24th Annual Needham Growth Conference January 10, 2022 Exhibit 99.1

Forward-Looking Statements Certain statements made in this document are “forward looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Words such as “estimates,” “projects,” “expects,” “anticipates,” “forecasts,” “plans,” “intends,” “believes,” “seeks,” “may,” “will,” “would,” “should,” “future,” “propose,” “target,” “goal,” “objective,” “outlook” and variations of these words or similar expressions (or the negative versions of such words or expressions) are intended to identify forward-looking statements. These forward-looking statements are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside the control of Fathom Digital Manufacturing Corporation (“Fathom”), that could cause actual results or outcomes to differ materially from those discussed in the forward-looking statements. Important factors, among others, that may affect actual results or outcomes include: the inability to recognize the anticipated benefits of our business combination with Altimar Acquisition Corp. II (“Altimar”); changes in general economic conditions, including as a result of the COVID-19 pandemic; the outcome of litigation related to or arising out of the business combination, or any adverse developments therein or delays or costs resulting therefrom; the ability to meet the New York Stock Exchange’s listing standards following the consummation of the business combination; costs related to the business combination and additional factors discussed in Altimar’s final prospectus/proxy statement filed with the Securities and Exchange Commission (the “SEC”) on December 3, 2021 (the “Proxy Statement/Prospectus”) and the documents of Altimar and Fathom filed, or to be filed, with the SEC. If any of the risks described above materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by our forward-looking statements. There may be additional risks that neither Altimar nor Fathom presently know or that Altimar and Fathom currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Altimar’s and Fathom’s expectations, plans or forecasts of future events and views as of the date of this press release. Although Altimar and Fathom may elect to update these forward-looking statements at some point in the future, Altimar and Fathom specifically disclaim any obligation to do so. These forward-looking statements should not be relied upon as representing Altimar’s and Fathom’s assessments as of any date subsequent to the date of this press release. Accordingly, undue reliance should not be placed upon the forward-looking statements. Disclaimer

Fathom is at the Center the Industry 4.0 Digital Manufacturing Revolution Leading on-demand digital manufacturing company in a $25bn+ market Deep technical expertise to deliver best-in-class service and unlock the full potential of Industry 4.0 for enterprise customers Expansive software suite complements growth prospects Attractive financial profile and cash generation Proven and profitable track record with a highly experienced leadership team “As manufacturing processes become more software based, a large portion of the production will be completed on an on-demand or hosted basis. Software will allow for multi-tenant models, which in turn will lower costs, increase speed and provide a more consistent, higher quality product.” Fathom is uniquely positioned to serve the manufacturing needs of the largest and most innovative companies in the world

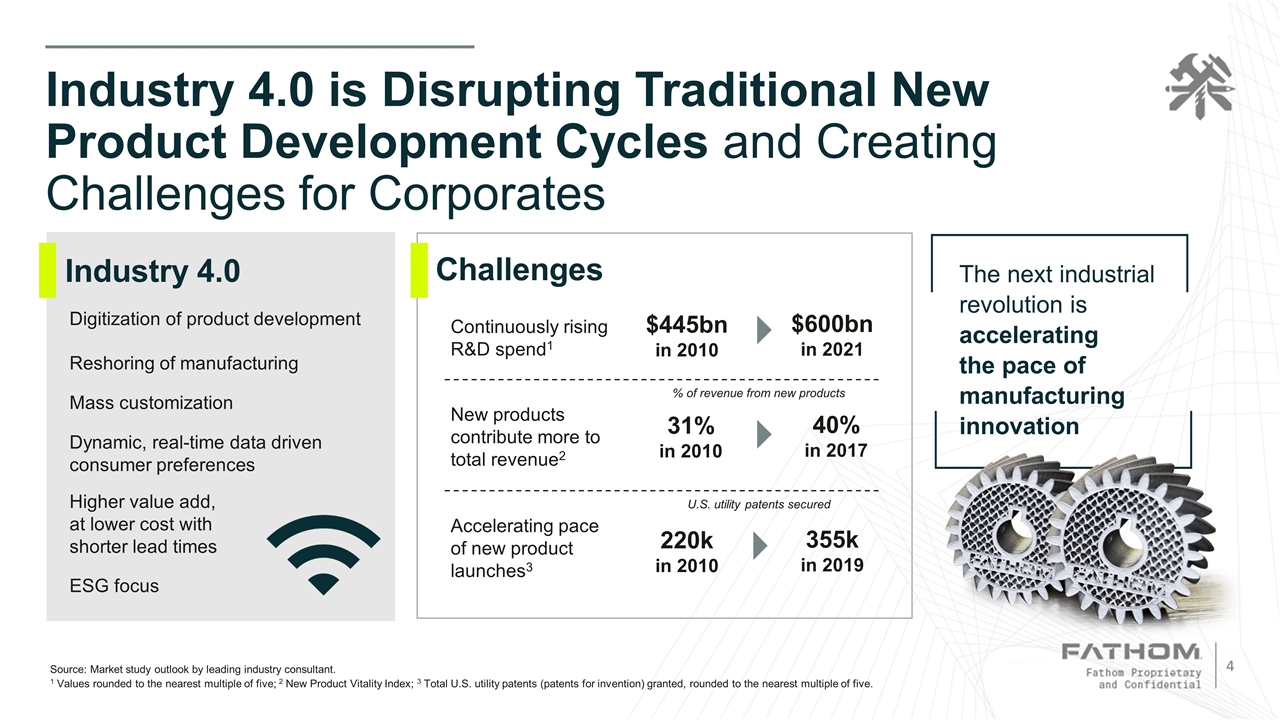

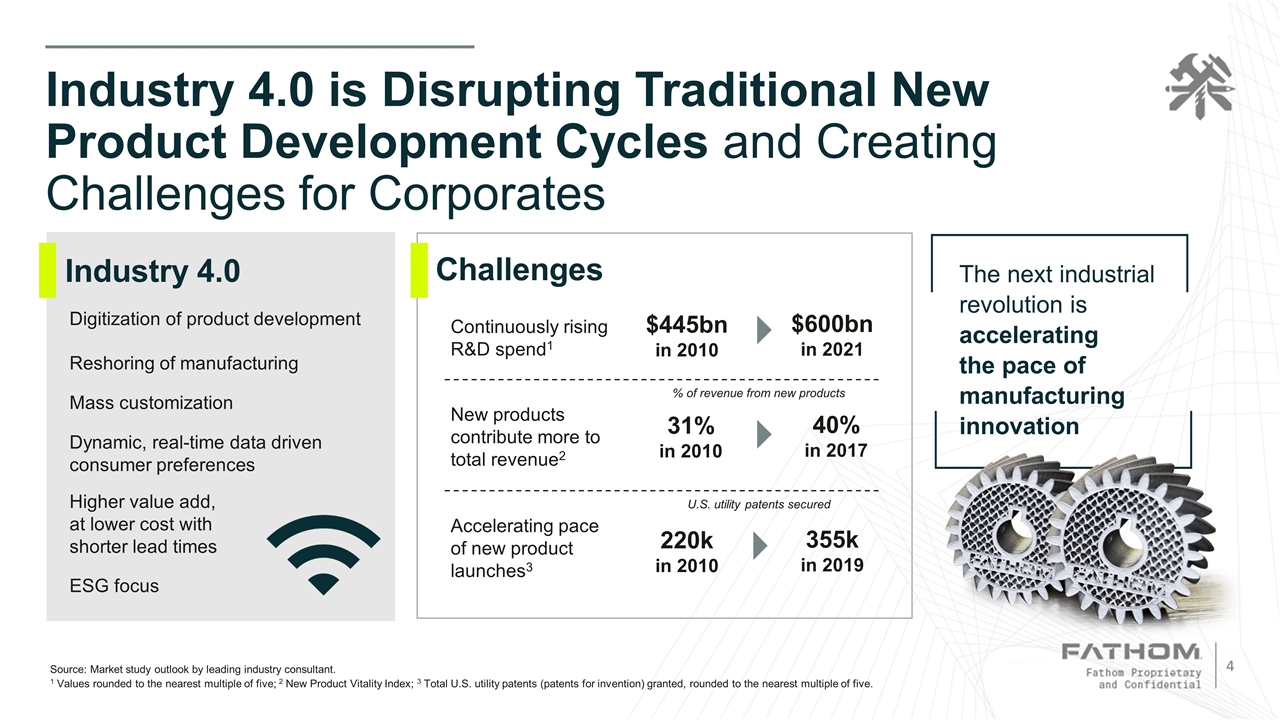

Industry 4.0 is Disrupting Traditional New Product Development Cycles and Creating Challenges for Corporates Continuously rising R&D spend1 $445bn in 2010 $600bn in 2021 New products contribute more to total revenue2 31% in 2010 40% in 2017 Accelerating pace of new product launches3 220k in 2010 355k in 2019 % of revenue from new products U.S. utility patents secured Dynamic, real-time data driven consumer preferences Higher value add, at lower cost with shorter lead times Digitization of product development Mass customization Reshoring of manufacturing ESG focus Industry 4.0 Source: Market study outlook by leading industry consultant. 1 Values rounded to the nearest multiple of five; 2 New Product Vitality Index; 3 Total U.S. utility patents (patents for invention) granted, rounded to the nearest multiple of five. Challenges The next industrial revolution is accelerating the pace of manufacturing innovation

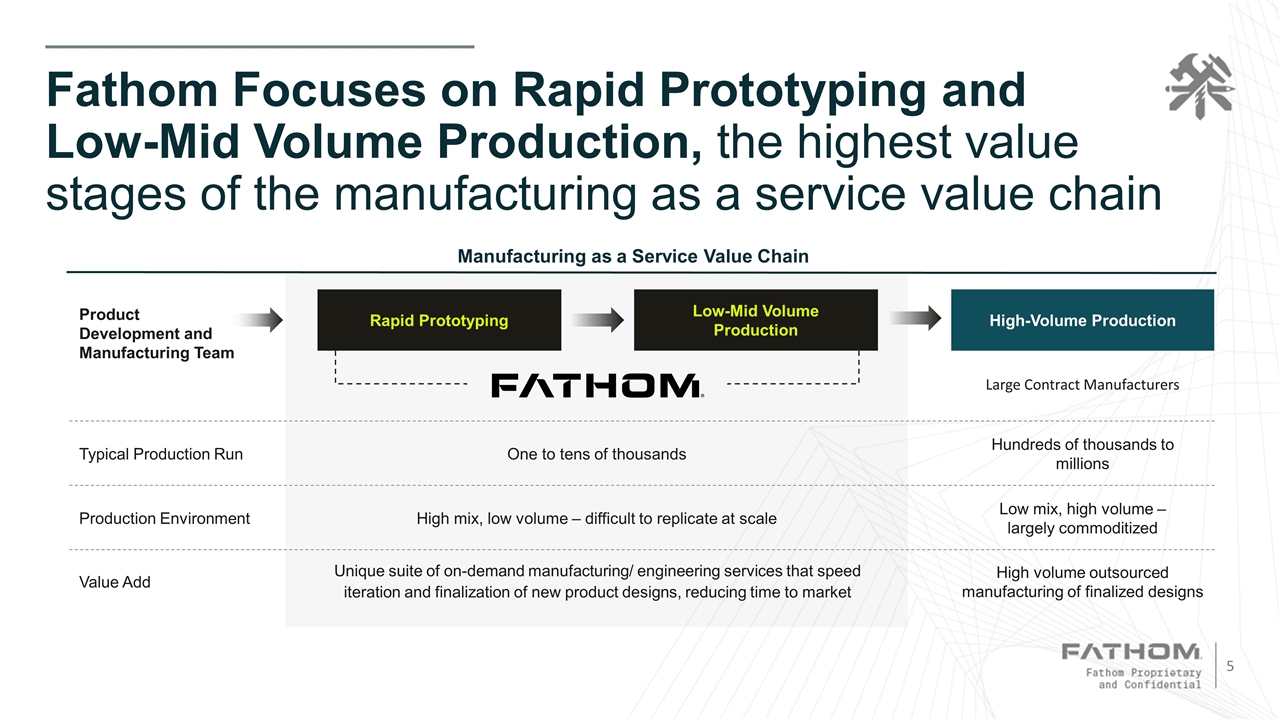

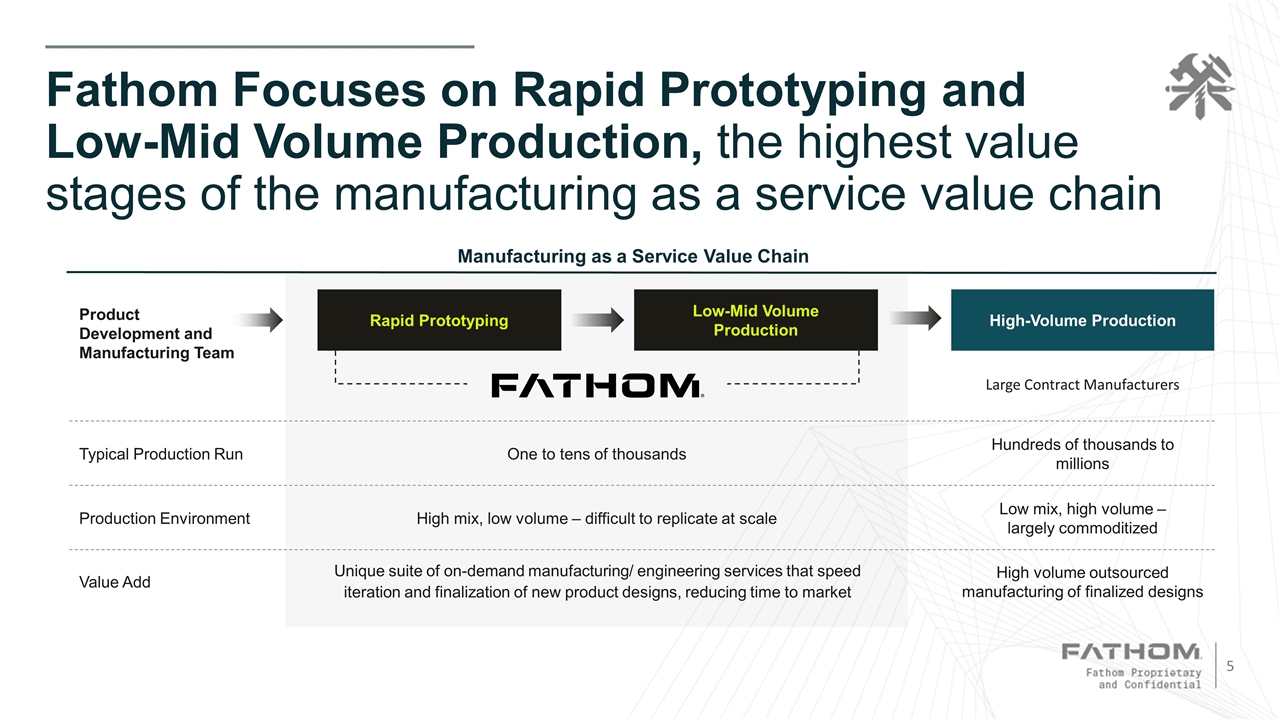

Fathom Focuses on Rapid Prototyping and Low-Mid Volume Production, the highest value stages of the manufacturing as a service value chain Manufacturing as a Service Value Chain Rapid Prototyping Low-Mid Volume Production High-Volume Production Typical Production Run Production Environment Value Add One to tens of thousands High mix, low volume – difficult to replicate at scale Unique suite of on-demand manufacturing/ engineering services that speed iteration and finalization of new product designs, reducing time to market Hundreds of thousands to millions Low mix, high volume – largely commoditized High volume outsourced manufacturing of finalized designs Product Development and Manufacturing Team Large Contract Manufacturers

