The unaudited pro forma condensed combined statement of operations for the nine months ended September 30, 2022 and year ended December 31, 2021 have been prepared using the following:

| | • | | Cartesian’s statement of operations; |

| | • | | Tiedemann Wealth Management Holdings’ statement of operations; |

| | • | | TIG Entities’ statement of operations; and |

| | • | | Alvarium Investments’ statement of comprehensive income |

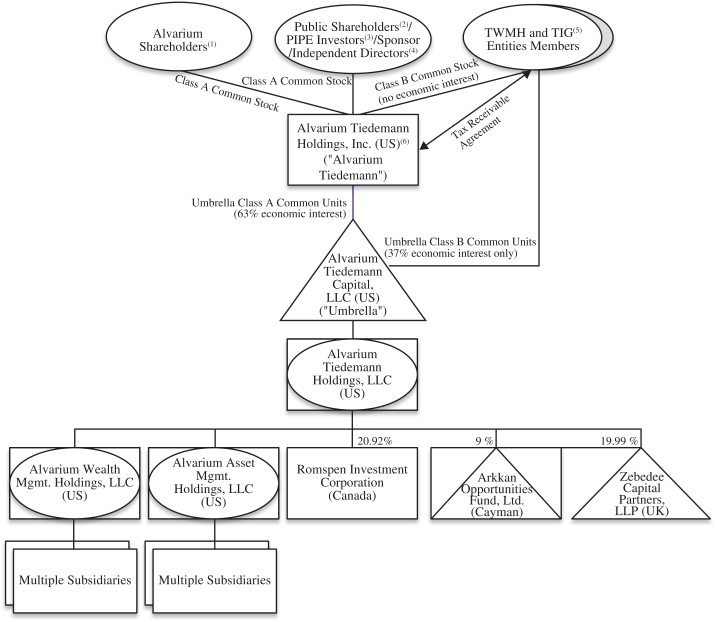

The merger between Alvarium Tiedemann and Umbrella was accounted for as a business combination under ASC Topic 805 and 810, and was accounted for using the acquisition method. Under this method of accounting, Umbrella was treated as the “acquired” company for financial reporting purposes.

Under the acquisition method, the acquisition-date fair value of the gross consideration transferred to effect the business combination, as described in Note 3—Adjustments to Unaudited Pro Forma Condensed Combined Balance Sheet, is allocated to the assets acquired and liabilities assumed based on their estimated fair values. The Company has made significant estimates and assumptions in determining the preliminary allocation of the gross consideration transferred in the unaudited pro forma condensed combined financial statements. As the unaudited pro forma condensed combined financial statements have been prepared based on these preliminary estimates, the final amounts recorded may differ materially from the information presented.

The unaudited pro forma condensed combined financial statements do not give effect to any anticipated operating efficiencies or cost savings that may be associated with the business combination. Certain reclassification adjustments have been made in the unaudited pro forma condensed combined financial statements to conform the Alvarium Tiedemann historical basis of presentation to that of TWMH, where applicable.

The pro forma adjustments reflecting the consummation of the Business Combination are based on certain estimates and assumptions. The unaudited pro forma adjustments may be revised as additional information becomes available. Therefore, it is likely that the actual adjustments will differ from the pro forma adjustments, and it is possible the difference may be material. Alvarium Tiedemann believes that assumptions made provide a reasonable basis for presenting all of the significant effects of the Business Combination contemplated based on information available to Alvarium Tiedemann at the time and that the pro forma adjustments give appropriate effect to those assumptions and are properly applied in the pro forma financial information. The unaudited pro forma condensed combined financial statements are not necessarily indicative of what the actual results of operations would have been had the business combination taken place on the date indicated, nor are they indicative of the future consolidated results of operations of the combined company. They should be read in conjunction with the historical consolidated financial statements and notes thereto of the Companies.

The historical financial statements have been adjusted in the unaudited pro forma condensed combined financial information to give effect to Pro Forma Adjustments, which are adjustments that depict in the pro forma condensed combined financial statements the accounting for the transactions required by U.S. GAAP.

The unaudited pro forma condensed combined provision for income taxes does not necessarily reflect the amounts that would have resulted had the Alvarium Tiedemann companies filed consolidated income tax returns during the period presented. The pro forma basic and diluted earnings per share amounts presented in the unaudited pro forma condensed combined statements of operations are based upon the number of the Alvarium Tiedemann shares outstanding, assuming the transaction occurred on January 1, 2021 and based upon the amount of redemptions.

Note 2—Accounting Policies

Upon consummation of the Business Combination, Alvarium Tiedemann will perform a comprehensive review of TWMH, the TIG Entities, and Alvarium’s accounting policies. As a result of the review, Alvarium

13