4Q 2022 earnings February 21, 2023 Olink Proteomics Vision Enable understanding of real-time human biology Mission Accelerate proteomics together Exhibit 99.2

Disclaimer This presentation may contain certain forward-looking statements and opinions. Forward-looking statements are statements that do not relate to historical facts and events and such statements and opinions pertaining to the future that, for example, contain wording such as “may,” “might,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “objective,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue,” “ongoing,” or the negative of these terms, or other comparable terminology intended to identify statements about the future. Forward-looking statements contained in this presentation include, but are not limited to, statements about: our addressable market, market growth, future revenue, key performance indicators, expenses, capital requirements and our needs for additional financing, our commercial launch plans, our strategic plans for our business and products, market acceptance of our products, our competitive position and developments and projections relating to our competitors, domestic and foreign regulatory approvals, third-party manufacturers and suppliers, our intellectual property, the potential effects of government regulation and local, regional and national and international economic conditions and events affecting our business. We cannot assure that the forward-looking statements in this presentation will prove to be accurate. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements. The forward-looking statements and opinions contained in this presentation are based on our management’s beliefs and assumptions and are based upon information currently available to our management as of the date of this presentation and, while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame, or at all. Actual results, performance or events may differ materially from those in such statements due to, without limitation, risks generally associated with product development, including delays or challenges that may arise in the development, launch or scaling of our new products, programs or services, challenges in the commercialization of our products and services, the risk that we may not maintain our existing relationships with suppliers or enter into new ones, or that we will not realize the intended benefits from such relationships, any inability to protect our intellectual property effectively, changes in general economic conditions, in particular economic conditions in the markets on which we operate, changes affecting interest rate levels, changes affecting currency exchange rates, changes in competition levels, and changes in laws and regulations, and other risks described under the caption "Risk Factors" in our Form 20-F (Commission file number 001-40277) and elsewhere in the documents we file with the Securities and Exchange Commission from time to time. The information, opinions ad forward-looking statements contained in this announcement speak only as of its date, and are subject to change without notice and we undertake no obligation to update any such forward-looking statements for any reason, except as required by law. This presentation contains estimates, projections and other information concerning our industry, our business, and the markets for our products and services. Information that is based on estimates, forecasts, projections, market research or similar methodologies is inherently subject to uncertainties, and actual events or circumstances may differ materially from events and circumstances that are assumed in this information. Unless otherwise expressly stated, we obtained this industry, business, market and other data from our own internal estimates and research as well as from reports, research surveys, studies and similar data prepared by market research firms and other third parties, industry, medical and general publications, government data and similar sources. While we believe our internal company research as to such matters is reliable and the market definitions are appropriate, neither such research nor these definitions have been verified by any independent source. 2

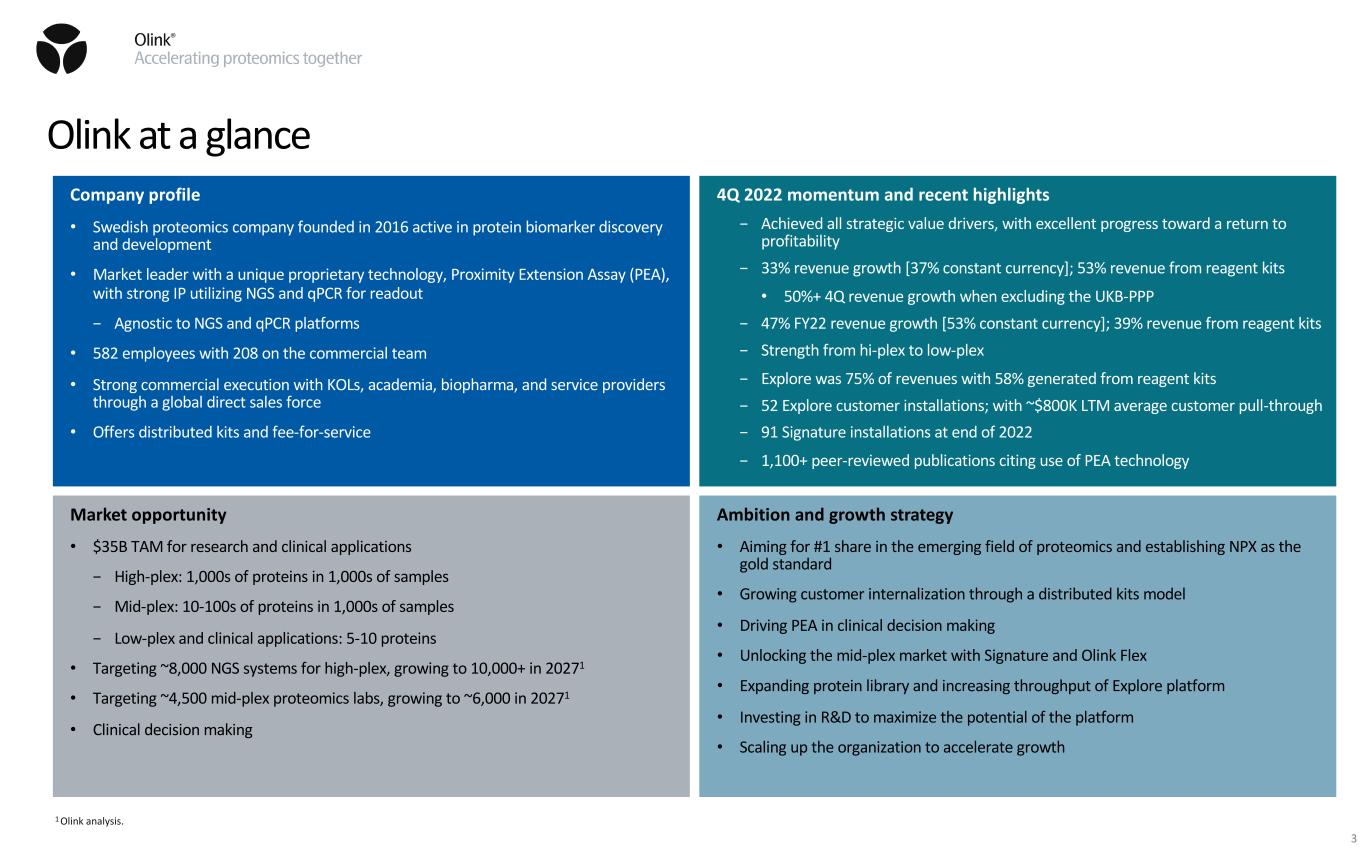

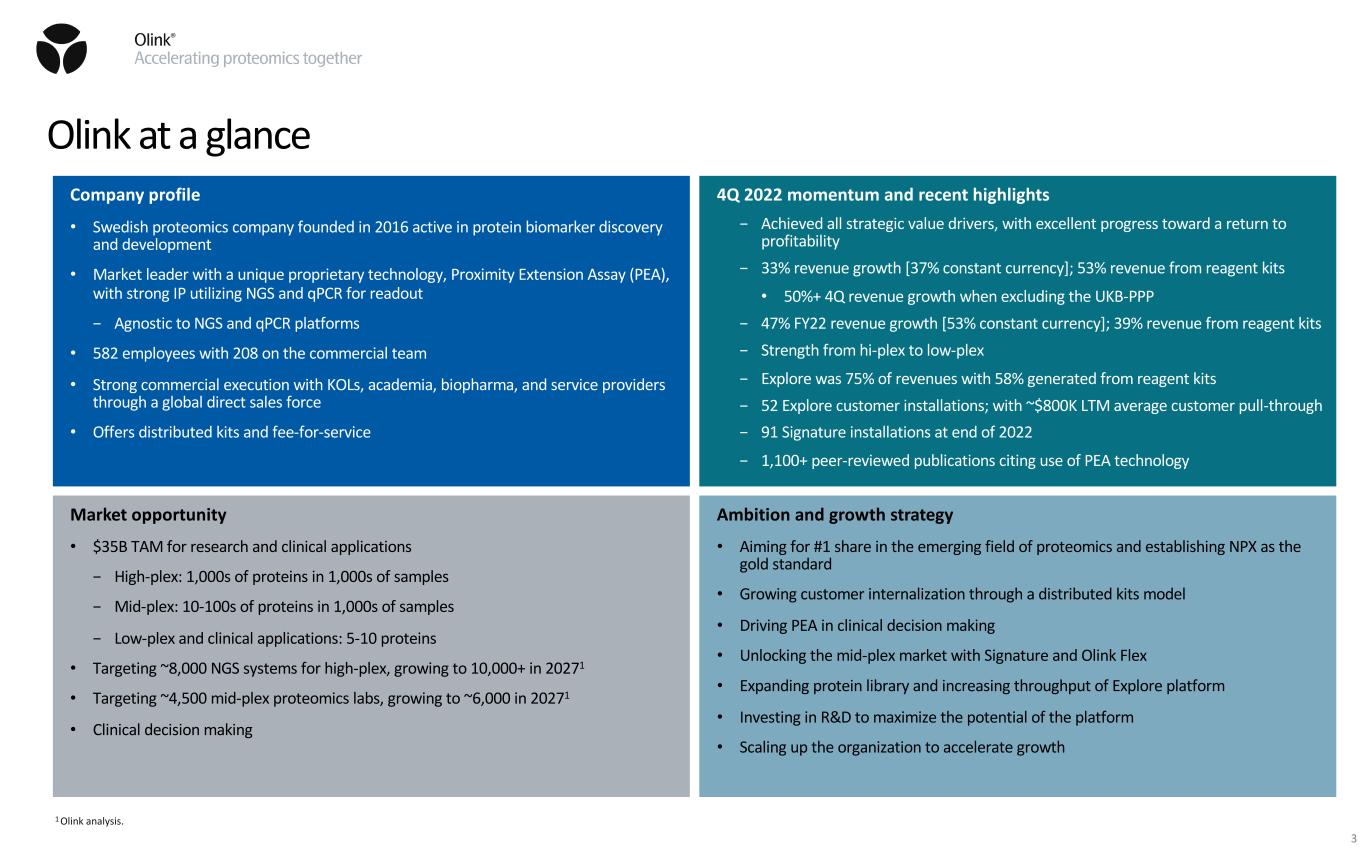

Olink at a glance Company profile • Swedish proteomics company founded in 2016 active in protein biomarker discovery and development • Market leader with a unique proprietary technology, Proximity Extension Assay (PEA), with strong IP utilizing NGS and qPCR for readout − Agnostic to NGS and qPCR platforms • 582 employees with 208 on the commercial team • Strong commercial execution with KOLs, academia, biopharma, and service providers through a global direct sales force • Offers distributed kits and fee-for-service 4Q 2022 momentum and recent highlights − Achieved all strategic value drivers, with excellent progress toward a return to profitability − 33% revenue growth [37% constant currency]; 53% revenue from reagent kits • 50%+ 4Q revenue growth when excluding the UKB-PPP − 47% FY22 revenue growth [53% constant currency]; 39% revenue from reagent kits − Strength from hi-plex to low-plex − Explore was 75% of revenues with 58% generated from reagent kits − 52 Explore customer installations; with ~$800K LTM average customer pull-through − 91 Signature installations at end of 2022 − 1,100+ peer-reviewed publications citing use of PEA technology Market opportunity • $35B TAM for research and clinical applications − High-plex: 1,000s of proteins in 1,000s of samples − Mid-plex: 10-100s of proteins in 1,000s of samples − Low-plex and clinical applications: 5-10 proteins • Targeting ~8,000 NGS systems for high-plex, growing to 10,000+ in 20271 • Targeting ~4,500 mid-plex proteomics labs, growing to ~6,000 in 20271 • Clinical decision making Ambition and growth strategy • Aiming for #1 share in the emerging field of proteomics and establishing NPX as the gold standard • Growing customer internalization through a distributed kits model • Driving PEA in clinical decision making • Unlocking the mid-plex market with Signature and Olink Flex • Expanding protein library and increasing throughput of Explore platform • Investing in R&D to maximize the potential of the platform • Scaling up the organization to accelerate growth 3 1 Olink analysis.

Sensitivity Specificity Dynamic range Sample consumption Throughput Cost“Casting a broad net” 4 Uniquely addressed all major challenges in proteomics – highest data quality

Focus Custom developed panel of up to 21 proteins for each client’s use case leveraging our entire library Explore 3072 Measure ~3k proteins with minimal biological sample Explore 384 Minute sample volume, and outstanding throughput Target 96 Choose from fifteen carefully designed panels built for specific area of disease or key biology process Target 48 Our 48-plex Cytokine panel with absolute quantification Signature Q100 Light and nimble benchtop system purpose built for PEA Insight A knowledge platform empowering users to understand and utilize the power of proteomics while streamlining the journey from results to discoveries Custom mix and match to 21-plex from pre-optimized library of ~200 proteins, setting a new standard in protein analysis Absolute quantification Flex 5 Unique and holistic product offering applicable from discovery to clinical applications

Break-through science with Olink in high-impact peer reviewed literature 1,100+ publications across every major therapeutic area 6