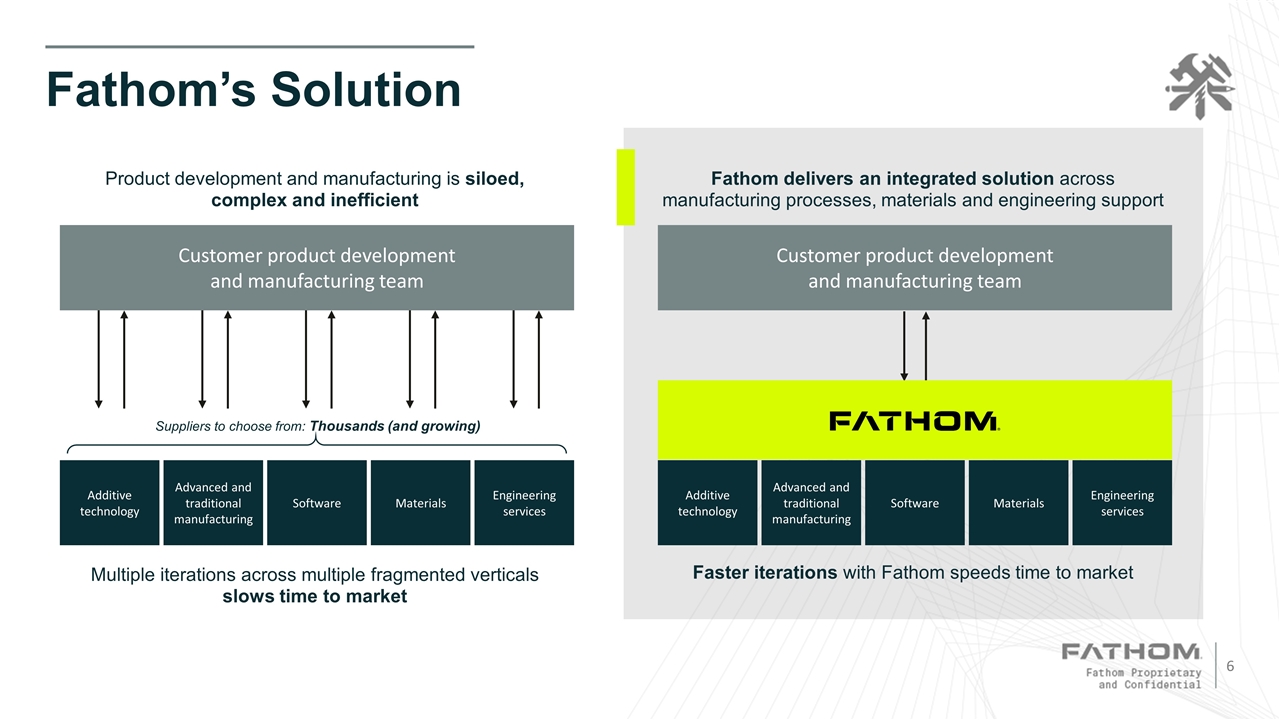

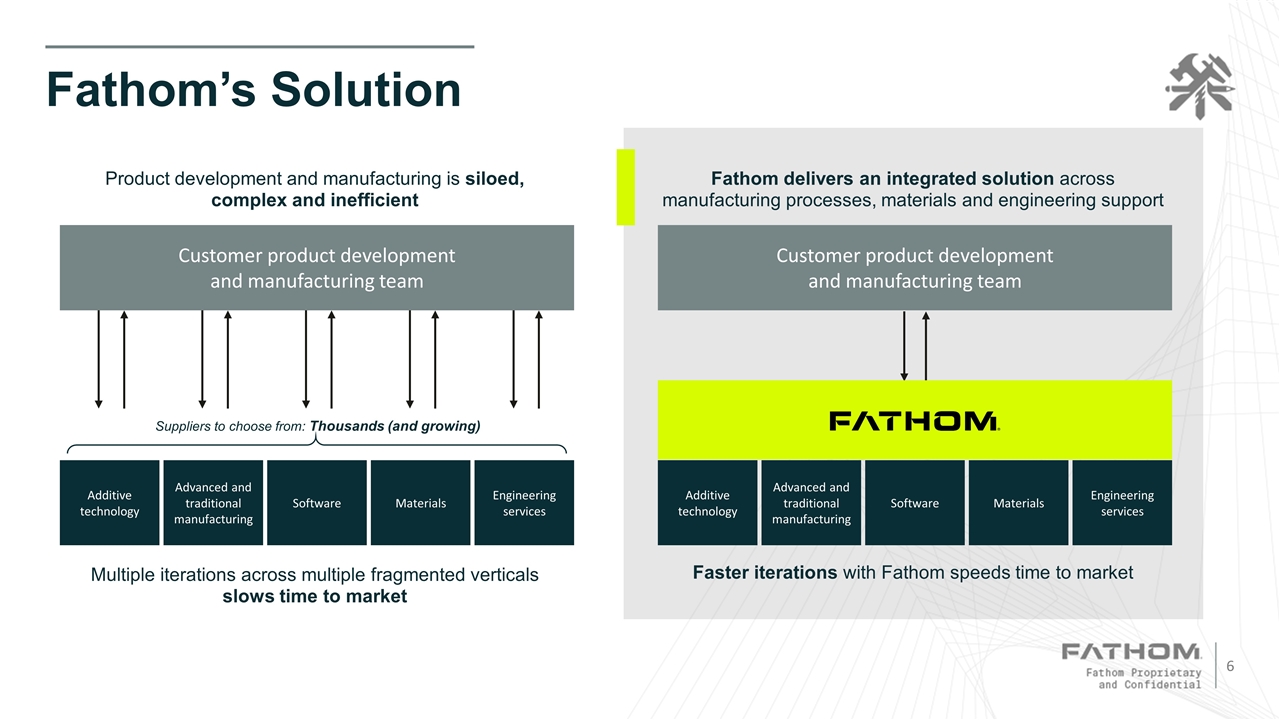

Fathom’s Solution Product development and manufacturing is siloed, complex and inefficient Customer product development and manufacturing team Additive technology Advanced and traditional manufacturing Software Materials Engineering services Multiple iterations across multiple fragmented verticals slows time to market Fathom delivers an integrated solution across manufacturing processes, materials and engineering support Customer product development and manufacturing team Additive technology Advanced and traditional manufacturing Software Materials Engineering services Faster iterations with Fathom speeds time to market Suppliers to choose from: Thousands (and growing)

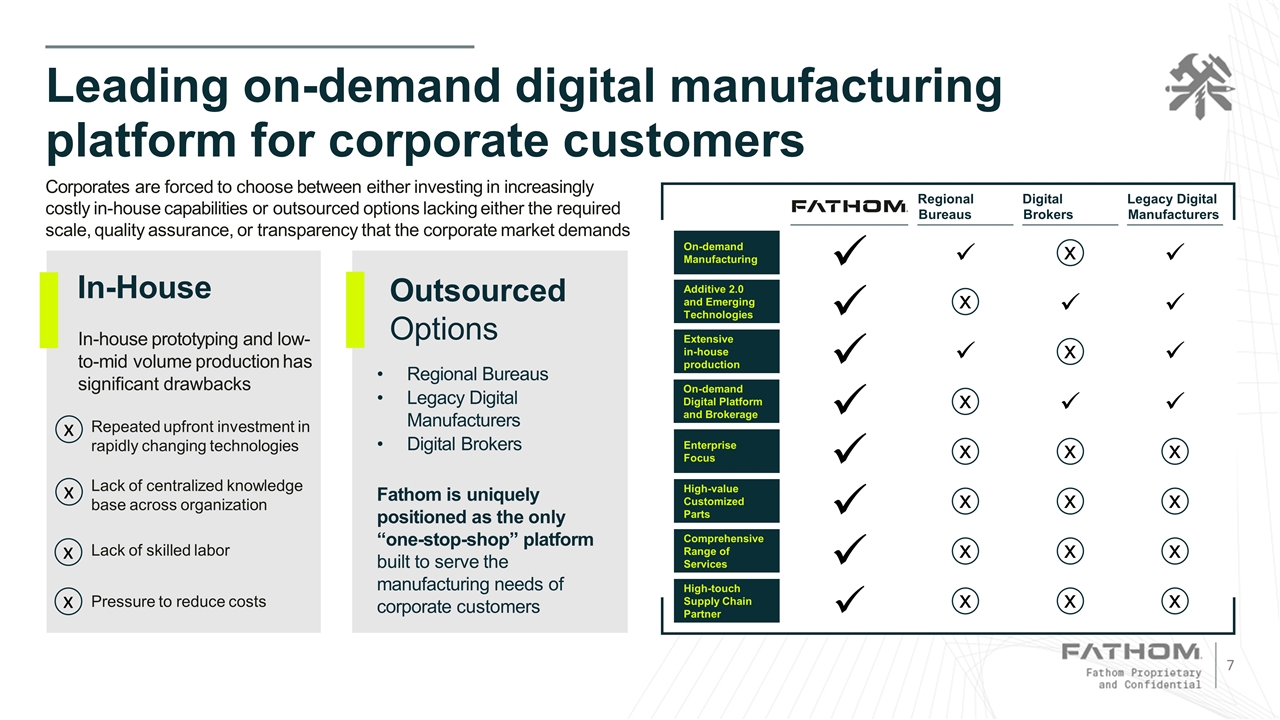

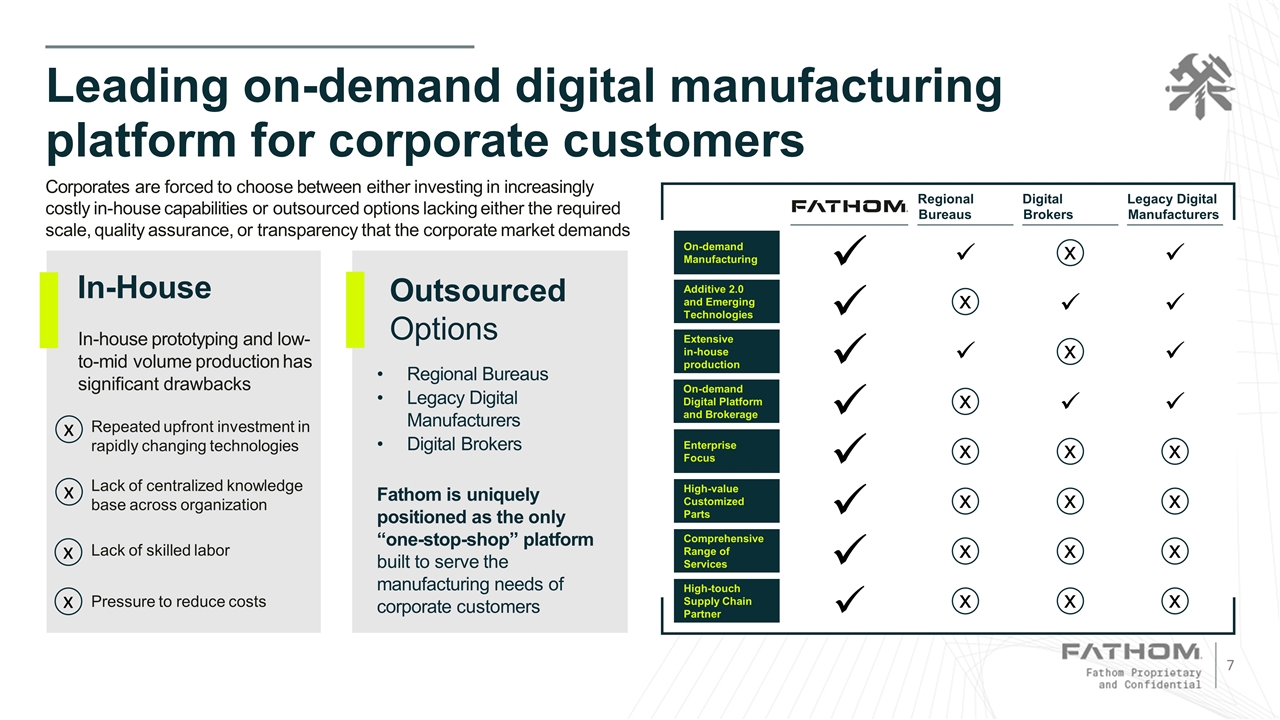

7 Leading on-demand digital manufacturing platform for corporate customers Corporates are forced to choose between either investing in increasingly costly in-house capabilities or outsourced options lacking either the required scale, quality assurance, or transparency that the corporate market demands Regional Bureaus Legacy Digital Manufacturers Digital Brokers Fathom is uniquely positioned as the only “one-stop-shop” platform built to serve the manufacturing needs of corporate customers In-house prototyping and low-to-mid volume production has significant drawbacks Lack of skilled labor Repeated upfront investment in rapidly changing technologies Lack of centralized knowledge base across organization Pressure to reduce costs In-House Outsourced Options x x x x Regional Bureaus Digital Brokers Legacy Digital Manufacturers Additive 2.0 and Emerging Technologies On-demand Digital Platform and Brokerage Extensive in-house production On-demand Manufacturing Enterprise Focus High-value Customized Parts Comprehensive Range of Services High-touch Supply Chain Partner x ü ü ü ü ü ü ü ü ü ü ü ü ü ü ü ü x x x x x x x x x x x x x x x

