Filed Pursuant to Rule 424(b)(3)

Registration No. 333-262194

PROSPECTUS SUPPLEMENT NO. 1

(to prospectus dated January 28, 2022)

FATHOM DIGITAL MANUFACTURING CORPORATION

45,423,250 SHARES OF CLASS A COMMON STOCK

9,900,000 WARRANTS TO PURCHASE SHARES OF CLASS A COMMON STOCK

18,525,000 SHARES OF CLASS A COMMON STOCK UNDERLYING WARRANTS TO

PURCHASE CLASS A COMMON STOCK AND

90,570,234 SHARES OF CLASS A COMMON STOCK UNDERLYING CLASS B COMMON STOCK

This prospectus supplement is being filed to update and supplement the information contained in the prospectus dated January 28, 2022 (and as may be further supplemented or amended from time to time, the “Prospectus”), with the information contained in our Current Report on Form 8-K, which we filed with the Securities and Exchange Commission (“SEC”) on March 4, 2022 (the “Current Report”). Accordingly, we have attached the Current Report to this prospectus supplement. Capitalized terms used but not defined in this prospectus supplement have the meanings given to such terms in the Prospectus.

The Prospectus and this prospectus supplement relate to the resale from time to time by the selling stockholders named in the Prospectus or their permitted transferees (collectively, the “Selling Stockholders”) of: (i) up to 36,661,014 shares of Class A common stock, par value $0.0001 per share (the “Class A common stock”) issued to the Legacy Fathom Owners in connection with the closing of the Business Combination, (ii) up to 4,770,000 shares of Class A common stock held by Altimar Sponsor II, LLC (“Sponsor”) and the other Altimar II Founders following the closing of the Business Combination, (iii) up to 2,724,736 Earnout Shares issued to certain Legacy Fathom Owners, and (iv) up to 1,267,500 Sponsor Earnout Shares. The Prospectus and this prospectus supplement also relate to (a) the resale of up to 9,900,000 Private Placement Warrants to purchase shares of Class A common stock held by Sponsor, (b) the issuance of up to 18,525,000 shares of Class A common stock upon the exercise of outstanding Public Warrants and Private Placement Warrants to purchase shares of Class A common stock, and (c) the issuance of up to 90,570,234 shares of Class A common stock issuable upon the exchange of New Fathom Units (together with a corresponding number of shares of Class B common stock) held by certain of the Selling Stockholders (including 6,275,264 Earnout Shares presently represented in the form of unvested New Fathom Units).

This prospectus supplement updates and supplements the information in the Prospectus and is not complete without, and may not be delivered or utilized except in combination with, the Prospectus, including any amendments or supplements thereto. This prospectus supplement should be read in conjunction with the Prospectus and if there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement.

Our Class A common stock is traded on the New York Stock Exchange (the “NYSE”) under the symbol “FATH.” On March 4, 2022, the closing price of our Class A common stock was $8.44 per share. Our Public Warrants are currently listed on the NYSE and trade under the symbol “FATH.WS.” One March 4, 2022, the closing price of our Public Warrants was $0.83 per Public Warrant.

Investing in our securities involves risks that are described in the “Risk Factors” section beginning on page 12 of the Prospectus. Neither the SEC nor any state securities commission has approved or disapproved of the securities to be issued under the Prospectus or determined if the Prospectus or this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is March 4, 2022.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): March 4, 2022

FATHOM DIGITAL MANUFACTURING CORPORATION

(Exact name of registrant as specified in its charter)

| | | | |

| Delaware | | 001-39994 | | 98-1571400 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

1050 Walnut Ridge Drive

Hartland, WI 53029

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (262) 367-8254

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | |

Title of each class | | Trading

Symbol(s) | | Name of each exchange

on which registered |

| Class A common stock, par value $0.0001 per share | | FATH | | NYSE |

| Warrants to purchase one share of Class A common stock, each at an exercise price of $11.50 per share | | FATH.WS | | NYSE |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02. | Results of Operations and Financial Condition. |

On March 4, 2022, Fathom Digital Manufacturing Corporation (“Fathom”) issued a press release announcing its preliminary unaudited financial results for the quarter and full year ended December 31, 2021. The press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K. In accordance with General Instruction B.2 of Form 8-K, the information contained in Item 2.02 of this Current Report and in Exhibit 99.1 is being furnished and shall not be deemed “filed” with the Securities and Exchange Commission (the “SEC”) for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section and will not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as expressly set forth by specific reference in such filing.

Exhibit 99.1 to this Current Report contains certain financial measures that are considered “non-GAAP financial measures” as defined in the SEC rules. Exhibit 99.1 to this Current Report also contains the reconciliation of these non-GAAP financial measures to their most directly comparable financial measures calculated and presented in accordance with generally accepted accounting principles, as well as the reasons why Fathom’s management believes that presentation of the non-GAAP financial measures provides useful information to investors regarding Fathom’s preliminary unaudited results of operations and, to the extent material, a statement disclosing any other additional purposes for which Fathom’s management uses the non-GAAP financial measures.

| Item 7.01. | Regulation FD Disclosure. |

Fathom is posting a preliminary unaudited earnings presentation to its website at https://investors.fathommfg.com. A copy of the presentation is being furnished herewith as Exhibit 99.2. Fathom will use the presentation during its conference call on March 4, 2022 and also may use the presentation from time to time in conversations with analysts, investors and others.

In accordance with General Instruction B.2 of Form 8-K, the information contained in Item 7.01 of this Current Report and in Exhibit 99.2 is being furnished and shall not be deemed “filed” with the Securities and Exchange Commission (the “SEC”) for purposes of Section 18 of the Exchange Act, or otherwise subject to the liability of that section and will not be incorporated by reference into any registration statement or other document filed under the Securities Act, or the Exchange Act, except as expressly set forth by specific reference in such filing.

The information contained in Exhibit 99.2 is summary information that is intended to be considered in the context of Fathom’s filings with the SEC. Fathom undertakes no duty or obligation to publicly update or revise the information contained in this Current Report, although it may do so from time to time as its management believes is warranted. Any such updating may be made through the filing of other reports or documents with the SEC, through press releases or through other public disclosure.

Exhibit 99.2 to this Current Report contains certain financial measures that are considered “non-GAAP financial measures” as defined in the SEC rules. Exhibit 99.2 to this Current Report also contains the reconciliation of these non-GAAP financial measures to their most directly comparable financial measures calculated and presented in accordance with generally accepted accounting principles, as well as the reasons why Fathom’s management believes that presentation of the non-GAAP financial measures provides useful information to investors regarding Fathom’s preliminary unaudited results of operations and, to the extent material, a statement disclosing any other additional purposes for which Fathom’s management uses the non-GAAP financial measures.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

| | |

Exhibit

Number | | Description |

| |

| 99.1 | | Press Release dated March 4, 2022 |

| |

| 99.2 | | Fathom Presentation, March 4, 2022 |

| |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | |

| FATHOM DIGITAL MANUFACTURING CORPORATION |

| |

| By: | | /s/ Mark Frost |

| Name: | | Mark Frost |

| Title: | | Chief Financial Officer |

Date: March 4, 2022

Exhibit 99.1

Fathom Digital Manufacturing Reports Fourth Quarter

and Full Year 2021 Preliminary Unaudited Financial Results

Fourth Quarter 2021 Highlights

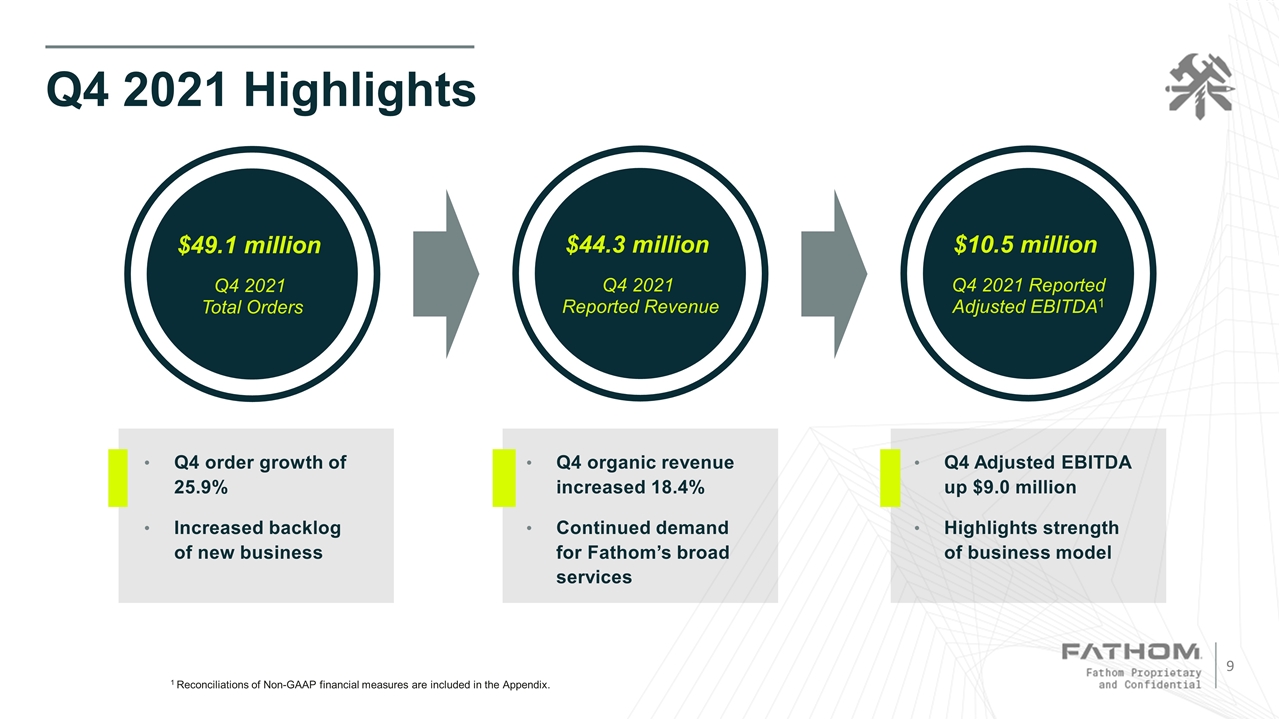

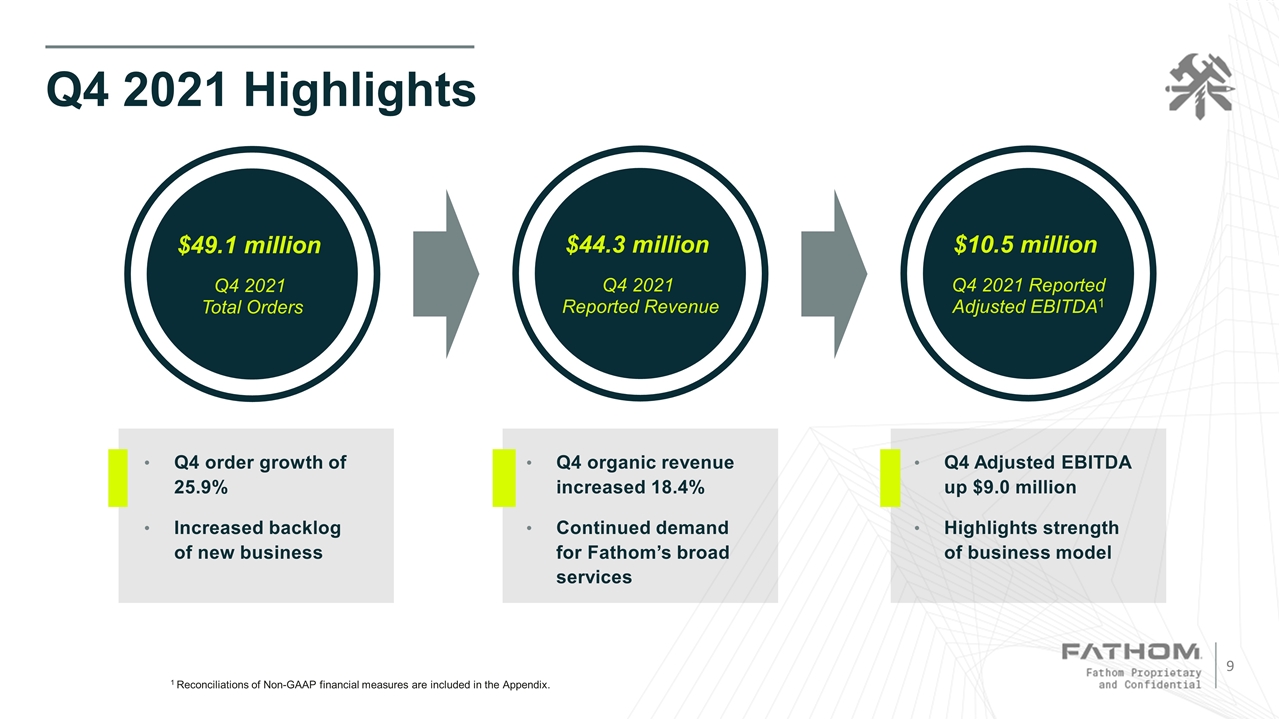

| | • | | Revenue increased 132.8% to $44.3 million; Pro forma revenue1 increased 18.4% |

| | • | | Total orders increased 25.9% to $49.1 million |

| | • | | Net income totaled $21.0 million; adjusted net loss totaled $1.7 million1 |

| | • | | Adjusted EBITDA1 increased to $10.5 million, representing an Adjusted EBITDA margin1 of 23.8% |

| | • | | Commenced trading on the New York Stock Exchange under the ticker “FATH” |

Full Year 2021 Highlights

| | • | | Revenue increased 148.5% to $152.2 million; Pro forma revenue1 increased 8.8% to $162.6 million |

| | • | | Net income totaled $13.0 million; adjusted net loss totaled $5.4 million1 |

| | • | | Adjusted EBITDA1 increased to $34.4 million, representing an Adjusted EBITDA margin1 of 22.6% |

HARTLAND, Wis., March 4, 2022 — Fathom Digital Manufacturing Corp. (NYSE: FATH), an industry leader in on-demand digital manufacturing services, today announced its preliminary unaudited financial results for the fourth quarter and full year ended December 31, 2021.

| | | | | | | | | | | | | | | | |

| | | Three Months Ended | | | Twelve Months Ended | |

| ($ in thousands) | | 12/31/2021 | | | 12/31/2020 | | | 12/31/2021 | | | 12/31/2020 | |

Revenue | | $ | 44,330 | | | $ | 19,040 | | | $ | 152,196 | | | $ | 61,240 | |

Pro forma revenue1 | | $ | 44,330 | | | $ | 37,455 | | | $ | 162,576 | | | $ | 149,400 | |

Net income (loss) | | $ | 20,981 | | | $ | (6,858 | ) | | $ | 13,019 | | | $ | (7,963 | ) |

Adjusted net income (loss) 1 | | $ | (1,682 | ) | | $ | (5,018 | ) | | $ | (5,408 | ) | | $ | (4,198 | ) |

Adjusted EBITDA1 | | $ | 10,534 | | | $ | 1,510 | | | $ | 34,353 | | | $ | 11,194 | |

Adjusted EBITDA margin1 | | | 23.8 | % | | | 7.9 | % | | | 22.6 | % | | | 18.3 | % |

| 1 | See “Non-GAAP Financial Information.” Reconciliations of non-GAAP financial measures are included in the appendix. |

“Fathom’s strong fourth quarter and full year 2021 financial results reflect the increasing demand for our comprehensive on-demand digital manufacturing services,” said Ryan Martin, Fathom Chief Executive Officer. “Our scalable, technology-agnostic platform for prototyping and low- to mid-volume production provides timely, value-added solutions with quality assurances for corporate enterprise customers, uniquely positioning Fathom to accelerate new product development and manufacturing innovation for some of the largest and most innovative companies in the world. During the fourth quarter, our record order volumes of $49.1 million translated into organic revenue growth of 18.4% while expanding our backlog of new business. We also maintained our focus on profitable growth by generating $10.5 million in Adjusted EBITDA, representing 23.8% of revenue for the quarter and demonstrating Fathom’s industry-leading margins.”

Mr. Martin added, “In December, Fathom commenced trading on the New York Stock Exchange, representing a major milestone in the company’s deep-rooted history. We believe our successful public listing enhances our ability to achieve continued market penetration for our additive and advanced traditional manufacturing technologies and take full advantage of the Industry 4.0 digital manufacturing revolution. Our focus remains on further strengthening Fathom’s breadth of leading offerings as we continue to invest in the business. Additionally, we intend to maintain Fathom’s role as an active consolidator in a large and highly fragmented $25 billion industry. By leveraging our proven business model and attractive financial profile, we expect to build upon our solid performance and drive long-term profitable growth in 2022 and beyond for the benefit of our shareholders.”

