Q2 2024 Investor Update August 2024

Disclaimer This presentation and any related oral presentation do not constitute an offer or invitation to subscribe for, purchase or otherwise acquire any securities or other instruments of Better Home & Finance Holding Company ("Better" or the "Company") and nothing contained herein or its presentation shall form the basis of any offer, contract or commitment whatsoever. The distribution of this presentation and any related oral presentation in certain jurisdictions may be restricted by law and persons into whose possession this presentation or any related oral presentation comes should inform themselves about, and observe, any such restriction. Any failure to comply with these restrictions may constitute a violation of the laws of any such other jurisdiction Forward Looking Statements This presentation contains certain forward-looking statements within the meaning of federal securities laws. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this communication. Such factors can be found in the most recent annual report on Form 10-K, quarterly report on Form 10-Q and current reports on Form 8-K of Better Home & Finance Holding Company (“Better” or the “Company"), which are available, free of charge, at the SEC’s website at www.sec.gov. New risks and uncertainties arise from time to time, and it is impossible for Better to predict these events or how they may affect us. You are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made, and Better undertakes no obligation, except as required by law, to update or revise the forward-looking statements, whether as a result of new information, changes in expectations, future events or otherwise. Amounts described as of and for the quarter ended June 30, 2024 represent a preliminary estimate as of the date of this presentation and may be revised upon filing our Quarterly Report on Form 10-Q with the SEC. More information as of and for the quarter ended June 30, 2024 will be provided upon filing our Quarterly Report on Form 10-Q with SEC. Use of Non-GAAP Measures and Other Financial Metrics This presentation includes certain financial measures not presented in accordance with generally accepted accounting principles (“GAAP”), including Adjusted Net Income (Loss), Adjusted EBITDA and other key metrics. We calculate Adjusted Net Income (Loss) as net income (loss) adjusted for the impact of stock-based compensation expense, change in the fair value of warrants, change in the fair value of bifurcated derivative, and other non-core operational expenses. We calculate Adjusted EBITDA as net income (loss) adjusted for the impact of stock-based compensation expense, change in the fair value of warrants, change in the fair value of bifurcated derivative, and other non-recurring or non-core operational expenses, as well as interest and amortization on non-funding debt (which includes interest on the Convertible Note (as defined in our Form 10-Q)), depreciation and amortization expense, and income tax expense. These non-GAAP financial measures should not be considered in isolation and are not intended to be a substitute for any GAAP financial measures. These non- GAAP measures provide supplemental information that we believe helps investors better understand our business, our business model and how we analyze our performance. We also believe these non-GAAP financial measures improve investors’ and analysts’ ability to compare our results with those of our competitors and other similarly situated companies, which commonly disclose similar performance measures. However, our calculation of Adjusted EBITDA and Adjusted Net Income (Loss) may not be comparable to similarly titled performance measures presented by other companies. Further, although we use these non-GAAP measures to assess the financial performance of our business, these measures exclude certain substantial costs related to our business, and investors are cautioned not to use such measures as a substitute for financial results prepared according to GAAP. Non-GAAP financial measures have limitations in their usefulness to investors because they have no standardized meaning prescribed by GAAP and are not prepared under any comprehensive set of accounting rules or principles. As a result, non- GAAP financial measures should be viewed as supplementing, and not as an alternative or substitute for, our financial results prepared and presented in accordance with GAAP. For a reconciliation of non-GAAP measures used in this presentation to the closest comparable GAAP measures, see the “Reconciliation of Non-GAAP Measures” section of this presentation. Key Metrics In this presentation, we refer to the following key metrics: Funded Loan Volume represents the aggregate dollar amount of all loans funded in a given period based on the principal amount of the loan at funding. Refinance Loan Volume represents the aggregate dollar amount of refinance loans funded in a given period based on the principal amount of the loan at refinancing date. Purchase Loan Volume represents the aggregate dollar amount of purchase loans funded in a given period based on the principal amount of the loan at purchase date. HELOC Loan Volume represents the aggregate dollar amount of HELOC and closed-end second lien loans funded in a given period based on the principal amount of the loan at funding. D2C Loan Volume represents the aggregate dollar amount of loans funded in a given period based on the principal amount of the loan at funding that have been generated from direct interactions with customers using all marketing channels other than our B2B partner relationships. B2B Loan Volume represents the aggregate dollar amount of loans funded in a given period based on the principal amount of the loan at funding that have been generated through one of our B2B partner relationships. Total Loans represents the total number of loans funded in a given period, including purchase loans, refinance loans, HELOC loans and closed-end second lien loans. Self-Funded Loans represents Mortgage loans held for sale, at fair value as presented on the Consolidated Balance Sheets less Warehouse lines of credit as presented on the Consolidated Balance Sheets. Use of Data The data contained herein is derived from various internal and external sources we believe to be reliable. No representation is made as to the reasonableness of the assumptions within or the accuracy or completeness of any projections or modeling or any other information contained herein. Accordingly, any liability in respect of the information contained herein or in respect of this presentation (including in respect of direct, indirect or consequential loss or damage) is expressly disclaimed. Any data on past performance or modeling contained herein is not an indication as to future performance, and the Company disclaims any obligation, except as required by law, to update or revise the information in this presentation, whether as a result of new information, future events or otherwise. 2

Executive Summary Large and Attractive Market Opportunity • Through cycles, U.S. home finance market is $3 trillion per year • Existing process is manual, costly and slow • Digital disruption is underway and accelerating Technology & Business Model Competitive Advantage Demonstrated Growth & Expense Discipline Well-Capitalized and Positioned for the Future • End-to-end proprietary origination technology powers faster, cheaper customer experience, lower manufacturing costs, and industry-leading products • Multiple distribution channels – D2C and B2B Partners (“Mortgage-as- a-Service”) • Reduced balance sheet and credit risk with large majority of Total Loans eligible for purchase by GSEs • In Q2’24, grew Funded Loan Volume 45% from Q1’24 and 83% from Q4’23 • In Q2’24, Total Expenses remained approximately flat to Q1’24 • Demonstrated growth through continued challenging market environment and concurrent expense discipline • Ended Q2’24 with $507 million of cash, restricted cash, short-term investments, and self-funded loans1 • Clear product roadmap and defined growth initiatives supported by differentiated technology and existing competitive advantage • Expect to continue leaning into growth while managing towards profitability in the medium term 1. Includes $321 million of Cash and Cash Equivalents, $26 million of Restricted Cash, $58 million of Short-term investments, and $102 million self-funded loans, as defined by Mortgage loans held for sale, at fair value less Warehouse lines of credit as of June 30, 2024 3

