Exhibit 99.2

March 2023 Learning Automation & Information Intelligence Platform www.ilearningengines.com

Disclaimers This confidential presentation (“Presentation”) is for informational purposes only. This Presentation has been prepared to assist interested parties in making their own evaluation with respect to a potential business combination between iLearningEngines, Inc. (“iLearningEngines”) and Arrowroot Acquisition Corp. (“Arrowroot”) and the related transactions (the “Proposed Business Combination”) and for no other purpose. This Presentation shall neither constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction. This Presentation is not an offer, or a solicitation of an offer, to buy or sell any investment or other specific product. Any offering of securities (the “Securities”) will not be registered under the Securities Act of 1933, as amended (the “Securities Act”). Accordingly, the Securities must continue to be held unless a subsequent disposition is exempt from the registration requirements of the Securities Act. Investors should consult with their counsel as to the applicable requirements for a purchaser to avail itself of any exemption under the Securities Act. The transfer of the Securities may also be subject to conditions set forth in an agreement under which they are to be issued. Investors should be aware that they might be required to bear the final risk of their investment for an indefinite period of time. Neither iLearningEngines, Arrowroot nor any of their respective affiliates, control persons, officers, directors, employees, representatives or advisors is making an offer of the Securities in any state where the offer is not permitted . This Presentation is intended solely for the purposes of familiarizing investors . To the extent the terms of any potential Proposed Business Combination are included in this Presentation, those terms are included for discussion purposes only . By participating in this Presentation, you acknowledge that you are (i) aware that the United States securities laws prohibit any person who has material, non - public information concerning a company from purchasing or selling securities of such company or from communicating such information to any other person under circumstances in which it is reasonably foreseeable that such person is likely to purchase or sell such securities, and (ii) familiar with the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder (collectively, the “Exchange Act”), and that you will neither use, nor cause any third party to use, this Presentation or any information contained herein in contravention of the Exchange Act, including, without limitation, Rule 10b - 5 thereunder. This Presentation relates to the potential financing of a portion of the Proposed Business Combination contemplated in this Presentation through a private placement of debt and equity securities. This Presentation shall not constitute a “solicitation” as defined in Section 14 of the Exchange Act. This Presentation contains proprietary and confidential information of iLearningEngines and Arrowroot, and the entire content should be considered “Confidential Information.” This Presentation is being delivered to you solely in your capacity as a potential investor in connection with the evaluation of the Proposed Business Combination. Any further distribution or reproduction of this Presentation, in whole or in part, or the divulgence of any of its contents, is unauthorized. By accepting the Presentation, each recipient of this Presentation and its directors, partners, officers, employees, attorneys, agents and representatives (“recipient”) shall maintain the confidentiality of the information contained herein and all otherwise non - public information disclosed by us, whether orally or in writing, during this Presentation or in these Presentation materials. You also agree not to distribute, disclose or use such information for any purpose, other than for the purpose of evaluating your participation in the Proposed Business Combination contemplated in this Presentation and to return to iLearningEngines and Arrowroot, delete or destroy this Presentation upon request. Neither iLearningEngines, Arrowroot, nor any of their respective affiliates, control persons, officers, directors, employees, representatives or advisors makes any representation or warranty, express or implied, as to the accuracy, completeness or reliability of the information contained herein, or any other written or oral information made available in the course of an evaluation of the Proposed Business Combination. This Presentation is not intended to be all - inclusive or to contain all the information that a person may desire in considering an investment in iLearningEngines or Arrowroot and is not intended to form the basis of any investment decision in iLearningEngines or Arrowroot, and any recipient should conduct its own independent analysis of iLearningEngines and Arrowroot and the data contained or referred to in this Presentation. The recipient acknowledges and agrees that the information contained in this Presentation is preliminary in nature and is subject to change, and any such changes may be material. iLearningEngines and Arrowroot assume no obligation to update or keep current the information contained in this Presentation, to remove any outdated information or to expressly mark it as being outdated. This Presentation does not constitute investment, tax, accounting or legal advice or a recommendation. You should consult your own legal, regulatory, tax, business, financial and accounting advisors to the extent you deem necessary, and you must make your own investment decision and perform your own independent investigation and analysis of an investment in iLearningEngines and Arrowroot and the Proposed Business Combination contemplated in this Presentation. To the fullest extent permitted by law, in no circumstances will iLearningEngines, Arrowroot, or any of their respective equityholders, affiliates, representatives, partners, directors, officers, employees, advisers, or agents be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from the use of this Presentation, its contents, its omissions, reliance on the information contained within it or on opinions communicated in relation thereto or otherwise arising in connection therewith. Industry and market data used in this Presentation have been obtained from third - party industry publications and sources as well as from research reports prepared for other purposes. Neither Arrowroot nor iLearningEngines has independently verified the data obtained from these sources and cannot assure you of the data’s accuracy or completeness. This data is subject to change. In addition, this Presentation does not purport to be all - inclusive or to contain all of the information that may be required to make a full analysis of iLearningEngines or the Proposed Business Combination. Viewers of this Presentation should each make their own evaluation of iLearningEngines, the Proposed Business Combination and of the relevance and adequacy of the information and should make such other investigations as they deem necessary. Any data on past performance or modeling contained herein are not an indication as to future performance. None of iLearningEngines, Arrowroot or any of their respective affiliates, control persons, officers, directors, employees, representatives or advisors assumes any obligation to update the information in this presentation. 2

Forward Looking Statements Certain statements included in this Presentation that are not historical facts are forward - looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995 . Forward looking statements generally are accompanied by words such as “believe,” “may,” “will, “estimate,” “continue,” “anticipate,” “intend,” expect,” “should,” “would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” and similar expressions that predict or indicate future events or trends or that are not statements of historical matters . These forward - looking statements include, but are not limited to statements regarding estimates and forecasts of financial and performance metrics, projections of market opportunity, operating results, potential revenues, growth forecasts, growth of customers, continued adherence of customers to iLearningEngines’ services, business strategy, various addressable markets, anticipated trends, developments in markets in which iLearningEngines operates, the market adoption of iLearningEngines’ technology, platform and products, the capabilities, performance, and advancement of iLearningEngines’ technology, platform and products, iLearningEngines’ projected economics and expansion in global markets, iLearningEngines’ pro forma information and iLearningEngines’ future technology and platform development and roadmap. These statements are based on various assumptions, whether or not identified in this Presentation, and on the current expectations of the respective management of iLearningEngines and Arrowroot and are not predictions of actual performance. These forward - looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by an investor as, a guarantee, an assurance, a prediction, or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions this presentation relies on. Many actual events and circumstances are beyond the control of iLearningEngines and Arrowroot. These forward - looking statements are subject to a number of risks and uncertainties, including (i) changes in domestic and foreign business, market, financial, political, and legal conditions; (ii) the inability of the parties to successfully or timely consummate the Proposed Business Combination, including the risk that any regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the Proposed Business Combination or that the approval of the stockholders of Arrowroot or iLearningEngines is not obtained; (iii) failure to realize the anticipated benefits of the Proposed Business Combination; (iv) risks relating to the uncertainty of the projected financial information with respect to iLearningEngines; (v) risks related to the rollout of iLearningEngines’ business and the timing of expected business milestones; (vi) the amount of redemption requests made by Arrowroot stockholders; (vii) the ability of Arrowroot or iLearningEngines to issue equity or equity - linked securities or obtain debt financing in connection with the Proposed Business Combination or in the future; (viii) the ability to maintain the listing of the combined company’s securities on NASDAQ or another national securities exchange; (ix) the risk that the Proposed Business Combination disrupts current plans and operations of iLearningEngines or Arrowroot as a result of the announcement and consummation of the Proposed Business Combination; (x) the risk that any of the conditions to closing are not satisfied in the anticipated manner or on the anticipated timeline; (xi) the effects of competition on iLearningEngines future business and the ability of the combined company to grow and manage growth profitably, maintain relationships with customers and suppliers and retain its management and key employees; (xii) risks related to political and macroeconomic uncertainty; (xiii) the outcome of any legal proceedings that may be instituted against iLearningEngines, Arrowroot or any of their respective directors or officers, following the announcement of the Proposed Business Combination; (xiv) the impact of the global COVID - 19 pandemic on any of the foregoing risks; (xv) any changes to the accounting matters of Arrowroot as a result of SEC guidance; (xvi) the risk factors included in this Presentation; and (xvii) those factors discussed in Arrowroot’s final prospectus dated March 1, 2021 under the heading “Risk Factors,” and other documents Arrowroot has filed, or will file, with the SEC. If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward - looking statements. There may be additional risks that neither Arrowroot nor iLearningEngines presently know, or that Arrowroot nor iLearningEngines currently believe are immaterial, that could also cause actual results to differ from those contained in the forward - looking statements. In addition, forward - looking statements reflect Arrowroot’s and iLearningEngines’ expectations, plans, or forecasts of future events and views as of the date of this Presentation. Arrowroot and iLearningEngines anticipate that subsequent events and developments will cause Arrowroot’s and iLearningEngines’ assessments to change. However, while Arrowroot and iLearningEngines may elect to update these forward - looking statements at some point in the future, Arrowroot and iLearningEngines specifically disclaim any obligation to do so. These forward - looking statements should not be relied upon as representing Arrowroot’s and iLearningEngines’ assessments as of any date subsequent to the date of this Presentation. Accordingly, undue reliance should not be placed upon the forward - looking statements. Use of Projections This Presentation contains projected financial information with respect to iLearningEngines . Such projected financial information constitutes forward - looking information, and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results . The assumptions and estimates underlying such financial forecast information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive, and other risks and uncertainties . See “Forward - Looking Statements” above . Actual results may differ materially from the results contemplated by the financial forecast information contained in this Presentation, and the inclusion of such information in this Presentation should not be regarded as a representation by any person that the results reflected in such forecasts will be achieved. Neither Arrowroot’s nor iLearningEngines’ independent auditors have audited, reviewed, compiled or performed any procedures with respect to the projections for the purpose of their inclusion in this Presentation or any other purpose, and accordingly, none of such independent auditors has expressed any opinion or provided any other form of assurance with respect to such projections. 3

Use of Projections (Continued) The risk factors summarized presented in this Presentation are certain of the risks related to the business of iLearningEngines, Arrowroot and the Proposed Business Combination, and such list is not exhaustive. The list in this presentation is qualified in its entirety by disclosures contained in future documents filed or furnished by iLearningEngines and Arrowroot with the SEC with respect to the proposed business combination. There are many risks that could affect the business and results of operations of iLearningEngines, many of which are beyond its control. If any of these risks or uncertainties occurs, iLearningEngines business, financial condition and/or operating results could be materially and adversely harmed. Additional risks and uncertainties not currently known or those currently viewed to be immaterial may also materially and adversely affect the iLearningEngines business, financial condition and/or operating results. Financial Information; Non - GAAP Financial Measures The financial information and data contained in this Presentation, including certain of the information as of and for fiscal years 2020, 2021, and 2022 is unaudited and does not conform to Regulation S - X promulgated under the Securities Act or the standards of the Public Company Accounting Oversight Board. Accordingly, such information and data may not be included in, may be adjusted in, or may be presented differently in, any proxy statement/prospectus or registration statement or other report or document to be filed or furnished by Arrowroot with the SEC. Some of the financial information and data contained in this Presentation, such as Adjusted EBITDA and Adjusted EBITDA Margin, has not been prepared in accordance with United States generally accepted accounting principles (“GAAP”). Arrowroot and iLearningEngines believe these non - GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to iLearningEngines’ financial condition and results of operations. iLearningEngines’ management uses these non - GAAP measures for trend analysis and for budgeting and planning purposes. Arrowroot and iLearningEngines believe that the use of these non - GAAP financial measures provide an additional tool for investors to use in evaluating projected operating results and trends in iLearningEngines’ business. Other similar companies may present different non - GAAP measures or calculate similar non - GAAP measures differently. Management does not consider these non - GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP. The principal limitation of these non - GAAP financial measures is that they exclude significant expenses that are required to be presented in iLearningEngines’ GAAP financial statements. In addition, they are subject to inherent limitations as they reflect the exercise of judgment by management about which expenses are excluded in determining these non - GAAP financial measures. You should review iLearningEngines’ audited financial statements prepared in accordance with GAAP, which will be included in a combined registration statement and proxy statement to be filed with the SEC. Additional Information About the Proposed Business Combination and Where To Find It The Proposed Business Combination will be submitted to stockholders of Arrowroot for their consideration. Arrowroot intends to file a registration statement on Form S - 4 (the “Registration Statement”) with the SEC which will include preliminary and definitive proxy statements to be distributed to Arrowroot’s stockholders in connection with Arrowroot’s solicitation for proxies for the vote by Arrowroot’s shareholders in connection with the Proposed Business Combination and other matters as described in the Registration Statement, as well as the prospectus relating to the offer of the securities to be issued to iLearningEngines’ shareholders in connection with the completion of the Proposed Business Combination. After the Registration Statement has been filed and declared effective, Arrowroot will mail a definitive proxy statement and other relevant documents to its stockholders as of the record date established for voting on the Proposed Business Combination. Arrowroot’s stockholders and other interested persons are advised to read, once available, the preliminary proxy statement / prospectus and any amendments thereto and, once available, the definitive proxy statement / prospectus, in connection with Arrowroot’s solicitation of proxies for its special meeting of stockholders to be held to approve, among other things, the Proposed Business Combination, because these documents will contain important inform ation about Arrowroot, iLearningEngines, and the Proposed Business Combination. Stockholders may also obtain a copy of the preliminary or definitive proxy statement, once available, as well as other documents filed with the SEC regarding the Proposed Business Combination and other documents filed with the SEC by Arrowroot, without charge, at the SEC’s website located at www.sec.gov. INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE. 4

Trademarks This presentation contains trademarks, service marks, trade names, and copyrights of Arrowroot, iLearningEngines, and other companies, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names, copyrights, logos and other intellectual property in this Presentation is not intended to, and does not imply, a relationship with iLearningEngines or Arrowroot, or an endorsement or sponsorship by or of iLearningEngines or Arrowroot. Solely for convenience, certain third party - trademarks and trade names referred to in this Presentation may appear with the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that such trademarks or trade names are held by iLearningEngines, Arrowroot, or any of their affiliates. The information contained herein is as of March 6, 2023 and does not reflect any subsequent events. 5

I. Executive Summary II. Company Overview III. Financial Information IV. Transaction Overview V. Appendix Table of Contents

I. Executive Summary

Matthew Safaii Chairman & CEO Tom Olivier President & CFO Harish Chidambaran Chairman & CEO Farhan Naqvi CFO Bala Krishnan President & CBO iLearningEngines (“iLE”) – Arrowroot Corp. Highlights Arrowroot Corp. Team: Deep Balanced Experience iLearningEngines Team: Visionary Senior Management iLE Highlights ~$309M 2022A GAAP Revenue ~$12M 2022A Adj. EBITDA Cash Efficient Minimal Equity Raised to Date 3.2 M Users $200B+ TAM 119% 2022A Net Dollar Retention 70% 2022A Gross Margin 47% 2019A - 2023E GAAP Revenue CAGR 8

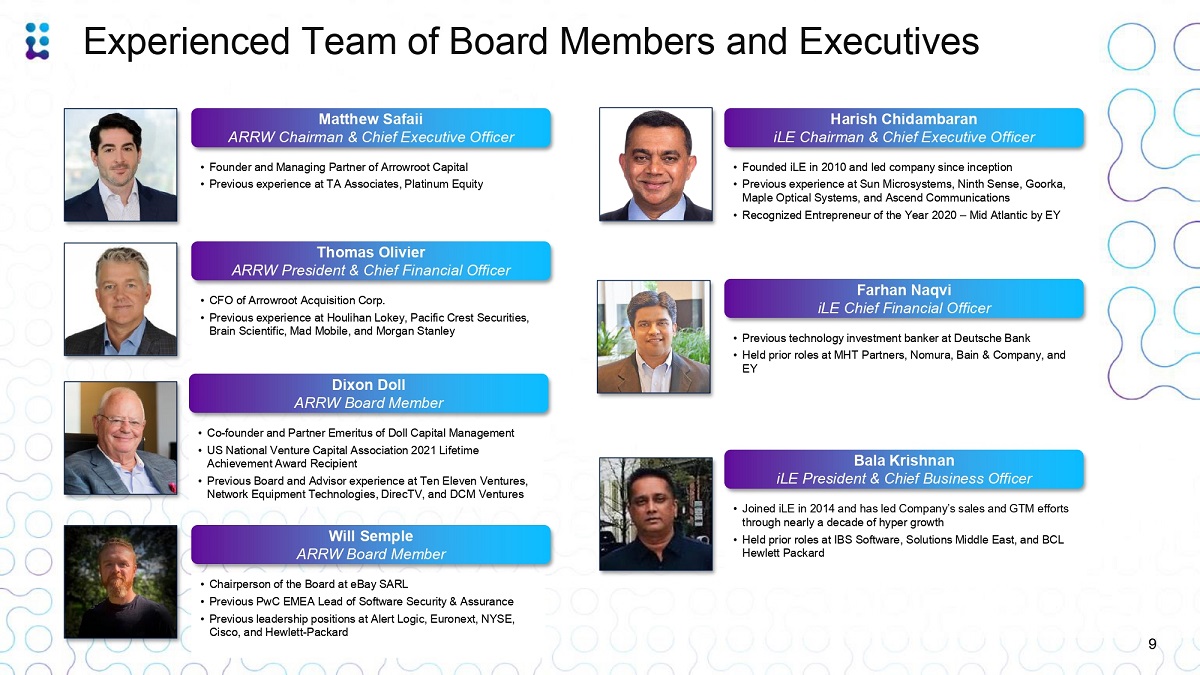

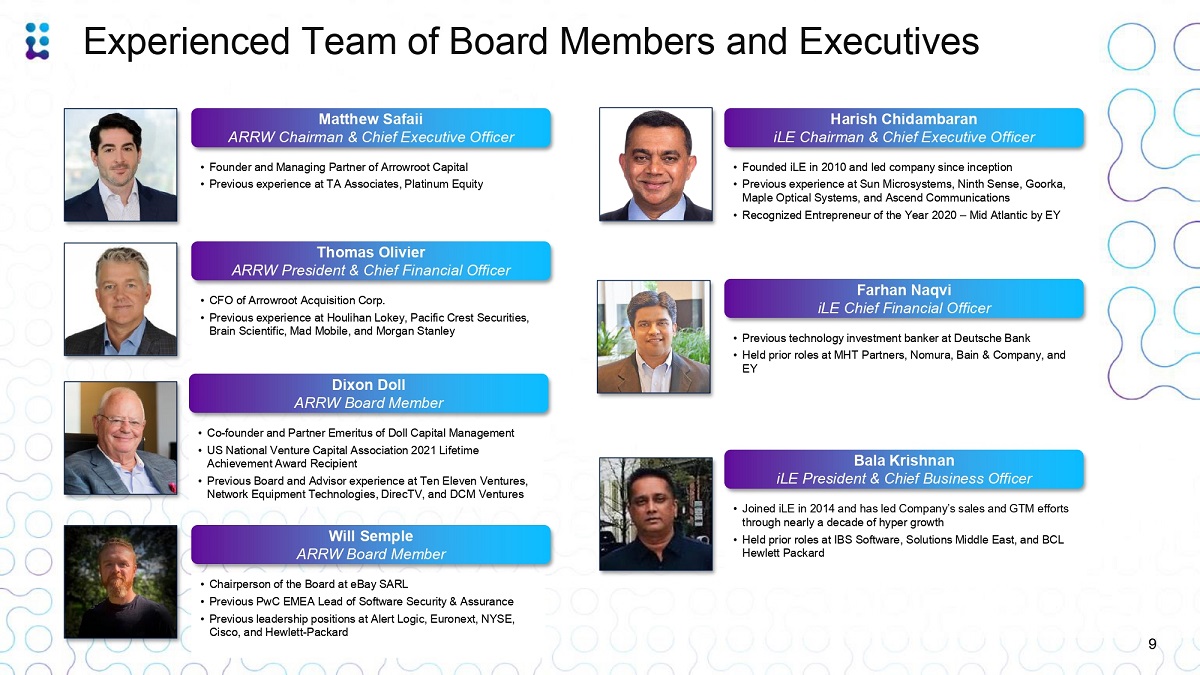

Experienced Team of Board Members and Executives Matthew Safaii ARRW Chairman & Chief Executive Officer • Founder and Managing Partner of Arrowroot Capital • Previous experience at TA Associates, Platinum Equity Thomas Olivier ARRW President & Chief Financial Officer • CFO of Arrowroot Acquisition Corp. • Previous experience at Houlihan Lokey, Pacific Crest Securities, Brain Scientific, Mad Mobile, and Morgan Stanley Dixon Doll ARRW Board Member • Co - founder and Partner Emeritus of Doll Capital Management • US National Venture Capital Association 2021 Lifetime Achievement Award Recipient • Previous Board and Advisor experience at Ten Eleven Ventures, Network Equipment Technologies, DirecTV, and DCM Ventures Will Semple ARRW Board Member • Chairperson of the Board at eBay SARL • Previous PwC EMEA Lead of Software Security & Assurance • Previous leadership positions at Alert Logic, Euronext, NYSE, Cisco, and Hewlett - Packard Harish Chidambaran iLE Chairman & Chief Executive Officer • Founded iLE in 2010 and led company since inception • Previous experience at Sun Microsystems, Ninth Sense, Goorka, Maple Optical Systems, and Ascend Communications • Recognized Entrepreneur of the Year 2020 – Mid Atlantic by EY Farhan Naqvi iLE Chief Financial Officer • Previous technology investment banker at Deutsche Bank • Held prior roles at MHT Partners, Nomura, Bain & Company, and EY Bala Krishnan iLE President & Chief Business Officer • Joined iLE in 2014 and has led Company’s sales and GTM efforts through nearly a decade of hyper growth • Held prior roles at IBS Software, Solutions Middle East, and BCL Hewlett Packard 9

