Exhibit 99

CDI Corp.

Committed to creating shareholder value through long-term profitable growth

CDI Corp proprietary information. Use or dissemination without prior consent is strictly prohibited.

1

NYSE: CDI

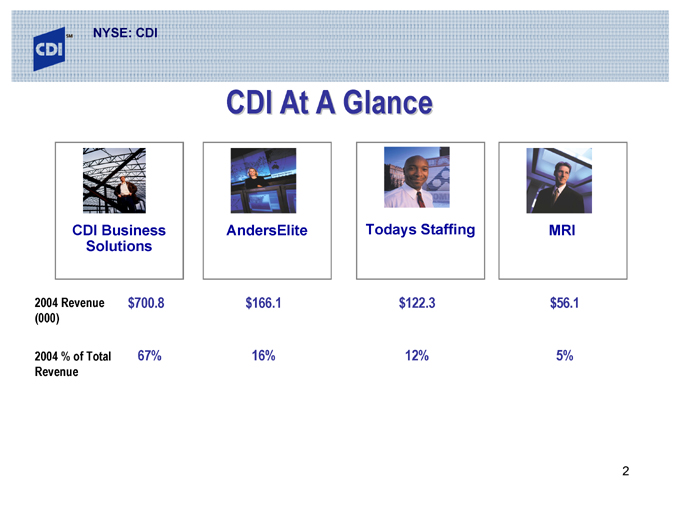

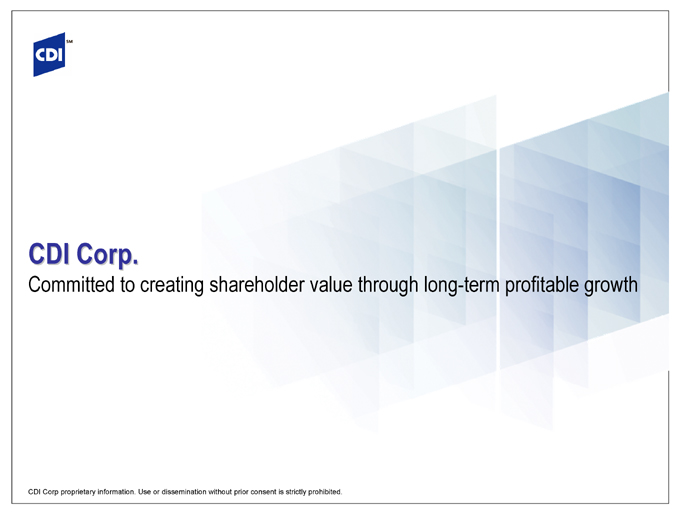

CDI Business Solutions

AndersElite

Todays Staffing

MRI

CDI At A Glance

2004 Revenue $700.8 $166.1 $122.3 $56.1

(000)

