1 Earnings Results Fourth Quarter 2024 Exhibit 99.3

2 This slide presentation and certain of our other filings with the Securities and Exchange Commission contain statements that constitute "forward-looking statements" within the meaning of, and subject to the protections of, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact are forward-looking statements. You can identify these forward-looking statements through Synovus' use of words such as "believes," "anticipates," "expects," "may," "will," "assumes," "predicts," "could," "should," "would," "intends," "targets," "estimates," "projects," "plans," "potential" and other similar words and expressions of the future or otherwise regarding the outlook for Synovus' future business and financial performance and/or the performance of the banking industry and economy in general. These forward-looking statements include, among others, statements on our expectations related to (1) loan growth and loan mix; (2) deposit growth, mix, pricing, and costs; (3) net interest income and net interest margin; (4) revenue growth; (5) non-interest expense; (6) credit trends and key credit performance metrics; (7) our future operating and financial performance; (8) our strategy and initiatives for future revenue growth, balance sheet optimization, capital management, and expense management; (9) our effective tax rate; and (10) our assumptions underlying these expectations. Prospective investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve known and unknown risks and uncertainties which may cause the actual results, performance or achievements of Synovus to be materially different from the future results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements are based on the information known to, and current beliefs and expectations of, Synovus' management and are subject to significant risks and uncertainties. Actual results may differ materially from those contemplated by such forward-looking statements. A number of factors could cause actual results to differ materially from those contemplated by the forward-looking statements in this presentation. Many of these factors are beyond Synovus' ability to control or predict. These forward-looking statements are based upon information presently known to Synovus' management and are inherently subjective, uncertain and subject to change due to any number of risks and uncertainties, including, without limitation, the risks and other factors set forth in Synovus' filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the year ended December 31, 2023 under the captions "Cautionary Notice Regarding Forward-Looking Statements" and "Risk Factors" and in Synovus' quarterly reports on Form 10-Q and current reports on Form 8-K. We believe these forward- looking statements are reasonable; however, undue reliance should not be placed on any forward-looking statements, which are based on current expectations and speak only as of the date that they are made. We do not assume any obligation to update any forward-looking statements as a result of new information, future developments or otherwise, except as otherwise may be required by law. This slide presentation contains certain non-GAAP financial measures determined by methods other than in accordance with generally accepted accounting principles. Such non-GAAP financial measures include the following: adjusted net income available to common shareholders; adjusted diluted earnings per share; adjusted return on average assets; return on average tangible common equity; adjusted return on average tangible common equity; adjusted non-interest revenue; adjusted total revenue taxable equivalent (TE); adjusted non-interest expense; adjusted tangible efficiency ratio; tangible common equity ratio; and adjusted pre-provision net revenue (PPNR). The most comparable GAAP measures to these measures are net income available to common shareholders; diluted earnings (loss) per share; return on average assets; return on average common equity; total non-interest revenue; total revenue; total non-interest expense; efficiency ratio-TE; total Synovus Financial Corp. shareholders' equity to total assets ratio; and PPNR, respectively. Management believes that these non-GAAP financial measures provide meaningful additional information about Synovus to assist management and investors in evaluating Synovus' operating results, financial strength, the performance of its business and the strength of its capital position. However, these non-GAAP financial measures have inherent limitations as analytical tools and should not be considered in isolation or as a substitute for analyses of operating results or capital position as reported under GAAP. The non-GAAP financial measures should be considered as additional views of the way our financial measures are affected by significant items and other factors, and since they are not required to be uniformly applied, they may not be comparable to other similarly titled measures at other companies. Adjusted net income available to common shareholders, adjusted diluted earnings per share and adjusted return on average assets are measures used by management to evaluate operating results exclusive of items that are not indicative of ongoing operations and impact period-to-period comparisons. Return on average tangible common equity and adjusted return on average tangible common equity are measures used by management to compare Synovus' performance with other financial institutions because it calculates the return available to common shareholders without the impact of intangible assets and their related amortization, thereby allowing management to evaluate the performance of the business consistently. Adjusted non-interest revenue and adjusted total revenue TE are measures used by management to evaluate non-interest revenue and total revenue exclusive of net investment securities gains (losses), fair value adjustments on non-qualified deferred compensation, and other items not indicative of ongoing operations that could impact period-to-period comparisons. Adjusted non-interest expense and the adjusted tangible efficiency ratio are measures utilized by management to measure the success of expense management initiatives focused on reducing recurring controllable operating costs. The tangible common equity ratio is used by stakeholders to assess our capital position. Adjusted PPNR is used by management to evaluate PPNR exclusive of items that management believes are not indicative of ongoing operations and impact period-to-period comparisons. The computations of the non-GAAP financial measures used in this slide presentation are set forth in the appendix to this slide presentation. Management does not provide a reconciliation for forward-looking non-GAAP financial measures where it is unable to provide a meaningful or accurate calculation or estimation of reconciling items and the information is not available without unreasonable effort. This is due to the inherent difficulty of forecasting the occurrence and the financial impact of various items that have not yet occurred, are out of Synovus’ control, or cannot be reasonably predicted. For the same reasons, Synovus’ management is unable to address the probable significance of the unavailable information. Forward-looking non-GAAP financial measures provided without the most directly comparable GAAP financial measures may vary materially from the corresponding GAAP financial measures. Forward-Looking Statements Use of Non-GAAP Financial Measures

3 Executed Key Strategies in 2024 Improved Profitability Strengthened Balance Sheet Supported Growth with Investments and New Initiatives • Improved NCOs Year over Year • Deepened and Expanded Relationships as Core Client Fees(1) Grew 7% YoY • Executed Company-Wide Expense Initiative Leading to Top Quartile Efficiency Ratio • Securities Repositioning / Active Deposit Pricing Management Aided NIM Expansion in 2H24 • Risk-Weighted Asset (RWA) Optimization Funded $2bn+ RWA Reduction • Grew Non-Public Funds Core Deposits by 2% • Reduced Wholesale Funding Ratio(2) to 11.0%, a 255 bps YoY Improvement • Rationalized Non-Relationship Credits in Syndicated Commercial and Third Party Consumer Lending • Increased CET1 Ratio(3) by 62 bps to 10.84% While Repurchasing $270 Million of Common Stock • Issued $500 Million of Senior Notes • Grew Middle Market, CIB, and Specialty Loans(4) $485 MM or 4% • Hired 11 New Middle Market Bankers • Launched New Legal Industry Deposit Vertical • Continued Growth in Treasury and Payment Solutions(5) Fees and Product Offerings • Implemented New Capital Markets Syndication Platform • Fully Onboarded New GreenSky Relationship and Expanded Commercial Sponsorship Fees(6) by 66% YoY • Added 236 New BOWs(7) Clients with Annual Revenue of $3 MM+ (1) Core Client Fees (ex. Mortgage) primarily include Core Banking Fees, Wealth Revenue, Capital Markets income, Commercial Sponsorship, and other miscellaneous income; (2) Defined as brokered deposits, long-term debt, and other borrowings (including other short-term borrowings and fed funds purchased) divided by total assets; (3) 4Q24 CET1 ratio is preliminary; (4) Includes Asset Based Lending, Structured Lending, Life Finance, and Restaurant Services; (5) Treasury and Payment Solutions includes Treasury Management, Commercial Card, International, and Letter of Credit fees; (6) Commercial Sponsorship income includes Greensky income (within other income) and ISO sponsorship NIR (within services charges on deposit accounts and card fees in core banking fees and other income); (7) BOWs = Business Owner Wealth Strategy

4 Fourth Quarter 2024 Key Messages Core Deposits(2) Up 1% QoQ and Brokered Deposits Declined Further – Diluted EPS up 6% QoQ and adjusted diluted EPS(1) up 2% – Profitability ratios(2) were 1.25%, 14.75%, and 16.72%, respectively Metrics Highlights Earnings Per Share and ROAA, ROCE and ROTCE(1) Net Interest Income Non-Interest Revenue Non-Interest Expense Credit Quality Capital – Operating expense control remains excellent with an efficiency ratio of 53.15% and adjusted tangible efficiency ratio(1) of 52.69% – Increased charitable contributions by $2.5 MM QoQ – Non-interest revenue up 1% QoQ – Adjusted non-interest revenue(1) up 2% QoQ, largely from growth in core banking, capital markets and wealth revenue – NCOs/average loans in line with expectations at $28 million or 0.26% annualized – CET1 Ratio(3) moved higher to 10.84% inclusive of ~$50 MM in share repurchases Note: Our recent guidance at an investor conference, as filed with the SEC on December 10, 2024, included an expected $7MM in 4Q24 tax expense related to a discrete state tax matter that was not resolved as of 12/31/2024. (1) Non-GAAP financial measure; see appendix for applicable reconciliation; (2) Annualized; (3) 4Q24 CET1 Ratio is preliminary – Net interest income increased 3% QoQ, while the NIM(2) expanded 6 bps – Core deposits rose $1.1 billion from public funds seasonality and middle market commercial growth – Cost of deposits down 26 bps from 3Q24 to 2.46% (~42% beta QoQ)

5 Note:Our recent guidance at an investor conference, as filed with the SEC on December 10, 2024, included an expected $7MM in 4Q24 tax expense related to a discrete state tax matter that was not resolved by 12/31/2024. (1) Annualized; (2) Non-GAAP financial measures; see appendix for applicable reconciliations; (3) TE - Taxable Equivalent Fourth Quarter 2024 Financial Highlights Profitability Metrics 4Q24 3Q24 4Q23 ROAA(1) 1.25% 1.21% 0.47% Adjusted ROAA(1)(2) 1.25% 1.26% 0.84% ROCE(1) 14.75% 14.38% 5.88% ROTCE(1)(2) 16.72% 16.38% 7.02% Adjusted ROTCE(1)(2) 16.67% 17.09% 13.28% Net Interest Margin(1) 3.28% 3.22% 3.11% Efficiency Ratio - TE(3) 53.15% 55.41% 72.03% Adjusted Efficiency Ratio(2) 52.69% 52.97% 61.97% Income Statement Summary (GAAP) ($ in thousands, except per share data) 4Q24 % Change QoQ % Change YoY Net Interest Income $454,993 3% 4% Provision for Credit Losses $32,867 40% (28)% Non-Interest Revenue $125,587 1% 144% Total Revenue $580,580 3% 19% Non-Interest Expense $309,311 (1)% (12)% Pre-Provision Net Revenue $271,269 8% 100% Net Income Available to Common Shareholders $178,848 5% 195% Diluted EPS $1.25 6% 204%

6 $4,796 $5,341 $706 $1,260 High Growth Vertical All Other 2023 2024 $1,476 $1,844 $141 $488 High Growth Vertical All Other 4Q23 4Q24 $4,647 $4,702 $1,855 $1,982 High Growth Vertical All Other 2023 2024 • Period end loans down $512 million or 1% QoQ, impacted by lower C&I utilization, strategic rationalization and elevated loan payoffs • Loan production(1) remained strong driven by commercial lines of business activity • High Growth Vertical(2) loans increased $485 million or 4% in 2024 Loans Total Loans: $43 billion Amounts may not total due to rounding; (1) Excluding secondary mortgage production; (2) See page 14 for definition of "High Growth Verticals"; (3) Certain immaterial loan portfolios are not reflected; (4) Excluding wholesale healthcare production as LOB was exited and portfolio sold in 2023 Loan Production(1) and Loan Payoffs(3) Accelerated in 2024 ($ in millions) Fourth Quarter 2024 Loan Growth Drivers ($ in millions) $823 $1,295 $247 $473 High Growth Vertical All Other 4Q23 4Q24 $43,121 $(339) $(157) $(16) $42,609 3Q24 C&I CRE Consumer 4Q24 (4) (2) (2) (2)(2) Production ProductionPayoffs Payoffs

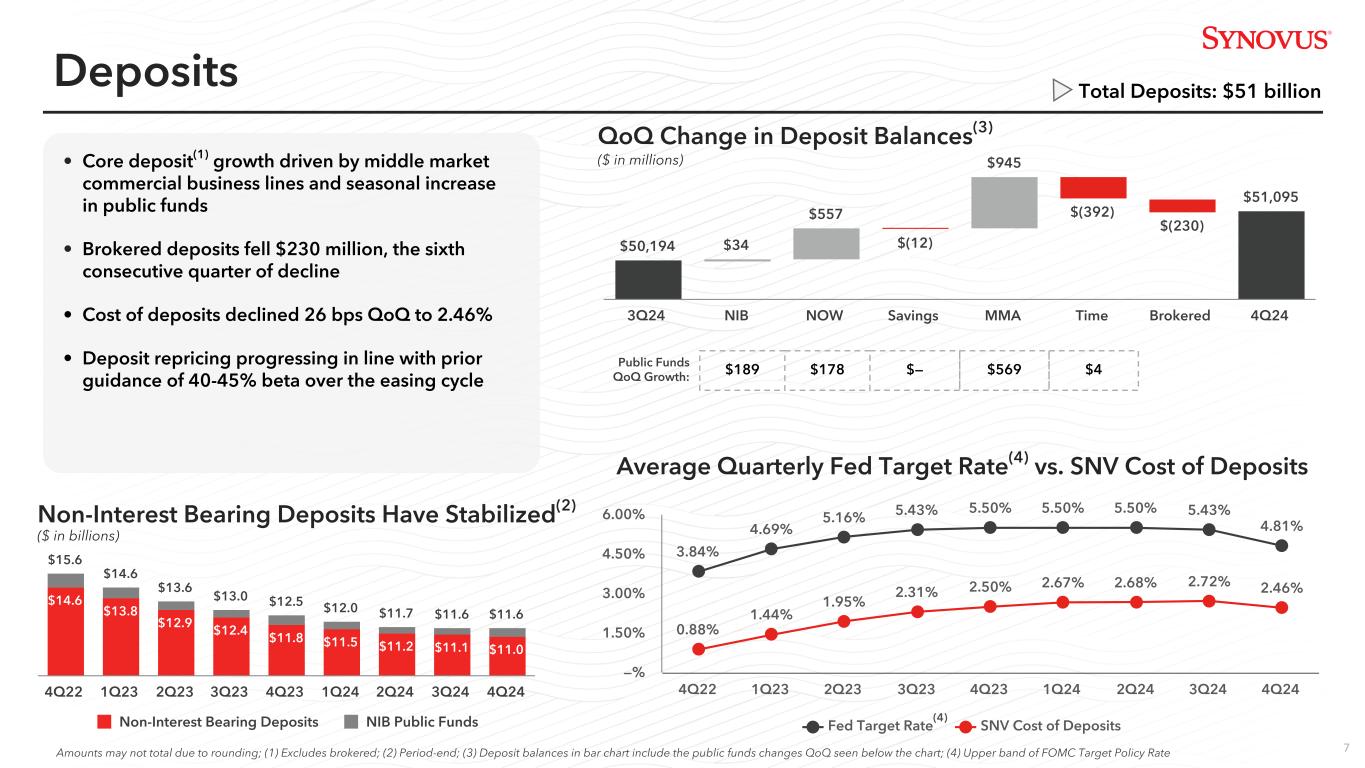

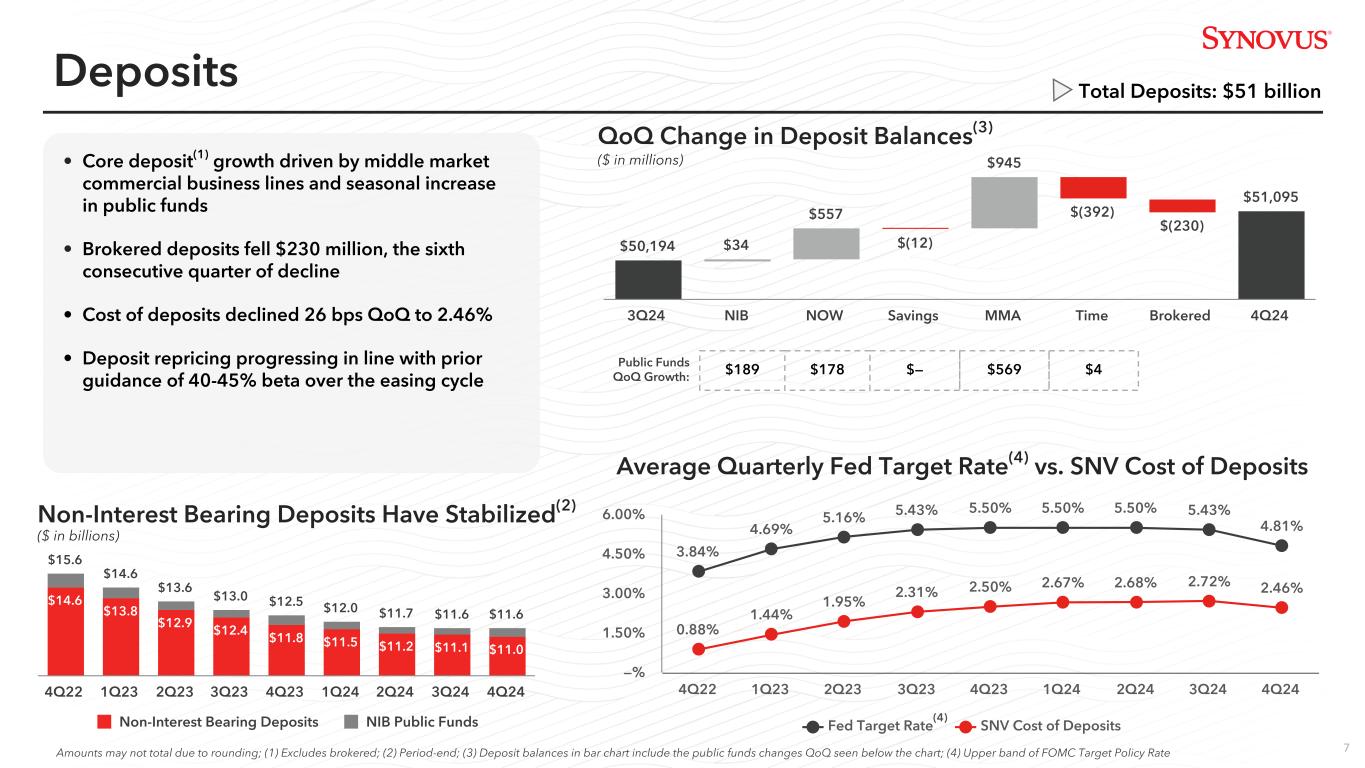

7 Deposits • Core deposit(1) growth driven by middle market commercial business lines and seasonal increase in public funds • Brokered deposits fell $230 million, the sixth consecutive quarter of decline • Cost of deposits declined 26 bps QoQ to 2.46% • Deposit repricing progressing in line with prior guidance of 40-45% beta over the easing cycle QoQ Change in Deposit Balances(3) ($ in millions) Amounts may not total due to rounding; (1) Excludes brokered; (2) Period-end; (3) Deposit balances in bar chart include the public funds changes QoQ seen below the chart; (4) Upper band of FOMC Target Policy Rate Total Deposits: $51 billion Non-Interest Bearing Deposits Have Stabilized(2) ($ in billions) $15.6 $14.6 $13.6 $13.0 $12.5 $12.0 $11.7 $11.6 $11.6 $14.6 $13.8 $12.9 $12.4 $11.8 $11.5 $11.2 $11.1 $11.0 Non-Interest Bearing Deposits NIB Public Funds 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 3.84% 4.69% 5.16% 5.43% 5.50% 5.50% 5.50% 5.43% 4.81% 0.88% 1.44% 1.95% 2.31% 2.50% 2.67% 2.68% 2.72% 2.46% Fed Target Rate SNV Cost of Deposits 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 —% 1.50% 3.00% 4.50% 6.00% Average Quarterly Fed Target Rate(4) vs. SNV Cost of Deposits $50,194 $34 $557 $(12) $945 $(392) $(230) $51,095 3Q24 NIB NOW Savings MMA Time Brokered 4Q24 Public Funds QoQ Growth: $189 $178 $— $569 $4 (4)