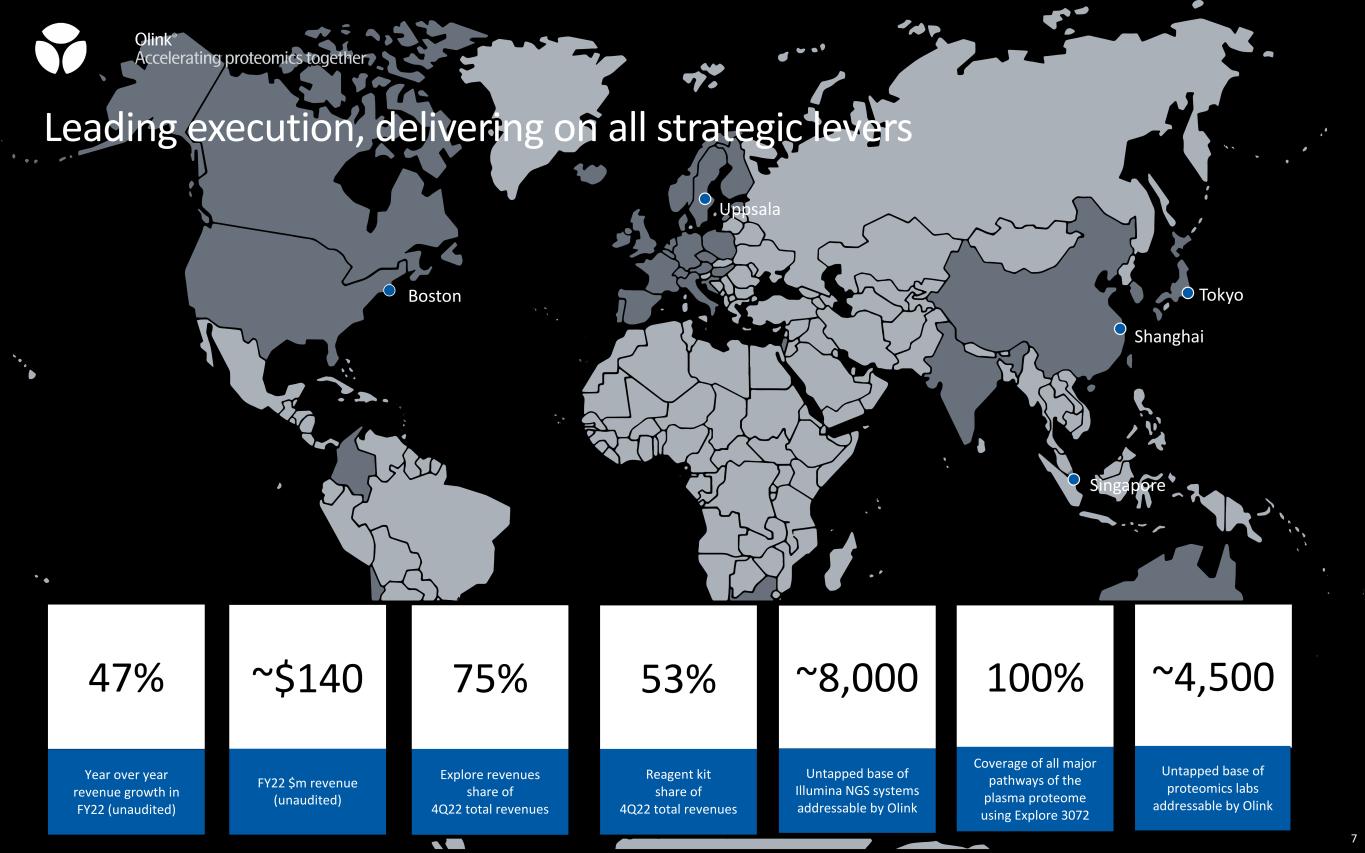

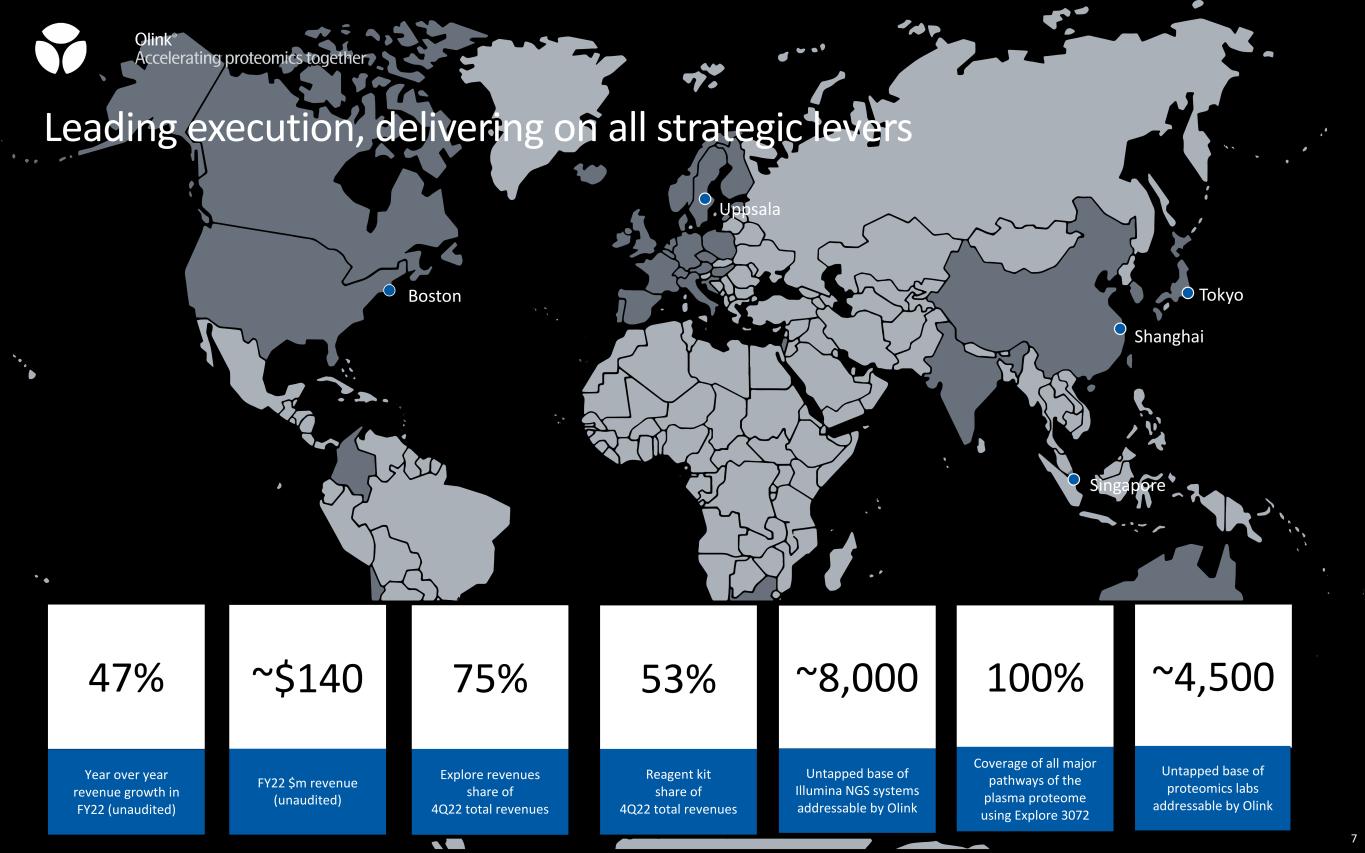

Singapore Shanghai Boston Tokyo Uppsala Leading execution, delivering on all strategic levers 47% Year over year revenue growth in FY22 (unaudited) 75% Explore revenues share of 4Q22 total revenues ~$140 FY22 $m revenue (unaudited) 100% Coverage of all major pathways of the plasma proteome using Explore 3072 ~4,500 Untapped base of proteomics labs addressable by Olink 7 ~8,000 Untapped base of Illumina NGS systems addressable by Olink 53% Reagent kit share of 4Q22 total revenues

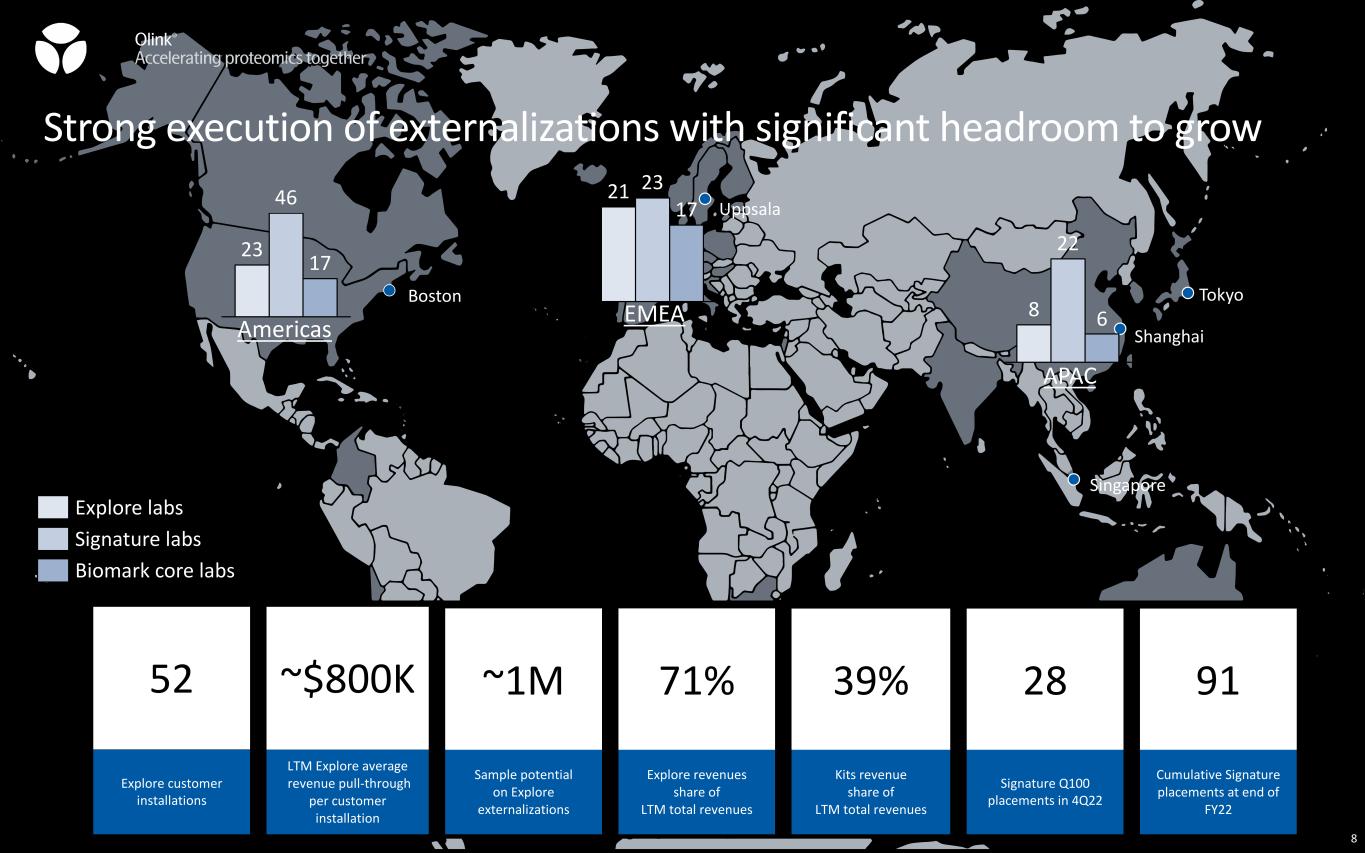

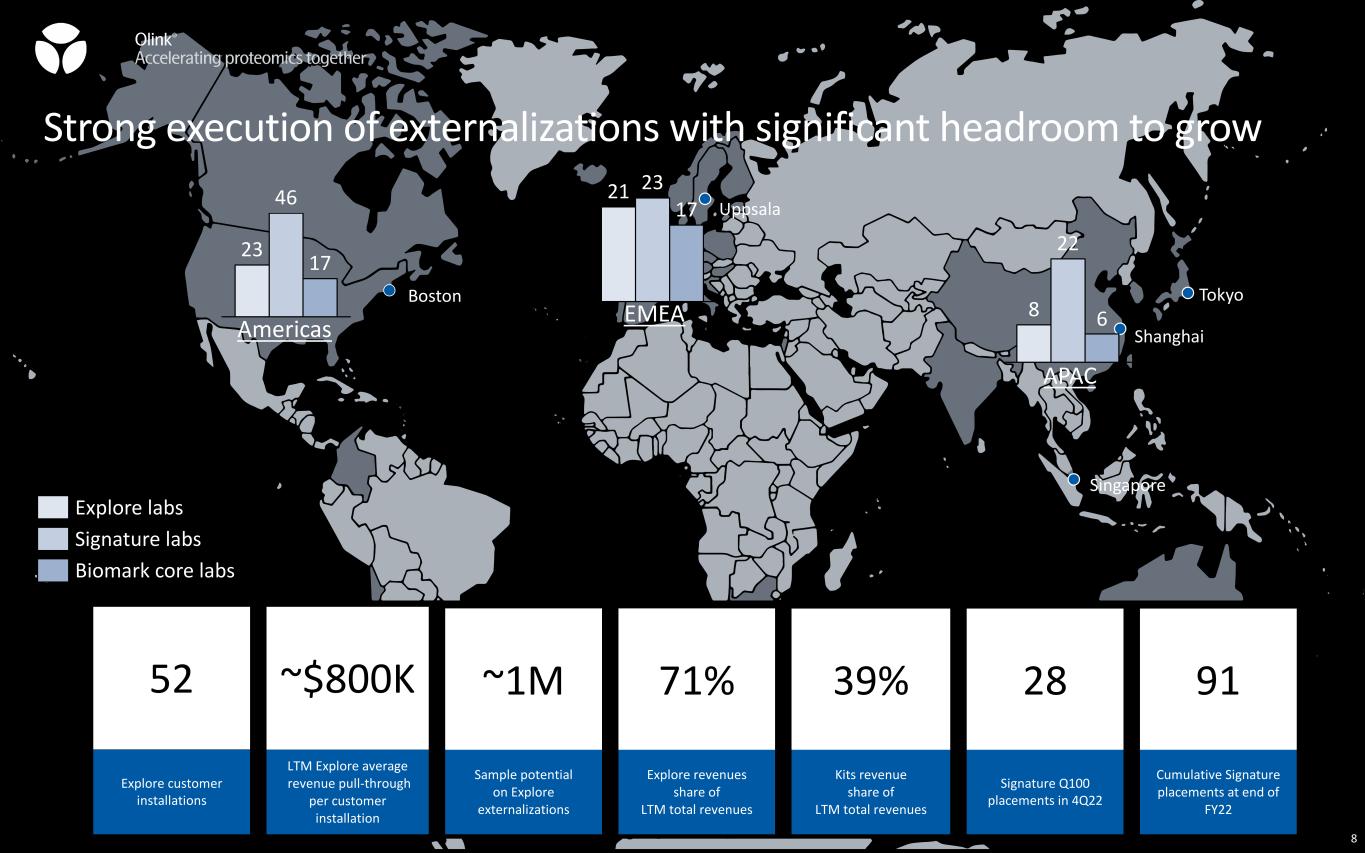

Singapore Shanghai Boston Tokyo Uppsala Strong execution of externalizations with significant headroom to grow 52 Explore customer installations APAC EMEAAmericas Explore labs 91 Cumulative Signature placements at end of FY22 8 71% Explore revenues share of LTM total revenues ~1M Sample potential on Explore externalizations 39% Kits revenue share of LTM total revenues 28 Signature Q100 placements in 4Q22 ~$800K LTM Explore average revenue pull-through per customer installation 23 46 17 21 23 17 8 22 6 Biomark core labs Signature labs

9 Proprietary PEA technology Discovery to clinical applications Proximity Extension Assay (PEA) Solving fundamental challenges in proteomics $35bn TAM opportunity A market leader Strong commercial execution Market leader with a differentiated technology platform enabling customers from discovery to clinical applications 9