Summary of Financial Results (preliminary unaudited)

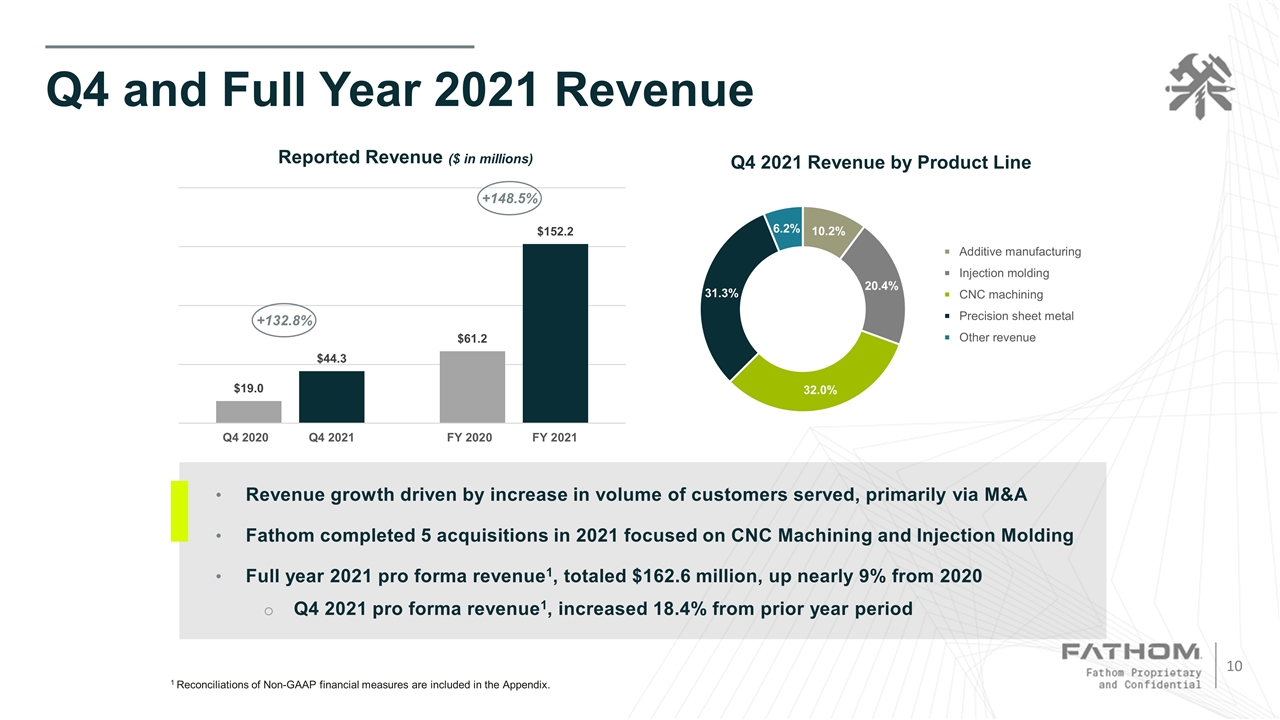

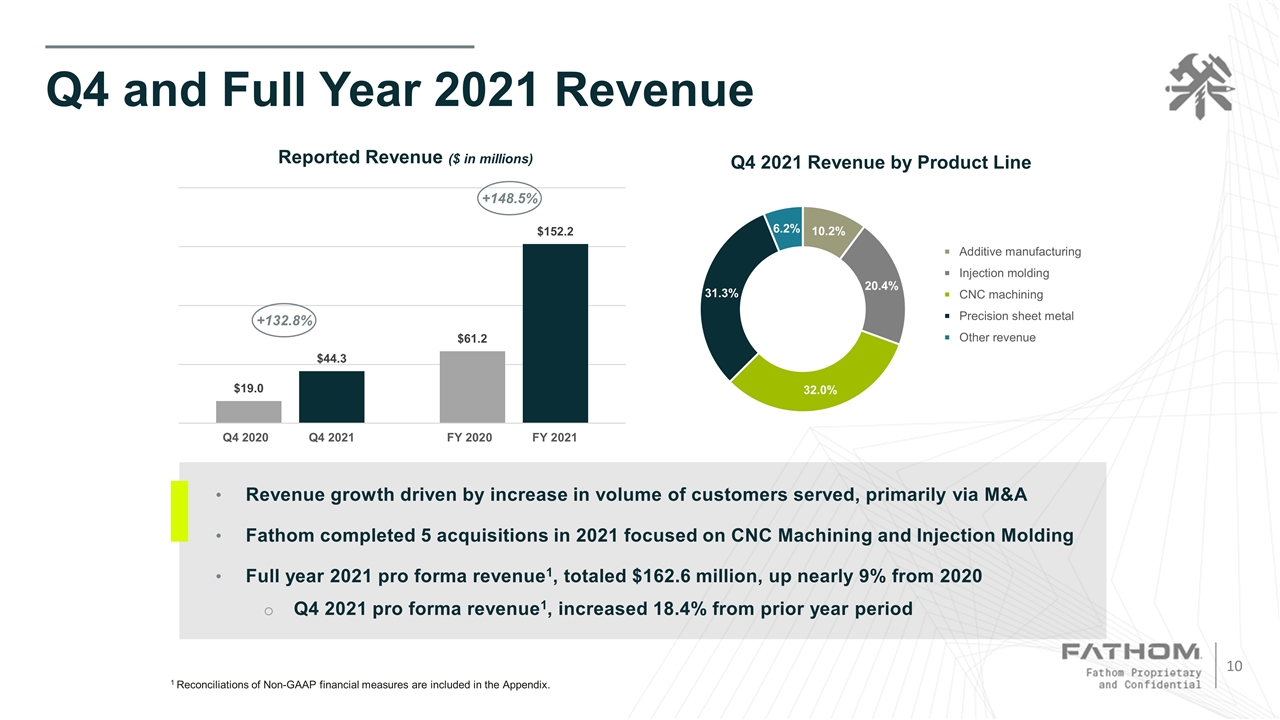

Revenue for the fourth quarter of 2021 was $44.3 million compared to $19.0 million in the fourth quarter of 2020, an increase of 132.8%. The year-over-year growth was driven by an increase in the volume of customers served, primarily through acquisition-related activity and growth within Fathom’s strategic accounts.

On a pro forma basis, which combines the results of Fathom for the applicable period with the pre-acquisition results of businesses acquired in 2021 and 2020 for the respective period, revenue for the fourth quarter of 2021 increased 18.4% to $44.3 million from $37.5 million for the fourth quarter of 2020.

For the year ended December 31, 2021, revenue increased 148.5% to $152.2 million from $61.2 million for the year ended December 31, 2020. Pro forma revenue for the full year 2021 totaled $162.6 million compared to $149.4 million for the full year 2020, representing an increase of 8.8%.

Net income for the fourth quarter of 2021 was $21.0 million compared to a net loss of $6.9 million in the fourth quarter of 2020. For the year ended December 31, 2021, the company reported a net income of $13.0 million compared to a net loss of $8.0 million for the same period in 2020.

On an adjusted basis excluding acquisition costs and purchase accounting adjustments related to the revaluation of Fathom warrants and earnout shares following the completion of its business combination on December 23, 2021, Fathom reported a net loss of $1.7 million compared to a net loss of $5.0 for the same period in 2020. For the year ended December 31, 2021, the adjusted net loss of $5.4 million compared to an adjusted net loss of $4.2 million for the same period in 2020.

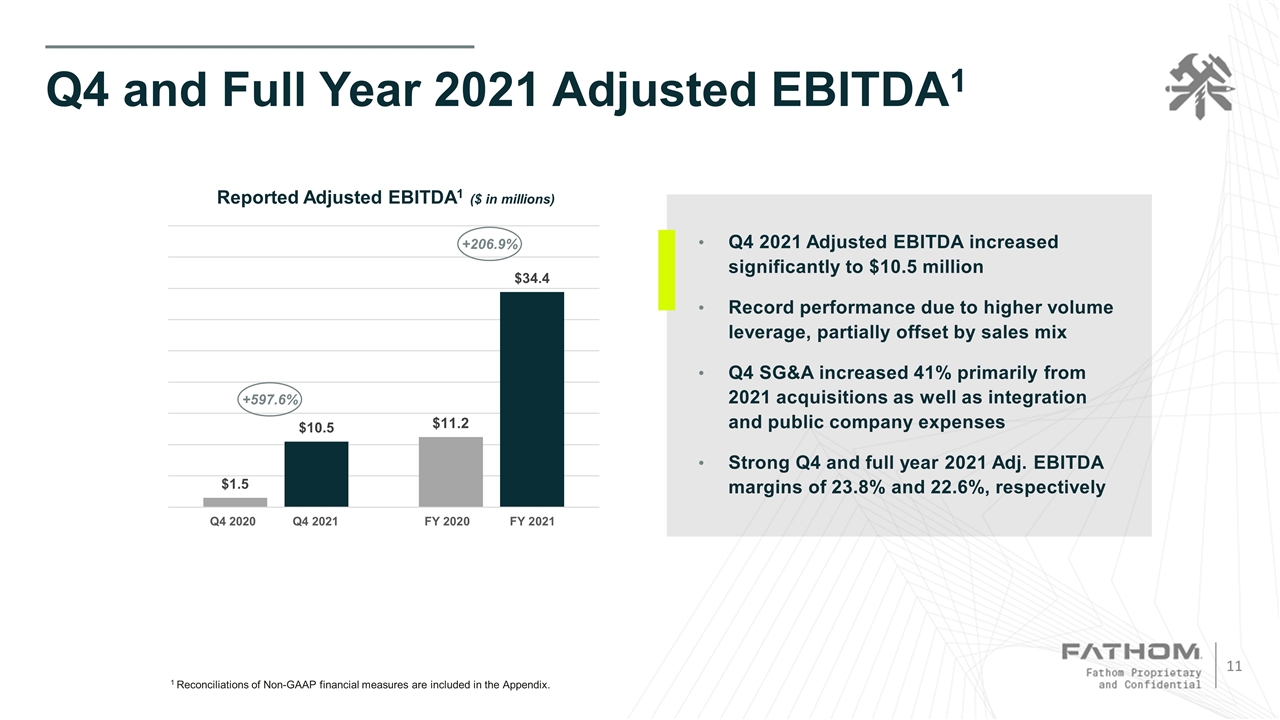

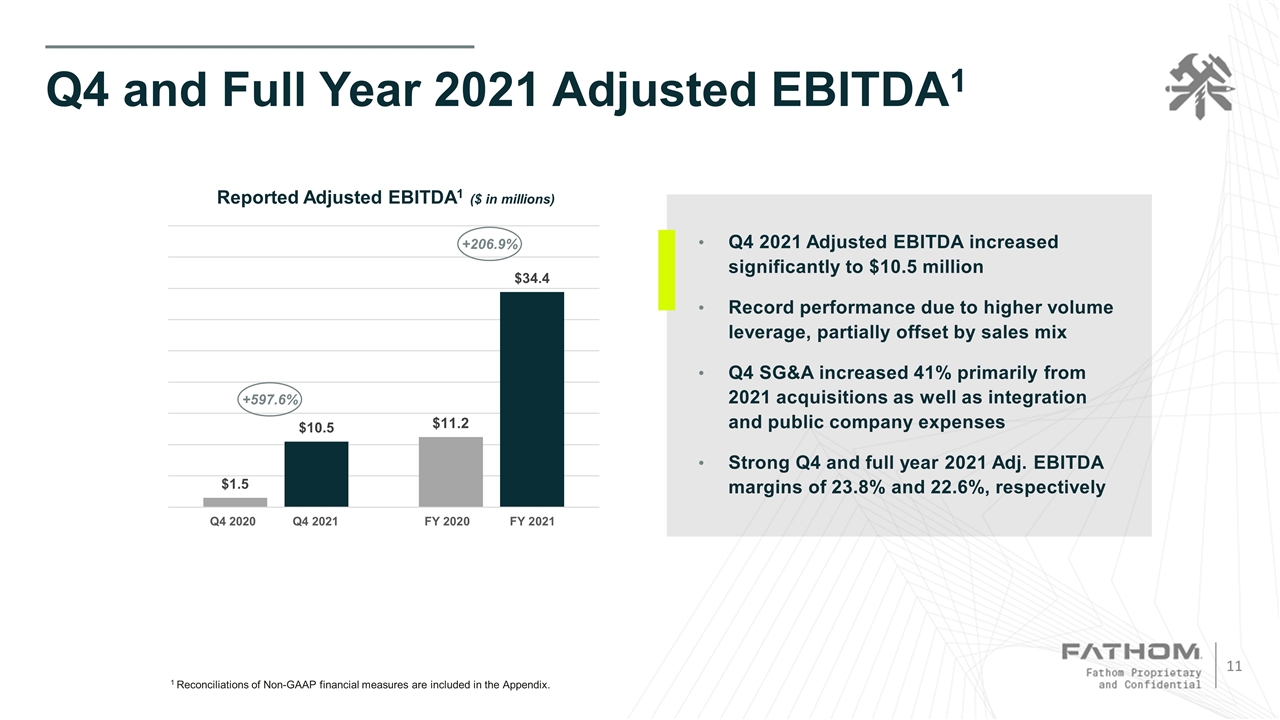

Adjusted EBITDA for the fourth quarter of 2021 increased to $10.5 million from $1.5 million for the same period in 2020 primarily due to higher volumes stemming from acquisition-related activity. The Adjusted EBITDA margin increased to 23.8% in the quarter from 7.9% in the fourth quarter of 2020.

For the year ended December 31, 2021, Adjusted EBITDA and Adjusted EBITDA margin were $34.4 million and 22.6%, respectively, compared to $11.2 million and 18.3%, respectively, for the same period in 2020.