Our Vision Relentlessly making homeownership Better for our customers Faster Cheaper+ Better= Description Home Finance Full range of mortgage and home equity loan products LAUNCHED Jan 2016 One Day Mortgage Enhanced traditional mortgage product offering faster certainty LAUNCHED 1H 2023 Buy & Sell Homes Real estate agent matching engine LAUNCHED Nov 2018 Title One-click title policy matching service LAUNCHED Feb 2019 Homeowners Insurance One-click Homeowners Insurance policy matching service LAUNCHED Jan 2019 Our Progress Under one roof, with one-click, at the lowest price Powered by our proprietary technology, Tinman, and customer and property data HELOC Monetize home equity without resetting your rate LAUNCHED 1H 2023 Large and Attractive Market Opportunity 4 Consumer Banking Banking services offered in the U.K. through Bank of Birmingham ACQUIRED 1H 2023

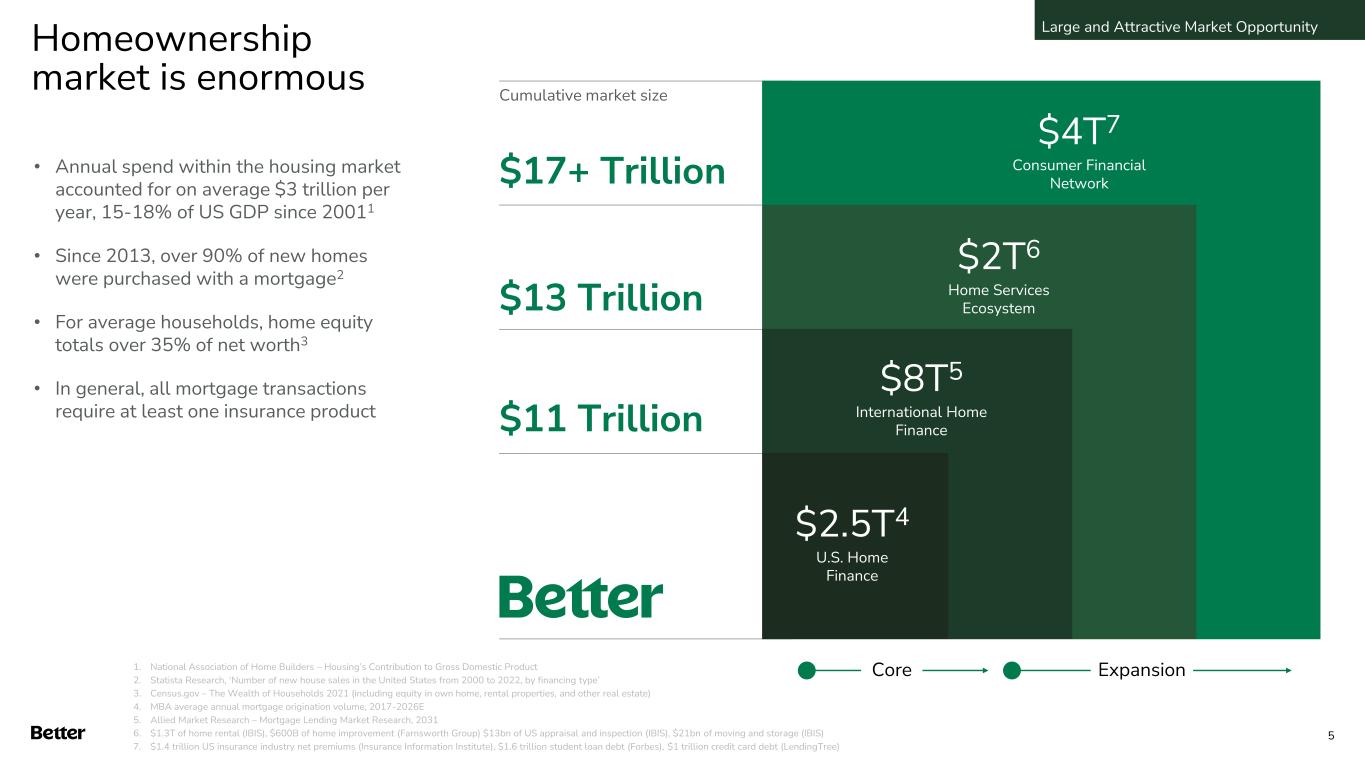

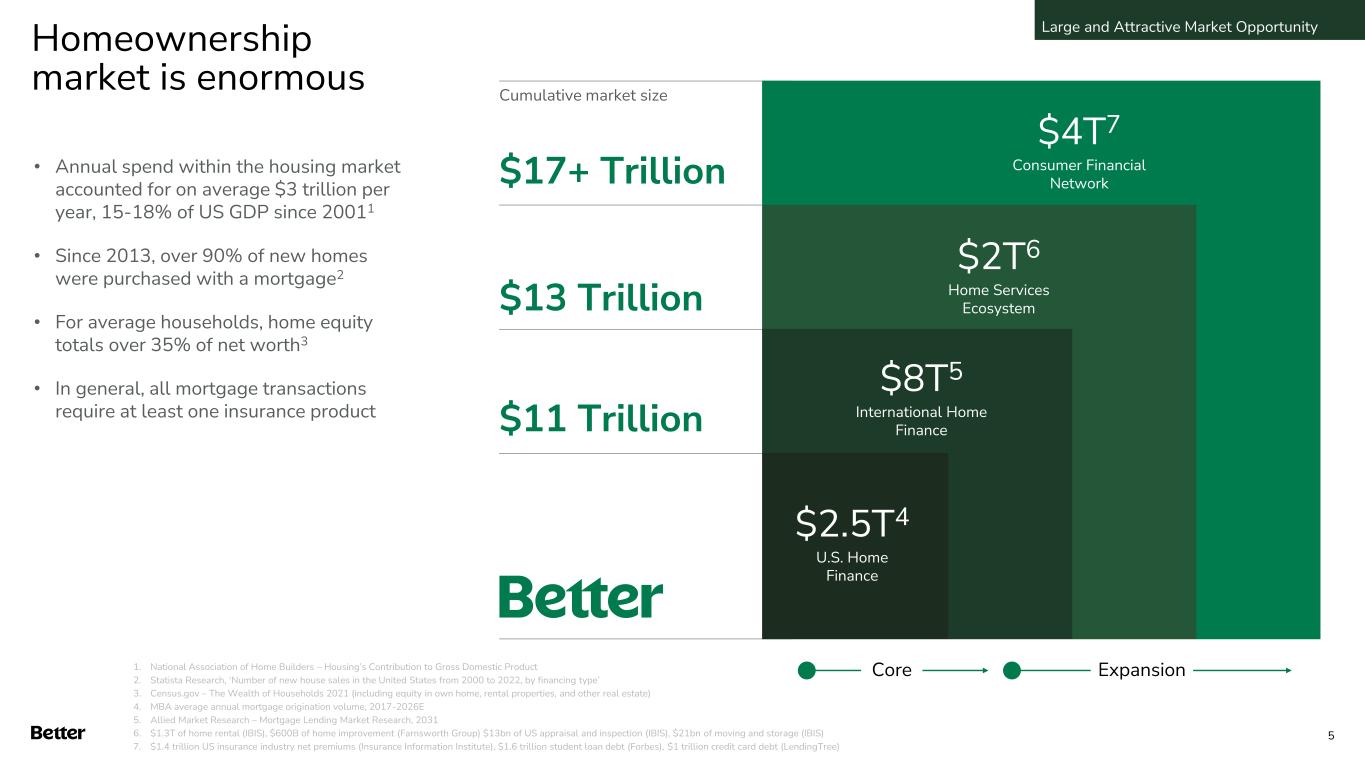

Homeownership market is enormous $11 Trillion $13 Trillion $17+ Trillion ~4T2 Financial Network ~2T Insurance (Title & Home) ~33tn U.S. Housing Market ~11tn1 U.S. Mortgage Core Expansion $ 7 Consumer Financial Network $2.5T4 U.S. Home Finance $8T5 International Home Finance $2T6 Home Services Ecosystem Cumulative market size 1. National Association of Home Builders – Housing’s Contribution to Gross Domestic Product 2. Statista Research, ‘Number of new house sales in the United States from 2000 to 2022, by financing type’ 3. Census.gov – The Wealth of Households 2021 (including equity in own home, rental properties, and other real estate) 4. MBA average annual mortgage origination volume, 2017-2026E 5. Allied Market Research – Mortgage Lending Market Research, 2031 6. $1.3T of home rental (IBIS), $600B of home improvement (Farnsworth Group) $13bn of US appraisal and inspection (IBIS), $21bn of moving and storage (IBIS) 7. $1.4 trillion US insurance industry net premiums (Insurance Information Institute), $1.6 trillion student loan debt (Forbes), $1 trillion credit card debt (LendingTree) • Annual spend within the housing market accounted for on average $3 trillion per year, 15-18% of US GDP since 20011 • Since 2013, over 90% of new homes were purchased with a mortgage2 • For average households, home equity totals over 35% of net worth3 • In general, all mortgage transactions require at least one insurance product Large and Attractive Market Opportunity 5

