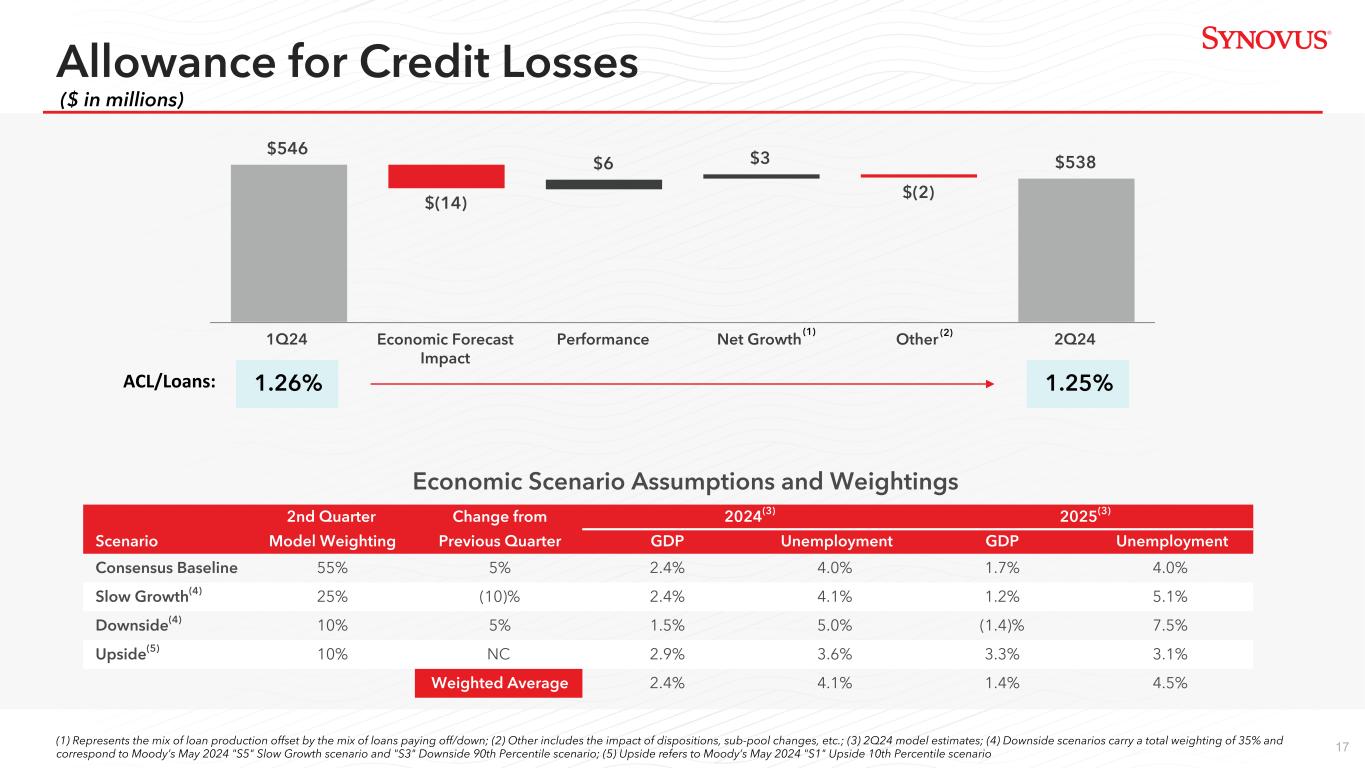

17 Allowance for Credit Losses ACL/Loans: 1.26% 1.25% (1) Represents the mix of loan production offset by the mix of loans paying off/down; (2) Other includes the impact of dispositions, sub-pool changes, etc.; (3) 2Q24 model estimates; (4) Downside scenarios carry a total weighting of 35% and correspond to Moody’s May 2024 "S5" Slow Growth scenario and "S3" Downside 90th Percentile scenario; (5) Upside refers to Moody’s May 2024 "S1" Upside 10th Percentile scenario Economic Scenario Assumptions and Weightings 2nd Quarter Change from 2024(3) 2025(3) Scenario Model Weighting Previous Quarter GDP Unemployment GDP Unemployment Consensus Baseline 55% 5% 2.4% 4.0% 1.7% 4.0% Slow Growth(4) 25% (10)% 2.4% 4.1% 1.2% 5.1% Downside(4) 10% 5% 1.5% 5.0% (1.4)% 7.5% Upside(5) 10% NC 2.9% 3.6% 3.3% 3.1% Weighted Average 2.4% 4.1% 1.4% 4.5% $546 $(14) $6 $3 $(2) $538 1Q24 Economic Forecast Impact Performance Net Growth Other 2Q24 (2) ($ in millions) (1)

18 Consumer Portfolio $8.3 billion CRE Portfolio $12.2 billion C&I Portfolio $22.5 billion 2Q24 Portfolio Characteristics C&I CRE Consumer NPL Ratio 0.76% 0.13% 0.83% QTD Net Charge-off Ratio (annualized) 0.53% (0.01)% 0.24% 30+ Days Past Due Ratio 0.08% 0.67% 0.37% 90+ Days Past Due Ratio 0.01% 0.00% 0.02% Amounts may not total due to rounding; (1) Industry-focused C&I is comprised of senior housing, structured lending (primarily lender finance), insurance premium finance, CIB, restaurant finance, and public funds portfolios; (2) LTV is calculated by dividing the most recent appraisal value (typically at origination) by the sum of the 6/30/2024 commitment amount and any existing senior lien Loan Portfolio by Category 27% 21% 4% 10% 6% 4% 4% 3% 1% 17% 3% Market-Based C&I Industry-Focused C&I Other C&I Multi-Family Other CRE Hotel Office Retail Residential C&D & Land Consumer Real Estate Consumer Non-Real Estate Highly Diverse Loan Mix (1) • C&I portfolio is well-diversified among multiple lines-of-business • Diverse C&I industry mix aligned with economic and demographic drivers • SNCs total $5.0 billion, ~$500 million of which is agented by SNV • 93% are income-producing properties • Diversity among property types and geographies • 30+ Days Past Due Ratio includes 0.30% attributable to one office loan that is no longer 30+ days past due as of July 17 • Weighted average credit score of 796 and 782 for Home Equity and Mortgage, respectively • Weighted average LTV of 72.9% and 70.8% for Home Equity and Mortgage, respectively(2)

19 Credit Indicator 2Q24 NPL Ratio 0.76% Net Charge-off Ratio (annualized) 0.53% 30+ Days Past Due Ratio 0.08% 90+ Days Past Due Ratio 0.01% • Finance/Insurance predominantly represented by secured lender finance portfolio ◦ 0.00% NPL Ratio ◦ (0.01)% Net Charge-Off Ratio (annualized) ◦ 0.00% 30+ Day Past Due Ratio • Senior Housing consists of 90% private pay assisted living/ independent living facilities Diverse Industry Exposure Total C&I Portfolio $22.5 billion 20.0% 13.4% 7.0% 6.5% 5.8% 5.4% 5.2% 5.1% 4.6% 4.2% 4.0% 3.9% 3.6% 3.1% 2.3% 2.1% 1.9% 1.0% 0.9% Finance/Insurance Senior Housing Accom. & Food Svcs. Health Care Manufacturing Lessors of R/E Wholesale Trade Retail Trade Construction Transport/Warehousing Other Services Prof., Scientific, Tech. Svcs. Other R/E and Rental & Leasing All Other Arts, Entertainment, & Rec. Public Administration Educational Svcs. Admin., Support, Waste Mgmt. Ag, Forestry, Fishing Amounts may not total due to rounding; (1) These segments are not two digit NAICS industry divisions; Senior Housing is a subset of NAICS 62 Health Care and Social Assistance, and R/E other and R/E leasing together comprise NAICS 53 Real Estate, Rental, and Leasing (1) (1) (1) C&I Loan Portfolio

