Filed Pursuant to General Instruction II.L of Form F-10;

File No. 333-260070

A copy of this preliminary prospectus supplement has been filed with the securities regulatory authorities in Alberta, British Columbia, Manitoba and Ontario, but has not yet become final for the purpose of the sale of securities. Information contained in this preliminary prospectus supplement may not be complete and may have to be amended.

Information contained herein is subject to completion or amendment. A registration statement relating to these securities has been filed with the United States Securities and Exchange Commission. These securities may not be sold nor may offers to buy be accepted prior to the time the registration statement becomes effective. This prospectus supplement shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

No securities regulatory authority has expressed an opinion about these securities and it is an offence to claim otherwise. This prospectus supplement, together with the accompanying amended and restated short form base shelf prospectus dated October 4, 2021 to which it relates, as amended or supplemented, and each document incorporated by reference or deemed incorporated by reference therein, constitutes a public offering of these securities only in those jurisdictions where they may be lawfully offered for sale and therein only by persons permitted to sell such securities.

Information has been incorporated by reference in this amended and restated short form base shelf prospectus from documents filed with securities commissions or similar authorities in Canada. Copies of the documents incorporated herein by reference may be obtained on request without charge from the Corporate Secretary of Skylight Health Group Inc. at 5520 Explorer Dr., Suite 402, Mississauga, Ontario L4W 5L1, telephone 1-855-874-4999, and are also available electronically at www.sedar.com.

Subject to Completion, Dated November 10, 2021

| | |

| New Issue | | November 10, 2021 |

PRELIMINARY PROSPECTUS SUPPLEMENT

TO THE AMENDED AND RESTATED SHORT FORM BASE SHELF PROSPECTUS DATED OCTOBER 4, 2021

SKYLIGHT HEALTH GROUP INC.

US$ ●

9.25% Series A Cumulative Redeemable Perpetual Preferred Shares

This preliminary prospectus supplement (the “Prospectus Supplement”), together with the amended and restated short form base shelf prospectus dated October 4, 2021 (the “Prospectus”) qualifies the distribution (the “Offering”) of ● 9.25% Series A Cumulative Redeemable Perpetual Preferred Shares (the “Preferred Shares” and together with the “Additional Shares” (as defined below), “Offered Shares”) in the capital of Skylight Health Group Inc. (“Skylight” or the “Company”) at a price of US$ ● per Offered Share (the “Offering Price”), for aggregate gross proceeds of US$ ● . Dividends on the Offered Shares are cumulative from the date they are issued and will be payable on the 20th day of each calendar month, when, as and if authorized by the Company’s Board of Directors and declared by Skylight. Dividends will be payable out of amounts legally available therefor at a rate equal to 9.25% per annum per US$25.00 of stated liquidation preference per share, or $2.3125 per Offered Share per year. Commencing on or after ● 2024 (the “Optional Redemption Date”), Skylight may redeem, at its option, the Offered Shares, in whole or in part, at a cash redemption price equal to US$25.00 per share, plus any accumulated and unpaid dividends to, but not including, the redemption date. Prior to the Optional Redemption Date, upon a Change of Control (as defined herein), Skylight may redeem, at its option, the Offered Shares, in whole or part, at a cash redemption price of US$25.00 per share, plus any accumulated and unpaid dividends to, but not including the redemption date. The Offered Shares have no stated maturity, will not be subject to any sinking fund or other mandatory redemption, and will not be convertible into or exchangeable for any other securities of the Company. Holders of the Offered Shares generally will have no voting rights except as set out herein. See “Description of Securities Being Distributed – Preferred Shares.”

This Prospectus Supplement qualifies the distribution of the Offered Shares in Canada and the United States. The Underwriters will only sell, either directly or through their respective U.S. broker dealer affiliates or agents, the Offered Shares in the United States. No Offered Shares will be sold in any Canadian jurisdiction. See “Plan of Distribution”. The Company will use the net proceeds from the sale of the Offered Shares as described in this Prospectus Supplement. See “Use of Proceeds”.

The Company will issue and sell the Offered Shares in the United States pursuant to an underwriting agreement (the “Underwriting Agreement”) dated ● , 2021 between the Company and The Benchmark Company, LLC as representative of the underwriting syndicate including: Aegis Capital Corp. (collectively, the “Underwriters”). See “Plan of Distribution”. The Offering Price was determined by arm’s length negotiation between the Company and the Underwriters.

Price: US$ ● per Offered Share

| | | | | | | | | | | | |

| | | Price to the

Public | | | Underwriters’

Fee (1) | | | Net Proceeds to

the Company(2)(3)(4) | |

Per Offered Share | | US$ | | ● | | US$ | | ● | | US$ | | ● |

Total Offering | | US$ | | ● | | US$ | | ● | | US$ | | ● |

Notes:

| (1) | A fee (the “Underwriters’ Fee”) equal to 8.0% of the aggregate gross proceeds realized on the sale of the Offered Shares under the Offering (including Additional Shares sold in connection with the exercise of the Over-Allotment Option, if applicable) will be paid to the Underwriters upon completion of the Offering. |

| (2) | After deducting the Underwriters’ Fee but before deducting expenses of the Offering, estimated to be US$ ● , which, together with the Underwriters’ Fee, will be paid from the gross proceeds of the Offering. See “Plan of Distribution” for additional information regarding total compensation payable to the Underwriters, including expenses for which the Company has agreed to reimburse the Underwriters. |

| (3) | The Offering Price is payable in U.S. dollars, except as otherwise may be agreed to by the Underwriters. |

| (4) | The Company has granted to the Underwriters an over-allotment option (the “Over-Allotment Option”) exercisable, in whole or in part, at the sole discretion of the Underwriters, at any time prior to the 30th day following the closing of the Offering, to purchase up to an additional ● Preferred Shares (representing 15% of the Offered Shares hereunder) at the Offering Price (the “Additional Shares”) to cover over-allotments, if any. This Prospectus Supplement, together with the Prospectus, also qualifies the grant of the Over-Allotment Option and the issuance of the Additional Shares, if any. A purchaser who acquires Additional Shares forming part of the Underwriters’ over-allocation position acquires those Additional Shares under this Prospectus Supplement, regardless of whether the over-allocation is ultimately filled through the exercise of the Over-Allotment Option or secondary market purchases. If the Over-Allotment Option is exercised in full, the total Price to the Public will be US$ ● , the total Underwriters’ Fee will be US$ ● , and the net proceeds to the Company will be US$ ● , before deducting the expenses of the Offering, which are expected to be US$ ● . See “Plan of Distribution”. |

There is no minimum amount of funds that must be raised under the Offering. This means that the Company could complete the Offering after raising only a small proportion of the Offering amount set out above.

The Underwriters, as principals, conditionally offer the Offered Shares, subject to prior sale, if, as and when issued by the Company and accepted by the Underwriters in accordance with the conditions contained in the Underwriting Agreement referred to under “Plan of Distribution”. In connection with the Offering, the Underwriters may, subject to applicable laws, overallot or effect transactions intended to stabilize or maintain the market price of the Preferred Shares at levels above that which might otherwise prevail in the open market. Such transactions, if commenced, may be discontinued at any time.

The following table sets out the number of securities that may be issued by the company to the Underwriters pursuant to the Over-Allotment Option.

| | | | | | |

Underwriters’ Position | | Maximum Size | | Exercise Period | | Exercise Price |

| Over-Allotment Option | | Up to ● Additional Shares | | Up to and including the 30th day after the closing of the Offering | | $ ● per Additional Share |

The issued and outstanding common shares of the Company (the “Common Shares”) are listed for trading on the TSX Venture Exchange (the “TSX-V”) under the symbol “SLHG” and the Nasdaq Capital Market (the “Nasdaq”) under the symbol “SLHG”. On November 9, 2021 the last trading day prior to the date of this Prospectus Supplement, the closing price of the Common Shares on the TSX-V was $3.12 and on the Nasdaq was US$2.51. The Company has applied to list the Offered Shares on the Nasdaq under the symbol “SLHGP”. Listing will be subject to the Company fulfilling all of the listing requirements of Nasdaq. See “Plan of Distribution”.

