Annual Information Form

SKYLIGHT HEALTH GROUP INC.

For the year ended December 31, 2021

Dated as of March 30, 2022

PRELIMINARY NOTES

This Annual Information Form (“AIF”) is prepared in the form prescribed by National Instrument 51-102 Continuous Disclosure Obligations of the Canadian Securities Administrators. All dollar amounts in this AIF are expressed in Canadian dollars unless otherwise indicated. All information in this AIF is as of December 31, 2021, unless otherwise indicated.

FORWARD-LOOKING INFORMATION

Certain information contained in this AIF and any documents incorporated by reference herein may constitute forward-looking statements, as such term is defined under Canadian, U.S. and any other applicable securities laws. These statements relate to future events or future performance and reflect management’s expectations and assumptions regarding the growth, results of operations, performances and business prospects and opportunities of the Company. All statements other than statements of historical fact are forward-looking statements. The use of any of the words “anticipate”, “plan”, “continue”, “estimate”, “expect”, “may”, “intend”, “will”, “project”, “could”, “believe”, “predict”, “potential”, “should” or the negative of these terms or other similar expressions are intended to identify forward-looking statements. In particular, information regarding the Company’s future operating results and economic performance is forward-looking information. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance, achievements or events to differ materially from those anticipated, discussed or implied in such forward-looking statements. The Company believes the expectations reflected in such forward- looking statements are reasonable but no assurance can be given that these expectations will prove to be correct and such forward-looking statements included in this AIF and any documents incorporated by reference herein should be considered carefully and investors should not place undue reliance on them as the Company cannot assure investors that actual results will be consistent with these forward-looking statements. These statements speak only as of the date of this AIF or the particular document incorporated by reference herein. Such statements are based on a number of assumptions which may prove to be incorrect, including, but not limited to, assumptions about:

•general business and economic conditions;

•the intentions, plans and future actions of the Company;

•the business and future activities of the Company after the date of this AIF;

•market position, ability to compete and future financial or operating performance of the Company after the date of this Prospectus;

•anticipated developments in operations; the future demand for the products and services developed, produced, supplied, or distributed by the Company;

•the timing and amount of estimated research & development expenditure in respect of the business of the Company;

•operating revenue, operating expenditures; success of marketing activities; estimated budgets;

•currency fluctuations;

•the sufficiency of the Company’s working capital;

•requirements for additional capital;

•risks associated with obtaining and maintaining the necessary government permits and licenses related to the business

•government regulation; limitations on insurance coverage; the timing and possible outcome of regulatory matters; goals; strategies; future growth; the adequacy of financial resources; and other events or conditions that may occur in the future;

•compliance with environmental, health, safety and other laws and regulations;

•the ability to attract and retain skilled staff;

•market competition; and

•the potential impact of the COVID-19 pandemic on the Company and/or its operations, and the healthcare industry and currency fluctuations.

Forward-looking statements are based on the beliefs of the management of the Company, as well as on assumptions, which such management believes to be reasonable based on information available at the time such statements were made. However, by their nature, forward-looking statements are based on assumptions and involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Forward-looking statements are subject to a variety of risks, uncertainties and other factors which could cause actual events or results to differ from those expressed or implied by the forward-looking statements, including, without limitation those risks outlined under the heading Risk Factors in this AIF.

The list of risk factors set out in this AIF is not exhaustive of the factors that may affect any forward-looking statements of the Company. The Company does not intend, and does not assume any obligation, to update any forward-looking statements, other than as required by applicable law. For all of these reasons, the security holders of the Company should not place undue reliance on forward-looking statements.

Market and Industry Data

This AIF includes market and industry data that has been obtained from third party sources, including industry publications. The Company believes that the industry data is accurate and that its estimates and assumptions are reasonable, but there is no assurance as to the accuracy or completeness of this data. Third party sources generally state that the information contained therein has been obtained from sources believed to be reliable, but there is no assurance as to the accuracy or completeness of included information. Although the data is believed to be reliable, the Company has not independently verified any of the data from third-party sources referred to in this AIF or ascertained the underlying economic assumptions relied upon by such sources.

NON-IFRS MEASURES

This AIF contains references to certain measures that are not defined under International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”). These non-IFRS measures are not recognized measures under IFRS, do not have a standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other companies. Rather, these measures are provided as additional information to complement IFRS measures by providing further understanding of the Company's results of operations from management’s perspective. Accordingly, they should not be considered in isolation nor as a substitute for analysis of the Company's financial information reported under IFRS.

This Company uses non-IFRS measures including EBITDA, adjusted EBITDA, realized revenue, realized gross profit and realized adjusted EBITDA. to provide investors with supplemental measures of its operating performance and thus highlight trends in its core business that may not otherwise be apparent when relying solely on IFRS measures. The Company believes that investors, securities analysts and other interested parties frequently use non-IFRS measures in the evaluation of issuers. Management also uses non-IFRS measures in order to facilitate operating performance comparisons from period to period, and assess the Company's ability to meet its future debt service, capital expenditure and working capital requirements.

Please refer to the Company’s annual Management Discussion and Analysis for the year ended December 31, 2021 for the definitions of EBITDA, adjusted EBITDA, realized revenue, realized gross profit and realized adjusted EBITDA presented by the Company and the reconciliation, where applicable, to the most directly comparable IFRS measure.

