Exhibit 99.3

SYNOVUS

Second Quarter 2011 Results

July 28, 2011

1

SYNOVUS

Forward-looking Statements

This slide presentation and certain of our other filings with the Securities and Exchange Commission contain statements that constitute “forward-looking statements” within the meaning of, and subject to the protections of, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact are forward-looking statements.You can identify these forward-looking statements through Synovus’ use of words such as “believes,”“anticipates,”“expects,”“may,”“will,”“assumes,”“should,” “predicts,”“could,”“should,”“would,”“intends,”“targets,”“estimates,”“projects,”“plans,”“potential” and other similar words and expressions of the future or otherwise regarding the outlook for Synovus’ future business and financial performance and/or the performance of the commercial banking industry and economy in general.These forward-looking statements include, among others, (1) our expectations on credit trends; (2) expectations on core lending activity; (3) expectations on deposit trends; (4) expectations on cost savings from our efficiency and process redesign initiatives; (5) impact of our target deposit mix on our cost of funding; (6) our expected future impact of DTA valuation allowance; (7) expected annual impact from regulatory reform on fee income; and (8) the assumptions underlying our expectations. Prospective investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve known and unknown risks and uncertainties which may cause the actual results, performance or achievements of Synovus to be materially different from the future results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements are based on the information known to, and current beliefs and expectations of, Synovus’ management and are subject to significant risks and uncertainties. Actual results may differ materially from those contemplated by such forward-looking statements. A number of factors could cause actual results to differ materially from those contemplated by the forward-looking statements in this report. Many of these factors are beyond Synovus’ ability to control or predict.

These forward-looking statements are based upon information presently known to Synovus’ management and are inherently subjective, uncertain and subject to change due to any number of risks and uncertainties, including, without limitation, risks relating to execution of our efficiency initiatives and plans for growth and the risks and other factors set forth in Synovus’ filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the year ended December 31, 2010 under the captions “Cautionary Notice Regarding Forward-Looking Statements” and “Risk Factors” and in Synovus’ quarterly reports on Form 10-Q and current reports on Form 8-K. We believe these forward-looking statements are reasonable; however, undue reliance should not be placed on any forward-looking statements, which are based on current expectations and speak only as of the date that they are made. We do not assume any obligation to update any forward-looking statements as a result of new information, future developments or otherwise, except as otherwise may be required by law.

2

SYNOVUS

Use of Non-GAAP Financial Measures

This slide presentation contains certain non-GAAP financial measures determined by methods other than in accordance with generally accepted accounting principles. Such non-GAAP financial measures include the following: pre-tax, pre-credit costs income; core deposits and core deposits excluding time deposits; net interest margin excluding negative impact of non-performing loans; fundamental non-interest expense; the ratio of pretax, pre-credit costs income to risk weighted assets, the tangible common equity to tangible assets ratio; and net loss per common share excluding restructuring charges. The most comparable GAAP measures to these measures are loss from continuing operations before income taxes; total deposits; net interest margin; total non-interest expense; the ratio of total equity to total assets; and net loss per common share, respectively. Management uses these non-GAAP financial measures to assess the performance of Synovus’ core business and the strength of its capital position. Synovus believes that these non-GAAP financial measures provide meaningful additional information about Synovus to assist investors in evaluating Synovus’ operating results, financial strength and capitalization. The non-GAAP measures should be considered as additional views of the way our financial measures are affected by significant charges for credit costs and other factors.The tangible common equity ratio to tangible assets ratio and tangible common equity to risk-weighted assets ratio are used by management to assess the strength of our capital position. Core deposits and core deposits excluding time deposits are a measure used by management and investment analysts to evaluate organic growth of deposits and the quality of deposits as a funding source. The net interest margin excluding the negative impact of non-performing loans is a measure used by management to evaluate the net interest margin excluding the adverse impact of non-performing loans and interest charge-offs. Pre-tax, pre-credit costs income is a measure used by management to evaluate core operating results exclusive of credit costs as well as certain non-core income/ expenses such as restructuring charges. Fundamental non-interest expense is a measure utilized by management to measure the success of expense management initiatives focused on reducing recurring controllable operating costs.These non-GAAP financial measures should not be considered as a substitute for operating results determined in accordance with GAAP and may not be comparable to other similarly titled measures of other companies. The computations of the non-GAAP financial measures used in this slide presentation are set forth in the Appendix to this slide presentation.

3

SYNOVUS

Financial Results Summary

(dollars in millions)

$0

($52)

($104)

($156)

($208)

($260)

Earnings Trend

($242.6)

($242.6)

2Q10

($192.4)

($195.8)

3Q10

($177.9)

($180.0)

(4Q10)

($69.3)

($93.7)

1Q11

($50.4)

($53.5)

2Q11

Net loss excluding restructuring charges Restructuring charges

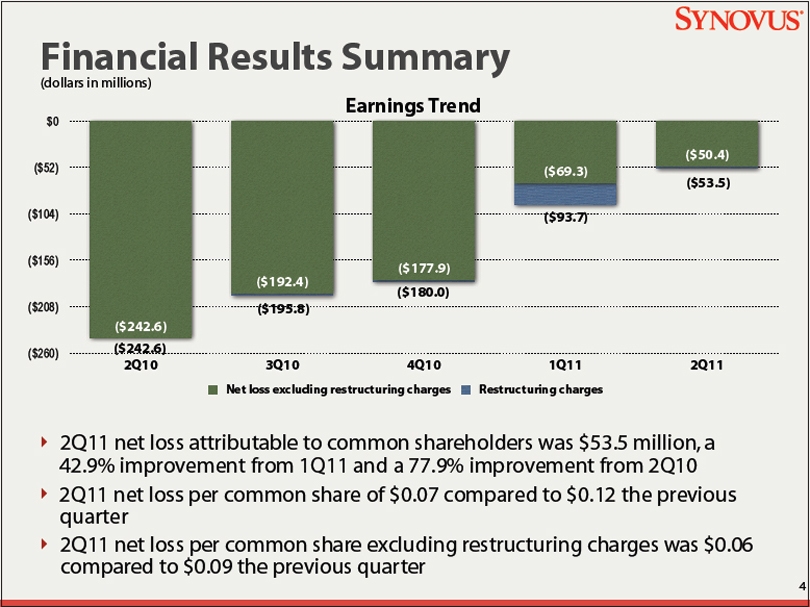

2Q11 net loss attributable to common shareholders was $53.5 million, a 42.9% improvement from 1Q11 and a 77.9% improvement from 2Q10

2Q11 net loss per common share of $0.07 compared to $0.12 the previous quarter

2Q11 net loss per common share excluding restructuring charges was $0.06 compared to $0.09 the previous quarter

4

SYNOVUS

Financial Results Summary, continued

(dollars in millions)

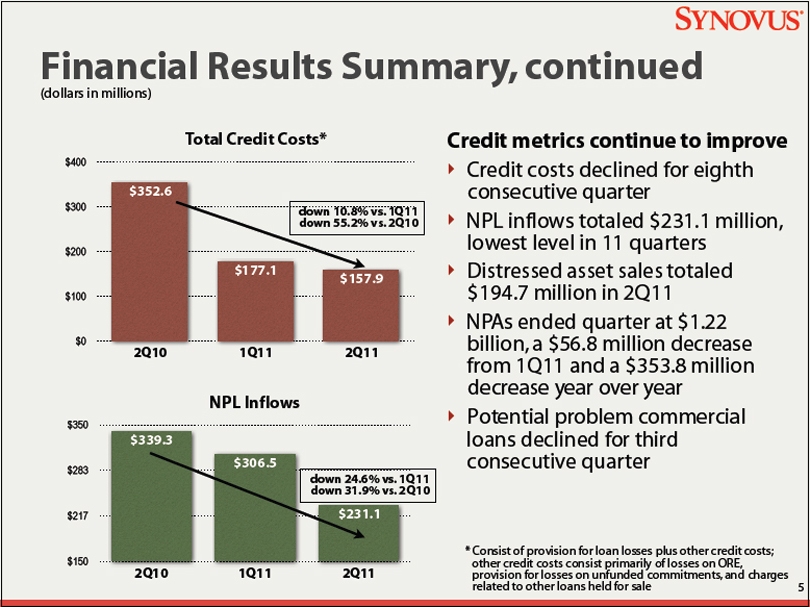

Total Credit Costs*

$400

$300

$200

$100

$0

$352.6

2Q10

$177.1

1Q11

$157.9

2Q11

down 10.8% vs. 1Q11 down 55.2% vs. 2Q10

NPL Inflows

$350

$283

$217

$150

$339.3

2Q10

$306.5

1Q11

$231.1

2Q11

down 24.6% vs. 1Q11 down 31.9% vs. 2Q10

Credit metrics continue to improve

Credit costs declined for eighth consecutive quarter

NPL inflows totaled $231.1 million, lowest level in 11 quarters

Distressed asset sales totaled $194.7 million in 2Q11

NPAs ended quarter at $1.22 billion, a $56.8 million decrease from 1Q11 and a $353.8 million decrease year over year

Potential problem commercial loans declined for third consecutive quarter

* Consist of provision for loan losses plus other credit costs; other credit costs consist primarily of losses on ORE, provision for losses on unfunded commitments, and charges related to other loans held for sale

5

SYNOVUS

Financial Results Summary, continued

Balance Sheet Trends

Loans

Net pay-downs* moderated during 2Q11 ($167.6 million)

Encouraged by recent core lending activity

New originations steadily increased during 2Q11

Building meaningful pipelines with momentum from corporate banking initiatives

Early success in pipeline growth and fundings from corporate banking team

Deposits

Core deposits excluding time deposits increased $114.6 million from 1Q11

Demand deposits were up $178.8 million or 15.3% (annualized) from prior quarter and $626.7 million or 14.7% from prior year

Increase in number of demand deposit accounts from prior quarter

*Excluding the impact of loan sales, transfers to loans held-for-sale, charge-offs, and foreclosures

