- MVLA Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

S-1/A Filing

Movella (MVLA) S-1/A2022 FY IPO registration (amended)

Filed: 19 May 23, 5:22pm

Delaware | 7372 | 98-1575384 | ||

(State or other jurisdiction of incorporation) | (Primary Standard Industrial Classification Code No.) | (I.R.S. Employer Identification No.) |

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ | |||

| Emerging growth company | ☒ | |||||

The information in this preliminary prospectus is not complete and may be changed. Neither we nor the selling stockholders may sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

(Prospectus cover continued on the following page)

SUBJECT TO COMPLETION, DATED MAY 19, 2023

PRELIMINARY PROSPECTUS

Movella Holdings Inc.

Up to 23,523,776 shares of common stock

This prospectus relates to the offer and sale from time to time by the selling stockholders named in this prospectus or their permitted transferees of up to 23,523,776 shares of our common stock, $0.00001 par value per share (the “common stock”), which includes (i) up to 4,100,000 shares of common stock held by Pathfinder Acquisition LLC (the “Sponsor”) and certain other persons and entities (collectively with the Sponsor, the “Original Holders”) holding shares of common stock initially purchased in a private placement at a purchase price of $0.003 per share in connection with the initial public offering (the “IPO”) of Pathfinder Acquisition Corporation (“Pathfinder”); (ii) 4,250,000 shares of common stock issuable upon the exercise of warrants purchased at a purchase price of $2.00 per warrant to purchase shares of common stock at an exercise price of $11.50 per share held by the Original Holders; (iii) 6,576,036 shares held by certain affiliates and former affiliates of Movella Inc. (“Legacy Movella”) (the “Movella-Related Holders”), which shares were purchased at an average purchase price of $2.88 per share (at per share prices ranging from $0.31 to $9.80); (iv) 8,500,000 shares of common stock held by FP Credit Partners II, L.P. and FP Credit Partners Phoenix II, L.P. (collectively, the “FP Purchasers”) as a result of the transfer of 1,000,000 shares from Pathfinder to the FP Purchasers pursuant to that certain Equity Grant Agreement, dated as of November 14, 2022, by and among Pathfinder and the FP Purchasers as consideration for the Note Purchase Agreement (as defined herein) and the purchase of 7,500,000 shares of common stock at a purchase price of $10.00 per share by the FP Purchasers from Pathfinder in a private placement in connection with the VLN Facility (as defined herein) (the “FP VLN Shares” and collectively with the 1,000,000 shares transferred by the Sponsor to the FP Purchasers, the “FP Shares”); and (v) up to 97,740 shares of common stock issuable upon exercise of certain outstanding options to acquire shares of our common stock held by a former employee of Legacy Movella, which options have an average exercise price of $1.81 per share. The per share prices for the shares of common stock held by the Movella-Related Holders or subject to Legacy Movella options reflect the original per share price as adjusted in connection with the Business Combination. In its initial public offering, Pathfinder issued units at a purchase price of $10.00 per unit, with each unit consisting of one Class A ordinary share and one-fifth of one public warrant to purchase one Class A ordinary share with a warrant exercise price of $11.50 per share, with the Class A ordinary shares and warrants to purchase Class A ordinary shares converted into shares of common stock and warrants to purchase common stock following the Domestication (as defined herein).

We will not receive any proceeds from the sale of shares of common stock by the selling stockholders pursuant to this prospectus. We will receive up to an aggregate of approximately $49.0 million from the exercise of the warrants and the options, assuming the exercise in full of all warrants and options for cash. If the options or warrants are exercised pursuant to a cashless exercise feature, we will not receive any cash from these exercises. We expect to use the net proceeds from the exercise of the warrants and options, if any, for general corporate purposes. In addition, in connection with the VLN Facility, we are entitled to receive a credit from the sale of any FP VLN Shares toward repayment of the VLN Facility as further described in “Use of Proceeds.” Any cash proceeds associated with the exercise of the warrants are dependent on the price of our common stock. Because the $11.50 exercise price per share of the warrants substantially exceeds the current trading price per share of our common stock ($1.51 per share as of May 18, 2023), there is no assurance that the warrants will be in the money prior to their expiration and it is unlikely that the warrant holders will be able to exercise such warrants in the near future, if at all. As a result, we are unlikely to receive any proceeds from the exercise of the warrants in the near future, if at all, and the warrants may not provide any additional capital. In considering our capital requirements and sources of liquidity, we have not assumed or relied on the receipt of proceeds from the exercise of the warrants. We will pay certain expenses associated with the registration of the securities covered by this prospectus, as described in the sections entitled “Use of Proceeds” and “Plan of Distribution.”

(Prospectus cover continued from preceding page)

We are registering the offer and sale of certain of the shares covered by this prospectus to satisfy registration rights we have granted to the selling stockholders. Our registration of the shares covered by this prospectus does not mean that the selling stockholders will offer or sell any of the shares. The selling stockholders may sell the shares of common stock covered by this prospectus in a number of different ways and at varying prices. We provide more information about how the selling stockholders may sell the shares in the section entitled “Plan of Distribution.” In connection with any sales of securities offered hereunder, the selling stockholders, any underwriters, agents, brokers or dealers participating in such sales may be deemed to be “underwriters” within the meaning of the Securities Act of 1933, as amended (the “Securities Act”).

Due to the significant number of shares of the then-outstanding Class A ordinary shares that were redeemed in connection with the Business Combination, the number of shares of common stock that the selling stockholders can sell into the public markets pursuant to this prospectus will constitute a considerable percentage of our public float. The 23,523,776 shares of common stock that may be resold and/or issued into the public markets pursuant to this prospectus represent approximately 43% of the 55,255,171 shares of common stock outstanding as of April 20, 2023 (based on shares of common stock outstanding as of April 20, 2023 and assuming the issuance of shares covered by this prospectus which are subject to warrants and options but excluding shares of common stock underlying any other outstanding options and warrants). As a result, the resale of shares of our common stock pursuant to this prospectus could have a significant negative impact on the trading price of our common stock. This impact may be exacerbated by the fact that, as described above, certain of the selling stockholders purchased shares of our common stock at prices that are well below the current trading price of our common stock.

The shares covered by this prospectus were issued in connection with consummation of the business combination among Pathfinder, Motion Merger Sub, Inc., a Delaware corporation and wholly owned subsidiary of Pathfinder (“Merger Sub”) and Legacy Movella pursuant to which Pathfinder’s name was changed to “Movella Holdings Inc.” (“Movella”) and Legacy Movella merged into Merger Sub and became a wholly owned subsidiary of Movella.

Our shares of common stock and warrants to purchase shares of common stock (the “public warrants”) are listed on Nasdaq under the symbols “MVLA” and “MVLAW,” respectively. On May 18, 2023, the closing price of our shares of common stock was $1.51 and the closing price for our public warrants was $0.0879. We are an “emerging growth company” and a “smaller reporting company” as those terms are defined under the federal securities laws and, as such, have elected to comply with certain reduced public company disclosure and reporting requirements.

Investing in our securities involves a high degree of risk. See the section entitled “Risk Factors” beginning on page 15 of this prospectus to read about factors you should consider before buying our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2023.

