Filed Pursuant to Rule 433 of the Securities Act of 1933 Issuer Free Writing Prospectus dated November 10, 2021 Registration No. 333-260070 From Volume to Value Skylight is changing how U.S. healthcare works SLHG: Nasdaq SLHG.V: TSXV Q3 2021

Issuer Free Writing Prospectus, Cautionary Statement Concerning Forward Looking Statements Filed pursuant to Rule 433 of the Securities Act of 1933, as amended. This free writing prospectus related to the public offering of Series A Preferred Stock of Skylight Health Group, Inc. (the “Company,” “we,” “our” or “us), which are being registered on a registration statement on Form F‐10 (File No. 333‐260070) (the “Registration Statement”). Before you invest, you should read the prospectus in the Registration Statement (including the risk factors described therein) and other documents the Company has filed with the United States Securities and Exchange Commission (“SEC”) for more complete information about the Company and the proposed offering. Certain information included in this document contains forward‐looking statements concerning the Company. These include, among others, statements with respect to the company's goals, objectives and the strategies to achieve these. The words “may”, “will”, “could”, “should”, “suspect”, “outlook” “anticipate”, “forecast”, “objective”, and words similar are intended to identify forward‐looking statements. By their nature, forward‐looking statements involve inherent risks and uncertainties, both general and specific, which give rise to the possibility that forecasts, projections and other forward‐looking statements will not be achieved. Certain assumptions are applied, and actual results may differ materially. The Company cautions readers not to place undue reliance on these statements, as a number of important factor, many of which are beyond the Company’s control, could cause actual results to differ materially. Not‐market‐specific factors include but are not limited to risks relating to general business, economic, competitive, political, regulatory and social uncertainties. The foregoing list of factors that may affect future results is not exhaustive. When reviewing the Company’s forward‐looking statements, readers should carefully consider the foregoing factors and other uncertainties and potential events. This document contains future‐oriented financial information and financial outlook information (collectively, “FOFI”) about the Company’s prospective results of operations, sales, revenues, funds flow, and components thereof, all of which are subject to the same assumptions, risk factors, limitations, and qualifications as set forth in the above paragraphs. FOFI contained in this document was made as of the date of this document and was provided for the purpose of providing further information about the Company’s future business operations. The Company disclaims any intention or obligation to update or revise any forward‐looking statements or FOFI contained in document, whether as a result of new information, future events or otherwise, unless required pursuant to applicable law. Readers are cautioned that the forward‐looking statements or FOFI contained in this document should not be used for purposes other than for which it is disclosed herein. This presentation shall not constitute an offer to sell, or the solicitation of an offer to buy, or will there be any sale of the Company’s securities in any state or other jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of such state or jurisdiction. The offering may only be made by means of a prospectus pursuant to a registration statement that is filed with the SEC after such registration become effective. Neither the SEC nor any other regulatory body has passed upon the adequacy or accuracy of this free writing prospectus. Any representation to the contrary is a criminal offense. All currencies unless otherwise mentioned are in $CAD. Investor Presentation Copyright © Skylight Health Group 2021 2

Terms of the Offering Issuer: Skylight Health Group Inc. Tickers: SLHG – NASDAQ / SLHG.V‐ TSXV Security Offered: 9.25% Series A Cumulative Redeemable Perpetual Preferred Stock Anticipated Nasdaq Symbol: SLHGP Annual Dividend Amount: $2.3125 th Dividend Payment Amount/Date: Monthly in the amount of $.1927 payable on or about the 20 of each month Liquidation Preference: $25.00 Maturity/Mandatory Redemption: None Optional Redemption: At the Company’s option any time on or after ________, 2024 Evaluating and completing possible acquisitions of clinical and medical services businesses, establishing primary care Use of Proceeds: and sub‐specialty services within existing facilities including HR and capacity development and working capital. Sole Bookrunning Manager: The Benchmark Company Lead Manager: Aegis Capital Corp Investor Presentation Copyright © Skylight Health Group 2021 3

