Exhibit 99.2

Harnessing the Power of Genetic Medicine September 2021 Investor Presentation CONFIDENTIAL

2 CONFIDENTIAL Disclaimer This presentation contains proprietary and confidential information of Amicus Therapeutics, Inc . ’s gene therapy business (“Caritas”) and ARYA Science Acquisition Corp IV (“ARYA”), and the entire content should be considered “Confidential Information . ” Neither ARYA, nor Caritas, nor Jefferies LLC (“Jefferies” or the “Placement Agent”) makes any representation or warranty as to the accuracy or completeness of the information contained in this presentation . This presentation is not intended to be all inclusive or to contain all the information that a person may desire in considering an investment in ARYA or Caritas and is not intended to form the basis of any investment decision in ARYA or Caritas . You should consult your own legal, regulatory, tax, business, financial and accounting advisors to the extent you deem necessary, and you must make your own investment decision and perform your own independent investigation and analysis of an investment in ARYA or Caritas and the transactions contemplated in this presentation . By participating in this presentation, you expressly agree to keep confidential this presentation and all otherwise non - public information disclosed by ARYA and Caritas, whether orally or in writing, during this presentation or in these presentation materials . You also agree not to distribute, disclose or use such information for any purpose, other than for the purpose of evaluating your participation in the potential financing of the transactions contemplated in this presentation and to return to Caritas and ARYA, delete or destroy this presentation upon request . By participating in this presentation, you acknowledge that you are (i) aware that the United States securities laws prohibit any person who has material, non - public information concerning a company from purchasing or selling securities of such company or from communicating such information to any other person under circumstances in which it is reasonably foreseeable that such person is likely to purchase or sell such securities, and (ii) familiar with the Securities Exchange Act of 1934 , as amended, and the rules and regulations promulgated thereunder (collectively, the “Exchange Act”), and that you will neither use, nor cause any third party to use, this presentation or any information contained herein in contravention of the Exchange Act, including, without limitation, Rule 10 b - 5 thereunder . This presentation relates to the potential financing of a portion of the transactions contemplated in this presentation through a private placement of equity securities . This presentation shall not constitute a “solicitation” as defined in Section 14 of the Exchange Act, or and offer to sell, a solicitation of an offer to buy, or a recommendation to purchase any security of Caritas, ARYA or any of their respective affiliates . This presentation shall neither constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction . This presentation is not an offer, or a solicitation of an offer, to buy or sell any investment or other specific product . Any offering of securities (the “Securities”) will not be registered under the Securities Act of 1933 , as amended (the “Act”), and will be offered as a private placement to a limited number of institutional "accredited investors" as defined in Rule 501 (a)( 1 ), ( 2 ), ( 3 ) or ( 7 ) under the Act and “Institutional Accounts” as defined in FINRA Rule 4512 (c) . Accordingly, the Securities must continue to be held unless a subsequent disposition is exempt from the registration requirements of the Act . Investors should consult with their counsel as to the applicable requirements for a purchaser to avail itself of any exemption under the Act . The transfer of the Securities may also be subject to conditions set forth in an agreement under which they are to be issued . Investors should be aware that they might be required to bear the final risk of their investment for an indefinite period of time . Neither Caritas nor ARYA is making an offer of the Securities in any state where the offer is not permitted . The information contained in this presentation is only addressed to and directed at persons in member states of the European Economic Area (“EEA”) and the United Kingdom (each a “Relevant State”) who are “qualified investors” (i) in the case of the EEA, within the meaning of Article 2 (e) of Regulation (EU) 2017 / 1129 (as amended, the “Prospectus Regulation”) and (ii) in the case of the United Kingdom, within the meaning of Regulation (EU) 2017 / 1129 as it forms part of domestic law in the United Kingdom by virtue of the European Union (Withdrawal) Act 2018 (the “UK Prospectus Regulation”) (together, “Qualified Investors”) . In addition, in the United Kingdom, this presentation is being distributed only to, and is directed only at, Qualified Investors who are (i) persons having professional experience in matters relating to investments falling within Article 19 ( 5 ) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended, the “Order”) ; (ii) high net worth entities or other persons falling within Article 49 ( 2 )(a) to (d) of the Order ; or (iii) other persons to whom it may otherwise lawfully be communicated (all such persons who are also Qualified Investors being referred to as “Relevant Persons”) . The information provided in this presentation must not be acted on or relied on (i) in the United Kingdom, by persons who are not Relevant Persons, and (ii) in any other Relevant State, by persons who are not Qualified Investors . Any investment or investment activity to which the information in this presentation relates is available only to or will only be engaged in with, (i) Relevant Persons in the United Kingdom, and (ii) Qualified Investors in any other Relevant State . This presentation is intended solely for the purposes of familiarizing investors . To the extent the terms of any potential transaction are included in this presentation, those terms are included for discussion purposes only . NEITHER THE SECURITIES AND EXCHANGE COMMISSION (“SEC”) NOR ANY STATE OR TERRITORIAL SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THE SECURITIES OR DETERMINED IF THIS PRESENTATION IS TRUTHFUL OR COMPLETE . ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE . You should not construe the contents of this presentation as legal, tax, accounting or investment advice or a recommendation . You should consult your own counsel and tax and financial advisors as to legal and related matters concerning the matters described herein, and, by accepting this Presentation, you confirm that you are not relying upon the information contained herein to make any decision . Use of Data . This presentation contains information concerning Caritas’ products and industry that are based on industry surveys and publications or other publicly available information, other third - party survey data and research reports commissioned by Caritas and its internal sources . This information involves many assumptions and limitations ; therefore, there can be no guarantee as to the accuracy or reliability of such assumptions and you are cautioned not to give undue weight to this information . Further, no representation is made as to the reasonableness of the assumptions made within or the accuracy or completeness of any projections or modeling or any other information contained herein . Neither Caritas nor ARYA has independently verified this third - party information . Similarly, other third - party survey data and research reports commissioned by Caritas or ARYA, while believed by to be reliable, are based on limited sample sizes and have not been independently verified by Caritas or ARYA . In addition, projections, assumptions, estimates, goals, targets, plans and trends of the future performance of the industry in which Caritas operates, and its future performance, are necessarily subject to uncertainty and risk due to a variety of factors, including those described below . These and other factors could cause results to differ materially from those expressed in the estimates made by independent parties and by Caritas and ARYA . None of ARYA, Caritas and the Placement Agent assumes any obligation to update the information in this presentation . Additional Information ; Participants in the Solicitation . If the contemplated business combination is pursued, ARYA will be required to file a preliminary and definitive proxy statement, which may be a part of a registration statement, and other relevant documents with the SEC . Shareholders and other interested persons are urged to read the proxy statement and any other relevant documents filed with the SEC when they become available because they will contain important information about ARYA, Caritas and the contemplated business combination . Shareholders will be able to obtain a free copy of the proxy statement (when filed), as well as other filings containing information about ARYA, Caritas and the contemplated business combination, without charge, at the SEC’s website located at www . sec . gov . ARYA and its directors and executive officers may be deemed to be participants in the solicitation of proxies from ARYA’s shareholders in connection with the proposed transaction . A list of the names of such directors and executive officers and information regarding their interests in the business combination will be contained in the proxy statement/prospectus when available . You may obtain free copies of these documents free of charge at the SEC's website at www . sec . gov or by directing a written request to ARYA at 51 Astor Place, 10 th Floor New York, NY 10003 . This presentation does not contain all the information that should be considered in the contemplated business combination . It is not intended to form any basis of any investment decision or any decision in respect to the contemplated business combination . The definitive proxy statement will be mailed to shareholders as of a record date to be established for voting on the contemplated business combination when it becomes available .

