Exhibit 99.1 Third Quarter Fiscal Year 2021 Update October 2021 1

Disclaimer Disclaimer This presentation (this “presentation”) is provided for informational purposes and has been prepared to assist interested parties in making their own evaluation with respect to a potential business combination (the “Transaction”) between Fathom Holdco, LLC (“Fathom”) and Altimar Acquisition Corp. II (“Altimar II”) and for no other purpose. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of any securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to a registration or qualification under the securities laws of such other jurisdiction. No Representations and Warranties This presentation is for informational purposes only and does not purport to contain all of the information that may be required to evaluate a possible investment decision with respect to Altimar II. This presentation is not intended to form the basis of any investment decision by the recipient and does not constitute investment, tax or legal advice. No representation or warranty, express or implied, is or will be given by Altimar II or Fathom or any of their respective affiliates, directors, officers, employees or advisers or any other person as to the accuracy or completeness of the information in this presentation or any other written, oral or other communications transmitted or otherwise made available to any party in the course of its evaluation of a possible transaction between Altimar II and Fathom or a possible investment in Fathom and no responsibility or liability whatsoever is accepted for the accuracy or sufficiency thereof or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. The information contained in this presentation is preliminary in nature and is subject to change, and any such changes may be material. Altimar II and Fathom disclaim any duty to update the information contained in this presentation. Forward-Looking Statements This presentation includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Altimar II’s and Fathom’s actual results may differ from their expectations, estimates and projections and consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as “expect”, “estimate”, “project”, “budget”, “forecast”, “plan,” “target,” “goal,” “anticipate”, “intend”, “plan”, “may”, “will”, “could”, “should”, “believes”, “predicts”, “potential”, “continue”, and similar expressions are intended to identify such forward-looking statements. These forward-looking statements include, without limitation, Altimar II’s and Fathom’s expectations with respect to future performance and anticipated financial impacts of the Transaction, the satisfaction of closing conditions to the Transaction and the timing of the completion of the Transaction. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. You should carefully consider the risks and uncertainties described in the “Risk Factors” section of Altimar II’s registration statement on Form S-1 and Reports under the Securities Exchange Act previously filed with the Securities and Exchange Commission (the “SEC”). In addition, there are risks and uncertainties described in the preliminary proxy statement/prospectus contained in the registration statement on Form S-4 relating to the proposed business combination, filed by Altimar II with the SEC on September 20, 2021, and other documents filed by Altimar II from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward- looking statements. Most of these factors are outside Altimar II’s and Fathom’s control and are difficult to predict. Factors that may cause such differences include, but are not limited to: (1) the outcome of any legal proceedings that may be instituted against Altimar II or Fathom following the announcement of the Transaction; (2) the inability to complete the Transaction, including due to the inability to concurrently close the proposed business combination and the private placement of Altimar II securities or due to failure to obtain approval of the stockholders of Altimar II; (3) delays in obtaining, adverse conditions contained in, or the inability to obtain necessary regulatory approvals or complete regulatory reviews required to complete the Transaction; (4) the risk that the Transaction disrupts current plans and operations as a result of the announcement and consummation of the Transaction; (5) the inability to recognize the anticipated benefits of the Transaction, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably, maintain relationships with customers and suppliers and retain its key employees; (6) costs related to the Transaction; (7) changes in the applicable laws or regulations; (8) the possibility that the combined company may be adversely affected by other economic, business, and/or competitive factors; (9) the continuing impact of the global COVID-19 pandemic; and (10) other risks and uncertainties indicated from time to time described in Altimar II’s registration statements on Form S-1 and S- 4, including those under “Risk Factors” therein, and in Altimar II’s other filings with the SEC. Altimar II and Fathom caution that the foregoing list of factors is not exclusive and not to place undue reliance upon any forward-looking statements, including projections, which speak only as of the date made. Neither Altimar II nor Fathom undertakes or accepts any obligation to provide any updates or revisions to any forward-looking statements to reflect any changes in its expectations or any change in events, conditions or circumstances on which any such statement is based. Financial Information Pro Forma Revenue in this presentation is unaudited and reflects various adjustments to give pro forma effect to acquisitions completed by Fathom between January 1, 2020, and April 30, 2021, as if such transactions occurred on January 1, 2021. This unaudited, adjusted financial information and data are for illustrative and informational purposes only and are not necessarily indicative of the operating or financial results that would have occurred if the acquisitions had been completed as of such date. This unaudited, adjusted financial information and data as well as the other financial information and data included in this presentation does not conform to SEC Regulation S-X or Public Company Accounting Oversight Board (PCAOB) standards. Accordingly, such information may not be included in, may be adjusted or may be presented differently in any proxy statement/prospectus to be filed with the SEC. 2