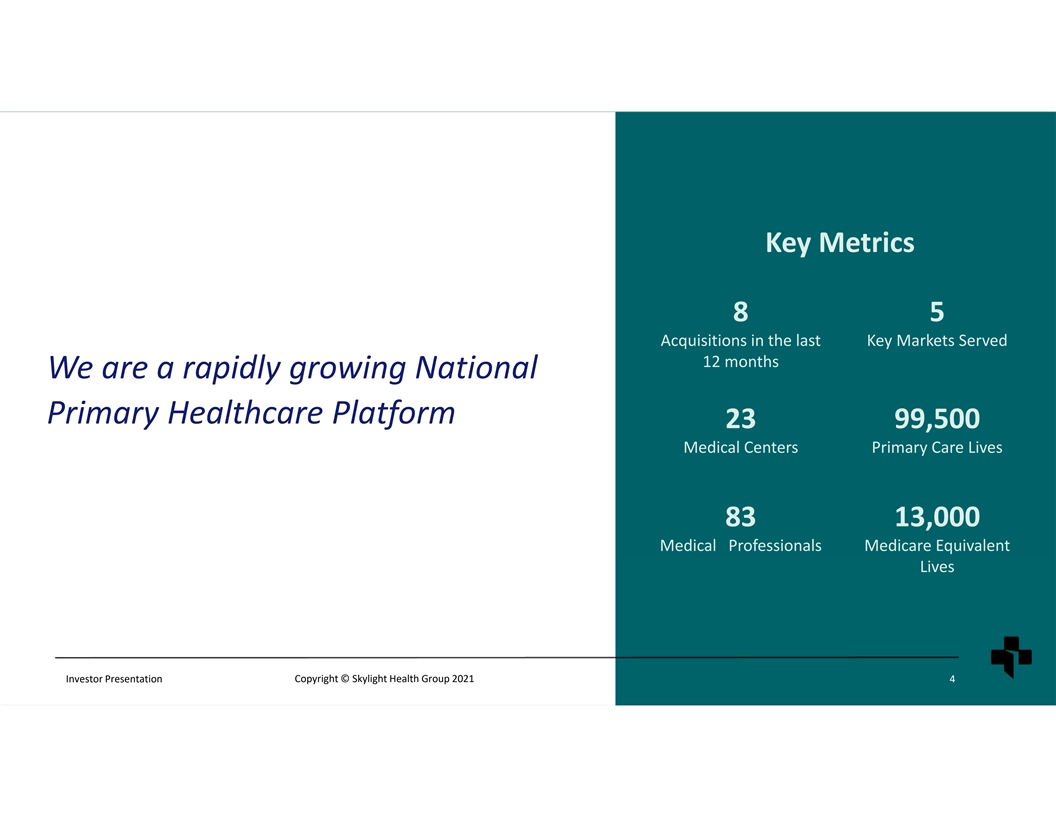

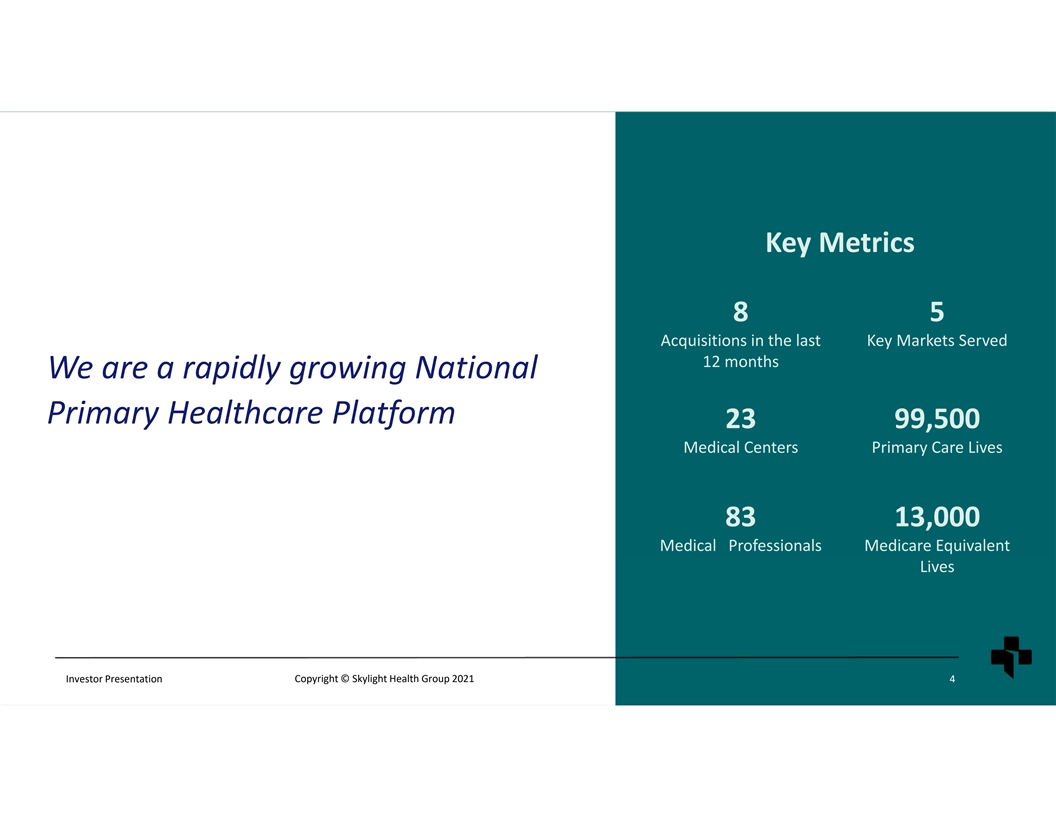

Key Metrics 8 5 Acquisitions in the last Key Markets Served 12 months We are a rapidly growing National Primary Healthcare Platform 23 99,500 Medical Centers Primary Care Lives 83 13,000 Medical Professionals Medicare Equivalent Lives Investor Presentation Copyright © Skylight Health Group 2021 4

Skylight is Focused on Two Fundamental Models of Growth Participation in Value‐Based Care Growth by Acquisition Reimbursement Progression from Fee‐For‐Service (FFS) to Value Based Care Focus on small to independent primary care practices (VBC) (PCP) in new and existing markets Focused on the Medicare population and future equivalent Motivated sellers + highly fragmented market with > programs 40% PCP’s independent Allows Skylight to recognize reimbursement from payors of up to Strong driver of quarter over quarter growth with $10K ‐ $12K per patient per year established revenue, EBITDA & patient base Goal of >100K VBC patients in the next 3‐5 years Attractively priced at 3‐7x EBITDA Current reimbursement of $200‐$400 per patient per year Investor Presentation Copyright © Skylight Health Group 2021 5

Investment Highlights • Strong growth both organically and through acquisition in the United States • 8 acquisitions successfully completed in the last 12 months contributing more than $35 million in annualized revenue growth • Strong history of accretive acquisitions in a fragmented marketplace with attractive multiples of 3x‐7x times EBITDA • 2021 guidance of $41 million with a robust pipeline of acquisition targets under review • Experienced leadership and executive team in primary and value‐based care • Attractive valuation trading at 3x 2021E EV/Revenue with average peers at 10x 2021E EV/Revenue • $3 trillion dollar U.S. healthcare industry opportunity ripe for disruption Investor Presentation Copyright © Skylight Health Group 2021 6

Primary Care is a Fast‐Growing Focus for Payors and the Government • Primary Care market represents over $290 billion or approximately 20‐25% of the total Healthcare Spend today • Primary Care Directly Influences more than $2 trillion of Downstream Healthcare Spend • Increasing costs in healthcare will drive further capital to Primary Care • Primary Care functions as the gatekeeper of all healthcare services and costs • Primary Care practices will need to change as the market transitions from fee‐for‐service to value‐based care • Over 32% of all specialties are in Primary Care and nearly 40% or more of all Primary Care operates Independently à highly fragmented Investor Presentation Copyright © Skylight Health Group 2021 7

The Future of Primary Care is at Risk FFS providers face the ultimate roadblocks to independent practice forcing them into consolidation Increased Shrinking Increased Network Lack of New Shift to Value is Administration Fee‐For‐Service Competition Physician Owners Costly & Time and Costs Rates Consuming The market for fee‐for‐service practices is large, but quality buyers are limited Investor Presentation Copyright © Skylight Health Group 2021 8

Skylight is a White Knight Solution for Primary Care Practices By partnering with Skylight Focus on higher acuity services Health Systems & Health, independent PCPs Value up‐front but limited growth post Networks across the U.S. alleviate major challenges they face by joining a national platform that can provide them access to Value tied up in a private model Private Equity & Typically, a Non‐Operating partner capital, technology, improved Backed Buyers contracting and participation in value‐based care programs Operating partner with MSO capabilities Skylight is a True 4P’s of alignment Operating Partner Investor Presentation Copyright © Skylight Health Group 2021 9