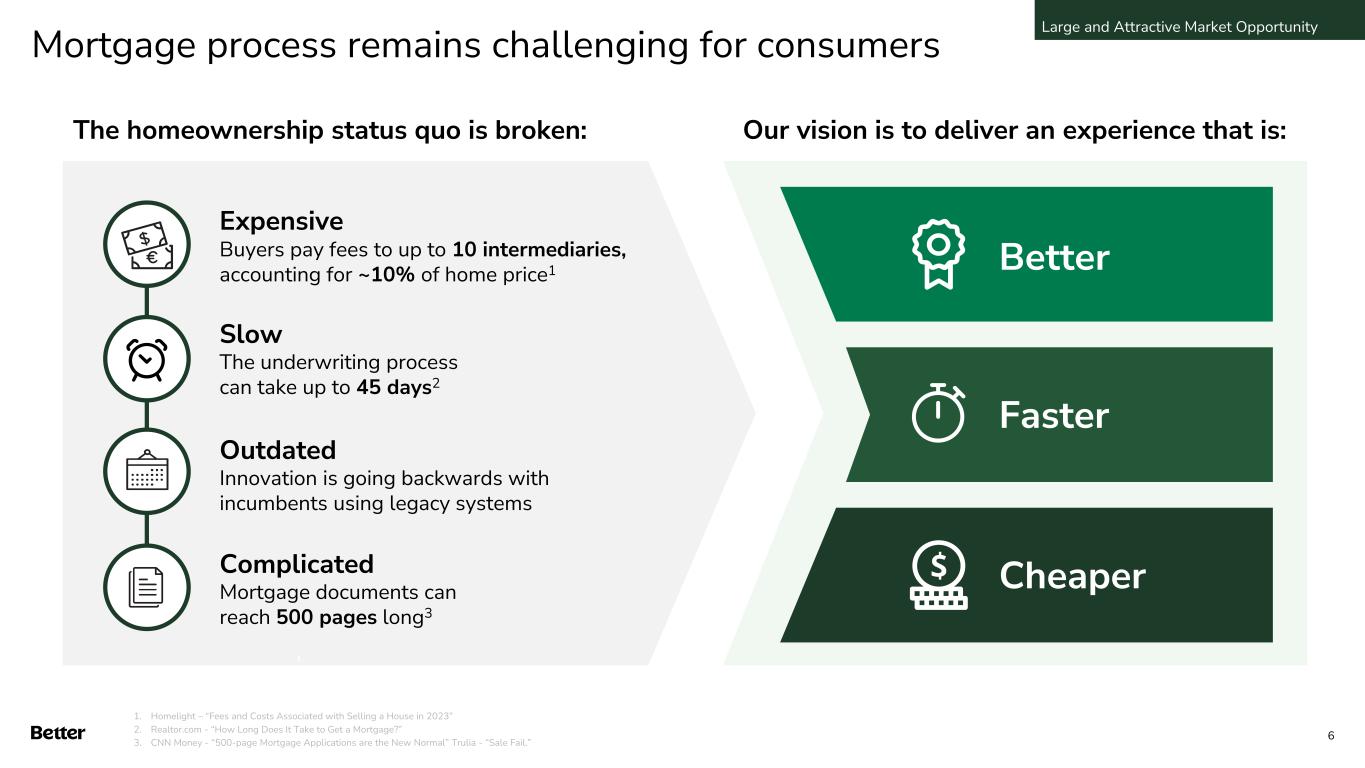

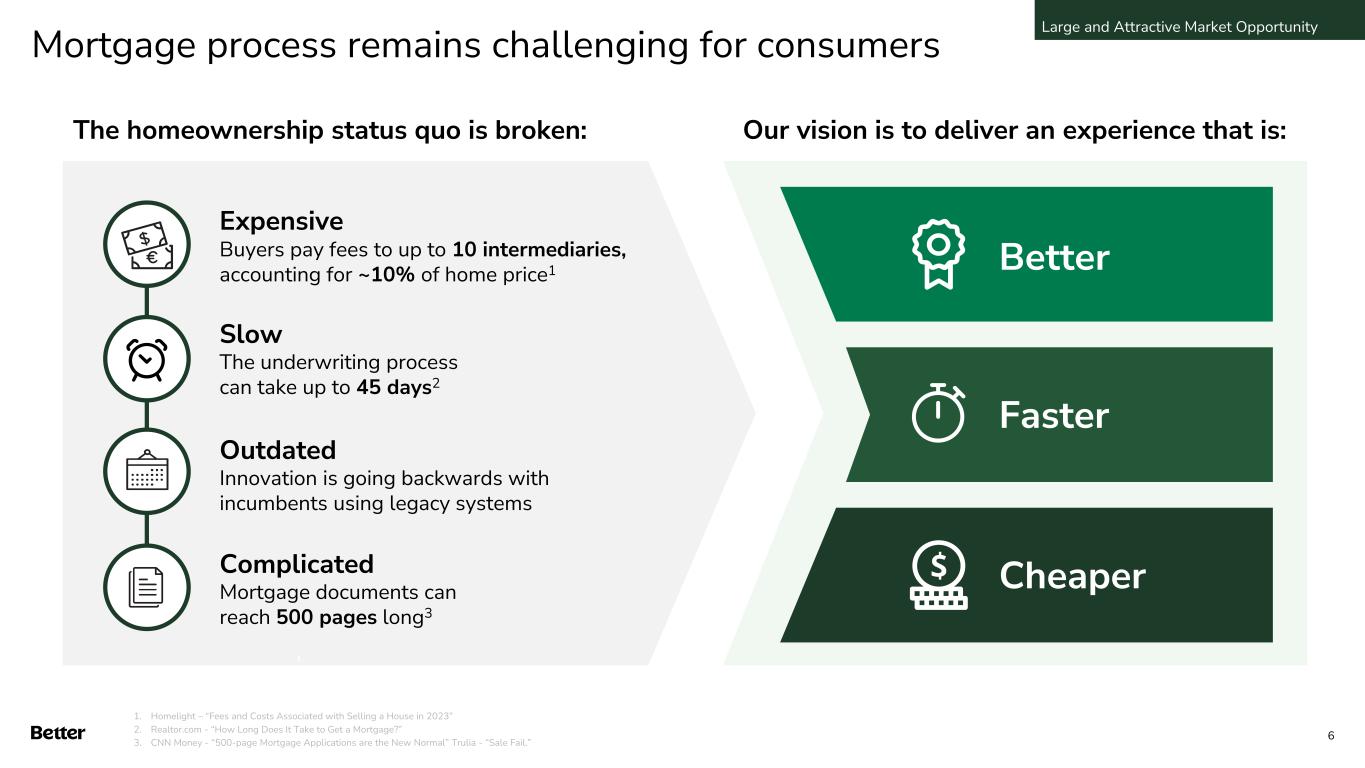

Mortgage process remains challenging for consumers 1. Homelight – “Fees and Costs Associated with Selling a House in 2023” 2. Realtor.com - “How Long Does It Take to Get a Mortgage?” 3. CNN Money - “500-page Mortgage Applications are the New Normal” Trulia - “Sale Fail.” Large and Attractive Market Opportunity The homeownership status quo is broken: Our vision is to deliver an experience that is: Expensive Buyers pay fees to up to 10 intermediaries, accounting for ~10% of home price1 Slow The underwriting process can take up to 45 days2 Outdated Innovation is going backwards with incumbents using legacy systems Complicated Mortgage documents can reach 500 pages long3 Better Faster Cheaper 6

Our end-to-end proprietary technology, Tinman, powers our digital competitive advantage Home finance lifecycle Better Real Estate Better Title and Settlement Services Better Insurance Manual tasks to non- licensed team members Customer-facing tasks to licensed team members D2C B2B Better Team Members Loan Purchasers Buy Refi Cash- out HELOC Tinman is the backbone that drives our better, faster and cheaper customer experience Technology & Business Model 7

Our proprietary technology delivers tangible results Better Customer Experience Get certainty on mortgage eligibility and terms within 24-hours Lower Rates, Higher Approvals for Customers Pass technology cost savings through to the customers Increased labor productivity & lower labor cost Automation drives higher output and ability to leverage less specialized labor Flexibly launch new products to meet market demand Launched HELOC in Q1’23 and dramatically scaled locked volume to meet market demand 1 Superior loan quality Outperforming industry on defect and delinquency rates 1H 2023 1.3% 1.8% Post Closing Defect Rate3,6 2020 2023 Purchase Approval Rate 66% 75%10 hours Average Commitment Letter turnaround since program launch in Q1’23 Avg. from 2018 - 2023 4.43% 4.70% Average Rate on Fixed 30-yr Fannie Conforming Mortgage1,5 Closings per US Fulfillment Employee per Month2 HELOC Locks per Week Q1’23 (Launch) 13 Q2’24 174 1. Industry Source: MBA Weekly Application Survey - MBA: FRM 30-Year Contract Interest Rate and Points 2. Calculated as average Total Loans per month in Q2’24 divided by Better US fulfillment team members as of June 30, 2024. Industry Avg. Source: MBA Q1 2023 Market Performance Report (latest available) 3. Industry Source: ACES Quality Management: Mortgage QC Industry Trends, Q2 2023 4. Defined as percent of total D2C loans funded excluding HELOC loans in Q4 2023 5. Data updated annually 6. Represents latest available data Better Industry Average Technology & Business Model 10.2 4.8 Q2’24 2 3 4 5 8 Q1’24 Represented 84% of Q2’24 D2C loans

Tinman powers Better and our partners D2C Own entire customer experience end-to-end ✓ Direct customer acquisition ✓ Low-cost value proposition ✓ Better-branded, high quality customer experience Mortgage-as-a-Service (B2B) Zero-CAC, co-branding or white-label solutions ✓ Same digital-first experience as D2C ✓ Strong brand affinity ✓ Powered 100% by Better technology ✓ Provide bespoke experience by combining existing solutions and customizing functionality ✓ Piloting multiple B2B programs, including early-stage partnership with a national roofing and basement contractor for Better’s One Day HELOC and Closed End Home Equity Loan products Reduce costs, improve experience, improve quality Technology & Business Model 9

