UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material pursuant to §240.14a-12 |

CDI Corp.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

| | |

| |

1717 Arch Street, 35th Floor Philadelphia, Pennsylvania 19103-2768 | | NOTICE OF ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 19, 2015 |

Dear Shareholder:

The 2015 Annual Meeting of the Shareholders of CDI Corp. will be held in the Trumbauer West Room on the 51st Floor of Three Logan Square, 1717 Arch Street, Philadelphia, Pennsylvania, on Tuesday, May 19, 2015 at 10:00 a.m., for the following purposes:

| 1. | To elect nine directors of CDI; |

| 2. | To approve CDI’s executive compensation in an advisory vote; |

| 3. | To approve the Amended and Restated Omnibus Stock Plan; |

| 4. | To approve the Executive Bonus Plan; |

| 5. | To ratify the appointment of KPMG LLP as CDI’s independent registered public accounting firm for 2015; and |

| 6. | To transact such other business as may properly come before the meeting or any and all adjournments or postponements of the meeting. |

Only shareholders of record on March 17, 2015 are entitled to notice of and to vote at the Annual Meeting. The vote of each shareholder is important to us. If you do not expect to attend the meeting in person and desire to have your shares represented and voted at the meeting, please fill in, sign and promptly return the accompanying proxy card in the accompanying postage-paid envelope. Most shareholders can also vote their shares online or by telephone. See the instructions on your proxy card or in the attached Proxy Statement. If you do attend the meeting, you may revoke your proxy and vote in person.

By Order of the Board of Directors

Brian D. Short, Secretary

Dated: April 16, 2015

Philadelphia, Pennsylvania

| | |

| |

1717 Arch Street, 35th Floor Philadelphia, Pennsylvania 19103-2768 | | PROXY STATEMENT FOR ANNUAL MEETING OF SHAREHOLDERS ON MAY 19, 2015 |

This Proxy Statement and the accompanying proxy card are being mailed to the

shareholders of CDI Corp. (which is referred to in this Proxy Statement as “CDI”,

“the company” or “we”) beginning on or about April 22, 2015.

2015 PROXY STATEMENT SUMMARY

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information you should consider. We encourage you to read the entire Proxy Statement carefully before voting.

2015 Annual Meeting Information

Date and Time: May 19, 2015 at 10:00 a.m.

Location: Trumbauer West Room, 51st Floor, Three Logan Square, 1717 Arch St., Philadelphia, PA

Record Date: March 17, 2015

Common Shares Outstanding as of Record Date: 19,645,679

How to Vote: Most shareholders can vote online, by telephone, by mail or in person at the Annual Meeting

Items to be Voted On and Board Recommendations

| | | | | | |

| Proposal | | Board Voting

Recommendation | | | Page Reference (for more information) |

1. Election of Directors | | | FOR ALL | | | 7-9 |

2. “Say-on-pay” advisory vote to approve executive compensation | | | FOR | | | 63 |

3. Approve the Amended and Restated Omnibus Stock Plan | | | FOR | | | 63-77 |

4. Approve the Executive Bonus Plan | | | FOR | | | 78-80 |

5. Ratify appointment of KPMG LLP as CDI’s independent registered public accounting firm for 2015 | | | FOR | | | 81-83 |

The Nine Nominees for Director

| | | | | | | | | | | | | | | | |

| | | | | | | | | Board Committees |

| Name | | Director Since | | Independent? | | Position | | Audit | | Compensation | | Executive | | Finance | | Governance &

Nominating |

Joseph L. Carlini | | 2014 | | Yes | | CEO of McKean Defense Group | | * | | | | | | * | | |

| | | | | | | | |

Michael J. Emmi | | 1999 | | Yes | | Chairman of the Board of IPR

International LLC | | | | *

(Chair) | | | | | | * |

| | | | | | | | |

Scott J. Freidheim | | 2014 | | No | | CEO of CDI Corp. | | | | | | | | | | |

| | | | | | | | |

Walter R. Garrison | | 1958 | | Yes | | Chairman of the Board of CDI

Corp. | | | | | | * | | | | |

| | | | | | | | |

Lawrence C. Karlson | | 1989 | | Yes | | Consultant for industrial

& technology companies | | *

(Chair) | | | | | | * | | |

| | | | | | | | |

Ronald J. Kozich | | 2003 | | Yes | | Retired Managing Partner,

Ernst & Young, Philadelphia | | * | | * | | | | | | * |

| | | | | | | | |

Anna M. Seal | | 2010 | | Yes | | Former SVP & CFO of Global

Manuf. & Supply Division of

GlaxoSmithKline | | * | | | | | | | | *

(Chair) |

| | | | | | | | |

Albert E. Smith | | 2008 | | Yes | | Lead Director of CDI Corp.;

Former Chairman of Tetra

Tech, Inc.; Former EVP of

Lockheed Martin | | | | * | | | | * | | |

| | | | | | | | |

Barton J. Winokur | | 1968 | | No | | Senior Partner at Dechert LLP

(law firm) | | | | | | * | | *

(Chair) | | |

1

Corporate Governance

Separate Chairman and CEO: Yes

Independent Lead Director: Yes

Non-Employee Directors Meet Without Management: Yes

Staggered Board: No (all directors are elected annually)

Cumulative Voting: No

Executive and Director Share Ownership Guidelines: Yes

Restrictions on Hedging and Pledging by Directors and Executives: Yes

Clawback Policy for Executive Compensation: Yes

Frequency of Advisory Vote on Executive Compensation: Annually

Members of Audit, Compensation and Governance & Nominating Committees: All are independent; none are current or former officers or employees of the company

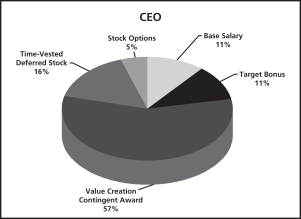

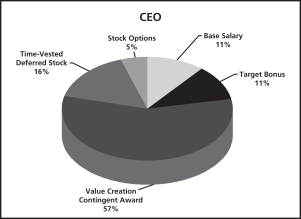

Executive Compensation

CDI’s executive compensation program is designed to promote a performance-based culture and align the interests of shareholders and executives through variable, at-risk compensation. Our compensation program is structured so that a large percentage of compensation is tied to the achievement of challenging levels of performance. In 2014, CDI hired a new CEO and three other senior executives. Their compensation arrangements were structured to emphasize long-term rewards based primarily on the creation of shareholder value. Those executives agreed to take a significant portion of their compensation in the form of value creation contingent awards that are dependent on CDI achieving share prices that are between two to three times the stock price at around the time of grant. These awards do not pay off at all in the event of unattractive or modest returns for shareholders, but deliver sufficient levels of compensation to attract and motivate talented executives when there are strong shareholder returns. We believe that our compensation policies and procedures clearly reflect a pay-for-performance philosophy.

The following table summarizes the compensation of our six Named Executive Officers for 2014, as reported in accordance with SEC rules. For more information, see pages 43-47.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Salary

($) | | | Bonus

($) | | | Stock Awards ($) | | | Option

Awards ($) | | | Non-Equity

Incentive Plan

Compensation ($) | | | All Other

Compensation($) | | | Total ($) | |

Scott J. Freidheim | | | 177,534 | | | | 177,534 | | | | 4,011,024 | | | | 272,045 | | | | 0 | | | | 211,252 | | | | 4,849,389 | |

David Arkless | | | 72,329 | | | | 50,630 | | | | 749,993 | | | | 0 | | | | 0 | | | | 0 | | | | 872,952 | |

Michael S. Castleman | | | 71,234 | | | | 299,863 | | | | 1,725,756 | | | | 0 | | | | 0 | | | | 12,758 | | | | 2,109,611 | |

D. Hugo Malan | | | 72,329 | | | | 300,630 | | | | 1,607,497 | | | | 0 | | | | 0 | | | | 12,134 | | | | 1,992,590 | |

Robert M. Larney | | | 475,000 | | | | 200,000 | | | | 200,150 | | | | 71,252 | | | | 190,545 | | | | 9,798 | | | | 1,146,745 | |

H. Paulett Eberhart | | | 188,975 | | | | 0 | | | | 93,578 | | | | 0 | | | | 0 | | | | 608,588 | | | | 891,141 | |

Ratification of KPMG LLP as CDI’s Independent Registered Public Accounting firm for 2015

KPMG LLP has been appointed by the Audit Committee to continue to serve as CDI’s independent registered public accounting firm for 2015, subject to ratification by our shareholders. The Audit Committee considers KPMG to be well-qualified for this engagement.

