UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| | |

| Filed by the Registrant ☒ | | |

| Filed by a Party other than the Registrant ☐ |

Check the appropriate box: | | |

☐ Preliminary Proxy Statement | | ☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☐ Definitive Proxy Statement |

☒ Definitive Additional Materials |

☐ Soliciting Material Pursuant to § 240.14a-12 |

BLACKROCK INNOVATION AND GROWTH TERM TRUST

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

BlackRock Innovation and Growth Term Trust | | |

« YOUR VOTE MATTERS «

MAKE YOUR VOICE HEARD BY VOTING ON THE ENCLOSED WHITE CARD AND PROTECT YOUR INVESTMENT

BlackRock Innovation and Growth Term Trust

(NYSE: BIGZ)

Fund launch: March 2021

| | | | |

| |  | |  |

| | |

Focus on innovation Invests in innovative companies with competitive advantages that are difficult to replicate and seeks to identify attractive business models that display resilient characteristics | | Flexible options strategy Tactical management of options seeks to potentially increase returns and generate cash flow | | Access to private markets Invests up to 25%1 in private investments with no performance fees and simplified tax reporting |

| | |

| |  |

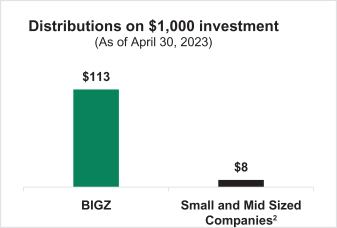

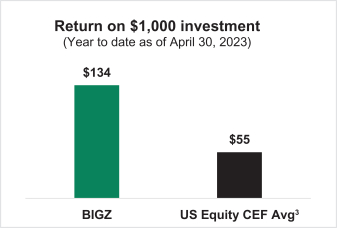

| Monthly distributions | | Strong returns |

| 11.3% | | #1 |

| Yield on Market Price | | Performing US Equity Closed-End Fund in 2023 |

Source: FTSE Russell and Morningstar data as of April 30, 2023

(1) Measured at the time of investment (2) Small and Mid Sized Companies are represented by the yield of the Russell 2500 Growth Index

(3) “US Equity CEFs” represents the Morningstar US Category Group for BIGZ

| | |

| | Your investment is under attack by a self-serving activist institution |

PROTECT YOUR INVESTMENT BY VOTING FOR

Your Board-Recommended Nominees

ON THE ENCLOSED WHITE CARD

| | | | |

| | |

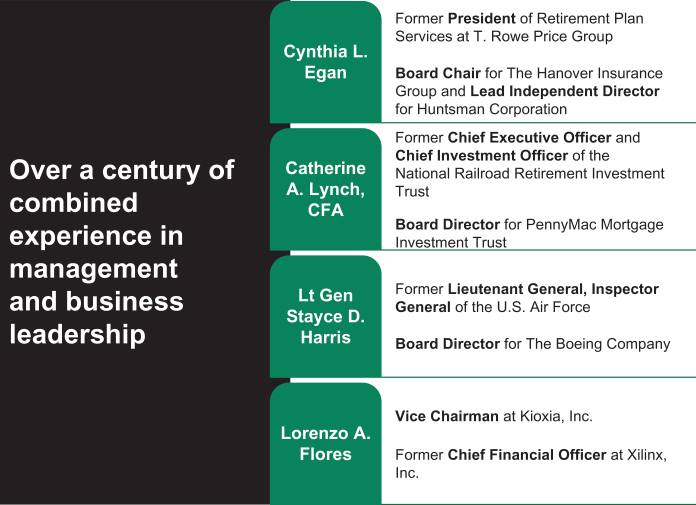

| Experience | | Diversity | | Independence |

| | |

| |

| Acting for all shareholders | | Executing for the long term |

| | |

BlackRock Innovation and Growth Term Trust | | |

Vote FOR your Trustees

on the enclosed WHITE proxy card

| | |

Experienced and Qualified Board Current board members are committed to ensuring that the Fund operates in a responsible manner that protects and advances the interests of the Fund and all of its shareholders |

Managed Distribution Pays a 11.3% yield on market price with a focus on distribution stability | |

Share Repurchases Repurchased over $160 million of shares, adding over $31 million to the Fund’s net asset value1 |

Liquidity at NAV In 2033, all shareholders will have an opportunity to receive 100% liquidity at net asset value via fund liquidation or tender offer |

Please do NOT send back any GOLD proxy card you may receive

Source: Morningstar data as of April 30, 2023, unless otherwise noted

(1) BlackRock data as of March 31, 2023

The Fund has adopted a managed distribution plan (a “Plan”) to support a level distribution of income, capital gains and/or return of capital. The fixed amounts distributed per share are subject to change at the discretion of the Fund’s Board of Trustees. Under its Plan, the Fund will distribute all available investment income to its shareholders, consistent with its investment objectives and as required by the Internal Revenue Code of 1986, as amended. If sufficient investment income is not available on a monthly basis, the Fund will distribute long-term capital gains and/or return capital to its shareholders in order to maintain a level distribution.