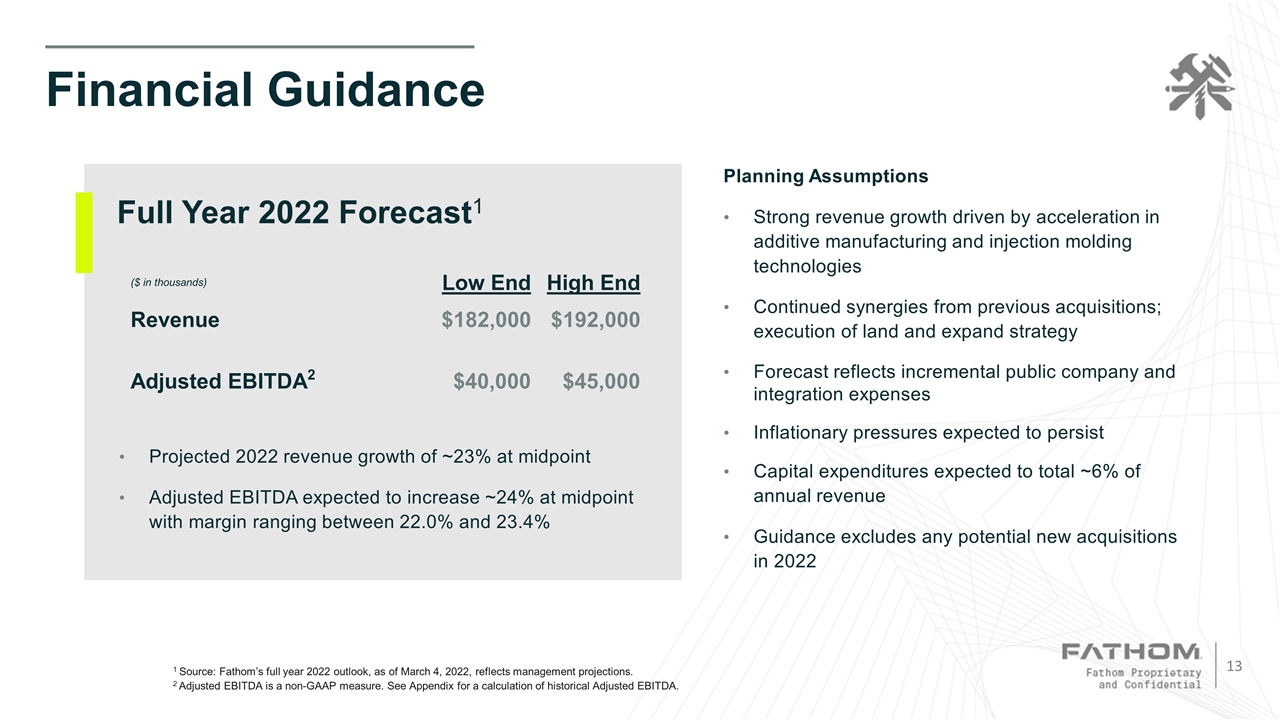

Full Year 2022 Outlook

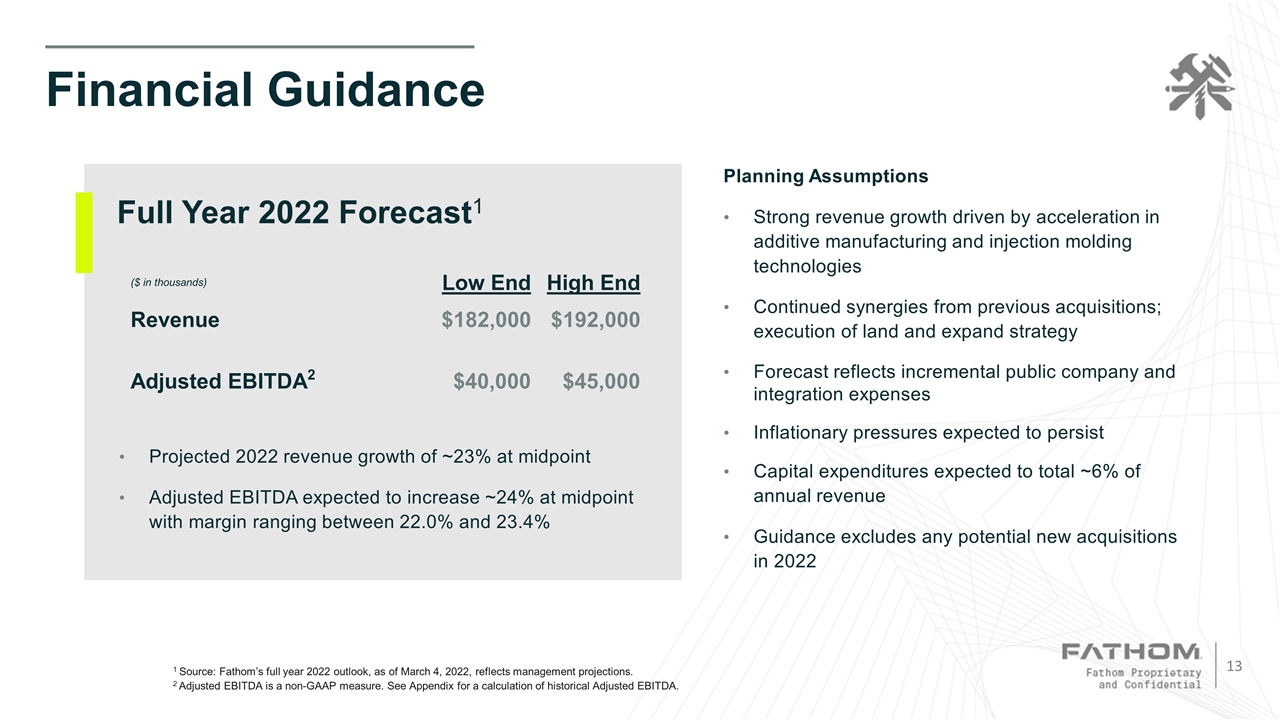

For the full year 2022, Fathom expects reported revenue to range between $182 million and $192 million, representing a year-over-year increase of approximately 23% at the midpoint. The company also expects Adjusted EBITDA to range between $40 million and $45 million, representing a year-over-year increase of approximately 26% at the midpoint and an implied Adjusted EBITDA margin of 22.0% to 23.4%. This outlook, as of March 4, 2022, reflects management’s current projections and excludes the impact of any potential new acquisitions.

Conference Call

Fathom will host a conference call on Friday, March 4, 2022 at 8:30 am Eastern Time. The dial-in number for callers in the U.S. is +1-844-200-6205 and the dial-in number for international callers is +1-929-526-1599. The access code for all callers is 830754. The conference call will be broadcast live over the Internet and include a slide presentation. To access the webcast and supporting materials, please visit the investor relations section of Fathom’s website at https://investors.fathommfg.com.

A replay of the conference call can be accessed through March 11, 2022 by dialing +1-866-813-9403 (US) or +1-226-828-7578 (international), and then entering the access code 983238. The webcast will also be archived on Fathom’s website.

About Fathom Digital Manufacturing

Fathom is one of the largest on-demand digital manufacturing platforms in North America, serving the comprehensive product development and low- to mid-volume manufacturing needs of some of the largest and most innovative companies in the world. With more than 25 unique manufacturing processes and a national footprint with nearly 450,000 square feet of manufacturing capacity across 12 facilities, Fathom

seamlessly blends in-house capabilities across plastic and metal additive technologies, CNC machining, injection molding & tooling, sheet metal fabrication, and design and engineering. With more than 35 years of industry experience, Fathom is at the forefront of the Industry 4.0 digital manufacturing revolution, serving clients in the technology, defense, aerospace, medical, automotive and IOT sectors. Fathom’s certifications include: ITAR Registered, ISO 9001:2015 Design Certified, ISO 9001:2015, ISO 13485:2016, AS9100:2016, and NIST 800-171. To learn more, visit https://fathommfg.com/.

Forward-Looking Statements

Certain statements made in this press release are “forward looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Words such as “estimates,” “projects,” “expects,” “anticipates,” “forecasts,” “plans,” “intends,” “believes,” “seeks,” “may,” “will,” “would,” “should,” “future,” “propose,” “target,” “goal,” “objective,” “outlook” and variations of these words or similar expressions (or the negative versions of such words or expressions) are intended to identify forward-looking statements. These forward-looking statements are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside the control of Fathom Digital Manufacturing Corporation (“Fathom”) that could cause actual results or outcomes to differ materially from those discussed in the forward-looking statements. Important factors, among others, that may affect actual results or outcomes include: the inability to recognize the anticipated benefits of our business combination with Altimar Acquisition Corp. II (“Altimar”); changes in general economic conditions, including as a result of the COVID-19 pandemic; the outcome of litigation related to or arising out of the business combination, or any adverse developments therein or delays or costs resulting therefrom; the ability to meet the New York Stock Exchange’s listing standards following the consummation of the business combination; costs related to the business combination and additional factors discussed in Altimar’s final prospectus/proxy statement filed with the Securities and Exchange Commission (the “SEC”) on December 3, 2021 (the “Proxy Statement/Prospectus”) and the documents of Altimar and Fathom filed, or to be filed, with the SEC. If any of the risks described above materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by our forward-looking statements. There may be additional risks that Fathom does not presently know or that Fathom currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Fathom’s expectations, plans or forecasts of future events and views as of the date of this presentation. Although Fathom may elect to update these forward-looking statements at some point in the future, Fathom specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as representing Fathom’s assessments as of any date subsequent to the date of this press release. Accordingly, undue reliance should not be placed upon the forward-looking statements.

Non-GAAP Financial Information

This press release includes Adjusted Net Income and Adjusted EBITDA, which are non-GAAP financial measures that we use to supplement our results presented in accordance with U.S. GAAP. We believe Adjusted Net Income and Adjusted EBITDA are useful in evaluating our operating performance, as they are similar to measures reported by our public competitors and regularly used by security analysts, institutional investors and other interested parties in analyzing operating performance and prospects. Adjusted Net Income and Adjusted EBITDA are not intended to be a substitute for any U.S. GAAP financial measure and, as calculated, may not be comparable to other similarly titled measures of performance of other companies in other industries or within the same industry.

We define and calculate Adjusted Net Income as net loss before the impact of any increase or decrease in the estimated fair value of the Company’s warrants or earnout shares. We define and calculate Adjusted EBITDA as net losses before the impact of interest income or expense, income tax expense and depreciation and amortization, and further adjusted for the following items: stock-based compensation, transaction-related costs, and certain other non-cash and non-core items, as described in the reconciliation included in the appendix to this press release. Adjusted EBITDA margin represents Adjusted EBITDA divided by total revenue. We include these non-GAAP financial measures because they are used by management to evaluate Fathom’s core operating performance and trends and to make strategic decisions regarding the allocation of capital and new investments. Adjusted EBITDA excludes certain expenses that are required in accordance with U.S. GAAP because they are non-recurring (for example, in the case of transaction-related costs), non-cash (for example, in the case of depreciation and amortization, stock-based compensation) or are not related to our underlying business performance (for example, in the case of interest income and expense).

Information reconciling forward-looking Adjusted EBITDA to GAAP financial measures is unavailable to Fathom without unreasonable effort. The company is not able to provide reconciliations of forward-looking Adjusted EBITDA to GAAP financial measures because certain items required for such reconciliations are outside of Fathom’s control and/or cannot be reasonably predicted, such as the provision for income taxes. Preparation of such reconciliations would require a forward-looking balance sheet, statement of income and statement of cash flow, prepared in accordance with GAAP, and such forward-looking financial statements are unavailable to Fathom without unreasonable effort. Fathom provides a range for its Adjusted EBITDA forecast that it believes will be achieved, however it cannot accurately predict all the components of the Adjusted EBITDA calculation. Fathom provides an Adjusted EBITDA forecast because it believes that Adjusted EBITDA, when viewed with the company’s results under GAAP, provides useful information for the reasons noted above. However, Adjusted EBITDA is not a measure of financial performance or liquidity under GAAP and, accordingly, should not be considered as an alternative to net income or cash flow from operating activities as an indicator of operating performance or liquidity.

As described in the Proxy Statement/Prospectus, during 2020 Fathom completed the acquisitions of Incodema Holdings, Inc., Newchem, Inc., GPI Prototype and Manufacturing Services, LLC, Dahlquist Machine, Inc., Majestic Metals, LLC, and Mark Two Engineering, Inc. (the “2020 Acquisitions”). During 2021 we completed the acquisitions of Summit Tooling, Inc., Summit Plastics, LLC, Centex Machine and Welding, Inc., Laser Manufacturing, Inc. and Screenshot Precisions, LLC d/b/a Micropulse West and Precisions Process Corp. (the “2021 Acquisitions”). Pro forma revenue gives pro forma effect to the 2020 Acquisitions and 2021 Acquisitions, as though such transactions occurred on January 1, 2020.

Financial Disclosure Disclaimer

Fathom has not yet completed its reporting process for the three and twelve months ended December 31, 2021. Full financial statements for these periods will be filed on or before March 31, 2022. The preliminary unaudited results presented herein are based on Fathom’s reasonable estimates and the information available at this time. The amounts reported herein are subject to various adjustments that are still under review, including potential adjustments relating to changes in the estimated fair value of warrants and earnout shares, purchase accounting and provision for income taxes. Such adjustments may be material and could impact the results reported herein.

Contact:

Michael Cimini

Director, Investor Relations

Fathom Digital Manufacturing

(262) 563-5575

michael.cimini@fathommfg.com

Q4 2021 U.S GAAP Income Statement (preliminary unaudited)

($ in thousands)

| | | | | | | | |

| | | Three Months Ended December 31, | |

| | | 2021 | | | 2020 | |

Net Sales | | | 44,330 | | | | 19,040 | |

Cost of Revenue1 | | | 26,290 | | | | 10,178 | |

| | | | | | | | |

Gross Profit | | | 18,040 | | | | 8,862 | |

Operating expenses | | | | | | | | |

Selling, general, and administrative (SG&A)1 | | | 12,276 | | | | 8,713 | |

Depreciation and amortization | | | 3,309 | | | | 2,028 | |

| | | | | | | | |

Total operating expenses | | | 15,585 | | | | 10,741 | |

| | | | | | | | |

Operating income (loss) | | | 2,455 | | | | (1,879 | ) |

| | | | | | | | |

Interest expense | | | 3,536 | | | | 1,330 | |

Other expense (income) | | | 9,387 | | | | 3,811 | |

Other income | | | (30,985 | ) | | | (162 | ) |

| | | | | | | | |

Total other expense, net | | | (18,062 | ) | | | 4,979 | |

| | | | | | | | |

Net income (loss) before income tax | | | 20,517 | | | | (6,858 | ) |

Provision for income tax (benefit) | | | (464 | ) | | | | |

| | | | | | | | |

Net income (loss) | | | 20,981 | | | | (6,858 | ) |

| | | | | | | | |

Net income (loss) attributable to noncontrolling interest | | | 13,092 | | | | — | |

| | | | | | | | |

Net income (loss) attributable to Fathom Digital Manufacturing Corporation | | | 7,889 | | | | (6,858 | ) |

| | | | | | | | |

| 1 | Fathom reclassified certain historically reported expenses within the statement of operations to reflect go-forward policy. Specifically, cost of revenue included a reclassification of certain expenses equal to 4.4% and 0.5% of revenue for the three months ended December 31, 2021, and December 31, 2020, respectively. Additionally, SG&A included a reclassification of certain expenses equal to 1.8% and 3.4% of revenue for the three months ended December 31, 2021, and December 31, 2020, respectively. Prior to the Company’s ownership of applicable acquired entities, these expenses were recorded inconsistently. The accounting reclassification had no impact on net income (loss). |

Full Year 2021 US GAAP Income Statement (preliminary unaudited)

($ in thousands)

| | | | | | | | |

| | | Year Ended December 31, | |

| | | 2021 | | | 2020 | |

Net Sales | | | 152,196 | | | | 61,240 | |

Cost of Revenue1 | | | 92,388 | | | | 33,064 | |

| | | | | | | | |

Gross Profit | | | 59,808 | | | | 28,176 | |

Operating expenses | | | | | | | | |

Selling, general, and administrative (SG&A)1 | | | 39,490 | | | | 24,642 | |

Depreciation and amortization | | | 10,606 | | | | 4,672 | |

| | | | | | | | |

Total operating expenses | | | 50,096 | | | | 29,314 | |

| | | | | | | | |

Operating income (loss) | | | 9,712 | | | | (1,138 | ) |

| | | | | | | | |

Interest expense | | | 12,318 | | | | 3,635 | |

Other expense | | | 14,846 | | | | 2,208 | |

Other expense (income) | | | (30,872 | ) | | | 959 | |

| | | | | | | | |

Total other expense, net | | | (3,707 | ) | | | 6,802 | |

| | | | | | | | |

Net income (loss) before income tax | | | 13,419 | | | | (7,940 | ) |

Provision for income tax | | | 400 | | | | 23 | |

| | | | | | | | |

Net income (loss) | | | 13,019 | | | | (7,963 | ) |

| | | | | | | | |

Net income (loss) attributable to noncontrolling interest | | | 8,124 | | | | — | |

| | | | | | | | |

Net income (loss) attributable to Fathom Digital Manufacturing Corporation | | | 4,895 | | | | (7,963 | ) |

| | | | | | | | |

| 1 | Fathom reclassified certain historically reported expenses within the statement of operations to reflect go-forward policy. Specifically, cost of revenue included a reclassification of certain expenses equal to 6.2% and 0.5% of revenue for the twelve months ended December 31, 2021, and December 31, 2020, respectively. Additionally, SG&A included a reclassification of certain expenses equal to 3.4% net of revenue for both the twelve months ended December 31, 2021, and December 31, 2020. Prior to the Company’s ownership of applicable acquired entities, these expenses were recorded inconsistently. The accounting reclassification had no impact on net income (loss). |

Consolidated Balance Sheet (preliminary unaudited)