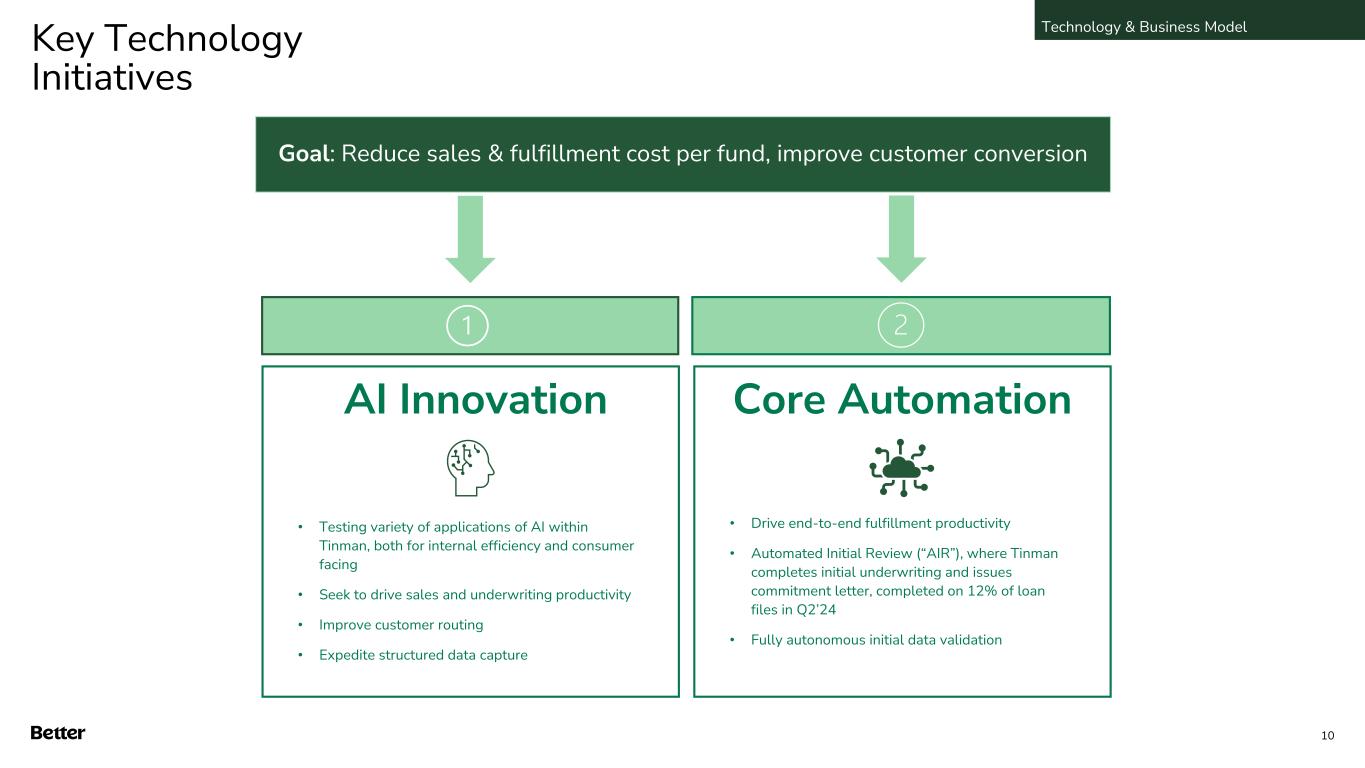

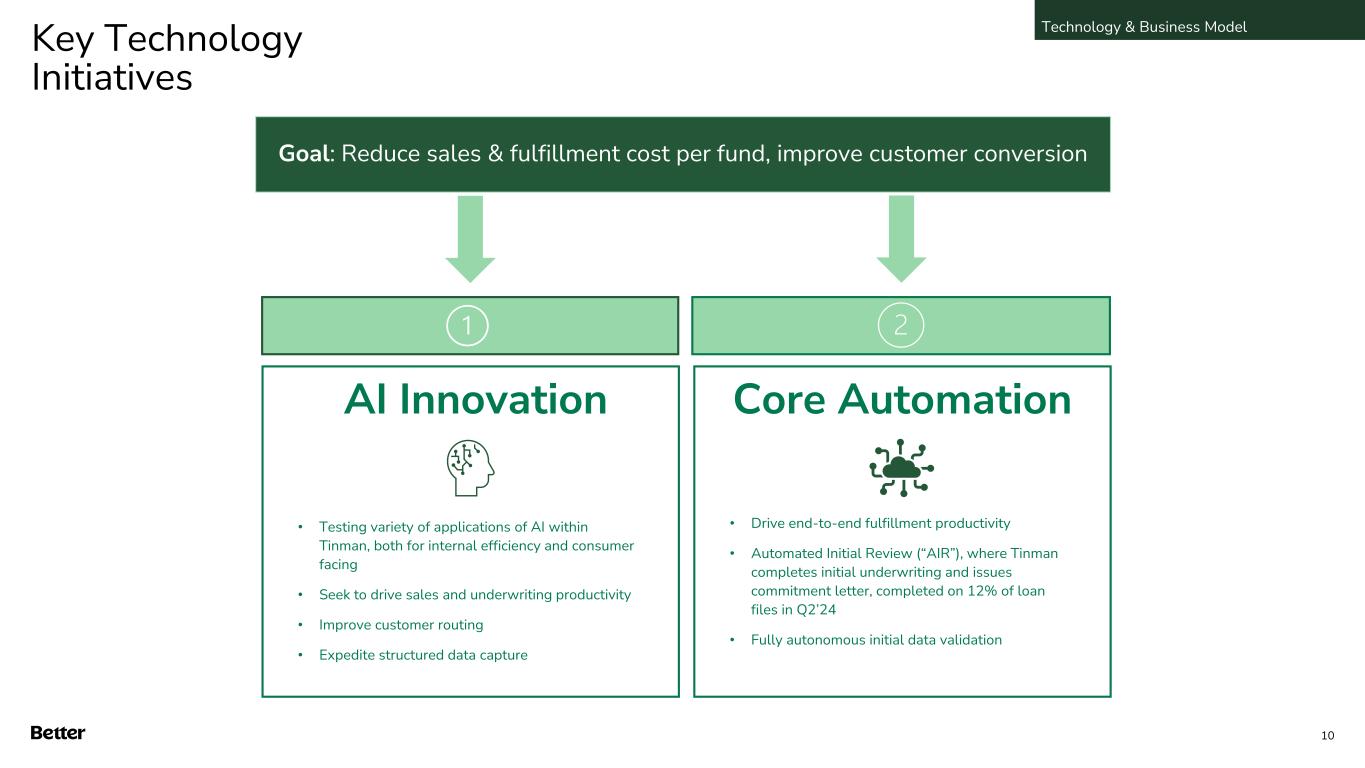

Key Technology Initiatives 10 AI Innovation Core Automation • Testing variety of applications of AI within Tinman, both for internal efficiency and consumer facing • Seek to drive sales and underwriting productivity • Improve customer routing • Expedite structured data capture • Drive end-to-end fulfillment productivity • Automated Initial Review (“AIR”), where Tinman completes initial underwriting and issues commitment letter, completed on 12% of loan files in Q2’24 • Fully autonomous initial data validation and calculations Goal: Reduce sales & fulfillment cost per fund, improve customer conversion Technology & Business Model

Q4’23 $69 Q1’24 $74 Total Expenses ($ millions) $73 Through growth, expenses relatively flat since Q4’23 Managing towards profitability while growing through improved technology efficiency and corporate cost reductions to offset increased growth expenses …and managing expenses while growing We are leaning into growth… Funded Loan Volume ($ millions) Q4’23 $527 Q1’24 $661 Q2’24 $962 Q3’24E $1,000+ 83% origination volume growth since Q4’23 Demonstrated Growth & Discipline 11 Q2’24