The Offering Price is stated in U.S. dollars, but most of the figures included in this Prospectus Supplement and the documents incorporated by reference herein, including the Company’s financial statements, are in Canadian dollars. See “Currency Presentation and Exchange Rate Information”.

The Offering is being made in the United States under the terms of the Company’s registration statement on Form F-10 (File No. 333-260070) (the “Registration Statement”) filed with the United States Securities and Exchange Commission (the “SEC” or the “Commission”).

Neither the Company nor the Underwriters has authorized anyone to provide any information other than that contained or incorporated by reference in this Prospectus Supplement or the accompanying Prospectus or any relevant free writing prospectus prepared by or on behalf of the Company or to which the Company has referred you. Neither the Company nor the Underwriters take any responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. It is important for you to read and consider all information contained in this Prospectus Supplement and the accompanying Prospectus, including the documents incorporated by reference herein and therein, and any free writing prospectus that the Company has authorized for use in connection with this Offering, in their entirety before making your investment decision.

An investment in the Offered Shares is subject to certain risks. The risk factors described in this Prospectus Supplement, the accompanying Prospectus and in the documents incorporated by reference herein and therein should be carefully reviewed and considered by prospective purchasers. See “Forward-looking Information” and “Risk Factors”.

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE COMMISSION OR ANY STATE OR CANADIAN SECURITIES REGULATOR, NOR HAS THE SEC OR ANY STATE OR CANADIAN REGULATOR PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS SUPPLEMENT OR THE ACCOMPANYING PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Prospective investors in the United States should be aware that this Offering is made by a foreign issuer that is permitted, under a multijurisdictional disclosure system adopted in the United States and Canada (“MJDS”), to prepare this Prospectus Supplement and the accompanying Prospectus in accordance with the disclosure requirements of its home country. Prospective investors should be aware that such requirements are different from those of the United States. The Company prepares its financial statements in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board; the financial statements incorporated herein have been prepared in accordance with IFRS and may be subject to foreign auditing and auditor independence standards, and thus may not be comparable to financial statements of United States companies.

Prospective investors should be aware that the acquisition of the Offered Shares described herein may have tax consequences both in Canada and the United States. Such consequences for investors who are resident in, or citizens of, or citizens of, Canada or the United States may not be described fully herein. See “Certain Canadian Federal Income Tax Considerations” and “Certain Material U.S. Federal Income Tax Considerations”.

The enforcement by investors of civil liabilities under United States federal securities laws may be affected adversely by the fact that the Company is existing and governed under the laws of Canada, that some of its officers and directors may be residents of a foreign country, that some or all of the Underwriters or the experts named herein or in the Registration Statement may be residents of a foreign country, and that all or a substantial portion of the assets of the Company and said persons may be located outside the United States. See “Risk Factors” and “Enforcement of Civil Liabilities”.

Certain legal matters relating to Canadian law with respect to the Offering will be passed upon on the Company’s behalf by Gardiner Roberts LLP and on behalf of the Underwriters by Aird & Berlis LLP. Certain legal matters relating to United States law with respect to the Offering will be passed upon on the Company’s behalf by Ellenoff Grossman & Schole LLP and on behalf of the Underwriters by Sheppard, Mullin, Richter & Hampton LLP.

Subscriptions will be received subject to rejection in whole or in part and the right is reserved to close the subscription books at any time without notice. Closing of the Offering is expected to take place on or about ● , 2021 (the

“Closing Date”), or such earlier or later date as the Company and the Underwriters may agree, but in any event, not later than ● , 2021. It is expected that the Company will arrange for the instant deposit of the Offered Shares offered hereby under the book-based system of registration, to be registered to The Depository Trust Company (“DTC”) or its nominee and deposited with DTC on the Closing Date. No certificates evidencing the Offered Shares offered hereby will be issued to purchasers of the Offered Shares. Purchasers of the Offered Shares will receive only a customer confirmation from the Underwriters or other registered dealer from or through which a beneficial interest in the Offered Shares is purchased. See “Plan of Distribution”.

The Company has its head and registered office located at 5520 Explorer Dr., Suite 402, Mississauga, Ontario L4W 5L1.

The Company is neither a “connected issuer” nor a “related issuer” of the Underwriters as defined in National Instrument 33-105 –

Underwriting Conflicts.

Grace Mellis and Patrick McNamee are directors of the Company and Mohammad Bataineh and Dr. Kit Brekhus are officers of the Company, each of whom reside outside of Canada.

The persons or entities named below have appointed the following agents for service of process:

| | |

Name of Person or Entity | | Name and Address of Agent |

| Patrick McNamee | | Skylight Health Group Inc. 5520 Explorer Dr., Suite 402, Mississauga, Ontario L4W 5L1 |

| Grace Mellis | | Skylight Health Group Inc. 5520 Explorer Dr., Suite 402, Mississauga, Ontario L4W 5L1 |

| Mohammad Bataineh | | Skylight Health Group Inc. 5520 Explorer Dr., Suite 402, Mississauga, Ontario L4W 5L1 |

| Kit Brekhus | | Skylight Health Group Inc. 5520 Explorer Dr., Suite 402, Mississauga, Ontario L4W 5L1 |

Purchasers are advised that it may not be possible for investors to enforce judgments obtained in Canada against any person or company that is incorporated, continued or otherwise organized under the laws of a foreign jurisdiction or resides outside of Canada, even if the party has appointed an agent for service of process. See also “Enforcement of Civil Liabilities”.

The Underwriters directly, or indirectly through their broker-dealer, affiliates, or agents, propose to initially offer the Offered Shares initially at the Offering Price. After the Underwriters have made a reasonable effort to sell all of the Offered Shares at such price, the Underwriters may subsequently reduce the selling price of the Offered Shares to purchasers. Any such reduction will not affect the proceeds received by the Company. See “Plan of Distribution”.

| | |

| Sole Book Running Manager | | Lead Manager |

| |

| The Benchmark Company | | Aegis Capital Corp |

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

SHELF PROSPECTUS

IMPORTANT NOTICE ABOUT THE INFORMATION IN THIS PROSPECTUS SUPPLEMENT AND THE ACCOMPANYING PROSPECTUS

This document is in two parts. The first part is this Prospectus Supplement, which describes the specific terms of the Offering and also adds to and updates certain information contained in the accompanying Prospectus and the documents incorporated by reference herein and therein. The second part, the accompanying Prospectus, gives more general information, some of which may not apply to the Offering. If the description of the Offered Shares varies between this Prospectus Supplement and the accompanying Prospectus, investors should rely on the information in this Prospectus Supplement. This Prospectus Supplement may add, update or change information contained in the accompanying Prospectus or any of the documents incorporated by reference herein or therein. To the extent that any statement made in this Prospectus Supplement is inconsistent with statements made in the accompanying Prospectus or any documents incorporated by reference herein or therein filed prior to the date of this Prospectus Supplement, the statements made in this Prospectus Supplement will be deemed to modify or supersede those made in the accompanying Prospectus and such documents incorporated by reference. This Prospectus Supplement and the accompanying Prospectus are part of the Registration Statement on Form F-10 that has been filed with the SEC. This Prospectus Supplement does not contain all of the information contained in the Registration Statement, certain parts of which are omitted in accordance with the rules and regulations of the SEC. You should refer to the Registration Statement and the exhibits thereto for further information with respect to the Company and its securities.

The Company is not offering the Offered Shares in any jurisdiction where the Offering is not permitted by law. This Prospectus Supplement and the accompanying Prospectus must not be used by anyone for any purpose other than in connection with the distribution of Offered Shares under this Offering. The Company does not undertake to update the information contained in this Prospectus Supplement or contained or incorporated by reference in the Prospectus, except as required by applicable securities laws.

Neither the Company nor the Underwriters have authorized anyone to provide any information other than that contained or incorporated by reference in this Prospectus Supplement or the accompanying Prospectus or any relevant free writing prospectus prepared by or on behalf of the Company or to which the Company has referred you. The Company and the Underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. It is important for you to read and consider all information contained in this Prospectus Supplement and the accompanying Prospectus, including the documents incorporated by reference herein and therein, and any free writing prospectus that the Company has authorized for use in connection with this Offering, in their entirety before making your investment decision.