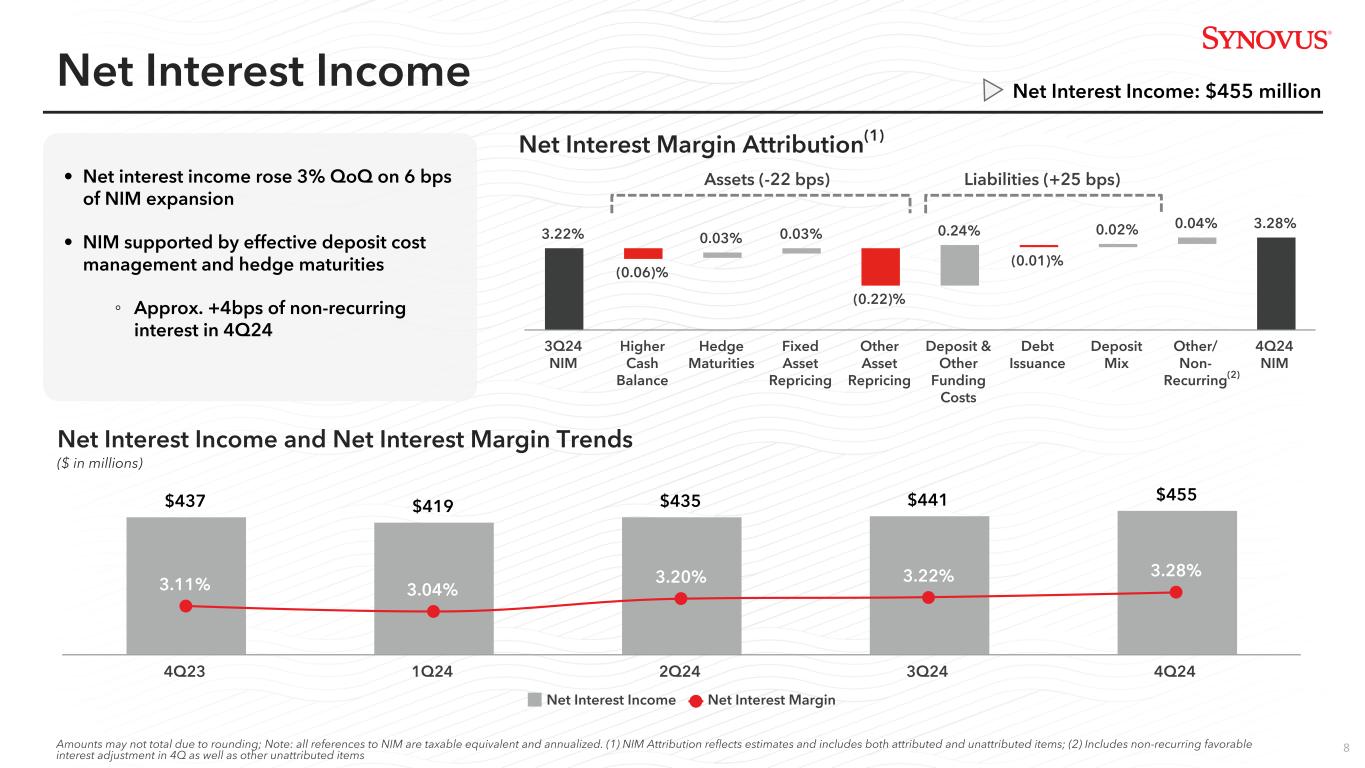

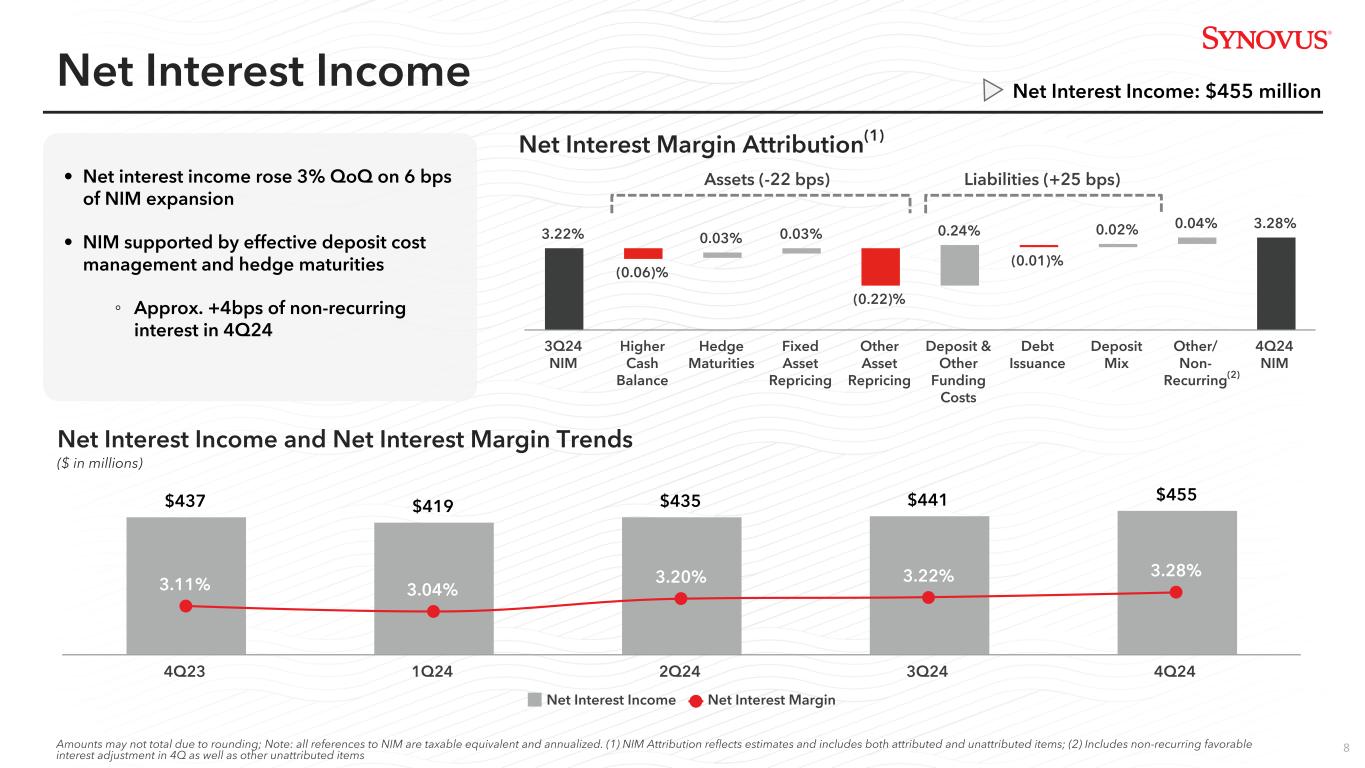

8 3.22% (0.06)% 0.03% 0.03% (0.22)% 0.24% (0.01)% 0.02% 0.04% 3.28% 3Q24 NIM Higher Cash Balance Hedge Maturities Fixed Asset Repricing Other Asset Repricing Deposit & Other Funding Costs Debt Issuance Deposit Mix Other/ Non- Recurring 4Q24 NIM $437 $419 $435 $441 $455 3.11% 3.04% 3.20% 3.22% 3.28% Net Interest Income Net Interest Margin 4Q23 1Q24 2Q24 3Q24 4Q24 Amounts may not total due to rounding; Note: all references to NIM are taxable equivalent and annualized. (1) NIM Attribution reflects estimates and includes both attributed and unattributed items; (2) Includes non-recurring favorable interest adjustment in 4Q as well as other unattributed items Net Interest Income Net Interest Income and Net Interest Margin Trends ($ in millions) • Net interest income rose 3% QoQ on 6 bps of NIM expansion • NIM supported by effective deposit cost management and hedge maturities ◦ Approx. +4bps of non-recurring interest in 4Q24 Net Interest Income: $455 million Net Interest Margin Attribution(1) (2) Assets (-22 bps) Liabilities (+25 bps)

9 $384 $399 $391 $428 $455 $293 $345 $374 $413 $441 Core Client Non-Interest Revenue (ex. Mortgage) Mortgage Revenue 2020 2021 2022 2023 2024 7% 10% 14% Capital Markets Wealth Revenue Treasury Management ($ in millions) 4Q24 QoQ Δ YoY Δ Core Banking Fees(3) $49 3% 1% Wealth Revenue(4) $43 4% 5% Capital Markets Income $12 17% 87% Net Mortgage Revenue $3 (34)% (12)% Other Income(5)(6) $18 (4)% (35)% Total Adjusted Non-Interest Revenue(7) $125 2% (1)% Total Non-Interest Revenue $126 1% 144% Amounts may not total due to rounding; (1) Includes Core Commercial Account Analysis and Other Miscellaneous Deposit Fees; (2) Commercial Sponsorship income includes Greensky income (within other income) and ISO sponsorship NIR (within services charges on deposit accounts and card fees in core banking fees and other income); (3) Includes service charges on deposit accounts, card fees, and other non-interest revenue components including line of credit non-usage fees, letter of credit fees, ATM fee income, and miscellaneous other service charges; (4) Consists of fiduciary/asset management, brokerage, and insurance revenues; (5) Includes earnings on equity method investments, income from BOLI, Commercial Sponsorship, and other miscellaneous income; (6) Excludes adjusted NIR items; See appendix for adjusted NIR non-GAAP reconciliation; (7) Non-GAAP financial measure; see appendix for applicable reconciliation; (8) Core Client NIR (ex. Mortgage) primarily includes Core Banking Fees, Wealth Revenue, Capital Markets income, Commercial Sponsorship, and other miscellaneous income; (9) Reclassification of Core Client NIR performed in 1Q24 Non-Interest Revenue Consistent Growth in Total Core Client Non-Interest Revenue(8)(9) ($ in millions) Non-Interest Revenue Non-Interest Revenue: $126 million Healthy 4-Year CAGR in Core Fee Categories 11% CAGR ex Mortgage (4) 11% CAGR ex Globalt due to sale in 2023 • Core Banking Fees, Wealth Revenue, and Capital Markets Income drove QoQ growth in non- interest revenue • Treasury Management(1) income drove YoY growth in core banking fees • Elevated Commercial Sponsorship(2) fees in 4Q23 impacted the YoY Other Income comparison (1)

10 Adjusted Non-Interest Expense, ex FDIC Special Assessment $353 $319 $302 $302 $309 $302 $306 $306 $303 $310 4Q23 1Q24 2Q24 3Q24 4Q24 Non-Interest Expense ($ in millions) 4Q24 QoQ Δ YoY Δ Total Employment $184 1% 6% Total Other $77 7% (41)% Total Occupancy, Equipment, and Software $47 1% (2)% Total Adjusted Non-Interest Expense(1) $309 2% (12)% Total Non-Interest Expense $309 (1)% (12)% Non-Interest Expense Non-Interest Expense: $309 million • Non-interest expense declined 1% QoQ • Higher personnel cost, FDIC premiums, charitable contributions and technology initiatives drove the QoQ increase in adjusted non-interest expense(1) ◦ Charitable giving was up $2.5 MM QoQ • Reported and adjusted non-interest expense(1) declined 12% YoY as a result of $51 million FDIC Special Assessment in 4Q23 5,389 5,247 4,998 5,114 4,879 4,775 2019 2020 2021 2022 2023 2024 Headcount Down 11% Since 2019 Amounts may not total due to rounding; (1) Non-GAAP financial measure; see appendix for applicable reconciliation; (2) FDIC Special Assessment of $51.0MM, $12.8MM, $(3.9MM), $(1.7MM) and,$(0.8MM) for 4Q23, 1Q24, 2Q24, 3Q24 and 4Q24 respectively Adjusted Non-Interest Expense Has Been Relatively Stable (ex FDIC Special Assessment)(1)(2) ($ in millions) $1,264 $1,232 $1,213 $1,225 2023 2024 (2) Adjusted Non-Interest Expense

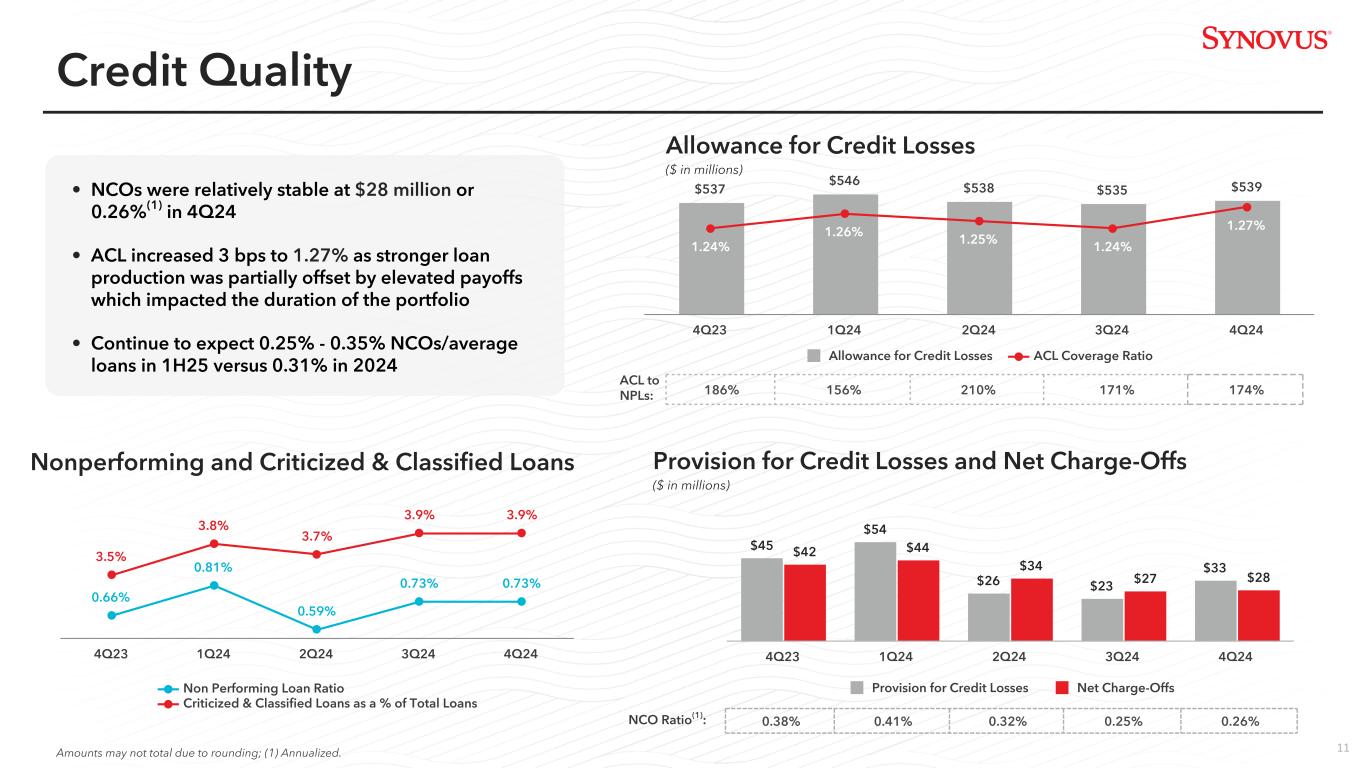

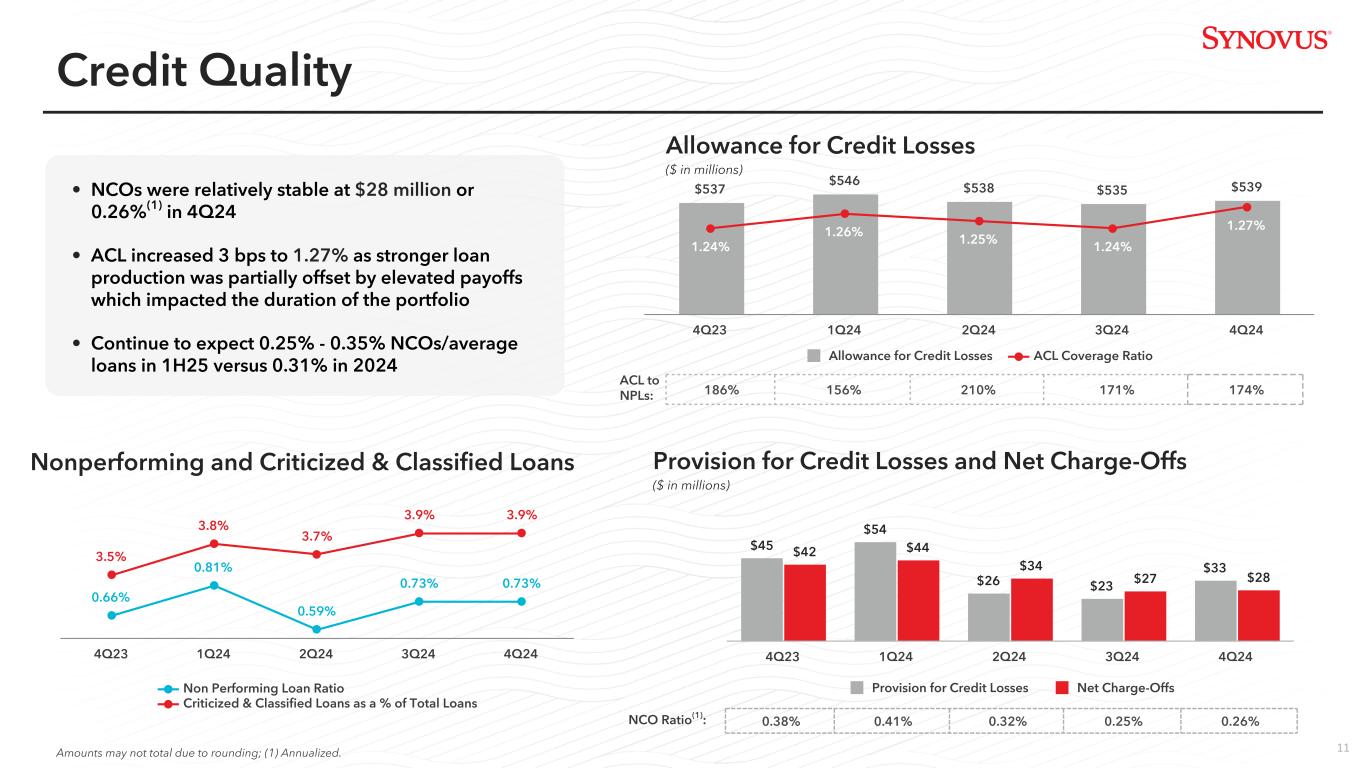

11 Credit Quality • NCOs were relatively stable at $28 million or 0.26%(1) in 4Q24 • ACL increased 3 bps to 1.27% as stronger loan production was partially offset by elevated payoffs which impacted the duration of the portfolio • Continue to expect 0.25% - 0.35% NCOs/average loans in 1H25 versus 0.31% in 2024 $45 $54 $26 $23 $33 $42 $44 $34 $27 $28 Provision for Credit Losses Net Charge-Offs 4Q23 1Q24 2Q24 3Q24 4Q24 0.38% 0.41% 0.32% 0.25% 0.26%NCO Ratio(1): Provision for Credit Losses and Net Charge-Offs ($ in millions) Amounts may not total due to rounding; (1) Annualized. $537 $546 $538 $535 $539 1.24% 1.26% 1.25% 1.24% 1.27% Allowance for Credit Losses ACL Coverage Ratio 4Q23 1Q24 2Q24 3Q24 4Q24 186% 156% 210% 171% 174% ACL to NPLs: Allowance for Credit Losses ($ in millions) 0.66% 0.81% 0.59% 0.73% 0.73% 3.5% 3.8% 3.7% 3.9% 3.9% Non Performing Loan Ratio Criticized & Classified Loans as a % of Total Loans 4Q23 1Q24 2Q24 3Q24 4Q24 Nonperforming and Criticized & Classified Loans