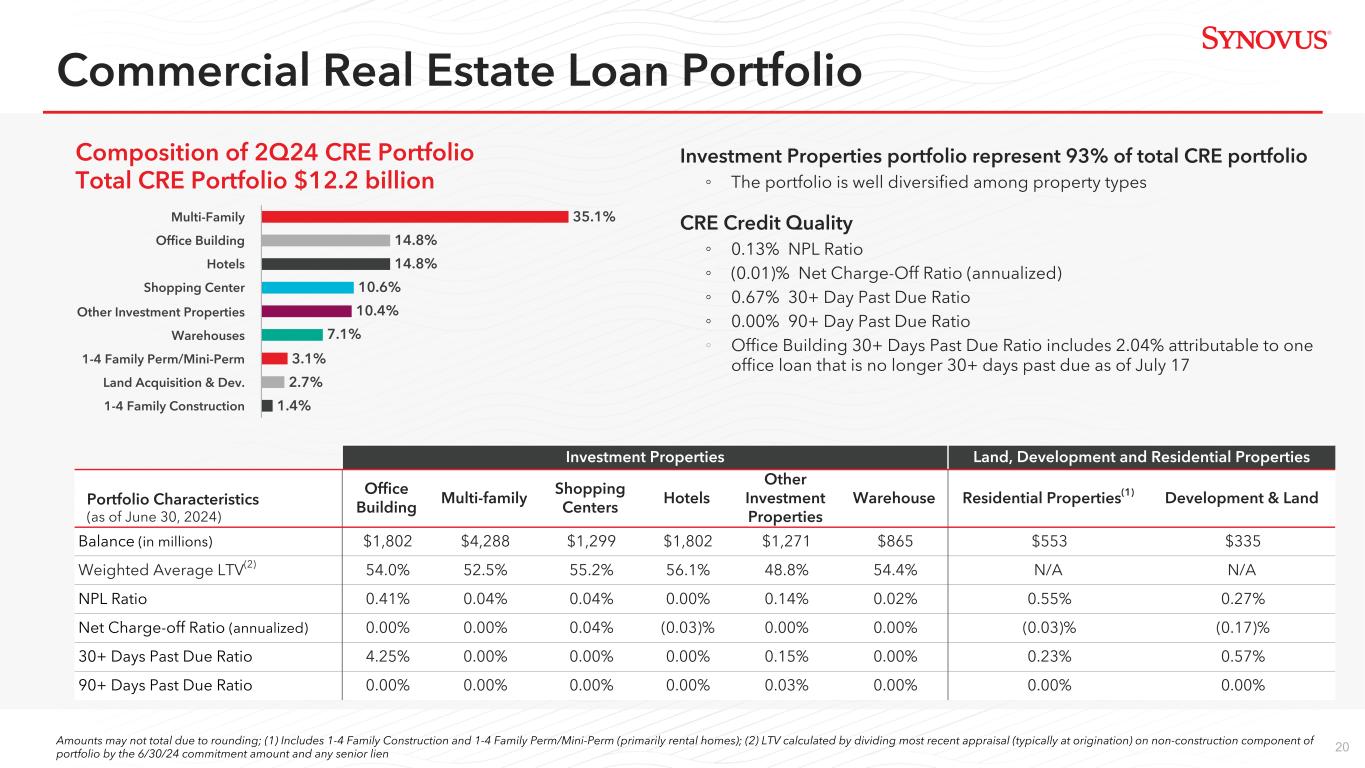

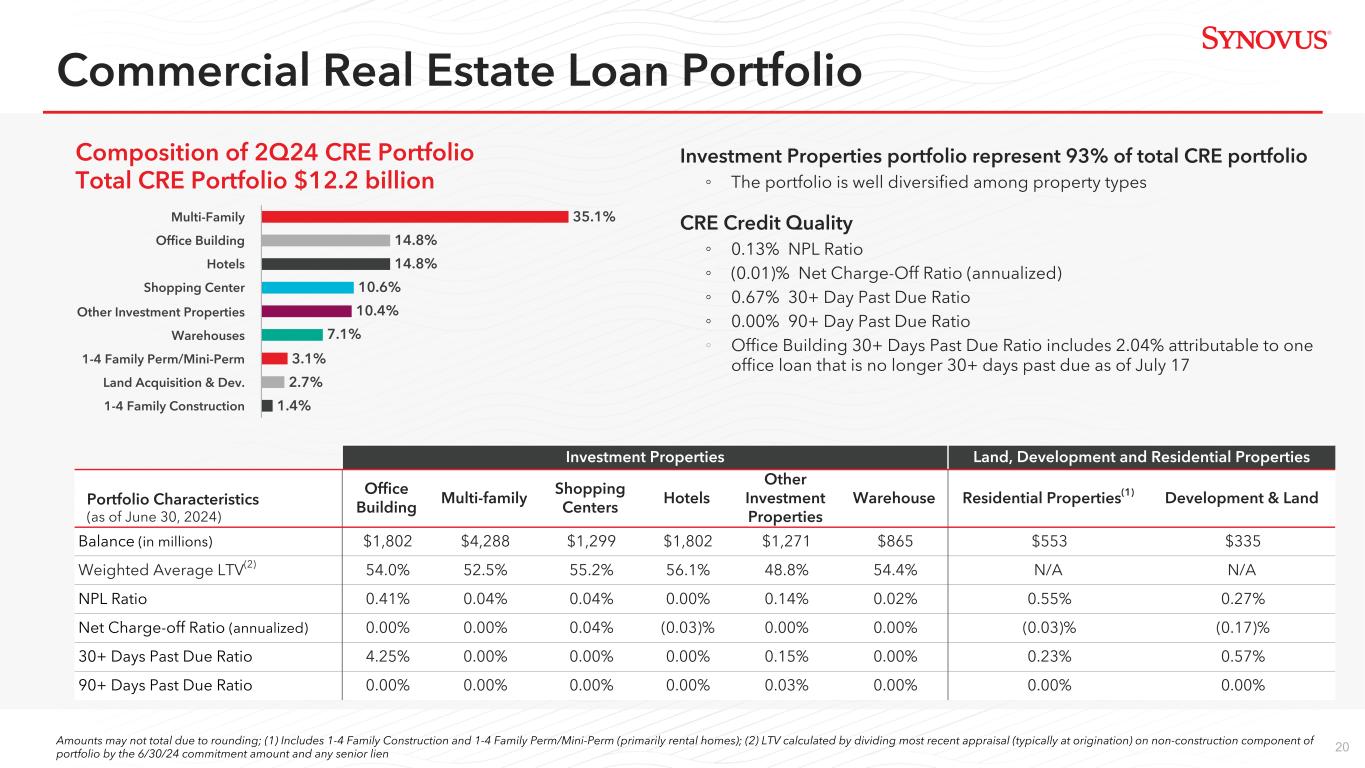

20 Commercial Real Estate Loan Portfolio Composition of 2Q24 CRE Portfolio Total CRE Portfolio $12.2 billion Investment Properties Land, Development and Residential Properties Portfolio Characteristics (as of June 30, 2024) Office Building Multi-family Shopping Centers Hotels Other Investment Properties Warehouse Residential Properties(1) Development & Land Balance (in millions) $1,802 $4,288 $1,299 $1,802 $1,271 $865 $553 $335 Weighted Average LTV(2) 54.0% 52.5% 55.2% 56.1% 48.8% 54.4% N/A N/A NPL Ratio 0.41% 0.04% 0.04% 0.00% 0.14% 0.02% 0.55% 0.27% Net Charge-off Ratio (annualized) 0.00% 0.00% 0.04% (0.03)% 0.00% 0.00% (0.03)% (0.17)% 30+ Days Past Due Ratio 4.25% 0.00% 0.00% 0.00% 0.15% 0.00% 0.23% 0.57% 90+ Days Past Due Ratio 0.00% 0.00% 0.00% 0.00% 0.03% 0.00% 0.00% 0.00% Investment Properties portfolio represent 93% of total CRE portfolio ◦ The portfolio is well diversified among property types CRE Credit Quality ◦ 0.13% NPL Ratio ◦ (0.01)% Net Charge-Off Ratio (annualized) ◦ 0.67% 30+ Day Past Due Ratio ◦ 0.00% 90+ Day Past Due Ratio ◦ Office Building 30+ Days Past Due Ratio includes 2.04% attributable to one office loan that is no longer 30+ days past due as of July 17 Amounts may not total due to rounding; (1) Includes 1-4 Family Construction and 1-4 Family Perm/Mini-Perm (primarily rental homes); (2) LTV calculated by dividing most recent appraisal (typically at origination) on non-construction component of portfolio by the 6/30/24 commitment amount and any senior lien 35.1% 14.8% 14.8% 10.6% 10.4% 7.1% 3.1% 2.7% 1.4% Multi-Family Office Building Hotels Shopping Center Other Investment Properties Warehouses 1-4 Family Perm/Mini-Perm Land Acquisition & Dev. 1-4 Family Construction

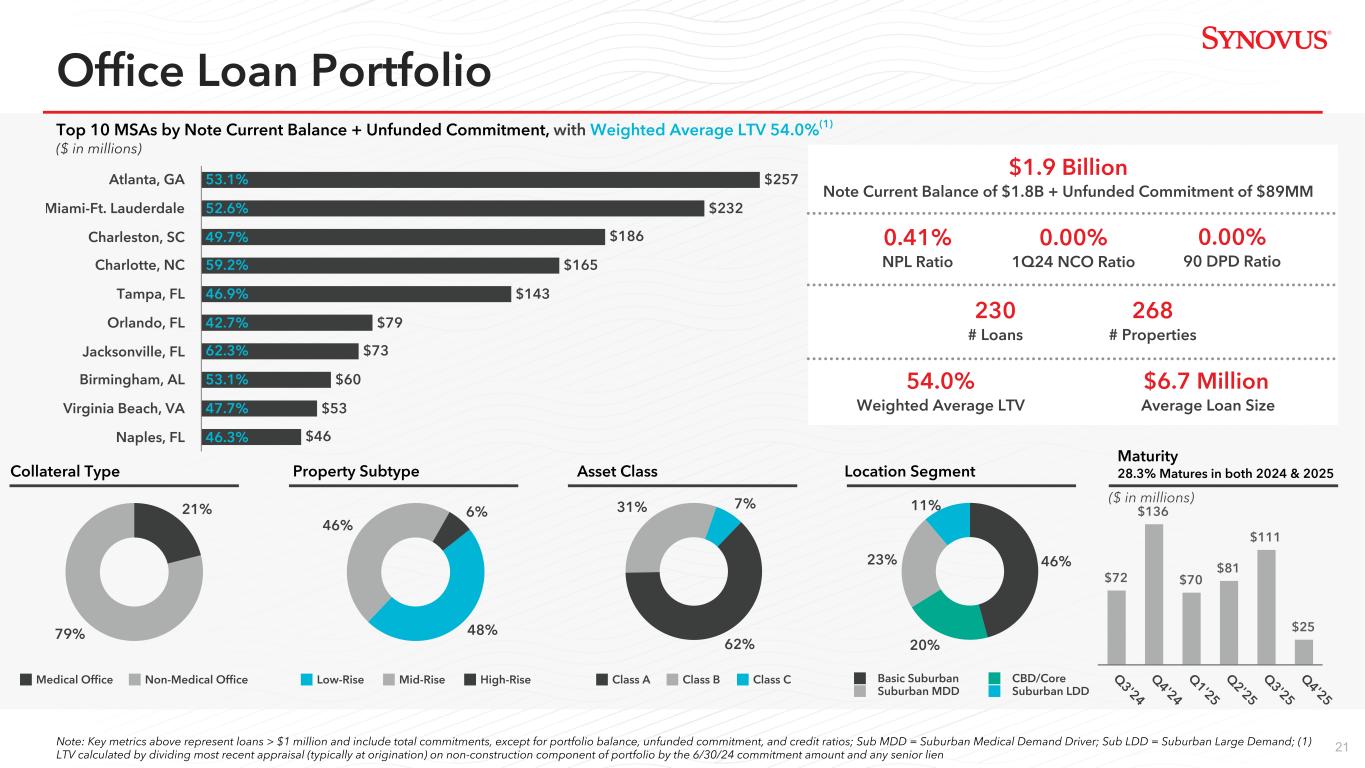

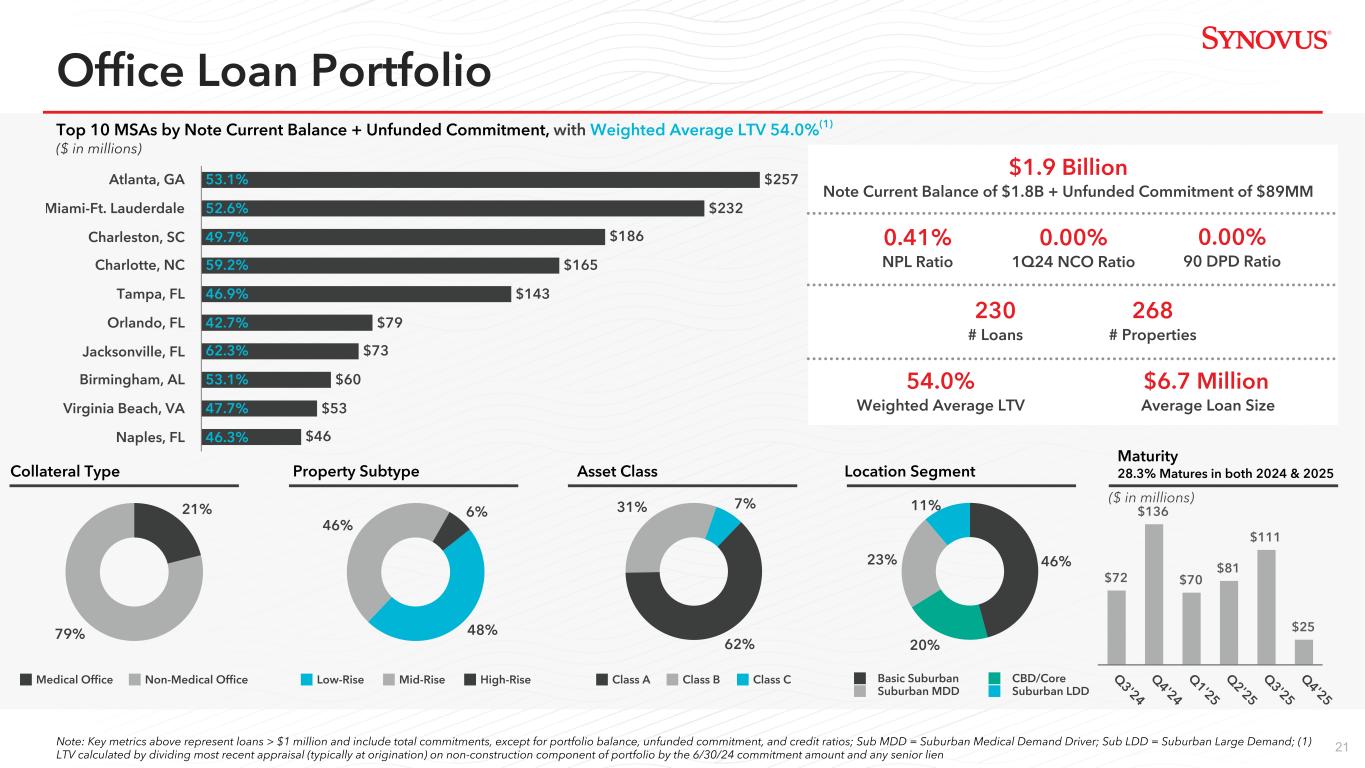

21 46% 20% 23% 11% Basic Suburban CBD/Core Suburban MDD Suburban LDD $257 $232 $186 $165 $143 $79 $73 $60 $53 $46 Atlanta, GA Miami-Ft. Lauderdale Charleston, SC Charlotte, NC Tampa, FL Orlando, FL Jacksonville, FL Birmingham, AL Virginia Beach, VA Naples, FL 62% 31% 7% Class A Class B Class C 48% 46% 6% Low-Rise Mid-Rise High-Rise 21% 79% Medical Office Non-Medical Office Collateral Type Property Subtype Asset Class Location Segment $72 $136 $70 $81 $111 $25 Q3'24 Q4'24 Q1'25 Q2'25 Q3'25 Q4'25 Top 10 MSAs by Note Current Balance + Unfunded Commitment, with Weighted Average LTV 54.0%(1) ($ in millions) $1.9 Billion Note Current Balance of $1.8B + Unfunded Commitment of $89MM 0.41% NPL Ratio 0.00% 1Q24 NCO Ratio 54.0% Weighted Average LTV 0.00% 90 DPD Ratio Office Loan Portfolio 230 # Loans 268 # Properties Note: Key metrics above represent loans > $1 million and include total commitments, except for portfolio balance, unfunded commitment, and credit ratios; Sub MDD = Suburban Medical Demand Driver; Sub LDD = Suburban Large Demand; (1) LTV calculated by dividing most recent appraisal (typically at origination) on non-construction component of portfolio by the 6/30/24 commitment amount and any senior lien ($ in millions) 53.1% 52.6% 49.7% 59.2% 46.9% 42.7% 62.3% 53.1% 47.7% 46.3% Maturity 28.3% Matures in both 2024 & 2025 $6.7 Million Average Loan Size