This Prospectus Supplement shall not be used by anyone for any purpose other than in connection with the Offering. The Company does not undertake to update the information contained or incorporated by reference herein or in the Shelf Prospectus, except as required by applicable securities laws. Information contained on, or otherwise accessed through, the Company’s website shall not be deemed to be a part of this Prospectus Supplement or the Shelf Prospectus and such information is not incorporated by reference herein or therein.

Unless otherwise noted or the context indicates otherwise, the “Company”, “Skylight”, “we”, “us” and “our” refer to Skylight Health Group Inc. and controlled entities included in its consolidated financial statements.

CURRENCY PRESENTATION AND EXCHANGE RATE INFORMATION

This Prospectus Supplement contains references to U.S. dollars and Canadian dollars. All dollar amounts referenced, unless otherwise indicated, are Canadian dollars, and United States dollars are referred to as “US$”.

The Canadian dollar is convertible into U.S. dollars at freely floating rates. There are no legal restrictions on the flow of Canadian dollars between Canada and the United States. Any remittances of dividends or other payments by us to persons in the United States are not and will not be subject to any exchange controls.

The table below sets forth for the periods indicated, certain exchange rates based upon the exchange rates published by the Bank of Canada during the respective periods. The Company makes no representation that any Canadian dollar or U.S. dollar amounts could have been, or could be, converted into U.S. dollars or Canadian dollars, as the case may be, at any particular rate, the rates stated below, or at all. The rates are set out as Canadian dollars per US$1.00.

1

| | | | | | | | | | | | | | | | |

| | | Period-End | | | Average | | | High | | | Low | |

For the year ended December 31, | | | | | | | | | | | | | | | | |

2020 | | $ | 1.2732 | | | $ | 1.3415 | | | $ | 1.4496 | | | $ | 1.2718 | |

2019 | | $ | 1.2988 | | | $ | 1.3269 | | | $ | 1.3600 | | | $ | 1.2988 | |

2018 | | $ | 1.3642 | | | $ | 1.2957 | | | $ | 1.3642 | | | $ | 1.2288 | |

On November 9, 2021, the closing rate of exchange for Canadian dollars in terms of the U.S. dollar, as quoted by the Bank of Canada daily rate, was U.S.$1.00 = $1.2448.

FORWARD-LOOKING INFORMATION

This Prospectus Supplement, the accompanying Prospectus and the documents incorporated by reference herein and therein contain “forward-looking information” about the Company within the meaning of applicable Canadian securities legislation, and “forward-looking statements” with the meaning of Section 27A of the United States Securities Act of 1933, as amended, and Section 21E of the United States Securities Exchange Act of 1934, as amended (the “U.S. Exchange Act”), and the United States Private Securities Litigation Reform Act of 1995, as amended, (collectively, “forward-looking statements”). These statements relate to future events or future performance and reflect management’s expectations and assumptions regarding the growth, results of operations, performances and business prospects and opportunities of the Company. All statements other than statements of historical fact are forward-looking statements. The use of any of the words “anticipate”, “plan”, “continue”, “estimate”, “expect”, “may”, “intend”, “will”, “project”, “could”, “believe”, “predict”, “potential”, “should” or the negative of these terms or other similar expressions are intended to identify forward-looking statements. In particular, information regarding the Company’s future operating results and economic performance is forward-looking information. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance, achievements or events to differ materially from those anticipated, discussed or implied in such forward-looking statements. The Company believes the expectations reflected in such forward- looking statements are reasonable but no assurance can be given that these expectations will prove to be correct and such forward-looking statements included in this Prospectus Supplement and the documents incorporated by reference herein should be considered carefully and investors should not place undue reliance on them as the Company cannot assure investors that actual results will be consistent with these forward-looking statements. These statements speak only as of the date of this Prospectus Supplement or the particular document incorporated by reference herein. Such statements are based on a number of assumptions which may prove to be incorrect, including, but not limited to, assumptions about:

| | • | | the completion of the Offering; |

| | • | | general business and economic conditions; |

| | • | | the intentions, plans and future actions of the Company; |

| | • | | the business and future activities of the Company after the date of this Prospectus Supplement; |

| | • | | market position, ability to compete and future financial or operating performance of the Company after the date of this Prospectus Supplement; |

| | • | | anticipated developments in operations; |

| | • | | the future demand for the products and services developed, produced, supplied, or distributed by the Company; |

| | • | | the timing and amount of estimated research & development expenditure in respect of the business of the Company; |

| | • | | operating revenue and operating expenditures; |

| | • | | success of marketing activities; |

| | • | | the sufficiency of the Company’s working capital; |

2

| | • | | requirements for additional capital; |

| | • | | risks associated with obtaining and maintaining the necessary government permits and licenses related to the business; |

| | • | | limitations on insurance coverage; |

| | • | | the timing and possible outcome of regulatory matters; |

| | • | | goals, strategies and future growth; |

| | • | | the adequacy of financial resources; |

| | • | | compliance with environmental, health, safety and other laws and regulations; |

| | • | | the ability to attract and retain skilled staff; |

| | • | | market competition; and |

| | • | | the potential impact of the COVID-19 pandemic on the Company and/or its operations, and the healthcare industry and currency fluctuations. |

These forward-looking statements involve risks and uncertainties relating to, among other things, access to skilled personnel, results of operating activities, uninsured risks, and regulatory changes. Actual results may differ materially from those expressed or implied by such forward-looking statements. Factors that could cause actual results to differ materially include, but are not limited to, the “Risk Factors” contained in this Prospectus Supplement, the accompanying Prospectus, the Company’s AIF (as defined here) and the documents incorporated by reference herein and therein. Investors should not place undue reliance on forward-looking statements as the plans, intentions or expectations upon which they are based might not occur. The Company cautions that the foregoing list of important factors is not exhaustive. The Company undertakes no obligation to publicly update or revise any forward-looking statements except as expressly required by applicable securities law. See “Forward-Looking Statements” in the AIF (as defined herein). The forward-looking statements contained in this Prospectus Supplement, the accompanying Prospectus or the documents incorporated by reference herein and therein are expressly qualified in their entirety by this cautionary statement. Potential investors should read this entire Prospectus Supplement and consult their own professional advisers to ascertain and assess the income tax and legal risks and other aspects associated with the Offered Shares.

NON-IFRS MEASURES

This Prospectus Supplement, the accompanying Prospectus and the documents incorporated by reference herein and therein contain references to certain measures that are not defined under IFRS.

These non-IFRS measures are not recognized measures under IFRS, do not have a standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other companies. Rather, these measures are provided as additional information to complement IFRS measures by providing further understanding of the Company’s results of operations from management’s perspective. Accordingly, they should not be considered in isolation nor as a substitute for analysis of the Company’s financial information reported under IFRS.

The Company uses non-IFRS measures, including EBITDA and Adjusted EBITDA to provide investors with supplemental measures of its operating performance and thus highlight trends in its core business that may not otherwise be apparent when relying solely on IFRS measures. The Company believes that investors, securities analysts and other interested parties frequently use non-IFRS measures in the evaluation of issuers. Management also uses non-IFRS measures in order to facilitate operating performance comparisons from period to period, and assess the Company’s ability to meet its future debt service, capital expenditure and working capital requirements.

Please refer to the Company’s Annual MD&A (as defined below), incorporated by reference into this Prospectus Supplement, for the definitions of EBITDA and Adjusted EBITDA presented by the Company and the reconciliation, where applicable, to the most directly comparable IFRS measure.

3

ADDITIONAL INFORMATION

The Company has filed with the SEC the Registration Statement on Form F-10 of which this Prospectus Supplement forms a part. This Prospectus Supplement does not contain all the information set out in the Registration Statement. For further information about the Company and the Offered Shares, please refer to the Registration Statement, including the exhibits to the Registration Statement.