12 10.22% 10.38% 10.60% 10.64% 10.84% Common Equity Tier 1 Tier 1 Total Risk-Based Capital 4Q23 1Q24 2Q24 3Q24 4Q24 Amounts may not total due to rounding; (1) 4Q24 capital ratios are preliminary; (2) Declaration of common dividends remains subject to Board approval; (3) As amended (1) 11.45% 13.24%(3) Capital Capital Ratio Trend Common Equity Tier 1 Ratio(1) At Highest Level in 10+ Years 10.64% 0.37% (0.11)% (0.10)% —% 0.04% 10.84% Beginning CET1 Ratio (3Q24) Net Income To Common Shareholders Common Dividends Share Repurchases RWA Other Ending CET1 Ratio (4Q24) Fourth Quarter 2024 CET1 Change 13.07% 11.28% 2024 Capital Actions 2025 Capital Plan • Grew CET1 Ratio(1) by 62 bps • Performed risk-weighted asset optimization which funded a securities repositioning in 2Q24 • Paid quarterly dividend of $0.38/share • Repurchased $270 million of common stock • Maintain relatively stable CET1 Ratio • Planned increase of quarterly dividend to $0.39/share (effective April 2025)(2) • Recently approved $400 million common share repurchase authorization 13.56% 11.72% (1) 13.60% 11.76% 13.80% 11.96%

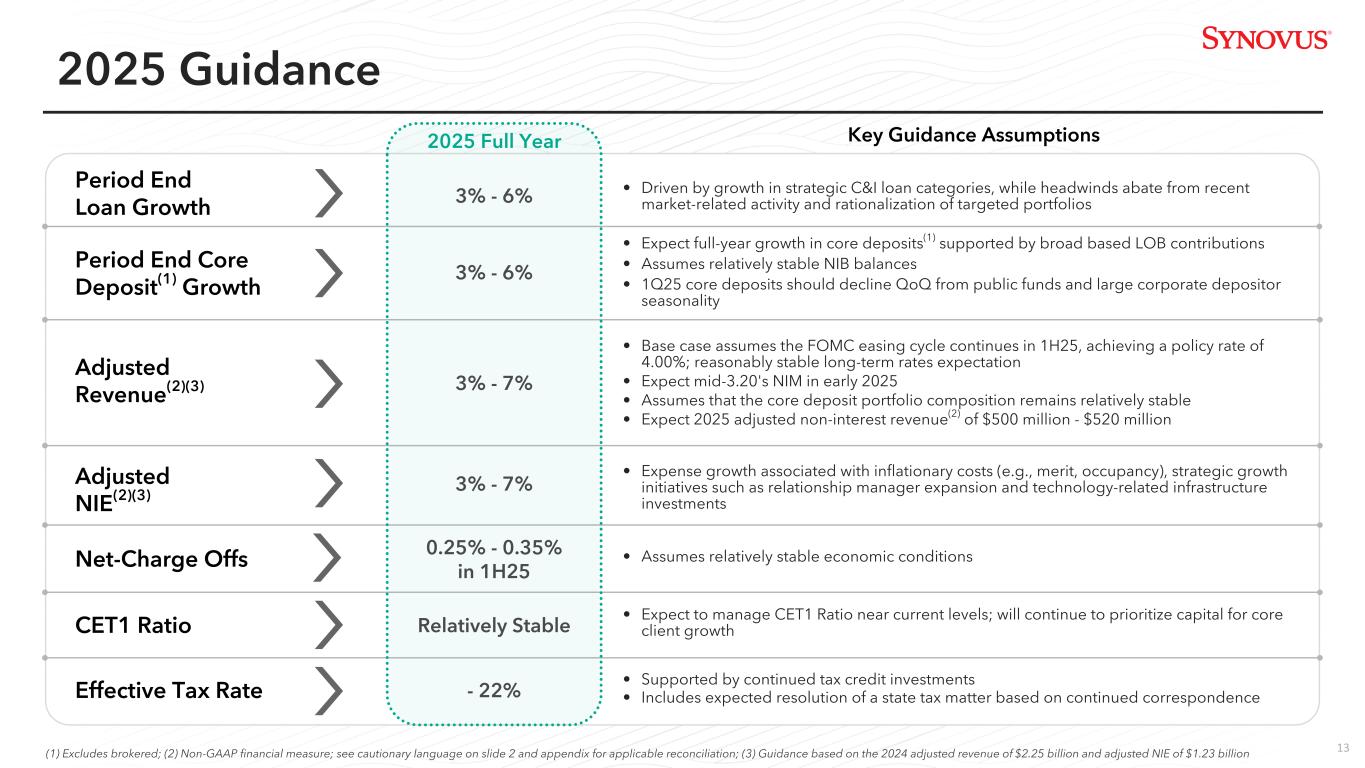

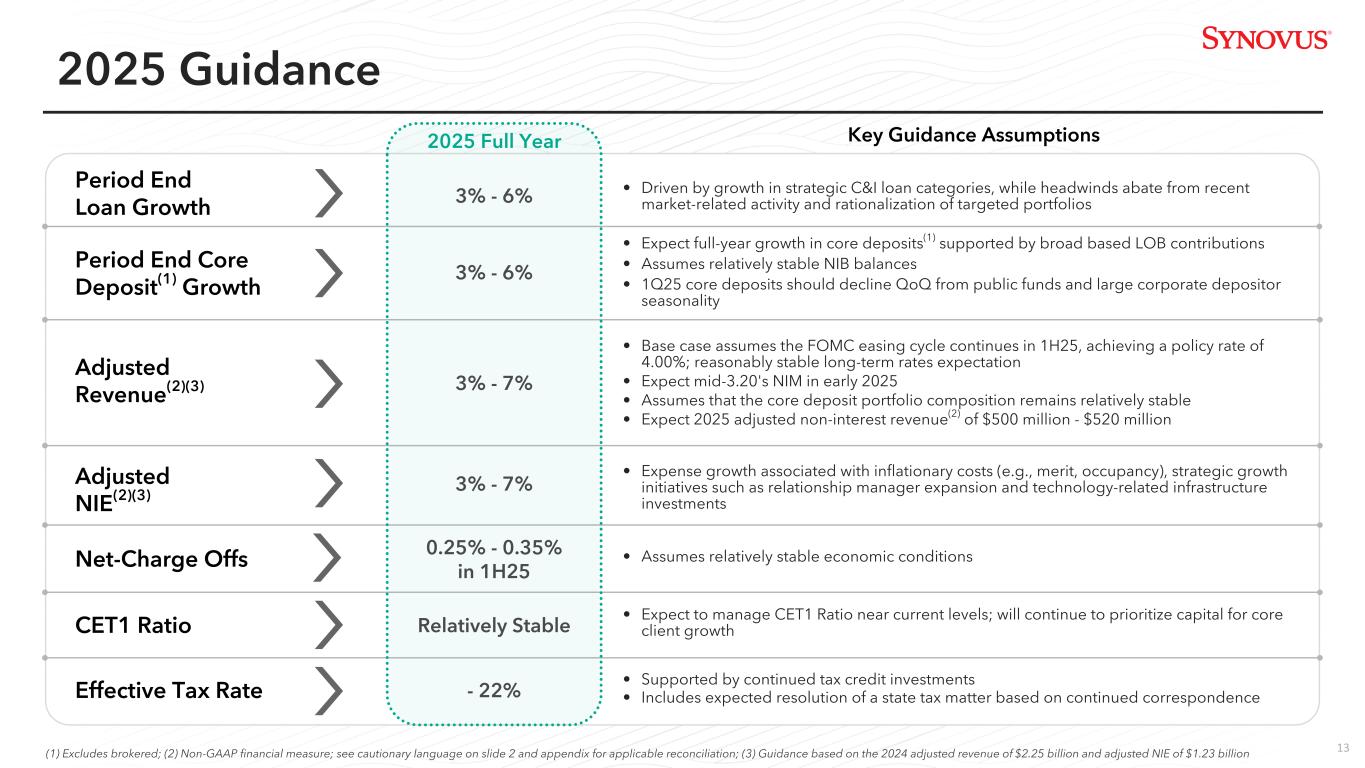

13 2025 Guidance Key Guidance Assumptions Period End Loan Growth Period End Core Deposit(1) Growth Adjusted Revenue(2)(3) Adjusted NIE(2)(3) Effective Tax Rate CET1 Ratio (1) Excludes brokered; (2) Non-GAAP financial measure; see cautionary language on slide 2 and appendix for applicable reconciliation; (3) Guidance based on the 2024 adjusted revenue of $2.25 billion and adjusted NIE of $1.23 billion • Driven by growth in strategic C&I loan categories, while headwinds abate from recent market-related activity and rationalization of targeted portfolios • Expect full-year growth in core deposits(1) supported by broad based LOB contributions • Assumes relatively stable NIB balances • 1Q25 core deposits should decline QoQ from public funds and large corporate depositor seasonality • Expect to manage CET1 Ratio near current levels; will continue to prioritize capital for core client growth • Supported by continued tax credit investments • Includes expected resolution of a state tax matter based on continued correspondence • Base case assumes the FOMC easing cycle continues in 1H25, achieving a policy rate of 4.00%; reasonably stable long-term rates expectation • Expect mid-3.20's NIM in early 2025 • Assumes that the core deposit portfolio composition remains relatively stable • Expect 2025 adjusted non-interest revenue(2) of $500 million - $520 million • Expense growth associated with inflationary costs (e.g., merit, occupancy), strategic growth initiatives such as relationship manager expansion and technology-related infrastructure investments Net-Charge Offs • Assumes relatively stable economic conditions 2025 Full Year 3% - 6% 3% - 7% Relatively Stable - 22% 0.25% - 0.35% in 1H25 3% - 6% 3% - 7%

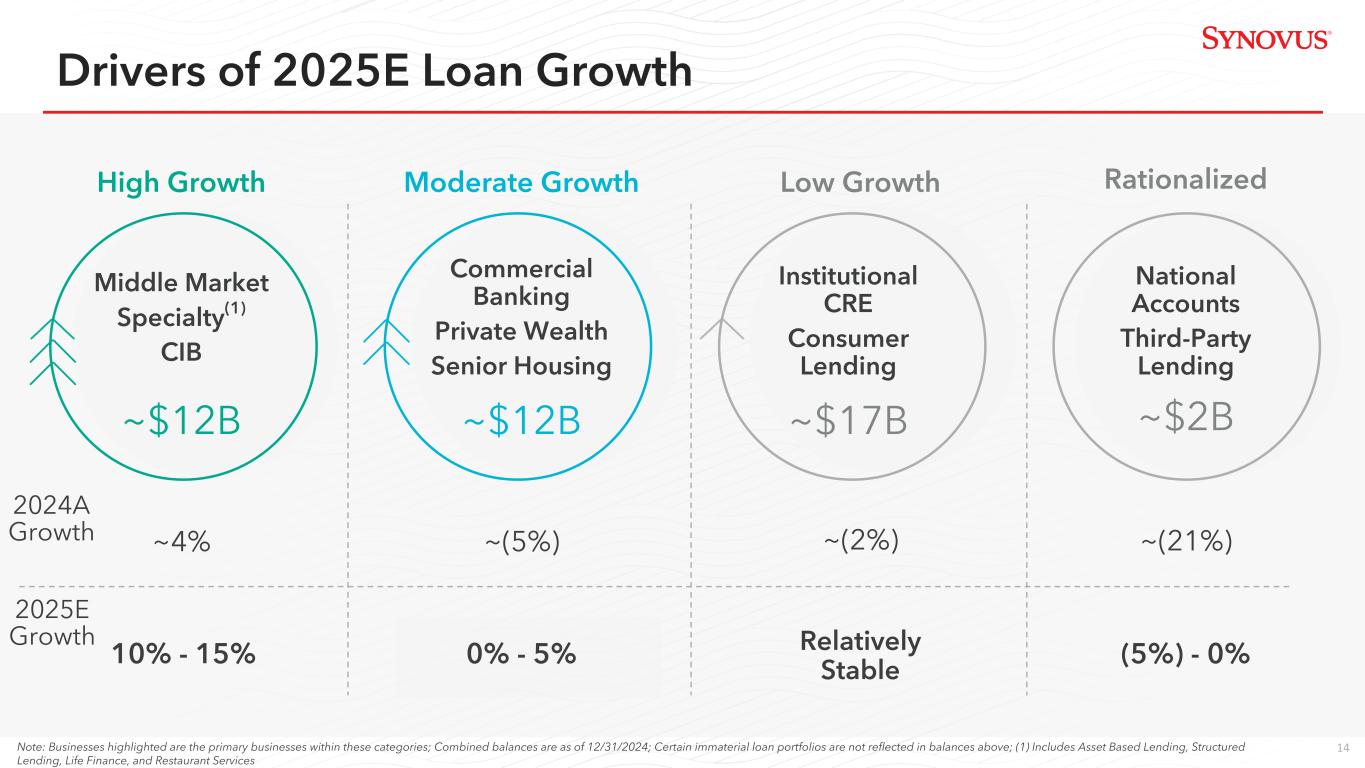

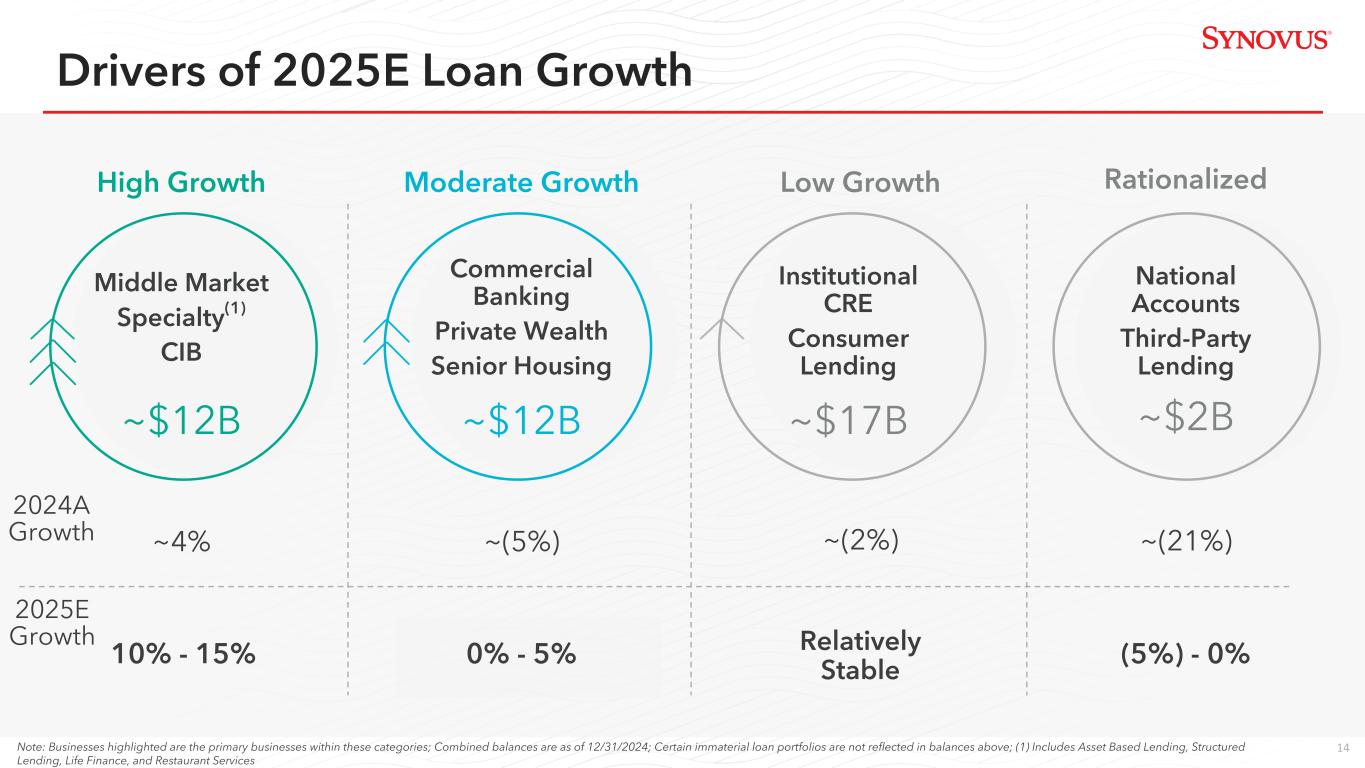

14 Drivers of 2025E Loan Growth 2024A Growth High Growth Middle Market Specialty(1) CIB ~4% 10% - 15% ~$12B Moderate Growth Commercial Banking Private Wealth Senior Housing ~(5%) 0% - 5% ~$12B Rationalized National Accounts Third-Party Lending ~(21%) (5%) - 0% ~$2B Note: Businesses highlighted are the primary businesses within these categories; Combined balances are as of 12/31/2024; Certain immaterial loan portfolios are not reflected in balances above; (1) Includes Asset Based Lending, Structured Lending, Life Finance, and Restaurant Services Low Growth Institutional CRE Consumer Lending Relatively Stable ~$17B ~(2%) 2025E Growth

15 2025 Strategic Priorities Winning in the Southeast Maintain Top Quartile Profitability Target Sustainable Returns • Accelerate Loan, Core Deposit and Fee Growth – Grow Relationship Managers by 20-30% in Middle Market, Commercial, and Wealth Services from 2025-2027 – Expand Structured Lending Team – Expand CIB FIG Industry Offering – Enhance Deposit Verticals to Support Core Funding Growth * Legal Industry Deposit Vertical • Continue Interest Rate Risk Management Which Reduces Revenue Volatility • Maintain Strong Asset Quality Metrics • Continue Enhancements to Risk Framework Amid Heightened Expectations • Continue Highly Disciplined Expense Management • Maintain Key Technology Investments • Leverage More Robust Product Set – Treasury and Payment Solutions (1) – Capital Markets – Wealth Strategy • Refine Delivery Models – Third Party Payments * Accelerate Sponsorship * Enhance Merchant Offering – Consumer Bank * Accelerate Small Business Revenue Growth – Wealth Services * Continued Focus on BOWs(2) Expansion 1 32 (1) Treasury and Payment Solutions includes Treasury Management, Commercial Card, International, and Letter of Credit fees; (2) BOWs = Business Owner Wealth Strategy

Appendix

17 Income Statement Summary (GAAP) ($ in thousands, except per share data) 2024 % Change YoY Net Interest Income $1,749,577 (4)% Provision for Credit Losses $136,685 (28)% Non-Interest Revenue $239,604 (41)% Total Revenue $1,989,181 (10)% Non-Interest Expense $1,247,543 (7)% Pre-Provision Net Revenue $741,638 (16)% Net Income Available to Common Shareholders $439,557 (13)% Diluted EPS $3.03 (12)% Note: Our recent guidance at an investor conference, as filed with the SEC on December 10, 2024, included an expected $7MM in 4Q24 tax expense related to a discrete state tax matter that was not resolved as of 12/31/2024. (1) Non-GAAP financial measures; see appendix for applicable reconciliations; (2) TE - Taxable Equivalent 2024 Financial Highlights Income Statement Summary (Adjusted)(1) ($ in thousands, except per share data) 2024 % Change YoY Net Interest Income (TE)(2) $1,755,062 (4)% Adjusted Non-Interest Revenue $490,386 6% Adjusted Total Revenue (TE)(2) $2,245,448 (2)% Adjusted Non-Interest Expense $1,231,563 (3)% Adjusted Pre-Provision Net Revenue $1,013,885 —% Adjusted Net Income Available to Common Shareholders $641,896 6% Adjusted Diluted EPS $4.43 7%

18 Period-End Balance Sheet Growth ($ in millions) 2024 % Change YoY Loans $42,609 (2)% Deposits $51,095 1% Core Deposits(1) $46,220 3% Non-Interest Bearing Deposits $11,596 (7)% Note: Our recent guidance at an investor conference, as filed with the SEC on December 10, 2024, included an expected $7MM in 4Q24 tax expense related to a discrete state tax matter that was not resolved as of 12/31/2024. (1) Excludes brokered; (2) Non-GAAP financial measure; see appendix for applicable reconciliation; (3) TE - Taxable equivalent; (4) 2023 NCO ratio excluding loan sales was 0.28%; (5) 2024 CET1 ratio is preliminary. 2024 Financial Highlights Profitability Metrics 2024 2023 ROAA 0.81% 0.90% Adjusted ROAA(2) 1.15% 1.07% ROCE 9.50% 12.17% ROTCE(2) 10.91% 14.11% Adjusted ROTCE(2) 15.84% 16.76% Net Interest Margin 3.19% 3.21% Efficiency Ratio - TE(3) 62.54% 60.01% Adjusted Efficiency Ratio(2) 54.33% 54.94% Credit & Capital Metrics 2024 2023 NCOs/Average Loans(4) 0.31% 0.35% NPLs/Loans 0.73% 0.66% Allowance for Credit Losses % 1.27% 1.24% CET1 Ratio(5) 10.84% 10.22%