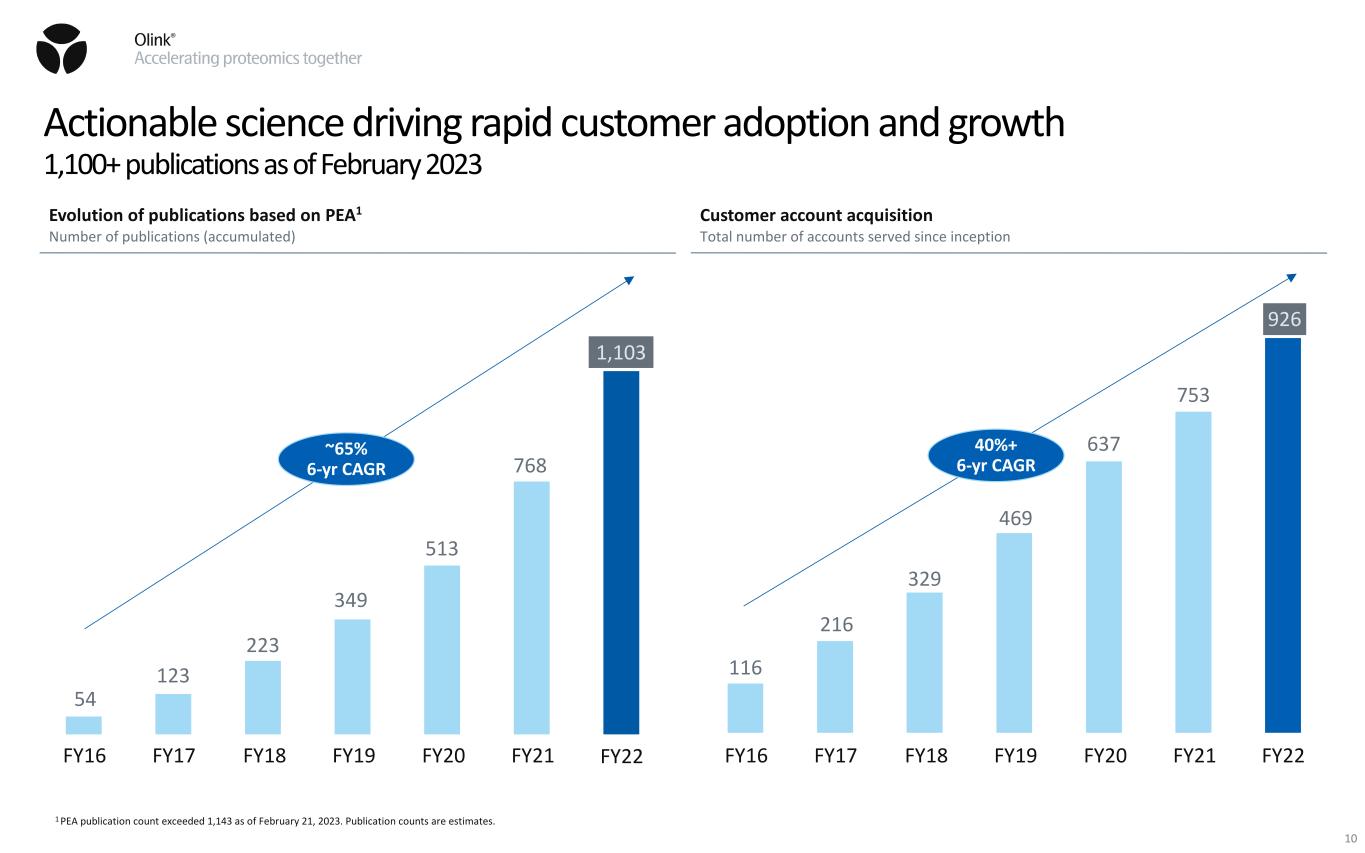

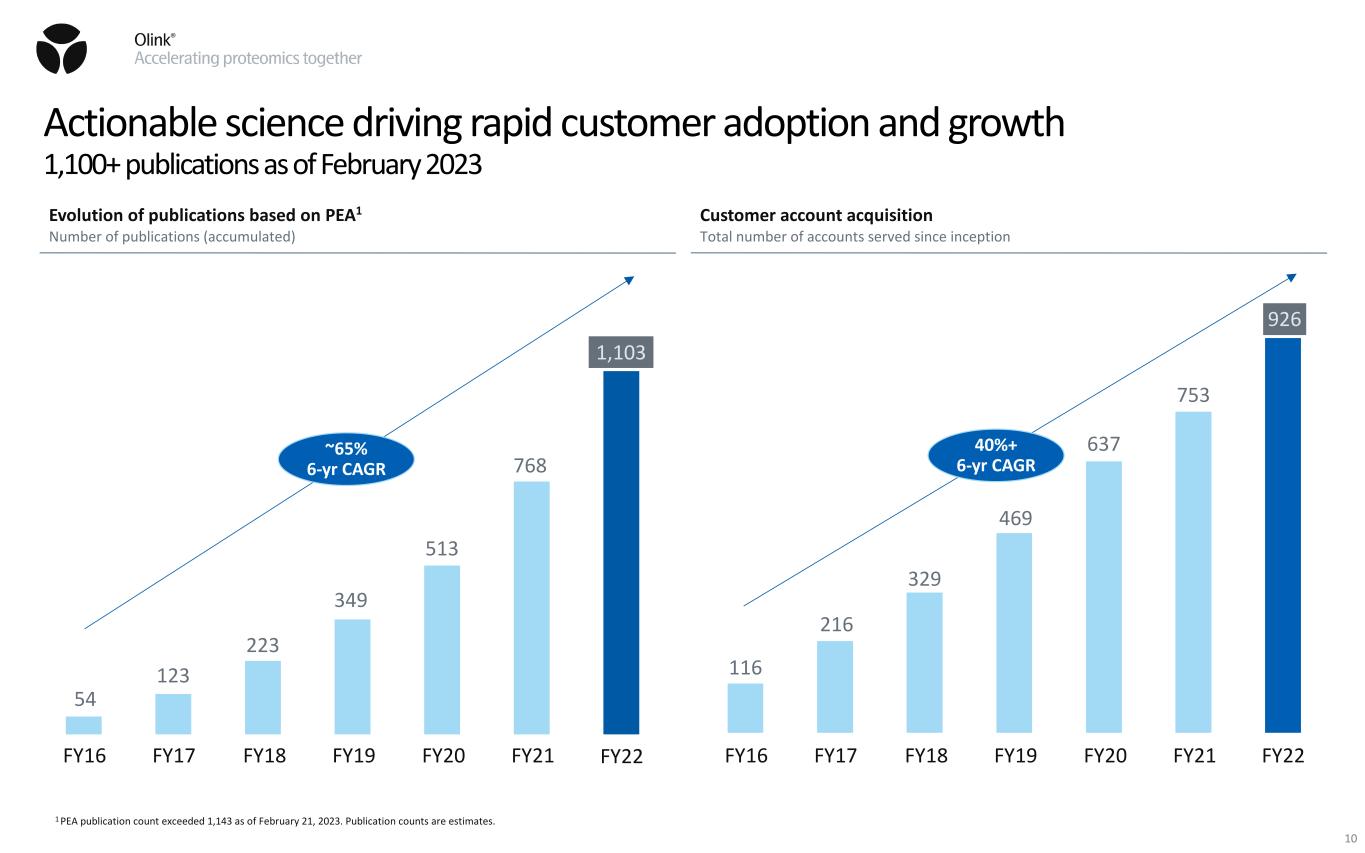

Actionable science driving rapid customer adoption and growth 1,100+ publications as of February 2023 Evolution of publications based on PEA1 Number of publications (accumulated) 54 123 223 349 513 768 1,103 FY17FY16 FY20FY19FY18 FY21 Customer account acquisition Total number of accounts served since inception FY22 116 216 329 469 637 753 926 FY17FY16 FY20FY19FY18 FY21 FY22 ~65% 6-yr CAGR 40%+ 6-yr CAGR 1 PEA publication count exceeded 1,143 as of February 21, 2023. Publication counts are estimates. 10

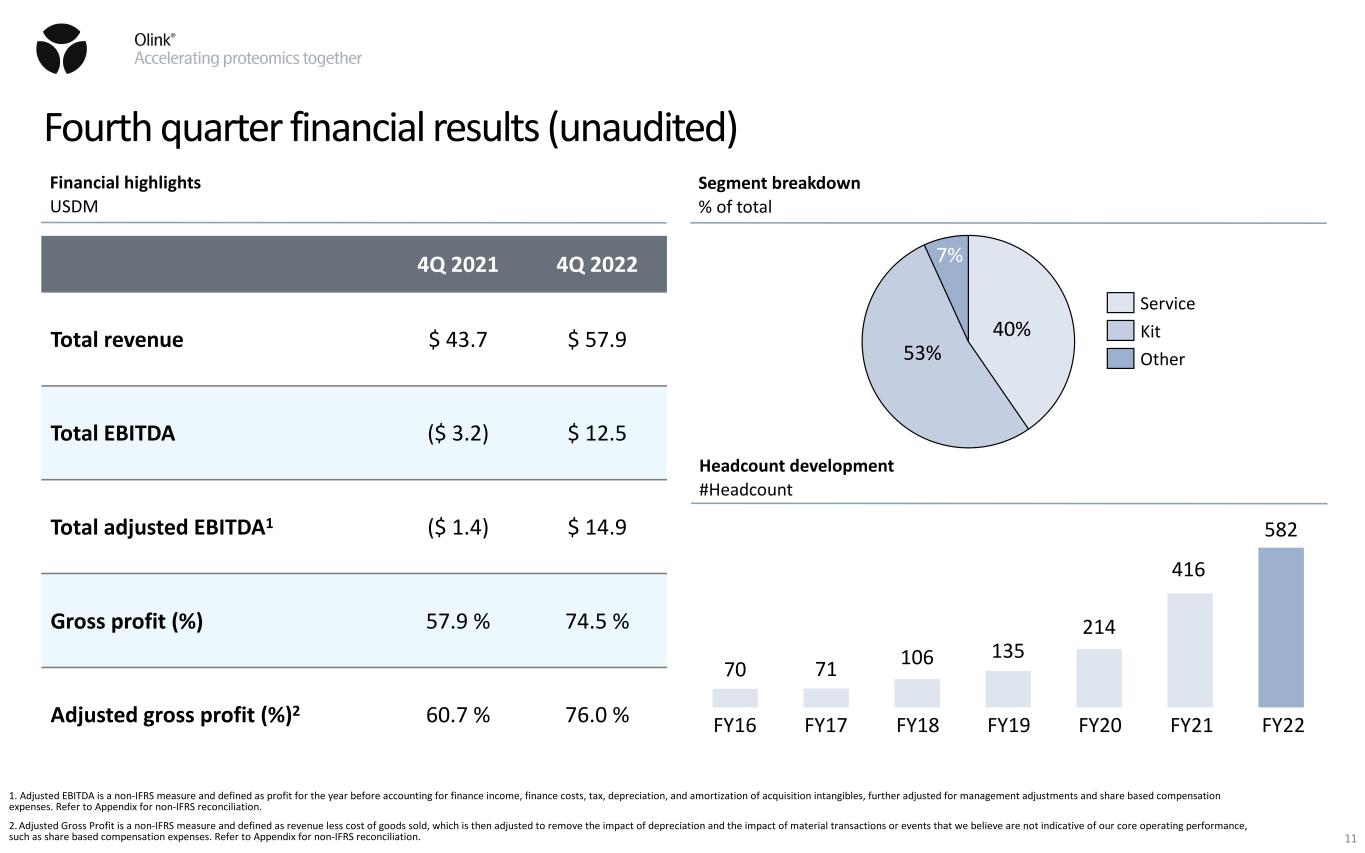

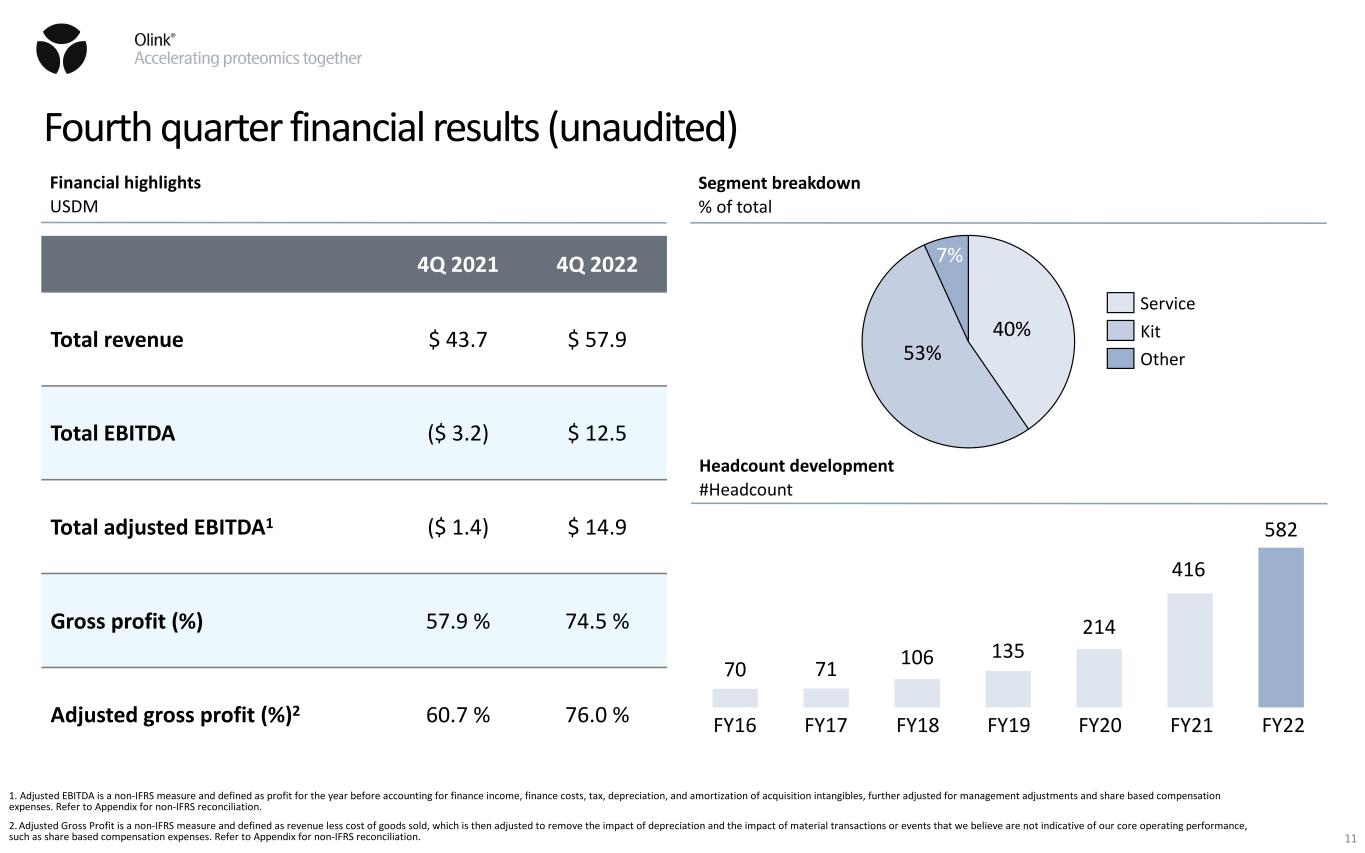

Fourth quarter financial results (unaudited) 1. Adjusted EBITDA is a non-IFRS measure and defined as profit for the year before accounting for finance income, finance costs, tax, depreciation, and amortization of acquisition intangibles, further adjusted for management adjustments and share based compensation expenses. Refer to Appendix for non-IFRS reconciliation. 2. Adjusted Gross Profit is a non-IFRS measure and defined as revenue less cost of goods sold, which is then adjusted to remove the impact of depreciation and the impact of material transactions or events that we believe are not indicative of our core operating performance, such as share based compensation expenses. Refer to Appendix for non-IFRS reconciliation. 4Q 2021 4Q 2022 Total revenue $ 43.7 $ 57.9 Total EBITDA ($ 3.2) $ 12.5 Total adjusted EBITDA1 ($ 1.4) $ 14.9 Gross profit (%) 57.9 % 74.5 % Adjusted gross profit (%)2 60.7 % 76.0 % 40% 53% 7% Service Kit Other Segment breakdown % of total Headcount development #Headcount Financial highlights USDM 70 71 106 135 214 416 582 FY16 FY17 FY19FY18 FY20 FY21 FY22 11