Arrowroot Capital, sponsor of Arrowroot Acquisition Corp., is a leading investor in enterprise software Arrowroot Acquisition Corp. (AAC) Overview 10 AAC at a Glance Select Arrowroot Capital Portfolio Investments Trust Summary ISSUER Arrowroot Acquisition Corporation TRUST ACCOUNT BALANCE $45,229,556 (1) Source: Company public filings, press releases, company management Positioned to Add Value to iLearningEngines • Management and Board with extensive experience investing and operating in the enterprise software space • Deep industry relationships to support both organic sales and product wins and inorganic growth strategy Proven Arrowroot Capital Investment Track Record • 10 year old leading global software growth equity firm • Deep domain expertise in supporting sales & marketing, human capital, technology, customer success and M&A (1) Reflective of ~85% SPAC public shareholder redemptions related to SPAC life extension

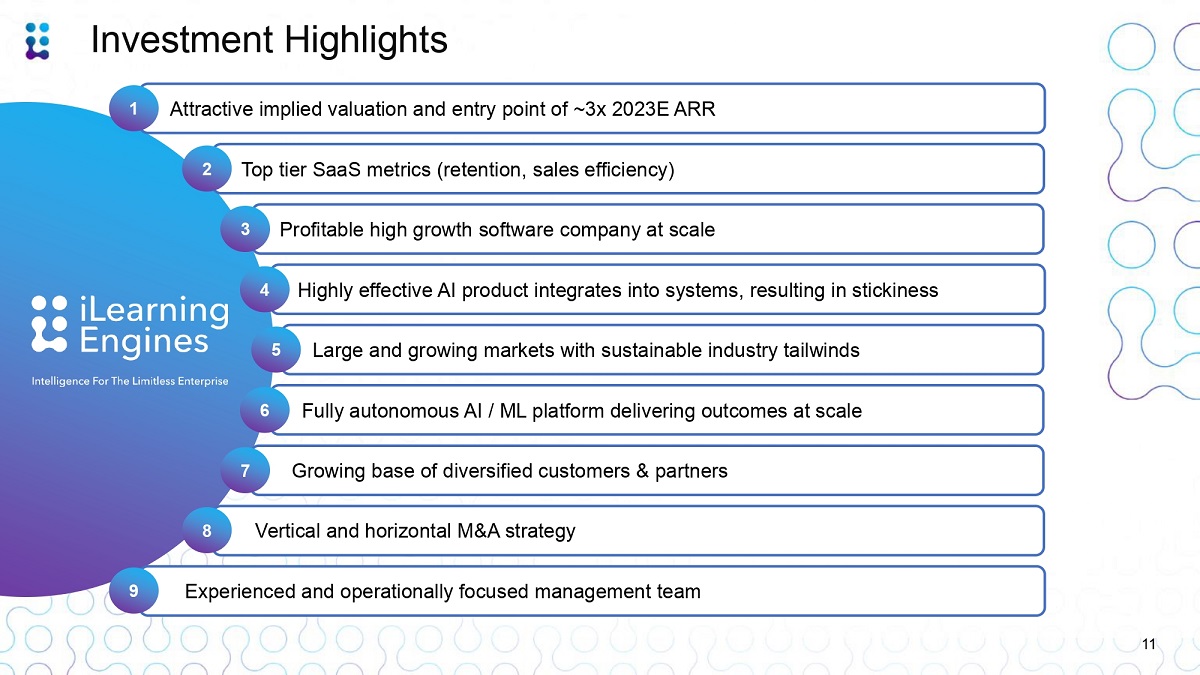

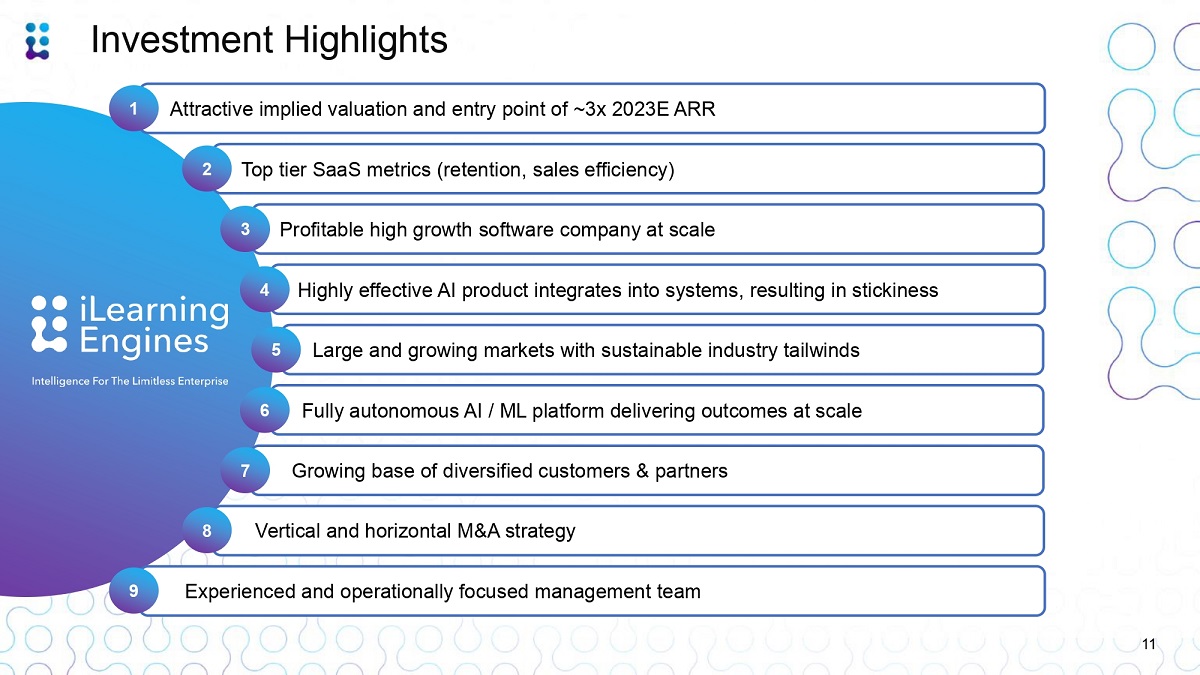

Investment Highlights Attractive implied valuation and entry point of ~3x 2023E ARR 1 Large and growing markets with sustainable industry tailwinds 5 Vertical and horizontal M&A strategy 8 6 Fully autonomous AI / ML platform delivering outcomes at scale Growing base of diversified customers & partners 7 2 Top tier SaaS metrics (retention, sales efficiency) Highly effective AI product integrates into systems, resulting in stickiness 4 Profitable high growth software company at scale 3 Experienced and operationally focused management team 9 11

iLE Positioned to Carry Established Momentum Within the Public Markets A Category Disruptor Proven Learning Automation Platform AI - Enhanced Datasets Scalable Application & Use Cases Education / Corporate Learning Automation 12

Large & Growing Addressable Markets Learning Automation is at the intersection of two accelerating markets across global e - learning and AI, supporting a category - defining market across multiple industries (1) Technavio Global e - Learning Market (2021) Global e - Learning (1) Global AI Systems (2) $277B 2025E Spend 16% 2021A - 2025E CAGR $221B 2025E Spend 26% 2021A - 2025E CAGR Category Defining Market (2) IDC MaturityScape: Artificial Intelligence 2.0 (May 2022) 13

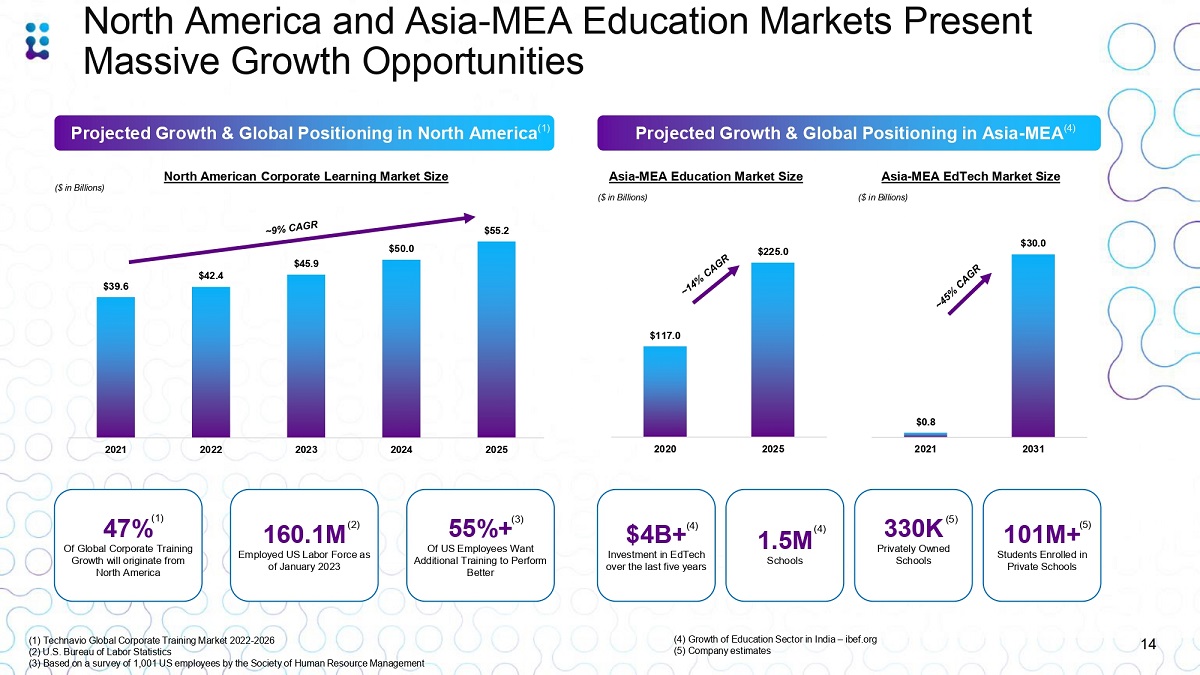

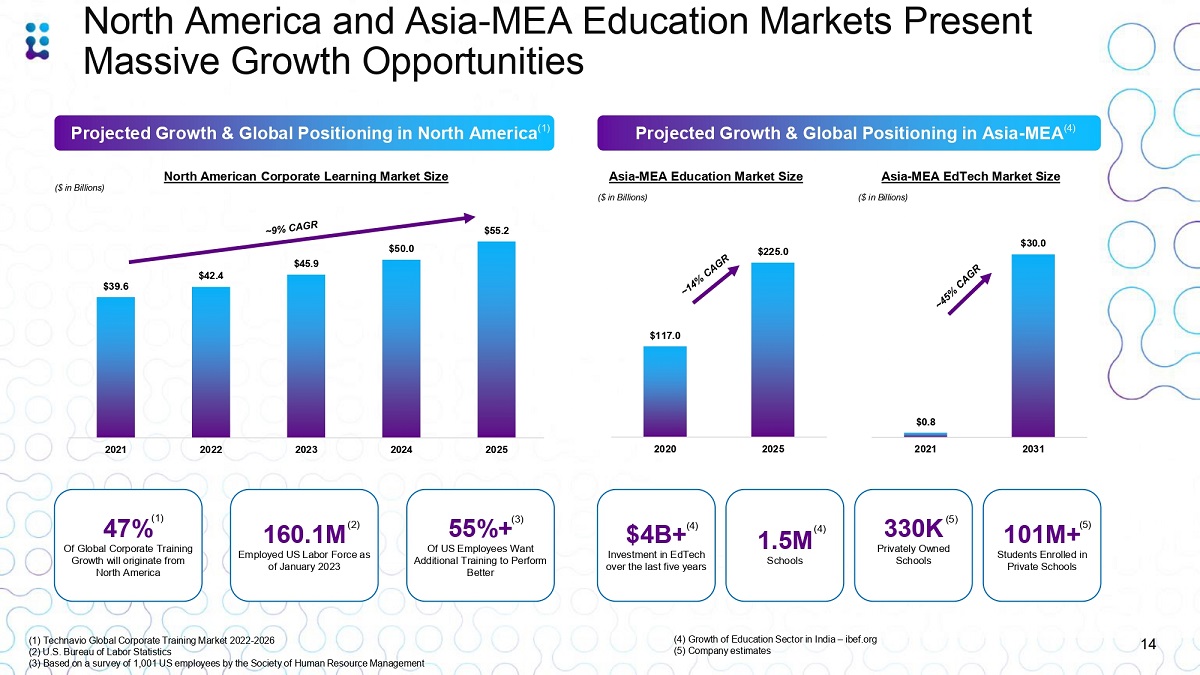

$39.6 $42.4 $45.9 $50.0 $55.2 2021 2022 2023 2024 2025 North America and Asia - MEA Education Markets Present Massive Growth Opportunities (1) Technavio Global Corporate Training Market 2022 - 2026 (2) U.S. Bureau of Labor Statistics (3) Based on a survey of 1,001 US employees by the Society of Human Resource Management $117.0 $225.0 2020 2025 1.5M Schools $0.8 $30.0 2021 2031 Asia - MEA EdTech Market Size ($ in Billions) Asia - MEA Education Market Size ($ in Billions) North American Corporate Learning Market Size ($ in Billions) 55%+ (3) Of US Employees Want Additional Training to Perform Better Projected Growth & Global Positioning in North America (1) 160.1M (2) Employed US Labor Force as of January 2023 Projected Growth & Global Positioning in Asia - MEA (4) 101M+ (5) Students Enrolled in Private Schools 330K (5) Privately Owned Schools (4) Growth of Education Sector in India – ibef.org (5) Company estimates 47% (1) Of Global Corporate Training Growth will originate from North America $4B+ (4) Investment in EdTech over the last five years (4) 14

II. Company Overview

Who We Are A learning automation and information intelligence platform that drives Enterprise outcomes at scale via proprietary AI systems. What We Do Build intelligent Knowledge Clouds for Enterprises from existing content and data. Embed AI learning automation and decision making tools into Enterprise workflows. iLearningEngines Overview and Platform Who We Sell To iLE’s cross - functional, multi - vertical AI platform delivers quantifiable ROI to global Enterprises. • Knowledge Cloud – Ingest and enable content for contextualized search, query recommendation and in - process learning • No - code AI Canvas - Integrate to Enterprise systems to design workflows and capture event triggers to identify process and performance gaps • Predictive Decision Making – Leverage analytics and AI powered insights to drive predictive and preventive decision making AI Platform Enabled 16

Communications Software Development Human Capital Management (“HCM”) / Learning & Development (“L&D”) Mobile Devices THE DISRUPTED THE DISTRUPTORS Learning Automation Disrupting Industry With Legacy Players Disruptive AI First Platform 17

AI Learning is Mission Critical for Enterprises 18 AI is Changing the World… Source: (1) Wall Street Journal (2) Reuters (3) Barron’s (4) Bloomberg (5) Company estimates …iLE has 10+ Years of Experience in AI Learning (5) 40+ Proprietary Algorithims Owned by iLE 100K+ Research & Development (“R&D”) Hours Spent in the System 3.2M Users, Demonstrating iLE’s Experience Operating an AI Platform at Scale 47% 2019A - 2023E GAAP Revenue CAGR (1) (2) (3) (1) (4)

No Code AI Canvas streamlines Enterprise integrations and delivers scale Encompasses neural networks and configurable and personalized user journeys based on role or function Business workflow designer to drive learning automation 19 Key Accelerator 1: No Code AI Canvas

Enterprise Applications HCM / HRMS Ticketing Systems ERP Content Platforms Front End Channels External Open External Paid Internal Extensive integrations across systems capturing event triggers, employee interactions and risk data, which form the basis of designing workflows, distributing learning automation and driving outcomes. 20 Key Accelerator 2: Extensive Integrations

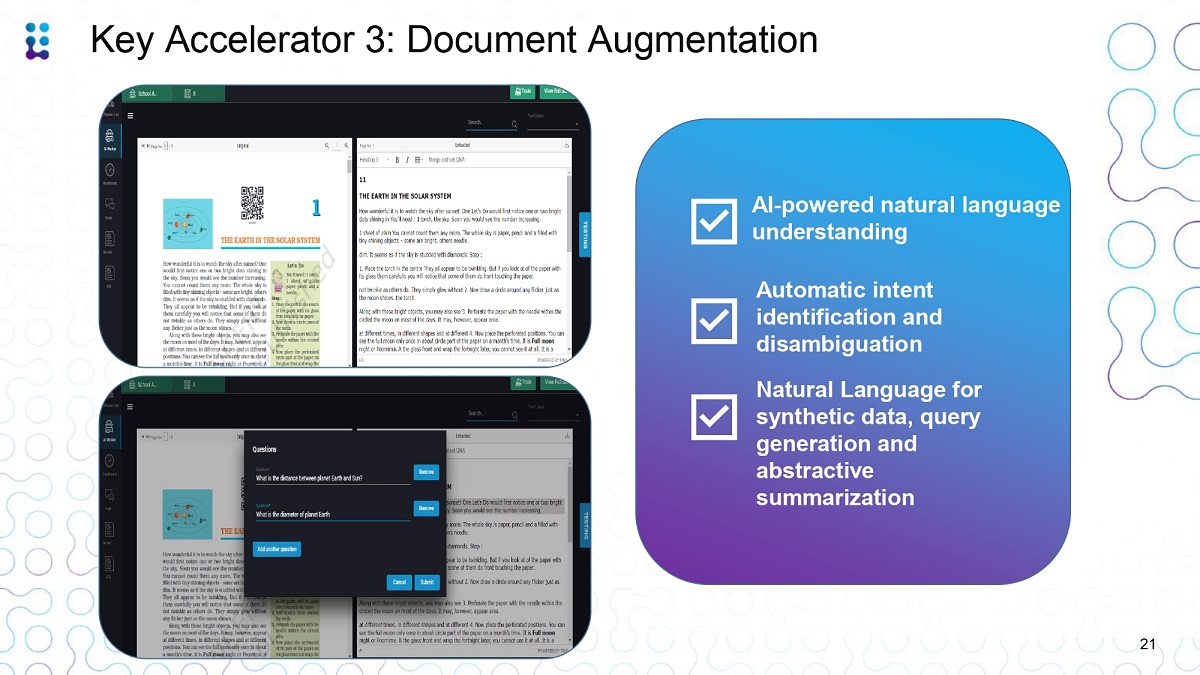

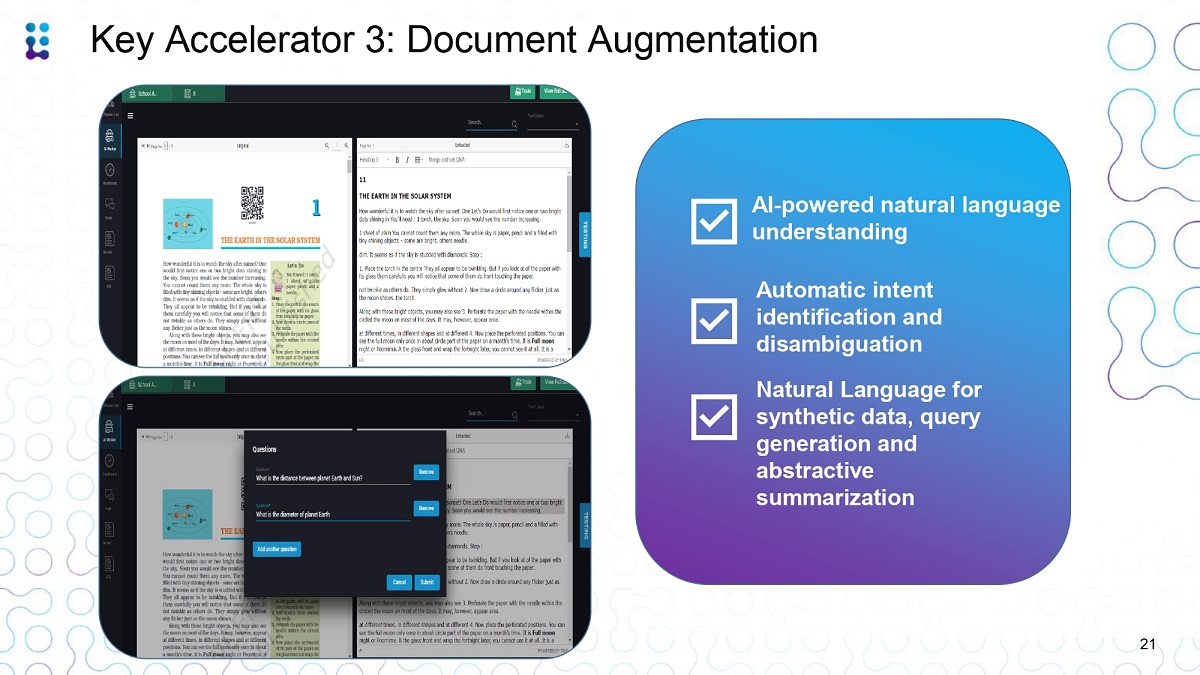

AI - powered natural language understanding Automatic intent identification and disambiguation Natural Language for synthetic data, query generation and abstractive summarization 21 Key Accelerator 3: Document Augmentation

