UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 20-F

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File No.: 001-40303

INSPIRA TECHNOLOGIES OXY B.H.N. LTD.

(Exact name of registrant as specified in its charter)

Translation of registrant’s name into English: Not applicable

State of Israel

(Jurisdiction of incorporation or organization)

2 Ha-Tidhar St.,

Ra’anana, 4366504 Israel

Tel: +972.4.6230333

(Address of principal executive offices)

Dagi Ben-Noon

2 Ha-Tidhar St.,

Ra’anana, 4366504 Israel

Tel: +972.4.6230333

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Ordinary Shares, no par value | | IINN | | Nasdaq Capital Market |

| Warrants to purchase Ordinary Shares | | IINNW | | Nasdaq Capital Market |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

24,252,096 ordinary shares, no par value, as of December 31, 2024.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act of 1934.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☐ No ☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | Large accelerated filer | ☐ | Accelerated filer | ☐ |

| | Non-accelerated filer | ☒ | Emerging Growth Company | ☒ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Yes ☐ No ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing.

U.S. GAAP ☒

International Financial Reporting Standards as issued by the International Accounting Standards Board ☐

Other ☐

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company.

Yes ☐ No ☒

TABLE OF CONTENTS

Inspira Technologies Oxy B.H.N. Ltd.

INTRODUCTION

We are a specialty medical device company engaged in the research, development, manufacturing, and marketing of proprietary life support technologies. We aim for our technology to supersede mechanical ventilators and revolutionize the global mechanical ventilation market.

Targeting to Revolutionize Life Support

We are a specialty medical device company engaged in the research, development, manufacturing, and marketing of proprietary life support technology with a vision to supersede traditional mechanical ventilators, or mechanical ventilation, which is the standard of care today for the treatment of acute respiratory failure. Mechanical ventilation may elevate risks, increase the cost of care, extend hospital stays, raise infection rates, lead to ventilator dependence and heighten mortality. Using our state-of-the-art life support technology, our goal is to set a new standard of care and provide patients with acute respiratory failure with an opportunity to preserve natural breathing and avoid intubation, induced coma and risks associated with the use of mechanical ventilation. As part of our strategy to reach this goal, and in parallel to pursuing regulatory approvals, we are actively working to establish collaborations with strategic partners, leading hospitals, medical device companies and distributors both for endorsement and early clinical adoption. We intend to target intensive care units, or ICUs, general medical units, operating theaters, and small urban and rural hospitals, with the goal of increasing access to our solutions to markets with millions of potential users. We expect these activities to support our strategy plan to reach market penetration and adoption of our life support technology.

We are developing the following products:

The INSPIRATM ART

The INSPIRA ART system, which is an augmented life support respiratory technology, also known as the INSPIRA ART500, is our flagship product The INSPIRA ART system aims to monitor and oxygenate blood to boost patient saturation levels, within minutes, while the patient is awake, without the need for an invasive mechanical ventilator.

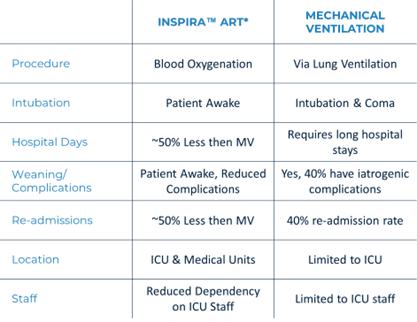

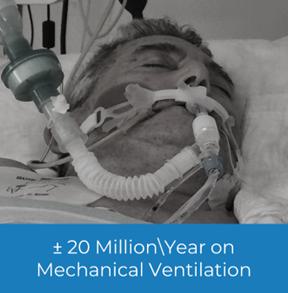

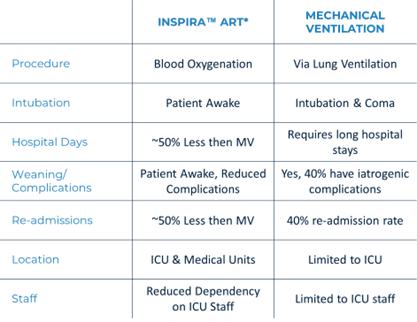

The INSPIRA ART is a potential alternative treatment for up to 20 million patients each year who are taken to ICUs and require mechanical ventilators. Mortality rates are highest for patients undergoing prolonged mechanical ventilation and may exceed 50%. As opposed to treating patients by forcing oxygen through their lungs in a procedure that requires intubation and medically induced coma, the INSPIRA ART system is designed to deliver oxygen directly into the blood to elevate and stabilize declining oxygen saturation levels within minutes, while performing blood parameter measurements in real-time without requiring intubation and induced coma. Our objective is to enable patient-treatment without resorting to mechanical ventilation, with the potential to reduce associated legacy risks, complications and high costs. This may allow for the treatment of larger patient populations even beyond ICU settings.

Our technology is designed to continuously monitor the patient’s blood parameters in real-time, while enriching small volumes of blood with oxygen and simultaneously removing carbon dioxide. Boosting oxygen saturation levels in minutes may allow patients to be awake, potentially making the treatment suitable in the future to migrate from ICUs to emergency rooms, medical units, emergency medical services and smaller rural hospitals with no ICUs.

| Patient treated awake and without mechanical ventilation.

Oxygen is delivered straight into the blood, with simultaneous carbon dioxide removal.

Blood parameters measured continuously and in real-time. |

The INSPIRA ART is being designed with the intent of treating those on life support as a result of acute respiratory failure, while awake, for longer than six hours, or prolonged life support, with extracorporeal circulation and physiologic gas exchange involving oxygenation and carbon dioxide removal from the patient’s blood. The INSPIRA ART is being designed to potentially eliminate the need for invasive mechanical ventilation, targeting acute respiratory failure patients in ICUs and potentially in general medical units. The Company believes that the INSPIRA ART may enable treatment of patients without the need for induced coma, intubation or weaning, all of which are associated with incurring the risk of lung infections and lung injury that may prolong hospital admission. The INSPIRA ART, which is in the development phase and has not yet been tested in humans, will likely be submitted to the U.S. Food and Drug Administration, or the FDA, for regulatory approval via the pre-market approval, or PMA, application or De Novo regulatory pathways. The Company aims to receive FDA regulatory approval through its submission of the INSPIRA ART through the 510(k) regulatory pathway as part of its multi-step approach in anticipation of a De Novo or PMA in connection with future clinical study results.

The INSPIRATM ART100

The INSPIRA ART100 system, previously referred to as the ALICE, Liby, INSPIRA ART (Gen1) or ECLS system, is also referred to as a device or system. The INSPIRA ART100 is an FDA-cleared advanced form of life support system, better known by the medical industry as a cardiopulmonary bypass system, or CPB, designed for use in surgical procedures requiring cardiopulmonary bypass for six hours or less. The INSPIRA ART100 utilizes a technique that circulates, adds oxygen to and removes carbon dioxide from blood, with the enriched blood being circulated back to the patient. The device takes over the function of the heart and/or lungs in critical care patients undergoing life-saving procedures.