2004 % of Total 67% 16% 12% 5%

Revenue

2

NYSE: CDI

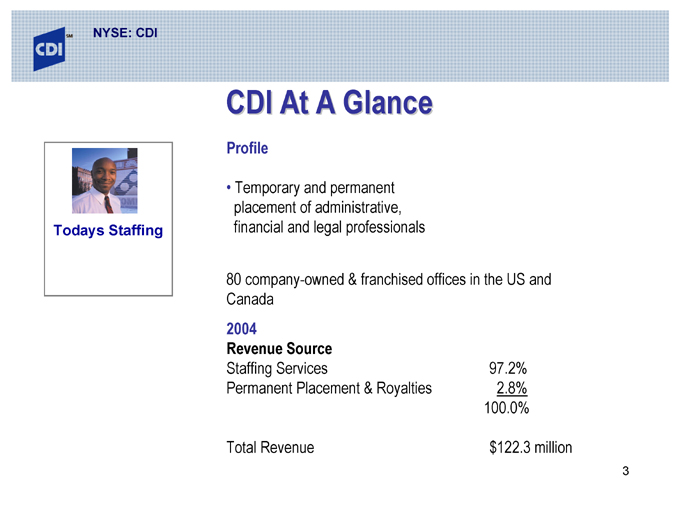

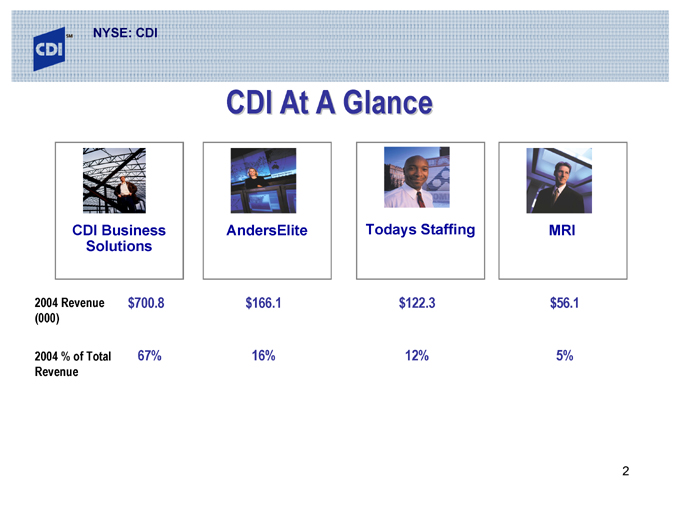

Todays Staffing

CDI At A Glance

Profile

Temporary and permanent placement of administrative, financial and legal professionals

80 company-owned & franchised offices in the US and Canada

2004

Revenue Source

Staffing Services 97.2%

Permanent Placement & Royalties 2.8%

100.0%

Total Revenue $122.3 million

3

NYSE: CDI

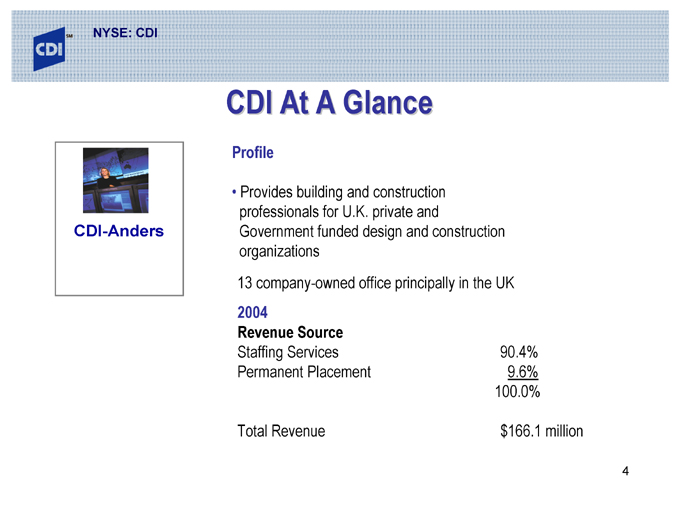

CDI-Anders

CDI At A Glance

Profile

Provides building and construction professionals for U.K. private and

Government funded design and construction organizations 13 company-owned office principally in the UK

2004

Revenue Source

Staffing Services 90.4%

Permanent Placement 9.6%

100.0%

Total Revenue $166.1 million

4

NYSE: CDI

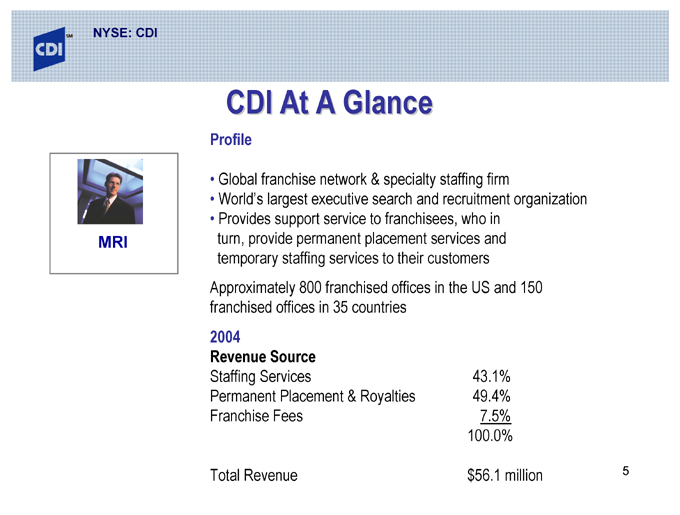

MRI

CDI At A Glance

Profile

Global franchise network & specialty staffing firm

World’s largest executive search and recruitment organization Provides support service to franchisees, who in turn, provide permanent placement services and temporary staffing services to their customers