($ in thousands)

| | | | | | | | |

| | | December 31,

2021 | | | December 31,

2020 | |

Assets | | | | | | | | |

Cash and cash equivalents | | $ | 20,099 | | | $ | 8,188 | |

Account receivables, net | | | 25,367 | | | | 15,563 | |

Inventory | | | 10,539 | | | | 6,325 | |

Prepaid expenses and other current assets | | | 1,980 | | | | 2,598 | |

| | | | | | | | |

Total current assets | | | 57,985 | | | | 32,674 | |

Investments held in trust account | | | — | | | | — | |

Property and equipment, net | | | 42,377 | | | | 26,386 | |

Intangible & other | | | 249,575 | | | | 83,466 | |

Goodwill | | | 1,242,482 | | | | 63,215 | |

Other non-current assets | | | 9,813 | | | | 1,038 | |

| | | | | | | | |

Total assets | | $ | 1,602,232 | | | $ | 206,779 | |

| | | | | | | | |

Liabilities and Stockholders’ Equity | | | | | | | | |

Accounts payable | | $ | 9,409 | | | $ | 4,404 | |

Accrued expenses | | | 4,391 | | | | 4,181 | |

Other current liabilities | | | 4,698 | | | | 2,778 | |

Contingent consideration | | | 2,750 | | | | 4,066 | |

Current portion of debt | | | 30,096 | | | | 2,853 | |

| | | | | | | | |

Total current liabilities | | | 51,345 | | | | 18,282 | |

Long-term debt, net | | | 120,913 | | | | 90,486 | |

Long-term contingent consideration | | | 65,150 | | | | 7,373 | |

Deferred tax liability | | | — | | | | — | |

Founders share liability | | | 9,400 | | | | — | |

Other non-current liabilities | | | 1,788 | | | | 514 | |

Warrant liability | | | 16,608 | | | | — | |

Payable to related parties pursuant to tax receivable agreement | | | 4,600 | | | | — | |

| | | | | | | | |

Total liabilities | | $ | 269,804 | | | $ | 116,655 | |

| | | | | | | | |

Contingently Redeemable Preferred Equity | | | | | | | | |

Class A Contingently Redeemable Preferred Units; $100 par value, authorized 1,167,418 units, issued and outstanding and 1,167,418 units as of December 31, 2021 and 2020, respectively | | $ | — | | | $ | 54,105 | |

| | | | | | | | |

Equity: | | | | | | | | |

Class A common stock | | | 5 | | | | 35,869 | |

Class B common stock | | | 8 | | | | 14,450 | |

Additional paid-in capital | | | 491,050 | | | | — | |

Accumulated other comprehensive loss | | | — | | | | (68 | ) |

Accumulated deficit | | | (1,585 | ) | | | (14,232 | ) |

Non-controlling interest in subsidiaries | | | 842,950 | | | | — | |

| | | | | | | | |

Total stockholders’ equity | | | 1,332,428 | | | | 36,019 | |

| | | | | | | | |

Total liabilities and stockholders’ equity | | $ | 1,602,232 | | | $ | 206,779 | |

| | | | | | | | |

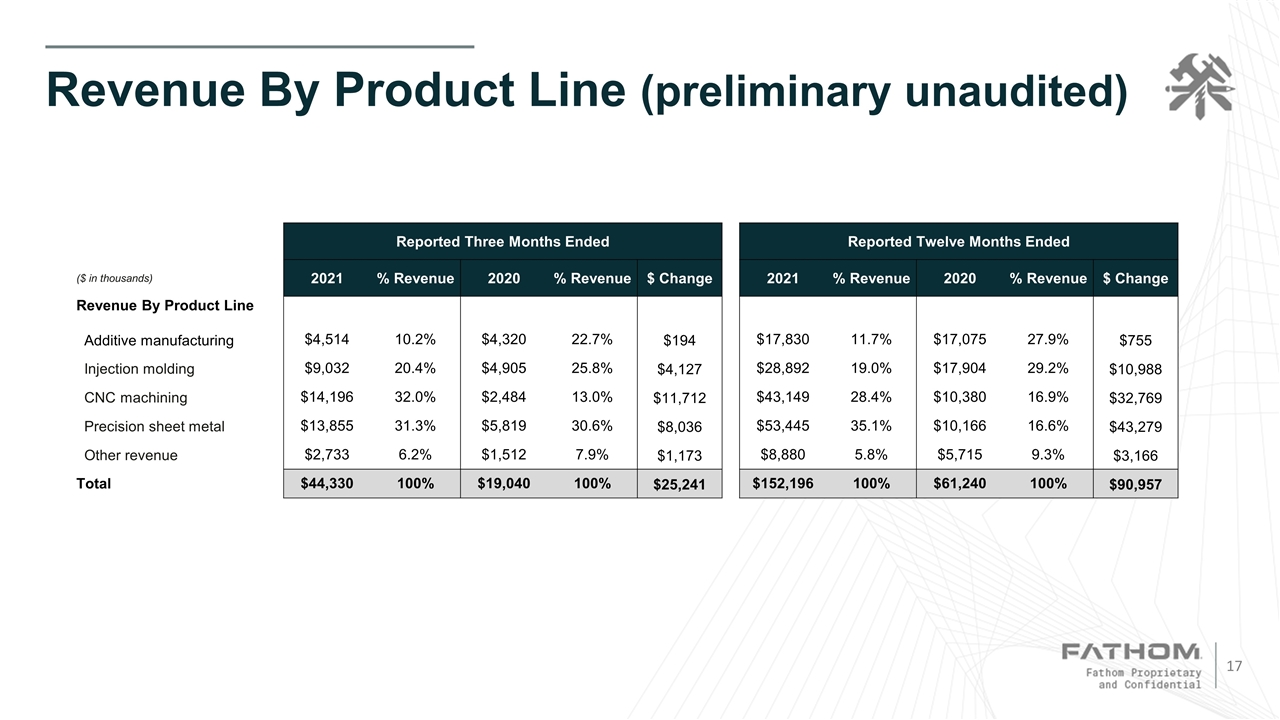

Q4 2021 Revenue by Product Line (preliminary unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | | Reported Revenue for Three Months Ended | |

| ($ in thousands) | | 12/31/2021 | | | Percentage | | | 12/31/2020 | | | Percentage | | | $ Change | |

Additive manufacturing | | $ | 4,514 | | | | 10.2 | % | | $ | 4,320 | | | | 22.7 | % | | $ | 194 | |

Injection molding | | $ | 9,032 | | | | 20.4 | % | | $ | 4,905 | | | | 25.8 | % | | $ | 4,127 | |

CNC machining | | $ | 14,196 | | | | 32.0 | % | | $ | 2,484 | | | | 13.0 | % | | $ | 11,712 | |

Precision sheet metal | | $ | 13,855 | | | | 31.3 | % | | $ | 5,819 | | | | 30.6 | % | | $ | 8,036 | |

Other revenue | | $ | 2,733 | | | | 6.2 | % | | $ | 1,512 | | | | 7.9 | % | | $ | 1,173 | |

| | | | | | | | | | | | | | | | | | | | |

Total | | $ | 44,330 | | | | 100.0 | % | | $ | 19,040 | | | | 100.0 | % | | $ | 25,241 | |

| | | | | | | | | | | | | | | | | | | | |

Full Year 2021 Revenue by Product Line (preliminary unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | | Reported Revenue for Twelve Months Ended | |

| ($ in thousands) | | 12/31/2021 | | | Percentage | | | 12/31/2020 | | | Percentage | | | $ Change | |

Additive manufacturing | | $ | 17,830 | | | | 11.7 | % | | $ | 17,075 | | | | 27.9 | % | | $ | 755 | |

Injection molding | | $ | 28,892 | | | | 19.0 | % | | $ | 17,904 | | | | 29.2 | % | | $ | 10,988 | |

CNC machining | | $ | 43,149 | | | | 28.4 | % | | $ | 10,380 | | | | 16.9 | % | | $ | 32,769 | |

Precision sheet metal | | $ | 53,445 | | | | 35.1 | % | | $ | 10,166 | | | | 16.6 | % | | $ | 43,279 | |

Other revenue | | $ | 8,880 | | | | 5.8 | % | | $ | 5,715 | | | | 9.3 | % | | $ | 3,166 | |

| | | | | | | | | | | | | | | | | | | | |

Total | | $ | 152,196 | | | | 100.0 | % | | $ | 61,240 | | | | 100.0 | % | | $ | 90,957 | |

| | | | | | | | | | | | | | | | | | | | |

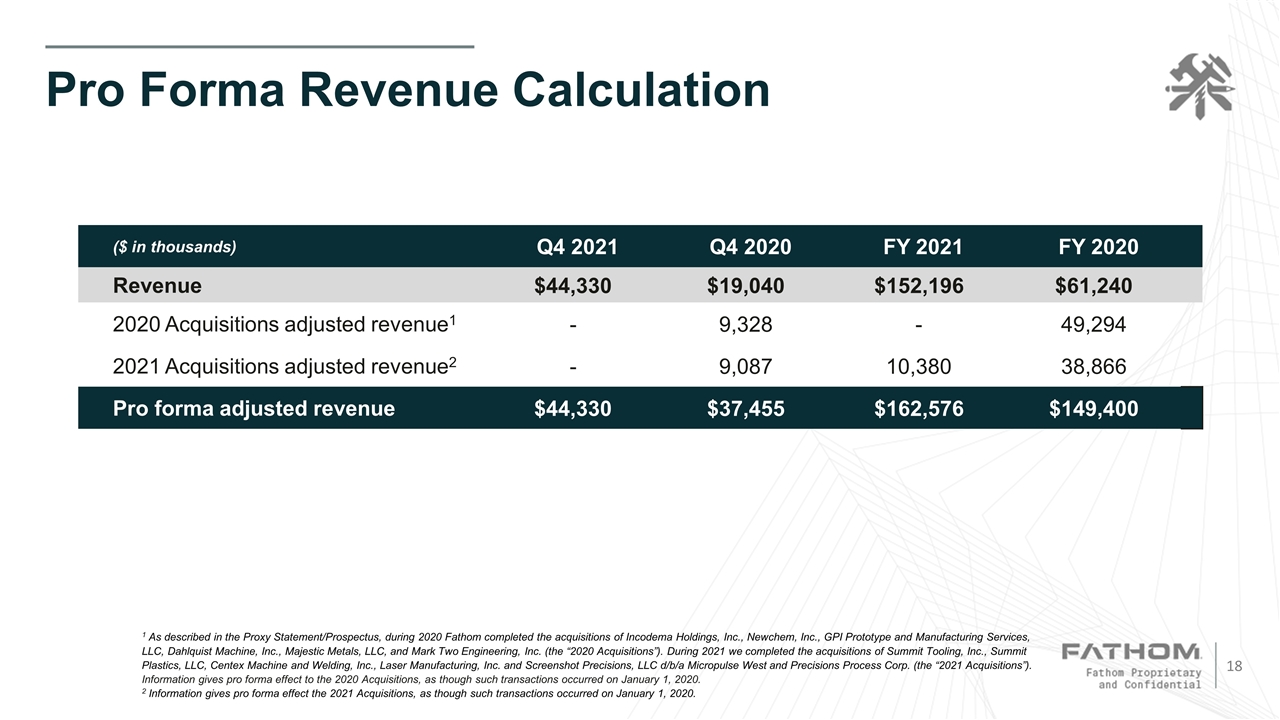

Pro Forma Revenue Calculation (preliminary unaudited)

| | | | | | | | | | | | | | | | |

($ in thousands) | | Q4 2021 | | | Q4 2020 | | | Full Year 2021 | | | Full Year 2020 | |

GAAP reported revenue | | $ | 44,330 | | | $ | 19,040 | | | $ | 152,196 | | | $ | 61,240 | |

| | | | | | | | | | | | | | | | |

2020 Acquisitions adjusted revenue1 | | | — | | | | 9,328 | | | | — | | | | 49,294 | |

2021 Acquisitions adjusted revenue2 | | | — | | | | 9,087 | | | | 10,380 | | | | 38,866 | |

| | | | | | | | | | | | | | | | |

Pro forma revenue | | $ | 44,330 | | | $ | 37,455 | | | $ | 162,576 | | | $ | 149,400 | |

| | | | | | | | | | | | | | | | |

| 1 | As described in the Proxy Statement/Prospectus, during 2020 Fathom completed the acquisitions of Incodema Holdings, Inc., Newchem, Inc., GPI Prototype and Manufacturing Services, LLC, Dahlquist Machine, Inc., Majestic Metals, LLC, and Mark Two Engineering, Inc. (the “2020 Acquisitions”). During 2021, we completed the acquisitions of Summit Tooling, Inc., Summit Plastics, LLC, Centex Machine and Welding, Inc., Laser Manufacturing, Inc. and Screenshot Precisions, LLC d/b/a Micropulse West and Precisions Process Corp. (the “2021 Acquisitions”). Information gives pro forma effect to the 2020 Acquisitions, as though such transactions occurred on January 1, 2020. |

| 2 | Information gives pro forma effect the 2021 Acquisitions, as though such transactions occurred on January 1, 2020. |

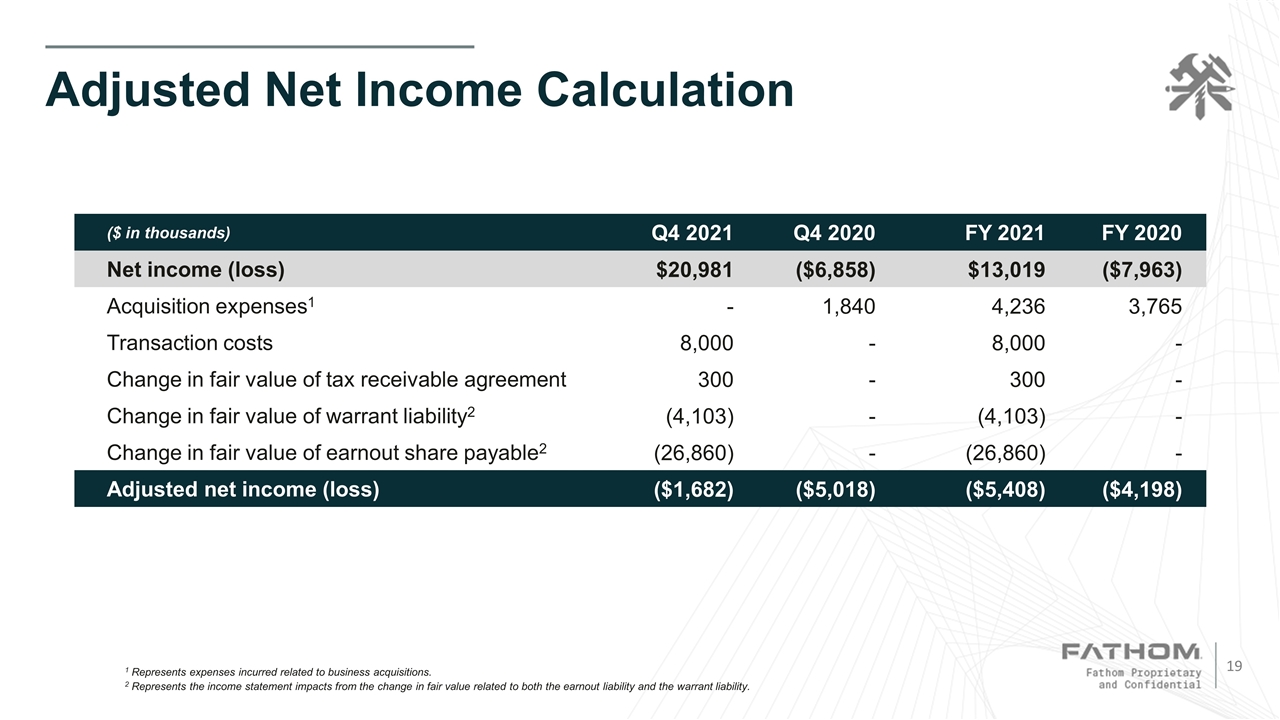

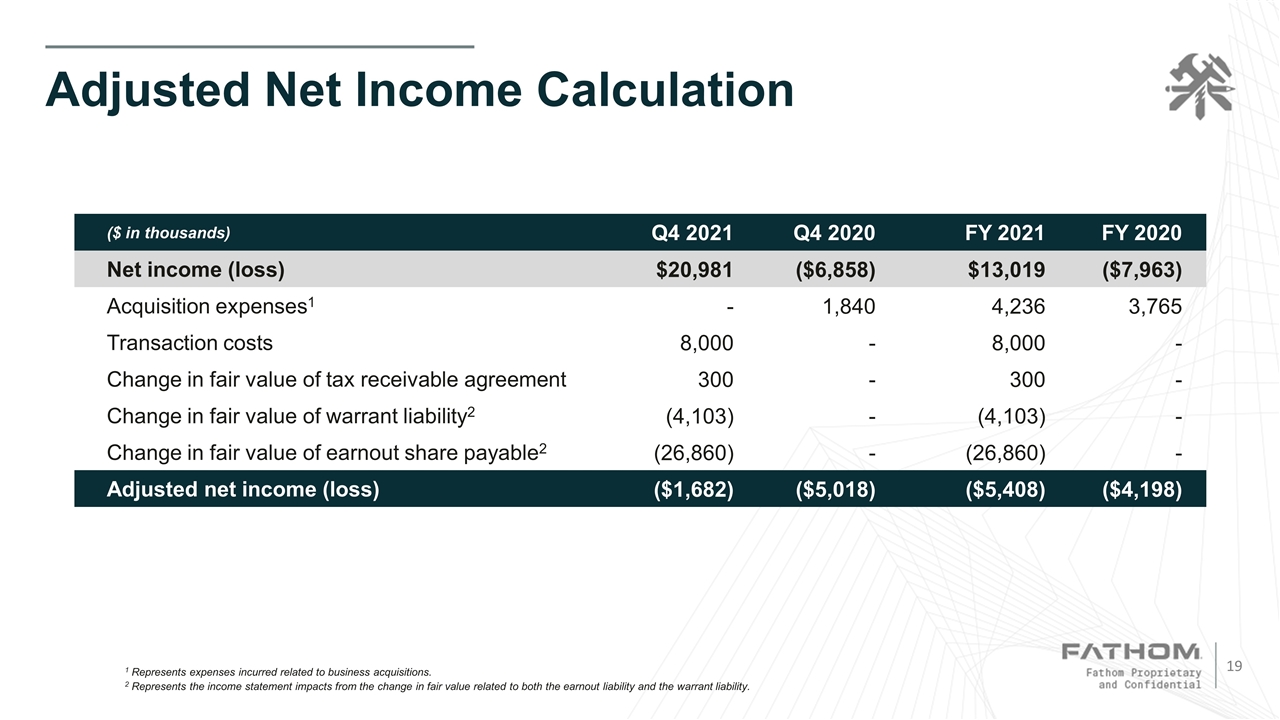

Reconciliation of GAAP Net Income to Adjusted Net Loss (preliminary unaudited)

| | | | | | | | | | | | | | | | |

($ in thousands) | | Q4 2021 | | | Q4 2020 | | | FY 2021 | | | FY 2020 | |

Net income (loss) | | $ | 20,981 | | | ($ | 6,858 | ) | | $ | 13,019 | | | $ | (7,963 | ) |

| | | | | | | | | | | | | | | | |

Acquisition expenses1 | | | — | | | | 1,840 | | | | 4,236 | | | | 3,765 | |

Transaction costs | | | 8,000 | | | | — | | | | 8,000 | | | | — | |

Change in fair value of tax receivable agreement (TRA) | | | 300 | | | | — | | | | 300 | | | | — | |