CORPORATE STRUCTURE

Name, Address and Incorporation

Skylight Health Group Inc. (formerly, CB2 Insights Inc.) (the “Company” or “Skylight”) was incorporated on December 27, 2017 under the Canada Business Corporations Act (the “CBCA”) as a wholly-owned subsidiary of Telferscot Resources Inc. (“Telferscot”). On February 16, 2018 the Company entered into an arrangement agreement with Telferscot and other subsidiaries of Telferscot. On March 18, 2018 the Company filed articles of amendment to effect a change in its share capital. Subsequently, on April 9, 2018 the Company completed an arrangement under the provisions of the CBCA and thereby became a reporting issuer in the provinces of

British Columbia, Alberta and Manitoba. Pursuant to articles of amendment dated December 20, 2018, the Company changed its name to “CB2 Insights Inc.” and consolidated its issued and outstanding common shares (a “Common Share”) on the basis of one (1) post-consolidation Common Share for every sixteen and one-half (16.5) pre-consolidation Common Shares. On February 27, 2019, the Company completed a reverse takeover (“RTO”) with MVC Technologies Inc. The transaction was effected by way of a “three-cornered” amalgamation, whereby a wholly-owned subsidiary of the Company amalgamated with MVC under the provisions of the Business Corporations Act (Ontario) (the “OBCA”) and the former shareholders of MVC received one (1) (post-consolidation) Common Share for each one (1) common share of MVC issued and outstanding on the closing date or the RTO. On November 23, 2020 the Company filed articles of amendment to change its name to Skylight Health Group Inc. On November 25, 2020 the Company announced the launch of its rebranding under the Skylight Health brand effective November 30, 2020. On March 31, 2021 the Company filed articles of amendment deleting the First Preferred Series A Shares. On May 28, 2021, the Company completed a consolidation of its share capital on the basis of five existing common shares for one new common share. As a result of the Share Consolidation, the 190,802,347 common shares issued and outstanding as at that date were consolidated to 38,160,473 common shares outstanding. All information in this AIF is presented on a post-Share Consolidation basis, including comparatives. On December 1, 2021, the Company filed articles of amendment to issue 9.25% Series A Cumulative Redeemable Perpetual Preferred Shares (“Series A Preferred Shares”).

The Company has its head and registered office located at 5520 Explorer Dr., Suite 402, Mississauga, Ontario L4W 5L1.

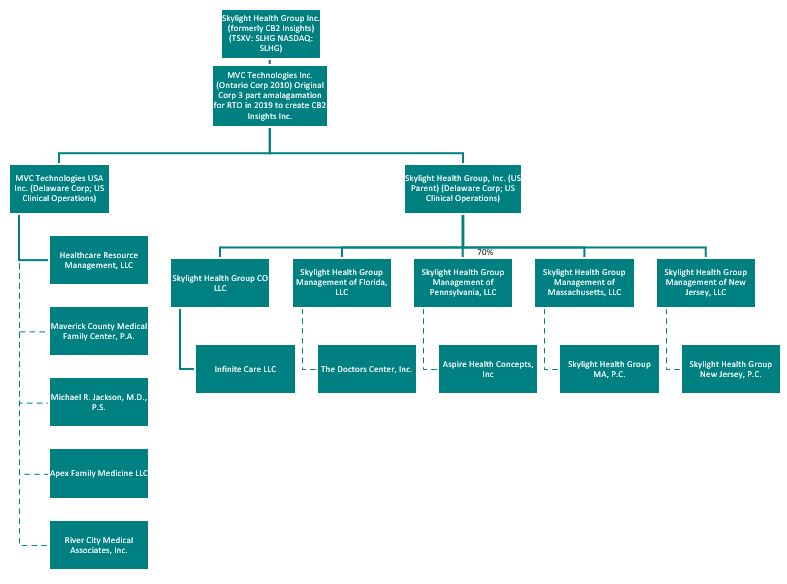

Inter-Corporate Relationships

Set out below is the corporate structure of the Company and its material subsidiaries, including the corporate jurisdiction of the subsidiary owned, controlled or directed by its parent.

1.Solid line indicates 100% ownership, unless otherwise noted.

2.Dotted line indicates control via administrative services agreements and succession agreements.

The Company holds directly or indirectly 100% of the issued and outstanding securities of MVC Technologies Inc. (“MVC”) a corporation incorporated under the OBCA. In the United States, the Company’s operations are carried out by Skylight Health Group, Inc. (“SHG USA”) and MVC Technologies USA Inc. (“MVC USA”), both Delaware corporations and wholly-owned subsidiaries of MVC.

GENERAL DEVELOPMENT OF THE BUSINESS

Skylight Health Group Inc. is a healthcare services and technology company, working to positively impact patient health outcomes. The Company operates a US multi-state primary care health network comprised of physical practices providing a range of services from primary care, sub-specialty, allied health, and laboratory/diagnostic testing. The Company is focused on helping small and independent practices shift from a traditional fee-for-service (FFS) only model to include value-based care (VBC) through tools including proprietary technology, data analytics and infrastructure. VBC will lead to improved patient outcomes, reduced cost of delivery and drive stronger financial performance from existing practices.

The Company was founded in 2014, by founders with extensive experience in clinical practice management in Canada and the US, as owners, operators, and consultants to outpatient medical centers across a variety of specialties from primary care, urgent-care, sub-specialty, and allied health & wellness. SHG is founded on a model designed to drive towards helping small and independent practices adopt value-based capabilities and take on varying levels of risk. According to a report on The State of Primary Care in the US from the Robert Graham Center, the US healthcare outpatient market is highly fragmented with over 56% of clinics and clinicians working independently and in small care groups. These practices struggle the most with developing and deploying VBC due to the increased investment in technology, infrastructure, and capacity. As the industry continues to be consolidated by large health networks, there is a need and demand by patients to maintain the same level of patient care and treatment outcomes lost within the consolidation by legacy health networks. SHG positions itself as the disruptor to legacy health networks. Providing an opportunity to consolidate with SHG while maintaining patient treatment quality, accessibility and affordability and preserving the way healthcare should be delivered. SHG also positions itself to partner with health plans as they aim to provide more comprehensive care services to patients across varying risk groups and capitation models to lower the cost of downstream costs.