3 CONFIDENTIAL Disclaimer (Cont'd) Forward Looking Statements . Certain statements in this presentation may constitute “forward - looking statements” within the meaning of the federal securities laws . Forward - looking statements include, but are not limited to, statements with respect to (i) Caritas’ commercialization of its current and future product candidates, (ii) trends in the genomic medicine industry, (iii) Caritas’ targeted customers and suppliers and the expected arrangements with them, (iv) Caritas’ projected operational performance, including relative to its competitors, and (v) other statements regarding ARYA’s or Caritas’ expectations, hopes, beliefs, intentions or strategies regarding the future . In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward - looking statements . The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,””should,” “strive,” “would” and similar expressions may identify forward - looking statements, but the absence of these words does not mean that a statement is not forward - looking . Forward - looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties . You should carefully consider the risks and uncertainties described in the “Risk Factors” section of ARYA’s registration statement on Form S - 1 , any proxy statement/prospectus relating to the business combination, which is expected to be filed by ARYA with the SEC, other documents filed by ARYA from time to time with the SEC, and any risk factors made available to you in connection with ARYA, Caritas and the business combination . These forward - looking statements involve a number of risks and uncertainties (some of which are beyond the control of ARYA and Caritas), and other assumptions, that may cause Caritas’ or ARYA’s actual results or performance to be materially different from those expressed or implied by these forward - looking statements . Such risks, uncertainties and assumptions that will be described in any proxy statement/prospectus relating to Caritas and the business combination, include, but are not limited to : Caritas’ assumptions about the size and timing of the market opportunity for its product candidates, which is based, in part, on third - party survey data and reports commissioned by Caritas, and Caritas’ assumptions about the portion of such market opportunity that Caritas can capture and the timing thereof ; Caritas’ ability to obtain required regulatory approvals for its product candidates ; inability to gain acceptance of any approved product candidates by physicians, patients, third - party payors and others in the medical community ; competition in the discovery, development and commercialization of products ; FDA and other regulatory approval of biosimilar products that compete with Caritas’ product candidates ; unfavorable pricing regulations, third - party coverage and reimbursement practices with respect to future products ; difficulty predicting the time cost of product candidate development ; ability to demonstrate safety and efficacy of product candidates in clinical trials ; reliance on third parties to conduct certain preclinical development activities and clinical trials and the potential failure of those third parties in meeting deadlines for such trials ; delays or difficulties enrolling patients in clinical trials ; the possibility that product candidates could cause undesirable side effects ; the possibility that any product candidate for which marketing approval is obtained could be subject to restrictions or withdrawal from the market ; negative public opinion and increased regulatory scrutiny of genomic medicines and their impact on public perception of the safety of Caritas’ product candidates ; inability to obtain or maintain designations for expeditated regulatory pathways for some or all Caritas’ current product candidates ; inability to obtain or maintain regulatory approves in foreign jurisdictions ; inability to enter into agreements for commercial supply with third - party manufacturers on acceptable terms ; inability to establish or maintain collaborations ; unavailability of materials necessary to manufacture Caritas’ product candidates on commercially reasonable terms ; inability to obtain and maintain patent protection for technology and future products ; inability to register trademarks in all potential markets ; inability to protect the confidentiality of trade secrets ; governmental responses to the COVID - 19 pandemic ; inability to obtain sufficient capital to meet operational financing requirements or comply with debt agreements ; inability to prevent computer system failures or security breaches ; potential product liability claims ; failure to hire, retain and motivate key executives and qualified personnel ; the significant increased expenses and administrative burden as a public company ; the potential need for substantial future funding to finance operations and the inability to be able to obtain such financing or acceptable terms or at all ; potential future acquisitions which could disrupt the Caritas’ business ; the occurrence of any event, change or other circumstances that could give rise to the termination of negotiations and any subsequent definitive agreements with respect to the proposed business combination ; the outcome of any legal proceedings that may be instituted against ARYA, the combined company or others following the announcement of the proposed business combination ; the inability to complete the proposed business combination due to the failure to obtain approval of the shareholders of ARYA, to obtain financing to complete the proposed business combination or to satisfy other conditions to closing ; changes to the proposed structure of the proposed business combination that may be required or appropriate as a result of applicable laws or regulations or as a condition to obtaining regulatory approval of the proposed business combination ; the ability to meet stock exchange listing standards following the consummation of the proposed business combination ; the risk that the proposed business combination disrupts current plans and operations of Caritas as a result of the announcement and consummation of the proposed business combination ; the ability to recognize the anticipated benefits of the proposed business combination ; costs related to the proposed business combination ; changes in applicable laws or regulations ; and the possibility that Caritas or the combined company may be adversely affected by other economic, business, and/or competitive factors . There may be additional risks that neither SPAC nor the Company presently know or that SPAC and the Company currently believe are immaterial that could also cause actual results to differ from those contained in the forward - looking statements . Should one or more of these risks or uncertainties materialize, they could cause actual results to differ materially from these forward - looking statements . You should not take any statement regarding past trends or activities as a representation that the trends or activities will continue in the future . Forward - looking statements speak only as of the date they are made . Readers are cautioned not to put undue reliance on forward - looking statements, and ARYA and Caritas assume no obligation and do not intend to update or revise these forward - looking statements, whether as a result of new information, future events, or otherwise . Neither ARYA nor Caritas gives any assurance that either ARYA or Caritas will achieve its expectations . This presentation is not intended to constitute, and should not be construed as, investment advice . Trademarks . Amicus and ARYA own or have rights to various trademarks, service marks and trade names that they use in connection with the operation of their respective businesses . This presentation may also contain trademarks, service marks, trade names and copyrights of third parties, which are the property of their respective owners . The use or display of third parties’ trademarks, service marks, trade names or products in this presentation is not intended to, and does not imply, a relationship with Amicus or ARYA, or an endorsement or sponsorship by or of Amicus or ARYA . Solely for convenience, the trademarks, service marks, trade names and copyrights referred to in this presentation may appear without the TM, SM, ‘ or © symbols, but such references are not intended to indicate, in any way, that Amicus or ARYA will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks, trade names and copyrights . Caritas and ARYA reserve the right to negotiate with one or more parties and to enter into a definitive agreement relating to the transaction at any time and without prior notice to the recipient or any other person or entity . Caritas and ARYA also reserve the right, at any time and without prior notice and without assigning any reason therefor, (i) to terminate the further participation by the recipient or any other person or entity in the consideration of, and proposed process relating to, the transaction, (ii) to modify any of the rules or procedures relating to such consideration and proposed process and (iii) to terminate entirely such consideration and proposed process . No representation or warranty (whether express or implied) has been made by Caritas, ARYA or any of their respective directors, officers, employees, affiliates, agents, advisors or representatives with respect to the proposed process or the manner in which the proposed process is conducted, and the recipient disclaims any such representation or warranty . The recipient acknowledges that Caritas, ARYA and their respective directors, officers, employees, affiliates, agents, advisors or representatives are under no obligation to accept any offer or proposal by any person or entity regarding the transaction . None of the Caritas, ARYA or any of their respective directors, officers, employees, affiliates, agents, advisors or representatives has any legal, fiduciary or other duty to any recipient with respect to the manner in which the proposed process is conducted .

4 CONFIDENTIAL Today’s Presenters [ PHOTO ] John F. Crowley CHAIRMAN & CHIEF EXECUTIVE OFFICER [ PHOTO ] Jill Weimer, Ph.D. SVP, DISCOVERY SCIENCE [ PHOTO ] Jeff Castelli, Ph.D. CHIEF DEVELOPMENT OFFICER [ PHOTO ] Jim Wilson, M.D., Ph.D. DIRECTOR OF THE ORPHAN DISEASE CENTER AT PENN • Amicus Chairman & CEO for 15+ years • Co - founder, President and CEO of Novazyme Pharmaceuticals (acquired by Genzyme in 2001) • Member of the Intellia and Entrada Therapeutics Board of Directors • Combat Veteran of Global War on Terrorism with Service in Afghanistan • B.S. from Georgetown University, J.D. from the University of Notre Dame Law School and an M.B.A. from Harvard • Director of the Gene Therapy program • Has made seminal contributions to the technology of gene transfer • Published over 600 papers and is named on over 200 patents • Launched faculty career in the Howard Hughes Medical Institute at the University of Michigan, moved to the University of Pennsylvania in 1993 • Multiple leadership roles over 15+ years at Amicus • Provides strategic leadership across all R&D activities • Extensive experience in leading program management, clinical development, portfolio planning and the Amicus Gene Therapy Business • Author on numerous publications and patents in the field of rare disease drug development • B.S. from West Chester University and a Ph.D. from the University of Pennsylvania • 2+ years at Amicus as SVP of Discovery Research and Gene Therapy Science • Led research team at Sanford Research in Sioux Falls, South Dakota focused on neuropediatric disorders • Oversaw the management and development of the translational arm of Sanford Research • B.S. and Ph. D in neuroscience from Univ. of Rochester, postdoc fellowship at UNC, Chapel Hill in the Neuroscience Center

5 CONFIDENTIAL Contents Executive Summary Core Technologies and Platforms Pipeline Manufacturing Strategy and Capabilities Collaboration with Amicus Combining with ARYA IV Mouse embryonic cortical neuron, magnified 600X, with dendrites (red) and axons (green)

6 CONFIDENTIAL Harnessing the Power of Genetic Medicine The mission of Caritas, the Latin word for compassion, is to transform the lives of children and adults living with genetic diseases by harnessing the power of genetic medicine through advanced protein engineering and innovative vector technologies

