Exhibit 99.3

Second Quarter 2014 Results

July 22, 2014

SYNOVUS®

Forward-looking Statements and Use of Non-GAAP Financial Measures

Forward Looking Statements

This slide presentation and certain of our other filings with the Securities and Exchange Commission contain statements that constitute “forward-looking statements” within the meaning of, and subject to the protections of, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact are forward-looking statements. You can identify these forward-looking statements through Synovus’ use of words such as “believes,” “anticipates,” “expects,” “may,” “will,” “assumes,” “should,” “predicts,” “could,” “should,” “would,” “intends,” “targets,” “estimates,” “projects,” “plans,” “potential” and other similar words and expressions of the future or otherwise regarding the outlook for Synovus’ future business and financial performance and/or the performance of the banking industry and economy in general. These forward-looking statements include, among others, (1) our expectations on credit trends and key credit metrics, including credit costs, future NPL inflows, and overall NPL levels; (2) expectations on future loan growth; (3) expectations on net interest margin; (4) expectations on mortgage banking income and other non-interest income; (5) expectations regarding adjusted non-interest expense levels and the impact of our ongoing efficiency initiatives and further cost savings; (6) the expected impact of Basel III on our capital ratios; (7) expectations regarding our strategic plan and future growth; and (8) the assumptions underlying our expectations. Prospective investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve known and unknown risks and uncertainties which may cause the actual results, performance or achievements of Synovus to be materially different from the future results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements are based on the information known to, and current beliefs and expectations of, Synovus’ management and are subject to significant risks and uncertainties. Actual results may differ materially from those contemplated by such forward-looking statements. A number of factors could cause actual results to differ materially from those contemplated by the forward-looking statements in this report. Many of these factors are beyond Synovus’ ability to control or predict.

These forward-looking statements are based upon information presently known to Synovus’ management and are inherently subjective, uncertain and subject to change due to any number of risks and uncertainties, including, without limitation, the risks and other factors set forth in Synovus’ filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the year ended December 31, 2013 under the captions “Cautionary Notice Regarding Forward-Looking Statements” and “Risk Factors” and in Synovus’ quarterly reports on Form 10-Q and current reports on Form 8-K. We believe these forward-looking statements are reasonable; however, undue reliance should not be placed on any forward-looking statements, which are based on current expectations and speak only as of the date that they are made. We do not assume any obligation to update any forward-looking statements as a result of new information, future developments or otherwise, except as otherwise may be required by law.

Use of Non-GAAP Financial Measures

This slide presentation contains certain non-GAAP financial measures determined by methods other than in accordance with generally accepted accounting principles. Such non-GAAP financial measures include the following: net income available to common shareholders excluding restructuring charges; adjusted non-interest income; adjusted non-interest expense; adjusted revenues; adjusted pre-tax, pre-credit costs income; the ratio of adjusted pre-tax, pre-credit costs income to risk weighted assets; average core deposits; average core deposits excluding average time deposits; the Tier 1 common equity ratio; the estimated Tier 1 common equity ratio under final Basel III rules; and the tangible common equity to tangible assets ratio. The most comparable GAAP measures to these measures are income before income taxes; the ratio of net income to average total assets, total non-interest income, total non-interest expense, net sequential quarter total loan growth; total deposits; and the ratio of total equity to total assets, respectively. Management uses these non-GAAP financial measures to assess the performance of Synovus’ core business and the strength of its capital position. Synovus believes that these non-GAAP financial measures provide meaningful additional information about Synovus to assist investors in evaluating Synovus’ operating results, financial strength and capitalization. The non-GAAP financial measures should be considered as additional views of the way our financial measures are affected by significant charges for credit costs and other factors. Adjusted pre-tax, pre-credit costs income and adjusted pre-tax, pre-credit costs income to risk weighted assets are measures used by management to evaluate core operating results exclusive of credit costs as well as certain income/expenses. Adjusted non-interest income is a measure used by management to evaluate non-interest income exclusive of net investment securities gains and other non-recurring income items. Adjusted non-interest expense is a measure utilized by management to measure the success of expense management initiatives focused on reducing recurring controllable operating costs. 1Q14 loan growth excluding the impact from the Memphis transaction is a measure used by management to evaluate organic loan growth. Core deposits, core deposits excluding the impact from the Memphis transaction, core deposits excluding time deposits and the impact from the Memphis transaction, and total deposits excluding the impact from the Memphis transaction are measures used by management to evaluate organic growth of deposits and the quality of deposits as a funding source. The Tier 1 common equity ratio, the estimated Tier 1 common ratio under final Basel III rules, and the tangible common equity to tangible assets ratio are used by management to assess the strength of our capital position. These non-GAAP financial measures should not be considered as a substitute for operating results determined in accordance with GAAP and may not be comparable to other similarly titled measures of other companies. The computations of the non-GAAP financial measures used in this slide presentation are set forth in the Appendix to this slide presentation.

2

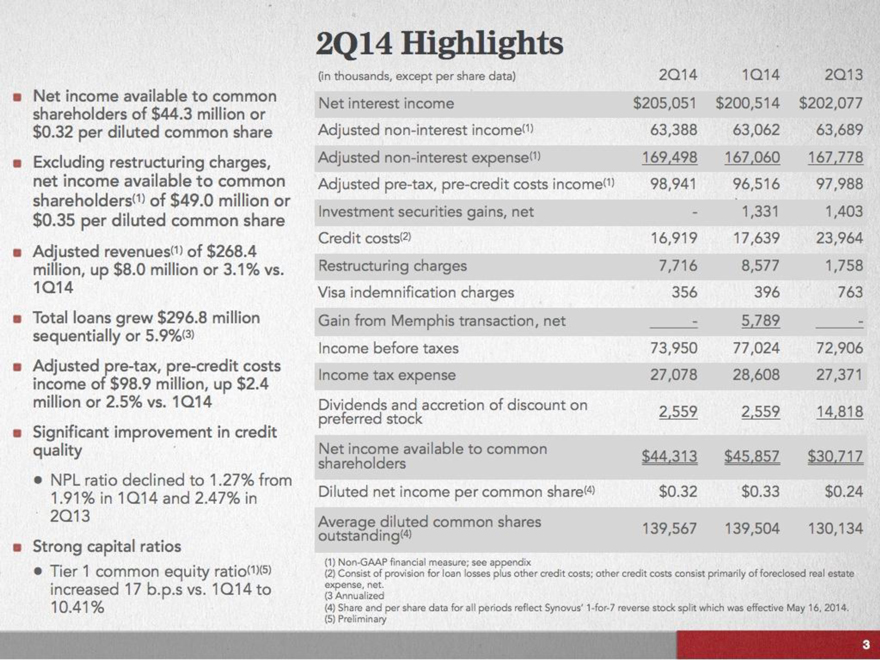

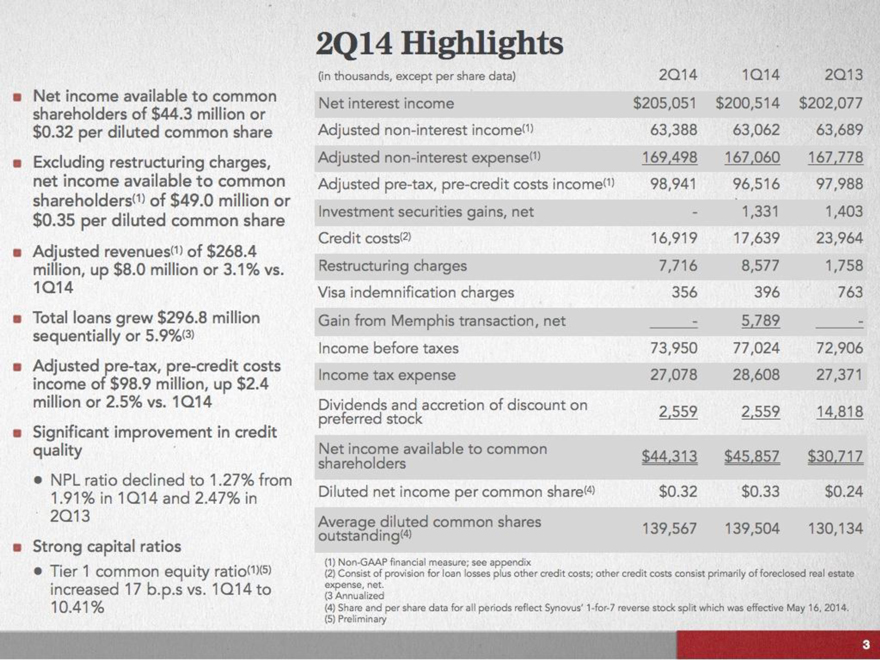

Net income available to common shareholders of $44.3 million or $0.32 per diluted common share

Excluding restructuring charges, net income available to common shareholders(1) of $49.0 million or $0.35 per diluted common share

Adjusted revenues(1) of $268.4 million, up $8.0 million or 3.1% vs. 1Q14

Total loans grew $296.8 million sequentially or 5.9%(3)

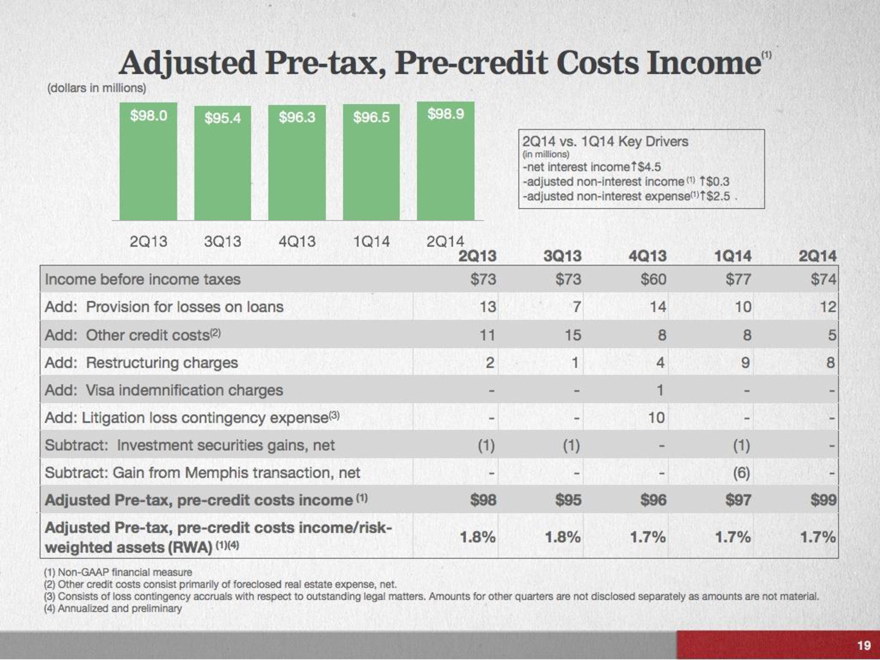

Adjusted pre-tax, pre-credit costs income of $98.9 million, up $2.4 million or 2.5% vs. 1Q14

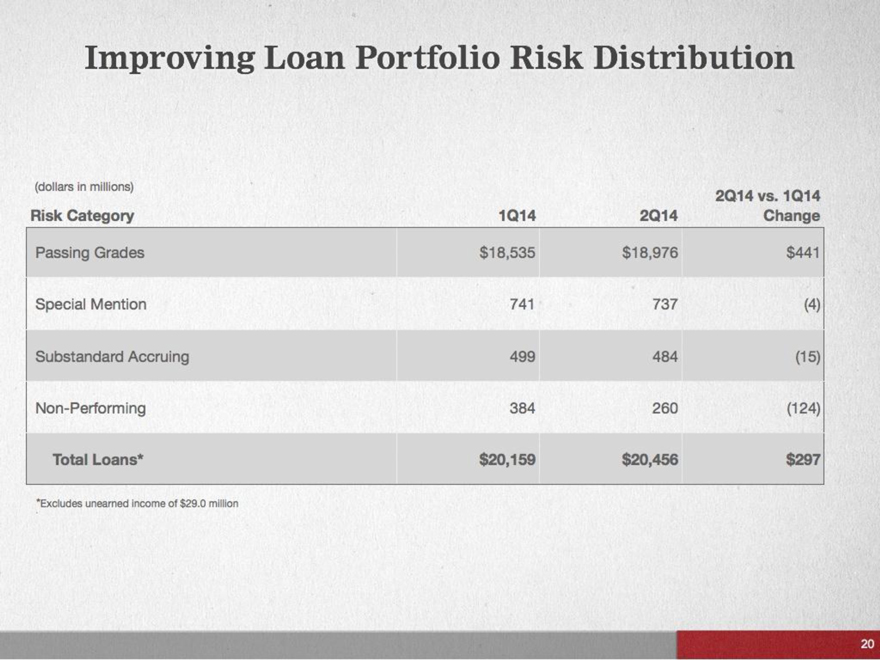

Significant improvement in credit quality

NPL ratio declined to 1.27% from 1.91% in 1Q14 and 2.47% in 2Q13

Strong capital ratios

Tier 1 common equity ratio(1)(5) increased 17 b.p.s vs. 1Q14 to 10.41%

2Q14 Highlights

(in thousands, except per share data) 2Q14 1Q14 2Q13

Net interest income $205,051 $200,514 $202,077

Adjusted non-interest income(1) 63,388 63,062 63,689

Adjusted non-interest expense(1) 169,498 167,060 167,778

Adjusted pre-tax, pre-credit costs income(1) 98,941 96,516 97,988

Investment securities gains, net – 1,331 1,403

Credit costs(2) 16,919 17,639 23,964

Restructuring charges 7,716 8,577 1,758

Visa indemnification charges 356 396 763

Gain from Memphis transaction, net – 5,789 –

Income before taxes 73,950 77,024 72,906

Income tax expense 27,078 28,608 27,371

Dividends and accretion of discount on preferred stock 2,559 2,559 14,818

Net income available to common shareholders $44,313 $45,857 $30,717

Diluted net income per common share(4) $0.32 $0.33 $0.24

Average diluted common shares outstanding(4) 139,567 139,504 130,134

(1) Non-GAAP financial measure; see appendix

(2) Consist of provision for loan losses plus other credit costs; other credit costs consist primarily of foreclosed real estate expense, net.

(3 Annualized

(4) Share and per share data for all periods reflect Synovus’ 1-for-7 reverse stock split which was effective May 16, 2014.