TABLE OF CONTENTS

| 1 | ||||

| 2 | ||||

| 4 | ||||

| 11 | ||||

| 15 | ||||

| 59 | ||||

| 60 | ||||

MARKET INFORMATION FOR SHARES OF COMMON STOCK AND DIVIDEND POLICY | 61 | |||

UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION | 62 | |||

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 75 | |||

| 119 | ||||

| 139 | ||||

| 159 | ||||

| 163 | ||||

| 166 | ||||

| 169 | ||||

| 182 | ||||

| 191 | ||||

| 191 | ||||

| 191 | ||||

| 192 | ||||

| F-1 |

You should rely only on the information provided in this prospectus, as well as the information incorporated by reference into this prospectus and any applicable prospectus supplement. Neither we nor the selling stockholders have authorized anyone to provide you with different information. Neither we nor the selling stockholders are making an offer of these securities in any jurisdiction where the offer is not permitted. You should not assume that the information in this prospectus or any applicable prospectus supplement is accurate as of any date other than the date of the applicable document. Since the date of this prospectus and the documents incorporated by reference into this prospectus, our business, financial condition, results of operations and prospects may have changed.

Except as otherwise set forth in this prospectus, neither we nor the selling stockholders have taken any action to permit a public offering of these securities outside the United States or to permit the possession or distribution of this prospectus outside the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions relating to the offering of these securities and the distribution of this prospectus outside the United States.

i

ABOUT THIS PROSPECTUS

Neither we nor the selling stockholders have authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus or any applicable prospectus supplement or any free writing prospectuses prepared by or on behalf of us or to which we have referred you. Neither we nor the selling stockholders take responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. Neither we nor the selling stockholders will make an offer to sell these securities in any jurisdiction where the offer or sale is not permitted.

We may also provide a prospectus supplement or post-effective amendment to the registration statement to add information to, or update or change information contained in, this prospectus. You should read both this prospectus and any applicable prospectus supplement or post-effective amendment to the registration statement together with the additional information to which we refer you in the sections of this prospectus entitled “Where You Can Find More Information.”

On February 10, 2023 (the “Closing Date”), Movella Holdings Inc., a Delaware corporation (formerly known as Pathfinder Acquisition Corporation (“Pathfinder”)) consummated the previously announced business combination (the “Business Combination”) contemplated by that certain Business Combination Agreement, dated October 3, 2022 (the “Business Combination Agreement”), by and among Pathfinder, Motion Merger Sub, Inc., a Delaware corporation and wholly owned subsidiary of Pathfinder (“Merger Sub”) and Movella Inc., a Delaware corporation (“Legacy Movella”). Pathfinder’s stockholders approved the Business Combination and the change of Pathfinder’s jurisdiction of incorporation from the Cayman Islands to the State of Delaware by deregistering as an exempted company in the Cayman Islands and domesticating and continuing as a corporation formed under the laws of the State of Delaware (the “Domestication”) at an extraordinary general meeting of stockholders held on February 8, 2023. In connection with the Domestication, on the Closing Date prior to the Effective Time (as defined below): (i) each issued and outstanding Class A ordinary share, $0.0001 par value per share (“Class A ordinary shares”), and each issued and outstanding Class B ordinary share, $0.0001 par value per share (“Class B ordinary shares”), of Pathfinder were converted into one share of common stock, $0.00001 par value per share, of Movella (“common stock”); (ii) each issued and outstanding whole warrant to purchase Class A ordinary shares of Pathfinder was automatically converted into a warrant to purchase one share of common stock at an exercise price of $11.50 per share on the terms and subject to the conditions set forth in the Warrant Agreement, dated as of February 16, 2021, between Pathfinder and Continental Stock Transfer & Trust Company (the “Warrant Agreement”); (iii) each outstanding Legacy Movella option to purchase a share of Legacy Movella common stock (a “Legacy Movella Option”) (whether vested or unvested) was cancelled and extinguished in exchange for an option to purchase Movella common stock (on an as-converted basis), subject to the same terms and conditions as applied to the Legacy Movella Options immediately prior to the closing of the Business Combination; (iv) the governing documents of Pathfinder were amended and restated and became the certificate of incorporation and the bylaws of Movella; and (v) Pathfinder’s name changed to “Movella Holdings Inc.” In connection with clauses (i) and (ii) of this paragraph, each issued and outstanding unit of Pathfinder issued in its initial public offering (the “IPO” or “the initial public offering”) (“Pathfinder Units”) (each Pathfinder Unit consisting of one Class A ordinary share of Pathfinder and one-fifth of one public warrant) that had not been previously separated into the underlying Class A ordinary shares of Pathfinder and the underlying warrants of Pathfinder prior to the Domestication were cancelled and entitled the holder thereof to one share of common stock and one-fifth of one warrant representing the right to purchase one share of common stock at an exercise price of $11.50 per share on the terms and subject to the conditions set forth in the Warrant Agreement. On the Closing Date, promptly following the consummation of the Domestication, Merger Sub merged with and into Legacy Movella (the “Merger”), with Legacy Movella continuing as the surviving company in the Merger and, after giving effect to the Merger, Legacy Movella became a wholly owned subsidiary of Movella (the time that the Merger became effective being referred to as the “Effective Time”). Unless the context indicates otherwise, references in this prospectus to the “Company,” “Movella,” “New Movella,” “we,” “us,” “our” and similar terms refer to Movella Holdings Inc., and, as the context requires, its consolidated subsidiaries (including Legacy Movella).

1

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

All statements in this prospectus or in the documents incorporated herein by reference that are not historical in nature constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, without limitation, statements regarding the financial position, business strategy, and the plans and objectives of management, and Movella’s product development plans and timeline and anticipated customer and strategic relationships, and are not guarantees of performance. The words “anticipate,” “believe,” “contemplate,” “continue,” “could,” “developing,” “enable,” “estimate,” “eventual,” “expand,” “expect,” “focus,” “future,” “goal,” “intend,” “may,” “might,” “opportunity,” “outlook,” “plan,” “possible,” “position,” “potential,” “predict,” “project,” “seem,” “should,” “trend,” “will,” “would,” and other terms that predict or indicate future events, trends, or expectations, and similar expressions or the negative of such expressions may identify forward-looking statements, but the absence of these words or terms does not mean that a statement is not forward-looking. The forward-looking statements include, but are not limited to:

| • | the benefits of the Business Combination; |

| • | the future financial performance of the Company following the Business Combination; |

| • | changes in client demand for our services and our ability to adapt to such changes; |

| • | the Company’s growth strategy and market opportunity; |

| • | the Company’s success in retaining or recruiting, or changes required in, its officers, key employees or directors following the completion of the Business Combination; |

| • | the Company’s future financial performance; |

| • | the ability of the Company to expand or maintain its existing customer base; |

| • | the effect of global economic conditions or political transitions on the Company’s customers and their ability to continue to purchase the Company’s products; |

| • | the ability to improve and maintain adequate internal controls over financial and management systems, and remediate identified material weaknesses; |

| • | the ability to raise financing in the future as and when needed or on market terms; |

| • | the ability to compete with existing competitors and the entry of new competitors in the market; |

| • | changes in applicable laws or regulations and the ability to maintain compliance; |

| • | the ability to protect our intellectual property rights; and |

| • | other risks and uncertainties indicated from time to time in our filings with the U.S. Securities and Exchange Commission (the “SEC”), including those described herein under the heading “Risk Factors.” |

The forward-looking statements contained in this prospectus, any prospectus supplement, and the disclosures and documents incorporated herein and therein by reference, are based on information available as of the date hereof or thereof, as well as on various assumptions, whether or not identified herein or therein, and on Movella’s current expectations, beliefs, and assumptions and are not predictions of actual performance. There can be no assurance that future developments affecting Movella will be those that have been anticipated. Accordingly, forward-looking statements in this prospectus and in any disclosure or document incorporated herein by reference should not be relied upon as representing Movella’s views as of any subsequent date.