6

SYNOVUS

Financial Results Summary, continued

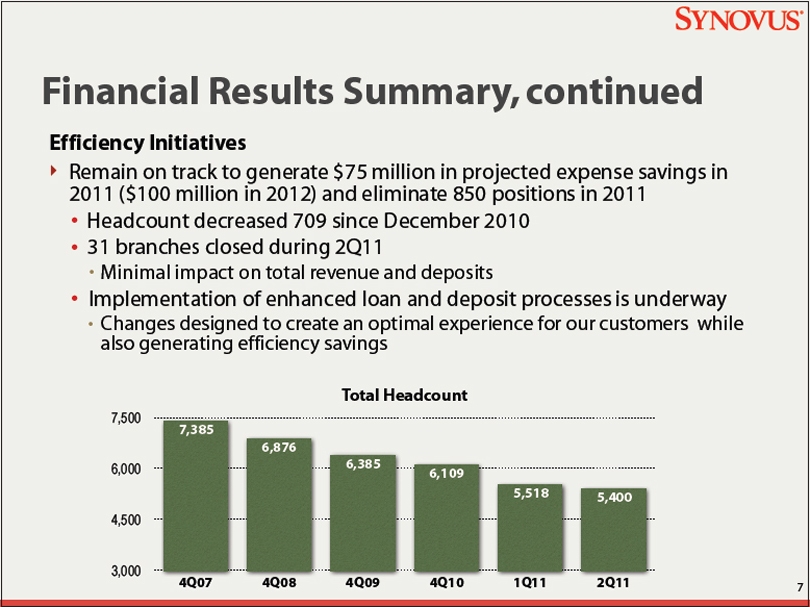

Efficiency Initiatives

Remain on track to generate $75 million in projected expense savings in 2011 ($100 million in 2012) and eliminate 850 positions in 2011

Headcount decreased 709 since December 2010

31 branches closed during 2Q11

Minimal impact on total revenue and deposits

Implementation of enhanced loan and deposit processes is underway

Changes designed to create an optimal experience for our customers while also generating efficiency savings

Total Headcount

7,500

6,000

4,500

3,000

7,385

4Q07

6,876

4Q08

6,385

4Q09

6,109

4Q10

5,518

1Q11

5,400

2Q11

7

SYNOVUS

Financial Results

8

SYNOVUS

Earnings Summary

(dollars in thousands, except per share data)

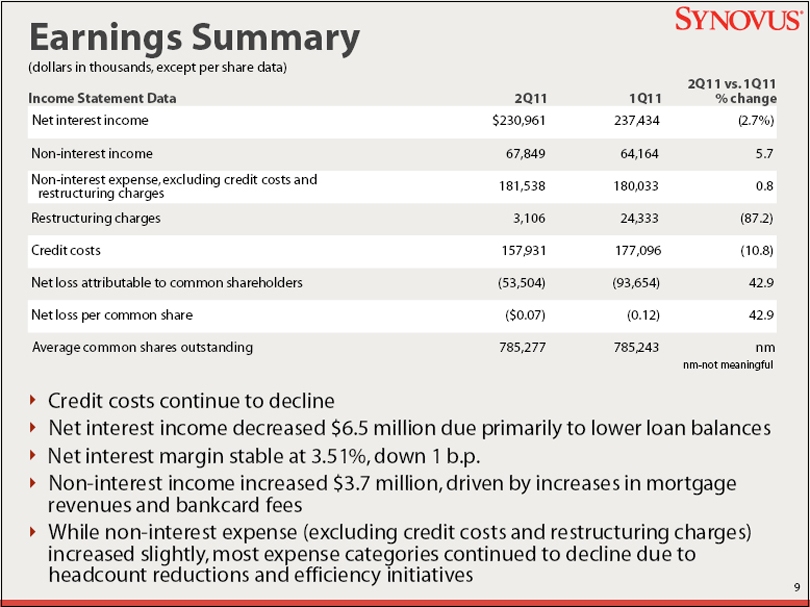

Income Statement Data 2Q11 1Q11 2Q11 vs. 1Q11 % change

Net interest income $230,961 237,434 (2.7%)

Non-interest income 67,849 64,164 5.7

Non-interest expense, excluding credit costs and restructuring charges 181,538 180,033 0.8

Restructuring charges 3,106 24,333 (87.2)

Credit costs 157,931 177,096 (10.8)

Net loss attributable to common shareholders (53,504) (93,654) 42.9

Net loss per common share ($0.07) (0.12) 42.9

Average common shares outstanding 785,277 785,243 nm

nm-not meaningful

Credit costs continue to decline

Net interest income decreased $6.5 million due primarily to lower loan balances

Net interest margin stable at 3.51%, down 1 b.p.

Non-interest income increased $3.7 million, driven by increases in mortgage

revenues and bankcard fees

While non-interest expense (excluding credit costs and restructuring charges)

increased slightly, most expense categories continued to decline due to

headcount reductions and efficiency initiatives

9

SYNOVUS

Loans Outstanding

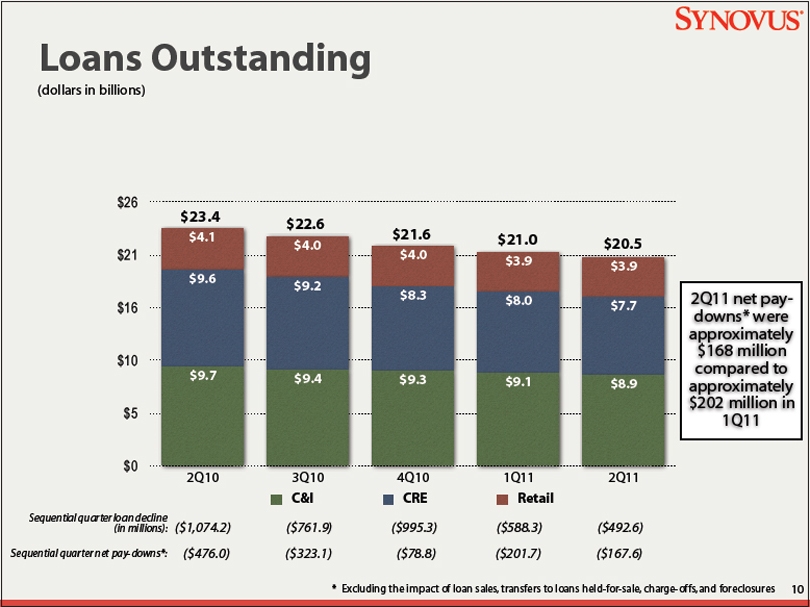

(dollars in billions)

$26

$21

$16

$10

$5

$0

$23.4

$4.1

$9.6

$9.7

2Q10

$22.6

$4.0

$9.2

$9.4

3Q10

$21.6

$4.0

$8.3

$9.3

4Q10

$21.0

$3.9

$8.0

$9.1

1Q11

$20.5

$3.9

$7.7

$8.9

2Q11

2Q11 net paydowns*

were

approximately

$168 million

compared to

approximately

$202 million in

1Q11

C&I CRE Retail

Sequential quarter loan decline

(in millions):

($1,074.2)

($761.9)

($995.3)

($588.3)

($492.6)

Sequential quarter net pay-downs*:

($476.0)

($323.1)

($78.8)

($201.7)

($167.6)

* Excluding the impact of loan sales, transfers to loans held-for-sale, charge-offs, and foreclosures

10

SYNOVUS

Deposit Mix Improvement Continues

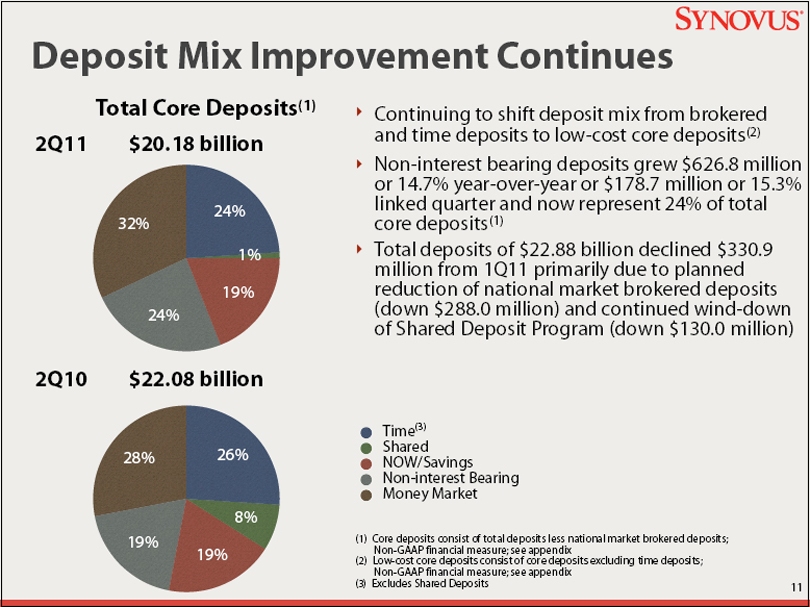

Total Core Deposits(1)

2Q11

$20.18 billion

32%

24%

1%

24%

19%

Continuing to shift deposit mix from brokered

and time deposits to low-cost core deposits(2)

Non-interest bearing deposits grew $626.8 million

or 14.7% year-over-year or $178.7 million or 15.3%

linked quarter and now represent 24% of total

core deposits(1)

Total deposits of $22.88 billion declined $330.9

million from 1Q11 primarily due to planned

reduction of national market brokered deposits

(down $288.0 million) and continued wind-down

of Shared Deposit Program (down $130.0 million)

2Q10

$22.08 billion

Time(3)

Shared

NOW/Savings

Non-interest Bearing

Money Market

28%

19%

19%

8%

26%

(1) Core deposits consist of total deposits less national market brokered deposits;

Non-GAAP financial measure; see appendix

(2) Low-cost core deposits consist of core deposits excluding time deposits;

Non-GAAP financial measure; see appendix

(3) Excludes Shared Deposits

11

SYNOVUS

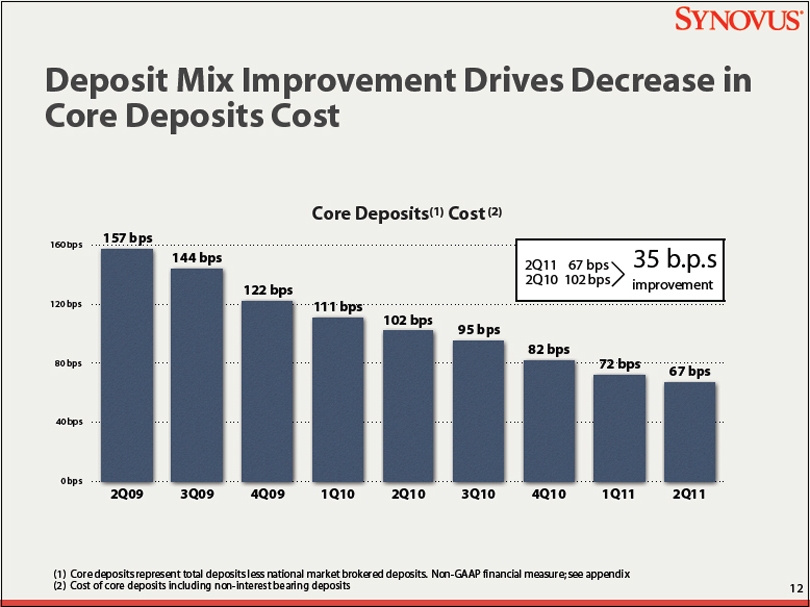

Deposit Mix Improvement Drives Decrease in Core Deposits Cost

Core Deposits(1) Cost (2)