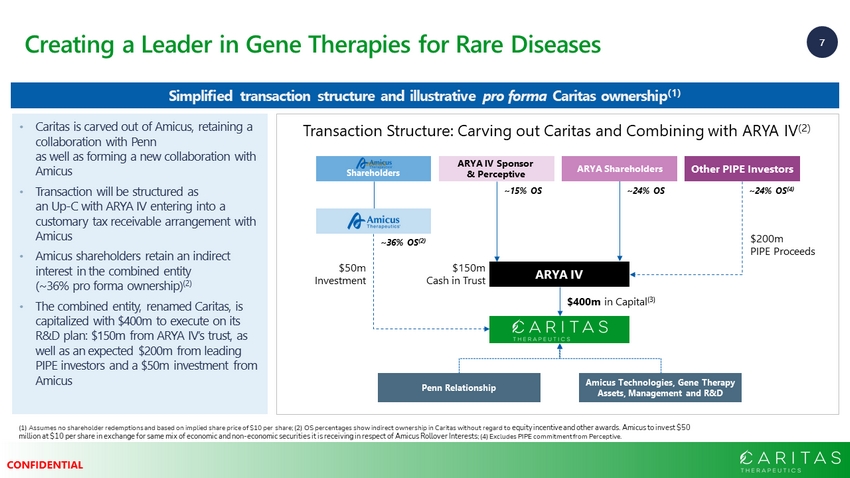

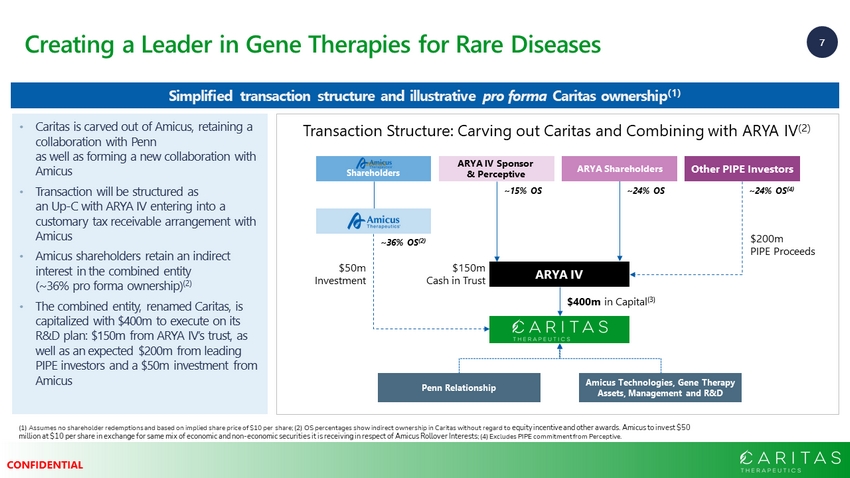

7 CONFIDENTIAL Creating a Leader in Gene Therapies for Rare Diseases (1) Assumes no shareholder redemptions and based on implied share price of $10 per share; (2) OS percentages show indirect ow ner ship in Caritas without regard to equity incentive and other awards. Amicus to invest $50 million at $10 per share in exchange for same mix of economic and non - economic securities it is receiving in respect of Amicus R ollover Interests ; (4) Excludes PIPE commitment from Perceptive. Simplified transaction structure and illustrative pro forma Caritas ownership (1) $400m in Capital (3) Other PIPE Investors ARYA IV Penn Relationship Amicus Technologies, Gene Therapy Assets, Management and R&D $200m PIPE Proceeds $150m Cash in Trust ~36% OS (2) ~24% OS (4) Amicus Shareholders • Caritas is carved out of Amicus, retaining a collaboration with Penn as well as forming a new collaboration with Amicus • Transaction will be structured as an Up - C with ARYA IV entering into a customary tax receivable arrangement with Amicus • Amicus shareholders retain an indirect interest in the combined entity (~36% pro forma ownership) (2) • The combined entity, renamed Caritas, is capitalized with $400m to execute on its R&D plan: $150m from ARYA IV’s trust, as well as an expected $200m from leading PIPE investors and a $50m investment from Amicus Transaction Structure: Carving out Caritas and Combining with ARYA IV (2) ARYA Shareholders ~24% OS ARYA IV Sponsor & Perceptive ~15% OS $50m Investment

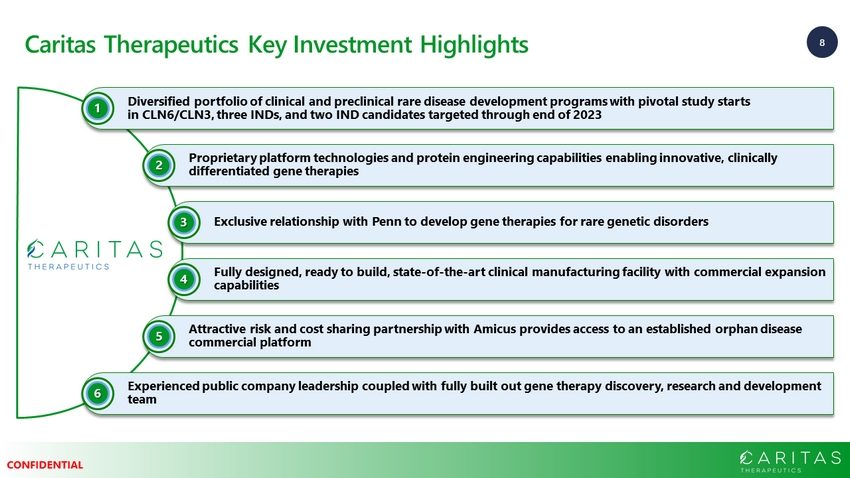

8 CONFIDENTIAL Caritas Therapeutics Key Investment Highlights Diversified portfolio of clinical and preclinical rare disease development programs with pivotal study starts in CLN6/CLN3, three INDs, and two IND candidates targeted through end of 2023 1 Proprietary platform technologies and protein engineering capabilities enabling innovative, clinically differentiated gene therapies 2 Exclusive relationship with Penn to develop gene therapies for rare genetic disorders 3 Fully designed, ready to build, state - of - the - art clinical manufacturing facility with commercial expansion capabilities 4 Attractive risk and cost sharing partnership with Amicus provides access to an established orphan disease commercial platform 5 Experienced public company leadership coupled with fully built out gene therapy discovery, research and development team 6

9 CONFIDENTIAL Three Strategic Value Drivers ▪ Modern protein engineering platforms generating bespoke solutions ▪ Engineered proteins and transgenes for enhanced expression, cross correction, targeting and immune protection Science Pipeline Partnerships ▪ 2 Batten Disease programs with clinical proof of concept ▪ 6 Active preclinical programs, including Fabry Disease, Pompe Disease, CDD ▪ Multiple discovery programs, including Angelman Syndrome ▪ Penn collaboration with exclusive rights to next - generation AAV technologies for named indications ▪ Strategic relationship with Thermo Fisher for manufacturing ▪ Amicus co - development and commercialization agreement (Fabry & Pompe GTx) Deep science in protein engineering driving a robust pipeline supported by industry - leading partnerships

10 CONFIDENTIAL A Diversified Pipeline Targeting Rare Diseases DISCOVERY PRECLINICAL PHASE 1/2 PHASE 3 REGULATORY Batten Franchise CLN6 Batten Disease CLN3 Batten Disease CLN1 Batten Disease Other forms of Batten Disease LSD Franchise Fabry Disease Pompe Disease MPS IIIA MPS IIIB Broader CNS/Neuromuscular Franchise CDKL5 Deficiency Disorder (CDD) Angelman Syndrome Others* Leading rare disease gene therapy pipeline focused on significant unmet medical needs, with multiple clinical and preclinical programs *Caritas Therapeutics has rights to Penn gene therapy technologies for the majority of LSDs, plus 11 additional larger Rare D ise ases, including Angelman Syndrome, Duchenne Muscular Dystrophy (DMD), Rett Syndrome, Myotonic Dystrophy and select other muscular d yst rophies Harnessing the power of genetic medicine

11 CONFIDENTIAL Organization and Capabilities Science Development Tech Ops G&A Functional Split Fully functional, separate entity with the ability to leverage Amicus’ G&A team through transitional services • Fully set up entity with a target of ~115 FTEs • Infused with Amicus’ entrepreneurial culture • Focused on science and patient - dedicated • Majority of positions to be filled by existing Amicus employees who transition to Caritas • Transition service agreements with Amicus to supplement the need for rapid personnel growth in G&A 54% 16% 10 % 20%

12 CONFIDENTIAL Contents Executive Summary Core Technologies and Platforms Pipeline Manufacturing Strategy and Capabilities Collaboration with Amicus Combining with ARYA IV Mouse embryonic cortical neuron, magnified 600X, with dendrites (red) and axons (green)

13 CONFIDENTIAL Novel Platform Technologies Caritas is advancing the next generation of gene therapies by leveraging proprietary protein engineering platforms to overcome many of the challenges currently facing the field Delivery Challenge: Inability to transduce a sufficient number of target cells Delivery Challenge: Inability to deliver transgene product to target cells and organelles Durability Challenge: Loss of expression and inability to re - dose if needed Safety Challenge: Class safety concerns associated with high dose AAV Cross - Correction Tissue and Cell Targeting Greater Potency Immune Modulation Platform Solutions