SHG practices offer both in clinic and virtual care services through telemedicine and remote patient monitoring. As part of developing the infrastructure for improved access within its practices, the Company expects to expand offerings to patients including a nursing and advisory hotline, same day access, annual wellness reminders and screening protocols, improved access to home-care and remote care services.

The Company’s vision and business model is to drive towards an outcome-based reimbursement model, more commonly referred to as the Value-Based model. The Company works through an acquisition strategy that focuses on current fee-for-service (FFS) practices that will convert to value-based care (VBC) or capitation-based payment models. In a FFS model, payors (commercial and government insurers) reimburse on an encounter-based approach. This puts a focus on volume of patients per day. In a VBC model, payors reimburse typically on a capitation (fixed fee per member per month) basis. This places an emphasis on quality over volume. The Company’s revenues will largely be driven by insurable services paid for by payors currently in a FFS model but in the future in a blended or VBC model.

Three Year History

The following is a description of how the Company’s business has developed over the last three completed financial years. This section focuses on the business undertaken by MVC prior to the RTO and excludes any of the Company’s business in order to take the reader through a logical journey to the business initiatives today.

2019

2019 brought about growth within the Company’s clinical operations and technology and research business units. The Company’s focus was on extending the clinical operations of its uninsured services and subsequently

amassing patient rosters across new states. Also, within the year, the Company focused on strengthening its technology platform and research capabilities both domestically and internationally.

On January 17, 2019, MVC completed a non-brokered private placement financing with the issuance of an aggregate of 75,000 units at a price of $2.50 per unit for gross proceeds of $0.2 million. Each unit consisted of one common share and one half of one common share purchase warrant. An aggregate of 37,500 warrants were issued with each whole warrant exercisable to purchase one common share of the Company at a price of $4.00 for a period of three years from the date of issuance.

During January and February 2019, MVC closed four tranches of a private placement financing of subscription receipts with the issuance of 951,668 subscription receipt units for gross proceeds of $2.4 million. Each subscription receipt unit was convertible into one MVC common share and one-half common share purchase warrant of MVC. An aggregate of 951,668 MVC common shares and 475,834 warrants were issued on the automatic conversion of the subscription receipt units immediately prior to the completion of the RTO, with each whole warrant exercisable to purchase one MVC common share at a price of $4.00 for a period of three (3) years from the date of issuance. MVC also issued 5,208 broker warrants in combination with the closing of the subscription receipt unit financing. Each broker warrant entitled the holder to purchase one subscription receipt unit at a price of $2.50 for a period of three (3) years, with each whole warrant exercisable to purchase one MVC common share at a price of $4.00 for a period of three (3) years from the date of issuance. In relation to this financing the MVC paid cash issuance costs of $23.7 thousand.

On February 27, 2019, the Company completed the RTO, whereby it acquired all of the issued and outstanding common shares of MVC pursuant to a three-cornered amalgamation. Pursuant to the RTO, a wholly-owned subsidiary of the Company and MVC amalgamated and the resulting entity, MVC Technologies Inc., became a wholly-owned subsidiary of the Company. Under the terms of the RTO, the Company issued one post-consolidation Common Share for each one common share of MVC then issued and outstanding and all convertible securities of MVC were exchanged for convertible securities of the Company on equivalent terms.

On March 5, 2019, $959,000 principal amount debentures, plus accrued interest of $0.1 million, were converted into 1,518,909 Common Shares, including a 10% penalty multiplier, as MVC was unable to complete the RTO by the conversion date as stipulated in the debenture agreement.

On March 5, 2019, the Company entered into a binding agreement to acquire the assets of MedEval Clinic LLC, (MedEval Clinic) an alternative medical care and education center group with multiple locations in Colorado and Arizona. The total consideration was US$0.2 million cash and the issuance of 90,000 Common Shares upfront at a price of $1.55 per Common Share and 20,000 Common Shares issued in November 2019 at a price of $0.625 per Common Share.

On March 6, 2019, the Company commenced trading on the CSE under the symbol “CBII”.

On March 27, 2019, the Company signed an agreement with Premier Health Group (PHG) to integrate its Clinical Decision Support into PHG’s Electronic Medical Records platform to provide physicians with a tool built for managing alternative therapies to be used at the point-of-care to assess treatment options for patients.

On April 4, 2019, the Company acquired the assets of Colorado-based Rae of Sunshine Health Services (“ROSH”) LLC, operating as “Relaxed Clarity” for a cash payment of US$0.2 million and the issuance of 100,000 Common Shares at a price of $1.55 per Common Share. During 2019, the Company issued ROSH 356,672 Common Shares in relation to the milestone incentive payments. During 2020, the Company issued ROSH a further 377,911 Common Shares in relation to milestone incentive payments.

On May 17, 2019, the Company commenced trading in the US on the OTCQB market under the symbol “CBIIF”.

On June 14, 2019, the Company entered into a binding agreement for the purchase of 100% of the patient list of New Jersey Alternative Medicine LLC (NJAM), an alternative medicine clinic group with multiple locations in New Jersey under an earn-out arrangement with no cash or other consideration payable on the closing date.

On January 28, 2020, the Company issued NJAM 500,000 Common Shares priced at $0.70 per Common Share to settle all obligations under the agreement.

On June 24, 2019, the Company entered into an agreement with Merida Capital Partners II LP (“Merida”) whereby the terms of the promissory note dated December 20, 2018 issued by the Company and referred to above were amended, an additional amount of US$0.6 million was advanced to the Company and the balance of such promissory note was increased from US$2.4 million to US$3.0 million. In connection with the agreement, all accrued unpaid interest payable to Merida Capital in accordance with the terms of the promissory note for the period of December 20, 2018 through June 24, 2019 was paid through the issuance of 243,904 Common Shares.

