EXHIBIT 99.3

Valneva Reports H1 2021 Financial Results and Provides Business Update Analyst Presentation August 10, 2021

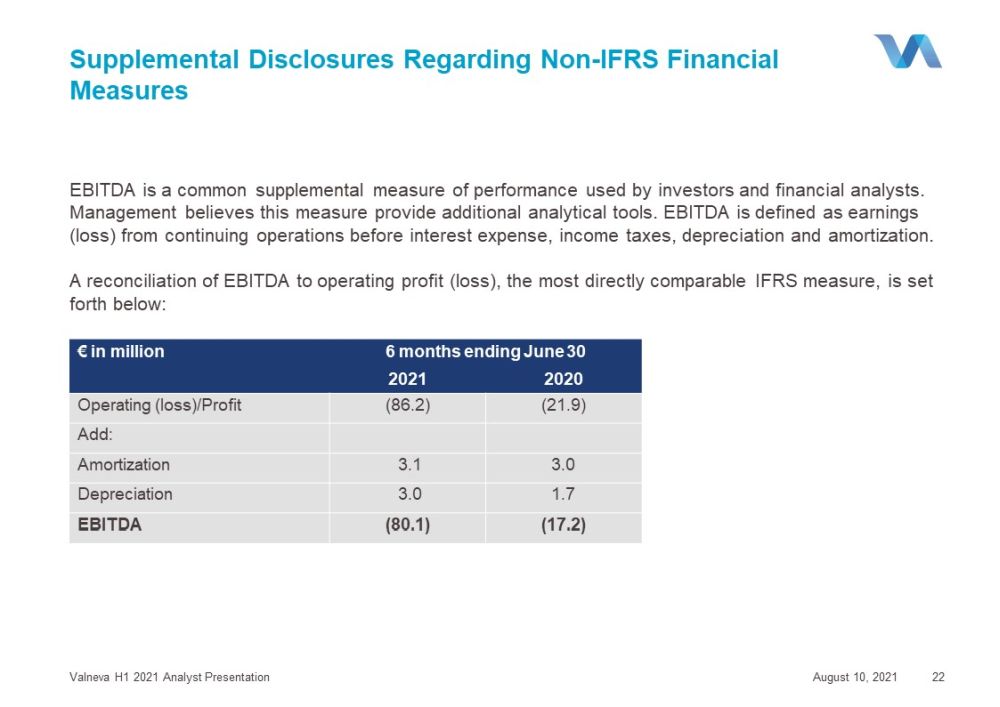

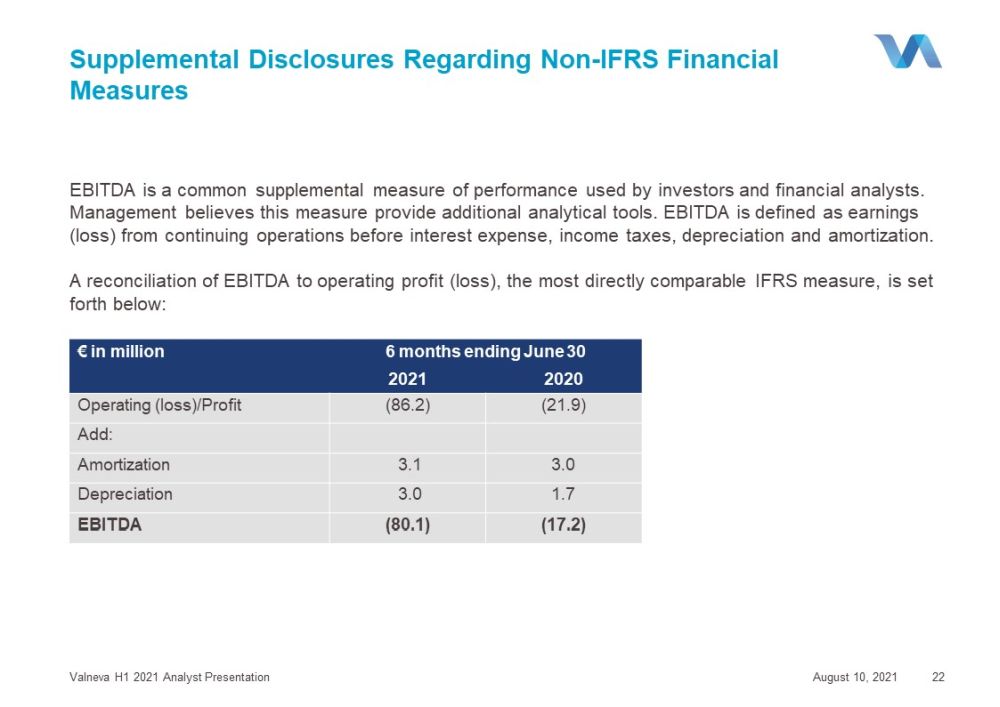

Disclaimer This presentation does not contain or constitute an offer of, or the solicitation of an offer to buy or subscribe for, Valneva SE shares to any person in the USA or in any jurisdiction to whom or in which such offer or solicitation is unlawful . Valneva is a European company . Information distributed is subject to European disclosure requirements that are different from those of the United States . Financial statements and information may be prepared according to accounting standards which may not be comparable to those used generally by companies in the United States . This presentation includes only summary information provided as of the date of this presentation only and does not purport to be comprehensive . Any information in this presentation is purely indicative and subject to modification at any time without notice . Valneva does not warrant the completeness, accuracy or correctness of the information or opinions contained in this presentation . None of Valneva, or any of their affiliates, directors, officers, advisors and employees is under any obligation to update such information or shall bear any liability for any loss arising from any use of this presentation . The information has not been subject to independent verification and is qualified in its entirety by the business, financial and other information that Valneva is required to publish in accordance with the rules, regulations and practices applicable in particular to companies listed on the regulated market of Euronext in Paris, including in particular the risk factors described in Valneva’s most recent universal registration document filed with the French Financial Markets Authority ( Autorité des Marchés Financiers, or AMF) and the Form F - 1 filed with the U . S . Securities and Exchange Commission on May 5 , 2021 , as well as in any other periodic report and in any other press release, which are available free of charge on the websites of Valneva (www . valneva . com) and/or the AMF (www . amffrance . org) . Certain information and statements included in this presentation are not historical facts but are forward - looking statements, including statements with respect to revenue guidance, the progress, timing, completion, and results of research, development and clinical trials for product candidates and estimates for future performance . The forward - looking statements (a) are based on current beliefs, expectations and assumptions, including, without limitation, assumptions regarding present and future business strategies and the environment in which Valneva operates, and involve known and unknown risk, uncertainties and other factors, which may cause actual results, performance or achievements to be materially different from those expressed or implied by these forward - looking statements, (b) speak only as of the date this presentation is released, and (c) are for illustrative purposes only . Investors are cautioned that forward - looking information and statements are not guarantees of future performances and are subject to various risks and uncertainties, many of which are difficult to predict and generally beyond the control of Valneva . Non - IFRS Financial Measures Management uses and presents IFRS results as well as the non - IFRS measure of EBITDA to evaluate and communicate its performance . While non - IFRS measures should not be construed as alternatives to IFRS measures, management believes non - IFRS measures are useful as an aid to further understand Valneva's current performance, performance trends, and financial condition . EBITDA is a common supplemental measure of performance used by investors and financial analysts . Management believes this measure provide additional analytical tools . EBITDA is defined as earnings (loss) from continuing operations before interest expense, income taxes, depreciation and amortization . A reconciliation of EBITDA to operating profit (loss), the most directly comparable IFRS measure, is set forth in this presentation . August 10, 2021 Valneva H1 2021 Analyst Presentation 2