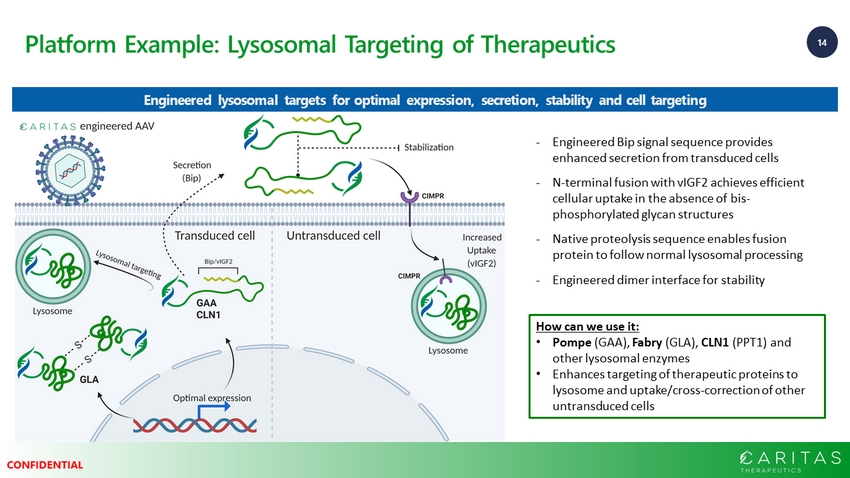

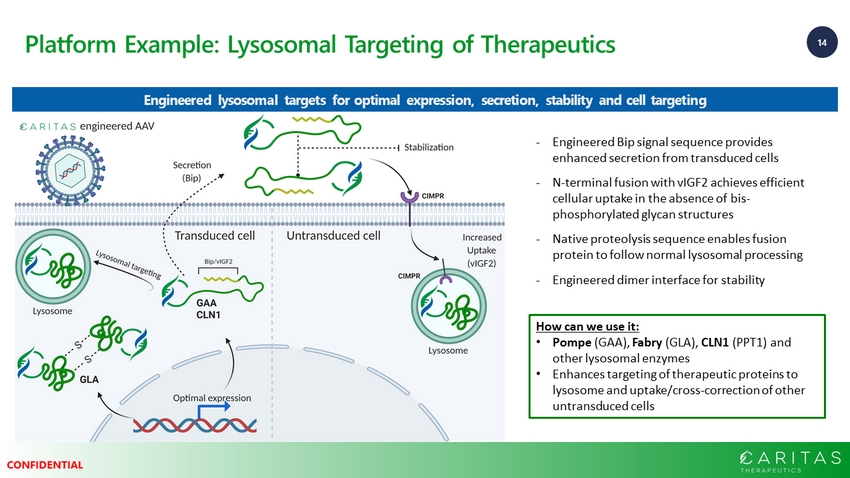

14 CONFIDENTIAL Platform Example: Lysosomal Targeting of Therapeutics - Engineered Bip signal sequence provides enhanced secretion from transduced cells - N - terminal fusion with vIGF2 achieves efficient cellular uptake in the absence of bis - phosphorylated glycan structures - Native proteolysis sequence enables fusion protein to follow normal lysosomal processing - Engineered dimer interface for stability How can we use it: • Pompe (GAA), Fabry (GLA), CLN1 (PPT1) and other lysosomal enzymes • Enhances targeting of therapeutic proteins to lysosome and uptake/cross - correction of other untransduced cells Engineered lysosomal targets for optimal expression, secretion, stability and cell targeting

15 CONFIDENTIAL Platform Example: Exosomal Targeting of Therapeutics Exosome - targeted mCherry Anti - CD63 Producer cell Recipient cells Exosome - targeted proteins for enhanced biodistribution and cellular uptake How can we use it: • Initial targets include CDKL5 , GAA and CLN3 • Many therapeutic proteins may benefit from exosomal cross - correction, particularly membrane proteins • We are producing a tool kit of targeting motifs that can be tested for each protein

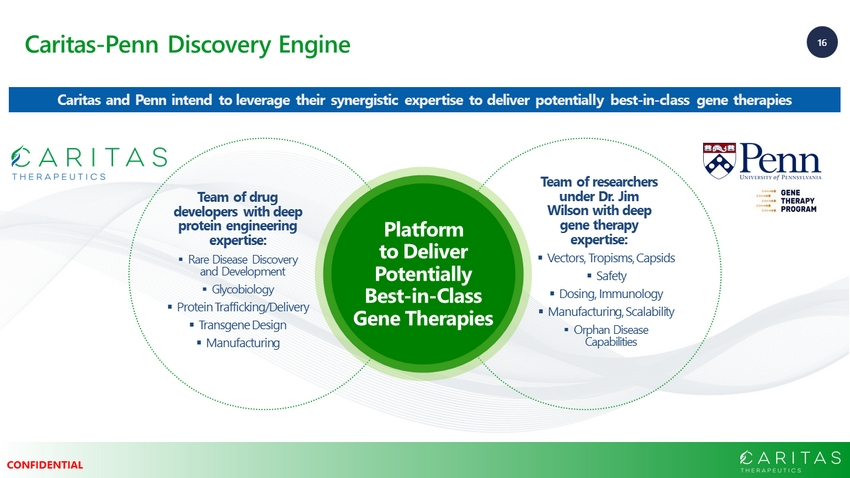

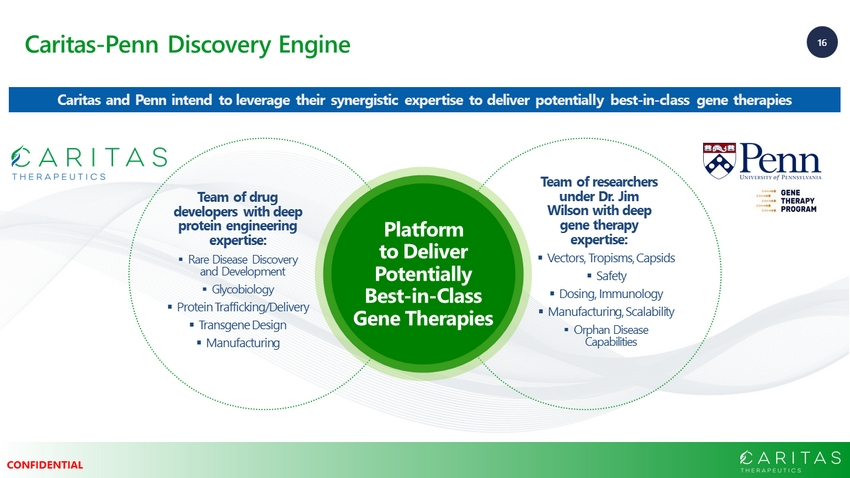

16 CONFIDENTIAL Caritas - Penn Discovery Engine Team of researchers under Dr. Jim Wilson with deep gene therapy expertise: Team of drug developers with deep protein engineering expertise: ▪ Rare Disease Discovery and Development ▪ Glycobiology ▪ Protein Trafficking/Delivery ▪ Transgene Design ▪ Manufacturing ▪ Vectors, Tropisms, Capsids ▪ Safety ▪ Dosing, Immunology ▪ Manufacturing, Scalability ▪ Orphan Disease Capabilities Platform to Deliver Potentially Best - in - Class Gene Therapies Caritas and Penn intend to leverage their synergistic expertise to deliver potentially best - in - class gene therapies

17 CONFIDENTIAL Access to Penn’s Proprietary Gene Therapy Technologies and Platform Delivery Safety Durability Manufacturability Programs leverage the Dr. Jim Wilson team’s wealth of knowledge and work at Penn to improve AAV delivery, safety, durability and manufacturability ▪ Routes of delivery and novel capsids for improved transduction AAV Discovery Example Workstreams ▪ Manufacturing process improvements to prevent deamidation ▪ Understanding and modulating loss of AAV expression DNA Protein ▪ Understanding and preventing toxicity of high dose Intrathecal AAV delivery

18 CONFIDENTIAL Contents Executive Summary Core Technologies and Platforms Pipeline Manufacturing Strategy and Capabilities Collaboration with Amicus Combining with ARYA IV Mouse embryonic cortical neuron, magnified 600X, with dendrites (red) and axons (green)

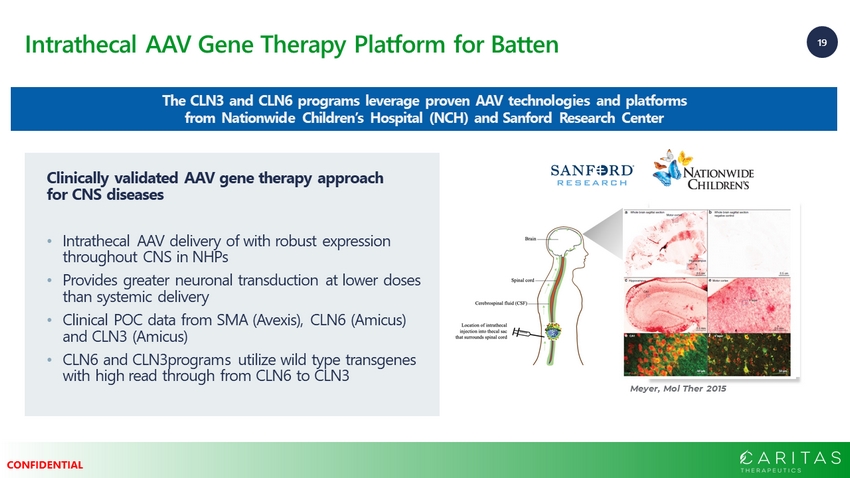

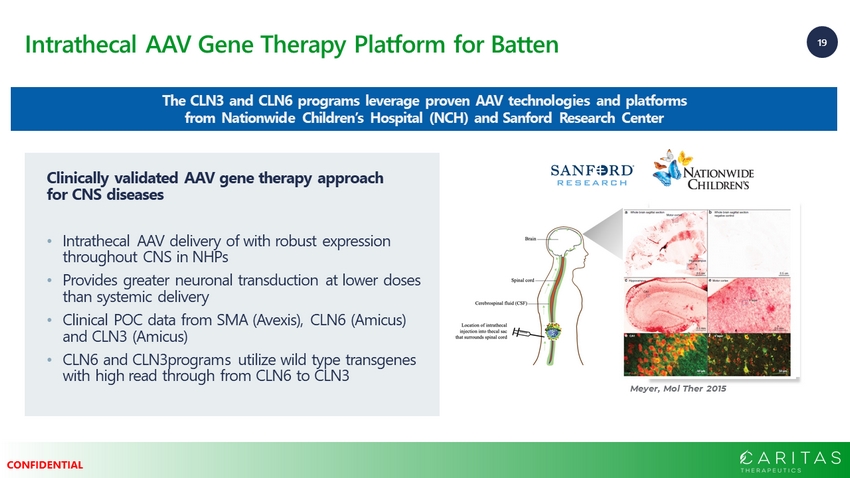

19 CONFIDENTIAL Intrathecal AAV Gene Therapy Platform for Batten The CLN3 and CLN6 programs leverage proven AAV technologies and platforms from Nationwide Children’s Hospital (NCH) and Sanford Research Center Meyer, Mol Ther 2015 Clinically validated AAV gene therapy approach for CNS diseases • Intrathecal AAV delivery of with robust expression throughout CNS in NHPs • Provides greater neuronal transduction at lower doses than systemic delivery • Clinical POC data from SMA (Avexis), CLN6 (Amicus) and CLN3 (Amicus) • CLN6 and CLN3programs utilize wild type transgenes with high read through from CLN6 to CLN3

