- BNAI Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

S-1 Filing

Brand Engagement Network (BNAI) S-1IPO registration

Filed: 14 Feb 25, 5:30pm

As filed with the Securities and Exchange Commission on February 14, 2025.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

BRAND ENGAGEMENT NETWORK INC.

(Exact name of registrant as specified in its charter)

| Delaware | 7372 | 98-1574798 | ||

| (State or other Jurisdiction of Incorporation Or Organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

145 E. Snow King Ave

PO Box 1045

Jackson, WY 83001

(307) 757-3650

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Paul Chang

145 E. Snow King Ave

PO Box 1045

Jackson, WY 83001

(307) 757-3650

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copies of all communications, including communications sent to agent for service, should be sent to:

Matthew L. Fry, Esq.

Haynes and Boone, LLP

2801 N. Harwood St.

Suite 2300

Dallas, Texas 75201

(214) 651-5000

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED FEBRUARY 14, 2025

PRELIMINARY PROSPECTUS

BRAND ENGAGEMENT NETWORK INC.

UP TO SHARES OF COMMON STOCK

PRE-FUNDED WARRANTS TO PURCHASE UP TO SHARES OF COMMON STOCK

UP TO SHARES OF COMMON STOCK UNDERLYING THE PRE-FUNDED WARRANTS

COMMON WARRANTS TO PURCHASE UP TO SHARES OF COMMON STOCK

UP TO SHARES OF COMMON STOCK UNDERLYING THE COMMON WARRANTS

PLACEMENT AGENT WARRANTS TO PURCHASE UP TO SHARES OF COMMON STOCK

UP TO SHARES OF COMMON STOCK UNDERLYING THE PLACEMENT AGENT WARRANTS

This is a best efforts public offering of up to shares of our common stock, par value $0.0001 per share (the “Common Stock”), together with warrants to purchase up to an aggregate of shares of our Common Stock (the “Common Warrants”) at an assumed combined public offering price of $ per share and one Common Warrant (the last reported sale price per share of our Common Stock on the Nasdaq Capital Market on , 2025). We are also offering pre-funded warrants to purchase up to shares of our Common Stock (the “Pre-Funded Warrants”) and the shares of Common Stock issuable upon exercise of the Pre-Funded Warrants, in lieu of shares of Common Stock, to those investors whose purchase of shares of our Common Stock in this offering would result in the investor, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the investor, 9.99%) of our outstanding Common Stock immediately following the consummation of this offering. Each Pre-Funded Warrant will be exercisable for one share of our Common Stock. Each Pre-Funded Warrant is being sold together with one Common Warrant. Each Pre-Funded Warrant and the accompanying Common Warrant will be offered at an offering price equal to the combined public offering price at which a share of Common Stock and accompanying Common Warrant is being offered, minus $0.0001. The exercise price of the Pre-Funded Warrants will be $0.0001 per share, and the Pre-Funded Warrants will be immediately exercisable and may be exercised at any time until exercised in full. For each Pre-Funded Warrant we sell, the number of shares of Common Stock we are offering will be decreased on a one-for-one basis. The number of Common Warrants sold in this offering will not change as a result of a change in the mix of the shares of our Common Stock and Pre-Funded Warrants sold. The exercise price of the Common Warrants will be $ per share. The Common Warrants will be exercisable immediately on the effective date of stockholder approval of the issuance of the shares upon exercise of the Common Warrants (the “Warrant Stockholder Approval Date” and such approval, the “Warrant Stockholder Approval”); provided, however, that, if and only if the Pricing Conditions (as defined below) are met, the Common Warrants will be exercisable upon issuance. As used herein “Pricing Conditions” means that the combined offering price per share and accompanying Common Warrant is such that the Warrant Stockholder Approval is not required under the rules of the Nasdaq Stock Market LLC (“Nasdaq”) because either (i) the offering is an at-the-market offering under the rules of the Nasdaq and such price equals or exceeds the sum of (a) the applicable “Minimum Price” per share under Nasdaq Rule 5635(d) plus (b) $0.125 per whole share of Common Stock underlying the Common Warrants or (ii) the offering is a discounted offering where the pricing and discount (including attributing a value of $0.125 per whole share underlying the Common Warrants) meet the pricing requirements under the Nasdaq’s rules. The Common Warrants will expire five years from the Warrant Stockholder Approval Date, provided that if the Pricing Conditions are met, the Warrants will expire five years from the date of issuance. This offering also relates to the shares of Common Stock issuable upon the exercise of any Pre-Funded Warrants and any Common Warrants. The shares of Common Stock and Pre-Funded Warrants, as the case may be, and the accompanying Common Warrant, can only be purchased together in this offering but will be issued separately and will be immediately separable upon issuance.

Our Common Stock is listed on The Nasdaq Capital Market under the symbol “BNAI,” and our warrants to purchase Common Stock (the “Public Warrants”) are listed on The Nasdaq Capital Market under the symbol “BNAIW”. On February 13, 2025, the last reported sales price of the Common Stock was $0.6621 per share, and the last reported sales price of our Public Warrants was $0.043 per Public Warrant. We are an “emerging growth company” and a “smaller reporting company” as defined under the U.S. federal securities laws and, as such, may elect to comply with certain reduced public company reporting requirements for this and future filings. All share, Pre-Funded Warrant and Common Warrant numbers are based on an assumed combined public offering price of $ per share and accompanying Common Warrant (or $ per Pre-Funded Warrant and accompanying Common Warrant). The actual public offering price per share of Common Stock and accompanying Common Warrant and per Pre-Funded Warrant and accompanying Common Warrant, as the case may be, will be determined between us, the Placement Agent (as defined below) and the investors at the time of pricing, may be at a discount to the current market price, and may be based upon a number of factors, including our history and our prospects, the industry in which we operate, our past and present operating results, the previous experience of our executive officers and the general condition of the securities markets at the time of this offering. Therefore, the assumed combined public offering price used throughout this prospectus may not be indicative of the final offering price. There is no established public trading market for the Pre-Funded Warrants or the Common Warrants, and we do not expect a market to develop. In addition, we do not intend to list the Pre-Funded Warrants or the Common Warrants on the Nasdaq Capital Market, any other national securities exchange or any other nationally recognized trading system.

This offering will terminate on , 2025, unless we decide to terminate the offering (which we may do at any time in our discretion) prior to that date. We will have one closing for all securities purchased in this offering and the combined public offering price per share of Common Stock (or Pre-Funded Warrant) and accompanying Common Warrant will be fixed for the duration of this offering.