Change in fair value of warrant liability2 | | | (4,103 | ) | | | — | | | | (4,103 | ) | | | — | |

Change in fair value of earnout share payable2 | | | (26,860 | ) | | | — | | | | (26,860 | ) | | | — | |

| | | | | | | | | | | | | | | | |

Adjusted net income (loss) | | ($ | 1,682 | ) | | ($ | 5,018 | ) | | ($ | 5,408 | ) | | ($ | 4,198 | ) |

| | | | | | | | | | | | | | | | |

| 1 | Represents expenses incurred related to business acquisitions; 2 Represents the income statement impacts from the change in fair value related to both the earnout liability and the warrant liability associated with the business combination completed on December 23, 2021. |

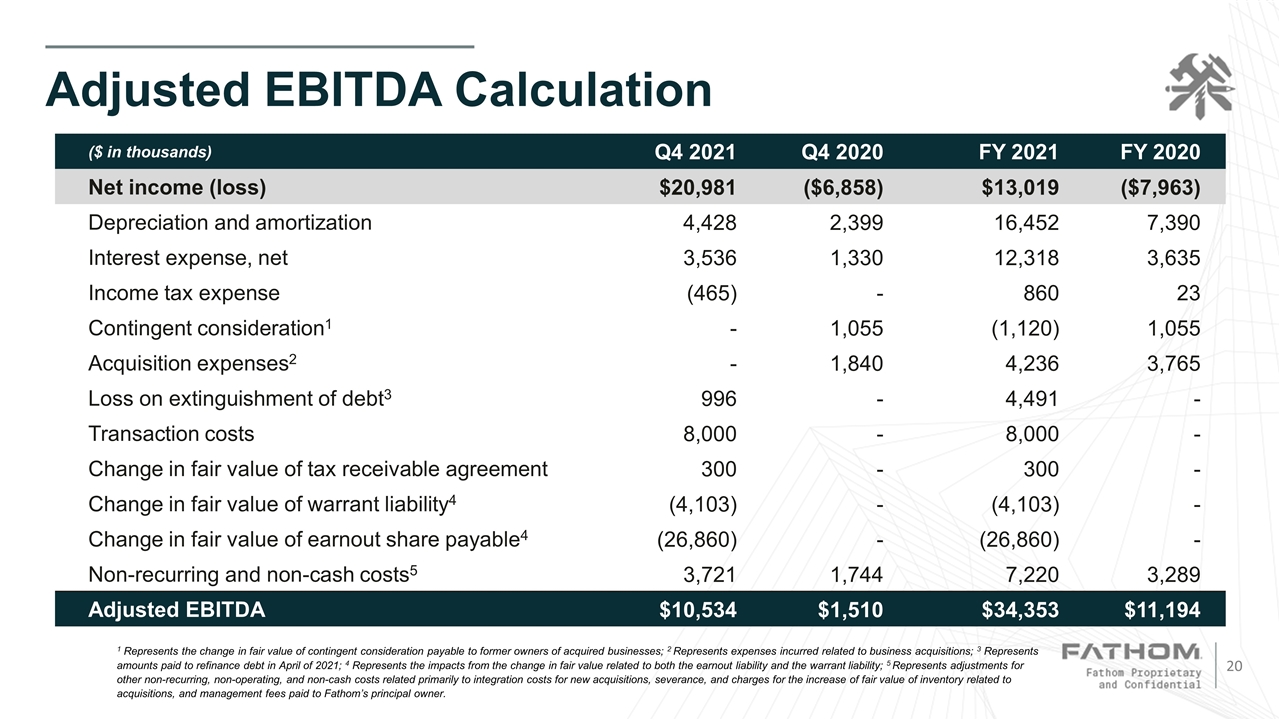

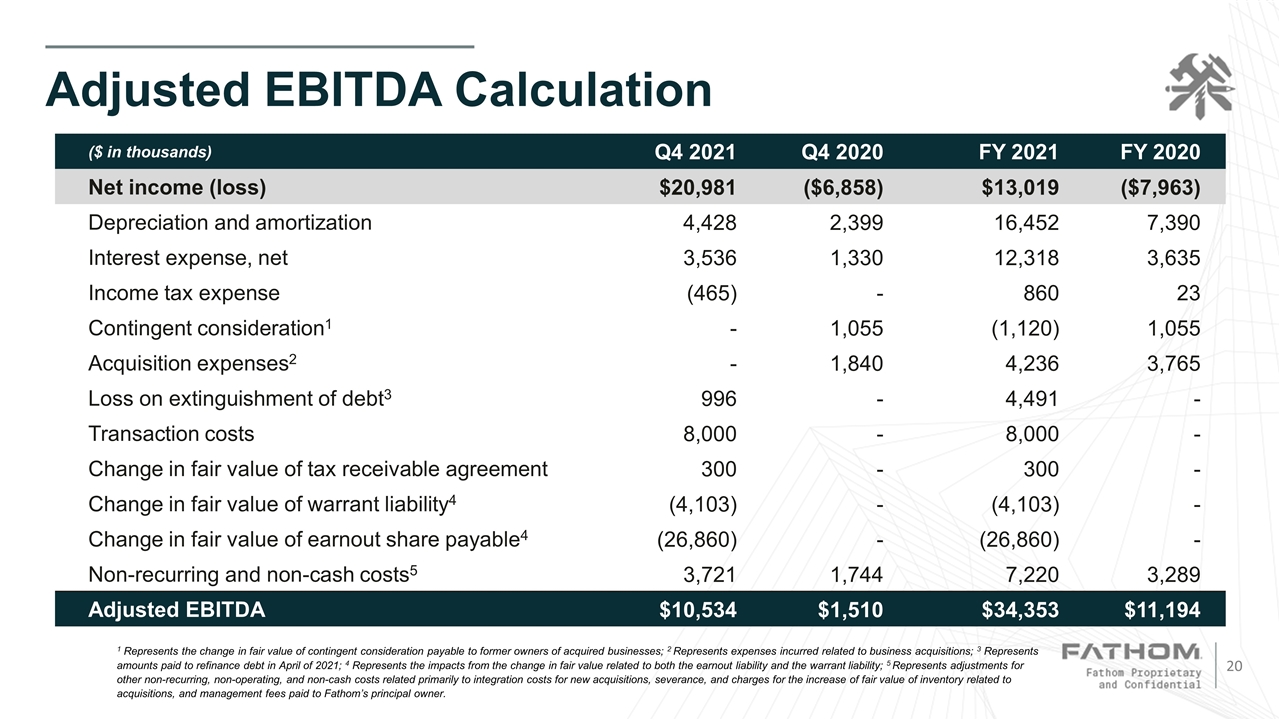

Reconciliation of GAAP Net Income to Adjusted EBITDA (preliminary unaudited)

| | | | | | | | | | | | | | | | |

($ in thousands) | | Q4 2021 | | | Q4 2020 | | | FY 2021 | | | FY 2020 | |

Net income (loss) | | $ | 20,981 | | | ($ | 6,858 | ) | | $ | 13,019 | | | $ | (7,963 | ) |

| | | | | | | | | | | | | | | | |

Depreciation and amortization | | | 4,428 | | | | 2,399 | | | | 16,452 | | | | 7,390 | |

Interest expense, net | | | 3,536 | | | | 1,330 | | | | 12,318 | | | | 3,635 | |

Income tax expense | | | (465 | ) | | | — | | | | 400 | | | | 23 | |

Contingent consideration1 | | | — | | | | 1,055 | | | | (1,120 | ) | | | 1,055 | |

Acquisition expenses2 | | | — | | | | 1,840 | | | | 4,236 | | | | 3,765 | |

Loss on extinguishment of debt3 | | | 996 | | | | — | | | | 4,491 | | | | — | |

Transaction costs | | | 8,000 | | | | — | | | | 8,000 | | | | — | |

Change in fair value of tax receivable agreement (TRA) | | | 300 | | | | — | | | | 300 | | | | — | |

Change in fair value of warrant liability4 | | | (4,103 | ) | | | — | | | | (4,103 | ) | | | — | |

Change in fair value of earnout share payable4 | | | (26,860 | ) | | | — | | | | (26,860 | ) | | | — | |

Non-recurring and non-cash costs5 | | | 3,721 | | | | 1,744 | | | | 7,220 | | | | 3,289 | |

| | | | | | | | | | | | | | | | |

Adjusted EBITDA | | $ | 10,534 | | | $ | 1,510 | | | $ | 34,353 | | | $ | 11,194 | |

| | | | | | | | | | | | | | | | |

| 1 | Represents the change in fair value of contingent consideration payable to former owners of acquired businesses; |

| 2 | Represents expenses incurred related to business acquisitions; 3 Represents amounts paid to refinance debt in April of 2021; 4 Represents the impacts from the change in fair value related to both the earnout liability and the warrant liability associated with the business combination completed on December 23, 2021; 5 Represents adjustments for other non-recurring, non-operating, and non-cash costs related primarily to integration costs for new acquisitions, severance, and charges for the increase of fair value of inventory related to acquisitions, and management fees paid to Fathom’s principal owner. |

###

Q4 and Full Year 2021 Financial Results March 4, 2022 Exhibit 99.2

Forward-Looking Statements Certain statements made in this presentation are “forward looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Words such as “estimates,” “projects,” “expects,” “anticipates,” “forecasts,” “plans,” “intends,” “believes,” “seeks,” “may,” “will,” “would,” “should,” “future,” “propose,” “target,” “goal,” “objective,” “outlook” and variations of these words or similar expressions (or the negative versions of such words or expressions) are intended to identify forward-looking statements. These forward-looking statements are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside the control of Fathom Digital Manufacturing Corporation (“Fathom”) that could cause actual results or outcomes to differ materially from those discussed in the forward-looking statements. Important factors, among others, that may affect actual results or outcomes include: the inability to recognize the anticipated benefits of our business combination with Altimar Acquisition Corp. II (“Altimar”); changes in general economic conditions, including as a result of the COVID-19 pandemic; the outcome of litigation related to or arising out of the business combination, or any adverse developments therein or delays or costs resulting therefrom; the ability to meet the New York Stock Exchange’s listing standards following the consummation of the business combination; costs related to the business combination and additional factors discussed in Altimar’s final prospectus/proxy statement filed with the Securities and Exchange Commission (the “SEC”) on December 3, 2021 (the “Proxy Statement/Prospectus”) and the documents of Altimar and Fathom filed, or to be filed, with the SEC. If any of the risks described above materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by our forward-looking statements. There may be additional risks that Fathom does not presently know or that Fathom currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Fathom’s expectations, plans or forecasts of future events and views as of the date of this presentation. Although Fathom may elect to update these forward-looking statements at some point in the future, Fathom specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as representing Fathom’s assessments as of any date subsequent to the date of this press release. Accordingly, undue reliance should not be placed upon the forward-looking statements. Disclaimers

Non-GAAP Information This presentation includes Adjusted Net Income and Adjusted EBITDA, which are non-GAAP financial measures that we use to supplement our results presented in accordance with U.S. GAAP. We believe Adjusted Net Income and Adjusted EBITDA are useful in evaluating our operating performance, as they are similar to measures reported by our public competitors and regularly used by security analysts, institutional investors and other interested parties in analyzing operating performance and prospects. Adjusted Net Income and Adjusted EBITDA are not intended to be a substitute for any U.S. GAAP financial measure and, as calculated, may not be comparable to other similarly titled measures of performance of other companies in other industries or within the same industry. We define and calculate Adjusted Net Income as net loss before the impact of any increase or decrease in the estimated fair value of the Company’s warrants or earnout shares. We define and calculate Adjusted EBITDA as net losses before the impact of interest income or expense, income tax expense and depreciation and amortization, and further adjusted for the following items: stock-based compensation, transaction-related costs, and certain other non-cash and non-core items, as described in the reconciliation included in the appendix to this press release. Adjusted EBITDA margin represents Adjusted EBITDA divided by total revenue. We include these non-GAAP financial measures because they are used by management to evaluate Fathom’s core operating performance and trends and to make strategic decisions regarding the allocation of capital and new investments. Adjusted EBITDA excludes certain expenses that are required in accordance with U.S. GAAP because they are non-recurring (for example, in the case of transaction-related costs), non-cash (for example, in the case of depreciation and amortization, stock-based compensation) or are not related to our underlying business performance (for example, in the case of interest income and expense). Information reconciling forward-looking Adjusted EBITDA to GAAP financial measures is unavailable to Fathom without unreasonable effort. The company is not able to provide reconciliations of forward-looking Adjusted EBITDA to GAAP financial measures because certain items required for such reconciliations are outside of Fathom's control and/or cannot be reasonably predicted, such as the provision for income taxes. Preparation of such reconciliations would require a forward-looking balance sheet, statement of income and statement of cash flow, prepared in accordance with GAAP, and such forward-looking financial statements are unavailable to Fathom without unreasonable effort. Fathom provides a range for its Adjusted EBITDA forecast that it believes will be achieved, however it cannot accurately predict all the components of the Adjusted EBITDA calculation. Fathom provides an Adjusted EBITDA forecast because it believes that Adjusted EBITDA, when viewed with the company's results under GAAP, provides useful information for the reasons noted above. However, Adjusted EBITDA is not a measure of financial performance or liquidity under GAAP and, accordingly, should not be considered as an alternative to net income or cash flow from operating activities as an indicator of operating performance or liquidity. As described in the Proxy Statement/Prospectus, during 2020 Fathom completed the acquisitions of Incodema Holdings, Inc., Newchem, Inc., GPI Prototype and Manufacturing Services, LLC, Dahlquist Machine, Inc., Majestic Metals, LLC, and Mark Two Engineering, Inc. (the “2020 Acquisitions”). During 2021 we completed the acquisitions of Summit Tooling, Inc., Summit Plastics, LLC, Centex Machine and Welding, Inc., Laser Manufacturing, Inc. and Screenshot Precisions, LLC d/b/a Micropulse West and Precisions Process Corp. (the “2021 Acquisitions”). Pro forma revenue gives pro forma effect to the 2020 Acquisitions and 2021 Acquisitions, as though such transactions occurred on January 1, 2020. Financial Disclosure Disclaimer Fathom has not yet completed its reporting process for the three and twelve months ended December 31, 2021. Full financial statements for these periods will be filed on or before March 31, 2022. The preliminary unaudited results presented herein are based on Fathom’s reasonable estimates and the information available at this time. The amounts reported herein are subject to various adjustments that are still under review, including potential adjustments relating to changes in the estimated fair value of warrants and earnout shares, purchase accounting and provision for income taxes. Such adjustments may be material and could impact the results reported herein. Disclaimers, continued

Agenda Fathom Overview Business Update Q4 and Full Year 2021 Financial Review Liquidity and Capital Resources Full Year 2022 Guidance Summary Q&A

Fathom is at the Center of the Industry 4.0 Digital Manufacturing Revolution Leading on-demand digital manufacturing company in a large and fragmented $25bn+ market Comprehensive hybridized services and deep technical expertise combine to deliver integrated solutions for enterprise customers Expansive software suite complements growth prospects Attractive financial profile and cash generation Proven and profitable track record with a highly experienced leadership team Fathom’s mission is to accelerate manufacturing innovation for the most product-driven companies in the world