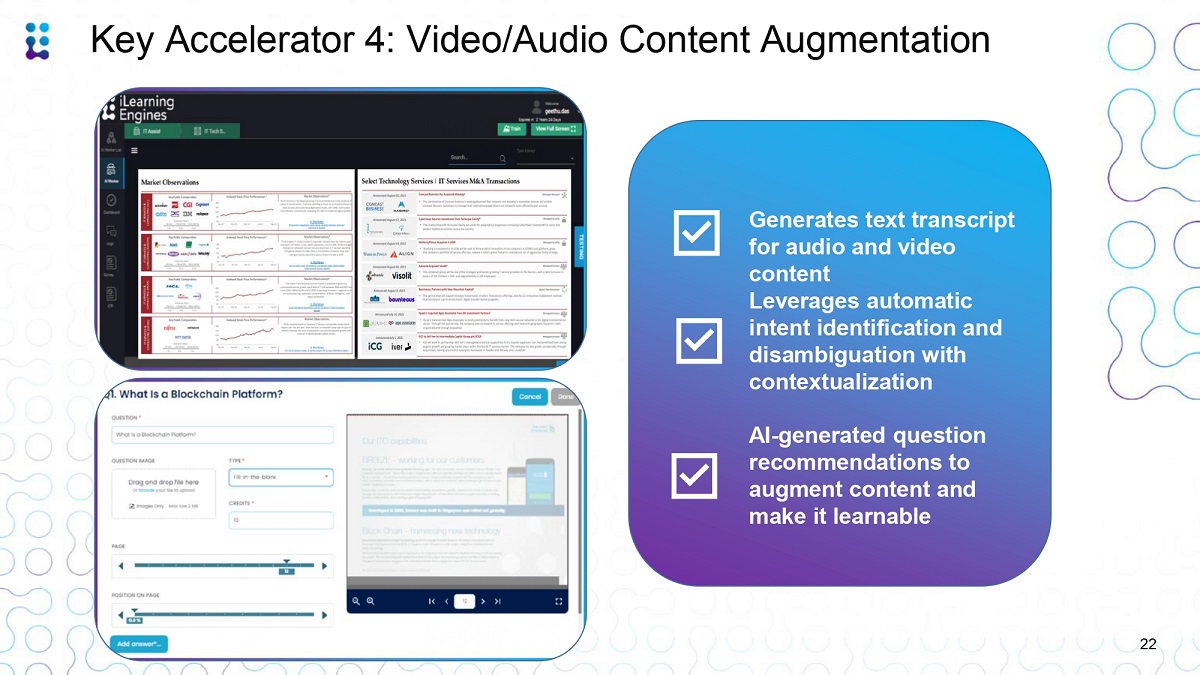

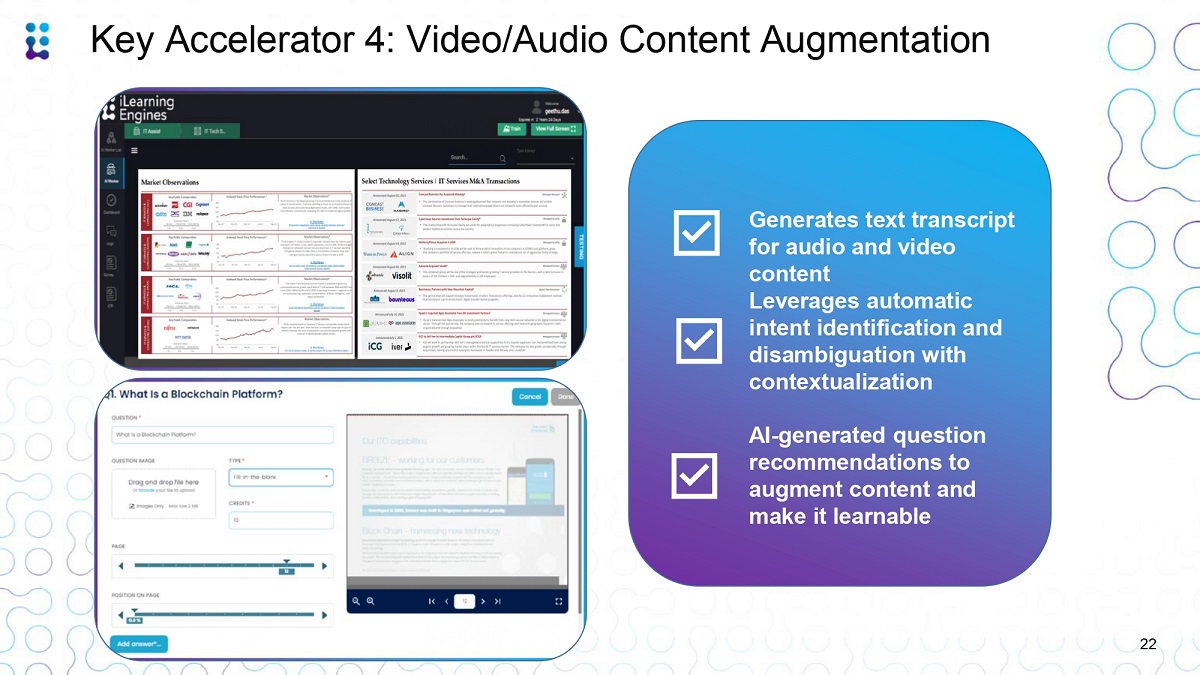

Generates text transcript for audio and video content Leverages automatic intent identification and disambiguation with contextualization AI - generated question recommendations to augment content and make it learnable Key Accelerator 4: Video/Audio Content Augmentation 22

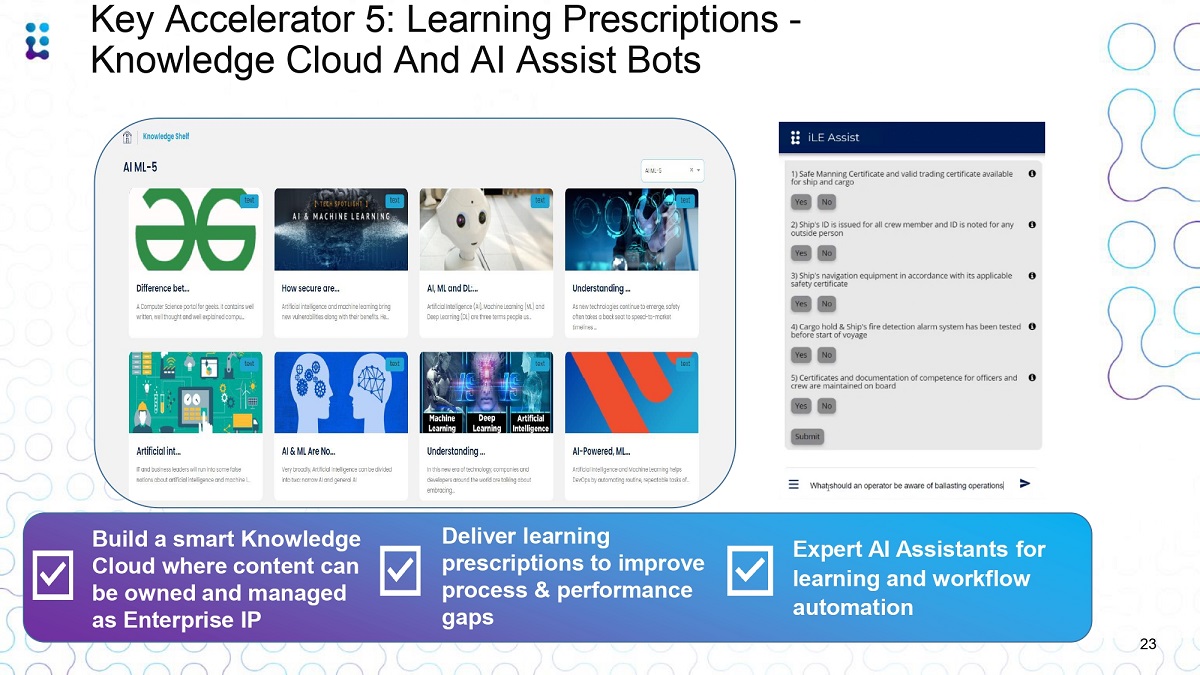

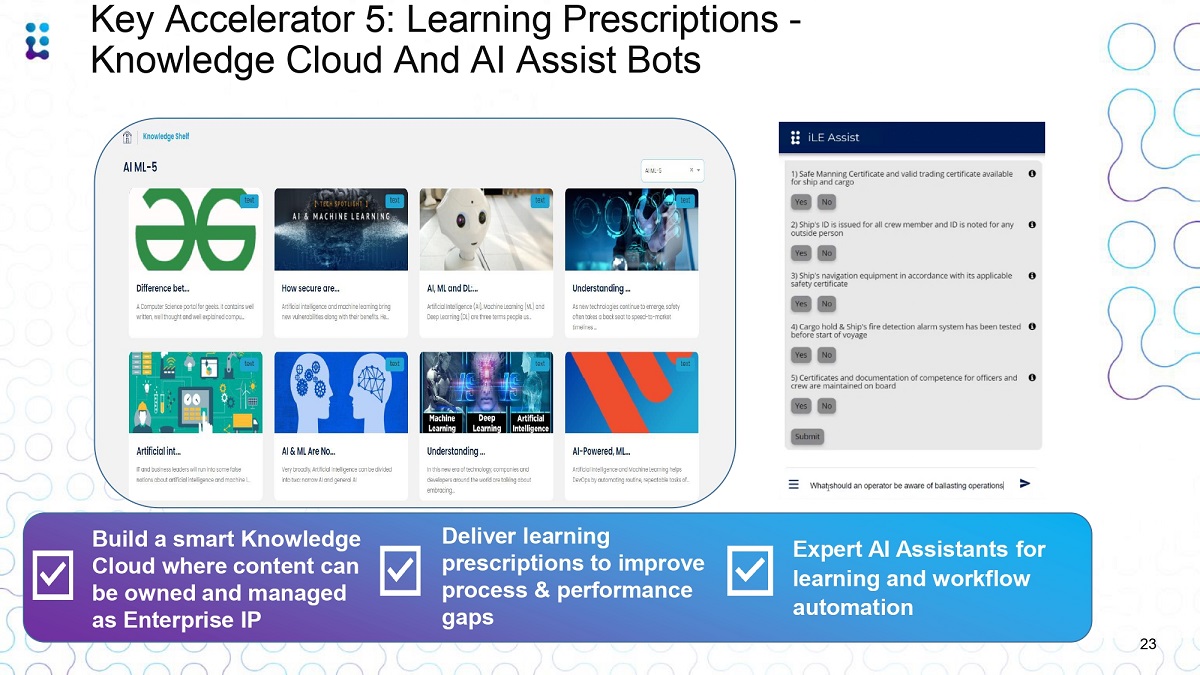

Expert AI Assistants for learning and workflow automation Deliver learning prescriptions to improve process & performance gaps Build a smart Knowledge Cloud where content can be owned and managed as Enterprise IP Key Accelerator 5: Learning Prescriptions - Knowledge Cloud And AI Assist Bots 23

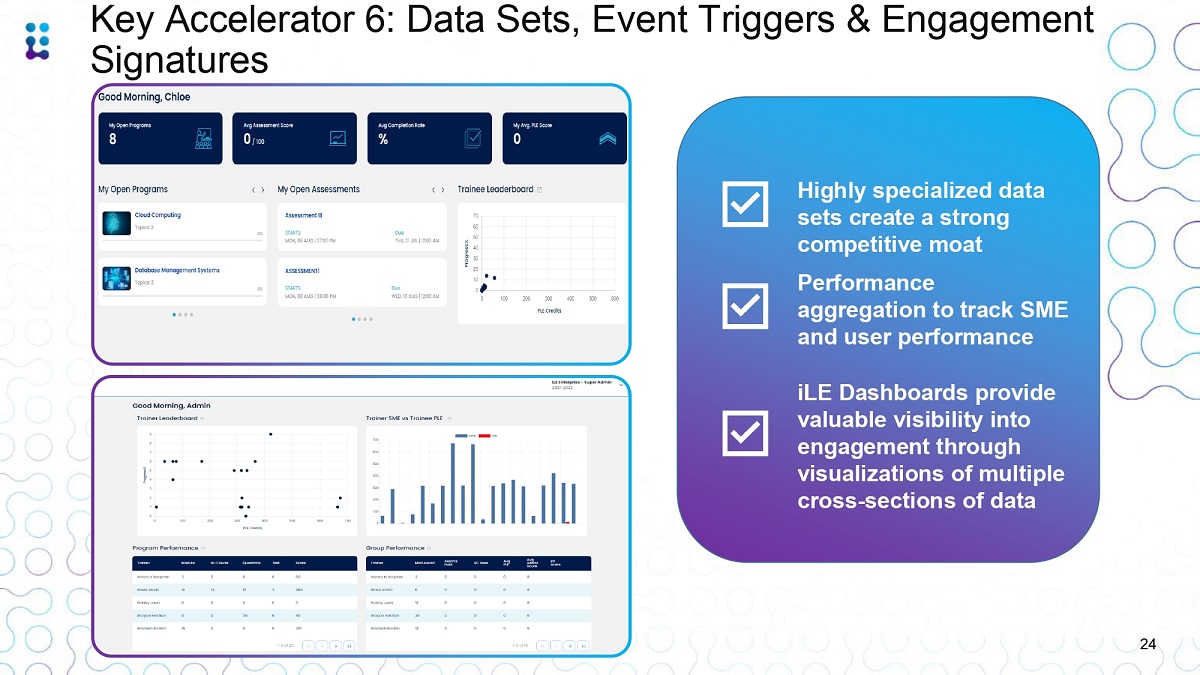

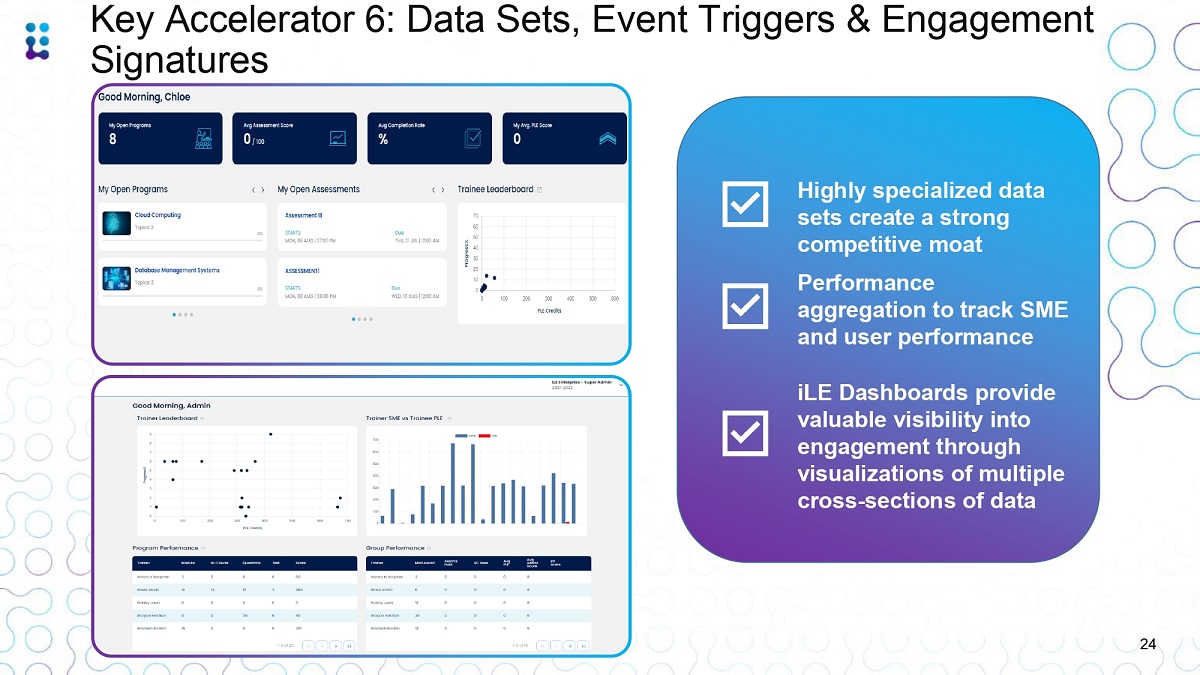

Buil a sm t Kno ledge Cloud where content can be owned and ma as Enterprise IP Highly specialized data sets create a strong competitive moat Performance aggregation to track SME and user performance iLE Dashboards provide valuable visibility into engagement through visualizations of multiple cross - sections of data 24 Key Accelerator 6: Data Sets, Event Triggers & Engagement Signatures

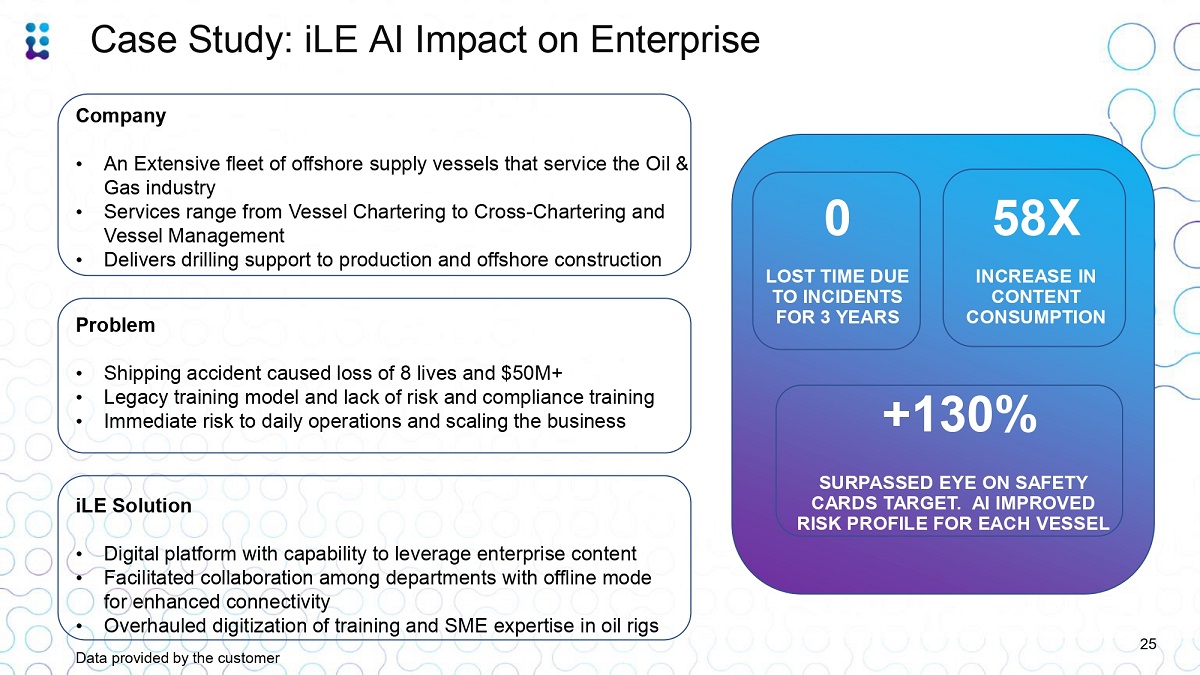

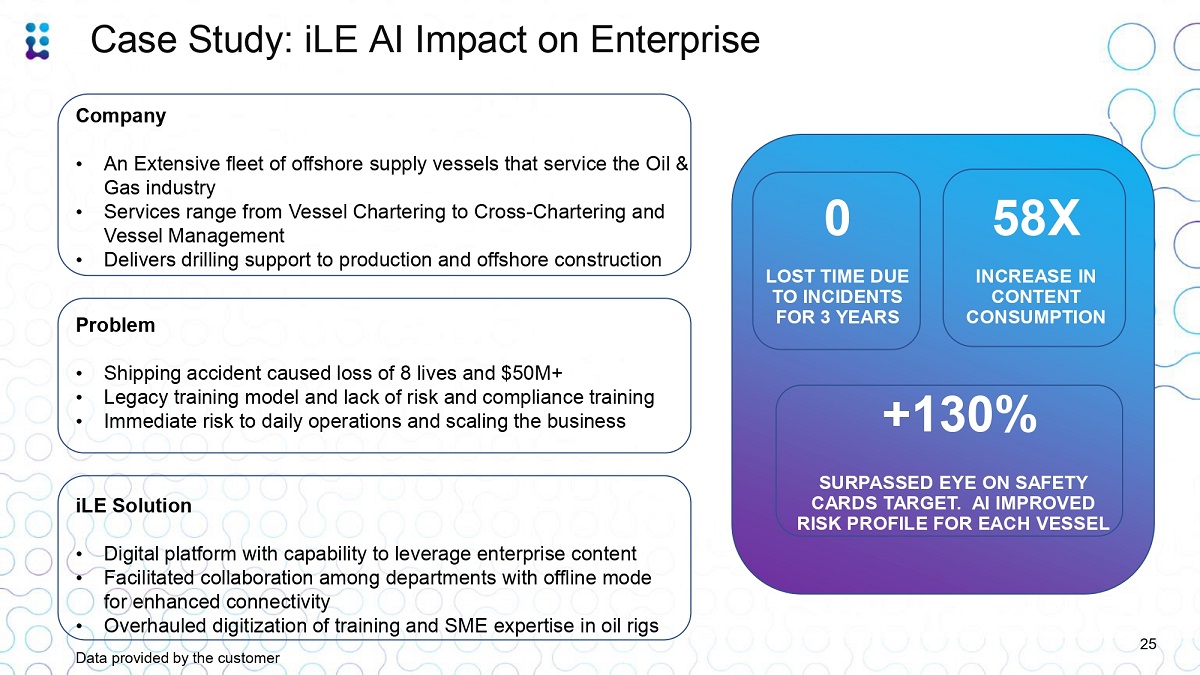

Company • An Extensive fleet of offshore supply vessels that service the Oil & Gas industry • Services range from Vessel Chartering to Cross - Chartering and Vessel Management • Delivers drilling support to production and offshore construction Problem • Shipping accident caused loss of 8 lives and $50M+ • Legacy training model and lack of risk and compliance training • Immediate risk to daily operations and scaling the business 0 LOST TIME DUE TO INCIDENTS FOR 3 YEARS +130% SURPASSED EYE ON SAFETY CARDS TARGET. AI IMPROVED RISK PROFILE FOR EACH VESSEL iLE Solution • Digital platform with capability to leverage enterprise content • Facilitated collaboration among departments with offline mode for enhanced connectivity • Overhauled digitization of training and SME expertise in oil rigs 58X INCREASE IN CONTENT CONSUMPTION 25 Data provided by the customer Case Study: iLE AI Impact on Enterprise