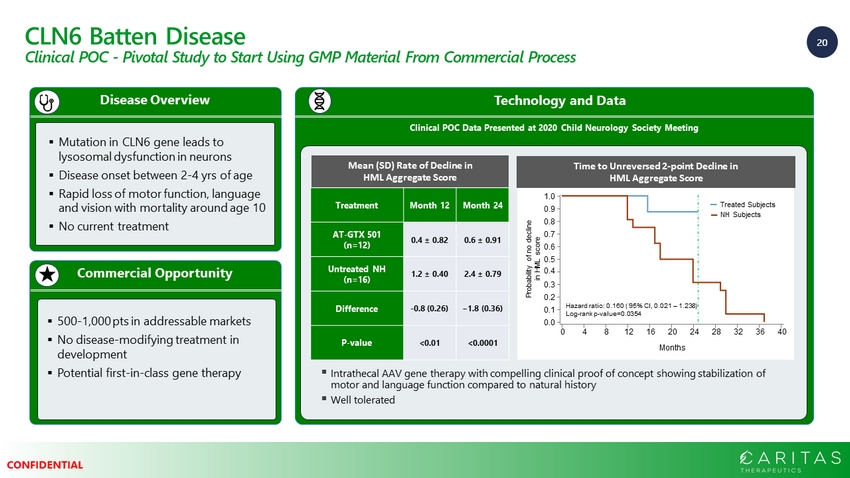

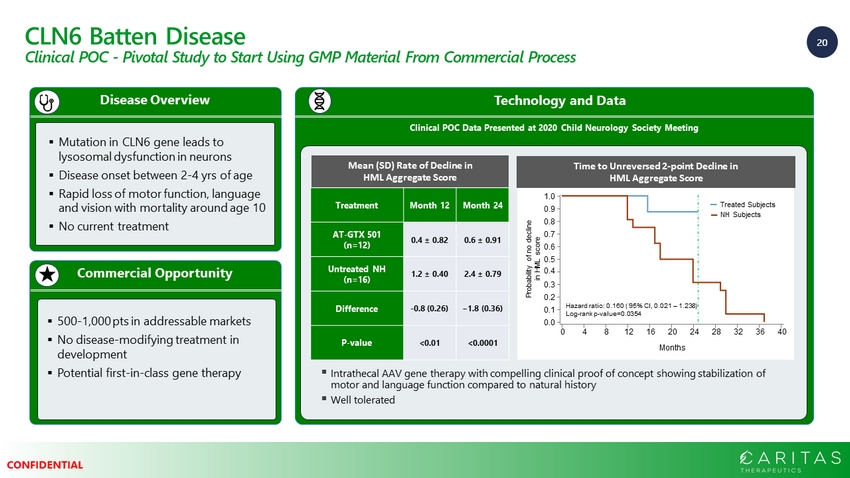

20 CONFIDENTIAL CLN6 Batten Disease Clinical POC - Pivotal Study to Start Using GMP Material From Commercial Process Technology and Data Clinical POC Data Presented at 2020 Child Neurology Society Meeting Commercial Opportunity Disease Overview ▪ Mutation in CLN6 gene leads to lysosomal dysfunction in neurons ▪ Disease onset between 2 - 4 yrs of age ▪ Rapid loss of motor function, language and vision with mortality around age 10 ▪ No current treatment ▪ 500 - 1,000 pts in addressable markets ▪ No disease - modifying treatment in development ▪ Potential first - in - class gene therapy ▪ Intrathecal AAV gene therapy with compelling clinical proof of concept showing stabilization of motor and language function compared to natural history ▪ Well tolerated Months 0 4 8 12 16 20 24 28 32 36 40 Hazard ratio: 0.160 ( 95% CI, 0.021 – 1.238) Log - rank p - value=0.0354 1.0 0.9 0.8 0.7 0.6 0.5 0.4 0.3 0.2 0.1 0.0 Probability of no decline in HML score Treated Subjects NH Subjects Time to Unreversed 2 - point Decline in HML Aggregate Score Treatment Month 12 Month 24 AT - GTX 501 (n=12) 0.4 ± 0.82 0.6 ± 0.91 Untreated NH (n=16) 1.2 ± 0.40 2.4 ± 0.79 Difference - 0.8 (0.26) −1.8 (0.36) P - value <0.01 <0.0001 Mean (SD) Rate of Decline in HML Aggregate Score

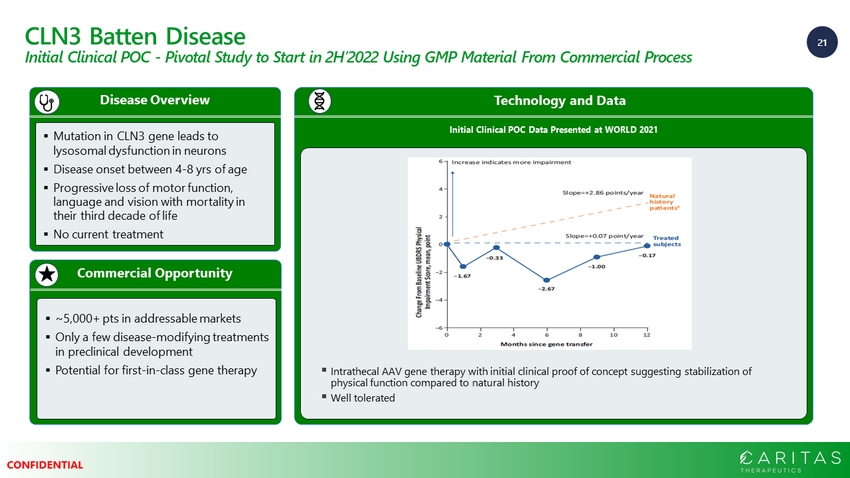

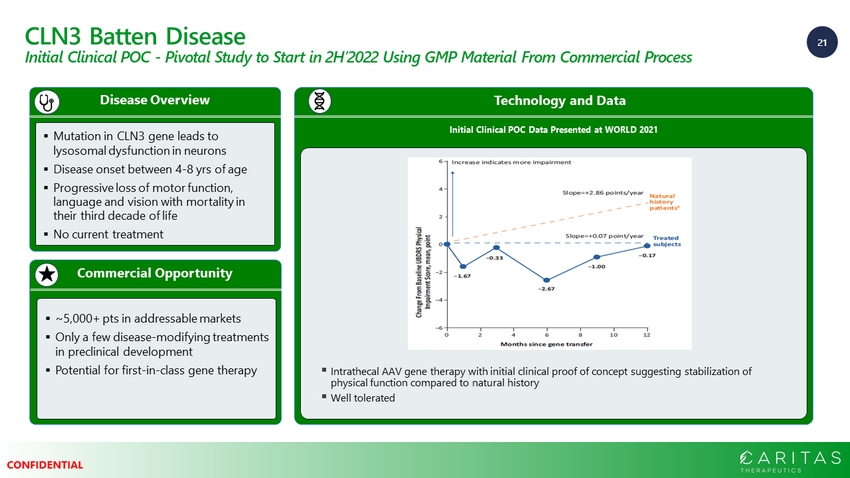

21 CONFIDENTIAL CLN3 Batten Disease Initial Clinical POC - Pivotal Study to Start in 2H’2022 Using GMP Material From Commercial Process Commercial Opportunity Disease Overview ▪ Mutation in CLN3 gene leads to lysosomal dysfunction in neurons ▪ Disease onset between 4 - 8 yrs of age ▪ Progressive loss of motor function, language and vision with mortality in their third decade of life ▪ No current treatment ▪ ~5,000+ pts in addressable markets ▪ Only a few disease - modifying treatments in preclinical development ▪ Potential for first - in - class gene therapy Technology and Data Initial Clinical POC Data Presented at WORLD 2021 ▪ Intrathecal AAV gene therapy with initial clinical proof of concept suggesting stabilization of physical function compared to natural history ▪ Well tolerated