The Company is currently subject to the information requirements under Canadian securities laws and, upon the effectiveness of the Registration Statement, the Company became subject to certain information requirements of the U.S. Exchange Act. Consequently, Skylight files reports and other information with the securities regulatory authorities of the provinces of Alberta, British Columbia, Manitoba and Ontario (the “Applicable Jurisdictions”) and as well as reports and other information with the SEC. Under MJDS, the Company may generally prepare these reports and other information in accordance with the disclosure requirements of Canada. These requirements are different from those of the United States. As a “foreign private issuer” (as defined under United States securities laws), the Company is exempt from the rules under the U.S. Exchange Act prescribing the furnishing and content of proxy statements, and officers, directors and principal shareholders of the Company are exempt from the reporting and short-swing profit recovery provisions contained in Section 16 of the U.S. Exchange Act. In addition, the Company may not be required to publish financial statements as promptly as United States companies.

The SEC maintains a website (www.sec.gov) that makes available reports and other information that the Company files electronically with it, including the Registration Statement that the Company has filed with respect hereto.

Copies of reports, statements and other information that the Company files with the Applicable Jurisdictions are available electronically on the System for Electronic Document Analysis and Retrieval (“SEDAR”) at www.sedar.com.

MARKET AND INDUSTRY DATA

This Prospectus Supplement, the Prospectus and the documents incorporated by reference herein and therein, includes market and industry data that has been obtained from third-party sources, including industry publications. The Company believes that the industry data is accurate and that its estimates and assumptions are reasonable, but there is no assurance as to the accuracy or completeness of this data. Third-party sources generally state that the information contained therein has been obtained from sources believed to be reliable, but there is no assurance as to the accuracy or completeness of included information. Although the data is believed to be reliable, the Company has not independently verified any of the data from third-party sources or ascertained the underlying economic assumptions relied upon by such sources. The Company does not intend, and undertakes no obligation, to update or revise any such information or data, whether as a result of new information, future events or otherwise, except as, and to the extent required by, applicable Canadian securities laws.

ENFORCEABILITY OF CIVIL LIABILITIES

The Company exists under the laws of Canada, and all of its executive offices and administrative activities are located outside the United States. In addition, all of the directors and officers of the Company, other than Patrick McNamee, Grace Mellis, Mohammad Bataineh and Kit Brekhus, are residents of jurisdictions other than the United States and all or a substantial portion of the assets of those persons are or may be located outside the United States.

As a result, investors who reside in the United States may have difficulty serving legal process in the United States upon the Company or its directors or officers, as applicable, or enforcing judgments obtained in United States courts against any of them or the assets of any of them located outside the United States, or enforcing against them in the appropriate Canadian court judgments obtained in United States courts, including, but not limited to, judgments predicated upon the civil liability provisions of the federal securities laws of the United States, or bringing an original action in the appropriate Canadian courts to enforce liabilities against the Company or any of its directors or officers, as applicable, based upon United States federal securities laws.

4

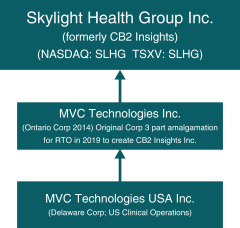

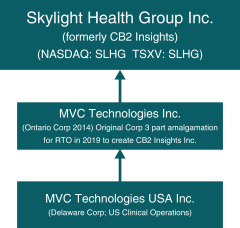

In the United States, the Company has filed with the SEC an appointment of agent for service of process on Form F-X. Under such Form F-X, the Company has appointed its subsidiary MVC Technologies USA Inc., 82 Hartwell St Floor 2, Fall River, MA, 02721 United States, as its agent for service of process in the United States in connection with any investigation or administrative proceeding conducted by the SEC, and any civil suit or action brought against the Company in a United States court arising out of or related to or concerning the offering of the Offered Shares under the Registration Statement.

DOCUMENTS INCORPORATED BY REFERENCE

This Prospectus Supplement is deemed, as of the date hereof, to be incorporated by reference in the accompanying Prospectus only for the purpose of the distribution of the Offered Shares under the Offering. The following documents, each of which has been filed with the securities regulatory authorities in the Applicable Jurisdictions and is available on SEDAR at www.sedar.com, are specifically incorporated by reference into, and form an integral part of, the Prospectus as supplemented by this Prospectus Supplement:

| | 1. | the annual information form of the Company for the fiscal year ended December 31, 2020, dated April 19, 2021 (the “AIF”); |

| | 2. | the Company’s audited consolidated financial statements for the years ended December 31, 2020 and 2019, together with the independent auditors’ reports thereon and the notes thereto; |

| | 3. | the Company’s management’s discussion and analysis for the year ended December 31, 2020 (the “Annual MD&A”); |

| | 4. | the Company’s unaudited condensed consolidated interim financial statements for the three and six-month periods ended June 30, 2021 and 2020 (“Interim Financial Statements”); |

| | 5. | the Company’s management discussion and analysis for the three and six-month periods ended June 30, 2021 (“Interim MD&A”); |

| | 6. | the management information circular dated July 20, 2020 relating to the annual general meeting of shareholders held on September 9, 2020; |

| | 7. | the management information circular dated October 7, 2020 relating to the special meeting of shareholders held on November 23, 2020; |

| | 8. | the management information circular dated January 18, 2021 relating to the special meeting of shareholders to be held on February 22, 2021; |

| | 9. | the material change report of the Company dated January 11, 2021 in respect of the announcement of a binding letter of intent to acquire a US primary and urgent care clinic group; |

| | 10. | the material change report of the Company dated February 14, 2021 in respect of the announcement of the appointment of Grace Mellis as a director; |

| | 11. | the material change report of the Company dated March 24, 2021 in respect of the announcement of the appointment of Patrick McNamee as a director; |

| | 12. | the material change report of the Company dated May 19, 2021 in respect of the announcement of an offering of securities pursuant to a short form prospectus supplement (the “May Offering”); |

| | 13. | the material change report of the company dated May 26, 2021 in respect of the closing of the May Offering; and |

| | 14. | “template version” (as such term is defined in National Instrument 41-101 – General Prospectus Requirements) of the investor presentation dated November 10, 2021. |

Material change reports (other than confidential reports), business acquisition reports, annual financial statements, interim financial statements, the associated management’s discussion and analysis of financial condition and results of operations and all other documents of the type referred to in section 11.1 of Form 44-101F1 of National Instrument 44-101 – Short Form Prospectus Distributions of the Canadian Securities Administrators to be incorporated by reference in a short form prospectus, filed by the Company with a securities commission or similar regulatory authority in Canada after the date of this Prospectus Supplement

5

but before the termination or completion of the distribution of the Offered Shares hereunder will be deemed to be incorporated by reference in the Prospectus, as supplemented by this Prospectus Supplement, for the purpose of this Offering. The documents incorporated or deemed to be incorporated herein by reference contain meaningful and material information relating to the Company and readers should review all information contained in this Prospectus Supplement, the accompanying Prospectus and the documents incorporated or deemed to be incorporated by reference herein and therein.

In addition, to the extent that any document or information incorporated by reference into this Prospectus Supplement pursuant to the foregoing paragraph is also included in any report that the Company files with or furnishes to the SEC pursuant to Section 13(a) or 15(d) of the U.S. Exchange Act, such document or information shall be deemed to be incorporated by reference as an exhibit to the Registration Statement of which this Prospectus forms a part. Further, the Company may incorporate by reference into the Registration Statement of which this Prospectus forms a part, any report on Form 6-K furnished to the SEC, including the exhibits thereto, if and to the extent provided in such report.

Any statement contained in this Prospectus Supplement or in the accompanying Prospectus or in a document incorporated or deemed to be incorporated by reference herein or therein is not deemed to be included or incorporated by reference to the extent that any such statement is modified or superseded by a statement contained herein or in any other subsequently filed document that also is or is deemed to be incorporated by reference herein or in the accompanying Prospectus. Any such modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. The making of a modifying or superseding statement shall not be deemed an admission for any purposes that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary to make a statement not misleading in light of the circumstances in which it was made. Any statement so modified or superseded shall not be considered in its unmodified or superseded form to constitute part of this Prospectus Supplement or the accompanying Prospectus; rather only such statement as so modified or superseded shall be considered to constitute part of this Prospectus Supplement or the accompanying Prospectus.

Copies of the documents incorporated herein by reference may be obtained on request without charge from the Chief Technology Officer of the Company at its head and registered office located at 5520 Explorer Dr., Suite 402, Mississauga, Ontario L4W 5L1, Telephone (855) 874-4999 Ext: 101. Copies are also available electronically through SEDAR at www.sedar.com.