Disclaimer, cont. Industry and Market Data In this presentation, Altimar II and Fathom rely on and refer to publicly available information and statistics regarding market participants in the sectors in which Fathom competes and other industry data. Any comparison of Fathom to the industry or to any of its competitors is based on this publicly available information and statistics and such comparisons assume the reliability of the information available to Altimar II and Fathom. Altimar II and Fathom obtained this information and statistics from third-party sources, including reports by market research firms and publicly available company filings. While Altimar II and Fathom believe such third-party information is reliable, there can be no assurance as to the accuracy or completeness of the referenced information. Neither Fathom nor Altimar II has independently verified the information provided by the third-party sources. Trademarks This presentation may contain trademarks, service marks, trade names and copyrights of other companies which are the property of their respective owners. Solely for convenience, some of the trademarks, service marks, trade names and copyrights presentation may be listed without the TM, SM © or ® symbols, but Altimar II and Fathom will assert, to the fullest extent under applicable law, the rights of the applicable owners, if any, to these trademarks, service marks, trade names and copyrights. Use of Projections This presentation also contains certain financial forecasts, including projected revenue and estimated. Neither Altimar II’s nor Fathom’s independent auditors have studied, reviewed, compiled or performed any procedures with respect to the projections for the purpose of their inclusion in this presentation, and accordingly, neither of them expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this presentation. These projections and estimates are for illustrative purposes only and should not be relied upon as being necessarily indicative of future results. In this presentation, certain of the above-mentioned projected and estimated information has been provided for purposes of providing comparisons with historical data. The assumptions and estimates underlying the prospective financial information are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information. Projections and estimates are inherently uncertain due to a number of factors outside of Altimar II’s or Fathom’s control. While all financial projections, estimates and targets are necessarily speculative, Altimar II and Fathom believe that the preparation of prospective financial information involves increasingly higher levels of uncertainty the further out the projection, estimate or target extends from the date of preparation. Accordingly, there can be no assurance that the prospective and estimated results are indicative of future performance of the combined company after the Transaction or that actual results will not differ materially from those presented in the prospective financial information. Inclusion of the prospective and estimated financial information in this presentation should not be regarded as a representation by any person that the results contained in the prospective financial information will be achieved. Additional Information; Participation in Solicitation Altimar II has filed a preliminary proxy statement/prospectus and expects to file a definitive proxy statement/prospectus, as part of a registration statement, and other relevant documents with the SEC. Altimar II stockholders and other interested persons are urged to read the proxy statement/prospectus and any other relevant documents filed with the SEC when they become available because they will contain important information about Altimar II, Fathom and the proposed business combination. Stockholders are able to obtain a free copy of the proxy statement, as well as other filings containing information about Altimar II, Fathom and the proposed business combination, without charge, at the SEC’s website located at www.sec.gov. Altimar II and Fathom and their respective directors and executive officers, under SEC rules, may be deemed to be participants in the solicitation of proxies of Altimar II’s shareholders in connection with the proposed business combination. Investors and security holders may obtain more detailed information regarding the names and interests in the proposed business combination of Altimar II’s directors and officers in Altimar II’s filings with the SEC, including Altimar II’s registration statement on Form S-1 and prospectus for its initial public offering, which was originally filed with the SEC on January 20, 2021. To the extent that holdings of Altimar II’s securities have changed from the amounts reported in Altimar II’s registration statement on Form S-4 for the proposed business combination, Altimar II’s registration statement on Form S-1, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies of Altimar II’s shareholders in connection with the proposed business combination are set forth in the proxy statement/prospectus on Form S-4 for the proposed business combination, originally filed by Altimar II with the SEC on September 20, 2021. Investors and security holders of Altimar II and Fathom are urged to read the proxy statement/prospectus and other relevant documents that will be filed with the SEC carefully and in their entirety when they become available because they will contain important information about the proposed business combination. Investors and security holders will be able to obtain free copies of the proxy statement and other documents containing important information about Altimar II and Fathom through the website maintained by the SEC at www.sec.gov. Copies of the documents filed with the SEC by Altimar II can be obtained free of charge by directing a written request to Altimar II. 3

Update Summary Strong Financial Momentum Software Platform Delivering Record Results Key Recent Business Wins Delivering Next-Gen. Additive Capabilities Fathom is at the Forefront of Manufacturing Supply Chain Transformation 4