Approximately 800 franchised offices in the US and 150 franchised offices in 35 countries

2004

Revenue Source

Staffing Services 43.1%

Permanent Placement & Royalties 49.4%

Franchise Fees 7.5%

100.0%

Total Revenue $56.1 million

5

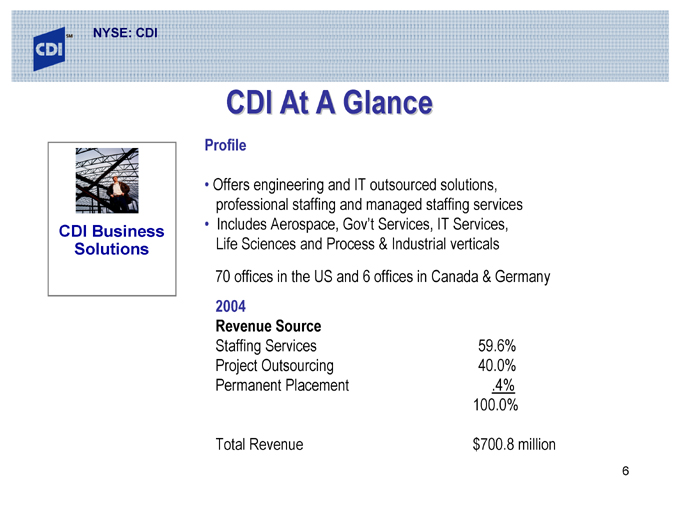

NYSE: CDI

CDI Business Solutions

CDI At A Glance

Profile

Offers engineering and IT outsourced solutions, professional staffing and managed staffing services Includes Aerospace, Gov’t Services, IT Services, Life Sciences and Process & Industrial verticals

70 offices in the US and 6 offices in Canada & Germany

2004

Revenue Source

Staffing Services 59.6%

Project Outsourcing 40.0%

Permanent Placement .4%

100.0%

Total Revenue $700.8 million

6

NYSE: CDI

Key Vertical Market Sectors – Business Solutions

CDI-IT Services – 39.9%*

Financial, Banking, Insurance, Travel, Automotive

Sample Services: IT Staffing, Outsourcing Solutions

CDI-Process & Industrial – 39.6%*

Chemicals, Oil, Gas, Refining, Telecom, Power Generation

Sample Services: Engineering, Procurement, Construction Management, Feasibility Studies & Process Consulting, Turnaround Services

CDI-Aerospace – 12.3%*

Commercial & Military Aerospace, Satellite/Space Systems

Sample Services: Mechanical Design & Structural Analysis, Electronics, Technical Publications, Logistics

7

NYSE: CDI

Key Vertical Market Sectors – Business Solutions (cont.)

CDI-Government Services – 6.9%*

U.S. Government Agencies & U.S. Allies

Sample Services: Marine Design, Systems Development, Military Aviation Support, IT Solutions

CDI-Life Sciences – 1.3%*

Pharmaceutical, Biotechnology

Sample Services: Feasibility Studies, Site Selection, Facility Design, Start Up Services, Validation, Clinical Staffing

