- XBP Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

XBP Europe (XBP) 8-KOther Events

Filed: 14 Feb 25, 5:24pm

Exhibit 99.1

PART I

ITEM 1. BUSINESS

Unless otherwise indicated or the context otherwise requires, references in this section to “we,” “our,” “us,” “XBP Europe, “the Company” and similar terms are to XBP Europe Inc. and its subsidiaries before the Business Combination, and to XBP Europe Holdings, Inc. following consummation of the Business Combination, except where the context requires otherwise.

Overview

We are a pan-European integrator of bills, payments and related solutions and services seeking to enable digital transformation of our clients. We believe our business ultimately advances digital transformation, improves market-wide liquidity by expediting payments, and encourages sustainable business practices.

Our solutions and services serve clients of varying sizes in multiple industries, and across public and private sectors. Our larger reporting segment is the Bills & Payments segment where revenue stems from transactions processed by our products and services, including bill and payments processing, from our locations or from client locations. In 2023, this revenue stream generated approximately $122 million (approximately 73% of total revenues). Our other reporting segment is the Technology segment where revenue stems from the sale of recurring and perpetual software licenses and related maintenance, professional services, and sale of hardware solutions and related maintenance, which represented the remainder of our revenue or $45 million (27% of total revenues) in 2023.

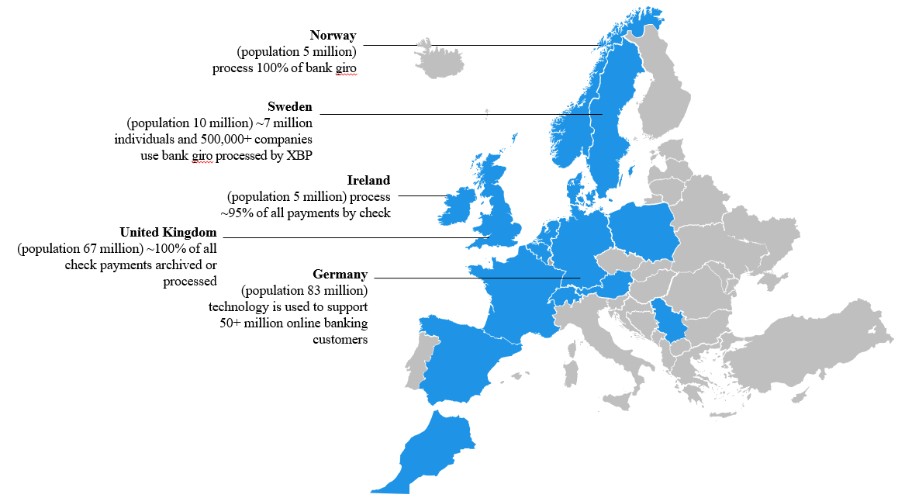

In total, we serve over 2,000 clients across Europe (including a smaller number in the Middle East and Africa). Our client concentration is relatively low, with the top 10 clients accounting for 26% of our revenue in each of 2023 and 2022, and the top 100 clients accounting for 76.3% and 73.8% of revenue in 2023 and 2022, respectively. For the fiscal year ended December 31, 2023, we generated $167 million of revenue.

We process several hundred million payment transactions annually. This volume is achieved using a hybrid of our cloud-based infrastructure and platforms, which enables us to deploy our business solutions to clients across the European market, and also to the Middle East and Africa (together with Europe, “EMEA”), where we have a smaller number of clients. Our physical footprint spans 15 countries and 32 locations. We host our products both on our own and our client premises and as a SaaS offering in the cloud. These offerings, along with several hybrid solutions are available to clients based on their needs and preferences. We offer a flexible model when it comes to our licenses, whereby clients can choose among licenses covering a maximum number of transactions, multi-year term licenses with renewal options, perpetual licenses or per user subscriptions. Our flexible deployment model has attracted many leading banking and financial institutions, including some of the largest in Europe. Among these institutions is Finanz Informatik (“FI”), the

1

IT service provider of the Savings Banks Finance Group, a German financial institution with approximately $3.0 trillion in business volume and more than 50 million end-customers.

We intend to enhance and expand our product and service offerings by adding emerging standards to our bills and payments solutions, such as our Request to Pay and Confirmation of Payee offerings, which should position us as one of the few companies within the broader open banking initiative that can offer solutions across industries. Since the Closing, we have expanded our offering to include XBP Omnidirect, a cloud-based communication management platform, and Reaktr.ai, our cyber-security, data modernization and cloud management business unit which is powered by AI, both of which are covered in more detail below, and which aim to expand our solution stack among the existing and new client base, thereby resulting in higher value client relationships.

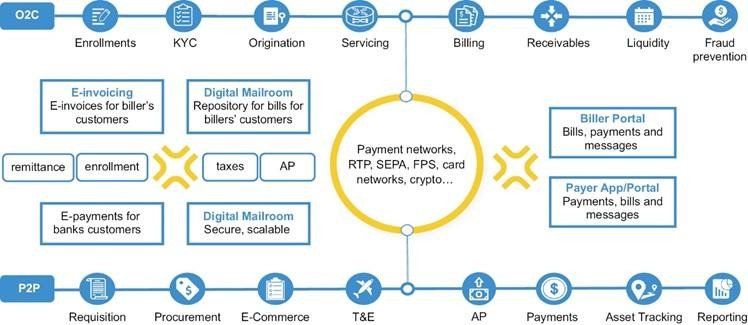

We offer an industry-agnostic and cross-departmental suite of products, which centers around finance and accounting (“F&A”) solutions and services and is comprised of the XBP Platform, Request to Pay, enterprise information management, robotic process automation, Digital Mailroom, business process management and workflow automation, and integrated communication services. We also offer industry specific solutions for banking and financial services. Since the COVID-19 pandemic has changed the way people and businesses operate, we have rolled out a suite of Work From Anywhere (“WFA”) applications with enterprise software for connectivity and productivity to better enable remote work.

Industry-agnostic and Cross-departmental Solutions

XBP Platform — exchange for bills and payments

The XBP platform provides a secured network, allowing billers, consumers and businesses to communicate and transact utilizing a modern technology stack that can connect to any client system without significant capital investments by new clients. Business-to-business (“B2B”) billers are able to communicate with payers electronically, offering transparency and simplified reconciliations. By structuring and linking data across disparate client systems, our XBP platform can be rapidly implemented using each client’s existing infrastructure and in-country settlement processes. This product allows payers to receive their bills in a single place, with analytics, alerts and several payment options. Downstream processes can be integrated with actionable data that is offered as a value-added service.

2

The XBP platform payment solutions enable consolidation of inbound payment channels and data continuity to enhance treasury management. Among other things, the product offers integrated receivables dashboards, multi-channel bill presentment and payment, reconciliation, exception and dispute management, ageing analytics, collections management, and targeted engagements.

Through the introduction of the XBP platform for small and medium sized businesses (“SMB”), clients are able to access our XBP web portal and leverage rich features to organize their bills, initiate communication and manage account receivables (“AR”) effectively, all designed to improve liquidity by expediting payments. We also use the XBP platform as the tool to support our ERP data consolidation offering, for which we see a market demand and which we will be offering our clients beginning in 2024. Any enterprise which has more than one ERP system likely faces challenges in consolidating the data from multiple ERPs, which is time consuming, prone to errors, and delays reporting and decision-making. We use our robotic process automation (“RPA”) suite, along with off the shelf ERP connectors to extract data from multiple ERPs, and feed it into XBP for clients to have one consolidated view without data being compromised or delayed due to manual handling.