In May 2024, we received 510(k) class II regulatory clearance from the FDA for the INSPIRA ART100 system. In July 2024, we received an Israeli Medical Equipment Division Ministry of Health, or AMAR, regulatory approval for extra-corporeal membrane oxygenation, or ECMO, and cardiopulmonary bypass procedure. In December 2024, our first devices were shipped for deployment to Westchester Medical Center in Valhalla, New York, as part of an evaluation and collaboration for the INSPIRA ART.

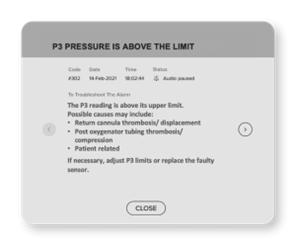

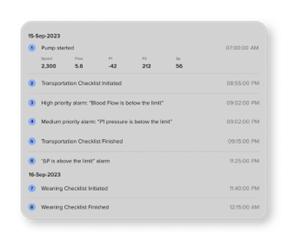

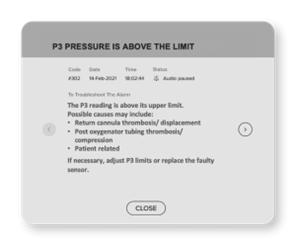

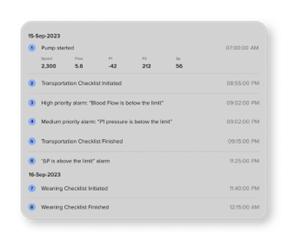

The INSPIRA™ ART100 system includes software that navigates the physician through the setup process and provides alerts while offering potential troubleshooting solutions. The system has a compact design, with extended battery life to support intra-hospital patient transfers between hospitals and is compatible with various disposable parts, allowing for customization of tubing and oxygenators, which simplifies purchasing and inventory management.

The HYLATM Blood Sensor

The HYLA blood sensor, described herein as the HYLA or HYLA blood sensor, is being designed to perform real-time sampling and analysis of key blood parameter measurements, without the need for blood draws. The HYLA is being designed to measure, in real-time, thousands of blood samples to be made accessible to physicians during a single ICU treatment or operating room procedure. The HYLA is being developed in its first configuration, HYLA 1, and is currently undergoing a clinical evaluation in patients undergoing open heart surgery, with a view to being submitted for 510(k) clearance in the second half of 2025.

The HYLA blood sensor is being designed to provide continuous, real-time monitoring of blood key parameters that can indicate oxygen deficiencies, without the need to take intermittent blood draws. Designed for patients undergoing medical procedures or needing frequent monitoring, this technology can detect sudden changes in medical conditions by tracking vital blood indicators.

Currently, the HYLA is undergoing clinical evaluation at Sheba Hospital in Israel, where it is being tested on six patients during open-heart procedures. The device is being developed to capture thousands of blood parameter measurements during a single procedure, with the data simultaneously validated against traditional blood analyzers and equipment.

We are developing the HYLA as both an integrated component of our INSPIRA ART100 and INSPIRA ART systems, and as a standalone device. This versatility may expand our market offering across multiple critical care applications and market segments.

Our development process combines in-house laboratory testing with hospital collaborations for clinical research. This comprehensive approach may allow for better validation of the technology in real-world medical settings, refinement of the sensor’s accuracy against industry standards, and optimization of the disposable components for practical clinical use.

We have a goal to set a new standard of care in various areas of patient care. As part of our strategy to reach these goals, and in parallel to pursuing regulatory approvals, we are actively working to establish collaborations with strategic partners and globally ranked health centers to provide endorsement and clinical adoption for regional deployments of our products and technologies. We plan to target ICUs, general medical units, operating theaters, and small urban and rural hospitals, with the goal of making our solutions more accessible to millions of patients.

We are an Israeli corporation based in Ra’anana, Israel, and were incorporated in Israel in 2018 under the name Clearx Medical Ltd. On April 10, 2018, our name was changed to Insense Medical Ltd. On July 30, 2020, our name was further changed to our current name, Inspira Technologies Oxy B.H.N. Ltd. Our principal executive offices are located at 2 Ha-Tidhar St., Ra’anana, 4366504 Israel. Our telephone number in Israel is +972 996 644 88. Our website address is www.inspira-technologies.com. The information contained on, or that can be accessed through, our website is not part of this annual report. We have included our website address in this annual report solely as an inactive textual reference.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain information included or incorporated by reference in this annual report on Form 20-F may be deemed to be “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. Forward-looking statements are often characterized by the use of forward-looking terminology such as “may,” “will,” “expect,” “anticipate,” “estimate,” “continue,” “believe,” “predict,” “should,” “intend,” “project” or other similar words, but are not the only way these statements are identified.

These forward-looking statements may include, but are not limited to, statements relating to our objectives, plans and strategies, statements that contain projections of results of operations or of financial condition, expected capital needs and expenses, statements relating to the research, development, completion and use of our products, and all statements (other than statements of historical facts) that address activities, events or developments that we intend, expect, project, believe or anticipate will or may occur in the future.

Forward-looking statements are not guarantees of future performance and are subject to risks and uncertainties. We have based these forward-looking statements on assumptions and assessments made by our management in light of their experience and their perception of historical trends, current conditions, expected future developments and other factors they believe to be appropriate.

Important factors that could cause actual results, developments and business decisions to differ materially from those anticipated in these forward-looking statements include, among other things:

| | ● | Our planned level of revenues and capital expenditures; |

| | ● | Our available cash and our ability to obtain additional funding; |

| | ● | Our ability to market and sell our products; |

| | ● | Our expectation regarding the sufficiency of our existing cash and cash equivalents to fund our current operations; |

| | ● | Our ability to advance the development of our products and future potential and product candidates; |

| | ● | Our ability to commercialize our products and future potential product candidates; |

| | ● | Our assessment of the potential of our products and future potential product candidates to treat certain indications; |

| | ● | Our planned level of capital expenditures and liquidity; |

| | ● | Our plans to continue to invest in research and development to develop technology for new products; |

| | ● | Our ability to maintain our relationships with suppliers, manufacturers, distributors and other partners; |

| | ● | Anticipated actions of the FDA, state regulators, if any, or other similar foreign regulatory agencies, including approval to conduct clinical trials, the timing and scope of those trials and the prospects for regulatory approval or clearance of, or other regulatory action with respect to our products or services; |

| | ● | The regulatory environment and changes in the health policies and regimes in the countries in which we intend to operate, including the impact of any changes in regulation and legislation that could affect the medical device industry; |

| | ● | Our ability to meet our expectations regarding the commercial supply of our products and future product candidates; |

| | ● | Our ability to retain key office holders; |

| | ● | Our ability to internally develop new inventions and intellectual property; |

| | ● | The overall global economic environment; |

| | ● | The impact of competition and new technologies; |

| | ● | The possible impacts of cybersecurity incidents on our business and operations; |

| | ● | General market, political and economic conditions in the countries in which we operate, including those related to the multi-front war risk that Israel faces; |

| | ● | The impact of competition and new technologies; |

| | ● | Our ability to internally develop new inventions and intellectual property; |

| | ● | Changes in our strategy; and |

Readers are urged to carefully review and consider the various disclosures made throughout this annual report on Form 20-F which are designed to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

You should not put undue reliance on any forward-looking statements. Any forward-looking statements in this annual report on Form 20-F are made as of the date hereof, and we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

In addition, the sections of this annual report on Form 20-F entitled “Introduction” and “Item 4. Information on the Company” contain information obtained from independent industry sources and other sources that we have not independently verified.