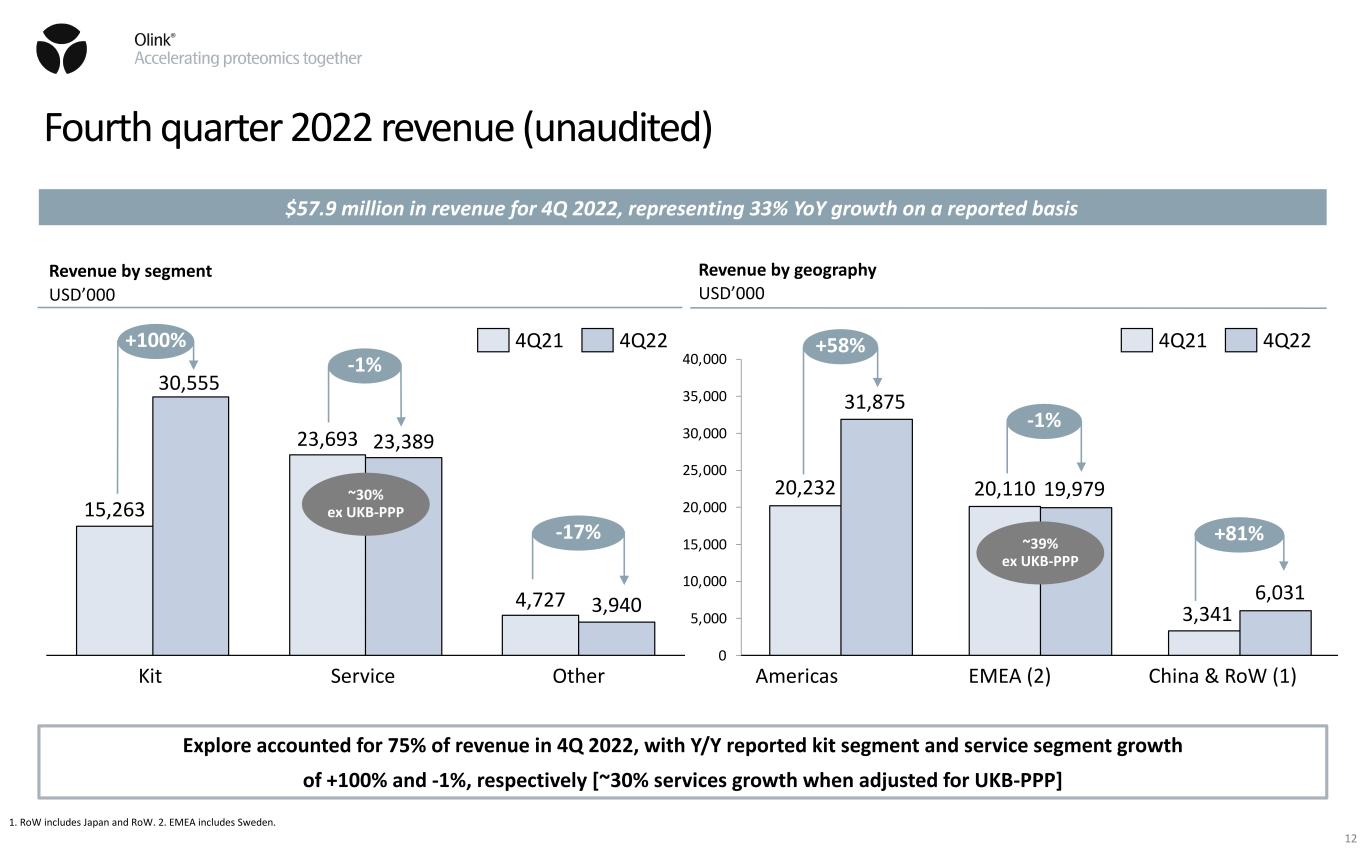

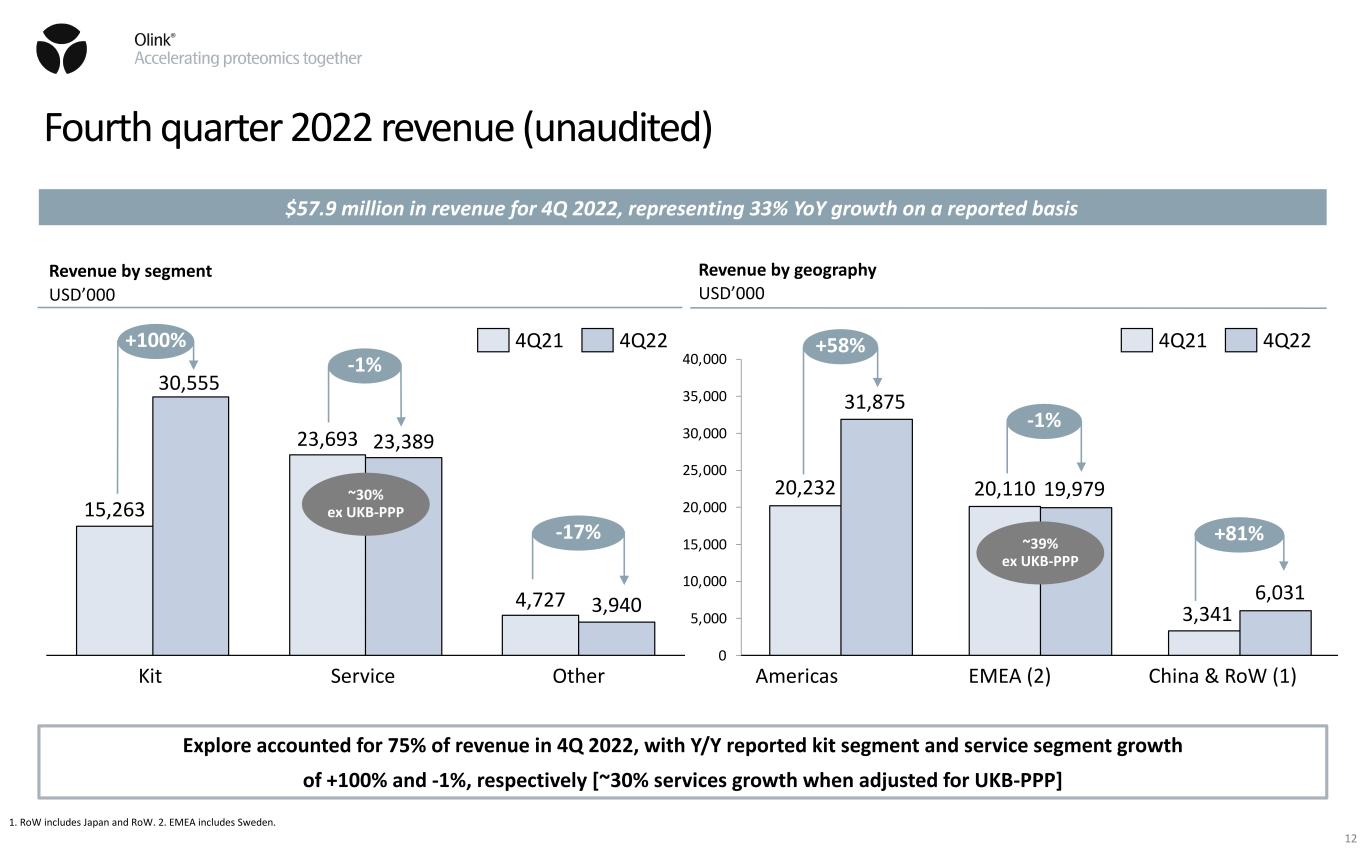

Fourth quarter 2022 revenue (unaudited) 1. RoW includes Japan and RoW. 2. EMEA includes Sweden. $57.9 million in revenue for 4Q 2022, representing 33% YoY growth on a reported basis Revenue by segment USD’000 Revenue by geography USD’000 15,263 23,693 4,727 30,555 23,389 3,940 OtherKit Service +100% -17% 4Q21 4Q22 20,232 20,110 3,341 31,875 19,979 6,031 0 5,000 10,000 15,000 20,000 25,000 30,000 35,000 40,000 China & RoW (1)Americas EMEA (2) +58% -1% +81% 4Q21 4Q22 Explore accounted for 75% of revenue in 4Q 2022, with Y/Y reported kit segment and service segment growth of +100% and -1%, respectively [~30% services growth when adjusted for UKB-PPP] -1% 12 ~30% ex UKB-PPP ~39% ex UKB-PPP

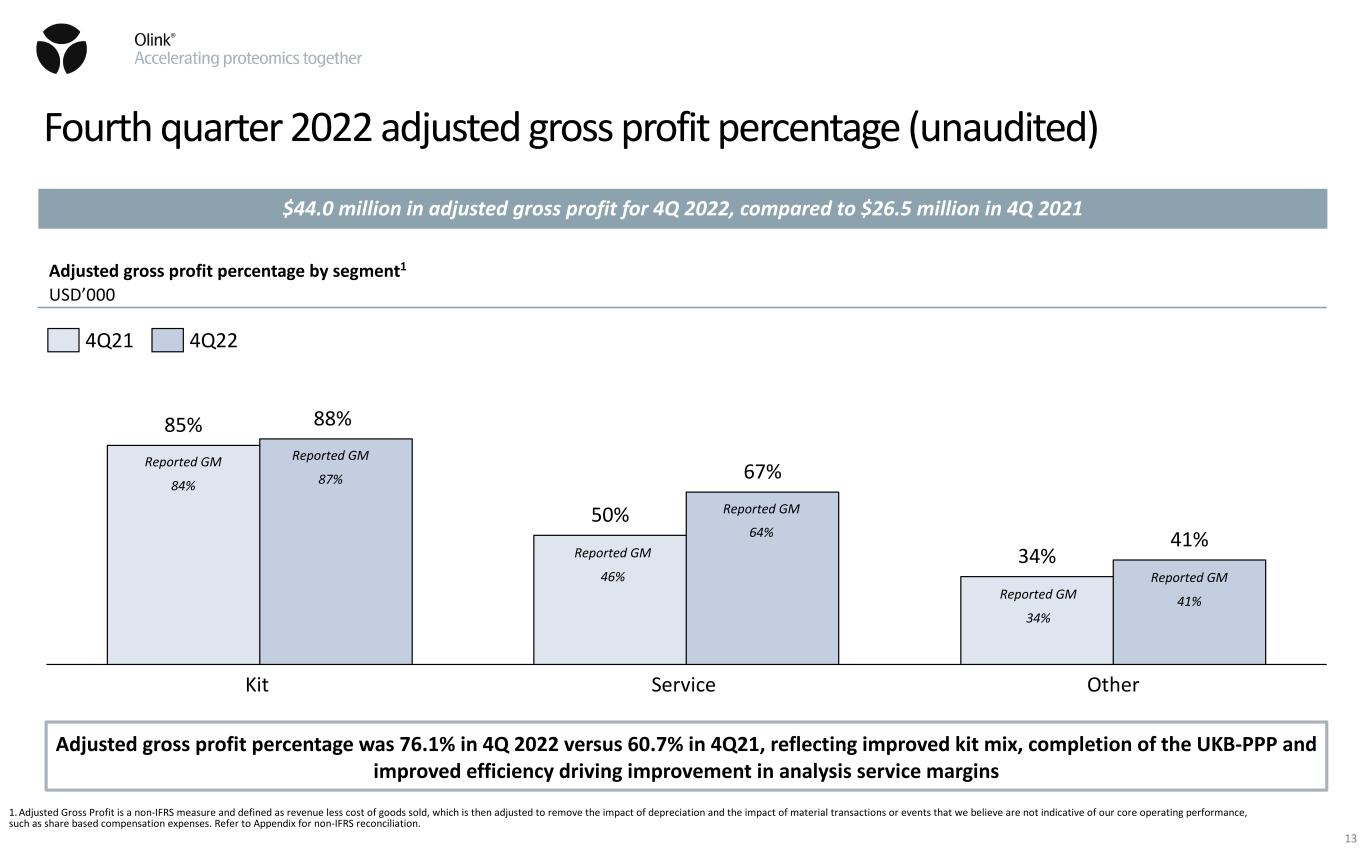

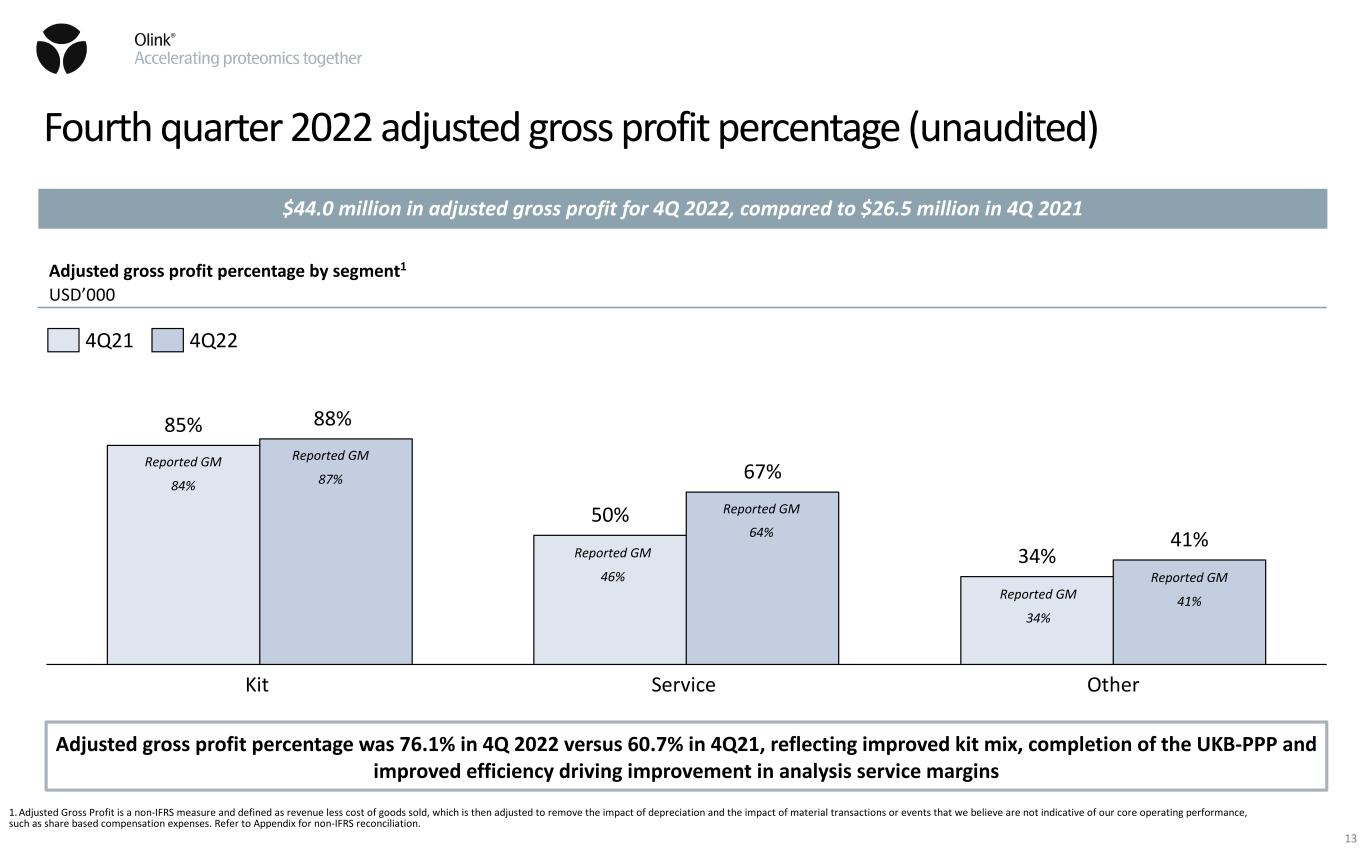

Fourth quarter 2022 adjusted gross profit percentage (unaudited) 1. Adjusted Gross Profit is a non-IFRS measure and defined as revenue less cost of goods sold, which is then adjusted to remove the impact of depreciation and the impact of material transactions or events that we believe are not indicative of our core operating performance, such as share based compensation expenses. Refer to Appendix for non-IFRS reconciliation. $44.0 million in adjusted gross profit for 4Q 2022, compared to $26.5 million in 4Q 2021 Adjusted gross profit percentage was 76.1% in 4Q 2022 versus 60.7% in 4Q21, reflecting improved kit mix, completion of the UKB-PPP and improved efficiency driving improvement in analysis service margins Adjusted gross profit percentage by segment1 USD’000 85% 50% 34% 88% 67% 41% Kit OtherService 4Q21 4Q22 Reported GM 84% Reported GM 87% Reported GM 46% Reported GM 64% Reported GM 34% Reported GM 41% 13