19 Income Statement Summary (GAAP) ($ in thousands, except per share data) 4Q24 % Change QoQ % Change YoY Net Interest Income $454,993 3% 4% Provision for Credit Losses $32,867 40% (28)% Non-Interest Revenue $125,587 1% 144% Total Revenue $580,580 3% 19% Non-Interest Expense $309,311 (1)% (12)% Pre-Provision Net Revenue $271,269 8% 100% Net Income Available to Common Shareholders $178,848 5% 195% Diluted EPS $1.25 6% 204% Note: Our recent guidance at an investor conference, as filed with the SEC on December 10, 2024, included an expected $7MM in 4Q24 tax expense related to a discrete state tax matter that was not resolved as of 12/31/2024. (1) Non-GAAP financial measures; see appendix for applicable reconciliations; (2) TE - Taxable Equivalent Fourth Quarter 2024 Financial Highlights Income Statement Summary (Adjusted)(1) ($ in thousands, except per share data) 4Q24 % Change QoQ % Change YoY Net Interest Income (TE)(2) $456,423 3% 4% Adjusted Non-Interest Revenue $124,631 2% (1)% Adjusted Total Revenue (TE)(2) $581,054 3% 3% Adjusted Non-Interest Expense $309,037 2% (12)% Adjusted Pre-Provision Net Revenue $272,017 4% 29% Adjusted Net Income Available to Common Shareholders $178,331 1% 53% Adjusted Diluted EPS $1.25 2% 57%

20 Period-End Balance Sheet Growth ($ in millions) 4Q24 % Change QoQ % Change YoY Loans $42,609 (1)% (2)% Deposits $51,095 2% 1% Core Deposits(1) $46,220 3% 3% Non-Interest Bearing Deposits $11,596 (1)% (7)% Note: Our recent guidance at an investor conference, as filed with the SEC on December 10, 2024, included an expected $7MM in 4Q24 tax expense related to a discrete state tax matter that was not resolved as of 12/31/2024. (1) Excludes brokered; (2) Annualized; (3) Non-GAAP financial measure; see appendix for applicable reconciliation; (4) TE - Taxable equivalent;; (5) 4Q24 capital ratios are preliminary Fourth Quarter 2024 Financial Highlights Profitability Metrics 4Q24 3Q24 4Q23 ROAA(2) 1.25% 1.21% 0.47% Adjusted ROAA(2)(3) 1.25% 1.26% 0.84% ROCE(2) 14.75% 14.38% 5.88% ROTCE(2)(3) 16.72% 16.38% 7.02% Adjusted ROTCE(2)(3) 16.67% 17.09% 13.28% Net Interest Margin(2) 3.28% 3.22% 3.11% Efficiency Ratio - TE(4) 53.15% 55.41% 72.03% Adjusted Efficiency Ratio(3) 52.69% 52.97% 61.97% Credit & Capital Metrics 4Q24 3Q24 4Q23 NCOs/Average Loans(2) 0.26% 0.25% 0.38% NPLs/Loans 0.73% 0.73% 0.66% Allowance for Credit Losses % 1.27% 1.24% 1.24% CET1 Ratio(5) 10.84% 10.64% 10.22%

21 Loan Trends $43,597 $43,378 $43,364 $42,908 $42,537 $22,744 $22,665 $22,729 $22,470 $22,257 $12,363 $12,278 $12,278 $12,140 $12,021 $8,491 $8,434 $8,358 $8,298 $8,259 C&I CRE Consumer 4Q23 1Q24 2Q24 3Q24 4Q24 $43,404 $43,310 $43,093 $43,121 $42,609 $22,598 $22,731 $22,537 $22,664 $22,331 $12,317 $12,194 $12,215 $12,177 $12,015 $8,489 $8,385 $8,341 $8,279 $8,263 C&I CRE Consumer 4Q23 1Q24 2Q24 3Q24 4Q24 Period End Loans ($ in millions) Average Loans ($ in millions) Amounts may not total due to rounding

22 $50,739 $50,580 $50,196 $50,194 $51,095 $12,508 $12,042 $11,656 $11,562 $11,596 $10,681 $10,644 $10,781 $10,960 $11,517 $12,902 $12,925 $12,854 $13,112 $14,056 $1,071 $1,055 $1,021 $995 $982 $7,534 $8,195 $8,482 $8,460 $8,068 $6,043 $5,719 $5,402 $5,105 $4,875 NIB DDA NOW MMA Savings Time Brokered 4Q23 1Q24 2Q24 3Q24 4Q24 Deposit Trends Period End Deposits ($ in millions) Average Deposits ($ in millions) $50,587 $50,186 $50,408 $50,481 $51,101 $12,744 $12,072 $12,099 $11,666 $11,784 $10,422 $10,590 $10,789 $10,835 $11,298 $13,054 $12,826 $12,617 $13,059 $13,768 $1,099 $1,057 $1,036 $1,008 $987 $7,198 $7,903 $8,383 $8,438 $8,252 $6,069 $5,737 $5,483 $5,476 $5,013 NIB DDA NOW MMA Savings Time Brokered 4Q23 1Q24 2Q24 3Q24 4Q24 Amounts may not total due to rounding

23 ACL/Loans: Economic Scenario Assumptions and Weightings 1.24% 1.27% $539 $535 $2 $2 $— $— 3Q24 Net Growth Performance Economic Uncertainty and Other Qualitatives Other Factors 4Q24(1) (1) Other factors include the addition to the ACL associated with the cessation of a third-party lending relationships and decline in that portfolio in 2023 as well as the impact of dispositions, etc.; (2) Downside scenarios carry a total weighting of 35%, and correspond to Moody's November 2024 "S5" Slow Growth scenario and "S3" Downside 10th Percentile scenario; (3) Upside refers to Moody's November 2024 "S1" Upside 10th Percentile scenario; (4) Corresponds to Moody's November scenarios 4th Quarter Change from 2025(4) 2026(4) Scenario Model Weighting Previous Quarter GDP Unemployment GDP Unemployment Consensus Baseline 55% +5% 2.0% 4.4% 2.0% 4.2% Slow Growth(2) 25% (5)% 1.5% 4.8% 1.3% 5.0% Downside(2) 10% NC (1.0)% 7.3% 0.5% 7.9% Upside(3) 10% NC 3.2% 3.3% 2.7% 3.2% Weighted Average 1.7% 4.7% 1.7% 4.7% Allowance for Credit Losses ($ in millions)

24 Risk Distribution ($ in millions) Composition Change Risk Category 4Q24 3Q24 4Q24 vs. 3Q24 Passing Grades $40,929 $41,427 $(499) Special Mention 755 732 23 Substandard Accruing 616 648 (32) Non-Performing Loans 309 313 (4) Total Loans $42,609 $43,121 $(512) Amounts may not total due to rounding. $1,032 $914 $929 $942 $1,086 $1,333 $1,484 $1,527 $1,634 $1,590 $1,693 $1,680 2.6% 2.2% 2.2% 2.2% 2.5% 3.0% 3.4% 3.5% 3.8% 3.7% 3.9% 3.9% Criticized and Classified Loans % of Total Loans 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 Portfolio Risk DistributionCriticized & Classified Loans

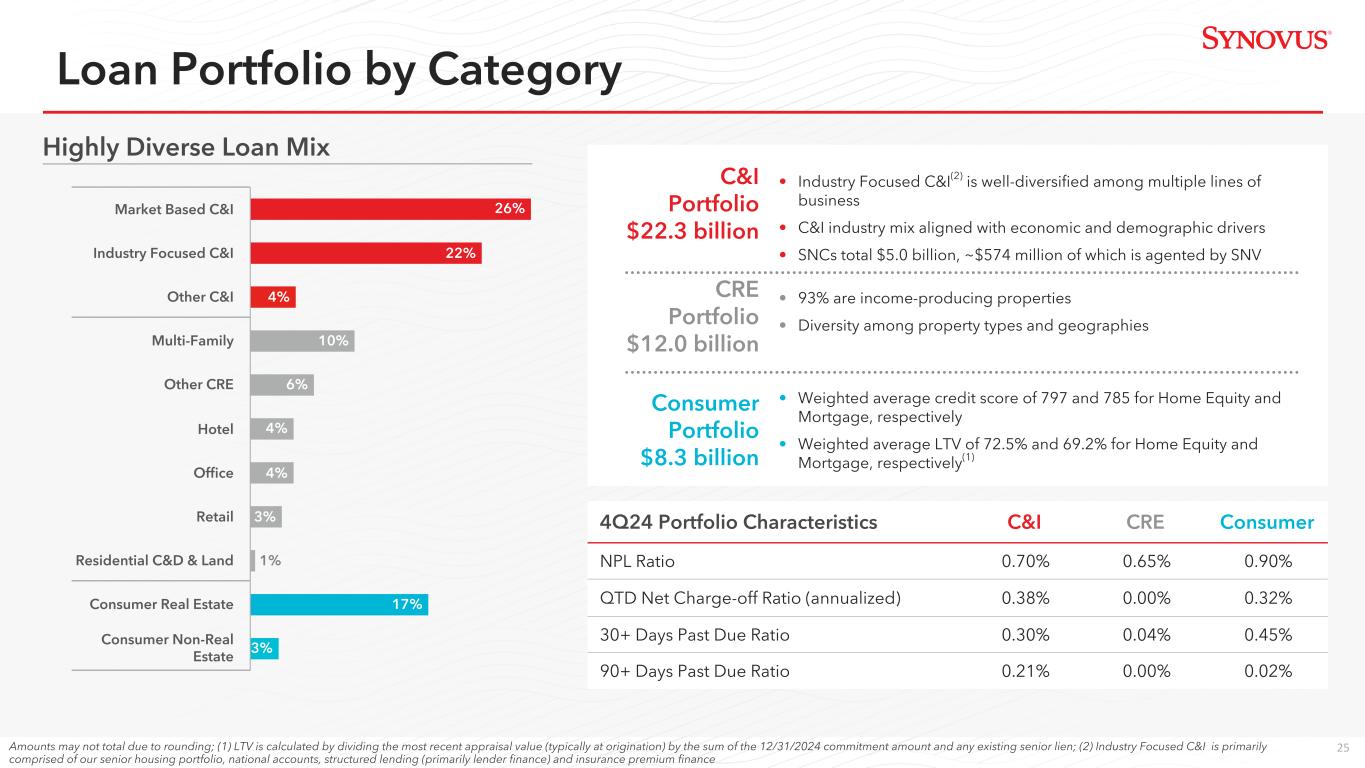

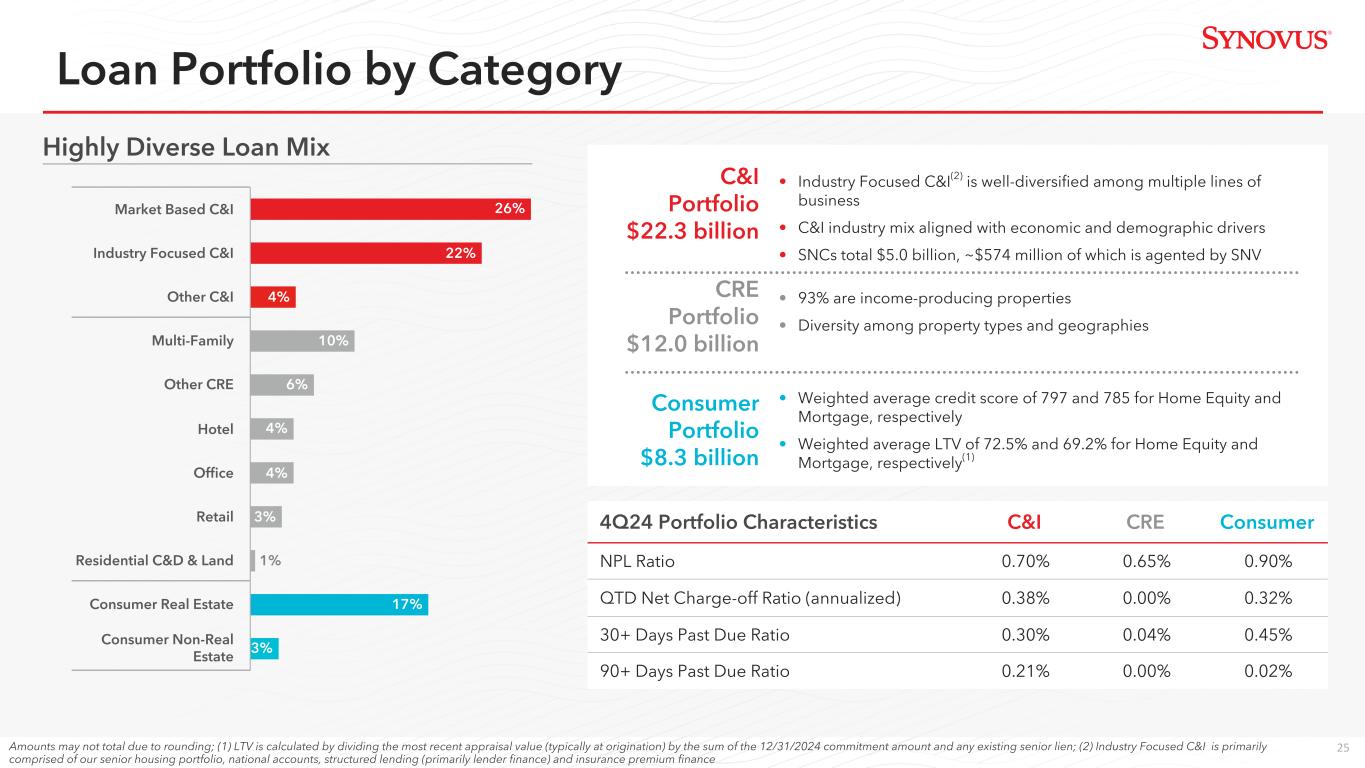

25 • 93% are income-producing properties • Diversity among property types and geographies • Industry Focused C&I(2) is well-diversified among multiple lines of business • C&I industry mix aligned with economic and demographic drivers • SNCs total $5.0 billion, ~$574 million of which is agented by SNV • Weighted average credit score of 797 and 785 for Home Equity and Mortgage, respectively • Weighted average LTV of 72.5% and 69.2% for Home Equity and Mortgage, respectively(1) Consumer Portfolio $8.3 billion CRE Portfolio $12.0 billion C&I Portfolio $22.3 billion 4Q24 Portfolio Characteristics C&I CRE Consumer NPL Ratio 0.70% 0.65% 0.90% QTD Net Charge-off Ratio (annualized) 0.38% 0.00% 0.32% 30+ Days Past Due Ratio 0.30% 0.04% 0.45% 90+ Days Past Due Ratio 0.21% 0.00% 0.02% Amounts may not total due to rounding; (1) LTV is calculated by dividing the most recent appraisal value (typically at origination) by the sum of the 12/31/2024 commitment amount and any existing senior lien; (2) Industry Focused C&I is primarily comprised of our senior housing portfolio, national accounts, structured lending (primarily lender finance) and insurance premium finance Loan Portfolio by Category 26% 22% 4% 10% 6% 4% 4% 3% 1% 17% 3% Market Based C&I Industry Focused C&I Other C&I Multi-Family Other CRE Hotel Office Retail Residential C&D & Land Consumer Real Estate Consumer Non-Real Estate Highly Diverse Loan Mix