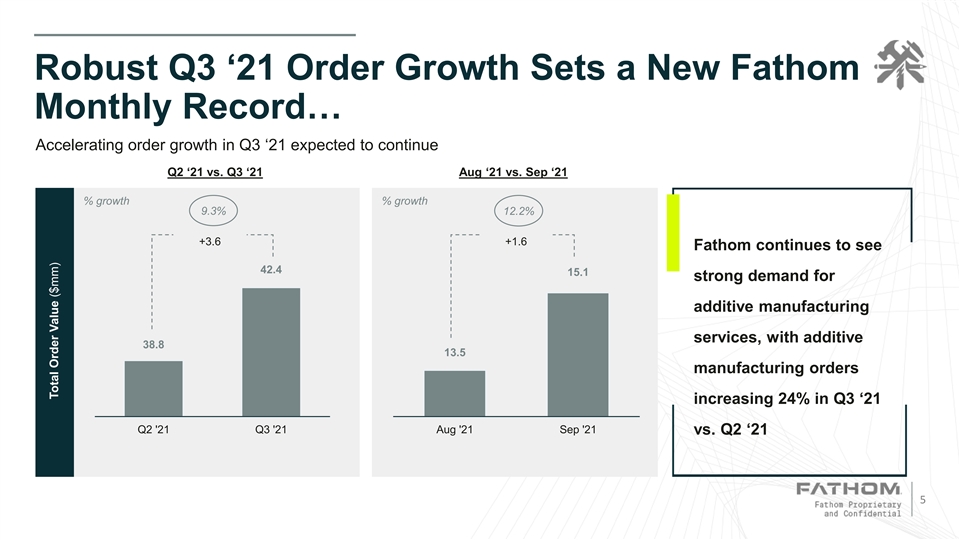

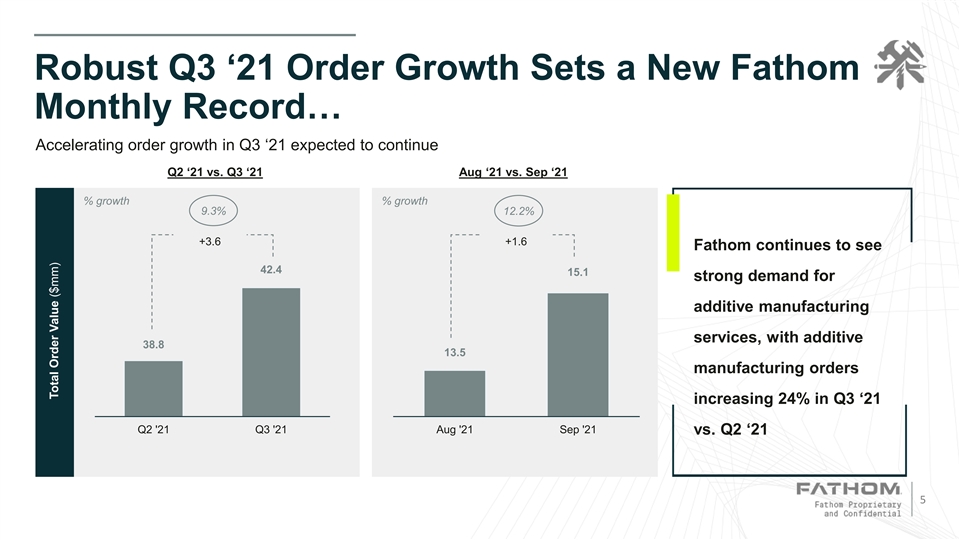

Robust Q3 ‘21 Order Growth Sets a New Fathom Monthly Record… Accelerating order growth in Q3 ‘21 expected to continue Q2 ‘21 vs. Q3 ‘21 Aug ‘21 vs. Sep ‘21 % growth % growth 9.3% 12.2% +3.6 +1.6 Fathom continues to see 42.4 15.1 strong demand for additive manufacturing services, with additive 38.8 13.5 manufacturing orders increasing 24% in Q3 ‘21 Q2 '21 Q3 '21 Aug '21 Sep '21 vs. Q2 ‘21 5 Total Order Value ($mm)