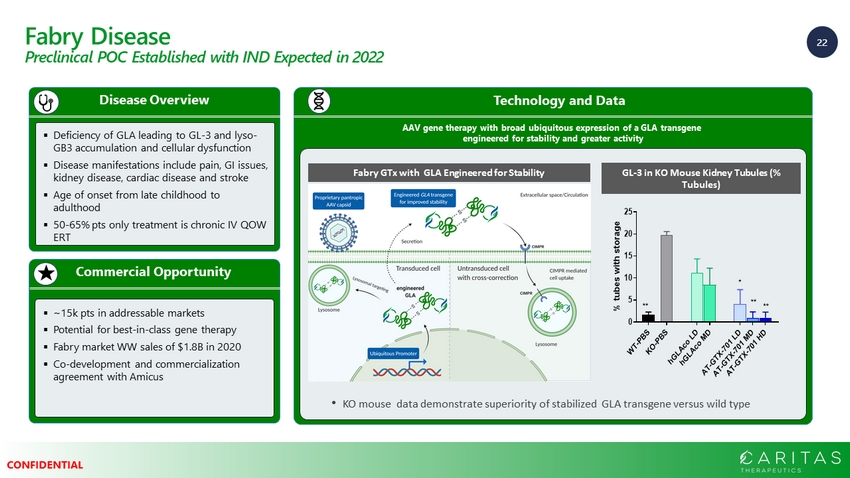

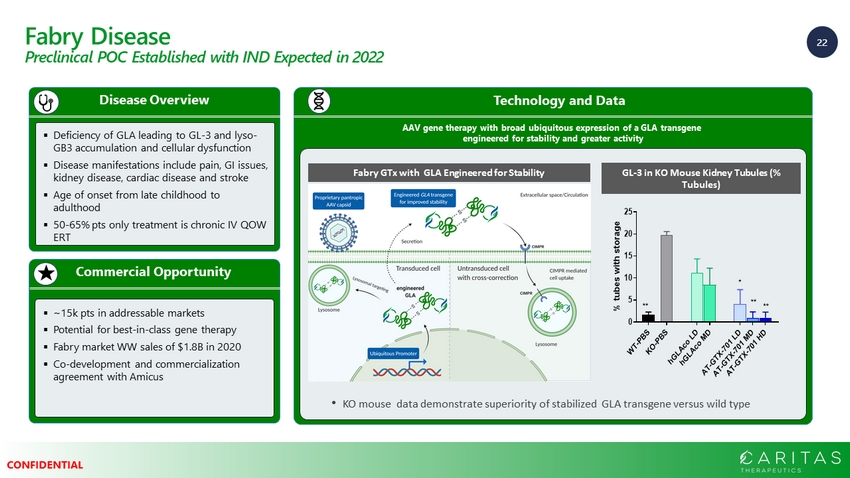

22 CONFIDENTIAL Fabry Disease Preclinical POC Established with IND Expected in 2022 Commercial Opportunity Disease Overview ▪ Deficiency of GLA leading to GL - 3 and lyso - GB3 accumulation and cellular dysfunction ▪ Disease manifestations include pain, GI issues, kidney disease, cardiac disease and stroke ▪ Age of onset from late childhood to adulthood ▪ 50 - 65% pts only treatment is chronic IV QOW ERT ▪ ~15k pts in addressable markets ▪ Potential for best - in - class gene therapy ▪ Fabry market WW sales of $1.8B in 2020 ▪ Co - development and commercialization agreement with Amicus Technology and Data AAV gene therapy with broad ubiquitous expression of a GLA transgene engineered for stability and greater activity • KO mouse data demonstrate superiority of stabilized GLA transgene versus wild type Fabry GTx with GLA Engineered for Stability GL - 3 in KO Mouse Kidney Tubules (% Tubules)

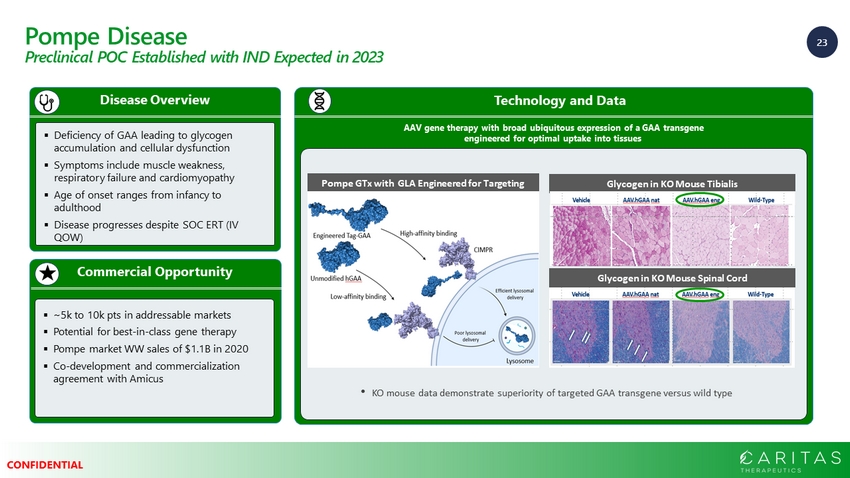

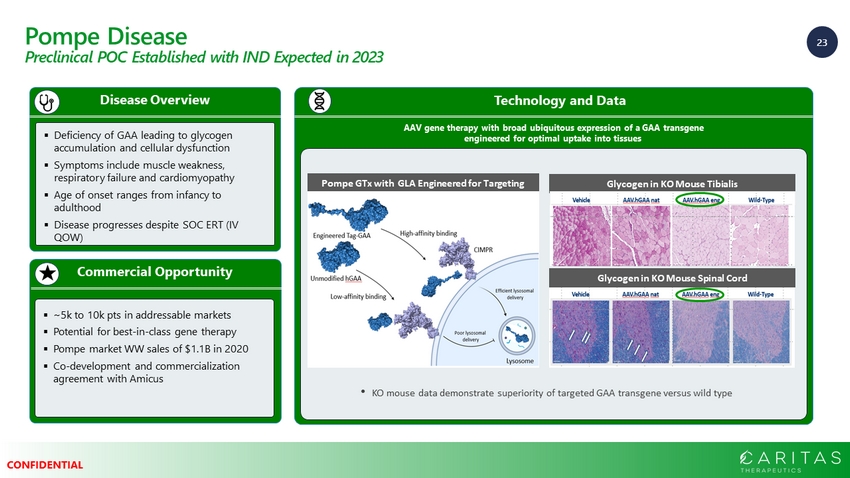

23 CONFIDENTIAL Pompe Disease Preclinical POC Established with IND Expected in 2023 Commercial Opportunity Disease Overview ▪ Deficiency of GAA leading to glycogen accumulation and cellular dysfunction ▪ Symptoms include muscle weakness, respiratory failure and cardiomyopathy ▪ Age of onset ranges from infancy to adulthood ▪ Disease progresses despite SOC ERT (IV QOW) ▪ ~5k to 10k pts in addressable markets ▪ Potential for best - in - class gene therapy ▪ Pompe market WW sales of $1.1B in 2020 ▪ Co - development and commercialization agreement with Amicus Technology and Data AAV gene therapy with broad ubiquitous expression of a GAA transgene engineered for optimal uptake into tissues • KO mouse data demonstrate superiority of targeted GAA transgene versus wild type Glycogen in KO Mouse Tibialis Glycogen in KO Mouse Spinal Cord Pompe GTx with GLA Engineered for Targeting

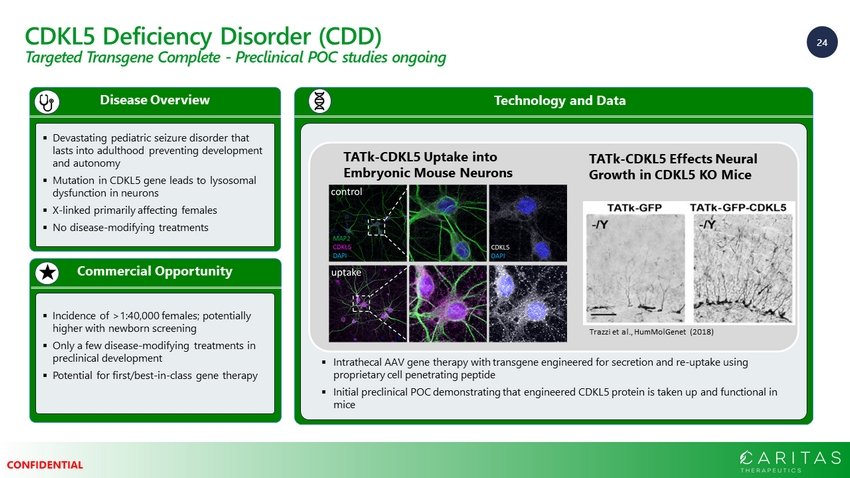

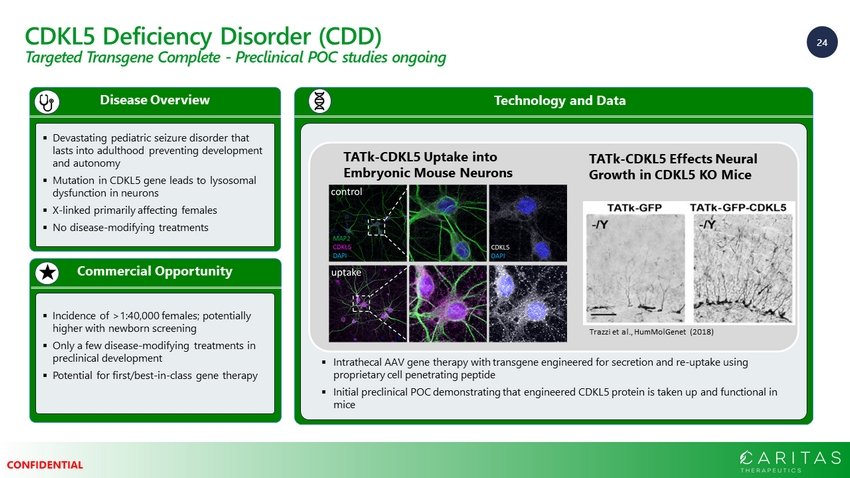

24 CONFIDENTIAL CDKL5 Deficiency Disorder (CDD) Targeted Transgene Complete - Preclinical POC studies ongoing Commercial Opportunity Disease Overview ▪ Devastating pediatric seizure disorder that lasts into adulthood preventing development and autonomy ▪ Mutation in CDKL5 gene leads to lysosomal dysfunction in neurons ▪ X - linked primarily affecting females ▪ No disease - modifying treatments ▪ Incidence of >1:40,000 females; potentially higher with newborn screening ▪ Only a few disease - modifying treatments in preclinical development ▪ Potential for first/best - in - class gene therapy Technology and Data ▪ Intrathecal AAV gene therapy with transgene engineered for secretion and re - uptake using proprietary cell penetrating peptide ▪ Initial preclinical POC demonstrating that engineered CDKL5 protein is taken up and functional in mice TATk - CDKL5 Uptake into Embryonic Mouse Neurons TATk - CDKL5 Effects Neural Growth in CDKL5 KO Mice Trazzi et al., HumMolGenet (2018)