We have engaged as our exclusive placement agent (the “Placement Agent”) to use its reasonable best efforts to solicit offers to purchase our securities in this offering. The Placement Agent has no obligation to purchase any of the securities from us or to arrange for the purchase or sale of any specific number or dollar amount of the securities. Because there is no minimum offering amount required as a condition to closing in this offering the actual public offering amount, Placement Agent’s fee, and proceeds to us, if any, are not presently determinable and may be substantially less than the total maximum offering amounts set forth above and throughout this prospectus. In addition, because there is no escrow trust or similar arrangement and no minimum offering amount, investors could be in a position where they have invested in our company, but we are unable to fulfill all of our contemplated objectives due to a lack of interest in this offering. We have agreed to pay the Placement Agent the Placement Agent fees set forth in the table below. See “Plan of Distribution” in this prospectus for more information. Because there is no minimum offering amount required as a condition to closing this offering, we may sell fewer than all of the securities offered hereby, which may significantly reduce the amount of proceeds received by us, and investors in this offering will not receive a refund in the event that we do not sell an amount of securities sufficient to pursue our business goals described in this prospectus. We will bear all costs associated with the offering.

| Per Pre- | ||||||||||||

| Funded | ||||||||||||

| Per Share and | Warrant and | |||||||||||

| Accompanying | Accompanying | |||||||||||

| Common | Common | |||||||||||

| Warrant | Warrant | Total | ||||||||||

| Public offering price | $ | $ | $ | |||||||||

| Placement Agent fees (1) | $ | $ | $ | |||||||||

| Proceeds, before expenses, to us (2) | $ | $ | $ | |||||||||

| (1) | Represents a cash fee equal to 6.5% of the aggregate purchase price paid by investors in this offering. In addition, we have agreed to reimburse the Placement Agent for certain expenses. In addition, we have agreed to issue the placement agent or its designees, as compensation in connection with this offering, warrants (the “Placement Agent Warrants”), to purchase a number of shares of Common Stock equal to 6.5% of the shares of Common Stock sold in this offering (including the shares of Common Stock issuable upon the exercise of the Pre-Funded Warrants), at an exercise price of $ per share, which represents 125% of the combined public offering price per share of Common Stock and accompanying Common Warrant. See “Plan of Distribution” on page 126 of this prospectus for more information. |

| (2) | Because there is no minimum number of securities or amount of proceeds required as a condition to closing in this offering, the actual public offering amount, placement agent fees, and proceeds to us, if any, are not presently determinable and may be substantially less than the total maximum offering amounts set forth above. The amount of the offering proceeds to us presented in this table does not give effect to the exercise, if any, of the Pre-Funded Warrants or the Common Warrants. |

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 17 to read about factors you should consider before investing in shares of our Common Stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

Delivery of the shares of Common Stock, Pre-Funded Warrants and Common Warrants offered hereby is expected to take place on , 2025, subject to satisfaction of certain conditions.

The date of this prospectus is , 2025

TABLE OF CONTENTS

| i |

ABOUT THIS PROSPECTUS

The registration statement we filed with the Securities and Exchange Commission (the “SEC”) includes exhibits that provide more detail of the matters discussed in this prospectus. You should read this prospectus and the related exhibits filed with the SEC before making your investment decision. You should rely only on the information provided in this prospectus. In addition, this prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information.

This prospectus includes important information about us, the securities being offered and other information you should know before investing in our securities. You should not assume that the information contained in this prospectus is accurate on any date subsequent to the date set forth on the front cover of this prospectus, even though this prospectus is delivered or securities are sold or otherwise disposed of on a later date. It is important for you to read and consider all information contained in this prospectus in making your investment decision. All of the summaries in this prospectus are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the heading “Where You Can Find More Information.”

We have not, and the Placement Agent has not, authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. The information contained in this prospectus or in any applicable free writing prospectus is current only as of its date, regardless of its time of delivery or any sale of our securities. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: We have not, and the Placement Agent has not, done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities and the distribution of this prospectus outside the United States.

This prospectus is an offer to sell only the securities offered hereby, and only under circumstances and in jurisdictions where it is lawful to do so. We are not, and the Placement Agent is not, making an offer to sell these securities in any state or jurisdiction where the offer or sale is not permitted.

We may also provide a prospectus supplement or post-effective amendment to the registration statement to add information to, or update or change information contained in, this prospectus. You should read both this prospectus and any applicable prospectus supplement or post-effective amendment to the registration statement together with the additional information to which we refer you in the sections of this prospectus titled “Where You Can Find Additional Information.”

CORPORATE HISTORY

On March 14, 2024 (the “Closing Date”), Brand Engagement Network Inc., a Delaware corporation f/k/a DHC Acquisition Corp. (“BEN”, the “Company” and, prior to the Closing Date, “DHC”), consummated the previously announced business combination pursuant to that certain Business Combination Agreement and Plan of Reorganization, dated as of September 7, 2023 (the “Business Combination Agreement”), by and among the Company, BEN Merger Subsidiary Corp., a Delaware corporation (“Merger Sub”), Brand Engagement Network Inc., a Wyoming Corporation (“Prior BEN”) and DHC Sponsor, LLC, a Delaware limited liability company (“Sponsor”) following approval thereof at a special meeting of the Company’s shareholders held on March 5, 2024 (the “Special Meeting”).

Pursuant to the terms of the Business Combination Agreement, on March 13, 2024, the Company migrated to and domesticated as a Delaware corporation in accordance with Section 388 of the Delaware General Corporation Law, as amended, and the Companies Act (As Revised) of the Cayman Islands (the “Domestication”) and changed its name to Brand Engagement Network Inc.

References to “BEN,” the “Company,” “we,” “us,” and “our,” prior to the effective time of the Domestication and Merger refer to Prior BEN, and such references following the effective time of the Domestication and Merger refer to the Company in its current corporate form as a Delaware corporation called “Brand Engagement Network Inc.”

MARKET AND INDUSTRY DATA

Certain industry data and market data included in this prospectus were obtained from independent third-party surveys, market research, publicly available information, reports of governmental agencies and industry publications and surveys. All of the estimates of the Company’s management presented herein are based upon review of independent third-party surveys and industry publications prepared by a number of sources and other publicly available information by the Company’s management. Third-party industry publications and forecasts state that the information contained therein has been obtained from sources generally believed to be reliable, yet not independently verified. The industry data, market data and estimates used in this prospectus involve assumptions and limitations, and you are cautioned not to give undue weight to such data and estimates. Although we have no reason to believe that the information from industry publications and surveys included in this prospectus is unreliable, we have not verified this information and cannot guarantee its accuracy or completeness. We believe that industry data, market data and related estimates provide general guidance, but are inherently imprecise. The industry in which the Company’s operates is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section titled “Risk Factors” and elsewhere in this prospectus.

| ii |

TRADEMARKS, SERVICE MARKS AND TRADE NAMES

This document contains references to trademarks and service marks belonging to other entities. Solely for convenience, trademarks and trade names referred to in this Registration Statement may appear without the ® or ™ symbols, but such references are not intended to indicate, in any way, that the applicable licensor will not assert, to the fullest extent under applicable law, its rights to these trademarks and trade names. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS AND RISK FACTOR SUMMARY

This prospectus includes forward-looking statements as defined in Section 27A of the Securities Act of 1933, as amended, (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended, (the “Exchange Act”). These forward-looking statements can be identified by the use of forward-looking terminology, including the words “anticipates,” “believes,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “will,” “would”, or, in each case, their negative or other variations or comparable terminology.