Why Fathom Wins Fathom Delivers Unique Proprietary Solutions that enable: Accelerated Time to Market Entrenched Long-Term Partnerships Resulting in: 8 Technology agnostic outcome-based approach 25+ Industry leading manufacturing processes Pioneer in the on-demand manufacturing space with 3 decades of experience One of the first adopters of plastic and metal additive manufacturing Proprietary software solution to enable the digitalization of manufacturing Supported by Fathom’s Proprietary Manufacturing Enablement Software Solution Additive Technology Advanced & Traditional Manufacturing Software Materials Corporate Customers want an integrated solution that delivers Comprehensive Manufacturing Capabilities Speed Quality Engineering Services Customer Service

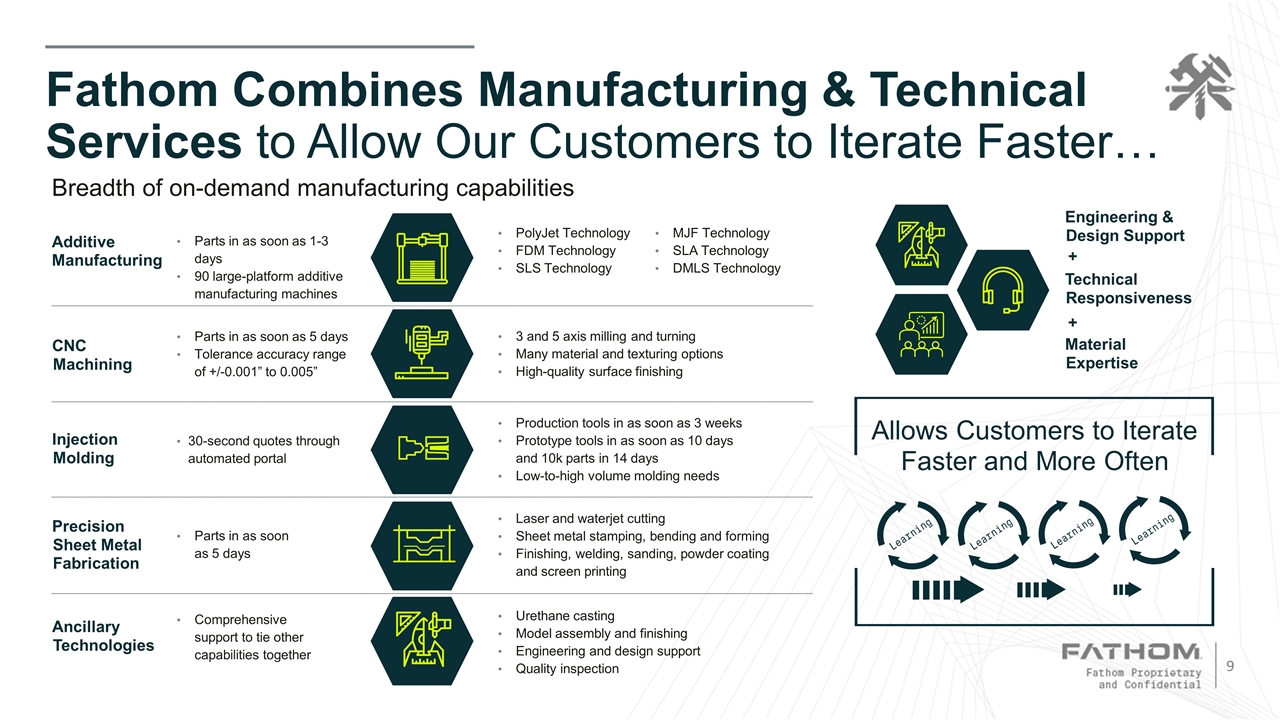

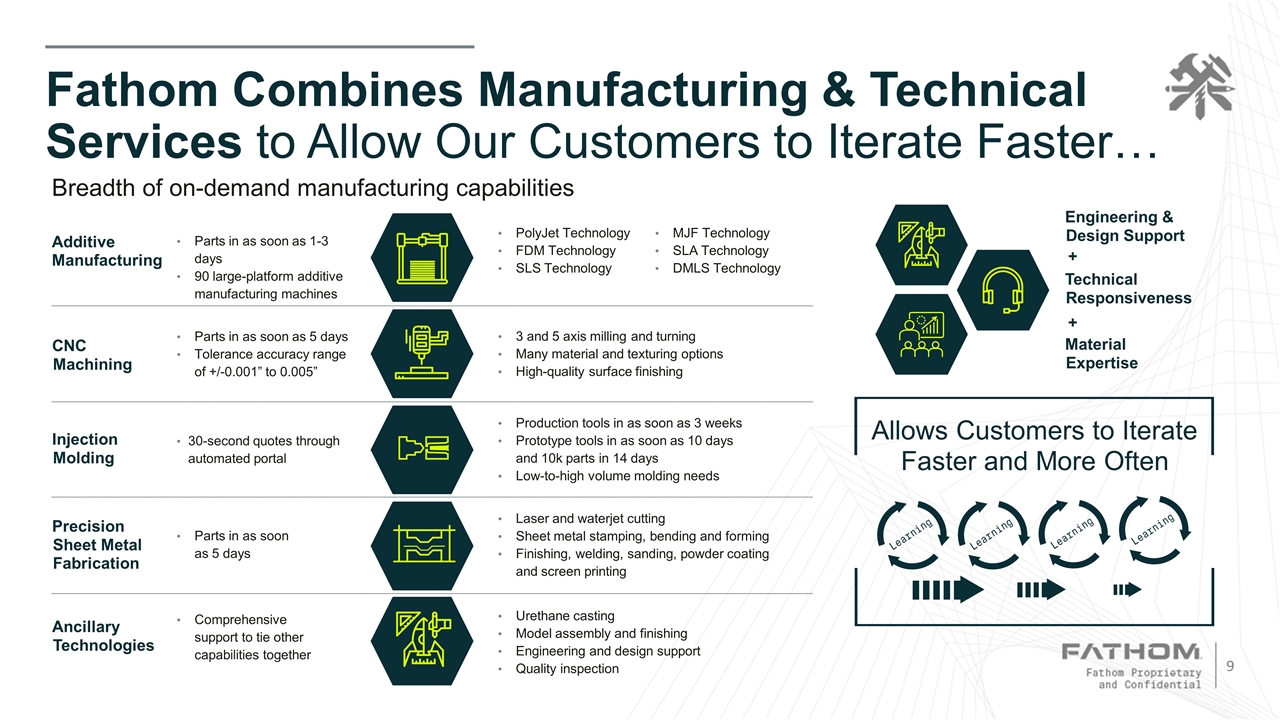

Fathom Combines Manufacturing & Technical Services to Allow Our Customers to Iterate Faster… 3 and 5 axis milling and turning Many material and texturing options High-quality surface finishing Production tools in as soon as 3 weeks Prototype tools in as soon as 10 days and 10k parts in 14 days Low-to-high volume molding needs PolyJet Technology FDM Technology SLS Technology MJF Technology SLA Technology DMLS Technology Laser and waterjet cutting Sheet metal stamping, bending and forming Finishing, welding, sanding, powder coating and screen printing Urethane casting Model assembly and finishing Engineering and design support Quality inspection CNC Machining Parts in as soon as 5 days Tolerance accuracy range of +/-0.001” to 0.005” Injection Molding 30-second quotes through automated portal Additive Manufacturing Parts in as soon as 1-3 days 90 large-platform additive manufacturing machines Precision Sheet Metal Fabrication Parts in as soon as 5 days Ancillary Technologies Comprehensive support to tie other capabilities together Engineering & Design Support Technical Responsiveness Material Expertise Breadth of on-demand manufacturing capabilities + + Allows Customers to Iterate Faster and More Often

Customer Project Technologies Used Global Electric Vehicle Manufacturer High-complexity, quick-turn automotive bridge to production ✓ ✓ ✓ ✓ Additive Manufacturing Precision Sheet Metal Design & Engineering Ancillary Technologies Global A&D Equipment Company Full size mockups of aircraft interior assemblies ✓ ✓ ✓ Additive Manufacturing CNC Machining Ancillary Technologies Global Power Generation Company Functional generator prototype for testing ✓ ✓ ✓ ✓ Additive Manufacturing Precision Sheet Metal CNC Machining Ancillary Technologies Global A&D Equipment Company High-complexity missile mockup ✓ ✓ ✓ ✓ Additive Manufacturing CNC Machining Design & Engineering Ancillary Technologies Global Medical Device Company Bridge to production for medical incubator ✓ ✓ ✓ ✓ ✓ Additive Manufacturing Injection Molding CNC Machining Design & Engineering Ancillary Technologies …and many more customers with complex manufacturing needs… …Accelerating Manufacturing for many of the Most Innovative Companies in the World… 1 Metrics based on combined results of the five customers described above. 33% Combined ‘18-’20 sales

…with a Proven Ability to Deliver Fast Turnaround Times for Projects Involving Multiple Complex Manufacturing Processes 15,000 55+ Tools to Injection Mold 15,000 Parts First Article in 2 weeks 3,000 3,000+ 3D Printed Parts 2,000 2,000+ Metal Fabricated Parts 3D Printing / Additive Manufacturing. Polyjet. SLS. MJF DFM Analysis + CAD Mods CNC Machining. Laser Cutting Stamping. Die Cutting. Post-Opp Drilling 24-hour Turnaround Urethane Casting Injection + Compression Molding Model Finishing. Insert Assembly Advanced Project Management $1mm Total revenue from project 20,000 Parts // Within 27 Days Hybridized Services Used A Fortune 10 technology company came to Fathom with a complex project that spanned the technologies and processes of rapid production…and needed it done fast. Fathom delivered.