0 bps

40 bps

80 bps

120 bps

160 bps

2Q09 3Q09 4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11

157 bps

144 bps

122 bps

111 bps

102 bps

95 bps

82 bps

72 bps

67 bps

2Q11 67 bps

2Q10 102 bps

35 b.p.s improvement

(1) Core deposits represent total deposits less national market brokered deposits. Non-GAAP financial measure; see appendix

(2) Cost of core deposits including non-interest bearing deposits

12

SYNOVUS

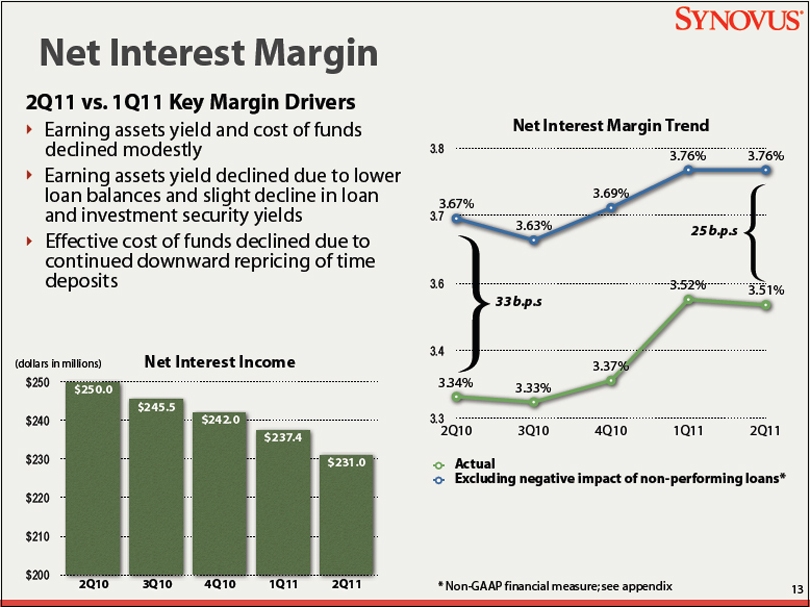

Net Interest Margin

2Q11 vs. 1Q11 Key Margin Drivers

Earning assets yield and cost of funds declined modestly

Earning assets yield declined due to lower loan balances and slight decline in loan and investment security yields

Effective cost of funds declined due to continued downward repricing of time deposits

(dollars in millions) Net Interest Income

$250

$240

$230

$220

$210

$200

2Q10 3Q10 4Q10 1Q11 2Q11

$250.0

$245.5

$242.0

$237.4

$231.0

Net Interest Margin Trend

3.8

3.7

3.6

3.4

3.3

2Q10 3Q10 4Q10 1Q11 2Q11

3.67%

3.63%

3.69%

3.76%

3.76%

3.34%

3.33%

3.37%

3.52%

3.51%

33 b.p.s

25 b.p.s

Actual

Excluding negative impact of non-performing loans*

* Non-GAAP financial measure; see appendix

13

SYNOVUS

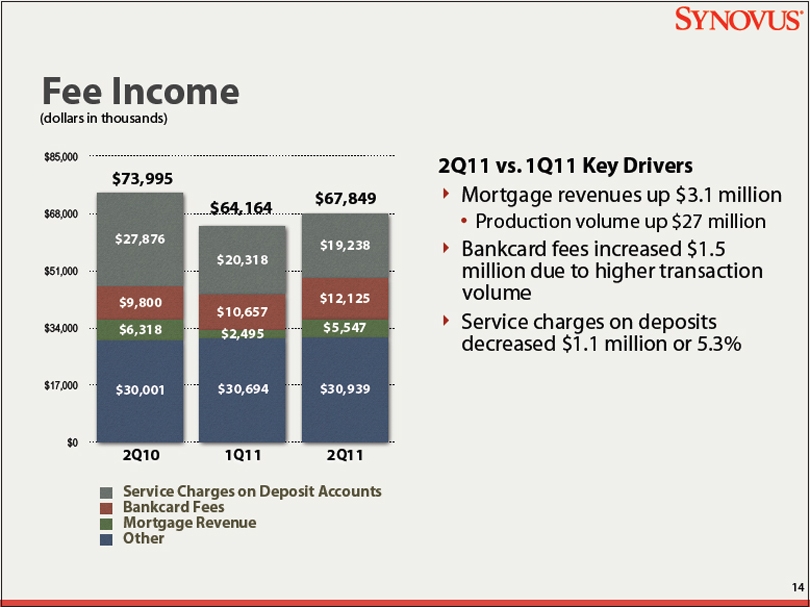

Fee Income

(dollars in thousands)

$85,000

$68,000

$51,000

$34,000

$17,000

$0

$73,995

$64,164

$67,849

$27,876

$9,800

$6,318

$30,001

$20,318

$10,657

$2,495

$30,694

$19,238

$12,125

$5,547

$30,939

2Q10 1Q11 2Q11

2Q11 vs. 1Q11 Key Drivers

Mortgage revenues up $3.1 million

Production volume up $27 million

Bankcard fees increased $1.5 million due to higher transaction volume

Service charges on deposits decreased $1.1 million or 5.3%

Service Charges on Deposit Accounts

Bankcard Fees

Mortgage Revenue

Other

14

SYNOVUS

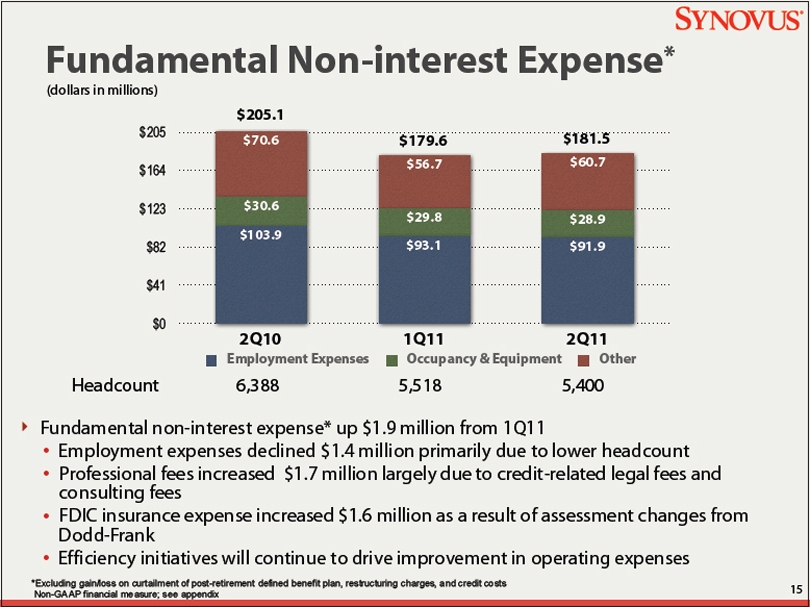

Fundamental Non-interest Expense*

(dollars in millions)

$205

$164

$123

$82

$41

$0

$205.1 $179.6 $181.5

$70.6

$30.6

$103.9

$56.7

$29.8

$93.1

$60.7

$28.9

$91.9

2Q10 1Q11 2Q11

Employment Expenses Occupancy & Equipment Other

Headcount 6,388 5,518 5,400

Fundamental non-interest expense* up $1.9 million from 1Q11

Employment expenses declined $1.4 million primarily due to lower headcount

Professional fees increased $1.7 million largely due to credit-related legal fees and consulting fees

FDIC insurance expense increased $1.6 million as a result of assessment changes from Dodd-Frank

Efficiency initiatives will continue to drive improvement in operating expenses

*Excluding gain/loss on curtailment of post-retirement defined benefit plan, restructuring charges, and credit costs

Non-GAAP financial measure; see appendix

15

SYNOVUS

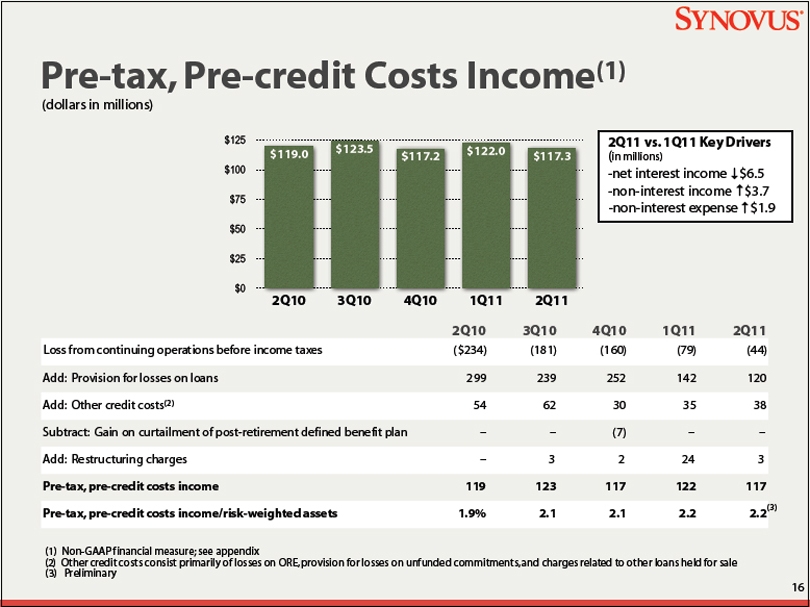

Pre-tax, Pre-credit Costs Income(1)

(dollars in millions)

$125

$100

$75

$50

$25

$0

$119.0 $123.5 $117.2 $122.0 $117.3

2Q10 3Q10 4Q10 1Q11 2Q11

2Q11 vs. 1Q11 Key Drivers

(in millions)

-net interest income $6.5

-non-interest income $3.7

-non-interest expense $1.9

2Q10 3Q10 4Q10 1Q11 2Q11

Loss from continuing operations before income taxes ($234) (181) (160) (79) (44)

Add: Provision for losses on loans 299 239 252 142 120

Add: Other credit costs(2) 54 62 30 35 38

Subtract: Gain on curtailment of post-retirement defined benefit plan – – (7) – –

Add: Restructuring charges – 3 2 24 3

Pre-tax, pre-credit costs income Pre-tax, pre-credit costs income/risk-weighted assets 119 1.9% 123 2.1 117 2.1 122 2.2 117 2.2(3)