Unless otherwise indicated, all references to the “Company,” “we,” “our” and “Inspira” refer to Inspira Technologies Oxy B.H.N. Ltd. References to “U.S. dollars, “dollars,” and “$” are to currency of the United States of America, and references to “NIS” are to New Israeli Shekels.

Beginning with the year ended December 31, 2023, we transitioned from preparing and reporting our financial statements in accordance with the International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or IASB, to preparing and reporting our financial statements in accordance with generally accepted accounting principles in the United States, or U.S. GAAP, which may cause our financial results to differ from results, or impact the comparability to our financial statements, prepared in accordance with IFRS.

Notwithstanding the foregoing, we have retroactively converted the historical financial statements that were prepared in accordance with IFRS and included in this report to present such financial statements in accordance with U.S. GAAP.

All trademarks or trade names referred to in this Form 20-F are the property of their respective owners. Solely for convenience, the trademarks and trade names in this annual report on Form 20-F are referred to without the ® and ™ symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend the use or display of other companies’ trademarks and trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

This Form 20-F contains various depictions and illustrations of the various products we are developing. These illustrations are representative of the current expected designs for our products and are subject to change.

Summary Risk Factors

The risk factors described below are a summary of the principal risk factors associated with an investment in us. These are not the only risks we face. You should carefully consider these risk factors, together with the risk factors set forth in Item 3D. of this annual report on Form 20-F and the other reports and documents filed by us with the SEC.

| | ● | Our financial statements for the year ended December 31, 2024, contain an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern. This going concern assessment may prevent us from obtaining new financing on reasonable terms, if at all, and imperil our ability to continue operating as a going concern; |

| | ● | Our principal shareholders, officers and directors currently beneficially own approximately 18.01% of our securities and may therefore be able to exert control over matters submitted to our shareholders for approval; |

| | ● | We have a limited operating history, and we have incurred significant operating losses since our inception and anticipate that we will incur continued losses for the foreseeable future. |

| ● | On March 10, 2025, we received a written notice, or the Notice, from Nasdaq indicating that we were not in compliance with the minimum bid price requirement for continued listing set forth in Nasdaq Listing Rule 5550(a)(2), which requires listed securities to maintain a minimum bid price of $1.00 per share. Under Nasdaq Listing Rule 5810(c)(3)(A), we were granted a period of 180 calendar days to regain compliance with the minimum bid price requirement. No assurance can be given that we will remain eligible to be listed on Nasdaq. Any delisting could adversely affect our ability to obtain financing for the continuation of our operations and could result in the loss of confidence by investors, customers and employees. |

| | ● | We have not generated any revenue from product sales and may never be profitable. |

| | ● | We will need to raise substantial additional funding, which may not be available on acceptable terms, if at all. Failure to obtain funding on acceptable terms and on a timely basis may require us to curtail, delay or discontinue our product development efforts or other operations; |

| | ● | We are highly dependent on the successful development, marketing and sale of our products and on receiving the required regulatory approvals for such products; |

| | ● | Our success depends on our ability to generate demand for our products, develop and commercialize new products and generate revenues and identify new markets for our technology; |

| | ● | Medical device development is costly and involves continual technological change, which may render certain of our current or future products obsolete; |

| | ● | Our customer acquisition strategy may not succeed; |

| | ● | We are dependent upon third-party service providers. If such third-party service providers fail to maintain a high quality of service, the functionality of our products could be impaired, which in turn may adversely affect our products, business, operating results and reputation; |

| | ● | We may be exposed to foreign currency exchange rate fluctuations, which could adversely affect our results of operations; |

| | ● | We manage our business through a small number of employees and key consultants; |

| | ● | We may need to expand our company but we may experience difficulties in recruiting needed additional employees and consultants, which could disrupt our operations; |

| | ● | International expansion of our business exposes us to business, regulatory, political, operational, financial and economic risk associated with doing business outside of the United States, or U.S., or Israel; |

| | ● | If third-party payors do not provide adequate coverage and reimbursement for the use of our products or services or any future product candidates, our revenue will be negatively impacted; |

| | ● | Our products and operations are subject to extensive government regulation and oversight both in the U.S. and abroad and our failure to comply with applicable requirements could harm our business; |

| | ● | We may not receive, or may be delayed in receiving, the necessary clearances or approvals for our products and failure to timely obtain necessary clearances or approvals for our products would adversely affect our ability to grow our business; |

| | ● | Failure to comply with post-marketing regulatory requirements could subject us to enforcement actions, including substantial penalties, and might require us to recall or withdraw a product from the market; |

| | ● | Our products may cause or contribute to adverse medical events or be subject to failures or malfunctions that we are required to report to the FDA, and if we fail to do so, we would be subject to sanctions that could harm our reputation, business, financial condition and results of operations. The discovery of serious safety issues with our products, or a recall of our products either voluntarily or at the direction of the FDA or another governmental authority, could have a negative impact on us; |

| | ● | Healthcare legislative and regulatory reform measures may have a material adverse effect on our business and results of operations; |

| | ● | Legislative or regulatory reforms in the U.S. or the European Union, or the EU, may make it more difficult and costly for us to obtain regulatory clearances or approvals for our products or to manufacture, market or distribute our products after clearance or approval is obtained; |

| | ● | If we are unable to obtain and maintain effective patent rights for our products and services, we may not be able to compete effectively in our markets. If we are unable to protect the confidentiality of our trade secrets or know-how, such proprietary information may be used by others to compete against us; |

| | ● | We may be subject, directly or indirectly, to federal and state healthcare fraud and abuse laws, false claims laws and health information privacy and security laws. If we are unable to comply, or have not fully complied, with such laws, we could face substantial penalties; |

| | ● | Our business and operations might be adversely affected by security breaches, including any cybersecurity incidents; and |

| | ● | Potential political, economic and military instability in Israel, where our headquarters, members of our management team and our research and development facilities are located, may adversely affect our results of operations. |

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

| B. | Capitalization and Indebtedness. |

Not applicable.

| C. | Reasons for the Offer and Use of Proceeds. |

Not applicable.

D. Risk Factors

You should carefully consider the risks and uncertainties described below, together with all of the other information in this annual report on Form 20-F. If any of these risks actually occurs, our business and financial condition could suffer, and the price of our securities could decline.

Risks Related to Our Business and Industry

We are highly dependent on the successful development, marketing and sale of our products and on receiving the required regulatory approvals.