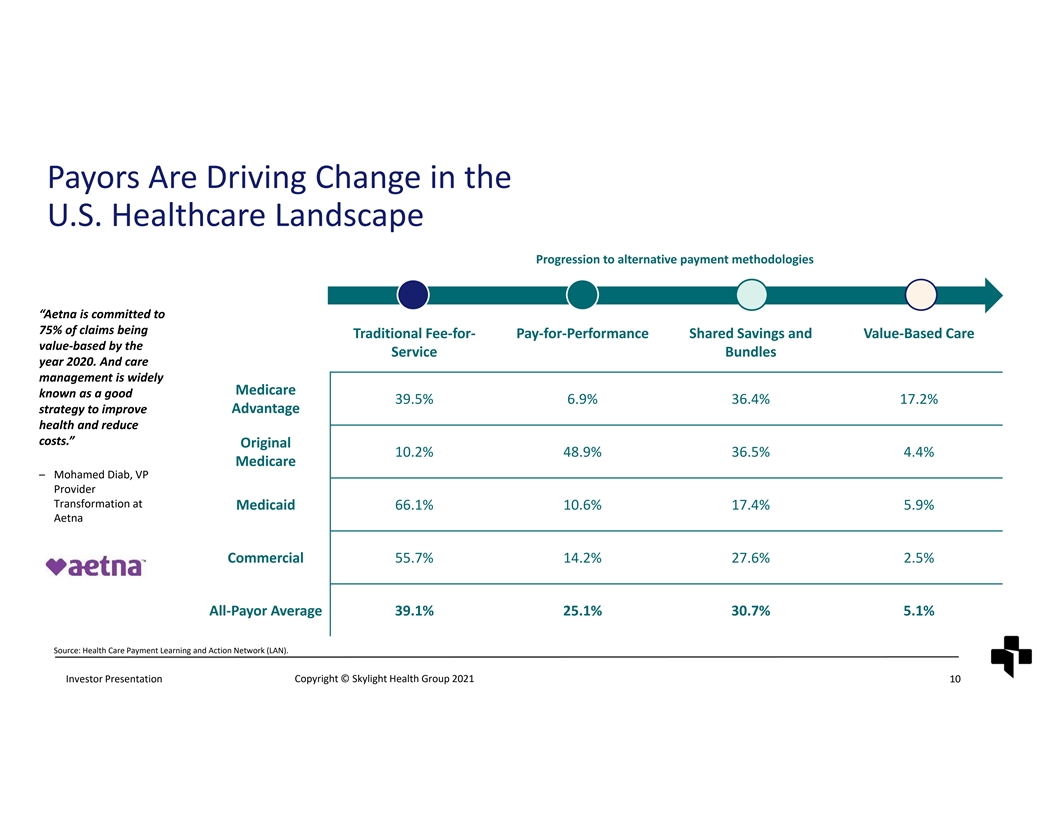

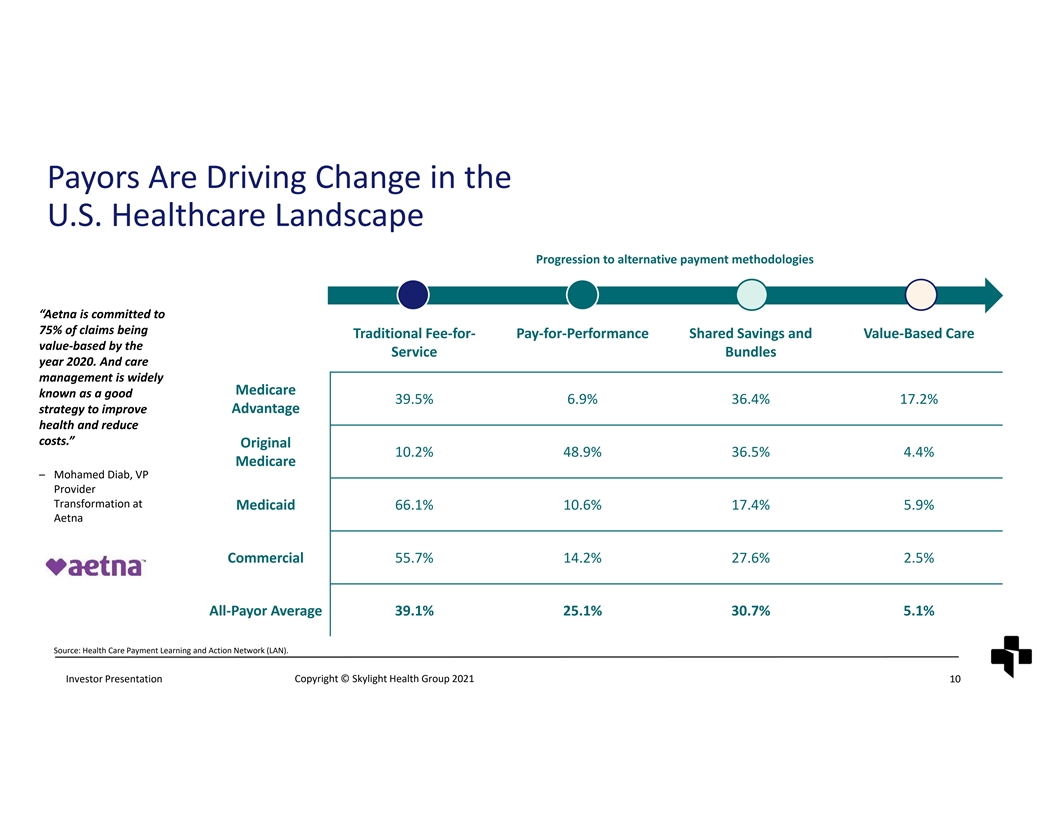

Payors Are Driving Change in the U.S. Healthcare Landscape Progression to alternative payment methodologies “Aetna is committed to 75% of claims being ` Traditional Fee‐for‐ Pay‐for‐Performance Shared Savings and Value‐Based Care value‐based by the Service Bundles year 2020. And care management is widely Medicare known as a good 39.5% 6.9% 36.4% 17.2% strategy to improve Advantage health and reduce costs.” Original 10.2% 48.9% 36.5% 4.4% Medicare – Mohamed Diab, VP Provider Transformation at Medicaid 66.1% 10.6% 17.4% 5.9% Aetna Commercial 55.7% 14.2% 27.6% 2.5% All‐Payor Average 39.1% 25.1% 30.7% 5.1% Source: Health Care Payment Learning and Action Network (LAN). Investor Presentation Copyright © Skylight Health Group 2021 10

