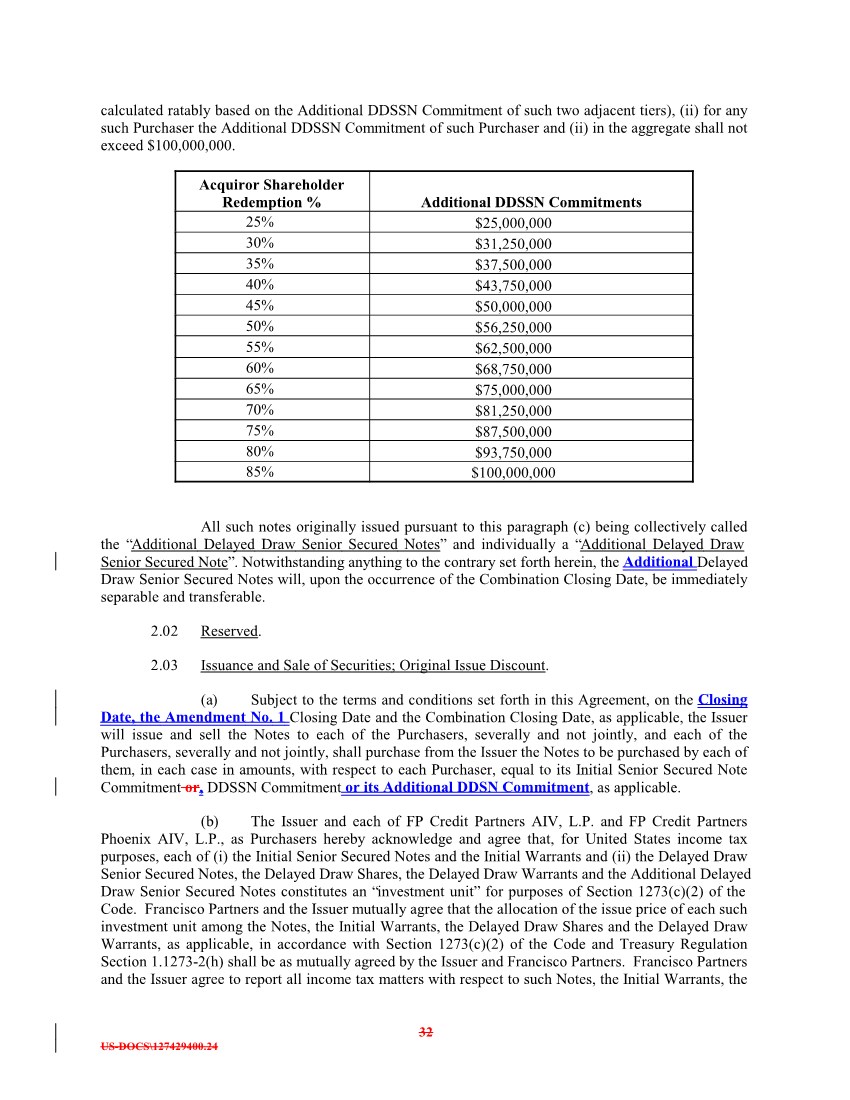

| US-DOCS\130287745.7 FORM OF STOCK AND WARRANT PURCHASE AGREEMENT1 This STOCK AND WARRANT PURCHASE AGREEMENT (this “Agreement”) is made as of [●], by and among [TAILWIND TWO ACQUISITION CORP.]2, a Delaware corporation (the “Company”), FP CREDIT PARTNERS II, L.P., a Cayman Islands limited partnership (“FPCP 1”), FP CREDIT PARTNERS PHOENIX II, L.P., a Cayman Islands limited partnership (“FPCP 2”, and, together with FPCP 1, the “FPCP Purchasers”), [BP], a [●] (“BP”), and [LM], a [●] (“LM”). Each of FPCP 1, FPCP 2, BP and LM is referred to herein individually as a “Purchaser”, and all of them are referred to herein collectively as “Purchasers.”3 WHEREAS, the Company, Titan Merger Sub, Inc. (“Merger Sub”), a wholly owned subsidiary of the Company, and Terran Orbital Corporation (the “Target”) are party to that certain Agreement and Plan of Merger, dated as of October 28, 2021 (as amended by Amendment No. 1 dated as of February 8, 2022, Amendment No. 2 dated as of March 9, 2022, and as may be further amended from time to time, the “Business Combination Agreement”), pursuant to which, among other things, Merger Sub will merge with and into the Target (the “Merger”), with the Target being the surviving corporation in the Merger; WHEREAS, on or prior to the date hereof, as contemplated by the Business Combination Agreement, the Company has transferred by way of continuation from the Cayman Islands to Delaware and domesticated as a Delaware corporation in accordance with applicable Laws; WHEREAS, the Target, as issuer, the guarantors party thereto, certain affiliates of FP Credit Partners, L.P. (“FPCP”) and Wilmington Savings Fund Society, FSB, as administrative agent and collateral agent, have entered into a Note Purchase Agreement, dated as of November 24, 2021 (as amended, restated, amended and restated, supplemented or otherwise modified from time to time to the date hereof, the “FP Note Purchase Agreement”), which provides for the issuance and sale by the Target to such affiliates of FPCP, on the terms and subject to the conditions set forth therein, of (A) on the Closing Date (as defined in the FP Note Purchase Agreement), certain Initial Senior Secured Notes (as defined in the FP Note Purchase Agreement) due 2026 in an aggregate original principal amount of $30,000,000, (B) on the Amendment No. 1 Closing Date (as defined in the FP Note Purchase Agreement), certain Delayed Draw Senior Secured Notes (as defined in the FP Note Purchase Agreement) due 2026 in an aggregate original principal amount of $24,000,000, and (C) on the Combination Closing Date (as defined in the FP Note Purchase Agreement), certain Additional Delayed Draw Senior Secured Notes (as defined in the FP Note Purchase Agreement) due 2026 in an aggregate original principal amount specified therein but not exceeding $100,000,000 and certain related transactions contemplated thereby (the foregoing, collectively, the “FP Note Transactions”); WHEREAS, (i) the Target as issuer, (ii) the guarantors party thereto, (iii) Lockheed Martin Corporation (“Lockheed Martin”), as a purchaser, (iv) BPC Lending II, LLC, as a purchaser (together with (iii), collectively, the “Existing LMT/BP Noteholders”), (v) Lockheed Martin, as authorized 1 Note to Draft: To be entered into following domestication of TW2 but pre-merger. 2 Note to Draft: To reflect name of TW2 post-domestication but pre-merger. 3 Note to Draft: LM/BP to designate purchasers in execution version. |