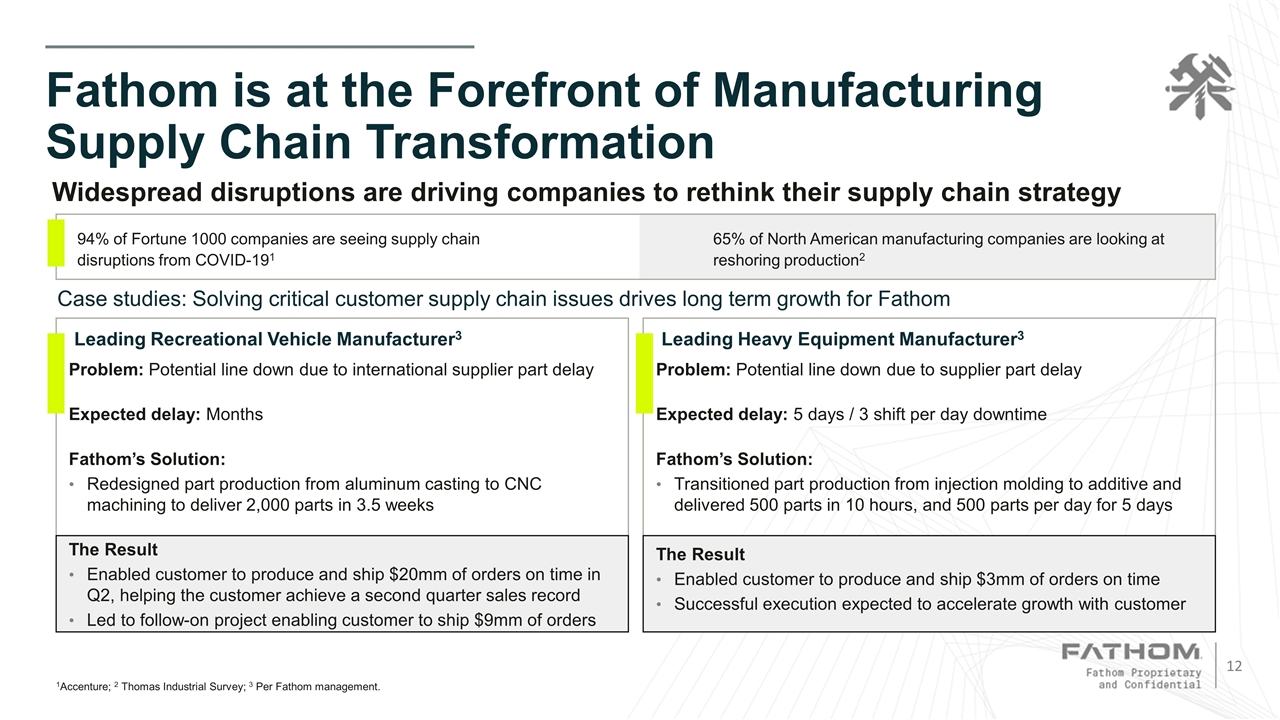

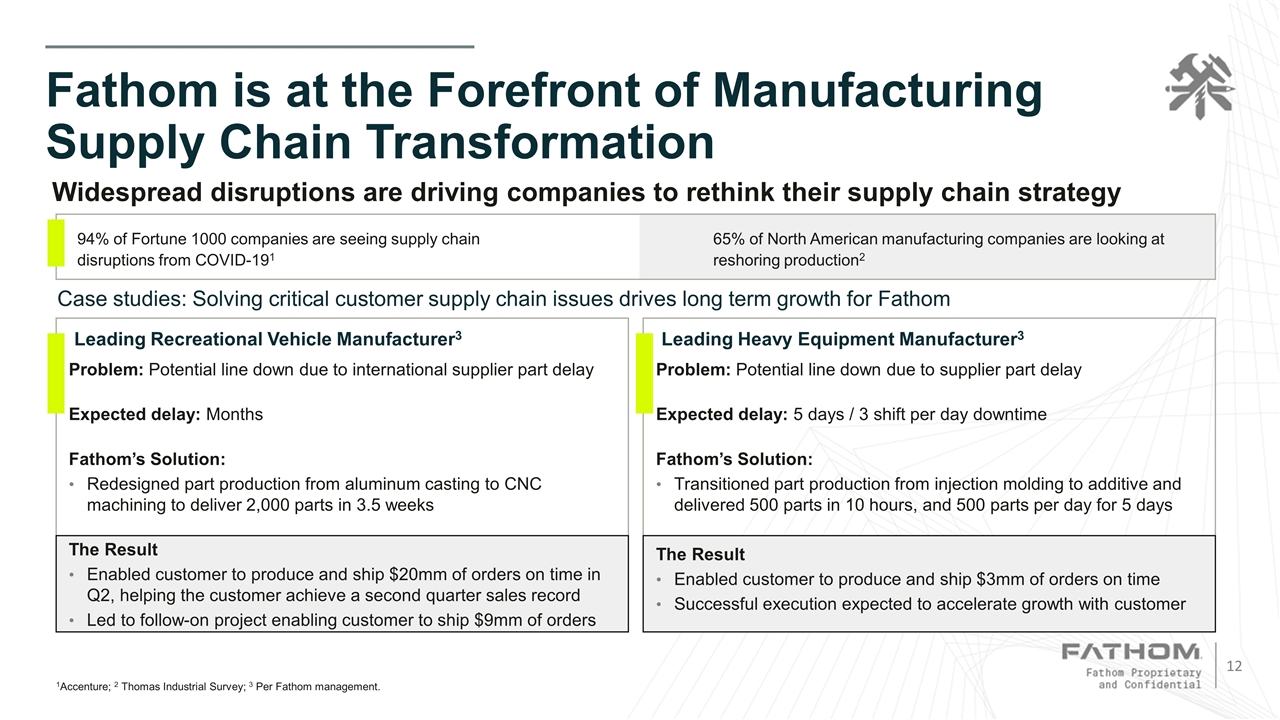

Fathom is at the Forefront of Manufacturing Supply Chain Transformation Leading Recreational Vehicle Manufacturer3 Case studies: Solving critical customer supply chain issues drives long term growth for Fathom 1Accenture; 2 Thomas Industrial Survey; 3 Per Fathom management. 94% of Fortune 1000 companies are seeing supply chain disruptions from COVID-191 65% of North American manufacturing companies are looking at reshoring production2 Widespread disruptions are driving companies to rethink their supply chain strategy Leading Heavy Equipment Manufacturer3 Problem: Potential line down due to international supplier part delay Expected delay: Months Fathom’s Solution: Redesigned part production from aluminum casting to CNC machining to deliver 2,000 parts in 3.5 weeks The Result Enabled customer to produce and ship $20mm of orders on time in Q2, helping the customer achieve a second quarter sales record Led to follow-on project enabling customer to ship $9mm of orders Problem: Potential line down due to supplier part delay Expected delay: 5 days / 3 shift per day downtime Fathom’s Solution: Transitioned part production from injection molding to additive and delivered 500 parts in 10 hours, and 500 parts per day for 5 days The Result Enabled customer to produce and ship $3mm of orders on time Successful execution expected to accelerate growth with customer

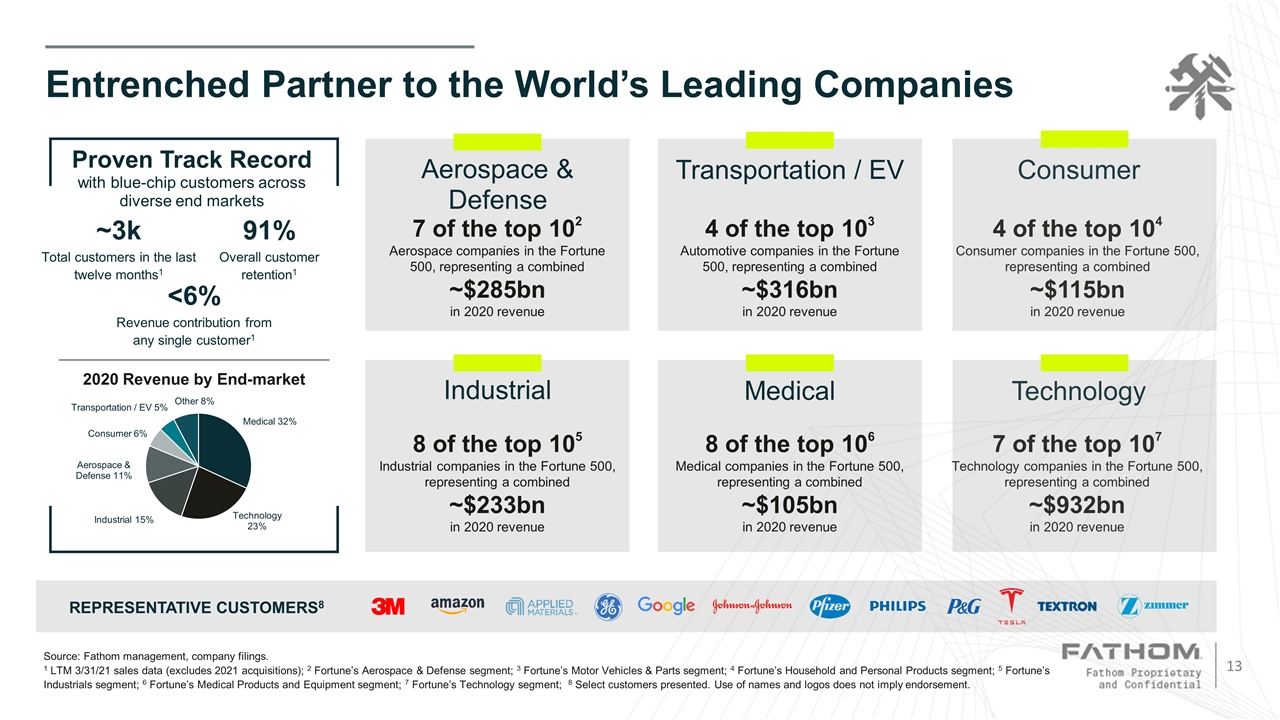

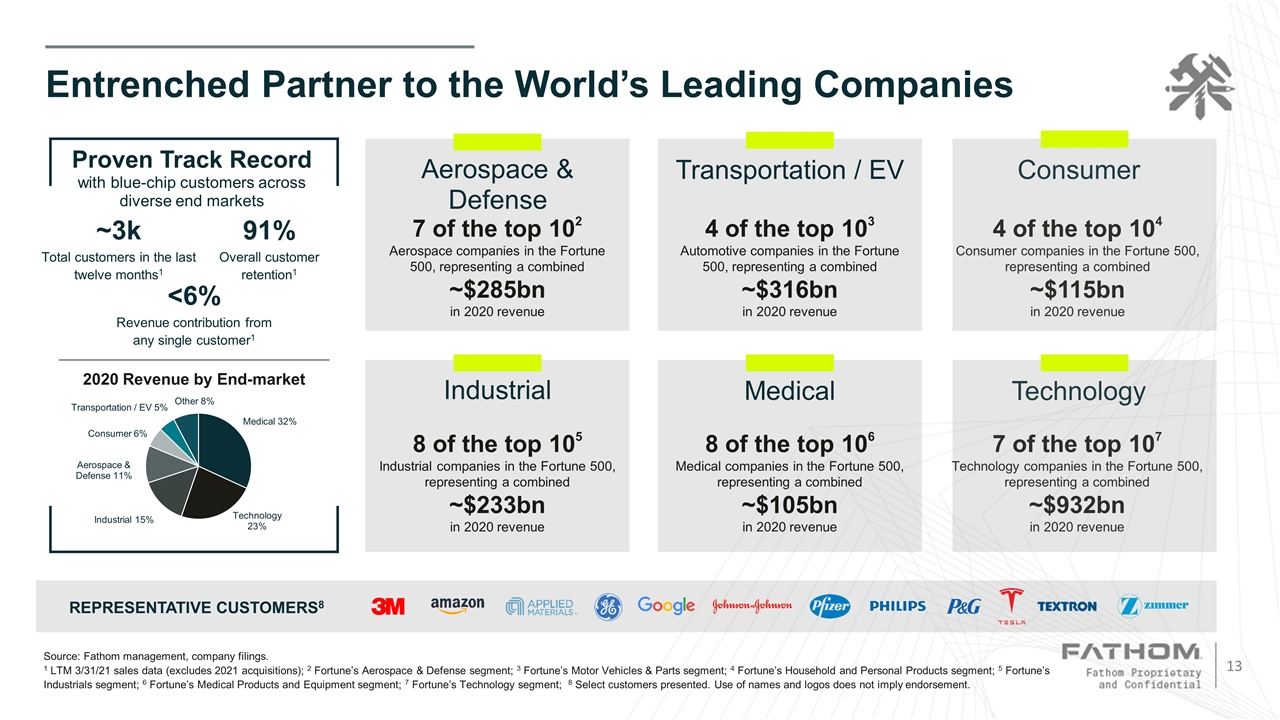

Entrenched Partner to the World’s Leading Companies Source: Fathom management, company filings. 1 LTM 3/31/21 sales data (excludes 2021 acquisitions); 2 Fortune’s Aerospace & Defense segment; 3 Fortune’s Motor Vehicles & Parts segment; 4 Fortune’s Household and Personal Products segment; 5 Fortune’s Industrials segment; 6 Fortune’s Medical Products and Equipment segment; 7 Fortune’s Technology segment; 8 Select customers presented. Use of names and logos does not imply endorsement. 4 of the top 104 Consumer companies in the Fortune 500, representing a combined ~$115bn in 2020 revenue 7 of the top 107 Technology companies in the Fortune 500, representing a combined ~$932bn in 2020 revenue REPRESENTATIVE CUSTOMERS8 Consumer Technology 7 of the top 102 Aerospace companies in the Fortune 500, representing a combined ~$285bn in 2020 revenue 8 of the top 105 Industrial companies in the Fortune 500, representing a combined ~$233bn in 2020 revenue Aerospace & Defense Industrial 4 of the top 103 Automotive companies in the Fortune 500, representing a combined ~$316bn in 2020 revenue 8 of the top 106 Medical companies in the Fortune 500, representing a combined ~$105bn in 2020 revenue Transportation / EV Medical <6% Revenue contribution from any single customer1 91% Overall customer retention1 ~3k Total customers in the last twelve months1 Proven Track Record with blue-chip customers across diverse end markets 2020 Revenue by End-market