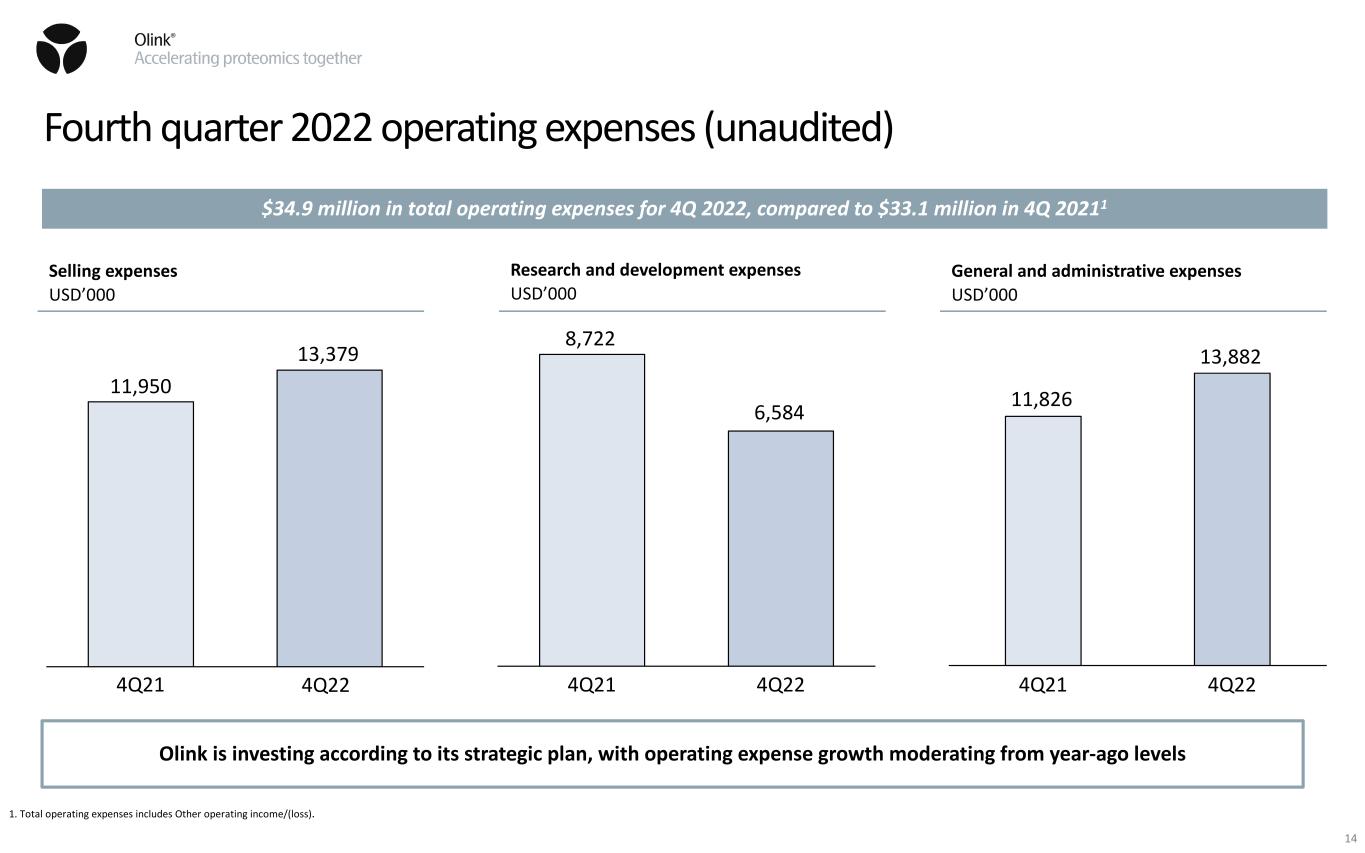

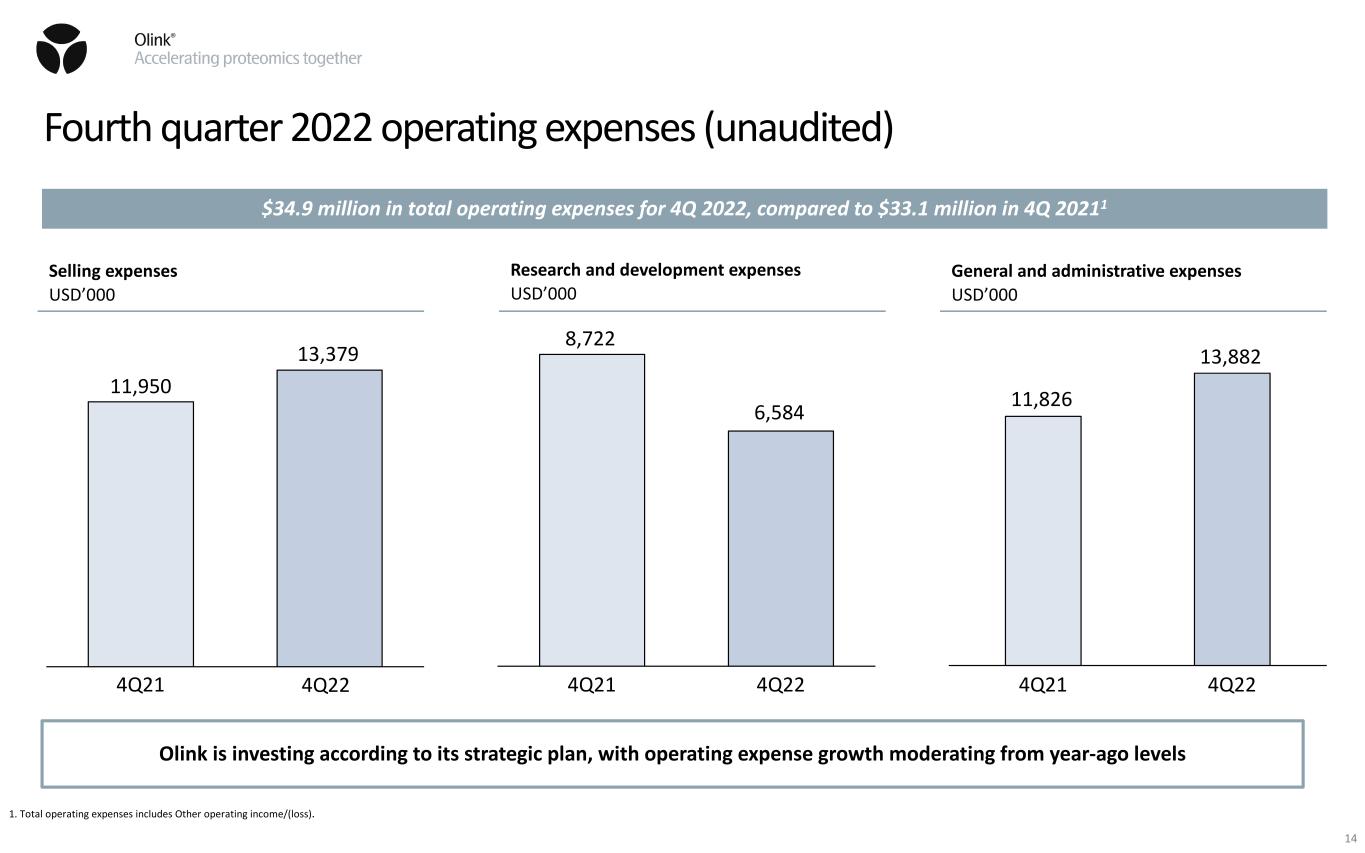

Fourth quarter 2022 operating expenses (unaudited) $34.9 million in total operating expenses for 4Q 2022, compared to $33.1 million in 4Q 20211 Olink is investing according to its strategic plan, with operating expense growth moderating from year-ago levels Selling expenses USD’000 11,950 13,379 4Q21 Research and development expenses USD’000 8,722 6,584 4Q21 4Q22 General and administrative expenses USD’000 11,826 13,882 4Q224Q21 1. Total operating expenses includes Other operating income/(loss). 4Q22 14