2

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE SHAREHOLDERS’ MEETING TO BE HELD ON MAY 19, 2015

The Proxy Statement and the Notice of Annual Meeting of Shareholders

are available at http://investor.shareholder.com/CDI/2015proxy.cfm.

CDI’s Annual Report and Form 10-K for 2014 can also be found at that website.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING

What is the purpose of this Proxy Statement?

The purpose of this Proxy Statement is to provide information regarding matters to be voted on at the 2015 Annual Meeting of Shareholders of CDI Corp. (the “Annual Meeting”). Also, this Proxy Statement contains certain information that the Securities and Exchange Commission (the “SEC”) and the New York Stock Exchange (the “NYSE”) require CDI to provide annually to shareholders. This Proxy Statement is the document used by CDI’s Board of Directors (the “Board”) to solicit proxies to be used at the Annual Meeting. Proxies are solicited to give shareholders an opportunity to vote on the matters to be presented at the Annual Meeting, even if they cannot attend the meeting. The Board has designated Brian D. Short and Craig H. Lewis (who are referred to in this Proxy Statement as the “named proxies”) to vote the shares represented by proxies at the Annual Meeting in the manner indicated by the proxies.

When and where is the Annual Meeting being held?

The Annual Meeting will be held on Tuesday, May 19, 2015 at 10:00 a.m. in the Trumbauer West Room on the 51st Floor of Three Logan Square, 1717 Arch Street, Philadelphia, Pennsylvania.

What will I be voting on?

| 1. | The election of nine directors of CDI; |

| 2. | An advisory vote on CDI’s executive compensation; |

| 3. | Approval of the Amended and Restated Omnibus Stock Plan; |

| 4. | Approval of the Executive Bonus Plan; and |

| 5. | The ratification of KPMG LLP as CDI’s independent registered public accounting firm for 2015. |

What are the Board’s recommendations?

CDI’s Board of Directors recommends the following votes:

| 1. | Proposal One – FOR the election of the nine persons nominated to serve as directors; |

| 2. | Proposal Two – FOR approval of the advisory vote on executive compensation; |

| 3. | Proposal Three – FOR approval of the Amended and Restated Omnibus Stock Plan; |

| 4. | Proposal Four – FOR approval of the Executive Bonus Plan; and |

| 5. | Proposal Five – FOR ratification of KPMG LLP as CDI’s independent registered public accounting firm for 2015. |

What options do I have in filling out my proxy card and what happens if I return the proxy card without marking a vote?

The proxy card is in a form that permits you to vote for the election of any or all of the nine nominated directors or to withhold authority to vote for the election of any or all of the nine nominated directors. You can separately approve or disapprove Proposals Two through Five, or abstain with respect to any of those proposals.

If you sign and return the proxy card, your shares will be voted (a) for the election of all of the nine nominated directors unless you indicate that authority to do so is withheld, and (b) forProposals Two through Five, unless you specify a different vote.

3

Who is entitled to vote on the matters discussed in this Proxy Statement?

You are entitled to vote if you were a shareholder of record of common stock, par value $.10 per share, of CDI (which is referred to throughout this Proxy Statement as “CDI stock”) as of the close of business on March 17, 2015 (the record date). Your shares can be voted at the meeting only if you are present or have submitted a valid proxy. An alphabetical list of CDI’s registered shareholders, showing the name, address and number of shares held by each shareholder as of the record date, will be available for inspection at the Annual Meeting and at our principal office (1717 Arch Street, 35th Floor, Philadelphia, PA 19103-2768) for at least five days prior to the Annual Meeting.

How many votes do I have?

You will have one vote on each proposal for every share of CDI stock you owned on March 17, 2015, the record date for this Annual Meeting.

How many votes can be cast by all shareholders?

19,645,679, which is the number of shares of CDI stock outstanding on the record date. CDI does not have cumulative voting (which is a system used by some companies where shareholders can cast all of their votes for a single nominee when a company has multiple openings on its board of directors).

What is the difference between a registered shareholder and a beneficial holder of shares?

If your shares of CDI stock are registered directly in your name with our transfer agent (Computershare), you are considered to be a “registered shareholder” of those shares. If that is the case, the proxy material has been sent or provided directly to you by our transfer agent.

If your shares of CDI stock are held in a stock brokerage account or by a bank or other nominee, you are considered to be the “beneficial holder” of the shares held for you in what is known as “street name”. If that is the case, the proxy material has been forwarded to you by your broker, bank or other nominee, which is considered the shareholder of record of those shares. As the beneficial holder, you have the right to direct your broker, bank or other nominee regarding how to vote your shares by using the voting instruction form or card included in the proxy material sent to you by your broker, bank or other nominee, or by voting online or by telephone. You should follow the voting instructions provided with your proxy material.

What are the ways I can vote?

You can vote in person by completing a ballot at the Annual Meeting (if you are a registered shareholder), or you can vote prior to the meeting by proxy. Even if you plan to attend the meeting, we encourage you to vote your shares as soon as possible by proxy. Most shareholders can vote by proxy using the Internet, telephone or mail as discussed below.

How do I vote by proxy?

Most shareholders of CDI can vote by proxy using the Internet, telephone or mail.

Voting Online:

Registered shareholders can vote by going to the website www.investorvote.com/CDIand should have their proxy card with them and follow the instructions online. Beneficial holders who wish to vote their shares on the Internet should have their proxy card or voting instruction form with them, go to the website indicated on the proxy card or voting form and follow the instructions online. If you vote online, you do not need to mail your proxy card.

Voting By Telephone:

A touch-tone telephone is necessary to vote by telephone. Registered shareholders can vote by dialing 1-800-652-VOTE (8683), which is toll-free in the United States, U.S. territories and Canada, and should have their proxy card with them and follow the instructions given. Beneficial holders who wish to vote their shares by telephone should

4

have their proxy card or voting instruction form with them, call the toll-free telephone number shown on the proxy card or voting form and follow the instructions given. If you vote by telephone, you do not need to mail your proxy card.

Voting By Mail:

If you vote by mail, mark the proxy card or voting instruction form, date and sign it, and mail it in the postage-paid envelope provided.

How is my CDI stock in the company’s 401(k) plan voted?

If you own CDI stock in the CDI Corporation 401(k) Savings Plan (which is referred to in this Proxy Statement as the “401(k) plan”), you will receive a proxy card that will serve as voting instructions to the trustee of that plan. The trustee will vote your shares in the manner you direct. Voting of shares in our 401(k) plan can only be done by mail.

Can I change my mind after I vote?

If you vote by proxy, you can revoke that proxy at any time before it is voted at the Annual Meeting. You can do this by: (1) voting again on the Internet or by telephone prior to the Annual Meeting; (2) signing another proxy card with a later date and mailing it so that it’s received prior to the Annual Meeting; or (3) if you are a registered shareholder, by giving written notice of revocation to the Secretary of CDI or by attending the Annual Meeting in person and casting a ballot. However, this does not apply to shares held in our 401(k) plan, where once a proxy card is submitted by an account holder, the vote cannot be changed.

If I am a beneficial holder, how are my shares voted if I do not return voting instructions?

Under the rules of the NYSE, brokers that have not received voting instructions from their customers ten days prior to the meeting date may vote their customers’ shares at the brokers’ discretion on the proposals regarding routine matters, which includes our Proposal Five, ratifying the appointment of the independent registered public accounting firm. Under NYSE rules, the other proposals (Proposals One through Five) are considered to be “non-discretionary” items, which mean that your broker cannot vote your shares on those matters if it has not received voting instructions from you. This is called a “broker non-vote.” In tabulating the voting result for any particular proposal, shares that constitute broker non-votes are not considered to be cast on that proposal.