Our accounts payable (“AP”) solution enables clients to simplify the complexities of supplier onboarding and management through a user-friendly user-interface (“UI”). Our AP solution can be integrated with our Digital Mailroom technology, which is able to process both digital and non-digital (e.g., paper) data. The AP solution process begins by initiating a requisition. Once approved, the requisition moves to procurement, where bids are solicited from an approved supplier network. We believe that supporting our clients by making our supplier network available may be a key differentiator in enabling a complete AP solution. Our AP solution also records receipt of goods and invoices and performs three-way matching digitally. Exceptions are processed and once approved in accordance with the client’s processes, the purchase is recorded in the client’s ERP system, so that it can be paid. We then use our system to generate and deliver a payment file in the format the bank needs so that a payment can be processed. Some of our clients also authorize us to process the payment on their behalf. Additionally, we deploy advanced AI-enabled solutions to decipher complex invoices and provide forecasts and insights into legacy accounting platforms.

Plug and play solutions across the Procure-to-Pay (P2P) and Order-to-Cash (O2C) cycle to simplify and personalize user experience, optimize treasury management, and facilitate compliance while reducing administrative cost.

3

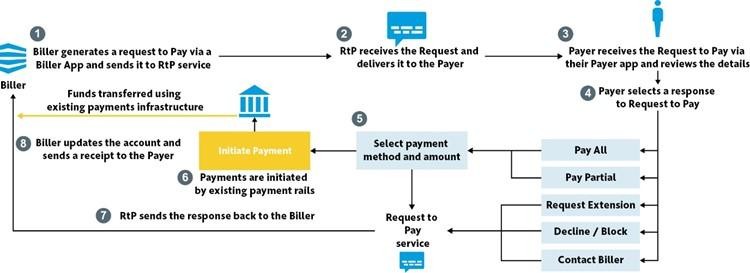

Request To Pay (RTP)

Our consistent focus on innovation in the open banking space allowed us to become one of the first market participants to develop an approved Request to Pay (“RTP”) solution for the UK market. This product was developed in cooperation with a key partner, Mastercard, and was approved by the UK’s regulatory body, Pay.UK in 2020. Meanwhile, the post-Brexit European Union is advancing its own RTP solution known as “R2P”, through the Single European Payment Area (“SEPA”) framework, sponsored by the European Payments Council (the “EPC”). Whether in the United Kingdom or EU, RTP/R2P enables billers to make payment requests and allows payers to act on such requests through a secure, unified messaging service that provides end-to-end audit trails for billers and facilitates two-way communication throughout the payment process. The solution is designed to help reduce the number of late payments by allowing the payer to exercise more options, including opening a line of communication regarding the amount, frequency and time of payment. According to a study by the Euro Banking Association, RTP has multiple potential uses, which include POS (point of sale) transactions, e-commerce, e-invoicing, and recurring payments. The benefits across these use cases are multifold and include: improved liquidity management, reduction of payment defaults, avoidance of credit card fees and reduced reliance on cash by enabling a low cost real time account to account transfer.

Enterprise Information Management

Our enterprise information management (“EIM”) solutions consume and organize large amounts of data across multiple formats and store the information in cloud-enabled proprietary platforms. We also gather transaction data from enterprise systems for hosting. The collected, extracted data is usually used to complete a client-mandated process, and is then made available to our clients and their end-consumers for a period of time in return for an access fee as part of the hosting service. We use this suite of solutions extensively in our digital transformation projects.

Robotic Process Automation

We have been at the forefront of using RPA. Our deployment model for RPA is desktop automation, followed by server level automation if the usage is reaching its capacity. We have built up a large library of RPA rules by both industry and client embedded into our solution suite. We view RPA as a step towards the automation of processes in instances where application programming interfaces (“APIs”) do not exist. An example of this is old legacy systems, which may only be accessed through UI that were intended for a human operator to access. In these instances, RPAs will allow a bot to mimic human interaction.

Digital Mailroom Solutions

We are one of the leading providers of digital mailroom and records digitization solutions and often handle the entire mailroom operation for our clients. Our digital mailroom product, called DMR, employs our technology and uses either our or a client’s infrastructure to process mailroom transactions. The end-to-end digital mailroom accommodates

4

inputs from paper, fax, emails and other electronic data. We also offer recorded voice, image, microfiche and video input channels. Users of DMR are able to view any of these inputs the same way they view emails in their inbox. The versatility of DMR means that it is used as both a module inside the XBP platform and as part of our WFA suite. The UI also connects to our other offerings, such as the Drysign e-signature platform, shipping and receiving services with digital receipt, and delivery and routing to our intelligent lockers offering.

We offer DMR for enterprise-wide deployment to captive mailrooms of clients, mailrooms outsourced to the Company and others. DMR is also suitable for business locations with no dedicated mailroom, such as a client’s front desk and can function as a virtual address solution, enabling businesses to acquire desirable addresses to support their evolution without needing to invest in additional physical office locations. Digital mailroom solutions are available as SaaS, BpaaS or as enterprise licenses. Our largest DMR deployment is with the German Savings Banks Finance Group, to which over 50 million users have access.

Business Process Management and Intelligent Workflow Automation

We have built extensive workflow automation and case management platforms for business process management, which can be leveraged to use our EIM engines. These platforms are designed to integrate popular databases and enterprise systems and are offered across three user categories: enterprise class (10,000 or more users or tasks), interdepartmental class (collaboration across departments), and case-management (off the shelf workflow automation platform which can be customized). Most of our deployments of the workflow automation suite are with banking clients in Germany and the United Kingdom and we typically use our platforms Plexus for more complex deployments, and Beats for off-the shelf workflows.

Integrated Communications

Our comprehensive multi-channel integrated communications solutions help clients communicate with other businesses or their clients. This suite of solutions can link through several channels, including email, print and mail, SMS, web, voice, and chat. Our solutions and services can be expanded to include design and marketing, selection of optimal engagement and least cost routing for mission critical communications. The cost of bills, statements, enrollments, client support, targeted marketing, mass notifications, reprographics, and regulatory notices can each be evaluated using these solutions. We also partner with clients to promote digital migration and improve user experience and help reduce, and even eliminate inefficient, wasteful communications.

Banking and Financial Industry Solutions and Services

XBP Europe is one of the largest non-bank processors of payments in Europe, having processed several hundred million payment transactions in 2023. Our banking and financial industry offerings include solutions for payment processing and payment enablement, mortgage enrollment, lending and loan management, confirmation of payee, know your client (“KYC”), anti-money laundering, governance, compliance and information management solutions and accounted for approximately 51% of revenue in 2023. We can provide these services as an end-to-end solution or as an augmentation of existing banking processes. We may also offer them as a technology license or through our employees who service clients.

We handle a variety of payment channels in addition to checks and credit cards, including Real Time Payments (called Faster Payments in the UK), SEPA, Bank Giro in the Nordics and other payment networks. We perform these services on behalf of banks or our other clients. Open banking is changing the regulatory environments in many of the Company’s markets, which are beginning to permit non-bank payment processors to connect to the payment networks directly. We operate core and mission critical payments services for a number of banks in Europe. These banks look to us to manage the payment infrastructure (software, hardware and hosting), the process design, the operational aspects of the services, payment scheme compliance (to the in-country interbank clearing schemes) and the application of the appropriate governance processes covering this heavily regulated industry. The bank clients outsource functions from their payments infrastructure and operations to us, and we then manage the end-to-end design, build, test and operate aspects of the payments processes using our in-house resources, software and know-how. We have internal policies and

5

procedures that conform to the standards required by banks and regulators for such sensitive and crucial activities and to comply with local laws and regulations.

The services that we provide are for certain services so critical to the banks’ core operational activities that they are exempt from value added tax. As part of our services, our staff and systems collect and aggregate outgoing payments, initiate and process payments, check those payments for validity and compliance, and submit them directly to the national interbank payments networks to which we are directly connected. Similarly, when payments are arriving (incoming requests for payment), our systems and staff validate them, perform anti-fraud checks (rejecting fraudulent payments) and make payment decisions if funds are available and the account credentials are met. Post-settlement, the time after a payment has been made, we operate systems and services that handle payment queries or errors.