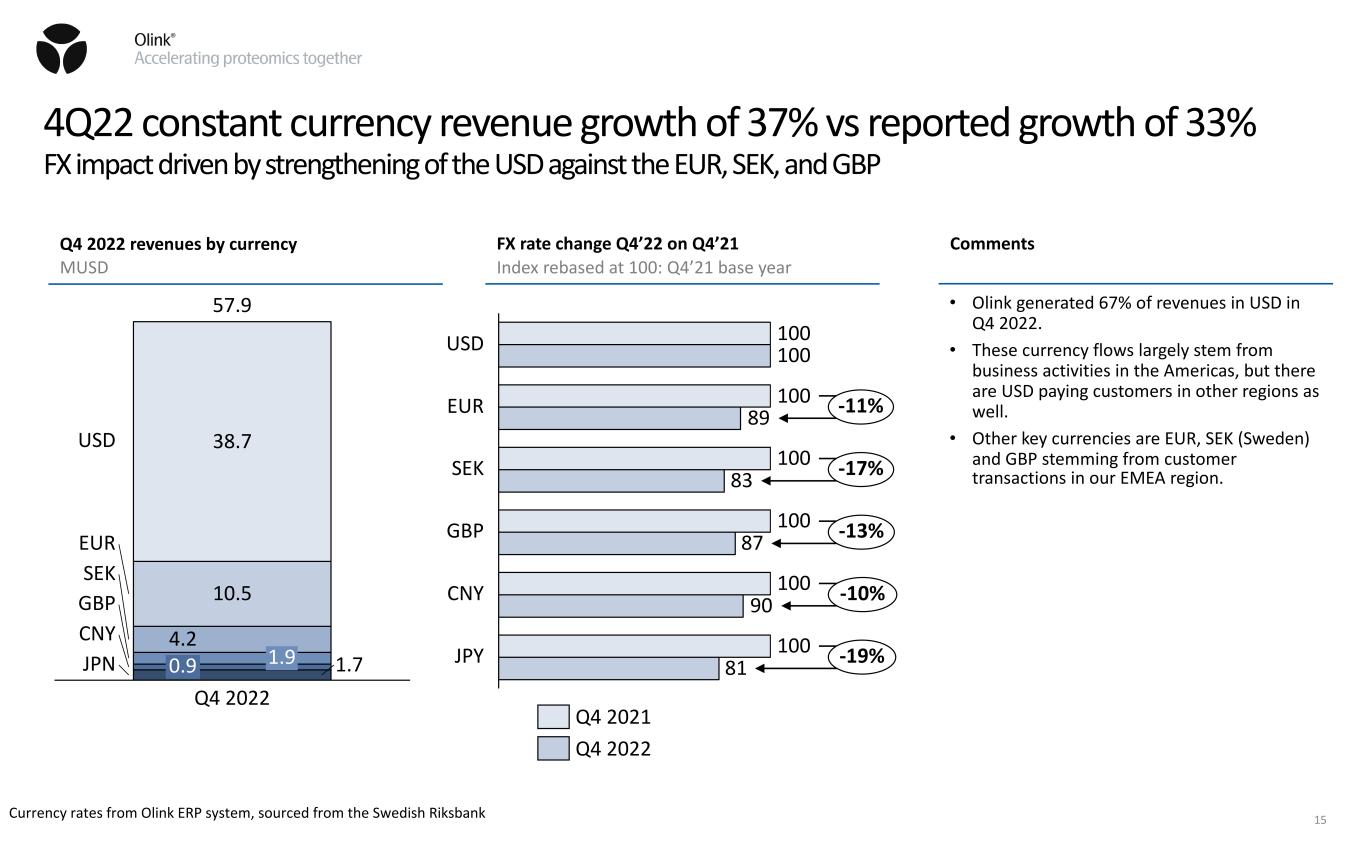

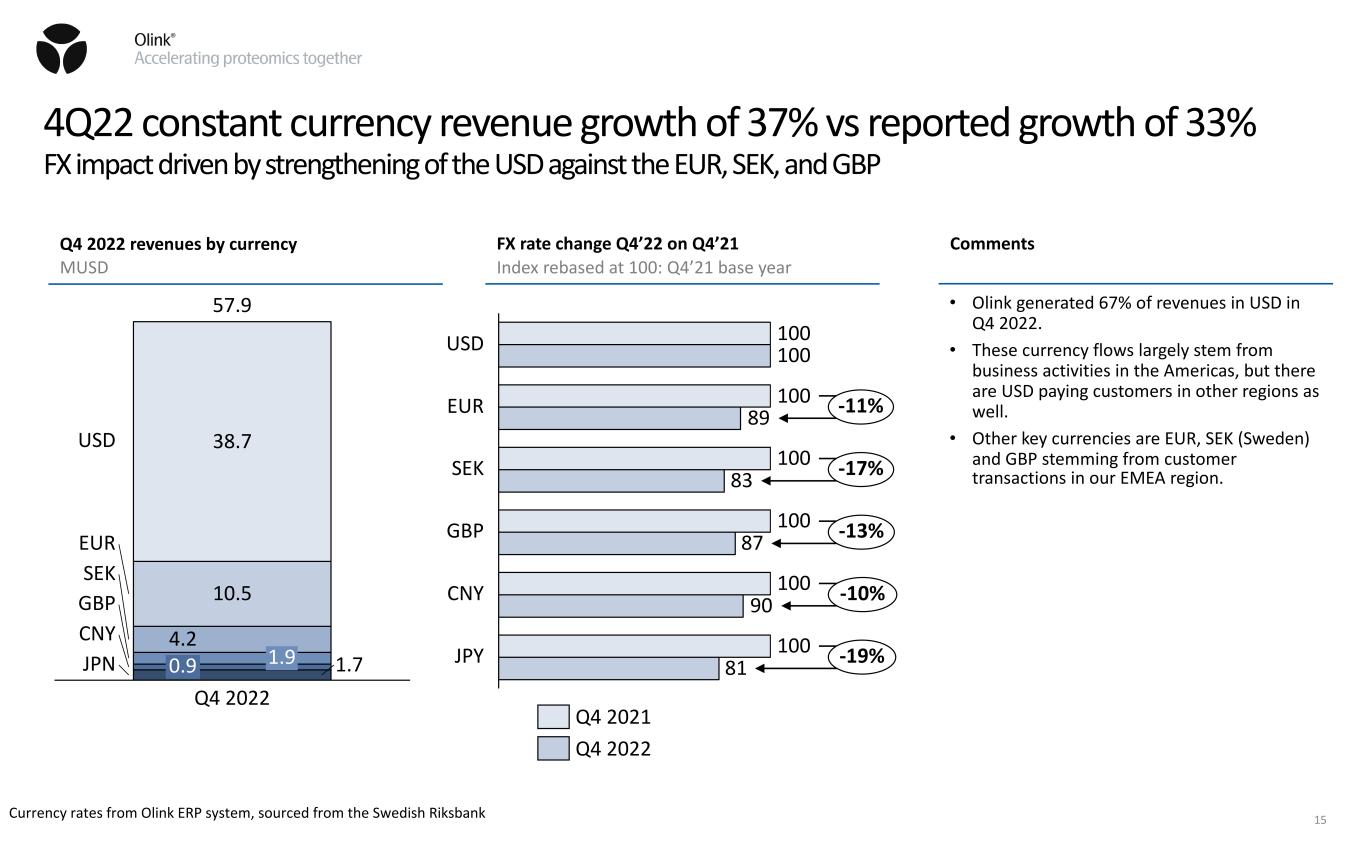

15Currency rates from Olink ERP system, sourced from the Swedish Riksbank Q4 2022 revenues by currency MUSD FX rate change Q4’22 on Q4’21 Index rebased at 100: Q4’21 base year 1.7 4.2 10.5 38.7 1.90.9 57.9 Q4 2022 SEK USD EUR GBP CNY JPN Comments • Olink generated 67% of revenues in USD in Q4 2022. • These currency flows largely stem from business activities in the Americas, but there are USD paying customers in other regions as well. • Other key currencies are EUR, SEK (Sweden) and GBP stemming from customer transactions in our EMEA region. 100 100 100 100 100 100 100 89 83 87 90 81 CNY USD SEK EUR GBP JPY -11% -17% -13% -10% -19% Q4 2021 Q4 2022 4Q22 constant currency revenue growth of 37% vs reported growth of 33% FX impact driven by strengthening of the USD against the EUR, SEK, and GBP

16Currency rates from Olink ERP system, sourced from the Swedish Riksbank FY 2022 revenues by currency MUSD FX rate change FY’22 on FY’21 Index rebased at 100: FY’21 base year 3.7 8.0 25.5 93.9 2.6 6.1 FY 2022 USD EUR SEK GBP CNY JPN 139.8 Comments • Olink generated 67% of revenues in USD in 2022. • These currency flows largely stem from business activities in the Americas, but there are USD paying customers in other regions as well. • Other key currencies are EUR, SEK (Sweden) and GBP stemming from customer transactions in our EMEA region. 100 100 100 100 100 100 100 89 85 90 96 84 USD GBP EUR SEK CNY JPY -11% -15% -10% -4% -16% FY 2021 FY 2022 FY22 constant currency revenue growth of 53% vs reported growth of 47% FX impact driven by strengthening of the USD against the EUR, SEK, and GBP

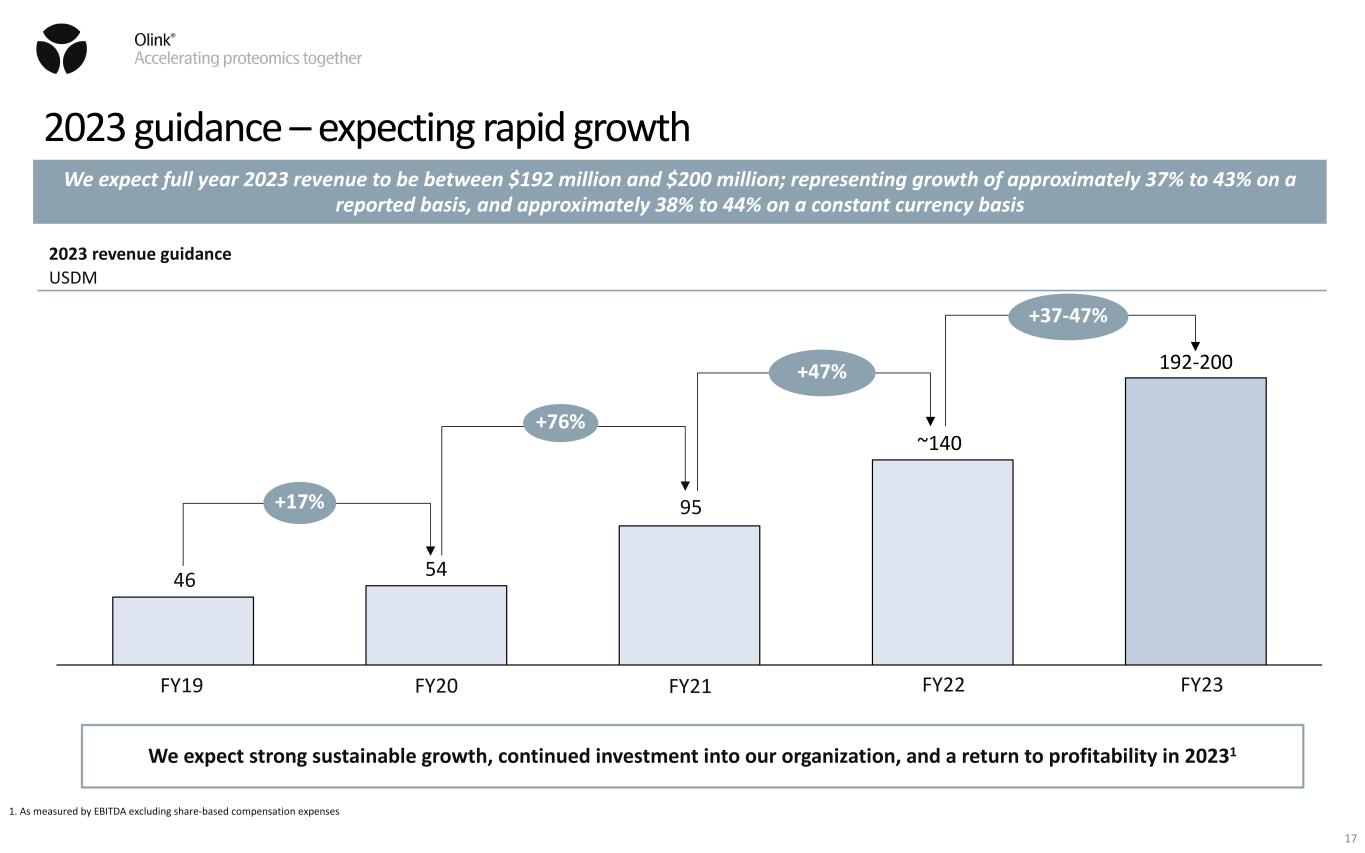

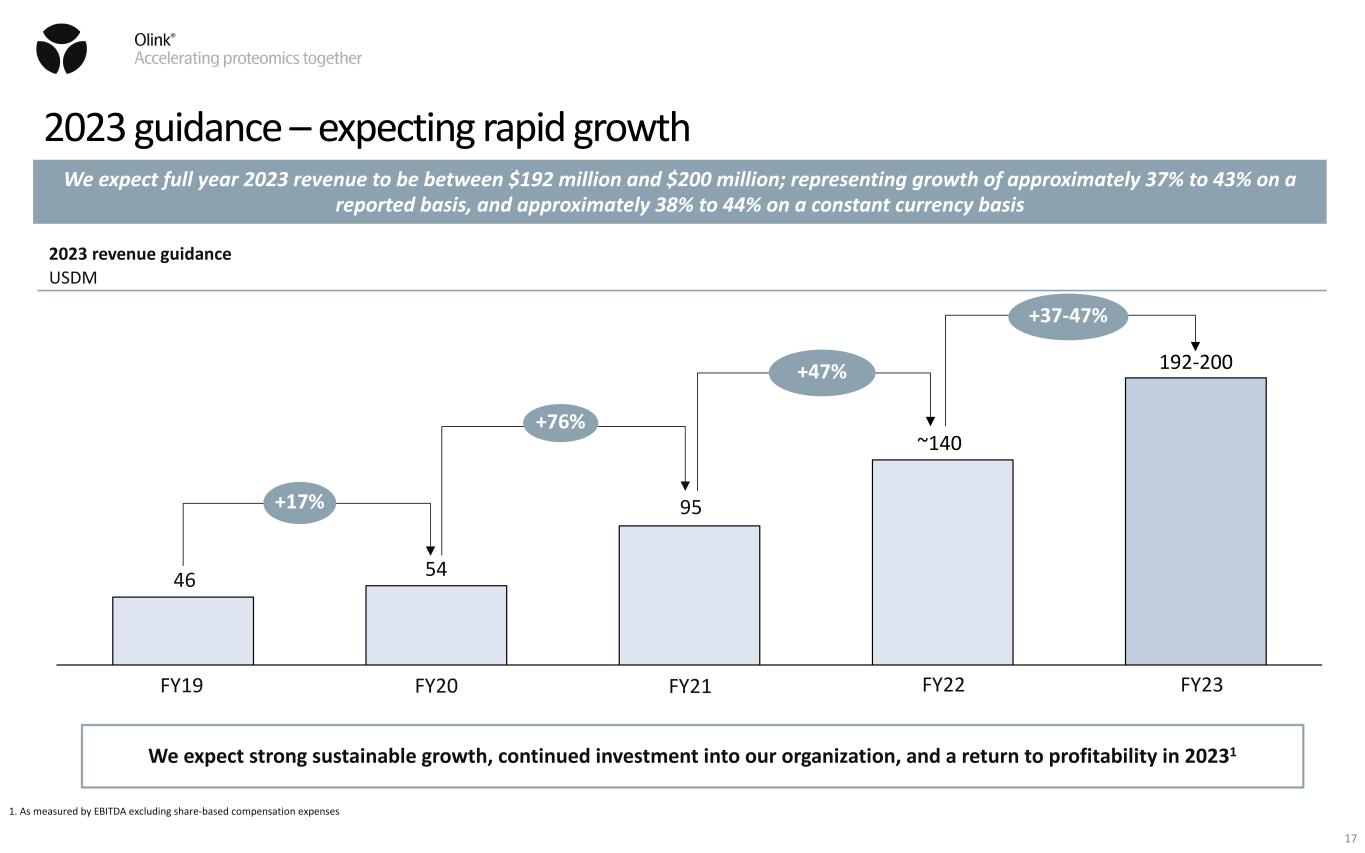

2023 guidance – expecting rapid growth We expect full year 2023 revenue to be between $192 million and $200 million; representing growth of approximately 37% to 43% on a reported basis, and approximately 38% to 44% on a constant currency basis We expect strong sustainable growth, continued investment into our organization, and a return to profitability in 20231 2023 revenue guidance USDM 46 54 95 ~140 192-200 FY19 FY20 FY21 FY22 +17% +76% +47% 17 FY23 +37-47% 1. As measured by EBITDA excluding share-based compensation expenses

A complete picture of real-time human biology Genomics ProteomicsEpigenomics Transcriptomics Metabolomics Accelerating proteomics together Our mission Enable understanding of real-time human biology Our vision

Non-IFRS reconciliations 19 We present certain non-IFRS financial measures because they are used by our management to evaluate our operating performance and formulate business plans. We believe that the use of these non-IFRS measures facilitates investors’ assessment of our operating performance. We caution readers that amounts presented in accordance with our definitions of adjusted EBITDA, adjusted gross profit, adjusted gross profit margin, adjusted gross profit margin by segment, and constant currency revenue growth, may not be the same as similar measures used by other companies. Not all companies and Wall Street analysts calculate the non-IFRS measures we use in the same manner. We compensate for these limitations by reconciling each of these non-IFRS measures to the nearest IFRS performance measure, which should be considered when evaluating our performance. We encourage you to review our financial information in its entirety and not rely on a single financial measure. We are not able to forecast constant currency revenue on a forward-looking basis without unreasonable efforts due to the high variability and difficulty in predicting foreign currency exchange rates and, as a result, are unable to provide a reconciliation to forecasted constant currency revenue.

