The information in this preliminary prospectus is not complete and may be changed. These securities may not be issued until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and does not constitute the solicitation of an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JANUARY 26, 2022

PRELIMINARY PROSPECTUS

PROSPECTUS FOR

45,423,250 SHARES OF CLASS A COMMON STOCK

9,900,000 WARRANTS TO PURCHASE SHARES OF CLASS A COMMON STOCK

18,525,000 SHARES OF CLASS A COMMON STOCK UNDERLYING WARRANTS TO

PURCHASE CLASS A COMMON STOCK AND

90,570,234 SHARES OF CLASS A COMMON STOCK UNDERLYING CLASS B COMMON

STOCK OF

FATHOM DIGITAL MANUFACTURING CORPORATION

This prospectus relates to the resale from time to time by the Selling Stockholders named in this prospectus or their permitted transferees (collectively, the “Selling Stockholders”) of: (i) up to 36,661,014 shares of Class A common stock, par value $0.0001 per share (the “Class A common stock”) issued to the Legacy Fathom Owners in connection with the closing of the Business Combination, (ii) up to 4,770,000 shares of Class A common stock held by Altimar Sponsor II, LLC (“Sponsor”) and the other Altimar II Founders following the closing of the Business Combination, (iii) up to 2,724,736 Earnout Shares issued to certain Legacy Fathom Owners, and (iv) up to 1,267,500 Sponsor Earnout Shares. This prospectus also relates to (a) the resale of up to 9,900,000 Private Placement Warrants to purchase shares of Class A common stock held by Sponsor (b) the issuance by us of up to 18,525,000 shares of Class A common stock upon the exercise of outstanding Public Warrants and Private Placement Warrants to purchase shares of Class A common stock, and (c) the issuance by us of up to 90,570,234 shares of Class A common stock issuable upon the exchange of New Fathom Units (together with a corresponding number of shares of Class B common stock) held by certain of the Selling Stockholders (including 6,275,264 Earnout Shares presently represented in the form of unvested New Fathom Units).

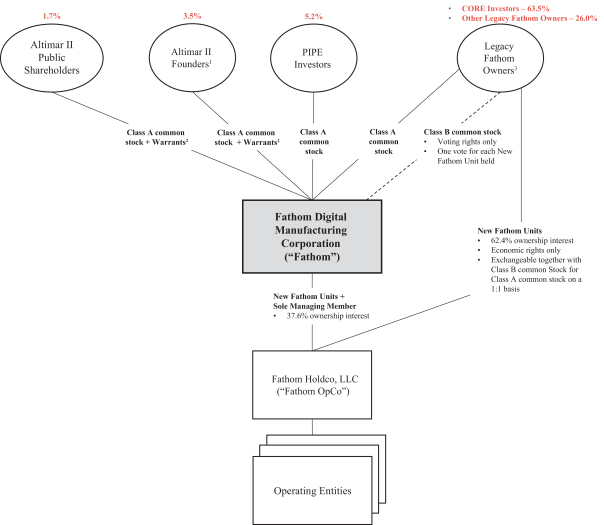

On December 23, 2021 (the “Closing Date”), Altimar Acquisition Corp. II, a blank check company incorporated as a Cayman Islands exempted company (“Altimar II”), domesticated as a Delaware corporation (the “Domestication”) and changed its name to “Fathom Digital Manufacturing Corporation” (“Fathom” or, the “Company”). Immediately following the Domestication, Fathom completed the previously announced business combination (the “Business Combination”) pursuant to the terms of the Business Combination Agreement, dated as of July 15, 2021, as amended by Amendment No. 1 to Business Combination Agreement, dated as of November 16, 2021 (as so amended, the “BCA” or the “Business Combination Agreement”) by and among Altimar II, Fathom Holdco, LLC, a Delaware limited liability company (“Fathom OpCo”), Rapid Merger Sub, LLC, a Delaware limited liability company and a direct, wholly owned subsidiary of Altimar II (“Merger Sub”), and the other parties thereto.

As part of the completion of the transactions contemplated by the Business Combination Agreement (the “Transactions,” and such completion, the “Closing”), Merger Sub merged with and into Fathom OpCo (the “Merger”), with Fathom OpCo being the surviving entity of the Merger. As a result of the Merger and the other Transactions, the combined company was organized in an “Up-C” structure, with Fathom now serving as the managing member of Fathom OpCo. Fathom OpCo is now owned in part by former public and private shareholders of Altimar II and in part by continuing equity owners of Fathom OpCo (the “Legacy Fathom Owners”).

The Selling Stockholders may offer, sell or distribute all or a portion of the shares of Class A common stock and Private Placement Warrants registered hereby publicly or through private transactions at prevailing market prices or at negotiated prices.

We provide more information about how the Selling Stockholders may sell their securities in the section entitled “Plan of Distribution.”

We are registering the resale of securities as required by that certain Registration Rights Agreement, dated as of December 23, 2021, by and among us and certain of our shareholders (the “Registration Rights Agreement”). We are also registering the issuance of the shares of Class A common stock underlying the Public Warrants and the Private Placement Warrants as required by that certain Warrant Agreement, dated as of February 4, 2021, by and between our predecessor entity, Altimar II, and Continental Stock Transfer & Trust Company.

We will receive the proceeds from any exercise of the Warrants for cash, but not from the resale of the shares of common stock or Warrants by the Selling Stockholders.

We will pay certain offering fees and expenses and fees in connection with the registration of the Class A common stock and Warrants and will not receive proceeds from the sale of the shares of Class A common stock or Private Placement Warrants by the Selling Stockholders. The Selling Stockholders will bear all commissions and discounts, if any, attributable to their respective sales of the Class A common stock and Private Placement Warrants.

Our Class A common stock is currently listed on the New York Stock Exchange (the “NYSE”) and trades under the symbol “FATH.” Our Public Warrants are currently listed on the NYSE and trade under the symbol “FATH.WS.” On January 25, 2022, the closing sale price of our common stock was $10.68 per share and the closing price of our Public Warrants was $1.11 per Public Warrant.

We are an “emerging growth company” and a “smaller reporting company” as those terms are defined under applicable federal securities laws, and as such, are subject to certain reduced public company reporting requirements.

INVESTING IN OUR COMMON STOCK OR WARRANTS INVOLVES RISKS THAT ARE DESCRIBED IN THE “RISK FACTORS” SECTION BEGINNING ON PAGE 12 OF THIS PROSPECTUS.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued under this prospectus or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2022.