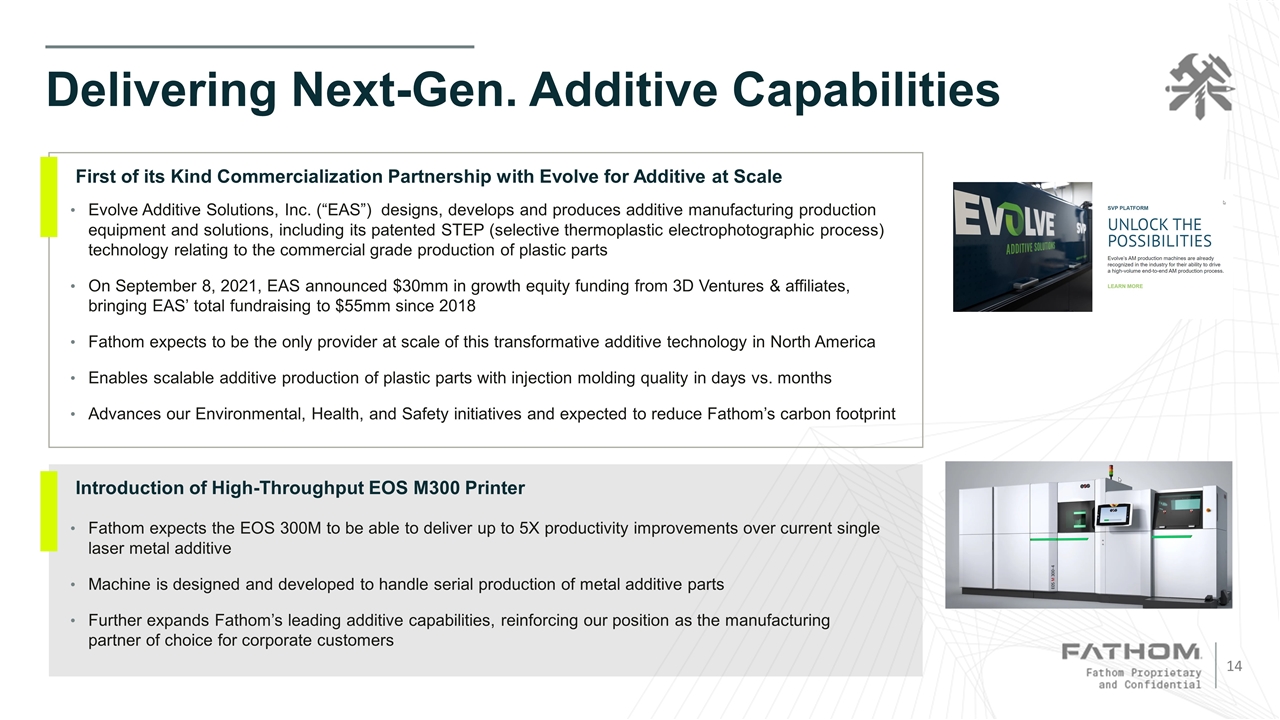

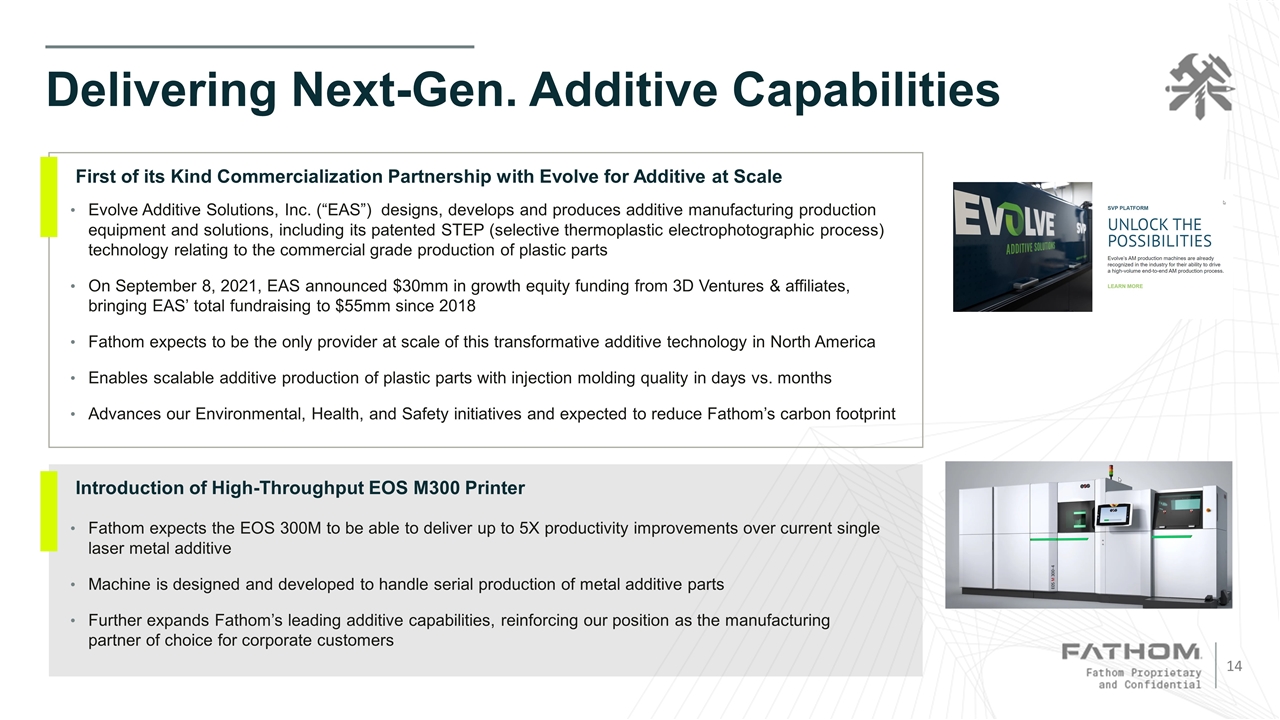

Delivering Next-Gen. Additive Capabilities Evolve Additive Solutions, Inc. (“EAS”) designs, develops and produces additive manufacturing production equipment and solutions, including its patented STEP (selective thermoplastic electrophotographic process) technology relating to the commercial grade production of plastic parts On September 8, 2021, EAS announced $30mm in growth equity funding from 3D Ventures & affiliates, bringing EAS’ total fundraising to $55mm since 2018 Fathom expects to be the only provider at scale of this transformative additive technology in North America Enables scalable additive production of plastic parts with injection molding quality in days vs. months Advances our Environmental, Health, and Safety initiatives and expected to reduce Fathom’s carbon footprint Fathom expects the EOS 300M to be able to deliver up to 5X productivity improvements over current single laser metal additive Machine is designed and developed to handle serial production of metal additive parts Further expands Fathom’s leading additive capabilities, reinforcing our position as the manufacturing partner of choice for corporate customers First of its Kind Commercialization Partnership with Evolve for Additive at Scale Introduction of High-Throughput EOS M300 Printer

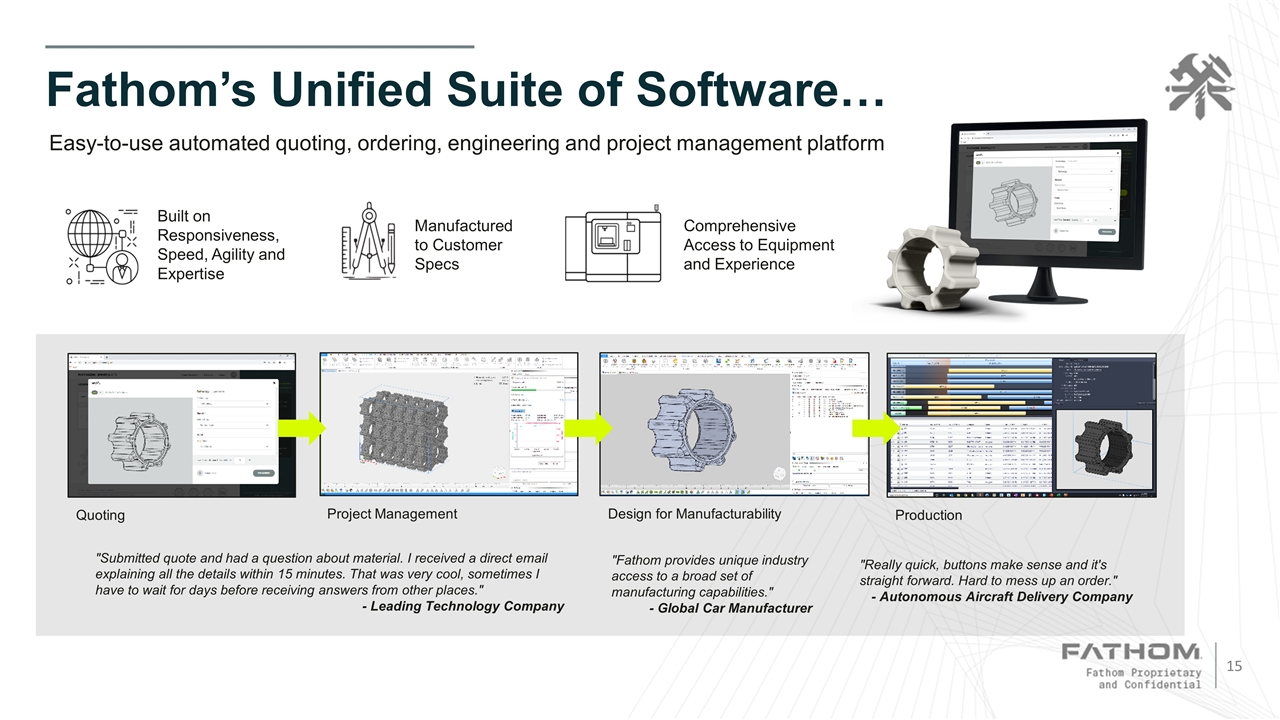

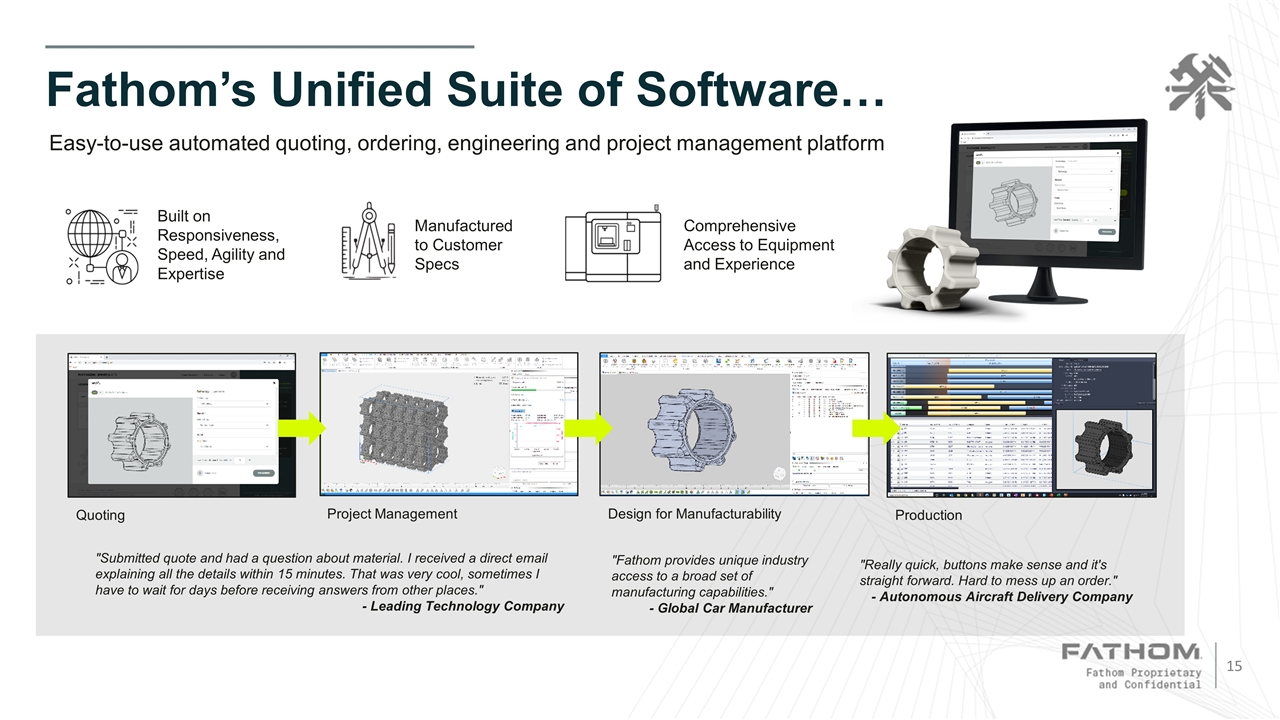

Fathom’s Unified Suite of Software… Comprehensive Access to Equipment and Experience Built on Responsiveness, Speed, Agility and Expertise Manufactured to Customer Specs Easy-to-use automated quoting, ordering, engineering and project management platform Quoting Design for Manufacturability Project Management Production "Submitted quote and had a question about material. I received a direct email explaining all the details within 15 minutes. That was very cool, sometimes I have to wait for days before receiving answers from other places." - Leading Technology Company "Fathom provides unique industry access to a broad set of manufacturing capabilities." - Global Car Manufacturer "Really quick, buttons make sense and it's straight forward. Hard to mess up an order." - Autonomous Aircraft Delivery Company

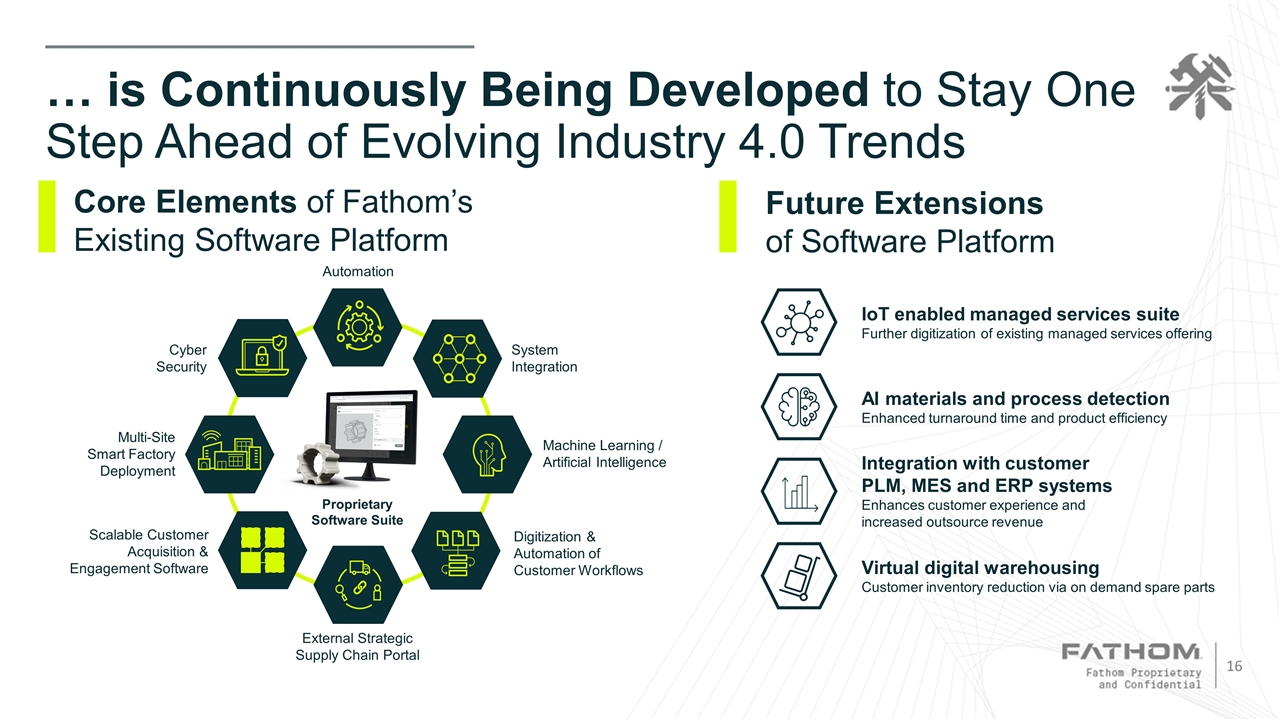

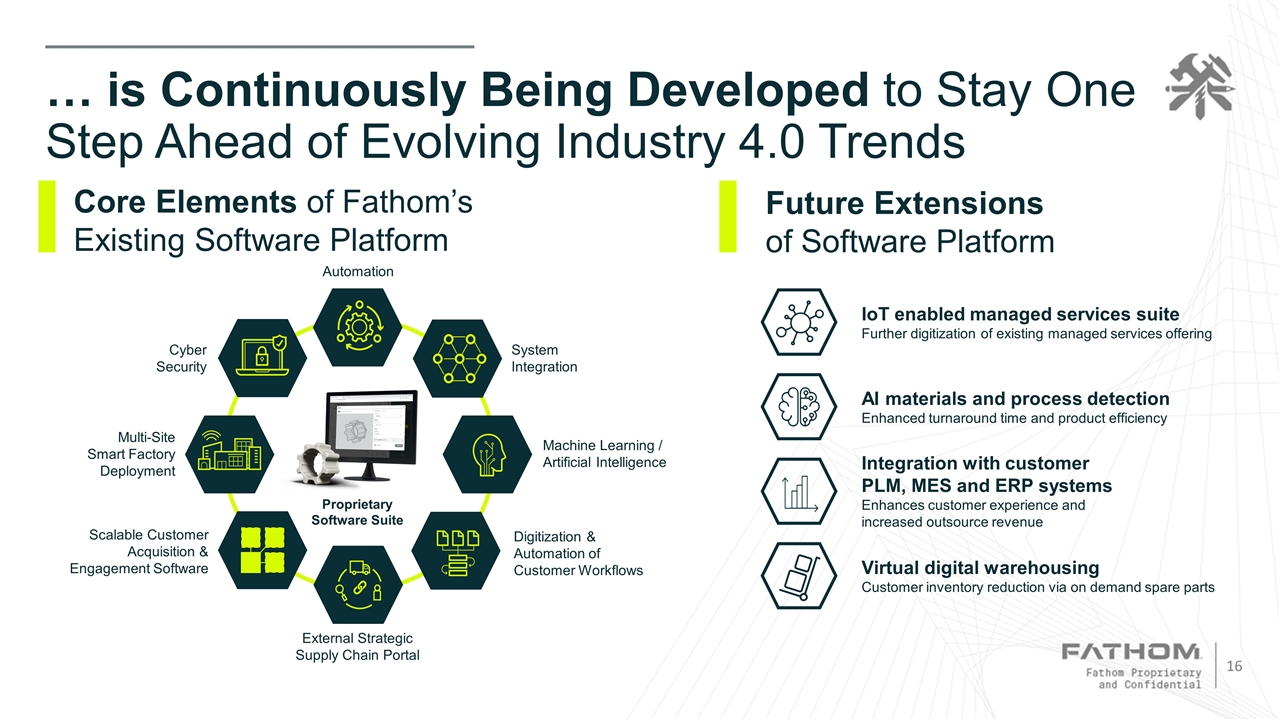

… is Continuously Being Developed to Stay One Step Ahead of Evolving Industry 4.0 Trends Core Elements of Fathom’s Existing Software Platform Future Extensions of Software Platform IoT enabled managed services suite Further digitization of existing managed services offering AI materials and process detection Enhanced turnaround time and product efficiency Integration with customer PLM, MES and ERP systems Enhances customer experience and increased outsource revenue Virtual digital warehousing Customer inventory reduction via on demand spare parts Machine Learning / Artificial Intelligence Multi-Site Smart Factory Deployment System Integration Cyber Security Automation External Strategic Supply Chain Portal Digitization & Automation of Customer Workflows Scalable Customer Acquisition & Engagement Software Proprietary Software Suite