Cross-border Payments

As well as domestic payments, we operate foreign currency services for five banks in the United Kingdom and Ireland. These services are more complex than domestic payments as they require us to comply with international sanctions regimes (e.g., OFAC) and involve many more regulations, rules and downstream processes including exchange rate charging tariffs.

Digitization of Checks

We provide mobile and remote deposit technologies to our banking and financial services clients. For example, when the United Kingdom transitioned from traditional check processing to an image-based clearing system (“ICS”) in 2017, to speed up the settlement of checks, XBP Europe and Vocalink (now part of Mastercard) were selected to jointly build and run the infrastructure of this new inter-bank clearing system. Today, all checks in the United Kingdom are processed via ICS. Separately, we have delivered ICS compliant services to seven of the nineteen participant banks in the United Kingdom and have been working to upgrade their mobile and remote deposit capabilities.

Confirmation of Payee

Payments in the United Kingdom and the European Union are moving toward real time account-to-account payments, which is expected to shift transactional volumes from traditional services such as card schemes, and batch-based payments such as direct debit. This move is largely driven by regulation, in part due to cost and speed benefits. Both the United Kingdom and the European Union payments regulators have encouraged the adoption of so-called overlay services that provide greater benefits to end users and reduced opportunities for fraud. Two of these overlays are RTP, which is described above, and Confirmation of Payee (“CoP”) and we are part of a select few in the industry that has adopted and deployed both of these services.

CoP is a service that verifies the payee’s bank account name and details before transmitting payments. This is a standard mandated by Pay.UK and conforms to the security requirements of open banking. CoP acts as an additional layer of payment protection and warns against sending payments to any non-verified payee account. This serves to transfer the fraud liability to the payer should the payer ignore any warnings. These validations help reduce the risk of payments to the wrong account holder, subsequent payment investigations and adjustment costs, and losses from, among other things, fraud. We were among the first service providers to launch a live client on our CoP service with the Co-operative Bank in 2020. We have since implemented the product with additional bank clients.

Mortgage and loan management

To improve the speed and provide cost efficiencies within a compliant mortgage and lending completion process, our proprietary mortgage and loan management solutions enable lenders to originate and service loans with greater efficiency by automating the entire mortgage lifecycle, from origination to submission and post-completion disbursements.

6

XBP Omnidirect

Following the Closing, we have begun offering XBP Omnidirect, a cloud-based platform that provides enterprise level client communication management centered around a digital storefront. In the Omnidirect storefront, clients manage all their printing, fulfillment, composition, marketing campaign needs, and do so for both internal and external purposes. As a result, the platform effectively transforms inventory management to become online based, but equally important, clients directly control multiple other channels, including marketing and fulfillment.

Cybersecurity, Data Modernization and Cloud management, and generative AI – Reaktr.ai

In January 2024, we announced the formation of Reaktr.ai, a business unit aimed at addressing the evolving needs of our clients in the cybersecurity, data modernization and cloud management, and generative AI spaces. With the constant threat of cybersecurity attacks, our clients’ operations are in need of robust fortification. Digital transformation is a broad subject, however all digital transformations have a common denominator, which is data modernization. Our data modernization solutions enable clients’ data to be cloud ready. In cases where clients are cloud ready but have not yet migrated or are considering whether to adopt a hybrid approach, Reaktr.ai is designed to advise on the right solution and to undertake the transition and subsequent management of the digital data. All of these solutions are complemented by AI-powered platforms which supplement operations to provide a competitive edge. We intend to invest in the expansion of local European talent for Reaktr.ai and to go to market over the course of 2024.

Overview of Revenues

Our two reportable segments are Bills & Payments and Technology. These segments are comprised of significant business units that align our products and services with how we manage our business, approach our key markets and interact with our clients based on their respective industries.

| ● | Bills and Payments: The Bills & Payments business unit primarily focuses on optimizing how bills and payments are processed by businesses of all sizes and industries. The Company offers automation of AP and AR processes and through an integrated platform, seeks to integrate buyers and suppliers across Europe. This business unit also includes our digital transformation revenue, which is both project based and recurring. |

| ● | Technology: The Technology business unit primarily focuses on sales of recurring and perpetual software licenses and related maintenance, hardware solutions and related maintenance and professional services. |

History and Development of Our Company

XBP Europe, Inc. was incorporated in Delaware on September 28, 2022 to facilitate the Business Combination. On November 30, 2023, following the Closing of the Business Combination, it became a wholly owned subsidiary of XBP Europe Holdings, Inc. (the “Company” or “XBP Europe”) and its shares started trading on the Nasdaq Stock Market under the ticker “XBP” and its warrants started trading on the Nasdaq Stock Market under the ticker symbol “XBPEW”. Together with its subsidiaries, the Company constitutes a collection of entities, which have comprised the core European business of ETI since the 1995 merger between Texas-based BancTec, Inc. and Recognition International, Inc. The Company’s subsidiaries and predecessor entities have been serving clients in the European marketplace for over 45 years. In 2018, through the acquisitions of Asterion International and Drescher Full-Service Versand, ETI further expanded its geographic and client reach across Europe.

Key Business Strategies

The Company’s business strategy aims to accelerate clients’ digital transformation through deployment of software and operations automation techniques, hosted on cloud. The Company’s overarching goal is to provide the highest value and lowest cost of ownership to its clients. The Company attempts to accomplish this by building scalable

7

systems that are used by its employees to deliver business process automation services across Europe. The key elements of the Company’s growth strategy are described below:

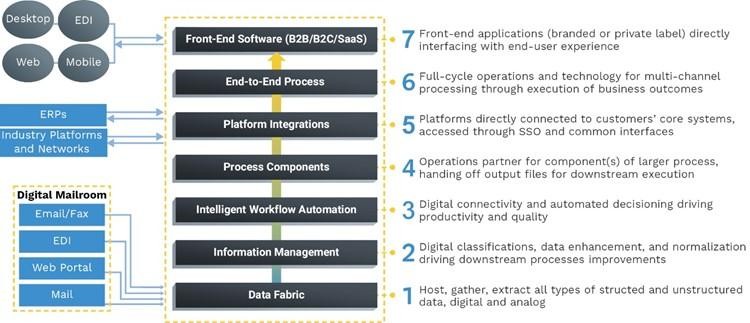

| ● | Expand Penetration of Solution Stack Across Client Base. We seek to move up in what we call “the seven layers of technology enabled solutions and services stack,” climbing the value chain of our clients from discrete services to end-to-end processes through use of front-end enterprise software. We believe continued deployment of our single sign on portals with on-demand applications will drive expansion of our front-end software (B2B/B2C/SaaS) and integrated offerings thereby enabling us to cross and up-sell within our existing client base. |

| ● | Expand XBP network of buyers and suppliers. We processed several hundred million payment transactions in 2023. The transactions we process touch tens of millions of consumers, buyers and suppliers across Europe, and present a significant opportunity to connect many more of them. We intend to expand the scope and scale of services we offer by leveraging the integration value our existing network provides as it endeavors to further connect buyers and suppliers to communicate and transact digitally. |

| ● | Work-from-Anywhere (WFA) enablement – We believe the modern workforce will continue to become more globalized, dynamic and distributed, demanding applications that support digital workflows, remote connectivity, productivity optimization and flexible facilities. We plan to continue expanding our WFA suite of enterprise software to meet the evolving needs of our clients and their employees. |

| ● | Pursue new client opportunities. We plan to continue to develop new long-term, strategic client relationships, especially where we have an opportunity to deliver a wide range of our capabilities and can have a meaningful impact on our clients’ business outcomes. For example, we plan to leverage the solutions we have already introduced in some European markets, like CoP or RTP (which we have introduced in the United Kingdom), and offer them to clients in other European markets. |

| ● | Capitalize on our enhanced scale and operating capacity. We intend to utilize our pan-European scale and track record of success to strengthen our ability to bid on new opportunities. We plan to dedicate additional resources to expand our range of service offerings and pursue additional cross-selling opportunities. We will also look to use our scale and operations expertise to improve utilization of our assets. |

| ● | Government Frameworks and Tenders. We are currently part of multiple government networks across a number of European countries and intend to intensify our presence and participation in such networks to utilize our pan-European scale and capacity to bid on new government and public agency led technology and |

8

| infrastructure opportunities. We plan to dedicate additional sales leadership resources to expand our presence and range of service offerings to government projects. |

| ● | Reaktr.ai - Taking the AI Plunge. Reaktr.AI was created as a direct result of the needs of our clients to fortify their operations and help them accelerate their digital transformation by serving as the data modernization and cloud migration partner, all of which are complemented by AI powered platforms. We have begun our outreach to clients and have commenced the investment cycle needed to make this a core offering of ours. |

Clients

We serve over 2,000 clients across a variety of industries. Our clients are among the leading companies in their respective industries, and many of them are recurring clients that have maintained long-term relationships with us and our predecessor companies.