These forward-looking statements involve a number of risks, uncertainties (many of which are beyond Movella’s control), or other assumptions that may cause actual results or performance to differ materially from those expressed or implied by these forward-looking statements. If any of these risks or uncertainties materialize, or should any of these assumptions prove incorrect, actual results may differ materially from those discussed in or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those discussed in the “Risk Factor Summary” and “Risk Factors” sections below.

2

Given these risks and uncertainties, you should not place undue reliance on these forward-looking statements. Additional cautionary statements or discussions of risks and uncertainties that could affect our results or the achievement of the expectations described in forward-looking statements may also be contained in any accompanying prospectus supplement.

These forward-looking statements made by us in this prospectus and any accompanying prospectus supplement speak only as of the date of this prospectus and any accompanying prospectus supplement. Except as required under the federal securities laws and rules and regulations of the SEC, we expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in our expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based. You should, however, review additional disclosures we make in our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K filed with the SEC.

You should read this prospectus and any accompanying prospectus supplement completely and with the understanding that our actual future results, levels of activity and performance as well as other events and circumstances may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

3

RISK FACTOR SUMMARY

The following is a summary of the principal risks described below in “Risk Factors” in this prospectus. We believe that the risks described in the “Risk Factors” section are material to investors, but other factors not presently known to us or that we currently believe are immaterial may also adversely affect us. The following summary should not be considered an exhaustive summary of the material risks facing us, and it should be read in conjunction with the “Risk Factors” section and the other information contained in this prospectus.

| • | We expect to continue to incur losses and may not generate sufficient revenues to achieve profitability. |

| • | Fluctuations in our financial and operating results may cause the trading price of our common stock to decline. |

| • | The estimates of market opportunity and forecasts of market growth included in this prospectus may prove to be inaccurate, and our business could fail to grow at similar rates, if at all. |

| • | The Note Purchase Agreement (as defined herein) and related security documents that will subject Movella to various risks, including the risk that if we default on our obligations, the agent for the noteholders (at the direction of the majority noteholders) could foreclose on substantially all of our assets. |

| • | We may not be successful in the timely manufacture and introduction of new products or product categories. |

| • | We may not be successful in our Metaverse strategy and investments. |

| • | If we are not able to maintain and enhance our brand and our reputation, our business and results of operations may be adversely affected. |

| • | If we are unable to develop new products and effectively manage our growth, if any, we may not be able to execute our business plan and our operating results could suffer. |

| • | Our business could be materially harmed if we fail to successfully identify, complete, and integrate strategic acquisitions, investments, strategic partnerships, or other similar ventures. |

| • | Any future licensing arrangements, joint ventures, or similar collaborations may not result in commercially viable products or the generation of significant future revenues. |

| • | If we fail to compete effectively, we could face price reductions, reduced margins, and loss of market share. |

| • | Our gross margins may fluctuate or decline due to several factors, including risks related to average selling prices, product costs, and inventory management. |

| • | Our customers do not have long-term subscriptions for our software-as-a-service (“SaaS”) applications, exposing us to risk of non-renewal by our customers, with little or no notice. |

| • | If our target markets do not develop as expected, or if we fail to successfully penetrate those markets, our revenues and financial condition would be harmed. |

| • | If we fail to further diversify our customer base, our business and results of operations could suffer. |

| • | Because we do not have long-term purchase commitments with our customers, orders may be cancelled, reduced, or rescheduled with little or no notice, which may harm our business and results of operations. |

| • | Maturation or contraction of the market for wearable devices or categories of these devices could adversely affect our revenues and profits. |

| • | We face risks related to our reliance on independent distributors and resellers to sell our products, the effective management of our sales channel inventory and product mix, and our ability to accurately forecast product demand, control costs, or maintain adequate supply of components and raw materials associated with our operations. |

4

| • | We face risks related to intellectual property matters. |

| • | Our reliance on third parties to manufacture and warehouse our products and to supply technology and components used in our products, exposes us to a number of risks outside our control. |

| • | Unauthorized access to or releases of proprietary or confidential information could result in significant reputational, financial, legal, and operational consequences. |

| • | Software or product errors, defects, or other problems, including security vulnerabilities, or incompatibility of our solutions with third- party technologies with which they are integrated, could result in loss of customers, increased costs, and damage to our operating results. |

| • | Our business is subject to risks from interruption of such Global Navigation Satellite Systems (“GNSS”) services or changes in policies related to their operation. |

| • | We may not be able to accurately predict our future capital needs or obtain additional financing to fund our operations. |

| • | If we fail to address the material weakness in our internal controls, our ability to accurately and timely report our financial results or prevent fraud may be adversely affected. |

| • | Adverse developments affecting the financial industry could adversely affect our business, financial condition and results of operations. |

| • | If we fail to accurately report and present non-GAAP financial measures, together with our financial results determined in accordance with GAAP, investors may lose confidence and our stock price could decline. |

| • | In preparing our consolidated financial statements, we make good faith estimates and judgments that may change or turn out to be erroneous, which could adversely affect our operating results for the affected periods. |

| • | Changes to financial accounting standards or to U.S., or non-U.S. tax laws may affect our results of operations. |

| • | Tax regulatory authorities may disagree with our positions and conclusions regarding certain tax positions. |

| • | We are subject to risks related to U.S. and international laws, government regulations, and policies, including those related to: anti- corruption or anti-bribery, U.S. or foreign trade policy, tariff, import, and export matters, economic sanctions, data and privacy protection, conflict minerals, environmental, health, and safety, and social and environmental responsibility. |

| • | Our international operations subject us to risks related to increased complexity and costs, geopolitical instability, complex and changing global laws and regulations, and fluctuations in foreign currency translation. |

| • | Our stock price and volume may fluctuate significantly and decline due to a variety of factors, and you could lose all or part of your investment. In addition, ownership of our common stock is concentrated, and as a result, certain stockholders may exercise significant influence over us. |

| • | If we fail to meet the continued listing standards of Nasdaq, it could result in a de-listing of our common stock. |

| • | We incur increased costs and are subject to additional regulations and requirements as a result of being a public company and our management team has limited experience managing a public company. |

| • | Our business may suffer if we are not able to hire and retain sufficient personnel, including our key personnel. |

5

IMPORTANT INFORMATION ABOUT GAAP AND NON-GAAP FINANCIAL MEASURES

Our financial statements are prepared in accordance with United States generally accepted accounting principles (“GAAP”). We refer in various places within this prospectus to EBITDA, Adjusted EBITDA, non-GAAP cost of revenues, non-GAAP gross margin and non-GAAP net loss, which are non-GAAP measures that are more fully explained in “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” The presentation of this non-GAAP information is not meant to be considered in isolation or as a substitute for our consolidated financial results prepared in accordance with GAAP.