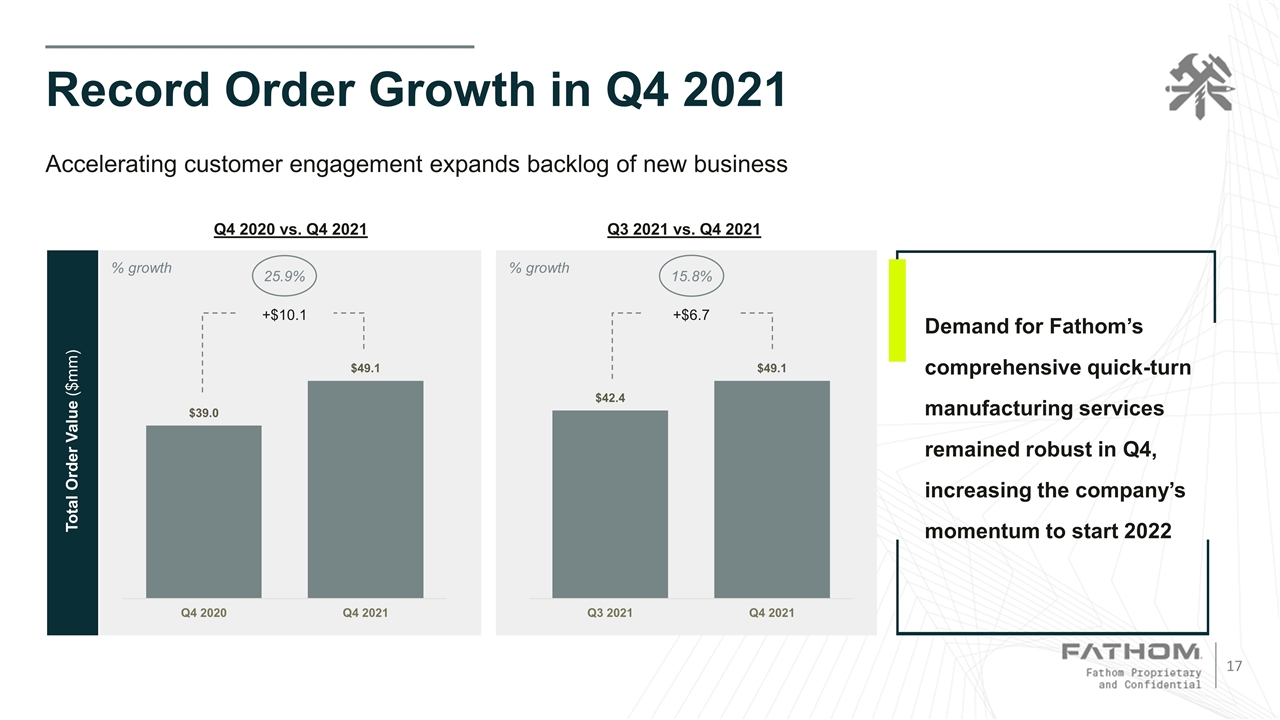

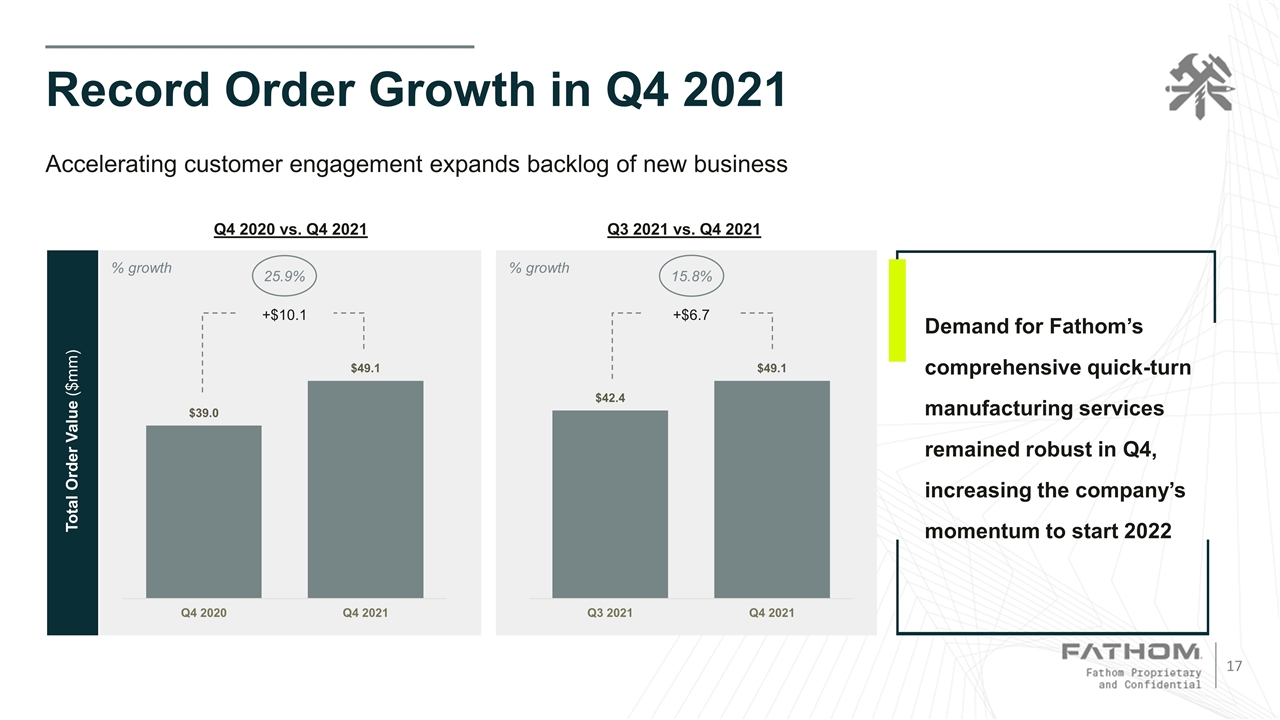

% growth 17 Record Order Growth in Q4 2021 Total Order Value ($mm) Accelerating customer engagement expands backlog of new business % growth Q4 2020 vs. Q4 2021 Q3 2021 vs. Q4 2021 Demand for Fathom’s comprehensive quick-turn manufacturing services remained robust in Q4, increasing the company’s momentum to start 2022 25.9% 15.8% +$10.1 +$6.7

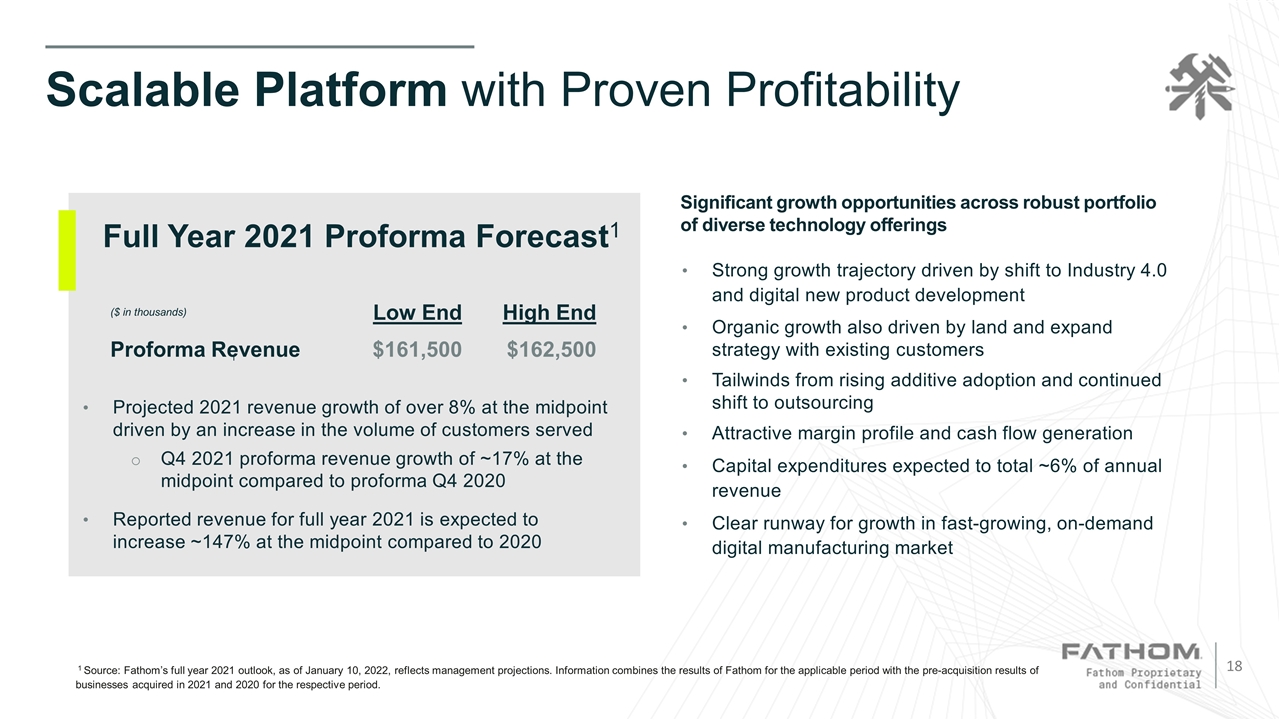

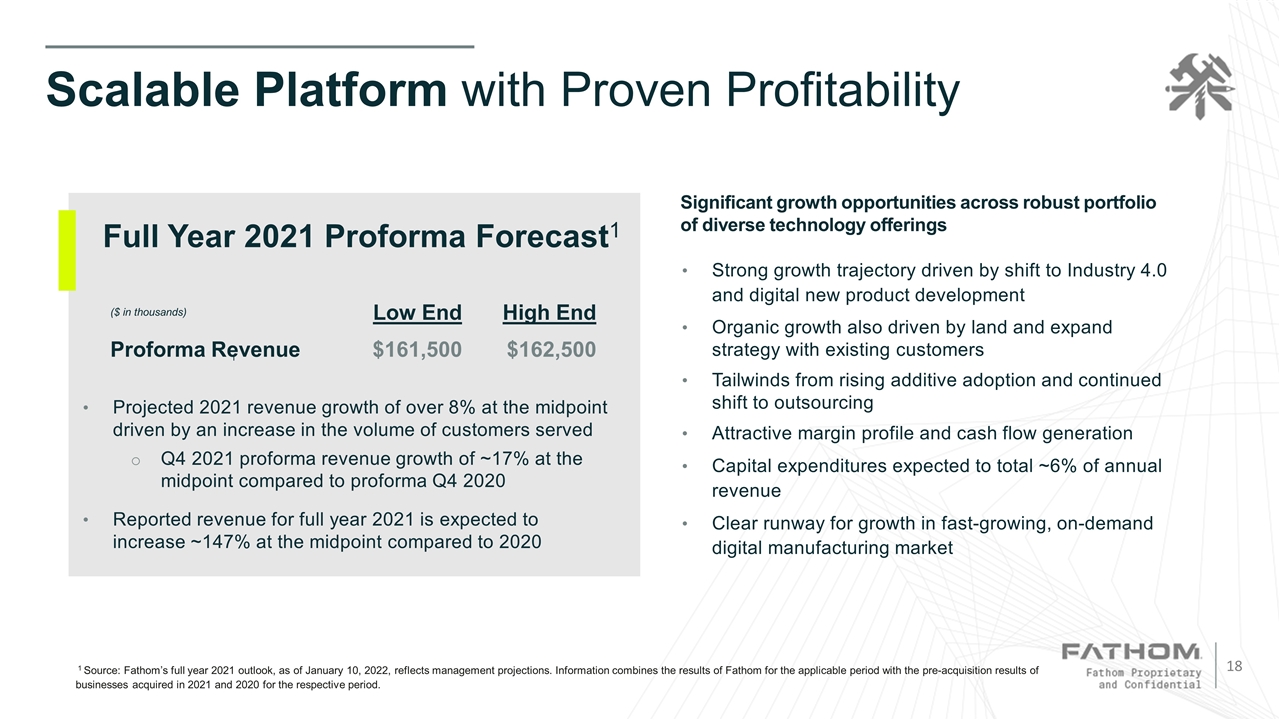

Scalable Platform with Proven Profitability Strong growth trajectory driven by shift to Industry 4.0 and digital new product development Organic growth also driven by land and expand strategy with existing customers Tailwinds from rising additive adoption and continued shift to outsourcing Attractive margin profile and cash flow generation Capital expenditures expected to total ~6% of annual revenue Clear runway for growth in fast-growing, on-demand digital manufacturing market 1 Source: Fathom’s full year 2021 outlook, as of January 10, 2022, reflects management projections. Information combines the results of Fathom for the applicable period with the pre-acquisition results of businesses acquired in 2021 and 2020 for the respective period. Full Year 2021 Proforma Forecast1 Significant growth opportunities across robust portfolio of diverse technology offerings Projected 2021 revenue growth of over 8% at the midpoint driven by an increase in the volume of customers served Q4 2021 proforma revenue growth of ~17% at the midpoint compared to proforma Q4 2020 Reported revenue for full year 2021 is expected to increase ~147% at the midpoint compared to 2020 ($ in thousands) Low End High End Proforma Revenue $161,500 $162,500 1