We have successfully leveraged our relationships with clients to offer extended value chain services. We believe that clients are turning to us due to a demonstrated ability to work on large-scale projects, past performance and record of delivery, and deep domain expertise accumulated from years of experience in key verticals. We believe our stable and significant base of clients and long-term relationships can contribute to predictable revenues.

The Company maintains a strong mix of diversified clients with low client concentration. No single client accounted for more than 6% of 2023 or 2022 revenue and the top 10 clients only accounted for 26% of our 2023 and 2022 revenue, respectively, and the top 100 clients accounted for 76.3% and 73.8% of revenue in 2023 and 2022, respectively.

Intellectual Property

We deploy a combination of proprietary knowledge platforms and applications, as well as generally available third-party licensed software. We have a worldwide, non-exclusive, fully paid perpetual irrevocable intellectual property license with ETI and its worldwide subsidiaries pursuant to which we have access to all of the intellectual property in existence at November 29, 2023 of ETI and its subsidiaries for use in the EMEA region on an exclusive basis. Until such time as we are no longer an affiliate of ETI, we may also employ any intellectual property improvements developed by ETI. We believe that the intellectual property we have at our disposal is a competitive strength.

Our platforms aim to enhance information management and workflow processes through automation and process optimization to minimize labor requirements or to improve labor performance. Our decisioning engines have been built with years of deep domain expertise, incorporating hundreds of thousands of client and industry specific rules which enable efficiency and lower cost preparation and decisioning of transactions. Our business processes and implementation methodologies are confidential and proprietary and include trade secrets that are important to our business.

Our licensed intellectual properties are generally governed by written agreements of varying duration, including some with fixed terms that are subject to renewal based on mutual agreement, and some are perpetual in nature. Generally, each agreement may be further extended, and we have historically been able to renew most existing agreements before they expire. We expect these and other similar agreements to be extended so long as it is mutually advantageous to both parties at the time of renewal.

Competition

Our competitors include both large and small businesses, as well as global companies. Such competitors broadly fall into the following categories:

| (a) | Bills and payments aggregators and processors, multinational companies providing data aggregation, information management and workflow automation; |

9

| (b) | Consulting, discrete process and platform integration service providers; |

| (c) | Platform and front-end software providers; |

| (d) | BPO companies; and |

| (e) | Niche local providers in specific verticals and/or geographies. |

We believe the principal competitive factors in providing our solutions include platforms, industry specific knowledge, quality, reliability and security of service, and price.

Regulation and Compliance

We operate across numerous jurisdictions and provide client solutions in a number of fields, any number of which could be subject to regulation in the future. We are subject to the general legal framework in such jurisdictions. Whilst we provide support to clients in highly regulated industries, including banking, healthcare, insurance and utilities, which in some cases will result in the clients placing contractual obligations on us to comply with certain rules and regulations applicable to those industries in the performance of its services, currently there are no industry-specific licenses or authorizations required for us to provide such services.

However, we believe that the current regulatory environment in many geographies presents opportunities for growth as many geographies allow non-bank payment processes to connect directly to payment networks through the open banking initiative. In connection with accessing such opportunities and expanding our business we may choose to opt into certain regulatory frameworks, or may be required to comply with new or existing regulations, any of which may impact our business operations and practices. We may, in the future, decide to subject ourselves to regulation to expand our service offerings. We partnered with Mastercard to develop an approved RTP solution for the United Kingdom market, which was approved by Pay.UK in 2020. In addition, the post-Brexit European Union is advancing R2P, which could be subject to regulation from the EPC.

There has been increased public attention regarding the use of personal information and data transfer, accompanied by legislation and regulations intended to strengthen data protection, information security and consumer and personal privacy. The law in these areas continues to develop and the changing nature of privacy laws in the European Union and elsewhere could impact us processing of personal information of our employees and processing of personal information on behalf of our clients. In the European Union the comprehensive GDPR went into effect in May 2018. The GDPR has introduced significant privacy-related changes for companies operating both in and outside the European Union. We have resources dedicated to compliance with existing and emerging laws and regulations. We also rely on outside experts and licensed technologies to help supplement our knowledge and resource base and to validate and audit our processes.

Human Capital

We consider our employees to be the foundation for our growth and success.

As of December 31, 2023, we had approximately 1,500 total employees (of which approximately 190 are part-time employees) across 16 countries (14 across Europe and in Morocco, as well as the U.S., where our chief executive officer and chief financial officer are located). Our employee count fluctuates from time to time based upon the timing and duration of client engagements. Our senior leadership team has extensive experience with business process management, and while we have grown through a number of acquisitions, we have retained an experienced and cohesive leadership team.

10

We are fully committed to developing and fostering a culture of diversity and inclusion, and understand that our ability to attract, train, and retain talented individuals from all backgrounds and perspectives is key to our continued success.

| ● | Diversity and inclusion. We continue to focus on the hiring, retention, and advancement of women and underrepresented populations. Recently, we have been expanding our efforts to recruit and hire world-class diverse talent, and identifying strategic partners to accelerate our inclusion and diversity programs. |

| ● | Compensation and benefits. We offer a complete set of benefits for our employees, including competitive base salaries and bonus opportunities. In addition, we expect to establish an equity incentive plan through which we will use targeted equity-based grants with vesting conditions to attract and retain personnel. |

| ● | Health, safety, and wellness. We are committed to the health, safety and wellness of our employees. In response to the COVID-19 pandemic, we implemented significant changes in the best interest of our employees and the communities in which we operate, by having the vast majority of our employees work from home, while implementing additional safety measures for employees continuing critical on-site work. |

| ● | Talent development. We invest significant resources to develop the talent needed to continue to be a leader in our industry. We deliver numerous training opportunities, provide rotational assignment opportunities, have expanded our focus on continuous learning and development, and implemented industry leading methodologies to manage performance, provide feedback and develop talent. Our talent development programs provide employees with the resources they need to help achieve their career goals, build management skills and lead their organizations. |

| ● | Building connections. We believe that building connections between our employees, their families, and our communities creates a more meaningful, fulfilling and enjoyable workplace. We are active and involved in the communities in which our employees live and work, and we promote a culture of volunteering and giving back. |

We locate our operation centers in areas where the value proposition it offers is attractive relative to other local opportunities, resulting in an engaged educated multi-lingual workforce that is able to make a meaningful global contribution from their local marketplace. Our platforms enable rapid learning and facilitate knowledge transfer among employees, reducing training time, and allowing employees to increase their skills and leadership capabilities with the goal of creating a long-term funnel of talent to support our growth.

Controlled Company

For purposes of the Nasdaq Listing Rule, the Company is a “controlled company.” Under the Nasdaq rules, controlled companies are companies of which more than 50% of the voting power for the election of directors is held by an individual, a group, or another company. ETI, through its ownership of BTC International, owns a majority of the Company’s issued and outstanding Common Stock.