(5) Preliminary

3

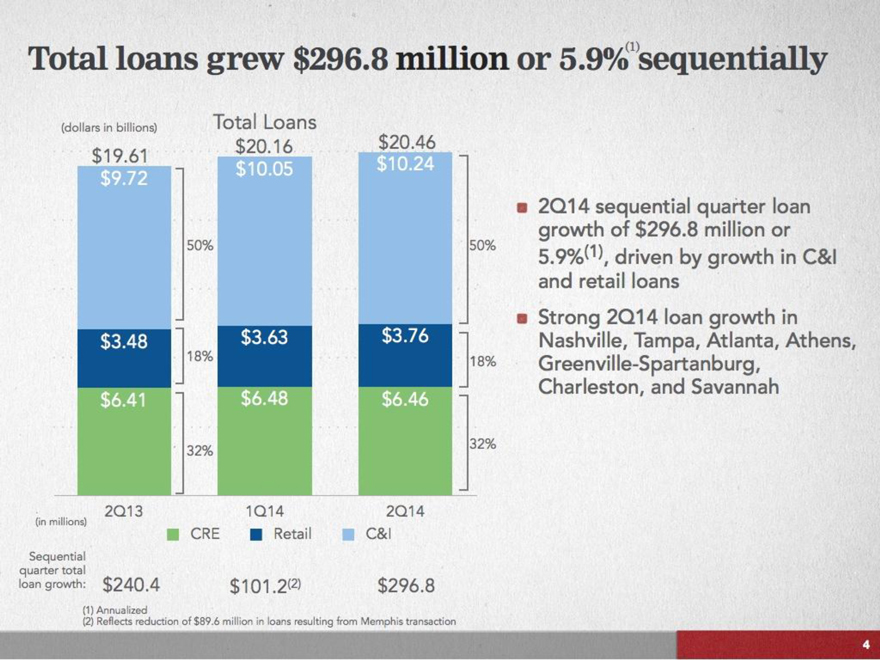

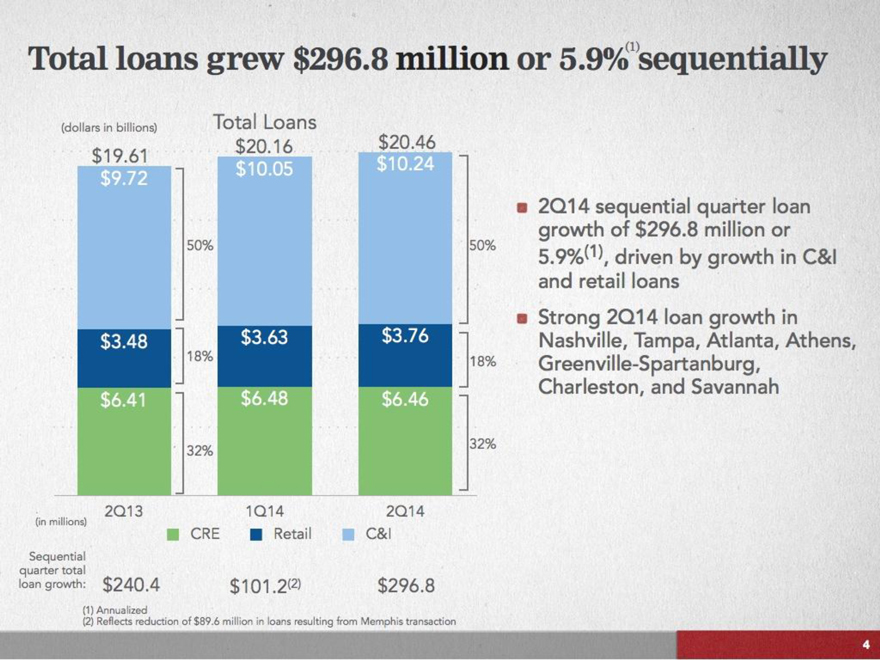

Total loans grew $296.8 million or 5.9%(1) sequentially

(dollars in billions) $19.61 $9.72 50% $3.48 18% $6.41 32%

Total Loans $20.16 $10.05 $3.63 $6.48

$20.46 $10.24 50% $3.76 18% $6.46 32%

2Q13 1Q14 2Q14 (in millions) CRE Retail C&I

Sequential quarter total loan growth: $240.4 $101.2(2) $296.8

(1) Annualized

(2) Reflects reduction of $89.6 million in loans resulting from Memphis transaction

2Q14 sequential quarter loan growth of $296.8 million or 5.9%(1), driven by growth in C&I and retail loans

Strong 2Q14 loan growth in Nashville, Tampa, Atlanta, Athens, Greenville-Spartanburg, Charleston, and Savannah

4

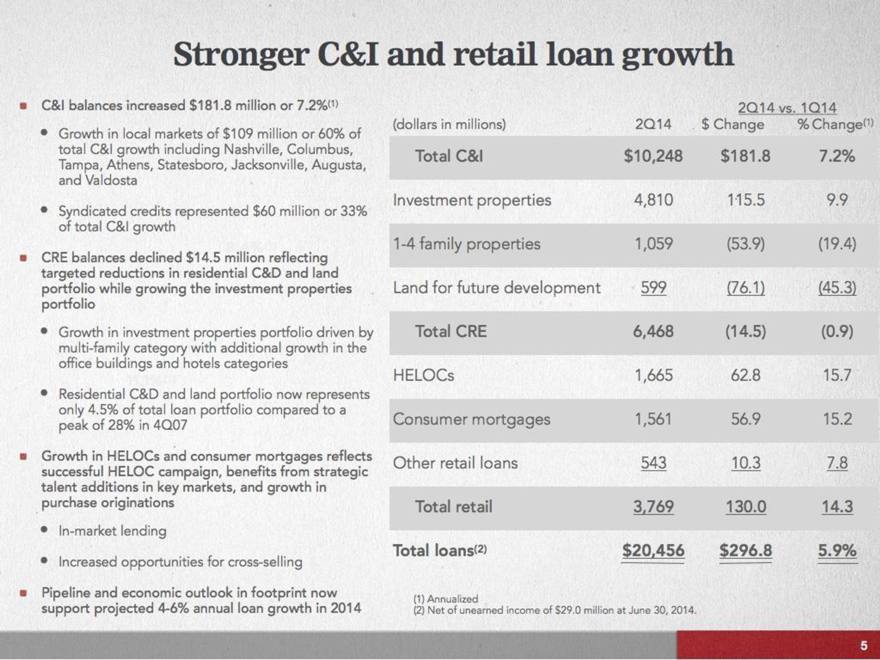

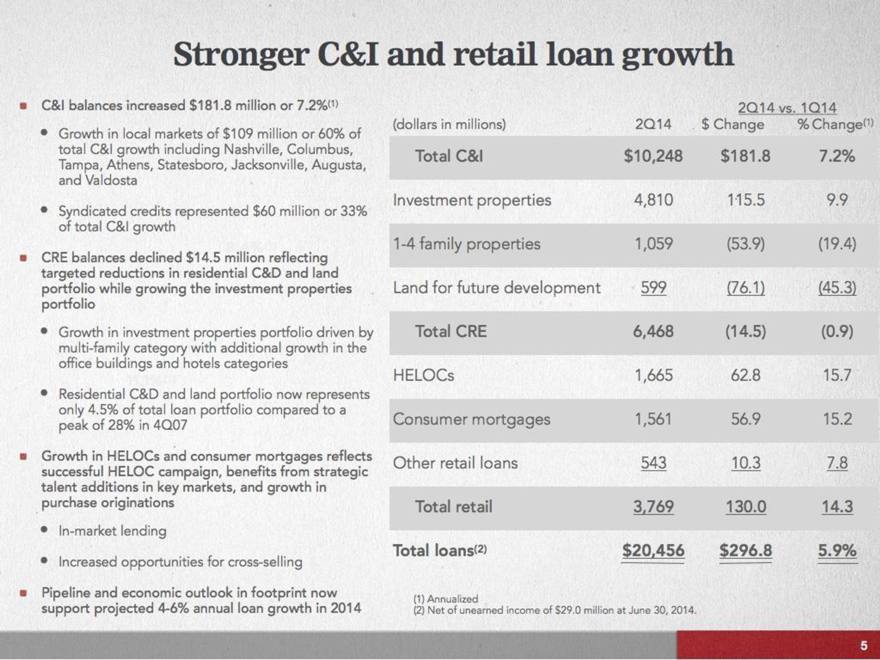

Stronger C&I and retail loan growth

C&I balances increased $181.8 million or 7.2%(1)

Growth in local markets of $109 million or 60% of total C&I growth including Nashville, Columbus, Tampa, Athens, Statesboro, Jacksonville, Augusta, and Valdosta

Syndicated credits represented $60 million or 33% of total C&I growth

CRE balances declined $14.5 million reflecting targeted reductions in residential C&D and land portfolio while growing the investment properties portfolio

Growth in investment properties portfolio driven by multi-family category with additional growth in the office buildings and hotels categories

Residential C&D and land portfolio now represents only 4.5% of total loan portfolio compared to a peak of 28% in 4Q07

Growth in HELOCs and consumer mortgages reflects successful HELOC campaign, benefits from strategic talent additions in key markets, and growth in purchase originations

In-market lending

Increased opportunities for cross-selling

Pipeline and economic outlook in footprint now support projected 4-6% annual loan growth in 2014

(dollars in millions) 2Q14 vs. 1Q14 2Q14 $ Change % Change(1)

Total C&I $10,248 $181.8 7.2%

Investment properties 4,810 115.5 9.9

1-4 family properties 1,059 (53.9) (19.4)

Land for future development 599 (76.1) (45.3)

Total CRE 6,468 (14.5) (0.9)

HELOCs 1,665 62.8 15.7

Consumer mortgages 1,561 56.9 15.2

Other retail loans 543 10.3 7.8

Total retail 3,769 130.0 14.3

Total loans(2) $20,456 $296.8 5.9%

(1) Annualized

(2) Net of unearned income of $29.0 million at June 30, 2014.

5

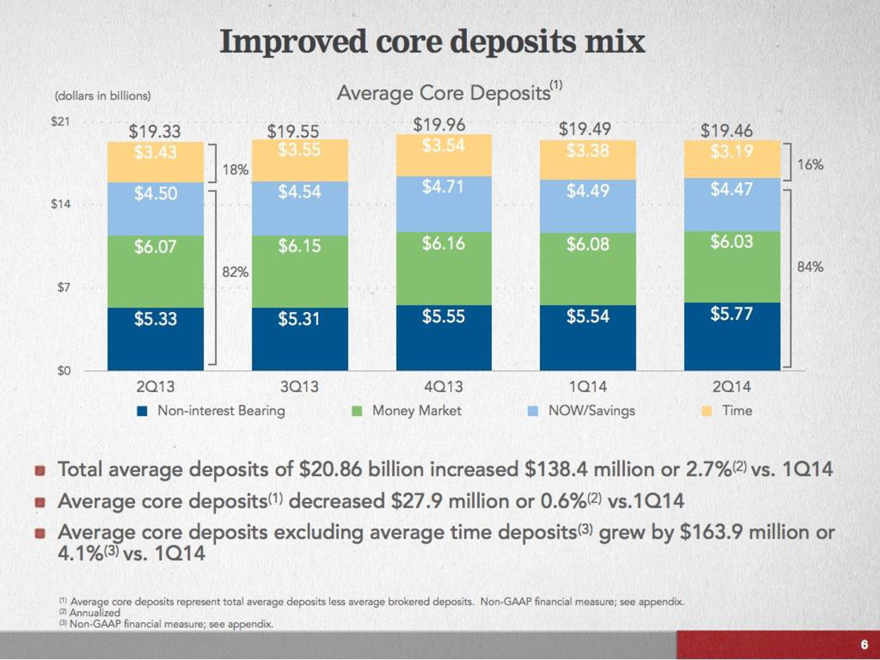

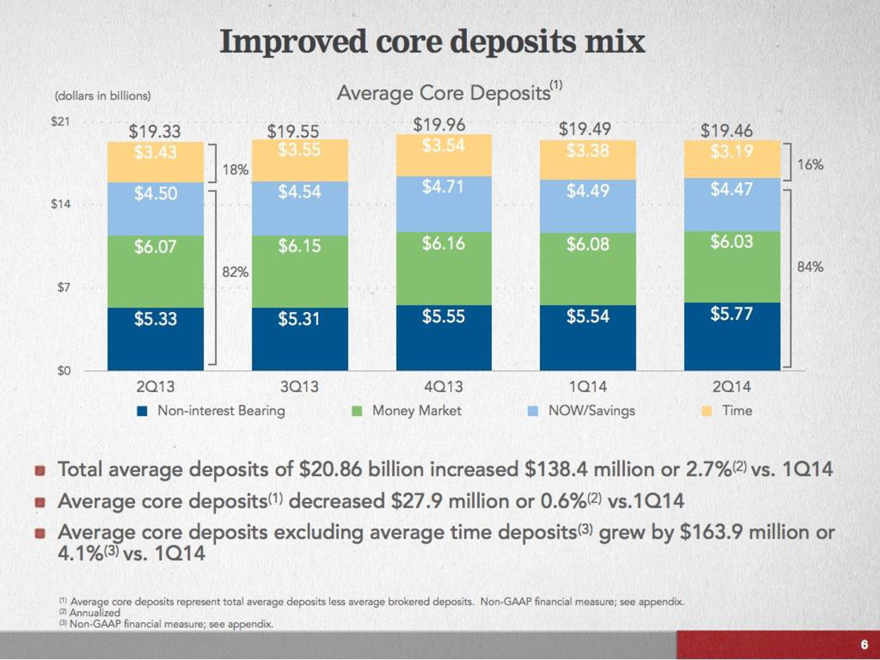

Improved core deposits mix

(dollars in billions)

Average Core Deposits(1)

$21 $14 $7 $0

$19.33 $3.43 $4.50 $6.07 $5.33

18% 82%

$19.55 $3.55 $4.54 $6.15 $5.31

$19.96 $3.54 $4.71 $6.16 $5.55

$19.49 $3.38 $4.49 $6.08 $5.54

$19.46 $3.19 $4.47 $6.03 $5.77

16% 84%

2Q13 3Q13 4Q13 1Q14 2Q14

Non-interest Bearing

Money Market

NOW/Savings

Time

Total Average deposits of $20.86 billion increased $138.4 million or 2.7%(2) vs. 1Q14

Average core deposits(1) decreased $27.9 million or 0.6%(2) vs. 1Q14

Average core deposits excluding average time deposits(3) grew by $163.9 million or 4.1%(3) vs. 1Q14

(1) Average core deposits represent total average deposits less average brokered deposits. Non-GAAP financial measure; see appendix.

(2) Annualized

(3) Non-GAAP financial measure; see appendix.