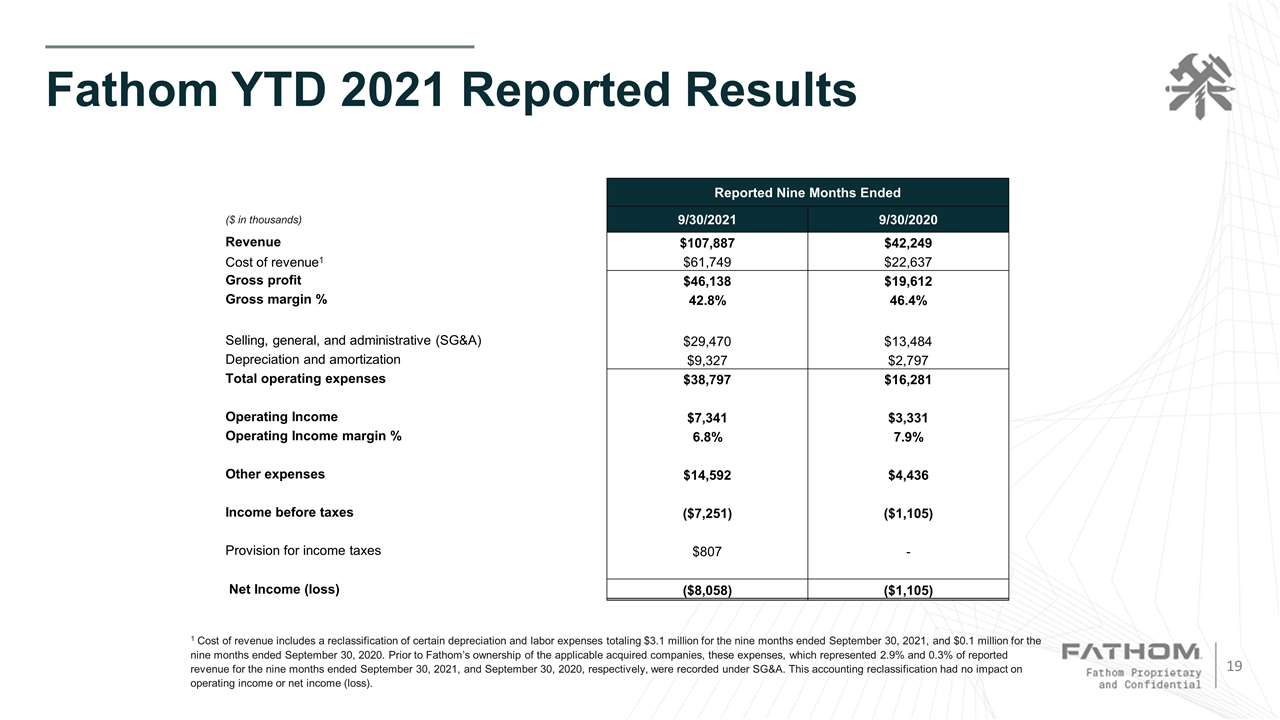

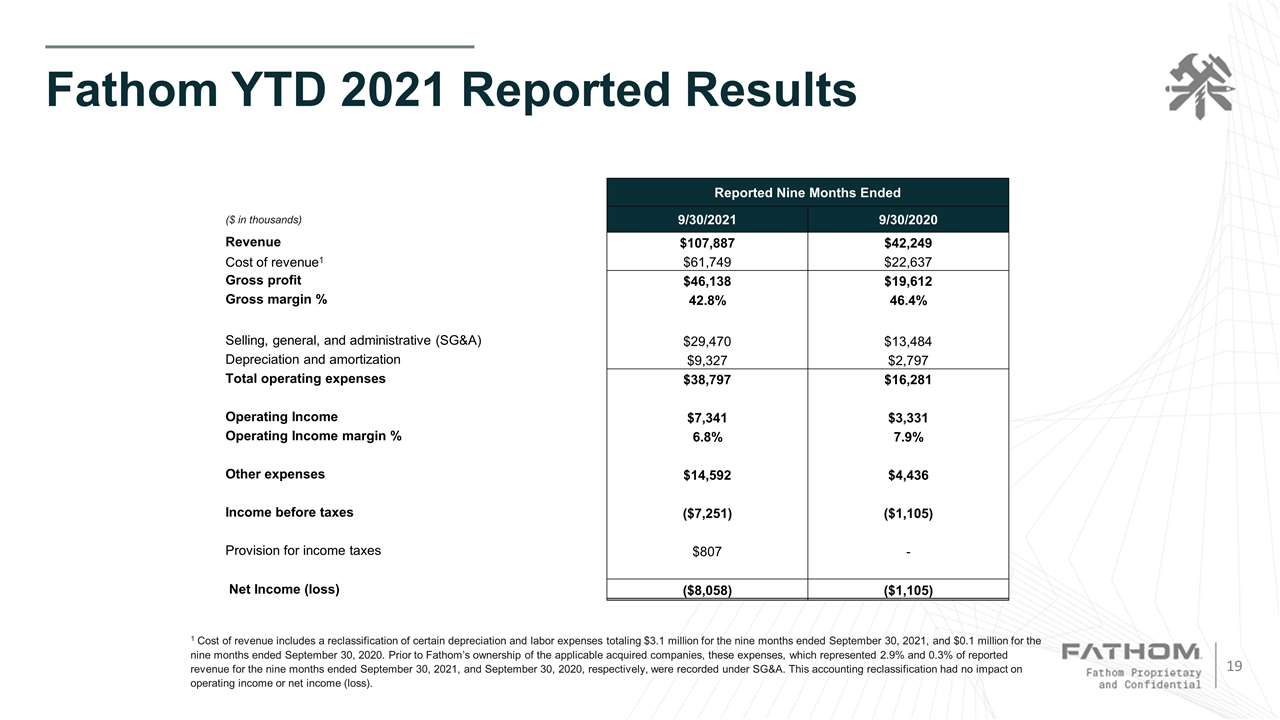

Fathom YTD 2021 Reported Results Reported Nine Months Ended ($ in thousands) 9/30/2021 9/30/2020 Revenue $107,887 $42,249 Cost of revenue1 $61,749 $22,637 Gross profit $46,138 $19,612 Gross margin % 42.8% 46.4% Selling, general, and administrative (SG&A) $29,470 $13,484 Depreciation and amortization $9,327 $2,797 Total operating expenses $38,797 $16,281 Operating Income $7,341 $3,331 Operating Income margin % 6.8% 7.9% Other expenses $14,592 $4,436 Income before taxes ($7,251) ($1,105) Provision for income taxes $807 - Net Income (loss) ($8,058) ($1,105) 1 Cost of revenue includes a reclassification of certain depreciation and labor expenses totaling $3.1 million for the nine months ended September 30, 2021, and $0.1 million for the nine months ended September 30, 2020. Prior to Fathom’s ownership of the applicable acquired companies, these expenses, which represented 2.9% and 0.3% of reported revenue for the nine months ended September 30, 2021, and September 30, 2020, respectively, were recorded under SG&A. This accounting reclassification had no impact on operating income or net income (loss).

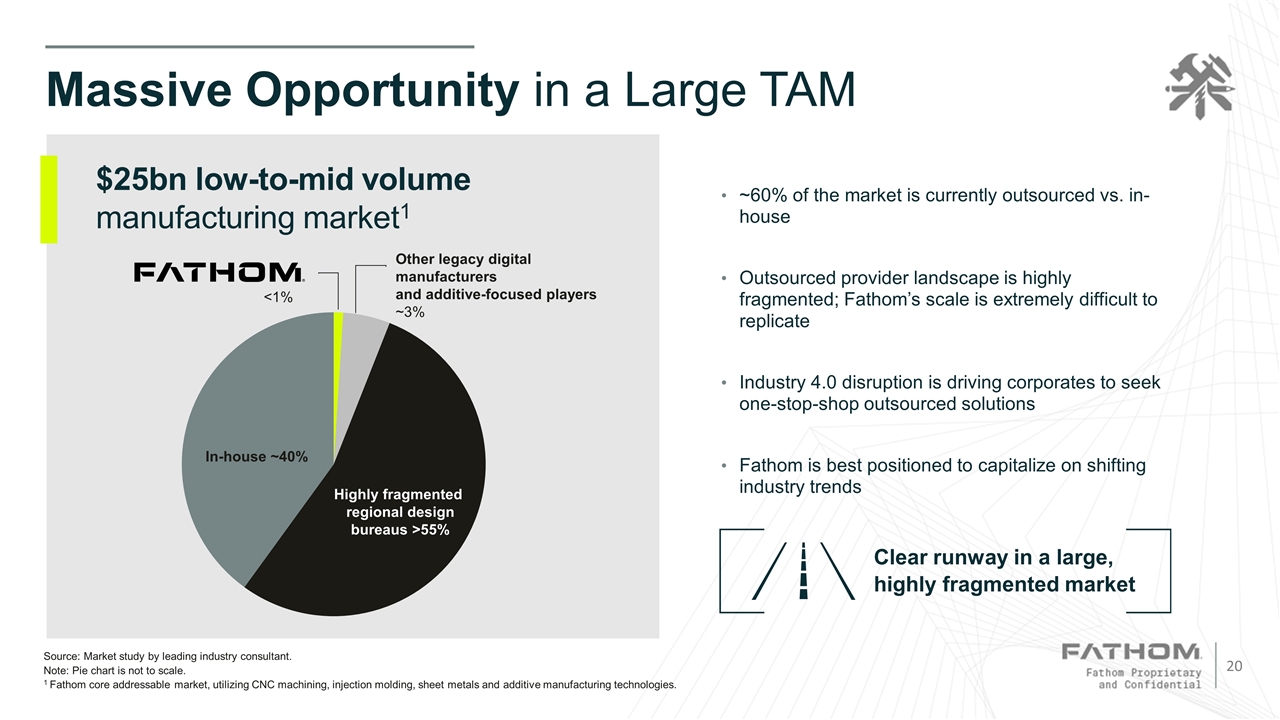

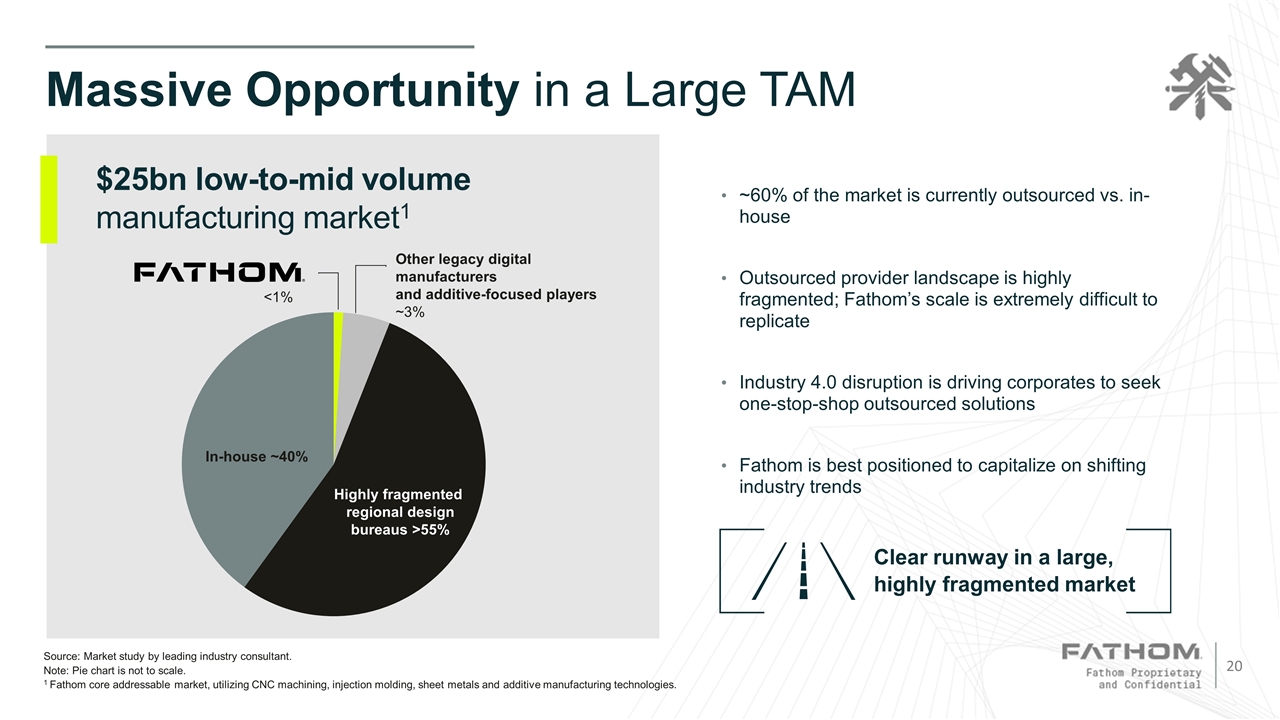

Massive Opportunity in a Large TAM ~60% of the market is currently outsourced vs. in-house Outsourced provider landscape is highly fragmented; Fathom’s scale is extremely difficult to replicate Industry 4.0 disruption is driving corporates to seek one-stop-shop outsourced solutions Fathom is best positioned to capitalize on shifting industry trends Source: Market study by leading industry consultant. Note: Pie chart is not to scale. 1 Fathom core addressable market, utilizing CNC machining, injection molding, sheet metals and additive manufacturing technologies. $25bn low-to-mid volume manufacturing market1 Clear runway in a large, highly fragmented market <1% Other legacy digital manufacturers and additive-focused players ~3% Highly fragmented regional design bureaus >55% In-house ~40%