Available Information

Our website address is www.xbpeurope.com. We are not including the information provided on our website as a part of, or incorporating it by reference into, this Annual Report. We make available free of charge (other than an investor’s own internet access charges) through our website our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to these reports, as soon as reasonably practicable after we electronically file such material with, or furnish such material to, the Securities and Exchange Commission (the “SEC”). In addition, we make available our code of ethics entitled “Global Code of Ethics and Business Conduct” free of charge through our website. We have posted on our website all disclosures that are required by law or Nasdaq listing standards concerning any amendments to, or waivers from, any provision of our code of ethics.

11

The SEC maintains an internet site that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC at www.sec.gov. The information contained on the websites referenced in this Annual Report is not incorporated by reference into this filing.

PART II

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Unless otherwise noted, this Management’s Discussion and Analysis of Financial Condition and Results of Operations relates solely to our continuing operations and does not include the operations of our certain on-demand printing operations. See “Pending Divestiture” below and Note 3 - Discontinued Operations of the notes to consolidated financial statements for additional information about the disposable group.

Forward Looking Statements

The following Management’s Discussion and Analysis of Financial Condition and Results of Operations should be read in conjunction with a review of the other Items included in this Annual Report and our December 31, 2023 Consolidated Financial Statements included elsewhere in this report. Certain statements contained in this “Management’s Discussion and Analysis of Financial Condition and Results of Operations” may be deemed to be forward-looking statements. See “Special Note Regarding Forward-Looking Statements.”

Overview

The Company is a pan-European integrator of bills, payments and related solutions and services seeking to enable digital transformation of our clients. The Company serves over 2,000 clients of varying sizes and across multiple industries and geographies. We believe our business ultimately advances digital transformation, improves market-wide liquidity, and encourages sustainable business practices.

The Company’s digital foundation was developed to deliver fully outsourced solutions to address current and evolving client needs. The Company hosts its products both on client premises and as a SaaS offering in the cloud. These offerings, along with several hybrid solutions are available to clients based on the client’s needs and preferences. When distributing its licenses, the Company offers a flexible model, whereby clients may choose among licenses covering a maximum number of transactions, multi-year term licenses with flexible renewal options, perpetual licenses, or per user subscriptions.

The Company’s primary source of revenue stems from transactions processed by its products, including bills and payments processing and constitutes the dominant part of revenue in our larger, Bills & Payments reporting segment. Other sources of revenue include the sale of recurring software licenses and professional services, perpetual software licenses, as well as hardware solutions and related maintenance and constitute our other Technology reporting segment. The Company offers an industry-agnostic and cross-departmental suite of products, which center around finance and accounting (“F&A”) solutions and services comprised of the XBP Platform, Request to Pay, enterprise information management, Digital Mailroom, business process management and workflow automation, and integrated communication services. The Company also offers core industry solutions for the banking and financial services sector, and has, as a consequence of the COVID-19 pandemic, rolled out a suite of Work From Anywhere (“WFA”) applications with enterprise software for connectivity and productivity to enable remote work.

The continued success of the Company’s business is driven by its people. Its operation centers are located in areas where the value proposition the Company offers is attractive relative to other local opportunities, resulting in an engaged, educated multi-lingual workforce that is able to make a meaningful global contribution from their local marketplace. As of December 31, 2023, the Company had approximately 1,500 employees (of which 190 were part-time employees) across 16 countries (14 across Europe and in Morocco as well as the U.S., where our chief executive officer and chief financial officer are located).

12

History

XBP Europe, Inc. was incorporated in Delaware on September 28, 2022 to facilitate the Business Combination. On November 30, 2023, following the closing of the Business Combination, it became a wholly owned subsidiary of XBP Europe Holdings, Inc. (the “Company” or “XBP Europe”) and its shares started trading on the Nasdaq Stock Market under the ticker “XBP” and its warrants started trading on the Nasdaq Stock Market under the ticker symbol “XBPEW”. Together with its subsidiaries, the Company constitutes a collection of entities, which have comprised the core European business of ETI since the 1995 merger between Texas-based BancTec, Inc. and Recognition International, Inc. The Company’s subsidiaries and predecessor entities have been serving clients in the European marketplace for over 45 years. In 2018, through the acquisitions of Asterion International and Drescher Full-Service Versand, ETI further expanded its geographic and client reach across Europe.

Recent developments

Merger Agreement

On October 9, 2022, XBP Europe, Inc. entered into the Merger Agreement with CF VIII, BTC International and Merger Sub. Pursuant to the Merger Agreement, Merger Sub, a newly formed subsidiary of CF VIII, merged with and into XBP Europe, Inc., with XBP Europe, Inc. surviving the Merger.

The Merger was accounted for as a reverse recapitalization, in accordance with GAAP. Under this method of accounting, CF VIII was treated as the “acquired” company for financial reporting purposes. Accordingly, the Merger was treated as the equivalent of the Company issuing stock for the net assets of CF VIII, accompanied by a recapitalization. The net assets of CF VIII were stated at historical cost, with no goodwill or other intangible assets recorded. Operations prior to the Merger were those of the Company.

As a consequence of the Merger, XBP Europe Holdings, Inc. became the successor to CF VIII, which required the Company to hire additional personnel and implement procedures and processes to address public company regulatory requirements and customary practices. The Company expects to incur additional expenses as a public company for, among other things, directors’ and officers’ liability insurance, director fees and additional internal and external accounting and legal and administrative resources, including increased audit and legal fees.

Pending Divestiture

During the third quarter of 2024, certain on-demand printing operations of the Company met the criteria to be disclosed as discontinued operations in the third quarter of fiscal year 2024. See Note 3 - Discontinued Operations of the notes to consolidated financial statements for additional information on discontinued operations.

Key Factors Affecting Company’s Business

The Company believes that its performance and future success depend upon several factors that present significant opportunities for us but also pose risks and challenges including those discussed below and in the section of this Annual Report titled “Risk Factors.”

Investment in Technology

The Company’s revenue growth depends heavily upon its ability to ensure a timely flow of competitive products, services and technologies to the marketplace while also leveraging its domain expertise. Through regular and sustained investment, licensing of intellectual property and acquisition of third-party businesses and technology, the Company continues to develop new knowledge platforms, applications and supporting service bundles that enhance and expand its existing suite of services. These efforts will require the Company to invest significant financial and other resources.

13

Acquiring new clients

The Company plans to continue developing new long-term, strategic client relationships, particularly where there is an opportunity to deliver a wide range of capabilities that have a meaningful impact on clients’ business outcomes. As such, the Company plans to leverage the solutions it has already introduced in some European markets, like Confirmation of Payee or Request To Pay, that are part of its XBP platform, and offer them to clients in other European markets as well as solutions and products within its F&A offering such as the ERP data consolidation solution. With the launch of XBP Omnidirect and Reaktr.ai, we are looking to expand our client base. Additionally, the Company continues to evaluate becoming a registered payment service provider to supplement its existing solutions and services. The Company believes there is a long-term opportunity to expand in these markets to serve new clients.

The Company’s ability to attract new clients also depends on a number of factors, including the effectiveness and pricing of its products, its competitors’ offerings, and successfully executing its marketing efforts. Acquisition of new clients is expected to have a positive impact on the Company’s long-term profitability and operations.

Expanding the Company’s relationships with existing clients

In addition to acquiring new clients, the Company intends to continue retaining existing clients and pursue cross-selling and up-selling opportunities. With an existing base of over 2,000 clients, the Company believes there are meaningful opportunities to offer a bundled suite of services and to be a “one-stop-shop” for its clients’ bills and payments automation and broader digital transformation journeys.

The Company’s ability to influence clients to process more transactions and payments on its platforms has a direct impact on its revenue. As such, the Company offers a full suite of solutions by bundling integrated accounts payable and receivables, payment solutions, F&A services, master data management, reporting analytics along with integrated communication services for enterprise and small and medium businesses.

Our Segments

Our two reportable segments are Bills & Payments and Technology. These segments are comprised of significant strategic business units that align our products and services with how we manage our business, approach our key markets and interact with our clients based on their respective industries.