Agenda August 10, 2021 Valneva H1 2021 Analyst Presentation 3 Introduction Business Update Financial Report H1 2021 Newsflow Q&A

Valneva Reports H1 2021 Financial Results and Provides Business Update August 10, 2021 Valneva H1 2021 Analyst Presentation 4 Major R&D objectives achieved ▪ Positive topline Phase 3 results for chikungunya vaccine candidate VLA1553 › World’s first ever Phase 3 trial results for a chikungunya vaccine ▪ Excellent progress on unique clinical assets › Lyme – recruitment completed for Phase 2 trial VLA15 - 221 including pediatric age group › COVID - 19 – recruitment completed for pivotal Phase 3 trial VLA2001 - 301 Strong financial position and platform ▪ $ 107.6 million raised in US IPO ▪ Cash and cash equivalents of € 329.8m at June 30, 2021

Agenda August 10, 2021 Valneva H1 2021 Analyst Presentation 5 Introduction Business Update Financial Report H 1 2021 Newsflow Q&A

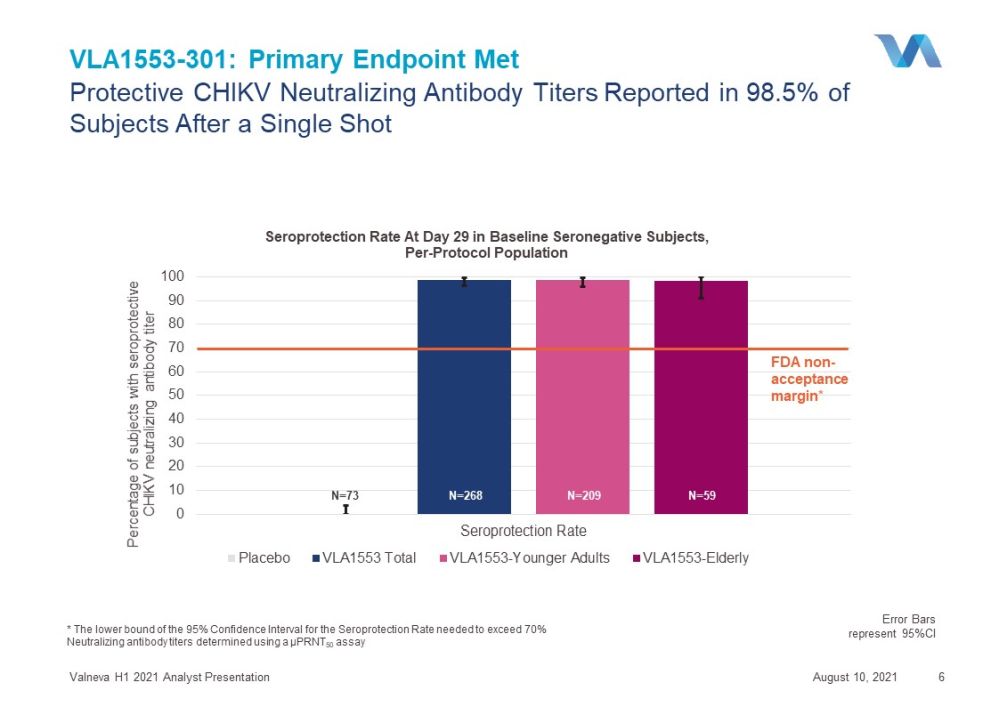

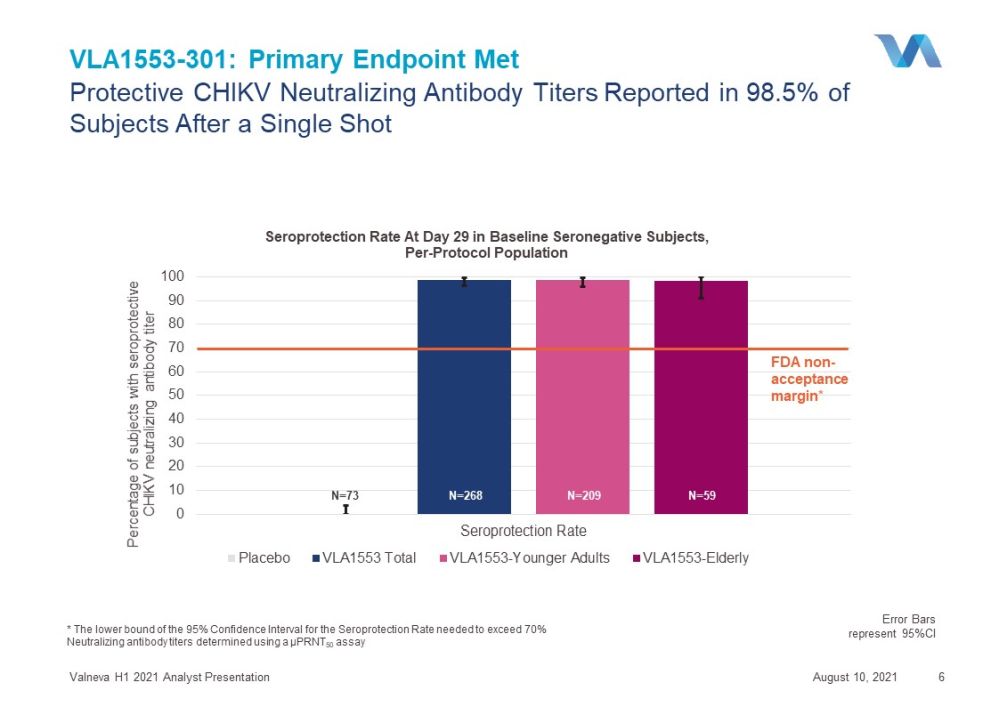

0 10 20 30 40 50 60 70 80 90 100 Seroprotection Rate Percentage of subjects with seroprotective CHIKV neutralizing antibody titer Seroprotection Rate At Day 29 in Baseline Seronegative Subjects , Per - Protocol Population Placebo VLA1553 Total VLA1553-Younger Adults VLA1553-Elderly VLA1553 - 301: Primary Endpoint Met August 10, 2021 Valneva H1 2021 Analyst Presentation 6 * The lower bound of the 95% Confidence Interval for the Seroprotection Rate needed to exceed 70% Neutralizing antibody titers determined using a µPRNT 50 assay Protective CHIKV Neutralizing A ntibody T iters Reported in 98.5% of Subjects A fter a Single Shot Error Bars represent 95%CI FDA non - acceptance margin * N= 268 N= 209 N= 59 N= 73

