MANAGEMENT’S DISCUSSION AND ANALYSIS (Restated)

For the three and nine months ended September 30, 2021

(Expressed in Canadian Dollars, unless otherwise stated)

March 30, 2022

| | |

Skylight Health Group Inc. (formerly CB2 Insights Inc.) Management Discussion and Analysis For the three and nine months ended September 30, 2021 |

Introduction

The following management’s discussion and analysis (“MD&A”) of the financial condition and results of the operations of Skylight Health Group Inc. (the “Company”, “SHG”, “we”, “us”, “our”) constitutes management’s review of the factors that affected the Company’s financial and operating performance for the three and nine months ended September 30, 2021. This MD&A was written to comply with the requirements of National Instrument 51-102 – Continuous Disclosure Obligations.

This discussion should be read in conjunction with the unaudited condensed interim consolidated financial statements of the Company for the three and nine months ended September 30, 2021, together with the notes thereto. Results are reported in Canadian dollars, unless otherwise noted.

The Company’s consolidated financial statements are prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”). In the opinion of management, all adjustments to arrive at adjusted EBITDA are considered necessary for a fair presentation and are further detailed in the Non-IFRS Measures section. Information contained herein is presented as at November 15, 2021, unless otherwise indicated.

The MD&A makes references to certain non-IFRS measures, including certain industry metrics. These metrics and measures are not recognized measures under IFRS, do not have meanings prescribed under IFRS and are as a result unlikely to be comparable to similar measures presented by other companies. These measures are provided as information complimentary to those IFRS measures by providing a further understanding of our operating results from the perspective of management. As such, these measures should not be considered in isolation or in lieu of review of our financial information reported under IFRS. This MD&A uses non-IFRS measures including “EBITDA” and “adjusted EBITDA”. EBITDA, and adjusted EBITDA are commonly used operating measures in the industry but may be calculated differently compared to other companies in the industry. These non-IFRS measures, including the industry measures, are used to provide investors with supplementary measures of our operating performance that may not otherwise be apparent when relying solely on IFRS metrics.

For the purposes of preparing this MD&A, management, in conjunction with the Board of Directors, considers the materiality of information. Information is considered material if:

(i)such information results in, or would reasonably be expected to result in, a significant change in the market price or value of SHG’s common shares;

(ii)there is a substantial likelihood that a reasonable investor would consider it important in making an investment decision; or

(iii)it would significantly alter the total mix of information available to investors. Management, in conjunction with the Board of Directors, evaluates materiality with reference to all relevant circumstances, including potential market sensitivity.

| | |

Skylight Health Group Inc. (formerly CB2 Insights Inc.) Management Discussion and Analysis For the three and nine months ended September 30, 2021 |

Further information about the Company and its operations can be obtained from the offices of the Company or on SEDAR at www.sedar.com.

Restatement of previously issued condensed interim consolidated financial statements for the correction of an overstatement of trade receivable and revenue

Subsequent to the original issuance of its condensed interim consolidated financial statements, the Company identified errors related to the accounting treatment of certain revenue transactions. The Company overstated revenue and accounts receivable due to not properly recording price concessions as a reduction of revenue. The Company concluded that the impact was material to the Company’s condensed interim consolidated financial statements prepared according to IFRS and have restated the impact of these errors. Refer to note 19 of the restated condensed interim consolidated financial statements as at September 30, 2021.

Company Overview

Skylight Health Group Inc. (“SHG” or the “Company”), is a healthcare services and technology company, working to positively impact patient health outcomes. The Company operates a US multi-state primary care health network comprised of clinics providing a range of services from primary care, sub-specialty, allied health, and laboratory/diagnostic testing. The Company is focused on helping small and independent practices shift from a traditional fee-for-service (FFS) model to value-based care (VBC) through our proprietary technology, unique data analytics and our robust operations infrastructure. In a FFS model, payors (commercial and government insurers) reimburse on an encounter-based approach which puts a focus on volume of patients per day rather than creating positive patient outcomes. In a VBC model, providers are rewarded for keeping patients healthy and lowering unnecessary health costs instead of volume of services. VBC will lead to improved patient outcomes, reduced cost of delivery and drive stronger financial performance from existing practices

As of September 30, 2021, the balance sheet had a cash balance of $5.6 million. The Company has continued to position itself to see rapid organic and acquisition-based growth in the coming quarters as it remains focused on shifting its clinical operations to a VBC model.

The Company was founded in 2014, by founders with extensive experience in clinical practice management in Canada and the US, as owners, operators, and consultants to outpatient medical centers across a variety of specialties from primary care, urgent-care, sub-specialty, and allied health & wellness. SHG is founded on a model designed to drive towards helping small and independent practices adopt value-based capabilities and take on varying levels of risk. SHG positions itself as the disruptor to legacy health networks. Providing an opportunity to consolidate with SHG while maintaining patient treatment quality, accessibility and affordability and preserving the way healthcare should be delivered. SHG also positions itself to partner with health plans as they aim to provide more comprehensive care services to patients across varying risk groups and capitation models to lower the cost of downstream costs.

| | |

Skylight Health Group Inc. (formerly CB2 Insights Inc.) Management Discussion and Analysis For the three and nine months ended September 30, 2021 |

SHG practices offer both in-clinic and virtual care services through telemedicine and remote patient monitoring. As part of developing the infrastructure for improved access within its practices, the Company expects to expand valued-based health service offerings to patients based on quality improvement plans aimed at population and patient health management.

Finally, SHG has a disciplined operating model that allows the Company to deliver desired results in a time-efficient and cost-effective manner to its clients and to run a fiscally responsible business.

Segmentation

The Company’s current revenue is generated predominantly through its medical services segment. In 2019, medical services were categorized as uninsured medical services. In 2020, the Company expanded significantly into insurable services which is where it expects to see its strongest growth in future periods. The Company has reported both insurable and uninsured services in a single consolidated medical services operating segment.

The Company also derives a small segment of revenue from projects in its Technology & Data Analytics division as well as its Contract and Research division (Software and Corporate segment). While both divisions are new, the Company expects growth in these areas as the Company’s offerings and the industry matures moving forward.

Key Highlights

The following are the major highlights of SHG’s operating results for the three and nine months ended September 30, 2021 compared to the three and nine months ended September 30, 2020:

Financial Highlights

•During the quarter, the Company has achieved a major milestone in revenue. Revenues for the quarter were $11.5 million, compared to $3.3 million for 2020, an increase of 248%. This increase was primarily due to additional revenue being contributed by the clinics acquired during the fiscal year ended December 31, 2020 and the nine months ended September 30, 2021, slightly offset by the decrease of revenue in legacy fee for services business, as the Company shifts focus towards value-based care.

•Organic growth of approximately 9% during the quarter driven by improved revenue cycle management, provider access and patient flow acquisition.

•Gross profit was $6.9 million for the quarter, compared to $2.3 million for 2020. Gross margin was 60% for the quarter, compared to 71% for 2020. As the Company has focused on primary care, the majority of the revenue in Q3 2021 is from insurable based services business which tend to have lower margins than the legacy uninsured fee for services business. The Company expects to see future improvement in contracts with payors to improve gross profit margins along with improved optimization and utilization of schedules.

| | |

Skylight Health Group Inc. (formerly CB2 Insights Inc.) Management Discussion and Analysis For the three and nine months ended September 30, 2021 |

•Operating expenses were $11.5 million for the quarter, compared to $2.6 million for 2020, an increase of 348%. The increase was a result of a growth in operating expenses such as staffing and rent from primary care related clinical acquisitions made to date. Loss from operations was $4.6 million for the quarter, compared to $0.2 million for 2020. The decrease is mainly attributed to salary and wage increases related to the recruitment of key leadership, management and operational hires, as well as increased office and administration costs tied towards practice acquisition growth. Increased non-cash expenses of $1.9 million were related to share-based compensation in 2021 and depreciation and amortization, compared to $0.8 million for 2020.