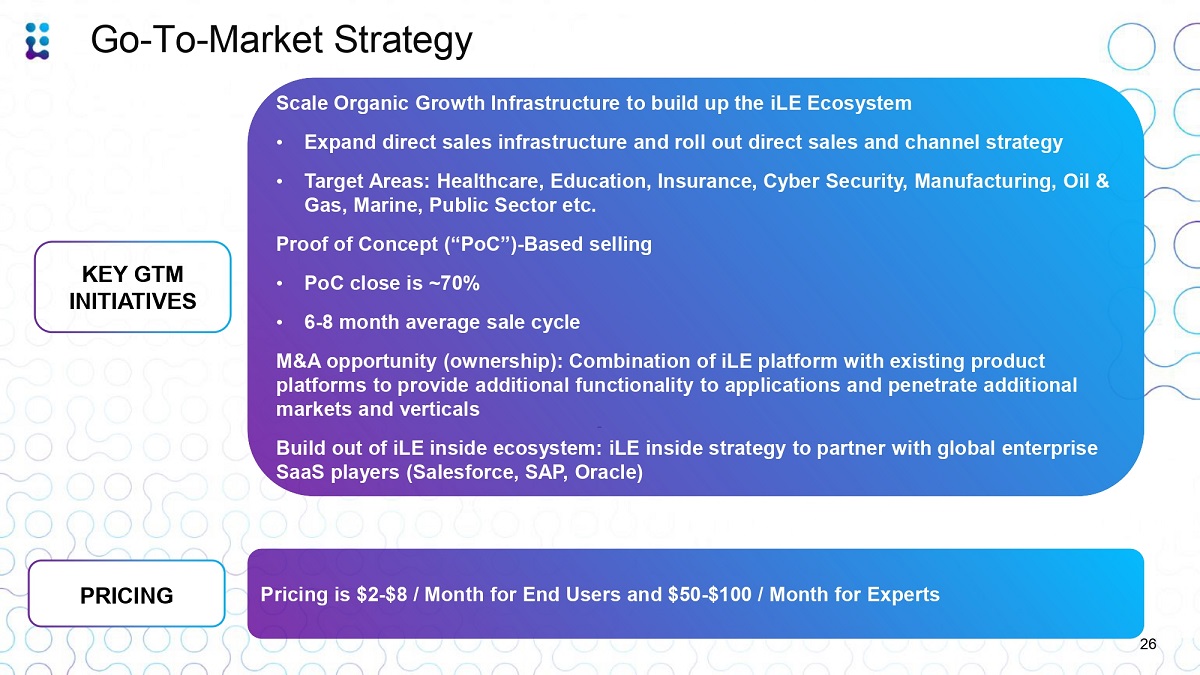

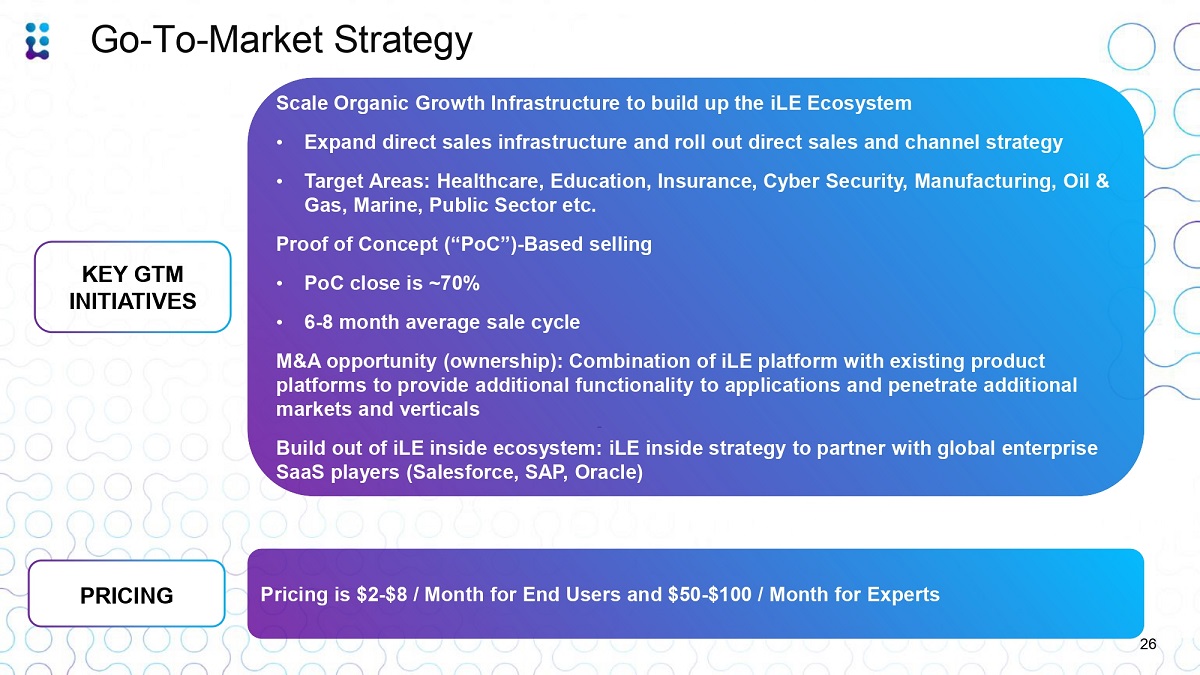

Pricing is $2 - $8 / Month for End Users and $50 - $100 / Month for Experts KEY GTM INITIATIVES PRICING Scale Organic Growth Infrastructure to build up the iLE Ecosystem • Expand direct sales infrastructure and roll out direct sales and channel strategy • Target Areas: Healthcare, Education, Insurance, Cyber Security, Manufacturing, Oil & Gas, Marine, Public Sector etc. Proof of Concept (“PoC”) - Based selling 26 • PoC close is ~70% • 6 - 8 month average sale cycle M&A opportunity (ownership): Combination of iLE platform with existing product platforms to provide additional functionality to applications and penetrate additional markets and verticals - Build out of iLE inside ecosystem: iLE inside strategy to partner with global enterprise SaaS players (Salesforce, SAP, Oracle) Go - To - Market Strategy

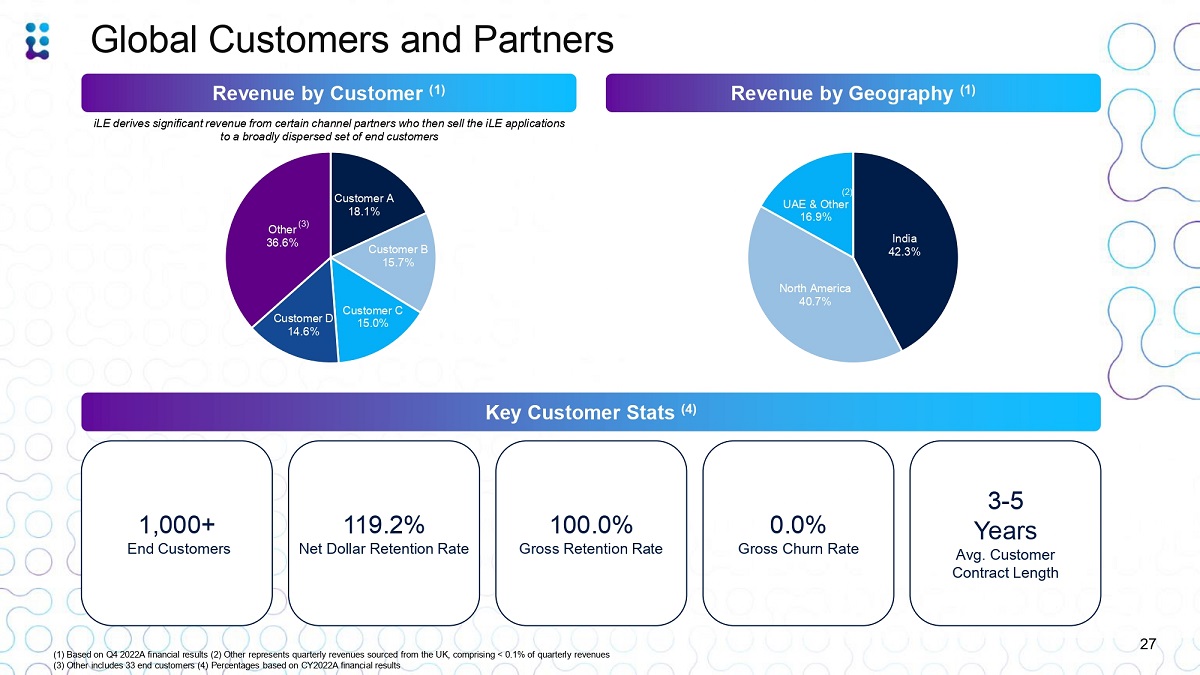

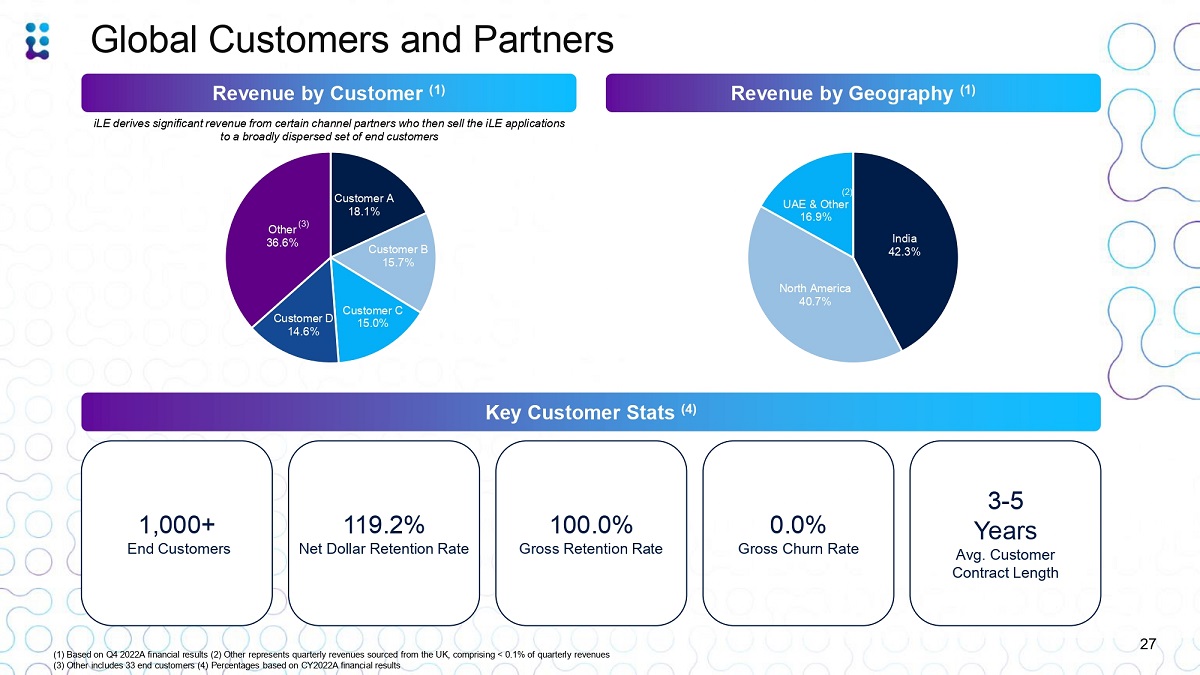

Customer A 18.1% Customer B 15.7% Customer C 15.0% Customer D 14.6% Other 36.6% (3) 27 Global Customers and Partners India 42.3% North America 40.7% (2) UAE & Other 16.9% Revenue by Geography (1) Key Customer Stats (4) 119.2% Net Dollar Retention Rate 100.0% Gross Retention Rate 0.0% Gross Churn Rate 3 - 5 Years Avg. Customer Contract Length (1) Based on Q4 2022A financial results (2) Other represents quarterly revenues sourced from the UK, comprising < 0.1% of quarterly revenues (3) Other includes 33 end customers (4) Percentages based on CY2022A financial results Revenue by Customer (1) iLE derives significant revenue from certain channel partners who then sell the iLE applications to a broadly dispersed set of end customers 1,000+ End Customers

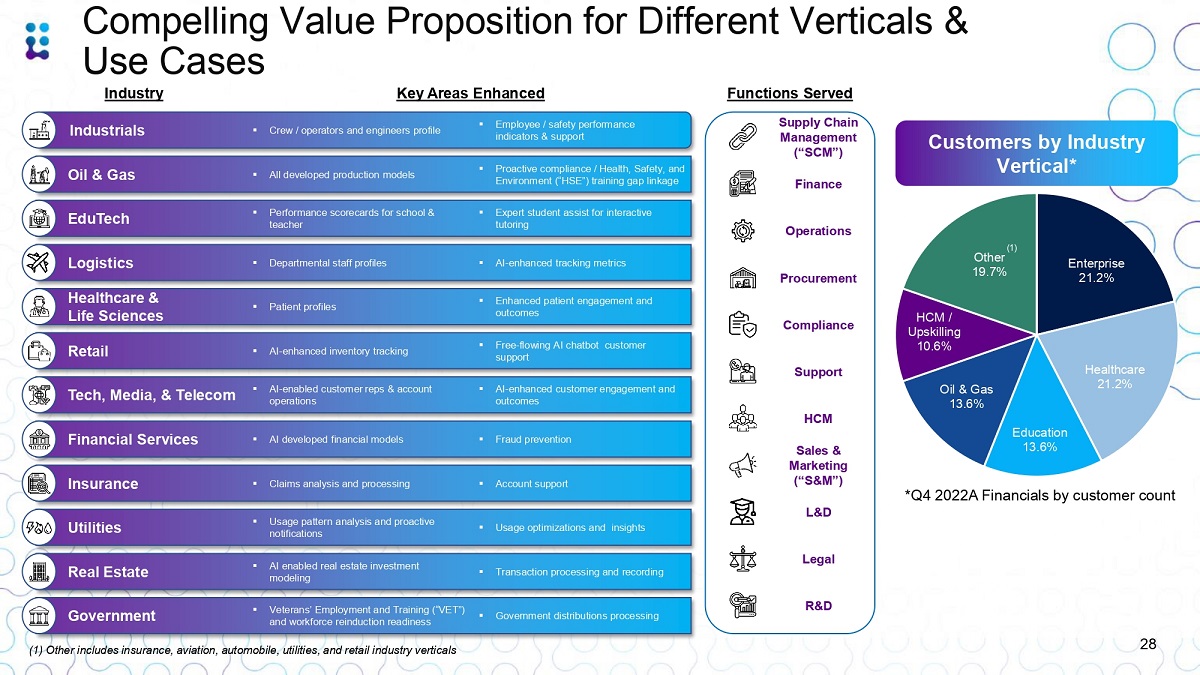

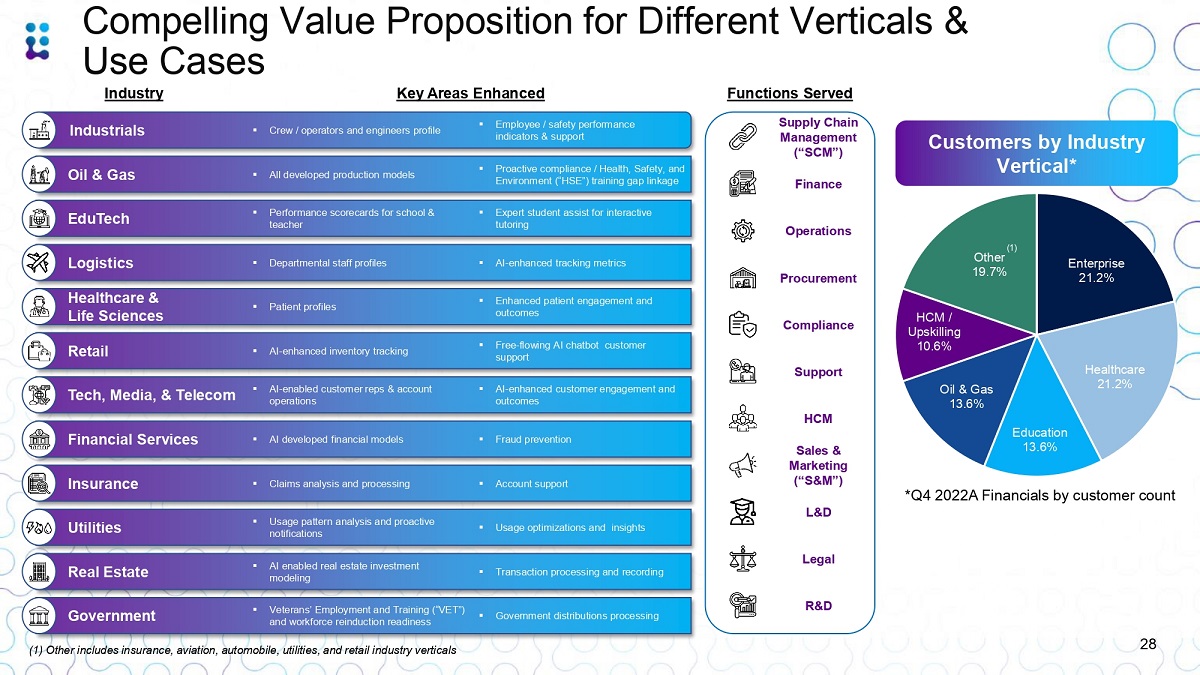

Enterprise 21.2% Healthcare 21.2% Education 13.6% Oil & Gas 13.6% HCM / Upskilling 10.6% Other 19.7% Industrials Compelling Value Proposition for Different Verticals & Use Cases 0: 28 ▪ Crew / operators and engineers profile ▪ Employee / safety performance indicators & support EduTech ▪ Performance scorecards for school & teacher ▪ Expert student assist for interactive tutoring Oil & Gas ▪ All developed production models ▪ Proactive compliance / Health, Safety, and Environment (“HSE”) training gap linkage Logistics ▪ Departmental staff profiles ▪ AI - enhanced tracking metrics Healthcare & Life Sciences ▪ Patient profiles ▪ Enhanced patient engagement and outcomes Retail ▪ AI - enhanced inventory tracking ▪ Free - flowing AI chatbot customer support Tech, Media, & Telecom ▪ AI - enabled customer reps & account operations ▪ AI - enhanced customer engagement and outcomes Financial Services ▪ AI developed financial models ▪ Fraud prevention Insurance ▪ Claims analysis and processing ▪ Account support Utilities ▪ Usage pattern analysis and proactive notifications ▪ Usage optimizations and insights Real Estate ▪ AI enabled real estate investment modeling ▪ Transaction processing and recording Government ▪ Veterans’ Employment and Training (“VET”) and workforce reinduction readiness ▪ Government distributions processing Industry Key Areas Enhanced L&D Legal Finance Operations Procurement Compliance Support HCM Sales & Marketing (“S&M”) R&D Functions Served Supply Chain Management (“SCM”) Customers by Industry Vertical* *Q4 2022A Financials by customer count (1) (1) Other includes insurance, aviation, automobile, utilities, and retail industry verticals

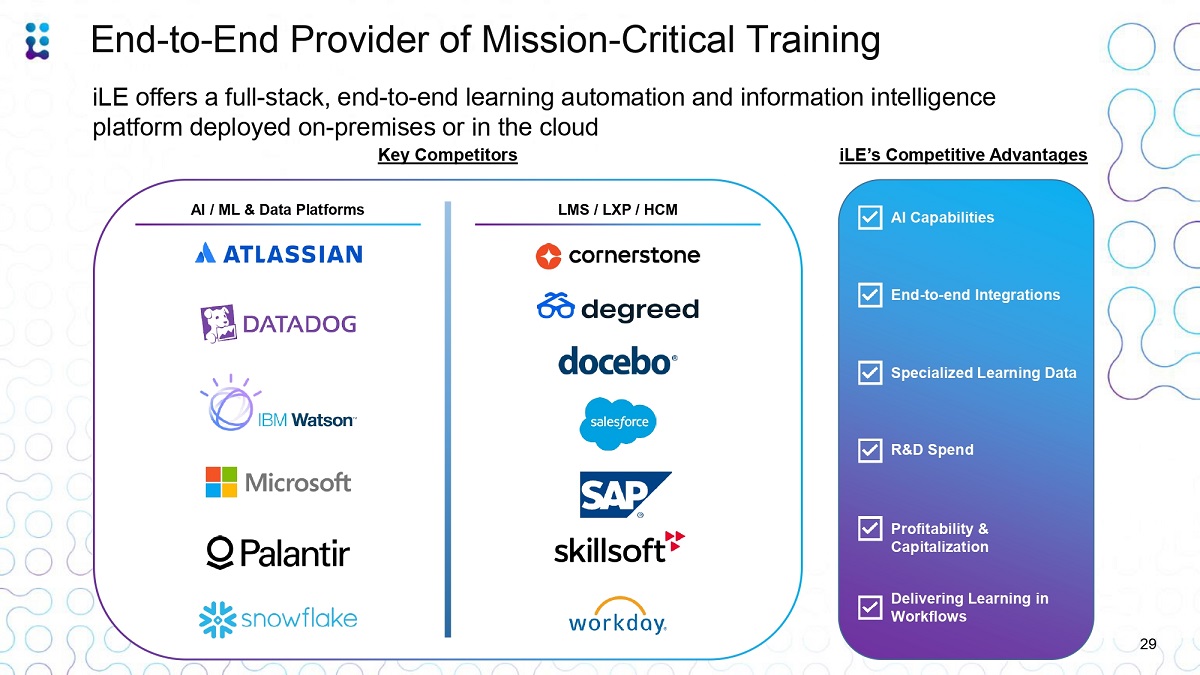

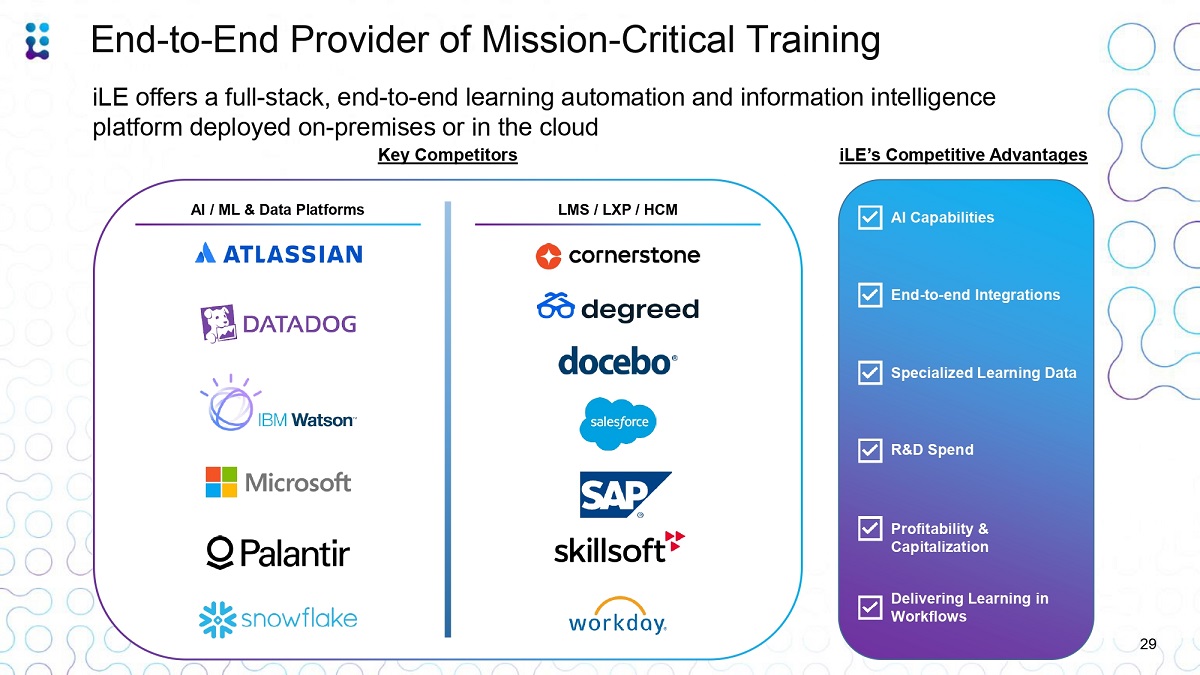

End - to - End Provider of Mission - Critical Training 29 AI / ML & Data Platforms LMS / LXP / HCM AI Capabilities End - to - end Integrations Specialized Learning Data R&D Spend Profitability & Capitalization Delivering Learning in Workflows iLE offers a full - stack, end - to - end learning automation and information intelligence platform deployed on - premises or in the cloud Key Competitors iLE’s Competitive Advantages