6

TERMS OF THE OFFERING

| | | | |

| Issuer: | | Skylight Health Group Inc. | | |

| |

| Tickers: | | SLHG – NASDAQ / SLHG.V – TSXV |

| |

| Security Offered: | | 9.25% Series A Cumulative Redeemable Perpetual Preferred Stock |

| |

| Anticipated Nasdaq Symbol: | | SLHGP |

| |

| Annual Dividend Amount: | | $2.3125 |

| |

| Dividend Payment Amount/Date: | | Monthly in the amount of $.1927 payable on or about the 20th of each month |

| |

| Liquidation Preference: | | $25.00 |

| |

| Maturity/Mandatory Redemption: | | None |

| |

| Optional Redemption: | | At the Company’s option any time on or after , 2024 |

| |

| Use of Proceeds: | | Evaluating and completing possible acquisitions of clinical and medical services businesses, establishing primary care and sub-specialty services within existing facilities including HR and capacity development and working capital. |

| |

| Sole Bookrunning Manager: | | The Benchmark Company |

| |

| Lead Manager: | | Aegis Capital Corp |

7

DESCRIPTION OF THE BUSINESS

Skylight is a healthcare services and technology company, working to positively impact patient health outcomes. The Company operates a United States multi-state primary care health network comprised of physical practices providing a range of services from primary care, sub-specialty, allied health, and laboratory/diagnostic testing. The Company is focused on helping small and independent practices shift from a traditional fee-for-service (“FFS”) model to value-based care (“VBC”) through tools including proprietary technology, data analytics and infrastructure. Management expects that VBC will lead to improved patient outcomes, reduced cost of delivery and drive stronger financial performance from existing practices.

The Company was founded in 2014 by founders with over 50 years of collective experience in clinical practice management in Canada and the United States, as owners, operators, and consultants to outpatient medical centers across a variety of specialties from primary care, urgent-care, sub-specialty, and allied health & wellness. Skylight was founded on a model designed to drive towards helping small and independent practices adopt value-based capabilities and take on varying levels of risk. According to a report on The State of Primary Care in the United States from the Robert Graham Center January 2018, the United States healthcare outpatient market is highly fragmented with over 56% of clinics and clinicians working independently and in small care groups.1 These practices struggle the most with developing and deploying VBC due to the increased investment in technology, infrastructure, and capacity. As the industry continues to be consolidated by large health networks, there is a need and demand by patients to maintain the same level of patient care and treatment outcomes lost within the consolidation by legacy health networks. Skylight positions itself as the disruptor to legacy health networks. Providing an opportunity to consolidate with Skylight while maintaining patient treatment quality, accessibility and affordability and preserving the way healthcare should be delivered. Skylight also positions itself to partner with health plans as they aim to provide more comprehensive care services to patients across varying risk groups and capitation models to lower the cost of downstream costs.

Skylight practices offer both in clinic and virtual care services through telemedicine and remote patient monitoring. As part of developing the infrastructure for improved access within its practices, the Company expects to expand offerings to patients including a nursing and advisory hotline, same day access, annual wellness reminders and screening protocols, improved access to home-care and remote care services.

The Company’s vision and business model is to drive towards an outcome-based reimbursement model, more commonly referred to as the value-based model. The Company works through an acquisition strategy that focuses on current FFS practices that will convert to VBC or capitation-based payment models. In a FFS model, payors (commercial and government insurers) reimburse on an encounter-based approach. This puts a focus on volume of patients per day. In a VBC model, payors reimburse typically on a capitation (fixed fee per member per month) basis. This places an emphasis on quality over volume. The Company’s revenues will largely be driven by insurable services paid for by payors currently in an FFS model that will convert to a blended or VBC model.

Business Metrics

The Company currently provides care to over 90,000 patients across six key markets including, Colorado, Florida, Tennessee, Texas, Pennsylvania and Washington. Additional clinics in both Massachusetts and Maine are currently in the process of opening and future planned markets include New Jersey, New York and California.

Within the existing Skylight network, the Company operates 23 medical centers and employs over 300 individuals on a full-time equivalent basis, including over 80 medical professionals on staff.

Market Information

According to Robert Graham Center,2 the Primary Care market in the United States represents over $290 billion with an annual growth rate of 4.7%. The largest segment of the market continues to be physician-owned practices (56%) with employee/non-physician-owned practices (26%). There is a major primary care physician shortage identified across the United States, representing only 32% of the market, in part driven by primary care being on the

| 1 | Petterson S, McNellis R, Klink K, Meyers D, Bazemore A. The State of Primary Care in the United States: A Chartbook of Facts and Statistics. January 2018 |

| 2 | Petterson S, McNellis R, Klink K, Meyers D, Bazemore A. The State of Primary Care in the United States: A Chartbook of Facts and Statistics. January 2018 |

8

low end of the compensation scale relative to other physician specialties which in turn nets a low interest by physicians to train to enter the primary care space. This new market shift to value-based payments provides a substantial opportunity to correct this market deficiency.

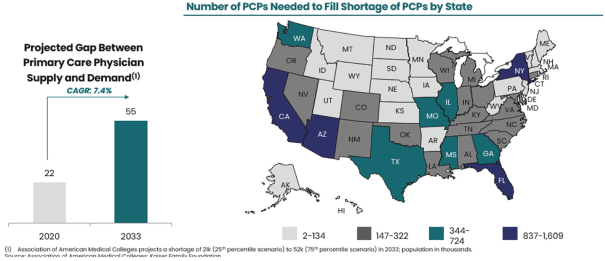

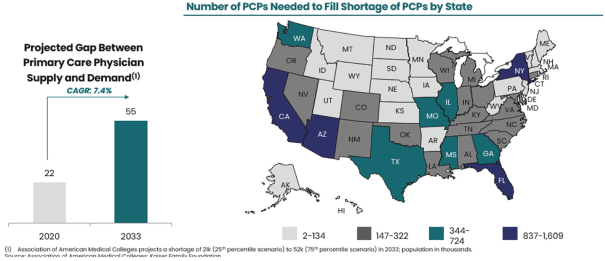

According to the Association of American Medical Colleges an estimated shortage of 21,000 to 52,000 primary care physicians will impact the United States healthcare market by 2033.3 The figure below illustrates where those shortfalls will be felt the most and the numbers that are estimated to help fill the gap.

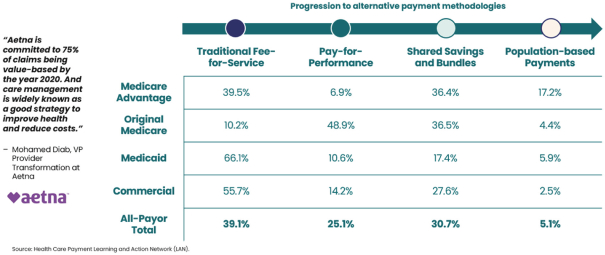

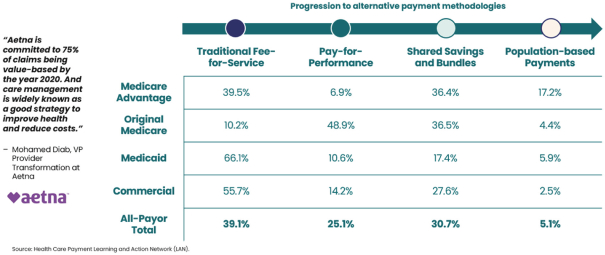

The largest change agent in the market today are payors. Insurance companies are pushing to revitalize primary care through value-based care models and in turn, incentivizing providers to achieve improved patient health and reduced costs. The chart below, based on the Health Care Payment Learning and Action Network (LAN) illustrates the progression being made from traditional models to future payment models.

These trends within the market are key to the Company’s business model and drive the execution of that model both through its M&A activity as well as the integration and overall management of its clinical network.