* % 2004 Business Solutions Revenue

8

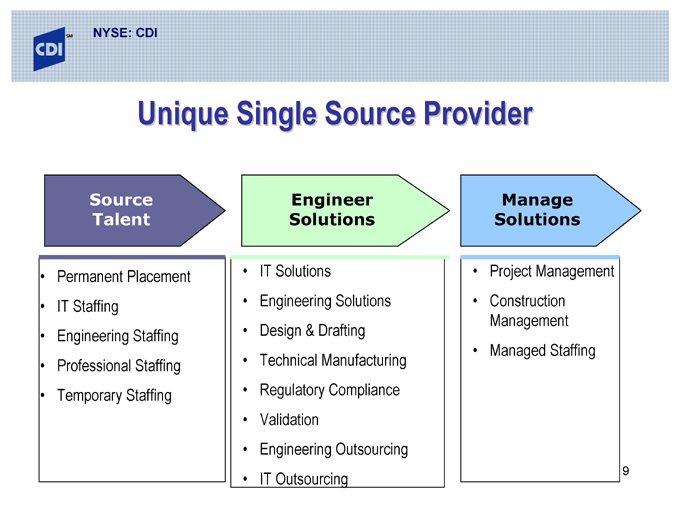

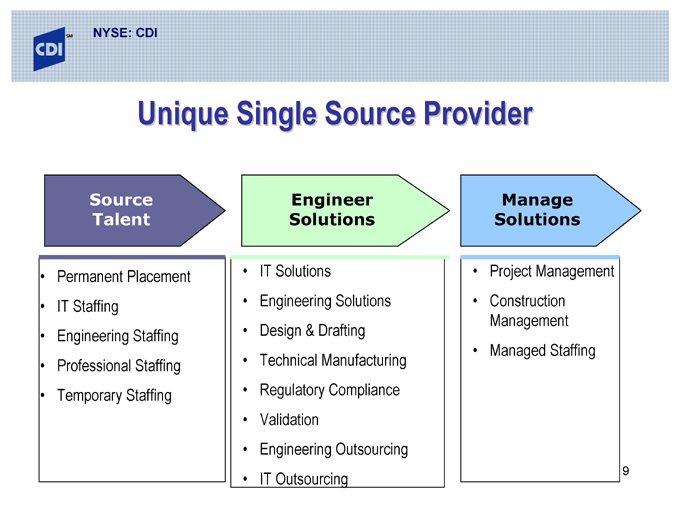

NYSE: CDI

Unique Single Source Provider

Source Talent

Engineer Solutions

Manage Solutions

Permanent Placement IT Staffing Engineering Staffing Professional Staffing Temporary Staffing

IT Solutions

Engineering Solutions Design & Drafting Technical Manufacturing Regulatory Compliance Validation Engineering Outsourcing IT Outsourcing

Project Management Construction Management Managed Staffing

9

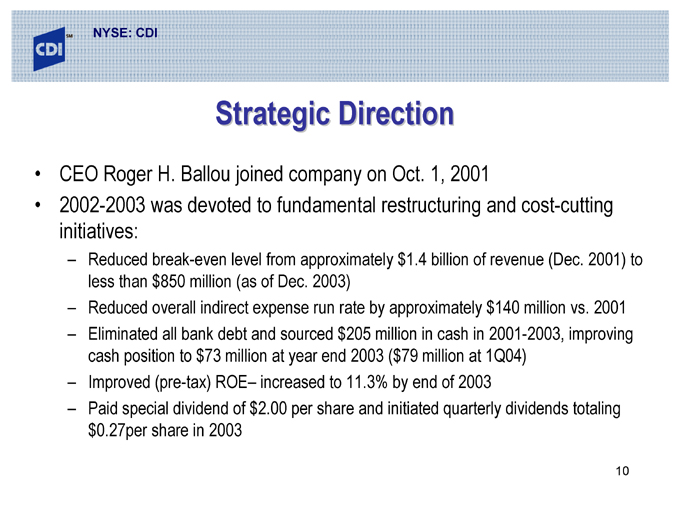

NYSE: CDI

Strategic Direction

CEO Roger H. Ballou joined company on Oct. 1, 2001

2002-2003 was devoted to fundamental restructuring and cost-cutting initiatives:

Reduced break-even level from approximately $1.4 billion of revenue (Dec. 2001) to less than $850 million (as of Dec. 2003)

Reduced overall indirect expense run rate by approximately $140 million vs. 2001

Eliminated all bank debt and sourced $205 million in cash in 2001-2003, improving cash position to $73 million at year end 2003 ($79 million at 1Q04)

Improved (pre-tax) ROE– increased to 11.3% by end of 2003

Paid special dividend of $2.00 per share and initiated quarterly dividends totaling $0.27per share in 2003

10

NYSE: CDI

Strategic Direction (cont.)