2020

The Company successfully navigated several major inflection points. Amidst the challenges of limited cash entering Q1 2020, the Company was able to continue improving on its operations and manage costs in line with seasonality of its US business.

The impact of the COVID-19 pandemic in March resulted in a significant shift in business model from in-clinic services to a near total virtual telehealth model. Thanks to the efforts of the team and established technology framework, the Company was able to quickly react and regain patient visits and volumes based on the lack of access to in-clinic services. In support of this, the Company also saw a rise in patient visits and adoption to its technology by physicians, patients, and clinical staff.

The Company also underwent a major shift in its overall business model and rebranded to Skylight Health Group as it re-positioned itself in the US markets to move to addressing a larger need in the market, accessibility and quality in primary care delivery to patients. Driven by patient need, the Company determined the shift in response to both factors driving the future trends in VBC as well as the need from patients for a more comprehensive form of care delivery. Skylight’s repositioning provided a further opportunity to see strong growth by way of acquisition, further enhancing the growth trajectory of the Company.

Following a strong demonstration of execution in Q2, the Company further bolstered its financial position through the extinguishing of its Amended Note and subsequent financings all at premiums to the first round in September 2020 adding over $20 million in aggregate net proceeds in Q3 and Q4 2020.

On January 29, 2020, the Company appointed Tom Brogan, as an independent director to Board of Directors. Mr. Brogan is currently the CEO and Chairman at Vestrum Health, an electronic healthcare record data company which delivers information systems to pharmaceutical manufacturers, physician practices and other healthcare stakeholders. On the same day, the Company also appointed Norton Singhavon Interim Chairman of the Board and the Audit Committee.

On January 27, 2020, the Company announced that it had issued an aggregate of 243,751 Common Shares to Merida Capital as part of its interest payment on a debt note. In addition, the Company agreed to issue an aggregate of 497,425 Common Shares as part of a debt settlement on current liabilities of which approximately 0.36 million Common Shares were be issued to insiders and directors in lieu of certain compensation.

In April 2020, the Company launched Skylight Health Group (“SHG”) as part of its clinical operations in the United States. SHG provides a range of integrated health services from primary medical care to consultative specialist care, alternative health, wellness and multi-disciplinary services and products to its patient population. SHG services are reimbursable in accordance with the rules, regulations and requirements by the Centers for Medicare and Medicaid Services (“CMS”), as well as other private health insurers within each operating state where its physicians, practitioners and patients will be able to enjoy the benefits of an expanded service offering. The primary focus of the SHG is to provide a broad array of primary and alternative healthcare services including family/specialty medicine and interdisciplinary services focusing on comprehensive care, chronic disease management and health promotion/education.

In April 2020, the Company qualified for relief funds in the United States due to the COVID-19 Pandemic. Total funds of USD $0.7 million were received to support payroll and rent relief efforts. The funds used as part of the

guidelines, provided support for the Company to withstand the initial impact to its brick-and-mortar services during the early impact of COVID-19 in March 2020.

In June 2020, the Company entered into an amended and restated promissory note (the “Amended Note”) with Merida, which amended the terms of a promissory note originally issued by the Company on December 20, 2018 and amended in June 2019. Under the terms of the Amended Note, the principal amount of USD $3 million would have become payable on December 24, 2022 instead of December 24, 2020 and earned an annual interest rate of 8% reduced from 12%. The Amended Note was payable at the Company’s option, either in cash or in Common Shares. The Amended Note was converted into 2,082,450 Common Shares fair valued at $2.65 per share on October 29, 2020. As consideration for the amendments, the Company issued warrants entitling the holder to purchase up to 0.6 million Common Shares at an exercise price of CAD $0.70 per Common Share during the period commencing on the first anniversary of date of issuance of the warrants and ending three years from such issuance date.

In September and October 2020, the Company issued 6,890,728 units (the “Units”) by way of a non-brokered private placement, at a price of $0.75 per Unit, for gross proceeds of $5.2 million (the “PP Offering”). Each Unit is comprised of one Common Share and one half of one whole Common Share purchase warrant (each whole warrant, a “PP Warrant”). Each PP Warrant is exercisable to acquire one additional Common Share at an exercise price of $1.00 for a period of 24 months following the closing date of the PP Offering. The Company paid finder’s fees in the aggregate amount of $0.2 million and issued an aggregate of 267,556 warrants (the “PP Finder Warrants”) to certain parties in connection with the PP Offering. Each PP Finder Warrant entitles the holder to purchase one Common Share at an exercise price of $1.00 for a period of 24 months following the closing date of the PP Offering.

On October 7, 2020, the company announced, that it had acquired assets of Maverick County Medical (“MCM”) - a Texas-based Primary Care Medical & Wellness Clinic. MCM provides Primary Care Services to over 10,300 patients in Eagle Pass and surrounding regions. The Company paid total cash consideration of $1.0 million (US$0.7 million), 50% of the cash awarded at signing of the transactions and 50% due in six months from the date of completion of transaction.

On October 28, 2020, the Company announced the completion of the acquisition of a Tacoma- Washington primary care services group Michael R. Jackson, M.D., P.S., operating as “JMC”. The Washington-based Tacoma medical clinic owned by Dr. Jackson has been providing Primary Care Services to over 10,000 patients in University Place and surrounding regions. The Company paid total cash consideration of $0.4 million (US$0.3 million). The terms of the transaction include a customary transition by the previous owners for a period of up to one year to ensure successful continuity of care for patients in the practice.