Business Model

The Company’s business model is primarily driven through its clinical operations that offer medical services to patients in the US through virtual and physical care in six (6) key markets. During 2019, the Company was able to begin validating its technology and contract research services, which generated incremental revenue by the end of the

| 3 | Association of American Medical Colleges: Kaiser Family Foundation |

9

fiscal year ended December 31, 2019 and continued to grow throughout the fiscal year ended December 31, 2020. The Company differentiates itself by being an integrative medical practice in the United States that owns its own proprietary technology data analytical assets, and clinical research expertise to support new market expansion, market access, data collection and analysis and drug discovery. At present, the Company operates and offers services in three vertical markets: medical services, technology & data analytics, and contract research and development services. Each vertical market is autonomous but works in tandem with the others. The Company integrates patient access, proprietary technology and consulting services to bring a comprehensive solution.

As more FFS providers face large roadblocks to converting from a FFS model to a VBC model, the market for acquiring small and independent service practices is large, but quality buyers remain limited. By partnering with Skylight Health, independent PCPs across the U.S. alleviate major challenges they face by joining a national platform that can provide them access to capital, technology, improved contracting and participation in value-based care programming.

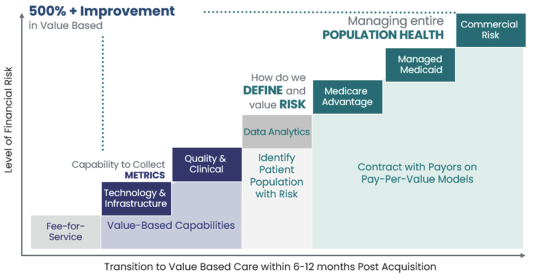

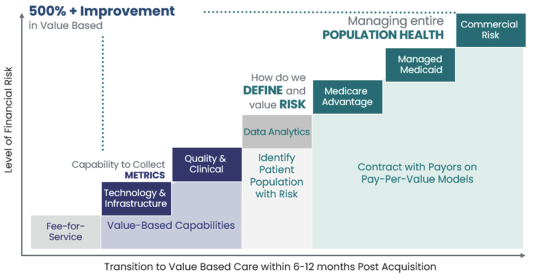

The Company is paving a unique path to a full conversion to VBC and when comparing to its peers, the chart below illustrates the differentiators that its business model brings to the market.

10

Key Goal Setting for the Company

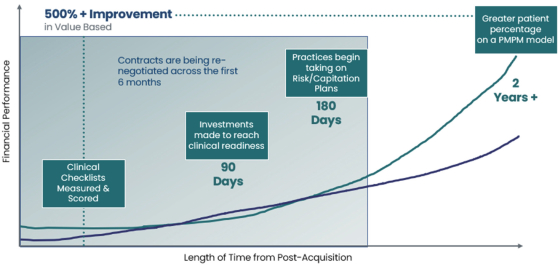

While the Company’s clinic network operates largely in a traditional FFS model, the goal is to become risk bearing with a shift towards a VBC model within 12 months of an acquisition for each clinic group acquired. The Company has mapped out the steps required to attain that goal and it is illustrated in the chart below.

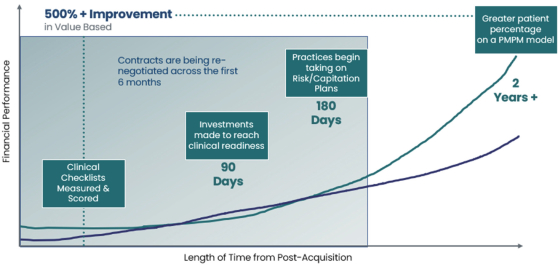

Further, the Company is committed to its proprietary platform driving its transition from FFS to a full VBC model with a 500%+ financial improvement within two years of acquiring a clinic, as illustrated below. Key steps in converting acquired clinics to VBC models include the tracking of over 250 identified quality service and delivery metrics within the first 30 days of acquisition, assessing and managing quality scores over the course of the first 90 days post-acquisition ensuring operational efficiencies, provider alignment and to develop value-based care readiness.

Recent Developments

On October 29, 2021, the Company announced the execution of an agreement to divest 100% of its assets related to its legacy business Canna Care Docs and Relaxed Clarity to New Frontier Data for total consideration of $8,628,000 payable over two years. Closing of the transaction is subject to regulatory approval and is anticipated to close no later than November 30, 2021.

11

CONSOLIDATED CAPITALIZATION

There have been no material changes in the consolidated capitalization of the Company since June 30, 2021, the date of the Company’s most recent Interim Financial Statements, which have not been disclosed in this Prospectus Supplement or in the documents incorporated by reference herein.

DESCRIPTION OF SECURITIES BEING DISTRIBUTED

Preferred Shares

The description of certain terms of the Preferred Shares in the Prospectus Supplement does not purport to be complete and is in all respects subject to, and qualified in its entirety by references to the relevant provisions of the articles of amendment to be filed prior to the closing of the Offering establishing the terms of the Preferred Shares.

General

Immediately prior to consummation of this Offering, there will be ● Preferred Shares authorized under the Company’s constating documents and no Preferred Shares outstanding. The Offered Shares hereby, when issued, delivered and paid for in accordance with the terms of the Underwriting Agreement, will be fully paid and non-assessable. The Board of Directors may, without the approval of holders of the Preferred Shares or the Common Shares, classify and designate shares of any class or series of preferred shares ranking senior to, junior to or on parity with the Preferred Shares or designate additional Preferred Shares and authorize the issuance of such shares.

No Maturity, Sinking Fund or Mandatory Redemption

The Preferred Shares have no stated maturity and will not be subject to any sinking fund or mandatory redemption. Preferred Shares will remain outstanding indefinitely unless the Company decides to redeem or otherwise repurchase them. The Company is not required to set aside funds to redeem the Preferred Shares.

Ranking

The Preferred Shares will rank, with respect to rights to the payment of dividends and the distribution of assets upon the liquidation, dissolution or winding up of the Company:

| | • | | senior to all classes or series of common shares and to all other equity securities issued by the Company other than equity securities referred to in the next two bullet points below; |

| | • | | on a parity with all equity securities issued with terms specifically providing that those equity securities rank on a parity with the Preferred Shares with respect to rights to the payment of dividends and the distribution of assets upon the liquidation, dissolution or winding up of the Company; |

| | • | | junior to all equity securities issued by the Company with terms specifically providing for ranking senior to the Preferred Shares with respect to rights to the payment of dividends and the distribution of assets upon the liquidation, dissolution or winding up of the Company (please see the section entitled “Voting Rights” below); and |

| | • | | effectively junior to all existing and future indebtedness of the Company (including indebtedness convertible into Common Shares or other securities of the Company) and to any indebtedness and other liabilities of (as well as any preferred equity interests held by others in) the Company’s subsidiaries. |

Dividends

Holders of Preferred Shares are entitled to receive, if, as and when authorized by the Board of Directors and declared by the Company, out of funds of the Company legally available for the payment of dividends, cumulative cash dividends at the rate of 9.25% of the US$25.00 per share liquidation preference per annum (equivalent to $2.3125 per annum per share). Dividends on the Preferred Shares shall be payable monthly on the 15th day of each month; provided that if any dividend payment date is not a Business Day (as defined in the articles of amendment creating the

12

Preferred Shares), then the dividend that would otherwise have been payable on that dividend payment date may be paid on the next succeeding Business Day and no interest, additional dividends or other sums will accrue on the amount so payable for the period from and after that dividend payment date to that next succeeding business day. Any dividend payable on the Preferred Shares, including dividends payable for any partial dividend period, will be computed on the basis of a 360-day year consisting of twelve 30-day months. Dividends will be payable to holders of record as they appear in the Company’s register for the Preferred Shares at the close of business on the applicable record date, which shall be the last day of the calendar month, whether or not a Business Day, immediately preceding the month in which the applicable dividend payment date falls. As a result, holders of Preferred Shares will not be entitled to receive dividends on a dividend payment date if such shares were not issued and outstanding on the applicable dividend record date.

Dividends will accrue and be cumulative from the date of original issuance, which is expected to be ● , 2021. The dividend payable on ● , 2021 will be paid to the persons who are the holders of record of the Preferred Shares at the close of business on the corresponding record date, which will be ● , 2021.