For the shares held in our 401(k) plan, the plan’s trustee will vote all shares held in a participant’s account in the manner directed by the participant. If a participant fails to direct the voting of shares held in his or her account, those shares will not be voted.

What constitutes a quorum for the Annual Meeting?

The presence, in person or by proxy, of a majority of the number of outstanding shares of CDI stock entitled to vote at the Annual Meeting will constitute a quorum for the transaction of business. Since there were 19,645,679 shares of CDI stock outstanding on the record date, 9,822,840 shares are necessary for a quorum at the Annual Meeting.

What vote is required to approve each item (assuming that a quorum is present)?

For Proposal One, directors are elected by a plurality of the votes cast, which means the nine nominees who receive the highest number of votes will be elected as directors, even if those nominees do not receive a majority of the votes cast. Each share of CDI stock is entitled to one vote for each of the nine director nominees and there is no cumulative voting. Shares represented by proxies that are marked “withhold authority” for the election of one or more director nominees will not be counted as a vote cast for those persons.

Approval of Proposals Two through Five each requires the affirmative vote of a majority of the votes cast on such matter at the Annual Meeting. Shares represented by proxies that reflect broker non-votes will not be considered to be a vote cast on any of Proposals One through Four. Shares represented by proxies that contain abstentions on any proposal will not be considered to be a vote cast on such proposal.

5

The vote described in Proposal Two is not binding on CDI, the Board or the Compensation Committee. However, the Board and the Compensation Committee will take the outcome of this vote into consideration when making future executive compensation decisions.

Who is soliciting proxies on behalf of the company?

The solicitation of proxies is being made by CDI’s Board at the company’s cost, principally by mail. If it appears desirable to do so in order to assure adequate representation of shareholders at the meeting, officers and other employees of CDI may contact shareholders, banks, brokerage firms or nominees by telephone, by e-mail or in person to request that proxies be returned in time for the meeting. No solicitation is being made by specially engaged employees or by paid solicitors.

How will a proposal or other matter that was not included in this Proxy Statement be handled for voting purposes if it comes up at the Annual Meeting?

If any matter that is not described in this Proxy Statement were to properly come before the Annual Meeting, the named proxies intend to vote the shares represented by them as the Board may recommend. At this time, we do not know of any other matters that might be presented for shareholder action at the Annual Meeting.

What happens if the Annual Meeting is postponed or adjourned?

Your proxy will still be valid and may be voted at the postponed or adjourned meeting. You will still be able to change or revoke your proxy as indicated above until it is voted.

What do I need to do if I want to attend the Annual Meeting?

You do not need to make a reservation to attend our Annual Meeting. However, please note that in order to be admitted to, and vote at, the meeting you may be required to demonstrate that you were a CDI shareholder on March 17, 2015.

If I am a beneficial holder, may I come to the Annual Meeting and vote my shares?

If you want to vote in person at the Annual Meeting and you hold shares of CDI stock in street name, you must obtain a proxy from your broker, bank or other nominee and bring that proxy to the Annual Meeting, together with a copy of a brokerage statement reflecting your stock ownership as of the record date.

What is householding?

If you and other residents at your mailing address own shares of CDI stock in street name, your broker, bank or other nominee may have notified you that your household will receive only one CDI Proxy Statement and Annual Report. This practice is known as “householding” and is designed to reduce printing and mailing costs. Unless you responded that you did not want to participate in householding, you were deemed to have consented to this practice. Each shareholder will continue to receive a separate proxy card or voting instruction form.

If you did not receive your own copy of this Proxy Statement or CDI’s Annual Report for 2014, we will send a copy to you if you mail a written request to Investor Relations, CDI Corp., 1717 Arch Street, 35th Floor, Philadelphia, PA 19103-2768 or call (215) 636-1240. This Proxy Statement is available online athttp://investor.shareholder.com/CDI/2015proxy.cfm. The current and past CDI proxy statements and annual reports can also be found atwww.cdicorp.com, in the Investor Relations section.

If you are a beneficial holder and would like to receive your own copy of CDI’s proxy statement and annual report in the future, or if you share an address with another CDI shareholder and together both of you would like to receive only a single set of these documents, you should contact your broker, bank or other nominee.

6

ELECTION OF DIRECTORS

Upon the recommendation of the Governance and Nominating Committee, the Board has nominated nine directors for election at CDI’s 2015 Annual Meeting, to hold office until next year’s annual meeting. Each of the nominees is currently a member of the Board. The named proxies intend to voteFOR the nine nominees identified below, except as to shares for which authority to do so is withheld. The Board is not aware of any reason why any nominee will be unable to stand for election as a director or serve if elected. However, if any such nominee should become unavailable to serve, the Board may nominate, and the named proxies may vote for, a substitute nominee.

Below is information about each nominee for election to the Board of Directors, including the person’s age, positions held, principal occupation and business experience for at least the past five years, and the names of other publicly-held companies of which the person currently serves as a director or has served as a director during at least the past five years. Information is also presented below regarding each nominee’s specific experience, qualifications, attributes and skills that led our Governance and Nominating Committee and our Board to the conclusion that he or she should serve as a director of CDI.

JOSEPH L. CARLINI

Mr. Carlini, age 52, has been a director of CDI since May 2014. Mr. Carlini has been the Chief Executive Officer of McKean Defense Group, an engineering and technology solutions firm that provides services to the U.S. Navy and other federal government customers, since 2006. From 1998 until 2006, he was a Group Senior Vice President of Science Applications International Corporation (SAIC), a provider of technical, engineering and enterprise IT services, primarily to the U.S. government.

Mr. Carlini has significant senior leadership, management and operational experience, including nine years as the CEO of a professional services company. He brings to our Board extensive knowledge and experience in the engineering, IT and outsourcing fields and in the federal defense industry, all of which are important to CDI’s business. He has an engineering degree, which gives him an advanced technical understanding of a major segment of CDI’s business.

MICHAEL J. EMMI

Mr. Emmi, age 73, has been a director of CDI since 1999. Since 2002, he has been the Chairman of the Board of IPR International LLC, which provides electronic data backup storage, archiving, business continuity and data center services. He was the Chief Executive Officer of IPR International LLC from 2002 to April 2013. From 1985 to 2002, he was the Chairman and CEO of Systems & Computer Technology Corporation, which provided information technology services and software to higher education, local government, utilities and manufacturing customers. He served as a director of Metallurg, Inc. from 2003 to 2007 and as a director of Education Management Corporation from 2004 to 2006.

Mr. Emmi has significant senior leadership, management and operational experience, including many years as CEO of a public professional services company. He brings to our Board extensive knowledge and experience in the IT and outsourcing fields, which are important parts of CDI’s business. He has considerable experience in corporate transactions, such as mergers and acquisitions, which is valuable to our Board. He also has experience as a director of other public companies.

SCOTT J. FREIDHEIM

Mr. Freidheim, age 49, has been the President and Chief Executive Officer of CDI, and a director of CDI, since September 2014. He was Vice Chairman, Post-Acquisition Management - Europe at Investcorp International (an alternative investment firm) from January 2014 to August 2014, where he was responsible for the post-acquisition

7

management of all of Investcorp’s portfolio companies in Europe. From 2011 to January 2014, he was Chief Executive Officer - Europe at Investcorp International. Mr. Freidheim was President of the Kenmore, Craftsman and Diehard business unit of Sears Holdings Corporation from 2010 to 2011 and Executive Vice President, Operating and Support Businesses at Sears Holdings Corporation from 2009 to 2010. From 2006 to 2008, he served as the Chief Administrative Officer and Executive Vice President at Lehman Brothers Holdings Inc., a global financial services firm. In September 2008, Lehman Brothers filed a petition under Chapter 11 of the U.S. Bankruptcy Code with the U.S. Bankruptcy Court for the Southern District of New York.