6

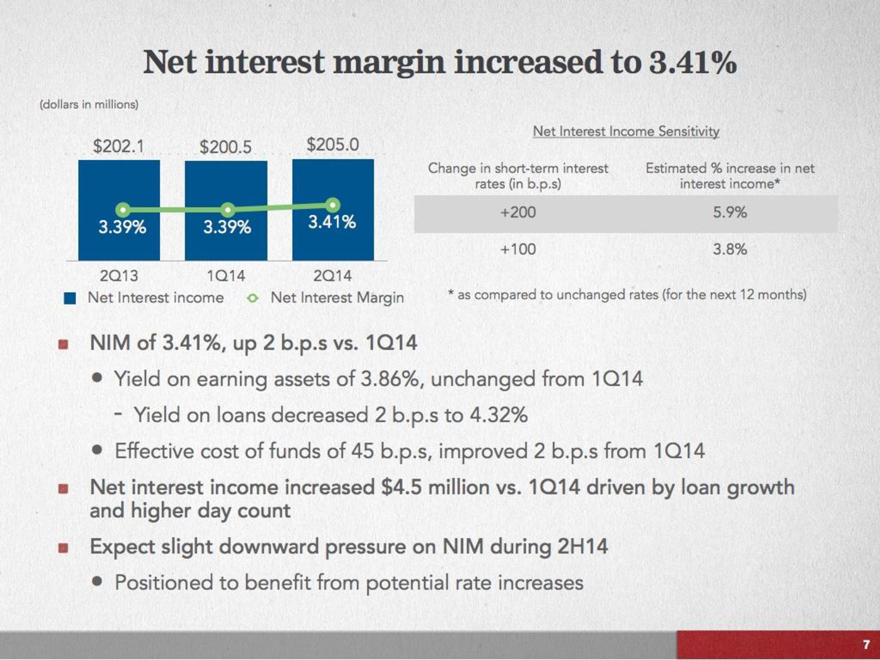

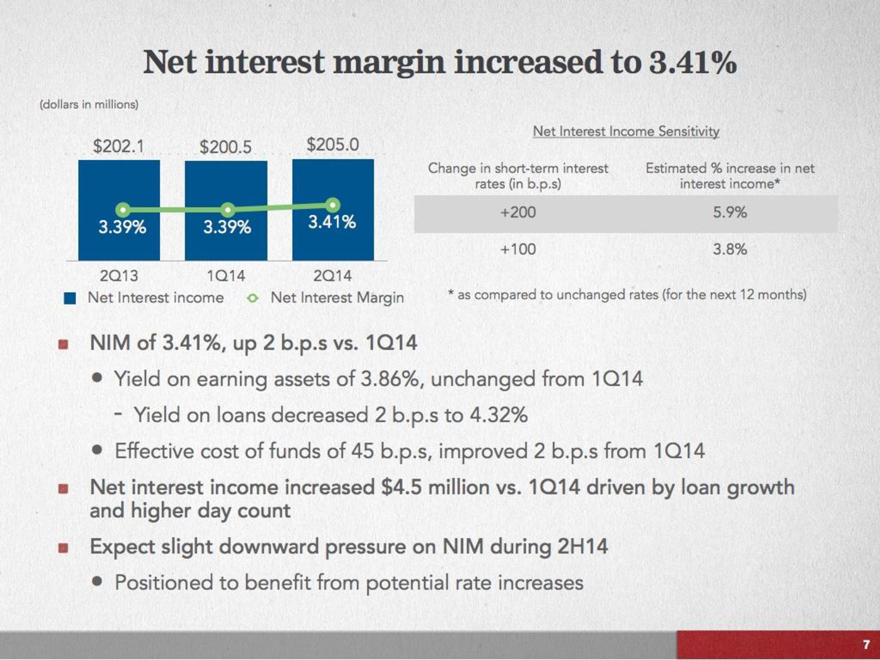

Net interest margin increased to 3.41%

(dollars in millions)

$202.1 $200.5 $205.0

3.39% 3.39% 3.41% 2Q13 1Q14 2Q14

Net Interest income Net Interest Margin

Net Interest Income Sensitivity

Change in short-term interest rates (in b.p.s)

Estimated % increase in net interest income*

+200 +100 5.9% 3.8%

NIM of 3.41%, up 2 b.p.s vs. 1Q14

Yield on earning assets of 3.86%, unchanged from 1Q14

- Yield on loans decreased 2 b.p.s to 4.32%

Effective cost of funds of 45 b.p.s, improved 2 b.p.s from 1Q14

Net interest income increased $4.5 million vs. 1Q14 driven by loan growth and higher day count

Expect slight downward pressure on NIM during 2H14

Positioned to benefit from potential rate increases

7

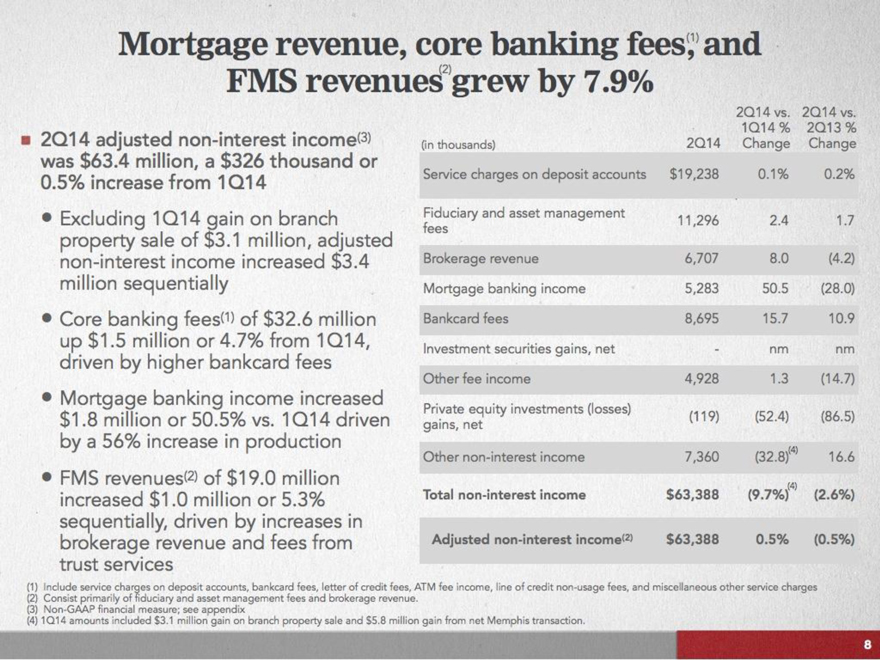

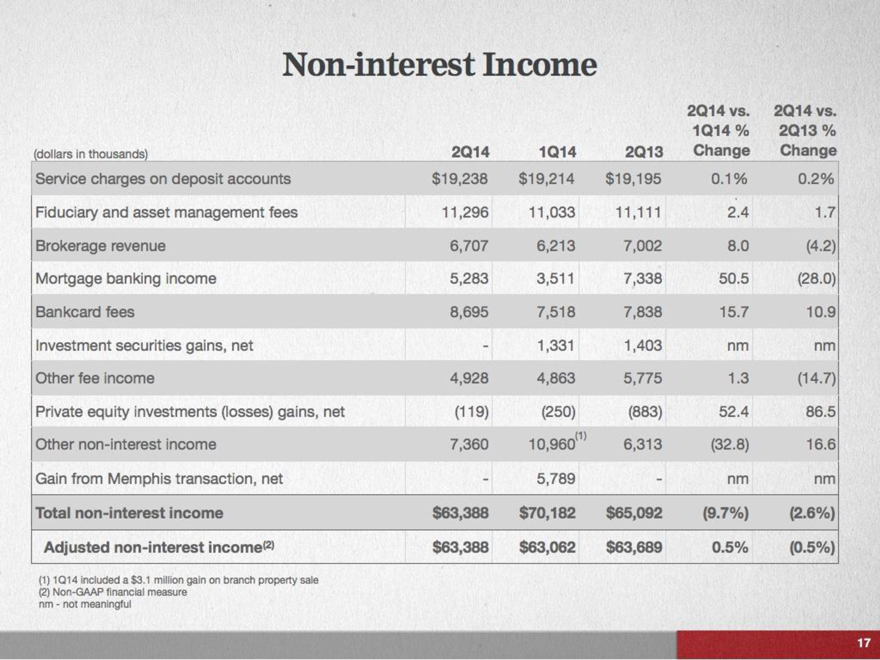

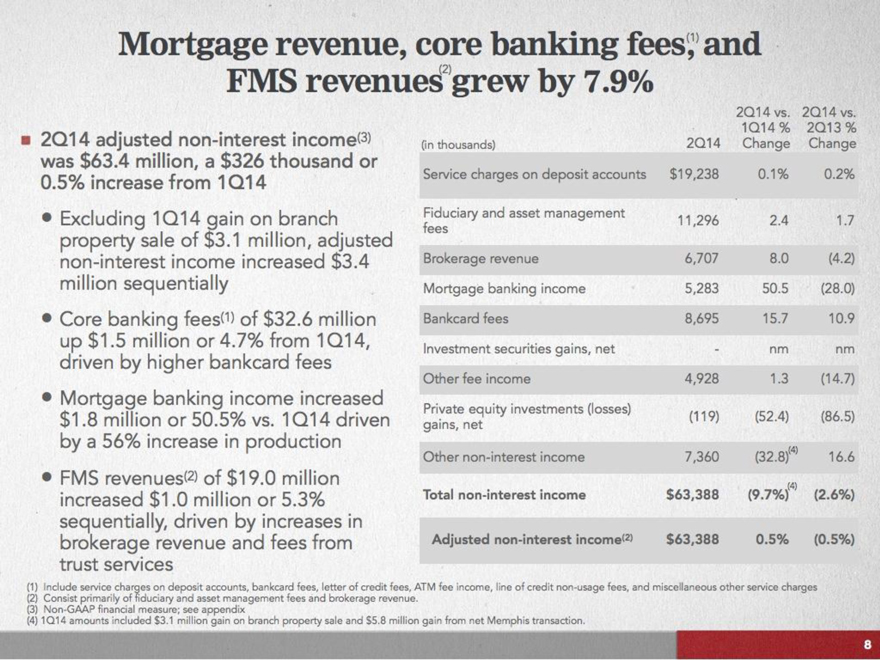

Mortgage revenue, core banking fees(1), and FMS revenues(2) grew by 7.9%

20Q14 adjusted non-interest income(3) was $63.4 million, a $326 thousand or 0.5% increase from 1Q14

Excluding 1Q14 gain on branch property sale of $3.1 million, adjusted non-interest income increased $3.4 million sequentially

Core banking fees(1) of $32.6 million up $1.5 million or 4.7% from 1Q14, driven by higher bankcard fees

Mortgage banking income increased $1.8 million or 50.5% vs. 1Q14 driven by a 56% increase in production

FMS revenues(2) of $19.0 million increased $1.0 million or 5.3% sequentially, driven by increases in brokerage revenue and fees from trust services

(1) Include service charges on deposit accounts, bankcard fees, letter of credit fees, ATM fee income, line of credit non-usage fees, and miscellaneous other service charges

(2) Consist primarily of fiduciary and asset management fees and brokerage revenue.

(3) Non-GAAP financial measure; see appendix

(4) 1Q14 amounts included $3.1 million gain on branch property sale and $5.8 million gain from net Memphis transaction.

(in thousands) 2Q14 2Q14 vs. 1Q14 % Change 2Q14 vs. 2Q13 % Change

Service charges on deposit accounts $19,238 0.1% 0.2%

Fiduciary and asset management fees 11,296 2.4 1.7

Brokerage revenue 6,707 8.0 (4.2)

Mortgage banking income 5,283 50.5 (28.0)

Bankcard fees 8,695 15.7 10.9

Investment securities gains, net—nm nm

Other fee income 4,928 1.3 (14.7)

Private equity investments (losses) gains, net (119) (52.4) (86.5)

Other non-interest income 7,360 (32.8)(4) 16.6

Total non-interest income $63,388 (9.7%)(4) (2.6%)

Adjusted non-interest income(2) $63,388 0.5% (0.5%)

8

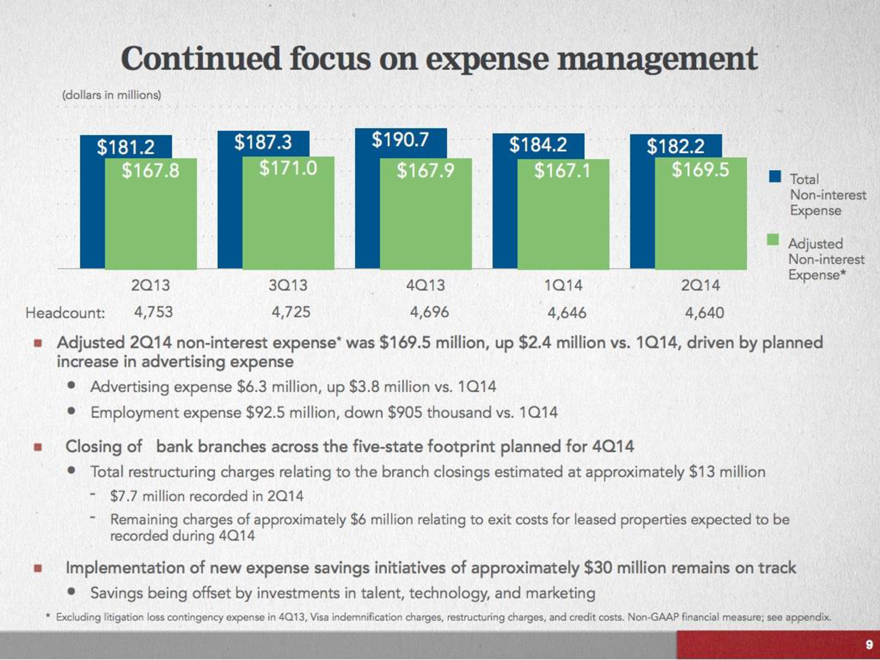

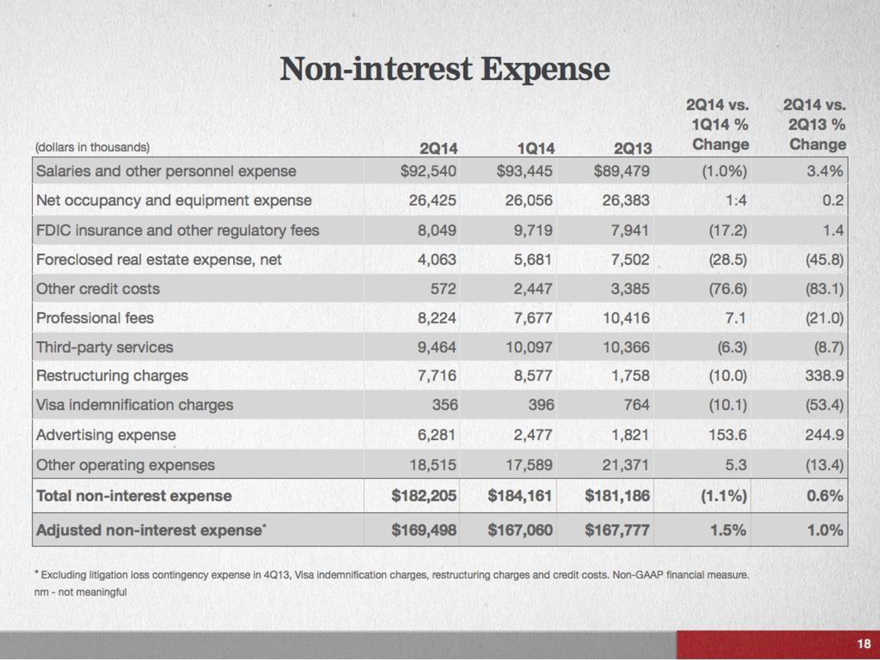

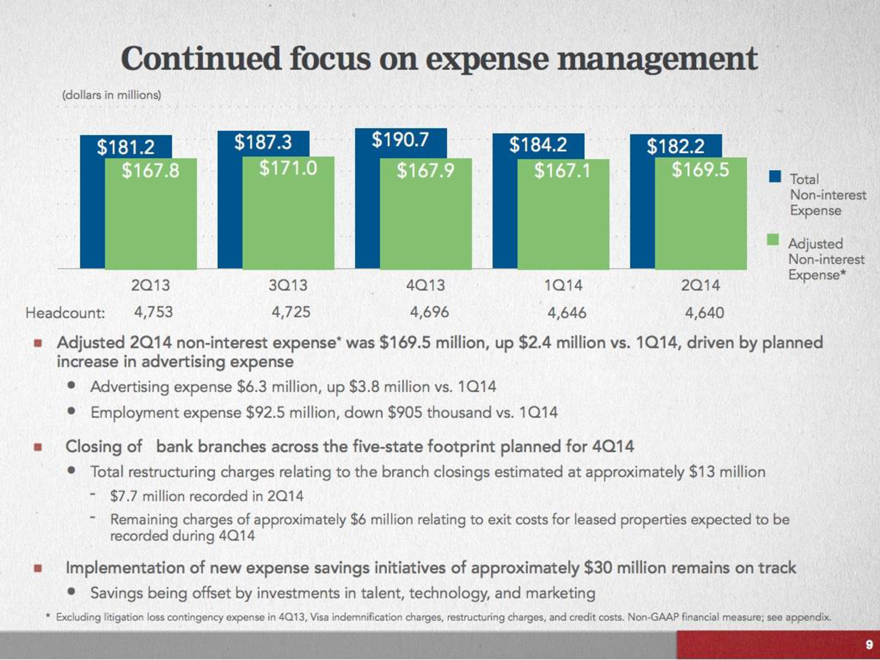

Continued focus on expense management

(dollars in millions)

$181.2 $187.3 $190.7 $184.2 $182.2

$167.8 $171.0 $167.9 $167.1 $169.5

2Q13 3Q13 4Q13 1Q14 2Q14

Headcount: 4,753 4,725 4,696 4,646 4,640

Total Non-interest Expense

Adjusted Non-interest Expense*

Adjusted 2Q14 non-interest expense* was $169.5 million, up $2.4 million vs. 1Q14, driven by planned increase in advertising expense

Advertising expense $6.3 million, up $3.8 million vs. 1Q14

Employment expense $92.5 million, down $905 thousand vs. 1Q14

Closing of bank branches across the five-state footprint planned for 4Q14

Total restructuring charges relating to the branch closings estimated at approximately $13 million

-$7.7 million recorded in 2Q14

-Remaining charges of approximately $6 million relating to exit costs for leased properties expected to be recorded during 4Q14

Implementation of new expense savings initiatives of approximately $30 million remains on track

Savings being offset by investment in talent, technology, and marketing

* Excluding litigation loss contingency expense in 4Q13, Visa indemnification charges, restructuring charges, and credit costs. Non-GAAP financial measure; see appendix.