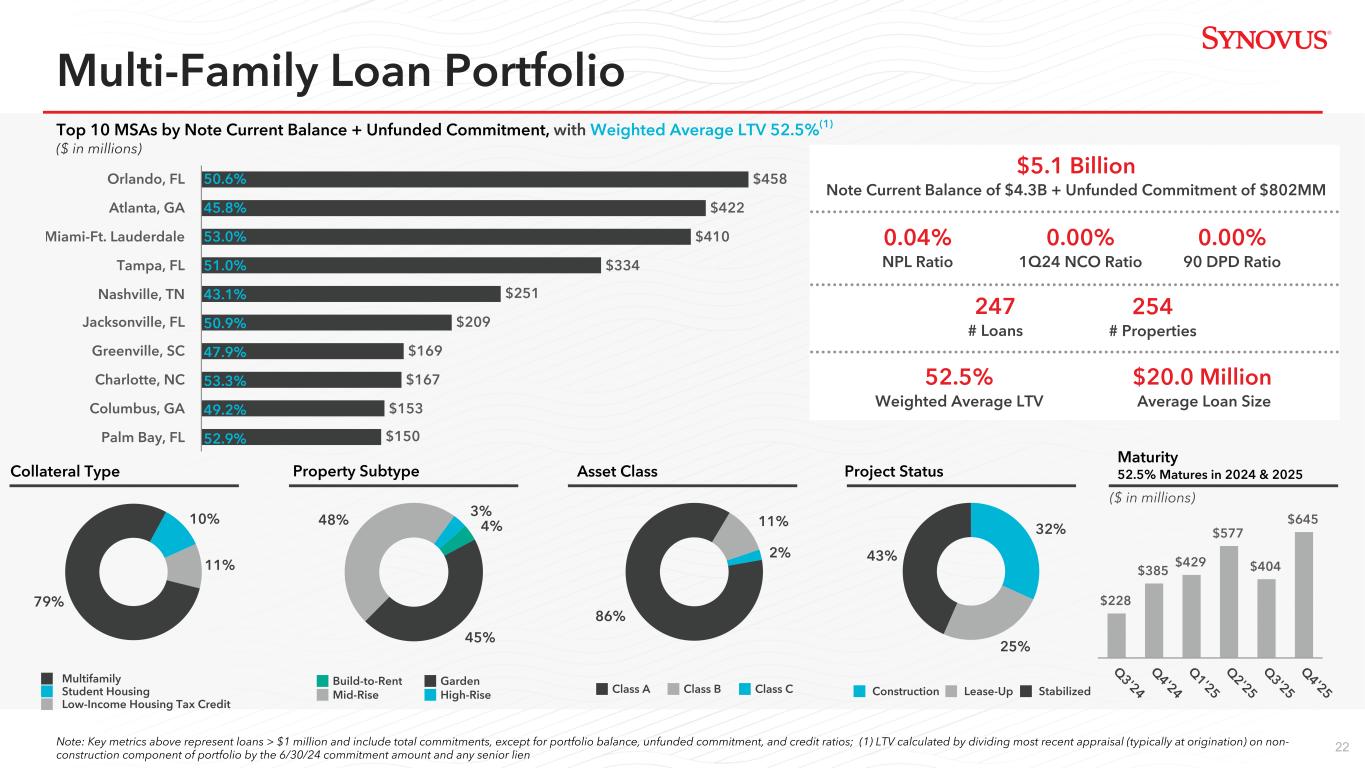

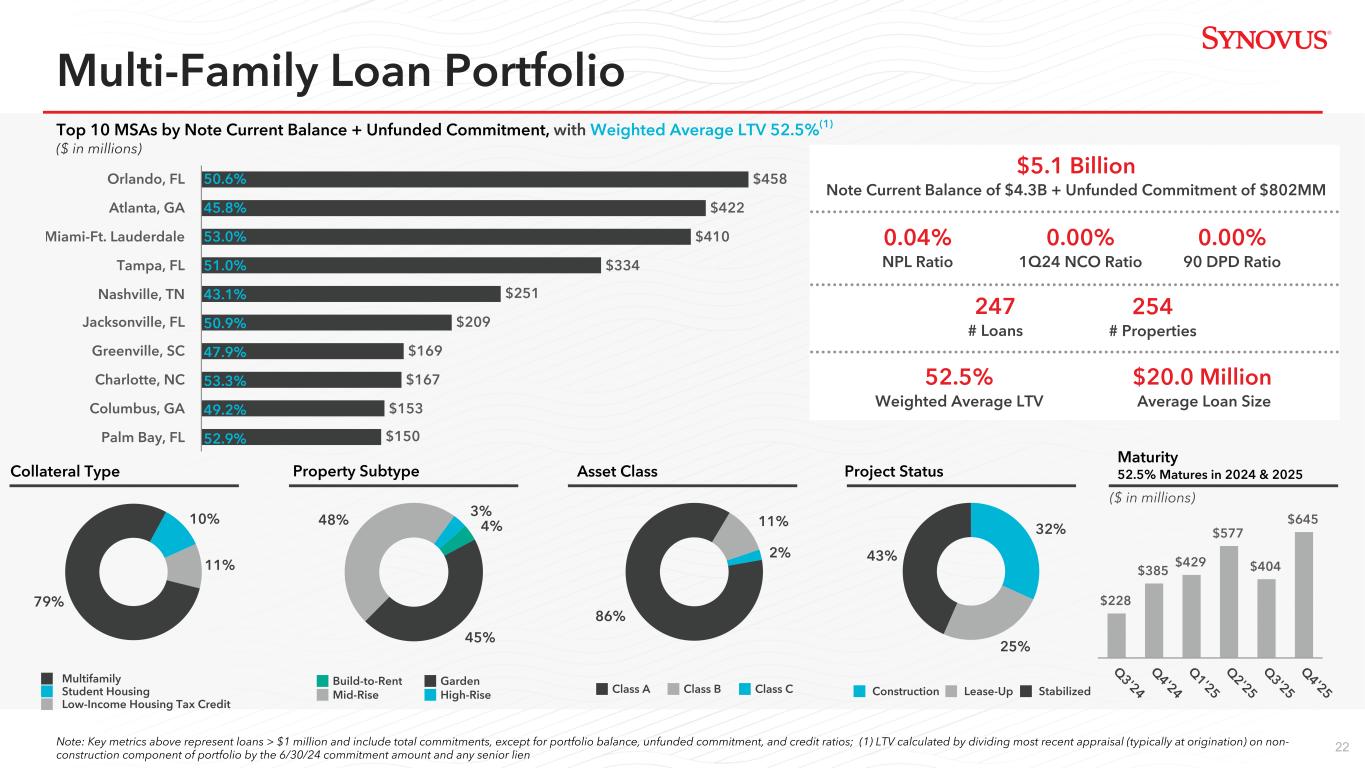

22 32% 25% 43% Construction Lease-Up Stabilized $458 $422 $410 $334 $251 $209 $169 $167 $153 $150 Orlando, FL Atlanta, GA Miami-Ft. Lauderdale Tampa, FL Nashville, TN Jacksonville, FL Greenville, SC Charlotte, NC Columbus, GA Palm Bay, FL 86% 11% 2% Class A Class B Class C 4% 45% 48% 3% Build-to-Rent Garden Mid-Rise High-Rise 79% 10% 11% Multifamily Student Housing Low-Income Housing Tax Credit Collateral Type Property Subtype Asset Class Project Status Maturity 52.5% Matures in 2024 & 2025 $228 $385 $429 $577 $404 $645 Q3'24 Q4'24 Q1'25 Q2'25 Q3'25 Q4'25 Multi-Family Loan Portfolio Top 10 MSAs by Note Current Balance + Unfunded Commitment, with Weighted Average LTV 52.5%(1) ($ in millions) Note: Key metrics above represent loans > $1 million and include total commitments, except for portfolio balance, unfunded commitment, and credit ratios; (1) LTV calculated by dividing most recent appraisal (typically at origination) on non- construction component of portfolio by the 6/30/24 commitment amount and any senior lien ($ in millions) 50.6% 45.8% 53.0% 51.0% 43.1% 50.9% 47.9% 53.3% 49.2% 52.9% $5.1 Billion Note Current Balance of $4.3B + Unfunded Commitment of $802MM 0.04% NPL Ratio 0.00% 1Q24 NCO Ratio 0.00% 90 DPD Ratio 247 # Loans 254 # Properties 52.5% Weighted Average LTV $20.0 Million Average Loan Size

23 Credit Indicator 2Q24 NPL Ratio 0.83% Net Charge-off Ratio (annualized) 0.24% 30+ Days Past Due Ratio 0.37% 90+ Days Past Due Ratio 0.02% Total Consumer Portfolio $8.3 billion Credit Indicator Home Equity Mortgage Weighted Average Credit Score of 2Q24 Originations 795 769 Weighted Average Credit Score of Total Portfolio 796 782 Weighted Average LTV(1) 72.9% 70.8% Average DTI(2) 33.7% 30.9% Utilization Rate 38.1% N/A 64.4% 21.7% 7.6% 4.1% 2.1% Consumer Mortgage Home Equity Third-Party HFI Other Consumer Credit Card Amounts may not total due to rounding; (1) LTV is calculated by dividing the most recent appraisal value (typically at origination) by the sum of the 6/30/2024 commitment amount and any existing senior lien; (2) Average DTI of 2Q24 originations Consumer Credit Quality • ~86% of Consumer portfolio is backed by residential real estate • Other Consumer includes secured and unsecured products • Average consumer card utilization rate is 22.3% • Third party HFI portfolio $641 million Consumer Loan Portfolio

24 Risk Distribution ($ in millions) Composition Change Risk Category 2Q24 1Q24 2Q24 vs. 1Q24 Passing Grades $41,504 $41,676 $(172) Special Mention 639 653 $(14) Substandard Accruing 695 631 $64 Non-Performing Loans 256 350 $(94) Total Loans $43,093 $43,310 $(217) Amounts may not total due to rounding $1,222 $1,028 $1,032 $914 $929 $942 $1,086 $1,333 $1,484 $1,527 $1,634 $1,590 3.2% 2.6% 2.6% 2.2% 2.2% 2.2% 2.5% 3.0% 3.4% 3.5% 3.8% 3.7% Criticized and Classified Loans % of Total Loans 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 Portfolio Risk DistributionCriticized & Classified Loans

25 $4,100 $3,350 $3,350 $3,350 $2,850 $2,600 $2,100 $2,100 $250 $500 $500 $500 $500 $500 2.37% 2.68% 2.78% 2.98% 3.16% 3.38% 3.60% 3.60% Notional Forward Starting Effective Rate 3Q24 4Q24 1Q25 2Q25 3Q25 4Q25 1Q26 2Q26 63% 62% 62% 62% 62% 37% 38% 38% 38% 38% 6.17% 6.34% 6.45% 6.49% 6.59% Floating Rate Fixed Rate Yield 2Q23 3Q23 4Q23 1Q24 2Q24 Note: Amounts may not total due to rounding; (1) Represents projected notional outstanding for effective cash-flow loan hedges, along with the estimated effective fixed-rate for the respective period; (2) NII sensitivity estimates reflect a dynamic balance sheet; beta sensitivity estimates represent approximations, based on total deposit cost betas Derivative Hedge Portfolio(1)Loan Portfolio Rate Mix and Yield Earning Assets Composition ($ in millions) 12-Month Net Interest Income Sensitivity: Rates & Betas(2) Parallel Shock % NII Impact +100bps 1.4% -100bps (1.5)% +100 Shock % NII Impact ~35 Beta 4.2% ~45 Beta 1.4% ~55 Beta (1.3)%