III. Financial Information

$130.8 $206.4 $287.0 $412.6 $141.8 $217.9 $308.9 $418.6 CY2020A CY2021A CY2022A CY2023E Recurring Revenue Implementation Revenue Note: The financial information and data contained in the summary financials is unaudited and does not conform to Regulation S - X or the standards of the Public Company Accounting Oversight Board. Accordingly, such information and data may not be included in, may be adjusted in, or may be presented differently in, any proxy statement/prospectus or registration statement or other report or document to be filed or furnished by Arrowroot with the SEC. See “Financial Information; Non - GAAP Financial Measures” on Slide 4; (1) Projected or estimated financial information constitutes forward - looking information and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results. The assumptions and estimates underlying such financial forecast information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive, and other risks and uncertainties. See “Forward - Looking Statements” and “Use of Projections” on Slide 3; (2) Includes 12 - Month Subscription Based Revenue and Implementation Revenue; (3) Adjusted EBITDA and Adjusted EBITDA Margin are non - GAAP financial measures. Proven Profitable Revenue Growth Profile (1) 31 iLearningEngines Pro Forma GAAP Revenue (2) ($ in millions) iLearningEngines Adjusted EBITDA & Margin (3) ($ in millions) Built scaled platform with minimal external capital funding $7.9 $8.2 $12.0 $23.4 5.6% 3.8% 3.9% 5.6% CY2020A CY2021A CY2022A CY2023E

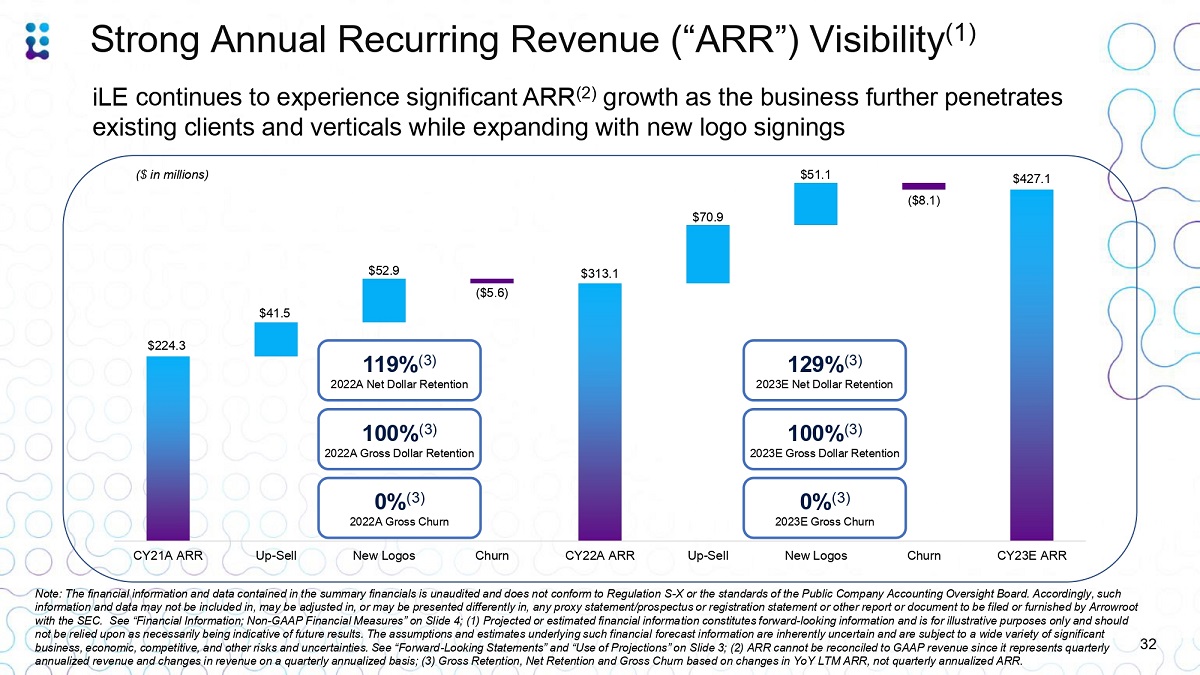

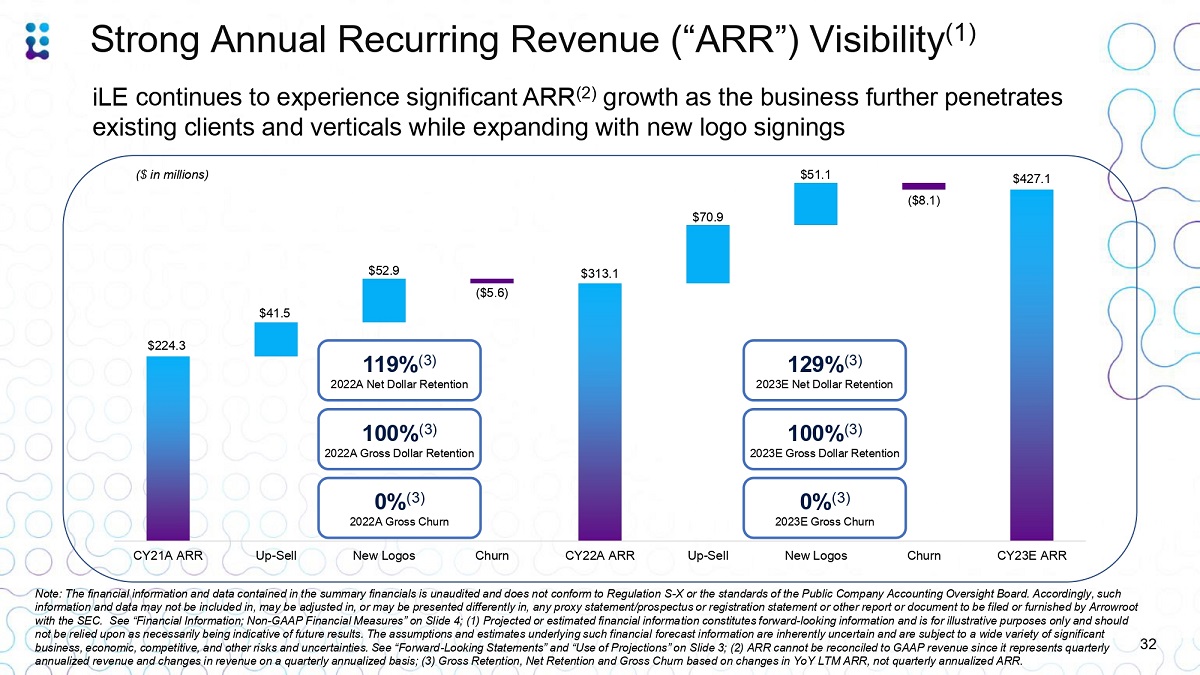

$313.1 $427.1 $41.5 $224.3 $70.9 $52.9 $51.1 ($5.6) ($8.1) CY23E ARR Strong Annual Recurring Revenue (“ARR”) Visibility (1) 32 iLE continues to experience significant ARR (2) growth as the business further penetrates existing clients and verticals while expanding with new logo signings Note: The financial information and data contained in the summary financials is unaudited and does not conform to Regulation S - X or the standards of the Public Company Accounting Oversight Board. Accordingly, such information and data may not be included in, may be adjusted in, or may be presented differently in, any proxy statement/prospectus or registration statement or other report or document to be filed or furnished by Arrowroot with the SEC. See “Financial Information; Non - GAAP Financial Measures” on Slide 4; (1) Projected or estimated financial information constitutes forward - looking information and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results. The assumptions and estimates underlying such financial forecast information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive, and other risks and uncertainties. See “Forward - Looking Statements” and “Use of Projections” on Slide 3; (2) ARR cannot be reconciled to GAAP revenue since it represents quarterly annualized revenue and changes in revenue on a quarterly annualized basis; (3) Gross Retention, Net Retention and Gross Churn based on changes in YoY LTM ARR, not quarterly annualized ARR. 119% (3) 2022A Net Dollar Retention 100% (3) 2022A Gross Dollar Retention 129% (3) 2023E Net Dollar Retention 100% (3) 2023E Gross Dollar Retention ($ in millions) 0% (3) 2022A Gross Churn CY21A ARR Up - Sell New Logos Churn 0% (3) 2023E Gross Churn CY22A ARR Up - Sell New Logos Churn

56.4% 35.9% 32.6% 31.7% 30.8% CY2019A CY2020A CY2021A CY2022A CY2023E Note: The financial information and data contained in the summary financials is unaudited and does not conform to Regulation S - X or the standards of the Public Company Accounting Oversight Board. Accordingly, such information and data may not be included in, may be adjusted in, or may be presented differently in, any proxy statement/prospectus or registration statement or other report or document to be filed or furnished by Arrowroot with the SEC. See “Financial Information; Non - GAAP Financial Measures” on Slide 4; (1) Projected or estimated financial information constitutes forward - looking information and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results. The assumptions and estimates underlying such financial forecast information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive, and other risks and uncertainties. See “Forward - Looking Statements” and “Use of Projections” on Slide 3 R&D as a Percentage of Revenue Significant Room For Operating Leverage (1) 33 R&D $49,848,273 $50,893,488 $70,950,019 $97,835,157 $128,755,709

34 Multiple Growth Opportunities Resulting in Accelerating ARR Grow in Existing Verticals • Penetrate further into existing strong verticals of healthcare, oil & gas, and education • Onboard channel partners in identified verticals for accelerated growth and increase sales force efficiency Geographic Expansion • Strategically invest in channel partners / direct sales in existing markets to minimize sales infrastructure requirements, maximizing reach in new geographies • Ramp up North American sales force and grow North American revenue share to 50% Digital Learning Megatrends • Capitalize on significant expected market growth • Capture increased demand in the wake of COVID - 19 that is driving increased remote workforces and learning environments Expand into New Verticals • Penetrate new verticals and capture demand for remote e - Learning capabilities • Verticalize salesforce to drive sector experience • Leverage M&A opportunities to expand geographic market presence and customer base (i.e. acquisition in April 2022) Expand Product Pipeline • Acquire and monetize cross - functional data sets from customers • Further develop AI - enabled cognitive ecosystem to create broader solutions across other corporate functions iLE’s unique IP creates high barriers to entry and switching costs that position the business to accelerate revenue growth with minimal equity capital raised to date

IV. Transaction Overview

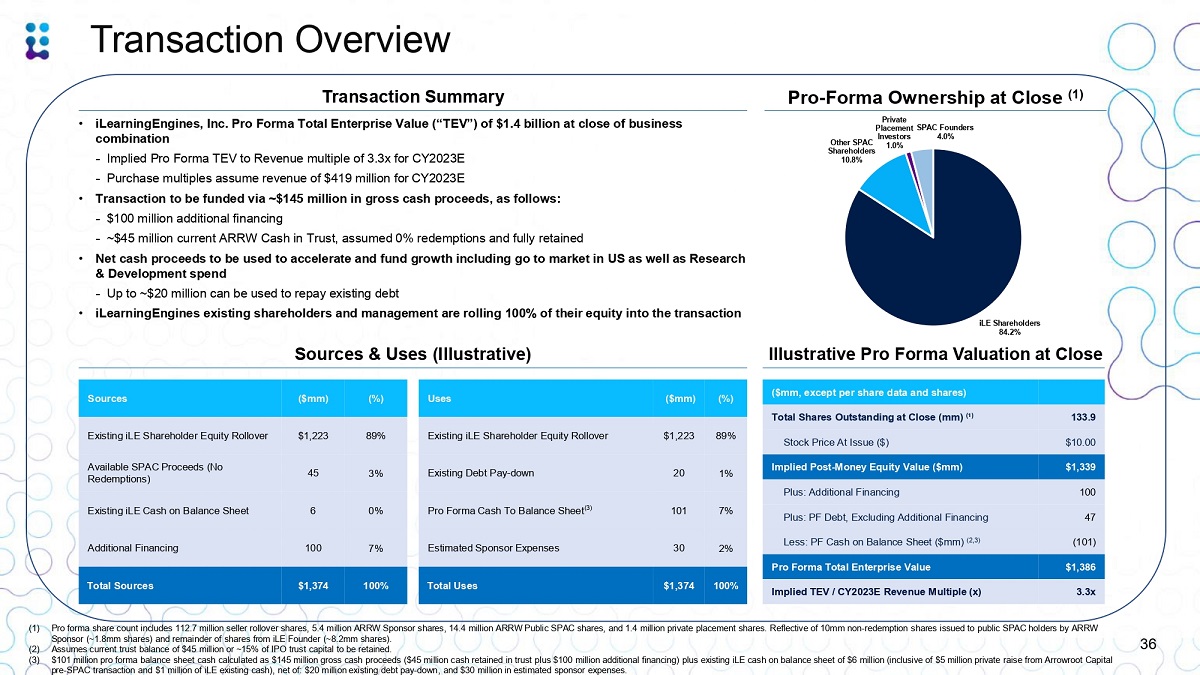

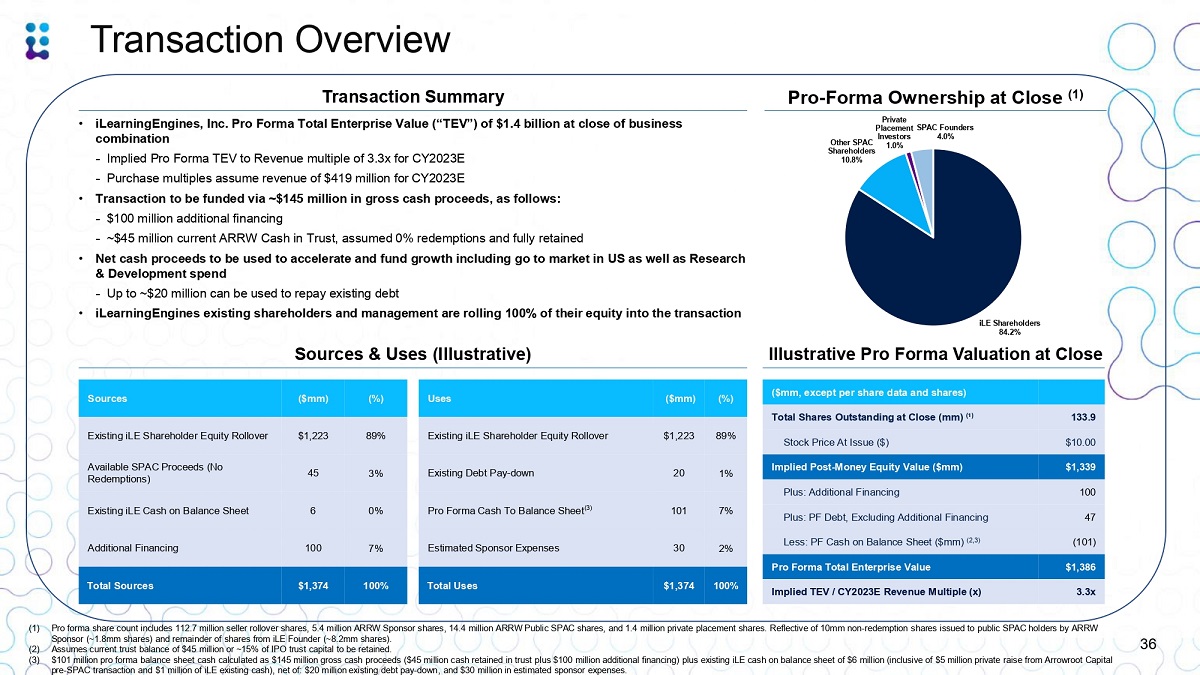

iLE Shareholders 84.2% Shareholders 10.8% Private Placement Investors Other SPAC 1.0% SPAC Founders 4.0% Transaction Overview Transaction Summary Pro - Forma Ownership at Close (1) • iLearningEngines, Inc. Pro Forma Total Enterprise Value (“TEV”) of $1.4 billion at close of business combination – Implied Pro Forma TEV to Revenue multiple of 3.3x for CY2023E – Purchase multiples assume revenue of $419 million for CY2023E • Transaction to be funded via ~$145 million in gross cash proceeds, as follows: – $100 million additional financing – ~$45 million current ARRW Cash in Trust, assumed 0% redemptions and fully retained • Net cash proceeds to be used to accelerate and fund growth including go to market in US as well as Research & Development spend – Up to ~$20 million can be used to repay existing debt • iLearningEngines existing shareholders and management are rolling 100% of their equity into the transaction Sources ($mm) (%) Existing iLE Shareholder Equity Rollover $1,223 89% Available SPAC Proceeds (No Redemptions) 45 3% Existing iLE Cash on Balance Sheet 6 0% Additional Financing 100 7% Total Sources $1,374 100% Uses ($mm) (%) Existing iLE Shareholder Equity Rollover $1,223 89% Existing Debt Pay - down 20 1% Pro Forma Cash To Balance Sheet (3) 101 7% Estimated Sponsor Expenses 30 2% Total Uses $1,374 100% ($mm, except per share data and shares) Total Shares Outstanding at Close (mm) ( ¹ ) 133.9 Stock Price At Issue ($) $10.00 Implied Post - Money Equity Value ($mm) $1,339 Plus: Additional Financing 100 Plus: PF Debt, Excluding Additional Financing 47 Less: PF Cash on Balance Sheet ($mm) (2,3) (101) Pro Forma Total Enterprise Value $1,386 Implied TEV / CY2023E Revenue Multiple (x) 3.3x Sources & Uses (Illustrative) (1) Pro forma share count includes 112.7 million seller rollover shares, 5.4 million ARRW Sponsor shares, 14.4 million ARRW Public SPAC shares, and 1.4 million private placement shares. Reflective of 10mm non - redemption shares issued to public SPAC holders by ARRW Sponsor (~1.8mm shares) and remainder of shares from iLE Founder (~8.2mm shares). (2) Assumes current trust balance of $45 million or ~15% of IPO trust capital to be retained. (3) $101 million pro forma balance sheet cash calculated as $145 million gross cash proceeds ($45 million cash retained in trust plus $100 million additional financing) plus existing iLE cash on balance sheet of $6 million (inclusive of $5 million private raise from Arrowroot Capital pre - SPAC transaction and $1 million of iLE existing cash), net of: $20 million existing debt pay - down, and $30 million in estimated sponsor expenses. 36 Illustrative Pro Forma Valuation at Close