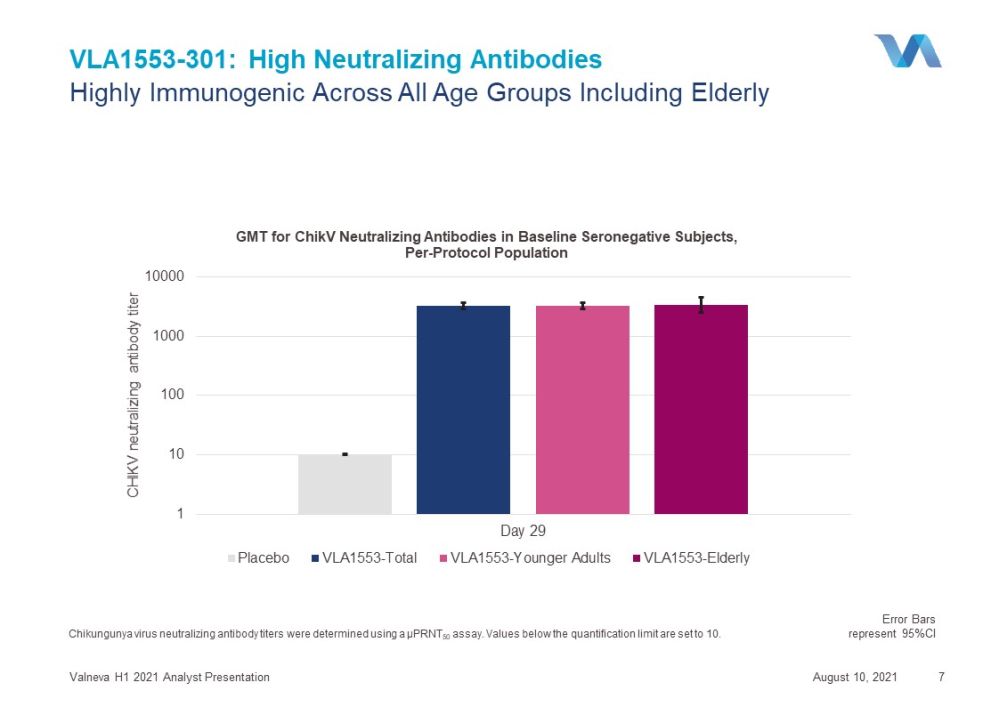

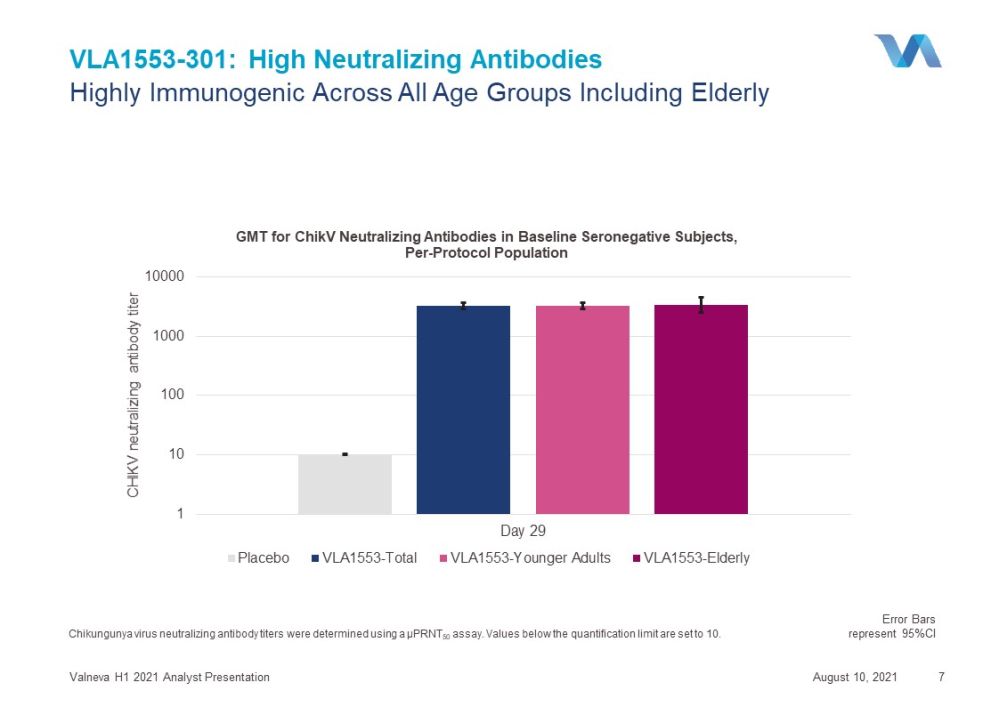

VLA1553 - 301: High Neutralizing Antibodies August 10, 2021 Valneva H1 2021 Analyst Presentation 7 Chikungunya virus neutralizing antibody titers were determined using a µPRNT 50 assay . Values below the quantification limit are set to 10. Highly Immunogenic Across All Age Groups Including Elderly 1 10 100 1000 10000 Day 29 CHIKV neutralizing antibody titer GMT for ChikV Neutralizing Antibodies in Baseline Seronegative Subjects, Per - Protocol Population Placebo VLA1553-Total VLA1553-Younger Adults VLA1553-Elderly Error Bars represent 95%CI