•Adjusted EBITDA for the three months ended September 30, 2021 was a loss of $3.3 million compared to a gain of $0.3 million in 2020. This decrease aligns to the loss from operations mentioned above. In addition, increased office and administration costs and professional fees (legal fees of $0.6 million, accounting fees of $0.3 million, consulting fees and other of $0.1 million during the three months ended September 30, 2021) were incurred as part of acquisition related expenses.

•The Company incurred negative cash-flow from operations for the nine months ended September 30, 2021 of approximately $7.8 million compared to positive cash flow from operation of $1.5 million in 2020 primarily due to higher salaries and wages, marketing and business development costs and professional fees to support future growth.

Operating Highlights

•On July 7, 2021, the Company appointed Dr. Kit Brekhus as Chief Medical Officer (“CMO”), taking over from Dr. Georges Feghali who served as CMO from February 2021.

•On July 13, 2021, the Company acquired 100% of the interest of ACO Partners LLC, a new Accountable Care Organization (“ACO”) that will begin participating in the Medicare Shared Savings Program offered by the Centers for Medicare and Medicaid Services (“CMS”) effective January 1, 2022 for a total cash consideration of $312.9 thousand (US$250.0 thousand). Subsequently, the Company determined it would not receive approval on the ACO application to the CMS by January 31, 2022. The cash paid on closing date of $78.2 thousand (US$62.5 thousand) has been recorded in trade receivable as of September 30, 2021.

•On August 26, 2021, the Company appointed Mohammad Bataineh as President, taking over from Kash Qureshi who will shift to Chief Corporate Officer, and will retain executive leadership and remains an Executive Member of the Board of Directors.

•On September 16, 2021, the Company acquired 70% of the membership interest of Pennsylvania based Primary Care Clinic Group, Aspire Health Concepts, Inc. (“Aspire”) for a total cash consideration of $2.0 million (US$1.6 million).

| | |

Skylight Health Group Inc. (formerly CB2 Insights Inc.) Management Discussion and Analysis For the three and nine months ended September 30, 2021 |

Key Subsequent Events of the three and nine months ended September 30, 2021

•On October 7, 2021, the Company announced the execution of a Participation Provider Contract with a leading Fortune 50 national healthcare organization who is a recipient of a Direct Contracting Entity (“DCE”) license, with the Company’s participation beginning in 2022.

•On October 12, 2021, the Company appointed Greg Sieman as senior vice president of marketing and communications. Prior to Skylight, Greg was SVP of Marketing at Oak Street Health, and, more recently, the chief revenue & communications officer at Lifespace Communities.

•On October 29, 2021, the Company announced the execution of a Definitive Agreement with New Frontier Data to divest 100% of assets related to its legacy businesses Canna Care Docs, MedEval Clinic LLC, Rae of Sunshine Health Services and New Jersey Alternative Medicine LLC (“Legacy Business”). Terms of the transaction will be total cash consideration of $11.1 million (US$8.6 million). Payment terms will include cash on closing of $5.2 million (US$4.0 million), with the remainder of the balance paid over three installments at 12 months, 18 months and 24 months from the date of closing. The closing occurred on December 15, 2021 and a gain on disposal of $5.6 million was recognized.

•On December 6, 2021, the Company announced the closing of the registered offering of 275,000 9.25% Series A Cumulative Redeemable Perpetual Preferred Shares (“Series A Preferred Shares”) at a price to the public of US$21 per share for gross proceeds of US$5.8 million. The Series A Preferred Shares trade on the Nasdaq Capital Market under the symbol “SLHGP”.

Overall Performance and Outlook

The accompanying unaudited condensed interim consolidated financial statements have been prepared on the basis of accounting principles applicable to a going concern, which assumes the realization of assets and settlement of liabilities in the normal course of business. Accordingly, they do not give effect to adjustments that would be necessary should the Company be unable to continue as a going concern and therefore be required to realize its assets and liquidate its liabilities and commitments in other than the normal course of business and at amounts different from those in the accompanying unaudited condensed interim consolidated financial statements. Such adjustments could be material.

Performance

The Company reported organic and inorganic growth with its results to both drive revenues through acquisitions and realize improved same practice revenue quarter over quarter. Revenue was up 16% from the previous quarter, and 248% compared to the same period the year before. Organic growth from acquisitions made in Q4 2020 and Q1-Q3 2021 contributed $0.6 million or 9% to revenue from the previous quarter. The Company also closed on the acquisition of Aspire Health, a primary care practice group in Pennsylvania during the quarter

| | |

Skylight Health Group Inc. (formerly CB2 Insights Inc.) Management Discussion and Analysis For the three and nine months ended September 30, 2021 |

which contributed to partial revenue growth for the quarter. The Company expects that partial contribution in Q3 reflected by the timing of the close of Aspire will result in a greater increase in Q4 revenues. The Company remains committed to a strong growth by acquisition model fueled by a robust pipeline and progressive opportunities for value-based care contract participation.

During the quarter, the Company placed a heavy emphasis on the integration of Rocky Mountain and Doctors Center, both practices that were acquired in Q2, and where improvements to workflows, provider access and shared services have yielded organic growth both from improved revenues as well as cost synergies. While the Company saw some near-term improvements, it is focused on further centralizing shared services, which it expects will drive additional revenue and cost synergies across all practice locations. As part of enhancing operations within acquired practices, the Company is centralizing key functional areas within practice operations to boost economies of scale. With the recent addition of Greg Sieman as SVP marketing & communications, the Company will bolster marketing efforts to drive new commercial and Medicare patients into existing practices, and for future de novo sites.

While gross margins remained healthy for practices under a traditional fee-for-service model, they did decline from the year before, but remain consistent with expectations of between 60-70%. Primary care services drive lower margins than the previous legacy business, and although primary care revenue has increased due to acquisitions, the contribution of higher margin services has reduced causing the decline. In the future, the Company expects that as it transitions to higher value-based care models, that these increased revenues will yield a higher gross margin. This will be a focus along with near term improvements and optimization of utilization rates of existing providers across the practices.

Skylight has seen a significant rise in expenses in the following major categories: salaries and wages, office and administration, share-based compensation, professional fees, and marketing activities as a result of eight clinical acquisitions made since Q4 2020. As a result of these acquisitions, the Company has increased total employee count by more than 360%. Of this, the majority of the increase (approximately 415%) is practice related while the home office shared service support team grew approximately 220%; our commitment to centralizing shared services will help create offsets allowing the Company to realize economies of scale. As the Company is in rapid growth mode driven by both an aggressive mergers & acquisition strategy and a future focus on organically shifting to VBC reimbursement models, additional investments in these areas enable the development of core competencies to realize stronger future growth potential met with higher value payor contracts.

During the three and nine months ended September 30, 2021, these items totaled $9.6 million and $23.9 million, respectively (three and nine months ended September 30, 2020: $1.9 million and $6.1 million, respectively). Over the nine months ended September 30, 2021, the Company worked to focus on bringing the right set of experience to its leadership and operational teams to cover all major functional areas. This included the hiring of Mohammad Bataineh as President, Dr. Kit Brekhus as Chief Medical Officer and Andrew Elinesky as Chief Financial Officer to name a few. In addition to these, the Company bolstered its operational teams in the areas of clinical leadership, marketing, revenue cycle

| | |

Skylight Health Group Inc. (formerly CB2 Insights Inc.) Management Discussion and Analysis For the three and nine months ended September 30, 2021 |

management, operations & integrations, and payor contracting. As the Company will continue to grow key team members, it is in a strong position today to begin integrating and preparing acquired practices towards the transition to valued-based care models.