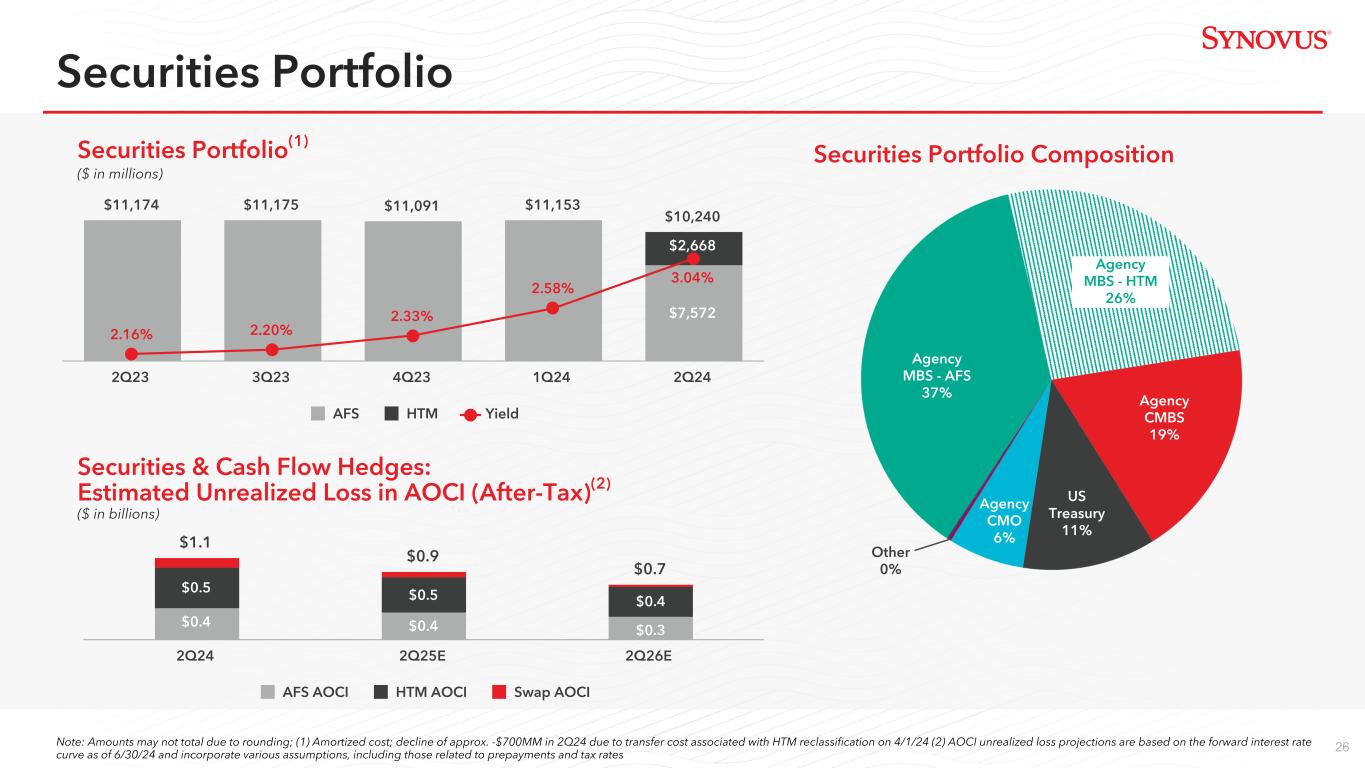

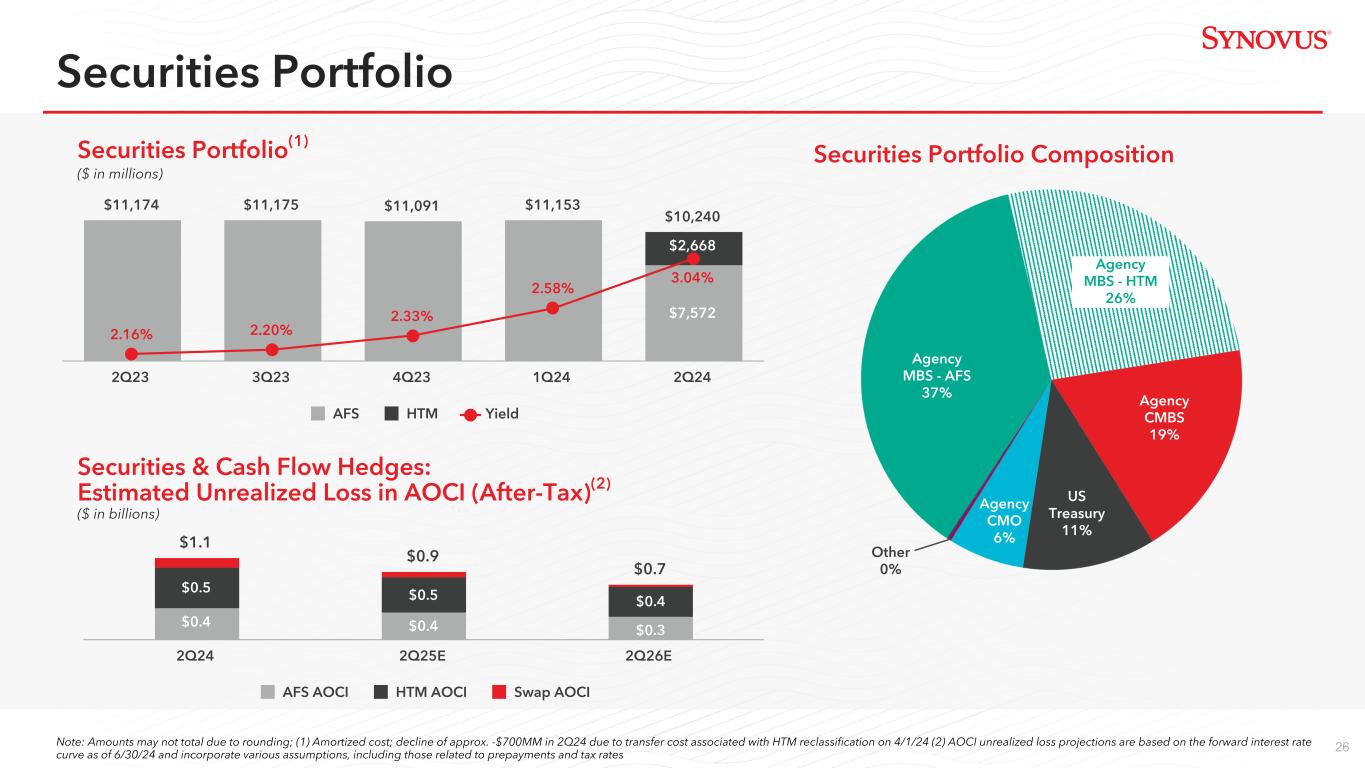

26 Securities Portfolio $11,174 $11,175 $11,091 $11,153 $10,240 $7,572 $2,668 2.16% 2.20% 2.33% 2.58% 3.04% AFS HTM Yield 2Q23 3Q23 4Q23 1Q24 2Q24 Securities Portfolio(1) ($ in millions) Securities & Cash Flow Hedges: Estimated Unrealized Loss in AOCI (After-Tax)(2) ($ in billions) $1.1 $0.9 $0.7 $0.4 $0.4 $0.3 $0.5 $0.5 $0.4 AFS AOCI HTM AOCI Swap AOCI 2Q24 2Q25E 2Q26E Note: Amounts may not total due to rounding; (1) Amortized cost; decline of approx. -$700MM in 2Q24 due to transfer cost associated with HTM reclassification on 4/1/24 (2) AOCI unrealized loss projections are based on the forward interest rate curve as of 6/30/24 and incorporate various assumptions, including those related to prepayments and tax rates Securities Portfolio Composition Agency MBS - AFS 37% Agency CMO 6% Agency CMBS 19% US Treasury 11% Other 0% Agency MBS - HTM 26%

27 Impact Securities Repositioning $1.6B of MBS (book value) Realized Loss: $257MM Book Yield: 1.4% Average Risk Weighting: 20% $1.5B of Treasuries, MBS, CMBS Book Yield: 5.0% Average Risk Weighting: 6% 5-year Payback Period Repositioning of AFS Securities in 2Q24 2Q24 NII Benefit: ~$6MM Annualized Benefit: ~$48MM Improved Risk Profile Reduced Risk Weight Securities Purchased Securities Sold

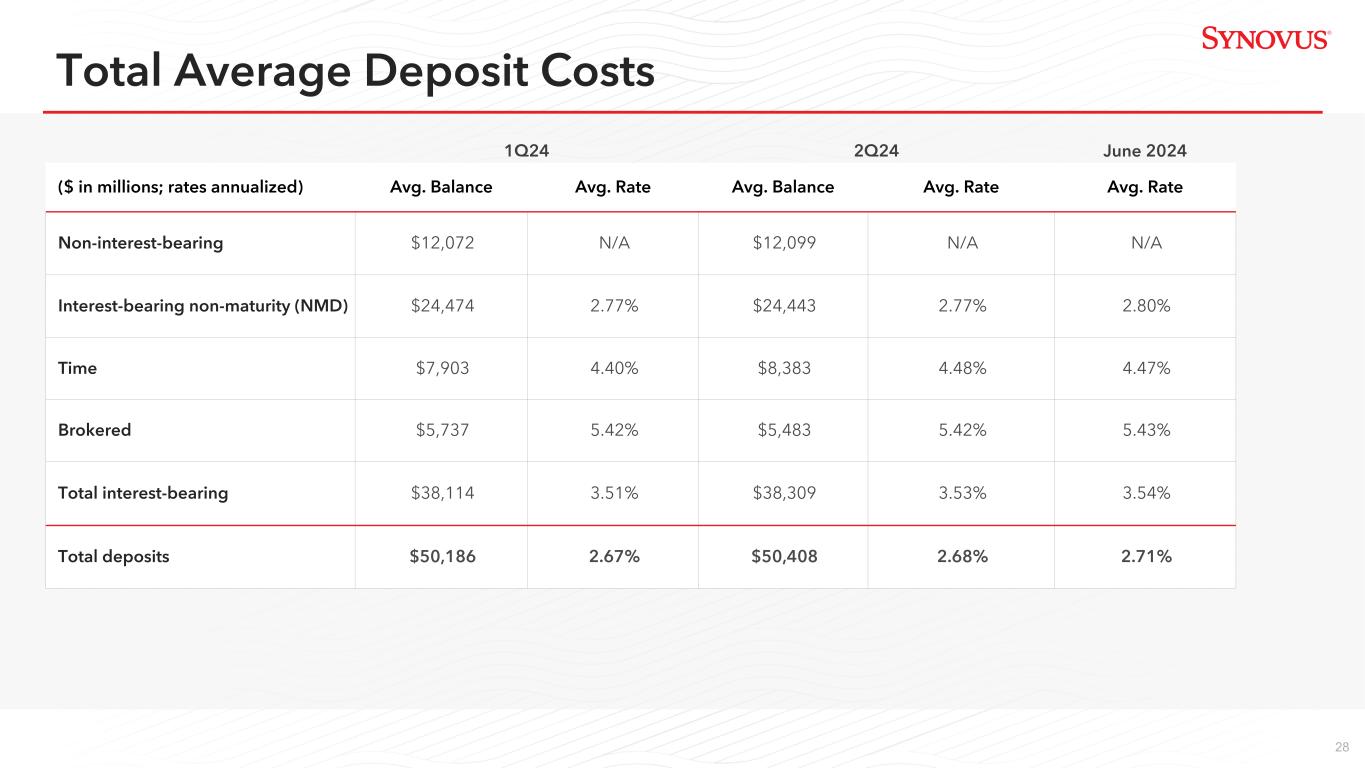

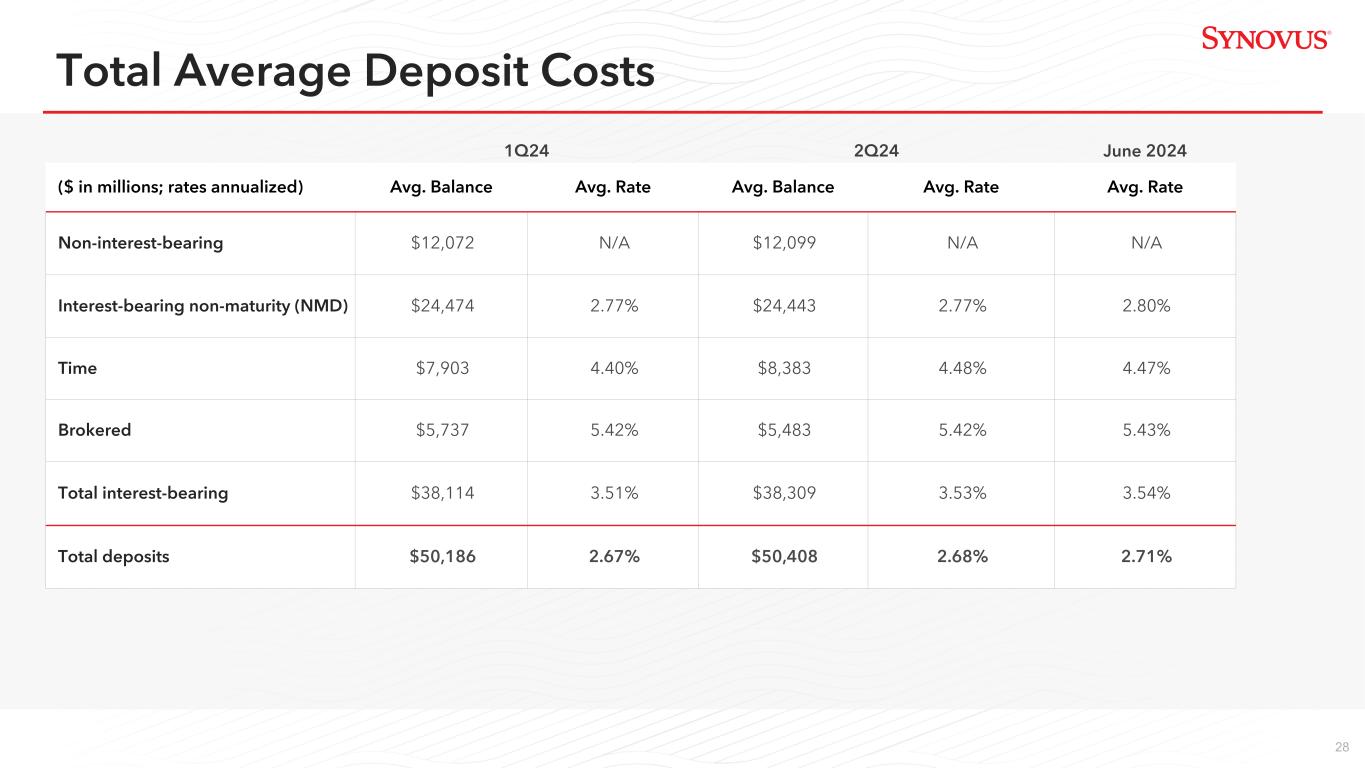

28 1Q24 2Q24 June 2024 ($ in millions; rates annualized) Avg. Balance Avg. Rate Avg. Balance Avg. Rate Avg. Rate Non-interest-bearing $12,072 N/A $12,099 N/A N/A Interest-bearing non-maturity (NMD) $24,474 2.77% $24,443 2.77% 2.80% Time $7,903 4.40% $8,383 4.48% 4.47% Brokered $5,737 5.42% $5,483 5.42% 5.43% Total interest-bearing $38,114 3.51% $38,309 3.53% 3.54% Total deposits $50,186 2.67% $50,408 2.68% 2.71% Total Average Deposit Costs