(1) Non-GAAP financial measure; see appendix

(2) Other credit costs consist primarily of losses on ORE, provision for losses on unfunded commitments, and charges related to other loans held for sale

(3) Preliminary

16

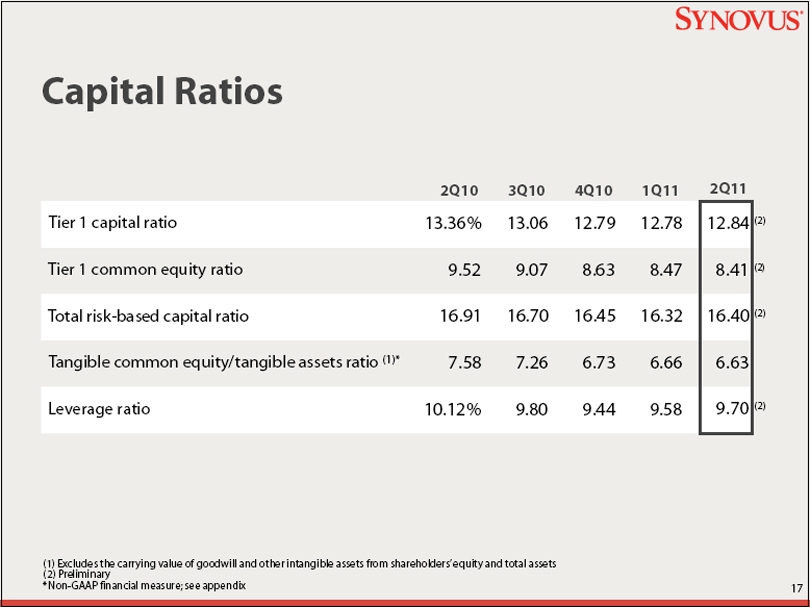

SYNOVUS

Capital Ratios

2Q10 3Q10 4Q10 1Q11 2Q11

Tier 1 capital ratio 13.36% 13.06 12.79 12.78 12.84 (2)

Tier 1 common equity ratio 9.52 9.07 8.63 8.47 8.41 (2)

Total risk-based capital ratio 16.91 16.70 16.45 16.32 16.40 (2)

Tangible common equity/tangible assets ratio (1)* 7.58 7.26 6.73 6.66 6.63

Leverage ratio 10.12% 9.80 9.44 9.58 9.70 (2)

(1) Excludes the carrying value of goodwill and other intangible assets from shareholders’ equity and total assets

(2) Preliminary

*Non-GAAP financial measure; see appendix

17

SYNOVUS

Credit Update

18

SYNOVUS

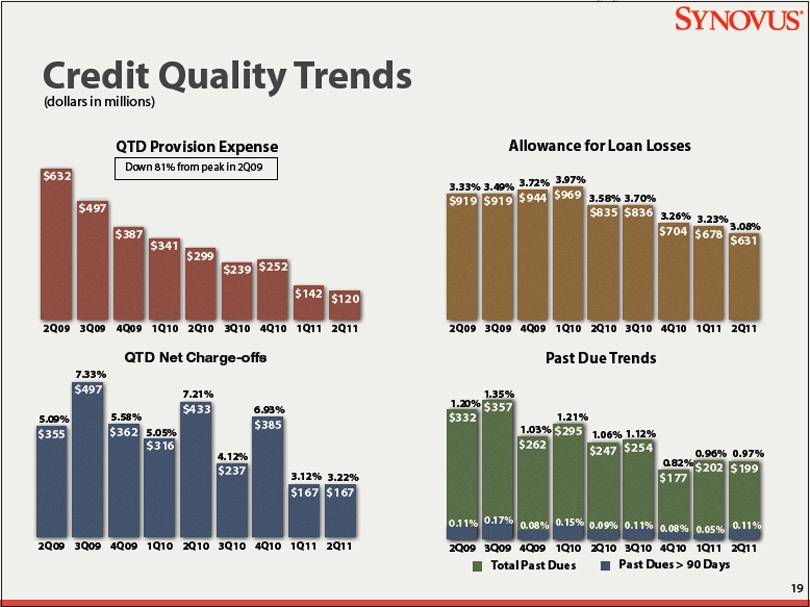

Credit Quality Trends

3.33%

(dollars in millions)

$202 $199

$177

$247 $254

$295

$262

$357

$332

2Q09 3Q09 4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11

2Q09 3Q09 4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11

$142 $120

$239 $252

$299

$341

$387

$497

$632

2Q09 3Q09 4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11

$704 $678 $631

$835 $836

$919 $919 $944 $969

1.03%

Total Past Dues

3.49%

1.20%

1.35%

0.11% 0.17%

3.72%

0.08%

3.97%

1.21%

0.15%

3.58%

1.06%

0.09%

Past Dues > 90 Days

3.70%

1.12%

0.11%

Down 81% from peak in 2Q09

Past Due Trends

Allowance for Loan Losses

QTD Provision Expense

3.26%

0.82%

0.08%

3.23%

0.96%

0.05%

2Q09 3Q09 4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11

$167 $167

$385

$237

$433

$316

$362

$497

$355

7.21%

7.33%

5.09% 5.58%

5.05%

4.12%

QTD Net Charge-offs

6.93%

3.12%

3.08%

3.22%

0.97%

0.11%

19

SYNOVUS

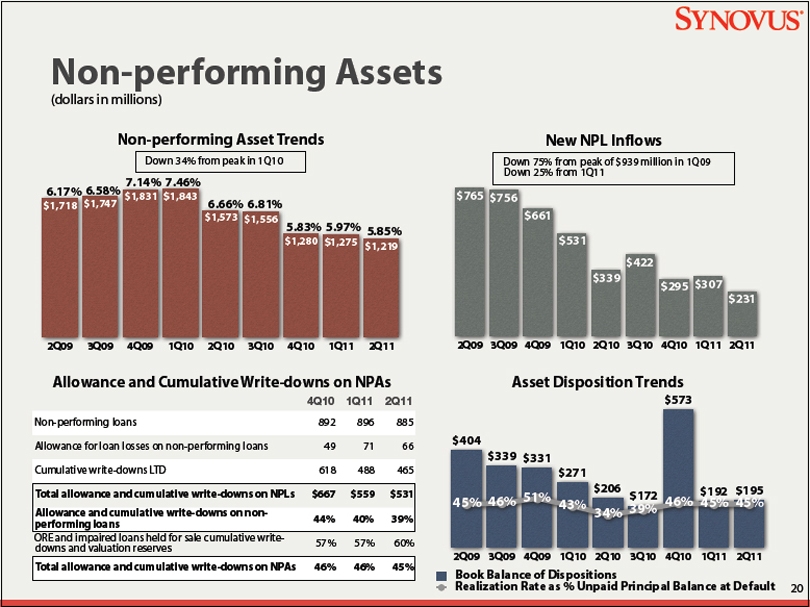

Non-performing Assets

(dollars in millions)

2Q09 3Q09 4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11

$1,280 $1,275 $1,219

$1,573 $1,556

$1,831 $1,843

$1,718 $1,747

Non-performing Asset Trends

Down 34% from peak in 1Q10

6.66% 6.81%

7.14% 7.46%

6.17% 6.58%

5.83%

5.97%

5.85%

Allowance and Cumulative Write-downs on NPAs

4Q10 1Q11 2Q11

Non-performing loans 892 896 885

Allowance for loan losses on non-performing loans 49 71 66

Cumulative write-downs LTD 618 488 465

Total allowance and cumulative write-downs on NPLs $667 $559 $531

Allowance and cumulative write-downs on nonperforming

loans 44% 40% 39%

ORE and impaired loans held for sale cumulative writedowns

and valuation reserves 57% 57% 60%

Total allowance and cumulative write-downs on NPAs 46% 46% 45%

New NPL Inflows

2Q09 3Q09 4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11

$231

$295 $307

$422

$339

$531

$661

$765 $756

Down 75% from peak of $939 million in 1Q09

Down 25% from 1Q11

2Q09 3Q09 4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11

$404

$339 $331

$271

$206

$172

$573

$192 $195

45% 46% 51% 43%

34% 39% 46% 45% 45%

Book Balance of Dispositions

Realization Rate as % Unpaid Principal Balance at Default

Asset Disposition Trends

20

SYNOVUS

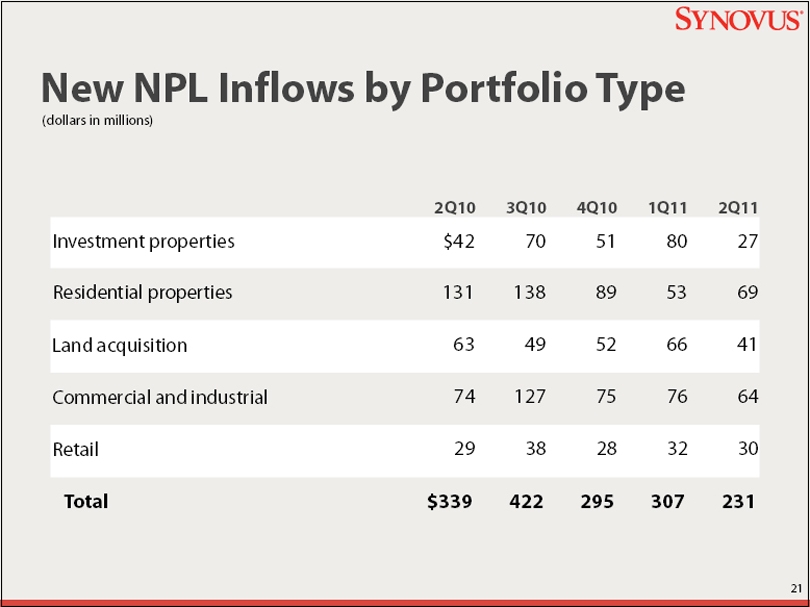

New NPL Inflows by Portfolio Type (dollars in millions)