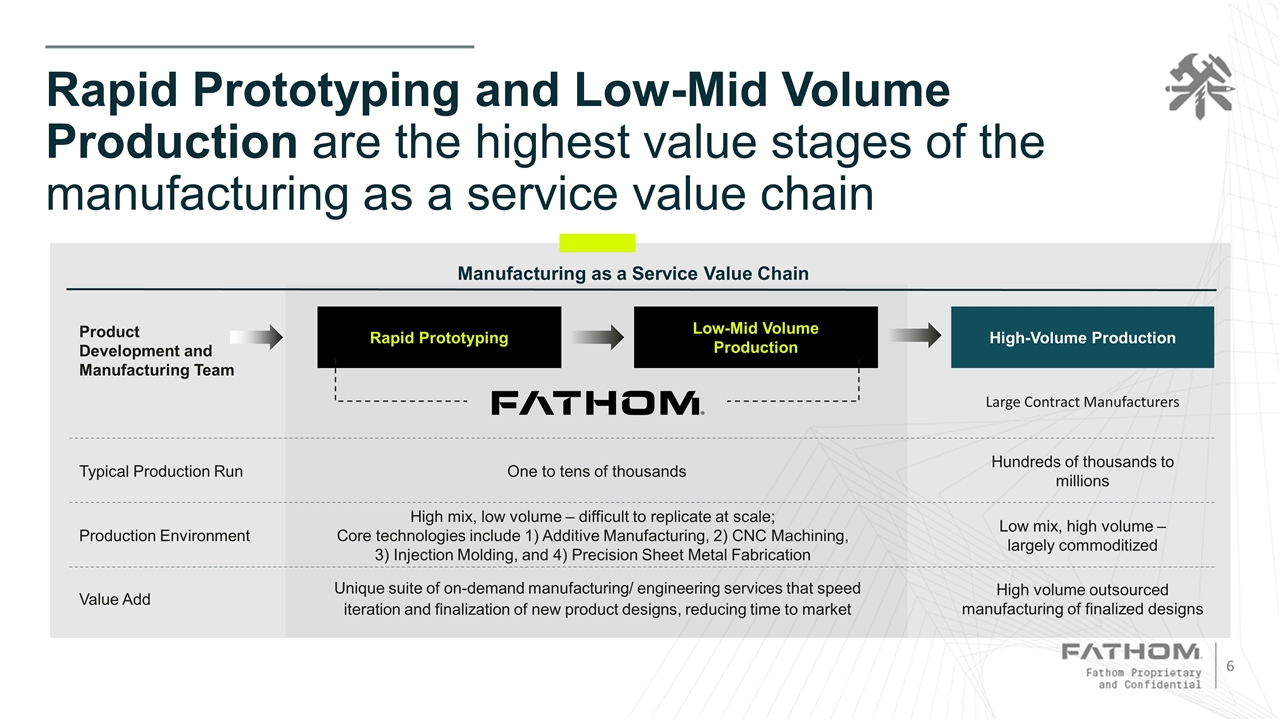

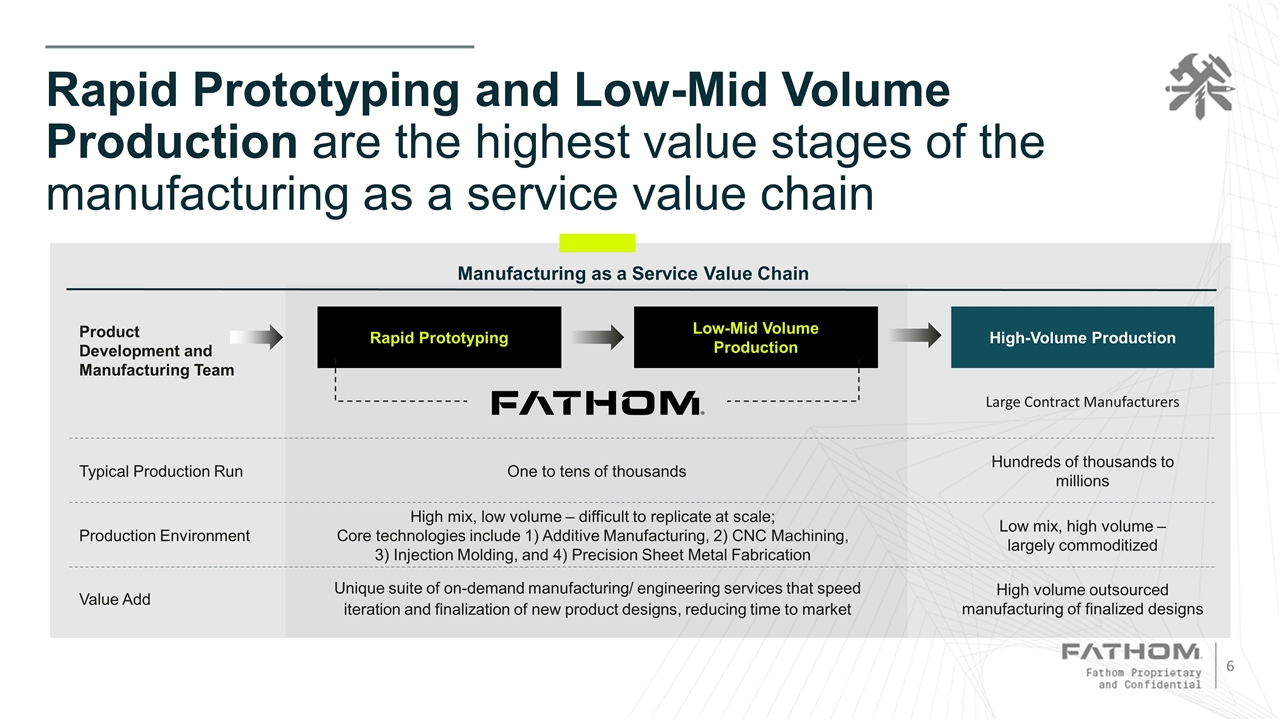

Rapid Prototyping and Low-Mid Volume Production are the highest value stages of the manufacturing as a service value chain Manufacturing as a Service Value Chain Rapid Prototyping Low-Mid Volume Production High-Volume Production Typical Production Run Production Environment Value Add One to tens of thousands High mix, low volume – difficult to replicate at scale; Core technologies include 1) Additive Manufacturing, 2) CNC Machining, 3) Injection Molding, and 4) Precision Sheet Metal Fabrication Unique suite of on-demand manufacturing/ engineering services that speed iteration and finalization of new product designs, reducing time to market Hundreds of thousands to millions Low mix, high volume – largely commoditized High volume outsourced manufacturing of finalized designs Product Development and Manufacturing Team Large Contract Manufacturers

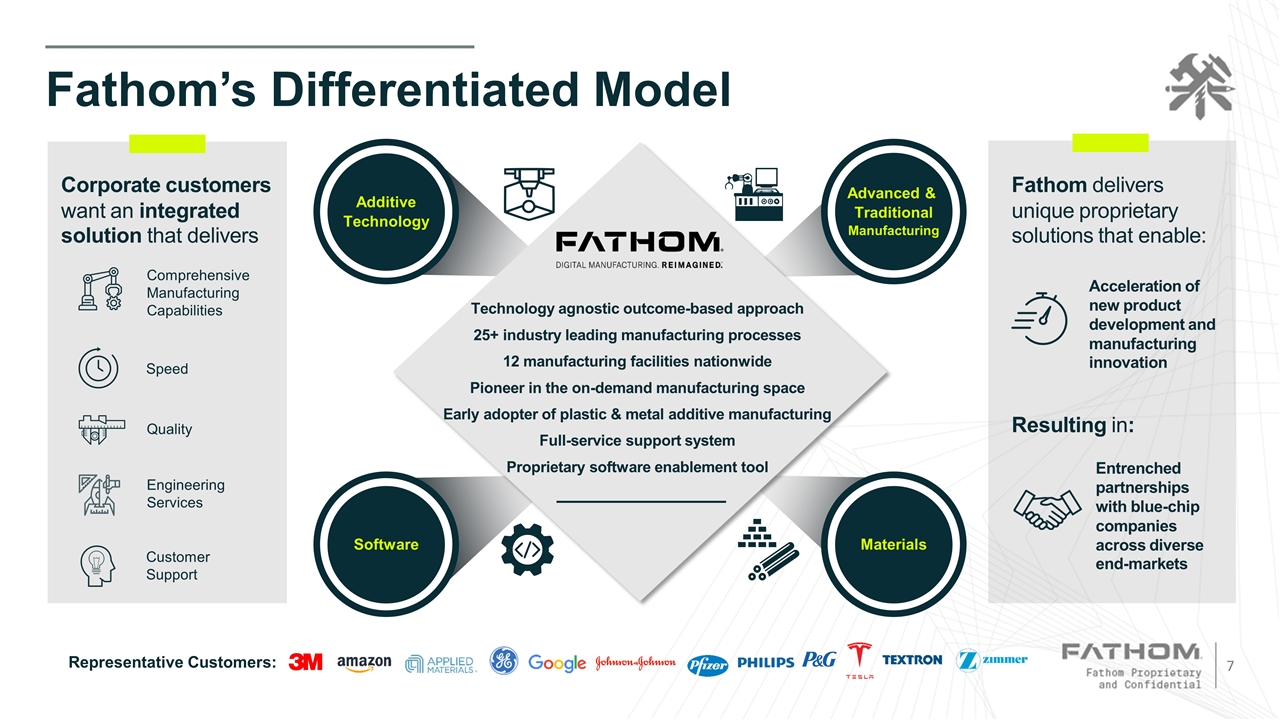

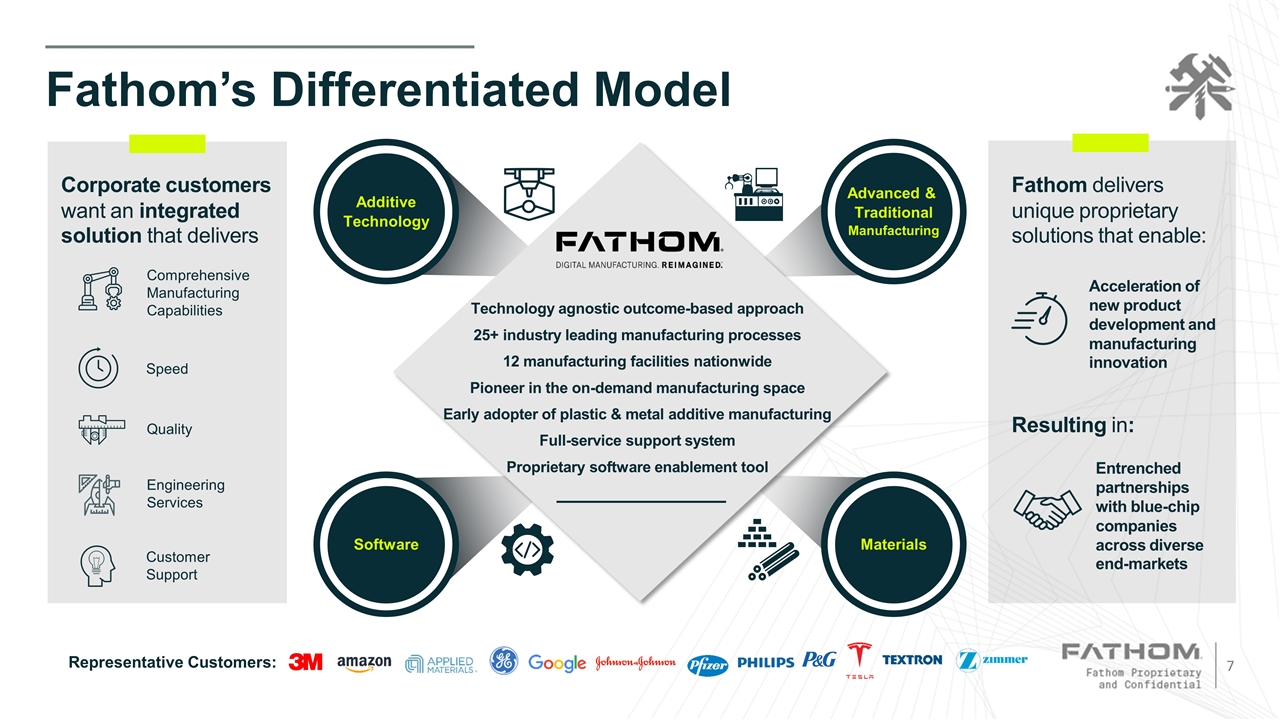

Fathom’s Differentiated Model Fathom delivers unique proprietary solutions that enable: Acceleration of new product development and manufacturing innovation Entrenched partnerships with blue-chip companies across diverse end-markets Resulting in: Technology agnostic outcome-based approach 25+ industry leading manufacturing processes 12 manufacturing facilities nationwide Pioneer in the on-demand manufacturing space Early adopter of plastic & metal additive manufacturing Full-service support system Proprietary software enablement tool Additive Technology Advanced & Traditional Manufacturing Software Materials Corporate customers want an integrated solution that delivers Comprehensive Manufacturing Capabilities Speed Quality Engineering Services Customer Support Representative Customers:

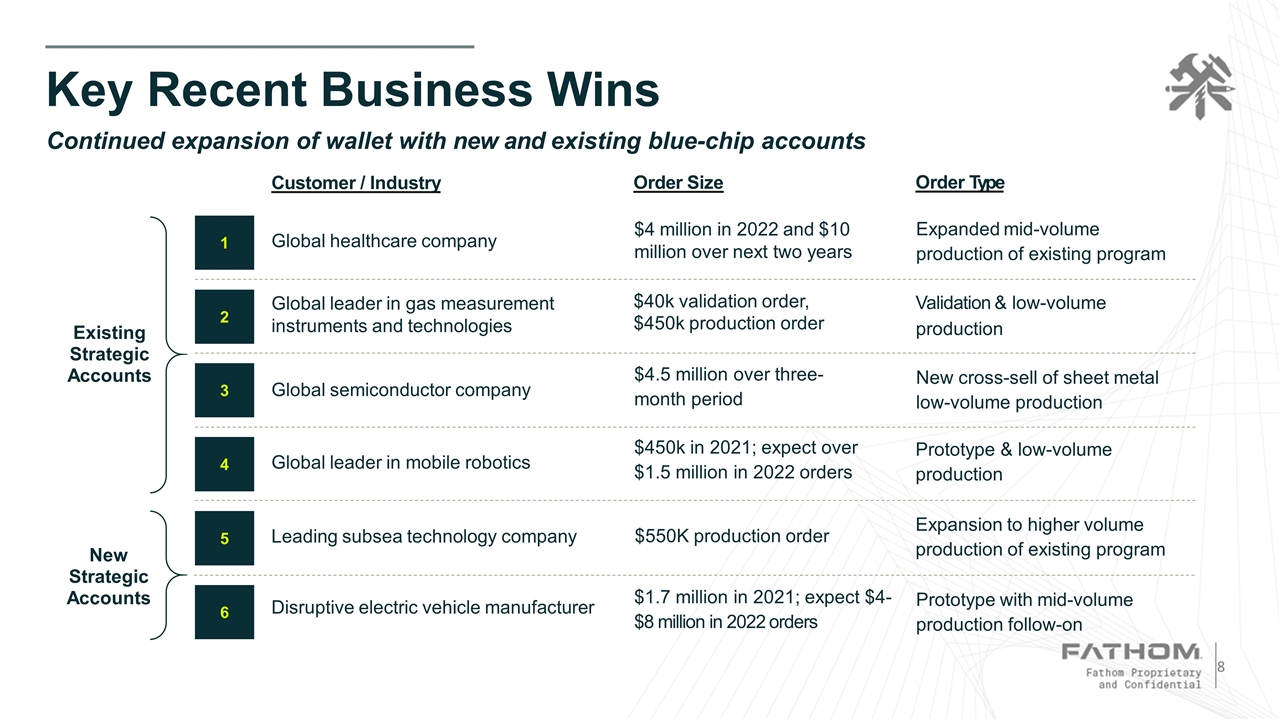

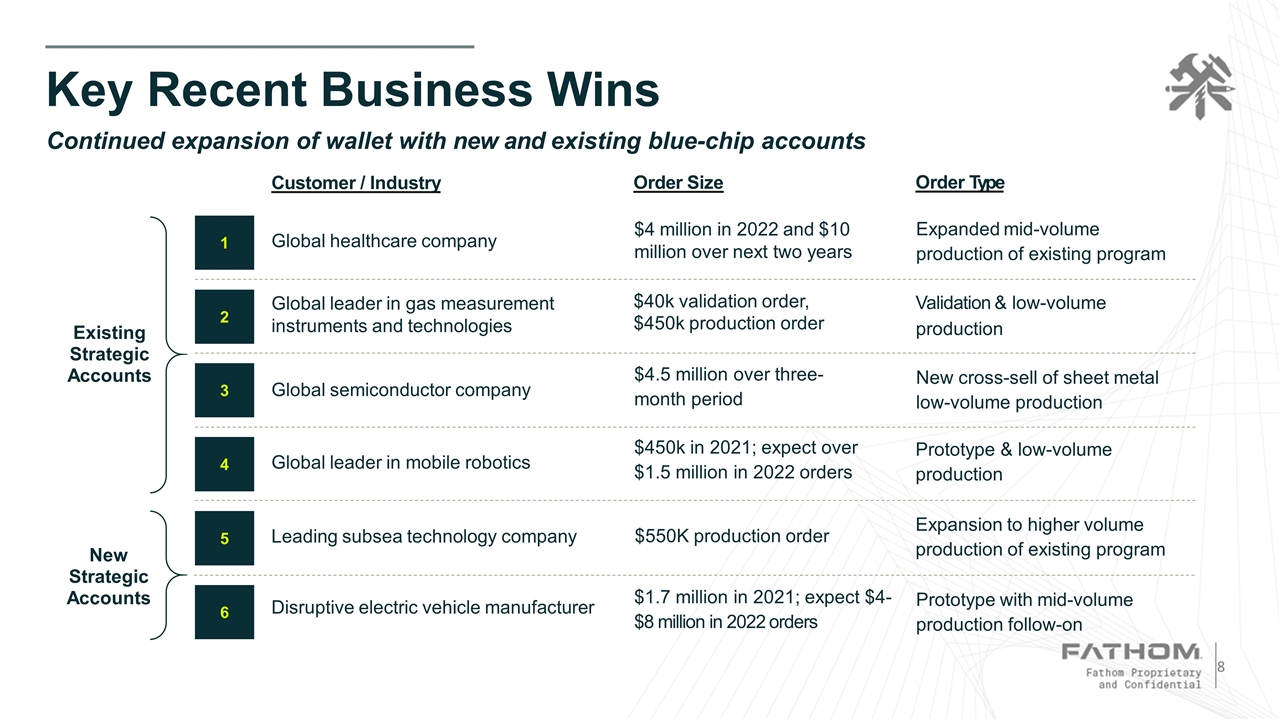

Key Recent Business Wins Continued expansion of wallet with new and existing blue-chip accounts Customer / Industry Order Size Order Type $40k validation order, $450k production order Validation & low-volume production $4 million in 2022 and $10 million over next two years Expanded mid-volume production of existing program $1.7 million in 2021; expect $4-$8 million in 2022 orders Prototype with mid-volume production follow-on $4.5 million over three-month period New cross-sell of sheet metal low-volume production $450k in 2021; expect over $1.5 million in 2022 orders Prototype & low-volume production Global healthcare company Global semiconductor company Disruptive electric vehicle manufacturer Global leader in mobile robotics 1 2 3 4 5 6 Global leader in gas measurement instruments and technologies Leading subsea technology company $550K production order Expansion to higher volume production of existing program New Strategic Accounts Existing Strategic Accounts

Q4 2021 Highlights 1 Reconciliations of Non-GAAP financial measures are included in the Appendix. $49.1 million Q4 2021 Total Orders $44.3 million Q4 2021 Reported Revenue $10.5 million Q4 2021 Reported Adjusted EBITDA1 Q4 order growth of 25.9% Increased backlog of new business Q4 organic revenue increased 18.4% Continued demand for Fathom’s broad services Q4 Adjusted EBITDA up $9.0 million Highlights strength of business model

Q4 and Full Year 2021 Revenue 1 Reconciliations of Non-GAAP financial measures are included in the Appendix. Revenue growth driven by increase in volume of customers served, primarily via M&A Fathom completed 5 acquisitions in 2021 focused on CNC Machining and Injection Molding Full year 2021 pro forma revenue1, totaled $162.6 million, up nearly 9% from 2020 Q4 2021 pro forma revenue1, increased 18.4% from prior year period +132.8% +148.5%

Q4 and Full Year 2021 Adjusted EBITDA1 Q4 2021 Adjusted EBITDA increased significantly to $10.5 million Record performance due to higher volume leverage, partially offset by sales mix Q4 SG&A increased 41% primarily from 2021 acquisitions as well as integration and public company expenses Strong Q4 and full year 2021 Adj. EBITDA margins of 23.8% and 22.6%, respectively 1 Reconciliations of Non-GAAP financial measures are included in the Appendix. +206.9% +597.6%

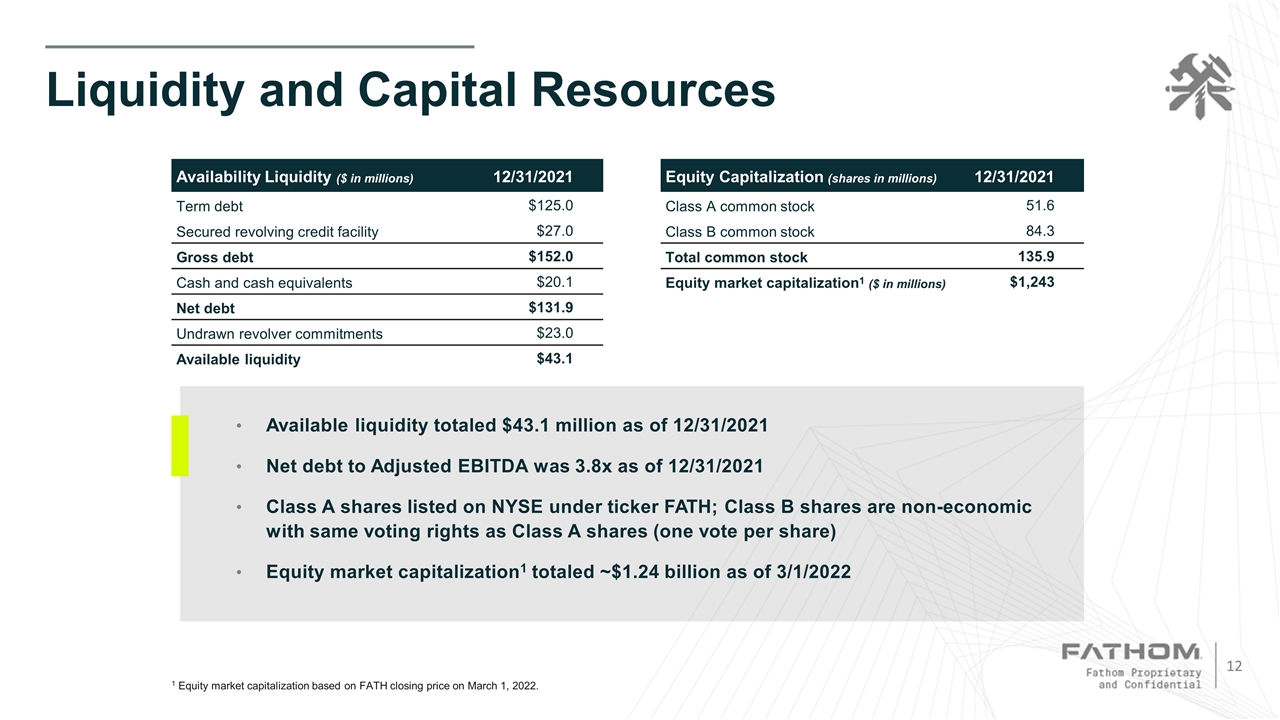

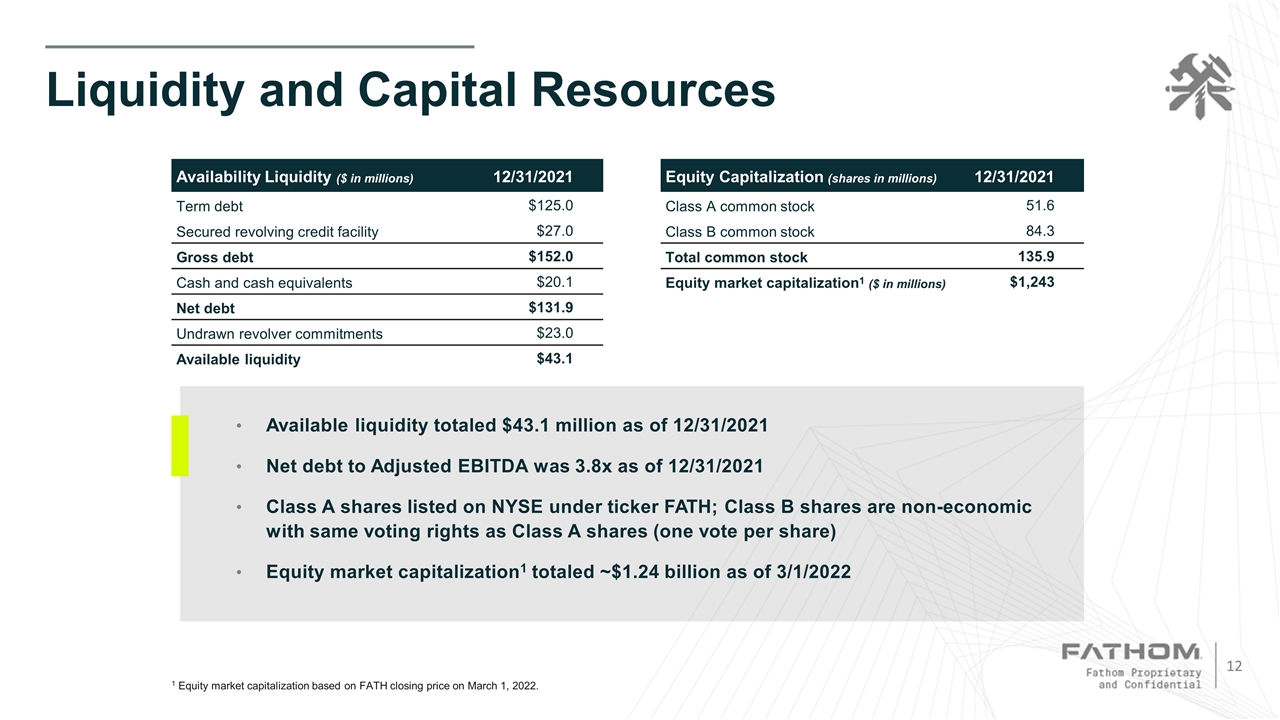

Liquidity and Capital Resources 1 Equity market capitalization based on FATH closing price on March 1, 2022. Availability Liquidity ($ in millions) 12/31/2021 Term debt $125.0 Secured revolving credit facility $27.0 Gross debt $152.0 Cash and cash equivalents $20.1 Net debt $131.9 Undrawn revolver commitments $23.0 Available liquidity $43.1 Equity Capitalization (shares in millions) 12/31/2021 Class A common stock 51.6 Class B common stock 84.3 Total common stock 135.9 Equity market capitalization1 ($ in millions) $1,243 Available liquidity totaled $43.1 million as of 12/31/2021 Net debt to Adjusted EBITDA was 3.8x as of 12/31/2021 Class A shares listed on NYSE under ticker FATH; Class B shares are non-economic with same voting rights as Class A shares (one vote per share) Equity market capitalization1 totaled ~$1.24 billion as of 3/1/2022

Financial Guidance Planning Assumptions Strong revenue growth driven by acceleration in additive manufacturing and injection molding technologies Continued synergies from previous acquisitions; execution of land and expand strategy Forecast reflects incremental public company and integration expenses Inflationary pressures expected to persist Capital expenditures expected to total ~6% of annual revenue Guidance excludes any potential new acquisitions in 2022 Projected 2022 revenue growth of ~23% at midpoint Adjusted EBITDA expected to increase ~24% at midpoint with margin ranging between 22.0% and 23.4% ($ in thousands) Low End High End Revenue $182,000 $192,000 Adjusted EBITDA2 $40,000 $45,000 Full Year 2022 Forecast1 1 Source: Fathom’s full year 2022 outlook, as of March 4, 2022, reflects management projections. 2 Adjusted EBITDA is a non-GAAP measure. See Appendix for a calculation of historical Adjusted EBITDA.

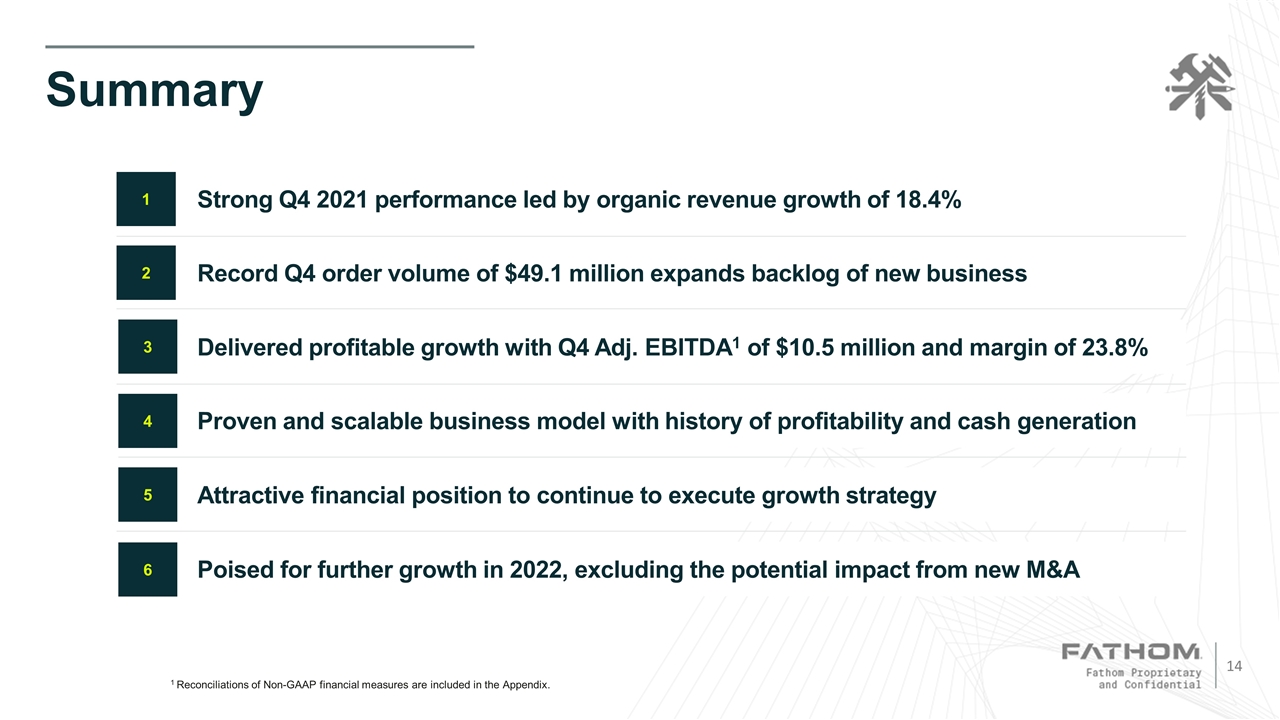

Summary 1 Reconciliations of Non-GAAP financial measures are included in the Appendix. Strong Q4 2021 performance led by organic revenue growth of 18.4% 1 2 4 6 5 3 Record Q4 order volume of $49.1 million expands backlog of new business Proven and scalable business model with history of profitability and cash generation Attractive financial position to continue to execute growth strategy Poised for further growth in 2022, excluding the potential impact from new M&A Delivered profitable growth with Q4 Adj. EBITDA1 of $10.5 million and margin of 23.8%

