Schedule

THIS WARRANT AND THE UNDERLYING SECURITIES HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “ACT”). THEY MAY NOT BE SOLD, OFFERED FOR SALE, PLEDGED OR HYPOTHECATED IN THE ABSENCE OF AN EFFECTIVE REGISTRATION STATEMENT AS TO SUCH SECURITIES UNDER THE ACT OR AN OPINION OF COUNSEL SATISFACTORY TO THE COMPANY THAT SUCH REGISTRATION IS NOT REQUIRED.

[COMPANY NAME]

WARRANT TO PURCHASE ORDINARY SHARES

THIS CERTIFIES THAT, for value received, UNITED PARCEL SERVICES GENERAL SERVICES CO. or its Permitted Affiliates (“Holder”), is entitled to subscribe for and purchase at the Exercise Price (defined below) from [•]1 (the “Company”), a number of Ordinary Shares as permitted by the terms of this Warrant to Purchase Ordinary Shares (this “Warrant”).

This Warrant is being issued to Holder pursuant to the terms of an agreement, dated as of [•]2 and made between the Company and the Holder.

Subject to the terms and conditions set forth herein, including a Change of Control (as defined below), this Warrant shall be exercisable during the period (the “Exercise Period”) commencing on the first date on which Holder exercises its Purchase Option (as defined in the Purchase Agreement (as defined below)) to purchase one or more electric vehicles pursuant to the terms of the Purchase Agreement and ending on the earlier to occur of the following: (a) 5:00 p.m., Atlanta, Georgia time, on the later of (i) the tenth (10th) anniversary of the issue date of this Warrant and (ii) December 31, 2031.

As used herein, the following terms shall have the following respective meanings:

“Change of Control” means (i) any consolidation, merger, reorganization, or similar transaction involving the Company or its subsidiaries in which the Company or its subsidiary, as applicable, is not the surviving entity or pursuant to which the Company’s equity holders immediately prior to such transaction own, immediately after such transaction, less than fifty percent (50%) of the voting securities of the surviving entity, (ii) any transaction or series of related transactions in which a person, or a group of related persons, acquires from equity holders of the Company shares representing more than fifty percent (50%) of the outstanding voting power of the Company (other than any internal reorganizations), or (iii) the sale, lease, exclusive license, or other transfer, in any transaction or series of related transactions, of all or substantially all of the assets of the Company and its subsidiaries.

“Current Market Per Share Price” means the average reported last sale price of the Ordinary Shares for the three (3) trading days immediately preceding the date that this Warrant is exercised by Holder from time to time.

| 1 | The Company will be the successor entity to Arrival S.à r.l., a private limited liability company governed by the laws of the Grand Duchy of Luxembourg. |

| 2 | To be populated once obligation captured in SPAC transaction documentation. It is expected that the Company will assume the conditional obligation to issue the warrant upon SPAC Completion |

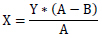

6