The forward-looking statements contained in this prospectus are based on our current expectations and beliefs concerning future developments and their potential effects on us. There can be no assurance that future developments affecting us will be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, the following risks, uncertainties (some of which are beyond our control) or other factors:

| ● | our ability to develop and attain market acceptance for our products and services; | |

| ● | our ability to maintain the listing of our securities on Nasdaq and to regain compliance with Nasdaq listing standards; | |

| ● | the attraction and retention of qualified directors, officers, employees and key personnel; | |

| ● | our need for additional capital and whether additional financing will be available on favorable terms, or at all; | |

| ● | the lack of a market for our Common Stock and Public Warrants and the volatility of the market price and trading price for our Common Stock and Public Warrants; | |

| ● | our ability to meet the conditions to close, including the raising of sufficient financing to fund our pending acquisition (the “Cataneo Acquisition”) of Cataneo Gmbh (“Cataneo”), our ability to pay down payments in accordance with the Purchase Agreement and our ability to integrate and realize the anticipated benefits of the Cataneo Acquisition; | |

| ● | the impact of lawsuits and other litigation matters on our business, including the AFG Lawsuit. | |

| ● | our limited operating history; | |

| ● | the length of our sales cycle and the time and expense associated with it; | |

| ● | our ability to grow our customer base; | |

| ● | our dependency upon third-party service providers for certain technologies; | |

| ● | competition from other companies offering artificial intelligence products that have greater resources, technology, relationships and/or expertise; |

| iii |

| ● | our ability to compete effectively in a highly competitive market; | |

| ● | our ability to protect and enhance our corporate reputation and brand; | |

| ● | our ability to hire, retain, train and motivate qualified personnel and senior management and our ability to deploy our personnel and resources to meet customer demand; | |

| ● | our ability to grow through acquisitions and successfully integrate any such acquisitions; | |

| ● | our ability to grow through acquisitions and successfully integrate any such acquisitions, including our pending acquisition of Cataneo; | |

| ● | the impact from future regulatory, judicial, and legislative changes in our industry; | |

| ● | increases in costs, disruption of supply or shortage of materials, which could harm our business; | |

| ● | our ability to successfully maintain, protect, enforce and grow our intellectual property rights; | |

| ● | our future financial performance, including the ability of future revenues to meet projected annual bookings; | |

| ● | our ability to forecast and maintain an adequate rate of revenue growth and appropriately plan our expenses; | |

| ● | our ability to generate sufficient revenue from each of our revenue streams; or | |

| ● | the other risks and uncertainties discussed in “Risk Factors” and elsewhere in this prospectus. |

The foregoing factors should not be construed as exhaustive and should be read together with the other cautionary statements included in this prospectus, which is incorporated by reference herein. If one or more events related to these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may differ materially from what we anticipate. Many of the important factors that will determine these results are beyond our ability to control or predict. Accordingly, you should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and, except as otherwise required by law, we do not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise. New factors emerge from time to time, and it is not possible for us to predict which will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

| iv |

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider before making an investment decision. This prospectus includes information about this offering, our business and our financial and operating data. You should carefully read the entire prospectus, including under the section titled “Risk Factors” included herein, before making an investment decision.

Overview

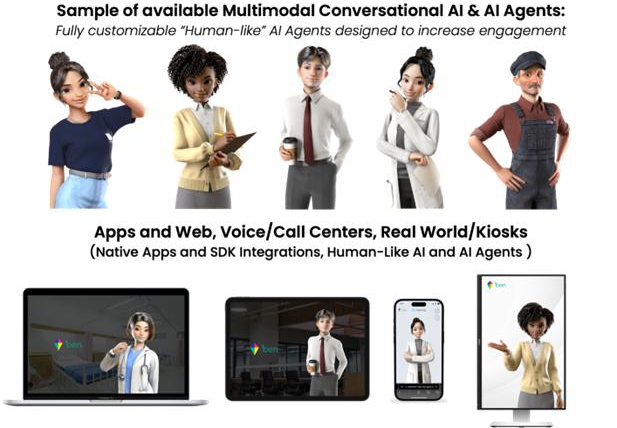

We are a generative AI (“GenAI”) company specializing in conversational AI solutions. Through our secure, human-like AI agents (“AI Agents”), available in different modalities, we seek to transform consumer engagement and elevate customer experience, productivity, and business performance. Our AI Agents are built on 16+ advanced AI modules spanning perception, understanding, and response, with advanced capabilities in natural language processing (“NLP”), multisensory awareness, sentiment and environmental analysis, and real-time individuation and personalization. Our conversational AI solutions are tailored to meet the unique needs of our business customers – from AI Agent customization in look, sound, and feel, to conversation design, business system integration, and cross-platform execution.

The AI Industry

We operate within the generative AI industry, a rapidly advancing segment within the broader AI market, positioned at the intersection of machine learning, deep learning, and natural language processing. Our conversational AI solutions allow us to target a total addressable market that is estimated to be worth $10 billion and is poised to grow to $47 billion1 by 2030, as substantiated by third-party industry reports and comprehensive studies related to our target sectors.

The growing adoption of generative AI is being driven by the pursuit of cost reduction, value enhancement, differentiated customer engagements and operational efficiency benefits that we believe are not available to organizations through legacy solutions. There are a number of trends that are impacting the rate of adoption and facilitating changes to the ways organizations manage their technology infrastructure. These key trends include:

Agentic AI. We believe the landscape of GenAI has evolved, shifting from knowledge-based tools like AI chatbots and co-pilots to GenAI-enabled agents capable of executing complex, multi-step workflows. These “agentic systems” can complete tasks autonomously and interact dynamically with their environments. Deloitte2 projects that in 2025, 25% of organizations leveraging GenAI will launch agentic pilots, with adoption expected to reach 50% by 2027. While multi-capable AI agents are not new, this trend reflects a broader industry recognition of AI’s potential to move beyond single-function responses toward more sophisticated, autonomous assistance.

Growing Acceptance of AI. According to a study conducted by McKinsey3, 72% of businesses have employed some kind of AI and 65% have utilized GenAI, specifically, in at least one business function during 2024. The study also suggested that 67% of respondents expect their organizations to invest more in AI in the next three years with analytics AI and GenAI being the likely recipient segments of this investment. Organizational experimentation of GenAI is also increasing according to a study published by Deloitte4, which found that 68% of represented organizations had more than ten proof-of-concepts currently being pursued as of September 2024. Awareness is also permeating throughout organizations according to another study published by McKinsey5, which indicated that nearly all employees (94%) and C-suite leaders (99%) had some familiarity with GenAI as of 2024. Additionally, demographic studies reveal that 62% of “Millennials”, 50% of “Gen Z”, and 22% of “Baby Boomers” report high levels of expertise with AI.6 These studies speak to the increasing pervasiveness of AI in organizations and the widespread proliferation of its adoption and acceptance across the population.

1 https://www.statista.com/statistics/1552183/global-agentic-ai-market-value/

2 https://www2.deloitte.com/us/en/insights/industry/technology/technology-media-and-telecom-predictions/2025/autonomous-generative-ai-agents-still-under-development.html

3 https://www.mckinsey.com/capabilities/quantumblack/our-insights/the-state-of-ai#/

4 https://www2.deloitte.com/content/dam/Deloitte/us/Documents/consulting/us-state-of-gen-ai-q4.pdf

5 https://www.mckinsey.com/capabilities/mckinsey-digital/our-insights/superagency-in-the-workplace-empowering-people-to-unlock-ais-full-potential-at-work#/

6 https://www.mckinsey.com/capabilities/mckinsey-digital/our-insights/superagency-in-the-workplace-empowering-people-to-unlock-ais-full-potential-at-work#/

| 1 |

Trust, Security & Reliability. As organizations increasingly experiment with and adopt GenAI, they have become more aware of its potential risks and challenges. Among the top barriers to adoption. Deloitte7 reported in 2025 that 29% of organizations cite a loss of trust due to bias, hallucinations, and inaccuracies, while 35% highlight concerns over errors with real-world consequences. Similarly, McKinsey’s8 research underscores these apprehensions, revealing that in 2024 51% of U.S. employees are concerned about cybersecurity risks, 50% about inaccuracies, 43% about personal privacy, and 40% about intellectual property infringement.