No dividends on Preferred Shares shall be authorized by the Board of Directors or paid or set apart for payment by the Company at any time when the terms and provisions of any agreement of the Company, including any agreement relating to indebtedness, prohibit the authorization, payment or setting apart for payment thereof or provide that the authorization, payment or setting apart for payment thereof would constitute a breach of the agreement or a default under the agreement, or if the authorization, payment or setting apart for payment shall be restricted or prohibited by law.

Notwithstanding the foregoing, dividends on the Preferred Shares will accrue whether or not the Company has earnings, whether or not there are funds legally available for the payment of those dividends and whether or not those dividends are authorized by the Board of Directors. No interest, or sum in lieu of interest, will be payable in respect of any dividend payment or payments on the Preferred Shares that may be in arrears, and holders of the Preferred Shares will not be entitled to any dividends in excess of full cumulative dividends described above. Any dividend payment made on the Preferred Shares shall first be credited against the earliest accumulated but unpaid dividend due with respect to those shares.

Future distributions on Common Shares or preferred shares, including the Preferred Shares will be at the discretion of the Board of Directors and will depend on, among other things, results of operations, cash flow from operations, financial condition and capital requirements, any debt service requirements, applicable law and any other factors the Board of Directors deems relevant. Accordingly, there is no guarantee that the Company will be able to make cash distributions on Preferred Shares or what the actual distributions will be for any future period.

Unless full cumulative dividends on all Preferred Shares have been or contemporaneously are declared and paid or declared and a sum sufficient for the payment thereof has been or contemporaneously is set apart for payment for all past dividend periods, no dividends (other than in Common Shares or in shares of any class or series of preferred shares that the Company may issue ranking junior to the Preferred Shares as to the payment of dividends and the distribution of assets upon liquidation, dissolution or winding up) shall be declared and paid or declared and set apart for payment upon Common Shares or preferred shares that may be issued ranking junior to, or on a parity with, the Preferred Shares as to the payment of dividends or the distribution of assets upon liquidation, dissolution or winding up. Nor shall any other distribution be declared and made upon shares of Common Shares or preferred shares that may be issued ranking junior to, or on a parity with, the Preferred Shares as to the payment of dividends or the distribution of assets upon liquidation, dissolution or winding up. Also, any Common Shares or preferred shares that may be issued ranking junior to or on a parity with the Preferred Shares as to the payment of dividends or the distribution of assets upon liquidation, dissolution or winding up shall not be redeemed, purchased or otherwise acquired for any consideration (or any moneys paid to or made available for a sinking fund for the redemption of any such shares) by the Company (except (x) by conversion into or exchange for other shares that may be issued ranking junior to the Preferred Shares as to the payment of dividends and the distribution of assets upon liquidation, dissolution or winding up and (y) for transfers, redemptions or purchases made pursuant to the ownership and transfer restrictions contained in the constating documents).

When dividends are not paid in full (or a sum sufficient for such full payment is not so set apart) upon the Preferred Shares and any other outstanding series of preferred shares that may be issued ranking on a parity as to the

13

payment of dividends with the Preferred Shares, all dividends declared upon the Preferred Shares and any other class or series of preferred shares that may be issued ranking on a parity as to the payment of dividends with the Preferred Shares shall be declared pro rata so that the amount of dividends declared per Preferred Share and such other class or series of preferred stock that may be issued shall in all cases bear to each other the same ratio that accrued dividends per share on the Preferred Shares and such other series of preferred shares that may be issued (which shall not include any accrual in respect of unpaid dividends for prior dividend periods if such preferred shares do not have a cumulative dividend) bear to each other. No interest, or sum of money in lieu of interest, shall be payable in respect of any dividend payment or payments on the Preferred Shares that may be in arrears.

A segregated dividend account will be established and funded at closing with proceeds sufficient to pre-fund twelve (12) monthly dividend payments. The segregated dividend account may only be used to pay dividends on the Preferred Shares, when legally permitted, and may not be used for other corporate purposes.

In addition, if at any time the Company declares a dividend on its Common Shares, holders of the Preferred Shares will be entitled to receive an equivalent dividend calculated on the basis of the number of Common Shares a holder would hold determined by dividing US$25.00 by the closing price of the Common Shares on its primary trading market on the record date for such dividend.

Liquidation Preference

In the event of a voluntary or involuntary liquidation, dissolution or winding up of the Company, the holders of the Preferred Shares will be entitled to be paid out of the assets that are legally available for distribution to shareholders, subject to the preferential rights of the holders of any class or series of shares that may be issued ranking senior to the Preferred Shares with respect to the distribution of assets upon liquidation, dissolution or winding up, a liquidation preference of US$25.00 per share, plus an amount equal to any accumulated and unpaid dividends to, but not including, the date of payment, before any distribution of assets is made to holders of Common Shares or any other class or series of securities that may be issued that rank junior to the Preferred Shares as to liquidation rights.

In the event that, upon any such voluntary or involuntary liquidation, dissolution or winding up, available assets are insufficient to pay the amount of the liquidating distributions on all outstanding Preferred Shares and the corresponding amounts payable on all shares of other classes or series of shares that may be issued ranking on a parity with the Preferred Shares in the distribution of assets, then the holders of the Preferred Shares and all other such classes or series of shares shall share rateably in any such distribution of assets in proportion to the full liquidating distributions to which they would otherwise be respectively entitled.

The Company will use commercially reasonable efforts to provide written notice of any such liquidation, dissolution or winding up no fewer than two days prior to the payment date. After payment of the full amount of the liquidating distributions to which they are entitled, the holders of Preferred Shares will have no right or claim to any of the Company’s remaining assets. The amalgamation or merger of the Company with or into any other corporation, trust or entity or of any other entity with or into the Company, or the sale, lease, transfer or conveyance of all or substantially all of the Company’s assets or business, shall not be deemed a liquidation, dissolution or winding up of the Company (although such events may give rise to the special optional redemption to the extent described below).

Redemption

The Preferred Shares are not redeemable by the Company prior to ● , 2024 except as described below under “ – Special Optional Redemption.”

Optional Redemption

On and after ● , 2024 the Optional Redemption Date, the Company may, at its option, upon not less than thirty (30) and not more than sixty (60) days’ written notice, redeem the Preferred Shares, in whole or in part, at any time or from time to time, for cash at a redemption price equal to US$25.00 per share, plus any accumulated and unpaid dividends thereon to, but not including, the date fixed for redemption.

14

Special Optional Redemption

Upon the occurrence of a Change of Control, the Company may, at its option, upon not less than thirty (30) and not more than sixty (60) days’ written notice, redeem the Preferred Shares, in whole or in part, within 120 days after the first date on which such Change of Control occurred, for cash at a redemption price of US$25.00 per share, plus any accumulated and unpaid dividends thereon to, but not including, the redemption date.

A “Change of Control” is deemed to occur when, after the original issuance date of the Preferred Shares, there is an acquisition by any person, of beneficial ownership, directly or indirectly, through a purchase, merger or other acquisition transaction or series of purchases, mergers or other acquisition transactions of the Company’s outstanding shares entitling that person to exercise more than 50% of the total voting power of all of the Company’s shares entitled to vote generally in the election of directors (except that such person will be deemed to have beneficial ownership of all securities that such person has the right to acquire, whether such right is currently exercisable or is exercisable only upon the occurrence of a subsequent condition).

Redemption Procedures.

In the event the Company elects to redeem Preferred Shares, the notice of redemption will be mailed to each holder of record of Preferred Shares called for redemption at such holder’s address as it appears on the Company’s share transfer records, not less than two days prior to the redemption date, and will state the following:

| | • | | the number of Preferred Shares to be redeemed; |

| | • | | the place or places where certificates (if any) for the Preferred Shares are to be surrendered for payment of the redemption price; |

| | • | | that dividends on the shares to be redeemed will cease to accumulate on the redemption date; |

| | • | | whether such redemption is being made pursuant to the provisions described above under “ – Optional Redemption” or “ – Special Optional Redemption”; and |

| | • | | if applicable, that such redemption is being made in connection with a Change of Control and, in that case, a brief description of the transaction or transactions constituting such Change of Control. |

If less than all of the Preferred Shares held by any holder are to be redeemed, the notice mailed to such holder shall also specify the number of Preferred Shares held by such holder to be redeemed. No failure to give such notice or any defect thereto or in the mailing thereof shall affect the validity of the proceedings for the redemption of any Preferred Shares except as to the holder to whom notice was defective or not given.