On November 19, 2020, the Company completed a short form prospectus offering by issuing 2,447,2000 Common Shares priced at $2.35 per share for gross proceeds of $5.8 million. The Company paid underwriters fees of $0.4 million and issued 174,496 broker warrants exercisable at $2.35 until November 19, 2022.

On November 25, 2020 the Company announced the approval of its name change to Skylight Health Group Inc. and announced the launch of its rebranding under the Skylight Health brand effective November 30, 2020.

On December 30, 2020, the Company completed a short form prospectus offering by issuing 2,760,000 Common Shares, priced at $5.00 per share for gross proceeds of $13.8 million. The Company paid underwriters fees of $0.7 million and issued 149,600 broker warrants exercisable at $5.00 until December 30, 2022.

On December 30, 2020, the Company announced the completion of the acquisition of the assets of Healthcare Resources Management LLC which operates Perimeter Pain and Primary Clinic in in Cookeville, Tennessee in consideration for the payment of $1.0 million (US$0.8 million).

2021

On January 4, 2021, the Company announced the completion of the acquisition of the assets of a medical clinic in Denver, Colorado in consideration for the payment of $2.3 million to be paid in installments over a six-month period.

On January 6, 2021, the Company commenced trading on the TSX-V under the symbol “SHG”.

On January 14, 2021, the Company appointed Grace Mellis, as an independent director to the Company’s Board of Directors. Ms. Mellis has a robust background in strategy and finance leadership roles with over 28 years of success and experience: Almost a decade at JP Morgan Chase serving as Managing Director, Head of International Strategy, and Investor Services CFO for EMEA within the Corporate and Investment Bank. Former CFO and VP of Corporate Finance and Business Intelligence at Greendot Corporation, a US $3.1B market cap NYSE listed company. Founder and director of IGA Capital which provides consulting and advisory services to primarily early-stage companies.

On February 3, 2021, the Company announced the completion of the acquisition of six medical clinics in Florida in consideration for a purchase price of $5.6 million (US$4.4 million) of which approximately 66% is payable in cash within 90 days of the closing date and the balance is payable in Common Shares issued quarterly over 15 months. On closing the Company issued 74,833 Common Shares priced at $6.39 per share representing 20% of the total share consideration. Each subsequent tranche of shares representing 16% of the share consideration will be priced at the greater of the 10 day average, the minimum price allowed by the TSX-V at the time of issuance.

On February 17, 2021, the Company announced the appointment of Dr. George Feghali as Chief Medical Officer.

On February 23, 2021 announced that it has partnered with Amazon Web Services (“AWS”) to utilize their infrastructure and tools as part of a big data strategy. The Company will combine data from hundreds of different sources and use tools available in AWS, from Business Intelligence platforms to Artificial Intelligence to identify ways to improve patient care while increasing clinic efficiency and revenue potential.

On February 26, 2021, the Company announced the appointment of Andrew Elinesky as Chief Financial Officer.

On March 4, 2021, the Company announced that it has entered into Letters of Intent to acquire 3 independent Primary Care practices in the United States each of which are anticipated to close in the second quarter of fiscal 2021.

On March 16, 2021, the Company announced the appointment of Patrick McNamee as Chairman of the Board of Directors. Mr. McNamee succeeded Norton Singhavon who remained involved as an active member of the Board. Mr. McNamee has previously acted as EVP and COO of Express Scripts, where he led all major activities of the $120B+ technology-driven pharmacy benefit management company.

On April 5, 2021, the Company announced the closing of primary care clinical group Rocky Mountain in Colorado. Rocky Mountain expands SHG to over seven new locations in the Denver and Boulder area. Skylight Health Group has agreed to pay a total of $13.3 million (US$10.7 million) in cash to acquire the full assets of Rocky Mountain.

On June 7, 2021, the Company commenced trading on the Nasdaq under the symbol “SLHG”. In conjunction with the new Nasdaq symbol, the common shares also began trading on the TSX Venture Exchange on June 7, 2021 under the new symbol “SLHG.”

On May 26, 2021, the Company closed a bought deal offering with a syndicate of underwriters led by Raymond James Ltd. as sole bookrunner and co-lead underwriter and Stifel GMP as co-lead underwriter on behalf of a syndicate including Beacon Securities Limited, Echelon Wealth Partners Inc., and Bloom Burton Securities Inc. (collectively the "Underwriters"). Pursuant to this, the Underwriters were issued, on a bought deal basis, with full exercise of the Underwriters' 15% over-allotment option, 1,970,360 common shares of the Company at a price of $7.00 per common share for gross proceeds of $13.8 million.

On May 28, 2021, the Company completed a consolidation (“Share Consolidation”) of its share capital on the basis of five existing common shares for one new common share. As a result of the Share Consolidation, the 190,802,347 common shares issued and outstanding as at that date were consolidated to 38,160,473 common

shares outstanding. The Share Consolidation was previously approved by the shareholders at the Annual General Meeting held on February 22, 2021.

On June 23, 2021, the Company acquired 100% of the identified assets of Florida based primary care group Doctors Center Inc. (“Doctors Center) for a total cash transaction value of $2.8 million (US$2.2 million).

On July 7, 2021, the Company appointed Dr. Kit Brekhus as Chief Medical Officer (“CMO), taking over from Dr. Georges Feghali who served as CMO from February 2021.

On July 13, 2021, the Company acquired 100% of the interest of ACO Partners LLC, a new Accountable Care Organization (“ACO”) that will begin participating in the Medicare Shared Savings Program offered by the Centers for Medicare and Medicaid Services (“CMS”) effective January 1, 2022 for a total cash consideration of $312.9 thousand (US$250.0 thousand). Subsequently, the Company determined it would not receive approval on the ACO application to the CMS by January 31, 2022. The cash paid on closing date of $78.2 thousand (US$62.5 thousand) has been written off as of December 31, 2021 and no further amounts are payable.