Ethical and Regulatory Change. The growing pervasiveness of AI technologies, including generative AI and data collection efforts, have spurred greater ethical and regulatory consideration over the potential privacy, bias and fairness implications inherent to the deployment of such technologies. Governments and regulatory bodies are introducing frameworks and guidelines to ensure responsible AI deployment and data privacy and protection. A study published by Deloitte9 in 2025 indicated that regulatory compliance concerns stand as the most significant barriers for businesses considering development and deployment of GenAI tools and applications. Addressing these ethical and compliance aspects is crucial for organizations to build trust with their customers, partners, and stakeholders, and to avoid or mitigate potential risks associated with noncompliance whether intentional or unintentional.

Timely, Personalized Experiences. We believe consumer satisfaction in business interactions hinges on the timely fulfillment of consumer needs, the consistency of these interactions and a preference for highly-personalized experiences. Gartner10 has previously reported that organizations that focus on personalization can expect 16% more commercial outcome impact. Research conducted by McKinsey indicated that 71% of consumers expect personalized interactions, and 76% of consumers experienced dissatisfaction when offerings did not achieve it.

Multimodal World. Beyond text, the internet has become a vast repository of multimedia information in the form of images and videos. It is now second nature for us to freely capture and use images and videos as part of our queries, in addition to traditional text and voice interactions. McKinsey suggests that the current investment landscape in generative AI is heavily focused on text-based applications such as chatbots, virtual assistants, and language translation. It is projected that at least one-fifth of generative AI usage will derive from multimodal interfaces. A recent survey investigating customer engagement revealed that four out of five individuals preferred a multimodal experience over a text-based interaction.

Integration of Emerging Technologies. Digital transformation efforts are increasingly focusing on the seamless integration of emerging technologies beyond generative AI. These include technologies like blockchain, cloud management and computing, and the internet of things (“IoT”). The strategic integration of these emerging technologies into existing infrastructure and processes is a critical aspect of future-proofing organizations and ensuring they stay at the forefront of technological advancements. As these emerging technologies gain broader acceptance and are further integrated into the world’s digital infrastructure, we expect the adoption of AI to be empowered and accelerated. Significant growth is projected in these technologies according to various industry studies: Statista forecasts that there will be over 29 billion IoT-connected devices globally by 2030, while Gartner estimates that by 2025, more than 95% of new digital workloads will be deployed on cloud-native platforms, a significant increase from the 30% observed in 2021. These statistics underscore the accelerating pace of technological adoption and the critical role of integration in driving successful digital transformations, which we believe will further the adoption of AI.

7 https://www2.deloitte.com/content/dam/Deloitte/us/Documents/consulting/us-state-of-gen-ai-q4.pdf

8 https://www.mckinsey.com/capabilities/mckinsey-digital/our-insights/superagency-in-the-workplace-empowering-people-to-unlock-ais-full-potential-at-work

9 https://www2.deloitte.com/us/en/pages/about-deloitte/articles/press-releases/state-of-generative-ai.html

10 https://www.gartner.com/en/executive-guidance/impact-of-personalization

| 2 |

Our Core Strengths

Versatile Applications and Customizable Designs that are Industry-Agnostic. We believe our AI Agents will be deployable across multiple differing industry verticals, regardless of whether a business leverages public or private cloud services, localized or hybrid environments. Whether in the automotive, healthcare or other industries or other developing markets, our AI Agents have been designed to deploy and integrate with our customers’ businesses regardless of industry or internal infrastructure. We believe our broad scope of application allows us to be nimble and respond to developing trends with our end-users and other potential customers, without having substantial delays and costs when entering emerging markets.

Customizable solutions delivering personalized experiences. We believe every engagement with a customer is unique and personalized. Although our AI Agents are designed to allow for consistent and brand-cohesive communication, our short-term and long-term memory design and proprietary secured-identity protocol can enable individualized experiences based on an understanding of the individual that changes with time. Our secure, private, prompt design can contextualize our human-like response generation with client-approved and validated data sets. In this way, each human-like AI Agent is designed to be unique to and aligned with the brand of our clients.

Adaptive analytics and machine learning driving speed to deployment. We believe the ability of our AI Agents to be trained to the data of our clients in short periods of time in an automated fashion will be a significant driver of our ability to deploy our platform quickly and efficiently. We believe we are capable of navigating substantial data demands through our pre-processing, remote streaming and sequential linking foundations. Fueled by cutting-edge analytics and machine learning, we believe our AI Agents are capable of processing vast volumes of data within the business environment of our customers. Leveraging our advanced analytics capabilities, we designed our AI Agents to provide actionable insights to businesses in real-time.

Experienced and passionate management team with a deep understanding of AI. Our seasoned management team has a proven track record of spearheading innovation in hardware, software and business processes across various sectors. We believe that our collective passion for AI, combined with our diverse expertise, positions us to succeed in an industry that is driving what we believe is a monumental generational shift in the delivery of new AI products.

Our Technology

We offer a customizable human-like AI Agent that can enhance customer engagement while delivering a secure, consistent and effective message for vertically-focused end markets. We aim to connect to clients’ real time data systems for access to customer specific files, accounts and records to provide meaningful personalized information to our clients’ customers from an approved data set, while maintaining compliance with applicable privacy and data protection laws and regulations. Additionally, we will seek to offer tools to help our clients’ customers manage their personal data and conversations.

Our AI Agents seek to emulate a discussion between the customers of our clients and our AI Agents as a way of enhancing the user experience by creating a more meaningful interaction. Our platforms are designed to quickly train and deploy the AI Agents into customer defined environments on multiple device types and engagement modes on the Web (desktop, mobile and app), the phone (voice and text) and installed to meet consumers in the physical world through kiosks. By “meeting the consumers where they are” and allowing interactions to occur on their preferred devices, our applications can be more easily and broadly adopted by the market. Furthermore, we aim to integrate with our customers’ business backend systems, such as customer relationship management, enterprise resource planning, and IoT systems within our full-stack. In addition, by providing customers a human-like interface and a secure environment through multi-model communication, we believe we are able to deliver scaled solutions for industries impacted by labor and cost burdens and whom have a desire to increase engagement with their customers.

| 3 |

AI Agents. We have assembled our technology components to create an integrated AI Agent that enables us to provide a seamless consumer-facing experience for our clients complete with our proprietary configurable safety and security features. Our customizable AI Agents are integrated into our clients’ environment and train on their internal data to provide a broad array of customer service and education solutions for our clients’ interactions with their current and potential customers. Our AI Agents are designed to work with several existing large language models (“LLMs”), including Anthropic LLM and Llama 2 LLM to configure and personalize our AI Agents’ responses to consumer inquiries to create client-specific solutions. We believe in the benefits of small footprint LLMs that work in tandem with other data retrieval and data processing techniques that seek to ensure a safe environment as well as minimize the required computations needed to achieve a human-like experience. Our AI Agents can change their dialogue, conversation design, personality and appearances based on the specific needs of our customers and the consumer environments in which they operate. Our AI Agents can be offered to our clients’ customers through mobile apps, desktops or laptops, as well as through in-store life-size kiosks and SDK integrations and are designed to be deployed in a fully ringfenced environment.