Mr. Freidheim brings significant executive and operational leadership and experience to CDI and its Board. His management responsibilities have included global operations, giving him a perspective that is important as CDI seeks international growth. As our CEO, his presence on our Board enhances the communication and working relationship between the Board and the company’s executive team.

WALTER R. GARRISON

Mr. Garrison, age 88, has been a director of CDI since 1958 and the Chairman of the Board of CDI since 1961. From 1961 until 1997, he was also the President and CEO of CDI.

As the long-time CEO and Chairman of the company, Mr. Garrison has demonstrated executive leadership and broad management skills in building CDI’s business. He brings to the Board his extensive knowledge of CDI and the engineering, staffing and outsourcing businesses. As a registered professional engineer, he possesses an advanced technical understanding of a major segment of CDI’s business.

LAWRENCE C. KARLSON

Mr. Karlson, age 72, has been a director of CDI since 1989. He is currently an independent consultant for industrial and technology companies. He was the Chairman and CEO of Berwind Financial Corporation, a leveraged buyout group, from 2001 to 2004. Prior to that time, he served as Chairman of Spectra-Physics AB, a provider of laser technology and products, President and CEO of Pharos AB, an instrumentation manufacturer, President and CEO of Nobel Electronics, a manufacturer of transducers, and President, U.S. Operations of Fischer & Porter Co., a designer and manufacturer of process instrumentation. He has served as a director of Campbell Soup Company since 2009 and as a director of H&E Equipment Services, Inc. since 2005. He was the Chairman of the Board of Mikron Infrared Company, Inc. from 2000 until 2007.

Mr. Karlson has broad senior leadership, management and operational experience. He has held senior executive positions at companies based outside the United States, giving him a global perspective that is important as CDI seeks international growth. He has substantial experience in corporate transactions, such as mergers and acquisitions, which is helpful to our Board. He also has experience as a director of numerous public companies over the years, including service as the chairman of public company boards, which benefits our Board.

RONALD J. KOZICH

Mr. Kozich, age 76, has been a director of CDI since 2003. He was the Managing Partner of the Philadelphia region of Ernst & Young LLP, a large accounting firm, from 1991 to 1999, when he retired. He is a Certified Public Accountant. He served as a director of Tasty Baking Company from 2000 to 2011.

Mr. Kozich’s extensive financial and accounting knowledge and experience is valuable to our Board and the Audit Committee. He fills an important role as an “audit committee financial expert”. He brings to the Board management, human resources and operational experience from his career at Ernst & Young LLP. He also served for many years on the board of directors of a public company (Tasty Baking Company) and as an audit committee financial expert at that public company.

8

ANNA M. SEAL

Ms. Seal, age 59, has been a director of CDI since 2010. From 2001 to 2012, she was Senior Vice President and Chief Financial Officer of the Global Manufacturing and Supply Division of GlaxoSmithKline, a major pharmaceutical and consumer healthcare company. She previously served as General Manager and CFO of Smithkline Beecham’s Animal Health Division, effecting a successful turnaround and subsequent sale of that business. Ms. Seal is a Certified Public Accountant and is a member of the Financial Executives Institute and American Institute of Certified Public Accountants. She served as a director of Arrow International, Inc. from 2005 until 2007 and served on that company’s Audit Committee as the “audit committee financial expert”.

Ms. Seal has substantial financial, executive and operational experience. Her extensive financial and accounting knowledge is valuable to our Board and to our Audit Committee. She serves as one of CDI’s audit committee financial experts. She also has significant experience in the areas of general management, strategic planning, business restructuring, and corporate acquisitions and dispositions, both domestically and internationally, which is beneficial to our Board.

ALBERT E. SMITH

Mr. Smith, age 65, has been a director of CDI since 2008 and has served as Lead Director since February 2014. He was the Chairman of Tetra Tech, Inc., an environmental engineering and consulting firm, from 2006 until January 2008. He was Executive Vice President of Lockheed Martin Corporation, an aerospace, defense, security and technology company, from 2000 to 2004. He has served as a director of Tetra Tech, Inc. since 2005 and as a director of Curtiss-Wright Corporation since 2006.

Mr. Smith has significant executive, management and operational experience, including his leadership roles at Tetra Tech, Inc. and Lockheed Martin Corporation. He brings broad knowledge of the engineering services business and the federal defense industry, which are important parts of CDI’s business. Mr. Smith has an engineering degree, which gives him an advanced technical understanding of CDI’s engineering business. He also has experience as a director of other public companies.

BARTON J. WINOKUR

Mr. Winokur, age 75, has been a director of CDI since 1968. He has been a partner at Dechert LLP, an international law firm, since 1972. He was the Chairman and CEO of Dechert LLP from 1996 to 2011.

Mr. Winokur has extensive experience as a lawyer in representing public and private companies in complex transactions such as mergers, acquisitions, divestitures and joint ventures. He has counseled many boards of directors of public companies in connection with a wide variety of corporate governance matters. His knowledge and background in those areas is valuable to CDI’s Board. Mr. Winokur also has demonstrated executive leadership as the Chairman and CEO of a large global law firm. As a long-serving director of CDI, Mr. Winokur has extensive knowledge of the company and its business. He also has experience as a director of other public companies.

The Board of Directors unanimously recommends a vote FOR the election of each of the nine nominees identified in Proposal One. Shares represented by the accompanying Proxy will be voted FOR all nine nominees unless a contrary choice is specified.

CORPORATE GOVERNANCE

Corporate Governance Principles

Corporate governance encompasses the internal policies and practices by which the CDI Board of Directors operates. The Board believes that effective and consistent corporate governance is an essential part of the company conducting itself in a responsible, legal and ethical manner. In that regard, the Board has adopted Corporate

9

Governance Principles to provide a framework for the governance of CDI. The Corporate Governance Principles address issues such as the Board’s role and responsibilities, the size and composition of the Board, meeting procedures, and committee structure. CDI’s Corporate Governance Principles are posted on our website atwww.cdicorp.com (in the Investor Relations section) and will be provided in print to any shareholder who delivers a written request to Investor Relations, CDI Corp., 1717 Arch Street, 35th Floor, Philadelphia, PA 19103-2768.

Independence of the Directors

CDI’s Corporate Governance Principles, as well as the listing standards of the NYSE, require that at least a majority of the directors of the company be “independent directors” (as that term is defined under the NYSE listing standards). The Board of Directors conducts an annual review of the independence of all of its members. In connection with that review, the Board examines and considers information provided by the directors and the company which might indicate any material relationships (e.g., commercial, consulting, banking, legal, accounting, charitable or family relationships) that would impair the independence of any of the directors. For purposes of this review, the Board has used the guidelines contained in the NYSE listing standards rather than developing its own categorical standards for independence.

The Board conducted this review during the past year and determined that all of the directors of CDI and the nominees for director are independent (and satisfy the independence requirements set forth in the listing standards of the NYSE) except for Scott Freidheim and Barton Winokur. Mr. Freidheim, the company’s CEO, is the only director who is a CDI employee. Mr. Winokur is a senior partner of Dechert LLP, a law firm that provides legal services to CDI (including services as counsel to the Audit Committee). Dechert’s billings to CDI for services rendered in 2014 were approximately $650,000.

Code of Conduct

The Board has adopted a Code of Conduct that sets forth the principles, policies and obligations that must be adhered to by CDI and its directors, officers and employees (including CDI’s principal executive officer, principal financial officer, principal accounting officer and controller). The Code of Conduct is designed to foster a culture within CDI of honesty and accountability by requiring all directors, officers and employees to conduct themselves in accordance with all applicable legal requirements and ethical standards. Associated with the Code of Conduct are various conduct policies focusing on specific topics, such as our Insider Trading Policy, Conflicts of Interest Policy, Disclosure Policy and Policy on Privacy of Personal Data. A copy of the Code of Conduct can be found on our website atwww.cdicorp.com (in the Investor Relations section) and will be provided in print to any shareholder who delivers a written request to Investor Relations, CDI Corp., 1717 Arch Street, 35th Floor, Philadelphia, PA 19103-2768.