Our products, focused on the treatment of respiratory failure, are the basis of our business. As a result, the success of our business plan is highly dependent on our ability to develop, manufacture and commercialize our products, and our failure to do so could cause our business to fail. Successful commercialization of medical devices is a complex and uncertain process, dependent on the efforts of management, manufacturers, local operators, integrators, medical professionals, third-party payors, as well as general economic conditions, among other factors. Any factor that adversely impacts the development and commercialization of our products, will have a negative impact on our business, financial condition, results of operations and prospects. We have limited experience in commercializing our products and we may face several challenges with respect to our commercialization efforts, including, among others, that:

| | ● | we may not have adequate financial or other resources to complete the development of our products; |

| | ● | we may not be able to manufacture our products in commercial quantities, at an adequate quality or at an acceptable cost; |

| | ● | we may not be able to establish adequate sales, marketing and distribution channels; |

| | ● | healthcare professionals and patients may not accept our products; |

| | ● | we may not be aware of possible complications from the continued use of our products since we have limited clinical experience with respect to the actual use of our products; |

| | ● | we may not be able to compete with existing solutions for respiratory failure; |

| | ● | technological breakthroughs in the respiratory support solutions may reduce the demand for our products; |

| | ● | third-party payors may not agree to reimburse patients for any or all of the purchase price of our products, which may adversely affect patients’ willingness to use our products; |

| | ● | we may face third-party claims of intellectual property infringement; and |

| | ● | we may fail to obtain or maintain regulatory clearance or approvals in our target markets or may face adverse regulatory or legal actions even if regulatory approval is obtained. |

If we are unable to meet any one or more of these challenges successfully, our ability to effectively commercialize our products and services could be limited, which in turn could have a material adverse effect on our business, financial condition and results of operations.

Our success depends upon market acceptance of our products, our ability to develop and commercialize new products and generate revenues and our ability to identify new markets for our technology.

We have developed, and are engaged in the development of, respiratory support technology. Our success will depend on the approval and acceptance of our products and any future products in the healthcare market. We are faced with the risk that the marketplace will not be receptive to our products or any future products over competing products and that we will be unable to compete effectively. Factors that could affect our ability to successfully commercialize our current and any potential future products:

| | ● | the challenges of developing (or acquiring externally developed) technology solutions that are adequate and competitive in meeting the requirements of next-generation design challenges; and |

| | ● | the dependence upon referrals from physicians for the sale of our products and provision of our service. |

We cannot assure that our products or any future products will gain broad market acceptance. If the market for our products fails to develop or develops more slowly than expected, our business and operating results would be materially and adversely affected.

If we fail to maintain existing strategic relationships with Innovimed, Glo-Med, our other distributors, or are unable to identify additional distributors of our products or any future products and technologies, our revenues may decrease.

We currently expect to record revenue through our strategic relationships and distribution agreements with Innovimed Sp. z o.o, or Innovimed, Bepex Ltd., or Bepex, Anita Técnica S.L, or WAAS Group, Glo-Med Networks Inc., or Glo-Med, and CIO MED GROUP, CORP, or CIO MED GROUP, as well as other distributors for the deployment of our products. If our relationships with our distributors are terminated or impaired for any reason and we are unable to replace these relationships with other means of distribution, we could suffer a material decrease in revenues.

We may need, or decide it is otherwise advantageous to us, to obtain the assistance of additional distributors to market and distribute our future products and technologies, as well as to market and distribute our INSPIRA ART system, INSPIRA ART100 system, HYLA blood sensors, and Inspira disposable devices to existing or new markets or geographical areas. We may not be able to find additional distributors who will agree to and are able to successfully market and distribute our systems and technologies on commercially reasonable terms, if at all. If we are unable to establish additional distribution relationships on favorable terms, our revenues may decline. In addition, our distributors may choose to favor the products of our competitors over ours and give preference to them.

Pursuant to our agreements with the aforementioned distributors, we will be responsible for obtaining and maintaining any and all regulatory approvals for our products. If we are unable to obtain or maintain such approvals, or if the parties to the distribution agreement fail to purchase the agreed upon products at the agreed upon pricing, it may adversely impact our relationships with these distributors, and we may never realize any revenues from these agreements ships as a result.

Medical device development is costly and involves continual technological change which may render our current or future products obsolete.

The market for medical device technologies and products is characterized by factors such as rapid technological change, medical advances, changing consumer requirements, short device lifecycles, changing regulatory requirements and evolving industry standards. Any one of these factors could reduce the demand for our devices or require substantial resources and expenditures for, among other things, research, design and development, to avoid technological or market obsolescence.

Our success will depend on our ability to enhance our current technology and develop or acquire new technologies to keep pace with technological developments and evolving industry standards, while responding to changes in customer needs. A failure to adequately develop or acquire device enhancements or new devices that will address changing technologies and customer requirements adequately, or to introduce such devices on a timely basis, may have a material adverse effect on our business, financial condition and results of operations.

We might have insufficient financial resources to improve our products, advance technologies and develop new devices at competitive prices. Technological advances by one or more competitors or future entrants into the field may result in our present services or devices becoming non-competitive or obsolete, which may decrease revenues and profits and adversely affect our business and results of operations.

We may encounter significant competition across our product lines and in each market in which we will sell our products and services from various companies, some of which may have greater financial and marketing resources than we do. Our competitors may include any companies engaged in the research, development, manufacture, and marketing of respiratory support solutions and technologies, as well as a wide range of medical device companies that sell a single or limited number of competitive products and services or participate in only a specific market segment.

Our customer acquisition strategy may not succeed and although we have executed distribution agreements with various parties in various geographic region, we may never realize any revenues from such agreements.

Our business will be dependent upon success in our customer acquisition strategy. To date, we have executed various distribution agreements in various geographic regions which are subject to regulatory approvals. If we do not obtain regulatory approval, or if the parties to the distribution agreement fail to purchase the agreed upon products at the agreed upon pricing, we may not realize any revenues from such agreements.

In addition, if we fail to maintain a high quality of device technology, we may fail to retain or add new customers. If we fail, our revenue, financial results and business may be significantly harmed. Our future success depends upon expanding our commercial operations in the U.S., Israel and Europe, as well as entering additional markets to commercialize our products and any future products. We believe that our expanded growth will depend on the further development, regulatory approval and commercialization of our products. If we fail to expand the use of our products in a timely manner, we may not be able to expand our markets or to grow our revenue, and our business may be adversely impacted. If people do not perceive our products to be useful and reliable, we may not be able to attract or retain new customers. A decrease in costumer growth could render less attractive to developers, which may have a material and adverse impact on our revenue, business, financial condition and results of operations.

Our business and operations would suffer in the event of computer system failures, cyber-attacks or a deficiency in our cybersecurity.