29 2Q23 3Q23 4Q23 1Q24 2Q24 Financial Performance Diluted EPS $1.13 $0.60 $0.41 $0.78 $(0.16) Net interest margin 3.20% 3.11% 3.11% 3.04% 3.20% Efficiency ratio-TE 53.99% 64.11% 72.03% 59.87% 98.15% Adjusted tangible efficiency ratio(1) 52.57% 55.01% 61.97% 58.88% 53.05% ROAA(2) 1.15% 0.64% 0.47% 0.85% (0.10)% Adjusted ROAA(1)(2) 1.18% 0.87% 0.84% 0.85% 1.21% Balance Sheet QoQ Growth Total loans 1% (2)% (1)% —% —% Total deposits —% —% 1% —% (1)% Credit Quality NPA ratio 0.59% 0.64% 0.66% 0.86% 0.60% NCO ratio(2) 0.24% 0.61% 0.38% 0.41% 0.32% Capital Common shares outstanding(3) 146,153 146,205 146,705 146,418 144,150 Leverage ratio 9.23% 9.38% 9.49% 9.62% 9.44% Tangible common equity ratio(1) 6.17% 5.90% 6.84% 6.67% 6.76% Amounts may not total due to rounding; (1) Non-GAAP financial measure; see applicable reconciliation; (2) Annualized; (3) In thousands; (4) Preliminary (4) Quarterly Highlights Trend

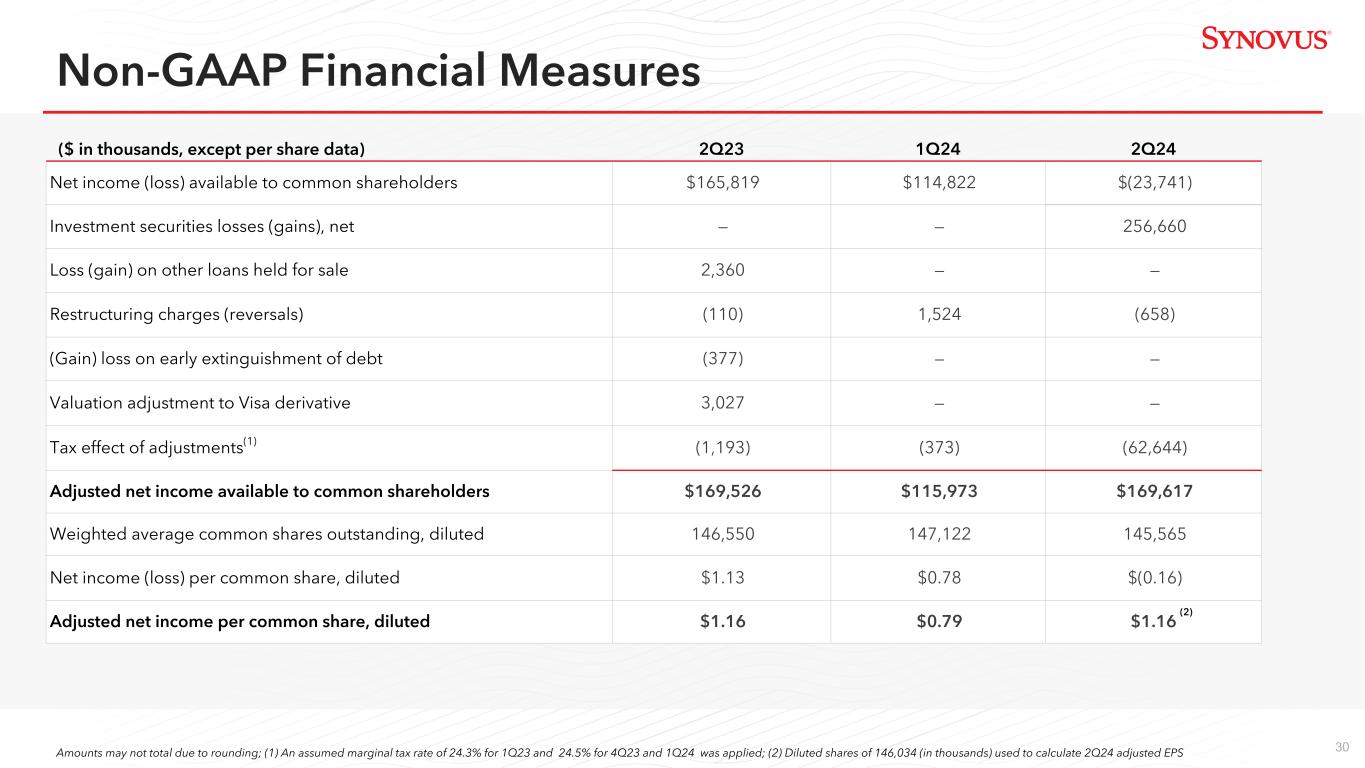

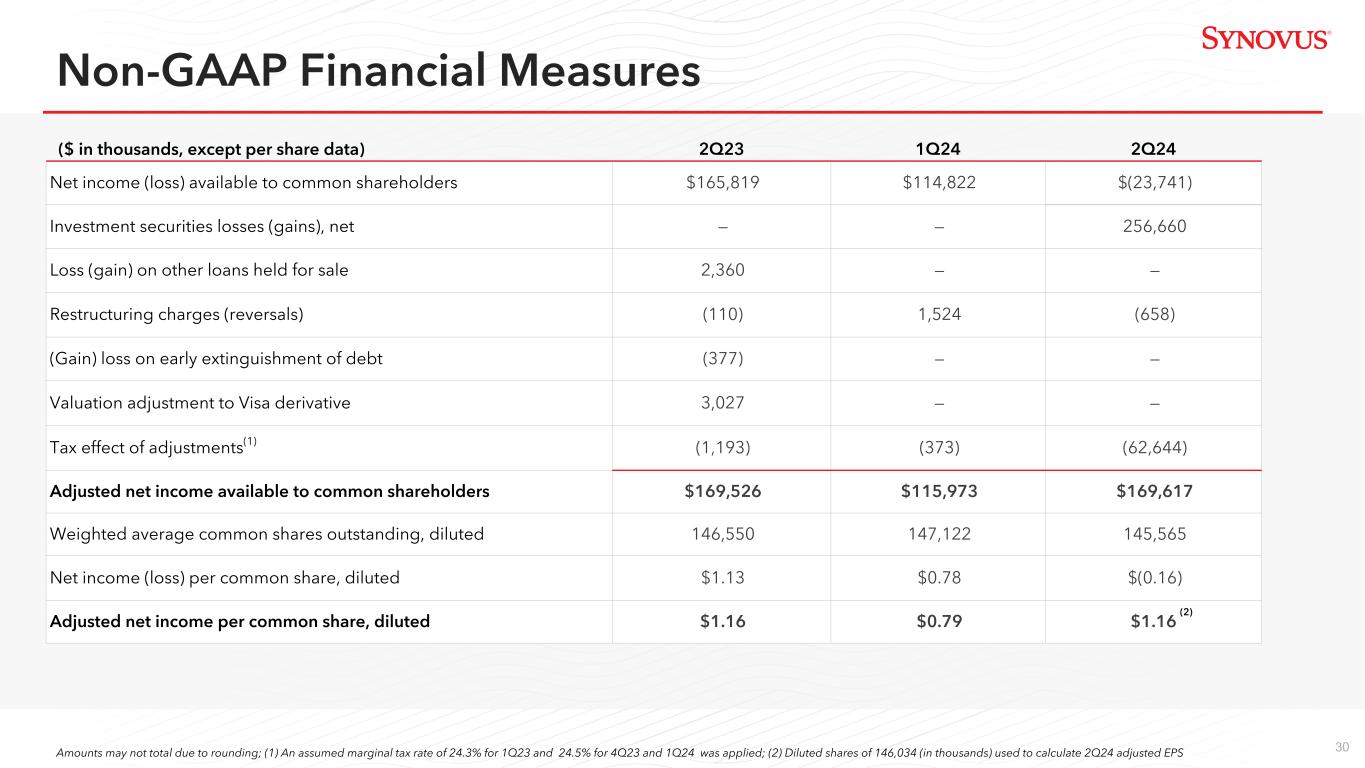

30 ($ in thousands, except per share data) 2Q23 1Q24 2Q24 Net income (loss) available to common shareholders $165,819 $114,822 $(23,741) Investment securities losses (gains), net — — 256,660 Loss (gain) on other loans held for sale 2,360 — — Restructuring charges (reversals) (110) 1,524 (658) (Gain) loss on early extinguishment of debt (377) — — Valuation adjustment to Visa derivative 3,027 — — Tax effect of adjustments(1) (1,193) (373) (62,644) Adjusted net income available to common shareholders $169,526 $115,973 $169,617 Weighted average common shares outstanding, diluted 146,550 147,122 145,565 Net income (loss) per common share, diluted $1.13 $0.78 $(0.16) Adjusted net income per common share, diluted $1.16 $0.79 $1.16 Amounts may not total due to rounding; (1) An assumed marginal tax rate of 24.3% for 1Q23 and 24.5% for 4Q23 and 1Q24 was applied; (2) Diluted shares of 146,034 (in thousands) used to calculate 2Q24 adjusted EPS Non-GAAP Financial Measures (2)