The increase in share-based compensation during the nine months ended September 30, 2021 is connected to the recruitment of key leadership, management and operational hires as part of its employee stock option plan. On a going forward basis, the Company expects to see further option issuances to employees as part of its human capital investment. Aligning employees to the growth of the Company is a strong differentiator and ensures a shared approach to driving shareholder value.

The increase in office and administration expenses during the nine months ended September 30, 2021 is related to the organic growth of the business due to the numerous acquisitions completed from Q4 2020 to Q3 2021, with increases to insurance, dues, and subscriptions also contributing. Compared to Q2 2021 and Q3 2020, the increase in office and administration related to the increase in directors and officers liability insurance, data conversion projects, increase in health insurance due to employee headcount and review of collectibles.

The increases in professional fees and marketing fees during the nine months ended September 30, 2021 mainly related to the acquisition of new clinics, listing on the TSX-V and Nasdaq and building a national Skylight brand.

The Company expects that by year end most investments made at the start of the year will result in both a higher growth of revenue driven organically and by acquisition but will also result in a stronger EBITDA recognition. The Company is focused on revenue growth which it believes is how its peers are measured and expects to compete aggressively for market share growth. Further, as the Company advances its participation in value-based care programs, it expects to see increased expenses in the near term which will be offset by the expected growth in revenue through shared savings and more economical payor agreements.

With a quarter of organic growth compared to the previous quarter, the Company has demonstrated its capabilities to not just acquire but integrate and manage practices under its umbrella. Further, while the Company continues to drive top line growth, it will continue to work to create opportunities for organic revenue and cost synergies.

With a robust acquisition pipeline, experienced operational team, existing contracts for Medicare and managed care patients, and an active market to support organic growth to value-based care, the Company believes it is well positioned for growth in the coming quarters.

Outlook

The need for improved primary care practice models in the US has never been greater than it is today. The Company believes its model for shifting fee-for-service primary care practices to a value-based care reimbursement model will close the gap in today’s widening shortage of

| | |

Skylight Health Group Inc. (formerly CB2 Insights Inc.) Management Discussion and Analysis For the three and nine months ended September 30, 2021 |

primary care physicians. With the growing demand for accessible and affordable medical services in the US, the Company believes the following external factors will be significant contributors for growth for services. The Company believes it is well positioned to meet this growing opportunity.

•Growing perceived distrust and lack of personalized care delivered by larger legacy health networks are paving the way for disruption in the healthcare services sector where quality of care, accessibility and affordability will help create a new model for healthcare delivery.

•The rising cost in healthcare driven by higher acuity hospital services and lack of comprehensive patient care at the primary practice level, is leading national payors and governments to change reimbursement models to VBC which prioritizes quality over volume and holds physicians accountable.

•VBC not only has the opportunity to improve quality of care, lower cost of care management but can also be significantly more financially rewarding for primary care practices willing to share in risk.

•With over 56% of outpatient medical care operated by smaller groups of localized practitioners, and a growing demand for administrative needs to deliver care, the high cost of investment to support a VBC model is prohibitive and a barrier.

•The impact of the pandemic to independent primary care practices, rising levels of chronic care management and an aging population further amplifies the push for consolidation and support to enable primary care providers to shift to a more profitable and long-term VBC model.

•Continued fragmentation of the primary care services market is leading to more opportunities to acquire disparate primary care clinics at attractive multiples. The Company is developing a robust national platform that not only generates overall efficiencies, but is aimed at integrating technology, access, and capabilities to transform current Fee for Service (“FFS”) practices to VBC. The conversion will lead to improved patient health outcomes, improved physician and patient satisfaction scoring, access, and better financial performance through strengthened contracts with payors.

•The Company serves as a white-knight platform for independent physician providers who find it both challenging and are limited in their capabilities to move into value-based care programs but have an active and robust patient base that can benefit from these programs. Skylight offers these practices, alignment, resources, technology, continuity, focus on patient care and the opportunity for growth within managed care contracts.

In addition to driving higher margins through improved patient outcomes, the Company believes it is well positioned for future growth through:

Acquisition of Primary Care Practice Groups

•The primary care sector in the US continues to remain highly fragmented with majority of consolidation done by regional and localized healthcare networks. Historically proven to be misaligned with primary care providers, health systems can be seen using practices as feeders to higher acuity service, and traditional private equity

| | |

Skylight Health Group Inc. (formerly CB2 Insights Inc.) Management Discussion and Analysis For the three and nine months ended September 30, 2021 |

consolidators can see these practices as a platform for future sale. There is a growing demand for primary care providers to remain independent, while partnering with the right group to bring scale and capabilities to support a VBC model.

•The Company has already acted on this opportunity with recent acquisitions. The Company has a robust pipeline of targeted deal flow that remains price disciplined often acquiring these practices for considerably less than what they would be worth once they make the shift to taking on VBC health plans.

•The Company believes that contingent on an active market, proper access to capital and demand from physicians and payors, that it will remain highly acquisitive as part of its three-pronged growth plan.

Developing a Single System of Operation and Clinical Leadership

•Through a national management platform, the Company is focused on developing efficiencies and operational scale through its network of acquired practices. Nearly 40% of physician practices today seeking to drive towards VBC are partnered with a Management Services Organization (MSO).

•Many providers are not only seeking partnership but acquisition where they can still participate in small levels of ownership and reduce the burden of practice administration.

•SHG, unlike a traditional MSO, acquires practices but brings with it the same infrastructure and support systems that practices can see in a MSO partnership. Through this capability, the Company is focused on driving clinical efficiencies that can lead to improved operations workflows, provider, patient and staff satisfaction and overall clinical profitability growth.

•SHG brings strong clinical leadership through its clinic, value & performance management teams that work with each provider and practice to educate, deliver and succeed on quality improvement plans for better patient health outcomes and an aligned cost of care practice.

Conversion from Fee-for-Service to Value-Based-Care

•The move to VBC continues to accelerate largely driven by payors and government. The shift enables a focus on quality over volume where the primary care provider services to be incented to provide a more comprehensive level of care for patients. This in turn creates improved quality outcomes for the patient improving the management of chronic care illnesses, prevention of future issues and management of downstream costs.

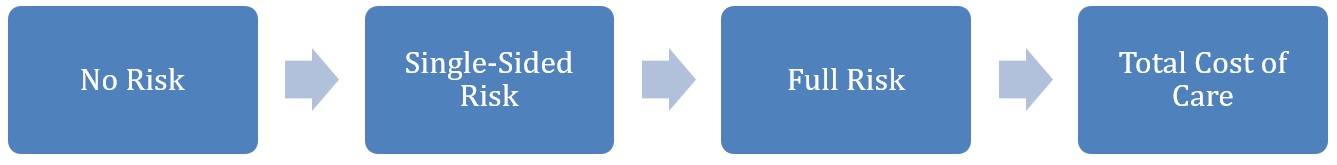

•The shift to value can take an evolutionary process where providers begin by stepping into managed care contracts offering shared savings, capitated care coordination, and/or a fixed per member per month model (PMPM) capitated model. The shift to value goes from:

| | |

Skylight Health Group Inc. (formerly CB2 Insights Inc.) Management Discussion and Analysis For the three and nine months ended September 30, 2021 |

•In the value-based model, the provider begins developing the tools and strategies to manage care and cost which can continue to drive them towards more risk sharing with payors and improving on the financial performance of contracts.

•As the provider continues to build the infrastructure to manage patient care and cost of care, the shift to total cost of care generates the greatest economic growth with the caveat that the provider is now responsible for the full healthcare dollar of that patient.

•SHG is committed to working with practices early in the conversion process, most of which are currently dominant FFS. FFS practices still represent the majority of practices in the US today.