Any amendments to, or waivers of, provisions in our Code of Conduct that apply to our CEO, CFO, principal accounting officer or controller will be posted on our website atwww.cdicorp.com (in the Investor Relations section) within four business days following the date of the amendment or waiver and will remain available on our website for at least a twelve-month period.

Board Leadership Structure and Executive Sessions of the Board

Our Corporate Governance Principles provide that the Board should have flexibility to decide whether it is best for the company at a given point in time for the roles of the Chief Executive Officer and Chairman of the Board to be separate or combined. This allows the Board to determine which structure provides the appropriate leadership for the company at a particular time. Since Walter Garrison retired as CEO of the company in 1997, he has remained Chairman and a different person has served as the CEO.

10

In February 2014, the Board established a Lead Director role, and appointed Albert Smith to serve in that position. The Lead Director, who must be an independent director, takes a leading role in coordinating the Board’s agenda with the Chairman, CEO and Secretary of the company, leads the directors in executive sessions, communicates with the CEO, Chairman and other directors between Board meetings on key topics affecting the company, and performs such other duties and responsibilities as the Board may determine.

The non-management directors meet by themselves in regularly scheduled executive sessions, without management directors or executive officers of CDI present. Those executive sessions, which are scheduled and presided over by the Lead Director, are generally held in conjunction with each Board meeting.

The Board believes that its current leadership structure is best for CDI at this time. It allows the CEO to focus on providing the day-to-day leadership and management of the company, while the Chairman and Lead Director can provide guidance to the CEO and set the agenda for Board meetings (in consultation with the CEO and other members of the Board). The Chairman presides over meetings of the Board and performs other administrative functions relating to the Board’s activities. The separation of roles also fosters greater independence between management and the Board. The Board considers Mr. Garrison well-suited to be CDI’s Chairman given the extensive knowledge of CDI and its business that he developed over nearly four decades as the company’s CEO. The Board considers Mr. Smith well-suited to be the Lead Director based on his years of experience as a director of other public companies and his broad knowledge and leadership in the engineering services business and the federal defense industry, which are important parts of CDI’s business.

Board Meetings, Directors’ Attendance at Shareholders’ Meetings and Board Self-Assessments

The Board of Directors of CDI held six meetings during 2014. Each of the directors in 2014 attended more than 90% of the total number of meetings held during 2014 by the Board and the committees of the Board on which he or she served during the year.

It is CDI’s policy that all Board members are expected to attend the annual meeting of shareholders. In order to facilitate such attendance, CDI’s practice is to schedule its annual shareholders’ meeting on the same day as a Board meeting. At CDI’s 2014 shareholders’ meeting, all of the company’s directors were present.

The Board and its Audit, Compensation and Governance and Nominating Committees conduct annual self-assessments to evaluate their performance and to improve that performance as appropriate. The Board also annually assesses the performance of its Chairman and the company’s CEO.

Committees of the Board

The Board of Directors has established the following five standing committees to assist the Board in carrying out its responsibilities: the Audit Committee, the Compensation Committee, the Executive Committee, the Finance Committee and the Governance and Nominating Committee. The charter of each of these committees is available on our website atwww.cdicorp.com (in the Investor Relations section) and will be provided in print to any shareholder who delivers a written request to Investor Relations, CDI Corp., 1717 Arch Street, 35th Floor, Philadelphia, PA 19103-2768.

Below are the current members of each standing committee:

| | | | | | | | |

| Audit | | Compensation | | Executive | | Finance | | Governance and

Nominating |

| | | | |

Lawrence Karlson * Joseph Carlini Ronald Kozich Anna Seal | | Michael Emmi * Ronald Kozich Albert Smith | | Walter Garrison Barton Winokur | | Barton Winokur * Joseph Carlini Lawrence Karlson Albert Smith | | Anna Seal * Michael Emmi Ronald Kozich |

* Chair of the Committee

11

TheAudit Committee assists the Board in fulfilling its oversight responsibilities by (a) reviewing the financial reports and other financial information provided by CDI to shareholders, the SEC and others, (b) monitoring the company’s financial reporting processes and internal control systems, (c) retaining the company’s independent registered public accounting firm (subject to shareholder ratification), (d) overseeing the company’s independent registered public accounting firm and internal auditors, and (e) monitoring CDI’s compliance with ethics policies and with applicable legal and regulatory requirements. This committee held thirteen meetings during 2014.

TheCompensation Committee reviews and approves CDI’s executive compensation arrangements and programs, as described in more detail beginning on page 23. This committee held nine meetings during 2014.

TheExecutive Committee exercises all the powers of the Board, subject to certain limitations, when the Board is not in session and is unable to meet or it is impractical for the Board to meet. This committee did not hold any meetings during 2014.

TheFinance Committee oversees the financial affairs and policies of CDI, including review of the company’s annual operating and capital plans, major acquisitions and dispositions, and borrowing arrangements. This committee held three meetings during 2014.

TheGovernance and Nominating Committee oversees matters relating to Board organization and composition, compliance with rules relating to the independence of directors, and evaluations of Board and executive management effectiveness. This committee also (a) provides the Board with recommendations for new members of the Board after evaluating candidates, and assists in attracting qualified candidates; (b) assists the Board in evaluating the performance of the CEO and making decisions about the retention of the CEO; (c) reviews executive succession planning and executive recruitment strategies and processes, and recommends procedures to assure a smooth and orderly CEO transition when the need arises; and (d) reviews CDI’s Corporate Governance Principles and recommends such changes as may be appropriate. This committee held six meetings during 2014.

Audit Committee Membership

No member of the Audit Committee is a current or former officer or employee of CDI. The NYSE and the SEC have adopted standards for independence of Audit Committee members. The Board has determined that each of the current members of the Audit Committee satisfies those independence standards and is financially literate.

The Board has also determined that Ronald Kozich and Anna Seal, each of whom is a member of the Audit Committee and an independent director, each qualifies as an “audit committee financial expert” and has accounting and related financial management expertise within the meaning of the listing standards of the NYSE. The rules of the SEC define an “audit committee financial expert” as a person who has acquired certain attributes through education and experience that are particularly relevant to the functions of an audit committee. Mr. Kozich is a former Managing Partner of the Philadelphia region of the accounting firm Ernst & Young LLP and is a Certified Public Accountant. Ms. Seal is the former Senior Vice President and Chief Financial Officer of the Global Manufacturing and Supply Division of GlaxoSmithKline and is a Certified Public Accountant.

Compensation Committee Membership, Authority and Procedures

The Compensation Committee (also referred to in this section as the “Committee”) is composed entirely of independent, nonemployee directors. The Committee has sole authority to determine the CEO’s compensation. The Committee also has decision-making authority with respect to the compensation arrangements for the other executives within certain policy guidelines.

As explained in “The Timing and Pricing of Equity Awards” section of the Compensation Discussion and Analysis (CD&A) that appears below in this Proxy Statement, the Compensation Committee has delegated limited authority to the Chair of the Committee and to the company’s CEO to approve equity awards between the times that the

12

Committee makes its annual awards. Any awards made by the CEO under that delegated authority must adhere to the Committee’s guidelines and be consistent with past practice in size and type. The CEO may not make awards to executive officers or to directors under this delegated authority.

As explained in the “Role of Management” section of the CD&A, the CEO provides input and recommendations to the Compensation Committee regarding the compensation for other executive officers of CDI and other members of the senior management team. However, all executive compensation must be approved by the Compensation Committee or the Board.

The agendas for the Compensation Committee’s meetings are determined by the Committee’s Chair with the assistance of the Chief Administrative Officer (CAO). The agenda and materials are mailed to the Committee members in advance of each meeting. The company’s CEO and CAO generally attend meetings of the Compensation Committee at the invitation of the Committee. The Committee usually meets in executive session (with only Committee members in attendance) at the end of each regularly-scheduled meeting. The Committee’s Chair reports on Committee actions to the full Board at each regularly scheduled Board meeting.