INDUSTRY AND MARKET DATA

In this prospectus, we rely on and refer to industry data, information, and statistics regarding the markets in which we compete from research as well as from publicly available information, industry and general publications and research and studies conducted by third parties. We have supplemented this information where necessary with our own internal estimates, considering publicly available information about other industry participants and our management’s best view as to information that is not publicly available. This information appears in “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Business” and other sections of this prospectus. We have taken such care as we consider reasonable in the extraction and reproduction of information from such data from third party sources.

Industry publications, research, studies, and forecasts generally state that the information they contain has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements in this prospectus. These forecasts and forward-looking information are subject to uncertainty and risk due to a variety of factors, including those described under “Risk Factors.” These and other factors could cause results to differ materially from those expressed in the forecasts or estimates from independent third parties and us.

6

SUMMARY

This summary highlights selected information appearing elsewhere in this prospectus. Because it is a summary, it may not contain all of the information that may be important to you. To understand this offering fully, you should read this entire prospectus carefully, including the information set forth under the heading “Risk Factors” and our financial statements. Unless the context otherwise requires, all references in this section to “we,” “us,” “our,” and “Movella” refer to Movella Holdings Inc. and, as applicable, its consolidated subsidiaries, following the Business Combination. Movella™, Xsens®, MVN™, MTi®, MVN Awinda®, MVN Link™, MVN Analyze™, MVN Animate®, Xsens Motion Cloud®, Xsens DOT®, Movella DOT™, Kinduct®, and OBSKUR™ are among the trademarks, registered trademarks, or service marks owned by Movella.

Recent Developments

On the Closing Date of the Business Combination, Movella consummated the previously announced Business Combination contemplated by the Business Combination Agreement. In connection with the consummation of the Business Combination, we changed our name from Pathfinder Acquisition Corporation to Movella Holdings Inc. In connection with the Stockholder Meeting and the Business Combination, holders of 28,961,090 of the 32,500,000 then-outstanding Class A ordinary shares exercised their right to redeem their shares for cash at a redemption price of approximately $10.16 per share, for an aggregate redemption amount of approximately $294.2 million. In connection with the closing of the Business Combination, all outstanding Class A ordinary shares and Class B ordinary shares automatically converted into shares of common stock on a one-for-one basis. The public warrants and private placement warrants became warrants to purchase common stock. Each outstanding Legacy Movella Option (whether vested or unvested) was cancelled and extinguished in exchange for an option to purchase Movella common stock (on an as-converted basis), subject to the same terms and conditions as applied to the Legacy Movella Options immediately prior to the closing of the Business Combination. Pathfinder Units automatically separated into the component securities and, as a result, no longer trade as a separate security. On February 13, 2023, our common stock and public warrants began trading on the Nasdaq Global Market and the Nasdaq Capital Market (collectively, “Nasdaq”) under the symbols “MVLA” and “MVLAW,” respectively.

Overview

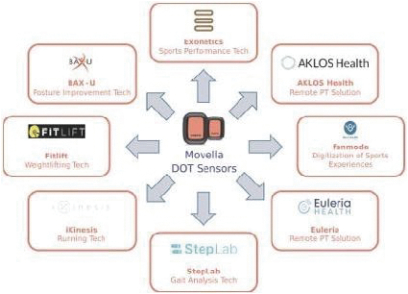

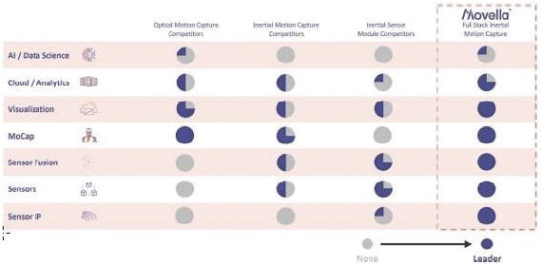

Movella is a global full-stack provider of integrated sensors, software, and analytics that enable the digitization of movement. Our solutions accelerate innovation and enable our customers, partners, and users to create extraordinary outcomes. Movella powers real-time character movement in digital environments, transforms movement into digital data that provides meaningful and actionable insights, renders digitized movement to enable the creation of sophisticated and true-to-life animated content, creates new forms of monetizable IP with unique biomechanical digital content, and provides spatial movement orientation and positioning data. Partnering with leading global brands such as Electronic Arts, EPIC Games, 20th Century Studios, Netflix, Toyota, and Siemens and over 2,000 customers in total, we currently serve the entertainment, health and sports, and automation and mobility markets.* Additionally, we believe we are well-positioned to provide critical enabling solutions for applications in emerging high-growth markets such as the Metaverse, next-generation gaming, live streaming, digital health, and autonomous robots with recently introduced offerings and products currently in development.

Our full-stack product portfolio includes differentiated sensor fusion modules, motion capture systems, visualization software, and AI cloud analytics enabled by our proprietary technologies. By offering full-stack solutions, we provide our customers and partners with significant technological advantages in the areas of

| * | We believe these customers reflect those with which we are currently actively engaged in terms of our innovation and strategic opportunities across our target markets. |

7

magnetic immunity, accuracy, and ease of use, among others. Our technologies are protected by our broad IP portfolio including 161 issued patents, 15 pending patent applications, extensive trade secrets, and decades of know-how.

We serve large and growing markets where digitized movement is critical to our customers’ success. In the entertainment market, our sensors and software are used by leading global motion picture studios, video game publishers and virtual creators for three-dimensional (“3D”) character animation, and other applications such as virtual concerts. In the health and sports market, our solutions are used to provide actionable movement insights for applications such as elite athlete performance and recovery, patient injury prevention and rehabilitation, and ergonomic studies. In the automation and mobility market, our sensors are used as the movement and orientation intelligence in applications such as robotics and unmanned vehicles. We believe the addressable market opportunity of our current products is approximately $14 billion today and expected to scale to $20 billion in the next five years, with emerging high-growth markets representing additional meaningful upside to that. For a description of our total addressable market, see “Business —Total Addressable Market.”

We plan to continue to scale within our existing markets through global channel expansion and growth in our direct sales force, further development and expansion of our independent application developer platform (which currently supports an ecosystem of 700+ third-party application developers), introductions of new products and software upgrades, enrichment of vTuber and Influencer applications, and potential new strategic partnerships.

In addition to our established markets, our solutions are a critical enabling technology for applications with significant potential in the Metaverse, next-generation gaming, live streaming, and other large, high-growth end markets. Applications include live streaming, virtual performances, monetizable “motion IP,” and virtual meetings with real-time digital representation. Our technology enables the creation and control of life-like digital characters and avatars with real-time 3D human body and facial movement. According to Bloomberg Intelligence, Metaverse and next-generation gaming have the potential to become $856 billion and $457 billion markets by 2025, respectively.