•Data aggregation, actionable insights, and clinical leadership, combined with improved access, population health management strategies and services for patients will enable these practices to begin the shift to single sided risk, then full risk and ultimately to manage the total cost of care.

•The move to VBC can lead to significantly improved patient economics for the practice that will further enhance, incent, and improve the quality of care for patients. Through participation in the announced DCE, SHG now looks to begin year 1 participation in VBC on January 1, 2022. As SHG demonstrates and expands its capabilities and competencies within the DCE, it expects to expand its delegation of duties from payors, enter higher risk contracts and leveraging these to negotiate more favorable contracts from payors where SHG looks to take on the total cost of care for its patients.

De Novo Based Growth to Build Additional Density in Core Markets

•Complementary towards the Company’s acquisition model, the Company has identified several opportunities to support density and capacity in existing markets through the organic model of new clinics buildout.

•Unlike a traditional de novo model, SHG will not be looking to enter a new market or region and building a brand or patient base with little to no previous brand exposure. Rather, SHG sees the de novo model as an opportunity to strengthen its current footprint in existing markets, where patients already recognize the brand, and benefits of the organizations.

•A centralized branding strategy enables SHG to build in existing markets where it may already have built up patient demand, and where existing facilities are not adequate to increase capacity.

•Additionally, a de novo strategy along with a focus on value-based care programs that can benefits patients in the community, in addition to increased convenience and access points across the network.

•SHG will look forward to communicating its de novo strategy in the coming months.

| | |

Skylight Health Group Inc. (formerly CB2 Insights Inc.) Management Discussion and Analysis For the three and nine months ended September 30, 2021 |

Discussion of Operations

For the three and nine months ended September 30, 2021, the Company has two reportable operating segments related to its software/research business and corporate, and medical services businesses, which also align with the two countries in which it operates, Canada and the United States.

Operating results

The following is selected financial data derived from the unaudited condensed interim consolidated financial statements of the Company for the three and nine months ended September 30, 2021 and 2020:

| | | | | | | | | | | | | | |

| (in 000’s of dollars) | Three months ended September 30, | Nine months ended September 30, |

| (Restated) | | (Restated) | |

| 2021 | 2020 | 2021 | 2020 |

| Revenue | 11,516 | | 3,310 | | 26,419 | | 9,942 | |

| Cost of sales | 4,609 | | 964 | | 9,999 | | 3,082 | |

| Gross profit | 6,907 | | 2,346 | | 16,420 | | 6,860 | |

| Operating expenses | | | | |

| Salaries and wages | 5,453 | | 1,182 | | 12,412 | | 3,688 | |

| Office and administration | 2,549 | | 388 | | 4,840 | | 1,187 | |

| Marketing and business development | 345 | | 111 | | 1,893 | | 217 | |

| Professional fees | 1,084 | | 48 | | 3,092 | | 539 | |

| Rent | 170 | | 14 | | 301 | | 111 | |

| Share-based compensation | 204 | | 217 | | 1,614 | | 501 | |

| Depreciation and amortization | 1,663 | | 602 | | 3,779 | | 1,843 | |

| Total operating expenses | 11,468 | | 2,562 | | 27,931 | | 8,086 | |

| Loss from operations | (4,561) | | (216) | | (11,511) | | (1,226) | |

| Net loss | (4,123) | | (1,312) | | (11,332) | | (2,909) | |

Revenue

The Company’s revenue for the three and nine months ended September 30, 2021 was $11.5 million and $26.4 million, respectively - growth of 248% and 166%, respectively. Revenue for the three and nine months ended September 30, 2021 consisted of clinic revenue amounting to $11.3 million and $26.1 million, respectively (three and nine months ended September 30, 2020: $3.3 million and $9.8 million, respectively) and contract research revenue and software amounting to $0.2 million and $0.4 million, respectively (three and nine months ended September 30, 2020: $0.1 million and $0.2 million, respectively).

Revenue compared to 2020 increased significantly due to additional revenue being contributed by the clinics acquired during the fiscal year ended December 31, 2020 and the nine months ended September 30, 2021. The new acquisition of Aspire Care contributed $0.3 million during the quarter ended September 30, 2021.

| | |

Skylight Health Group Inc. (formerly CB2 Insights Inc.) Management Discussion and Analysis For the three and nine months ended September 30, 2021 |

Cost of sales

Cost of sales during the three and nine months ended September 30, 2021 totaled $4.6 million and $10.0 million, respectively (three and nine months ended September 30, 2020: $1.0 million and $3.1 million, respectively). The increase in cost of sales is due to new acquisitions during the past fiscal year and the nine months ended September 30, 2021 in comparison to the nine months ended September 30, 2020 and grew at a similar rate as the growth rate in revenues. Cost of sales pertains directly to the US clinical operations and mainly comprises service fees paid to doctors and nurse practitioners.

The implementation of technology owned by the Company, including telehealth, improved both time per visit, but also expanded on clinician’s availability per hour. Despite this, the gross profit margin was 60% in Q3 2021 compared to 71% in Q3 2020. The margins in Q3 2020 were higher due to better margins on legacy fee for services business which was the primary source of revenue in Q3 2020 while in Q3 2021, the majority of the revenue is from insurable services business which have lower margins than the legacy fee for services business.

Operating expenses

Operating expenses during the three and nine months ended September 30, 2021 totaled $11.5 million and $27.9 million, respectively (three and nine months ended September 30, 2020: $2.6 million and $8.1 million, respectively). Operating expenses for the US and Canadian operations during the three months ended September 30, 2021 were $9.6 million and $1.9 million, respectively (three months ended September 30, 2020: $1.5 million and $1.1 million, respectively).

The increase in operating expenses during the three and nine months ended September 30, 2021 to $11.5 million and $27.9 million, respectively was mainly in relation to acquisitions of new clinics, listing on the TSX-V and Nasdaq, the recruitment of key leadership, management and operational hires as part of the employee stock option plan and building a national Skylight brand.

An increase in headcount mainly as a result of acquisitions and organic growth of the Company, listing on the TSX-V and Nasdaq, the recruitment of key leadership, management and operational hires as part of the employee stock option plan and building a national Skylight brand are the main reasons for the increase in operating expenses during the three and nine months ended September 30, 2021 versus the comparative period.

The Company was committed in 2020 and 2021 to reduce operating expenses realized through efficiencies in technology and economies of scale including those realized from the new acquisitions. As a result, comparing Q3 2021 to Q2 2021, total operating expenses (excluding the effect of share-based compensation) increased by 14%, in line with the increase of 16% of revenue of the business with the addition of Aspire Care and full quarter of Doctors Center acquired.

| | |

Skylight Health Group Inc. (formerly CB2 Insights Inc.) Management Discussion and Analysis For the three and nine months ended September 30, 2021 |

Net Loss

During the three and nine months ended September 30, 2021, the Company recorded a net loss amounting to $4.1 million and $11.3 million, respectively (three and nine months ended September 30, 2020: $1.3 million and $2.9 million, respectively). Net loss in the three and nine months ended September 30, 2021 was primarily due to higher marketing and business development in order to build a national Skylight brand, professional fees related to acquisitions and listing on the TSX-V and Nasdaq, office and administration, depreciation and amortization and share-based compensation expenses relating to the recruitment of key leadership, management and operational hires as part of the employee stock option plan.