2Q10 3Q10 4Q10 1Q11 2Q11

Investment properties $42 70 51 80 27

Residential properties 131 138 89 53 69

Land acquisition 63 49 52 66 41

Commercial and industrial 74 127 75 76 64

Retail 29 38 28 32 30

Total $339 422 295 307 231

21

SYNOVUS

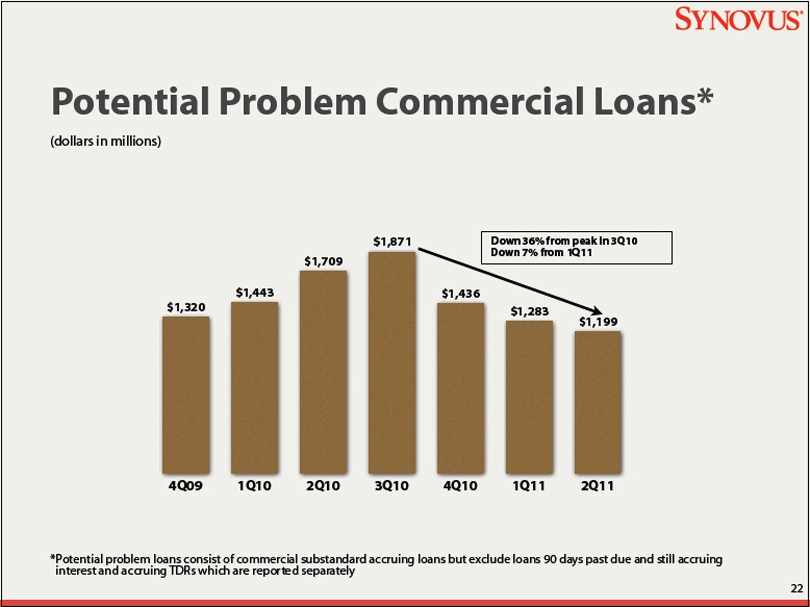

Potential Problem Commercial Loans*

(dollars in millions)

4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11

$1,199

$1,283

$1,436

$1,871

$1,709

$1,443

$1,320

Down 36% from peak in 3Q10

Down 7% from 1Q11

*Potential problem loans consist of commercial substandard accruing loans but exclude loans 90 days past due and still accruing

interest and accruing TDRs which are reported separately

22

SYNOVUS

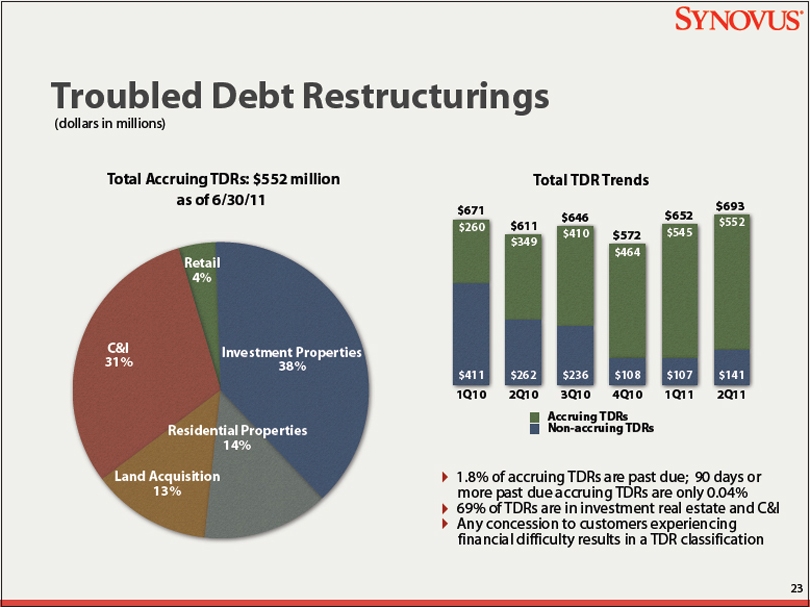

Troubled Debt Restructurings

(dollars in millions)

Total Accruing TDRs: $552 million

as of 6/30/11

Retail

4%

C&I

31%

Land Acquisition

13%

Residential Properties

14%

Investment Properties

38%

1Q10 2Q10 3Q10 4Q10 1Q11 2Q11

$552

$545

$464

$410

$349

$260

$411 $262 $236 $108 $107 $141

Total TDR Trends

$671

$611

$646

$572

$652

$693

Non-accruing TDRs

Accruing TDRs

1.8% of accruing TDRs are past due; 90 days or

more past due accruing TDRs are only 0.04%

69% of TDRs are in investment real estate and C&I

Any concession to customers experiencing

financial difficulty results in a TDR classification

23

SYNOVUS

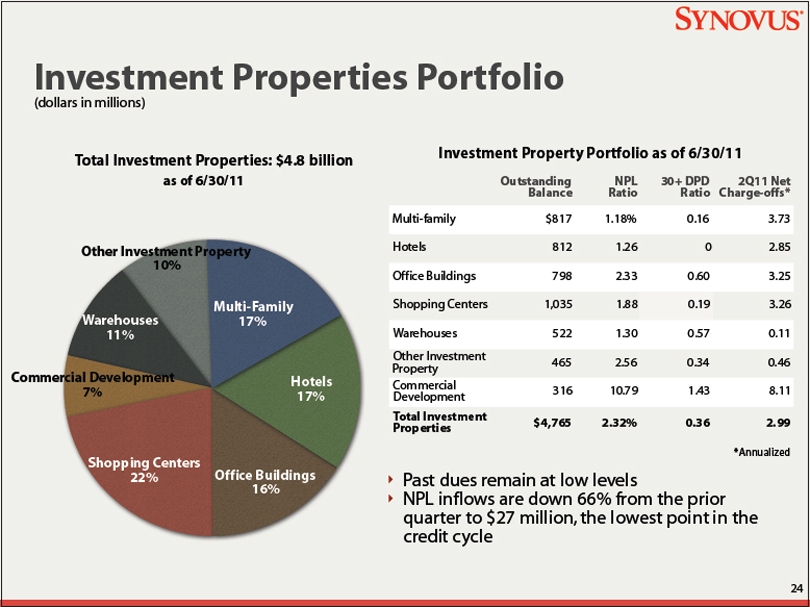

Investment Properties Portfolio

(dollars in millions)

Total Investment Properties: $4.8 billion

as of 6/30/11

Other Investment Property

10%

Warehouses

11%

Commercial Development

7%

Shopping Centers

22% Office Buildings

16%

Hotels

17%

Multi-Family

17%

Investment Property Portfolio as of 6/30/11

Outstanding

Balance NPL Ratio 30+ DPD Ratio 2Q11 Net Charge-offs*

Multi-family $817 1.18% 0.16 3.73

Hotels 812 1.26 0 2.85

Office Buildings 798 2.33 0.60 3.25

Shopping Centers 1,035 1.88 0.19 3.26

Warehouses 522 1.30 0.57 0.11

Other Investment Property Commercial Development Total Investment Properties 465 316 $4,765 2.56 10.79 2.32% 0.34 1.43 0.36 0.46 8.11 2.99

*Annualized

Past dues remain at low levels

NPL inflows are down 66% from the prior

quarter to $27 million, the lowest point in the

credit cycle

24

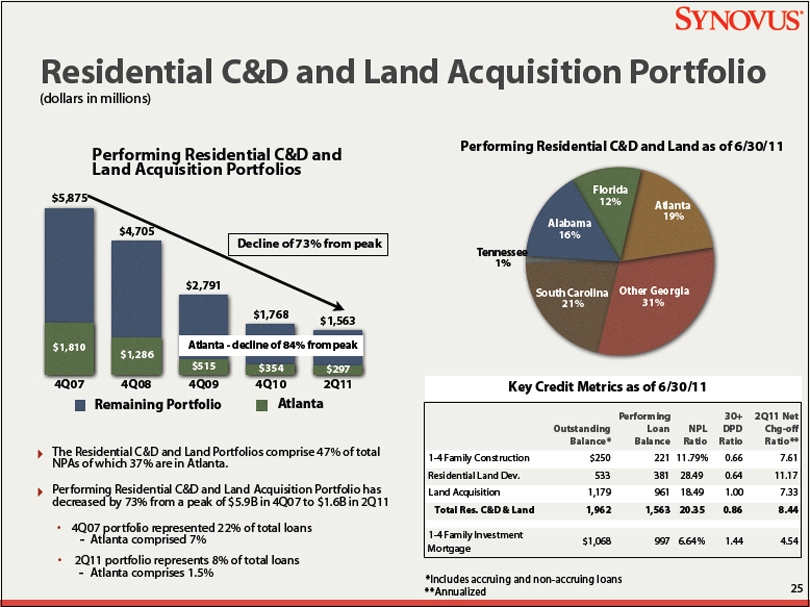

SYNOVUS

Residential C&D and Land Acquisition Portfolio

(dollars in millions)

Performing Residential C&D and

Land Acquisition Portfolios

4Q07 4Q08 4Q09 4Q10 2Q11

$1,768 $1,563

$2,791

$4,705

$5,875

$515 $354 $297

$1,286

$1,810

Remaining Portfolio

Atlanta

Decline of 73% from peak

Atlanta - decline of 84% from peak

The Residential C&D and Land Portfolios comprise 47% of total

NPAs of which 37% are in Atlanta.

Performing Residential C&D and Land Acquisition Portfolio has

decreased by 73% from a peak of $5.9B in 4Q07 to $1.6B in 2Q11

4Q07 portfolio represented 22% of total loans

Atlanta comprised 7%

2Q11 portfolio represents 8% of total loans

Atlanta comprises 1.5%

Performing Residential C&D and Land as of 6/30/11

Tennessee

1%

South Carolina

21%

Other Georgia

31%

Atlanta

19%

Florida

12%

Alabama

16%

Key Credit Metrics as of 6/30/11

Outstanding

Balance*

Performing

Loan

Balance

NPL

Ratio

30+

DPD

Ratio

2Q11 Net

Chg-off

Ratio**

1-4 Family Construction $250 221 11.79% 0.66 7.61

Residential Land Dev. 533 381 28.49 0.64 11.17

Land Acquisition 1,179 961 18.49 1.00 7.33

Total Res. C&D & Land 1,962 1,563 20.35 0.86 8.44

1-4 Family Investment

Mortgage $1,068 997 6.64% 1.44 4.54

*Includes accruing and non-accruing loans

**Annualized

25

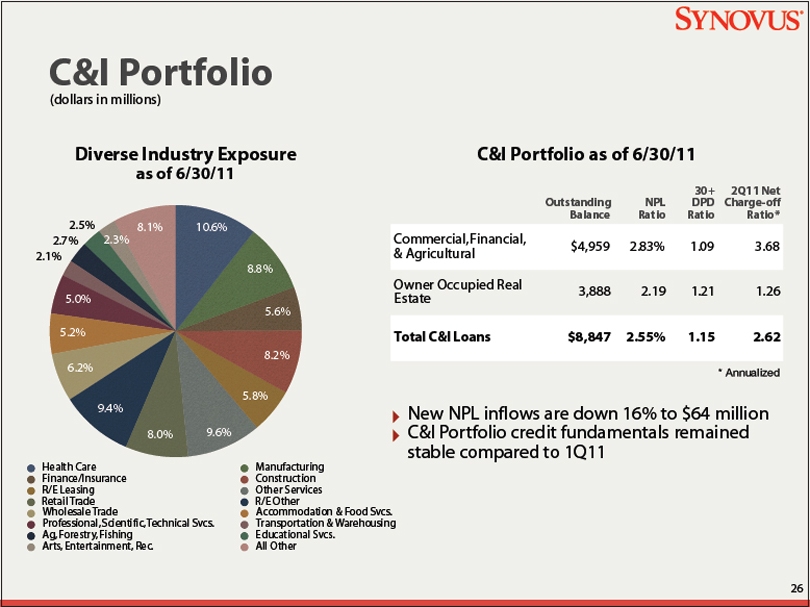

SYNOVUS

C&I Portfolio

(dollars in millions)

Diverse Industry Exposure as of 6/30/11

8.1%

2.3%

2.5%

2.7%

2.1%

5.0%

5.2%

6.2%

9.4%

8.0%

9.6%

5.8%

8.2%

5.6%

8.8%

10.6%

Health Care

Manufacturing

Finance/Insurance

Construction

R/E Leasing

Other Services

Retail Trade

R/E Other

Wholesale Trade Accommodation & Food Svcs.