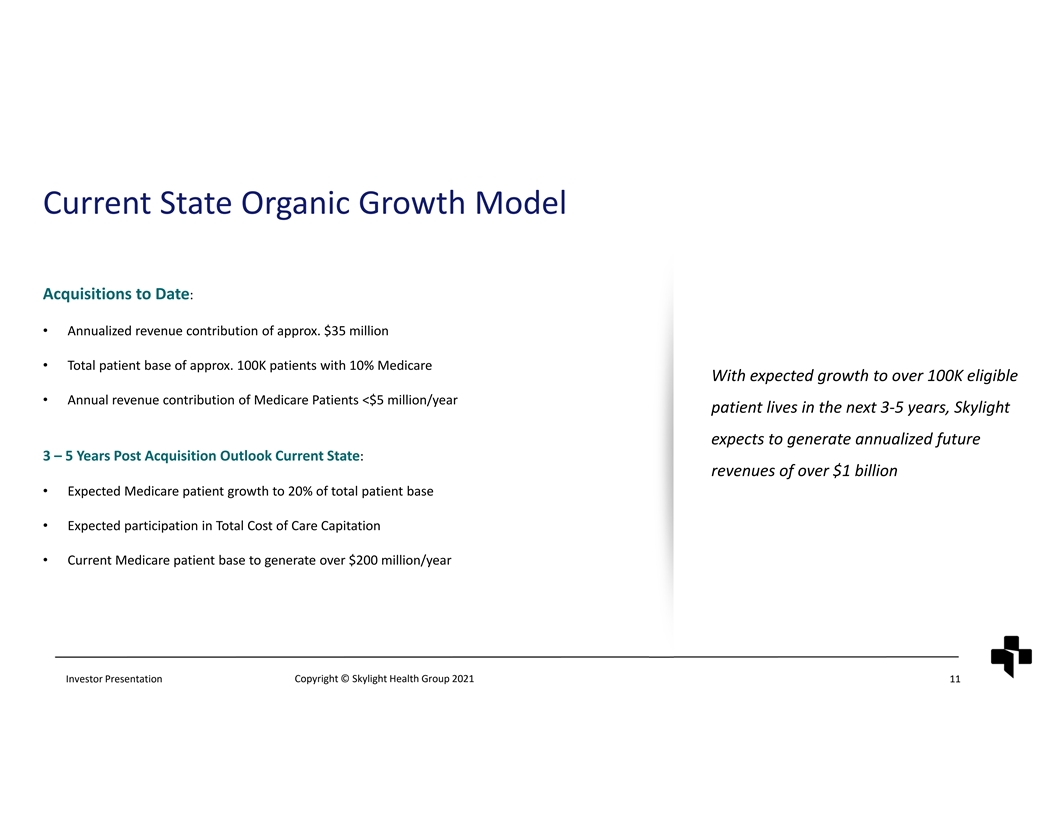

Current State Organic Growth Model Acquisitions to Date: • Annualized revenue contribution of approx. $35 million • Total patient base of approx. 100K patients with 10% Medicare With expected growth to over 100K eligible • Annual revenue contribution of Medicare Patients <$5 million/year patient lives in the next 3‐5 years, Skylight expects to generate annualized future 3 – 5 Years Post Acquisition Outlook Current State: revenues of over $1 billion • Expected Medicare patient growth to 20% of total patient base • Expected participation in Total Cost of Care Capitation • Current Medicare patient base to generate over $200 million/year Investor Presentation Copyright © Skylight Health Group 2021 11