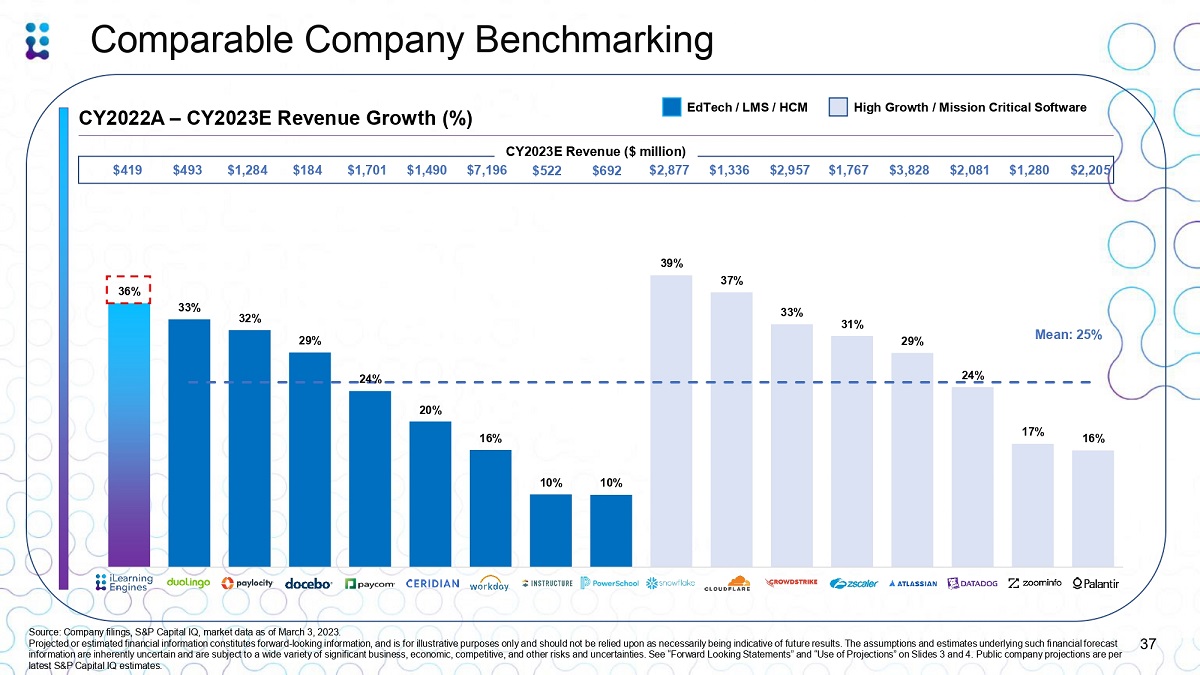

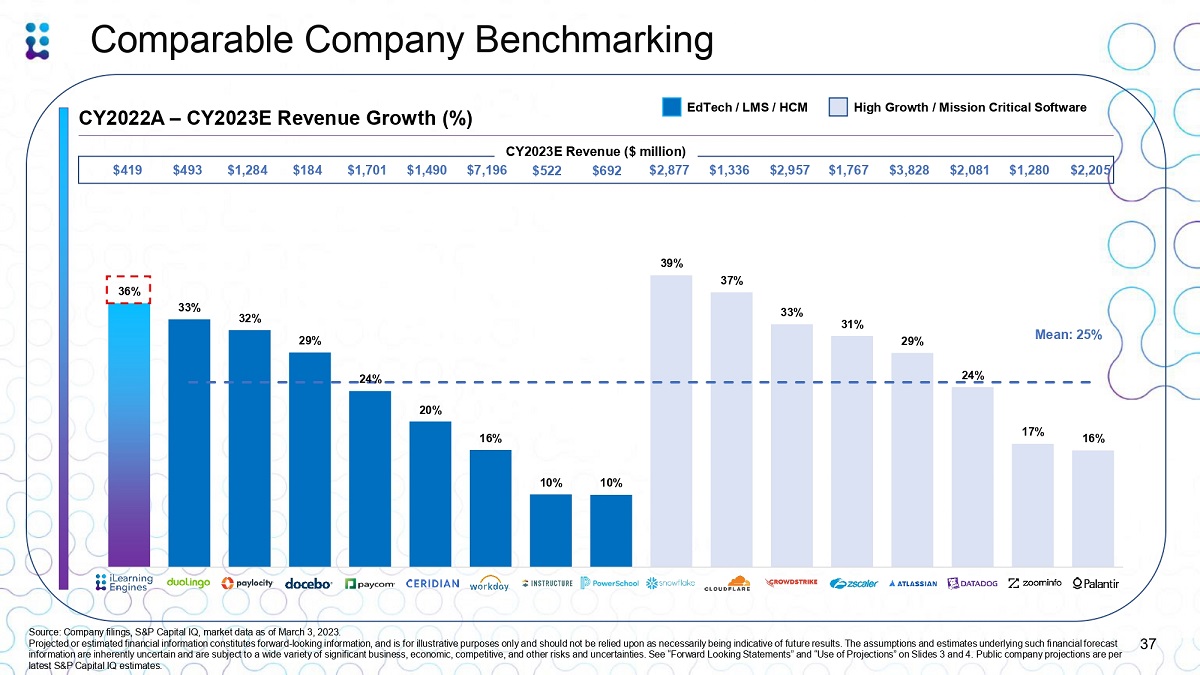

36% 33% 32% 29% 24% 20% 16% 10% 10% 39% 37% 33% 31% 29% 24% 17% 16% Comparable Company Benchmarking EdTech / LMS / HCM High Growth / Mission Critical Software Source: Company filings, S&P Capital IQ, market data as of March 3, 2023. Projected or estimated financial information constitutes forward - looking information, and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results. The assumptions and estimates underlying such financial forecast information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive, and other risks and uncertainties. See “Forward Looking Statements” and “Use of Projections” on Slides 3 and 4. Public company projections are per latest S&P Capital IQ estimates. 37 CY2022A – CY2023E Revenue Growth (%) CY2023E Revenue ($ million) $419 $493 $1,284 $184 $1,701 $1,490 $7,196 $522 $692 $2,877 $1,336 $2,957 $1,767 $3,828 $2,081 $1,280 $2,205 Mean: 25%

3.3x 8.7x 8.3x 5.3x 9.7x 8.3x 6.5x 7.6x 6.1x 15.2x 14.6x 9.4x 9.3x 11.8x 11.3x 8.8x 6.9x Comparable Company Benchmarking (Cont’d) Total Enterprise Value / CY2023E Revenue Multiple (x) Mean: 9.2x Source: Company filings, S&P Capital IQ, market data as of March 3, 2023. Projected or estimated financial information constitutes forward - looking information, and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results. The assumptions and estimates underlying such financial forecast information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive, and other risks and uncertainties. See “Forward Looking Statements” and “Use of Projections” on Slides 3 and 4. Public company projections are per latest S&P Capital IQ estimates. 38 EdTech / LMS / HCM High Growth / Mission Critical Software

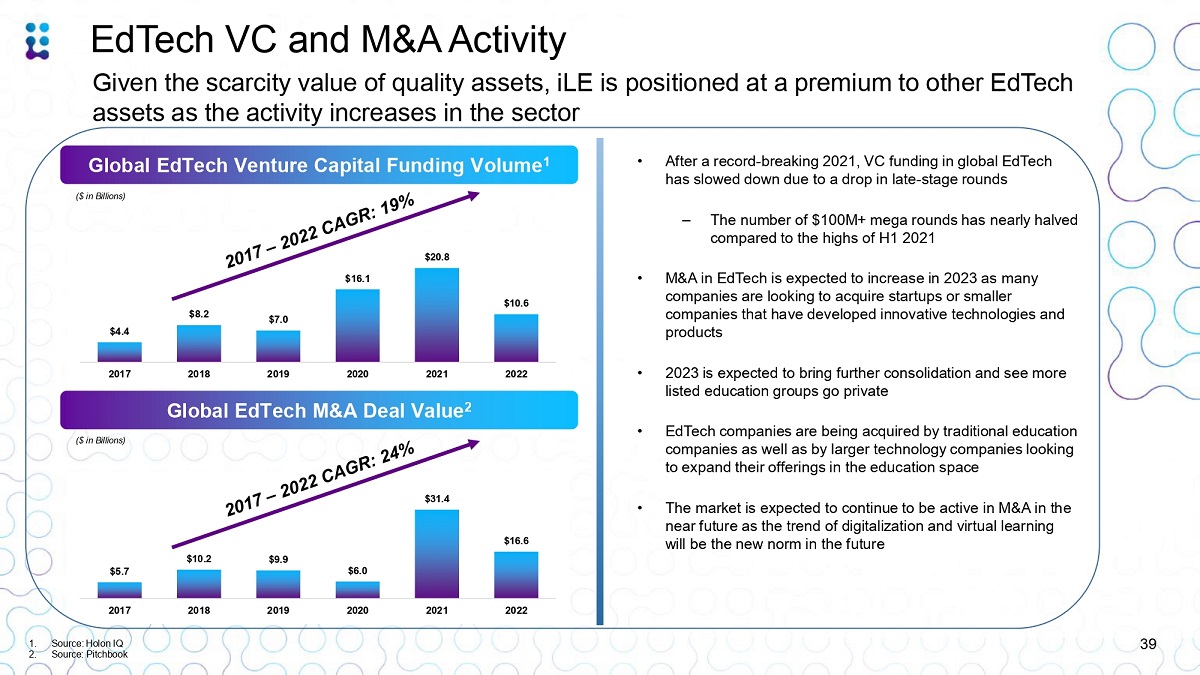

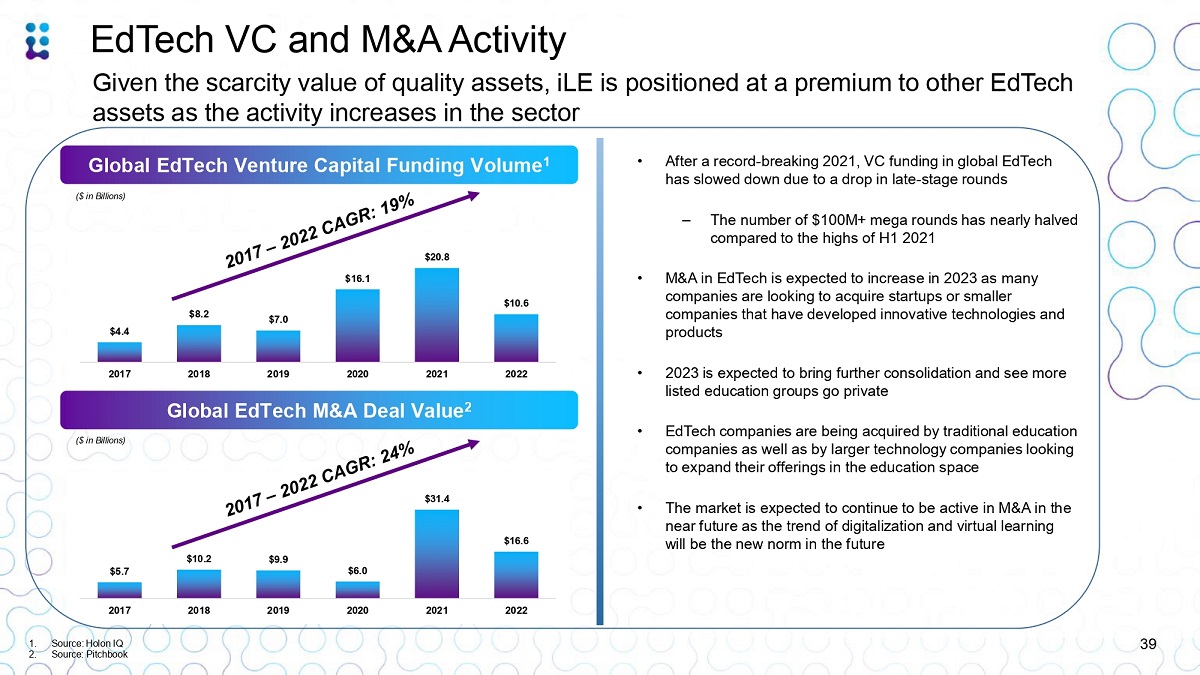

$4.4 $8.2 $7.0 $16.1 $20.8 $10.6 2017 2022 $5.7 $10.2 $9.9 $6.0 $31.4 $16.6 2017 2018 2019 2020 2021 2022 39 EdTech VC and M&A Activity Global EdTech Venture Capital Funding Volume 1 ($ in Billions) • After a record - breaking 2021, VC funding in global EdTech has slowed down due to a drop in late - stage rounds ‒ The number of $100M+ mega rounds has nearly halved compared to the highs of H1 2021 • M&A in EdTech is expected to increase in 2023 as many companies are looking to acquire startups or smaller companies that have developed innovative technologies and products • 2023 is expected to bring further consolidation and see more listed education groups go private • EdTech companies are being acquired by traditional education companies as well as by larger technology companies looking to expand their offerings in the education space • The market is expected to continue to be active in M&A in the near future as the trend of digitalization and virtual learning will be the new norm in the future 1. Source: Holon IQ 2. Source: Pitchbook 2018 2019 2020 2021 Global EdTech M&A Deal Value 2 ($ in Billions) Given the scarcity value of quality assets, iLE is positioned at a premium to other EdTech assets as the activity increases in the sector

V. Appendix

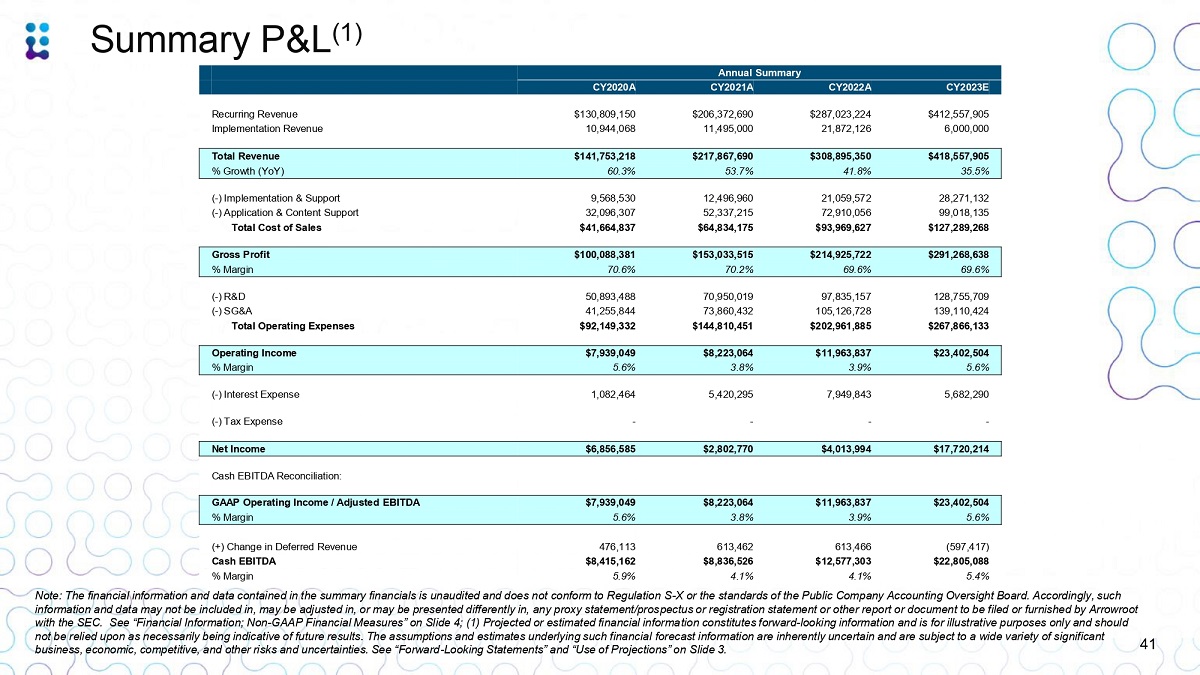

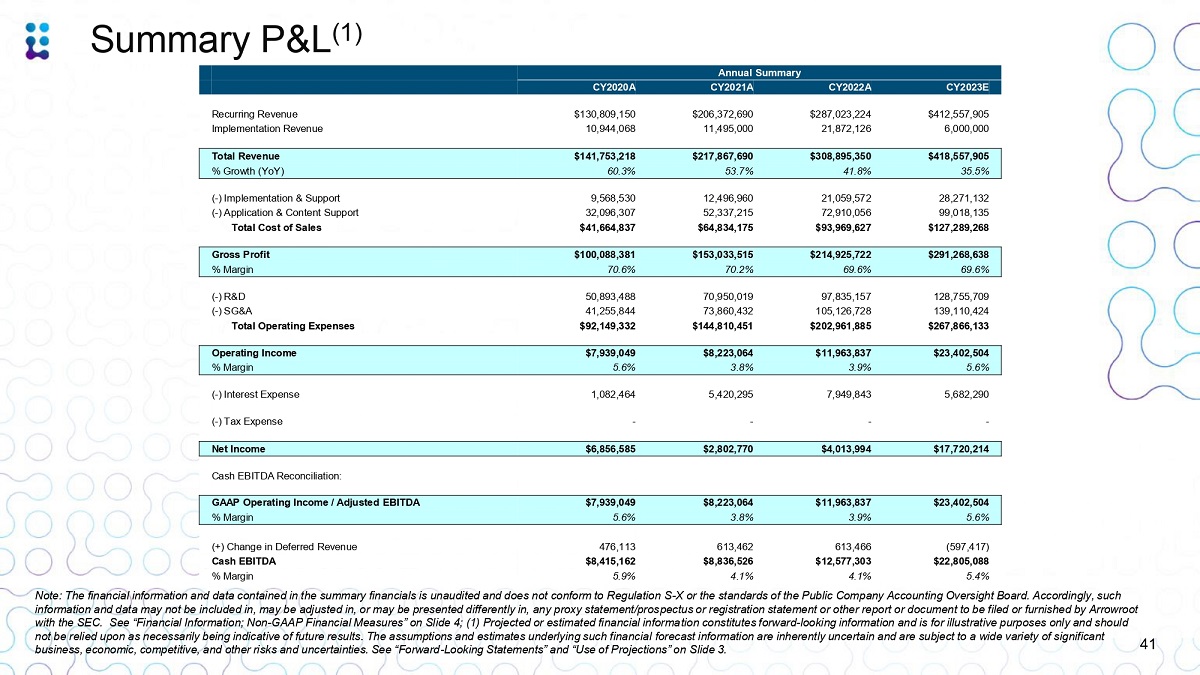

Summary P&L (1) 41 Annual Summary CY2020A CY2021A CY2022A CY2023E Recurring Revenue $130,809,150 $206,372,690 $287,023,224 $412,557,905 Implementation Revenue 10,944,068 11,495,000 21,872,126 6,000,000 Total Revenue $141,753,218 $217,867,690 $308,895,350 $418,557,905 % Growth (YoY) 60.3% 53.7% 41.8% 35.5% ( - ) Implementation & Support 9,568,530 12,496,960 21,059,572 28,271,132 ( - ) Application & Content Support 32,096,307 52,337,215 72,910,056 99,018,135 Total Cost of Sales $41,664,837 $64,834,175 $93,969,627 $127,289,268 Gross Profit $100,088,381 $153,033,515 $214,925,722 $291,268,638 % Margin 70.6% 70.2% 69.6% 69.6% ( - ) R&D 50,893,488 70,950,019 97,835,157 128,755,709 ( - ) SG&A 41,255,844 73,860,432 105,126,728 139,110,424 Total Operating Expenses $92,149,332 $144,810,451 $202,961,885 $267,866,133 Operating Income $7,939,049 $8,223,064 $11,963,837 $23,402,504 % Margin 5.6% 3.8% 3.9% 5.6% ( - ) Interest Expense ( - ) Tax Expense 1,082,464 5,420,295 7,949,843 5,682,290 - - - - Net Income $6,856,585 $2,802,770 $4,013,994 $17,720,214 Cash EBITDA Reconciliation: GAAP Operating Income / Adjusted EBITDA $7,939,049 $8,223,064 $11,963,837 $23,402,504 % Margin 5.6% 3.8% 3.9% 5.6% 613,466 (597,417) $12,577,303 $22,805,088 (+) Change in Deferred Revenue 476,113 613,462 $8,836,526 Cash EBITDA $8,415,162 % Margin 5.9% 4.1% 4.1% 5.4% Note: The financial information and data contained in the summary financials is unaudited and does not conform to Regulation S - X or the standards of the Public Company Accounting Oversight Board. Accordingly, such information and data may not be included in, may be adjusted in, or may be presented differently in, any proxy statement/prospectus or registration statement or other report or document to be filed or furnished by Arrowroot with the SEC. See “Financial Information; Non - GAAP Financial Measures” on Slide 4; (1) Projected or estimated financial information constitutes forward - looking information and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results. The assumptions and estimates underlying such financial forecast information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive, and other risks and uncertainties. See “Forward - Looking Statements” and “Use of Projections” on Slide 3.