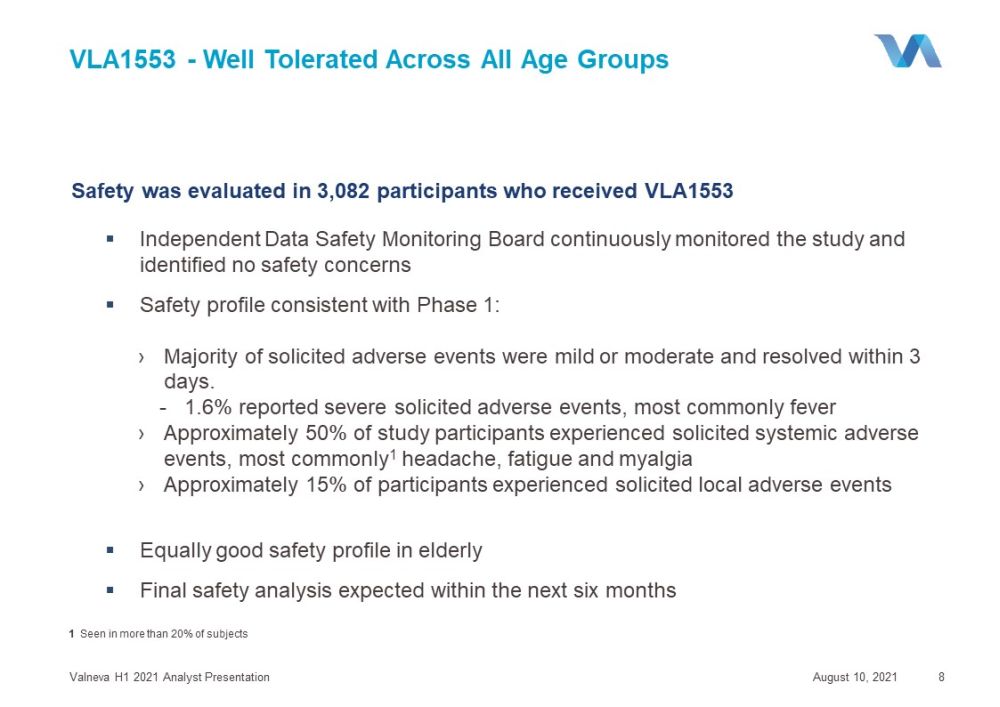

VLA1553 - Well Tolerated Across All A ge Groups Safety was evaluated in 3,082 participants who received VLA1553 ▪ Independent Data Safety Monitoring Board continuously monitored the study and identified no safety concerns ▪ Safety profile consistent with Phase 1: › Majority of solicited adverse events were mild or moderate and resolved within 3 days. - 1.6 % reported severe solicited adverse events, most commonly fever › Approximately 50% of study participants experienced solicited systemic adverse events, most commonly 1 headache, fatigue and myalgia › Approximately 15% of participants experienced solicited local adverse events ▪ Equally good safety profile in elderly ▪ Final safety analysis expected within the next six months August 10, 2021 Valneva H1 2021 Analyst Presentation 8 1 Seen in more than 20% of subjects

VLA1553: Development Outlook August 10, 2021 Valneva H1 2021 Analyst Presentation 9 1 Valneva Announces Positive Phase 3 Pivotal Results for its Single - Shot Chikungunya Vaccine Candidate ; 2 Valneva Initiates Phase 3 Clinical Lot Consistency Study for its Single - Shot Chikungunya Vaccine Candidate . 3 In collaboration with development partner Instituto Butantan , under CEPI funding ; 4 Valneva Announces Publication of 2020 Universal Registration Document and Provides Business Updates 5 https ://www.fda.gov/about - fda/center - drug - evaluation - and - research - cder/tropical - disease - priority - review - voucher - program . Pivotal Phase 3 Trial – Final Data Expected Within the Next 6 Months Most advanced clinical d evelopment p rogram in the world ▪ Pivotal Phase 3 safety and immunogenicity trial progressing toward s final analysis, expected within the next six months 1 ▪ Lot - to - Lot consistency trial fully recruited (VLA1553 - 302), data expected late 2021 2 ▪ Antibody persistence follow - up trial ( VLA1553 - 303) ongoing – up to 375 volunteers from VLA1553 - 301 will be followed up annually for five years after a single immunization 1 Valneva is discussing with the FDA to bring VLA1553 to a potential licensure as soon as possible

Exclusive , worldwide partnership with Pfizer FDA Fast Track Designation granted Multivalent vaccine (six serotypes) to protect against Lyme disease in the United States and Europe Follows proven Mechanism of Action for a Lyme disease vaccine Initial results reported from Phase 2 trials 1 , 2 , Recruitment completed for Phase 2 trial VLA15 - 221 incl. pediatric participants 3 VLA15 – Multivalent Lyme Disease Vaccine Candidate Only Lyme Disease Program in Advanced Clinical Development Today August 10, 2021 Valneva H1 2021 Analyst Presentation 10 1 2 4 5 3 1 Valneva announces p ositive initial results for Phase 2 study of Lyme Disease vaccine candidate . 2 Valneva announces positive initial results for second Phase 2 study of Lyme Disease vaccine candidate VLA15. 3 Valneva and Pfizer Complete Recruitment for Phase 2 Trial of Lyme Disease Vaccine Candidate

VLA15: Development Progress August 10, 2021 Valneva H1 2021 Analyst Presentation 11 VLA15 - 221 recruitment completed with a total of 625 participants, 5 to 65 years of age, randomized 2 ▪ The trial triggered a milestone payment of $10 million, upon dosing of the first subject, from Pfizer to Valneva ▪ Topline results for VLA15 - 221 are expected in the first half of 2022. ▪ VLA15 - 221 will also investigate a booster dose of VLA15, administered one year following the 6 Month dose 1 Phase 3 pivotal efficacy trial planned to commence pending positive readout from VA15 - 221 in 2022 1 ▪ Clinical readout, based on one tick season, projected end 2023 Initial submission for regulatory approval anticipated in H2 2024, assuming positive data 1 Valneva and Pfizer Announce Initiation of Phase 2 Study for Lyme Disease Vaccine Candidate . , 2 Valneva and Pfizer Complete Recruitment for Phase 2 Trial of Lyme Disease Vaccine Candidate Phase 2 trial 1 in Adults and Pediatric S ubjects O ngoing

UK government deal worth up to €1.4 billion 1 with development and manufacturing funding ; ongoing dialogue with the European Commission P rogram acceleration enabled through use of Valneva’s FDA - registered facility in UK; commercial manufacturing commenced January 2021 2 2 Phase 1/2 clinical trial results reported 4 , Phase 3 trial “ Cov - Compare” fully recruited 4 Regulatory submission to MHRA planned in autumn 2021, deliveries thereafter, subject to approval 5 Combines Valneva’s proven approach of inactivated vaccines with Dynavax’s advanced CpG 1018 adjuvant 3 3 VLA2001 – The Only Inactivated Vaccine in Clinical Development in Europe August 10, 2021 Valneva H1 2021 Analyst Presentation 12 Note: Photo credit: CDC/Alissa Eckert, MSMI; Dan Higgins, MAM. 1 Valneva announces major COVID - 19 vaccine partnership with U.K. Government . 2 Valneva commences manufacturing of its Inactivated, Adjuvanted COVID - 19 vaccine , completes Phase 1/2 study recruitment . 3 Valneva and Dynavax announce commercial supply agreement for Inactivated , Adjuvanted COVID - 19 vaccine ; 4 Valneva Reports Positive Phase 1/2 Data for Its Inactivated, Adjuvanted COVID - 19 Vaccine Candidate, VLA2001 1