Quarterly Results

The following is selected financial data derived from the unaudited condensed interim consolidated financial statements for the quarters ended Q1 to Q3 2021 and 2020 and audited consolidated financial statements for the years ended December 31, 2021, 2020 and 2019:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in 000’s of dollars) | 2021 | 2020 | 2019 |

| (Restated) | | | | | | | |

| Q3 | Q2 | Q1 | Q4 | Q3 | Q2 | Q1 | Q4 |

| Revenue | 11,516 | | 9,913 | | 4,990 | | 3,199 | | 3,310 | | 3,701 | | 2,932 | | 3,124 | |

| Cost of sales | 4,609 | | 3,770 | | 1,619 | | 1,029 | | 964 | | 1,088 | | 1,030 | | 1,052 | |

| Gross profit | 6,907 | | 6,143 | | 3,371 | | 2,170 | | 2,346 | | 2,613 | | 1,902 | | 2,072 | |

| Operating expenses | | | | | | | | |

| Salaries and wages | 5,453 | | 4,663 | | 2,296 | | 2,458 | | 1,182 | | 1,115 | | 1,391 | | 2,028 | |

| Office and administration | 2,549 | | 1,722 | | 569 | | 379 | | 388 | | 422 | | 377 | | 393 | |

| Marketing and business development | 345 | | 645 | | 902 | | 410 | | 111 | | 49 | | 57 | | 108 | |

| Professional fees | 1,084 | | 1,379 | | 630 | | 432 | | 48 | | 265 | | 226 | | 253 | |

| Rent | 170 | | 105 | | 27 | | 25 | | 14 | | 31 | | 68 | | 30 | |

| Share-based compensation | 204 | | 361 | | 1,049 | | 3,812 | | 217 | | 124 | | 159 | | 371 | |

| Depreciation and amortization | 1,663 | | 1,365 | | 751 | | 482 | | 602 | | 627 | | 614 | | 610 | |

| Impairment loss | — | | | — | | — | | — | | — | | — | | 3,607 | |

| Total operating expenses | 11,468 | | 10,240 | | 6,224 | | 7,998 | | 2,562 | | 2,633 | | 2,892 | | 7,400 | |

| Loss from operations | (4,561) | | (4,097) | | (2,853) | | (5,828) | | (216) | | (20) | | (990) | | (5,328) | |

Non-IFRS Measures

The MD&A makes references to certain non-IFRS measures, including certain industry metrics. These metrics and measures are not recognized measures under IFRS, do not have meanings prescribed under IFRS and are as a result unlikely to be comparable to similar measures presented by other companies. These measures are provided as information complimentary to those IFRS measures by providing a further understanding of our operating

| | |

Skylight Health Group Inc. (formerly CB2 Insights Inc.) Management Discussion and Analysis For the three and nine months ended September 30, 2021 |

results from the perspective of management. As such, these measures should not be considered in isolation or in lieu of review of our financial information reported under IFRS.

Adjusted EBITDA

Adjusted EBITDA for the three and nine months ended September 30, 2021 was a loss of $3.3 million and $6.2 million, respectively, compared to an adjusted EBITDA gain (loss) of $0.3 million and $0.1 million, respectively, for the comparative periods. The decrease was mainly due to salaries and wages related to the recruitment of key leadership, management and operational hires, increased office and administration costs and increased professional fees (legal, accounting and consulting). See below for reconciliation of adjusted EBITDA to loss from operations:

| | | | | | | | | | | | | | |

| (in 000’s of dollars) | Three months ended September 30, | Nine months ended September 30, |

| (Restated) | | (Restated) | |

| 2021 | 2020 | 2021 | 2020 |

| Income (loss) from operations | (4,561) | | (216) | | (11,511) | | (1,226) | |

| Depreciation, amortization (Note 1) | 1,663 | | 602 | | 3,779 | | 1,843 | |

| Interest (Note 1) | 8 | | — | | 8 | | — | |

| EBITDA | (2,890) | | 386 | | (7,724) | | 617 | |

| Share based compensation (Note 2) | 204 | | 296 | | 1,614 | | 595 | |

| Write-off of lease deposits (Note 3) | — | | — | | — | | 36 | |

| Capitalization of software development cost (Note 4) | (62) | | (116) | | (208) | | (371) | |

| Capitalization of lease payments (Note 4) | (763) | | (235) | | (1,729) | | (768) | |

| Acquisition costs (Note 5) | — | | — | | 257 | | — | |

| Nasdaq and TSX-V listing cost (Note 6) | 64 | | — | | 455 | | — | |

| Severance (Note 6) | 134 | | — | | 134 | | — | |

| Corporate marketing cost (Note 7) | 32 | | — | | 1,042 | | — | |

| Adjusted EBITDA | (3,281) | | 331 | | (6,159) | | 109 | |

Note 1

Depreciation, amortization, and interest are items which are typically excluded to arrive at EBITDA. To calculate EBITDA, the Company adjusts all material items which do not reflect operational performance of the business.

Note 2

Share-based compensation is a non-cash item which is typically excluded to arrive at adjusted EBITDA. To calculate adjusted EBITDA, the Company adjusts all material items which do not reflect operational performance of the business.

Note 3

Lease deposits were received by the Company over time but not adjusted to the appropriate accounts. These have been written off from the books during the period but are not an operational recurring expense for the Company and therefore adjusted to calculate adjusted EBITDA.

Note 4

Capitalization has been included as an expense in the calculation of adjusted EBITDA because these expenses either relate to payroll or the Company’s leased properties and are not part of the unaudited condensed interim consolidated statement of loss and comprehensive loss. The Company believes that these are operational expenses and should be adjusted to arrive at adjusted EBITDA.

Note 5

Acquisition costs in relation to Rocky Mountain have been included as an adjustment to EBITDA given the size and magnitude of Rocky Mountain versus the other acquisitions which the Company has completed.

Note 6

Nasdaq and TSX-V listing and severance costs have been added back in the adjusted EBITDA calculation given they are not an operational recurring expense for the Company and therefore adjusted to calculate adjusted EBITDA.

Note 7

Certain corporate marketing costs have been added back in the adjusted EBITDA calculation as they are expenses the Company incurred as it rebranded and built a national brand and therefore adjusted to calculate adjusted EBITDA.

| | |

Skylight Health Group Inc. (formerly CB2 Insights Inc.) Management Discussion and Analysis For the three and nine months ended September 30, 2021 |

Financial Position

Significant Assets

| | | | | | | | |

| (in 000’s of dollars) | (Restated) | |

| September 30, 2021 | December 31, 2020 |

| $ | $ |

| Cash | 5,622 | | 20,052 | |

| Trade and other receivables | 7,145 | | 529 | |

| Other intangible assets | 19,774 | | 6,474 | |

| Goodwill | 10,747 | | 2,224 | |

| Right of use assets | 17,077 | | 1,325 | |

The significant increase in trade and other receivables is related to the River City Medical Associates Inc. and Rocky Mountain acquisitions, with increases in personal injury revenue and urgent care revenue, respectively. The increases in other intangible assets, goodwill and right of use assets is due to all the newly acquired clinics during the nine months ended September 30, 2021. Significant decrease in cash is due to cash flows used by operations together with cash utilized in the acquisition of the new clinics.

Contractual Obligations

The Company’s contractual obligations primarily consisted of three areas: i) Accounts payable and accrued liabilities of $7.0 million as at September 30, 2021 which are expected to be paid in the next 12 months; ii) Purchase consideration payable of $3.9 million from the Company’s clinic acquisitions completed in Q4 2020 and the nine months ended September 30, 2021; and iii) Lease liabilities of $16.8 million ($1.7 million current and $15.1 million non-current) primarily as a result of the clinic acquisitions completed.