Despite the implementation of security measures intended to secure our data against impermissible access and to preserve the integrity and confidentiality of our data, our internal computer systems, and those of third parties on which we rely, are vulnerable to damage from computer viruses, malware, natural disasters, terrorism, war, telecommunication and electrical failures, cyber-attacks or cyber-intrusions, attachments to emails, persons inside our organization, or persons with access to systems inside our organization. The risk of a security breach or disruption, particularly through cyber-attacks or cyber intrusion, including by computer hackers, foreign governments, and cyber terrorists, has generally increased as the number, intensity and sophistication of attempted attacks and intrusions from around the world have increased. If such an event were to occur and cause interruptions to our operations, it could result in a material disruption of our drug development programs. For example, the loss of clinical trial data from completed or ongoing or planned clinical trials could result in delays in our regulatory approval efforts and significantly increase our costs to recover or reproduce the data. To the extent that any disruption or security breach was to result in a loss of or damage to our data or applications, or inappropriate disclosure of confidential or proprietary information, we could incur material legal claims and liability, including under data privacy laws such as the General Data Protection Regulation, or the GDPR, damage to our reputation, and the further development of our drug candidates could be delayed.

We are dependent upon third-party manufacturers and suppliers, which makes us vulnerable to potential supply shortages and problems, increased costs and quality or compliance issues, any of which could harm our business.

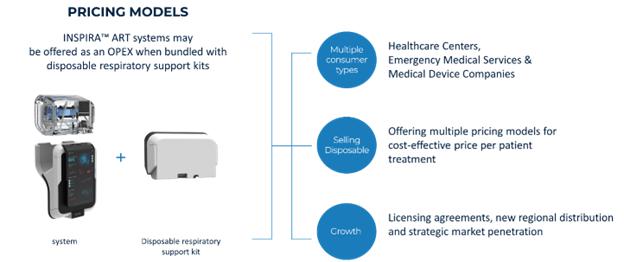

Our products are comprised of multiple components. We are planning to sell an assembled product as well as its disposable respiratory support unit. The components of the assembled product and the disposable unit consist of both proprietary and off the shelf components. Proprietary components will be manufactured on our behalf at good manufacturing practices, or GMP, approved production plant to adhere to regulatory requirements, whereas off the shelf components will be sourced and manufactured by GMP suppliers. GMP sub-contractors will assemble proprietary and off the shelf components together to create our products.

Therefore, we rely on third parties to manufacture and supply us with proprietary custom components. Although we rely on a number of suppliers who provide us materials and components as well as manufacture and assemble certain components of our products, we do not rely on single-source suppliers. Our suppliers may encounter problems during manufacturing for a variety of reasons, including, for example, failure to follow specific protocols and procedures, failure to comply with applicable legal and regulatory requirements, equipment malfunction and environmental factors, failure to properly conduct their own business affairs, and infringement of third-party intellectual property rights, any of which could delay or impede their ability to meet our requirements. Our reliance on these third-party suppliers also subjects us to other risks that could harm our business, including:

| | ● | we are not currently a major customer of many of our suppliers, and these suppliers may therefore prioritize other customers’ needs; |

| | ● | we may not be able to obtain an adequate supply in a timely manner or on commercially reasonable terms; |

| | ● | our suppliers, especially new suppliers, may make errors in manufacturing that could negatively affect the efficacy or safety of our products or cause delays in shipment; |

| | ● | we may have difficulty locating and qualifying alternative suppliers; |

| | ● | switching components or suppliers may require product redesign and possibly submission to the FDA or other similar foreign regulatory agencies, which could impede or delay our commercial activities; |

| | ● | one or more of our suppliers may be unwilling or unable to supply components of our products; |

| | ● | the occurrence of a fire, natural disaster or other catastrophe impacting one or more of our suppliers may affect their ability to deliver products to us in a timely manner; and |

| | ● | our suppliers may encounter financial or other business hardships unrelated to our demand, which could inhibit their ability to fulfill our orders and meet our requirements. |

We may not be able to quickly establish additional or alternative suppliers, if necessary, in part because we may need to undertake additional activities to establish such suppliers as required by the regulatory approval process. Any interruption or delay in obtaining products from our third-party suppliers, or our inability to obtain products from qualified alternate sources at acceptable prices in a timely manner, could impair our ability to meet the demand of our customers and cause them to switch to competing products. Given our reliance on certain suppliers, we may be susceptible to supply shortages while looking for alternate suppliers.

We have limited manufacturing history on which to assess the prospects for our business and we anticipate that we will incur significant losses once we initiate our in-house manufacturing until we are able to successfully commercialize our products globally.

If our future manufacturing operation or any current or future contracted manufacturing operations become unreliable or unavailable, we may not be able to proceed with our intended business operations and our entire business plan could fail. There is no assurance that our manufacturing operation or any third-party manufacturers will be able to meet commercialized scale production requirements in a timely manner or in accordance with applicable standards.

We may not be able to replace our manufacturing capabilities in a timely manner.

If our future manufacturing facility or any current or future contracted manufacturing operations suffer any type of prolonged interruption, whether caused by regulator action, equipment failure, critical facility services (such as water purification, clean steam generation or building management and monitoring system), fire, natural disaster or any other event that causes the cessation of manufacturing activities, we may be exposed to long-term loss of sales and profits. There are limited facilities which are capable of contract manufacturing some of our products and product candidates. Replacement of our current manufacturing capabilities may have a material adverse effect on our business and financial condition.

We are dependent upon third-party service providers. If such third-party service providers fail to maintain a high quality of service, the utility of our products could be impaired, which could adversely affect the penetration of our products, our business, operating results and reputation.

The success of certain services and products that we provide are dependent upon third-party service providers. Such service providers include manufacturers of proprietary custom components for our products. As we expand our commercial activities, an increased burden will be placed upon the quality of such third-party providers. If third-party providers fail to maintain a high quality of service, our products, business, reputation and operating results could be adversely affected. In addition, poor quality of service by third-party service providers could result in liability claims and litigation against us for damages or injuries.

Non-U.S. governments often impose strict price controls, which may adversely affect our future profitability.

We may be subject to rules and regulations in the U.S. and non-U.S. jurisdictions relating to our products or any future products. In some countries, including countries of the EU, each of which has developed its own rules and regulations, pricing may be subject to governmental control under certain circumstances. In these countries, pricing negotiations with governmental agencies can take considerable time after the receipt of marketing approval for a medical device candidate. To obtain reimbursement or pricing approval in some countries, we may be required to conduct a clinical trial that compares the cost-effectiveness of our product to other available products. If reimbursement of our products is unavailable or limited in scope or amount, or if pricing is set at unsatisfactory levels, we may be unable to achieve or sustain profitability.

We manage our business through a small number of employees and key consultants.

As of March 3, 2025, we had 38 full-time employees (including our senior management team), seven part-time employees, and two additional independent contractors and consultants. Our future growth and success depend to a large extent on the continued services of members of our current management including, in particular, Dagi Ben-Noon, our chief executive Officer, and Joe Hayon, our president. Any of our employees and consultants may leave our company at any time, subject to certain notice periods. The loss of the services of any of our executive officers or any key employees or consultants would adversely affect our ability to execute our business plan and harm our operating results. Our operational success will substantially depend on the continued employment of senior executives, technical staff and other key personnel. The loss of key personnel may have an adverse effect on our operations and financial performance.

We may need to expand our organization and we may experience difficulties in recruiting needed additional employees and consultants, which could disrupt our operations.

