DESCRIPTION OF SHARE CAPITAL

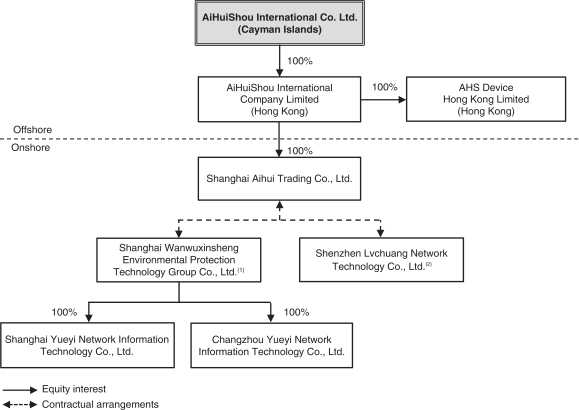

We are a Cayman Islands exempted company incorporated with limited liability and our affairs are governed by our memorandum and articles of association, the Companies Act (As Revised) of the Cayman Islands, which we refer to as the Companies Act below, and the common law of the Cayman Islands.

As of the date of this prospectus, our authorized share capital is US$300,000 divided into 300,000,000 shares with a par value of US$0.001 each, comprising of (i) 182,665,628 ordinary shares with a par value of US$0.001 each; (ii) 9,497,040 Series A preferred shares with a par value of US$0.001 each; (iii) 7,586,836 Series B preferred shares with a par value of US$0.001 each, comprising of (a) 1,758,711 Series B-1 preferred shares, (b) 2,879,784 Series B-2 preferred shares and (c) 2,948,341 Series B-3 preferred shares; (iv) 44,226,287 Series C preferred shares with a par value of US$0.001 each, comprising of (a) 2,747,350 Series C-1 preferred shares, (b) 17,099,501 Series C-2 preferred shares and (c) 24,379,436 Series C-3 preferred shares; (v) 10,068,160 Series D preferred shares with a par value of US$0.001 each, comprising of (a) 2,115,755 Series D-1 preferred shares and (b) 7,952,405 Series D-2 preferred shares; (vi) 36,178,666 Series E preferred shares and 9,777,383 Series F preferred shares with a par value of US$0.001 each.

As of the date of this prospectus, 18,782,620 ordinary shares, 9,497,040 Series A preferred shares, 1,758,711 Series B-1 preferred shares, 2,879,784 Series B-2 preferred shares, 2,948,341 Series B-3 preferred shares, 2,747,350 Series C-1 preferred shares, 17,099,501 Series C-2 preferred shares, 24,379,436 Series C-3 preferred shares, 2,115,755 Series D-1 preferred shares, 7,952,405 Series D-2 preferred shares, 36,178,666 Series E preferred shares and 9,777,383 Series F preferred shares are issued and outstanding. All of our issued and outstanding ordinary shares and preferred shares are fully paid.

Immediately prior to the completion of this offering, our authorized share capital will be US$1,000,000 divided into 1,000,000,000 shares comprising of (i) 941,472,561 Class A Ordinary Shares of a par value of US$0.001 each, (ii) 47,240,103 Class B Ordinary Shares of a par value of US$0.001 each, and (iii) 11,287,336 Class C Ordinary Shares of a par value of US$0.001 each, and there will be ordinary shares outstanding, including a total of Class A ordinary shares, Class B ordinary shares and Class C ordinary shares, assuming the underwriters do not exercise the over-allotment option.

Our Post-Offering Memorandum and Articles of Association

Subject to the approval of our shareholders, we will adopt a further amended and restated memorandum and articles of association, which will become effective and replace our currently effective memorandum and articles of association in its entirety immediately prior to the completion of this offering. The following are summaries of material provisions of the post-offering memorandum and articles of association and of the Companies Act, insofar as they relate to the material terms of our ordinary shares.

Objects of Our Company. Under our post-offering memorandum and articles of association, the objects of our company are unrestricted and we have the full power and authority to carry out any object not prohibited by the laws of the Cayman Islands.

Ordinary Shares. Our ordinary shares are divided into Class A ordinary shares, Class B ordinary shares and Class C ordinary shares. Holders of our Class A ordinary shares, Class B ordinary

209