Professional, Scientific, Technical Svcs.

Transportation & Warehousing

Ag, Forestry, Fishing

Educational Svcs.

Arts, Entertainment, Rec.

All Other

C&I Portfolio as of 6/30/11

Outstanding Balance

NPL Ratio

30+ DPD Ratio

2Q11 Net Charge-off Ratio*

Commercial, Financial, & Agricultural $4,959 2.83% 1.09 3.68

Owner Occupied Real Estate 3,888 2.19 1.21 1.26

Total C&I Loans $8,847 2.55% 1.15 2.62

* Annualized

New NPL inflows are down 16% to $64 million C&I Portfolio credit fundamentals remained stable compared to 1Q11

26

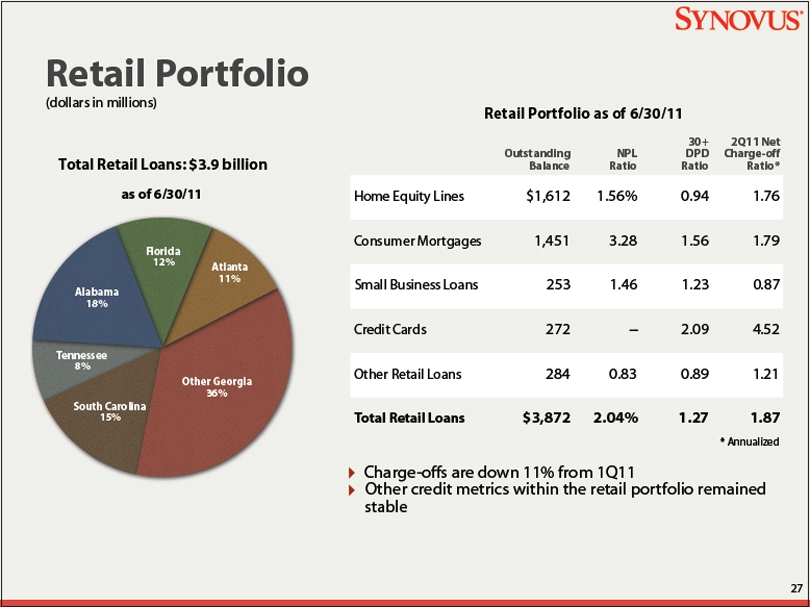

SYNOVUS

Retail Portfolio

(dollars in millions)

Total Retail Loans: $3.9 billion as of 6/30/11

Tennessee

8%

South Carolina

15%

Other Georgia

36%

Atlanta

11%

Florida

12%

Alabama

18%

Retail Portfolio as of 6/30/11

Outstanding Balance

NPL Ratio

30+ DPD Ratio

2Q11 Net Charge-off Ratio*

Home Equity Lines

Consumer Mortgages

Small Business Loans

Credit Cards

Other Retail Loans

Total Retail Loans

$1,612

1,451

253

272

284

$3,872

1.56%

3.28

1.46

–

0.83

2.04%

0.94

1.56

1.23

2.09

0.89

1.27

1.76

1.79

0.87

4.52

1.21

1.87

*Annualized

Charge-offs are down 11% from 1Q11

Other credit metrics within the retail portfolio remained stable

27

SYNOVUS

Appendix

28

SYNOVUS

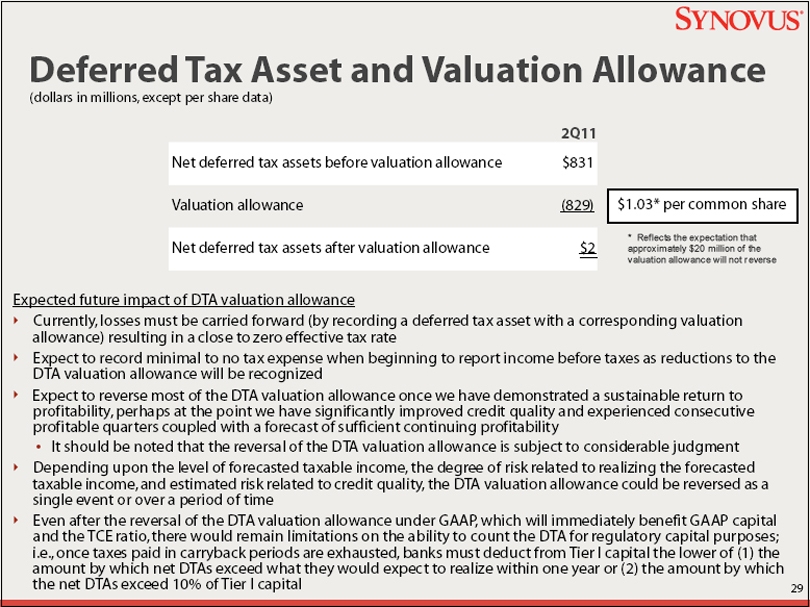

Deferred Tax Asset and Valuation Allowance

(dollars in millions, except per share data)

2Q11

Net deferred tax assets before valuation allowance $831

Valuation allowance (829)

Net deferred tax assets after valuation allowance $2

$1.03* per common share

* Reflects the expectation that approximately $20 million of the valuation allowance will not reverse

Expected future impact of DTA valuation allowance

Currently, losses must be carried forward (by recording a deferred tax asset with a corresponding valuation allowance) resulting in a close to zero effective tax rate

Expect to record minimal to no tax expense when beginning to report income before taxes as reductions to the

DTA valuation allowance will be recognized

Expect to reverse most of the DTA valuation allowance once we have demonstrated a sustainable return to profitability, perhaps at the point we have significantly improved credit quality and experienced consecutive profitable quarters coupled with a forecast of sufficient continuing profitability

It should be noted that the reversal of the DTA valuation allowance is subject to considerable judgment

Depending upon the level of forecasted taxable income, the degree of risk related to realizing the forecasted taxable income, and estimated risk related to credit quality, the DTA valuation allowance could be reversed as a single event or over a period of time

Even after the reversal of the DTA valuation allowance under GAAP, which will immediately benefit GAAP capital and the TCE ratio, there would remain limitations on the ability to count the DTA for regulatory capital purposes; i.e., once taxes paid in carryback periods are exhausted, banks must deduct from Tier I capital the lower of (1) the amount by which net DTAs exceed what they would expect to realize within one year or (2) the amount by which the net DTAs exceed 10% of Tier I capital

29

SYNOVUS

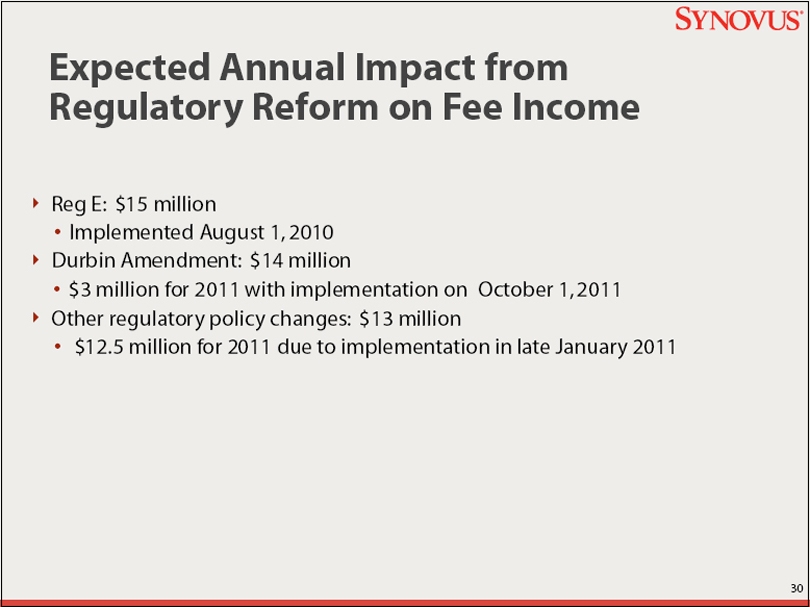

Expected Annual Impact from

Regulatory Reform on Fee Income

Reg E: $15 million

Implemented August 1, 2010

Durbin Amendment: $14 million

$3 million for 2011 with implementation on October 1, 2011

Other regulatory policy changes: $13 million

$12.5 million for 2011 due to implementation in late January 2011

30

SYNOVUS

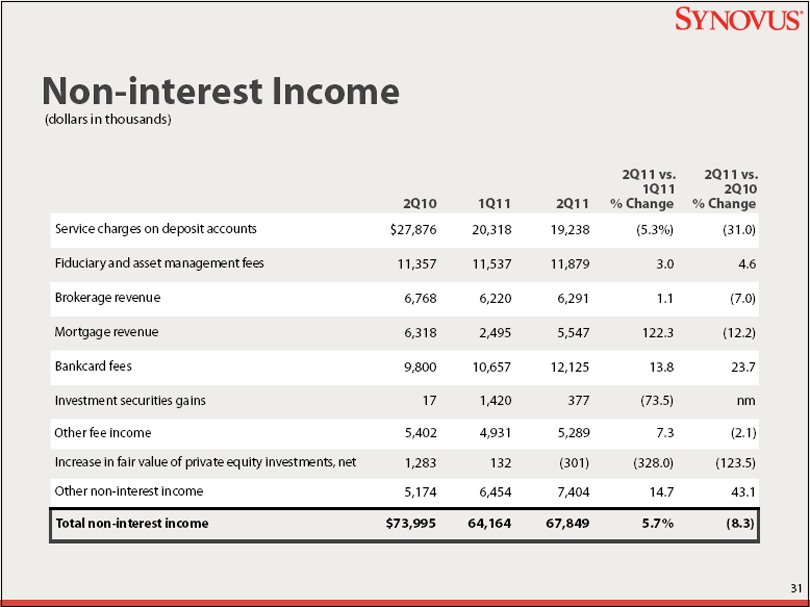

Non-interest Income

(dollars in thousands)

2Q10 1Q11 2Q11

2Q11 vs.