We derive our revenues from the sales of our integrated suite of sensors and right-to-use software licenses. We are in the process of transitioning from a one-time license to an annual subscription model. We sell our products through our direct global sales organization and through regional channel partners around the world. In 2022, approximately 38% of Legacy Movella’s revenues were from our channel partners and the rest was direct, with both sales channels contributing GAAP gross margins of approximately 50% and non-GAAP gross margins of approximately 65%. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non-GAAP Financial Measures” for a reconciliation of non-GAAP gross margin to GAAP gross margin. We utilize an “asset-light” contract manufacturer model for the manufacturing of our sensor modules and wearable sensor systems and perform final calibration in-house to maintain consistently high quality and ensure the performance of the solutions.

Our success in developing our technologies, scaling our channel relationships globally, and expanding our applications has led to a continued track record of growth. For the years ended December 31, 2022 and 2021, Legacy Movella’s total revenues were $40.5 million and $34.4 million, respectively. For the three months ended March 31, 2023, our total revenues were $9.2 million. As of March 31, 2023, we had an accumulated deficit of $(126.2) million. We are headquartered in Henderson, Nevada with offices in Los Angeles and San Jose, California, Canada, the Netherlands, China, India and Taiwan. As of March 31, 2023, we had 226 employees worldwide.

Our shares of common stock and public warrants are currently listed on Nasdaq (“Nasdaq”) under the symbols “MVLA” and “MVLAW,” respectively.

8

Corporate Information

We were incorporated as a Cayman Islands exempted company in December 2020 as a blank check company under the name Pathfinder Acquisition Corporation for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses. On February 10, 2023, Movella and Pathfinder consummated the transactions contemplated under the Business Combination Agreement. In connection with the closing of the Business Combination, we changed our name to Movella Holdings Inc.

We file electronically with the SEC, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act. We make available on our website at www.movella.com, free of charge, copies of these reports as soon as reasonably practicable after filing these reports with, or furnishing them to, the SEC. Our website and the information contained on or through that site are not incorporated into this prospectus. All website addresses in this prospectus are intended to be inactive textual references only.

Implications of Being an Emerging Growth Company and a Smaller Reporting Company

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). As an emerging growth company, we intend to take advantage of certain exemptions from specified disclosure and other requirements that are otherwise generally applicable to public companies. These exemptions include:

| • | not being required to comply with the auditor attestation requirements for the assessment of our internal control over financial reporting provided by Section 404 of the Sarbanes-Oxley Act of 2002; |

| • | reduced disclosure obligations regarding executive compensation; and |

| • | not being required to hold a nonbinding advisory vote on executive compensation or seek stockholder approval of any golden parachute payments not previously approved. |

We intend to take advantage of these provisions for up to five years or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company upon the earliest to occur of (1) the last day of the fiscal year (a) following the fifth anniversary of the date of the first sale of common equity securities pursuant to an effective registration statement, (b) in which we have total annual gross revenue of at least $1.07 billion, or (c) in which we are deemed to be a large accelerated filer, which means the market value of our shares of common stock that is held by non-affiliates exceeds $700 million as of the prior June 30th, and (2) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period.

We are also deemed to be a “smaller reporting company” as defined in Rule 12b-2 under the Exchange Act, and are thus allowed to provide simplified executive compensation disclosures in our SEC filings, will be exempt from the provisions of Section 404(b) of Sarbanes-Oxley requiring that an independent registered public accounting firm provide an attestation report on the effectiveness of internal control over financial reporting and will have certain other reduced disclosure obligations with respect to our SEC filings. We may choose to take advantage of some or all of these accommodations. We have taken advantage of reduced reporting requirements in this prospectus. Accordingly, the information contained herein may be different from the information you receive from U.S. public companies that do not qualify as an emerging growth company or a smaller reporting company.

For additional details see “Risk Factors—We qualify as an “emerging growth company” within the meaning of the Securities Act, and if we take advantage of certain exemptions from disclosure requirements available to

9

emerging growth companies, it could make our securities less attractive to investors and may make it more difficult to compare our performance to the performance of other public companies.”

Risk Factors

Investing in our securities entails a high degree of risk as more fully described in the “Risk Factors” section of this prospectus beginning on page 15. You should carefully consider such risks before deciding to invest in our securities.

10

BACKGROUND OF THE OFFERING

This prospectus relates to the offer and sale from time to time by the selling stockholders of up to 23,523,776 shares of our common stock. The shares of common stock that may be offered and sold by the selling stockholders include (i) up to 4,100,000 shares held by the Sponsor and the Original Holders that were issued in a private placement at a purchase price of $0.003 per share in connection with the IPO of Pathfinder; (ii) 4,250,000 shares of common stock issuable upon the exercise of the warrants held by the Original Holders, which warrants were purchased at a purchase price of $2.00 per warrant and have an exercise price of $11.50 per share; (iii) 6,576,036 shares held by the Movella-Related Holders, which shares were purchased at an average purchase price of $2.88 per share (at per share prices ranging from $0.31 to $9.80), (iv) 8,500,000 shares of common stock held by the FP Purchasers, of which 1,000,000 shares were acquired pursuant to the Equity Grant Agreement as consideration for the Note Purchase Agreement and 7,500,000 shares were purchased in a private placement at a purchase price of $10.00 per share in connection with the VLN Facility; and (v) up to 97,740 shares of common stock issuable upon exercise of certain outstanding options to acquire shares of our common stock held by a former employee of Movella, which options have an average exercise price of $1.81 per share.

Shares issuable upon exercise of options

As part of this offering, we are registering 97,740 shares of common stock issuable upon the exercise of certain outstanding options held by a former employee of Movella that became options to acquire shares of our common stock as part of the Business Combination. Such options have an average exercise price of $1.81 per share.

Shares offered for resale by the selling stockholders

As part of this offering, we are registering for resale 19,326,036 shares of common stock owned by the Original Holders, the Movella-Related Holders, and the FP Purchasers (including shares of common stock issuable open the exercise of warrants held by the Original Holders). In connection with the Business Combination, we entered into a Shareholder Rights Agreement with the Original Holders, the Movella-Related Holders and the FP Purchasers. Pursuant to the terms of the Shareholder Rights Agreement, we granted these stockholders demand, “piggy-back” and Form S-1 or Form S-3 registration rights, subject to certain minimum requirements and customary conditions. For further details see the section titled “Certain Relationships and Related Person Transactions.”

The shares owned by the Original Holders and the Movella-Related Holders are subject to certain transfer restrictions and the Original Holders and the Movella-Related Holders agreed not to effect any sale or distribution of any equity securities of Movella held by any of them during the period commencing on the Closing Date and ending on the earlier of (a) the date that is three hundred and sixty five (365) days following the Closing Date and (b) (i) the first date on which the closing price of our common stock has been greater than or equal to $12.00 per share (as adjusted for share subdivisions, share capitalizations, share consolidations, reorganizations, recapitalizations and the like) measured using the daily closing price for any 20 trading days within a 30-trading day period commencing at least one hundred and fifty (150) days after the Closing Date or (ii) the date on which we complete a liquidation, merger, share exchange, reorganization or other similar transaction that results in all of our stockholders having the right to exchange their shares of common stock for cash, securities or other property. Except for the FP Purchasers with respect to the FP VLN Shares, all other investors party to the Shareholder Rights Agreement have each agreed not to effect any sale or distribution of any equity securities of Movella held by any of them during the period commencing on the Closing Date and ending on the date that is one hundred and eighty (180) days following the Closing Date. For further details see the section entitled “Selling Stockholders—Certain Relationships with Selling Stockholders.”