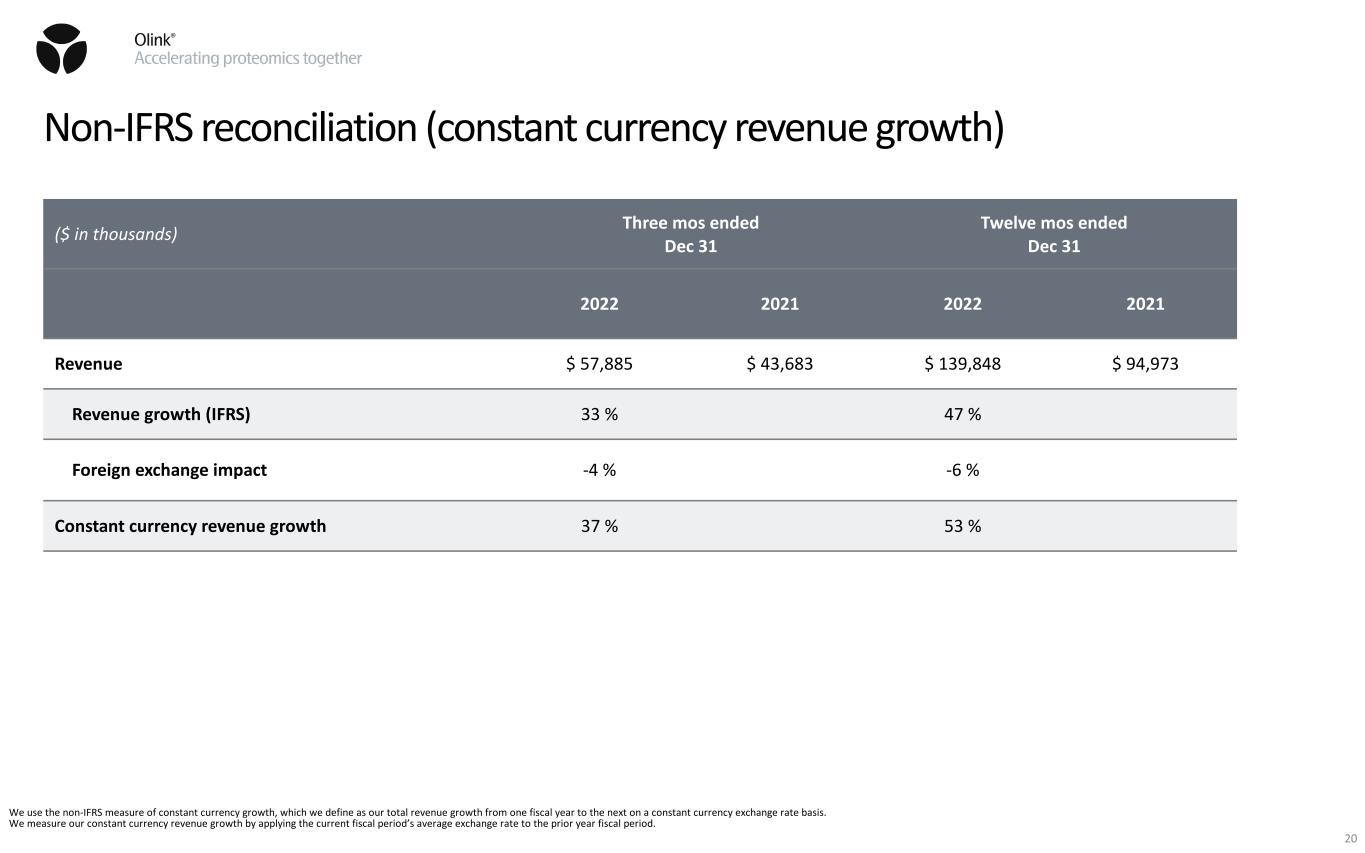

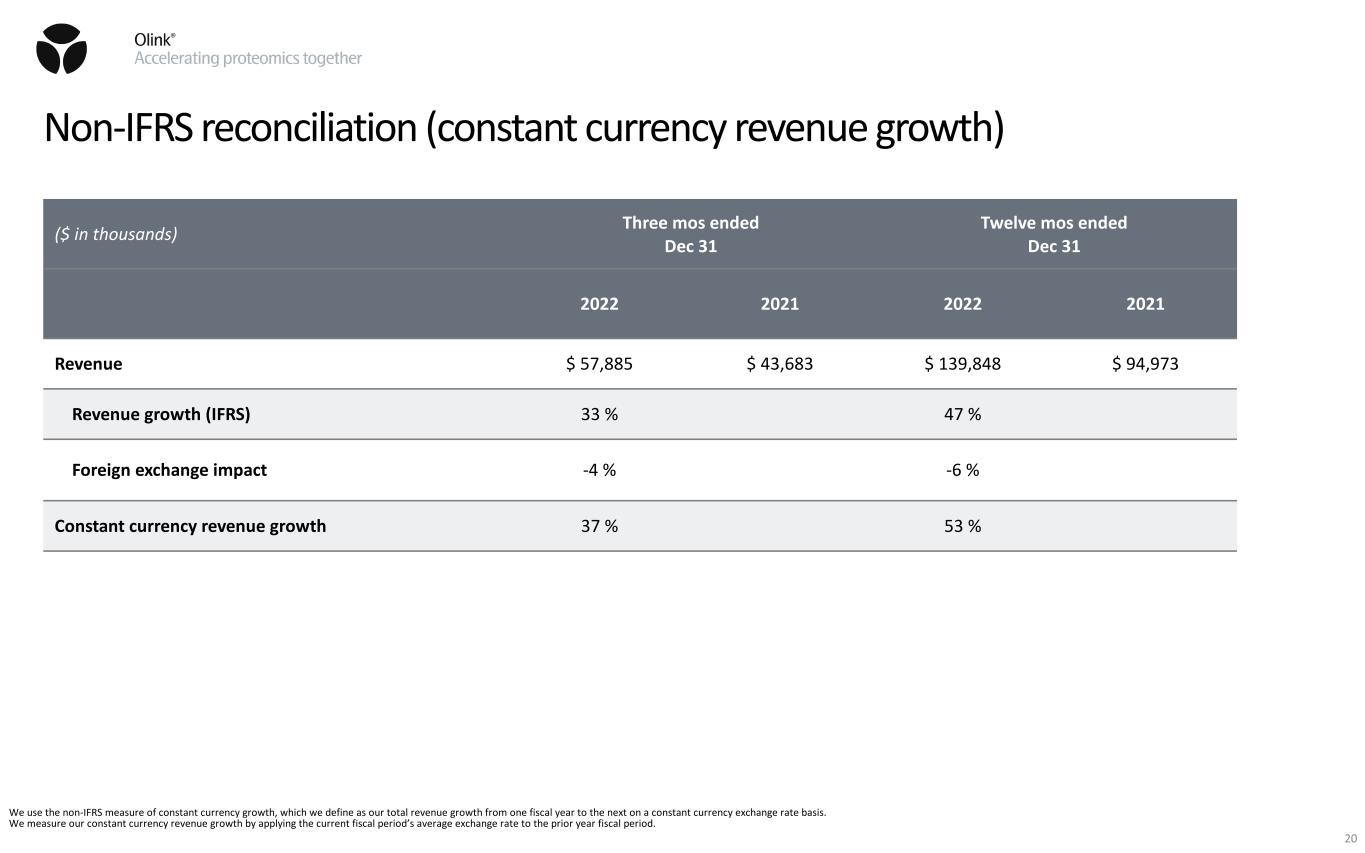

Non-IFRS reconciliation (constant currency revenue growth) 20 ($ in thousands) Three mos ended Dec 31 Twelve mos ended Dec 31 2022 2021 2022 2021 Revenue $ 57,885 $ 43,683 $ 139,848 $ 94,973 Revenue growth (IFRS) 33 % 47 % Foreign exchange impact -4 % -6 % Constant currency revenue growth 37 % 53 % We use the non-IFRS measure of constant currency growth, which we define as our total revenue growth from one fiscal year to the next on a constant currency exchange rate basis. We measure our constant currency revenue growth by applying the current fiscal period’s average exchange rate to the prior year fiscal period.

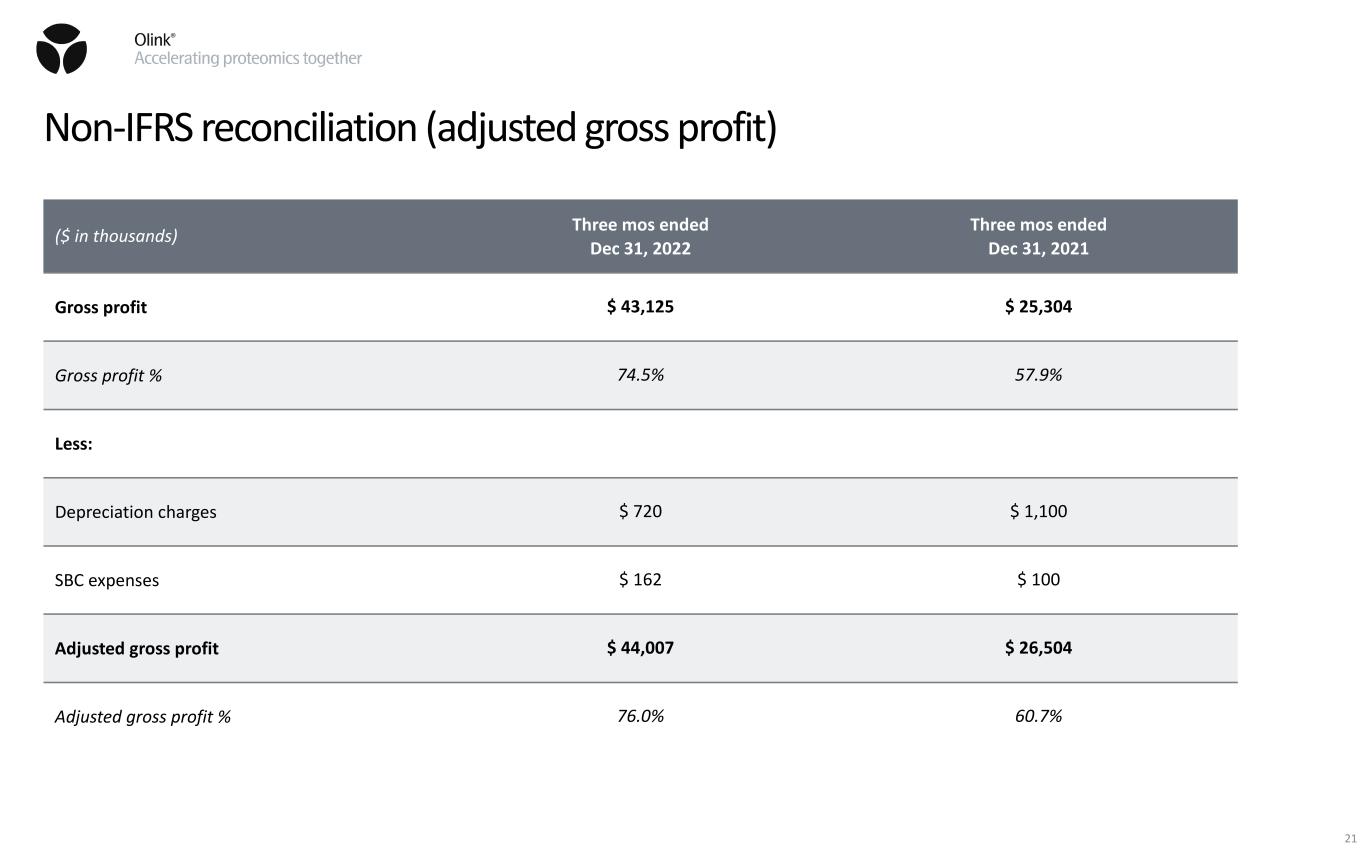

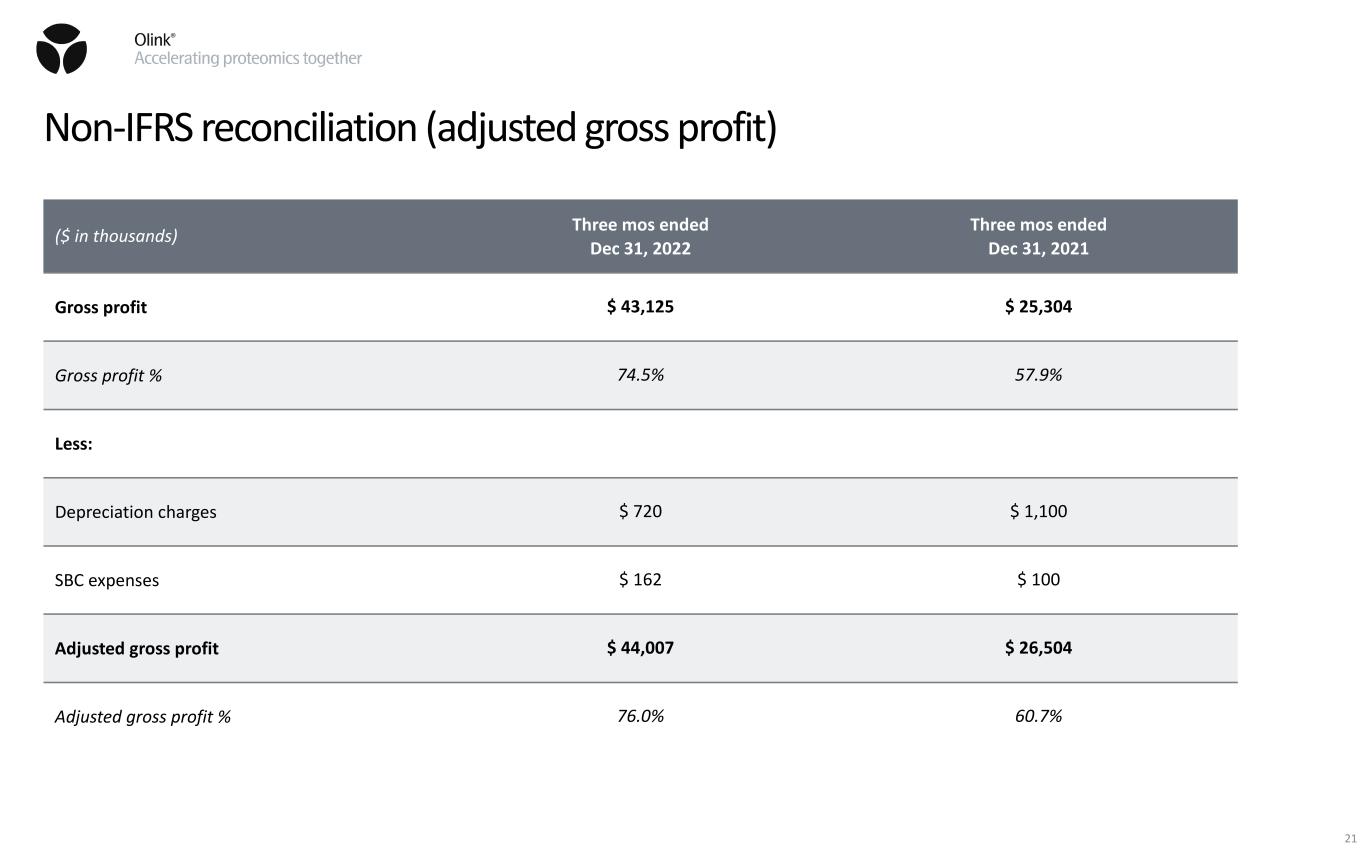

Non-IFRS reconciliation (adjusted gross profit) ($ in thousands) Three mos ended Dec 31, 2022 Three mos ended Dec 31, 2021 Gross profit $ 43,125 $ 25,304 Gross profit % 74.5% 57.9% Less: Depreciation charges $ 720 $ 1,100 SBC expenses $ 162 $ 100 Adjusted gross profit $ 44,007 $ 26,504 Adjusted gross profit % 76.0% 60.7% 21