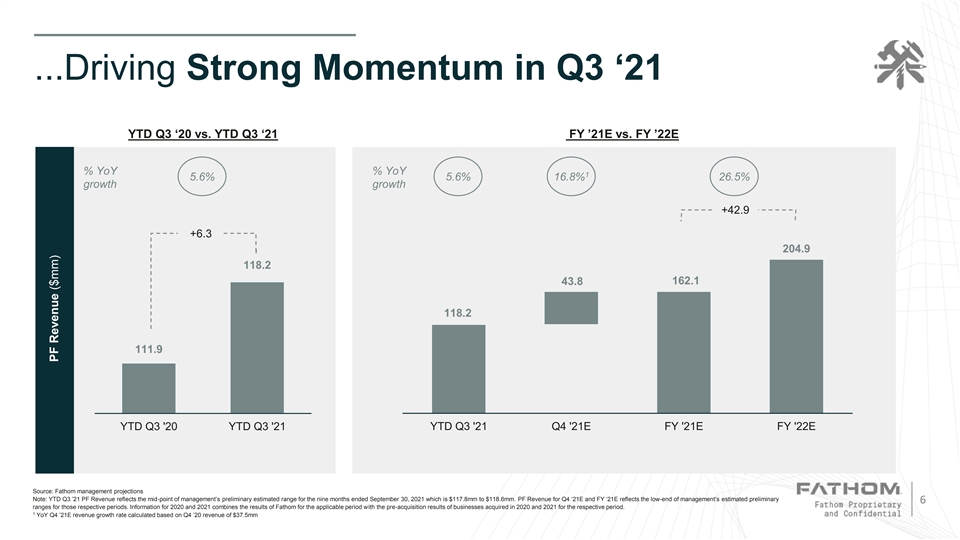

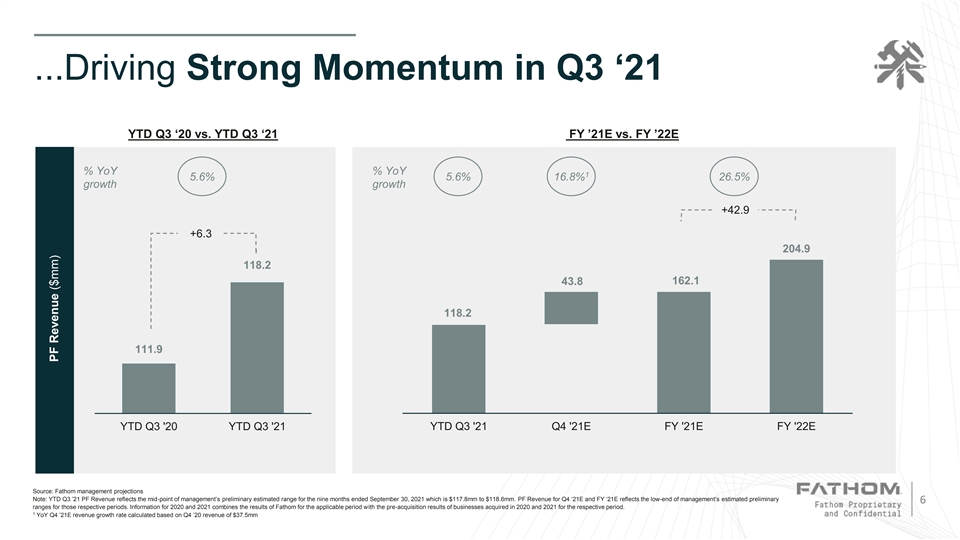

...Driving Strong Momentum in Q3 ‘21 YTD Q3 ‘20 vs. YTD Q3 ‘21 FY ’21E vs. FY ’22E % YoY % YoY 1 5.6% 5.6% 16.8% 26.5% growth growth +42.9 +6.3 204.9 118.2 162.1 43.8 118.2 111.9 YTD Q3 '20 YTD Q3 '21 YTD Q3 '21 Q4 '21E FY '21E FY '22E Source: Fathom management projections Note: YTD Q3 ’21 PF Revenue reflects the mid-point of management’s preliminary estimated range for the nine months ended September 30, 2021 which is $117.8mm to $118.6mm. PF Revenue for Q4 ‘21E and FY ‘21E reflects the low-end of management’s estimated preliminary 6 ranges for those respective periods. Information for 2020 and 2021 combines the results of Fathom for the applicable period with the pre-acquisition results of businesses acquired in 2020 and 2021 for the respective period. 1 YoY Q4 ’21E revenue growth rate calculated based on Q4 ’20 revenue of $37.5mm PF Revenue ($mm)

Proprietary Full Stack Software Platform Delivers Record Results for Fathom Robust Customer Engagement Across Software Platform We continue to grow our IP • Digital orders up 35% YoY Q3 ‘21 YTD and 47% YoY portfolio, with in September ‘21 formal notice of issuance for a • Average digital order size up 15% YoY YTD ’21 and new data 40% YoY in September ‘21 aggregation patent received • New proprietary digital platform users up 60% YoY in Q3 ‘21 Q3’ 21 YTD 7 Note: Information for 2020 and 2021 in YTD comparison represents the combined results of Fathom for the applicable period with the pre-acquisition results of businesses acquired in 2020 and 2021 for the respective periods

Key Recent Business Wins Continued expansion of wallet with existing blue chip accounts Customer Order Size Order Type Lifetime Revenue Prototype & mid-volume 1 $2.5mm through 2022 $14.5mm Leading Semiconductor OEM production Expanded mid-volume 2 Fortune 50 Medical Company $2.0mm in 2021 production of existing $48.5mm program Expanded mid-volume 3 $1.2mm in 2021 production of existing $2.9mm Leading Medical Device Company program $900k in 2021, with Prototype with mid- 4 Disruptive EV Manufacturer expected $8mm 2022 volume production $1.5mm production order follow-on 8