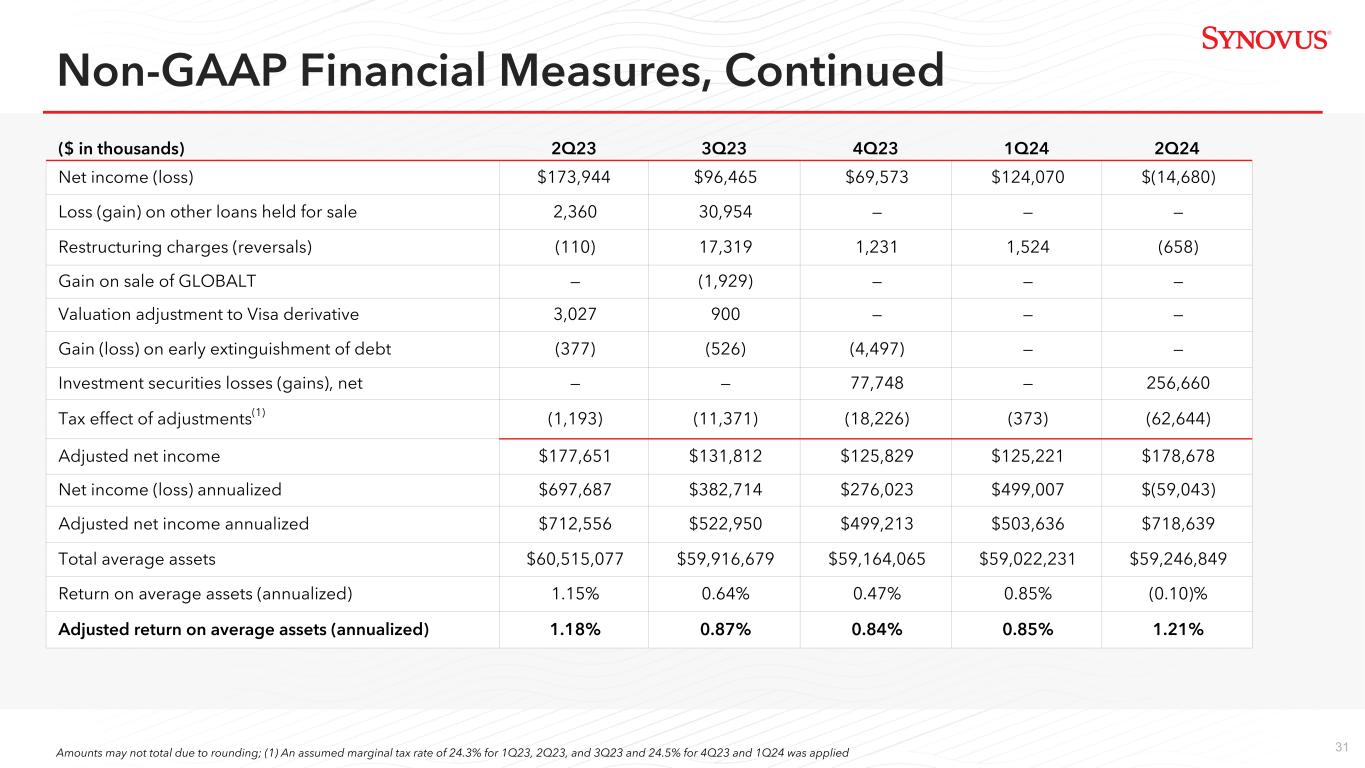

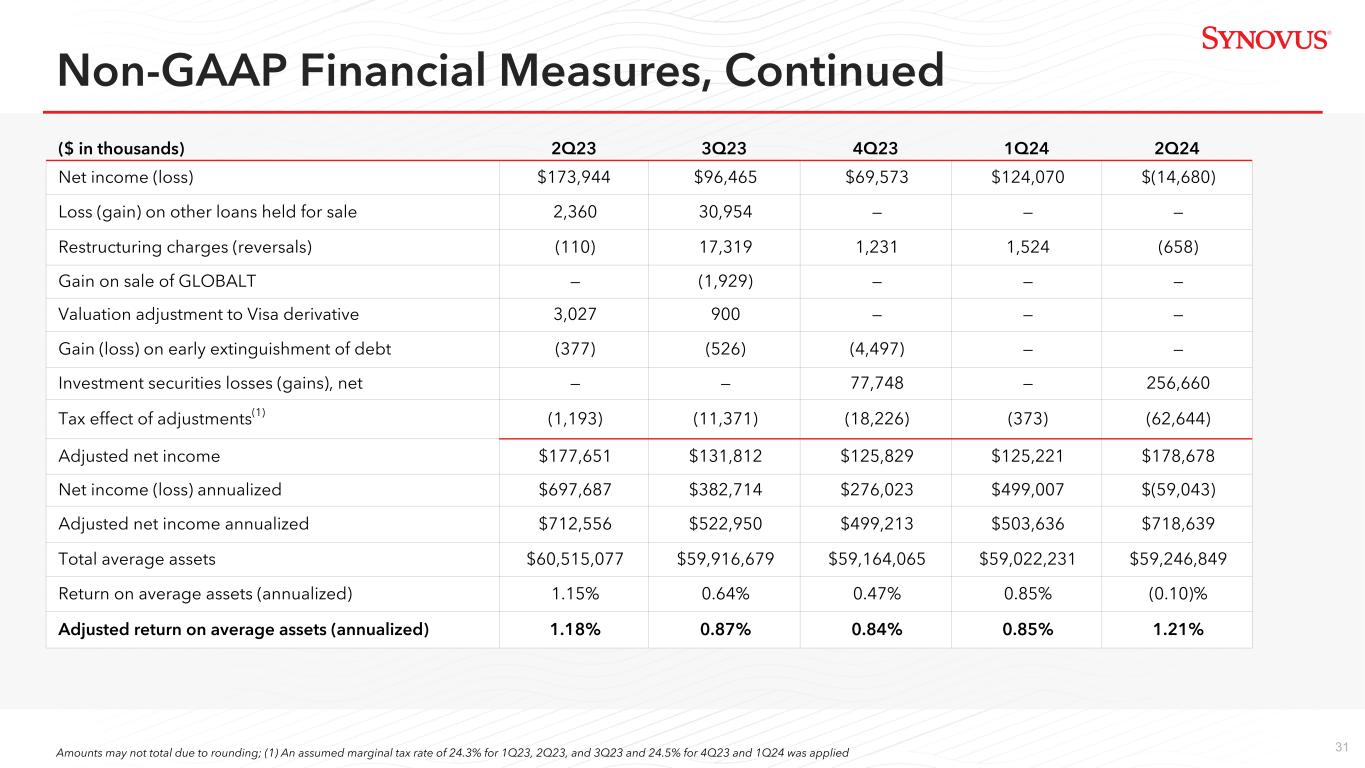

31 ($ in thousands) 2Q23 3Q23 4Q23 1Q24 2Q24 Net income (loss) $173,944 $96,465 $69,573 $124,070 $(14,680) Loss (gain) on other loans held for sale 2,360 30,954 — — — Restructuring charges (reversals) (110) 17,319 1,231 1,524 (658) Gain on sale of GLOBALT — (1,929) — — — Valuation adjustment to Visa derivative 3,027 900 — — — Gain (loss) on early extinguishment of debt (377) (526) (4,497) — — Investment securities losses (gains), net — — 77,748 — 256,660 Tax effect of adjustments(1) (1,193) (11,371) (18,226) (373) (62,644) Adjusted net income $177,651 $131,812 $125,829 $125,221 $178,678 Net income (loss) annualized $697,687 $382,714 $276,023 $499,007 $(59,043) Adjusted net income annualized $712,556 $522,950 $499,213 $503,636 $718,639 Total average assets $60,515,077 $59,916,679 $59,164,065 $59,022,231 $59,246,849 Return on average assets (annualized) 1.15% 0.64% 0.47% 0.85% (0.10)% Adjusted return on average assets (annualized) 1.18% 0.87% 0.84% 0.85% 1.21% Amounts may not total due to rounding; (1) An assumed marginal tax rate of 24.3% for 1Q23, 2Q23, and 3Q23 and 24.5% for 4Q23 and 1Q24 was applied Non-GAAP Financial Measures, Continued

32 ($ in thousands) 2Q23 1Q24 2Q24 Net income (loss) available to common shareholders $165,819 $114,822 $(23,741) Loss (gain) on other loans held for sale 2,360 — — Restructuring charges (reversals) (110) 1,524 (658) Valuation adjustment to Visa derivative 3,027 — — Gain (loss) on early extinguishment of debt (377) — — Investment securities losses (gains), net — — 256,660 Tax effect of adjustments(1) (1,193) (373) (62,644) Adjusted net income available to common shareholders $169,526 $115,973 $169,617 Adjusted net income available to common shareholders annualized $679,967 $466,441 $682,196 Amortization of intangibles, tax effected, annualized 7,344 8,831 8,831 Adjusted net income available to common shareholders excluding amortization of intangibles annualized $687,311 $475,272 $691,027 Net income (loss) available to common shareholders annualized $665,098 $461,812 $(95,486) Amortization of intangibles, tax effected, annualized 7,344 8,831 8,831 Net income (loss) available to common shareholders excluding amortization of intangibles annualized $672,442 $470,643 $(86,655) Total average Synovus Financial Corp. shareholders' equity less preferred stock $4,303,722 $4,542,616 $4,455,198 Average goodwill (460,118) (480,440) (480,902) Average other intangible assets, net (36,738) (44,497) (41,547) Total average Synovus Financial Corp. tangible shareholders' equity less preferred stock $3,806,866 $4,017,679 $3,932,749 Return on average common equity (annualized) 15.5% 10.2% (2.1)% Adjusted return on average common equity (annualized) 15.8% 10.3% 15.3% Return on average tangible common equity (annualized) 17.7% 11.7% (2.2)% Adjusted return on average tangible common equity (annualized) 18.1% 11.8% 17.6% Non-GAAP Financial Measures, Continued Amounts may not total due to rounding; (1) An assumed marginal tax rate of 24.3% for 1Q23 and 24.5% for 4Q23 and 1Q24 was applied

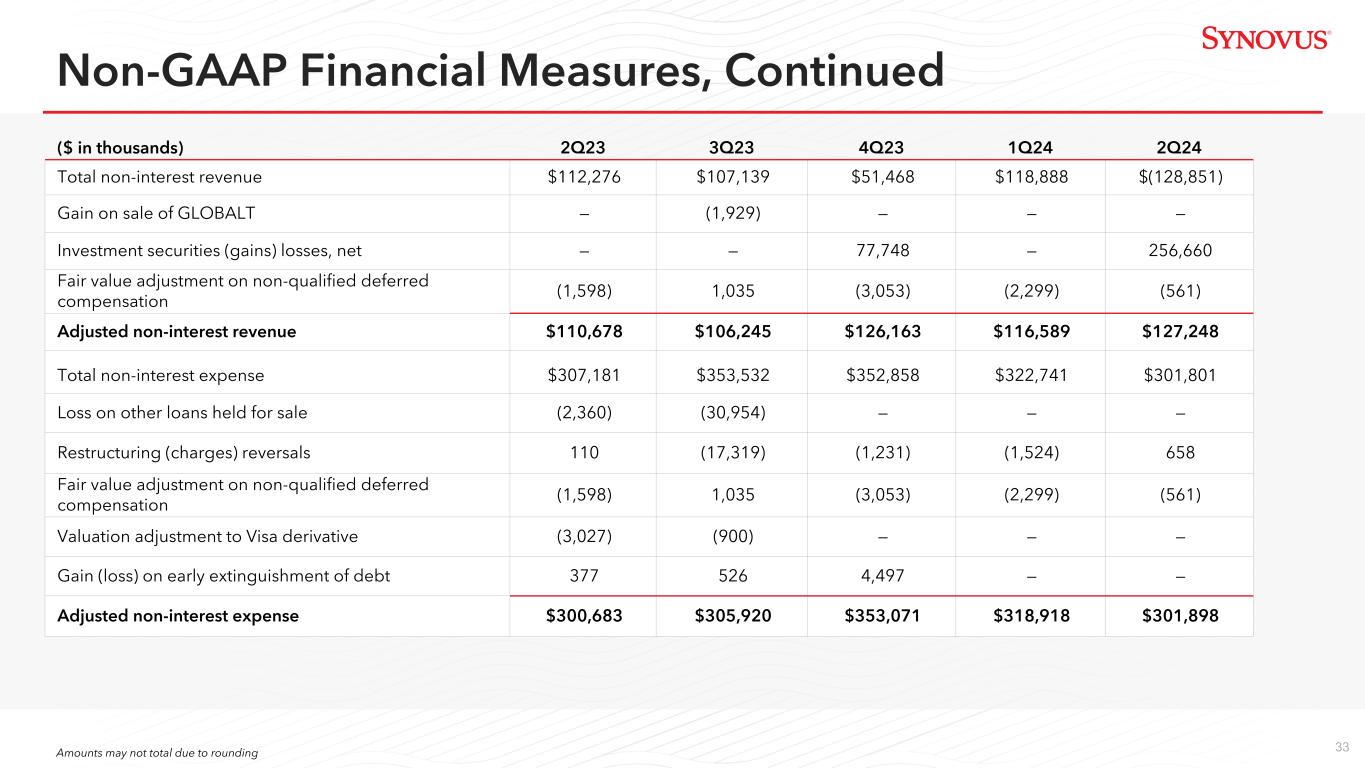

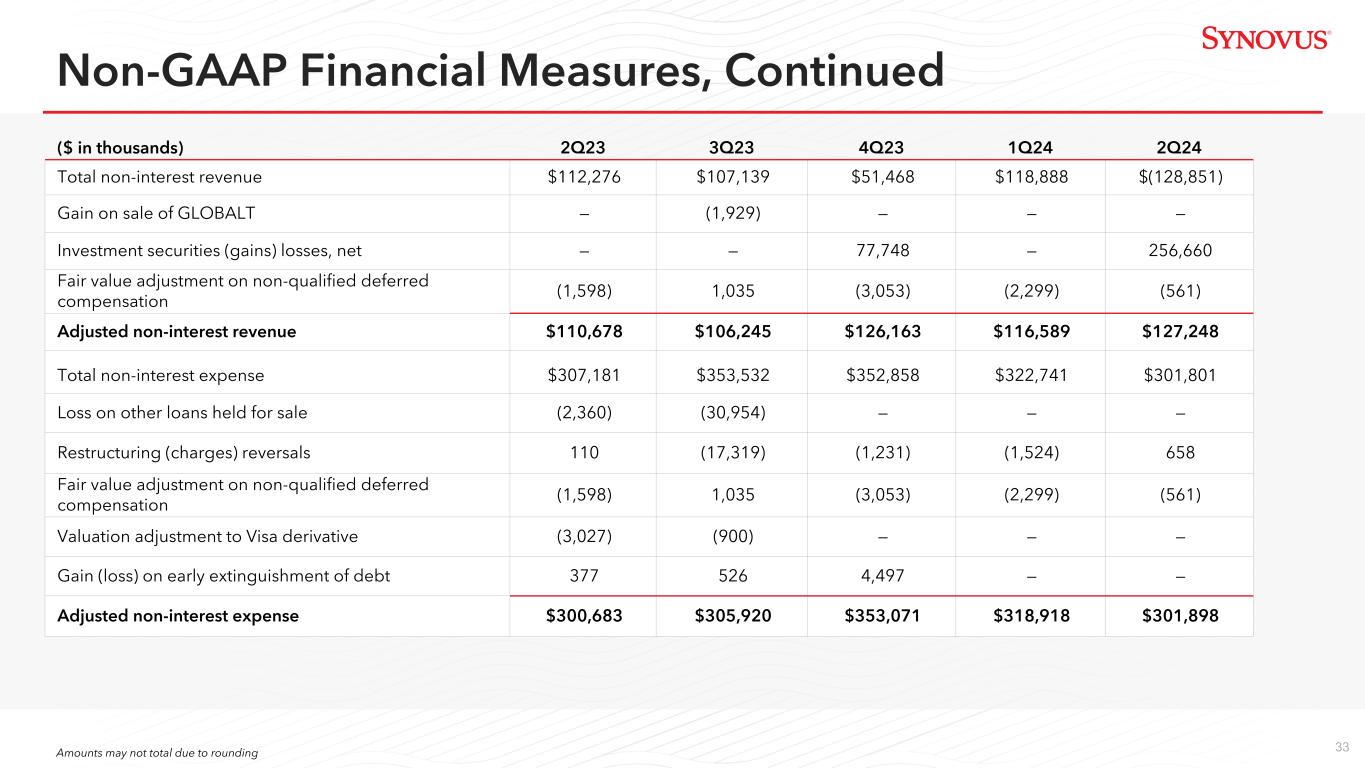

33 Non-GAAP Financial Measures, Continued ($ in thousands) 2Q23 3Q23 4Q23 1Q24 2Q24 Total non-interest revenue $112,276 $107,139 $51,468 $118,888 $(128,851) Gain on sale of GLOBALT — (1,929) — — — Investment securities (gains) losses, net — — 77,748 — 256,660 Fair value adjustment on non-qualified deferred compensation (1,598) 1,035 (3,053) (2,299) (561) Adjusted non-interest revenue $110,678 $106,245 $126,163 $116,589 $127,248 Total non-interest expense $307,181 $353,532 $352,858 $322,741 $301,801 Loss on other loans held for sale (2,360) (30,954) — — — Restructuring (charges) reversals 110 (17,319) (1,231) (1,524) 658 Fair value adjustment on non-qualified deferred compensation (1,598) 1,035 (3,053) (2,299) (561) Valuation adjustment to Visa derivative (3,027) (900) — — — Gain (loss) on early extinguishment of debt 377 526 4,497 — — Adjusted non-interest expense $300,683 $305,920 $353,071 $318,918 $301,898 Amounts may not total due to rounding