1Q11

% Change

2Q11 vs.

2Q10

% Change

Service charges on deposit accounts $27,876 20,318 19,238 (5.3%) (31.0)

Fiduciary and asset management fees 11,357 11,537 11,879 3.0 4.6

Brokerage revenue 6,768 6,220 6,291 1.1 (7.0)

Mortgage revenue 6,318 2,495 5,547 122.3 (12.2)

Bankcard fees 9,800 10,657 12,125 13.8 23.7

Investment securities gains 17 1,420 377 (73.5) nm

Other fee income 5,402 4,931 5,289 7.3 (2.1)

Increase in fair value of private equity investments, net 1,283 132 (301) (328.0) (123.5)

Other non-interest income 5,174 6,454 7,404 14.7 43.1

Total non-interest income $73,995 64,164 67,849 5.7% (8.3)

31

SYNOVUS

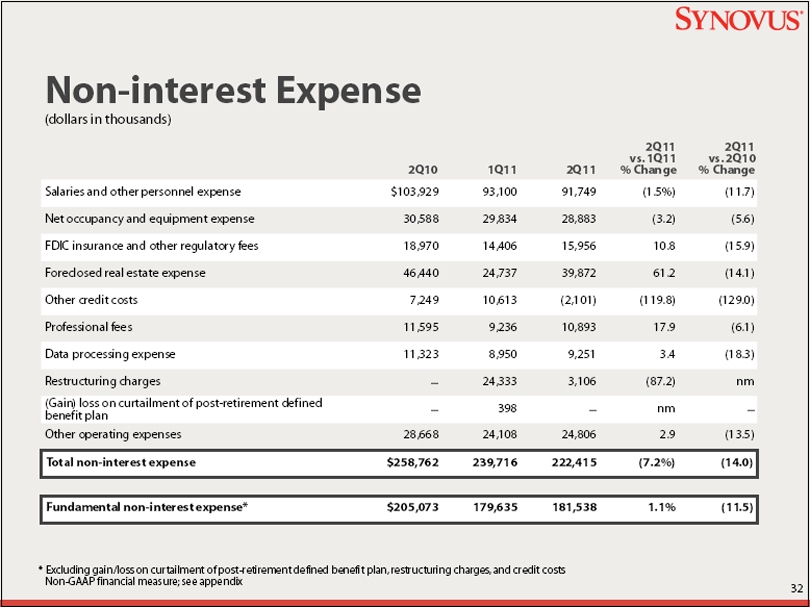

Non-interest Expense

(dollars in thousands)

2Q10 1Q11 2Q11

2Q11

vs. 1Q11

% Change

2Q11

vs. 2Q10

% Change

Salaries and other personnel expense $103,929 93,100 91,749 (1.5%) (11.7)

Net occupancy and equipment expense 30,588 29,834 28,883 (3.2) (5.6)

FDIC insurance and other regulatory fees 18,970 14,406 15,956 10.8 (15.9)

Foreclosed real estate expense 46,440 24,737 39,872 61.2 (14.1)

Other credit costs 7,249 10,613 (2,101) (119.8) (129.0)

Professional fees 11,595 9,236 10,893 17.9 (6.1)

Data processing expense 11,323 8,950 9,251 3.4 (18.3)

Restructuring charges - 24,333 3,106 (87.2) nm

(Gain) loss on curtailment of post-retirement defined

benefit plan - 398 - nm -

Other operating expenses 28,668 24,108 24,806 2.9 (13.5)

Total non-interest expense $258,762 239,716 222,415 (7.2%) (14.0)

Fundamental non-interest expense* $205,073 179,635 181,538 1.1% (11.5)

* Excluding gain/loss on curtailment of post-retirement defined benefit plan, restructuring charges, and credit costs

Non-GAAP financial measure; see appendix

32

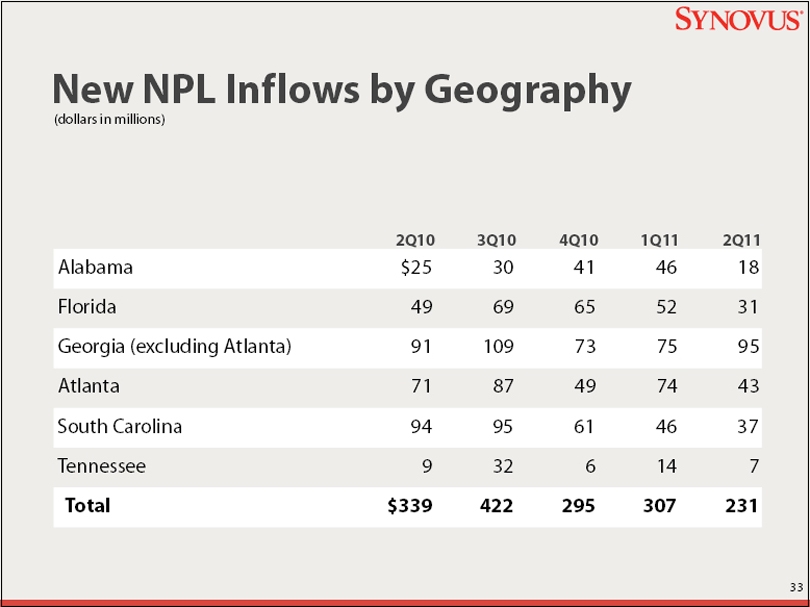

SYNOVUS

New NPL Inflows by Geography

(dollars in millions)

2Q10 3Q10 4Q10 1Q11 2Q11

Alabama $25 30 41 46 18

Florida 49 69 65 52 31

Georgia (excluding Atlanta) 91 109 73 75 95

Atlanta 71 87 49 74 43

South Carolina 94 95 61 46 37

Tennessee 9 32 6 14 7

Total $339 422 295 307 231

33

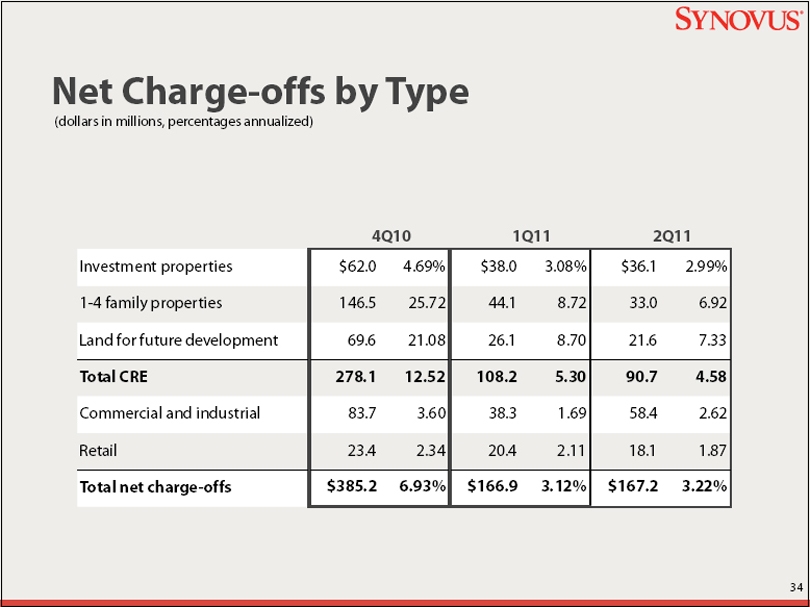

SYNOVUS

Net Charge-offs by Type

(dollars in millions, percentages annualized)

4Q10 1Q11 2Q11

Investment properties $62.0 4.69% $38.0 3.08% $36.1 2.99%

1-4 family properties 146.5 25.72 44.1 8.72 33.0 6.92

Land for future development 69.6 21.08 26.1 8.70 21.6 7.33

Total CRE 278.1 12.52 108.2 5.30 90.7 4.58

Commercial and industrial 83.7 3.60 38.3 1.69 58.4 2.62

Retail 23.4 2.34 20.4 2.11 18.1 1.87

Total net charge-offs $385.2 6.93% $166.9 3.12% $167.2 3.22%

34

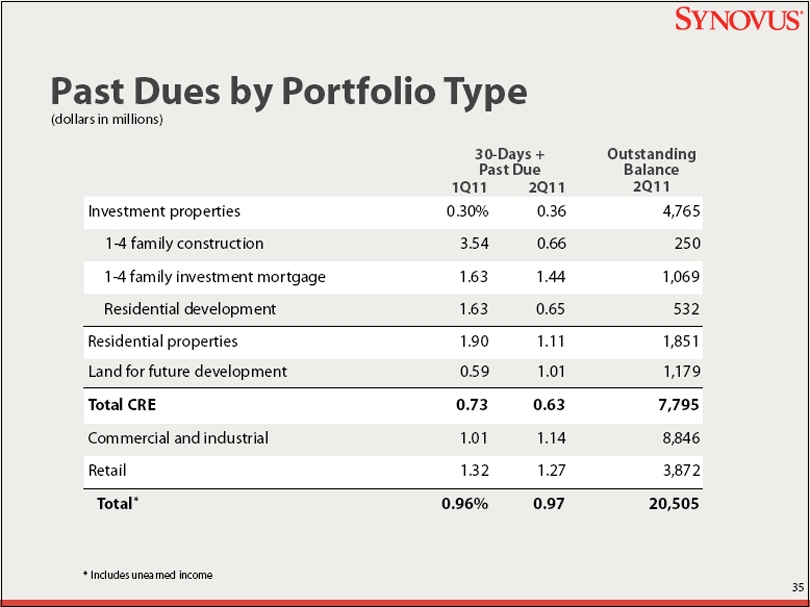

SYNOVUS

Past Dues by Portfolio Type

(dollars in millions)