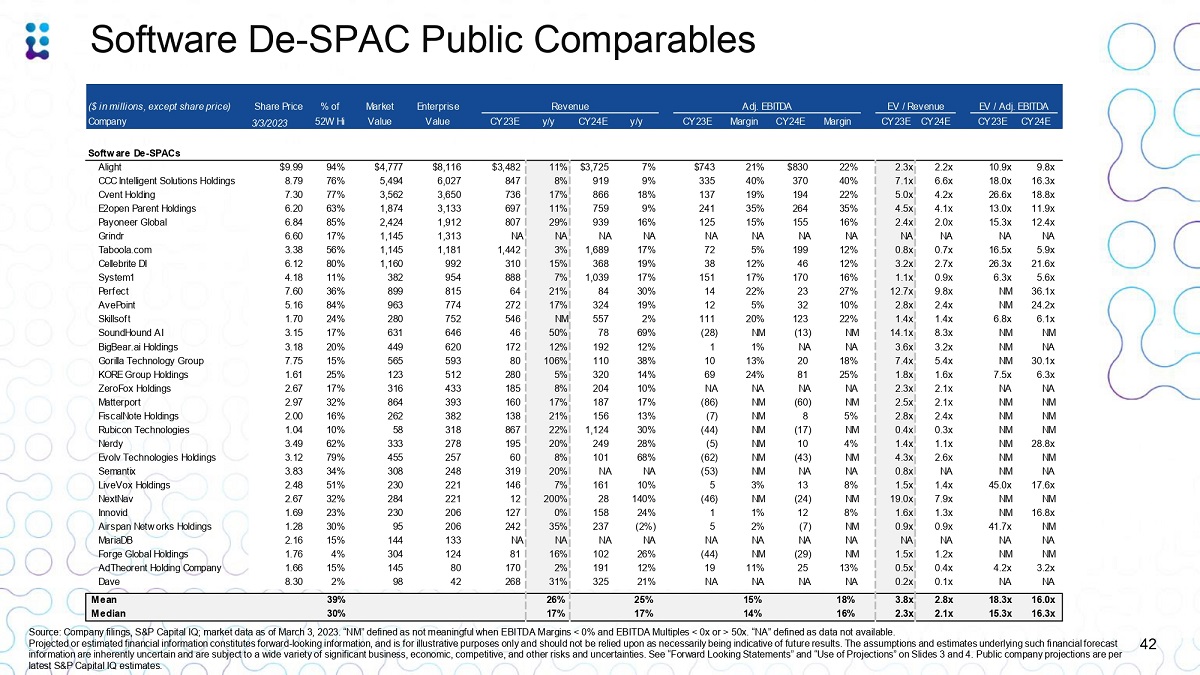

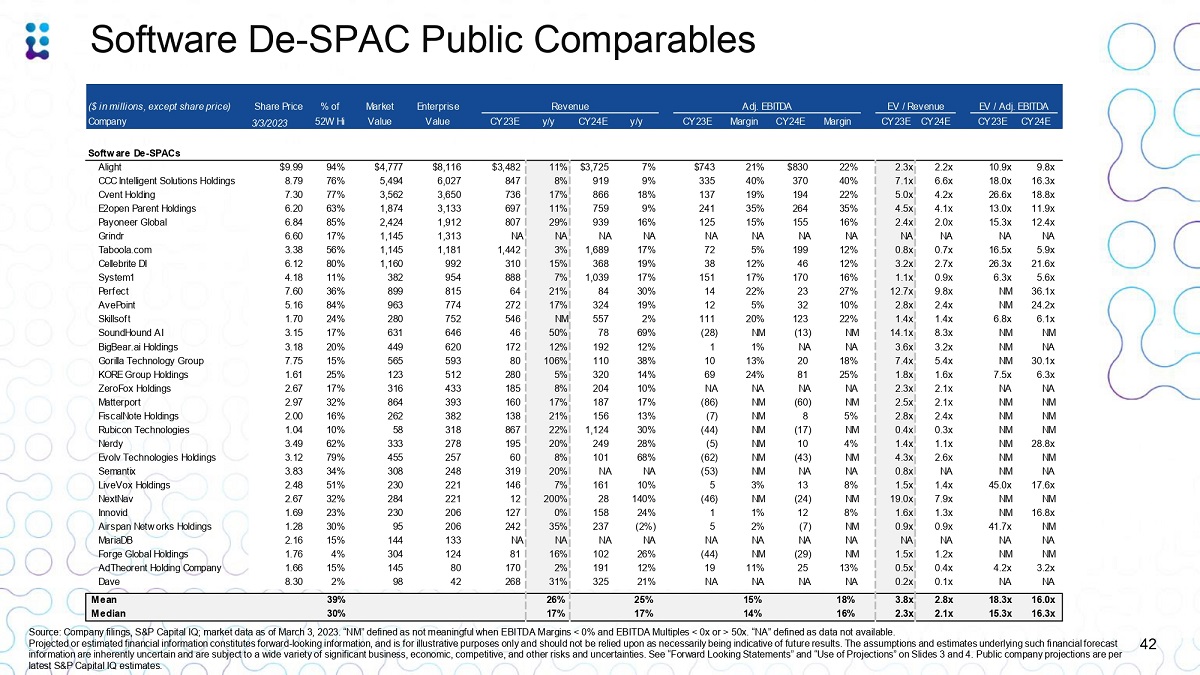

Software De - SPAC Public Comparables 42 Source: Company filings, S&P Capital IQ; market data as of March 3, 2023. “NM” defined as not meaningful when EBITDA Margins < 0% and EBITDA Multiples < 0x or > 50x. “NA” defined as data not available. Projected or estimated financial information constitutes forward - looking information, and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results. The assumptions and estimates underlying such financial forecast information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive, and other risks and uncertainties. See “Forward Looking Statements” and “Use of Projections” on Slides 3 and 4. Public company projections are per latest S&P Capital IQ estimates. Share Price % of Revenue ($ in millions, except share price) Company 3/3/2023 52W Hi Market Value Enterprise Value CY23E y/y CY24E y/y Adj. EBITDA CY23E Margin CY24E Margin EV / Revenue CY23E CY24E EV / Adj. EBITDA CY23E CY24E Softw are De - SPACs Alight $9.99 94% $4,777 $8,116 $3,482 11% $3,725 7% $743 21% $830 22% 2.3x 2.2x 10.9x 9.8x CCC Intelligent Solutions Holdings 8.79 76% 5,494 6,027 847 8% 919 9% 335 40% 370 40% 7.1x 6.6x 18.0x 16.3x Cvent Holding 7.30 77% 3,562 3,650 736 17% 866 18% 137 19% 194 22% 5.0x 4.2x 26.6x 18.8x E2open Parent Holdings 6.20 63% 1,874 3,133 697 11% 759 9% 241 35% 264 35% 4.5x 4.1x 13.0x 11.9x Payoneer Global 6.84 85% 2,424 1,912 807 29% 939 16% 125 15% 155 16% 2.4x 2.0x 15.3x 12.4x Grindr 6.60 17% 1,145 1,313 NA NA NA NA NA NA NA NA NA NA NA NA Taboola.com 3.38 56% 1,145 1,181 1,442 3% 1,689 17% 72 5% 199 12% 0.8x 0.7x 16.5x 5.9x Cellebrite DI 6.12 80% 1,160 992 310 15% 368 19% 38 12% 46 12% 3.2x 2.7x 26.3x 21.6x System1 4.18 11% 382 954 888 7% 1,039 17% 151 17% 170 16% 1.1x 0.9x 6.3x 5.6x Perfect 7.60 36% 899 815 64 21% 84 30% 14 22% 23 27% 12.7x 9.8x NM 36.1x AvePoint 5.16 84% 963 774 272 17% 324 19% 12 5% 32 10% 2.8x 2.4x NM 24.2x Skillsoft 1.70 24% 280 752 546 NM 557 2% 111 20% 123 22% 1.4x 1.4x 6.8x 6.1x SoundHound AI 3.15 17% 631 646 46 50% 78 69% (28) NM (13) NM 14.1x 8.3x NM NM BigBear.ai Holdings 3.18 20% 449 620 172 12% 192 12% 1 1% NA NA 3.6x 3.2x NM NA Gorilla Technology Group 7.75 15% 565 593 80 106% 110 38% 10 13% 20 18% 7.4x 5.4x NM 30.1x KORE Group Holdings 1.61 25% 123 512 280 5% 320 14% 69 24% 81 25% 1.8x 1.6x 7.5x 6.3x ZeroFox Holdings 2.67 17% 316 433 185 8% 204 10% NA NA NA NA 2.3x 2.1x NA NA Matterport 2.97 32% 864 393 160 17% 187 17% (86) NM (60) NM 2.5x 2.1x NM NM FiscalNote Holdings 2.00 16% 262 382 138 21% 156 13% (7) NM 8 5% 2.8x 2.4x NM NM Rubicon Technologies 1.04 10% 58 318 867 22% 1,124 30% (44) NM (17) NM 0.4x 0.3x NM NM Nerdy 3.49 62% 333 278 195 20% 249 28% (5) NM 10 4% 1.4x 1.1x NM 28.8x Evolv Technologies Holdings 3.12 79% 455 257 60 8% 101 68% (62) NM (43) NM 4.3x 2.6x NM NM Semantix 3.83 34% 308 248 319 20% NA NA (53) NM NA NA 0.8x NA NM NA LiveVox Holdings 2.48 51% 230 221 146 7% 161 10% 5 3% 13 8% 1.5x 1.4x 45.0x 17.6x NextNav 2.67 32% 284 221 12 200% 28 140% (46) NM (24) NM 19.0x 7.9x NM NM Innovid 1.69 23% 230 206 127 0% 158 24% 1 1% 12 8% 1.6x 1.3x NM 16.8x Airspan Netw orks Holdings 1.28 30% 95 206 242 35% 237 (2%) 5 2% (7) NM 0.9x 0.9x 41.7x NM MariaDB 2.16 15% 144 133 NA NA NA NA NA NA NA NA NA NA NA NA Forge Global Holdings 1.76 4% 304 124 81 16% 102 26% (44) NM (29) NM 1.5x 1.2x NM NM AdTheorent Holding Company 1.66 15% 145 80 170 2% 191 12% 19 11% 25 13% 0.5x 0.4x 4.2x 3.2x Dave 8.30 2% 98 42 268 31% 325 21% NA NA NA NA 0.2x 0.1x NA NA Mean 39% 26% 25% 15% 18% 3.8x 2.8x 18.3x 16.0x Median 30% 17% 17% 14% 16% 2.3x 2.1x 15.3x 16.3x

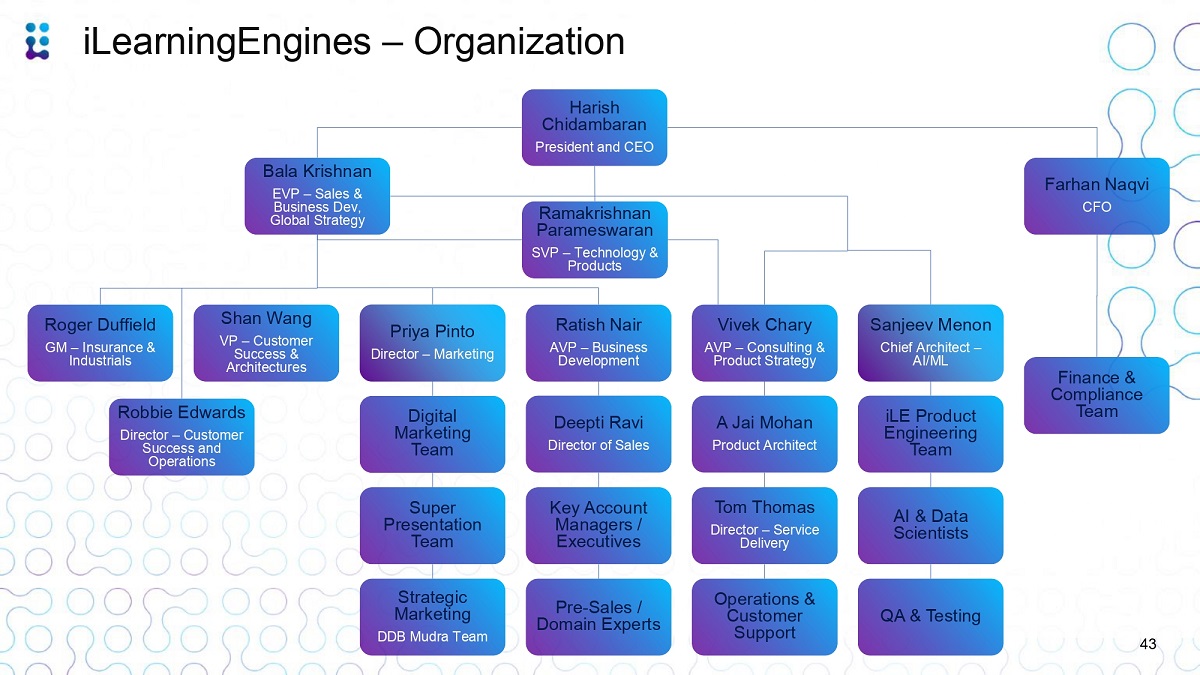

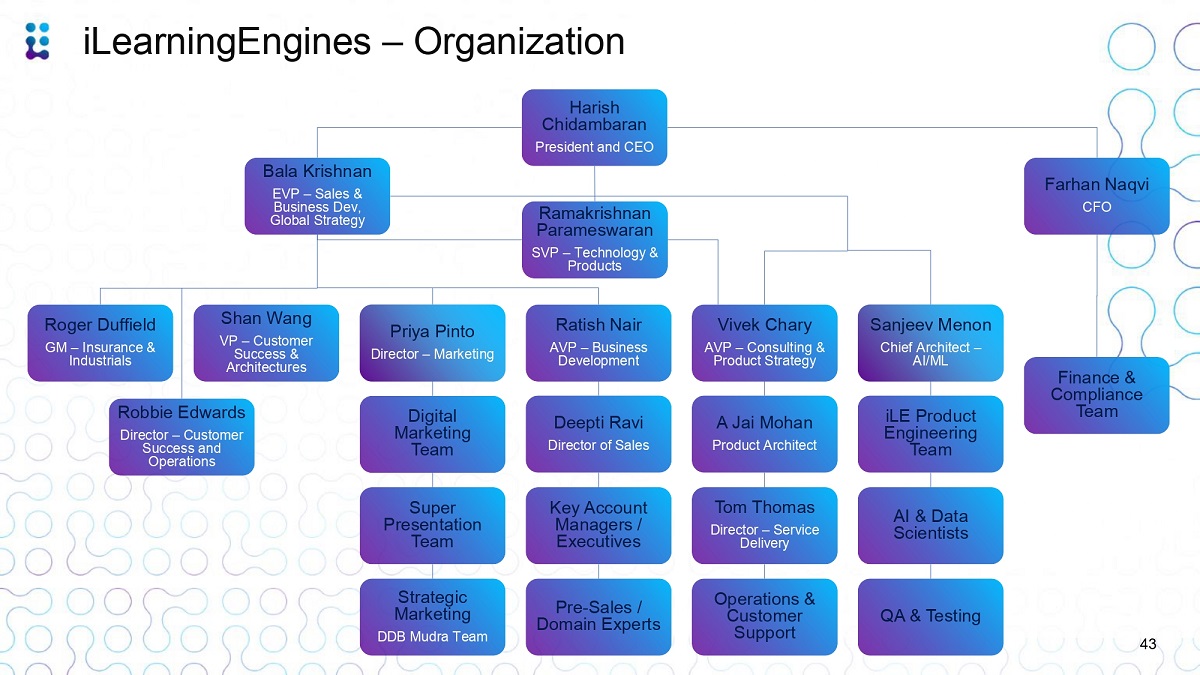

iLearningEngines – Organization 43 Harish Chidambaran President and CEO Bala Krishnan EVP – Sales & Business Dev, Global Strategy Ramakrishnan Parameswaran SVP – Technology & Products Farhan Naqvi CFO Finance & Compliance Team Roger Duffield GM – Insurance & Industrials Robbie Edwards Director – Customer Success and Operations Shan Wang VP – Customer Success & Architectures Priya Pinto Director – Marketing Ratish Nair AVP – Business Development Vivek Chary AVP – Consulting & Product Strategy Sanjeev Menon Chief Architect – AI/ML Digital Marketing Team Deepti Ravi Director of Sales A Jai Mohan Product Architect iLE Product Engineering Team Super Presentation Team Key Account Managers / Executives Tom Thomas Director – Service Delivery AI & Data Scientists Strategic Marketing DDB Mudra Team Pre - Sales / Domain Experts Operations & Customer Support QA & Testing

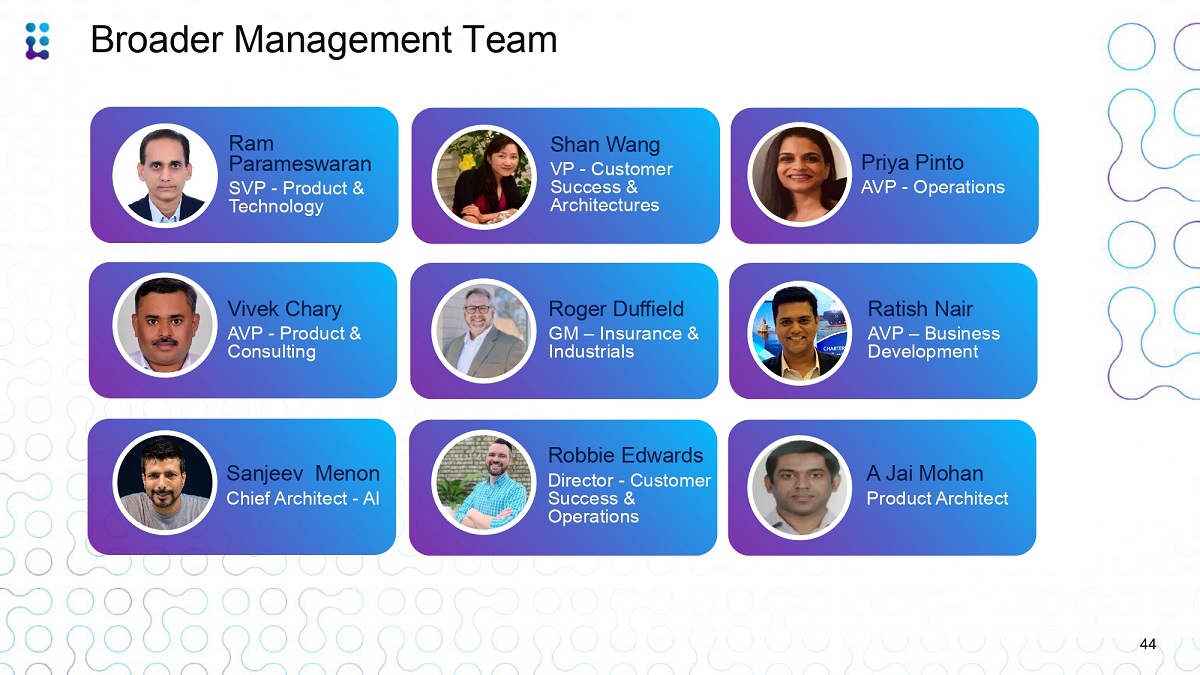

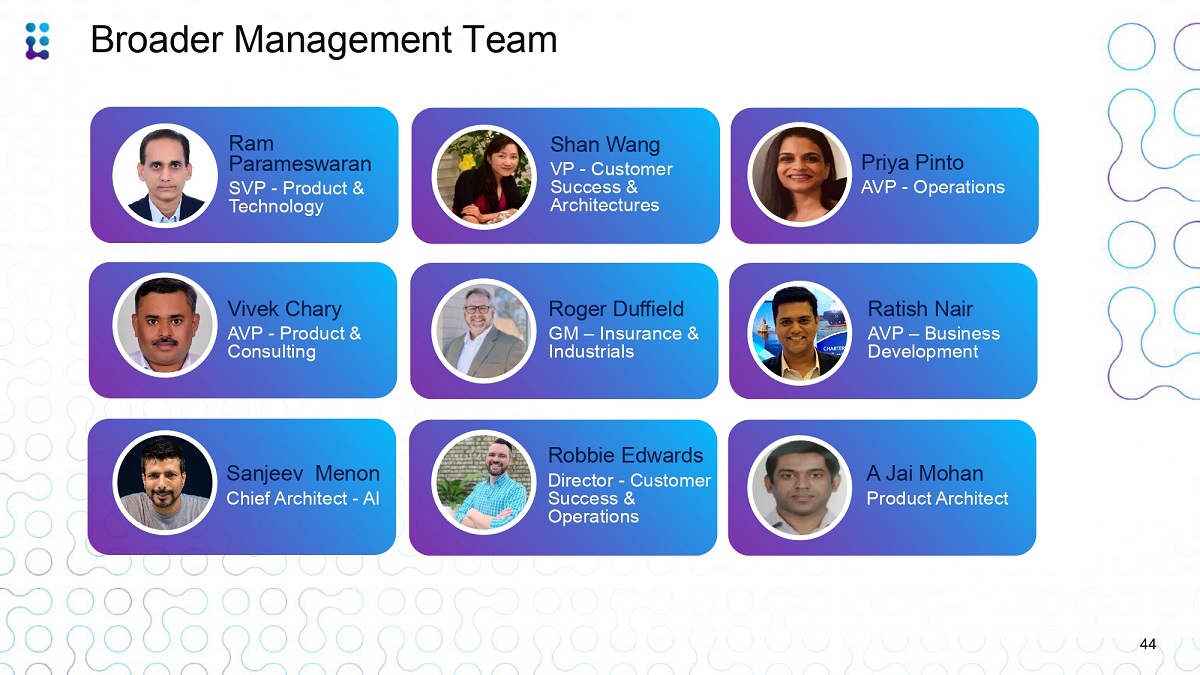

Ram Parameswaran SVP - Product & Technology Priya Pinto AVP - Operations Shan Wang VP - Customer Success & Architectures Vivek Chary AVP - Product & Consulting Ratish Nair AVP – Business Development Roger Duffield GM – Insurance & Industrials Sanjeev Menon Chief Architect - AI A Jai Mohan Product Architect Robbie Edwards Director - Customer Success & Operations Broader Management Team 44

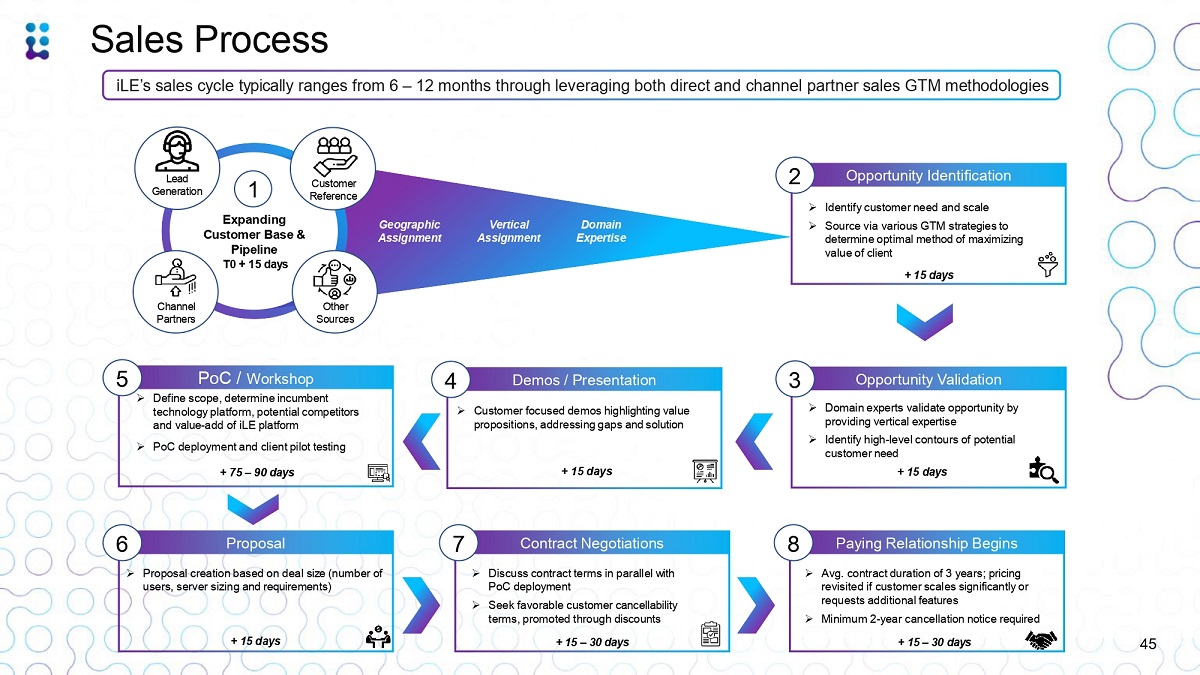

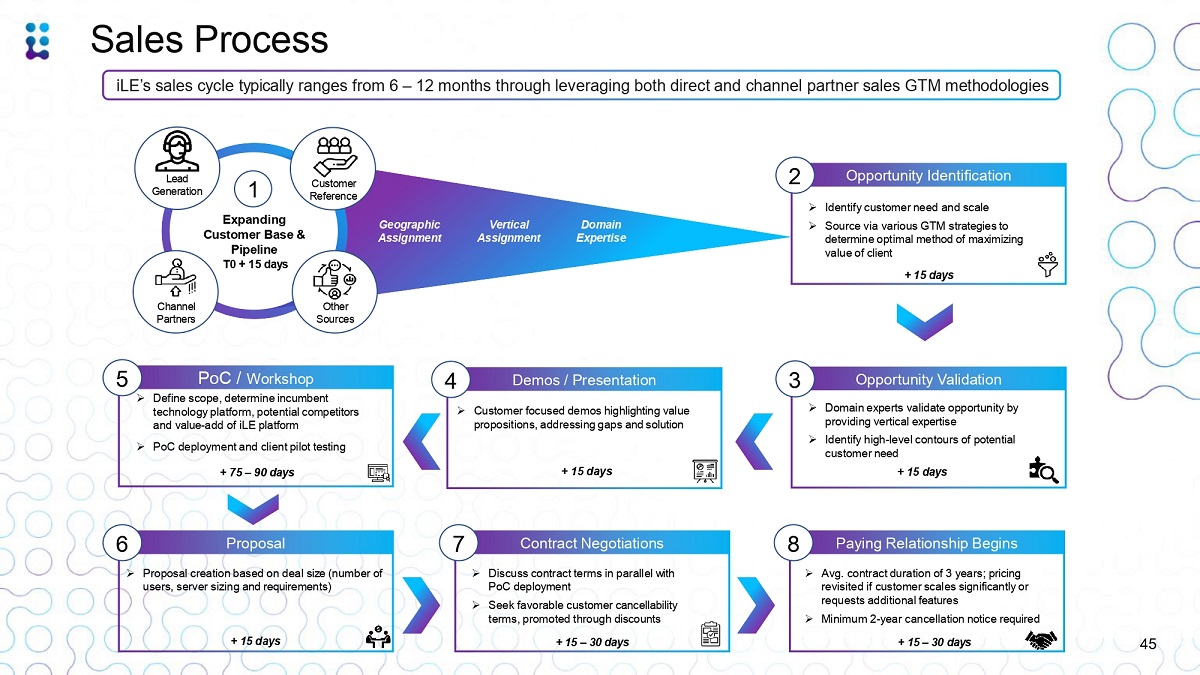

Lead Generation Customer Reference Channel Partners Other Sources 1 Expanding Customer Base & Pipeline T0 + 15 days Vertical Assignment Geographic Assignment Domain Expertise Opportunity Identification 2 » Identify customer need and scale » Source via various GTM strategies to determine optimal method of maximizing value of client + 15 days » Proposal creation based on deal size (number of users, server sizing and requirements) + 15 days Proposal 6 » Discuss contract terms in parallel with PoC deployment » Seek favorable customer cancellability terms, promoted through discounts + 15 – 30 days Contract Negotiations 7 » Avg. contract duration of 3 years; pricing revisited if customer scales significantly or requests additional features » Minimum 2 - year cancellation notice required + 15 – 30 days Paying Relationship Begins 8 » Define scope, determine incumbent technology platform, potential competitors and value - add of iLE platform » PoC deployment and client pilot testing + 75 – 90 days PoC / Workshop 5 » Customer focused demos highlighting value propositions, addressing gaps and solution + 15 days Demos / Presentation 4 » Domain experts validate opportunity by providing vertical expertise » Identify high - level contours of potential customer need + 15 days Opportunity Validation 3 iLE’s sales cycle typically ranges from 6 – 12 months through leveraging both direct and channel partner sales GTM methodologies Sales Process 45