Differentiation Through Configurable Safety and Security. We believe the primary differentiation of our AI Agents is the ability to reduce bias and minimize “hallucinations,” filtering for inappropriate inputs and responses and managing customer identity resolution. We implement retrieval-augmented generation, a process of optimizing the output of a LLM, so it references an authoritative knowledge base outside of its training data sources before generating a response, and focus on embedding techniques for retrieval. We utilize pre-trained foundation models, which we do not train ourselves, and augment such models with our carefully curated knowledge bases. Our belief in our ability to reduce bias and minimize hallucinations is based on:

| ● | High-Quality Knowledge Base: We maintain a carefully vetted and regularly updated knowledge base to provide accurate, current information. The information is generally provided to us by our clients who utilize their own experts in their corresponding fields. |

| 4 |

| ● | Sophisticated Retrieval Mechanisms: Our retrieval system is designed to find the most relevant and reliable information for each query. | |

| ● | Careful Curation of Retrieved Information: We prompt the foundation model to base its responses primarily on the retrieved information, reducing the likelihood of generating unfounded statements. | |

| ● | Uncertainty Communication: We implement prompting strategies that encourage the model to express uncertainty when retrieved information is insufficient or ambiguous. Our prompting strategies are triggered whenever our systems detect that the safety threshold is too low. |

Additionally, we expect to implement data anonymization techniques to safeguard against proprietary data leakage to third-party LLMs. Our platform has been designed with a “middle layer” that performs these configurable safety functions without inducing delay in the overall experience. If desired, the responses will only come from a select dataset that has been ingested while still providing a natural conversation to the user with appropriate natural language responses. In addition, all conversations or sessions can be transcribed and further analyzed to audit the system and the dialogues for continuous monitoring of the configurable safety and security protocols of our platforms.

Customization, Configuration, and Optimization. Our AI Agents can enable substantial variations in customer experiences. ASR, TTS, and NLP can be tweaked for tone, cadence, personality, emotions and other auditory features. The voices used in our AI Agents can be matched with broad variations of agent appearance design with customized ethnicity, skin tone, facial features, and other physical attributes. AI Agents can be dressed in broad variations of outfits appropriate for the application, such as a nurse’s scrubs, auto repair uniform, formal business attire, casual-friendly attire, and other profession-appropriate attire. NLP can be configured to provide various levels of responses appropriate for the audience, including comprehensive, detailed, and technical responses to assist a doctor or a nurse or concise responses using commonly spoken vocabulary to assist a consumer.

| 5 |

Deployment. Our modular architecture enables source data to be ingested for training and response generation in a few hours through a standardized data interface. Once a dataset has been ingested by the application, dialogue management can begin with several tactics and methods to reduce the learning period of the AI Agent. Our unique approach of using statistical methods combined with more intuitive methods can accelerate the training of our AI Agents significantly. The deployment of the AI Agent “meets our customers where they are” by having a combination of cloud-based, server-based and local-device-based functionality. Deployments of our AI Agents can be completely optimized to take advantage of the dataset, solution environment, device hardware and operating systems and existing IT infrastructure. Furthermore, our AI Agents are designed to be quickly deployed into customer defined environments on multiple device types and engagement modes on the web (desktop, mobile and app), the phone (voice and text) and installed to meet consumers in the physical world through kiosks.

Use Cases. We have recently debuted the following use cases for our AI Agents, which we intend to pilot with our customers:

Automotive Assistants:

| ● | Web AI Agent: A solution for transforming the online experience for dealership customers. By understanding customer needs and preferences, our AI Agent works in tandem with the sales team to provide enhanced customer experiences online that carry through to the dealership. | |

| ● | In-Vehicle Experience: Connecting directly with vehicle data, mobile application, and contextual information to provide drivers with engaging experiences, providing relevant and meaningful engagement opportunities from automotive vertical participants. | |

| ● | Sales AI Agent: Available on life-size kiosks, and offers uniformity and personalization to each customer through an intuitive interface. This integration ensures a smooth transition from online browsing to in-person dealership experience. | |

| ● | Service AI Agent: Designed to enhance the way customers interact with automotive service departments by combining proprietary cutting-edge AI and an intuitive interface to deliver enhanced customer service experiences for consumers requiring vehicle maintenance, booking appointments and those who want to learn more about service options and service programs. | |

| ● | Technician AI Agent: Offering real-time guidance, know-how and information to automotive technicians, safeguarding OEM compliance and serving as a vital partner in the garage. |

Healthcare Assistants:

| ● | Drug Adherence AI Agent: Providing educational assistance to patients concerning newly prescribed or existing medications, including administration methods, with the goal of driving drug adherence and improving disease management. | |

| ● | Vaccine AI Agent: Providing vaccine education and scheduling assistance for seasonal vaccines like the flu and COVID-19, as well as age-related vaccines such as human papillomavirus, herpes simplex virus and shingles and other potential vaccines. | |

| ● | Health Insurance AI Agent: Supporting healthcare insurance, Medicare Advantage, information, and decision support. | |

| ● | Chronic Disease Management AI Agent: Designed to support chronic disease management, with a current focus on type 2 diabetes, rheumatology, and behavioral health. |

In the future, we expect to increase the number of use cases for our AI Agents in the automotive and healthcare markets, as well as in new markets to which we intend to expand, such as financial services.

| 6 |

Recent Developments

Cohen Convertible Note

On April 12, 2024, we issued a convertible promissory note to J.V.B. Financial Group, LLC, acting through its Cohen & Company Capital Markets division in the principal amount of $1.9 million (the “Cohen Convertible Note”), to settle outstanding invoices totaling $1.9 million related to investment banking services rendered to the Company in connection with its merger with Prior BEN and DHC (the “Business Combination”). Beginning on October 14, 2024, interest will accrue at the fixed rate of 8% per annum on the outstanding principal amount until the Cohen Convertible Note is paid in full. Interest is payable monthly in cash or in-kind at the election of the Company. The Company may prepay the Cohen Convertible Note in whole or in part at any time or from time to time without penalty or premium. The Company may be required to prepay all or a portion of the Cohen Convertible Note upon the consummation of certain capital raising activities as described therein. The maturity date of the Cohen Convertible Note is March 14, 2025. As of February 14, 2025, J.V.B Financial Group, LLC has converted $1,139,999.2 of aggregate principal of the Cohen Convertible Note.

May Private Placement

On May 28, 2024, the Company entered into a Securities Purchase Agreement (the “May SPA”) with certain investors (the “May Purchasers”), pursuant to which the Company sold to the May Purchasers an aggregate of 1,980,000 shares of Common Stock and 3,960,000 warrants, consisting of warrants to purchase 1,980,000 shares of Common Stock with a term of one year (the “May One-Year Warrants”) and warrants to purchase 1,980,000 shares of Common Stock with a term of five years (the “May Five-Year Warrants” and, together with the May One-Year Warrants, the “May Warrants”), for aggregate proceeds consisting of $4,425,000 in cash and $525,000 through the offset of an obligation of the Company to the Purchasers. All May Warrants were originally exercisable for shares of Common Stock at an exercise price of $2.50 per share.