30-Days +

Past Due

Outstanding

Balance

1Q11 2Q11 2Q11

Investment properties 0.30% 0.36 4,765

1-4 family construction 3.54 0.66 250

1-4 family investment mortgage 1.63 1.44 1,069

Residential development 1.63 0.65 532

Residential properties 1.90 1.11 1,851

Land for future development 0.59 1.01 1,179

Total CRE 0.73 0.63 7,795

Commercial and industrial 1.01 1.14 8,846

Retail 1.32 1.27 3,872

Total* 0.96% 0.97 20,505

* Includes unearned income

35

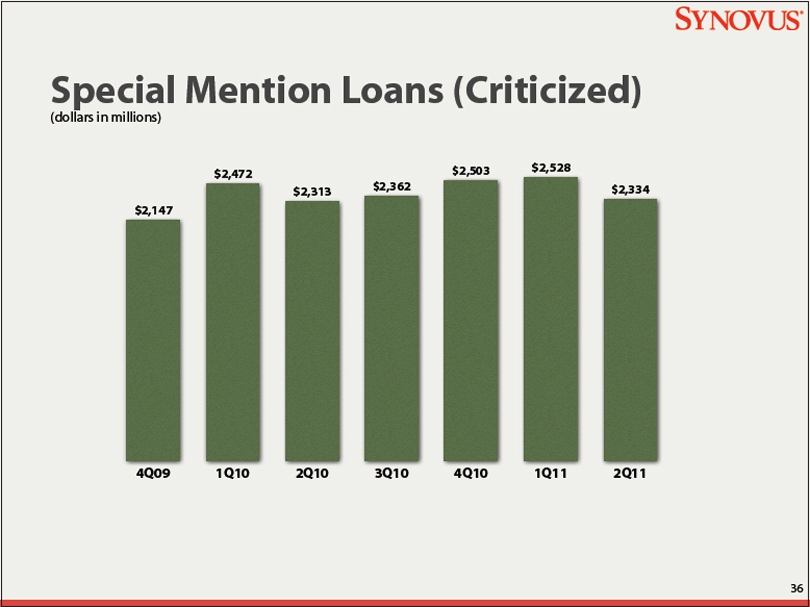

SYNOVUS

Special Mention Loans (Criticized)

(dollars in millions)

$2,147

$2,472

$2,313

$2,362

$2,503

$2,528

$2,334

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

36

SYNOVUS

Non-GAAP Financial Measures

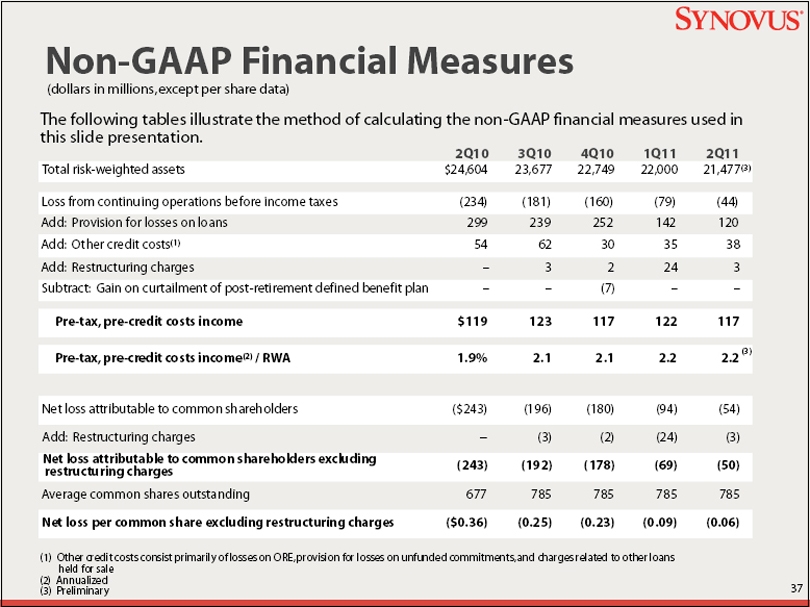

(dollars in millions, except per share data)

The following tables illustrate the method of calculating the non-GAAP financial measures used in this slide presentation.

2Q10 3Q10 4Q10 1Q11 2Q11

Total risk-weighted assets $24,604 23,677 22,749 22,000 21,477 (3)

Loss from continuing operations before income taxes (234) (181) (160) (79) (44)

Add: Provision for losses on loans 299 239 252 142 120

Add: Other credit costs(1) 54 62 30 35 38

Add: Restructuring charges - 3 2 24 3

Subtract: Gain on curtailment of post-retirement defined benefit plan - - (7) - -

Pre-tax, pre-credit costs income $119 123 117 122 117

Pre-tax, pre-credit costs income(2) / RWA 1.9% 2.1 2.1 2.2 2.2 (3)

Net loss attributable to common shareholders ($243) (196) (180) (94) (54)

Add: Restructuring charges - (3) (2) (24) (3)

Net loss attributable to common shareholders excluding restructuring charges (243) (192) (178) (69) (50)

Average common shares outstanding 677 785 785 785 785

Net loss per common share excluding restructuring charges ($0.36) (0.25) (0.23) (0.09) (0.06)

(1) Other credit costs consist primarily of losses on ORE, provision for losses on unfunded commitments, and charges related to other loans held for sale

(2) Annualized

(3) Preliminary

37

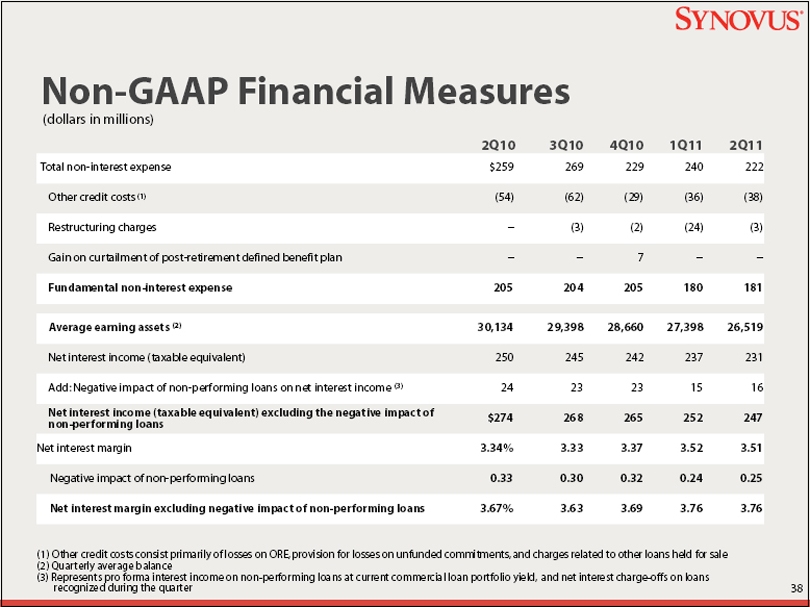

SYNOVUS

Non-GAAP Financial Measures

(dollars in millions)

2Q10 3Q10 4Q10 1Q11 2Q11

Total non-interest expense $259 269 229 240 222

Other credit costs (1) (54) (62) (29) (36) (38)

Restructuring charges - (3) (2) (24) (3)

Gain on curtailment of post-retirement defined benefit plan - - 7 - -

Fundamental non-interest expense 205 204 205 180 181

Average earning assets (2) 30,134 29,398 28,660 27,398 26,519

Net interest income (taxable equivalent) 250 245 242 237 231

Add: Negative impact of non-performing loans on net interest income (3) 24 23 23 15 16

Net interest income (taxable equivalent) excluding the negative impact of non-performing loans $274 268 265 252 247

Net interest margin 3.34% 3.33 3.37 3.52 3.51

Negative impact of non-performing loans 0.33 0.30 0.32 0.24 0.25

Net interest margin excluding negative impact of non-performing loans 3.67% 3.63 3.69 3.76 3.76

(1) Other credit costs consist primarily of losses on ORE, provision for losses on unfunded commitments, and charges related to other loans held for sale

(2) Quarterly average balance

(3) Represents pro forma interest income on non-performing loans at current commercial loan portfolio yield, and net interest charge-offs on loans recognized during the quarter

38

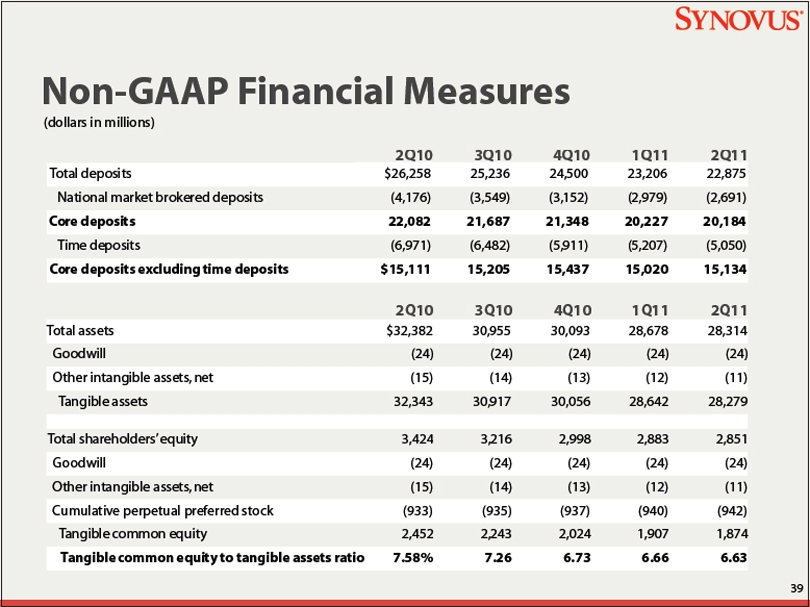

SYNOVUS

Non-GAAP Financial Measures

(dollars in millions)

2Q10 3Q10 4Q10 1Q11 2Q11

Total assets $32,382 30,955 30,093 28,678 28,314

Goodwill (24) (24) (24) (24) (24)

Other intangible assets, net (15) (14) (13) (12) (11)

Tangible assets 32,343 30,917 30,056 28,642 28,279

Total shareholders’ equity 3,424 3,216 2,998 2,883 2,851

Goodwill (24) (24) (24) (24) (24)

Other intangible assets, net (15) (14) (13) (12) (11)

Cumulative perpetual preferred stock (933) (935) (937) (940) (942)

Tangible common equity 2,452 2,243 2,024 1,907 1,874

Tangible common equity to tangible assets ratio 7.58% 7.26 6.73 6.66 6.63

2Q10 3Q10 4Q10 1Q11 2Q11

Total deposits $26,258 25,236 24,500 23,206 22,875

National market brokered deposits (4,176) (3,549) (3,152) (2,979) (2,691)

Core deposits 22,082 21,687 21,348 20,227 20,184

Time deposits (6,971) (6,482) (5,911) (5,207) (5,050)

Core deposits excluding time deposits $15,111 15,205 15,437 15,020 15,134

39