August 10, 2021 Valneva H1 2021 Analyst Presentation 13 “ Cov - Compare ” (VLA2001 - 301) is a randomized , observer - blind , controlled , comparative immunogenicity trial in over 4,000 adults ▪ Immunological comparison against a licensed vaccine to reasonably predict efficacy ( superiority of VLA2001 in a two - dose immunization schedule four weeks apart - GMTs of neutralising antibodies, at two weeks after the second vaccination ) ▪ Study conducted in UK supported by DHSC/NIHR, including funding ▪ Protocol agreed with MHRA; discussion with other regulatory bodies ongoing ▪ Cov - Compare Phase 3 topline data expected early in the fourth quarter. Valneva expects to commence rolling submission with MHRA in the coming weeks and, subject to the Phase 3 data, believes that initial approval may be granted by the end of 2021. Valneva participating in the world’s first COVID - 19 vaccine booster trial in the UK 2 Additional studies planned ( including reduced booster dose) Valneva studying other variants, to be in a position to manufacture variant - based vaccines VLA2001: Development Outlook Pivotal Phase 3 trial “ Cov - Compare” Recruitment Completed 1 1 Valneva Completes Phase 3 Trial Recruitment for its Inactivated COVID - 19 Vaccine Candidate , 2 Valneva to Participate in the World’s First COVID - 19 Vaccine Booster Trial in the UK

Agenda August 10, 2021 Valneva H1 2021 Analyst Presentation 14 Introduction Business Update Financial Report H1 2021 Newsflow Q&A

Results Dynamics and Out look Updated guidance including COVID - 19 expected ▪ Ongoing Phase 3 trials and regulatory discussions ▪ Role of VLA2001 as a booster ▪ Studying variants in order to be in a position to produce variant - based vaccines ▪ Ongoing discussions with EC Valneva reconfirms its 2021 financial guidance (excluding COVID - 19) ▪ Total revenues, excluding VLA2001, of €80 million to €105 million ▪ R&D expenses, excluding VLA2001, of €65 million to €75 million August 10, 2021 Valneva H1 2021 Analyst Presentation 15

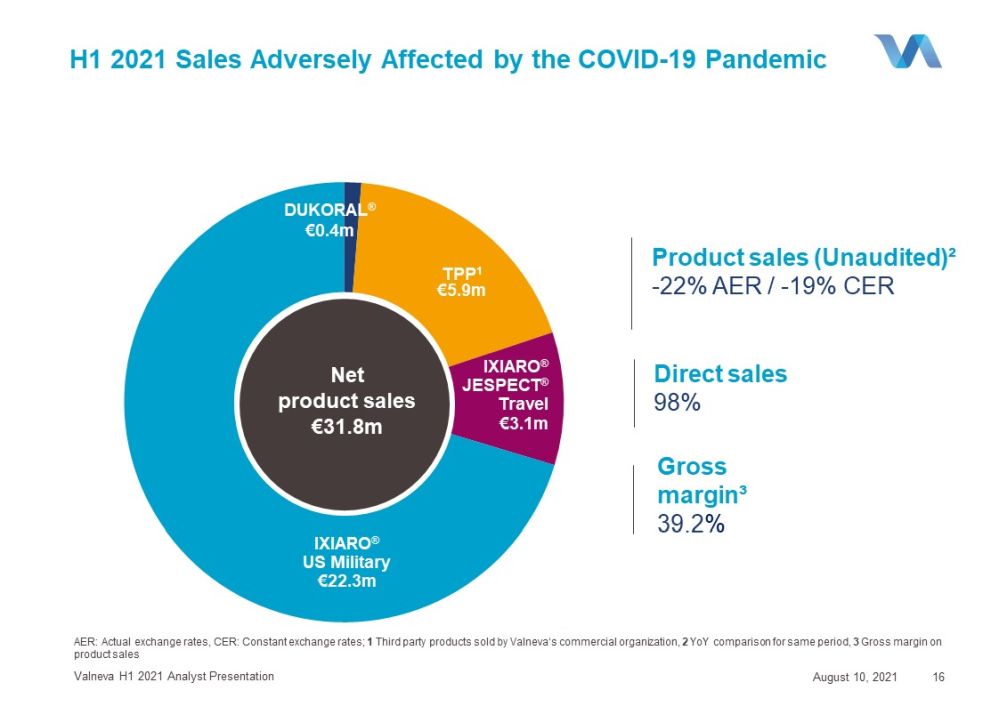

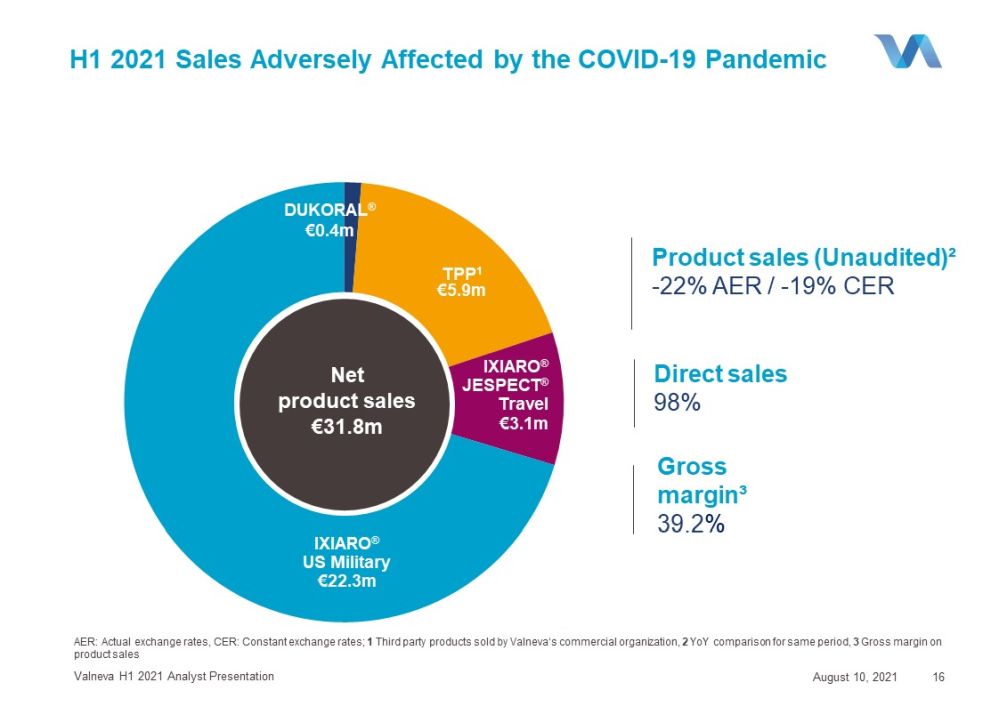

IXIARO ® US Military €22.3m TPP 1 €5.9m IXIARO ® JESPECT ® Travel €3.1m H1 2021 Sales Adversely Affected by the COVID - 19 Pandemic August 10, 2021 Valneva H1 2021 Analyst Presentation 16 Direct sales 98% Gross margin³ 39.2 % Product sales (Unaudited)² - 22% AER / - 19% CER AER: Actual exchange rates , CER: C onstant exchange rates ; 1 Third party products sold by Valneva‘s commercial organization , 2 YoY comparison for same period , 3 Gross margin on product sales Net product sales €31.8m DUKORAL ® €0.4m