Bills and Payments: The Bills & Payments business unit primarily focuses on optimizing how bills and payments are processed by businesses of all sizes and industries. The Company offers automation of AP and AR processes and through an integrated platform, seeks to integrate buyers and suppliers across Europe. This business unit also includes our digital transformation revenue, which is both project based and recurring.

Technology: The Technology business unit primarily focuses on sales of recurring and perpetual software licenses and related maintenance, hardware solutions and related maintenance and professional services.

Key Performance Indicators

We use a variety of operational and financial measures to assess our performance. Among the measures considered by our management are the following:

| ● | Revenue by segment; |

| ● | Gross profit by segment; and |

| ● | Adjusted EBITDA (which is a non-GAAP financial measure). |

14

Revenue by segment

We analyze our revenue by comparing actual monthly revenue to internal projections and prior periods across our operating segments in order to assess performance, identify potential areas for improvement, and determine whether segments are meeting management’s expectations.

Gross profit by segment

The Company defines Gross Profit as revenue less cost of revenue (exclusive of depreciation and amortization). The Company uses Gross Profit by segment to assess financial performance at the segment level.

Non-GAAP Financial Measures

To supplement its financial data presented on a basis consistent with GAAP, this Annual Report contains certain non-GAAP financial measures, including EBITDA and Adjusted EBITDA. The Company has included these non-GAAP financial measures because they are financial measures used by management to evaluate the Company’s core operating performance and trends, to make strategic decisions regarding the allocation of capital and new investments. These measures exclude certain expenses that are required under GAAP. The Company excludes these items because they are non-recurring or non-cash expenses that are determined based in part on the Company’s underlying performance.

EBITDA and Adjusted EBITDA

We define EBITDA as net income (loss), plus taxes, interest expense, and depreciation and amortization. We define Adjusted EBITDA as EBITDA plus restructuring and related expenses, related party management fee and royalties, foreign exchange gains or losses, changes in fair value of warrant liability, and non-recurring transaction costs incurred in connection with the Business Combination.

Note Regarding Non-GAAP Financial Measures

EBITDA and Adjusted EBITDA are not financial measures presented in accordance with GAAP. We believe that the presentation of these non-GAAP financial measures will provide useful information to investors in assessing our financial performance and results of operations as our board of directors and management use EBITDA and Adjusted EBITDA to assess our financial performance, because it allows them to compare our operating performance on a consistent basis across periods by removing the effects of our capital structure (such as varying levels of interest expense), asset base (such as depreciation and amortization) and items outside the control of our management team. Net income/loss is the GAAP measure most directly comparable to EBITDA and Adjusted EBITDA. Our non-GAAP financial measures should not be considered as alternatives to the most directly comparable GAAP financial measure. Each of these non-GAAP financial measures has important limitations as analytical tools because they exclude some but not all items that affect the most directly comparable GAAP financial measures. These non-GAAP financial measures are not required to be uniformly applied, are not audited and should not be considered in isolation or as substitutes for results prepared in accordance with GAAP. Because EBITDA and Adjusted EBITDA may be defined differently by other companies in our industry, our definitions of these non-GAAP financial measures may not be comparable to similarly titled measures of other companies, thereby diminishing their utility.

15

The following tables present a reconciliation of EBITDA and Adjusted EBITDA to our net loss from continuing operations, the most directly comparable GAAP measure, for the years ended December 31, 2023 and 2022:

| | | | | | |

| | Year Ended December 31, | ||||

(dollars in thousands) | | 2023 |

| 2022 | ||

Net loss from continuing operations | | $ | (5,568) | | $ | (3,873) |

Income tax expense | | | 606 | |

| 2,562 |

Interest expense including related party interest expense, net | | | 7,006 | |

| 2,943 |

Depreciation and amortization | | | 2,944 | |

| 3,625 |

EBITDA from continuing operations | | | 4,988 | |

| 5,257 |

Restructuring and related expenses(1) | | | 5,053 | |

| 1,869 |

Employee litigation matter(2) | | | 1,431 | | | 267 |

Related party management fee and royalties(3) | | | 1,330 | |

| 4,907 |

Foreign exchange losses, net | | | 599 | |

| 1,175 |

Changes in fair value of warrant liability | | | (597) | | | — |

Transaction Fees(4) | | | 2,970 | |

| 3,595 |

Adjusted EBITDA from continuing operations | | $ | 15,774 | | $ | 17,070 |

| (1) | Adjustment represents costs associated with restructuring, including employee severance and vendor and lease termination costs. |

| (2) | Represents litigation settlement and associated expenses incurred in connection with the Company subsidiary litigation. See Note 15 - Commitments and Contingencies for more details. |

| (3) | Primarily represents management fee incurred in exchange for services, which included provision of legal, human resources, corporate finance, and marketing support. The management services agreement was terminated in connection with the Business Combination and was replaced by the related party service fee pursuant to the Services Agreement which reduced the fee and modified the services provided. |

| (4) | Represents transaction costs incurred as part of the Business Combination. |

The following tables present a reconciliation of EBITDA and Adjusted EBITDA to our net loss from discontinued operations, the most directly comparable GAAP measure, for the years ended December 31, 2023 and 2022:

| | | | | | |

| | Year Ended December 31, | ||||

(dollars in thousands) | | 2023 |

| 2022 | ||

Net loss from discontinued operations, net of income taxes | | $ | (5,479) | | $ | (4,056) |

Income tax expense | | | — | | | — |

Interest expense, net | | | 189 | |

| 95 |

Depreciation and amortization | | | 907 | |

| 765 |

EBITDA from discontinued operations | | | (4,383) | |

| (3,196) |

Restructuring and related expenses(1) | | | 187 | |

| 111 |

Related party service fees and royalties(2) | | | 25 | | | 494 |

Foreign exchange losses (gains), net | | | (5) | |

| 8 |

Adjusted EBITDA from discontinued operations | | $ | (4,176) | | $ | (2,583) |

| (1) | Adjustment represents costs associated with restructuring related to employee severance. |

| (2) | Primarily represents management fee incurred in exchange for services, which included provision of legal, human resources, corporate finance and marketing support. The management services agreement was terminated in connection with the Business Combination and was replaced by the related party service fee pursuant to the Services Agreement which reduced the fee and modified the services provided. |

16

Key Components of Revenue and Expenses

Revenue

The Company earns revenue from transactions processed using its products and services. In addition, the Company also sells recurring and perpetual software licenses, as well as maintenance and other professional services. Licensing options are flexible and clients can purchase a license covering a maximum number of transactions, multi-year term licenses with flexible renewal options and per-user subscriptions. The Company derives a majority of its revenue from transactions processing as well as from the sale of licenses and technology implementation services.

Related party revenue — Related party revenue consists of sales of the above products or services to related parties.

Costs and Expenses

Cost of revenue — Cost of revenue consists primarily of salaries and employee benefits, including performance bonuses, facility costs and cost of products.

Related party cost of revenue — Related party cost of revenue consists of the cost of the products or services purchased or acquired from related parties, plus a related party transfer pricing markup.

Selling, general and administrative expenses — Selling, general and administrative expenses consist primarily of administrative personnel and officers’ salaries and benefits including performance bonuses, legal and audit expenses, insurance, operating lease expenses (mainly facilities and vehicles) and other facility costs.

Related party expenses — Related party expenses primarily consist of the shared service cost, service fee, royalties and related party management fee which was replaced by the related party service fee in connection with the Business Combination.

Depreciation and amortization — Depreciation and amortization of intangible assets expenses consist of depreciation of property and equipment and amortization of client relationship asset.

Interest expense, net — Interest expense consists of interest related to pensions, debt, and finance leases.

Related party interest expense — Related party interest expense consists of interest incurred on amounts due to related parties.

Foreign exchange losses, net — Foreign exchange losses, net is comprised of losses and gains due to foreign currency remeasurement that are netted together for reporting purposes.