On August 26, 2021, the Company appointed Mohammad Bataineh as President, taking over from Kash Qureshi who became Chief Corporate Officer.

On September 16, 2021, the Company acquired 70% of the membership interest of Pennsylvania based Primary Care Clinic Group, Aspire Health Concepts, Inc. (“Aspire”) for a total cash consideration of $2.0 million (US$1.6 million).

On October 7, 2021, the Company announced the execution of a Participation Provider Contract with a leading Fortune 50 national healthcare organization who is a recipient of a Direct Contracting Entity (“DCE”) license, with the Company’s participation beginning in 2022.

On October 12, 2021, the Company appointed Greg Sieman as senior vice president of marketing and communications. Prior to Skylight, Greg was SVP of Marketing at Oak Street Health, and, more recently, the chief revenue & communications officer at Lifespace Communities.

On October 29, 2021, the Company announced the execution of a Definitive Agreement with New Frontier Data to divest 100% of assets related to its legacy businesses Canna Care Docs, MedEval Clinic LLC, ROSH and New Jersey Alternative Medicine LLC (“Legacy Business”) for total cash consideration of $11.1 million (US$8.6 million). $5.2 million (US$4.0 million) was paid on closing on December 15, 2021, with the remainder of the balance paid over three installments at 12 months, 18 months and 24 months from the date of closing. A gain on disposal of $5.6 million was recognized.

On December 6, 2021, the Company announced the closing of the registered offering of the Series A Preferred Shares at a price to the public of US$21 per share for gross proceeds of US$5.8 million. The Series A Preferred Shares trade on the Nasdaq Capital Market under the symbol “SLHGP”.

On December 6, 2021, the Company declared dividends on the Series A Preferred Shares to the shareholders of record on December 6, 2021, payable on December 20, 2021, in the amount of US$0.0964 per share. Declaration of monthly dividends of US$0.1927 per share on the Series A Preferred Shares commenced on December 22, 2021 and has continued to date.

Impact of COVID 19

On March 11, 2020, the COVID-19 outbreak was declared a pandemic by the World Health Organization, which has since caused significant financial market and social dislocation. In particular, the federal government of the United States responded to the pandemic with various declarations of emergency, which resulted in travel and entry restrictions. It also imposed guidelines and recommendations regarding the closure of schools and public meeting places, lockdowns, and other restrictions intended to slow the progression of the virus, which state, territorial, tribal, and local governments have followed. To date, the COVID-19 crisis has not materially impacted the Company’s operations, financial condition, cash flows and financial performance. The Company’s

employees and consultants have been able to continue their work uninterrupted and the Company continues to have full access to its business operations in Canada and the United States.

In response to the outbreak, the Company has instituted operational and monitoring protocols to ensure the health and safety of its employees, which follow the advice of local governments and health authorities where it operates. The Company has adopted a work from home policy where possible. The Company continues to operate effectively whilst working remotely. The Company will continue to monitor developments of the pandemic and continuously assess the pandemic’s potential further impact on the Company’s operations and business. The situation is dynamic, and the ultimate duration and magnitude of the impact of the pandemic on the economy and the financial effect on the Company’s operations and business are not known at this time.

See “Risk Factors - Public Health Crises such as the COVID-19 Pandemic and other Uninsurable Risk”.

DESCRIPTION OF THE BUSINESS

General

Business Model

The Company’s business model is primarily driven through its clinical operations that offer medical services to patients in the US through virtual and physical care in 6 US states. During 2019, the Company was also able to begin validating its technology and contract research services, which generated incremental revenue by the end of 2019, and continued to grow throughout the 2020 and 2021 calendar years. The Company operates a US multi-state primary care health network comprised of clinics providing a range of services from primary care, sub-specialty, allied health, and laboratory/diagnostic testing. The Company is focused on helping small and independent practices shift from a traditional FFS only model to include VBC through our proprietary technology, unique data analytics and our robust operations infrastructure.

At present, the Company operates and offers services in three vertical markets: medical services, technology & data analytics, and contract research and development services, as described in more detail below. Each vertical market is autonomous but works in tandem with the others. The Company integrates patient access, proprietary technology and consulting services to bring a comprehensive solution.

The Company’s practices offer both in-clinic and virtual care services through telemedicine and remote patient monitoring. As part of developing the infrastructure for improved access within its practices, the Company expects to expand valued-based health service offerings to patients based on quality improvement plans aimed at population and patient health management.

The Company has a disciplined operating model that allows the Company to deliver desired results in a time-efficient and cost-effective manner to its clients and to run a fiscally responsible business.

Clinical Operations - Access to patient-centred integrative healthcare services. Operating as Skylight Health Group, the Company’s clinical operations span more than 5 states in the US and currently serve over 85,000 unique patients annually from continuing operations (66,000 from discontinued operations from sale of the Legacy Business).

As a result of organic clinical growth and strategic acquisitions outlined above, the Company is now a major medical services organization in the US that specializes in integrative medical services. The Company’s acquisition strategy was designed to provide it with improved access to new markets and enable the Company to realize significant economies of scale that would improve on the overall profitability margin of the business.

The Company expects going forward that most investments made during the year ended December 31, 2021 will result in both a higher growth of revenue driven organically and by acquisition but will also result in a stronger EBITDA recognition. The Company is focused on revenue growth which it believes is how its peers are measured and expects to compete aggressively for market share growth. Further, as the Company advances its

participation in value-based care programs, it expects to see increased expenses in the near term which will be offset by the expected growth in revenue through shared savings and more economical payor agreements.