25 CONFIDENTIAL Angelman Syndrome Transgene engineering work ongoing Commercial Opportunity Disease Overview ▪ Severe neurodevelopmental disorder affecting 1:12,000 - 20,000 children and adults ▪ UBE3A mutations lead to deficient levels of ubiquitin - protein ligase E3A in neurons ▪ Results in severe cognitive, motor and language impairment and seizures ▪ Developmental delays first noted ~6 mo of age ▪ >30k pts in addressable commercial markets ▪ No current disease - modifying treatment ▪ Potential for first/best - in - class gene therapy “Power of Cross - Correction” Engineering Approach

26 CONFIDENTIAL CLN1 Preclinical POC Established Commercial Opportunity Disease Overview ▪ Mutation in CLN1 gene leads to lysosomal dysfunction in neurons ▪ Disease onset between 1 - 3 yrs of age ▪ Rapid loss of motor function, language and vision with mortality around age 8 ▪ No current treatment ▪ ~1,500 pts in addressable markets ▪ Only a few disease - modifying treatments in preclinical development ▪ Opportunity for a first and best - in - class gene therapy Technology and Data ▪ Intrathecal AAV gene therapies with transgene engineered for optimal uptake into tissues ▪ Preclinical POC established showing engineered transgene significantly better than wild - type transgene in KO mice KO Mouse: Accumulated Substrate Material (ASM) Storage Material Vehicle WT CLN1 Amicus Eng 101 Amicus Eng 104

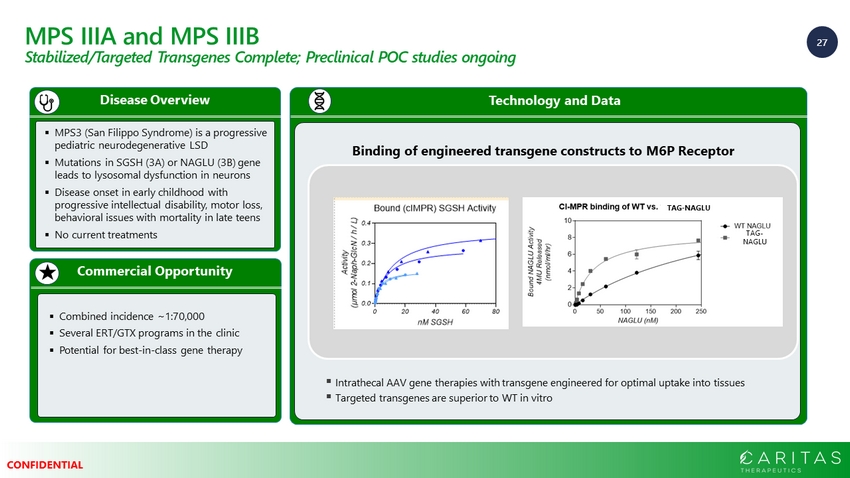

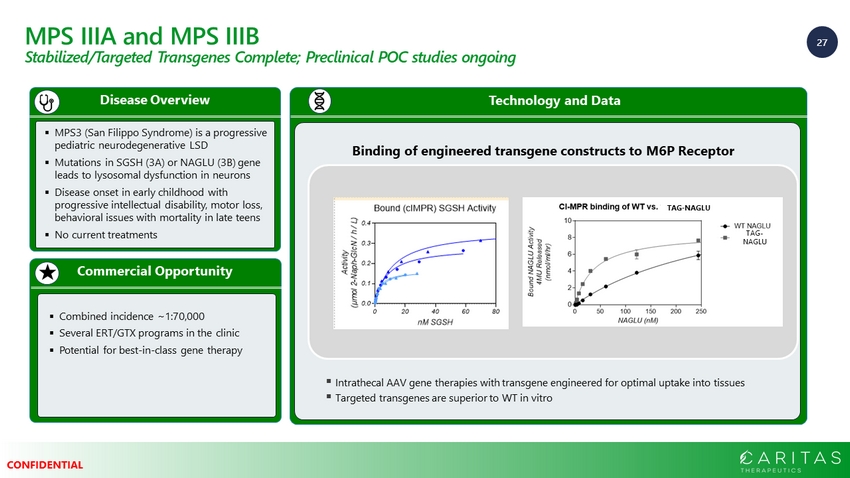

27 CONFIDENTIAL MPS IIIA and MPS IIIB Stabilized/Targeted Transgenes Complete; Preclinical POC studies ongoing Commercial Opportunity Disease Overview ▪ MPS3 (San Filippo Syndrome) is a progressive pediatric neurodegenerative LSD ▪ Mutations in SGSH (3A) or NAGLU (3B) gene leads to lysosomal dysfunction in neurons ▪ Disease onset in early childhood with progressive intellectual disability, motor loss, behavioral issues with mortality in late teens ▪ No current treatments ▪ Combined incidence ~1:70,000 ▪ Several ERT/GTX programs in the clinic ▪ Potential for best - in - class gene therapy Technology and Data Binding of engineered transgene constructs to M6P Receptor ▪ Intrathecal AAV gene therapies with transgene engineered for optimal uptake into tissues ▪ Targeted transgenes are superior to WT in vitro TAG - NAGLU TAG - NAGLU

28 CONFIDENTIAL Contents Executive Summary Core Technologies and Platforms Pipeline Manufacturing Strategy and Capabilities Collaboration with Amicus Combining with ARYA IV Mouse embryonic cortical neuron, magnified 600X, with dendrites (red) and axons (green)

29 CONFIDENTIAL Manufacturing Capabilities and Strategy Caritas plans to leverage strategic relationships with Thermo Fisher in the near term as it builds its own gene therapy manufacturing capabilities beginning with buildout of MFG1 which can be operational in ~18 months Build Amicus manufacturing capabilities and capacity Now 2023+ 2025+ ▪ Current research supply from Penn ▪ Tech transfers underway to Thermo Fisher (Brammer) with secured capacity for clinical and commercial manufacturing ▪ Long - term plasmid supply agreement with Aldevron ▪ Continue strategic partnership with Thermo Fisher ▪ Begin transferring select workstreams to Caritas MFG1 facility ▪ Continued strategic use of Thermo Fisher capacity ▪ Long - term strategy to build Caritas Manufacturing Center of Excellence for proprietary commercial manufacturing

30 CONFIDENTIAL Gene Therapy Manufacturing Facility - MFG1 • MFG1 to include GMP manufacturing, process development, analytical, QC Laboratories and office space • Will support adherent (iCellis) and suspension (500L SUB) manufacturing platforms • Potential for future small scale commercial production (cell culture, down - stream, up - stream, finishing) • Construction to begin Q1 2022 with anticipated completion in 2023 MFG1 will be a state of the art, flexible ~35,000 sq ft GMP manufacturing facility located in an existing new building at Medical Innovation City at Lake Nona (Orlando), FL Area Summary (~SF) Area - facility total 32,220 Area - clinical mfg 20,200 Area - admin office 9,700 Area - existing core 2,320

31 CONFIDENTIAL Contents Executive Summary Core Technologies and Platforms Pipeline Manufacturing Strategy and Capabilities Collaboration with Amicus Merging with ARYA IV Mouse embryonic cortical neuron, magnified 600X, with dendrites (red) and axons (green)

32 CONFIDENTIAL Strategic Collaboration with Amicus • Select members of Amicus senior leadership team joining Caritas • Immediate transfer of Amicus science, program management, regulatory and other personnel dedicated to GTx programs to Caritas (~90) • Short - term transition services agreement across further relevant functions to support transition • Immediate access to newly built, state of the art laboratory and office space in Philadelphia at Amicus’ Global Gene Therapy & Research Center of Excellence • Joint development agreement with Amicus on Fabry and Pompe GTx including cost sharing and shared downstream economics to leverage Amicus expertise and commercial capabilities • $50m investment into Caritas (1) Broad strategic relationship with Amicus to immediately stand up a fully integrated R&D organization with continued transition support and long - term collaboration in Fabry and Pompe diseases (1) Amicus to invest $50 million at $10 per share in exchange for same mix of economic and non - economic securities it is receivi ng in respect of Amicus Rollover Interests