The Fund’s estimated sources of the distributions paid this month and for its current fiscal year are as follows:

Estimated Allocations as of April 28, 2023

| | | | | | | | | | | | | | | | | | | | | | | | | |

Fund | | Distribution | | Net Income | | Net Realized Short-

Term Gains | | Net Realized Long-

Term Gains | | Return of Capital |

| | | | | | |

| BIGZ1 | | $0.070000 | | $0 (0%) | | $0 (0%) | | $0 (0%) | | $0.070000 (100%) |

Estimated Allocations for the fiscal year through April 28, 2023

| | | | | | | | | | | | | | | | | | | | | | | | | |

Fund | | Distribution | | Net Income | | Net Realized Short-

Term Gains | | Net Realized Long-

Term Gains | | Return of Capital |

| | | | | | |

| BIGZ1 | | $0.280000 | | $0 (0%) | | $0 (0%) | | $0 (0%) | | $0.280000 (100%) |

1The Fund estimates that it has distributed more than its income and net-realized capital gains in the current fiscal year; therefore, a portion of your distribution may be a return of capital. A return of capital may occur, for example, when some or all of the shareholder’s investment is paid back to the shareholder. A return of capital distribution does not necessarily reflect the Fund’s investment performance and should not be confused with ‘yield’ or ‘income’. When distributions exceed total return performance, the difference will reduce the Fund’s net asset value per share.

The amounts and sources of distributions reported are only estimates and are being provided to you pursuant to regulatory requirements and are not being provided for tax reporting purposes. The actual amounts and sources of the amounts for tax reporting purposes will depend upon the Fund’s investment experience during the remainder of its fiscal year and may be subject to changes based on tax regulations. The Fund will send you a Form 1099-DIV for the calendar year that will tell you how to report these distributions for federal income tax purposes.

Fund Performance and Distribution Rate Information:

| | | | | | | | |

| | | | | |

| Fund | | Average annual

total return (in

relation to NAV)

for the 5-year

period ending

on 3/31/2023 | | Annualized current

distribution rate

expressed as a

percentage of net asset

value (NAV) as of

3/31/2023 | | Cumulative total return

(in relation to NAV) for the

fiscal year through

3/31/2023 | | Cumulative fiscal year

distributions as a

percentage of NAV as of

3/31/2023 |

| | | | | |

| BIGZ* | | (25.79)% | | 9.11% | | 7.41% | | 2.28% |

* Fund launched within the past 5 years; the performance and distribution rate information presented for the Fund reflects data from inception to 3/31/2023.

Shareholders should not draw any conclusions about the Fund’s investment performance from the amount of the Fund’s current distributions or from the terms of the Fund’s Plan.

All investments involve risk, including the possible loss of the principal amount invested.

Important information about the Fund

This material is not an advertisement and is intended for existing shareholder use only. This document and the information contained herein relates solely to BlackRock Innovation and Growth Term Trust (BIGZ). The information contained herein does not relate to, and is not relevant to, any other fund or product sponsored or distributed by BlackRock or any of its affiliates. This document is not an offer to sell any securities and is not a solicitation of an offer to buy any securities.

Common shares for the closed-end fund identified above are only available for purchase and sale at current market price on a stock exchange. A closed-end fund’s dividend yield, market price and NAV will fluctuate with market conditions. The information for this Fund is provided for informational purposes only and does not constitute a solicitation of an offer to buy or sell Fund shares.

Performance results reflect past performance and are no guarantee of future results. Current performance may be lower or higher than the performance data quoted. All returns assume reinvestment of all dividends. The market value and net asset value (NAV) of a fund’s shares will fluctuate with market conditions. Closed-end funds may trade at a premium to NAV but often trade at a discount.

© 2023 BlackRock, Inc. or its affiliates. All Rights Reserved. BLACKROCK is a trademark of BlackRock, Inc., or its affiliates. All other trademarks are those of their respective owners.

| | |

| |

| May 2023 | BlackRock Innovation and Growth Term Trust (BIGZ) | | Not FDIC Insured • May Lose Value • No Bank Guarantee |

BIGZLTR_0723