ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

References in this section of the Annual Report to “we,” “us” or the “Company” refer to Cartesian Growth Corporation, a Cayman Islands exempted company. References to our “management” or our “management team” refer to our officers and directors. The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our audited financial statements and the notes thereto which are included in “Item 8. Financial Statements and Supplementary Data” of this Annual Report. Certain information contained in the discussion and analysis set forth below includes forward-looking statements. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of many factors, including those set forth under “Cautionary Note Regarding Forward-Looking Statements,” “Item 1A. Risk Factors” and elsewhere in this Annual Report.

Overview

As of December 31, 2022, we were a blank check company incorporated on December 18, 2020 as a Cayman Islands exempted company, for the purpose of entering into a merger, capital stock exchange, asset acquisition, stock purchase, or reorganization or engaging in any other similar business combination with one or more businesses or entities.

Recent Developments

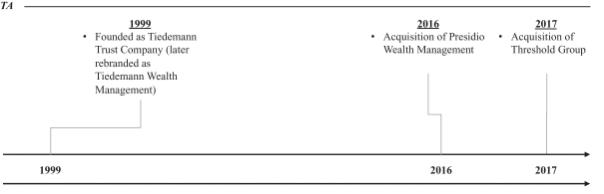

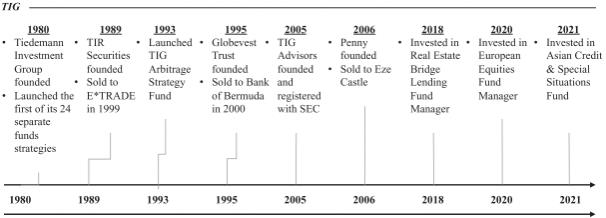

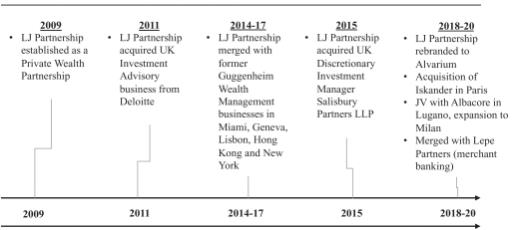

On January 3, 2023, we consummated our previously announced business combination with TWMH, the TIG Entities and Alvarium. In connection with the business combination, we were renamed “Alvarium Tiedemann Holdings, Inc.” and domesticated as a Delaware corporation.

Results of Operations

Our only activities through December 31, 2022 were organizational activities, those necessary to prepare for our initial public offering (described below) and, after our initial public offering, identifying a target company for an initial business combination. We do not expect to generate any operating revenues until after the completion of an initial business combination. We generate non-operating income in the form of interest income on marketable securities held in the trust account established for the benefit of our public shareholders. We incur expenses as a result of being a public company (for legal, financial reporting, accounting and auditing compliance), as well as for due diligence expenses in connection with searching for, and completing, an initial business combination.

For the year ended December 31, 2022, we had a net income of $8,779,014, which included an interest earned on cash and marketable securities held in trust account of $4,974,899, change in fair value of warrant liabilities of $12,562,468, and other income of $ 195,587, offset by a change in fair value of conversion option liability of $40,776, a loss from operations of $8,858,651, interest expense on debt discount of $32,145, and unrealized loss on treasury bills of $22,368.

For the year ended December 31, 2021, we had a net loss of $1,035,380, which included a loss from operations of $1,012,448, offering cost expense allocated to warrants of $868,131, an expense for the fair value in excess of cash received for private placement warrants of $3,097,200, offset by gain from the change in fair value of warrant liabilities of $3,911,091 and interest earned on cash and marketable securities held in trust account of $31,308.

Liquidity and Capital Resources

Until the consummation of the initial public offering, our only sources of liquidity were an initial subscription for 7,187,500 Class B ordinary shares, par value $0.0001 per share (the “Founder Shares”), by the Sponsor for an aggregate subscription price of $25,000 and loans from the Sponsor.

On February 26, 2021, we consummated the initial public offering of 34,500,000 units, at $10.00 per unit, which included the full exercise by the underwriters of their over-allotment option in the amount of 4,500,000 units, generating gross proceeds of $345,000,000. Simultaneously with the closing of the initial public offering, we consummated a private placement of an aggregate of 8,900,000 private placement warrants to the Sponsor at a price of $1.00 per private placement warrant, generating gross proceeds of $8,900,000.

87