9

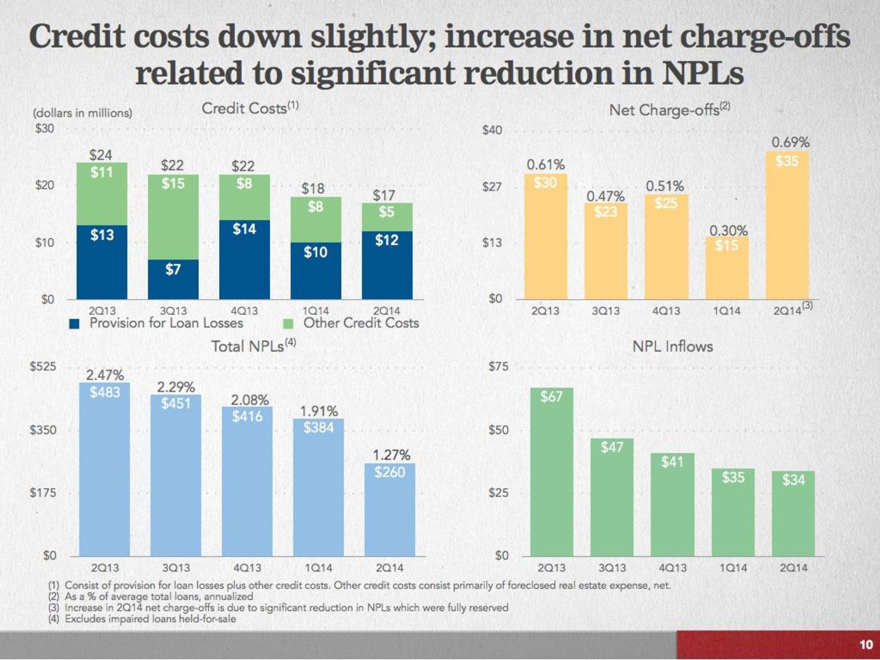

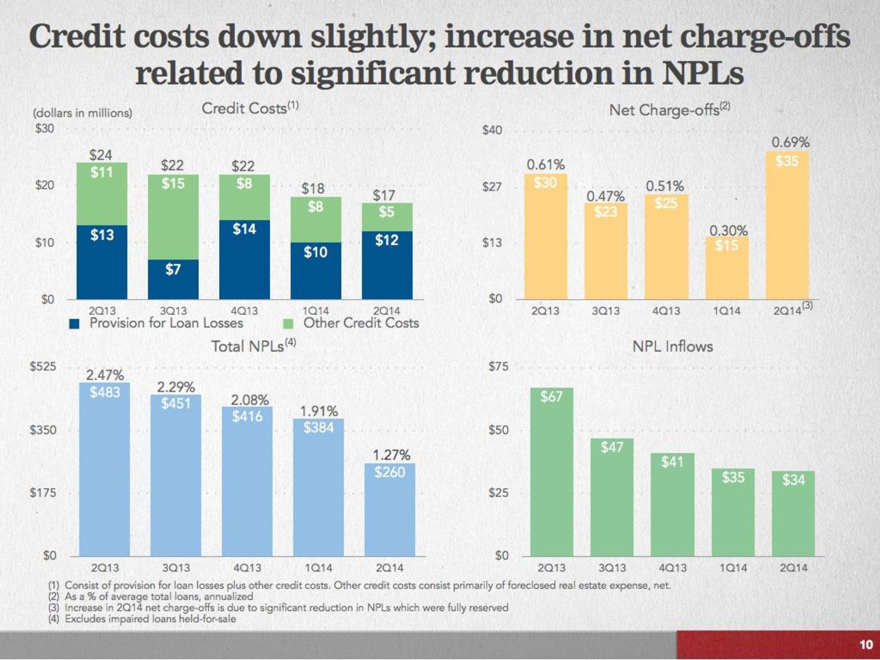

Credit costs down slightly; increase in net charge-offs related to significant reduction in NPLs

(dollars in millions) Credit Costs(1)

$30

$20 $24 $22 $22 $18 $17

$11 $15 $8 $8 $5

$10 $13 $7 $14 $10 $12

$0 2Q13 3Q13 4Q13 1Q14 2Q14

Provision for Loan Losses Other Credit Costs

Total NPLs(4)

$525

2.47% 2.29% 2.08% 1.91% 1.27%

$483 $451 $416 $384 $260

$350 $175 $0 2Q13 3Q13 4Q13 1Q14 2Q14

Net Charge-offs(2)

$40 0.69%

0.61% 0.47% 0.51% 0.30%

$27 $30 $23 $25 $15 $35

$13

$0 2Q13 3Q13 4Q13 1Q14 2Q14(3)

NPL Inflows

$75 $67 $47 $41 $35 $34

$50 $25 $0

2Q13 3Q13 4Q13 1Q14 2Q14

(1) Consist of provision for loan losses plus other credit costs. Other credit costs consist primarily of foreclosed real estate expense, net.

(2) As a % of average total loans, annualized

(3) Increase in 2Q14 net charge-offs is due to significant reduction in NPLs which were fully reserved

(4) Excludes impaired loans held-for-sale

10

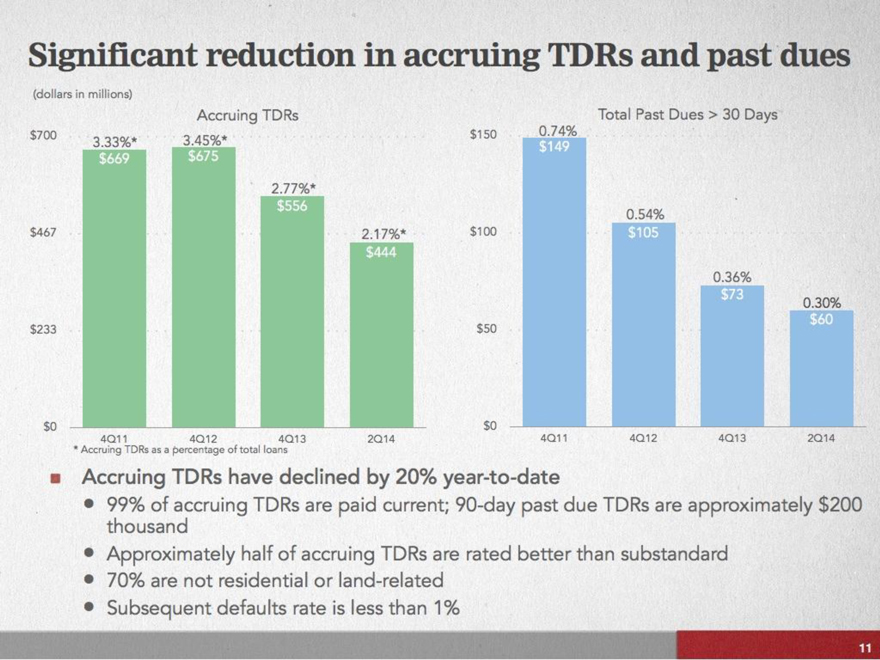

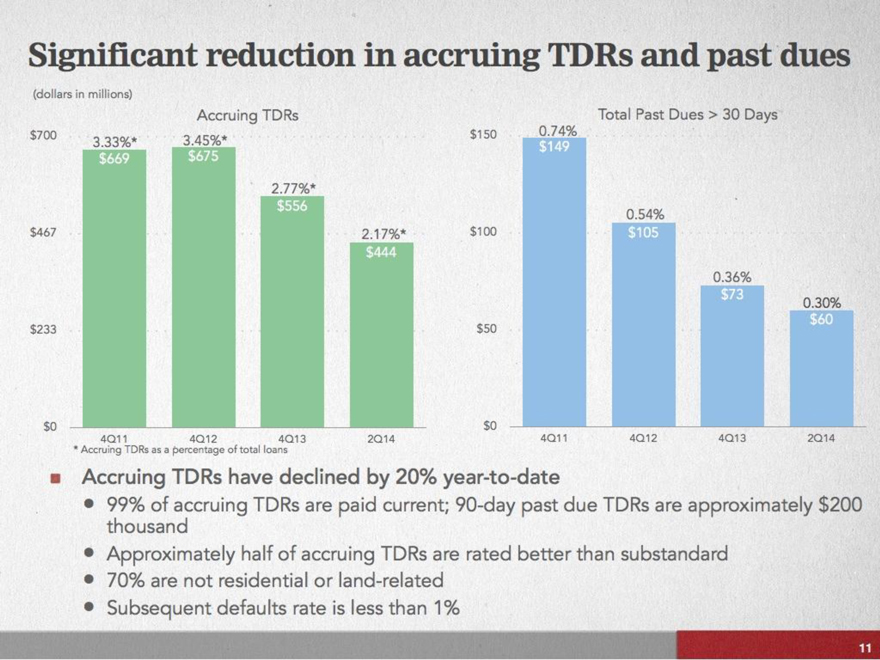

Significant reduction in accruing TDRs and past dues

(dollars in millions)

Accruing TDRs Total Past Dues > 30 Days

$700 3.33%* 3.45%* $150 0.74%

$669 $675 $149

$467 2.77%* $556 2.17%* $444 $100 0.54% $105

$233 $50 0.36% $73 0.30% $60

$0 $0

4Q11 4Q12 4Q13 2Q14 4Q11 4Q12 4Q13 2Q14

Accruing TDRs have declined by 20% year-to-date

99% of accruing TDRs are paid current; 90-day past due TDRs are approximately $200 thousand

Approximately half of accruing TDRs are rated better than substandard

70% are not residential or land-related

Subsequent defaults rate is less than 1%

11

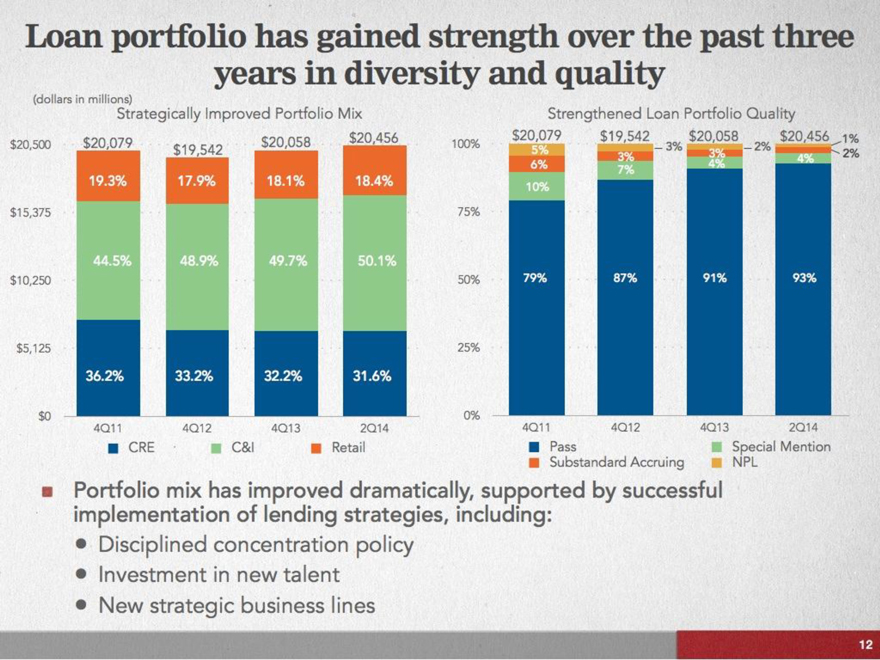

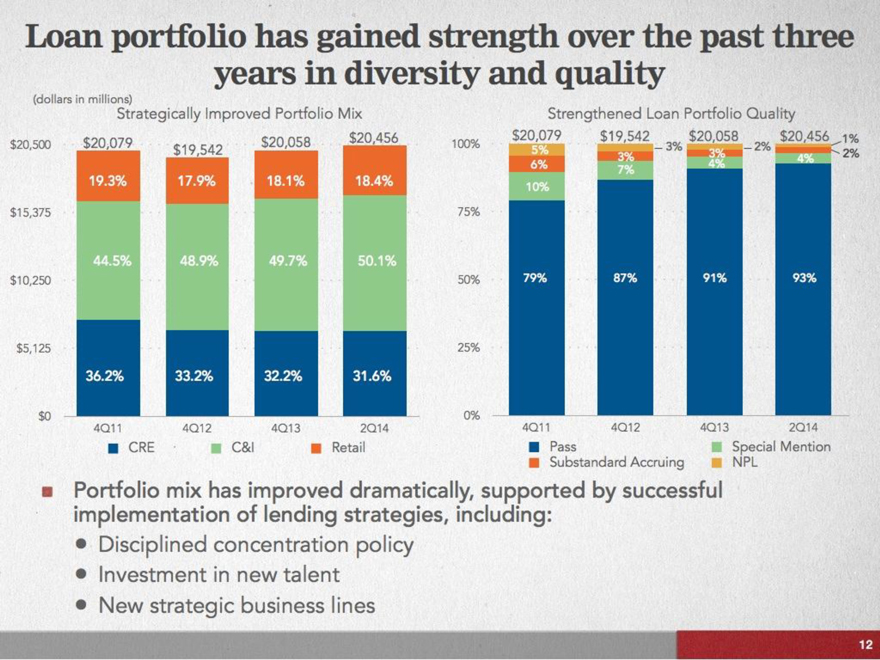

Loan portfolio has gained strength over the past three years in diversity and quality

(dollars in millions)

Strategically Improved Portfolio Mix

Strengthened Loan Portfolio Quality

$20,500 $15,375 $10,250 $5,125 $0

$20,079 19.3% 44.5% 36.2% 4Q11

$19,542 17.9% 48.9% 33.2% 4Q12

$20,258 18.1% 49.7% 32.2% 4Q13

$20,456 18.4% 50.1% 31.6% 2Q14

100% 75% 50% 25% 0%

$20,079 5% 6% 10% 79% 4Q11

$19,542 3% 7% 87% 4Q12

3%

$20,058 3% 4% 91% 4Q13

2%

$20,456 4% 93% 2Q14 1% 2%

CRE C&I Retail Pass Special Mention Substandard Accruing NPL

Portfolio mix has improved dramatically, supported by successful implementation of lending strategies, including:

Disciplined concentration policy

Investment in new talent

New strategic business lines

12

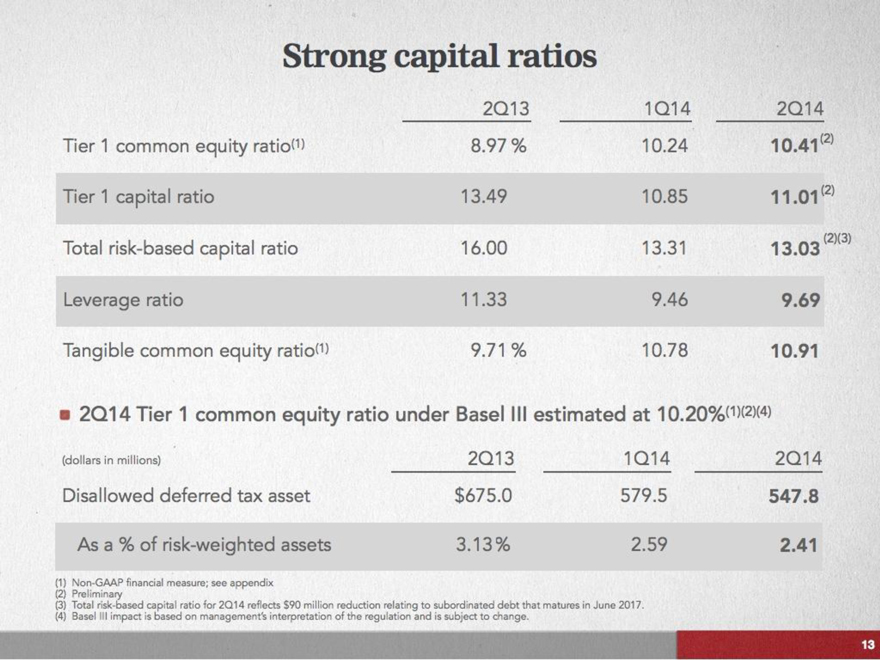

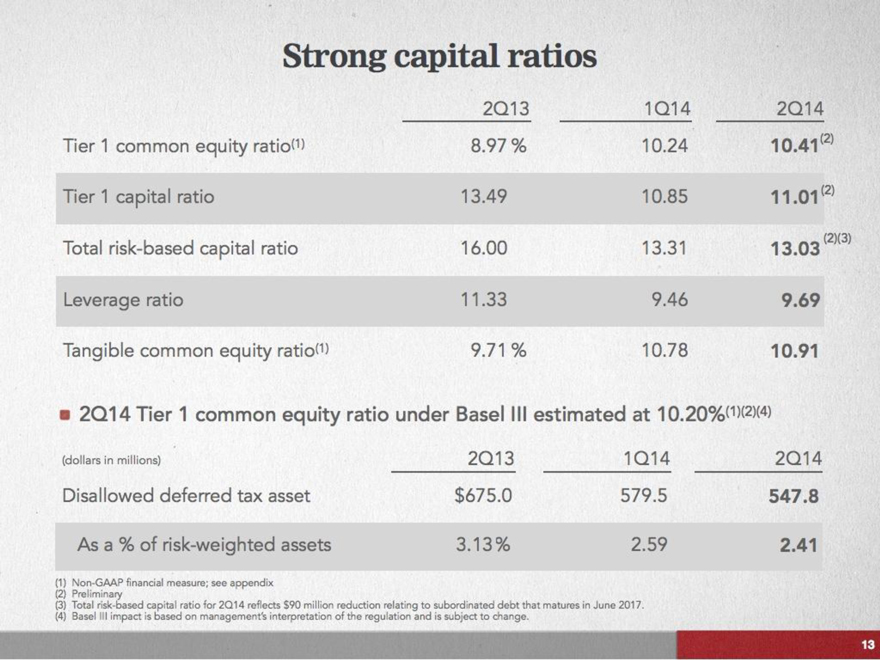

Strong capital ratios

2Q13 1Q14 2Q14

Tier 1 common equity ratio(1) 8.97% 10.24 10.41(2)

Tier 1 capital ratio 13.49 10.85 11.01(2)

Total risk-based capital ratio 16.00 13.31 13.03(2)(3)

Leverage ratio 11.33 9.46 9.69

Tangible common equity ratio(1) 9.71% 10.78 10.91

2Q14 Tier 1 common equity ratio under Based III estimated at 10.20%(1)(2)(4)

(dollars in millions) 2Q13 1Q14 2Q14

Disallowed deferred tax asset $675.0 579.5 547.8

As a % of risk-weighted assets 3.13% 2.59 2.41

(1) Non-GAAP financial measure; see appendix

(2) Preliminary

(3) Total risk-based capital ratio for 2Q14 reflects $90 million reduction relating to subordinated debt that matures in June 2017.

(4) Basel III impact is based on management’s interpretation of the regulation and is subject to change.

13

Path to improved earnings

Brand awareness work continues with…

Launch of capability ads and expansion of initial awareness ads in additional markets to promote our comprehensive offerings and increase market share

Balance sheet growth through…

Better alignment of commercial banking talent with customer needs and targeted market opportunities

Increased penetration in the high-opportunity middle market segment

Strategic expansion into specialized lending areas, most recently healthcare and equipment financing

Refreshed retail banking strategy to better serve consumer and small business customers

New and enhanced technology that offers added customer convenience

Net interest income growth driven by…

Balance sheet growth and continued focus on pricing

Accelerated by an increase in short-term interest rates

14

Path to improved earnings

Fee income growth generated by…

Growing our team of retail brokerage financial consultants, mortgage originators, and trust professionals

Offering highly-specialized training and licensing to our Private Wealth Management and Retail bank teams

Credit-related expense improvements through…

Further reduction of credit costs as legacy problem loans subside

Continued reduction in credit-related environmental costs

Focus on efficiency through…

Appropriately managing the level and positioning of headcount

Regularly reviewing and adjusting our branch network and operations to match evolving customer behaviors and preferences

Streamlining and enhancing internal processes while ensuring a positive customer experience

15

Appendix

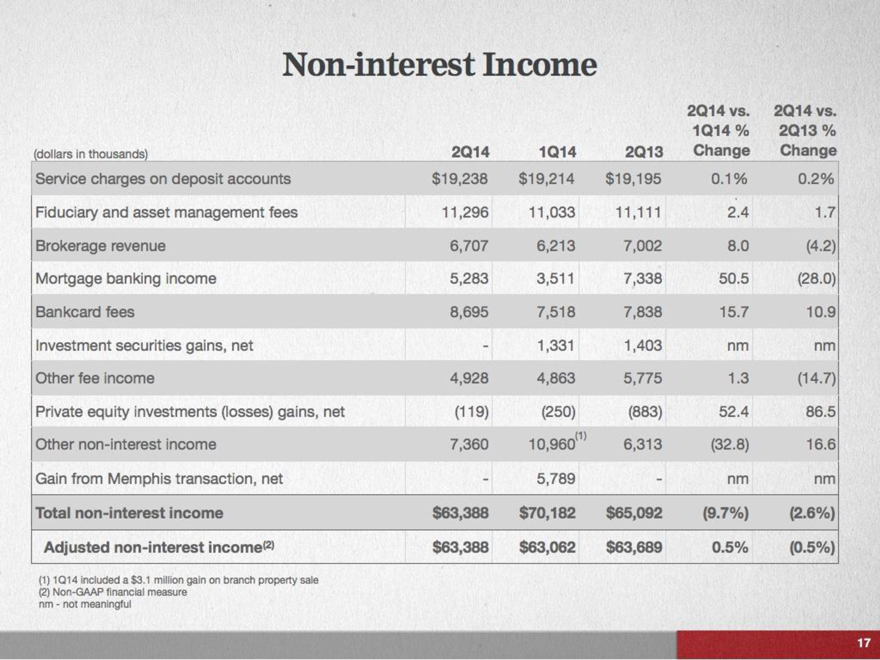

Non-interest Income

(dollars in thousands) 2Q14 1Q14 2Q13 2Q14 vs. 1Q14 % Change 2Q14 vs. 2Q13 % Change

Service charges on deposit accounts $19,238 $19,214 $19,195 0.1% 0.2%

Fiduciary and asset management fees 11,296 11,033 11,111 2.4 1.7

Brokerage revenue 6,707 6,213 7,002 8.0 (4.2)

Mortgage banking income 5,283 3,511 7,338 50.5 (28.0)

Bankcard fees 8,695 7,518 7,838 15.7 10.9

Investment securities gains, net – 1,331 1,403 nm nm

Other fee income 4,928 4,863 5,775 1.3 (14.7)

Private equity investments (losses) gains, net (119) (250) (883) 52.4 86.5

Other non-interest income 7,360 10,960(1) 6, 313 (32.8) 16.6

Gain from Memphis transaction, net – 5,789 – nm nm

Total non-interest income $63,388 $70,182 $65,092 (9.7%) (2.6%)

Adjusted non-interest income(2) $63,388 $63,062 $63,689 0.5% (0.5%)

(1) 1Q14 included a $3.1 million gain on branch property sale

(2) Non-GAAP financial measure

nm – not meaningful

17

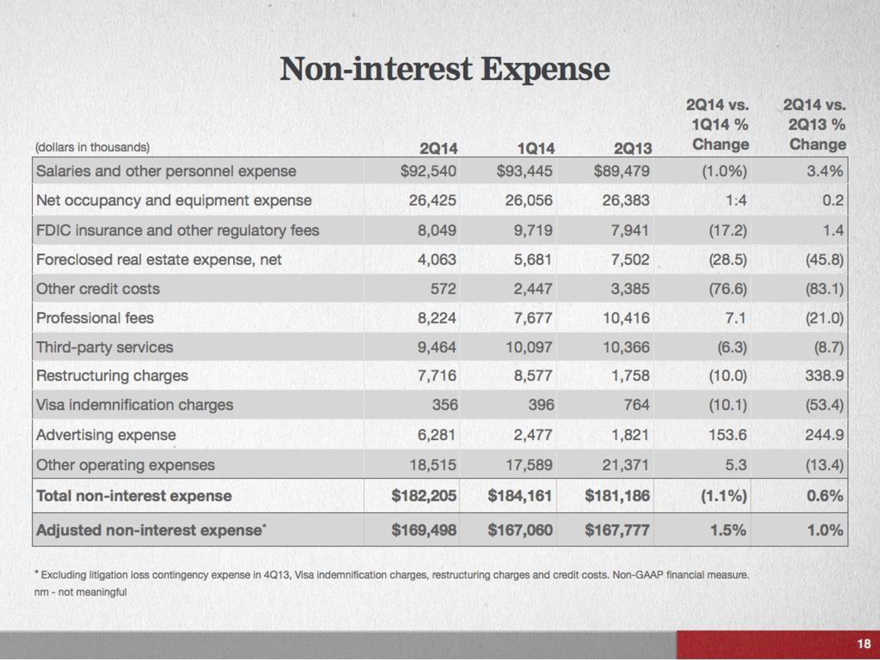

Non-interest Expense

(dollars in thousands) 2Q14 1Q14 2Q13 2Q14 vs. 1Q14 % Change 2Q14 vs. 2Q13 % Change

Salaries and other personnel expense $92,540 $93,445 $89,479 (1.0%) 3.4%

Net occupancy and equipment expense 26,425 26,056 26,383 1.4 0.2

FDIC insurance and other regulatory fees 8,049 9,719 7,941 (17.2) 1.4

Foreclosed real estate expense, net 4,063 5,681 7,502 (28.5) (45.8)

Other credit costs 572 2,447 3,385 (76.6) (83.1)

Professional fees 8,224 7,677 10,416 7.1 (21.0)

Third-party services 9,464 10,097 10,366 (6.3) (8.7)

Restructuring charges 7,716 8,577 1,758 (10.0) 338.9

Visa indemnification charges 356 396 764 (10.1) (53.4)

Advertising expense 6,281 2,477 1,821 153.6 244.9

Other operating expenses 18,515 17,589 21,371 5.3 (13.4)

Total non-interest expense $182,205 $184,161 $181,186 (1.1%) 0.6%

Adjusted non-interest expense* $169,498 $167,060 $167,777 1.5% 1.0%

* Excluding litigation loss contingency expense in 4Q13, Visa indemnification charges, restructuring charges and credit costs. Non-GAAP financial measure.

nm – not meaningful

18

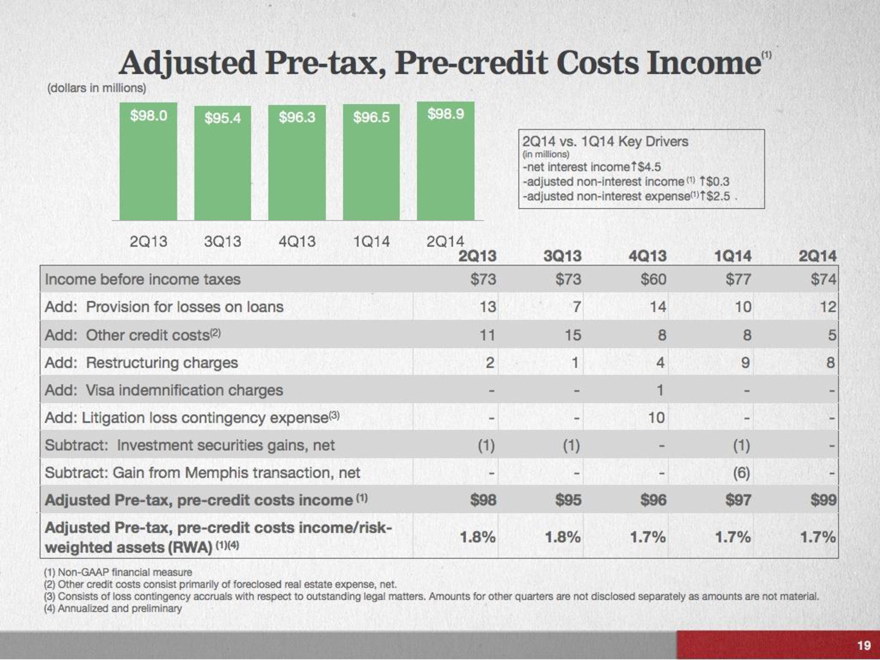

Adjusted Pre-tax, Pre-credit Costs Income(1)

(dollars in millions)

$98.0 $95.4 $96.3 $96.5 $98.9

2Q13 3Q13 4Q13 1Q14 2Q14

2Q14 vs. 1Q14 Key Drivers

(in millions)

-net interest income $4.5

-adjusted non-interest income(1) $0.3

-adjusted non-interest expense(1) $2.5

Income before income taxes

Add: Provision for losses on loans

Add: Other credit costs(2)

Add: Restructuring charges

Add: Visa indemnification charges

Add: Litigation loss contingency expense(3)

Subtract: Investment securities gains, net

Subtract: Gain from Memphis transaction, net

Adjusted Pre-tax, pre-credit costs income (1)

Adjusted Pre-tax, pre-credit costs income/risk- weighted assets (RWA) (1)(4)

2Q13 $73 13 11 2 - - (1) - $98 1.8%

3Q13 $73 7 15 1 - - (1) - $95 1.8%

4Q13 $60 14 8 4 1 10 - - $96 1.7%

1Q14 $77 10 8 9 - - (1) (6) $97 1.7%

2Q14 $74 12 5 8 - - - - $99 1.7%

(1) Non-GAAP financial measure

(2) Other credit costs consist primarily of foreclosed real estate expense, net.