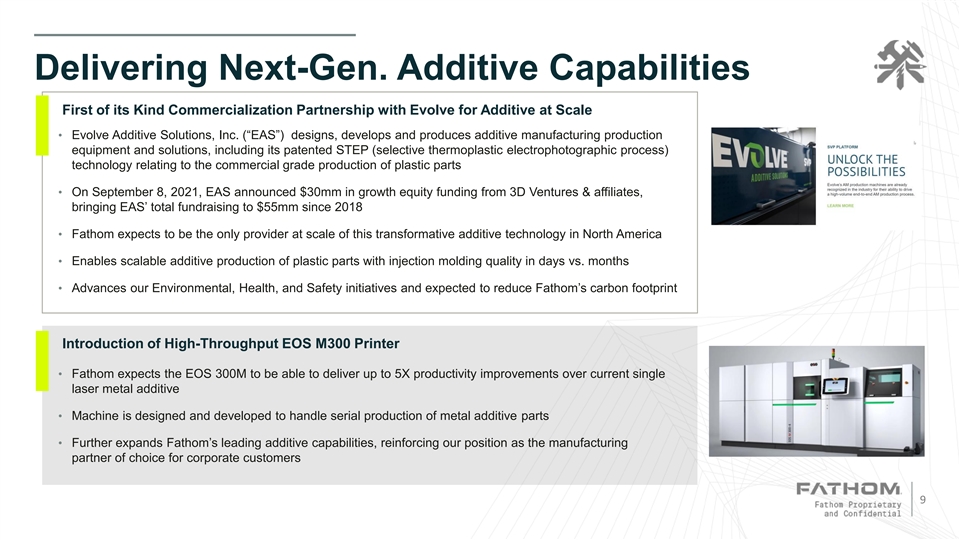

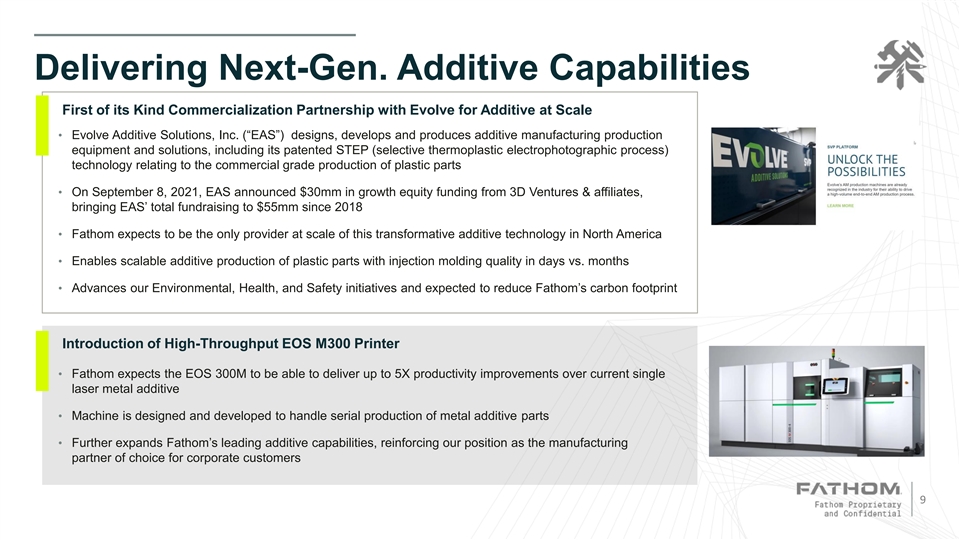

Delivering Next-Gen. Additive Capabilities First of its Kind Commercialization Partnership with Evolve for Additive at Scale • Evolve Additive Solutions, Inc. (“EAS”) designs, develops and produces additive manufacturing production equipment and solutions, including its patented STEP (selective thermoplastic electrophotographic process) technology relating to the commercial grade production of plastic parts • On September 8, 2021, EAS announced $30mm in growth equity funding from 3D Ventures & affiliates, bringing EAS’ total fundraising to $55mm since 2018 • Fathom expects to be the only provider at scale of this transformative additive technology in North America • Enables scalable additive production of plastic parts with injection molding quality in days vs. months • Advances our Environmental, Health, and Safety initiatives and expected to reduce Fathom’s carbon footprint Introduction of High-Throughput EOS M300 Printer • Fathom expects the EOS 300M to be able to deliver up to 5X productivity improvements over current single laser metal additive • Machine is designed and developed to handle serial production of metal additive parts • Further expands Fathom’s leading additive capabilities, reinforcing our position as the manufacturing partner of choice for corporate customers 9