Outstanding share information

As at March 30, 2022, the date of the MD&A, the Company had the following number of common shares, warrants and options:

| | | | | |

| # |

| Common shares | 39,450,260 | |

| Preferred shares | 275,000 | |

| Restricted share units | 125,800 | |

| Deferred share units | 93,518 | |

| Warrants | 3,585,442 | |

| Options | 2,359,228 | |

| | |

Skylight Health Group Inc. (formerly CB2 Insights Inc.) Management Discussion and Analysis For the three and nine months ended September 30, 2021 |

Liquidity and Capital Resources

| | | | | | | | |

| Nine Months Ended September 30, | 2021 | 2020 |

| (in 000’s of dollars) | $ | $ |

| Cash (used in) provided by operating activities | (7,814) | 1,499 |

| Cash used in investing activities | (20,205) | (371) |

| Cash provided by financing activities | 13,801 | 5,338 |

Adjustments to arrive at operating cash flow for the nine months ended September 30, 2021 include adjustment for depreciation and amortization of $3.8 million (September 30, 2020: $1.8 million), foreign exchange gain of $0.2 million (September 30, 2020: gain of $0.3 million), accretion on purchase consideration payable and loan payable amounting to $0.2 million (September 30, 2020: $nil), interest on lease liabilities of $0.7 million (September 30, 2020: $0.1 million), share-based compensation of $1.6 million relating to the recruitment of key leadership, management and operational hires as part of the employee stock option plan (September 30, 2020: $0.6 million), adjustment for change in fair value of financial instruments amounting to gain of $12.0 thousand (September 30, 2020: loss $2.2 million), other income related to the forgiveness of the loan payable amounting to $0.9 million (September 30, 2020: $nil), gain on debt settlement of $nil (September 30, 2020: $0.3 million), and the change in non-cash working capital balances due to decrease (increase) in trade and other receivables of ($3.7 million) (September 30, 2020: $0.1 million), decrease (increase) in prepaid expenses of ($0.3 million) (September 30, 2020: $12.0 thousand), increase (decrease) in accounts payable and accrued liabilities of $2.3 million (September 30, 2020: $0.2 million). The increase in cash utilized from operations during the nine months ended September 30, 2021 compared to the nine months ended September 30, 2020 is attributable to higher net loss during the nine months ended September 30, 2021.

The Company’s cash used in investing activities for the nine months ended September 30, 2021 was $20.2 million (September 30, 2020: $0.4 million). The increase was primarily due to the purchase consideration paid related to the Q1 to Q3 2021 acquisitions of new clinics, purchase of furniture and equipment and software development.

The Company’s financing activities in the nine months ended September 30, 2021 comprised raising net proceeds of $12.7 million from a bought deal offering with a syndicate of underwriters, $0.8 million from the exercise of options, $1.4 million from the exercise of warrants, $1.0 million of loan proceeds for a short-term loan payable due in less than one year, partially offset by payment of principal on the loan amounting to $0.4 million and the payment of principal and interest on lease liabilities amounting to $1.7 million on the company’s leased premises.

The Company’s financing activities in nine months ended September 30, 2020 comprised raising net proceeds of $5.0 million from a private placement that closed on September 24, 2020, net proceeds of $0.2 million on exercises of warrants and proceeds from PPP loan amounting to $0.9 million, partially offset by the payment of principal and interest on lease liabilities amounting to $0.8 million on the company’s leased premises and repayment of related party loan amounting to $25.0 thousand.

| | |

Skylight Health Group Inc. (formerly CB2 Insights Inc.) Management Discussion and Analysis For the three and nine months ended September 30, 2021 |

As at September 30, 2021, the Company had a working capital surplus of $2.2 million (December 31, 2020: $18.6 million) and a cash balance of $5.6 million (December 31, 2020: $20.1 million). The working capital position has reduced primarily due to payments made for new and prior acquisitions as per their acquisition agreements.

The unaudited condensed interim consolidated financial statements of the Company for the three and nine months ended September 30, 2021 have been prepared on a going concern basis in accordance with IFRS. The going concern basis of presentation assumes that the Company will continue in operation for the foreseeable future and be able to realize its assets and discharge its liabilities and commitments in the normal course of business. The Company is subject to numerous risk factors that may impact its ability as a going concern, such as, but not limited to, governmental regulations, currency fluctuations, operational risks and extended and unforeseen issues resulting from the current COVID-19 pandemic.

As of the balance sheet date, the Company had an accumulated deficit of $34,811 and negative cash flow from operations of $7,814 for the nine months ended September 30, 2021. The Company has positive working capital as of the balance sheet date of $2,206. The Company has raised debt and equity financing through 2017 to 2020 and during the nine months ended September 30, 2021 in order to pursue acquisitions and platform development resulting in growth in its customer base. The Company expects that the investments it has made over this period will result in increased revenue and operating cash flow however, the Company anticipates further investment and will require additional debt and/or equity financing in order to continue to develop its business.

Although the Company has been successful in raising funds to date, there can be no assurance that adequate or sufficient funding will be available in the future or available under terms acceptable to the Company, or that the Company will be able to generate sufficient returns from operations. The ability of the Company to continue as a going concern and to realize the carrying value of its assets and discharge its liabilities and commitments when due is dependent on the Company generating revenue and debt and/or equity financing sufficient to fund its cash flow needs. The Company is not currently eligible to raise funds using a registration statement in the United States. These circumstances indicate the existence of a material uncertainty that may raise substantial doubt on the ability of the Company to meet its obligations as they come due, and accordingly the appropriateness of the use of the accounting principles applicable to a going concern.

The condensed interim consolidated financial statements do not reflect adjustments that would be necessary if the going concern assumption were not appropriate. If the going concern basis were not appropriate for these consolidated financial statements, then adjustments would be necessary in the carrying value of the assets and liabilities, the reported revenue and expenses and the classifications used in the consolidated statement of financial position. Such differences in amounts could be material.

The assessment of material uncertainties related to events and circumstances that may raise substantial doubt on the Company’s ability to continue as a going concern involves significant judgment. In making this assessment, management considers all relevant information, as described above.

| | |

Skylight Health Group Inc. (formerly CB2 Insights Inc.) Management Discussion and Analysis For the three and nine months ended September 30, 2021 |

Off-Balance Sheet Arrangements

The Company does not have any off-balance sheet arrangements as of September 30, 2021.

Related Party Transactions

Key management personnel are those persons having authority and responsibility for planning, directing and controlling the activities of the Company, directly or indirectly. Key management personnel include the Company’s Chief Executive Officer ("CEO"), President, Chief Financial Officer ("CFO"), Chief Medical Officer, Chief Operating Officer, Chief Corporate Officer and members of the Company’s Board of Directors. Professional services for the three and nine months ended September 30, 2021 relate to professional fees to a full-service business law firm. Mohammad Bataineh, President, is a former shareholder of the business law firm.

The amounts disclosed in the table below are the amounts recognized as an expense during the reporting period.

| | | | | | | | | | | | | | |

| Three months ended September 30, | Nine months ended September 30, |

| 2021 | 2020 | 2021 | 2020 |

| $ | $ | $ | $ |

| Salary and short-term employee benefits | 593 | | 321 | | 1,409 | | 545 | |

| Share based compensation | 202 | | 193 | | 504 | | 293 | |

| Directors’ fees | 71 | | — | | 202 | | 94 | |

| 866 | | 514 | | 2,115 | | 932 | |

Professional services of $19 and $37 for the three and nine months ended September 30, 2021 relate to professional fees paid to a full-service business law firm. Mohammad Bataineh, President, is a former shareholder of the business law firm. Professional services of $12 and $42 for the three and nine months ended September 30, 2020 relate to professional fees paid to a financial accounting and reporting services firm. The former CFO was outsourced from the firm.