(3) Consists of loss contingency accruals with respect to outstanding legal matters. Amounts for other quarters are not disclosed separately as amounts are not material. (4) Annualized and preliminary

19

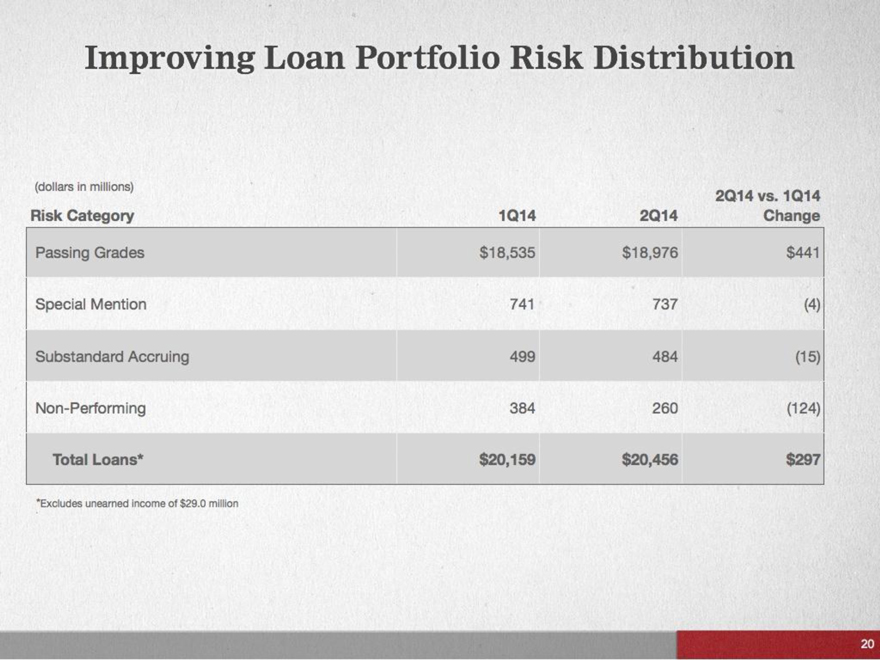

Improving Loan Portfolio Risk Distribution

(dollars in millions)

Risk Category

Passing Grades

Special Mention

Substandard Accruing

Non-Performing

Total Loans*

1Q14

$18,535

741

499

384

$20,159

2Q14

$18,976

737

484

260

$20,456

2Q14 vs. 1Q14 Change

$441

(4)

(15)

(124)

$297

*Excludes unearned income of $29.0 million

20

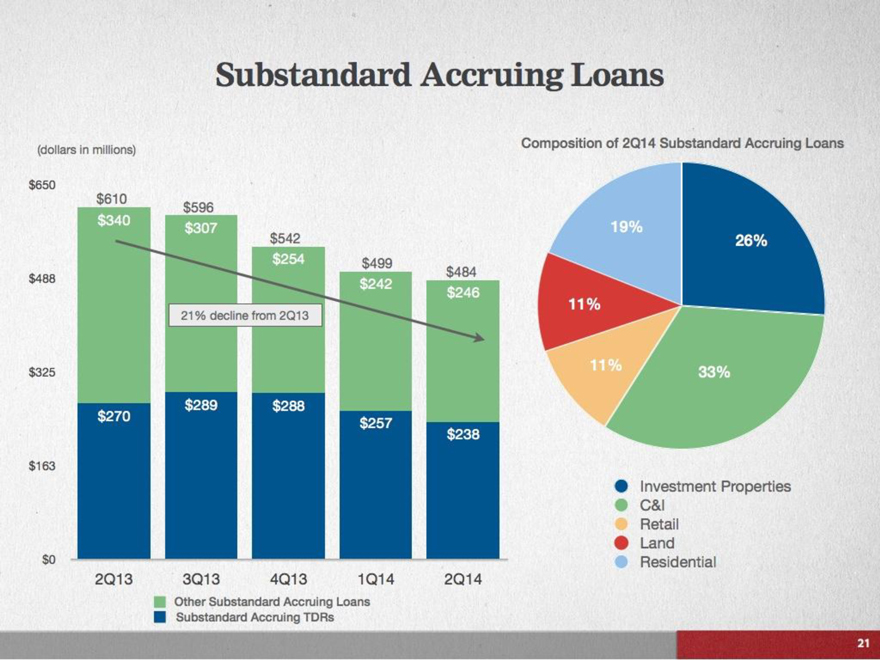

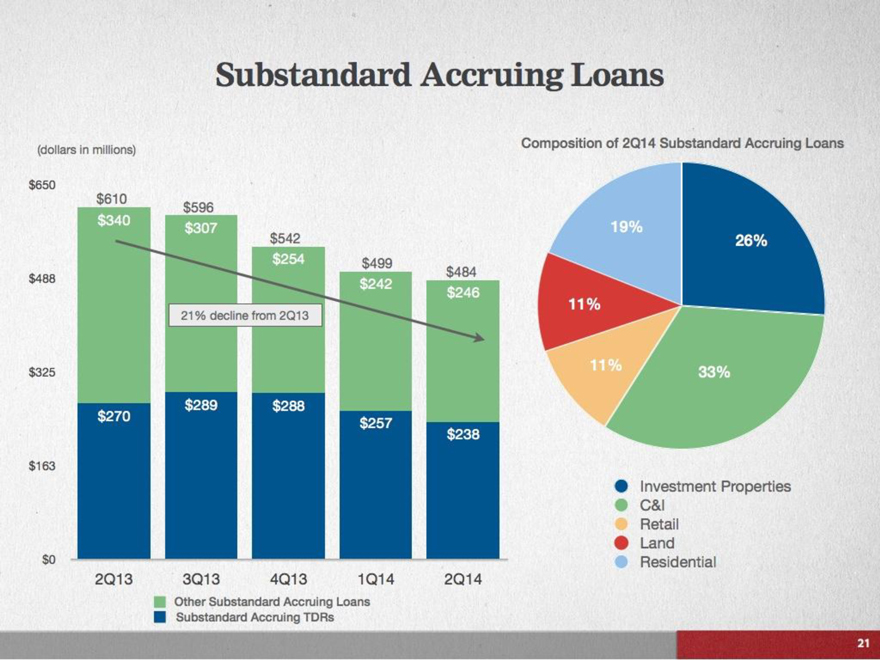

Substandard Accruing Loans

(dollars in millions)

$650

$488

$325

$163

$0

$610

$340

21% decline from 2Q13

$270

2Q13

$596

$307

$289

3Q13

$542

$254

$288

4Q13

$499

$242

$257

1Q14

$484

$246

$238

2Q14

Other Substandard Accruing Loans

Substandard Accruing TDRs

Composition of 2Q14 Substandard Accruing Loans

19%

11%

11%

26%

33%

Investment Properties

C&I Retail

Land

Residential

21

Troubled Debt Restructurings

(dollars in millions)

Composition of 2Q14 Performing TDRs

Risk Categories:

Pass

22%

$99

Substandard 54% $238 Special Mention 24% $107

Loan Type:

Retail 11%

C&I

33%

Land 11%

Resi. Prop.

19%

Inv. Prop. 26%

Accruing TDR Trends

$635

2Q13

$574

3Q13

$556

4Q13

$495

1Q14

$444

2Q14

99% of performing TDRs are paid current; 90-days past due TDRs are only $200 thousand

46% of performing TDRs are rated better than substandard

Approximately 70% of performing TDRs are not residential or land-related

Subsequent defaults rate is less than 1 %

22

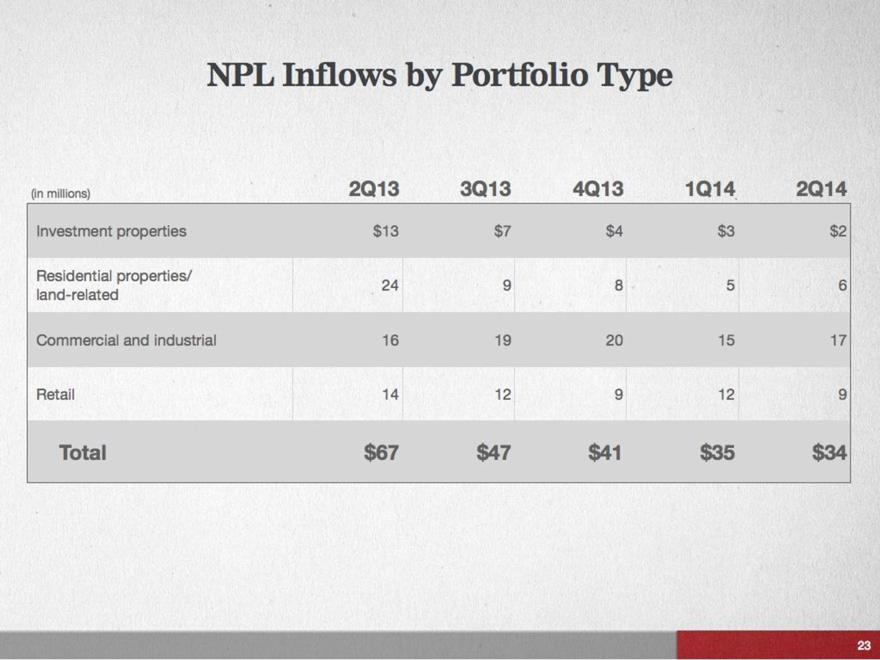

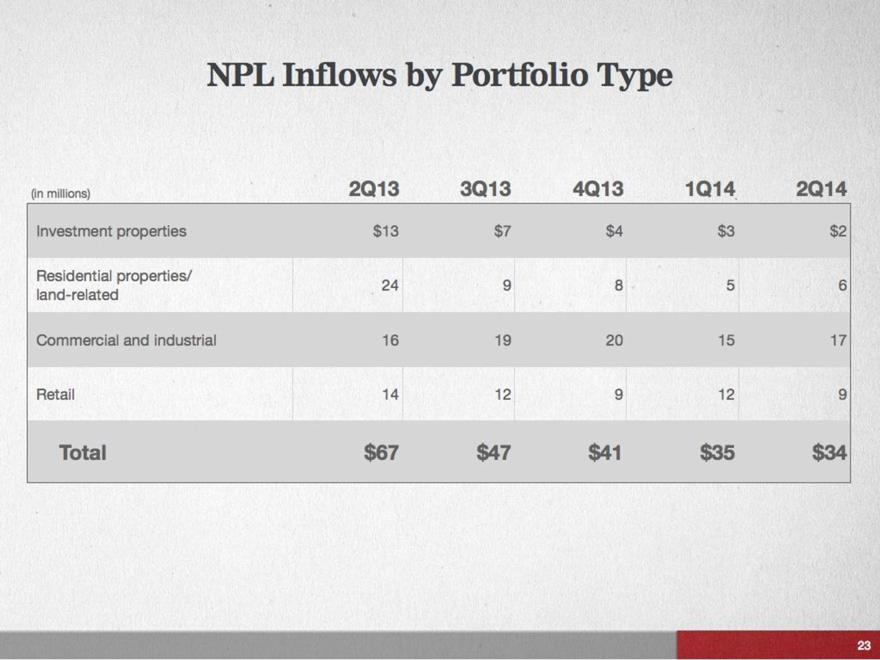

NPL Inflows by Portfolio Type

(in millions)

Investment properties

Residential properties/ land-related

Commercial and industrial

Retail

Total

2Q13

$13

24

16

14

$67

3Q13

$7

9

19

12

$47

4Q13

$4

8

20

9

$41

1Q14

$3

5

15

12

$35

2Q14

$2

6

17

9

$34

23

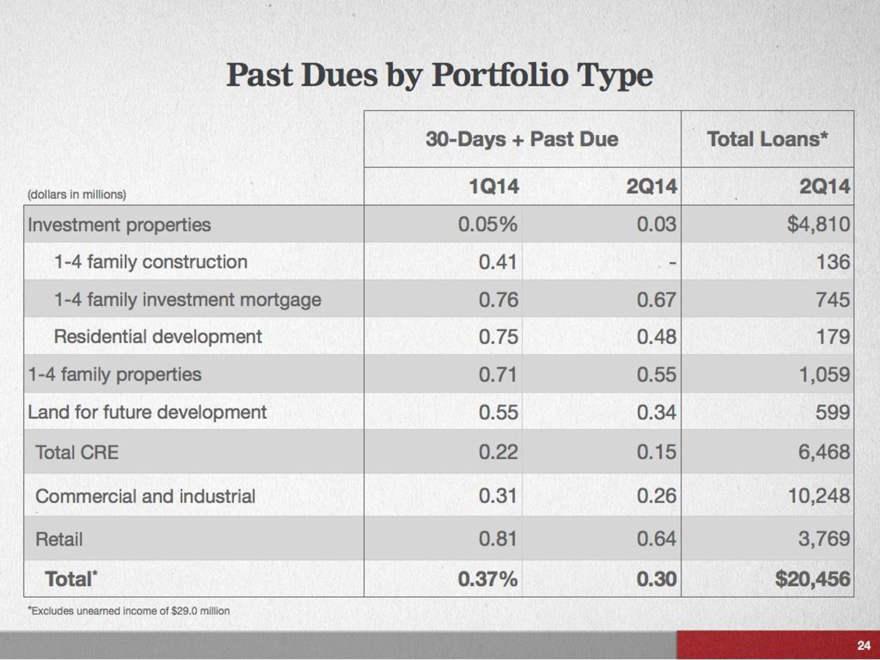

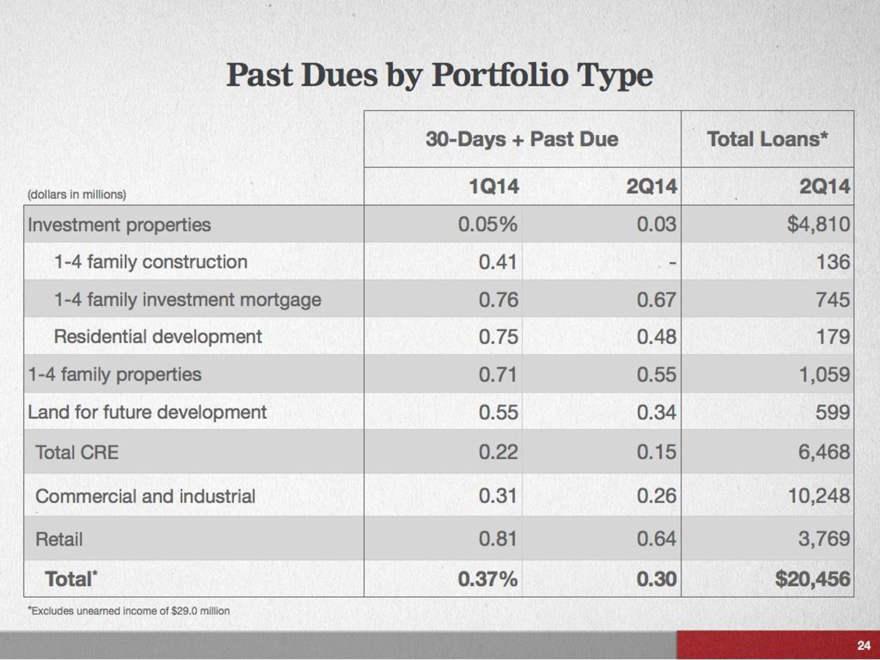

Past Dues by Portfolio Type

(dollars in millions)