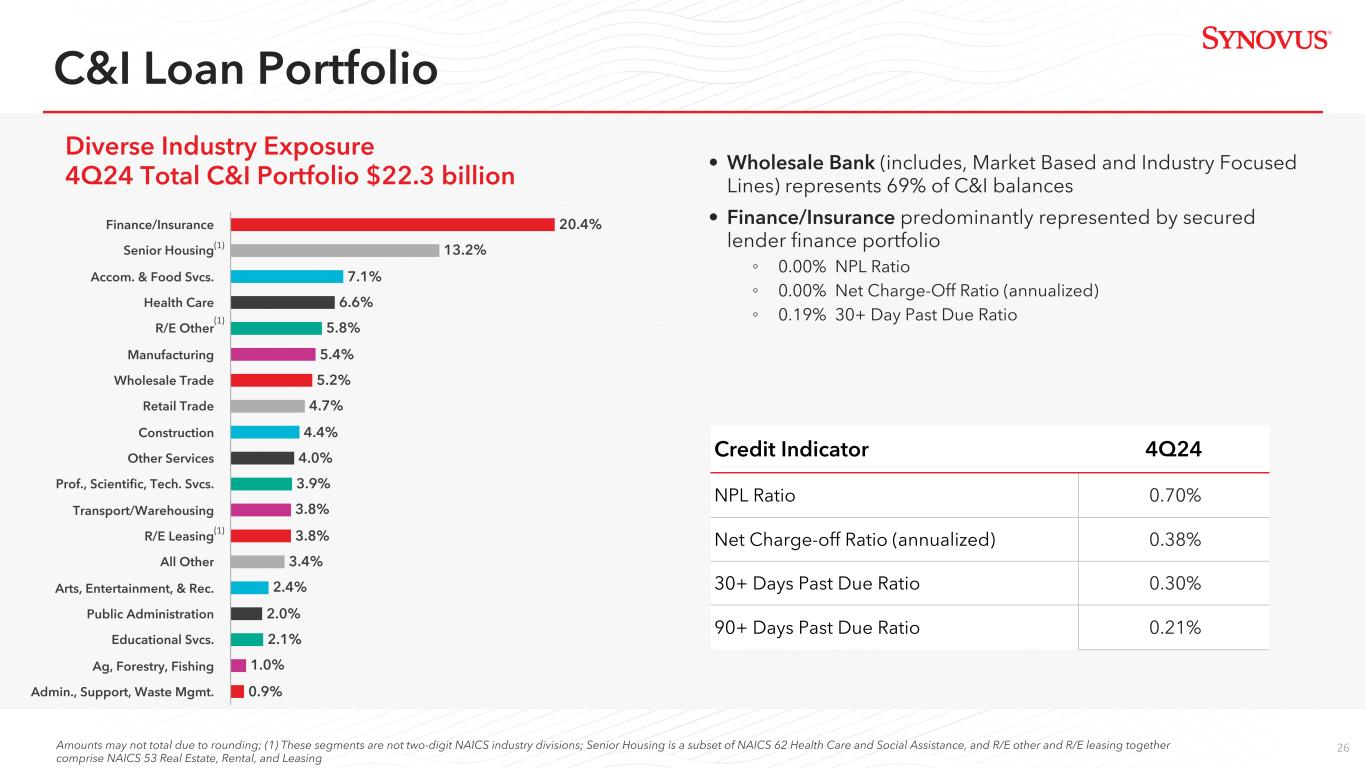

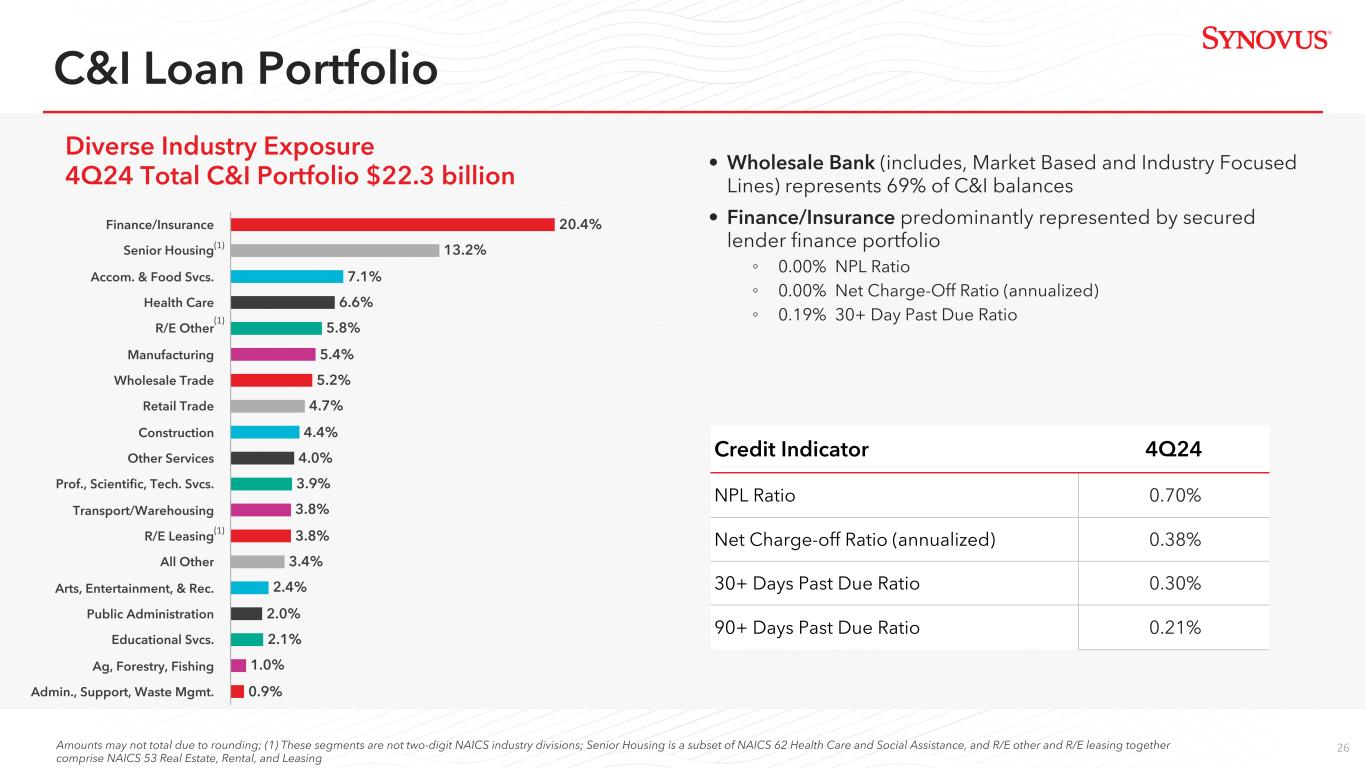

26 Credit Indicator 4Q24 NPL Ratio 0.70% Net Charge-off Ratio (annualized) 0.38% 30+ Days Past Due Ratio 0.30% 90+ Days Past Due Ratio 0.21% • Wholesale Bank (includes, Market Based and Industry Focused Lines) represents 69% of C&I balances • Finance/Insurance predominantly represented by secured lender finance portfolio ◦ 0.00% NPL Ratio ◦ 0.00% Net Charge-Off Ratio (annualized) ◦ 0.19% 30+ Day Past Due Ratio Diverse Industry Exposure 4Q24 Total C&I Portfolio $22.3 billion Amounts may not total due to rounding; (1) These segments are not two-digit NAICS industry divisions; Senior Housing is a subset of NAICS 62 Health Care and Social Assistance, and R/E other and R/E leasing together comprise NAICS 53 Real Estate, Rental, and Leasing C&I Loan Portfolio 20.4% 13.2% 7.1% 6.6% 5.8% 5.4% 5.2% 4.7% 4.4% 4.0% 3.9% 3.8% 3.8% 3.4% 2.4% 2.0% 2.1% 1.0% 0.9% Finance/Insurance Senior Housing Accom. & Food Svcs. Health Care R/E Other Manufacturing Wholesale Trade Retail Trade Construction Other Services Prof., Scientific, Tech. Svcs. Transport/Warehousing R/E Leasing All Other Arts, Entertainment, & Rec. Public Administration Educational Svcs. Ag, Forestry, Fishing Admin., Support, Waste Mgmt. (1) (1) (1)

27 Commercial Real Estate Loan Portfolio Composition of 4Q24 CRE Portfolio Total Portfolio $12.0 billion Investment Properties Land, Development and Residential Properties Portfolio Characteristics (as of December 31, 2024) Office Building Multi-family Shopping Centers Hotels Other Investment Properties Warehouse Residential Properties(1) Development & Land Balance (in millions) $1,743 $4,186 $1,273 $1,769 $1,363 $846 $546 $287 Weighted Average LTV(2)(3) 54.2% 52.2% 53.0% 54.7% 51.8% 51.7% N/A N/A NPL Ratio 4.15% 0.00% 0.04% 0.00% 0.06% 0.02% 0.44% 0.48% Net Charge-off Ratio (annualized) (0.07)% 0.00% 0.00% 0.00% 0.10% 0.00% (0.01)% (0.01)% 30+ Days Past Due Ratio 0.01% 0.01% 0.00% 0.00% 0.10% 0.00% 0.30% 0.46% 90+ Days Past Due Ratio 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.07% Investment Properties portfolio represent 93% of total CRE portfolio ◦ The portfolio is well diversified among property types CRE Credit Quality ◦ 0.65% NPL Ratio ◦ 0.00% Net Charge-Off Ratio (annualized) ◦ 0.04% 30+ Day Past Due Ratio ◦ 0.00% 90+ Day Past Due Ratio Amounts may not total due to rounding; (1) Includes 1-4 Family Construction and 1-4 Family Perm/Mini-Perm (primarily rental homes); (2) LTV calculated by dividing most recent appraisal (typically at origination) on non-construction component of portfolio by the 12/31/24 commitment amount and any senior lien. (3) Methodology for calculated LTV differs from LTV’s noted on other CRE slides 34.8% 14.7% 14.5% 11.3% 10.6% 7.0% 2.8% 2.4% 1.8% Multi-Family Hotels Office Building Other Investment Properties Shopping Center Warehouses 1-4 Family Perm/Mini-Perm Land Acquisition & Dev. 1-4 Family Construction

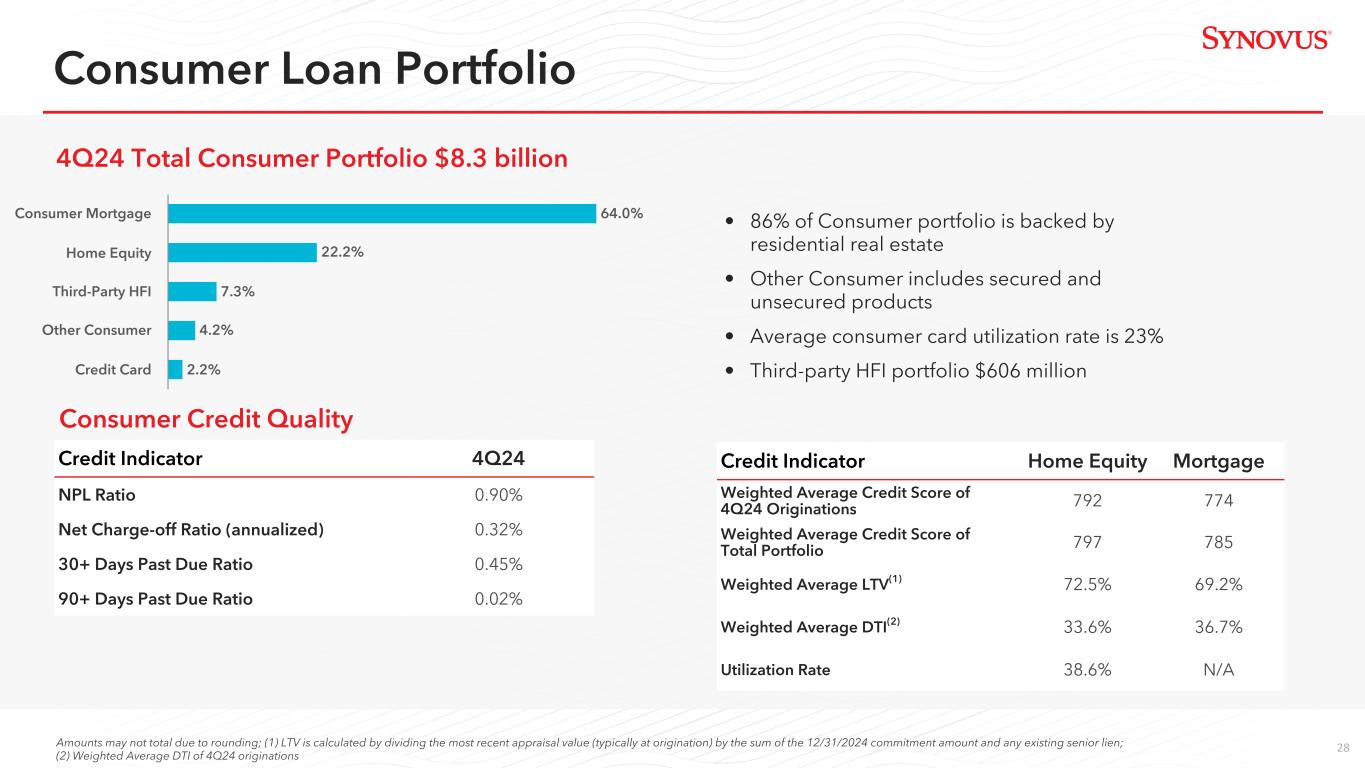

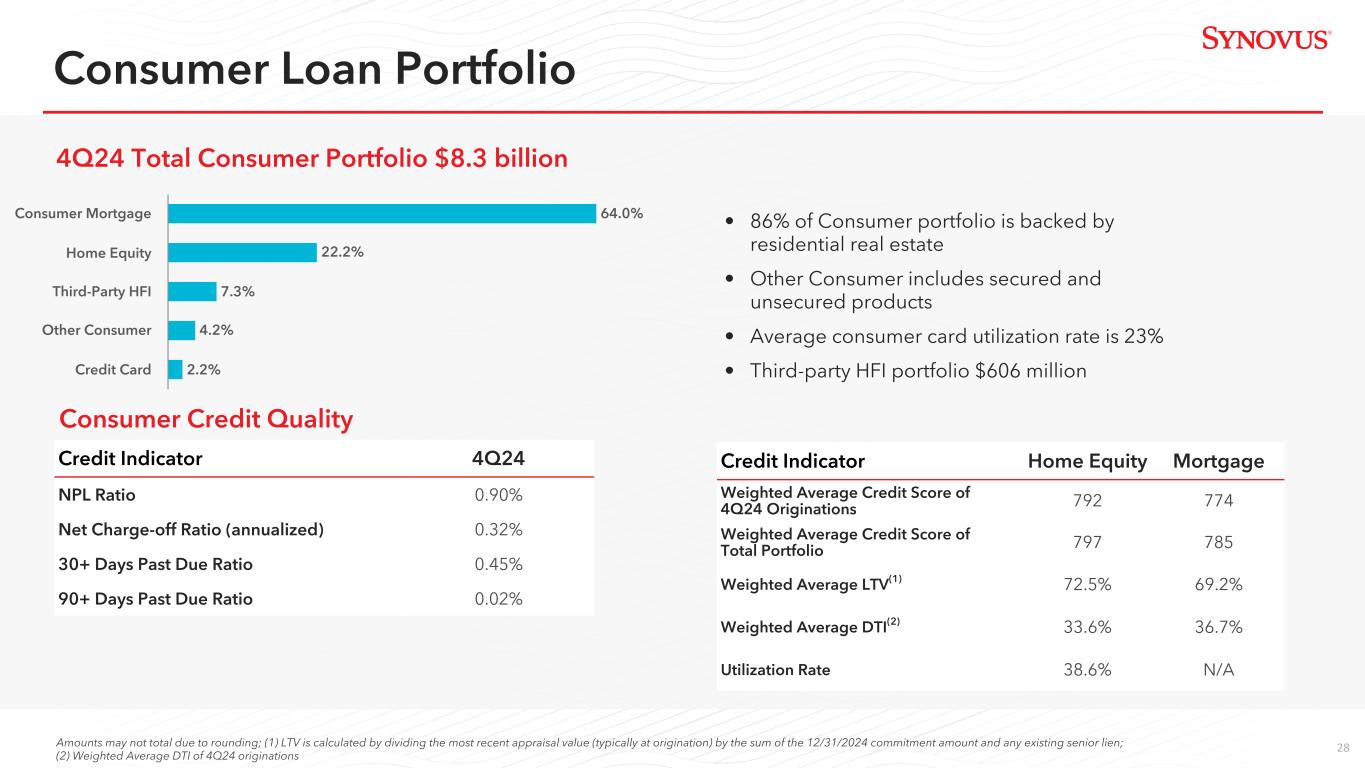

28 Credit Indicator 4Q24 NPL Ratio 0.90% Net Charge-off Ratio (annualized) 0.32% 30+ Days Past Due Ratio 0.45% 90+ Days Past Due Ratio 0.02% 4Q24 Total Consumer Portfolio $8.3 billion Credit Indicator Home Equity Mortgage Weighted Average Credit Score of 4Q24 Originations 792 774 Weighted Average Credit Score of Total Portfolio 797 785 Weighted Average LTV(1) 72.5% 69.2% Weighted Average DTI(2) 33.6% 36.7% Utilization Rate 38.6% N/A Amounts may not total due to rounding; (1) LTV is calculated by dividing the most recent appraisal value (typically at origination) by the sum of the 12/31/2024 commitment amount and any existing senior lien; (2) Weighted Average DTI of 4Q24 originations Consumer Credit Quality Consumer Loan Portfolio • 86% of Consumer portfolio is backed by residential real estate • Other Consumer includes secured and unsecured products • Average consumer card utilization rate is 23% • Third-party HFI portfolio $606 million 64.0% 22.2% 7.3% 4.2% 2.2% Consumer Mortgage Home Equity Third-Party HFI Other Consumer Credit Card

29 $3,350 $3,350 $3,350 $2,850 $2,600 $2,350 $2,350 $2,100 $1,600 $250 $500 $500 $500 $750 $750 $1,000 $1,000 2.68% 2.78% 2.98% 3.16% 3.38% 3.62% 3.62% 3.64% 3.60% Effective Forward Starting Effective Rate 4Q24 1Q25 2Q25 3Q25 4Q25 1Q26 2Q26 3Q26 4Q26 62% 62% 62% 63% 63% 38% 38% 38% 37% 37% 6.45% 6.49% 6.59% 6.59% 6.41% Floating Rate Fixed rate Yield 4Q23 1Q24 2Q24 3Q24 4Q24 Note: Amounts may not total due to rounding; (1) Represents projected notional outstanding for effective cash-flow loan hedges, along with the estimated effective fixed-rate for the respective period; (2) NII sensitivity estimates reflect a dynamic balance sheet Derivative Hedge Portfolio(1)Loan Portfolio Rate Mix and Yield Earning Assets Composition ($ in millions) 12-Month Net Interest Income Sensitivity(2) Parallel Shock % NII Impact +100bps 2.0% -100bps (2.0)%

30 $1.0 $0.8 $0.7 $0.9 $0.8 $0.7 Securities AOCI Swap AOCI 4Q24 4Q25E 4Q26E Securities Portfolio $11,091 $11,153 $10,240 $10,449 $10,661 $2,668 $2,623 $2,582 2.33% 2.58% 3.04% 3.36% 3.43% AFS HTM Yield 4Q23 1Q24 2Q24 3Q24 4Q24 Total Securities Portfolio(1) AFS Securities & Cash Flow Hedges: Est. Unrealized Loss in AOCI (After-Tax)(2) ($ in millions) Note: Amounts may not total due to rounding; (1) Amortized cost; (2) AOCI unrealized loss projections are based on the forward interest rate curve as of 12/31/24 and incorporate various assumptions, including those related to prepayments and tax rates. ($ in billions)

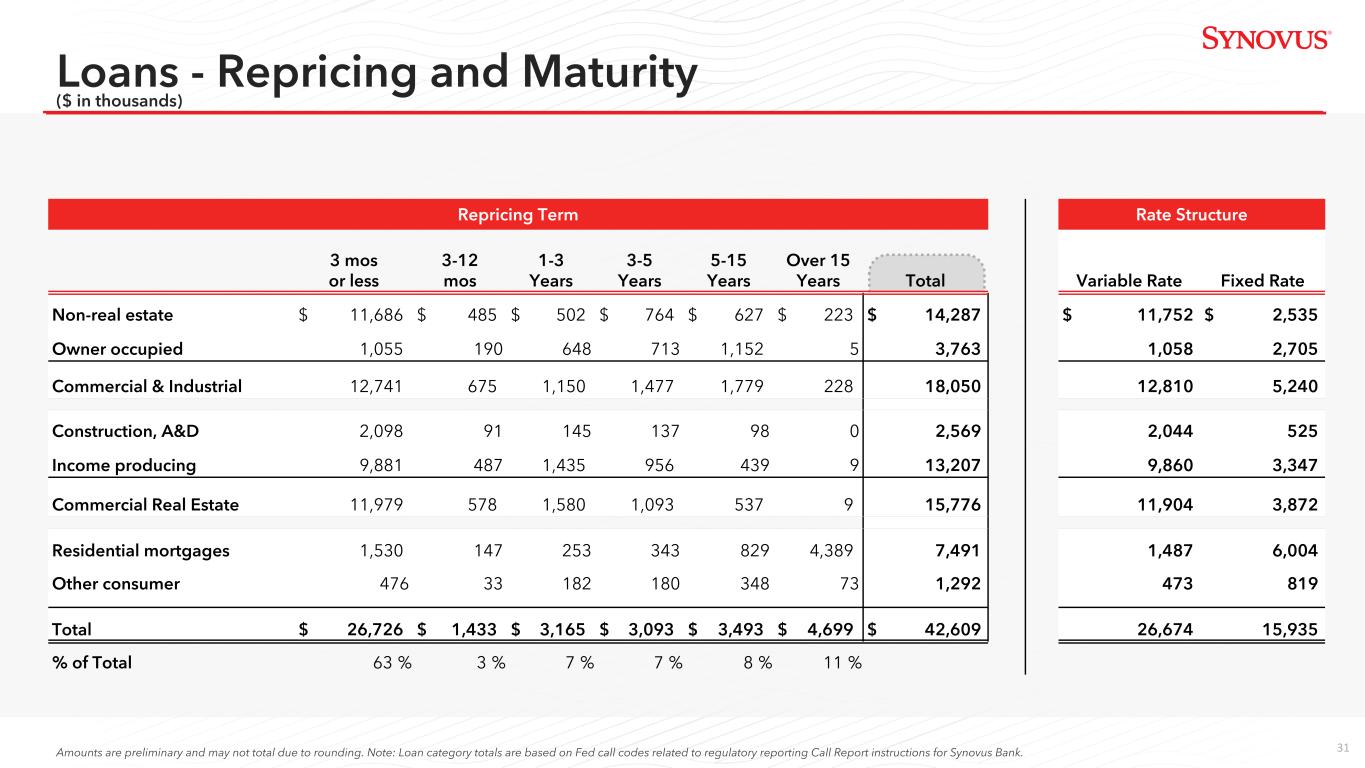

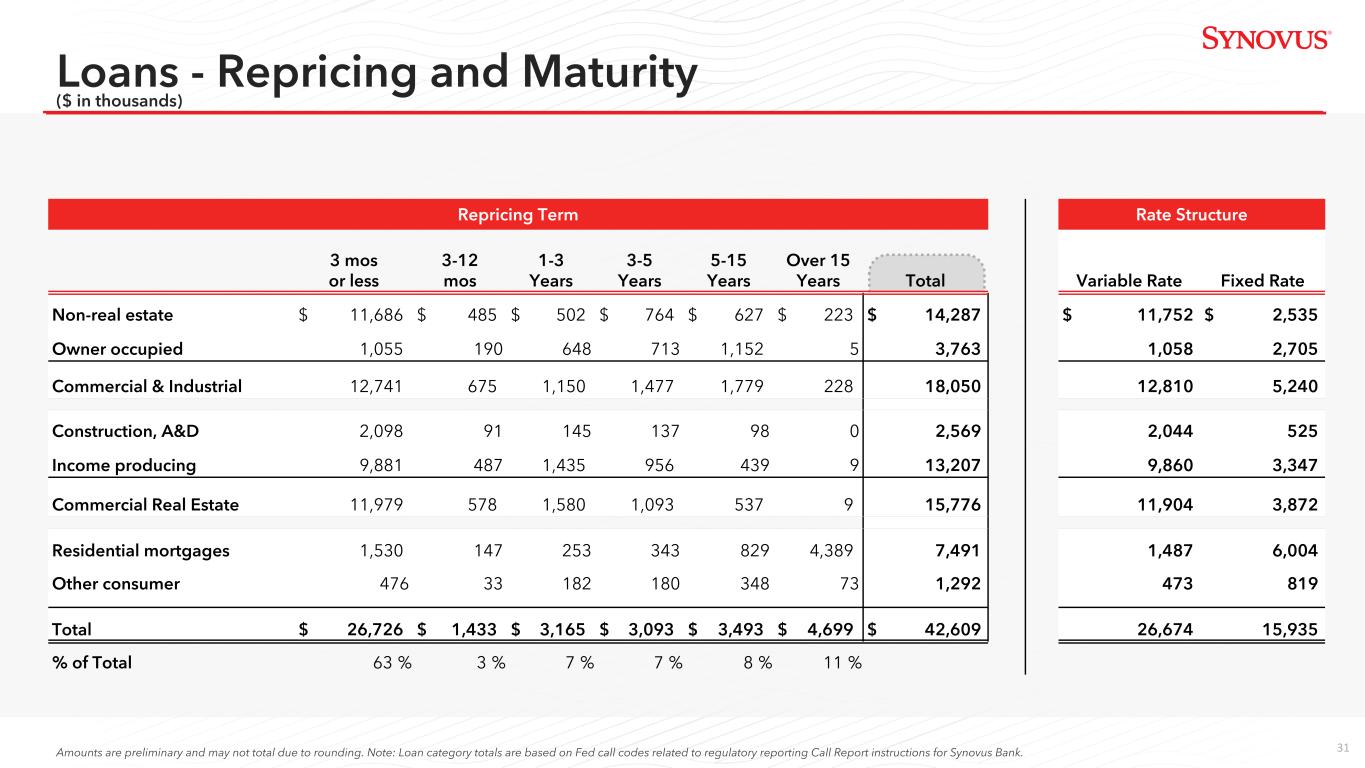

31 Repricing Term Rate Structure 3 mos or less 3-12 mos 1-3 Years 3-5 Years 5-15 Years Over 15 Years Total Variable Rate Fixed Rate Non-real estate $ 11,686 $ 485 $ 502 $ 764 $ 627 $ 223 $ 14,287 $ 11,752 $ 2,535 Owner occupied 1,055 190 648 713 1,152 5 3,763 1,058 2,705 Commercial & Industrial 12,741 675 1,150 1,477 1,779 228 18,050 12,810 5,240 Construction, A&D 2,098 91 145 137 98 0 2,569 2,044 525 Income producing 9,881 487 1,435 956 439 9 13,207 9,860 3,347 Commercial Real Estate 11,979 578 1,580 1,093 537 9 15,776 11,904 3,872 Residential mortgages 1,530 147 253 343 829 4,389 7,491 1,487 6,004 Other consumer 476 33 182 180 348 73 1,292 473 819 Total $ 26,726 $ 1,433 $ 3,165 $ 3,093 $ 3,493 $ 4,699 $ 42,609 26,674 15,935 % of Total 63 % 3 % 7 % 7 % 8 % 11 % Loans - Repricing and Maturity ($ in thousands) Amounts are preliminary and may not total due to rounding. Note: Loan category totals are based on Fed call codes related to regulatory reporting Call Report instructions for Synovus Bank.