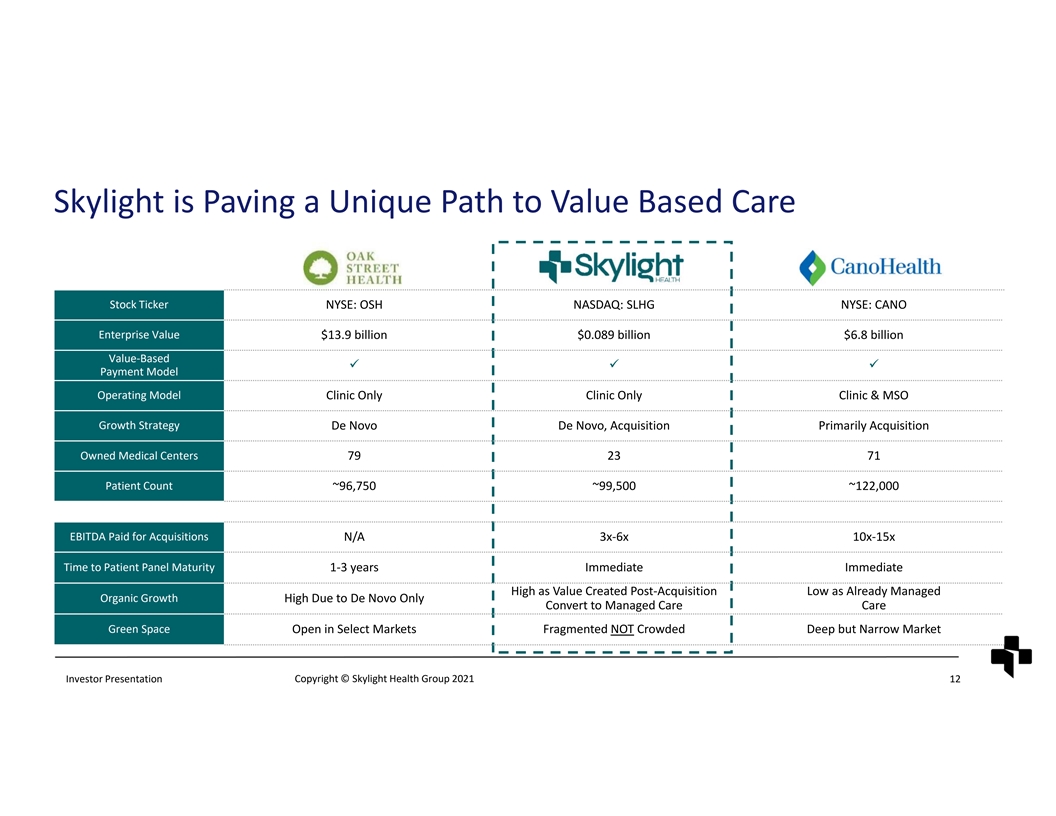

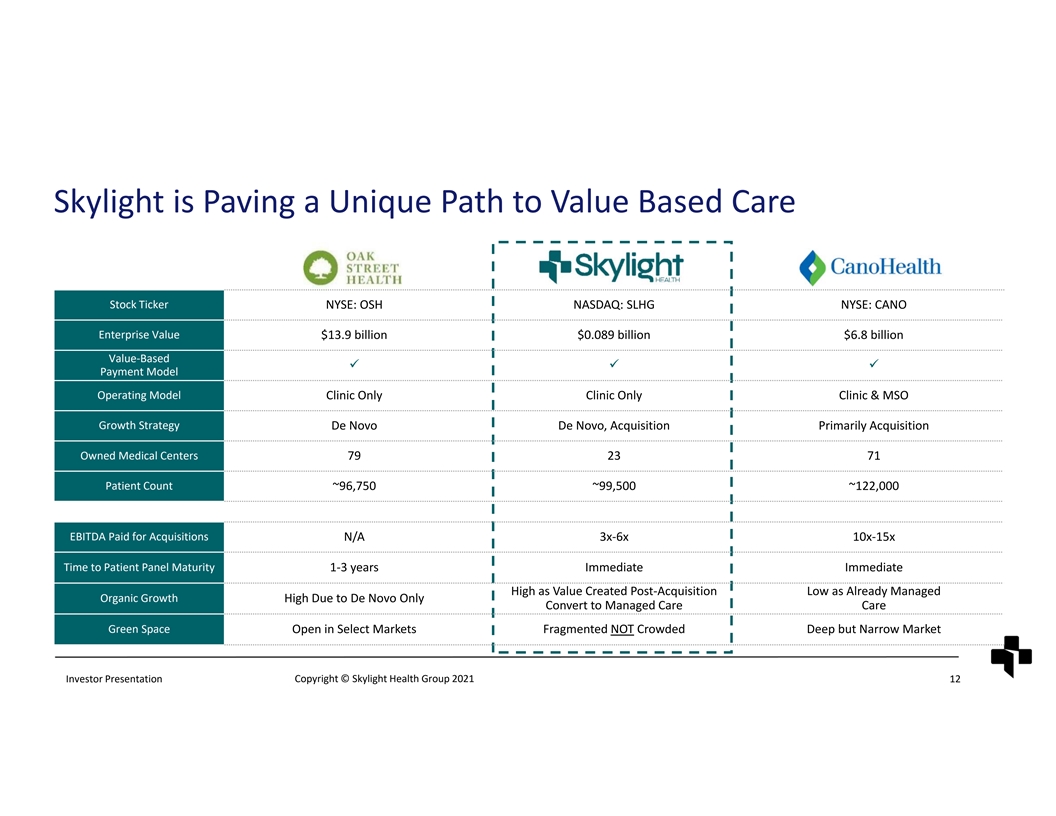

Skylight is Paving a Unique Path to Value Based Care Stock Ticker NYSE: OSH NASDAQ: SLHG NYSE: CANO Enterprise Value $13.9 billion $0.089 billion $6.8 billion Value‐Based üü ü Payment Model Operating Model Clinic Only Clinic Only Clinic & MSO Growth Strategy De Novo De Novo, Acquisition Primarily Acquisition Owned Medical Centers 79 23 71 Patient Count ~96,750 ~99,500 ~122,000 EBITDA Paid for Acquisitions N/A 3x‐6x 10x‐15x Time to Patient Panel Maturity 1‐3 years Immediate Immediate High as Value Created Post‐Acquisition Low as Already Managed Organic Growth High Due to De Novo Only Convert to Managed Care Care Green Space Open in Select Markets Fragmented NOT Crowded Deep but Narrow Market Investor Presentation Copyright © Skylight Health Group 2021 12

Our Leadership is Rich with Industry Experience Board of Directors Executive Team Pradyum Sekar, CEO & Co‐Founder Patrick McNamee, Chairman of the Board More than 15 years experience in Canadian Healthcare in technology, practice Deep‐rooted healthcare executive including as former COO of Express Scripts where he led management and large multi‐disciplinary health centers. organic and M&A revenue growth from $3B to $120B and former CEO at Health Insurance Innovations. Mohammad Bataineh, President More than 20 years experience in strategic M&A activity and legal oversight for small, mid‐ Grace Mellis, Independent Director sized and large healthcare corporations. Decade‐long career at JP Morgan Chase as MD and Head of Int’l Strategy and deep financial and capital markets experience including as CFO of NASDAQ‐listed Greendot Corp (U.S. $3.1B market capitalization). Kash Qureshi, CCO & Co‐Founder More than 20 years experience in Canadian Healthcare in technology, wellness Peter Cummins, Independent Director development, practice management and commercial banking. Former Johnson & Johnson Executive with leadership roles in research & development, innovation and regulatory affairs globally. Andrew Elinesky, Chief Financial Officer More than 20 years of experience as CFO and in senior leadership roles with public Norton Singhavon, Independent Director companies in both the US and Canada. Former founder and partner of Doventi Capital with extensive experience in capital markets, M&A activity and consolidation. Dr. Kit Brekhus, Chief Medical Officer More than 25 years of clinical experience Developed a health network with more than Tom Brogan, Independent Director 250,000 value based care lives. Former founder of Brogan Consulting – now IQVIA (NYSE:IQV) – now a $11B global healthcare technology and research firm. Investor Presentation Copyright © Skylight Health Group 2021 13

Financial Snapshot EQUITY RESEARCH COVERAGE Market Cap (in MM) $91.5 Northland Capital Price Target USD $9.00 Enterprise Value (in MM) $86.9 Lake Street Capital Price Target USD $8.00 52 Week High/Low $7.54 / $2.00 Echelon Capital Markets Price Target $8.00 Current Share Price (10/12/2021) $2.50 Raymond James Price Target $7.00 Basic Shares Outstanding (in MM) 38.8 Beacon Securities Price Target $7.00 Research Capital Corporation Price Target $4.80 1 Year Stock Chart OWNERSHIP SUMMARY 2% Institutions 11% Individuals/Insiders 13% PE/VC Firms 74% Public and Other 14 Investor Presentation Copyright © Skylight Health Group 2021