Late in each calendar year, in connection with the process of determining executive compensation for the following year, the Compensation Committee reviews tally sheets for the CEO, the other executive officers and certain other members of the company’s senior management. These tally sheets, which are prepared by CDI’s Human Resources department, summarize the company’s compensation arrangements with each person, including (a) the total compensation expected to be earned in the current year and the total compensation earned in the previous year, (b) potential payouts under various scenarios, including voluntary and involuntary termination of employment, death, disability, retirement and a change in control of the company, and (c) information regarding the equity awards and any nonqualified deferred compensation held by each person, including the sort of information set forth in the various executive compensation tables contained in this Proxy Statement. The tally sheets are intended to give Committee members a comprehensive picture of an executive’s total compensation, enhance their understanding of how the various components of an executive’s compensation package fit together and provide a context for making future pay decisions.

The Compensation Committee’s charter provides that the Committee will be directly responsible for the appointment, compensation and oversight of the work of any compensation consultant or other advisor retained by the Committee. Before retaining any such advisor, the Committee takes into consideration all factors relevant to the advisor’s independence from management, including those factors specified in the applicable NYSE listing standards. Over the years, the Compensation Committee has from time to time retained the services of independent outside consulting firms to provide advice and to perform periodic market compensation studies, which are considered by the Committee in evaluating and determining CDI’s executive compensation. See the CD&A for more information regarding the nature of the independent compensation studies. These consulting firms have reported to the Committee and not to management. The Committee did not retain an outside consulting firm in 2014.

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee is or has been an officer or employee of CDI or any of its subsidiaries. No executive officer of CDI served on the compensation committee of another entity (or on any other committee of the board of directors of another entity performing similar functions) during 2014, where an executive officer of that other entity served on the Compensation Committee or the Board of CDI. In addition, no executive officer of CDI served as a director of another entity, one of whose executive officers served on the Compensation Committee of CDI.

13

Related Party Transactions and Approval Policy

The Board has adopted a written policy setting forth procedures for the review and approval of transactions involving CDI and related parties. For purposes of this policy, a related party is:

| | Ÿ | | an executive officer or director of CDI or any of such person’s immediate family members; |

| | Ÿ | | a shareholder owning more than 5% of CDI’s stock; or |

| | Ÿ | | an entity which is owned or controlled by one of the above parties or an entity in which one of the above parties has a substantial ownership interest or control. |

Under this policy, the company may not enter into a transaction with a related party unless:

| | Ÿ | | the Governance and Nominating Committee has reviewed the transaction, determined it to be on terms comparable to those that could be obtained in arm’s length dealings with an unrelated third party, and recommended its approval to the Board; and |

| | Ÿ | | the transaction is subsequently approved by the disinterested members of the Board. |

Transactions available to all employees generally and transactions related to an executive officer’s employment with CDI or a director’s performance of services as a director of CDI (such as payment of salary, bonus, director fees, equity compensation, travel expenses and similar payments) are not subject to these review and approval procedures. The company’s use of Dechert LLP as outside counsel (Mr. Winokur, a CDI director, is a senior partner in that firm) has been approved under this policy.

Director Qualifications, Diversity and Nominating Process

As provided in its charter, the Governance and Nominating Committee (also referred to in this section as the “Committee”) is responsible for identifying qualified Board candidates and recommending their nomination for election to the Board as well as for recommending the slate of nominees for election to the Board at each annual meeting of shareholders. The Board has concluded that all of the members of the Governance and Nominating Committee meet the standards for independence established by the NYSE. No member of the Governance and Nominating Committee is a former officer or employee of CDI.

When the Board wishes to add a new director, the Governance and Nominating Committee does an analysis of the skills and experience of the current directors in order to identify the particular additional skills and experience that would be desirable in a new director so as to complement and enhance the existing Board. To be considered for Board membership, a candidate must, in the Committee’s judgment, possess superior intelligence and sound judgment, exhibit the highest levels of personal character and integrity, and have demonstrated significant ability in his or her professional field. Other factors considered include the extent to which the candidate’s business experience and background are relevant to CDI’s business, the person’s available time to devote to CDI Board matters, and whether the candidate meets the existing independence requirements.

The Committee considers diversity as one of a number of factors in identifying nominees for director. It does not, however, have a formal policy in this regard. The Committee views diversity broadly to include diversity of experience, skills, perspectives and personal characteristics as well as traditional diversity concepts such as race or gender. The Committee seeks to assemble a Board that is strong in its collective knowledge and that consists of individuals who bring a variety of complementary attributes and who, taken together, have the appropriate skills and experience to oversee CDI’s business.

14

When it wishes to add a new director to the Board, the Committee solicits from the current directors the names of potential new Board members. At times in the past, the Governance and Nominating Committee has retained a third party search firm to assist the Committee in identifying prospective candidates for the Board. No search firm was retained in 2014.

The Committee is willing to consider prospective candidates recommended by CDI’s shareholders. Shareholders wishing to recommend prospective candidates for nomination to the Board of Directors should submit to the Secretary of the company the name, a statement of qualifications and the written consent of the prospective candidate. Recommendations may be submitted at any time and will be brought to the attention of the Governance and Nominating Committee. The address to which such recommendations should be sent is:

Governance and Nominating Committee

Attention: Company Secretary

CDI Corp.

1717 Arch Street, 35th Floor

Philadelphia, PA 19103-2768

Once a prospective candidate is identified, the Governance and Nominating Committee does an initial review of his or her background and credentials. If the proposed candidate passes the initial review, the candidate is invited to meet with one or two Committee members. Then, if those Committee members believe the candidate would be a good addition to the Board, arrangements are made for the candidate to meet with all members of the Board, typically in informal settings. While the Committee makes recommendations for director nominations, the Board is responsible for final approval. The Committee’s process for evaluating candidates is the same regardless of whether a candidate is recommended by a search firm, a Board member, a shareholder or others.

In determining whether to recommend a current director for re-election, the Committee considers, in addition to the basic qualifications for a new director which are described above, the director’s past attendance at and participation in meetings and his or her overall contributions to the activities of the Board.

The Board’s Role in Risk Oversight

The Board is responsible for overseeing CDI’s management of risk. Our full Board regularly engages in discussions concerning the most significant risks that CDI faces in its business as part of the Board’s review of the company’s operations with the CEO at each regular Board meeting, including discussion regarding how those risks are being managed. In addition, the Board receives reports on risks in the business from senior operations management in connection with their periodic presentations to the Board. Risk issues related to the company’s business strategy are also considered when the Board meets to discuss strategic planning. The Board’s role in risk oversight of the company is aligned with the company’s leadership structure, with the CEO and other members of senior management having responsibility for assessing and managing CDI’s risk exposure, and the Board and its committees providing oversight in connection with those efforts.

The Board delegates some of the activities relating to risk oversight to its committees, particularly to the Audit Committee. Under its charter, the Audit Committee is responsible for reviewing and discussing with management the company’s policies regarding risk assessment and risk management. At each regularly-scheduled meeting, the Audit Committee receives reports from management and from our internal auditors concerning risk issues. All significant potential or actual claims and exposures identified by management and internal auditors are reviewed with the Audit Committee. CDI’s General Counsel usually attends Audit Committee meetings and addresses with the committee members the company’s legal and business risks and how the company seeks to control and mitigate those risks, including through its insurance program. This presentation also includes a review of CDI’s corporate compliance program (founded on our Code of Conduct and conduct policies), for which the Audit Committee has

15

oversight responsibility, and the training programs used throughout the CDI organization to support the compliance program. By overseeing the evaluation of CDI’s internal control over financial reporting, the Audit Committee gains valuable insight into the company’s risk management and risk mitigation activities. To assist it in overseeing the company’s risk management, the Audit Committee has regular meetings, outside the presence of management, with our independent registered public accounting firm and the head of our internal audit group.