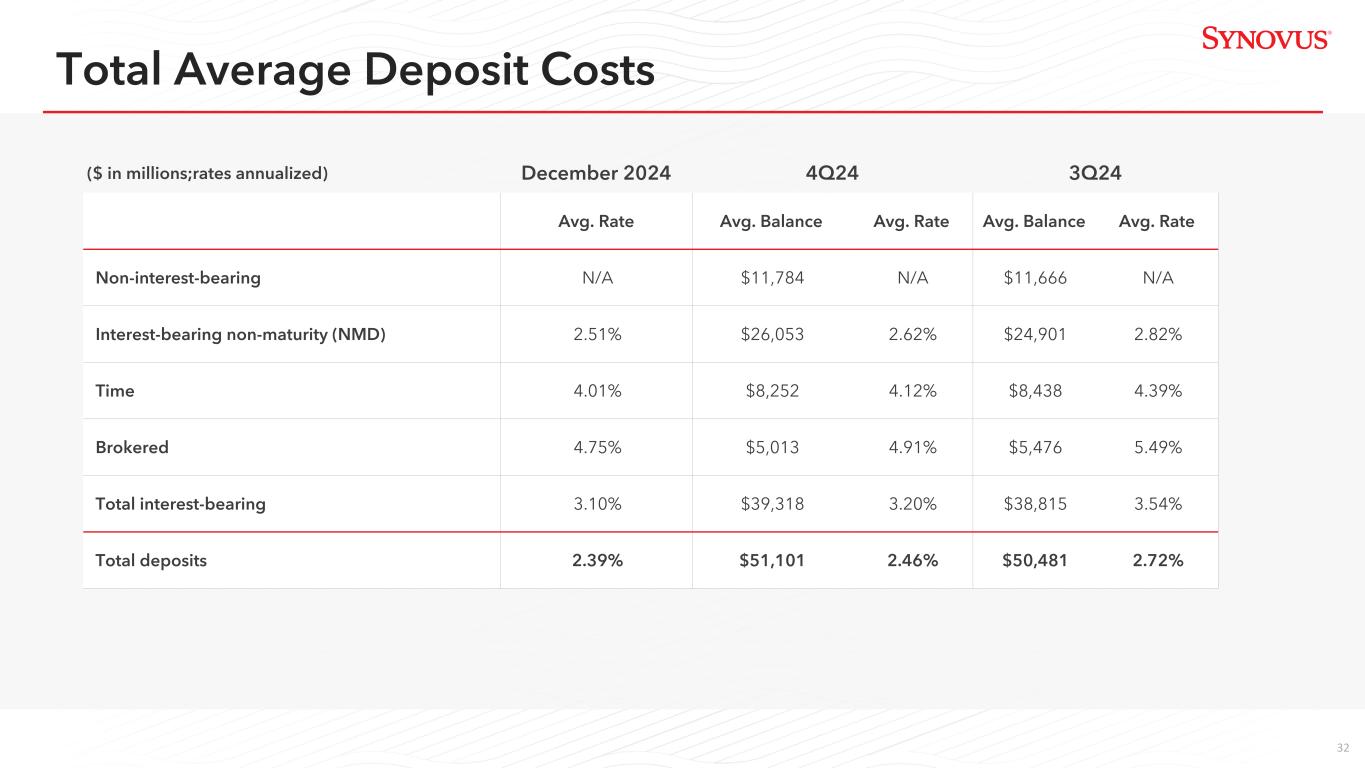

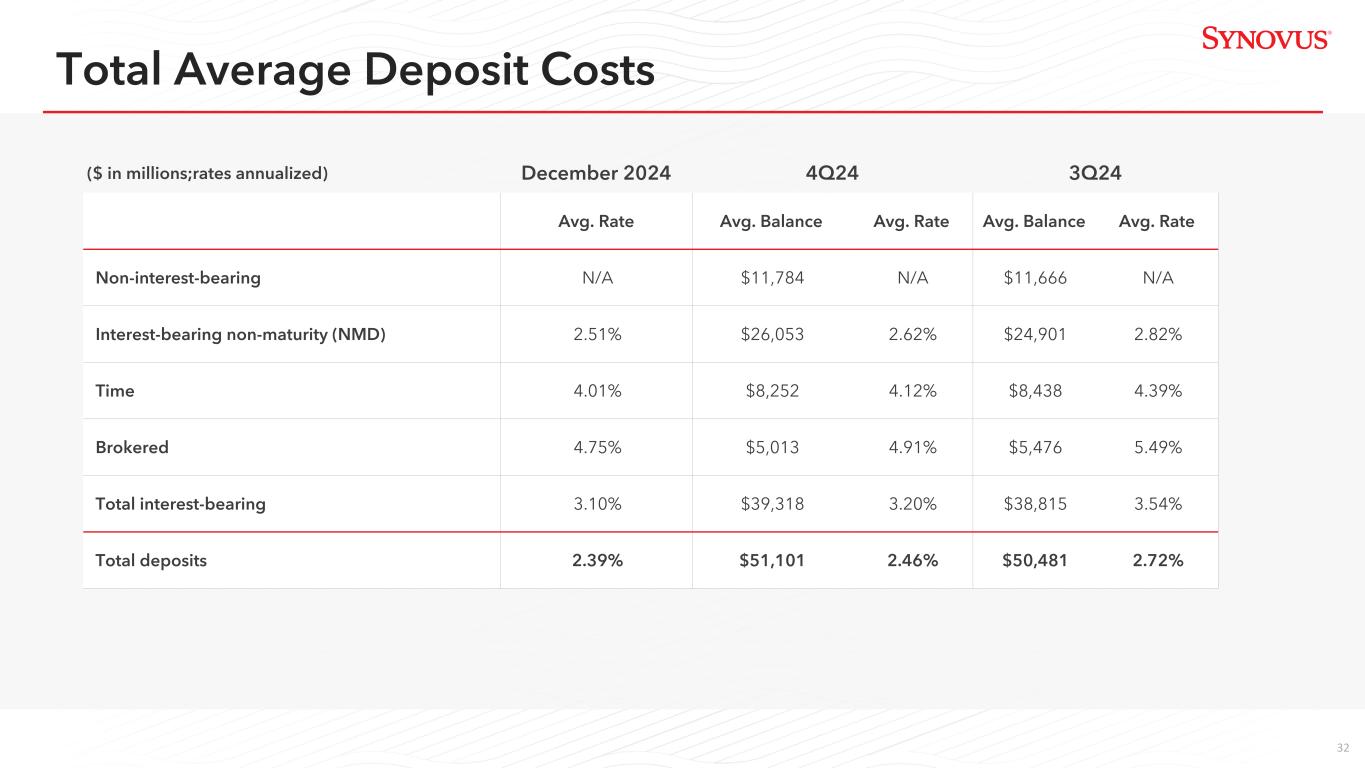

32 ($ in millions;rates annualized) December 2024 4Q24 3Q24 Avg. Rate Avg. Balance Avg. Rate Avg. Balance Avg. Rate Non-interest-bearing N/A $11,784 N/A $11,666 N/A Interest-bearing non-maturity (NMD) 2.51% $26,053 2.62% $24,901 2.82% Time 4.01% $8,252 4.12% $8,438 4.39% Brokered 4.75% $5,013 4.91% $5,476 5.49% Total interest-bearing 3.10% $39,318 3.20% $38,815 3.54% Total deposits 2.39% $51,101 2.46% $50,481 2.72% Total Average Deposit Costs

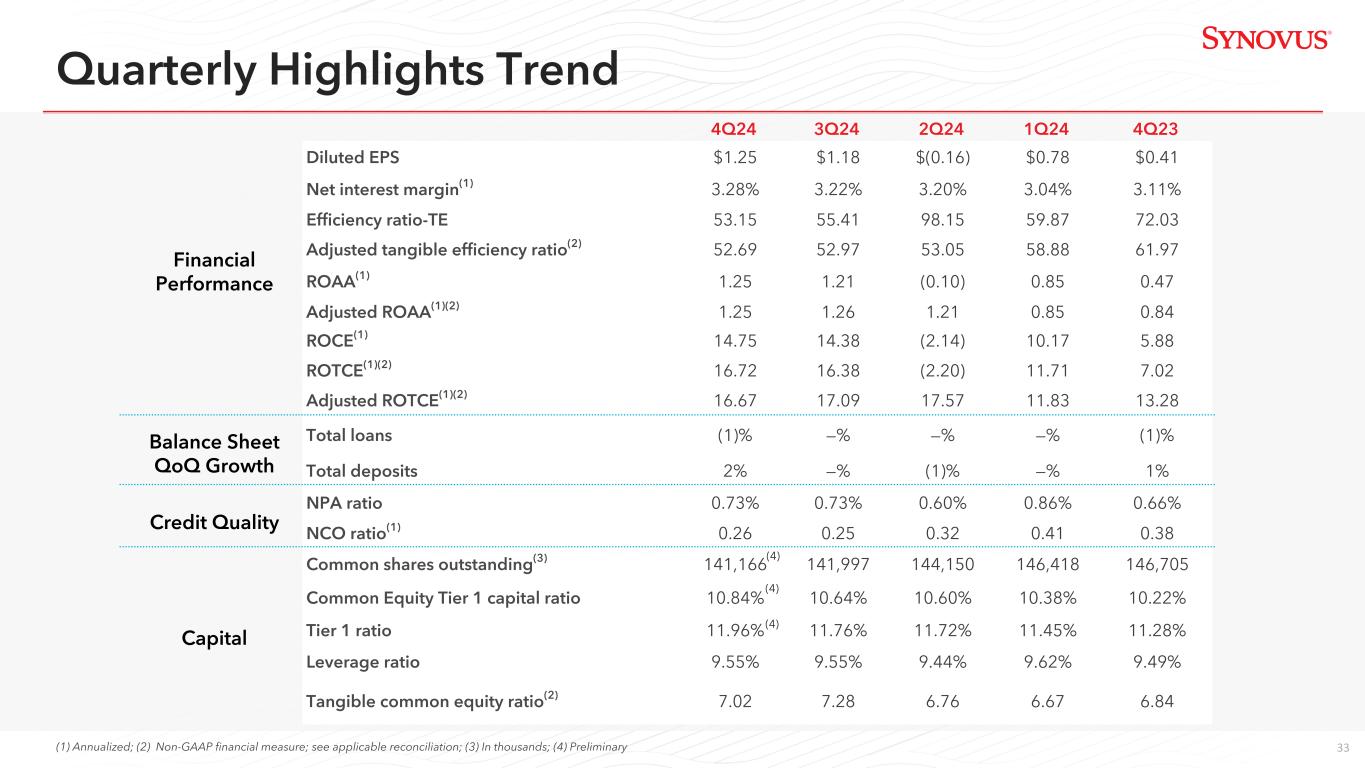

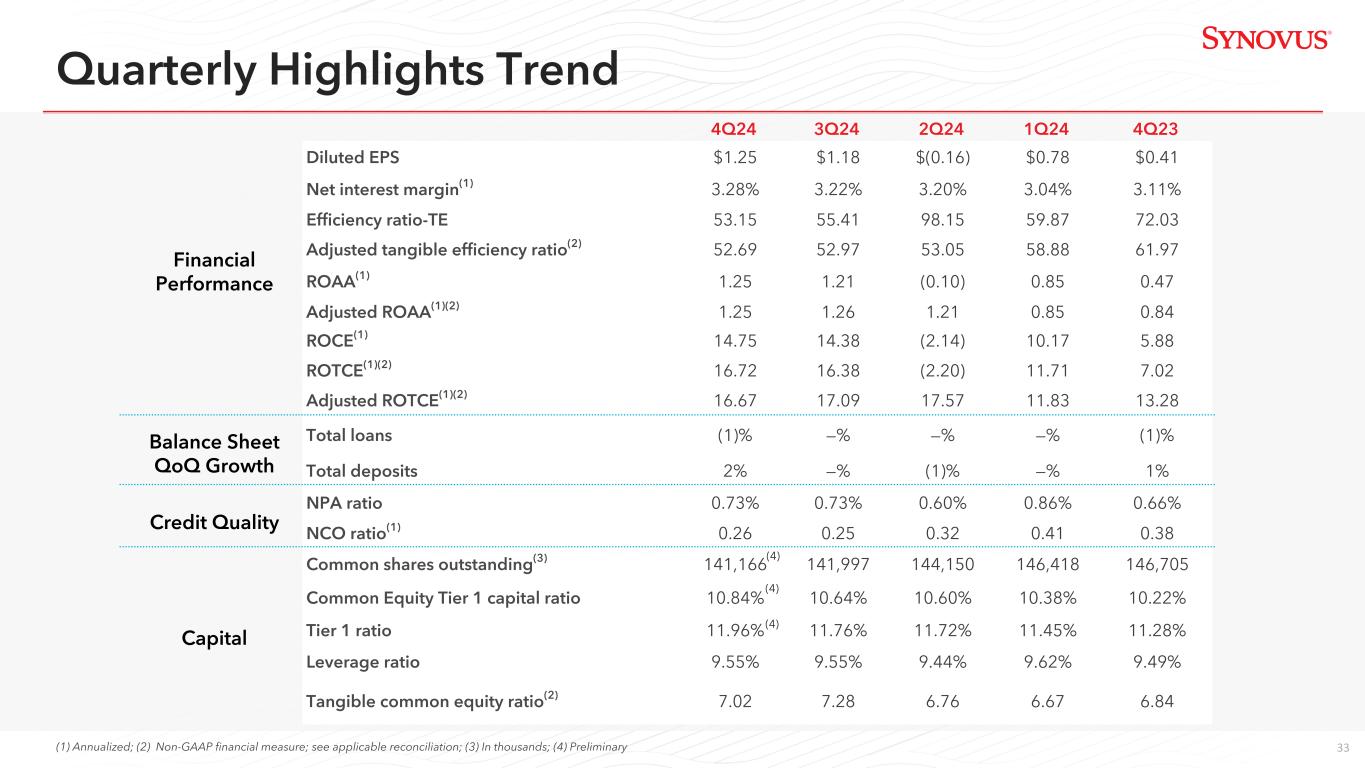

33 4Q24 3Q24 2Q24 1Q24 4Q23 Diluted EPS $1.25 $1.18 $(0.16) $0.78 $0.41 Net interest margin(1) 3.28% 3.22% 3.20% 3.04% 3.11% Efficiency ratio-TE 53.15 55.41 98.15 59.87 72.03 Adjusted tangible efficiency ratio(2) 52.69 52.97 53.05 58.88 61.97 ROAA(1) 1.25 1.21 (0.10) 0.85 0.47 Adjusted ROAA(1)(2) 1.25 1.26 1.21 0.85 0.84 ROCE(1) 14.75 14.38 (2.14) 10.17 5.88 ROTCE(1)(2) 16.72 16.38 (2.20) 11.71 7.02 Adjusted ROTCE(1)(2) 16.67 17.09 17.57 11.83 13.28 Total loans (1)% —% —% —% (1)% Total deposits 2% —% (1)% —% 1% NPA ratio 0.73% 0.73% 0.60% 0.86% 0.66% NCO ratio(1) 0.26 0.25 0.32 0.41 0.38 Common shares outstanding(3) 141,166 141,997 144,150 146,418 146,705 Common Equity Tier 1 capital ratio 10.84% 10.64% 10.60% 10.38% 10.22% Tier 1 ratio 11.96% 11.76% 11.72% 11.45% 11.28% Leverage ratio 9.55% 9.55% 9.44% 9.62% 9.49% Tangible common equity ratio(2) 7.02 7.28 6.76 6.67 6.84 Financial Performance (1) Annualized; (2) Non-GAAP financial measure; see applicable reconciliation; (3) In thousands; (4) Preliminary (4) Balance Sheet QoQ Growth Credit Quality Capital Quarterly Highlights Trend (4) (4)