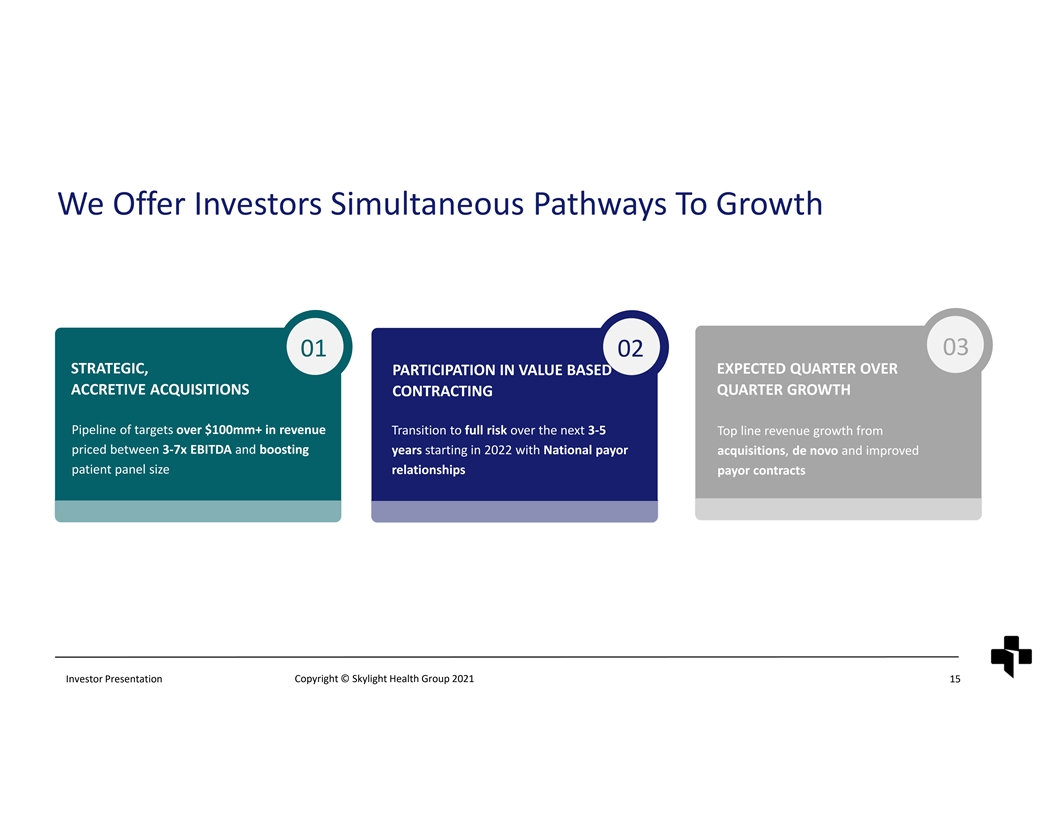

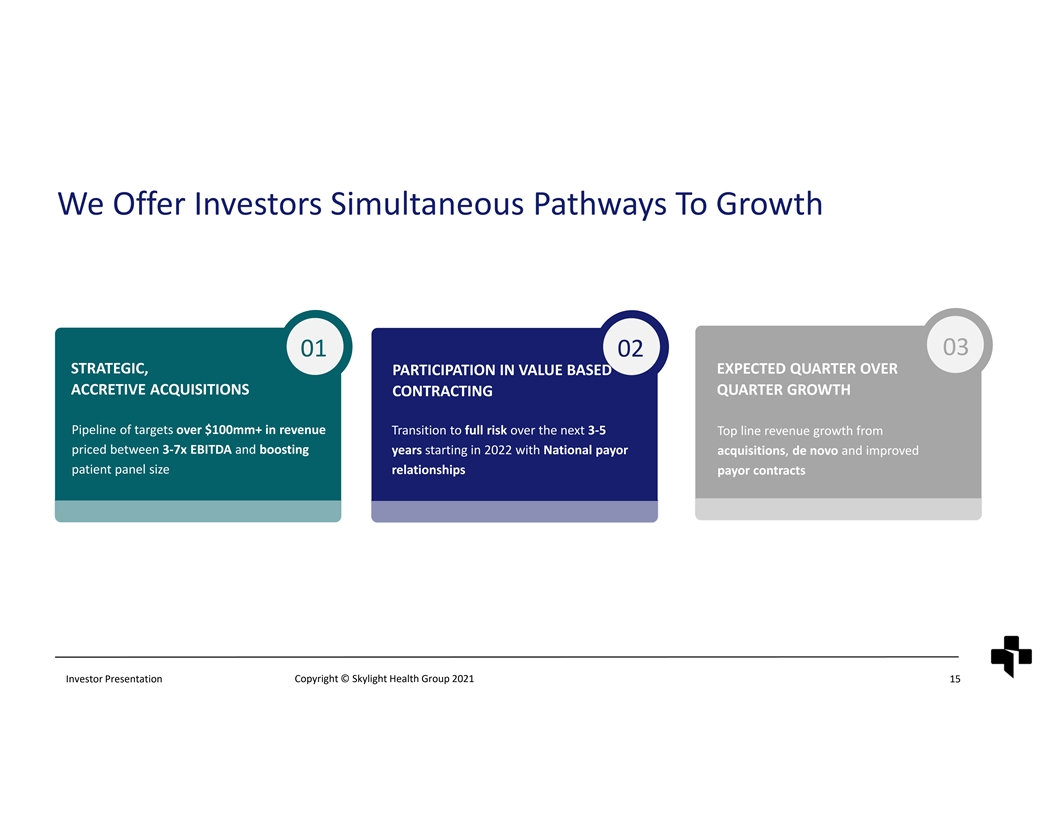

We Offer Investors Simultaneous Pathways To Growth 03 01 02 STRATEGIC, EXPECTED QUARTER OVER PARTICIPATION IN VALUE BASED ACCRETIVE ACQUISITIONS QUARTER GROWTH CONTRACTING Pipeline of targets over $100mm+ in revenue Transition to full risk over the next 3‐5 Top line revenue growth from priced between 3‐7x EBITDA and boosting years starting in 2022 with National payor acquisitions, de novo and improved patient panel size relationships payor contracts Investor Presentation Copyright © Skylight Health Group 2021 15

Thank You Email: investors@skylighthealthgroup.com Website: www.skylighthealthgroup.com @SkylightGroupIR @SkylightHealthGroup SLHG: Nasdaq SLHG.V: TSXV Q3 2021