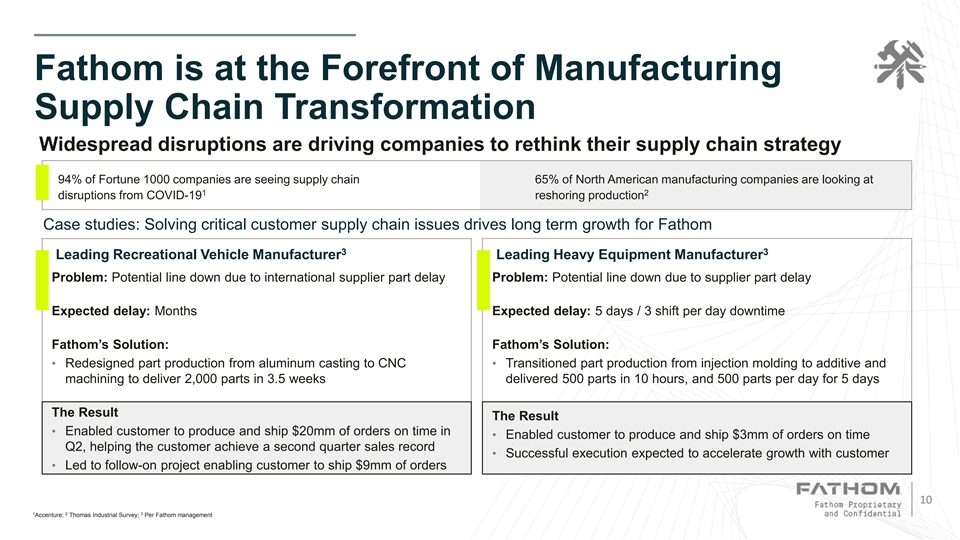

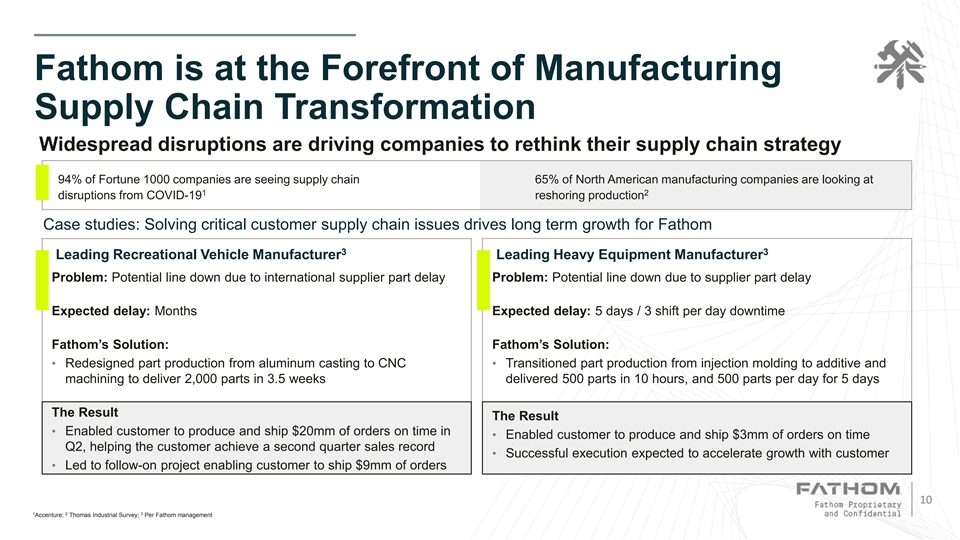

Fathom is at the Forefront of Manufacturing Supply Chain Transformation Widespread disruptions are driving companies to rethink their supply chain strategy 94% of Fortune 1000 companies are seeing supply chain 65% of North American manufacturing companies are looking at 1 2 disruptions from COVID-19 reshoring production Case studies: Solving critical customer supply chain issues drives long term growth for Fathom 3 3 Leading Recreational Vehicle Manufacturer Leading Heavy Equipment Manufacturer Problem: Potential line down due to international supplier part delay Problem: Potential line down due to supplier part delay Expected delay: Months Expected delay: 5 days / 3 shift per day downtime Fathom’s Solution: Fathom’s Solution: • Redesigned part production from aluminum casting to CNC • Transitioned part production from injection molding to additive and machining to deliver 2,000 parts in 3.5 weeks delivered 500 parts in 10 hours, and 500 parts per day for 5 days The Result The Result • Enabled customer to produce and ship $20mm of orders on time in • Enabled customer to produce and ship $3mm of orders on time Q2, helping the customer achieve a second quarter sales record • Successful execution expected to accelerate growth with customer • Led to follow-on project enabling customer to ship $9mm of orders 10 1 2 3 Accenture; Thomas Industrial Survey; Per Fathom management

Risk Factors Risks related to Fathom’s Business and Industry • Fathom faces significant competition and expects to face increasing competition in many aspects of its business, which could cause its operating results to suffer. • Fathom’s success depends on its ability to deliver products and product lines that meet the needs of its customers and to effectively respond to changes in its industry. • Fathom’s failure to meet the expectations of its customers regarding turnaround time, quality or price would adversely affect its business and results of operations. • The strength of Fathom’s brand is important to its business, and any failure to maintain and enhance its brand would hurt its ability to retain and expand its customer base as well as further penetrate existing customers. • If Fathom’s present single or limited source suppliers become unavailable or inadequate, its customer relationships, results of operations and financial condition may be adversely affected. • Wage increases and pressure in certain geographies may prevent Fathom from sustaining its competitive advantage and may reduce its profit margin. • Fathom’s business depends in part on its ability to process a large volume of new part designs from a diverse group of customers and successfully identify significant opportunities for its business based on those submissions. • The loss of one or more key members of Fathom’s management team or personnel, or its failure to attract, integrate and retain additional personnel in the future, could harm its business and negatively affect its ability to successfully grow its business. • If Fathom is unable to manage its growth and expand its operations successfully, its reputation and brand may be damaged, and its business and results of operations may be harmed. • Fathom may not timely and effectively scale and adapt its existing technology, processes and infrastructure to meet the needs of its business. • Numerous factors may cause Fathom not to maintain the revenue growth that it has historically experienced. • Interruptions to or other problems with Fathom’s website and interactive user interface, information technology systems, manufacturing processes or other operations could damage its reputation and brand and substantially harm its business and results of operations. • Cybersecurity risks and cyber incidents could adversely affect Fathom’s business by disrupting its operations or by compromising or corrupting its confidential information or confidential information in its possession, which could negatively impact its business, financial condition and operating results. • Aspects of Fathom’s business are subject to privacy, data use and data security regulations, which may impact the way it uses data to target customers. • Global economic conditions may harm Fathom’s ability to do business, increase its costs and negatively affect its business and operations. • If a natural or man-made disaster strikes any of Fathom’s manufacturing facilities, it will be unable to manufacture its products for a substantial period of time and its sales will decline. • Fathom may not be able to adequately protect or enforce its intellectual property rights, which could impair its competitive position. • Fathom may be subject to intellectual property infringement claims. • Fathom may be subject to product liability claims, which could result in material expense, diversion of management time and attention and 11 damage to its business, reputation and brand.