Second Quarter 2024 Financial Review • Continued leaning into growth while managing expenses through a challenging mortgage macro environment with average 30-year fixed mortgage rates above 7% through the first half of 2024 • Funded loan volume and revenue growth driven by home equity (which includes HELOCs and closed-end second lien loans), and purchase growth • Revenue increase 41% from Q1’24 to approximately $31 million • Q2’24 revenue included approximately $9 million of nonrecurring benefits, including a positive mark-to-market impact on our lock pipeline, and a recovery from a release of our Loan Repurchase Reserve • Total Expenses of approximately $73 million were flat compared to Q1’24, with increases to marketing spend and production team compensation being offset by lower vendor and corporate compensation expenses • Q2’24 expenses included approximately $1 million of nonrecurring benefits, including reductions in certain reserves and a refund of a state tax refund • GAAP Net Loss improved to approximately $42 million in Q2’24 from a loss of $51 million in Q1’24 • Adjusted EBITDA loss improved to approximately $25 million in Q2’24 from a loss of $31 million in Q1’24 $962 million Funded Loan Volume Key Financial Highlights Q2’24 Statistics 83% Purchase Volume 70% D2C Volume 2,995 Total Loans 9% HELOC Volume 2.43% Gain on Sale Margin Demonstrated Growth & Discipline 12