New accounting standards issued but not yet effective

Amendments to IAS 1 - Presentation of financial statements (“IAS 1”)

In January 2020, the IASB issued Classification of Liabilities as Current or Non-current (Amendments to IAS 1). The amendments aim to promote consistency in applying the requirements by helping companies determine whether debt and other liabilities with an uncertain settlement date should be classified as current (due or potentially due to be settled within one year) or non-current. The amendments include clarifying the classification requirements for debt a Company might settle by converting it into equity. The amendments are effective for annual reporting periods beginning on or after January 1, 2023, with earlier application permitted. The Company is currently evaluating the impact of this amendment.

| | |

Skylight Health Group Inc. (formerly CB2 Insights Inc.) Management Discussion and Analysis For the three and nine months ended September 30, 2021 |

Use of estimates and judgments

The preparation of the financial statements requires management to make judgments, estimates and assumptions that affect the application of accounting policies and the reported amounts of assets and liabilities at the date of the financial statements and reporting amounts of revenues and expenses during the reporting period. Estimates and assumptions are continually evaluated and are based on management’s experience and other factors, including expectations of future events that are believed to be reasonable under the circumstances. However, actual outcomes may differ materially from these estimates.

The estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are generally recognized in the period in which the estimates are revised.

Our significant judgments, estimates and assumptions are disclosed in note 3 of the audited consolidated financial statements for the year ended December 31, 2020.

Disclosure Controls and Procedures and Internal Controls Over Financial Reporting

Management concluded that internal control over financial reporting (ICFR) was not effective as of September 30, 2021 as a result of a material weakness in internal control over financial reporting.

A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the Company's annual or interim financial statements will not be prevented or detected on a timely basis. In connection with the assessment of the effectiveness of our internal control over financial reporting, management identified a material weakness that existed as of September 30, 2021 in the control environment.

The Company did not design and maintain effective controls over revenue recognition for certain contracts in recently acquired medical clinics. Specifically, the Company did not design controls to properly record price concessions as a reduction of revenue. This material weakness resulted in audit adjustments to trade receivables, revenue and related financial statement disclosures, which were recorded prior to the issuance of the consolidated financial statements as of and for the year ended December 31, 2021. Under IAS 8, Accounting Policies, Changes in Accounting Estimates and Errors, this change was considered an error and thus a restatement of the consolidated financial statements for the interim periods ended September 30, 2021, June 30, 2021 and March 31, 2021 was required.

| | |

Skylight Health Group Inc. (formerly CB2 Insights Inc.) Management Discussion and Analysis For the three and nine months ended September 30, 2021 |

Status of Remediation Plan

Management is in the process of implementing new processes to address the material weakness as follows:

•Establish clear responsibility and accountability for key financial reporting processes and controls related to revenue recognition, and related training for financial reporting personnel.

•We are continuing to establish an internal audit function and we have engaged external consultants to assist management with designing and implementing internal controls. As a result, a project was commenced to reassess risks related to financial reporting, understand and document significant financial reporting processes, and to re-assess the design and operation of key controls.

Management believes these actions will remediate the material weakness and have not yet completed all of the corrective processes, procedures and related evaluation or remediation that we believe are necessary. As we continue to evaluate and work to remediate the material weakness, we may need to take additional measures. Until the remediation steps set forth above, including the efforts to implement any additional control activities identified through our remediation processes, are fully implemented and concluded to be operating effectively, the material weakness described above will not be considered fully remediated.

Other than disclosed above, there have been no significant changes to the Company’s ICFR for the three and nine months ended September 30, 2021, which have materially affected, or are reasonably likely to materially affect the Company’s ICFR.

Limitation on scope of design

The Company has limited the scope on its disclosure controls and procedures and internal control over financial reporting evaluation to exclude acquisitions in the last 12 months, as permitted by securities regulators. The table below presents certain summary financial information included in the Company’s condensed interim consolidated financial statements related to these acquisitions excluded from our evaluation:

| | |

Skylight Health Group Inc. (formerly CB2 Insights Inc.) Management Discussion and Analysis For the three and nine months ended September 30, 2021 |

| | | | | |

| Selected financial information from the condensed interim consolidated statements of loss and comprehensive loss | Nine months ended September 30, 2021 |

| (Restated) |

| (in 000’s of dollars) | $ |

| Revenue | 15,550 | |

| Net income | (1,205) | |

| |

| Selected financial information from the condensed interim consolidated statements of financial position | As at September 30, 2021 |

| (Restated) |

| (in 000’s of dollars) | $ |

| Current assets | 7,202 | |

| Non-current assets | 38,420 | |

| Current liabilities | 8,242 | |

| Non-current liabilities | 14,596 | |

Risk Factors

The following section describes specific and general risks that could affect the Company. These risks and uncertainties are not the only ones the Company is facing. Additional risks and uncertainties not presently known to the Company, or that it currently deems immaterial, may also impair its operations. If any such risks actually occur, the business, financial condition, liquidity, and results of the Company’s operations could be materially adversely affected. The risk factors described below should be carefully considered by readers.

Limited Operating History

The Company, while incorporated in November 2014, began carrying on business in 2017 and has only very recently begun to generate revenue. The Company is therefore subject to many of the risks common to early-stage enterprises, including under-capitalization, cash shortages, limitations with respect to personnel, financial, and other resources, and lack of revenues. There is no assurance that the Company will be successful in achieving a return on shareholders’ investment and likelihood of success must be considered in light of the early stage of operations.

Going Concern

The Company has historically not generated positive cash flow from operations. The Company is devoting significant resources to its business, however there can be no assurance that it will generate positive cash flow from operations in the future. The Company may continue to incur negative consolidated operating cash flow and losses. For the three and nine months ended September 30, 2021, the Company had negative cash flows from operations of $3.5 million and $7.8 million, respectively, and reported a net loss of $4.1 million and $11.3 million, respectively. To the extent that the Company has negative cash flow in future periods, the Company may need to obtain additional financing to fund such negative cash flow.

| | |

Skylight Health Group Inc. (formerly CB2 Insights Inc.) Management Discussion and Analysis For the three and nine months ended September 30, 2021 |

Risks Associated with Acquisitions

As part of the Company's overall business strategy, the Company may pursue strategic acquisitions designed to expand its operations in both existing and new jurisdictions. Future acquisitions may expose it to potential risks, including risks associated with: (a) the integration of new operations, services and personnel; (b) unforeseen or hidden liabilities; the diversion of resources from the Company's existing business and technology; (d) potential inability to generate sufficient revenue to offset new costs; (e) the expenses of acquisitions; or (f) the potential loss of or harm to relationships with both employees and existing users resulting from its integration of new businesses. In addition, any proposed acquisitions may be subject to regulatory approval.

The Company is dependent on its relationships with the Skylight Health PCs

The Company is dependent on its relationships with the “Skylight Health PCs”, which are affiliated professional entities that the Company does not own, to provide healthcare services, and the Company’s business would be harmed if those relationships were disrupted or if the arrangements with the Skylight Health PCs become subject to legal challenges.

A prohibition on the corporate practice of medicine by statute, regulation, board of medicine, attorney general guidance, or case law, exists in certain of the U.S. states in which the Company operates. These laws generally prohibit the practice of medicine by lay persons or entities and are intended to prevent unlicensed persons or entities from interfering with or inappropriately influencing providers’ professional judgment. Due to the prevalence of the corporate practice of medicine doctrine, including in certain of the states where the Company conducts its business, it does not own the Skylight Health PCs and contracts for healthcare provider services for its members through administrative services agreements (“ASAs”) with such entities and controls these entities through succession agreements with the providers. As a result, the Company’s ability to receive cash fees from the Skylight Health PCs is limited to the fair market value of the services provided under the ASAs. To the extent the Company’s ability to receive cash fees from the Skylight Health PCs is limited, the Company’s ability to use that cash for growth, debt service or other uses at the Skylight Health PC may be impaired and, as a result, the Company’s results of operations and financial condition may be adversely affected.