Appendix SLHG: Nasdaq SLHG.V: TSXV Q3 2021

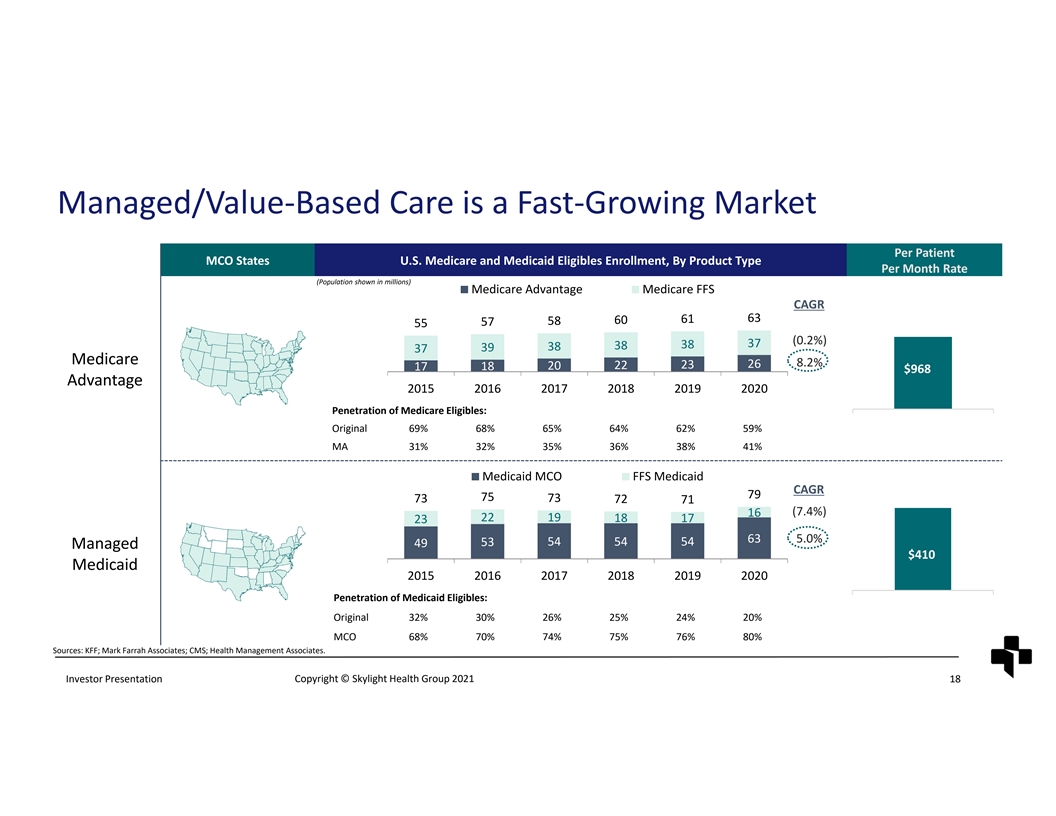

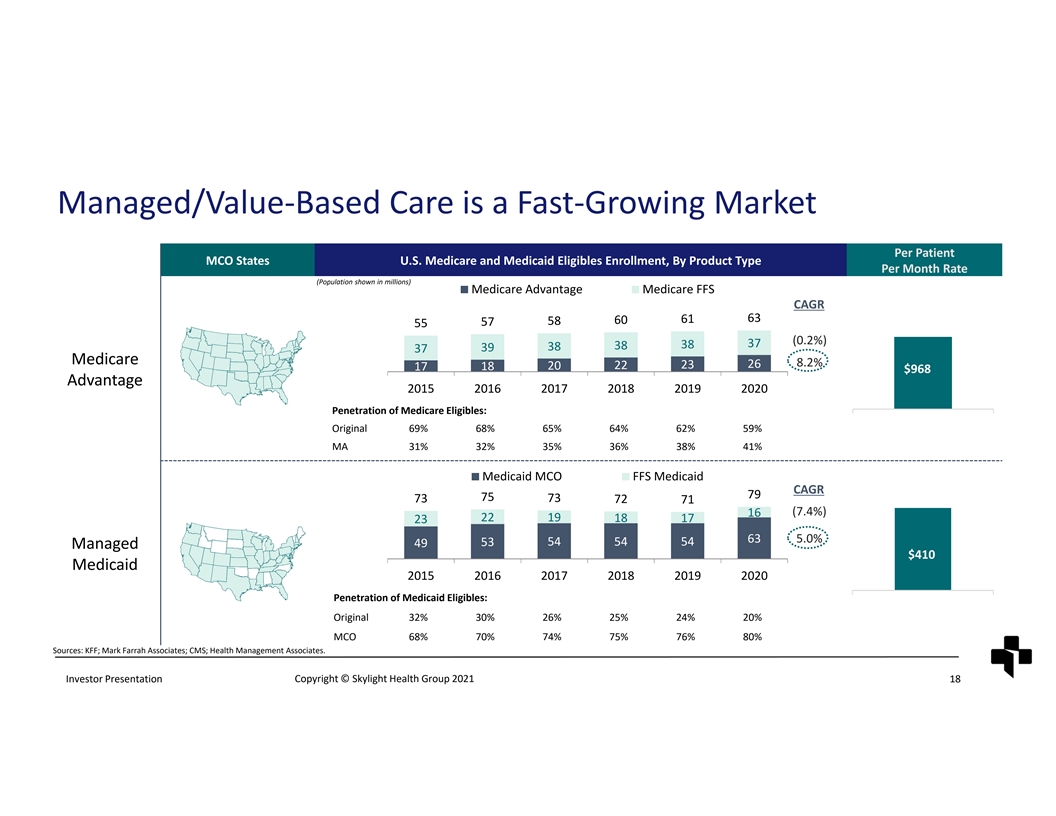

Managed/Value‐Based Care is a Fast‐Growing Market Per Patient MCO States U.S. Medicare and Medicaid Eligibles Enrollment, By Product Type Per Month Rate (Population shown in millions) Medicare Advantage Medicare FFS CAGR 61 63 60 58 57 55 (0.2%) 37 38 38 38 39 37 Medicare 8.2% 26 20 22 23 17 18 $968 Advantage 2015 2016 2017 2018 2019 2020 Penetration of Medicare Eligibles: Category 1 Original 69% 68% 65% 64% 62% 59% MA 31% 32% 35% 36% 38% 41% Medicaid MCO FFS Medicaid CAGR 79 75 73 73 72 71 (7.4%) 16 22 19 18 17 23 63 5.0% 54 54 54 53 49 Managed $410 Medicaid 2015 2016 2017 2018 2019 2020 Penetration of Medicaid Eligibles: Category 1 Original 32% 30% 26% 25% 24% 20% MCO 68% 70% 74% 75% 76% 80% Sources: KFF; Mark Farrah Associates; CMS; Health Management Associates. Investor Presentation Copyright © Skylight Health Group 2021 18

Manage & Measure: Proprietary Population Health & Informatics Platform Data Ingestion Actionable Insights Centralized Electronic Medical Record Leveraged by Clinical & Operations, insights generated from our population health tools enable the advanced capabilities to track quality and cost Centralized RCM measures that drive success in VBC contracts and programs as well as Proprietary establish confidence in participating in Data total cost of care and full risk models Integration Operational & Clinical Platform Financial Systems Investor Presentation Copyright © Skylight Health Group 2021 19

Common Challenges to Transitioning to VBC FFS providers face the ultimate roadblocks to Convert to enable risk sharing and capitation‐based payment models Documentation Confidence in Resource Strength in Can’t Manage what Drives Accountability Constrained Numbers you can’t Measure Treatment Challenges faced create the greatest opportunity for Skylight Health Investor Presentation Copyright © Skylight Health Group 2021 20

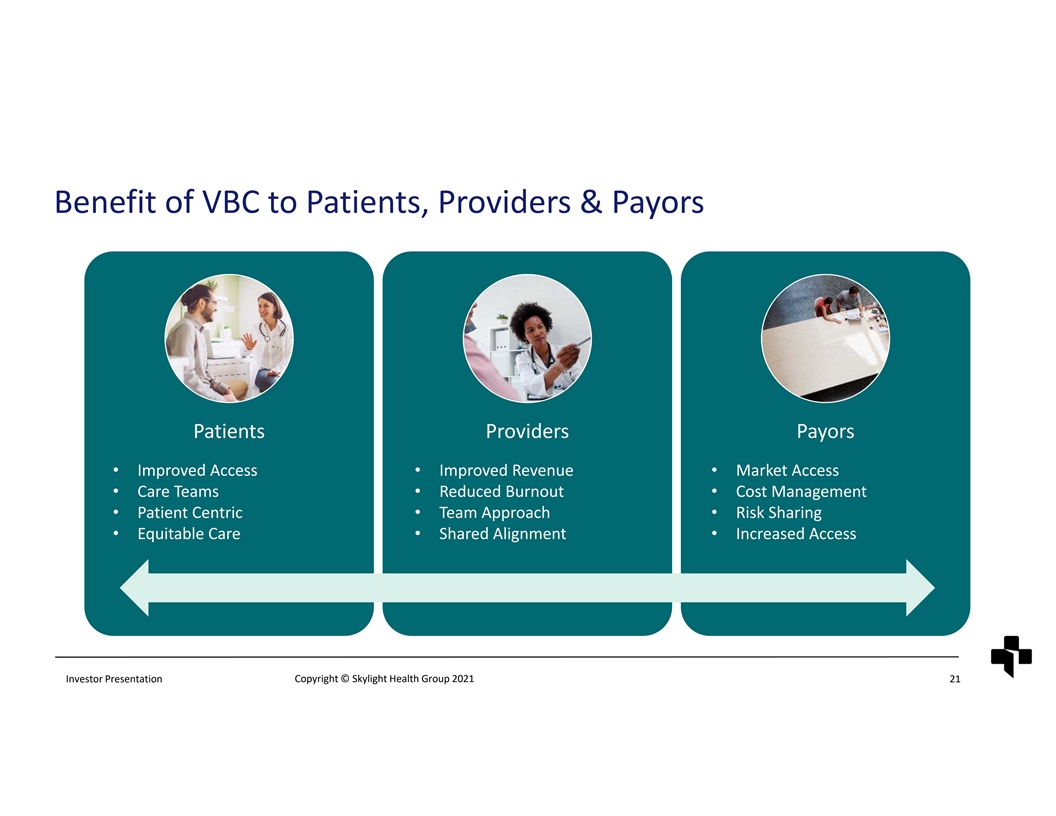

Benefit of VBC to Patients, Providers & Payors Patients Providers Payors • Improved Access • Improved Revenue• Market Access • Care Teams• Reduced Burnout• Cost Management • Patient Centric• Team Approach• Risk Sharing • Equitable Care• Shared Alignment• Increased Access Investor Presentation Copyright © Skylight Health Group 2021 21