2 4 OPERATIONALIZE Phase 4 is to operationalize Support Teams operationalized, Workforce Strategy definition 1 3 USER ONBOARDING Phase 3 is on platform adoption, for which Org change management, communication and User trainings are crucial factors Organization Change management, User Trainings DEPLOYMENT Phase 2 is to translate agreed Design - Strategy intent to Deployment AI Learning Platform Deployment, AI - enabled Content Strategy, iLE Expert Strategy, iLE Workforce Strategy Rollout DISCOVERY Phase 1 is to ensure better fit to business processes and effective platform adoption into an organization Understanding existing learning landscape, processes and define strategic road map EXECUTIVE REVIEWS: Spanning across phases & driven by Onboarding metrics, Learning Outcomes tracking & cross - Org. Platform adoption 46 Scalable & Accelerated Deployment (1 - 3 months)

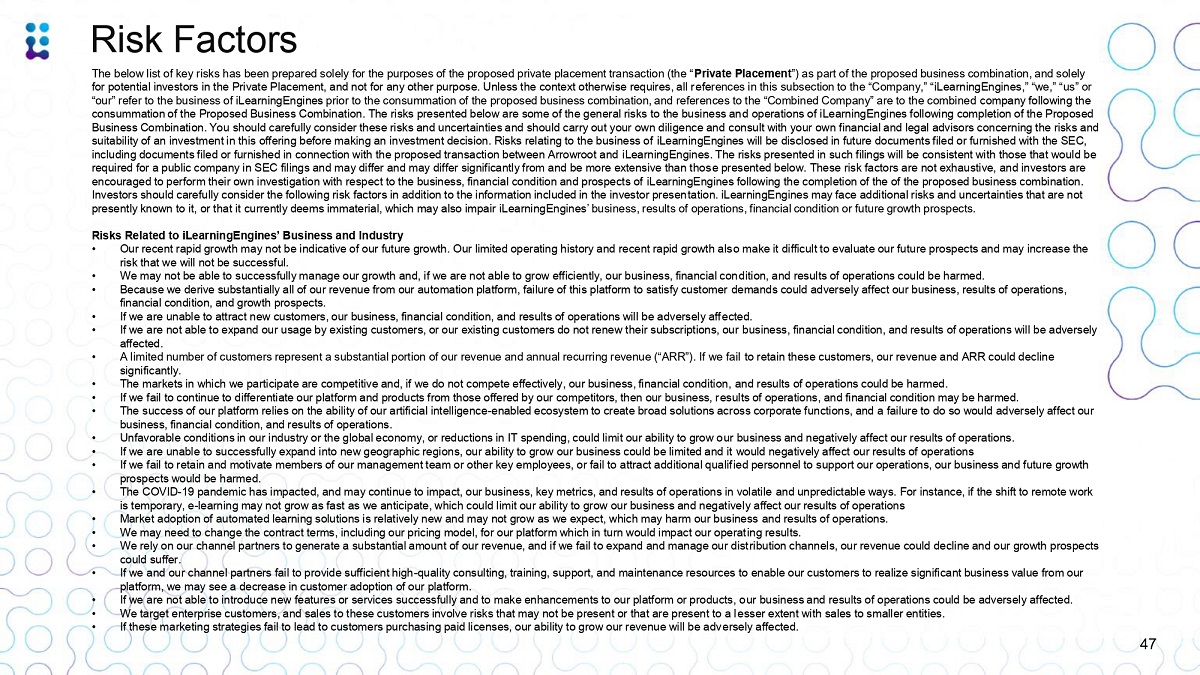

Risk Factors 47 The below list of key risks has been prepared solely for the purposes of the proposed private placement transaction (the “ Private Placement ”) as part of the proposed business combination, and solely for potential investors in the Private Placement, and not for any other purpose. Unless the context otherwise requires, all references in this subsection to the “Company,” “iLearningEngines,” “we,” “us” or “our” refer to the business of iLearningEngines prior to the consummation of the proposed business combination, and references to the “Combined Company” are to the combined company following the consummation of the Proposed Business Combination. The risks presented below are some of the general risks to the business and operations of iLearningEngines following completion of the Proposed Business Combination. You should carefully consider these risks and uncertainties and should carry out your own diligence and consult with your own financial and legal advisors concerning the risks and suitability of an investment in this offering before making an investment decision. Risks relating to the business of iLearningEngines will be disclosed in future documents filed or furnished with the SEC, including documents filed or furnished in connection with the proposed transaction between Arrowroot and iLearningEngines. The risks presented in such filings will be consistent with those that would be required for a public company in SEC filings and may differ and may differ significantly from and be more extensive than those presented below. These risk factors are not exhaustive, and investors are encouraged to perform their own investigation with respect to the business, financial condition and prospects of iLearningEngines following the completion of the of the proposed business combination. Investors should carefully consider the following risk factors in addition to the information included in the investor presentation. iLearningEngines may face additional risks and uncertainties that are not presently known to it, or that it currently deems immaterial, which may also impair iLearningEngines’ business, results of operations, financial condition or future growth prospects. Risks Related to iLearningEngines’ Business and Industry • • • • • • • • • • • • • • • • • • • • Our recent rapid growth may not be indicative of our future growth. Our limited operating history and recent rapid growth also make it difficult to evaluate our future prospects and may increase the risk that we will not be successful. We may not be able to successfully manage our growth and, if we are not able to grow efficiently, our business, financial condition, and results of operations could be harmed. Because we derive substantially all of our revenue from our automation platform, failure of this platform to satisfy customer demands could adversely affect our business, results of operations, financial condition, and growth prospects. If we are unable to attract new customers, our business, financial condition, and results of operations will be adversely affected. If we are not able to expand our usage by existing customers, or our existing customers do not renew their subscriptions, our business, financial condition, and results of operations will be adversely affected. A limited number of customers represent a substantial portion of our revenue and annual recurring revenue (“ARR”). If we fail to retain these customers, our revenue and ARR could decline significantly. The markets in which we participate are competitive and, if we do not compete effectively, our business, financial condition, and results of operations could be harmed. If we fail to continue to differentiate our platform and products from those offered by our competitors, then our business, results of operations, and financial condition may be harmed. The success of our platform relies on the ability of our artificial intelligence - enabled ecosystem to create broad solutions across corporate functions, and a failure to do so would adversely affect our business, financial condition, and results of operations. Unfavorable conditions in our industry or the global economy, or reductions in IT spending, could limit our ability to grow our business and negatively affect our results of operations. If we are unable to successfully expand into new geographic regions, our ability to grow our business could be limited and it would negatively affect our results of operations If we fail to retain and motivate members of our management team or other key employees, or fail to attract additional qualified personnel to support our operations, our business and future growth prospects would be harmed. The COVID - 19 pandemic has impacted, and may continue to impact, our business, key metrics, and results of operations in volatile and unpredictable ways. For instance, if the shift to remote work is temporary, e - learning may not grow as fast as we anticipate, which could limit our ability to grow our business and negatively affect our results of operations Market adoption of automated learning solutions is relatively new and may not grow as we expect, which may harm our business and results of operations. We may need to change the contract terms, including our pricing model, for our platform which in turn would impact our operating results. We rely on our channel partners to generate a substantial amount of our revenue, and if we fail to expand and manage our distribution channels, our revenue could decline and our growth prospects could suffer. If we and our channel partners fail to provide sufficient high - quality consulting, training, support, and maintenance resources to enable our customers to realize significant business value from our platform, we may see a decrease in customer adoption of our platform. If we are not able to introduce new features or services successfully and to make enhancements to our platform or products, our business and results of operations could be adversely affected. We target enterprise customers, and sales to these customers involve risks that may not be present or that are present to a lesser extent with sales to smaller entities. If these marketing strategies fail to lead to customers purchasing paid licenses, our ability to grow our revenue will be adversely affected.

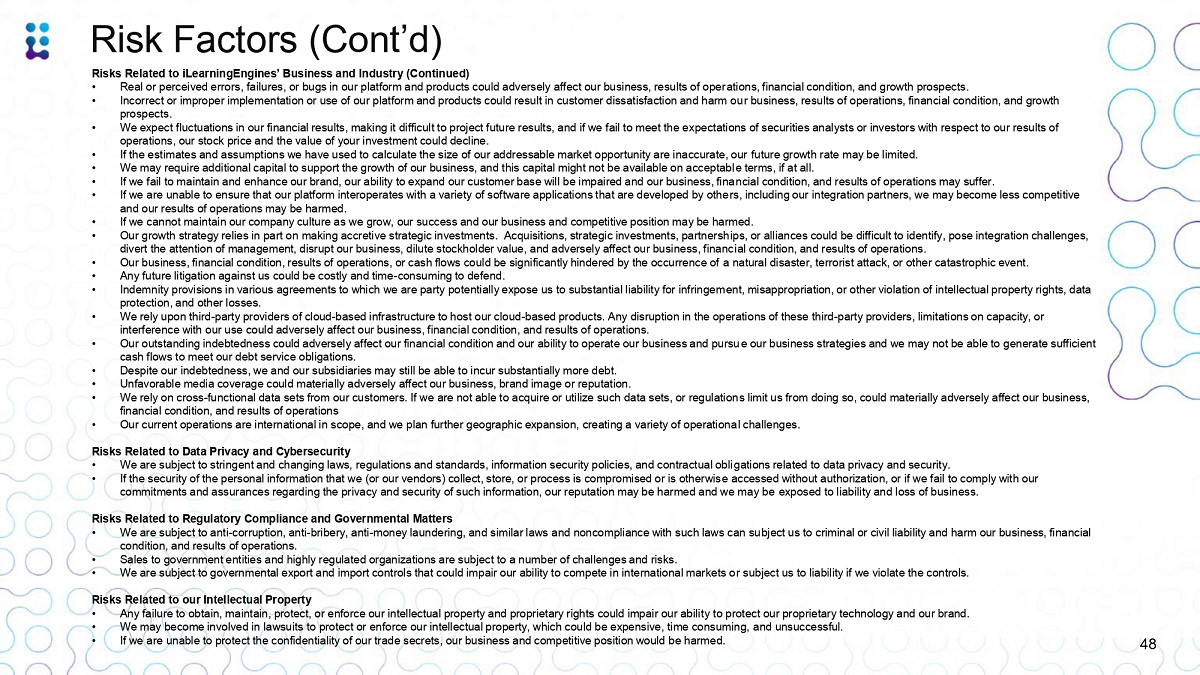

Risk Factors (Cont’d) Risks Related to iLearningEngines’ Business and Industry (Continued) • • • • • • • • • • • • • • • • • Real or perceived errors, failures, or bugs in our platform and products could adversely affect our business, results of operations, financial condition, and growth prospects. • Incorrect or improper implementation or use of our platform and products could result in customer dissatisfaction and harm our business, results of operations, financial condition, and growth prospects. We expect fluctuations in our financial results, making it difficult to project future results, and if we fail to meet the expectations of securities analysts or investors with respect to our results of operations, our stock price and the value of your investment could decline. If the estimates and assumptions we have used to calculate the size of our addressable market opportunity are inaccurate, our future growth rate may be limited. We may require additional capital to support the growth of our business, and this capital might not be available on acceptable terms, if at all. If we fail to maintain and enhance our brand, our ability to expand our customer base will be impaired and our business, financial condition, and results of operations may suffer. If we are unable to ensure that our platform interoperates with a variety of software applications that are developed by others, including our integration partners, we may become less competitive and our results of operations may be harmed. If we cannot maintain our company culture as we grow, our success and our business and competitive position may be harmed. Our growth strategy relies in part on making accretive strategic investments. Acquisitions, strategic investments, partnerships, or alliances could be difficult to identify, pose integration challenges, divert the attention of management, disrupt our business, dilute stockholder value, and adversely affect our business, financial condition, and results of operations. Our business, financial condition, results of operations, or cash flows could be significantly hindered by the occurrence of a natural disaster, terrorist attack, or other catastrophic event. Any future litigation against us could be costly and time - consuming to defend. Indemnity provisions in various agreements to which we are party potentially expose us to substantial liability for infringement, misappropriation, or other violation of intellectual property rights, data protection, and other losses. We rely upon third - party providers of cloud - based infrastructure to host our cloud - based products. Any disruption in the operations of these third - party providers, limitations on capacity, or interference with our use could adversely affect our business, financial condition, and results of operations. Our outstanding indebtedness could adversely affect our financial condition and our ability to operate our business and pursue our business strategies and we may not be able to generate sufficient cash flows to meet our debt service obligations. Despite our indebtedness, we and our subsidiaries may still be able to incur substantially more debt. Unfavorable media coverage could materially adversely affect our business, brand image or reputation. We rely on cross - functional data sets from our customers. If we are not able to acquire or utilize such data sets, or regulations limit us from doing so, could materially adversely affect our business, financial condition, and results of operations Our current operations are international in scope, and we plan further geographic expansion, creating a variety of operational challenges. Risks Related to Data Privacy and Cybersecurity • We are subject to stringent and changing laws, regulations and standards, information security policies, and contractual obligations related to data privacy and security. • If the security of the personal information that we (or our vendors) collect, store, or process is compromised or is otherwise accessed without authorization, or if we fail to comply with our commitments and assurances regarding the privacy and security of such information, our reputation may be harmed and we may be exposed to liability and loss of business. Risks Related to Regulatory Compliance and Governmental Matters • • • We are subject to anti - corruption, anti - bribery, anti - money laundering, and similar laws and noncompliance with such laws can subject us to criminal or civil liability and harm our business, financial condition, and results of operations. Sales to government entities and highly regulated organizations are subject to a number of challenges and risks. We are subject to governmental export and import controls that could impair our ability to compete in international markets or subject us to liability if we violate the controls. Risks Related to our Intellectual Property • Any failure to obtain, maintain, protect, or enforce our intellectual property and proprietary rights could impair our ability to protect our proprietary technology and our brand. • We may become involved in lawsuits to protect or enforce our intellectual property, which could be expensive, time consuming, and unsuccessful. • If we are unable to protect the confidentiality of our trade secrets, our business and competitive position would be harmed. 48

Risk Factors (Cont’d) Risks Related to our Intellectual Property (Continued) • • • We may be subject to claims that our employees, consultants, or advisors have wrongfully used or disclosed alleged trade secrets of their current or former employers or claims asserting ownership of what we regard as our own intellectual property. We use open source software in our products, which could negatively affect our ability to sell our services or subject us to litigation or other actions. If we cannot license rights to use technologies on reasonable terms, we may be unable to license rights that are critical to our business. Risks Related to Tax and Accounting Matters • • • • • • • Our corporate structure and intercompany arrangements cause us to be subject to the tax laws of various jurisdictions, and we could be obligated to pay additional taxes, which could materially adversely affect our business, financial condition, results of operations, and prospects. Changes in tax laws or tax rulings could materially affect our financial position, results of operations, and cash flows. Changes in our effective tax rate or tax liability may have an adverse effect on our results of operations. We could be required to collect additional sales or indirect taxes or be subject to other tax liabilities that may increase the costs our customers would have to pay for our products and adversely affect our results of operations. Our ability to use our net operating losses to offset future taxable income may be subject to certain limitations. Our reported financial results may be adversely affected by changes in GAAP. Our revenue recognition policy and other factors may distort our financial results in any given period and make them difficult to predict. Risks Related to the Proposed Business Combination and the Combined Company • • • • • • • • • • • • • • • If the benefits of the Proposed Business Combination do not meet the expectations of investors or securities analysts, the market price of the Combined Company’s securities may decline. • The NYSE or Nasdaq may not list the Combined Company’s common stock, which could limit investors’ ability to make transactions in the Combined Company’s Class A shares and subject it to additional trading restrictions. Legal proceedings in connection with the Proposed Business Combination, the outcomes of which are uncertain, could delay or prevent the completion of the Proposed Business Combination. The announcement of the Proposed Business Combination could disrupt iLearningEngines’ relationships with its customers, suppliers, finance partners and others, as well as its operating results and business generally. Third parties may terminate or alter existing contracts or relationships with Arrowroot or iLearningEngines. Subsequent to the consummation of the Proposed Business Combination, the Combined Company may be required to take write - downs or write - offs, restructuring and impairment or other charges that could have a significant negative effect on its financial condition, results of operations and share price, which could cause you to lose some or all of your investment. Arrowroot and iLearningEngines will incur significant transaction and transition costs in connection with the Proposed Business Combination, which may be incurred or payable whether the Proposed Business Combination is consummated or not. The only principal asset of the Combined Company following the Proposed Business Combination will be its interest in iLearningEngines, and accordingly it will depend on distributions from iLearningEngines to pay taxes and expenses. Future resales of the Combined Company’s securities may cause the market price of such securities to drop significantly, even if the Combined Company’s business is doing well. The Combined Company may issue additional shares or other equity securities without your approval, which would dilute your ownership interest and may depress the market price of the Combined Company’s Class A shares. Fluctuations in operating results, quarter to quarter earnings and other factors, including incidents involving customers and negative media coverage, may result in significant decreases in the price of the Combined Company’s securities. A market for the Combined Company’s securities may not develop, which would adversely affect the liquidity and price of the Combined Company’s securities. Concentration of ownership after the Proposed Business Combination may have the effect of delaying or preventing a change in control. Claims for indemnification by the combined company’s directors and officers may reduce its available funds to satisfy successful third - party claims against the Combined Company and may reduce the amount of money available to the Combined Company. The Combined Company will be deemed to be an “emerging growth company” and, as a result of the reduced disclosure and governance requirements applicable to emerging growth companies, the Combined Company’s Class A shares may be less attractive to investors. Arrowroot is a recently organized company with no operating history and no revenues and has no basis on which to evaluate its ability to effectuate the Proposed Business Combination. 49

Risk Factors (Cont’d) Risks Related to the Proposed Business Combination and the Combined Company (Continued) • • • • • • • Arrowroot’s stockholders may not be afforded an opportunity to vote on the Proposed Business Combination, which means Arrowroot may complete the Proposed Business Combination even though a majority of the Arrowroot public stockholders do not support the Proposed Business Combination. Arrowroot may not hold an annual meeting of stockholders until after the consummation of the Proposed Business Combination. The ability of Arrowroot’s public stockholders to exercise redemption rights with respect to a large number of our shares could increase the probability that the Proposed Business Combination will be unsuccessful. Arrowroot’s initial stockholders, directors, executive officers, advisors and their affiliates may elect to purchase shares or public warrants from public stockholders, which may influence the stockholder vote on the Proposed Business Combination and reduce the public “float” of the Class A common stock. The grant of registration rights to Arrowroot’s initial stockholders may make it more difficult to complete the Proposed Business Combination, and the future exercise of such rights may adversely affect the market price of the shares of the Class A common stock. Arrowroot’s warrants or founder shares may have an adverse effect on the market price of the Class A common stock and make it more difficult to effectuate the Proposed Business Combination. Arrowroot’s management may rely on the availability of all of the funds from the Private Placement to be used as part of the consideration provided for in the Proposed Business Combination. If the Private Placement fails to close, there may be insufficient funds to complete the Proposed Business Combination. 50

www.ilearningengines.com