August Private Placement

On August 26, 2024, we consummated a series of transactions for an aggregate purchase price of $5,925,000 (the “August Financing”) whereby we (i) agreed to issue 1,185,000 shares of our Common Stock at a price per share of $5.00 pursuant to that certain Securities Purchase Agreement (the “August SPA”), dated August 26, 2024, by and among the Company and certain investors signatory thereto (the “August Purchasers”), (ii) issued 960,000 warrants (the “August Warrants”) to purchase our Common Stock at an exercise price of $5.00 pursuant to that certain Warrant Purchase Agreement (“Warrant Purchase Agreement”), dated August 26, 2024, by and among the Company and certain purchasers signatory thereto and (iii) facilitated the transfer of 1,185,000 shares held by Sponsor issued in connection with the Company’s predecessor, DHC Acquisition Corp.’s (“DHC”) initial public offering to the August Purchasers, pursuant to that certain share assignment and lockup release agreement (the “Assignment Agreement”) with certain members of Sponsor and certain other existing stockholders and affiliates of the Company and the August Purchasers in exchange for releases from certain restrictions on transfer contained in either a (i) prior letter agreement by and among the Company’s predecessor, DHC, Sponsor and the other signatories thereto or (ii) in certain lock-up agreements executed by certain members of Sponsor in connection with the consummation of the Company’s prior business combination.

On August 30, 2024, the Company issued to the August Purchasers an aggregate of 100,000 shares of Common Stock and 960,000 August Warrants, and the August Purchasers paid an aggregate of $500,000 in connection with the closing of the August Financing.

| 7 |

The remaining shares were issued to an escrow account and such shares remain in escrow until the conditions in the August SPA are satisfied. The August Purchasers are required to pay to the Company monthly cash installments in the amounts and on the dates as determined in the August SPA ending on April 5, 2025. For every $5.00 paid to the Company, the Company will release one share of Common Stock under the August SPA and one share of Common Stock under the Assignment Agreement to the August Purchasers. If an investor fails to pay its required funding by the respective deadline, the investor’s entire commitment under the August SPA will become immediately due and payable. As of February 14, 2025, a total of 110,000 shares of Common Stock have been issued to the August Purchasers for gross proceeds of $550.000. As of the date hereof, the August SPA has been terminated with respect to certain Purchasers who have exercised their portion of the Committed Warrants under the January Warrant Exercise Agreement. As of the date hereof, one Purchaser has failed to make its required exercises for the January 31, 2025 exercise date under the January Warrant Exercise Agreement. To the extent a Purchaser fails to exercise its portion of the Committed Warrants, the obligations of such Purchaser under the August SPA and such obligations of any investor under the August SPA who is not a Purchaser under the January Warrant Exercise Agreement, shall remain, and the August SPA will only terminate as to the Purchasers who have completed their January 31, 2025 exercise pursuant to the terms of the January Warrant Exercise Agreement. For additional information, please see “Warrant Exercise and Reload Agreement” below.

Standby Equity Purchase Agreement

On August 26, 2024, the Company issued 280,899 shares (the “Commitment Shares”) of Common Stock to YA II PN, Ltd. (“Yorkville”), pursuant a Standby Equity Purchase Agreement (the “SEPA”), dated August 26, 2024. The issuance of such shares to Yorkville pursuant to the SEPA was not registered under the Securities Act. As of February 14, 2025, the Company has issued 2,462,023 shares to Yorkville under the SEPA.

The Cataneo Purchase Agreement

On October 29, 2024, Company entered into a Share Purchase and Transfer Agreement with Christian Unterseer, in his individual capacity (“Unterseer”), CUTV GmbH, a limited liability company incorporated under the laws of the Federal Republic of Germany (“CUTV”), and CUNEO AG, a stock corporation incorporated under the laws of the Federal Republic of Germany (“Cuneo” and together with Unterseer and CUTV, the “Sellers”) (as amended by the Addendum, the “Purchase Agreement”) pursuant to which the Sellers have agreed to sell all of the outstanding equity interests of Cataneo to the Company for an aggregate purchase price of $19,500,000, consisting of (i) $9,000,000 in cash (the “Cash Consideration”) and (ii) 4,200,000 shares of the Company’s Common Stock at an agreed upon value of $2.50 per share (“Equity Consideration,” and collectively, with the Cash Consideration, the “Consideration Shares”) (the transactions governed by the Purchase Agreement, the “Acquisition”), subject to customary adjustments. Prior to the closing of the Acquisition (the “Cataneo Closing Date”), the Sellers may elect to convert a portion of the Equity Consideration to cash for up to $3,000,000 at a price per share of $2.50 (the “Cash Election”). Additionally, an aggregate of 400,000 shares of Common Stock issued as part of the Equity Consideration shall be subject to an escrow arrangement for a period of one year (the “Escrow Period”) following Cataneo Closing Date (the “Escrow Shares”). The Escrow Shares may be utilized to offset certain claims, fines, penalties, outstanding debts or other costs owed by the Sellers following the Cataneo Closing Date. Thirty days prior to the end of the Escrow Period, certain of the Sellers shall have the right, but not the obligation, to cause the Company to repurchase their portion of the Escrow Shares at a price per share of $2.50.

The Purchase Agreement contains customary representations, warranties and covenants, as well as indemnification provisions subject to specified limitations. Among other things, the Sellers have agreed, subject to certain exceptions, to cause Cataneo to conduct its business in the ordinary course, consistent with past practice, from the date of the Purchase Agreement until the Cataneo Closing Date and not to take certain actions prior to the Cataneo Closing Date without the prior written consent of the Company.

The transaction is expected to close in the first half of 2025 and is subject to conditions, including, (i) the making of the Cash Election, (ii) the initiation of the process to register for resale the Equity Consideration, (iii) written confirmation that the Company has not received any delisting notice or similar notification affecting its listing status with Nasdaq, (iv) the execution by one or several of the Company’s major stockholders of a personal guarantee of the Agreed Share Value (as defined therein) for a period of one year following the Cataneo Closing Date (the “Personal Guarantee”), (v) the obtaining of joint approval of the terms of the financing of the cash purchase price of the Acquisition by the Company and the Sellers, (vi) the receipt of customary third-party approvals and the release of the Sellers from customary bank guarantees, securities and indemnities, and (vii) the Company’s board of directors’ approval of the Company’s due diligence investigation (collectively, the “Closing Conditions”). The Company intends to finance the transaction through third-party financing, which may take the form of debt or equity.

| 8 |

The Purchase Agreement contains certain customary termination rights, as amended and described below, for the Company and the Sellers, including the right to terminate the Purchase Agreement if (i) not all of the Closing Conditions have been satisfied by January 29, 2025 (which has been extended as described below), (ii) a party has not performed all of its Closing Actions (as defined therein) within ten business days of the Closing Date, or (iii) the registration process of the Equity Consideration has not been initiated prior to the Closing Date to the satisfaction of the Sellers. Notwithstanding any termination right, any party may seek specific performance of the other parties to the Purchase Agreement. In the event the Purchase Agreement is terminated by the Sellers by virtue of the failure of the Company to deliver the Personal Guarantee, the Sellers shall be entitled to a termination fee of $350,000.