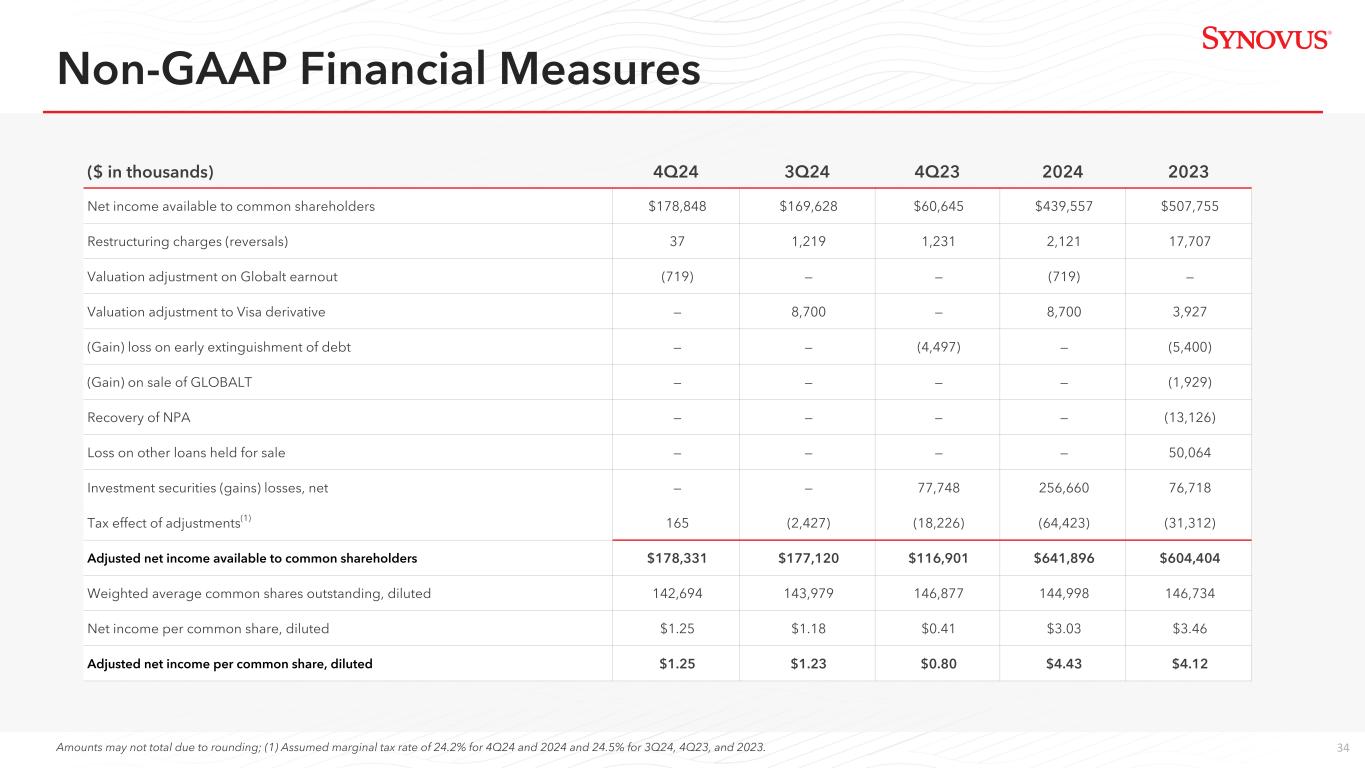

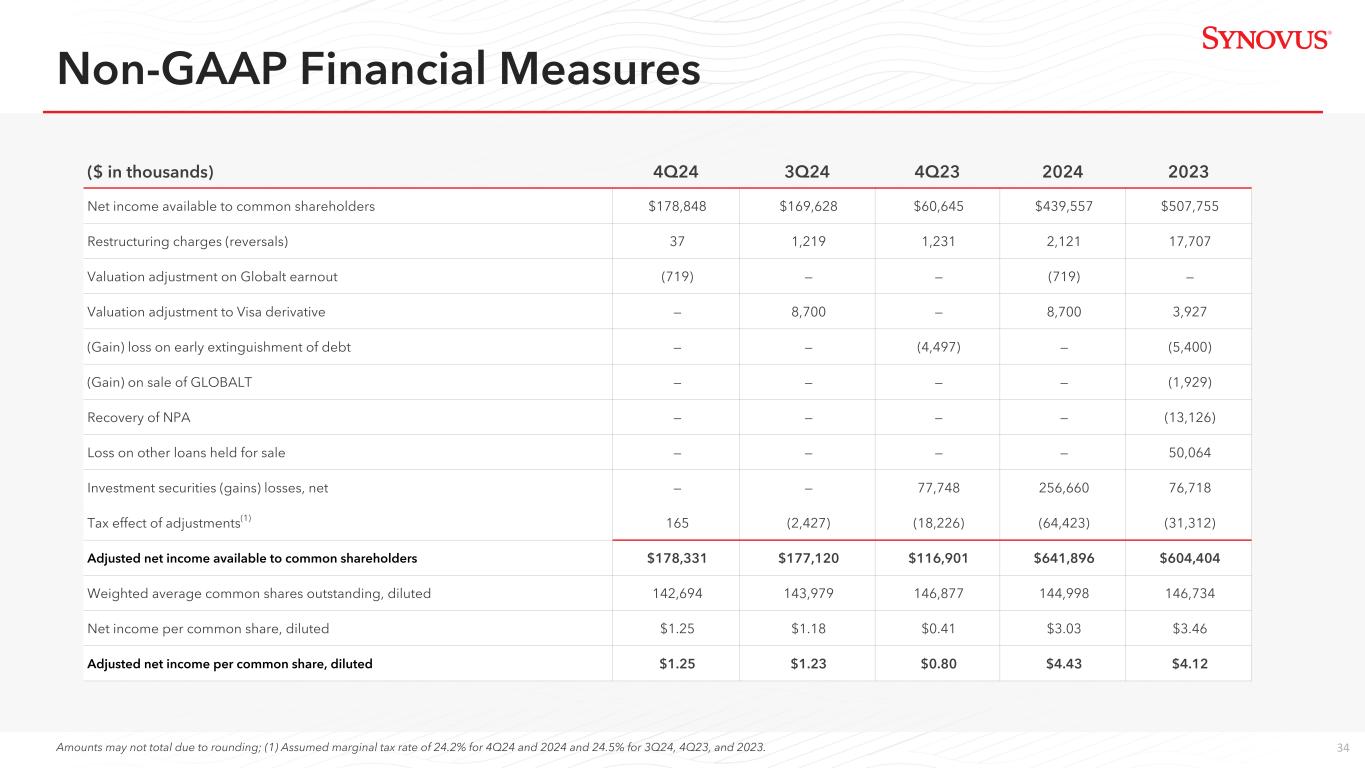

34 ($ in thousands) 4Q24 3Q24 4Q23 2024 2023 Net income available to common shareholders $178,848 $169,628 $60,645 $439,557 $507,755 Restructuring charges (reversals) 37 1,219 1,231 2,121 17,707 Valuation adjustment on Globalt earnout (719) — — (719) — Valuation adjustment to Visa derivative — 8,700 — 8,700 3,927 (Gain) loss on early extinguishment of debt — — (4,497) — (5,400) (Gain) on sale of GLOBALT — — — — (1,929) Recovery of NPA — — — — (13,126) Loss on other loans held for sale — — — — 50,064 Investment securities (gains) losses, net — — 77,748 256,660 76,718 Tax effect of adjustments(1) 165 (2,427) (18,226) (64,423) (31,312) Adjusted net income available to common shareholders $178,331 $177,120 $116,901 $641,896 $604,404 Weighted average common shares outstanding, diluted 142,694 143,979 146,877 144,998 146,734 Net income per common share, diluted $1.25 $1.18 $0.41 $3.03 $3.46 Adjusted net income per common share, diluted $1.25 $1.23 $0.80 $4.43 $4.12 Amounts may not total due to rounding; (1) Assumed marginal tax rate of 24.2% for 4Q24 and 2024 and 24.5% for 3Q24, 4Q23, and 2023. Non-GAAP Financial Measures

35 ($ in thousands) 4Q24 3Q24 4Q23 2024 2023 Net interest income $454,993 $440,740 $437,214 $1,749,577 $1,816,655 Total non-interest revenue 125,587 123,980 51,468 239,604 404,010 Total non-interest expense (309,311) (313,690) (352,858) (1,247,543) (1,335,424) Pre-provision net revenue (PPNR) $271,269 $251,030 $135,824 $741,638 $885,241 Net interest income $454,993 $440,740 $437,214 $1,749,577 $1,816,655 Taxable equivalent adjustment 1,430 1,393 1,216 5,485 4,621 TE net interest income 456,423 442,133 438,430 1,755,062 1,821,276 Total non-interest revenue 125,587 123,980 51,468 239,604 404,010 Total TE revenue 582,010 566,113 489,898 1,994,666 2,225,286 Valuation adjustment on Globalt earnout (719) — — (719) — (Gain) on sale of GLOBALT — — — — (1,929) Recovery of NPA — — — — (13,126) Investment securities (gains) losses, net — — 77,748 256,660 76,718 Fair value adjustment on non-qualified deferred compensation (237) (2,062) (3,053) (5,159) (4,987) Adjusted total revenue (TE) $581,054 $564,051 $564,593 $2,245,448 $2,281,962 Total non-interest expense $309,311 $313,690 $352,858 $1,247,543 $1,335,424 Loss on other loans held for sale — — — — (50,064) Restructuring (charges) reversals (37) (1,219) (1,231) (2,121) (17,707) Gain (loss) on early extinguishment of debt — — 4,497 — 5,400 Valuation adjustment to Visa derivative — (8,700) — (8,700) (3,927) Fair value adjustment on non-qualified deferred compensation (237) (2,062) (3,053) (5,159) (4,987) Adjusted non-interest expense $309,037 $301,709 $353,071 $1,231,563 $1,264,139 Adjusted revenue (TE) $581,054 $564,051 $564,593 $2,245,448 $2,281,962 Adjusted non-interest expense (309,037) (301,709) (353,071) (1,231,563) (1,264,139) Adjusted PPNR $272,017 $262,342 $211,522 $1,013,885 $1,017,823 Amounts may not total due to rounding. Non-GAAP Financial Measures, Continued

36 ($ in thousands) 4Q24 3Q24 2Q24 1Q24 4Q23 Net income (loss) $189,377 $180,684 $(14,680) $124,070 $69,573 Restructuring charges (reversals) 37 1,219 (658) 1,524 1,231 Valuation adjustment on Globalt earnout (719) — — — — Valuation adjustment to Visa derivative — 8,700 — — — (Gain) loss on early extinguishment of debt — — — — (4,497) Investment securities (gains) losses, net — — 256,660 — 77,748 Tax effect of adjustments(1) 165 (2,427) (62,644) (373) (18,226) Adjusted net income $188,860 $188,176 $178,678 $125,221 $125,829 Net income annualized $753,391 $718,808 $(59,043) $499,007 $276,023 Adjusted net income annualized $751,334 $748,613 $718,639 $503,636 $499,213 Total average assets $60,174,616 $59,183,624 $59,246,849 $59,022,231 $59,164,065 Return on average assets (annualized) 1.25% 1.21% (0.10)% 0.85% 0.47% Adjusted return on average assets (annualized) 1.25% 1.26% 1.21% 0.85% 0.84% Amounts may not total due to rounding; (1) Assumed marginal tax rate of 24.2% for 4Q24 and 24.5% for 3Q24, 2Q24, 1Q24, and 4Q23. Non-GAAP Financial Measures, Continued

37 ($ in thousands) 2024 2023 Net income $479,451 $542,141 Restructuring charges (reversals) 2,121 17,707 Valuation adjustment to Visa derivative 8,700 3,927 Valuation adjustment on Globalt earnout (719) — (Gain) loss on early extinguishment of debt — (5,400) (Gain) on sale of GLOBALT — (1,929) Recovery of NPA — (13,126) Loss on other loans held for sale — 50,064 Investment securities losses (gains), net 256,660 76,718 Tax effect of adjustments(1) (64,423) (31,312) Adjusted net income $681,790 $638,790 Total average assets $59,408,317 $59,921,868 Return on average assets 0.81% 0.90% Adjusted return on average assets 1.15% 1.07% Amounts may not total due to rounding; (1) Assumed marginal tax rate of 24.2% for 2024 and 24.5% for 2023. Non-GAAP Financial Measures, Continued

38 ($ in thousands) 4Q24 3Q24 2Q24 1Q24 4Q23 Net income (loss) available to common shareholders $178,848 $169,628 $(23,741) $114,822 $60,645 Restructuring charges (reversals) 37 1,219 (658) 1,524 1,231 Valuation adjustment on Globalt earnout (719) — — — — (Gain) on early extinguishment of debt — — — — (4,497) Valuation adjustment to Visa derivative — 8,700 — — — Investment securities losses (gains), net — — 256,660 — 77,748 Tax effect of adjustments(1) 165 (2,427) (62,644) (373) (18,226) Adjusted net income available to common shareholders $178,331 $177,120 $169,617 $115,973 $116,901 Adjusted net income available to common shareholders annualized $709,447 $704,630 $682,196 $466,441 $463,792 Amortization of intangibles, tax effected, annualized 8,715 8,735 8,831 8,831 9,493 Adjusted net income available to common shareholders excluding amortization of intangibles annualized $718,162 $713,365 $691,027 $475,272 $473,285 Net income (loss) available to common shareholders annualized $711,504 $674,824 $(95,486) $461,812 $240,602 Amortization of intangibles, tax effected, annualized 8,715 8,735 8,831 8,831 9,493 Net income (loss) available to common shareholders excluding amortization of intangibles annualized $720,219 $683,559 $(86,655) $470,643 $250,095 Total average Synovus Financial Corp. shareholders' equity less preferred stock $4,824,003 $4,692,722 $4,455,198 $4,542,616 $4,090,163 Average goodwill (480,440) (480,440) (480,902) (480,440) (479,858) Average other intangible assets, net (35,869) (38,793) (41,547) (44,497) (47,502) Total average Synovus Financial Corp. tangible shareholders' equity less preferred stock $4,307,694 $4,173,489 $3,932,749 $4,017,679 $3,562,803 Return on average common equity (annualized) 14.75% 14.38% (2.14)% 10.17% 5.88% Adjusted return on average common equity (annualized) 14.71% 15.02% 15.31% 10.27% 11.34% Return on average tangible common equity (annualized) 16.72% 16.38% (2.20)% 11.71% 7.02% Adjusted return on average tangible common equity (annualized) 16.67% 17.09% 17.57% 11.83% 13.28% Amounts may not total due to rounding; (1) Assumed marginal tax rate of 24.2% for 4Q24 and 24.5% for 3Q24, 2Q24,1Q24, and 4Q23. Non-GAAP Financial Measures, Continued

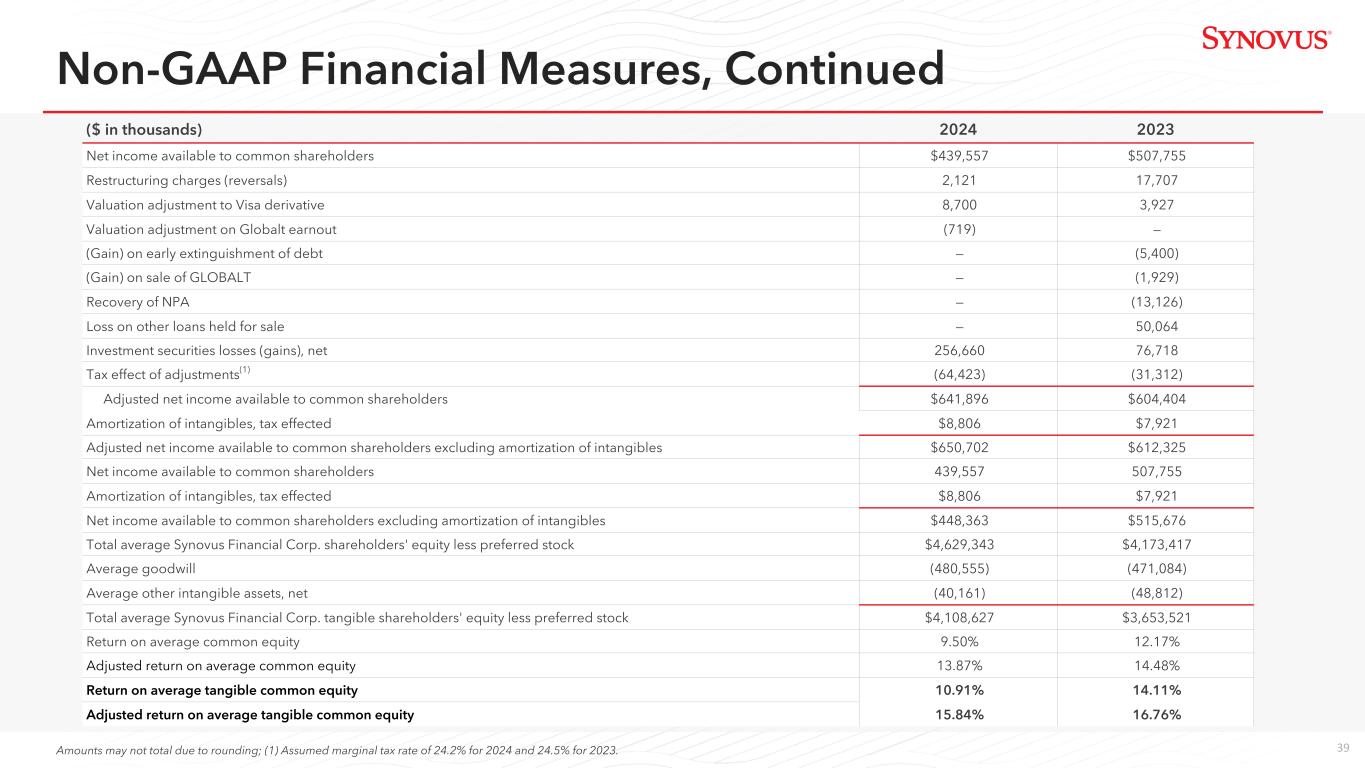

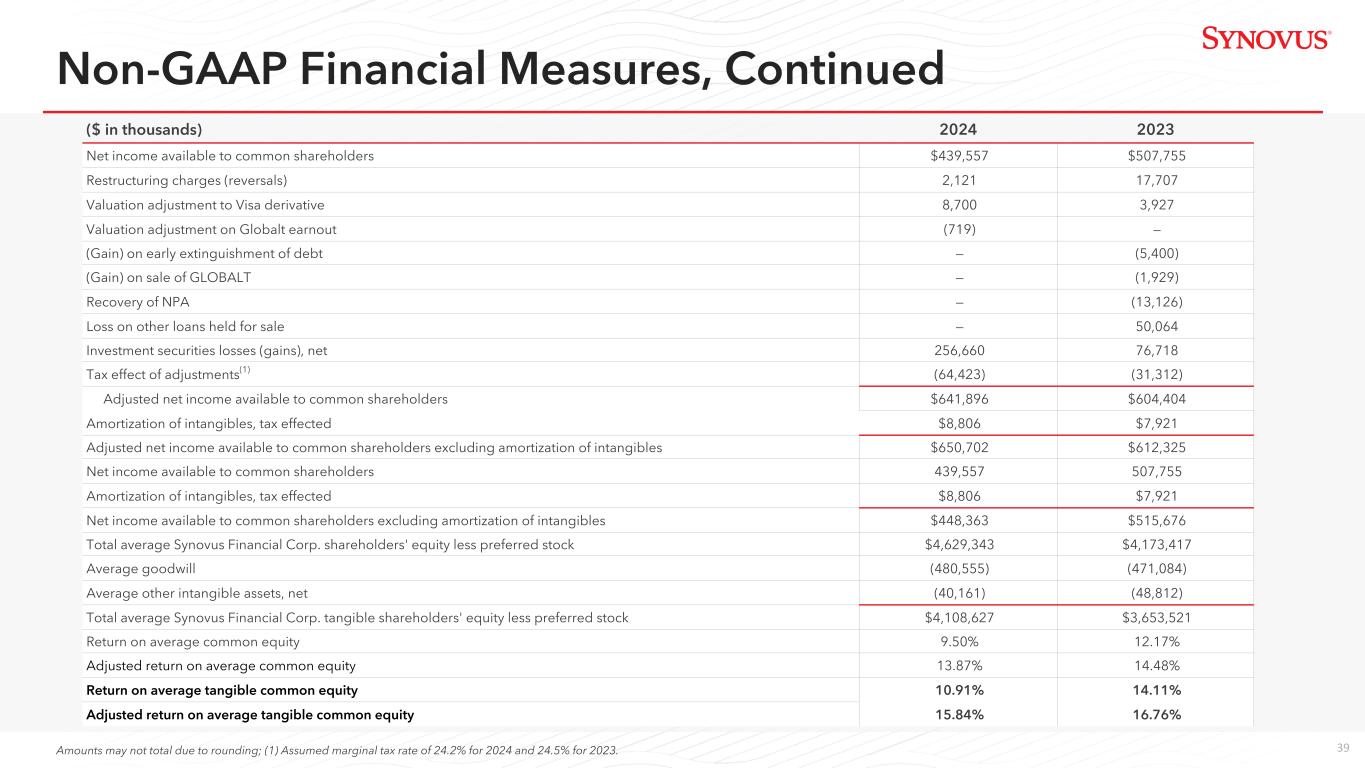

39 ($ in thousands) 2024 2023 Net income available to common shareholders $439,557 $507,755 Restructuring charges (reversals) 2,121 17,707 Valuation adjustment to Visa derivative 8,700 3,927 Valuation adjustment on Globalt earnout (719) — (Gain) on early extinguishment of debt — (5,400) (Gain) on sale of GLOBALT — (1,929) Recovery of NPA — (13,126) Loss on other loans held for sale — 50,064 Investment securities losses (gains), net 256,660 76,718 Tax effect of adjustments(1) (64,423) (31,312) Adjusted net income available to common shareholders $641,896 $604,404 Amortization of intangibles, tax effected $8,806 $7,921 Adjusted net income available to common shareholders excluding amortization of intangibles $650,702 $612,325 Net income available to common shareholders 439,557 507,755 Amortization of intangibles, tax effected $8,806 $7,921 Net income available to common shareholders excluding amortization of intangibles $448,363 $515,676 Total average Synovus Financial Corp. shareholders' equity less preferred stock $4,629,343 $4,173,417 Average goodwill (480,555) (471,084) Average other intangible assets, net (40,161) (48,812) Total average Synovus Financial Corp. tangible shareholders' equity less preferred stock $4,108,627 $3,653,521 Return on average common equity 9.50% 12.17% Adjusted return on average common equity 13.87% 14.48% Return on average tangible common equity 10.91% 14.11% Adjusted return on average tangible common equity 15.84% 16.76% Amounts may not total due to rounding; (1) Assumed marginal tax rate of 24.2% for 2024 and 24.5% for 2023. Non-GAAP Financial Measures, Continued