Other committees of the Board also play a role in the oversight of risk. The Compensation Committee reviews the company’s executive compensation policies and programs to confirm that they do not encourage unnecessary and excessive risk taking. In addition, the company reviews its compensation policies and procedures, including the incentives that they create and factors that may reduce the likelihood of excessive risk taking, to determine whether they present a significant risk to CDI. Based on this review, the company has concluded that its compensation policies and procedures are not reasonably likely to have a material adverse effect on CDI. See the CD&A for additional information regarding compensation-related risks at CDI. The Governance and Nominating Committee is responsible for overseeing corporate governance issues that may create risks for the company, including in areas such as director selection and related party transactions. The Finance Committee oversees our management of risks relating to financial affairs and policies, including risks associated with the availability of capital and major acquisitions and dispositions. The chair of each committee regularly reports to the Board regarding the areas of risk they oversee.

Communicating with CDI’s Board of Directors

Shareholders of CDI and any other interested parties who wish to communicate with the Chairman of the Board or with the non-management directors as a group may do so by writing to:

CDI Corp. Board of Directors

Attn: Non-Management Directors (or Chairman of the Board)

c/o Company Secretary

1717 Arch Street, 35th Floor

Philadelphia, PA 19103-2768

All such letters will be forwarded to the Chairman of the Board (if he or she is an independent director, as is presently the case) or to the Lead Director (if the Chairman were not an independent director).

DIRECTOR COMPENSATION AND STOCK OWNERSHIP REQUIREMENTS

The compensation paid to the company’s non-employee directors is structured to attract and retain qualified non-employee directors and to further align their interests with the interests of CDI’s shareholders by linking a significant portion of their compensation to CDI’s stock performance. Directors who are not employees of CDI or one of its subsidiaries receive the following as compensation for their service on the Board and on committees of the Board:

| • | | Retainer Fee. Each non-employee director receives a retainer fee of $55,000 per year. Under the compensation arrangements in effect during 2014, the director could elect to be paid in any combination of (a) cash, (b) CDI stock options, or (c) CDI stock on a deferred basis under the Amended and Restated 2004 Omnibus Stock Plan. If a director elects to receive deferred stock for all or a portion of the retainer fee, the director would receive shares of time-vested deferred stock (TVDS), each of which correspond to a right to receive one share of CDI stock upon completion of the applicable vesting period (from three to ten years, as selected by the director). The number of shares of TVDS would be calculated by dividing the amount of the retainer fee which the director chose to defer by the market value of CDI stock at the beginning of the directors’ fee year. A directors’ fee year is the approximately twelve-month period for which a director is paid and runs from one annual meeting of shareholders to the next. The company would make a matching contribution of one share of TVDS for every three shares of TVDS acquired by the director. If a director elects to receive stock options for all or a portion of the retainer fee, the number of options which the director receives is determined using a Black-Scholes valuation methodology. |

16

| • | | Time-Vested Deferred Stock (TVDS). Each non-employee director receives, at the beginning of the directors’ fee year, an annual grant of shares of TVDS, which upon vesting on the third anniversary of the date of grant, are converted into an equivalent number of shares of CDI stock. The value of the annual TVDS grant to each director is $100,000. The number of shares of TVDS awarded is based on the market price of CDI stock on the date of grant. Upon vesting, holders of TVDS receive additional shares of CDI stock having a value equal to the total dividends paid on CDI stock during the period from the grant date to the vesting date. |

| • | | Committee Service Fees and Committee Chairman Fees. For service on committees of the Board, non-employee directors receive an additional $5,000 per year for each committee chaired ($10,000 in the case of the Audit Committee and the Compensation Committee) and $3,000 per year for each committee served on in excess of one. |

| • | | Meeting AttendanceFees. Non-employee directors are paid meeting attendance fees of $1,000 for each Board meeting and committee meeting attended. |

| • | | Board Chairman Fees. The Chairman of the Board is paid an additional fee of $60,000 per year, and also receives reimbursement of $40,000 for administrative support services to assist in the performance of the Chairman’s duties. |

| • | | Lead Director Fee. The Lead Director is paid an additional fee of $10,000 per year. |

The compensation arrangements for non-employee directors are developed by the Governance and Nominating Committee and recommended to the Board for final approval. Neither that committee nor the Board retained a compensation consultant during 2014 in connection with determining the amount or form of director compensation.

No consulting fees were paid in 2014 to any of CDI’s directors.

Directors who are also employees of CDI do not receive any compensation for their services as directors (other than reimbursements for reasonable expenses incurred in connection with the performance of such services).

The following table shows the 2014 compensation for our non-employee directors.

Director Compensation Table for 2014

| | | | | | | | | | | | | | | | |

| Name | | Fees Earned or

Paid in Cash ($) | | | Stock Awards ($) | | | All Other Compensation ($) | | | Total ($) | |

Joseph L. Carlini | | | 46,913 | | | | 100,006 | | | | 0 | | | | 146,919 | |

Michael J. Emmi | | | 89,000 | | | | 100,006 | | | | 11,881 | | | | 200,887 | |

Walter R. Garrison | | | 127,046 | | | | 100,006 | | | | 11,881 | | | | 238,933 | |

Lawrence C. Karlson | | | 89,000 | | | | 100,006 | | | | 11,881 | | | | 200,887 | |

Ronald J. Kozich | | | 90,858 | | | | 100,006 | | | | 11,881 | | | | 202,745 | |

Anna M. Seal | | | 85,096 | | | | 100,006 | | | | 16,237 | | | | 201,339 | |

Albert E. Smith | | | 91,692 | | | | 100,006 | | | | 19,174 | | | | 210,872 | |

Barton J. Winokur | | | 72,000 | | | | 100,006 | | | | 11,881 | | | | 183,887 | |

17

Notes to the Director Compensation Table for 2014:

The “Fees Earned or Paid in Cash” Column

This column represents a total of the retainer fees, Board Chairman fees, Lead Director fees, committee chairman fees, fees for service on more than one committee, Board meeting attendance fees and committee meeting attendance fees earned by the non-employee directors in 2014. The table below shows a breakdown of those fees for each director.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Retainer Fees ($) | | | Board

Chairman

and Lead

Director

Fees ($) | | | Committee

Chairman

Fees ($) | | | Additional

Committee

Service

Fees ($) | | | Board

Meeting

Attendance

Fees ($) | | | Committee

Meeting

Attendance

Fees ($) | | | Total ($) | |

Joseph Carlini | | | 34,055 | | | | 0 | | | | 0 | | | | 1,858 | | | | 2,000 | | | | 9,000 | | | | 46,913 | |

Michael Emmi | | | 55,000 | | | | 0 | | | | 10,000 | | | | 3,000 | | | | 6,000 | | | | 15,000 | | | | 89,000 | |

Walter Garrison | | | 55,000 | | | | 60,000 | | | | 1,904 | | | | 1,142 | | | | 6,000 | | | | 3,000 | | | | 127,046 | |

Lawrence Karlson | | | 55,000 | | | | 0 | | | | 10,000 | | | | 3,000 | | | | 6,000 | | | | 15,000 | | | | 89,000 | |

Ronald Kozich | | | 55,000 | | | | 0 | | | | 0 | | | | 4,858 | | | | 6,000 | | | | 25,000 | | | | 90,858 | |

Anna Seal | | | 55,000 | | | | 0 | | | | 3,096 | | | | 3,000 | | | | 6,000 | | | | 18,000 | | | | 85,096 | |

Albert Smith | | | 55,000 | | | | 8,692 | | | | 0 | | | | 3,000 | | | | 6,000 | | | | 19,000 | | | | 91,692 | |

Barton Winokur | | | 55,000 | | | | 0 | | | | 5,000 | | | | 3,000 | | | | 6,000 | | | | 3,000 | | | | 72,000 | |

None of the directors elected to receive a portion of the 2014 retainer fees which are included in the “Fees Earned or Paid in Cash” column in the form of TVDS or stock options.