Risk Factors, cont. Risks related to Fathom’s Business and Industry (cont’d) • Government regulation of the internet and e-commerce is evolving, and unfavorable changes or failure by Fathom to comply with these regulations could substantially harm its business and results of operations. • Fathom may require additional capital to support business growth, and this capital might not be available on acceptable terms, if at all. • Any acquisition, strategic relationship, joint venture or investment could disrupt Fathom’s business and harm its operating results and financial condition. • Fathom’s business involves the use of hazardous materials, and it and its suppliers must comply with environmental laws and regulations, which can be expensive and restrict how Fathom does business. • If Fathom is unable to meet regulatory quality standards applicable to its manufacturing and quality processes for the parts it manufactures, its business, financial condition or operating results could be harmed. • Fathom is subject to payment-related risks. • The audit report from Fathom’s independent auditors on Fathom’s audited financial statements for the years ended December 31, 2020 and December 31, 2019 included emphasis of a matter regarding going concern because the committed financing necessary to repay Fathom’s $172 million term loan due April 2022 is contingent upon the closing of the Transaction. Risks related to being a Public Company • Fathom’s management team has limited experience managing a public company and may not successfully or effectively manage Fathom’s transition to public company status. • As with any public company, Altimar II may be subject to securities litigation, which is expensive and could divert management’s attention. • Fathom’s failure to achieve and maintain effective internal control over financial reporting could result in its failure to accurately or timely report its financial condition or results of operations, which could have a material adverse effect on its business and stock price. • Because Fathom will become a publicly traded company by means other than at traditional underwritten public offering, Fathom’s stockholders may face other risks and uncertainties. 12

Risk Factors, cont. Risks related to organizational structure and ownership • Fathom’s organizational structure following the proposed business combination, including the tax receivable agreement described below, provides certain benefits to the continuing owners of Fathom that will not benefit Class A common stockholders to the same extent as it will benefit such continuing owners of Fathom. • Altimar II’s principal asset after the completion of the transaction will be its interest in Fathom, and, accordingly, it will depend on distributions from Fathom to pay taxes and expenses, including payments under a tax receivable agreement with the continuing equity owners of Fathom that requires Fathom to make cash payments to them in respect of certain tax benefits to which Altimar II may become entitled, and it is expected that the payments Altimar II will be required to make under such agreement will be substantial. • CORE Industrial Partners will own a significant interest in the combined company and its interests may conflict with the interests of Fathom and the Class A common stockholders. Through its interest in the combined company, “negative control” rights and its rights to nominate directors to the combined company’s board under an investor rights agreement that will be entered as part of the Transaction, CORE Industrial Partners will have substantial influence over Fathom’s management and policies. Risks Related to Altimar II’s Securities • If the benefits of the proposed business combination do not meet the expectations of investors or securities analysts, the market price of Altimar II’s securities may decline, either before or after the closing of the proposed business combination. • The combined entity will incur significant increased expenses and administrative burdens as a public company, which could have an adverse effect on its business, financial condition and results of operations. • The stock price of Altimar II’s securities may be extremely volatile, and stockholders could lose a significant part of their investment. • Altimar II’s Class A ordinary shares may fail to meet the continued listing standards of the New York Stock Exchange (“NYSE”), and additional shares may not be approved for listing on NYSE. • Because the combined company has no current plans to pay cash dividends for the foreseeable future, investors may not receive any return on investment unless they sell their shares for a price greater than that which was paid for them. • If following the proposed business combination, securities or industry analysts do not publish or cease publishing research or reports about Fathom, its business, or its market, or if they change their recommendations regarding Fathom’s securities adversely, the price and trading volume of Fathom’s securities could decline. • Future sales and issuances of common stock in Fathom or rights to purchase such common stock following the closing of the Transaction, including pursuant to any equity incentive plans and future exercise of registration rights, could result in additional dilution of the percentage ownership of its stockholders and could cause the share price to fall. • Following the Transaction, Fathom will be an emerging growth company within the meaning of the Securities Act, and if it takes advantage of certain exemptions from disclosure requirements available to emerging growth companies, this could make its securities less attractive to investors and may make it more difficult to compare the combined company’s performance with other public companies that do not enjoy such disclosure exemptions 13