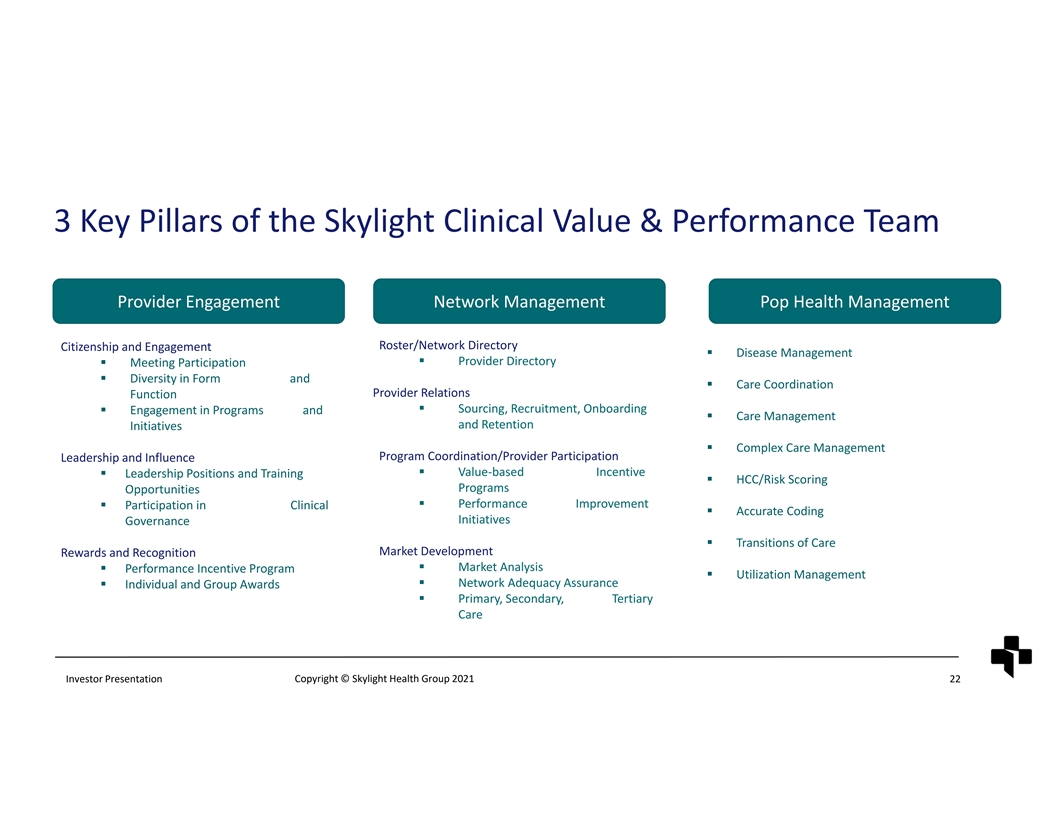

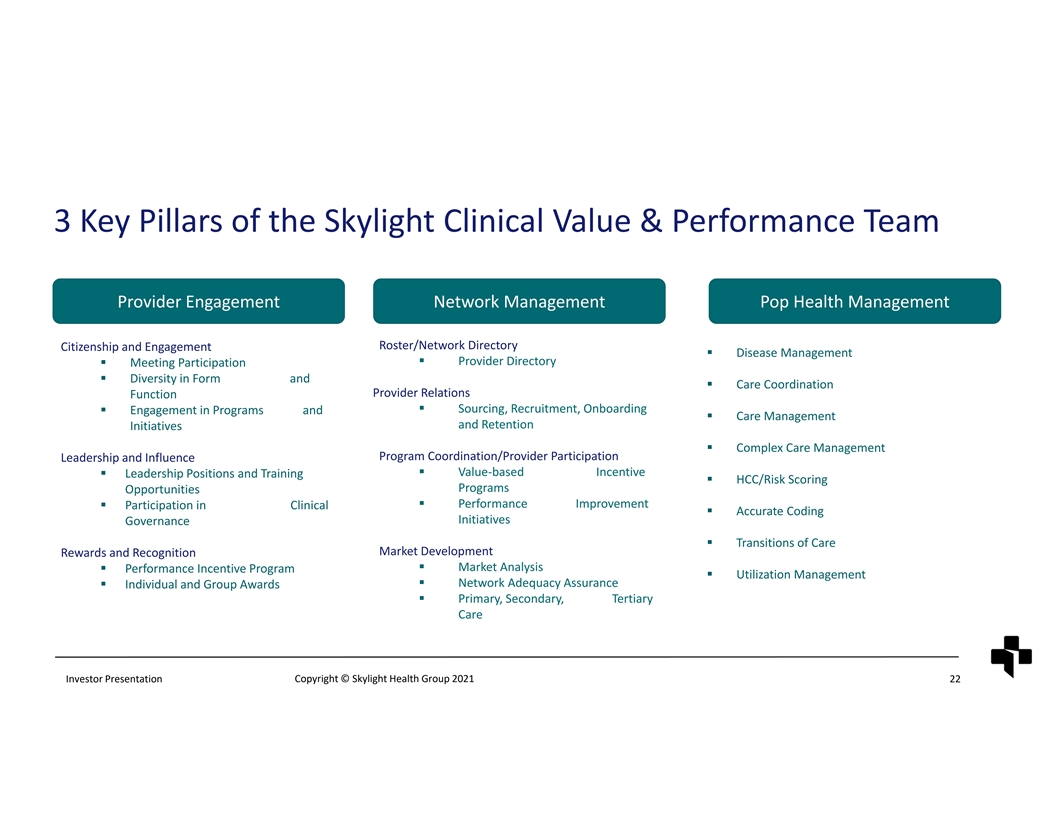

3 Key Pillars of the Skylight Clinical Value & Performance Team Provider Engagement Network Management Pop Health Management Roster/Network Directory Citizenship and Engagement § Disease Management § Provider Directory § Meeting Participation § Diversity in Form and § Care Coordination Provider Relations Function § Sourcing, Recruitment, Onboarding § Engagement in Programs and § Care Management and Retention Initiatives § Complex Care Management Program Coordination/Provider Participation Leadership and Influence § Value‐based Incentive § Leadership Positions and Training § HCC/Risk Scoring Programs Opportunities § Performance Improvement § Participation in Clinical § Accurate Coding Initiatives Governance § Transitions of Care Market Development Rewards and Recognition § Market Analysis § Performance Incentive Program § Utilization Management § Network Adequacy Assurance § Individual and Group Awards § Primary, Secondary, Tertiary Care Investor Presentation Copyright © Skylight Health Group 2021 22