2004 expected to focus on execution and revenue growth, but instead:

Delayed return on revenue-building investments in sales organizations due to:

Continued delay in capital spending by key clients in Aerospace, Refining, PowerGen, Telecom, Chemicals Slower-than-anticipated ramp-up in new account wins

Management and key producer turnover in AndersElite Higher-than-anticipated Sarbanes-Oxley spend

Identified a material weakness in int. control environment and restatement initiated “Perfect Storm” of unanticipated pre-tax items

11

NYSE: CDI

Full Year 2004 Review

Net earnings of $7.5 million on revenues of $1.05 billion for EPS of $0.38

Included in pre-tax earnings were the following unanticipated pre-tax items: $5.4 million legal claims and litigation costs $2.9 million real estate charges due to exiting of facilities

12

NYSE: CDI

Full Year 2004 Review (cont.)

CDI positioned itself for growth by investing in revenue-producing staff across all business units that has produced the following:

$5.0 million higher revenue run rate in Q4 ‘04 vs.Q4 ‘03

A recruiting productivity model that yielded 40% improvement

A national sales team that has numerous contracts ramping up in Q1 ‘05

Staff in all segments poised to take advantage of perm placement opportunities

Gross profit margin: 23.5% Paid $47.3 million in cash dividends

No bank debt with cash balance of $32.7 million

13

NYSE: CDI

CDI’s Value Proposition

CDI’s customers leverage our skill, speed and scale to achieve a faster and higher return on capital investment. CDI offers clients a single-source provider of best-of-breed engineering and IT solutions and professional staffing; freeing our customers to focus on their core competencies, accelerate change, and drive profitable growth.

14

NYSE: CDI

15

NYSE: CDI

Strategic Growth Plan

Reposition CDI to be a single source provider of engineering and IT solutions and professional staffing Capture market share in key verticals by:

Continuing to execute business solutions focusing on higher knowledge content and longer cycle areas

Increasing recruiter productivity

Leveraging industry expertise in key verticals to provide tailored products to customers

16

NYSE: CDI

Strategic Growth Plan (cont.)

Expand permanent placement business, including MRI growth into new international markets with master franchise model Build skill and scale to enhance core capabilities and expand company’s range of services Leverage cash-generative business model to self-fund organic growth, pay dividends and support prudent, strategic acquisitions

17

NYSE: CDI

2005 Growth Objectives

Achieve annualized targeted revenue growth rates of 5 to 7%

Expect to achieve pre-tax return on invested capital of 20%+ by end of 2006 and redeploy assets unable to meet target Maintain financial discipline and lean headquarter operations to generate highly leveraged variable contribution and, over time, return to above historic operating margins which were, at their peak, approximately 5% Derive at least 60% of revenues from higher-margin, longer-cycle business Maintain or establish a top five leadership position in targeted verticals

18

NYSE: CDI

Investment Summary

A strong balance sheet and lean cost structure

Poised to leverage anticipated increase in capital spending through business model which can create variable contribution margin in the low to mid teens Business model produces solid cash flow to enable organic growth, acquisitions and dividend payments

Paid quarterly dividends totaling $0.42 per share – 2004

Paid two special dividends of $2.00 per share – 2003 and 2004

19

NYSE: CDI

Investment Summary (cont.)

Unique player in the Professional Services sector

Less cyclical with more than 50% of revenues from higher-margin, longer-cycle engineering and IT business

Only single-source provider of engineering and IT solutions and professional staffing

Poised to leverage highly favorable incremental margins at MRI as recovery in perm placement marketplace continues

20

NYSE: CDI

Safe Harbor Statement

Certain information in this news release contains forward-looking statements as such term is defined in Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Certain forward-looking statements can be identified by the use of forward-looking terminology such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “approximately,” “hopes,” “intends,” “plans,” “estimates,” or “anticipates” or the negative thereof or other comparable terminology, or by discussions of strategy, plans or intentions. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. In addition to those risks and uncertainties referred to in our public filings, these include risks and uncertainties such as competitive market pressures, material changes in demand from larger customers, availability of labor, the company’s performance on contracts, changes in customers’ attitudes towards outsourcing, government policies or judicial decisions adverse to the staffing industry and changes in economic conditions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. The company assumes no obligation to update such information.

21

www.cdicorp.com

CDI Corp proprietary information. Use or dissemination without prior consent is strictly prohibited.