Investment properties

1-4 family construction

1-4 family investment mortgage

Residential development

1-4 family properties

Land for future development

Total CRE

Commercial and industrial

Retail

Total*

30-Days + Past Due

Total Loans*

2Q14

$4,810

136

745

179

1,059

599

6,468

10,248

3,769

$20,456

1Q14

0.05%

0.41

0.76

0.75

0.71

0.55

0.22

0.31

0.81

0.37%

2Q14

0.03

-

0.67

0.48

0.55

0.34

0.15

0.26

0.64

0.30

*Excludes unearned income of $29.0 million

24

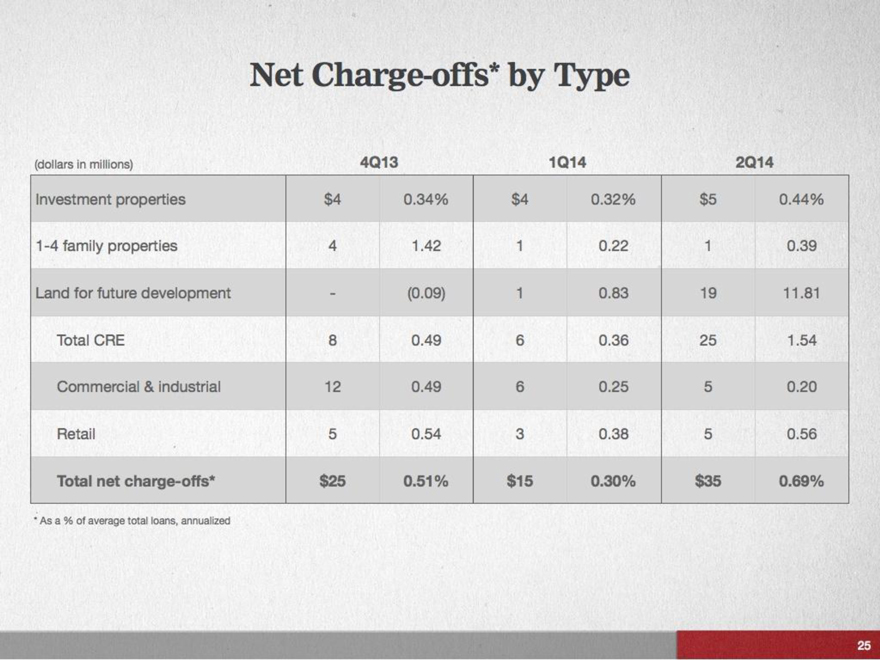

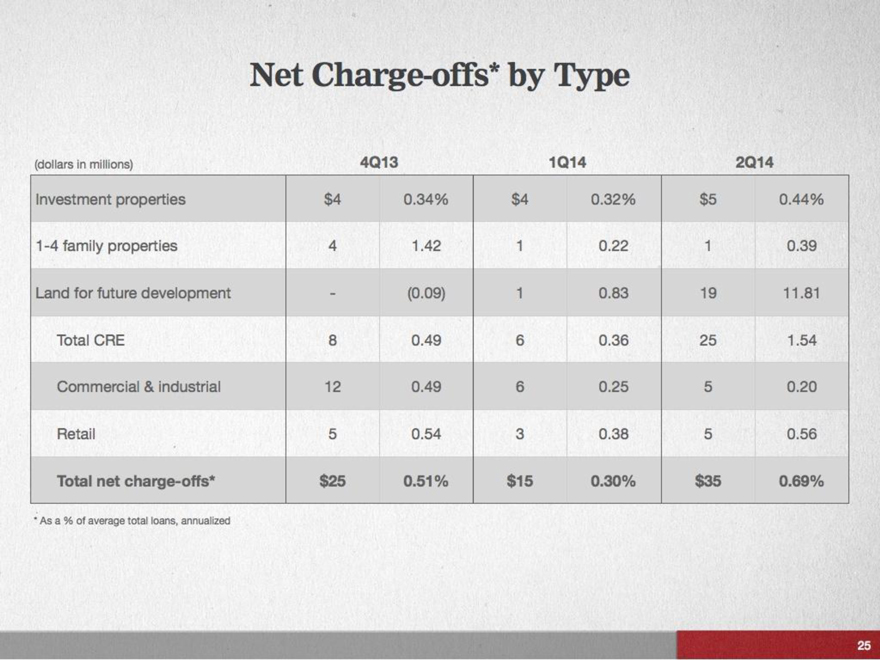

Net Charge-offs* by Type

(dollars in millions)

4Q13

1Q14

2Q14

Investment properties

$4

0.34%

$4

0.32%

$5

0.44%

1-4 family properties

4

1.42

1

0.22

1

0.39

Land for future development

-

(0.09)

1

0.83

19

11.81

Total CRE

8

0.49

6

0.36

25

1.54

Commercial & industrial

12

0.49

6

0.25

5

0.20

Retail

5

0.54

3

0.38

5

0.56

Total net charge-offs*

$25

0.51%

$15

0.30%

$35

0.69%

* As a % of average total loans, annualized

25

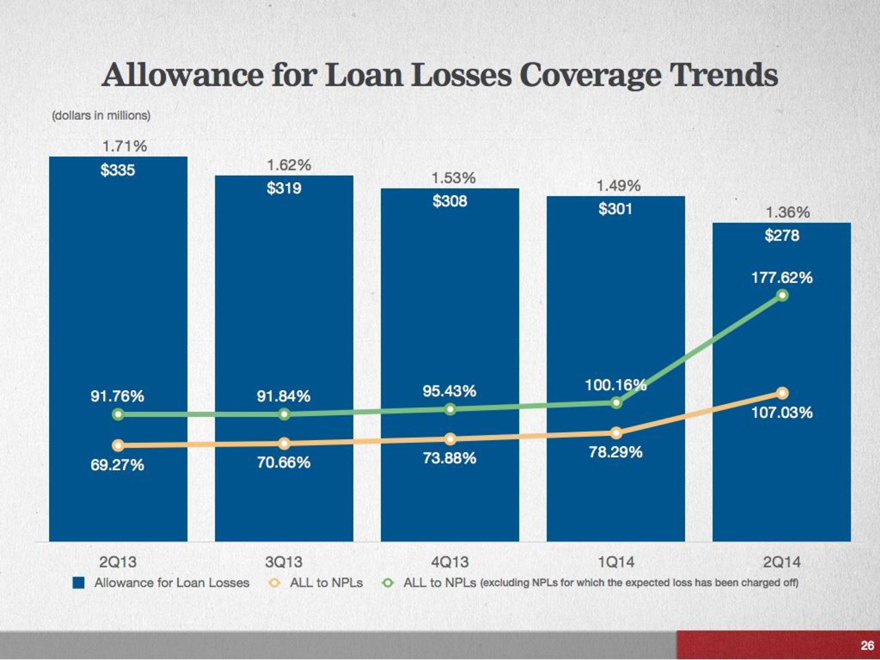

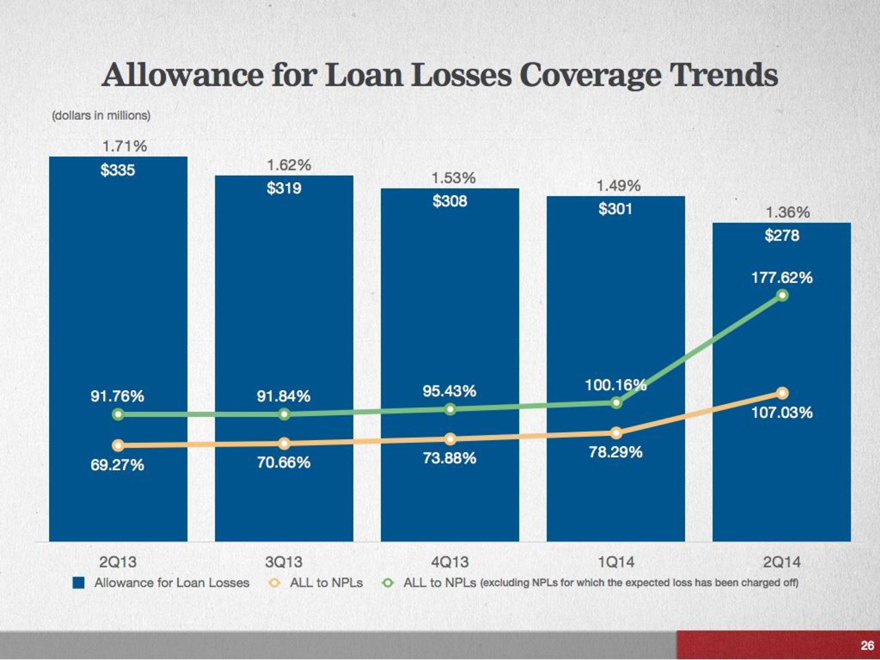

Allowance for Loan Losses Coverage Trends

(dollars in millions)

1.71%

$335

1.62%

1.53%

1.49%

1.36%

$319

$308

$301

$278

177.62%

91.76%

91.84%

95.43%

100.16%

107.03%

69.27%

70.66%

73.88%

78.29%

2Q13

3Q13

4Q13

1Q14

2Q14

Allowance for Loan Losses

ALL to NPLs

ALL to NPLs (excluding NPLs for which the expected loss has been charged off)

26

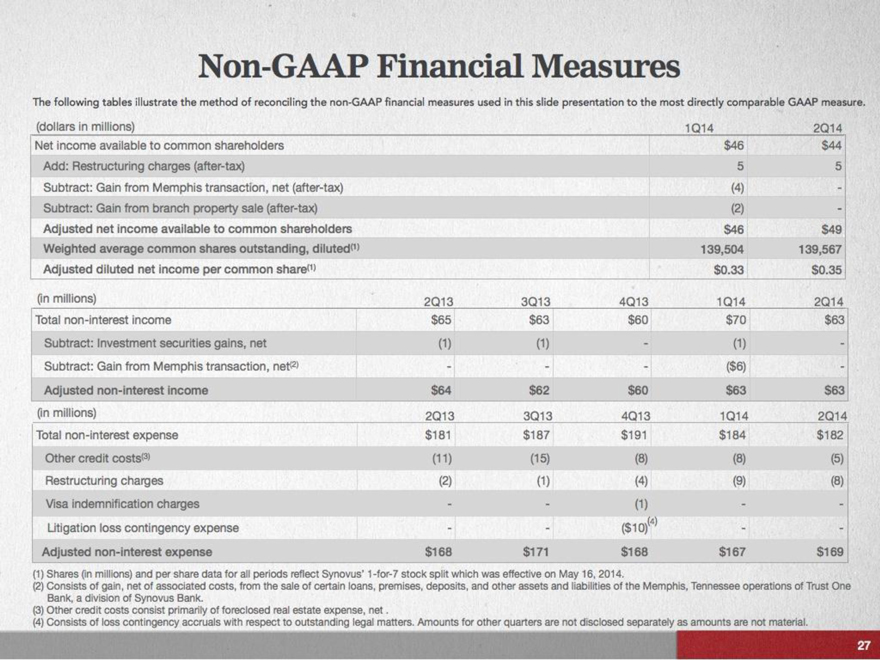

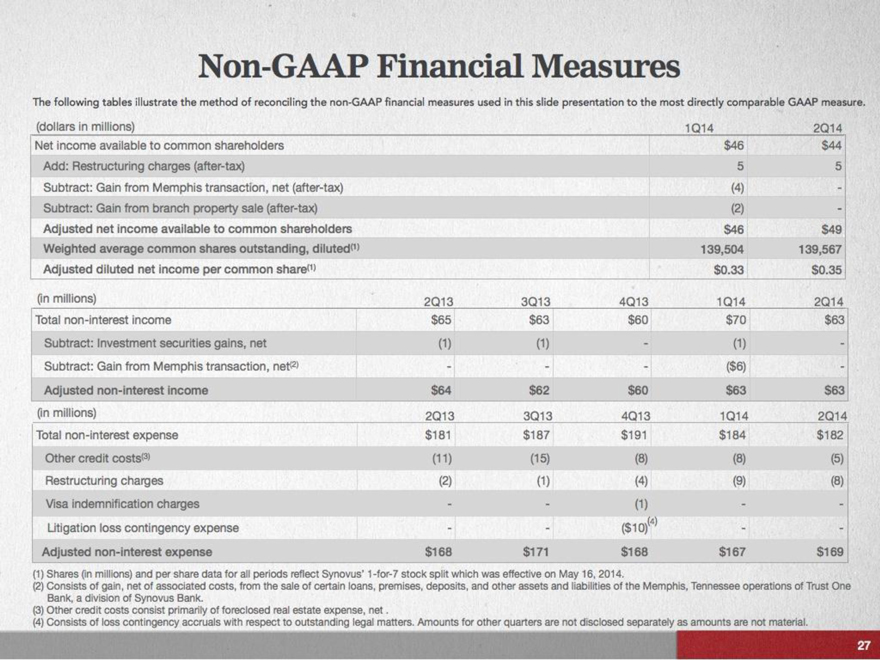

Non-GAAP Financial Measures

The following tables illustrate the method of reconciling the non-GAAP financial measures used in this slide presentation to the most directly comparable GAAP measure.

(dollars in millions)

1Q14

2Q14

Net income available to common shareholders

$46

$44

Add: Restructuring charges (after-tax)

5

5

Subtract: Gain from Memphis transaction, net (after-tax)

(4)

-

Subtract: Gain from branch property sale (after-tax)

(2)

-

Adjusted net income available to common shareholders

$46

$49

Weighted average common shares outstanding, diluted(1)

139,504

139,567

Adjusted diluted net income per common share(1)

$0.33

$0.35

(in millions)

2Q13

3Q13

4Q13

1Q14

2Q14

Total non-interest income

$65

$63

$60

$70

$63

Subtract: Investment securities gains, net

(1) (1)

-

(1)

-

Subtract: Gain from Memphis transaction, net(2)

-

-

-

($6)

-

Adjusted non-interest income

$64

$62

$60

$63

$63

(in millions)

2Q13

3Q13

4Q13

1Q14

2Q14

Total non-interest expense

$181

$187

$191

$184

$182

Other credit costs(3)

(11)

(15)

(8) (8)

(5)

Restructuring charges

(2)

(1)

(4)

(9) (8)

Visa indemnification charges

-

-

(1)

-

-

Litigation loss contingency expense

-

-

($10)(4)

-

-

Adjusted non-interest expense

$168

$171

$168

$167

$169

(1) Shares (in millions) and per share data for all periods reflect Synovus’ 1-for-7 stock split which was effective on May 16, 2014.

(2) Consists of gain, net of associated costs, from the sale of certain loans, premises, deposits, and other assets and liabilities of the Memphis, Tennessee operations of Trust One Bank, a division of Synovus Bank.

(3) Other credit costs consist primarily of foreclosed real estate expense, net.

(4) Consists of loss contingency accruals with respect to outstanding legal matters. Amounts for other quarters are not disclosed separately as amounts are not material.