EBITDA Loss Reflecting Increasing R&D Expenses H1 2021 Profit & Loss Report ( unaudited) August 10, 2021 Valneva H1 2021 Analyst Presentation 17 1 EBITDA is a non - IFRS financial measure . A reconciliation to operating profit (loss), the most directly comparable financial measures calculated in accordance with IFRS, is included herein . H 1 2021 EBITDA was calculated by excluding € 6 . 1 million (H 1 2020 : € 4 . 7 million) of depreciation and amortization from the € 86 . 2 million operating loss (H 1 2020 : € 21 . 9 million) as recorded in the consolidated income statement under IFRS . €m H1 2021 H1 2020 Product sales 31.8 40.9 Revenues from collaboration, licensing and services 15.7 7.0 Revenues 47.5 47.9 Cost of goods (23.5) (18.1) Cost of services (11.3) (4.4) Research and development expenses (78.7) (33.1) Marketing and distribution expenses (9.6) (10.0) General and administrative expenses (20.9) (10.6) Other income / ( expense ), net 10.4 6.5 Operating profit / (loss) (86.2) (21.9) Finance, investment in associates & income taxes (0.2) (3.7) Loss for the period (86.4) (25.6) EBITDA 1 (80.1) (17.2)

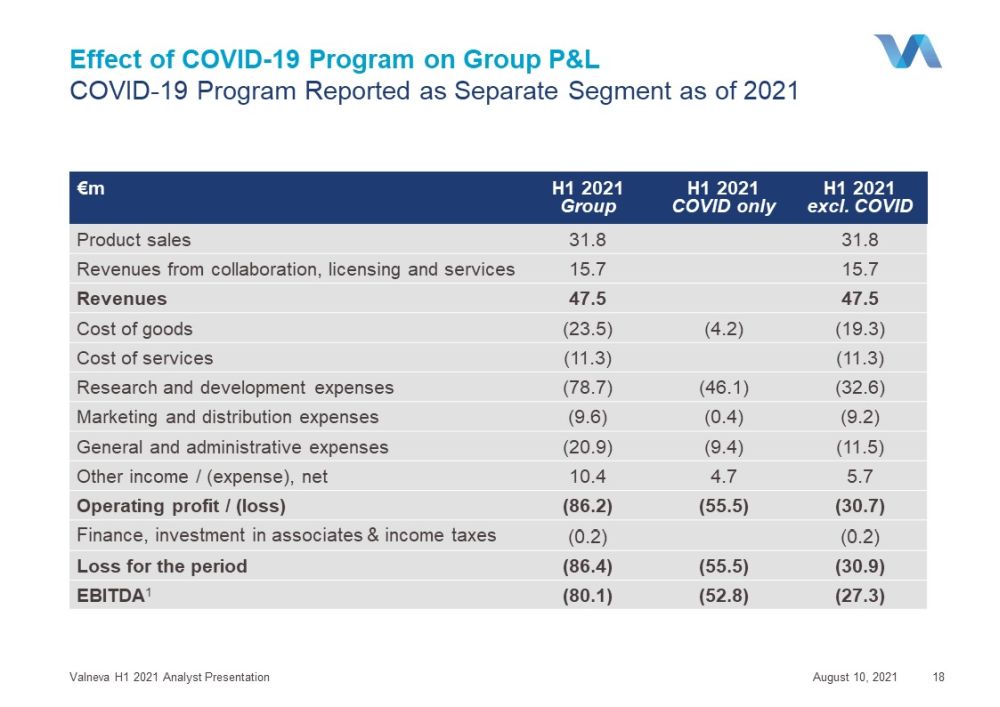

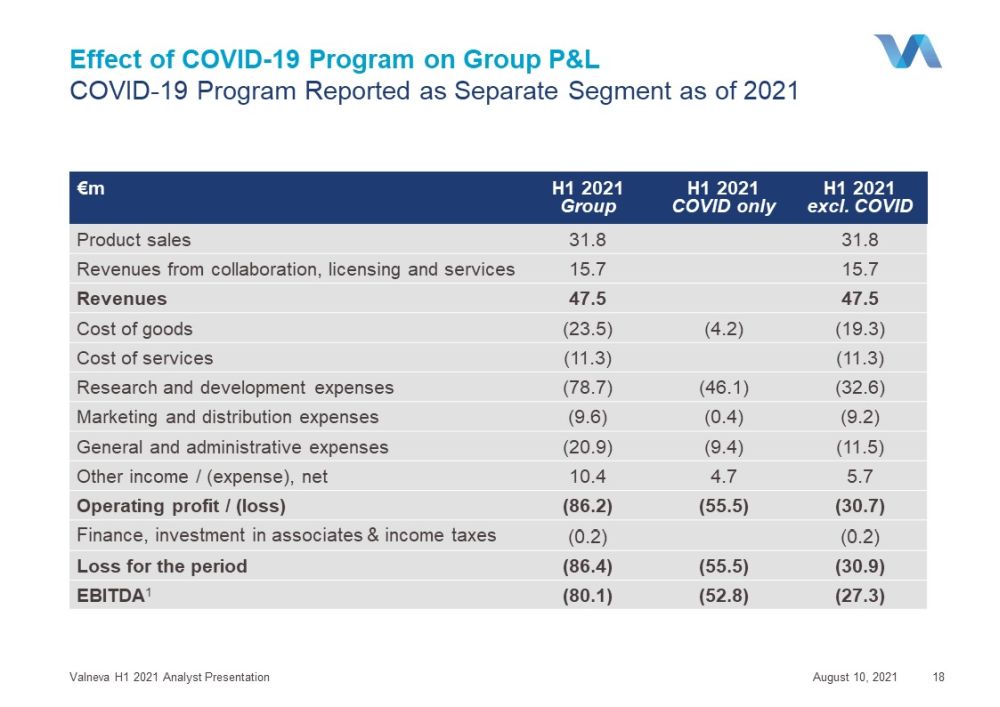

Effect of COVID - 19 P rogram on Group P&L COVID - 19 P rogram R eported as Separate Segment as of 2021 August 10, 2021 Valneva H1 2021 Analyst Presentation 18 €m H1 2021 Group H1 2021 COVID only H1 2021 excl. COVID Product sales 31.8 31.8 Revenues from collaboration, licensing and services 15.7 15.7 Revenues 47.5 47.5 Cost of goods (23.5) (4.2) (19.3) Cost of services (11.3) (11.3) Research and