On February 6, 2025, the Company and the Sellers entered into that certain Addendum to Share Purchase and Transfer Agreement (the “Addendum”), pursuant to which the parties amended certain provisions of the Purchase Agreement to provide the parties additional time to prepare for and close the Acquisition. More specifically, the Addendum amends the Purchase Agreement to, among other things: (i) provide that the Company pay to Mr. Unterseer, as authorized recipient of the Sellers $350,000 as a partial down payment (“Initial Down Payment”) on the Cash Consideration by February 13, 2025, which amount was paid in full on February 12, 2025 and temporarily suspend Sellers’ right to withdraw from the Purchase Agreement until February 28, 2025, unless the Company fails to pay Initial Down Payment; (ii) provide for additional temporary suspensions of Sellers’ right to withdraw for two successive one-month periods through April 30, 2025, dependent upon the Company’s payment each month of a down payment of $100,000 to Mr. Unterseer, as authorized recipient of the Sellers (each an “Additional Down Payment”), with each Additional Down Payment to be credited toward the Cash Consideration to be owed by the Company; (iii) add a requirement of Sellers to use their best efforts to coordinate and to cause Cataneo to work with the Company and the Company’s financial advisors towards the implementation of the percentage of completion method of accounting for past and current customer projects; (iv) provide that Sellers’ agree to rescind Sellers’ previous notification to exercise their right (the “Election Right”) to receive the Equity Consideration in the amount of $3,000,000 in cash instead of Consideration Shares as set forth in the Purchase Agreement, provided that the Sellers’ may re-exercise such Election Right prior to the Closing of the Acquisition; (v) waive Sellers’ right to approve the terms of the financing of the transaction; and (vi) provide that if the Purchase Agreement were to be terminated upon the Company’s failure to pay or the expiration of April 30, 2025, or for other reasons the Company withdraws from the Purchase Agreement pursuant to the early termination provisions of the Purchase Agreement or should the Purchase Agreement terminate before Closing, Seller’s agree to set-off under certain circumstances any claims Sellers may have pursuant to such early termination provisions of the Purchase Agreement against the Initial Down Payment and any Additional Down Payment; however, the remainder of the Initial Down Payment and any Additional Down Payment will not be repayable to the Company by Sellers.

Yorkville Promissory Note

On November 11, 2024, the Company issued a non-convertible unsecured promissory note (the “Promissory Note”) in the aggregate original principal amount of approximately $1.7 million to Yorkville. The Promissory Note does not bear interest, subject to a potential increase of the interest rate to 18.0% per annum upon the occurrence of certain events of default as described in the Promissory Note. The Promissory Note matures on March 11, 2025, and was issued at an original issue discount of 10%. The Company is required to make monthly cash payments beginning on December 15, 2024, and continuing on the same day of each successive calendar month (each, an “Installment Date”) of principal in the amount of the sum of (i) $0.4 million of principal (or the outstanding principal amount if less than such amount), plus (ii) a payment premium in an amount equal to 5% of the principal amount being paid, if applicable (the “Payment Premium”), and (iii) any accrued and unpaid interest as of each Installment Date (“Installment Amounts”). The Company shall, at its own option, repay each Installment Amount either (i) in cash on or before each Installment Date, or (ii) by submitting one or more an advance notice(s) under the SEPA (as defined below) (an “Advance Repayment”), on or before the applicable Installment Date, or any combination of (i) or (ii) as determined by the Company. If the Company repays the Installment Amount in cash, the cash payment shall include the Payment Premium. If the Company elects an Advance Repayment for all or a portion of an Installment Amount, then no Payment Premium will apply. In addition, for so long as the Promissory Note is outstanding, with respect to any advance notice submitted by the Company under the SEPA, the Company shall select an Option 2 Pricing Period (as defined in the SEPA), unless otherwise agreed by Yorkville.

| 9 |

Nasdaq Minimum Bid Price Compliance

On December 30, 2024, the Company received a letter (the “Notice”) from the Listing Qualifications Department (the “Staff”) of Nasdaq notifying the Company that, for the previous 30 consecutive business days, the closing bid price for the Company’s Common Stock, had been below the minimum $1.00 per share required for continued listing on The Nasdaq Capital Market under Nasdaq Listing Rule 5450(a)(1) (the “Bid Price Requirement”). The Notice has no effect at this time on the Common Stock, which continues to trade on The Nasdaq Capital Market under the symbol “BNAI”.

In accordance with Nasdaq Listing Rule 5810(c)(3)(A), the Company has been provided an initial period of 180 calendar days, or until June 28, 2025 (the “Compliance Date”), to regain compliance with the Bid Price Requirement. If, at any time before the Compliance Date, the bid price for the Common Stock closes at $1.00 or more for a minimum of 10 consecutive business days, the Staff will provide written notification to the Company that it has regained compliance with the Bid Price Requirement (unless the Staff exercises its discretion to extend the 10-day period).

If the Company is not in compliance with the Bid Price Requirement by the Compliance Date, the Company may qualify for a second 180 calendar day period to regain compliance with the Bid Price Requirement. To qualify for an additional compliance period, the Company will be required to meet the continued listing requirement for market value of publicly held shares and all other initial listing standards for The Nasdaq Capital Market, except for the Bid Price Requirement, and will need to provide written notice of its intention to cure the deficiency during the second compliance period, by effecting a reverse stock split, if necessary. If the Company does not qualify for or fails to regain compliance during the second compliance period, then the Staff will provide written notification to the Company that its Common Stock will be subject to delisting. At that time, the Company may appeal the Staff’s delisting determination to the Nasdaq Listing Qualifications Panel. However, there can be no assurance that, if the Company receives a delisting notice and appeals the delisting determination, that such an appeal would be successful.

The Company intends to monitor the closing bid price of its Common Stock and is evaluating available options, including seeking to effect a reverse stock split, to resolve the noncompliance matters described herein and intends to take appropriate steps to maintain its listing on Nasdaq. However, there can be no assurance that the Company will be able to regain compliance with the Bid Price Requirement.

Warrant Exercise and Reload Agreement

On January 13, 2025, the Company entered into that certain Warrant Exercise and Reload Agreement (the “January Warrant Exercise Agreement”) with certain investors (the “Purchasers”). Pursuant to the August SPA (as defined below), the Purchasers previously purchased 110,000 shares of Common Stock, and the Company issued the contribution warrant (the “Contribution Warrant”) to purchase up to 960,000 shares of Common Stock at an exercise price of $5.00 per share in exchange for certain holders of Common Stock contributing 1,185,000 shares of Common Stock into an escrow account maintained in connection with the August SPA, of which 1,075,000 shares of Common Stock remain in such escrow account (the “Escrow Shares”).