As our development and commercialization plans and strategies develop and because we are leanly staffed, we may need additional managerial, operational, sales, marketing, financial, legal and other resources. The competition for qualified personnel in the medical device industry is intense. Due to this intense competition, we may be unable to attract and retain qualified personnel necessary for the development of our business or to recruit suitable replacement personnel.

Our management may need to divert its attention away from our day-to-day activities and devote a substantial amount of time to managing these growth activities. We may not be able to effectively manage the expansion of our operations, which may result in weaknesses in our infrastructure, operational mistakes, loss of business opportunities, loss of employees and reduced productivity among remaining employees. Our expected growth could require significant capital expenditures and may divert financial resources from other projects, such as the development of additional medical device products. If our management is unable to effectively manage our growth, our expenses may increase more than expected, our ability to generate and/or grow revenue could be reduced and we may not be able to implement our business strategy. Our future financial performance and our ability to commercialize medical device products and services and compete effectively will depend, in part, on our ability to effectively manage any future growth.

International expansion of our business exposes us to business, regulatory, political, operational, financial and economic risks associated with doing business outside of the U.S. or Israel.

Other than our headquarters and other operations which are located in Israel (as further described below), our business strategy incorporates significant international expansion, particularly in anticipated expansion of regulatory approvals of our products. Doing business internationally involves a number of risks, including but not limited to:

| | ● | multiple, conflicting and changing laws and regulations such as privacy regulations, tax laws, export and import restrictions, employment laws, regulatory requirements and other governmental approvals, permits and licenses; |

| | ● | failure by us to obtain regulatory approvals for the use of our products and services in various countries; |

| | ● | additional potentially relevant third-party patent rights; |

| | ● | complexities and difficulties in obtaining protection and enforcing our intellectual property; |

| | ● | difficulties in staffing and managing foreign operations; |

| | ● | complexities associated with managing multiple regulatory, governmental and reimbursement regimes; |

| | ● | limits in our ability to penetrate international markets; |

| | ● | financial risks, such as longer payment cycles, difficulty collecting accounts receivable, the impact of local and regional financial crises on demand and payment for our products and exposure to foreign currency exchange rate fluctuations; |

| | ● | natural disasters, political and economic instability, including wars, terrorism and political unrest, outbreak of disease, boycotts, curtailment of trade and other business restrictions; |

| | ● | certain expenses including, among others, expenses for travel, translation and insurance; and |

| | ● | regulatory and compliance risks that relate to maintaining accurate information and control over sales and activities that may fall within the purview of the U.S. Foreign Corrupt Practices Act, its books and records provisions or its anti-bribery provisions. |

Any of these factors could significantly harm our future international expansion and operations and, consequently, our results of operations.

We face intense competition, and we may be unable to effectively compete in our industry.

The market participants in the ICU and the acute respiratory care space include Boston Scientific Corporation (NYSE: BSX), ResMed Inc., (NYSE: RMD), Masimo Corporation (Nasdaq: MASI), Becton, Dickinson and Company (NYSE: BDX), Chart Industries, Inc. (Nasdaq: GTLS), Philips Healthcare, Medtronic plc (NYSE: MDT), Fisher & Paykel Healthcare Corporation Limited, Drägerwerk AG & Co. KGaA, Drägerwerk AG, Hamilton Medical AG, Smiths Medical Inc. (acquired by ICU Medical Inc.), Siemens Healthineers AG ADR (OTCMKTS: SMMNY), Baxter International (NYSE: BAX), Getinge AB (OTCMKTS: GNGBY), GE HealthCare, Terumo Corporation (TYO: 4543, Nikkei 225 Component), LivaNova PLC (Nasdaq: LIVN), Fresenius SE & Co. KGaA (OTCMKTS: FSNUY), Johnson & Johnson (NYSE: JNJ), Zoll Medical Corporation (TYO: 3407 ), Resuscitec GmbH, Spectrum Medical Limited, Abiomed, Inc. (Nasdaq: ABMD), Abbott Laboratories (NYSE: ABT), DataMed s.r.l, Chalice Medical Ltd., APMTD Global Limited, Eurosets s.r.l. and Braile Biomedica. These companies have either developed or acquired respiratory care devices and solutions, such as ventilators, ECMO devices and blood sensors.

The aforementioned companies, have substantially greater brand recognition, research and development, and regulatory capabilities, as well as financial, technical, manufacturing, marketing and human resources than we do and significantly greater experience and infrastructure in the research and development of medical devices, obtaining FDA and other regulatory clearances of those devices and commercializing those devices around the world. Further, some of these companies hold significant market share. Their dominant market position and significant control over the market could significantly limit our ability to introduce or effectively market and generate sales of our products.

Many of our competitors have long histories and strong reputations within the industry. They have significantly greater brand recognition, financial and human resources than we do. They also have more experience and capabilities in researching and developing testing devices, obtaining and maintaining regulatory clearances and other requirements, manufacturing and marketing those products than we do. There is a significant risk that we may be unable to overcome the advantages held by our competition, and our inability to do so could lead to the failure of our business. In addition, we may be unable to develop additional products in the future or to keep pace with developments and innovations in the market and lose market share to our competitors.

Competition in the medical devices and more specifically respiratory support technologies and solutions markets is intense, which can lead to, among other things, price reductions, longer selling cycles, lower product margins, loss of market share and additional working capital requirements. To succeed, we must, among other critical matters, gain consumer acceptance for our products, as compared to other solutions currently available in the market for the treatment of respiratory failure and potential future medical devices incorporating our principal technology or offering other advanced respiratory support solutions. If our competitors offer significant discounts on certain products and solutions, we may need to lower our prices or offer other favorable terms in order to compete successfully. Moreover, any broad-based changes to our prices and pricing policies could make it difficult to generate revenues or cause our revenues to decline. Moreover, if our competitors develop and commercialize products and solutions that are more effective or desirable than products and solutions that we may develop, we may not convince our customers to use our products and solutions. Any such changes would likely reduce our commercial opportunity and revenue potential and could materially adversely impact our operating results.

If third-party payors do not provide adequate coverage and reimbursement for the use of our products or any future products, our revenue will be negatively impacted.

Our products are not yet approved for third-party payor coverage or reimbursement. Such reimbursement may vary based on the particular device used in providing services and is based on the identity of the third-party. Our ability to obtain and maintain a leading position in the medical device market, and specifically in the respiratory care market, depends on our relationships with private third parties.

We expect to engage with private third parties to allow our customers to receive reimbursement from insurance companies for our products. The loss of a significant number of private third-party contracts may have an adverse effect on our revenues, which could have an adverse effect on our business, financial condition and results of operations. Over the past few years, reimbursement rates from certain third parties have declined, in some cases significantly. There can be no assurance that this trend will not continue or apply on more third parties.

In addition, private third parties may not reimburse any new products offered by us or reimburse those new products at commercially viable rates. The failure to receive reimbursement at adequate levels for our existing or future products may adversely affect demand for those products, our revenues and expected growth. This could have an adverse effect on our business, financial condition and results of operations.

We may be subject to litigation for a variety of claims, which could adversely affect our results of operations, harm our reputation or otherwise negatively impact our business.