Technology & Data Analytics - Skylight Health Group – Technology and Data Analytics to Improve Patient Care, Health Outcomes, and Clinical Efficiencies

Skylight Health Group is employing a big data strategy that utilizes cloud infrastructure to combine data from hundreds of data sources and to provide a framework for the development analytics solutions. These analytic solutions will be used across the organization to improve patient care while increasing clinic efficiency, revenue potential and identifying opportunities for growth.

The Skylight Health Group approach will enable acquired clinics to take advantage of the guidance from its centralized team of clinical and operational experts whose insights will be powered by this big data strategy.

Aggregating the data from its clinics will allow Skylight Health Group to:

•Improve patient outcomes by identifying key markers of health and disease, reduce hospital visits, enhance monitoring, and increase satisfaction and quality of life by tracking metrics that are important to patients.

•Increase patient engagement in their own health by identifying and targeting patients who may benefit from preventative care, improve treatment plan compliance through targeted communication and education, and remove barriers allowing patients to become active in their own care.

•Improve safety by identifying patients at risk, and then enabling appropriate care and monitoring.

•Increase operational efficiency by decreasing the administrative burden on physicians and allowing for ways to improve billing and revenue cycle management.

Skylight Health Group has also developed several proprietary technologies that function as patient record platforms or integrate with other electronic health systems currently used by the clinics. These systems have been designed to standardize and optimize the workflows and management of the Company’s wholly owned clinical operations.

Contract Research and Development - The Company has amassed a substantial registry of patients seeking and using integrative treatments, conventional medications and alternative plant-based medicines. This allows the Company’s partners to have access to the Company’s database for a more time efficient and cost-effective approach. The Company’s team has extensive experience in providing CRO services to allow the Company to offer a turnkey solution across all phases of drug development including randomized control, pragmatic and post-marketing clinical trials. The Company’s services are designed to identify and support clinical trial data through the generation of safety and efficacy claims from RWE. The Company may leverage any combination of its technology, patient registry and/or industry knowledge to support large-scale projects that focus on studying integrative therapies in various markets.

The Company’s research and development team can work to support internal research departments and organizations to complement the services offered, or act as a full service CRO providing support from feasibility studies, clinical trial designs, regulatory and drug applications, protocol development and ethics/IRB approval,

patient clinical site recruitment, site monitoring and adverse events reporting, medical writing and publication submission.

Segmentation

The Company’s current revenue is generated predominantly through its clinical operations by way of medical services.

The following table shows the details of revenues for the years ended December 31, 2021 and December 31, 2020.

| | | | | | | | |

| in 000’s of dollars | December 31, 2021 | December 31, 2020 |

| Revenues | | |

| Clinic | 26,553 | 446 |

| Contract Research solutions | 584 | 190 |

| Software | 20 | 53 |

| Total | 27,157 | 689 |

| Revenue from discontinued operations | 10,613 | | 12,452 | |

| Realized revenue | 37,770 | | 13,141 | |

Specialized Skill and Knowledge

The Company’s business is dependent on skilled employees and contractors in the areas of practice management and on skilled and knowledgeable medical practitioners and trained medical assistants.

Competitive Conditions

The Company experiences competition from other healthcare providers, hospitals and telemedicine companies. Most competition is regionalized and highly fragmented. The US Healthcare market, in particular in the primary care market, is comprised of about 56% independent or small group practices. The Company believes that it has the financial resources and specialized skills and knowledge to compete with others in the markets where it is currently carrying on business.

Intangible Properties

The Company’s intangible assets are an important part of its business and its ability to compete in the markets where it is currently carrying on business. These intangible assets include patient lists, software, trademarks, and its brands for its offered services. The Company’s intangible assets are wholly owned by it.

Cycles

The business of the Company is in part cyclical in nature. Sales of the Company’s services tend to be slower in the first and last calendar quarter than in the remainder of each year. However, the Company does not anticipate being affected by more general economic downturns.

Economic Dependence

The Company’s business is dependent on the availability of medical insurance in the United States. In this regard, the Company’s business may be affected by changes in insurable services, as it may affect its billings and services offered. The Company’s services are governed by the policies of the Centers for Medicare and Medicaid, a federal agency of the United States that administers the nation's major healthcare programs including Medicare, Medicaid, and CHIP.

The Company is dependent on its relationships with the “Skylight Health PCs”, which are affiliated professional entities that the Company does not own, to provide healthcare services, and the Company’s business would be harmed if those relationships were disrupted or if the arrangements with the Skylight Health PCs become subject to legal challenges. See “Risk Factors - The Company is dependent on its relationships with the Skylight Health PCs.”

Environmental Protection

The Company uses, generates, stores, handles, and disposes of potentially hazardous materials at its clinical operations.

New laws and regulations, stricter enforcement of existing laws and regulations, the discovery of previously unknown contamination, new clean-up requirements or claims on environmental indemnities the Company committed to may result in the Company having to incur substantial costs. This could have a materially negative effect on the Company’s financial condition and results of operations.

The Company believes its current operations are in compliance in all material respects with environmental laws and regulations. Environmental protection requirements do not have material financial or operational effects on the Company’s capital expenditures, profit or loss or competitive position.

Employees

As of December 31, 2021, the Company has 259 employees and contractors in Canada and the United States. These numbers exclude physicians who provide services though the Company’s clinical operations

Foreign Operations

The Company derives most of its revenue from its operations in the United States. In addition, the Company is working on pilot programs with clients in the United Kingdom and Canada. At present, the Company is dependent only on revenues from its US operations and not from these activities in the United Kingdom and Canada.

RISK FACTORS

The Company’s business involves numerous inherent risks as a result of the nature of the business, global economic trends, as well as local social, political, environmental and economic conditions in Canada, the Company’s areas of operation. As such, the Company is subject to several financial and operational risks that could have a significant impact on its ability to generate any future profitability and its levels of operating cash flows.

