“Permitted Liens” means (a) statutory Liens for current Taxes or other governmental charges not yet due and payable or the amount or validity of which is being contested in good faith and for which adequate reserves have been established in accordance with GAAP, (b) mechanics’, carriers’, workers’, repairers’, contractors’, subcontractors’, suppliers’ and similar statutory Liens arising or incurred in the ordinary course of business in respect of the construction, maintenance, repair or operation of assets for amounts that are (i) not due and payable, or (ii) the amount or validity of which is being contested in good faith and for which appropriate reserves have been established in accordance with GAAP, (c) zoning, entitlement, building and other land use regulations imposed by any Governmental Body having jurisdiction over the Real Property which are not violated by the current use or occupancy of the Real Property or the operation of the Business thereon, (d) covenants, conditions, restrictions, easements, encumbrances and other similar matters of record affecting title to the Real Property which do not materially impair the use or occupancy of such Real Property in the operation of the Business conducted thereon, (e) Liens arising under workers’ compensation, unemployment insurance and social security, (f) purchase money liens for personal property and liens securing rental payments under Finance Leases for personal property, (i) Liens that will be released and, as appropriate, removed of record in connection with the Closing (including, for the avoidance of doubt, Liens securing the Payoff Indebtedness that will be released pursuant to the Payoff Letters) and (j) those matters identified as Permitted Liens in the Company Disclosure Letter, as applicable.

“Person” means an individual, a partnership, a corporation, a limited liability company, an unlimited liability company, an association, a joint stock company, a trust, a joint venture, an unincorporated organization, any other entity, a governmental entity or any department, agency or political subdivision thereof.

“Personal Information” means any data or other information that (a) identifies, relates to, describes, is reasonably capable of being associated with, or could reasonably be linked, directly or indirectly, with a particular individual, household, or device or (b) is otherwise protected by or subject to any Law or defined as “personal information”, “personal data”, “personally identifiable information”, or “protected health information” under any Law.

“Plan” means an “employee benefit plan” within the meaning of Section 3(3) of ERISA and any other compensation or benefit plan, program, policy, Contract or agreement, whether written or unwritten, funded or unfunded, subject to ERISA or not, including any stock purchase, stock option, restricted stock, other equity-based, phantom equity, severance, separation, retention, employment, individual consulting, change in control, bonus, incentive, deferred compensation, pension, retirement, supplemental retirement, health, dental, vision, disability, life insurance, death benefit, vacation, paid time off, leave of absence, employee assistance, tuition assistance or other fringe benefit plan, program, policy, Contract or agreement.

“Pre-Closing Period” has the meaning set forth in Section 5.1(a).

“Preferred Share” means each share of Company Preferred Stock (and, collectively, “Preferred Shares”).

“Processing” means creation, access, collection, use, processing, storage, maintenance, protection, sharing, distribution, disclosure, modification, manipulation, transmission, destruction, theft, loss, or disposal of or to, or other activity regarding, any data or information.

“Products” has the meaning set forth in Section 3.22(b).

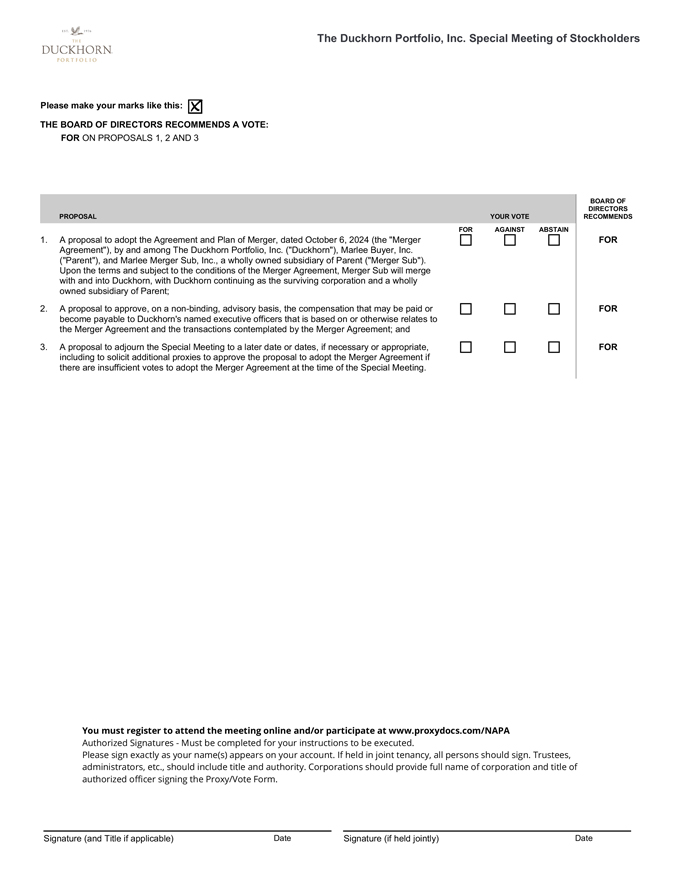

“Proxy Statement” has the meaning set forth in Section 3.25.

“Qualified Termination” has the meaning set forth in Section 7.5(c)(i).

“Real Property” means, collectively, the Leased Real Property and Owned Real Property.

A-64