Changes in fair value of warrant liability – Changes in fair value of warrant liability represents the mark-to-market fair value adjustments to the outstanding Private Warrants issued as part of the consummation of the Business Combination. The change in fair value of Private Warrants is primarily the result of the change in the underlying stock price of our stock used in the Black-Scholes option pricing model. The warrant liability is remeasured at the end of each subsequent reporting period.

Pension income, net — Pension income, net consists of expected return on employee benefit plan assets, amortization of prior service cost and amortization of net loss.

Income tax expense — Income taxes consist primarily of income taxes related to federal, and foreign jurisdictions in which the Company conducts its business. The Company maintains a full valuation allowance on net deferred tax assets for its U.S. federal taxes and certain foreign and state taxes as the Company has concluded that it is not more likely than not that the deferred assets will be utilized.

17

Results of Operations

Year Ended December 31, 2023 Compared to Year Ended December 31, 2022 (US dollars in thousands)

| | | | | | |

| | Years Ended December 31, | ||||

|

| 2023 |

| 2022 | ||

Revenue: |

| |

|

| |

|

Bills and Payments | | $ | 110,458 | | $ | 115,733 |

Technology | |

| 44,719 | |

| 43,634 |

Revenue, net (including related party revenue of $0.2 million and $0.1 million, respectively) | |

| 155,177 | |

| 159,367 |

Cost of revenue: | |

| | |

|

|

Bills and Payments | |

| 95,572 | |

| 95,660 |

Technology | |

| 19,738 | |

| 22,490 |

Total cost of revenue (including related party cost of revenue of $0.1 million and $0.5 million, respectively, exclusive of depreciation and amortization) | |

| 115,310 | |

| 118,150 |

Selling, general and administrative expenses (exclusive of depreciation and amortization) | |

| 31,173 | |

| 27,773 |

Related party expense | |

| 4,633 | |

| 7,816 |

Depreciation and amortization | |

| 2,944 | |

| 3,625 |

Operating profit | |

| 1,117 | |

| 2,003 |

Interest expense, net | |

| 5,035 | |

| 2,968 |

Related party interest expense/(income), net | |

| 1,971 | |

| (25) |

Foreign exchange losses, net | |

| 599 | |

| 1,175 |

Changes in fair value of warrant liability | | | (597) | | | — |

Pension income, net | |

| (929) | |

| (804) |

Net loss before income taxes | |

| (4,962) | |

| (1,311) |

Income tax expense | |

| 606 | |

| 2,562 |

Net loss from continuing operations | | $ | (5,568) | | $ | (3,873) |

For the purposes of trend analysis, constant currency refers to the prevailing rate of the US dollar against relevant currencies for the year ended December 31, 2022.

Revenue

For the year ended December 31, 2023, our revenue on a consolidated basis decreased by $4.2 million, or 2.6%, to $155.2 million (including related party revenue of $0.2 million) from $159.4 million (including related party revenue of $0.1 million) for the year ended December 31, 2022. On a constant currency basis, revenue declined by $5.5 million, or 3.4%, offset by the positive impact of foreign currency accounting for $1.2 million or 0.7%.

Bills & Payments and Technology segments constituted 71.2%, and 28.8%, respectively, of our total revenue for the year ended December 31, 2023, compared to 72.6%, and 27.4%, respectively, for the year ended December 31, 2022. The revenue changes by reporting segment were as follows:

Bills & Payments — Net revenue attributable to bills and payments segment was $110.5 million for the year ended December 31, 2023 compared to $115.7 million for the year ended December 31, 2022. The revenue decline of $5.3 million, or 4.6%, is primarily attributable to completion of one time projects, lower volumes and client contract end, offset by the positive impact of newly won business. On a constant currency basis, revenue declined by $6.1 million, or 5.3%, offset by the positive impact of foreign currency accounting for a $0.8 million or 0.7%.

Technology — For the year ended December 31, 2023, revenue attributable to the Technology segment increased by $1.1 million, or 2.5%, to $44.7 million from $43.6 million for the year ended December 31, 2022. The revenue increase in the Technology segment was largely due to a higher volume of software licenses sold and a increase

18

in technology implementation and professional services revenue. On a constant currency basis, revenue increased by $0.7 million, or 1.7%, with a positive impact of foreign currency accounted for $0.4 million or 0.8%.

Cost of Revenue

For the year ended December 31, 2023, the cost of revenue decreased by $2.8 million (including decrease in related party cost of $0.4 million), or 2.4%, compared to the year ended December 31, 2022. Total cost of revenue decreased by $4.2 million or 3.6% on a constant currency basis, offset by the positive impact of foreign currency of $1.4 million or 1.2%, when compared to the cost of revenue for the year ended December 31, 2022.

In the Bills & Payments segment, cost of revenue decrease by $0.1 million or 0.1%. On a constant currency basis, cost of revenue at Bills & Payments segment declined by $1.2 million, or 1.3%, offset by the positive impact of foreign currency of 1.2% or $1.1 million.

The cost of revenue in the Technology segment decreased by $2.8 million, or 12.2%, primarily due to the change in the revenue mix within the Technology segment. On a constant currency basis, cost of revenue at the Technology segment decreased by $3.0 million, or 13.4%, offset by the foreign currency impact accounting for $0.3 million or 1.2%.

The increase in cost of revenues as a percent of revenue on a consolidated basis was primarily due to an increase in cost of supplies for resale and external services. Cost of revenue for the year ended December 31, 2023 was 74.3% of revenue compared to 74.1% of revenue for the year ended December 31, 2022.

Selling, General and Administrative Expenses

Selling, general and administrative expenses (“SG&A expenses”) increased by $3.4 million, or 12.2%, to $31.2 million for the year ended December 31, 2023, compared to $27.8 million for the year ended December 31, 2022. The increase was primarily attributable to transaction expenses incurred in connection with the Business Combination and restructuring expenses, partially offset by reduced operating lease and facility expenses for the year ended December 31, 2023 relative to the year ended December 31, 2022. SG&A expenses increased as a percentage of revenue to 20.1% for the year ended December 31, 2023 as compared to 17.4% for the year ended December 31, 2022.

Related Party Expenses

Related party expense was $4.6 million for the year ended December 31, 2023 compared to $7.8 million for the year ended December 31, 2022. The decrease was primarily driven by a decrease in the management fee. On October 9, 2022, the management fee was terminated in connection with the execution of the Merger Agreement and was replaced by the related party service fee which reduced the fees and modified the services provided.

Depreciation and Amortization

Total depreciation and amortization expense was $2.9 million and $3.6 million for the years ended December 31, 2023 and 2022, respectively. The decrease in total depreciation and amortization expense by $0.7 million was primarily due to a reduction in depreciation expense as a result of the expiration of the lives of assets acquired in prior periods and decrease in intangibles amortization expense due to end of the useful lives for certain intangible assets during the year ended December 31, 2023 compared to the year ended December 31, 2022.

Interest Expense

Interest expense was $5.0 million for the year ended December 31, 2023, compared to $3.0 million for the year ended December 31, 2022, largely due to higher pension interest cost and an increase in borrowing costs due to an increase in relevant borrowing reference rates during the year ended December 31, 2023 compared to the year ended December 31, 2022.

19

Related Party Interest Expense/Income, Net

Related party interest expense, net was $2.0 million for the year ended December 31, 2023 compared to related party interest income, net of $25 thousand for the year ended December 31, 2022. The increase in the related party interest expense, net was due to an elimination of a related party interest receivable as required by the Ultimate Parent Support Agreement during the prior year.

Foreign Exchange Losses, net

Foreign exchange losses were $0.6 million for the year ended December 31, 2023 compared to foreign exchange losses of $1.2 million for the year ended December 31, 2022, primarily due to a higher unrealized foreign exchange losses, partially offset by lower realized foreign exchange losses for the year ended December 31, 2023 compared to the year ended December 31, 2022.