We may be subject to litigation for a variety of claims arising from our normal business activities. These may include claims, suits, and proceedings involving labor and employment, wage and hour, commercial and other matters. The outcome of any litigation, regardless of its merits, is inherently uncertain. Any claims and lawsuits, and the disposition of such claims and lawsuits, could be time-consuming and expensive to resolve, divert management attention and resources, and lead to attempts on the part of other parties to pursue similar claims. Any adverse determination related to litigation could adversely affect our results of operations, harm our reputation or otherwise negatively impact our business. In addition, depending on the nature and timing of any such dispute, a resolution of a legal matter could materially affect our future operating results, our cash flows or both.

We could become subject to product liability, warranty or similar claims and product recalls that could be expensive, divert management’s attention and harm our business reputation and financial results.

Our business exposes us to an inherent risk of potential product liability, warranty or similar claims and product recalls. The medical device industry has historically been litigious, and we face financial exposure to product liability, warranty or similar claims if the use of any of our products were to cause or contribute to injury or death. There is also the possibility that defects in the design or manufacture of any of our products might necessitate a product recall. Although we maintain product liability insurance, the coverage limits of these policies may not be adequate to cover future claims. In the future, we may be unable to maintain product liability insurance on acceptable terms or at reasonable costs and such insurance may not provide us with adequate coverage against potential liabilities. A product liability claim, regardless of merit or ultimate outcome, or any product recall could result in substantial costs to us, damage to our reputation, customer dissatisfaction and frustration and a substantial diversion of management attention. A successful claim brought against us in excess of, or outside of, our insurance coverage could have a material adverse effect on our business, financial condition and results of operations.

Our business may be impacted by changes in general economic conditions.

Our business is subject to risks arising from changes in domestic and global economic conditions, including adverse economic conditions in markets in which we operate, which may harm our business.

Disruption to the global economy could also result in a number of follow-on effects on our business, including a possible slow-down resulting from lower customer expenditures; inability of customers to pay for products, solutions or services on time, if at all; more restrictive export regulations which could limit our potential customer base; negative impact on our liquidity, financial condition and share price, which may impact our ability to raise capital in the market, obtain financing and secure other sources of funding in the future on terms favorable to us.

In addition, the occurrence of catastrophic events, such as hurricanes, storms, earthquakes, tsunamis, floods, epidemics and other catastrophes that adversely affect the business climate in any of our markets could have a material adverse effect on our business, financial condition and results of operations. Some of our operations are located in areas that have been in the past, and may be in the future, susceptible to such occurrences.

Unstable market and economic conditions may have serious adverse consequences on our business, financial condition and share price.

The global economy, including credit and financial markets, has experienced extreme volatility and disruptions, including severely diminished liquidity and credit availability, declines in consumer confidence, declines in economic growth, increases in unemployment rates, increases in inflation rates and uncertainty about economic stability. Any such volatility and disruptions may have adverse consequences on us or the third parties on whom we rely. If the equity and credit markets deteriorate, including as a result of political unrest or war, it may make any necessary debt or equity financing more difficult to obtain in a timely manner or on favorable terms, more costly or more dilutive. Further, inflation can adversely affect us by increasing our costs. Increased cost of living around the world has caused and may cause increased costs, such as higher wages, increase direct service costs, increased freight costs and costs of components, and higher manufacturing costs. Any significant increases in inflation and related increase in interest rates could have a material adverse effect on our business, results of operations and financial condition.

We incur significant increased costs as a result of the listing of our securities for trading on Nasdaq. Our management is required to devote substantial time to new compliance initiatives as well as compliance with ongoing U.S. requirements.

As a public company in the U.S., we incur additional significant accounting, legal and other expenses that we did not incur prior to being a public company in the U.S. We also incur costs associated with corporate governance requirements of the SEC, as well as requirements under Section 404 and other provisions of the Sarbanes-Oxley Act. These rules and regulations increase our legal and financial compliance costs, introduce new costs such as investor relations, stock exchange listing fees and shareholder reporting, and make some activities more time consuming and costly. The implementation and testing of such processes and systems may require us to hire outside consultants and incur other significant costs. Any future changes in the laws and regulations affecting public companies in the U.S., including Section 404 and other provisions of the Sarbanes-Oxley Act, and the rules and regulations adopted by the SEC, for so long as they apply to us, will result in increased costs to us as we respond to such changes. These laws, rules and regulations could make it more difficult or more costly for us to obtain certain types of insurance, including director and officer liability insurance, and we may be forced to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. The impact of these requirements could also make it more difficult for us to attract and retain qualified persons to serve on our board of directors, our board committees, or as executive officers.

We could fail to maintain the listing of our securities on Nasdaq, which could seriously harm the liquidity of our shares and our ability to raise capital.

Companies trading on Nasdaq, such as our Company, must be reporting issuers under Section 12 of the Exchange Act, and must meet the listing requirements in order to maintain the listing of its shares on the Nasdaq Capital Market. If we do not meet these requirements, the market liquidity for our securities could be severely adversely affected by limiting the ability of broker-dealers to sell our securities and the ability of shareholders to sell their securities in the secondary market.

On March 10, 2025, we received a written notice, or the Notice, from Nasdaq indicating that we are not in compliance with the minimum bid price requirement for continued listing set forth in Nasdaq Listing Rule 5550(a)(2), which requires listed securities to maintain a minimum bid price of $1.00 per share. Under Nasdaq Listing Rule 5810(c)(3)(A), we were granted a period of 180 calendar days to regain compliance with the minimum bid price requirement, or until September 8, 2025. There is a risk that we could be subject to additional notices of delisting for failure to comply with Nasdaq Listing Rule 5550(a)(2) or other Nasdaq Listing Rules and no assurance can be given that we will remain eligible to be listed on Nasdaq. If we do not regain compliance with Nasdaq Listing Rule 5550(a)(2), our Ordinary Shares will be subject to delisting. A delisting from Nasdaq would likely result in a reduction in some or all of the following, each of which could have a material adverse effect on shareholders:

| ● | the liquidity of our Ordinary Shares; |

| ● | the market price of our Ordinary Shares; |

| ● | the availability of information concerning the trading prices and volume of our Ordinary Shares; |

| ● | our ability to obtain financing or complete a strategic transaction; |

| ● | the number of institutional and other investors that will consider investing in our Ordinary Shares; and |

| ● | the number of market markers or broker-dealers for our Ordinary Shares. |

We intend to monitor the closing bid price of our Ordinary Shares and may, if appropriate, consider implementing available options to regain compliance with the minimum bid price rule under the Nasdaq Listing Rules, including initiating a reverse stock split.

If we are not able to attract and retain highly skilled managerial, scientific, technical and marketing personnel, we may not be able to implement our business model successfully.