Risk Factors, cont. General risks • Economic downturns and political and market conditions beyond Altimar II’s and the combined company’s control could adversely affect its business, financial condition and results of operations. • Fathom is exposed to the risk of natural disasters, political events, health crises such as the global Covid-19 outbreak, war and terrorism and other macroeconomic events, each of which could disrupt its business and adversely impact its results of operations. Risk related to Altimar II and the business combination • Directors of Altimar II have potential conflicts of interest in recommending that Altimar II’s stockholders vote in favor of the adoption of the merger agreement and the proposed business combination and approval of the other proposals to be described in the proxy statement/prospectus. • Altimar II’s founders, directors, officers, advisors and their affiliates may elect to purchase Altimar II Class A common stock or Altimar II warrants from public stockholders, which may influence the vote on the proposed business combination and reduce the public “float” of Altimar II’s Class A common stock. • Altimar II’s sponsor will agree to vote in favor of the proposed business combination, regardless of how Altimar II’s public stockholders vote. • Altimar II’s warrants are accounted for as derivative liabilities and are recorded at fair value upon issuance with changes in fair value each period reported in earnings, which may have an adverse effect on the market price of Altimar II’s securities or may make it more difficult for us to consummate the proposed business combination. • The combined company will incur significant increased costs as a result of operating as a public company, and its management will be required to devote substantial time to new compliance initiatives. • The combined company’s charter and bylaws to be in effect following the consummation of the proposed business combination and certain Delaware laws contain provisions that may have the effect of delaying, preventing or making undesirable an acquisition of all or a significant portion of the combined company’s shares or assets or preventing a change in control. • The ability of Altimar II’s stockholders to exercise redemption rights with respect to a large number of outstanding Altimar II Class A common stock and the related funding of such redemptions could increase the probability that the proposed business combination would not occur. Completion of the proposed business combination is subject to conditions, including certain conditions that may not be satisfied on a timely basis, if at all. • Altimar II’s board has not obtained and will not obtain a third-party valuation or financial opinion in determining whether to proceed with the proposed business combination. • Current Altimar II stockholders will own a smaller proportion of the post-Transaction company than they currently own of Altimar II ordinary shares. In addition, following the closing of the Transaction, Altimar II may issue additional shares or other equity securities without the approval of its stockholders, which would further dilute their ownership interests and may depress the market price of its shares. • Altimar II’s actual financial position and results of operations may differ materially from the unaudited pro forma condensed combined financial information to be included in its proxy statement/prospectus and may not be indicative of what its actual financial position or results of operations would have been. 14

Risk Factors, cont. Risk related to Altimar II and the business combination (cont’d) • If third parties bring claims against Altimar II or if Altimar II files a bankruptcy petition or an involuntary bankruptcy petition is filed against Altimar II that is not dismissed, the proceeds held in trust could be reduced and the per-share redemption price received by stockholders may be less than $10.00 (which was the offering price in Altimar II’s initial public offering). • If, after Altimar II distributes the proceeds in the Trust Account to its public stockholders, we file a bankruptcy petition or an involuntary bankruptcy petition is filed against Altimar II that is not dismissed, a bankruptcy court may seek to recover such proceeds, and the members of Altimar II’s board of directors may be viewed as having breached their fiduciary duties to Altimar II’s creditors, thereby exposing the members of Altimar II’s board of directors and Altimar II to claims of punitive damages. • Altimar II’s ability to successfully effect the proposed business combination and to be successful thereafter will be totally dependent upon the efforts of key personnel. Past performance by Altimar II or Altimar II’s Sponsor or management team and their respective affiliates may not be indicative of future performance of an investment in Fathom or the combined company. • In the event that the proceeds in the Trust Account are reduced below the lesser of (i) $10.00 per share and (ii) the actual amount per share held in the Trust Account as of the date of the liquidation of the Trust Account if less than $10.00 per share due to reductions in the value of the trust assets, in each case less taxes payable, and Altimar II’s Sponsor asserts that it is unable to satisfy its obligations or that it has no indemnification obligations related to a particular claim, our independent directors may decide not to enforce the indemnification obligations of Altimar II’s Sponsor, resulting in a reduction in the amount of funds in the Trust Account available for distribution to Altimar II’s public stockholders. • Our public stockholders will experience immediate dilution if the Transaction is completed. Having a minority share position may reduce the influence that our current stockholders have on the management of the combined company. • The proposed business combination will be subject to conditions, including certain conditions that may not be satisfied on a timely basis, if at all. • Altimar II or Fathom may waive one or more of the closing conditions to consummation of the business combination without re-soliciting stockholder approval. • Obtaining required regulatory approvals may prevent or delay completion of the proposed business combination or reduce the anticipated benefits of the proposed business combination or may require changes to the structure or terms of the proposed business combination. • Altimar II’s and Fathom’s ability to consummate the Business Combination, and the operations of the combined company following the proposed business combination, may be materially adversely affected by the continuing effects of the COVID-19 pandemic. 15

16