The Company’s ability to perform medical and digital health services in a particular U.S. state is directly dependent upon the applicable laws governing the practice of medicine, healthcare delivery and fee splitting in such locations, which are subject to changing political, regulatory, and other influences. The extent to which a U.S. state considers particular actions or relationships to constitute the practice of medicine is subject to change and to evolving interpretations by medical boards and state attorneys general, among others, each of which has broad discretion. There is a risk that U.S. state authorities in some jurisdictions may find that the Company’s contractual relationships with the Skylight Health PCs, which govern the provision of medical and digital health services and the payment of administrative and operations support fees, violate laws prohibiting the corporate practice of medicine and fee splitting. The extent to which each state may consider particular actions or contractual relationships to constitute improper influence of professional judgment varies across the

| | |

Skylight Health Group Inc. (formerly CB2 Insights Inc.) Management Discussion and Analysis For the three and nine months ended September 30, 2021 |

states and is subject to change and to evolving interpretations by state boards of medicine and state attorneys general, among others. Accordingly, the Company must monitor its compliance with laws in every jurisdiction in which it operates on an ongoing basis, and the Company cannot provide assurance that its activities and arrangements, if challenged, will be found to be in compliance with the law. Additionally, it is possible that the laws and rules governing the practice of medicine, including the provision of digital health services, and fee splitting in one or more jurisdictions may change in a manner adverse to the Company’s business. While the ASAs prohibit the Company from controlling, influencing or otherwise interfering with the practice of medicine at each Skylight Health PC, and provide that physicians retain exclusive control and responsibility for all aspects of the practice of medicine and the delivery of medical services, there can be no assurance that the Company’s contractual arrangements and activities with the Skylight Health PCs will be free from scrutiny from U.S. state authorities, and the Company cannot guarantee that subsequent interpretation of the corporate practice of medicine and fee splitting laws will not circumscribe the Company’s business operations. State corporate practice of medicine doctrines also often impose penalties on physicians themselves for aiding the corporate practice of medicine, which could discourage providers from participating in the Company’s network of physicians. If a successful legal challenge or an adverse change in relevant laws were to occur, and the Company was unable to adapt its business model accordingly, the Company’s operations in affected jurisdictions would be disrupted, which could harm its business.

Operational Risks

The Company will be affected by a number of operational risks and the Company may not be adequately insured for certain risks, including: labour disputes; catastrophic accidents; fires; blockades or other acts of social activism; changes in the regulatory environment; impact of non- compliance with laws and regulations; natural phenomena, such as inclement weather conditions, floods, earthquakes and ground movements. There is no assurance that the foregoing risks and hazards will not result in personal injury or death, environmental damage, adverse impacts on the Company's operation, costs, monetary losses, potential legal liability, and adverse governmental action, any of which could have an adverse impact on the Company's future cash flows, earnings, and financial condition. Also, the Company may be subject to or affected by liability or sustain loss for certain risks and hazards against which the Company cannot insure or which the Company may elect not to insure because of the cost. This lack of insurance coverage could have an adverse impact on the Company's future cash flows, earnings, results of operations and financial condition.

Financial Projections May Prove Materially Inaccurate or Incorrect

The Company’s financial estimates, projections and other forward-looking information accompanying this document were prepared by the Company without the benefit of reliable historical industry information or other information customarily used in preparing such estimates, projections and other forward-looking statements. Such forward-looking information is based on assumptions of future events that may or may not occur, which assumptions may not be disclosed in such documents. Investors should inquire of the Company and become familiar with the assumptions underlying any estimates, projections or

| | |

Skylight Health Group Inc. (formerly CB2 Insights Inc.) Management Discussion and Analysis For the three and nine months ended September 30, 2021 |

other forward-looking statements. Projections are inherently subject to varying degrees of uncertainty and their achievability depends on the timing and probability of a complex series of future events.

There is no assurance that the assumptions upon which these projections are based will be realized. Actual results may differ materially from projected results for a number of reasons including increases in operating expenses, changes or shifts in regulatory rules, undiscovered and unanticipated adverse industry and economic conditions, and unanticipated competition. Accordingly, investors should not rely on any projections to indicate the actual results the Company and its subsidiaries might achieve.

Difficulty to Forecast

The Company must rely largely on its own market research to forecast sales as detailed forecasts are not generally obtainable from other sources at this early stage of the Company’s business. A failure in the demand for its services to materialize as a result of competition, technological change or other factors could have a material adverse effect on the business, results of operations, and financial condition of the Company.

Public Health Crises such as the COVID-19 Pandemic and other Uninsurable Risks

Events in the financial markets have demonstrated that businesses and industries throughout the world are very tightly connected to each other. General global economic conditions seemingly unrelated to the Company or to the medical health services sector, including, without limitation, interest rates, general levels of economic activity, fluctuations in the market prices of securities, participation by other investors in the financial markets, economic uncertainty, national and international political circumstances, natural disasters, or other events outside of the Company’s control may affect the activities of the Company directly or indirectly. The Company’s business, operations and financial condition could also be materially adversely affected by the outbreak of epidemics or pandemics or other health crises. For example, in late December 2019, a novel coronavirus (“COVID-19”) originated, subsequently spread worldwide and on March 11, 2020, the World Health Organization declared it was a pandemic. The risks of public health crises such as the COVID-19 pandemic to the Company’s business include without limitation, the ability to raise funds, employee health, workforce productivity, increased insurance premiums, limitations on travel, the availability of industry experts and personnel, disruption of the Company’s supply chains and other factors that will depend on future developments beyond the Company’s control. In particular, the continued spread of the coronavirus globally, prolonged restrictive measures put in place in order to control an outbreak of COVID-19 or other adverse public health developments could materially and adversely impact the Company’s business in the United States. There can be no assurance that the Company’s personnel will not ultimately see its workforce productivity reduced or that the Company will not incur increased medical costs or insurance premiums as a result of these health risks. In addition, the coronavirus pandemic or the fear thereof could adversely affect global economies and financial markets resulting in volatility or an economic downturn that could have an adverse effect on the demand for the Company’s service offerings and future prospects. Epidemics such as COVID-19 could have a material adverse impact on capital markets and the Company’s ability to raise sufficient

| | |

Skylight Health Group Inc. (formerly CB2 Insights Inc.) Management Discussion and Analysis For the three and nine months ended September 30, 2021 |

funds to finance the ongoing development of its material business. All of these factors could have a material and adverse effect on the Company’s business, financial condition, and results of operations. The extent to which COVID-19 impacts the Company’s business, including its operations and the market for its securities, will depend on future developments, which are highly uncertain and cannot be predicted at this time, and include the duration, severity and scope of the outbreak and the actions taken to contain or treat the coronavirus outbreak. It is not always possible to fully insure against such risks, and the Company may decide not to insure such risks as a result of high premiums or other reasons. Should such liabilities arise, they could reduce or eliminate any future profitability and result in increasing costs and a decline in the value of the Common Shares of the Company. Even after the COVID-19 pandemic is over, the Company may continue to experience material adverse effects to its business, financial condition, and prospects as a result of the continued disruption in the global economy and any resulting recession, the effects of which may persist beyond that time. The COVID-19 pandemic may also have the effect of heightening other risks and uncertainties disclosed herein. To date, the COVID-19 crisis has not materially impacted the Company’s operations, financial condition, cash flows and financial performance. In response to the outbreak, the Company has instituted operational and monitoring protocols to ensure the health and safety of its employees and stakeholders, which follow the advice of local governments and health authorities where it operates. The Company has adopted a work from home policy where possible. The Company continues to operate effectively whilst working remotely. The Company will continue to monitor developments of the pandemic and continuously assess the pandemic’s potential further impact on the Company’s operations and business.

Economic Environment

The Company’s operations could be affected by the economic context should the unemployment level, interest rates or inflation reach levels that influence consumer trends and consequently, impact the Company’s sales and profitability. As well, general demand for banking services and alternative banking or financial services cannot be predicted and future prospects of such areas might be different from those predicted by the Company’s management.

Global Economic Risk