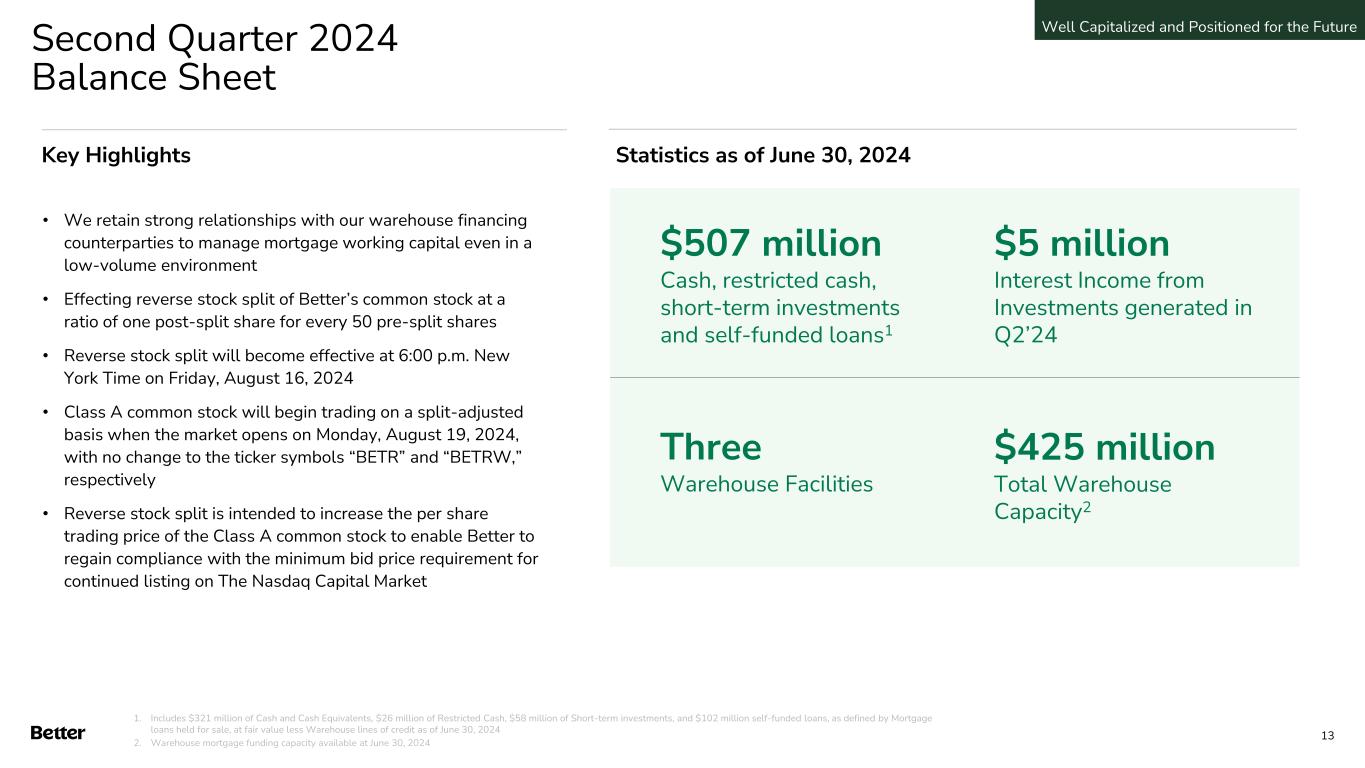

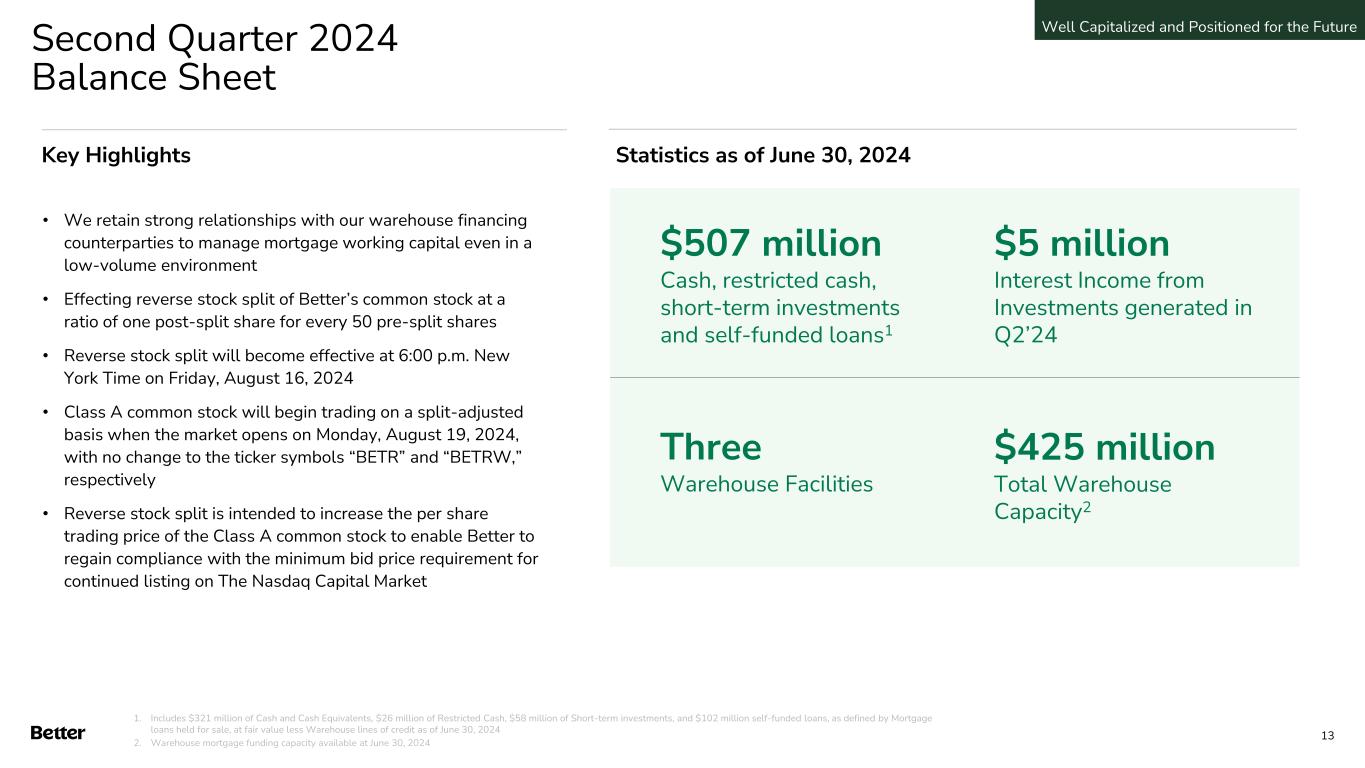

1. Includes $321 million of Cash and Cash Equivalents, $26 million of Restricted Cash, $58 million of Short-term investments, and $102 million self-funded loans, as defined by Mortgage loans held for sale, at fair value less Warehouse lines of credit as of June 30, 2024 2. Warehouse mortgage funding capacity available at June 30, 2024 Second Quarter 2024 Balance Sheet • We retain strong relationships with our warehouse financing counterparties to manage mortgage working capital even in a low-volume environment • Effecting reverse stock split of Better’s common stock at a ratio of one post-split share for every 50 pre-split shares • Reverse stock split will become effective at 6:00 p.m. New York Time on Friday, August 16, 2024 • Class A common stock will begin trading on a split-adjusted basis when the market opens on Monday, August 19, 2024, with no change to the ticker symbols “BETR” and “BETRW,” respectively • Reverse stock split is intended to increase the per share trading price of the Class A common stock to enable Better to regain compliance with the minimum bid price requirement for continued listing on The Nasdaq Capital Market Key Highlights Statistics as of June 30, 2024 $507 million Cash, restricted cash, short-term investments and self-funded loans1 $5 million Interest Income from Investments generated in Q2’24 Three Warehouse Facilities $425 million Total Warehouse Capacity2 Well Capitalized and Positioned for the Future 13

Focus on Target Opportunities Funnel Conversion • Increase pull-through on approximately 60,000 monthly mortgage application starts through product & service enhancements • Strengthen relationships with real estate agents to improve purchase distribution • Continue hiring experienced Loan Officers with demonstrated customer service track records on highly variable, low fixed compensation plans to align incentives with business outcomes Acquisition Channel Diversification Continued Investment in Automation Fixed Cost Reduction for Improved Profitability • Increase acquisition spend in performing