27

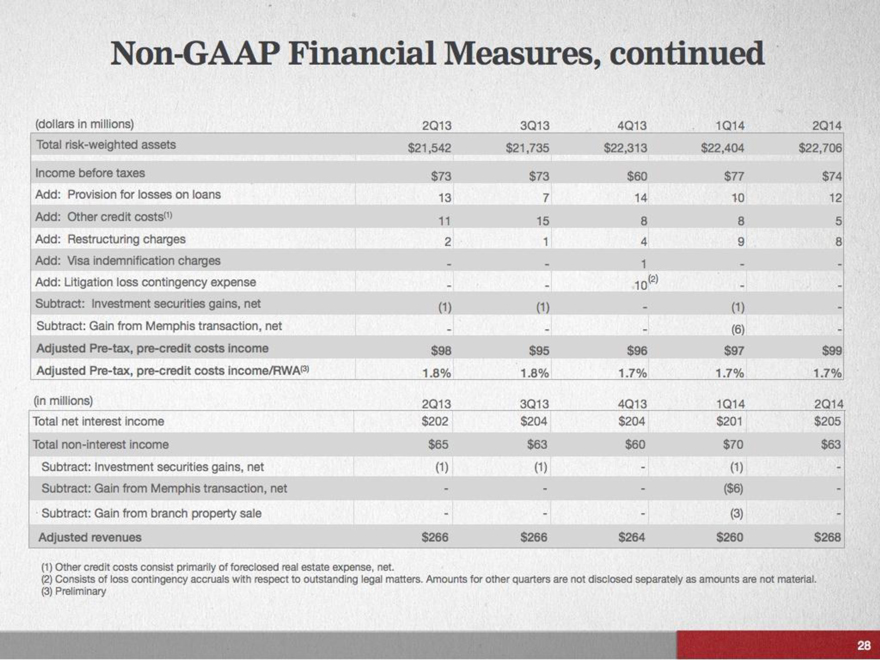

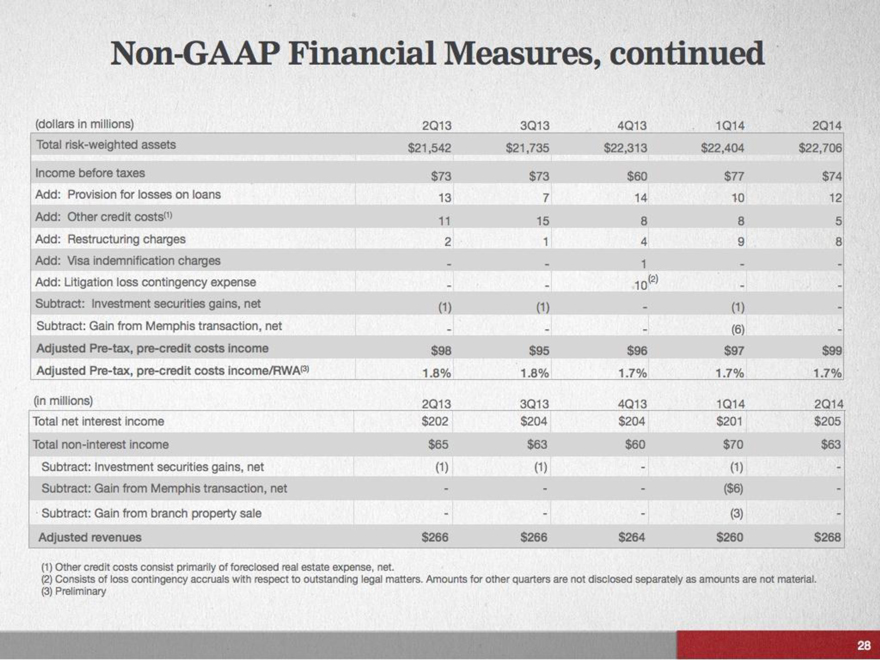

Non-GAAP Financial Measures, continued

(dollars in millions)

2Q13

3Q13

4Q13

1Q14

2Q14

Total risk-weighted assets

$21,542

$21,735

$22,313

$22,404

$22,706

Income before taxes

$73

$73

$60

$77

$74

Add: Provision for losses on loans

13

7

14

10

12

Add: Other credit costs(1)

11

15

8

8

5

Add: Restructuring charges

2

1

4

9

8

Add: Visa indemnification charges

-

-

1

-

-

Add: Litigation loss contingency expense

-

-

10(2)

-

-

Subtract: Investment securities gains, net

(1)

(1)

-

(1)

-

Subtract: Gain from Memphis transaction, net

-

-

(6)

-

Adjusted Pre-tax, pre-credit costs income

$98

$95

$96

$97

$99

Adjusted Pre-tax, pre-credit costs income/RWA(3)

1.8%

1.8%

1.7%

1.7%

1.7%

(in millions)

2Q13

3Q13

4Q13

1Q14

2Q14

Total net interest income

$202

$204

$204

$201

$205

Total non-interest income

$65

$63

$60

$70

$63

Subtract: Investment securities gains, net

(1)

(1)

-

(1)

-

Subtract: Gain from Memphis transaction, net

-

-

-

($6)

-

Subtract: Gain from branch property sale

-

-

-

(3)

-

Adjusted revenues

$266

$266

$264

$260

$268

(1) Other credit costs consist primarily of foreclosed real estate expense, net.

(2) Consists of loss contingency accruals with respect to outstanding legal matters. Amounts for other quarters are not disclosed separately as amounts are not material.

(3) Preliminary

28

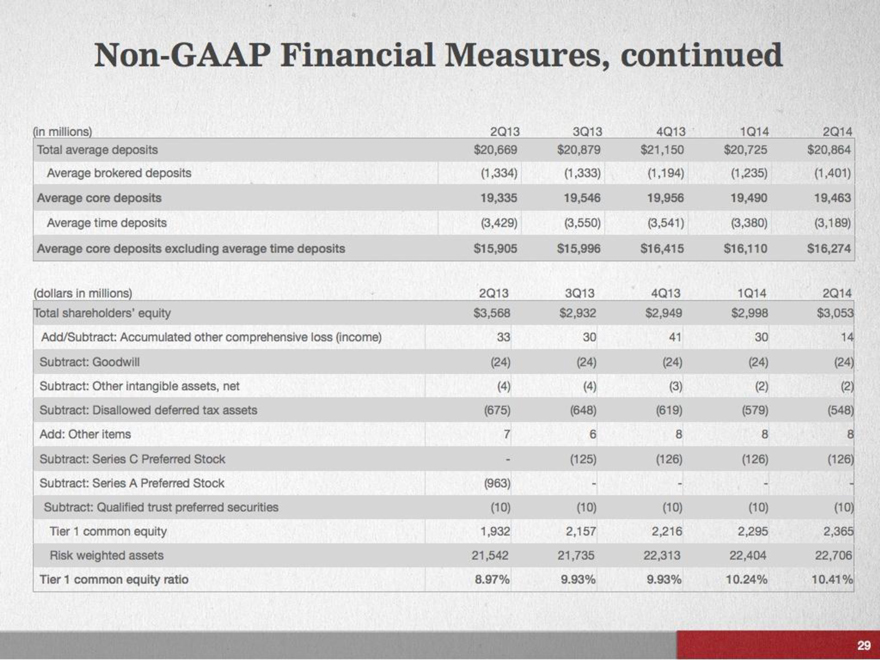

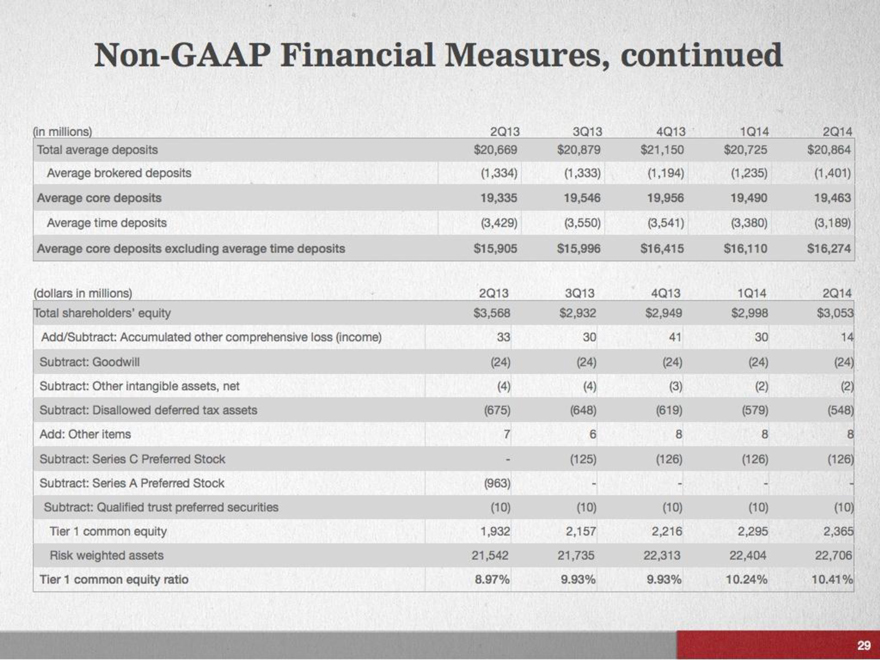

Non-GAAP Financial Measures, continued

(in millions)

2Q13

3Q13

4Q13

1Q14

2Q14

Total average deposits

$20,669

$20,879

$21,150

$20,725

$20,864

Average brokered deposits

(1,334)

(1,333)

(1,194)

(1,235)

(1,401)

Average core deposits

19,335

19,546

19,956

19,490

19,463

Average time deposits

(3,429)

(3,550)

(3,541)

(3,380)

(3,189)

Average core deposits excluding average time deposits

$15,905

$15,996

$16,415

$16,110

$16,274

(dollars in millions)

2Q13

3Q13

4Q13

1Q14

2Q14

Total shareholders’ equity

$3,568

$2,932

$2,949

$2,998

$3,053

Add/Subtract: Accumulated other comprehensive loss (income)

33

30

41

30

14

Subtract: Goodwill

(24)

(24)

(24)

(24)

(24)

Subtract: Other intangible assets, net

(4) (4)

(3)

(2)

(2)

Subtract: Disallowed deferred tax assets

(675)

(648)

(619)

(579)

(548)

Add: Other items

7

6

8

8

8

Subtract: Series C Preferred Stock

-

(125)

(126)

(126)

(126)

Subtract: Series A Preferred Stock

(963)

-

-

-

-

Subtract: Qualified trust preferred securities

(10)

(10)

(10)

(10)

(10)

Tier 1 common equity

1,932

2,157

2,216

2,295

2,365

Risk weighted assets

21,542

21,735

22,313

22,404

22,706

Tier 1 common equity ratio

8.97%

9.93%

9.93%

10.24%

10.41%

29

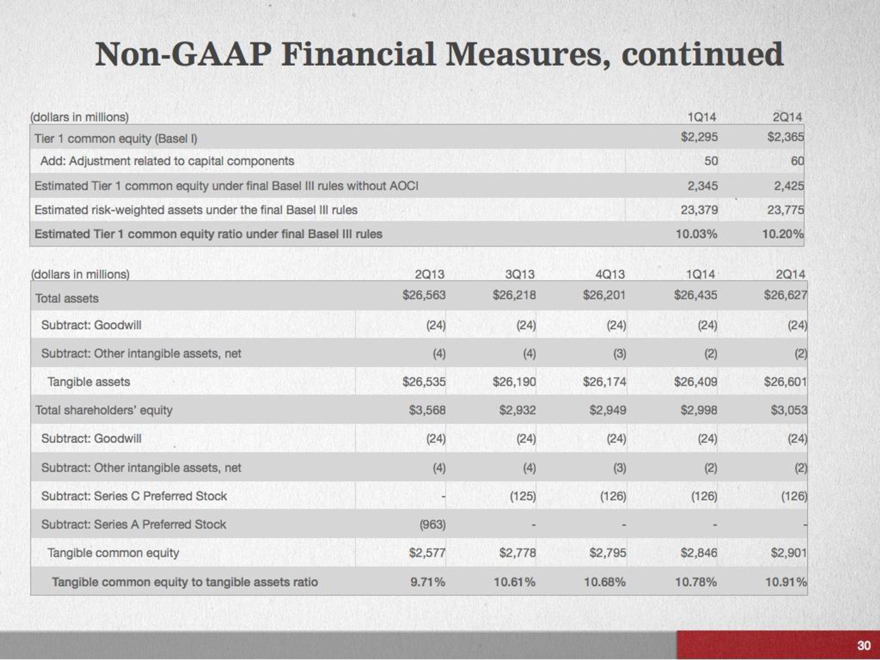

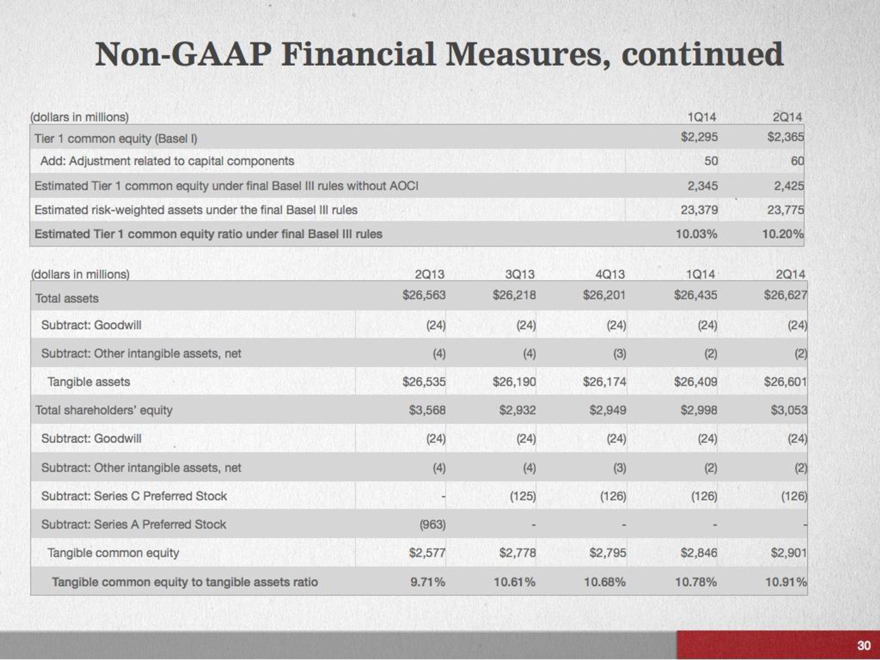

Non-GAAP Financial Measures, continued

(dollars in millions) 1Q14 2Q14

Tier 1 common equity (Basel I)

$2,295

$2,365

Add: Adjustment related to capital components

50

60

Estimated Tier 1 common equity under final Basel III rules without AOCI

2,345

2,425

Estimated risk-weighted assets under the final Basel III rules

23,379

23,775

Estimated Tier 1 common equity ratio under final Basel III rules

10.03%

10.20%

(dollars in millions)

2Q13

3Q13

4Q13

1Q14

2Q14

Total assets

$26,563

$26,218

$26,201

$26,435

$26,627

Subtract: Goodwill

(24)

(24)

(24)

(24)

(24)

Subtract: Other intangible assets, net

(4)

(4)

(3)

(2)

(2)

Tangible assets

$26,535

$26,190

$26,174

$26,409

$26,601

Total shareholders’ equity

$3,568

$2,932

$2,949

$2,998

$3,053

Subtract: Goodwill

(24)

(24)

(24)

(24)

(24)

Subtract: Other intangible assets, net

(4)

(4)

(3)

(2)

(2)

Subtract: Series C Preferred Stock

-

(125)

(126)

(126)

(126)

Subtract: Series A Preferred Stock

(963)

-

-

-

-

Tangible common equity

$2,577

$2,778

$2,795

$2,846

$2,901

Tangible common equity to tangible assets ratio

9.71%

10.61%

10.68%

10.78%

10.91%

30