The “Stock Awards” Column

The Stock Awards column represents the aggregate grant date fair value of shares of TVDS received by the directors in 2014, in accordance with FASB ASC Topic 718, calculated without regard to any estimated forfeitures. The grant date fair value of the directors’ Stock Awards is equal to the market price of CDI stock on the date of grant multiplied by the number of Stock Awards received on that date. For additional information regarding the valuation assumptions relating to CDI’s Stock Awards, see Note 7 to the company’s consolidated financial statements in the Form 10-K for the year ended December 31, 2014. The grant date fair value of the Stock Awards included in the Directors Compensation Table for 2014 was $13.54 for each share of TVDS received by all of the non-employee directors on May 20, 2014. The amounts in this column reflect the grant date fair value for these awards under accounting rules and do not correspond to the actual value that will be realized by the directors.

One director, Anna Seal, still holds SPP units (similar to deferred stock) under the company’s old Stock Purchase Plan for Management Employees and Non-Employee Directors (the “SPP”). The SPP was terminated in May 2012. Under the SPP, a director could elect to receive SPP units for all or a portion of the retainer fee. Each SPP unit corresponds to a right to receive one share of CDI stock upon completion of the applicable vesting period (from three to ten years, as selected by the director). The number of SPP units was calculated by dividing the amount of the retainer fee which the director chose to defer by the market value of CDI stock at the beginning of the directors’ fee year. Under the SPP, the company made a matching contribution of one SPP unit for every three SPP units acquired by the director.

18

The following table indicates the number of shares of TVDS and SPP units held by each non-employee director at the end of 2014.

| | | | | | | | |

| Name | | Shares of TVDS as of December 31, 2014 | | | SPP Units as of

December 31, 2014 | |

Joseph Carlini | | | 7,386 | | | | 0 | |

Michael Emmi | | | 20,406 | | | | 0 | |

Walter Garrison | | | 20,406 | | | | 0 | |

Lawrence Karlson | | | 20,406 | | | | 0 | |

Ronald Kozich | | | 20,406 | | | | 0 | |

Anna Seal | | | 20,406 | | | | 2,030 | |

Albert Smith | | | 20,406 | | | | 0 | |

Barton Winokur | | | 20,406 | | | | 0 | |

The “All Other Compensation” Column

For each director, the amounts in this column represent the dollar value of additional shares of CDI stock received by the director upon vesting of TVDS and SPP units relating to accrued dividends (upon vesting, holders of shares of TVDS and SPP units receive additional shares of CDI stock having a value equal to the total dividends paid on CDI stock during the period from the grant date to the vesting date).

Stock Ownership Requirements for Directors

Under the Board’s stock ownership requirements, each non-employee director who has served on the Board for at least four years is required to own at least $400,000 in market value of CDI stock. Any non-employee director who does not own the required amount of stock by and after the director’s fourth year on the Board would then have up to $30,000 of the director’s retainer fee payable in subsequent years automatically paid in the form of deferred stock, with no company match, until the required ownership level was met. The following shares and units count towards meeting the non-employee directors’ stock ownership requirements: (1) shares of CDI stock owned by the director, the director’s spouse or a trust for the benefit of the director or members of his or her family, (2) shares of TVDS or other deferred stock, (3) SPP units, and (4) shares of CDI stock held in the company’s 401(k) plan or an IRA maintained by the director. As of March 17, 2015, all of CDI’s current directors who have served on the Board for at least four years have satisfied these stock ownership requirements.

PRINCIPAL SHAREHOLDERS

As of March 17, 2015, the following persons and entities were known by the company to be beneficial owners of more than 5% of the outstanding shares of CDI stock. The following table shows, as of that date (or such other date as is indicated in the footnotes), the number of shares of CDI stock beneficially owned by those principal shareholders and the percentage which that number represents of the total outstanding shares of CDI stock beneficially owned as of that date. Under SEC rules, any shares which a person has the right to acquire (such as by exercising a stock option or SAR or by a vesting of TVDS) within the sixty-day period after March 17, 2015 are considered to be beneficially owned as of March 17, 2015.

19

| | | | | | | | |

Name and Address of

Beneficial Owner | | Number of Shares of

CDI Stock

Beneficially Owned* | | | Percentage of Total

Shares of CDI Stock

Beneficially Owned | |

Lawrence C. Karlson and Barton J. Winokur, as Trustees of certain trusts for the benefit of Walter R. Garrison’s children; and Michael J. Emmi, Donald W. Garrison, Lawrence C. Karlson and Barton J. Winokur, as Trustees of certain other trusts for the benefit of Walter R. Garrison’s children c/o Arthur R. G. Solmssen, Jr., Esquire Dechert LLP Cira Centre 2929 Arch Street Philadelphia, PA 19104 | | | 3,360,516 | (1) | | | 17.1% | |

| | |

Heartland Advisors, Inc. 789 North Water Street Milwaukee, WI 53202 | | | 1,896,718 | (2) | | | 9.6% | |

| | |

Dimensional Fund Advisors LP Palisades West, Building One 6300 Bee Cave Road Austin, TX 78746 | | | 1,383,239 | (2) | | | 7.0% | |

| | |

BlackRock, Inc. 40 East 52nd Street New York, NY 10022 | | | 1,327,530 | (2) | | | 6.7% | |

| | |

Walter R. Garrison 800 Manchester Avenue, 3rd Floor Media, PA 19063 | | | 1,284,001 | (3) | | | 6.5% | |

Notes to the Principal Shareholders Table:

| | * | Except as indicated in the following footnotes, the respective beneficial owners have sole voting power and sole investment power with respect to the shares shown opposite their names. |

| | (1) | Each trustee under these trusts has joint voting and investment power with the other trustee(s) with respect to these shares but disclaims any beneficial interest except as a fiduciary. Those trustees who are also directors of CDI own, of record and beneficially, the number of shares of CDI stock shown opposite their names in the table which appears in the following section (entitled “CDI Stock Ownership by Directors and Executive Officers”). |

| | (2) | These numbers are as of December 31, 2014, and are based on Schedule 13G’s filed by the shareholders with the SEC. In their respective Schedule 13G’s: (a) Heartland Advisors, Inc. noted that the shares of CDI stock may be deemed beneficially owned by it by virtue of its investment discretion and voting authority granted by certain clients; and (b) Dimensional Fund Advisors LP noted that it and its subsidiaries, in their role as investment advisors for various funds, investment companies and trusts, possess voting and/or investment power over the shares of CDI stock, but the shares are owned by the various funds, investment companies and trusts, and Dimensional Fund Advisors LP disclaims beneficial ownership of the shares. |

| | (3) | Does not include the shares held by the various family trusts referred to in this table. See also footnotes (1) and (3) to the following table, in the “CDI Stock Ownership by Directors and Executive Officers” section. |

20

CDI STOCK OWNERSHIP BY DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth, as to each person who is a director, director nominee or named executive officer (as identified in the Executive Compensation section of this Proxy Statement), and as to all directors, director nominees and executive officers of CDI as a group, the number of shares of CDI stock beneficially owned as of March 17, 2015 and the percentage which that number represents of the total outstanding shares of CDI stock beneficially owned as of that date. Under SEC rules, any shares which a person has the right to acquire (such as by exercising a stock option or SAR or by a vesting of TVDS) within the sixty-day period after March 17, 2015 are considered to be beneficially owned as of March 17, 2015. The number of SARs which the person would acquire upon exercise has been calculated based on the closing price of CDI stock on March 17, 2015.

| | | | | | | | |

| Name of Individual or Group | | Number of Shares of

CDI Stock

Beneficially Owned** | | | Percentage of Total

Shares of CDI Stock

Beneficially Owned | |

David Arkless | | | 0 | | | | * | |

Joseph L. Carlini | | | 0 | | | | * | |

Michael S. Castleman | | | 7,500 | | | | * | |

H. Paulett Eberhart | | | 100 | | | | * | |

Michael J. Emmi | | | 46,363 | (1) (2) | | | 0.2% | |

Scott J. Freidheim | | | 20,000 | | | | 0.1% | |

Walter R. Garrison | | | 1,284,001 | (1) (2) (3) | | | 6.5% | |

Lawrence C. Karlson | | | 120,813 | (1) (2) | | | 0.6% | |