channels, while cautiously investing in new channels and brand marketing • Onboard additional B2B partners, leaning into home equity demand • Persist through extended B2B sales cycles given our platform advantage and favorable medium-term trends of banks and others exiting mortgage • Investments made over the past three years enable operating leverage as we grow, where we expect to grow revenue faster than expenses • Continued investments in One Day Mortgage to make customer experience highly automated and best in class • Continued investments in AI to reduce labor cost and customer time spent • Continued re-evaluation of vendor costs and criticality • Continued targeted reductions in corporate overheads • Sustain well capitalized positioning by cautiously managing liquidity Well Capitalized and Positioned for the Future 14

2H’24 Outlook: Continue leaning into growth while maintaining cost discipline • Continue leaning into growth with initiatives to increase Funded Loan Volume and market share • Continued disciplined cost management to target medium-term profitability Key Expectation Impacted FY2024 Metric versus FY2023 Total Expenses • Increase marketing spend in highest-returning channels to drive increased volume, particularly on purchase and second lien products • Continue adding origination capacity through hiring of experienced loan officers on low-fixed, highly-variable compensation plans Funded Loan Volume • Continued investments in AI and automation to improve Tinman • Continued investments in purchase and real estate agent relationships Conversion • Continued focused on adding partners and nurturing pipeline • Largest opportunities have multi-year sales and integration cycles • Expect 2024 growth to be driven by the D2C channel MaaS Prospects • Targeted marketing around enabling customers to flexibly tap into home equity during rate environment uncertainty through second lien and cash-out refinance products • Demonstrate positive results in B2B home equity pilot programs HELOC Volume Well Capitalized and Positioned for the Future 15We expect 2024 Revenue to increase and Adjusted EBITDA to improve vs. 2023