development expenses (78.7) (46.1) (32.6) Marketing and distribution expenses (9.6) (0.4) (9.2) General and administrative expenses (20.9) (9.4) (11.5) Other income / ( expense ), net 10.4 4.7 5.7 Operating profit / (loss) (86.2) (55.5) (30.7) Finance, investment in associates & income taxes (0.2) (0.2) Loss for the period (86.4) (55.5) (30.9) EBITDA 1 (80.1) (52.8) (27.3)

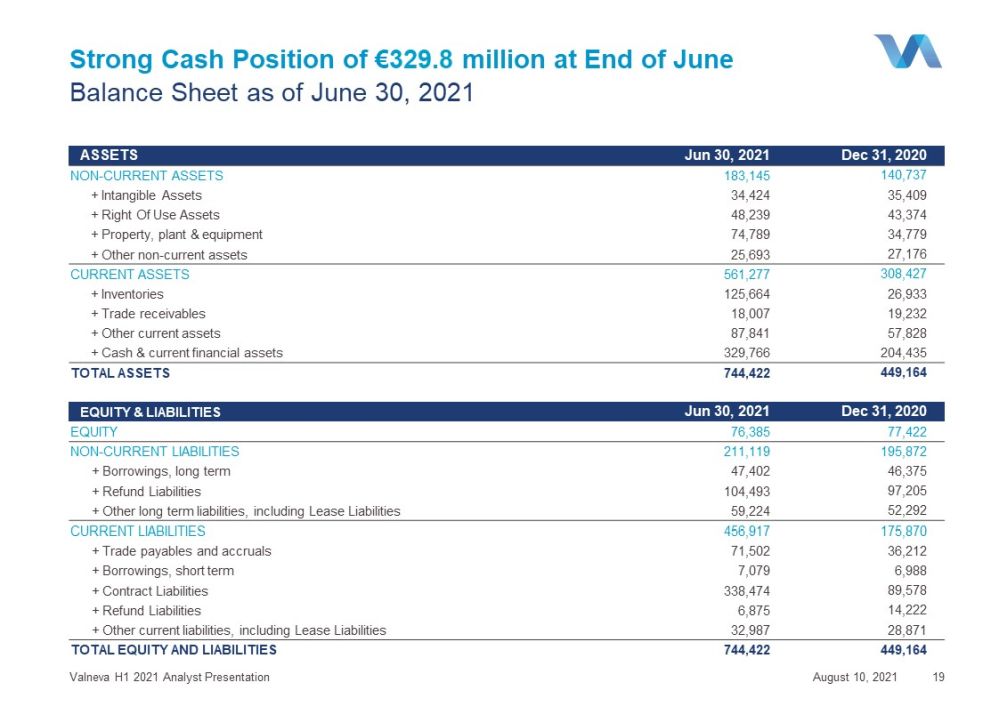

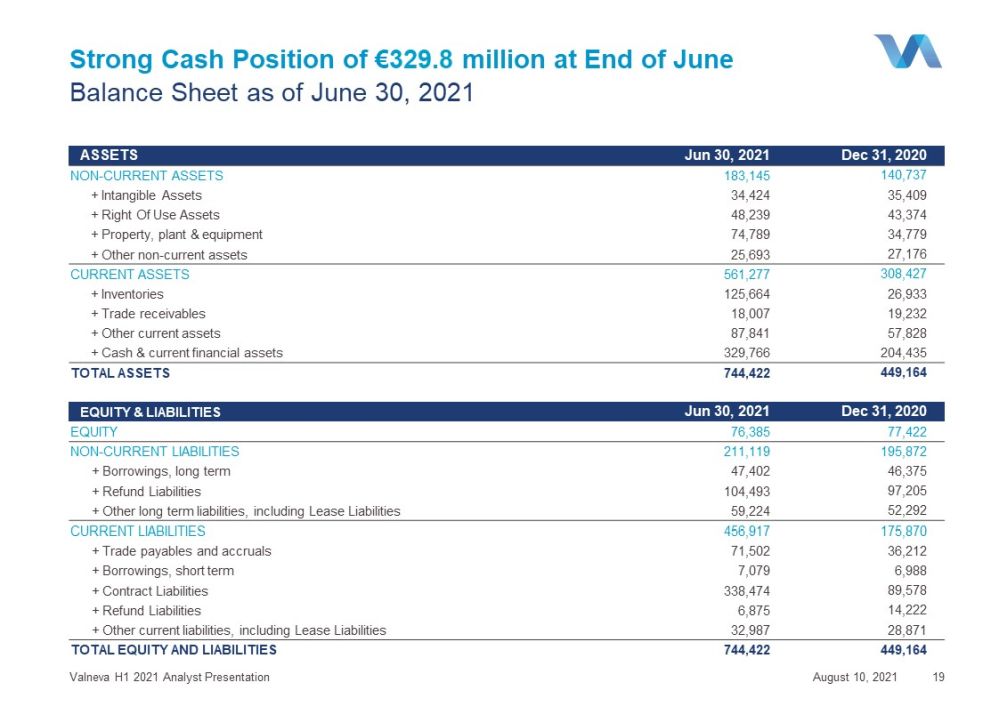

Strong Cash Position of € 329.8 million at End of June August 10, 2021 Valneva H1 2021 Analyst Presentation 19 Balance Sheet as of June 30, 2021 ASSETS Jun 30, 2021 Dec 31, 2020 NON - CURRENT ASSETS 183,145 140,737 + Intangible Assets 34,424 35,409 + Right Of Use Assets 48,239 43,374 + Property, plant & equipment 74,789 34,779 + Other non - current assets 25,693 27,176 CURRENT ASSETS 561,277 308,427 + Inventories 125,664 26,933 + Trade receivables 18,007 19,232 + Other current assets 87,841 57,828 + Cash & current financial assets 329,766 204,435 TOTAL ASSETS 744,422 449,164 EQUITY & LIABILITIES Jun 30 , 2021 Dec 31, 2020 EQUITY 76,385 77,422 NON - CURRENT LIABILITIES 211,119 195,872 + Borrowings, long term 47,402 46,375 + Refund Liabilities 104,493 97,205 + Other long term liabilities, including Lease Liabilities 59,224 52,292 CURRENT LIABILITIES 456,917 175,870 + Trade payables and accruals 71,502 36,212 + Borrowings, short term 7,079 6,988 + Contract Liabilities 338,474 89,578 + Refund Liabilities 6,875 14,222 + Other current liabilities, including Lease Liabilities 32,987 28,871 TOTAL EQUITY AND LIABILITIES 744,422 449,164