Holders of the Preferred Shares to be redeemed shall surrender the Preferred Shares at the place designated in the notice of redemption and shall be entitled to the redemption price and any accumulated and unpaid dividends payable upon the redemption following the surrender. If notice of redemption of any Preferred Shares has been given and if the Company has irrevocably set apart the funds necessary for redemption in trust for the benefit of the holders of the Preferred Shares so called for redemption, then from and after the redemption date (unless default shall be made by us in providing for the payment of the redemption price plus accumulated and unpaid dividends, if any), dividends will cease to accrue on those Preferred Shares, those Preferred Shares shall no longer be deemed outstanding and all rights of the holders of those shares will terminate, except the right to receive the redemption price plus accumulated and unpaid dividends, if any, payable upon redemption. If any redemption date is not a Business Day, then the redemption price and accumulated and unpaid dividends, if any, payable upon redemption may be paid on the next Business Day and no interest, additional dividends or other sums will accrue on the amount payable for the period from and after that redemption date to that next business day. If less than all of the outstanding Preferred Shares are to be redeemed, the Preferred Shares to be redeemed shall be selected pro rata (as nearly as may be practicable without creating fractional shares) or by any other equitable method the Company determines that will not result in the automatic transfer of any Preferred Shares to a charitable trust pursuant to the ownership and transfer restrictions contained in the constating documents.

15

In connection with any redemption of Preferred Shares, the Company shall pay, in cash, any accumulated and unpaid dividends to, but not including, the redemption date, unless a redemption date falls after a dividend record date and prior to the corresponding dividend payment date, in which case each holder of Preferred Shares at the close of business on such dividend record date shall be entitled to the dividend payable on such shares on the corresponding dividend payment date notwithstanding the redemption of such shares before such dividend payment date. Except as provided above, the Company will make no payment or allowance for unpaid dividends, whether or not in arrears, on Preferred Shares to be redeemed.

No Preferred Shares shall be redeemed unless full cumulative dividends on all Preferred Shares have been or contemporaneously are declared and paid or declared and a sum sufficient for the payment thereof has been or contemporaneously is set apart for payment for all past dividend periods unless all outstanding Preferred Shares are simultaneously redeemed. The Company shall not otherwise purchase or acquire directly or indirectly any Preferred Shares (except by exchanging it for shares ranking junior to the Preferred Shares as to the payment of dividends and distribution of assets upon liquidation, dissolution or winding up); provided, however, that the foregoing shall not prevent the purchase by the Company of shares transferred to a charitable trust pursuant to the ownership and transfer restrictions contained in the Company’s constating documents or the purchase or acquisition by the Company of Preferred Shares pursuant to a purchase or exchange offer made on the same terms to holders of all outstanding Preferred Shares.

Subject to applicable law, the Company may purchase Preferred Shares in the open market, by tender or by private agreement. Any Preferred Shares that have been redeemed or otherwise acquired by the Company, will, after such redemption or acquisition, be cancelled.

Voting Rights

Holders of the Preferred Shares do not have any voting rights, except as expressly provided for in the Canada Business Corporations Act (the “CBCA”) and as set forth below.

So long as any Preferred Shares remain outstanding, the Company will not, without the vote or consent of the holders of at least two-thirds of the votes entitled to be cast by the holders of the Preferred Shares outstanding at the time, given in person or by proxy, either in writing or at a meeting (voting together as a class with all other classes or series of parity preferred shares that may be issued upon which like voting rights have been conferred and are exercisable), create a new class or series of preferred shares ranking ahead of the Preferred Shares with respect to dividends or capital.

The foregoing voting provisions will not apply if, at or prior to the time when the act with respect to which such vote would otherwise be required shall be effected, all outstanding Preferred Shares shall have been redeemed or called for redemption upon proper notice and sufficient funds shall have been deposited in trust to effect such redemption.

Except as expressly stated in the constating documents, the Preferred Shares do not have any relative, participating, optional or other special voting rights or powers and the consent of the holders thereof shall not be required for the taking of any corporate action.

No Conversion Rights

The Preferred Shares are not convertible into Common Shares or any other security.

No Pre-emptive Rights

No holders of the Preferred Shares will, as holders of Preferred Shares, have any pre-emptive rights to purchase or subscribe for Common Shares or any other security.

Change of Control

Provisions in the constating documents, including the articles of amendment creating the Preferred Shares may make it difficult and expensive for a third party to pursue a tender offer, change in control or takeover attempt, which is opposed by management and the Board of Directors.

16

Book-Entry Procedures

DTC acts as securities depository for the Preferred Shares. With respect to the Preferred Shares offered hereunder, the Company will issue one or more fully registered global securities certificates in the name of DTC’s nominee, Cede & Co. These certificates will represent the total aggregate number of Preferred Shares. The Company will deposit these certificates with DTC or a custodian appointed by DTC. The Company will not issue certificates to you for the Preferred Shares that are purchased, unless DTC’s services are discontinued as described below.

Title to book-entry interests in the Preferred Shares will pass by book-entry registration of the transfer within the records of DTC in accordance with its procedures. Book-entry interests in the securities may be transferred within DTC in accordance with procedures established for these purposes by DTC. Each person owning a beneficial interest in Preferred Shares must rely on the procedures of DTC and the participant through which such person owns its interest to exercise its rights as a holder of the Preferred Shares.

DTC has advised us that it is a limited-purpose trust company organized under the New York Banking Law, a member of the Federal Reserve System, a “clearing corporation” within the meaning of the New York Uniform Commercial Code and a “clearing agency” registered under the provisions of Section 17A of the Exchange Act. DTC holds securities that its participants (“Direct Participants”) deposit with DTC. DTC also facilitates the settlement among Direct Participants of securities transactions, such as transfers and pledges in deposited securities through electronic computerized book-entry changes in Direct Participants’ accounts, thereby eliminating the need for physical movement of securities certificates. Direct Participants include securities brokers and dealers, banks, trust companies, clearing corporations, and certain other organizations. Access to the DTC system is also available to others such as securities brokers and dealers, including the underwriters, banks and trust companies that clear through or maintain a custodial relationship with a Direct Participant, either directly or indirectly (“Indirect Participants”). The rules applicable to DTC and its Direct and Indirect Participants are on file with the SEC.

When Preferred Shares are purchased within the DTC system, the purchase must be by or through a Direct Participant. The Direct Participant will receive a credit for the Preferred Shares on DTC’s records. You will be considered to be the “beneficial owner” of the Preferred Shares. Your beneficial ownership interest will be recorded on the Direct Participants’ and Indirect Participants’ records, but DTC will have no knowledge of your individual ownership. DTC’s records reflect only the identity of the Direct Participants to whose accounts Preferred Shares are credited.

Purchasers will not receive written confirmation from DTC of a purchase. The Direct Participants or Indirect Participants through whom Preferred Shares are purchased should send written confirmations providing details of the purchasers, as well as periodic statements of your holdings. The Direct Participants and Indirect Participants are responsible for keeping an accurate account of the holdings of their customers like you.

Transfers of ownership interests held through Direct Participants and Indirect Participants will be accomplished by entries on the books of Direct and Indirect Participants acting on behalf of the beneficial owners.

Conveyance of notices and other communications by DTC to Direct Participants, by Direct Participants to Indirect Participants, and by Direct Participants and Indirect Participants to beneficial owners will be governed by arrangements among them, subject to any statutory or regulatory requirements as may be in effect from time to time.

The Company understands that, under DTC’s existing practices, in the event that the Company requests any action of the holders, or an owner of a beneficial interest in a global security, such as a purchaser, desires to take any action that a holder is entitled to take under the constating documents (including the articles of amendment creating the Preferred Shares), DTC would authorize the Direct Participants holding the relevant shares to take such action, and those Direct Participants and any Indirect Participants would authorize beneficial owners owning through those Direct and Indirect Participants to take such action or would otherwise act upon the instructions of beneficial owners owning through them.