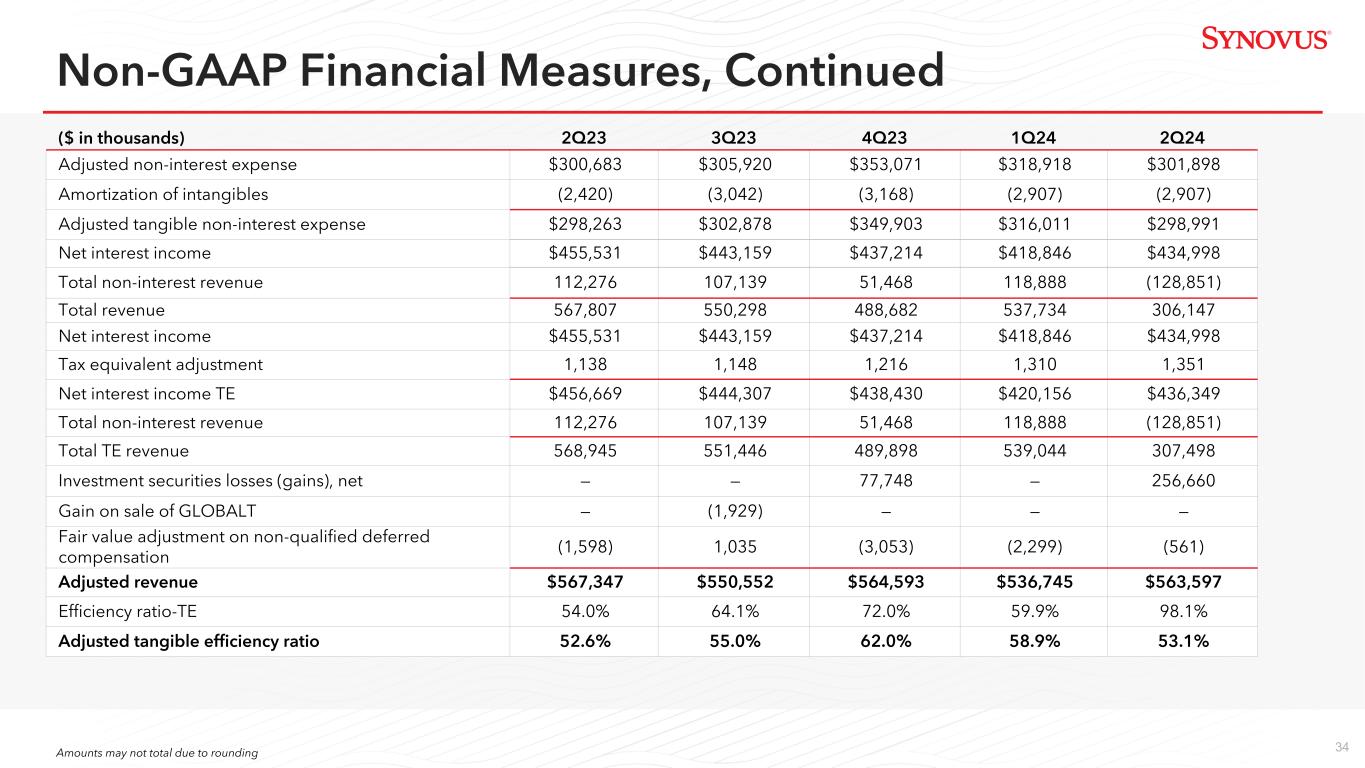

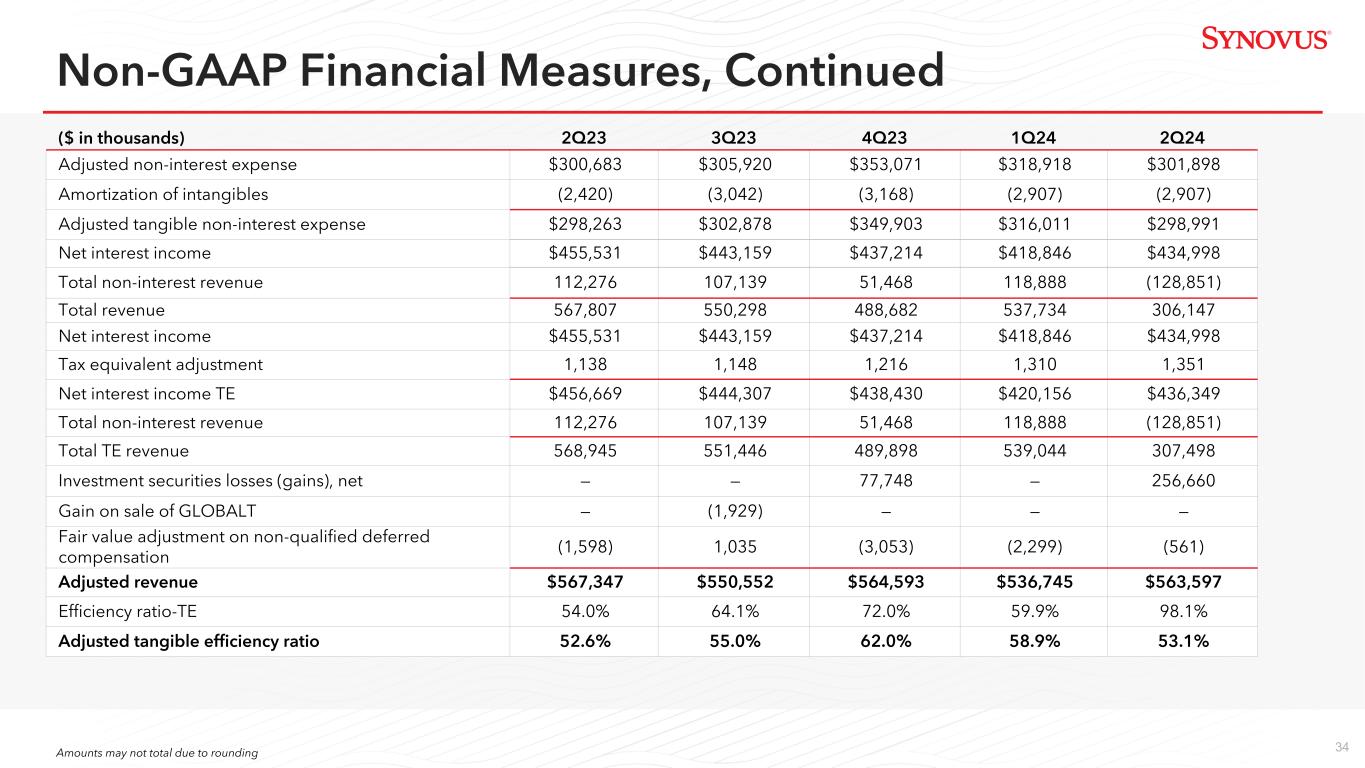

34 ($ in thousands) 2Q23 3Q23 4Q23 1Q24 2Q24 Adjusted non-interest expense $300,683 $305,920 $353,071 $318,918 $301,898 Amortization of intangibles (2,420) (3,042) (3,168) (2,907) (2,907) Adjusted tangible non-interest expense $298,263 $302,878 $349,903 $316,011 $298,991 Net interest income $455,531 $443,159 $437,214 $418,846 $434,998 Total non-interest revenue 112,276 107,139 51,468 118,888 (128,851) Total revenue 567,807 550,298 488,682 537,734 306,147 Net interest income $455,531 $443,159 $437,214 $418,846 $434,998 Tax equivalent adjustment 1,138 1,148 1,216 1,310 1,351 Net interest income TE $456,669 $444,307 $438,430 $420,156 $436,349 Total non-interest revenue 112,276 107,139 51,468 118,888 (128,851) Total TE revenue 568,945 551,446 489,898 539,044 307,498 Investment securities losses (gains), net — — 77,748 — 256,660 Gain on sale of GLOBALT — (1,929) — — — Fair value adjustment on non-qualified deferred compensation (1,598) 1,035 (3,053) (2,299) (561) Adjusted revenue $567,347 $550,552 $564,593 $536,745 $563,597 Efficiency ratio-TE 54.0% 64.1% 72.0% 59.9% 98.1% Adjusted tangible efficiency ratio 52.6% 55.0% 62.0% 58.9% 53.1% Non-GAAP Financial Measures, Continued Amounts may not total due to rounding