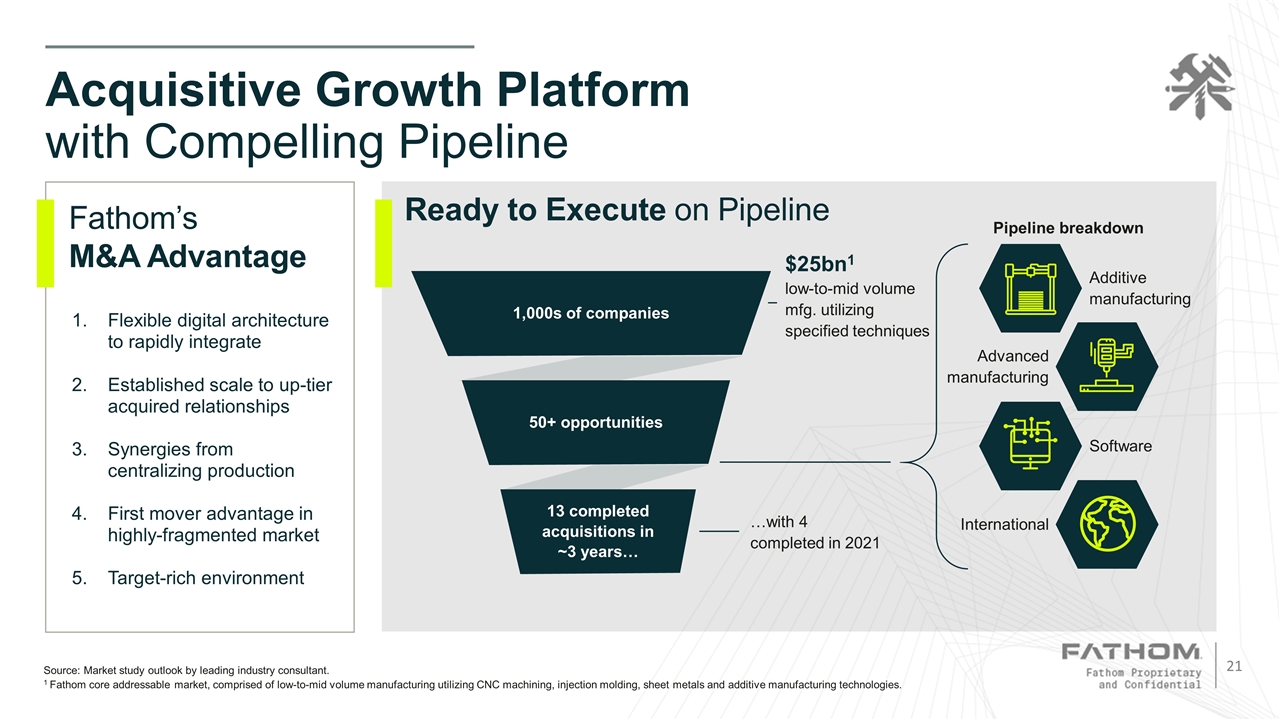

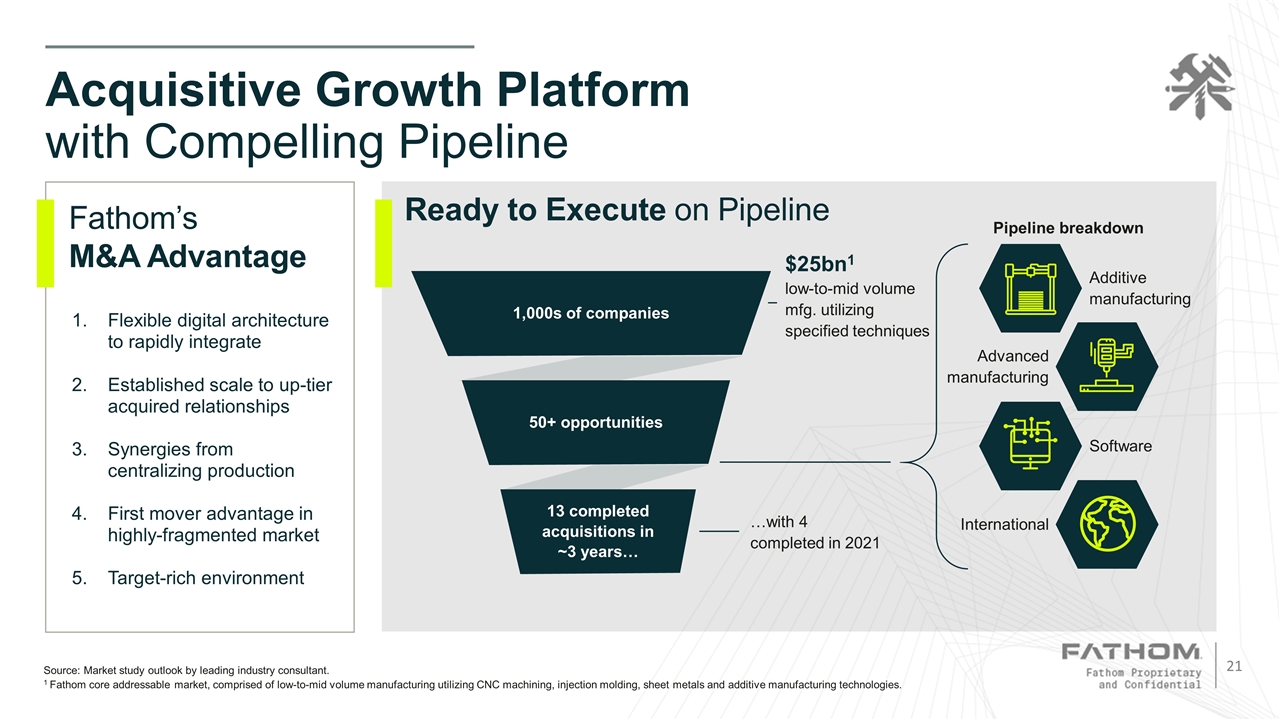

Acquisitive Growth Platform with Compelling Pipeline Flexible digital architecture to rapidly integrate Established scale to up-tier acquired relationships Synergies from centralizing production First mover advantage in highly-fragmented market Target-rich environment Source: Market study outlook by leading industry consultant. 1 Fathom core addressable market, comprised of low-to-mid volume manufacturing utilizing CNC machining, injection molding, sheet metals and additive manufacturing technologies. Fathom’s M&A Advantage Ready to Execute on Pipeline $25bn1 low-to-mid volume mfg. utilizing specified techniques …with 4 completed in 2021 1,000s of companies 50+ opportunities 13 completed acquisitions in ~3 years… Pipeline breakdown Additive manufacturing Advanced manufacturing Software International

Highly Experienced Leadership Team & Board of Directors Leadership Team Bob Nardelli Former Chairman & CEO, Chrysler Corporation and The Home Depot Ryan Martin Chief Executive Officer & Board Member Mark Frost Chief Financial Officer Rich Stump Co-Founder & Chief Commercial Officer Additional Leadership Team has deep manufacturing expertise with nearly 200 years of combined experience Maria Green Board Director, Littelfuse // Board Director, Tennant // Former SVP and GC, Ingersoll Rand and ITW Dr. Caralynn Nowinski Collens CEO, Dimension Inx // Former Chairman, MxD John May Managing Partner, CORE Industrial Partners Carey Chen Former CEO, Incodema Group // Former CEO, Cincinnati, Inc Board of Directors Pete Leemputte Board Director, MasterCraft // Board Director, Beazer Homes // Former CFO of Green Mountain Keurig, Mead Johnson, Brunswick TJ Chung (Chairman), Senior Partner, CORE Industrial Partners // Board Director, Littlefuse // Board Director, Mastercraft // Board Director, Airgain David Fisher Chariman & CEO, Enova // Board Director, Just Eat Takeaway.com // Board Director, Friss // Former CEO, optionsXpress Adam Dewitt CEO and former President & CFO, Grubhub // CFO, optionsXpress // Board Director, Ritchie Bros

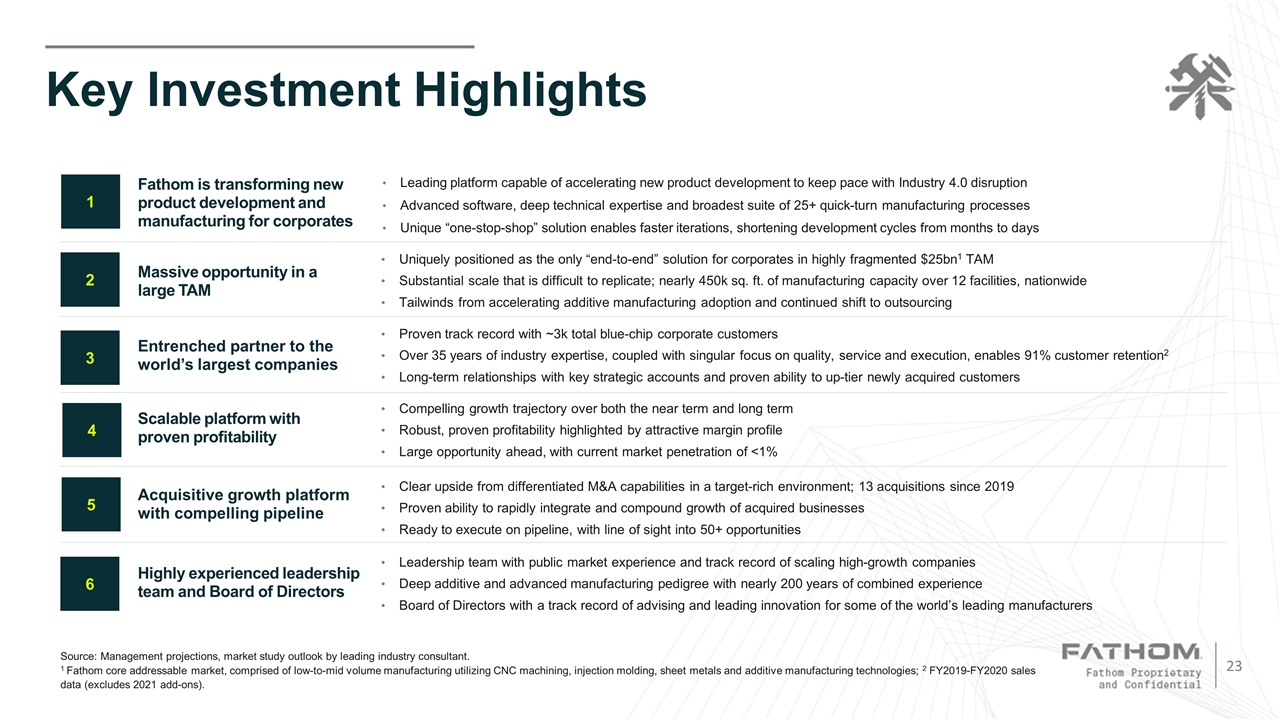

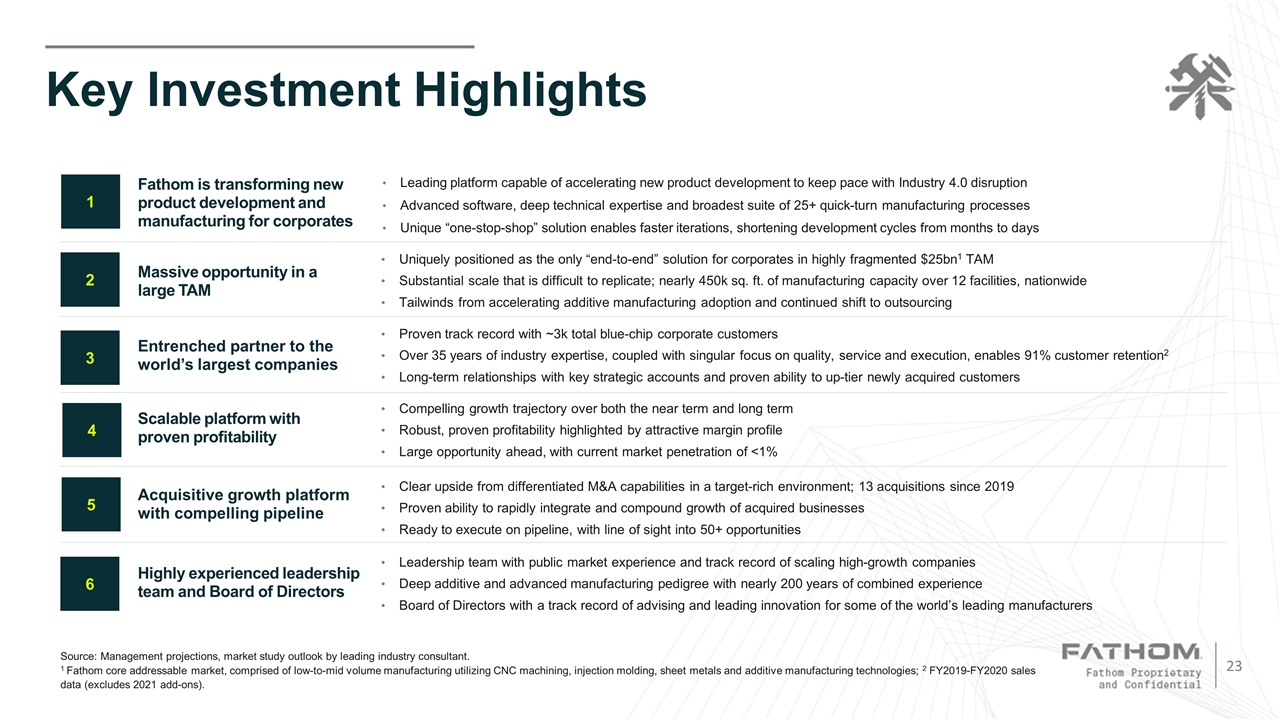

Key Investment Highlights Entrenched partner to the world’s largest companies Scalable platform with proven profitability Highly experienced leadership team and Board of Directors Acquisitive growth platform with compelling pipeline Massive opportunity in a large TAM Uniquely positioned as the only “end-to-end” solution for corporates in highly fragmented $25bn1 TAM Substantial scale that is difficult to replicate; nearly 450k sq. ft. of manufacturing capacity over 12 facilities, nationwide Tailwinds from accelerating additive manufacturing adoption and continued shift to outsourcing Leading platform capable of accelerating new product development to keep pace with Industry 4.0 disruption Advanced software, deep technical expertise and broadest suite of 25+ quick-turn manufacturing processes Unique “one-stop-shop” solution enables faster iterations, shortening development cycles from months to days Proven track record with ~3k total blue-chip corporate customers Over 35 years of industry expertise, coupled with singular focus on quality, service and execution, enables 91% customer retention2 Long-term relationships with key strategic accounts and proven ability to up-tier newly acquired customers Compelling growth trajectory over both the near term and long term Robust, proven profitability highlighted by attractive margin profile Large opportunity ahead, with current market penetration of <1% Leadership team with public market experience and track record of scaling high-growth companies Deep additive and advanced manufacturing pedigree with nearly 200 years of combined experience Board of Directors with a track record of advising and leading innovation for some of the world’s leading manufacturers Clear upside from differentiated M&A capabilities in a target-rich environment; 13 acquisitions since 2019 Proven ability to rapidly integrate and compound growth of acquired businesses Ready to execute on pipeline, with line of sight into 50+ opportunities Source: Management projections, market study outlook by leading industry consultant. 1 Fathom core addressable market, comprised of low-to-mid volume manufacturing utilizing CNC machining, injection molding, sheet metals and additive manufacturing technologies; 2 FY2019-FY2020 sales data (excludes 2021 add-ons). Fathom is transforming new product development and manufacturing for corporates 1 2 3 4 5 6