11

Shares offered for resale by our affiliates

Rule 144 is not available, including for “affiliates” (as such term is defined under the Securities Act), for the resale of our securities until at least one year has elapsed from the time we file current Form 10 type information with the SEC, which we filed on February 13, 2023. We are registering for resale shares of common stock beneficially owned by our affiliates and certain former affiliates to provide them with access to liquidity opportunities until they are able to rely on Rule 144 for resales of their shares. Our common stock received by these current and former affiliates are subject to a 180 day lock-up period, subject to certain other terms and conditions depending on the price of our common stock. Equity awards granted to such stockholders are generally subject to vesting as described in this prospectus.

12

THE OFFERING

Issuer | Movella Holdings Inc. |

Securities offered by the selling stockholders | Up to 23,523,776 shares of common stock (which includes: (i) 4,100,000 shares of common stock held by the Original Holders purchased by the Original Holders at a purchase price of $0.003 per share; (ii) 4,250,000 shares of common stock issuable upon the exercise of warrants held by the Original Holders, which warrants were purchased by the Original Holders at a purchase price of $2.00 per warrant; (iii) 6,576,036 shares of common stock held by Movella-Related Holders, which shares were purchased at an average purchase price of $2.88 per share (at per share prices ranging from $0.31 to $9.80); (iv) 8,500,000 shares held by the FP Purchasers, of which 1,000,000 shares were acquired pursuant to the Equity Grant Agreement as consideration for the Note Purchase Agreement and 7,500,00 shares were purchased in a private placement at a purchase price of $10.00 per share in connection with the VLN Facility; and (v) 97,740 shares of common stock issuable upon the exercise of options held by a former employee, which options have an average exercise price of $1.81 per share). |

Terms of warrants | Each whole warrant entitles the registered holder one Ordinary Share at a price of $11.50 per share. These warrants expire on February 10, 2028 at 5:00 p.m. New York City time, or earlier upon redemption. |

Shares of common stock outstanding | 50,907,431 shares (as of April 20, 2023). |

Use of proceeds | We will not receive any proceeds from the sale of shares of common stock by the selling stockholders. However, if and to the extent any FP VLN Shares are sold, a percentage of the proceeds (which percentage is a function of when proceeds are generated, based on a predetermined schedule with a sliding scale) will be applied as a credit against the outstanding obligations under the VLN Facility upon the repayment of the VLN Facility in full or a refinancing event. We will receive up to an aggregate of approximately $49.0 million from the exercise of the warrants and options, assuming the exercise in full of all the warrants and options for cash. If the warrants or options are exercised pursuant to a cashless exercise feature, we will not receive any cash from these exercises. Further, any cash proceeds associated with the exercise of the warrants are dependent on the price of our common stock. Because the exercise price of the warrants substantially exceeds the current trading price of our common stock, there is no assurance that the warrants will be in the money prior to their expiration and it is unlikely that holders of the warrants will exercise such warrants in the near future, if at all. As a result, we are unlikely to receive any proceeds from the exercise of the warrants in the near future, if at all, and the warrants may not provide any additional capital. We will pay the expenses associated with registering the sales by the selling stockholders, as described under |

13

“Use of Proceeds” and “Plan of Distribution” elsewhere in this prospectus. We expect to use the net proceeds from the exercise of the warrants and options, if any, for general corporate purposes. In considering our capital requirements and sources of liquidity, we have not assumed or relied on the receipt of proceeds from the exercise of the warrants. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources.” |

Lock-up restrictions | Certain stockholders are subject to certain restrictions on transfer until the termination of applicable lock-up periods. See “Selling Stockholders—Certain Relationships with Selling Stockholders” for further discussion. |

Dividend policy | We have not paid any cash dividends on our shares of common stock to date and have no current plans to pay cash dividends on our shares of common stock. See “Market Information for shares of common stock and Dividend Policy—Dividend Policy.” |

Market for shares of common stock and warrants | Our shares of common stock and public warrants are currently traded on the Nasdaq under the symbols “MVLA” and “MVLAW,” respectively. |

Registration rights | We are registering the offer and sale of the shares of common stock covered by this prospectus to satisfy certain registration rights we have granted. See “Certain Relationships and Related Party Transactions —Shareholder Rights Agreement.” |

Risk factors | See “Risk Factors” beginning on page 15 and other information included in this prospectus for a discussion of factors you should consider before investing in our securities. As discussed in “Risk Factors” and elsewhere in this prospectus, due to the significant number of shares that were redeemed in connection with the Business Combination, the number of shares of common stock that can be sold into the public markets pursuant to this prospectus will constitute a considerable percentage of our public float. Further, although the current trading price of our common stock is significantly below the Pathfinder IPO price, the selling stockholders may have incentive to sell or experience a positive rate of return based on the purchase price they paid for their common stock. Our public stockholders may not experience a similar rate of return on the securities they purchased due to differences in the purchase prices and the current trading price of our common stock. The resale of shares of our common stock pursuant to this prospectus could have a significant negative impact on the trading price of our common stock. |

14

RISK FACTORS

Investing in our securities involves risks. Before you make a decision to buy our securities, in addition to the risks and uncertainties discussed above under “Forward-Looking Statements,” you should carefully consider the specific risks set forth herein. If any of these risks actually occur, it may materially harm our business, financial condition, liquidity, results of operations, and prospects. As a result, the market price of our securities could decline, and you could lose all or part of your investment. Additionally, the risks and uncertainties described in this prospectus or any prospectus supplement are not the only risks and uncertainties that we face. Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial may become material and adversely affect our business. If any of the following risks or other risks not specified below materialize, our business financial condition and results of operations could be materially and adversely affected. In that case, the trading price of our shares of common stock could decline.

Risks Related to Our Business and Industry

We have a history of net losses and expect to continue to incur losses for the foreseeable future. If our current products and solutions do not achieve broad commercial acceptance, or if we are not able to fully commercialize products we have under development, or if our products and solutions experience significant delays or other setbacks, our business, financial condition, and results of operation will be materially and adversely affected and we may not be able to generate sufficient revenues to achieve and sustain profitability.