40 ($ in thousands) 4Q24 3Q24 2Q24 1Q24 4Q23 2024 2023 Total non-interest revenue $125,587 $123,980 $(128,851) $118,888 $51,468 $239,604 $404,010 (Gain) on sale of GLOBALT — — — — — — (1,929) Valuation adjustment on Globalt earnout (719) — — — — (719) — Investment securities gains, net — — 256,660 — 77,748 256,660 76,718 Recovery of NPA — — — — — — (13,126) Fair value adjustment on non-qualified deferred compensation (237) (2,062) (561) (2,299) (3,053) (5,159) (4,987) Adjusted non-interest revenue $124,631 $121,918 $127,248 $116,589 $126,163 $490,386 $460,686 Non-GAAP Financial Measures, Continued Amounts may not total due to rounding

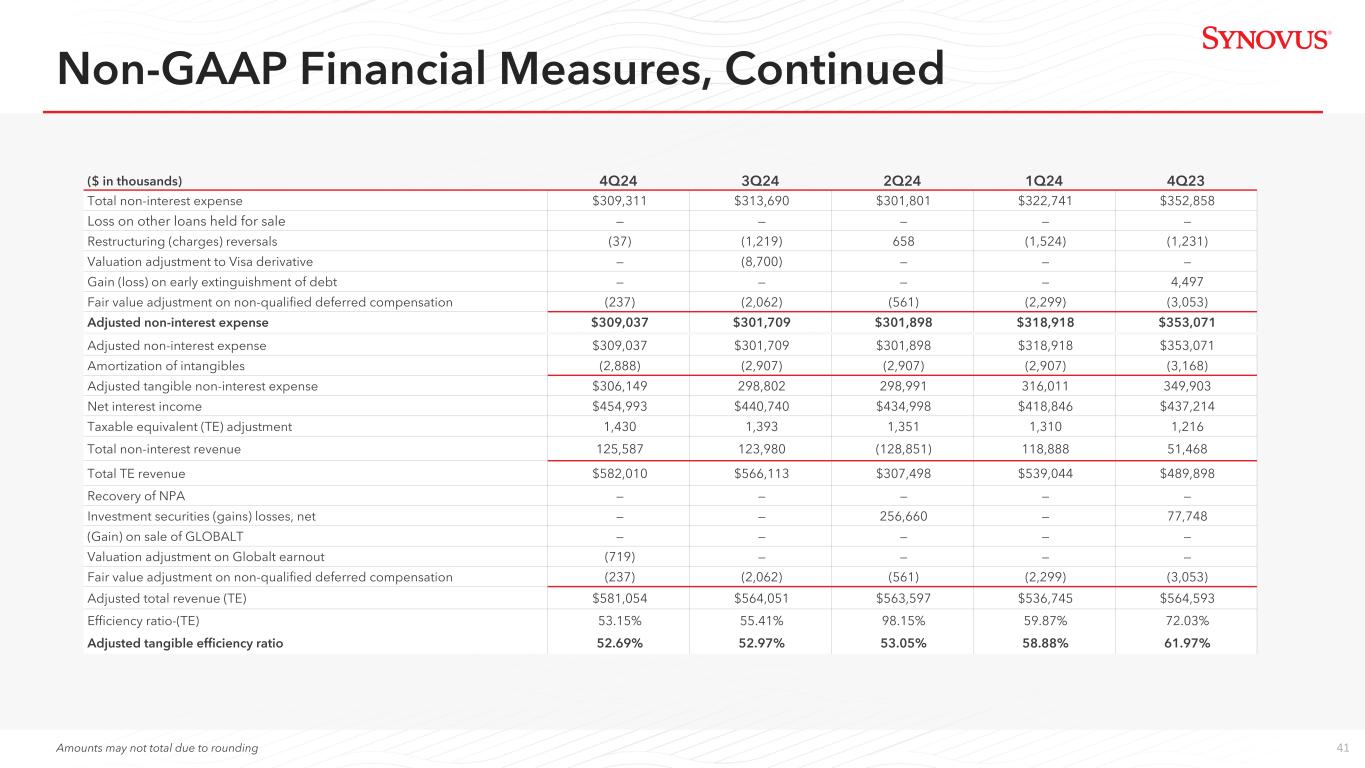

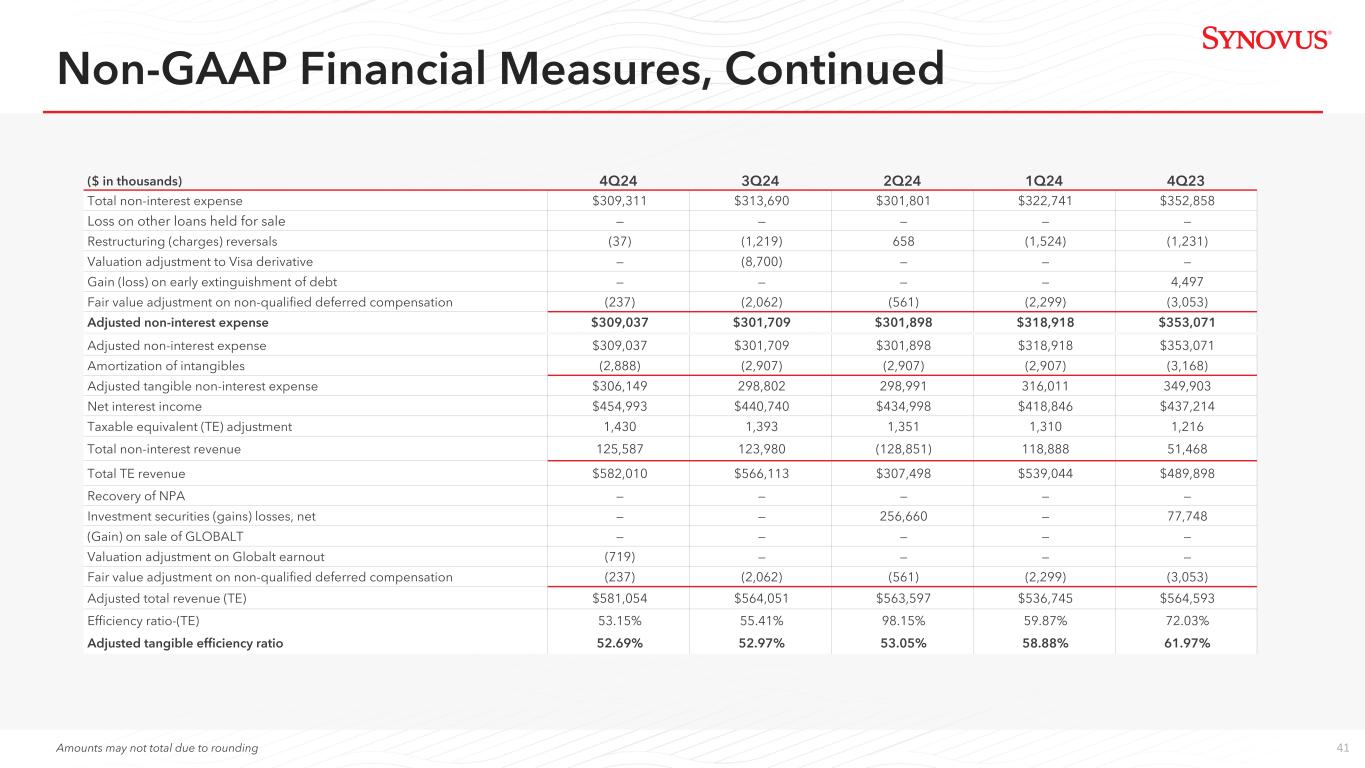

41 ($ in thousands) 4Q24 3Q24 2Q24 1Q24 4Q23 Total non-interest expense $309,311 $313,690 $301,801 $322,741 $352,858 Loss on other loans held for sale — — — — — Restructuring (charges) reversals (37) (1,219) 658 (1,524) (1,231) Valuation adjustment to Visa derivative — (8,700) — — — Gain (loss) on early extinguishment of debt — — — — 4,497 Fair value adjustment on non-qualified deferred compensation (237) (2,062) (561) (2,299) (3,053) Adjusted non-interest expense $309,037 $301,709 $301,898 $318,918 $353,071 Adjusted non-interest expense $309,037 $301,709 $301,898 $318,918 $353,071 Amortization of intangibles (2,888) (2,907) (2,907) (2,907) (3,168) Adjusted tangible non-interest expense $306,149 298,802 298,991 316,011 349,903 Net interest income $454,993 $440,740 $434,998 $418,846 $437,214 Taxable equivalent (TE) adjustment 1,430 1,393 1,351 1,310 1,216 Total non-interest revenue 125,587 123,980 (128,851) 118,888 51,468 Total TE revenue $582,010 $566,113 $307,498 $539,044 $489,898 Recovery of NPA — — — — — Investment securities (gains) losses, net — — 256,660 — 77,748 (Gain) on sale of GLOBALT — — — — — Valuation adjustment on Globalt earnout (719) — — — — Fair value adjustment on non-qualified deferred compensation (237) (2,062) (561) (2,299) (3,053) Adjusted total revenue (TE) $581,054 $564,051 $563,597 $536,745 $564,593 Efficiency ratio-(TE) 53.15% 55.41% 98.15% 59.87% 72.03% Adjusted tangible efficiency ratio 52.69% 52.97% 53.05% 58.88% 61.97% Non-GAAP Financial Measures, Continued Amounts may not total due to rounding

42 ($ in thousands) 2024 2023 Total non-interest revenue $239,604 $404,010 Valuation adjustment on Globalt earnout (719) — (Gain) on sale of GLOBALT — (1,929) Recovery of NPA — (13,126) Investment securities losses (gains), net 256,660 76,718 Fair value adjustment on non-qualified deferred compensation (5,159) (4,987) Adjusted non-interest revenue $490,386 $460,686 Total non-interest expense $1,247,543 $1,335,424 Restructuring (charges) reversals (2,121) (17,707) Valuation adjustment to Visa derivative (8,700) (3,927) Gain (loss) on early extinguishment of debt — 5,400 Fair value adjustment on non-qualified deferred compensation (5,159) (4,987) Loss on other loans held for sale — (50,064) Adjusted non-interest expense $1,231,563 $1,264,139 Adjusted non-interest expense $1,231,563 $1,264,139 Amortization of intangibles (11,609) (10,487) Adjusted tangible non-interest expense $1,219,954 $1,253,652 Net interest income 1,749,577 1,816,655 Tax equivalent adjustment 5,485 4,621 Total non-interest revenue 239,604 404,010 Total TE revenue $1,994,666 $2,225,286 Valuation adjustment on Globalt earnout (719) — (Gain) on sale of GLOBALT — (1,929) Recovery of NPA — (13,126) Investment securities losses (gains), net 256,660 76,718 Fair value adjustment on non-qualified deferred compensation (5,159) (4,987) Adjusted total revenue (TE) $2,245,448 $2,281,962 Efficiency ratio-(TE) 62.54% 60.01% Adjusted tangible efficiency ratio 54.33% 54.94% Amounts may not total due to rounding. Non-GAAP Financial Measures, Continued

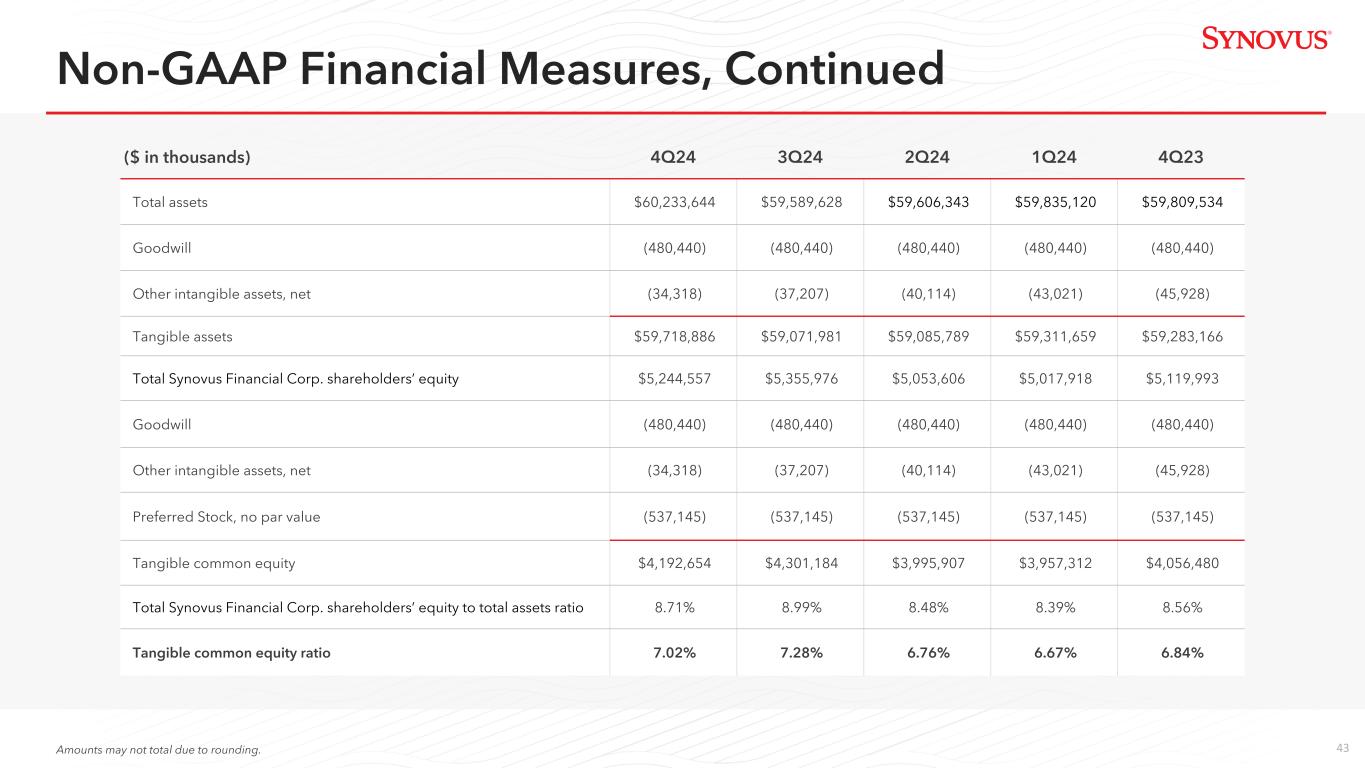

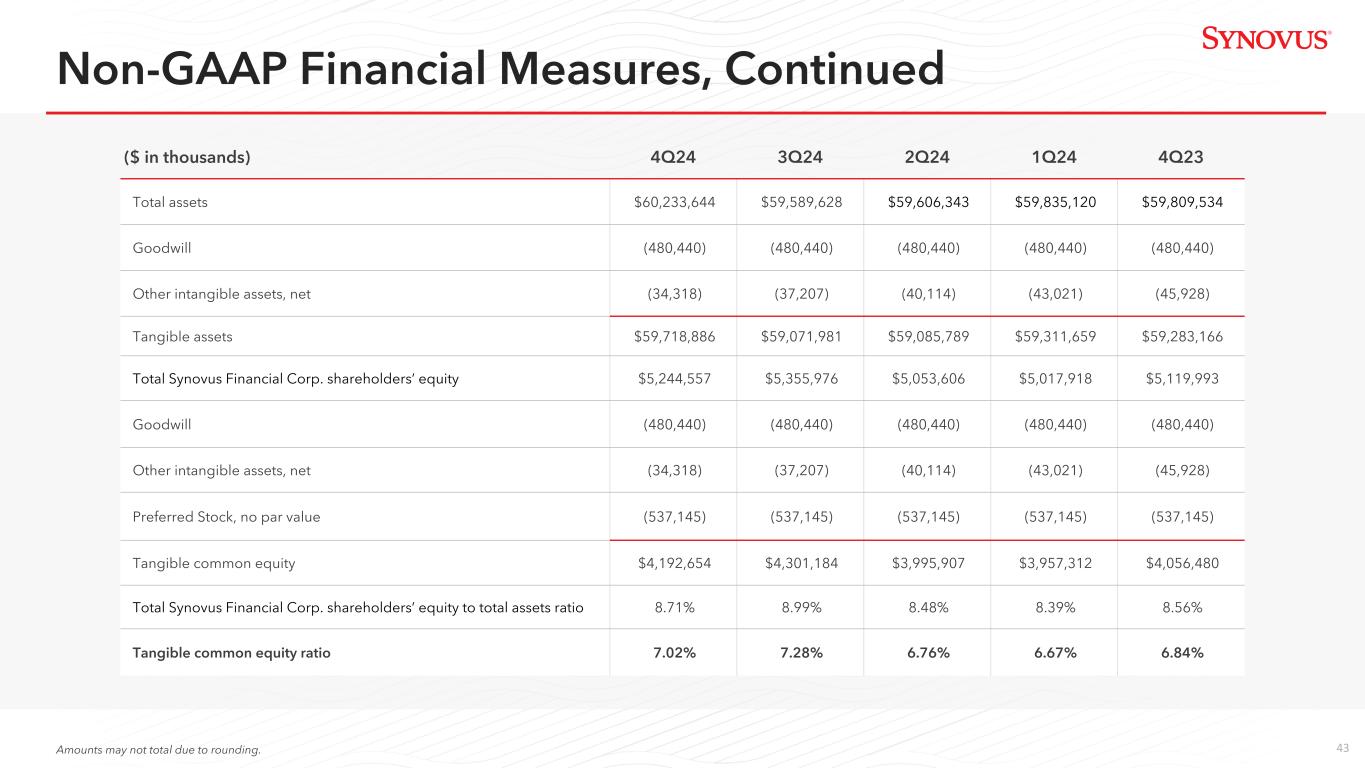

43 ($ in thousands) 4Q24 3Q24 2Q24 1Q24 4Q23 Total assets $60,233,644 $59,589,628 $59,606,343 $59,835,120 $59,809,534 Goodwill (480,440) (480,440) (480,440) (480,440) (480,440) Other intangible assets, net (34,318) (37,207) (40,114) (43,021) (45,928) Tangible assets $59,718,886 $59,071,981 $59,085,789 $59,311,659 $59,283,166 Total Synovus Financial Corp. shareholders’ equity $5,244,557 $5,355,976 $5,053,606 $5,017,918 $5,119,993 Goodwill (480,440) (480,440) (480,440) (480,440) (480,440) Other intangible assets, net (34,318) (37,207) (40,114) (43,021) (45,928) Preferred Stock, no par value (537,145) (537,145) (537,145) (537,145) (537,145) Tangible common equity $4,192,654 $4,301,184 $3,995,907 $3,957,312 $4,056,480 Total Synovus Financial Corp. shareholders’ equity to total assets ratio 8.71% 8.99% 8.48% 8.39% 8.56% Tangible common equity ratio 7.02% 7.28% 6.76% 6.67% 6.84% Amounts may not total due to rounding. Non-GAAP Financial Measures, Continued