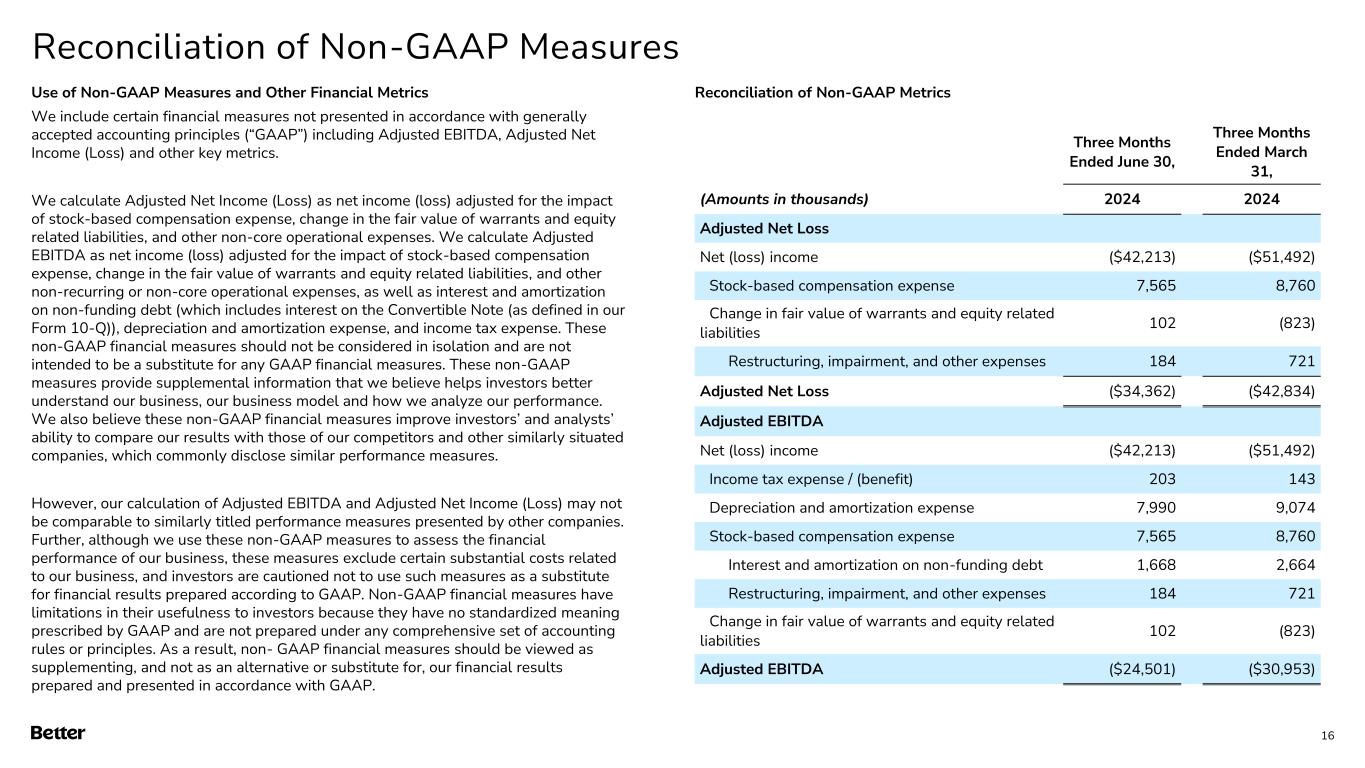

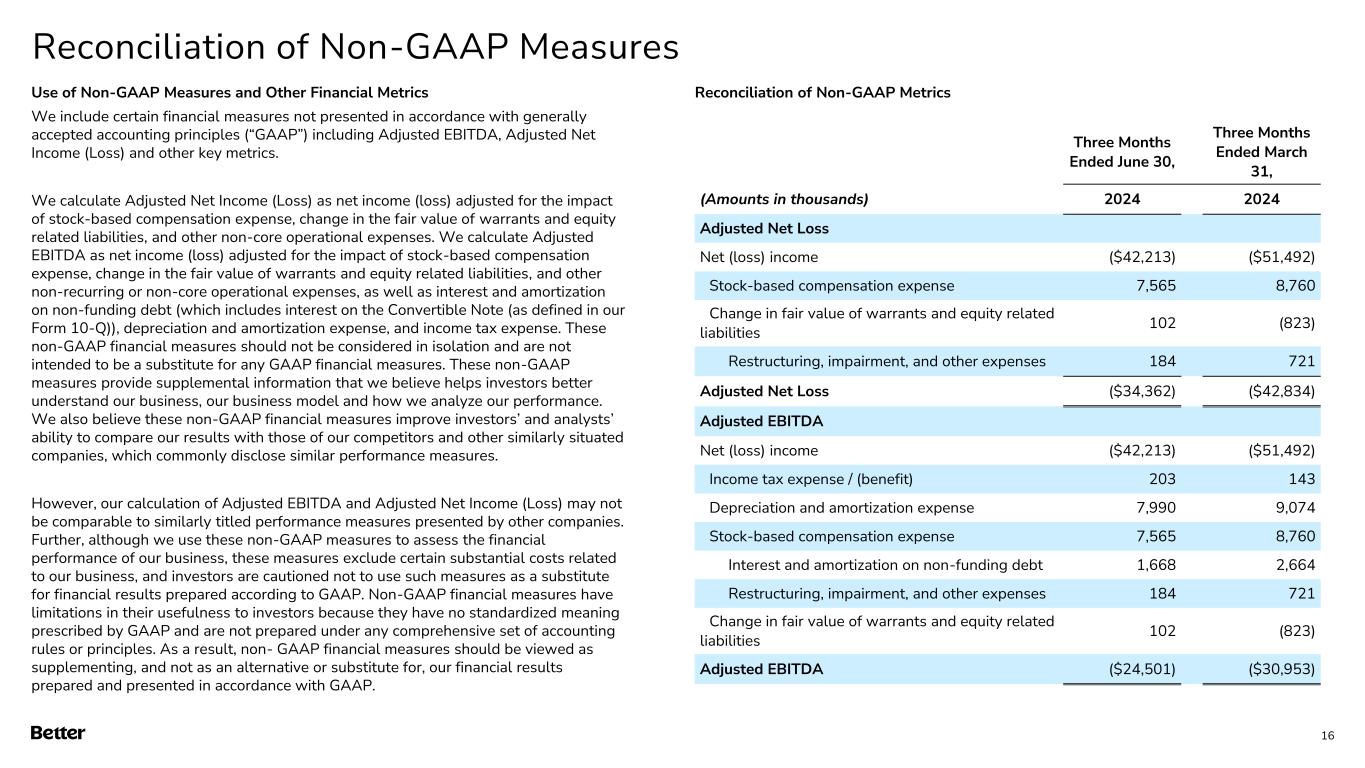

Reconciliation of Non-GAAP Measures 16 Use of Non-GAAP Measures and Other Financial Metrics We include certain financial measures not presented in accordance with generally accepted accounting principles (“GAAP”) including Adjusted EBITDA, Adjusted Net Income (Loss) and other key metrics. We calculate Adjusted Net Income (Loss) as net income (loss) adjusted for the impact of stock-based compensation expense, change in the fair value of warrants and equity related liabilities, and other non-core operational expenses. We calculate Adjusted EBITDA as net income (loss) adjusted for the impact of stock-based compensation expense, change in the fair value of warrants and equity related liabilities, and other non-recurring or non-core operational expenses, as well as interest and amortization on non-funding debt (which includes interest on the Convertible Note (as defined in our Form 10-Q)), depreciation and amortization expense, and income tax expense. These non-GAAP financial measures should not be considered in isolation and are not intended to be a substitute for any GAAP financial measures. These non-GAAP measures provide supplemental information that we believe helps investors better understand our business, our business model and how we analyze our performance. We also believe these non-GAAP financial measures improve investors’ and analysts’ ability to compare our results with those of our competitors and other similarly situated companies, which commonly disclose similar performance measures. However, our calculation of Adjusted EBITDA and Adjusted Net Income (Loss) may not be comparable to similarly titled performance measures presented by other companies. Further, although we use these non-GAAP measures to assess the financial performance of our business, these measures exclude certain substantial costs related to our business, and investors are cautioned not to use such measures as a substitute for financial results prepared according to GAAP. Non-GAAP financial measures have limitations in their usefulness to investors because they have no standardized meaning prescribed by GAAP and are not prepared under any comprehensive set of accounting rules or principles. As a result, non- GAAP financial measures should be viewed as supplementing, and not as an alternative or substitute for, our financial results prepared and presented in accordance with GAAP. Reconciliation of Non-GAAP Metrics Three Months Ended June 30, Three Months Ended March 31, (Amounts in thousands) 2024 2024 Adjusted Net Loss Net (loss) income ($42,213) ($51,492) Stock-based compensation expense 7,565 8,760 Change in fair value of warrants and equity related liabilities 102 (823) Restructuring, impairment, and other expenses 184 721 Adjusted Net Loss ($34,362) ($42,834) Adjusted EBITDA Net (loss) income ($42,213) ($51,492) Income tax expense / (benefit) 203 143 Depreciation and amortization expense 7,990 9,074 Stock-based compensation expense 7,565 8,760 Interest and amortization on non-funding debt 1,668 2,664 Restructuring, impairment, and other expenses 184 721 Change in fair value of warrants and equity related liabilities 102 (823) Adjusted EBITDA ($24,501) ($30,953)

Thank You