33 CONFIDENTIAL Amicus Co - Development & Commercialization Agreement Substantial collaboration around genetic medicine for Fabry and Pompe diseases • Partnering with experts in the Fabry and Pompe field • Secures key long - term relationship reducing operational overhang • De - risks funding for Fabry and Pompe programs with 50% funding split to commercialization • Caritas maintains full upside with profit split on sales • Potential for other disease collaborations given Amicus’ right of first negotiation for muscular dystrophies

34 CONFIDENTIAL Contents Executive Summary Core Technologies and Platforms Pipeline Manufacturing Strategy and Capabilities Collaboration with Amicus Combining with ARYA IV Mouse embryonic cortical neuron, magnified 600X, with dendrites (red) and axons (green)

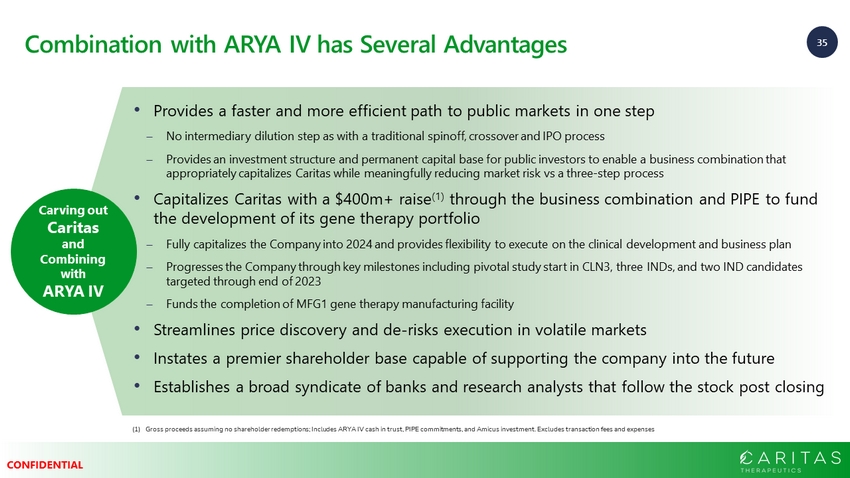

35 CONFIDENTIAL Combination with ARYA IV has Several Advantages Carving out Caritas and Combining with ARYA IV • Provides a faster and more efficient path to public markets in one step No intermediary dilution step as with a traditional spinoff, crossover and IPO process Provides an investment structure and permanent capital base for public investors to enable a business combination that appropriately capitalizes Caritas while meaningfully reducing market risk vs a three - step process • Capitalizes Caritas with a $400m+ raise (1) through the business combination and PIPE to fund the development of its gene therapy portfolio Fully capitalizes the Company into 2024 and provides flexibility to execute on the clinical development and business plan Progresses the Company through key milestones including pivotal study start in CLN3, three INDs, and two IND candidates targeted through end of 2023 Funds the completion of MFG1 gene therapy manufacturing facility • Streamlines price discovery and de - risks execution in volatile markets • Instates a premier shareholder base capable of supporting the company into the future • Establishes a broad syndicate of banks and research analysts that follow the stock post closing (1) Gross proceeds assuming no shareholder redemptions; Includes ARYA IV cash in trust, PIPE commitments, and Amicus investment. Exc ludes transaction fees and expenses

36 CONFIDENTIAL Terms of Transaction (1) Pro Forma Valuation Sources of Funds (2) Uses of Funds (2) Pro Forma Shares Outstanding (3) 61,687 Implied Share Price $ 10.00 PF Equity Value $ 616,865 Less: PF Cash $ (374,500) Implied PF Enterprise Value $ 242,365 Equity Retained by Caritas Equity Holders (5) $ 175,000 Estimated Transaction Fees & Expenses (6) $ 25,000 Remaining Cash (Balance Sheet) $ 374,500 Total Uses of Funds $ 574,500 Pro Forma Ownership (7) Cash Held in Trust $ 149,500 (4) Caritas Equity Holder Rollover $ 175,000 PIPE Proceeds $ 200,000 Amicus Investment (5) $ 50,000 Total Sources of Funds $ 574,500 Shares % ARYA IV Insiders 9,237 15% o/w Sponsor Promote Shares 3,648 6% o/w Sponsor Private Placement Shares 499 1% o/w Perceptive PIPE Shares 5,000 8% o/w Other Class B Shares (8) 90 0% Public Shareholders (excl. ARYA IV Sponsor) 14,950 24% Amicus and Affiliates 22,500 36% o/w Amicus Rollover Interests 17,500 28% o/w Amicus Investment Shares 5,000 8% Third Party PIPE Investors (excl. Perceptive) 15,000 24% Totals 61,687 100% (1) Customary “Up - C” transaction structure, with existing owner of Caritas LLC (i.e., Amicus) holding economic, non - voting inter ests in an LLC and non - economic, interests in ARYA (the public company that is the parent company of Caritas LLC) and all other shareholders will hold economic, voting interests in ARYA; (2) As per closing anticipated in Q4 2021; (3) Includes ARYA sh ares and Caritas units; (4) Assumes no shareholder redemptions and based on implied share price of $10 per share; Approximate, excluding any interest earned on cash in trust; (5) Allocation of equity consideration to Caritas equity holders ; A ll percentages are reflective of interests in Caritas on a fully - diluted basis excluding equity incentive and other awards; (6) Estimated fees and expenses for both Caritas and SPAC, includes deferred underwriting fees from ARYA IV’s IPO; (7) Amicus to inv est $50 million at $10 per share in exchange for same mix of economic and non - economic securities it is receiving in respect of Amicus Rollover Interests; (8) These shares are held by the independent directors of ARYA IV. Shares and $ in thousands (other than share price)

37 CONFIDENTIAL Use of Proceeds • Approximately $375 million (1) of post - transaction cash projected on the combined company balance sheet to pursue Caritas' research and development programs – Expected to provide cash runway into 2024 • Proceeds intended to be sufficient to fund Caritas through multiple value - creating milestones: – Generate 1 - 2 INDs per year – Initiate registration studies in CLN3/CLN6 Batten Disease – Generate initial clinical POC in Fabry Disease – Build GMP GTx manufacturing facility – Generate key preclinical POC across proprietary GTx platforms Projected proceeds will be primarily used to fund Caritas' research and development programs (1) Net proceeds assuming no shareholder redemptions

38 CONFIDENTIAL Expected Near - Term Key Milestones Key Milestones Anticipated Event Timing ▪ Initial 2 - year data from CLN3 Batten disease Phase 1/2 study 2022 ▪ Preclinical POC established and IND candidate declared for CDD 2022 ▪ IND submitted for Fabry disease 2022/2023 ▪ Pivotal study start in CLN3 Batten disease 2022/2023 ▪ Preclinical POC established and IND candidate declared for Angelman 2022/2023 ▪ IND submitted for Pompe disease 2023 ▪ Pivotal study start in CLN6 Batten disease 2023 ▪ IND submitted for CDD 2023 ▪ License request for MFG1 manufacturing site 2023 ▪ Initial clinical POC data Fabry disease Phase 1/2 study 2024 Capital intended to be sufficient to generate multiple near - term value creating milestones across the portfolio

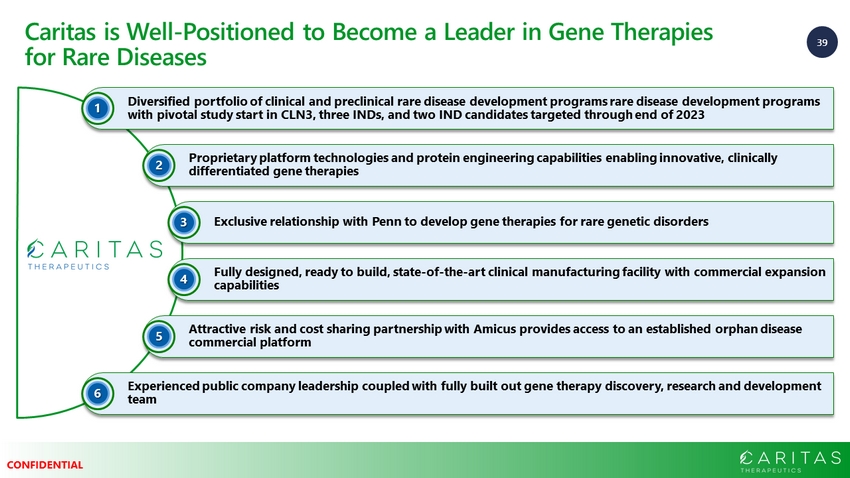

39 CONFIDENTIAL Diversified portfolio of clinical and preclinical rare disease development programs rare disease development programs with pivotal study start in CLN3, three INDs, and two IND candidates targeted through end of 2023 1 Proprietary platform technologies and protein engineering capabilities enabling innovative, clinically differentiated gene therapies 2 Exclusive relationship with Penn to develop gene therapies for rare genetic disorders 3 Fully designed, ready to build, state - of - the - art clinical manufacturing facility with commercial expansion capabilities 4 Attractive risk and cost sharing partnership with Amicus provides access to an established orphan disease commercial platform 5 Experienced public company leadership coupled with fully built out gene therapy discovery, research and development team 6 Caritas is Well - Positioned to Become a Leader in Gene Therapies for Rare Diseases

CONFIDENTIAL Harnessing the Power of Genetic Medicine