Appendix

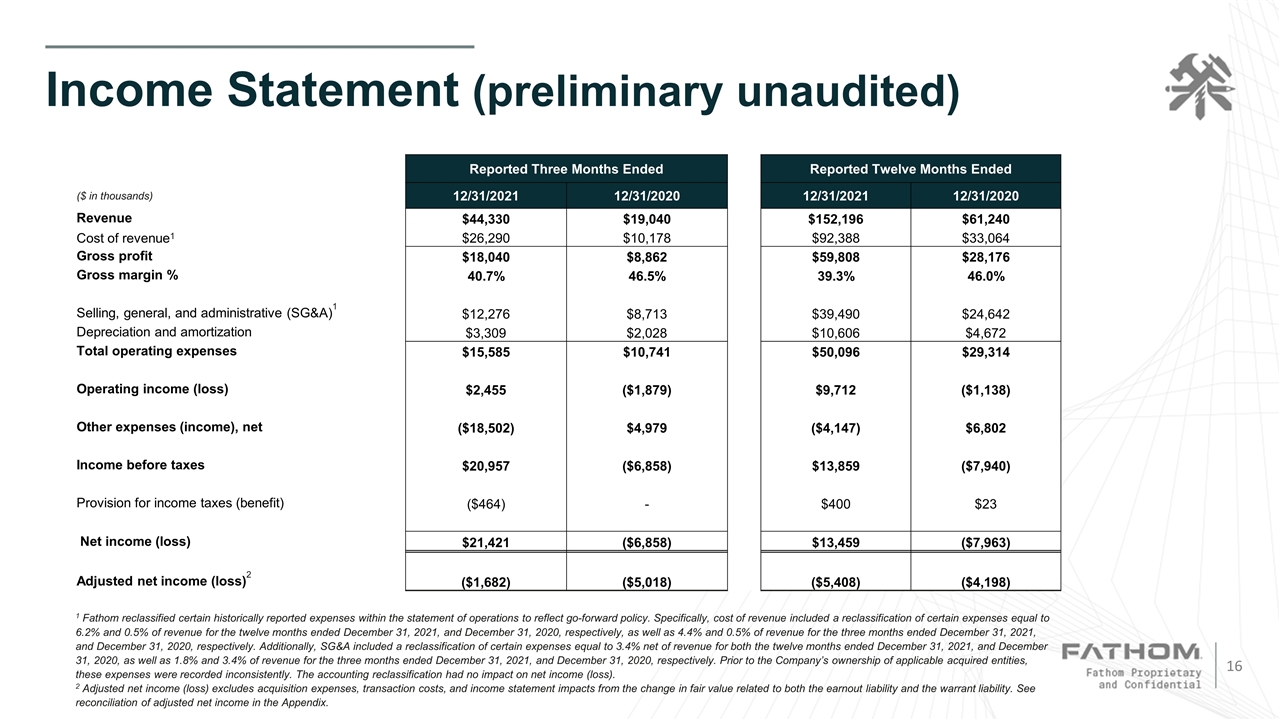

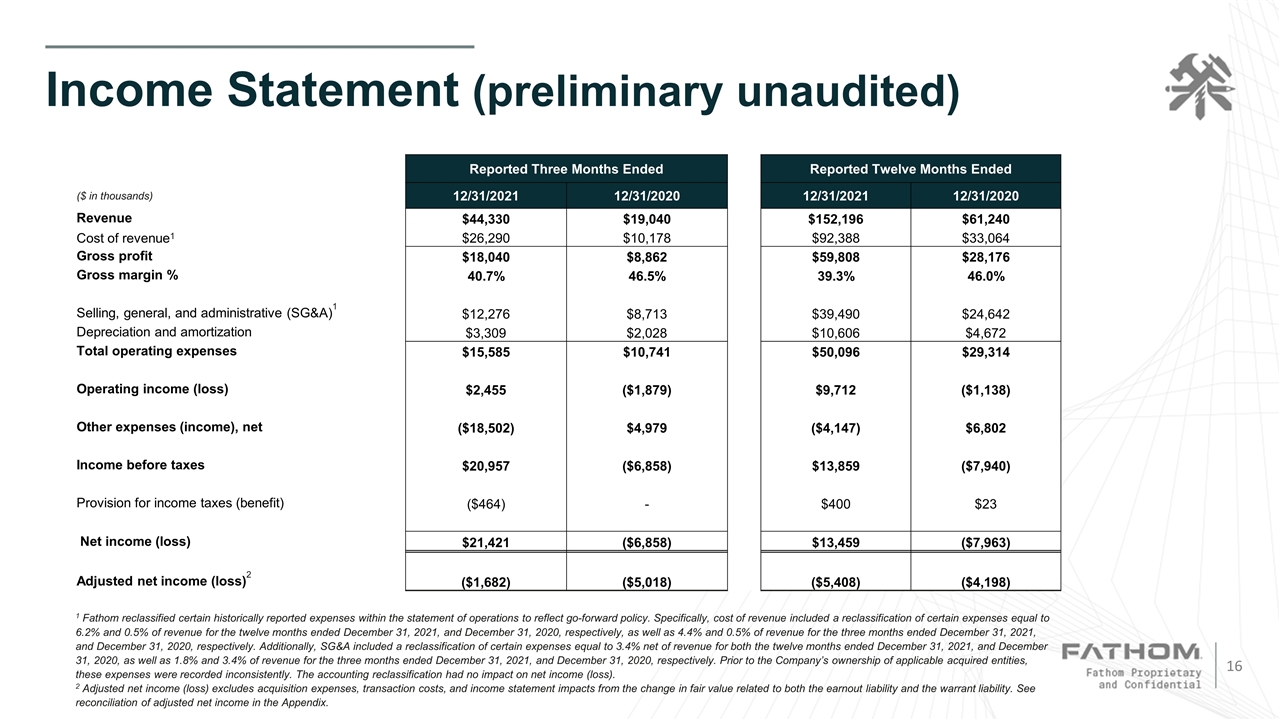

Income Statement (preliminary unaudited) Reported Three Months Ended Reported Twelve Months Ended ($ in thousands) 12/31/2021 12/31/2020 12/31/2021 12/31/2020 Revenue $44,330 $19,040 $152,196 $61,240 Cost of revenue1 $26,290 $10,178 $92,388 $33,064 Gross profit $18,040 $8,862 $59,808 $28,176 Gross margin % 40.7% 46.5% 39.3% 46.0% Selling, general, and administrative (SG&A)1 $12,276 $8,713 $39,490 $24,642 Depreciation and amortization $3,309 $2,028 $10,606 $4,672 Total operating expenses $15,585 $10,741 $50,096 $29,314 Operating income (loss) $2,455 ($1,879) $9,712 ($1,138) Other expenses (income), net ($18,502) $4,979 ($4,147) $6,802 Income before taxes $20,957 ($6,858) $13,859 ($7,940) Provision for income taxes (benefit) ($464) - $400 $23 Net income (loss) $21,421 ($6,858) $13,459 ($7,963) Adjusted net income (loss)2 ($1,682) ($5,018) ($5,408) ($4,198) 1 Fathom reclassified certain historically reported expenses within the statement of operations to reflect go-forward policy. Specifically, cost of revenue included a reclassification of certain expenses equal to 6.2% and 0.5% of revenue for the twelve months ended December 31, 2021, and December 31, 2020, respectively, as well as 4.4% and 0.5% of revenue for the three months ended December 31, 2021, and December 31, 2020, respectively. Additionally, SG&A included a reclassification of certain expenses equal to 3.4% net of revenue for both the twelve months ended December 31, 2021, and December 31, 2020, as well as 1.8% and 3.4% of revenue for the three months ended December 31, 2021, and December 31, 2020, respectively. Prior to the Company’s ownership of applicable acquired entities, these expenses were recorded inconsistently. The accounting reclassification had no impact on net income (loss). 2 Adjusted net income (loss) excludes acquisition expenses, transaction costs, and income statement impacts from the change in fair value related to both the earnout liability and the warrant liability. See reconciliation of adjusted net income in the Appendix.

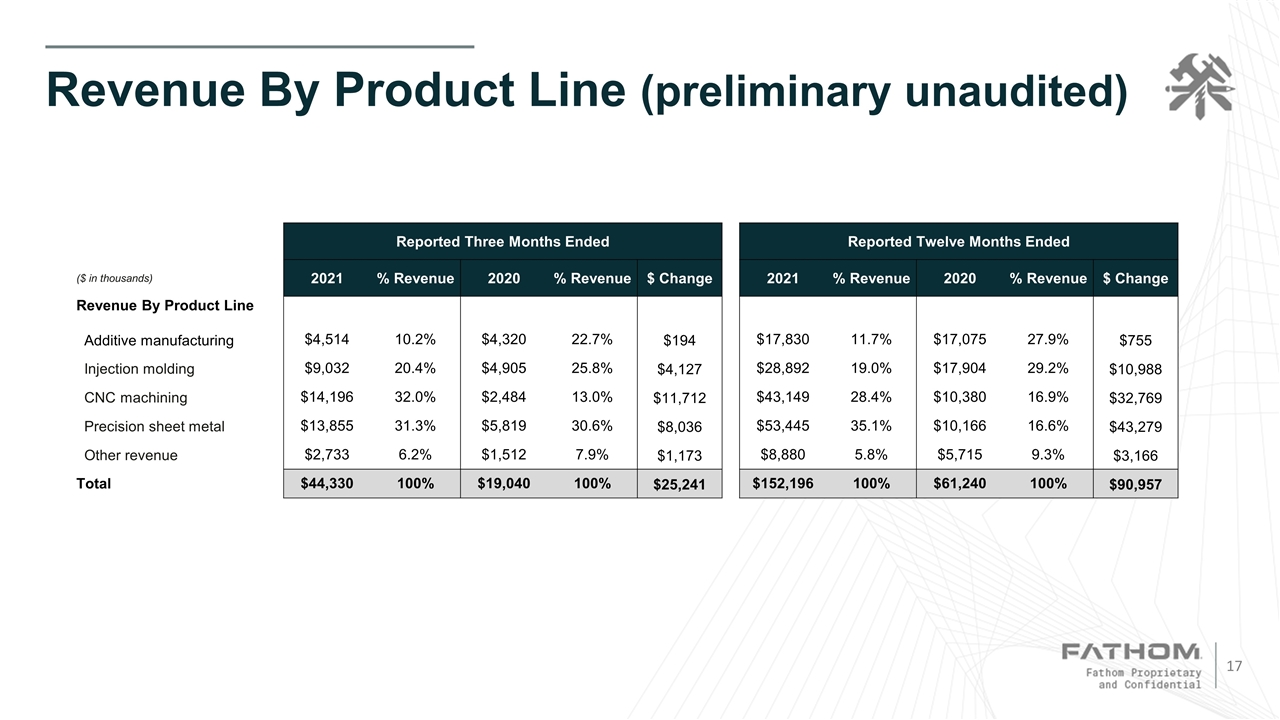

Revenue By Product Line (preliminary unaudited) Reported Three Months Ended Reported Twelve Months Ended ($ in thousands) 2021 % Revenue 2020 % Revenue $ Change 2021 % Revenue 2020 % Revenue $ Change Revenue By Product Line Additive manufacturing $4,514 10.2% $4,320 22.7% $194 $17,830 11.7% $17,075 27.9% $755 Injection molding $9,032 20.4% $4,905 25.8% $4,127 $28,892 19.0% $17,904 29.2% $10,988 CNC machining $14,196 32.0% $2,484 13.0% $11,712 $43,149 28.4% $10,380 16.9% $32,769 Precision sheet metal $13,855 31.3% $5,819 30.6% $8,036 $53,445 35.1% $10,166 16.6% $43,279 Other revenue $2,733 6.2% $1,512 7.9% $1,173 $8,880 5.8% $5,715 9.3% $3,166 Total $44,330 100% $19,040 100% $25,241 $152,196 100% $61,240 100% $90,957

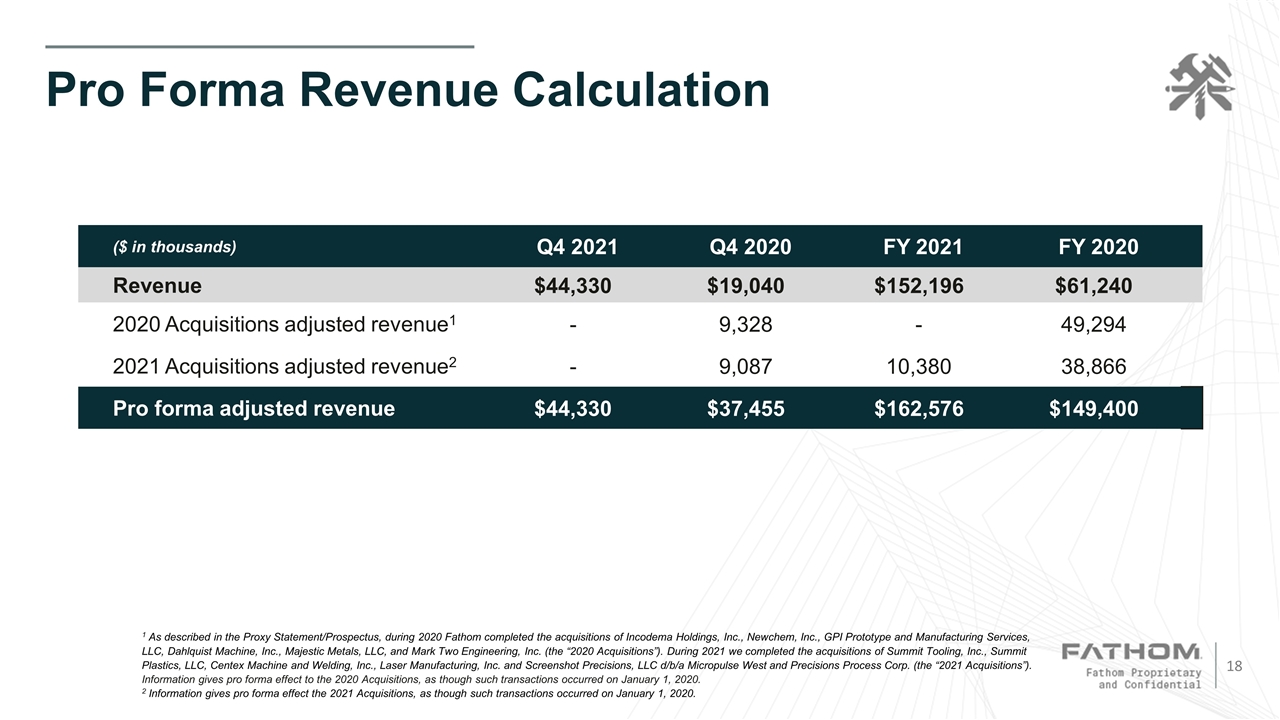

Pro Forma Revenue Calculation ($ in thousands) Q4 2021 Q4 2020 FY 2021 FY 2020 Revenue $44,330 $19,040 $152,196 $61,240 2020 Acquisitions adjusted revenue1 - 9,328 - 49,294 2021 Acquisitions adjusted revenue2 - 9,087 10,380 38,866 Pro forma adjusted revenue $44,330 $37,455 $162,576 $149,400 1 As described in the Proxy Statement/Prospectus, during 2020 Fathom completed the acquisitions of Incodema Holdings, Inc., Newchem, Inc., GPI Prototype and Manufacturing Services, LLC, Dahlquist Machine, Inc., Majestic Metals, LLC, and Mark Two Engineering, Inc. (the “2020 Acquisitions”). During 2021 we completed the acquisitions of Summit Tooling, Inc., Summit Plastics, LLC, Centex Machine and Welding, Inc., Laser Manufacturing, Inc. and Screenshot Precisions, LLC d/b/a Micropulse West and Precisions Process Corp. (the “2021 Acquisitions”). Information gives pro forma effect to the 2020 Acquisitions, as though such transactions occurred on January 1, 2020. 2 Information gives pro forma effect the 2021 Acquisitions, as though such transactions occurred on January 1, 2020.

Adjusted Net Income Calculation ($ in thousands) Q4 2021 Q4 2020 FY 2021 FY 2020 Net income (loss) $20,981 ($6,858) $13,019 ($7,963) Acquisition expenses1 - 1,840 4,236 3,765 Transaction costs 8,000 - 8,000 - Change in fair value of tax receivable agreement 300 - 300 - Change in fair value of warrant liability2 (4,103) - (4,103) - Change in fair value of earnout share payable2 (26,860) - (26,860) - Adjusted net income (loss) ($1,682) ($5,018) ($5,408) ($4,198) 1 Represents expenses incurred related to business acquisitions. 2 Represents the income statement impacts from the change in fair value related to both the earnout liability and the warrant liability.

Adjusted EBITDA Calculation ($ in thousands) Q4 2021 Q4 2020 FY 2021 FY 2020 Net income (loss) $20,981 ($6,858) $13,019 ($7,963) Depreciation and amortization 4,428 2,399 16,452 7,390 Interest expense, net 3,536 1,330 12,318 3,635 Income tax expense (465) - 860 23 Contingent consideration1 - 1,055 (1,120) 1,055 Acquisition expenses2 - 1,840 4,236 3,765 Loss on extinguishment of debt3 996 - 4,491 - Transaction costs 8,000 - 8,000 - Change in fair value of tax receivable agreement 300 - 300 - Change in fair value of warrant liability4 (4,103) - (4,103) - Change in fair value of earnout share payable4 (26,860) - (26,860) - Non-recurring and non-cash costs5 3,721 1,744 7,220 3,289 Adjusted EBITDA $10,534 $1,510 $34,353 $11,194 1 Represents the change in fair value of contingent consideration payable to former owners of acquired businesses; 2 Represents expenses incurred related to business acquisitions; 3 Represents amounts paid to refinance debt in April of 2021; 4 Represents the impacts from the change in fair value related to both the earnout liability and the warrant liability; 5 Represents adjustments for other non-recurring, non-operating, and non-cash costs related primarily to integration costs for new acquisitions, severance, and charges for the increase of fair value of inventory related to acquisitions, and management fees paid to Fathom’s principal owner.