We have experienced net losses since inception. For the years ended December 31, 2022 and 2021, our revenues were $40.5 million and $34.4 million, respectively, and our net loss attributable to common stockholders was ($35.1) million and ($20.2) million, respectively. For the three months ended March 31, 2023, our total revenues were $9.2 million and our net income attributable to common stockholders was $15.5 million. As of March 31, 2023, we had an accumulated deficit of $(126.2) million. We expect to continue to incur operating and net losses for the foreseeable future as we expect our costs and expenses to increase in future periods. In particular, we intend to continue to invest significant resources in:

| • | the continued development of our product lines, including investments in our research and development, the development or acquisition of new products, features, and functionality, and improvements to the scalability, availability, and security of our platform; |

| • | our technology infrastructure, including enhancements to our network operations and infrastructure, and hiring of additional employees; |

| • | sales and marketing; |

| • | additional international expansion, in an effort to increase our customer base and sales; and |

| • | general administration, including legal, accounting, and other expenses. |

In addition, part of our business strategy is to focus on our long-term growth. As a result, our profitability may be lower in the near-term than it would be if our strategy were to maximize short-term profitability. Our future potential profitability is dependent upon the successful development and commercial acceptance of our products and solutions. Because we expect to incur significant expenditures on sales and marketing efforts, expanding our platforms, products, features, and functionality, and expanding our research and development, we may experience losses in future periods and may not ultimately grow our business, or achieve or sustain long-term profitability. If we are ultimately unable to achieve profitability at the level anticipated by industry or financial analysts and our stockholders, our stock price may decline.

Our efforts to grow our business may be costlier than we expect, or our revenue growth rate may be slower than we expect, and we may not be able to increase our revenues enough to offset the increase in operating expenses resulting from these investments. If we are unable to continue to grow our revenues, the value of our business and common stock may significantly decrease.

15

We expect fluctuations in our financial results, which may cause the trading price of our common stock to fluctuate and make it difficult to project future results. If we fail to meet the expectations of securities analysts or investors with respect to our results of operations, our stock price could decline.

Our revenues, financial, and operating results have fluctuated in the past and may fluctuate from period to period in the future due to a variety of factors, many of which are beyond our control. Factors relating to our business that may contribute to these fluctuations include the following factors, as well as other factors described elsewhere in this prospectus:

| • | our ability to attract new customers and retain existing customers; |

| • | our ability to accurately forecast revenues and plan our expenses; |

| • | our ability to accurately predict customer and end-market demand and plan product life cycles; |

| • | the receipt, reduction, or cancellation of, or changes in the forecasts or timing of, orders by customers; |

| • | fluctuations in the levels of inventories held by our distributors and resellers or end customers; |

| • | the gain or loss of significant customers; |

| • | market acceptance of our products and our customers’ products; |

| • | our ability to develop, introduce, and market new products and technologies on a timely basis, including our OBSKUR platform which is currently under development and is intended to target the market for live streamers and vTubers; |

| • | the timing and extent of product development costs; |

| • | our research and development costs and related new product expenditures, and our ability to achieve cost reductions in a timely or predictable manner; |

| • | seasonality and fluctuations in sales by our customers; |

| • | significant warranty claims, including those not covered by our suppliers; |

| • | changes in, or other factors impacting, our pricing, product cost, production schedules, and product mix; |

| • | changes in, or other factors impacting, our average selling prices and gross margins; |

| • | supply chain disruptions, delays, shortages, and capacity limitations; |

| • | our ability to accurately predict changes in customer demand due to matters beyond our control; |

| • | the actions of our competitors, including consolidation within the industry, pricing changes or the introduction of new services; |

| • | our ability to effectively manage our growth; |

| • | our ability to attract and retain key employees, given intense competition for qualified personnel; |

| • | our ability to successfully manage and realize the anticipated benefits of any future divestitures or acquisitions of businesses, solutions, or technologies; |

| • | our ability to successfully launch new products, services or solutions or sell existing services or solutions into additional geographies or vertical markets; |

| • | the timing and cost of developing or acquiring and integrating technologies, services, or businesses; |

| • | the timing, operating costs, and capital expenditures related to the operation, maintenance, and expansion of our business; |

| • | service outages or security breaches and any related occurrences which could impact our reputation; |

16

| • | geopolitical crises such as the Russian invasion of Ukraine, other outbreaks of hostilities or acts of aggression, or other international crises; |

| • | the impact of worldwide economic, industry, and market conditions, including disruptions in financial markets and the deterioration of the underlying economic conditions in some countries; |

| • | the emergence of global public health emergencies, such as the outbreak of COVID-19, which could further extend lead times in our supply chain and lengthen sales cycles with our customers; |

| • | fluctuations in currency exchange rates; |

| • | trade protection measures (such as tariffs and duties) and import or export licensing requirements; |

| • | costs associated with defending intellectual property infringement and other claims; and |

| • | changes in laws and regulations affecting our business. |

As a result of these and other factors, you should not rely on the results of any prior quarterly or annual periods, or any historical trends reflected in such results, as indications of our future revenues, financial, or other operating performance. Fluctuations in our revenues and financial and other operating results could cause the value of our capital stock to decline and, as a result, you may lose some or all of your investment. In addition, if our results of operations do not meet the expectations of securities analysts or investors, our stock price would likely decline.

The terms of our financing arrangements subject us to various risks, including restrictive debt covenants that may limit our ability to finance our future operations and capital needs and to pursue business opportunities and activities.

The terms of our financing arrangements expose us to significant risks. For example, due to market conditions, regulatory restrictions, liability exposure, or other factors there can be no assurance that we will be able to benefit from provisions under our venture-linked note facility (the “VLN Facility”) that allow us to, subject to certain exceptions, cause the FP Purchasers to sell all or a portion of the FP VLN Shares and to apply a percentage of those proceeds (which percentage is a function of when proceeds are generated, based on a predetermined schedule with a sliding scale) as a credit against the outstanding obligations under the VLN Facility upon a repayment of the VLN Facility in full or a refinancing event. Moreover, sales of FP VLN Shares, or the perception that such sales may occur, could materially and adversely impact the price of our common stock. In addition, our obligations under the VLN Facility are guaranteed and secured by substantially all of the assets of Movella, Legacy Movella and certain of their subsidiaries and include affirmative and negative covenants which could impose significant operating and financial restrictions on us. As a result of these covenants and restrictions, we may be limited in how we conduct our business and we may be unable to raise additional debt or equity financing to pursue our business plan or otherwise compete effectively or to take advantage of new business opportunities. These restrictions may significantly limit our ability to operate our businesses and may prohibit or limit activity to enhance our operations or take advantage of potential business opportunities as they arise. These covenants could limit our ability to finance our future operations and capital needs and our ability to pursue business opportunities and activities that may be in our interest. There is no assurance that we will be able to maintain compliance with these covenants in the future or have the ability to obtain waivers from the lenders under the VLN Facility and/or amend the covenants thereunder.

If we breach any of these covenants, we would be in default under the VLN Facility, which may then become immediately due and payable. Our ability to comply with the provisions of our financing arrangements may be affected by changes in economic or business conditions or other events beyond our control. These restrictions and covenants, or our failure to maintain compliance with them, would materially and adversely affect our business, financial condition, results of operations, and our growth prospects.

17

Our obligations under the VLN Facility are secured by substantially all of our assets. As a result, if we default on those obligations, the agent for the noteholders (on behalf of the noteholders) could foreclose on these assets.