Our success depends in part on our continued ability to attract, retain and motivate highly qualified management, clinical and scientific personnel. We are highly dependent upon our senior management as well as other employees, consultants and scientific and medical collaborators. Our management team must be able to act decisively to apply and adapt our business model in the rapidly changing markets in which we will compete. In addition, we will rely upon technical and scientific employees or third-party contractors to effectively establish, manage and grow our business. Consequently, we believe that our future viability will depend largely on our ability to attract and retain highly skilled managerial, sales, scientific and technical personnel. In order to do so, we may need to pay higher compensation or fees to our employees or consultants than currently expected and such higher compensation payments may have a negative effect on our operating results. Competition for experienced, high-quality personnel in the medical device field is intense. We may not be able to hire or retain the necessary personnel to implement our business strategy. Our failure to hire and retain quality personnel on acceptable terms could impair our ability to develop new products and services and manage our business effectively.

If we engage in future acquisitions or strategic partnerships, this may increase our capital requirements, dilute our shareholders, cause us to incur debt or assume contingent liabilities, and subject us to other risks.

We may evaluate various acquisition opportunities and strategic partnerships, including licensing or acquiring complementary products, intellectual property rights, technologies or businesses. Any potential acquisition or strategic partnership may entail numerous risks, including:

| | ● | increased operating expenses and cash requirements; |

| | ● | the assumption of additional indebtedness or contingent liabilities; |

| | ● | the issuance of our equity securities; |

| | ● | assimilation of operations, intellectual property and products of an acquired company, including difficulties associated with integrating new personnel; |

| | ● | the diversion of our management’s attention from our existing product programs and initiatives in pursuing such a strategic merger or acquisition; |

| | ● | retention of key employees, the loss of key personnel and uncertainties in our ability to maintain key business relationships; |

| | ● | risks and uncertainties associated with the other party to such a transaction, including the prospects of that party and their existing products or product candidates and marketing approvals; and |

| | ● | our inability to generate revenue from acquired technology and/or products sufficient to meet our objectives in undertaking the acquisition or even to offset the associated acquisition and maintenance costs. |

We are subject to certain U.S. and foreign anticorruption, anti-money laundering, export control, sanctions and other trade laws and regulations. We can face serious consequences for violations.

Among other matters, U.S. and foreign anticorruption, anti-money laundering, export control, sanctions and other trade laws and regulations, which are collectively referred to as Trade Laws, prohibit companies and their employees, agents, clinical research organizations, legal counsel, accountants, consultants, contractors and other partners from authorizing, promising, offering, providing, soliciting or receiving, directly or indirectly, corrupt or improper payments or anything else of value to or from recipients in the public or private sector. Violations of Trade Laws can result in substantial criminal fines and civil penalties, imprisonment, the loss of trade privileges, debarment, tax reassessments, breach of contract and fraud litigation, reputational harm, and other consequences. We have direct or indirect interactions with officials and employees of government agencies or government-affiliated hospitals, universities and other organizations. We also expect our non-U.S. activities to increase over time. We plan to engage third parties for clinical trials and/or to obtain necessary permits, licenses, patent registrations and other regulatory approvals, and we can be held liable for the corrupt or other illegal activities of our personnel, agents or partners, even if we do not explicitly authorize or have prior knowledge of such activities.

Our business and operations might be adversely affected by security breaches, including any cybersecurity incidents.

We depend on the efficient and uninterrupted operation of our computer and communications systems, and those of our consultants, contractors and vendors, which we use for, among other things, sensitive company data, including our intellectual property, financial data and other proprietary business information.

While certain of our operations have business continuity and disaster recovery plans and other security measures intended to prevent and minimize the impact of IT-related interruptions, our IT infrastructure and the IT infrastructure of our consultants, contractors and vendors are vulnerable to damage from cyberattacks, computer viruses, unauthorized access, electrical failures and natural disasters or other catastrophic events. We could experience failures in our information systems and computer servers, which could result in an interruption of our normal business operations and require substantial expenditure of financial and administrative resources to remedy. System failures, accidents or security breaches can cause interruptions in our operations and can result in a material disruption of our product development activities and other business operations. The loss of data from completed or future studies or clinical trials could result in delays in our research, development or regulatory approval efforts and significantly increase our costs to recover or reproduce the data. To the extent that any disruption or security breach were to result in a loss of, or damage to, our data or applications, or inappropriate disclosure of confidential or proprietary information, we could incur regulatory investigations and redresses, penalties and liabilities and the development of our products could be delayed or otherwise adversely affected.

Even though we believe we carry commercially reasonable business interruption and liability insurance, we may suffer losses as a result of business interruptions that exceed the coverage available under our insurance policies or for which we do not have coverage. For example, we are not insured against terrorist or cyber-attacks. Any natural disaster or catastrophic event could have a significant negative impact on our operations and financial results. Moreover, any such event could delay the development of our products.

Changes in laws or regulations relating to data protection, or any actual or perceived failure by us to comply with such laws and regulations or our privacy policies, could materially and adversely affect our business or could lead to government enforcement actions and significant penalties against us, and adversely impact our operating results.

We expect to receive health information and other highly sensitive or confidential information and data of patients and other third parties (e.g., healthcare providers who refer patients for scans), which we expect to compile and analyze. Collection and use of this data might raise privacy and data protection concerns, which could negatively impact our business. There are numerous federal, state and international laws and regulations regarding privacy, data protection, information security, and the collection, storing, sharing, use, processing, transfer, disclosure, and protection of personal information and other data, and the scope of such laws and regulations may change, be subject to differing interpretations, and may be inconsistent among countries and regions we intend to operate in (e.g., the U.S., the EU and Israel), or conflict with other laws and regulations. The regulatory framework for privacy and data protection worldwide is, and is likely to remain for the foreseeable future, uncertain and complex, and this or other actual or alleged obligations may be interpreted and applied in a manner that we may not anticipate or that is inconsistent from one jurisdiction to another and may conflict with other rules or practices including ours. Further, any significant change to applicable laws, regulations, or industry practices regarding the collection, use, retention, security, or disclosure of data, or their interpretation, or any changes regarding the manner in which the consent of relevant users for the collection, use, retention, or disclosure of such data must be obtained, could increase our costs and require us to modify our services and candidate products, possibly in a material manner, which we may be unable to complete, and may limit our ability to store and process patients’ data or develop new services and features.

In particular, we will be subject to U.S. data protection laws and regulations (i.e., laws and regulations that address privacy and data security) at both the federal and state levels. The legislative and regulatory landscape for data protection continues to evolve, and in recent years there has been an increasing focus on privacy and data security issues. Numerous federal and state laws, including state data breach notification laws, state health information privacy laws, and federal and state consumer protection laws, govern the collection, use, and disclosure of health-related and other personal information. Failure to comply with such laws and regulations could result in government enforcement actions and create liability for us (including the imposition of significant civil or criminal penalties), private litigation and/or adverse publicity that could negatively affect our business. For instance, California enacted the California Consumer Privacy Act, or the CCPA, on June 28, 2018, which took effect on January 1, 2020. The CCPA creates individual privacy rights for California consumers and increases the privacy and security obligations of entities handling certain personal data. The CCPA provides for civil penalties for violations, as well as a private right of action for data breaches that is expected to increase data breach litigation. The CCPA may increase our compliance costs and potential liability, and many similar laws have been proposed at the federal level and in other states.