Agenda August 10, 2021 Valneva H1 2021 Analyst Presentation 20 Introduction Business Update Financial Report H 1 2021 Newsflow Q&A

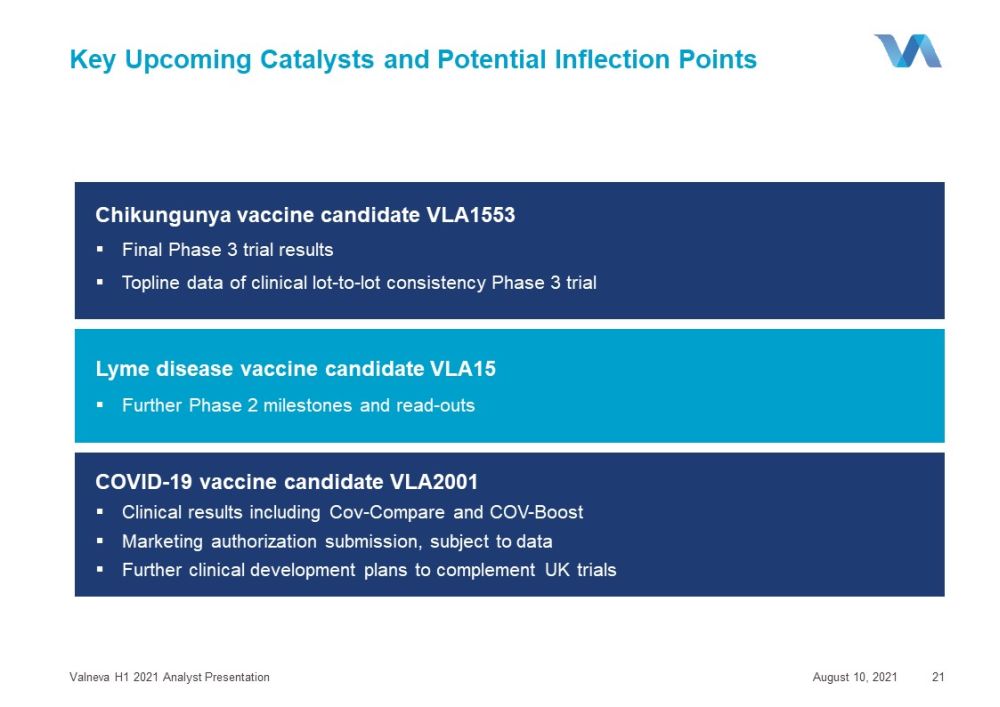

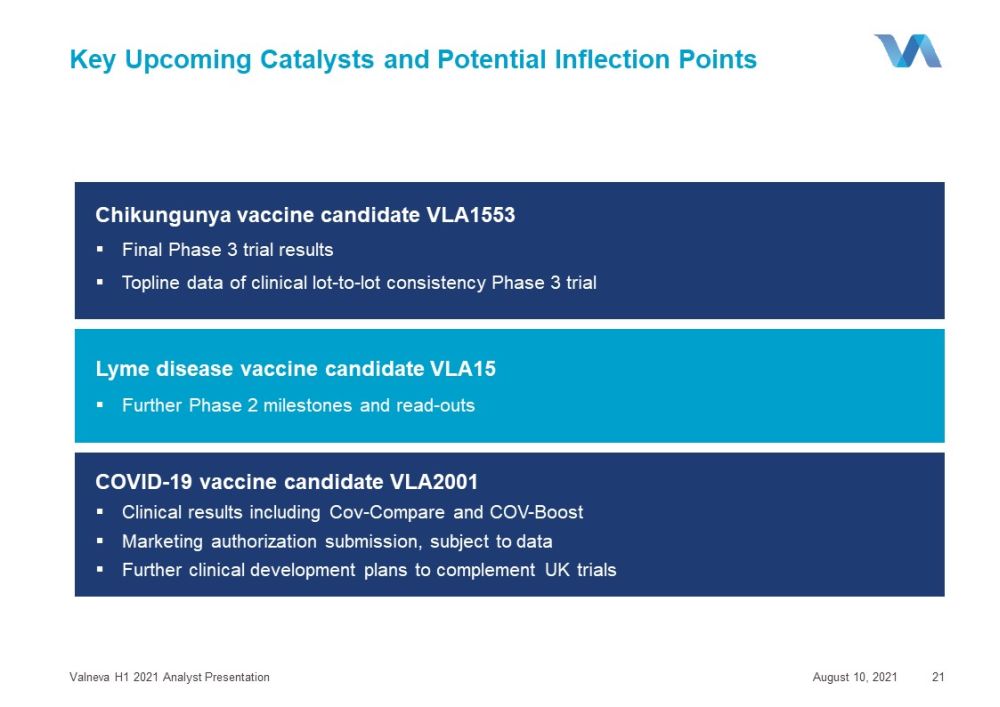

Key Upcoming Catalysts and Potential Inflection Points August 10, 2021 Valneva H1 2021 Analyst Presentation 21 Lyme disease vaccine candidate VLA15 ▪ Further Phase 2 milestones and read - outs Chikungunya vaccine candidate VLA1553 ▪ Final Phase 3 trial results ▪ Topline data of clinical lot - to - lot consistency Phase 3 trial COVID - 19 vaccine candidate VLA2001 ▪ Clinical results including Cov - Compare and COV - Boost ▪ Marketing authorization submission, subject to data ▪ Further clinical development plans to complement UK trials

Supplemental Disclosures Regarding Non - IFRS Financial Measures EBITDA is a common supplemental measure of performance used by investors and financial analysts. Management believes this measure provide additional analytical tools. EBITDA is defined as earnings (loss) from continuing operations before interest expense, income taxes, depreciation and amortization. A reconciliation of EBITDA to operating profit (loss), the most directly comparable IFRS measure, is set forth below: August 10, 2021 Valneva H1 2021 Analyst Presentation 22 € in million 6 months ending June 30 2021 2020 Operating (loss)/Profit (86.2) (21.9) Add : Amortization 3.1 3.0 Depreciation 3.0 1.7 EBITDA (80.1) (17.2)

Agenda August 10, 2021 Valneva H1 2021 Analyst Presentation 23 Introduction Business Update Financial Report H 1 2021 Newsflow Q&A

Thank you Merci Danke Tack