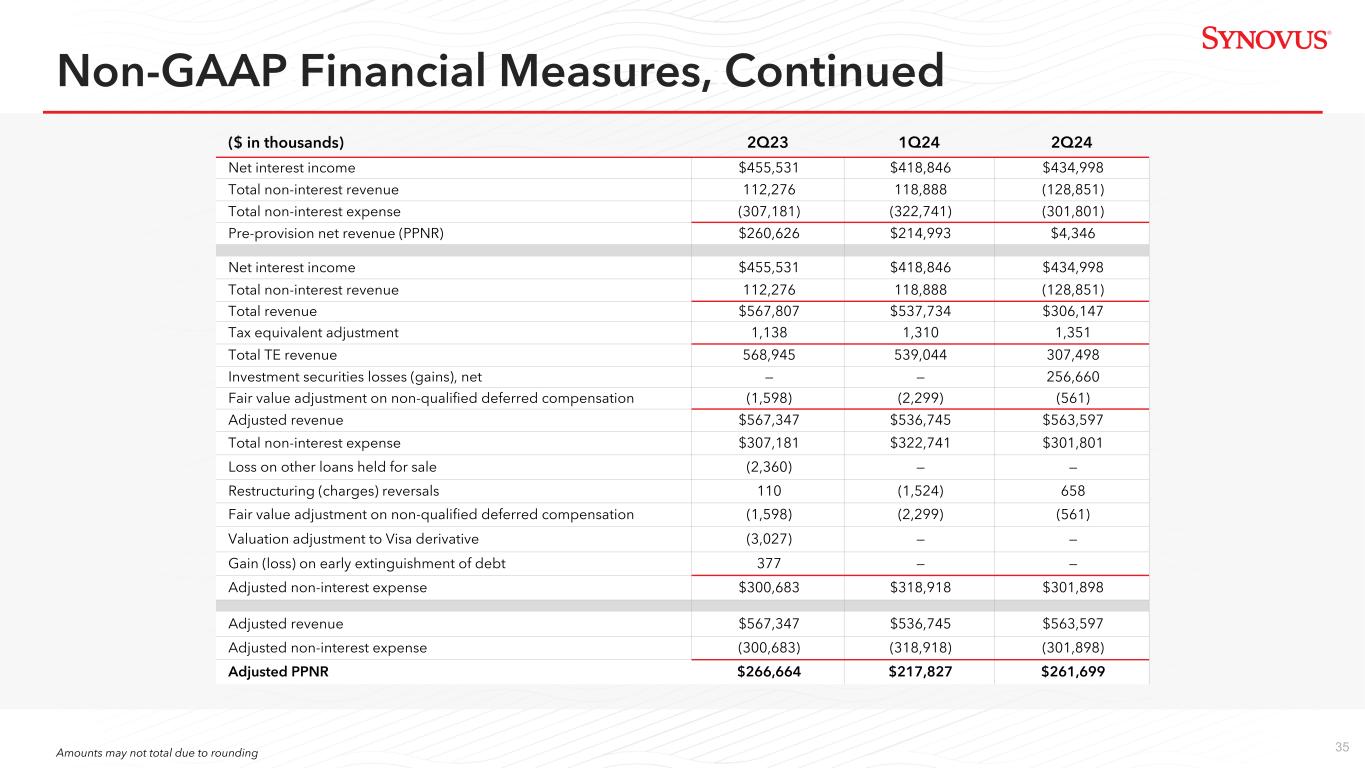

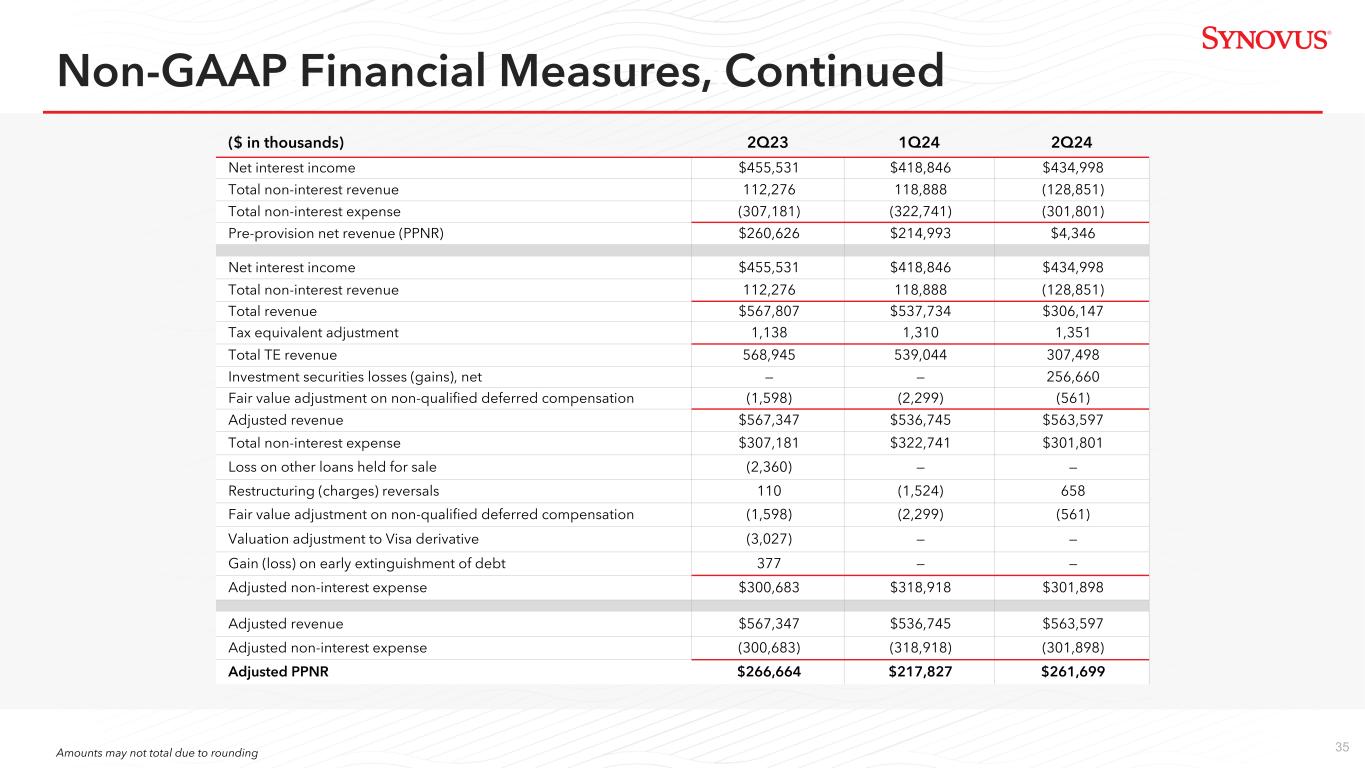

35 Non-GAAP Financial Measures, Continued Amounts may not total due to rounding ($ in thousands) 2Q23 1Q24 2Q24 Net interest income $455,531 $418,846 $434,998 Total non-interest revenue 112,276 118,888 (128,851) Total non-interest expense (307,181) (322,741) (301,801) Pre-provision net revenue (PPNR) $260,626 $214,993 $4,346 Net interest income $455,531 $418,846 $434,998 Total non-interest revenue 112,276 118,888 (128,851) Total revenue $567,807 $537,734 $306,147 Tax equivalent adjustment 1,138 1,310 1,351 Total TE revenue 568,945 539,044 307,498 Investment securities losses (gains), net — — 256,660 Fair value adjustment on non-qualified deferred compensation (1,598) (2,299) (561) Adjusted revenue $567,347 $536,745 $563,597 Total non-interest expense $307,181 $322,741 $301,801 Loss on other loans held for sale (2,360) — — Restructuring (charges) reversals 110 (1,524) 658 Fair value adjustment on non-qualified deferred compensation (1,598) (2,299) (561) Valuation adjustment to Visa derivative (3,027) — — Gain (loss) on early extinguishment of debt 377 — — Adjusted non-interest expense $300,683 $318,918 $301,898 Adjusted revenue $567,347 $536,745 $563,597 Adjusted non-interest expense (300,683) (318,918) (301,898) Adjusted PPNR $266,664 $217,827 $261,699 Non-G P Financial Mea ures, Continued

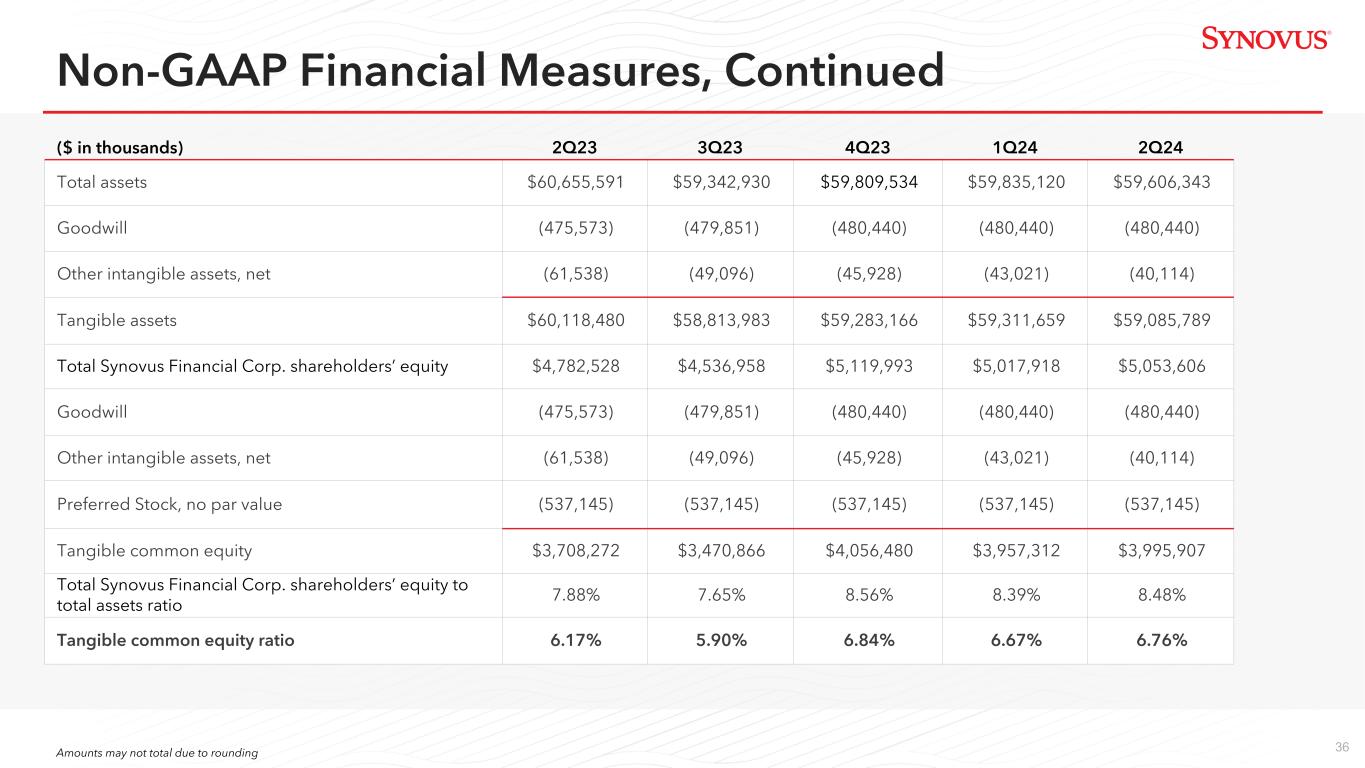

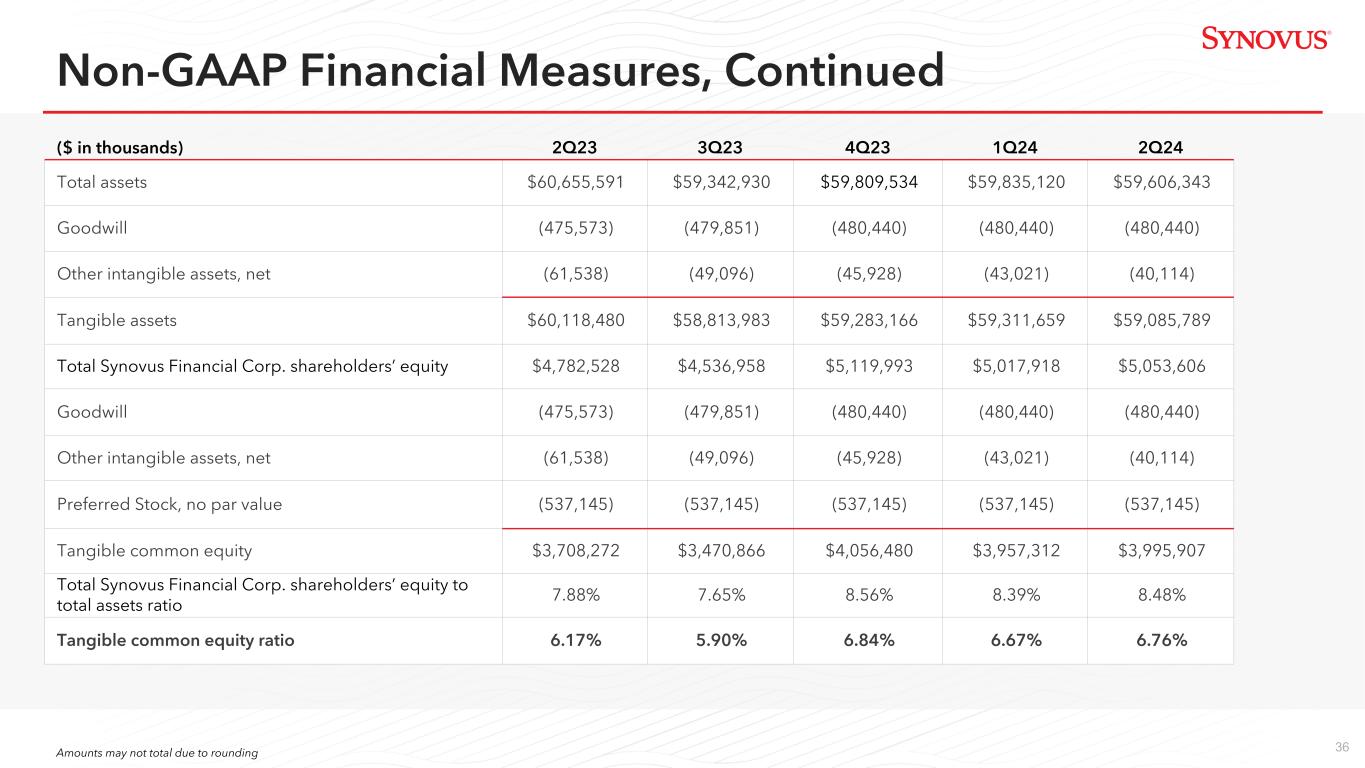

36 ($ in thousands) 2Q23 3Q23 4Q23 1Q24 2Q24 Total assets $60,655,591 $59,342,930 $59,809,534 $59,835,120 $59,606,343 Goodwill (475,573) (479,851) (480,440) (480,440) (480,440) Other intangible assets, net (61,538) (49,096) (45,928) (43,021) (40,114) Tangible assets $60,118,480 $58,813,983 $59,283,166 $59,311,659 $59,085,789 Total Synovus Financial Corp. shareholders’ equity $4,782,528 $4,536,958 $5,119,993 $5,017,918 $5,053,606 Goodwill (475,573) (479,851) (480,440) (480,440) (480,440) Other intangible assets, net (61,538) (49,096) (45,928) (43,021) (40,114) Preferred Stock, no par value (537,145) (537,145) (537,145) (537,145) (537,145) Tangible common equity $3,708,272 $3,470,866 $4,056,480 $3,957,312 $3,995,907 Total Synovus Financial Corp. shareholders’ equity to total assets ratio 7.88% 7.65% 8.56% 8.39% 8.48% Tangible common equity ratio 6.17% 5.90% 6.84% 6.67% 6.76% Non-GAAP Financial Measures, Continued Amounts may not total due to rounding