In connection with the VLN Facility, we entered into a Note Purchase Agreement and certain other related note documents. Our obligations under the VLN Facility pursuant to the Note Purchase Agreement and the related note documents are secured by substantially all of Movella’s, Legacy Movella’s and certain of their subsidiaries’ assets. Accordingly, if we default on our obligations under the Note Purchase Agreement or related note documents, the agent for the noteholders (on behalf of the noteholders) could foreclose on its security interest by liquidating some or all of our assets, which would harm our business, financial condition, and results of operations and could require us to reduce or cease operations.

Additionally, in the event of a bankruptcy, insolvency, liquidation, or other reorganization, the agent for the noteholders (on behalf of the noteholders) would have a first priority right to such assets, to the exclusion of our general creditors. In that event, such assets would first be used to repay in full all indebtedness and other obligations under the Note Purchase Agreement and related note documents, resulting in all or a portion of such assets being unavailable to satisfy the claims of our other creditors. Only after satisfying the claims of our secured creditors, unsecured creditors, and our subsidiaries’ secured and unsecured creditors would an amount, if any, be available for distribution to holders of our equity securities.

If we are not successful in the continued development, timely manufacture, and introduction of new products or product categories, overall demand for our products could decrease and we may fail to compete effectively.

We expect that a significant portion of our future revenues will continue to be derived from sales of newly introduced products and services, such as our OBSKUR software that is currently scheduled for commercial launch during the first half of 2023. However, the timing of any future product introductions is uncertain and there can be no assurance that we will be able to launch our OBSKUR software during the anticipated timeframe or at all, if such launch will be successful, or if our OBSKUR platform will achieve broad market acceptance. The market for our products is characterized by rapidly changing technology, evolving industry standards, and changes in customer needs. If we fail to introduce new products, or to modify or improve our existing products, in response to changes in technology, industry standards or customer needs, or if we are delayed in launching new or improved products, our products could rapidly become less competitive or obsolete. We must continue to make significant investments in research and development in order to continue to develop new products, enhance existing products, and achieve market acceptance for such products. However, there can be no assurance that development stage products will be successfully completed or, if developed, will achieve significant customer acceptance.

If we are unable to successfully develop and introduce competitive new products, and enhance our existing products, our future results of operations would be materially and adversely affected. Our pursuit of necessary technology may require substantial time and expense. We may need to license new technologies to respond to technological change. These licenses may not be available to us on terms that we can accept or may materially change the gross profits that we are able to obtain on our products. We may not succeed in adapting our products to new technologies as they emerge. Development and manufacturing schedules for technology products are difficult to predict, and there can be no assurance that we will achieve timely initial customer shipments of new products. The timely availability of these products in volume and their acceptance by customers are important to our future success. Any future challenges related to new products, whether due to product development delays, manufacturing delays, supply chain constraints, lack of market acceptance, delays in regulatory approval, or otherwise, could have a material adverse effect on our results of operations.

As we develop and introduce new products, we face the risk that customers may not value or be willing to bear the cost of incorporating these newer products into their product offerings, particularly if they believe their customers are satisfied with prior offerings. Regardless of the improved features or superior performance of the newer products, customers may be unwilling to adopt our new products due to design or pricing constraints,

18

among other reasons. Because of the extensive time and resources that we invest in developing new products, if we are unable to sell new generations of our products, our revenues could decline and our business, financial condition, and results of operations would be negatively affected.

We may not be successful in our Metaverse strategy and investments, which could adversely affect our reputation, business, financial condition, and results of operations.

We believe the Metaverse, an embodied internet where people have immersive experiences beyond two-dimensional screens, is the next evolution in social technology. We are developing solutions to help our customers participate in the Metaverse. We expect this will be a complex, evolving, and long- term initiative that will involve the development of new and emerging technologies, continued investment in privacy, safety, and security efforts, and collaboration with other companies, developers, partners, and other participants. However, the Metaverse may not develop in accordance with our expectations, and market acceptance of features, products, or services we build for the Metaverse is uncertain. We may be unsuccessful in our research and product development efforts, including if we are unable to develop relationships with key participants in the Metaverse or develop products that operate effectively with Metaverse technologies, products, systems, networks, or standards. Our Metaverse efforts may also divert resources and management attention from other areas of our business. We expect to continue to make significant investments to support these efforts, and our ability to support these efforts is dependent on generating sufficient profits from other areas of our business. In addition, as our Metaverse efforts evolve, we may be subject to a variety of existing or new laws and regulations in the United States and international jurisdictions, including in the areas of privacy and e-commerce, which may delay or impede the development of our products and services, increase our operating costs, require significant management time and attention, or otherwise harm our business. As a result of these or other factors, our Metaverse strategy and investments may not be successful in the foreseeable future, or at all, which could adversely affect our business, reputation, or financial results.

If we are not able to establish, maintain and enhance our brand and our reputation as a global leader, our business, and results of operations may be adversely affected.

We believe that establishing, maintaining and enhancing our brand and our reputation as a global leader in our products and solutions is critical to our relationship with existing customers and our channel partners and our ability to attract new customers and channel partners. The successful promotion of our brand will depend on a number of factors, including our marketing efforts, our ability to continue to develop and enhance our software platforms and sensor solutions, and our ability to successfully differentiate our products and services Platform from competitive data intelligence solutions. Although we believe it is important for our growth, our brand promotion activities may not be successful or yield increased revenues.

In addition, independent industry or financial analysts and research firms often test our products and solutions and provide reviews, as well as the products of our competitors, and the perception of our products and services in the marketplace may be significantly influenced by these reviews. If these reviews are negative, or less positive as compared to those of our competitors’ products, our brand may be adversely affected. In addition, we have in the past worked, and continue to work, with high profile customers. Our work with such customers has exposed us to publicity and media coverage. Negative publicity about us, including about our management, the efficacy and reliability of our platform, our products and service offerings, and the customers we work with, even if inaccurate, could adversely affect our reputation and brand.

If we are unable to develop new products, achieve growth, and effectively manage our growth, we may not be able to execute our business plan and our operating results could suffer.

To successfully execute our business plan, including expected debt repayment obligations, we will need to grow and to manage our growth effectively as we make significant investments in research and development, sales and marketing, and expand our operations and infrastructure both domestically and internationally. Our growth trajectory depends on our ability to successfully grow our customer base and enter new markets, and develop new products.

19

To manage our growth effectively, we must continue to expand our operations, engineering, financial accounting, internal management, and other systems, procedures, and controls. This may require substantial managerial and financial resources, and our efforts may not be successful. Any failure to successfully implement systems enhancements and improvements, or any failure to avoid delays in implementation, will likely have a negative impact on our ability to manage our expected growth, as well as our ability to ensure uninterrupted operation of key business systems and compliance with the rules and regulations applicable to public companies. If we are unable to manage our growth effectively, we may not be able to take advantage of market opportunities or develop new solutions, and we may fail to satisfy customer product or support requirements, maintain the quality of our solutions, execute our business plan or respond to competitive pressures. The occurrence of any of the foregoing could negatively affect our business, financial condition, and results of operations.

We may pursue strategic acquisitions, investments, strategic partnerships or other ventures, and our business could be materially harmed if we fail to successfully identify, evaluate, complete, and integrate such transactions.