Under the January Warrant Exercise Agreement, the exercise price of 1,074,999 May Warrants (the “Committed Warrants”) was reduced to $1.96 per share, until May 30, 2025, after which point the exercise price for any unexercised Committed Warrants shall automatically revert back to $2.50 per share. Pursuant to the January Warrant Exercise Agreement, the Purchasers agreed to exercise the Committed Warrants for cash on a schedule set forth in the January Warrant Exercise Agreement, with exercises taking place on or before January 31, 2025, February 28, 2025 and March 27, 2025 (the “Exercise Schedule”). Upon each Committed Warrant exercised in accordance with the Exercise Schedule, the Company shall issue (i) one new warrant to purchase one share of Common Stock exercisable for a term of two years and (ii) one new warrant to purchase one share of Common Stock exercisable for a term of five years, each with an exercise price of $1.71 per share (together, the “Reload Warrants”). Upon a Purchaser’s completion in full under the Warrant Exercise but no later than May 30, 2025, all remaining May Warrants issued under the May SPA held by such Purchaser shall immediately upon completion of such exercise automatically be amended to become exercisable for $1.96 per share for the remainder of their term (the “Optional Warrants”). If a Purchaser exercises an Optional Warrant by June 30, 2025, the Company shall issue to such Purchaser (i) one new warrant to purchase one share of Common Stock with an exercise price of $1.71 per share with a term of two years and (ii) one new warrant to purchase one share of Common Stock with an exercise price of $1.71 with a term of five years (the “Optional Reload Warrants”). In addition, under the January Warrant Exercise Agreement, for each share of Common Stock for which a Purchaser exercises a Committed Warrant, one Escrow Share will be released from escrow and transferred to such Purchaser, for an aggregate of up to 1,074,999 Escrow Shares among all Purchasers, rounded down to the nearest whole share. Additionally, the exercise price of the Contribution Warrant was reduced to $1.71 per share.

| 10 |

As of the date hereof, Purchasers have exercised 340,092 Committed Warrants to purchase 340,092 shares of Common Stock pursuant to the January Warrant Exercise Agreement for aggregate gross proceeds of $666,585.97, and such Purchasers shall be issued 340,092 shares of Common Stock, 340,092 Escrow Shares, and 680,000 Reload Warrants. The August SPA has been terminated with respect to such Purchasers. As of the date hereof, one Purchaser has failed to make its required exercises for the January 31, 2025 exercise date under the January Warrant Exercise Agreement, in an aggregate amount of $168,209.16. To the extent a Purchaser fails to exercise its portion of the Committed Warrants, the obligations of such Purchaser under the August SPA and such obligations of any investor under the August SPA who is not a Purchaser under the January Warrant Exercise Agreement, shall remain, and the August SPA will only terminate as to the Purchasers who have completed their January 31, 2025 exercise pursuant to the terms of the January Warrant Exercise Agreement.

AFG Subscription Agreement; Termination of Reseller Agreement

On August 19, 2023, the Company and AFG entered into a Reseller Agreement (the “Reseller Agreement”) providing for, among other things, AFG to act as BEN’s exclusive reseller of certain products in a designated territory on certain terms and conditions. As partial consideration to AFG for such services to BEN, Prior BEN issued to AFG (i) a number of shares of Prior BEN common stock which converted into 1,750,000 shares of Common Stock and (ii) a non-transferable warrant to purchase up to 3,750,000 shares of Common Stock at a price of $10.00 per share, with AFG’s right to exercise such warrant vesting based upon revenues earned from the sales of BEN products paid by AFG to BEN pursuant to the Reseller Agreement (the “Reseller Warrant”).

On September 7, 2023, the Company and AFG entered into a Subscription Agreement (the “AFG Subscription Agreement”) providing for (i) the purchase of shares of Prior BEN Common Stock in a private placement by the AFG Investors as of immediately prior to the Closing Date, which converted into the right to receive 650,000 shares of Common Stock with an aggregate initial value of $6.5 million (such obligation to purchase such shares of BEN Common Stock, the “Initial Commitment”) and (ii) the purchase of shares Common Stock in four installments commencing on March 14, 2025, with an aggregate purchase price of $26.0 million, at a purchase price per share prior to the installment purchase date that is the lesser of $10.00 and the average of the last reported sales prices of Common Stock for the twenty (20) trading days immediately preceding the applicable installment purchase date, subject to a floor price of $2.11 (the “AFG Installment Shares”).

On January 17, 2025, the Company delivered a notice of termination (“Notice”) to AFG Companies, Inc. (“AFG”) terminating the Exclusive Reseller Agreement, dated August 19, 2023, as amended, by and between the Company and AFG (the “Reseller Agreement”). The Notice only applies to the Reseller Agreement and does not affect AFG’s obligations under the Subscription Agreement; however, in light of the Notice and the AFG Lawsuit (as defined below), the Company is uncertain whether AFG will fulfill its obligations under the Subscription Agreement. Accordingly, none of the information presented in this prospectus assumes that either the Reseller Warrant will become exercisable or that any AFG Installment Shares will be issued.

On January 16, 2025, the Company filed a lawsuit against AFG and its Chief Executive Officer, Ralph Wright Brewer III, in the Northern District of Texas, Dallas Division alleging fraudulent misrepresentation, breach of contract, and the concealment of a ransomware attach on its own network shortly before the Reseller Agreement was executed (the “AFG Lawsuit”).

| 11 |

The Company remains committed to, and intends to continue developing, its automotive vertical. The Company intends to utilize additional channel partners and grow its sales team to further expand its customer base and drive revenues. The Company is finalizing preparations to launch its Automotive AI Agent, a solution that integrates with major automotive data and service platform providers and supports over 13,000 dealerships nationwide. Additionally, the Company plans to expand its efforts through pilot programs in the Midwest, stronger reseller partnerships in Mexico, and collaborations with Canadian dealership groups. Recently, the Company has secured automotive pilots using its AI agent, which the Company believes will improve lead conversions, automates scheduling tools, enhances service efficiency, and enables advanced analytics to streamline operations.

Corporate Information

BEN’s principal executive offices are located at 145 E. Snow King Ave PO Box 1045 Jackson, WY 83001, and its phone number is (307) 757-3650. BEN’s website is https://beninc.ai/. Information found on or accessible though out website is not incorporated by reference into this prospectus and should not be considered part of this prospectus.

Implications of Being an Emerging Growth Company and a Smaller Reporting Company

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). For so long as we remain an emerging growth company, we are permitted, and currently intend, to rely on the following provisions of the JOBS Act that contain exceptions from disclosure and other requirements that otherwise are applicable to public companies and file periodic reports with the SEC. These provisions include, but are not limited to:

| ● | being permitted to present only two years of audited financial statements and selected financial data and only two years of related “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our periodic reports and registration statements, including this prospectus, subject to certain exceptions; | |

| ● | not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act of 2002 (“Sarbanes-Oxley”), as amended; | |

| ● | reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements, and registration statements, including in this prospectus; | |

| ● | not being required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements; and | |

| ● | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. | |

We will remain an emerging growth company until the earliest to occur of:

| ||

| ● | the fifth anniversary of the effectiveness of DHC’s registration statement on Form S-1, March 3, 2026; | |

| ● | the last day of the fiscal year in which we have total annual gross revenue of at least $1.235 billion, adjusted yearly for inflation; | |

| ● | the date on which we are deemed to be a “large accelerated filer,” as defined in the Exchange Act; and | |

| ● | the date on which we have issued more than $1 billion in non-convertible debt over a three-year period. |

| 12 |

We have elected to take advantage of certain of the reduced disclosure obligations in this prospectus and may elect to take advantage of other reduced reporting requirements in our future filings with the SEC. As a result, the information that we provide to holders of our stockholders may be different than what you might receive from other public reporting companies in which you hold equity interests.

We have elected to avail ourselves of the provision of the JOBS Act that permits emerging growth companies to take advantage of an extended transition period to comply with new or revised accounting standards applicable to public companies. As a result, we will not be subject to new or revised accounting standards at the same time as other public companies that are not emerging growth companies.