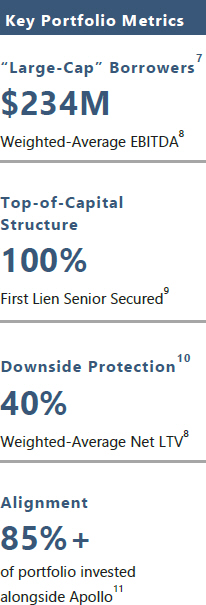

ALIGNMENT: Since Apollo’s merger with retirement services business Athene, Apollo is often among the largest investors in its own funds. ADS invests alongside a number of Apollo’s direct lending funds where Apollo/Athene also have exposure, and these investments make up greater than 85% of ADS’ portfolio, showcasing Apollo’s willingness to invest alongside its third-party investors.11

KEY TRANSACTIONS IN 3Q2416

In July 2024, Apollo served as a Lead Arranger on a $1.85 billion first lien term loan to R.R. Donnelley to fund an acquisition. Following this deal, Apollo also participated in a $775 million first lien term loan as part of a broader $2.3 billion financing to repay the previous facility and refinance R.R. Donnelley’s existing debt. R.R. Donnelley is a global commercial printing company that publishes manuals, brochures, marketing materials, packaging and business cards. As an incumbent lender, Apollo had a pivotal role in the transaction.

In August 2024, Apollo served as agent on a credit facility for Jensen Hughes to refinance its existing debt. Jensen Hughes is a provider of fire protection engineering and other risk-based engineering and consulting services. Due to Apollo’s strong relationship with the sponsor, Apollo was able to play a meaningful role in the deal.

In September 2024, Apollo served as the Sole Lead Arranger on a €269 million first lien term loan to Ardagh Metal Packaging (“AMP”), a subsidiary of Ardagh Group SA. The loan proceeds were used to finance general corporate purposes. Due to our relationship with AMP from incumbency in other parts of the capital structure, Apollo was able to exclusively lead and commit to the transaction.

OUTLOOK

ADS participated alongside other Apollo funds in all of the above transactions.

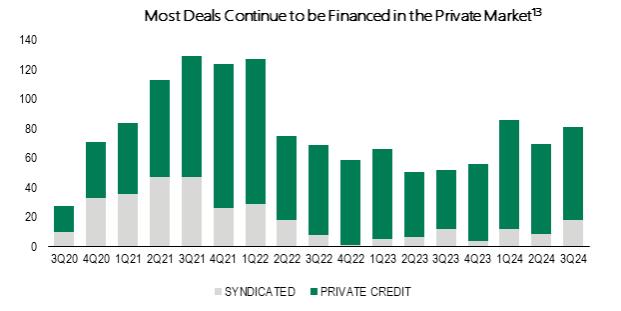

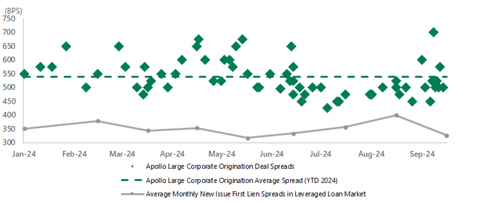

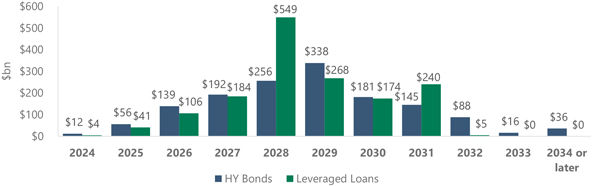

We continue to believe that the opportunity set to lend to bigger businesses on a first lien senior secured basis at elevated yields remains attractive. We expect the momentum in the capital markets to continue to build and deal activity—which is typically financed in the private market—to increase meaningfully. The recently published economic data points to a continued economic expansion in the US, which we believe will translate into a ripe environment for refinancings, IPOs and M&A. Additionally, we expect to see a boost in deal activity once investors get more clarity on the outcome of the November 5th US elections.

We’ve recently heard executives on earning calls express their confidence in the state of the US economy. Jeremy Barnum, JPMorgan Chase’s CFO, said that the consumer health remains stable and that the corporate segment is benefiting from a “Goldilocks economic situation.” Sharon Yeshaya, Morgan Stanley’s CFO, said that the bank continues to believe that the US is in the early stages of a “multi-year capital markets recovery.”

We continue to maintain a cautious approach—given upside risks to inflation, further geopolitical tensions, and uncertainty leading into the US elections—but we believe this environment may provide an attractive opportunity for large, scaled investors, and we expect our “credit first” philosophy to be on full display as we seek to deliver more stable returns throughout the rest of the year.

END NOTES

Data as of September 30, 2024, unless otherwise indicated. Reflects Apollo’s views and beliefs as of the date of this material and is subject to change without notice. Past performance is not indicative of future results. There can be no assurance that investment strategies or objectives described herein will be achieved and there can be no assurances that any of the trends described herein will continue or will not reverse. The value of any investment could decline and/or become worthless.

Certain information contained in this document constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue” or other similar words, or the negatives thereof. These may include financial projections and estimates and their underlying assumptions, statements about plans, objectives and expectations with respect to future operations, and statements regarding future performance. Such forward-looking statements are inherently uncertain and there are or may be important factors that could cause actual outcomes or results to differ materially from those indicated in such statements. Apollo believes these factors include but are not limited to those described under the section entitled “Risk Factors”, in the Fund’s prospectus, and any such updated factors included in the Fund’s periodic filings with the Securities and Exchange Commission (the “SEC”), which are accessible on the SEC’s website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in the Fund’s prospectus and other filings. Except as otherwise required by federal securities laws, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future developments or otherwise.

Important Note on Index Performance: Index performance is shown for illustrative purposes only and have limitations when used for comparison or for other purposes due to, among other matters, volatility, credit or other factors (such as number of investments, recycling or reinvestment of distributions, and types of assets). It may not be possible to directly invest in one or more of these indices and the holdings of the Fund may differ markedly from the holdings of any such index in terms of levels of diversification, types of securities or assets represented and other significant factors. Indices are unmanaged, do not charge any fees or expenses, assume reinvestment of income and do not employ special investment techniques such as leveraging or short selling. No such index is indicative of the future results of the Fund. There can be no assurances that any of the trends described herein will continue or will not reverse. Past events and trends do not imply, predict or guarantee, and are not necessarily indicative of future events or results.

5