Changes in fair value of warrant liability

The change in fair value of warrant liability during the year ended December 31, 2023 was a income of $0.6 million. The change in fair value of warrant liability resulted from the remeasurement of the Private Warrant liability between November 29, 2023 and the end of the reporting period, December 31, 2023.

Pension Income, net

Pension income, net was $0.9 million for the year ended December 31, 2023 compared to pension income, net of $0.8 million for the year ended December 31, 2022. The increase in income was primarily due to an increase in pension-related income recorded in the year ended December 31, 2023.

Income Tax Expense

The Company had an income tax expense of $0.6 million for the year ended December 31, 2023 compared to an income tax expense of $2.6 million for the year ended December 31, 2022. The decrease in tax expense over prior year is largely due to decrease in profitability in France.

Liquidity and Capital Resources

Overview

At December 31, 2023 and 2022 cash and cash equivalents totalled $6.5 million and $7.4 million, respectively.

The Company currently expects to spend approximately $1.5 million to $2.5 million on total capital expenditures over the next twelve months. The Company will continue to evaluate additional capital expenditure needs that may arise.

As of December 31, 2023, and in comparison to December 31, 2022, total debt decreased by $2.4 million primarily due to repayments of term loans, and due to the entry into the Amended Factoring Agreement on September 15, 2023, which resulted in an off-balance sheet treatment of the Secured Borrowing Facility.

The Company has utilized COVID-19 relief measures in various European jurisdictions, including permitted deferrals of certain payroll, social security and value added taxes. At the end of the fourth quarter 2023, the Company paid a significant portion of these deferred payroll taxes, social security and value added taxes. The remaining balance of deferred payroll taxes, social security and value added taxes will be paid by April 2027, or later, as per deferment timeline as established by local laws and regulations.

The Company believes the current cash, cash equivalents and cash flows from financing activities, including the reduction in cash used in principal repayment on borrowings under factoring arrangement, are sufficient to meet the

20

Company’s working capital and capital expenditure requirements for a period of at least twelve months. To the extent existing cash, cash from operations, and amounts available for borrowing are insufficient to fund future activities, the Company may need to raise additional capital. The Company may require funding for a variety of reasons, including, but not limited to, cost overruns for reasons outside of its control and it may experience slower sales than anticipated. If the Company’s current cash on hand is not sufficient to meet its financing requirements for the next twelve months, it may have to raise funds to allow it to continue to operate its business and execute on its business plan. The Company cannot be certain that funding will be available on acceptable terms or at all particularly given the amount of Company securities being offered, the terms of such securities and the potential duration of any offering. To the extent that the Company raises additional funds by issuing equity securities, its stockholders may experience significant dilution. Any debt financing, if available, may involve restrictive covenants that may impact the Company’s ability to conduct business or return capital to investors. If the Company is unable to raise additional capital on acceptable terms, it may have to significantly scale back, delay or discontinue certain businesses, restrict its operations or obtain funds by entering into agreements on unattractive terms.

Cash Flows

Our consolidated statements of cash flows include cash flows related to the disposable group. Significant non-cash items and capital expenditures of discontinued operations related to our disposable group are presented separately in Note 3 - Discontinued Operations of the notes to consolidated financial statements in this Annual Report.

The following table summarizes our cash flows for the years indicated:

| | | | | | |

| | Year Ended December 31, | ||||

(dollars in thousands) |

| 2023 |

| 2022 | ||

Net cash used in operating activities |

| $ | (1,535) | | $ | 9,890 |

Net cash used in investing activities | | | (2,669) | |

| (6,366) |

Net cash provided by (used in) financing activities | | | (305) | |

| (1,329) |

Effect of exchange rates on cash and cash equivalents | | | 3,941 | |

| 2,369 |

Net increase (decrease) in cash and cash equivalents | | | (568) | |

| 4,562 |

Analysis of Cash Flow Changes between the years ended December 31, 2023 and 2022

Operating Activities — Net cash used in operating activities was $1.5 million for the year ended December 31, 2023, compared to net cash provided in operating activities of $9.9 million for the year ended December 31, 2022. The decrease of $11.4 million in cash provided by operating activities was largely due to a higher net loss driven by transaction expenses, inflows related to accounts receivable and accrued expenses and other liabilities, both of which were partially offset by higher outflows from accounts payable.

Investing Activities — Net cash used in investing activities was $2.7 million for the year ended December 31, 2023, compared to net cash used in investing activities of $6.4 million for the year ended December 31, 2022. The decrease of $3.7 million in cash used in investing activities was a result of a purchase of the Company’s Irish headquarters in Dublin, Ireland, which took place during the year ended December 31, 2022.

The cash outflow of $2.7 million in investing activities for the year ended December 31, 2023was primarily due to additions to property, plant and equipment in 2023.

Financing Activities — Net cash used in financing activities was $0.3 million for the year ended December 31, 2023, compared to net cash used in financing activities of $1.3 million for the year ended December 31, 2022.The decrease of $1.0 million in cash used in financing activities for the year ended December 31, 2023was primarily due to proceeds from the Business Combination offset by repayments under the securitization facility.

21

Indebtedness

Secured Borrowing Facility

On August 25, 2020, certain entities entered into an agreement wherein amounts due from clients were pledged to a third party, in exchange for a borrowing facility in amounts up to a total of €31.0 million (the “Secured Borrowing Facility”). The proceeds from the Secured Borrowing Facility were determined by the amounts invoiced to our clients. The amounts due from clients were recorded in accounts receivable and the amount due to the third party as a liability, presented under “Current portion of long-term debt” on the consolidated balance sheets. The cost of the Secured Borrowing Facility was 0.10% of newly assigned receivables with minimum of €0.1 million in annual fees and the Secured Borrowing Facility bore interest at Euribor rate plus 0.70% on the unpaid principal amount. The Company incurred interest expenses of $0.6 million and $0.3 million for the years ended December 31, 2023 and 2022, respectively, related to the Secured Borrowing Facility. As of December 31, 2023 and 2022, the outstanding balances payable under the Secured Borrowing Facility were $0.1 million and $3.7 million, respectively.

On September 15, 2023, the relevant entities entered into an amendment to the Secured Borrowing Facility (the “Amended Factoring Agreement”) to convert the existing arrangement into a non-recourse factoring program wherein an unrelated third party (the “Factor”) shall provide financing to certain subsidiaries of the Company by purchase of certain approved and partially approved accounts receivables (as defined in the Amended Factoring Agreement) up to a maximum amount of €15.0 million while assuming the risk of non-payment on the purchased accounts receivables up to the level of approval. The relevant entities shall have no continuing involvement in the transferred accounts receivable, other than collection and administrative responsibilities and, once sold, the accounts receivable shall no longer be available to satisfy creditors of the relevant entities.

The Company accounted for the transactions under the Amended Factoring Agreement as a sale under ASC 860, Transfers and Servicing, and treats it as an off-balance sheet arrangement. Net funds received from the transfers reflect the face value of the account less a fee, which is recorded as an increase to cash and a reduction to accounts receivable outstanding in the consolidated balance sheets. The Company reports the cash flows attributable to the sale of account receivables to the Factor and the cash receipts from collections made on behalf of and paid to the Factor under the Amended Factoring Agreement, on a net basis as trade accounts receivables in cash flows from operating activities in the Company’s consolidated statements of cash flows.

During the year ended December 31, 2023, the Company factored accounts receivable invoices totaling approximately $6.8 million pursuant to the Amended Factoring Agreement, representing the face value of the invoices. The Company recognizes factoring costs upon disbursement of funds. The Company incurred a loss on sale of accounts receivables including expenses pursuant to the Amended Factoring Agreement totaling approximately $0.3 million for the year ended December 31, 2023, which is presented in selling, general and administrative expenses (exclusive of depreciation and amortization) on the consolidated statements of operations.

2019 Credit Agreement