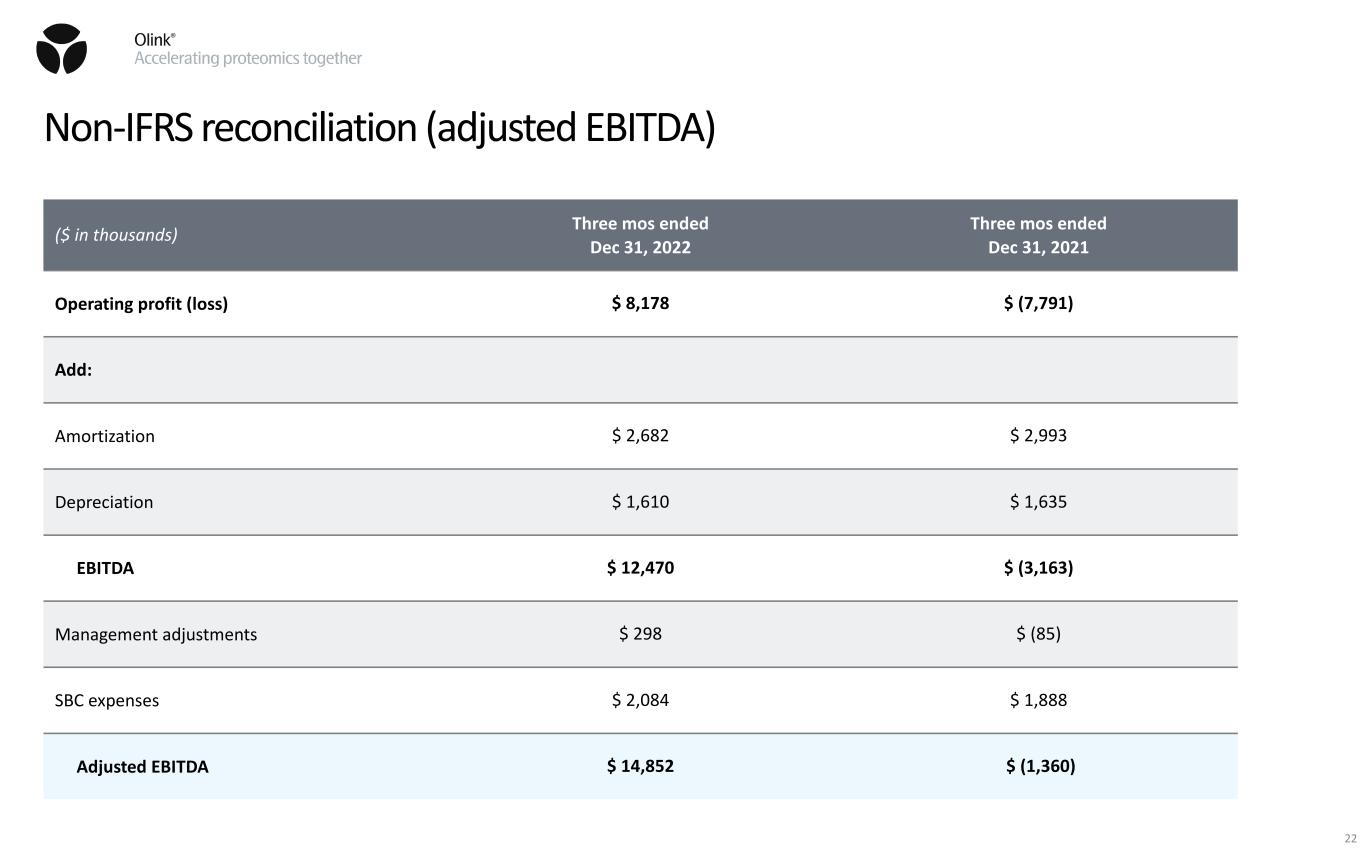

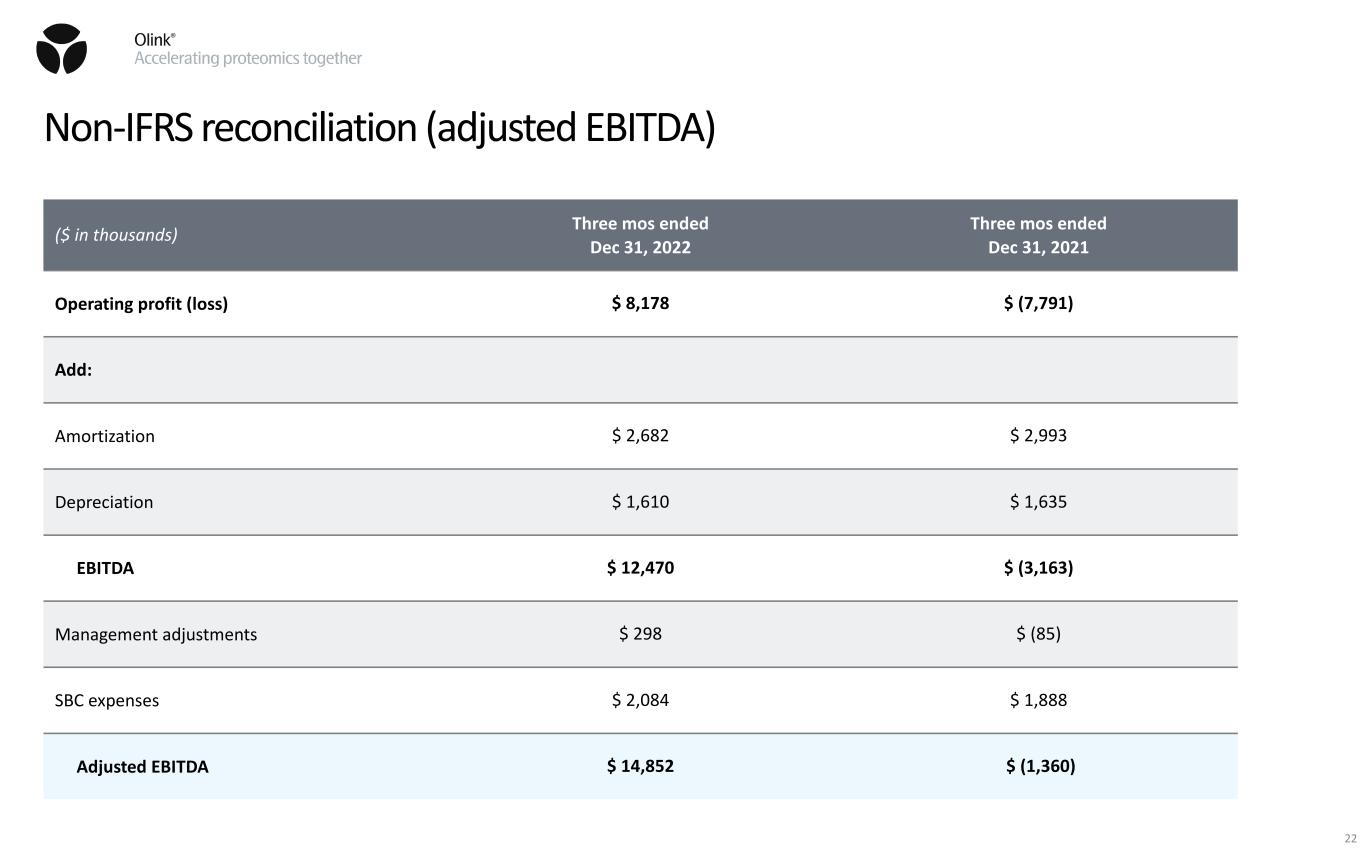

Non-IFRS reconciliation (adjusted EBITDA) ($ in thousands) Three mos ended Dec 31, 2022 Three mos ended Dec 31, 2021 Operating profit (loss) $ 8,178 $ (7,791) Add: Amortization $ 2,682 $ 2,993 Depreciation $ 1,610 $ 1,635 EBITDA $ 12,470 $ (3,163) Management adjustments $ 298 $ (85) SBC expenses $ 2,084 $ 1,888 Adjusted EBITDA $ 14,852 $ (1,360) 22

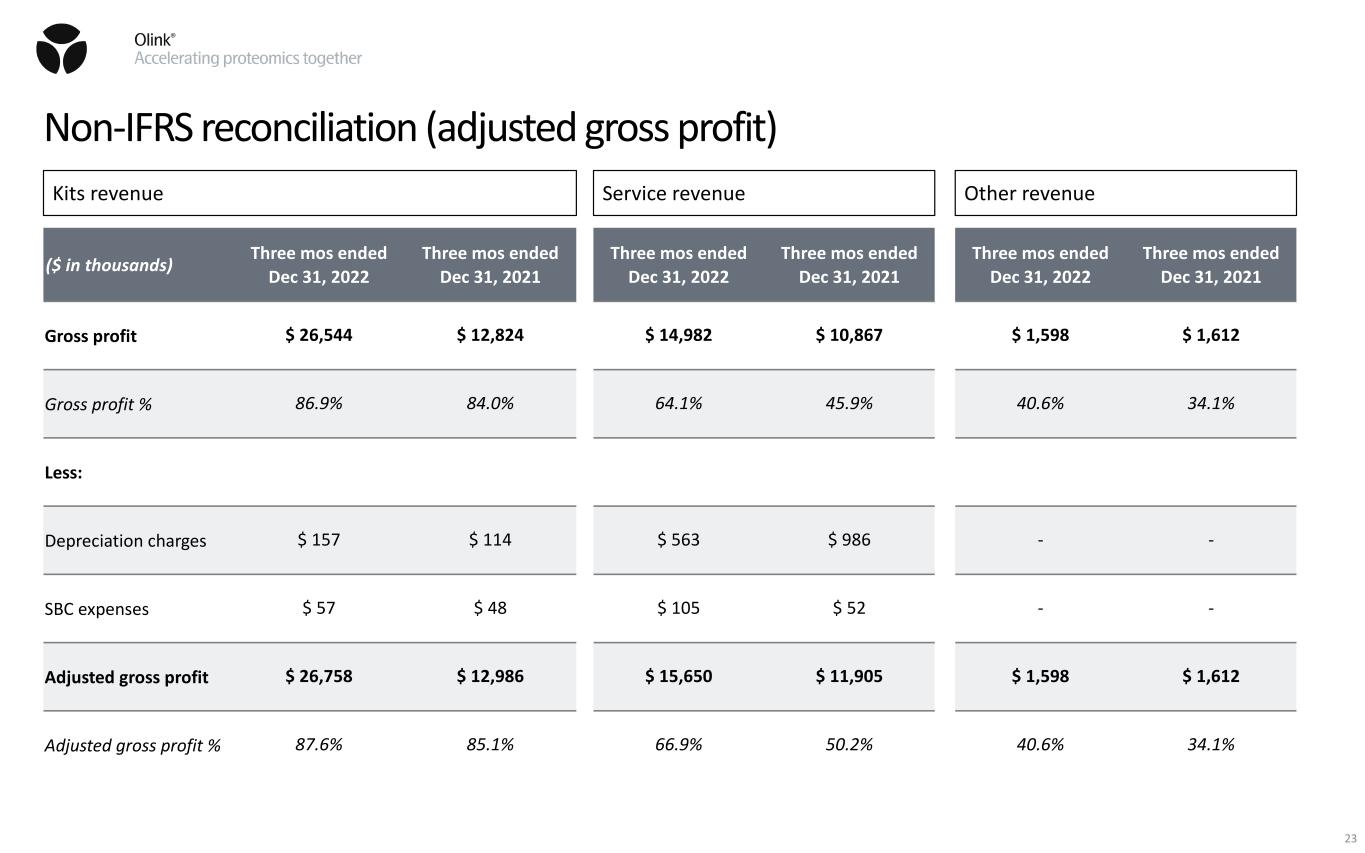

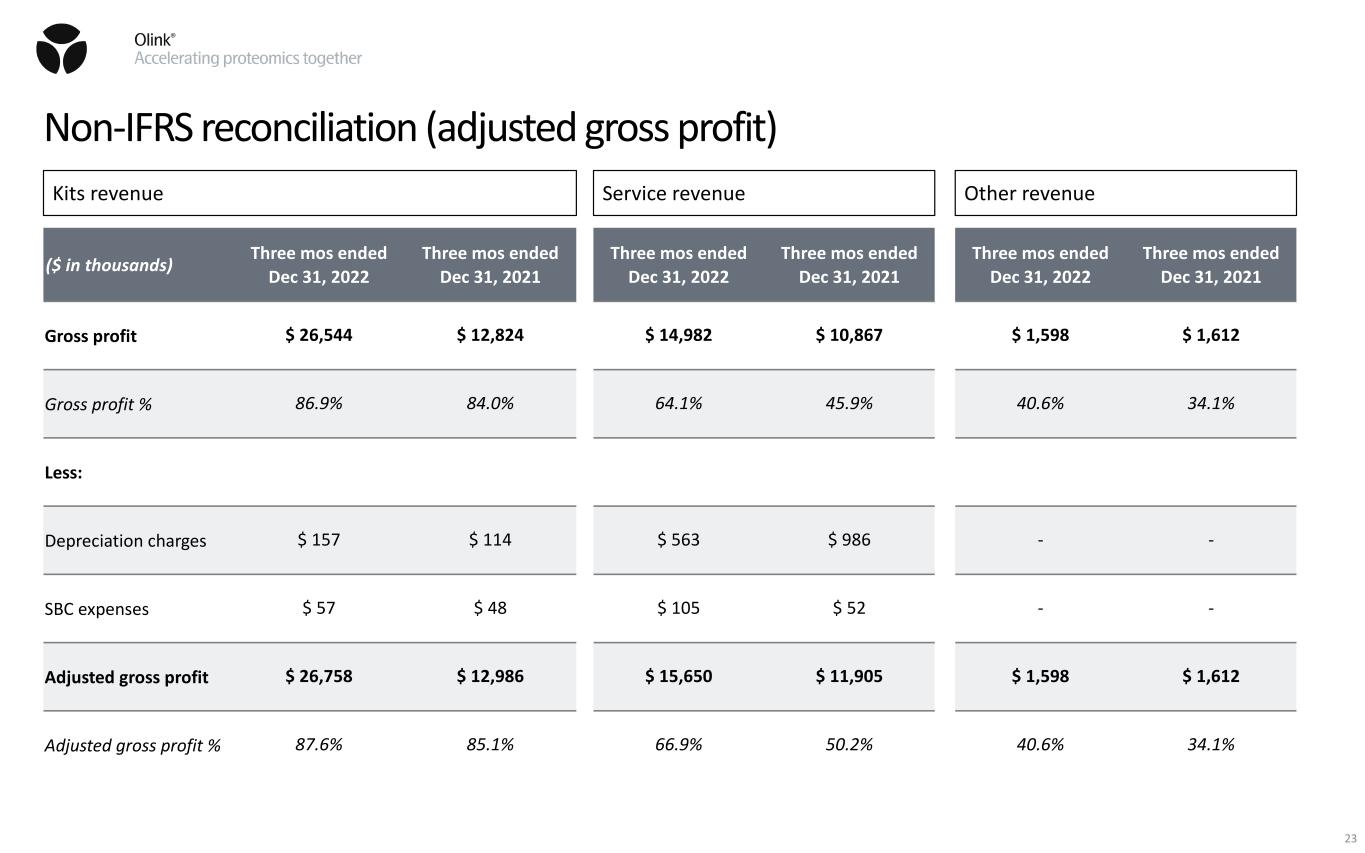

Non-IFRS reconciliation (adjusted gross profit) ($ in thousands) Three mos ended Dec 31, 2022 Three mos ended Dec 31, 2021 Gross profit $ 26,544 $ 12,824 Gross profit % 86.9% 84.0% Less: Depreciation charges $ 157 $ 114 SBC expenses $ 57 $ 48 Adjusted gross profit $ 26,758 $ 12,986 Adjusted gross profit % 87.6% 85.1% Three mos ended Dec 31, 2022 Three mos ended Dec 31, 2021 $ 14,982 $ 10,867 64.1% 45.9% $ 563 $ 986 $ 105 $ 52 $ 15,650 $ 11,905 66.9% 50.2% Three mos ended Dec 31, 2022 Three mos ended Dec 31, 2021 $ 1,598 $ 1,612 40.6% 34.1% - - - - $ 1,598 $ 1,612 40.6% 34.1% Kits revenue Service revenue Other revenue 23