The Company assesses and attempts to minimize the effects of these risks through careful management and planning of its operations and hiring qualified personnel but is subject to a number of limitations in managing risk resulting from its early stage of development and the jurisdictions of its exploration activities.

Below is a summary of the principal risks and related uncertainties facing the Company. Such risk factors could have a material adverse effect on the Company’s business, financial condition and results of operations or the trading price of the Common Shares.

General

A purchase of any of the securities of the Company involves a high degree of risk and should be undertaken only by purchasers whose financial resources are sufficient to enable them to assume such risks and who have no need for immediate liquidity in their investment. An investment in the securities of the Company should not constitute a major portion of an individual’s investment portfolio and should only be made by persons who can afford a total loss of their investment. Prospective purchasers should evaluate carefully the following risk factors associated with an investment in the Company’s securities prior to purchasing any of the securities.

Limited Operating History

MVC, while incorporated in November 2014, began carrying on business in 2017 and the Company has only recently begun to generate revenue. The Company is therefore subject to many of the risks common to early- stage enterprises, including under-capitalization, cash shortages, limitations with respect to personnel, financial,

and other resources and lack of revenues. There is no assurance that the Company will be successful in achieving a return on shareholders’ investment and likelihood of success must be considered in light of the early stage of operations.

Going Concern

The Company has historically not generated positive cash flow from operations. The Company is devoting significant resources to its business, however there can be no assurance that it will generate positive cash flow from operations in the future. The Company may continue to incur negative consolidated operating cash flow and losses. For the year ended December 31, 2021, the Company had negative cash flows from continuing operations of 15.2 million and reported a net loss of 13.6 million. To the extent that the Company has negative cash flow in future periods, the Company may need to obtain additional financing to fund such negative cash flow.

Although the Company has been successful in raising funds to date, there can be no assurance that adequate or sufficient funding will be available in the future or available under terms acceptable to the Company, or that the Company will be able to generate sufficient returns from operations. The ability of the Company to continue as a going concern and to realize the carrying value of its assets and discharge its liabilities and commitments when due is dependent on the Company generating revenue and debt and/or equity financing sufficient to fund its cash flow needs. The Company is not currently eligible to raise funds using a registration statement in the United States. These circumstances indicate the existence of a material uncertainty that may raise substantial doubt on the ability of the Company to meet its obligations as they come due, and accordingly the appropriateness of the use of the accounting principles applicable to a going concern.

The consolidated financial statements do not reflect adjustments that would be necessary if the going concern assumption were not appropriate. If the going concern basis were not appropriate for the consolidated financial statements, then adjustments would be necessary in the carrying value of the assets and liabilities, the reported revenue and expenses and the classifications used in the consolidated statement of financial position. Such differences in amounts could be material.

The assessment of material uncertainties related to events and circumstances that may raise substantial doubt on the Company’s ability to continue as a going concern involves significant judgment. In making this assessment, management considers all relevant information, as described above.

Economic Environment

The Company’s operations could be affected by the economic context should the unemployment level, interest rates or inflation reach levels that influence consumer trends and consequently, impact the Company’s sales and profitability. As well, general demand for banking services and alternative banking or financial services cannot be predicted and future prospects of such areas might be different from those predicted by the Company’s management.

Global Economic Risk

Global economic conditions could have an adverse effect on the Company's business, financial condition, or results of operations. Adverse changes in general economic or political conditions in the United States or any of the states within the United States or any jurisdiction in which the Company operates or intends to operate could adversely affect the Company's business, financial condition, or results of operations.

Risks Associated with Acquisitions

As part of the Company's overall business strategy, the Company may pursue select strategic acquisitions, which would provide additional product offerings, vertical integrations, additional industry expertise, and a stronger industry presence in both existing and new jurisdictions. Future acquisitions may expose it to potential risks, including risks associated with: (a) the integration of new operations, services and personnel; (b) unforeseen or hidden liabilities; (c) the diversion of resources from the Company's existing business and technology; (d) potential inability to generate sufficient revenue to offset new costs; (e) the expenses of

acquisitions; or (f) the potential loss of or harm to relationships with both employees and existing users resulting from its integration of new businesses. In addition, any proposed acquisitions may be subject to regulatory approval.

US Securities

The Company’s common shares are listed on the Nasdaq, and as such, the Company must satisfy the Nasdaq’s continued listing requirements, or risk possibly delisting, which would have a material adverse effect on our business and it would make it more difficult to buy or sell our securities and to obtain accurate quotations, and the price of our common stock could suffer a material decline. In addition, a delisting would impair our ability to raise capital through the public markets, could deter broker-dealers from making a market in or otherwise seeking or generating interest in our securities and might deter certain institutions and persons from investing in our securities at all. There can be no assurance that we will be able to maintain compliance with Nasdaq’s continued listing requirements.

Multi-Jurisdictional Disclosure System

Due to the decrease in our common share price, the Company is no longer eligible to utilize the multi-jurisdictional disclosure system (MJDS). As a result, the Company will no longer be afforded the ability to prepare and file its disclosure reports and other information with the SEC incorporating (accordance with) the disclosure requirements of Canada and will now be required to file the same reports that a non-MJDS eligible foreign private issuer (FPI) is required to file with the SEC, including the requirement to file an Annual Report on Form 20-F with financial statements audited under rules of the Public Company Accounting Oversight Board (“PCAOB”), the additional costs of which will be significant. The Company does not have PCAOB audits completed on its December 31, 2019 or December 31, 2020 financial statements. Accordingly, the Company may not be able to timely file its Annual Report on Form 20-F for the year ended December 31, 2021 (the “2021 20-F”) which is due on or prior to April 30, 2022. If the Company is unable to timely file its 2021 20-F, there will be several consequences, including, but not limited to, (i) the Company will no longer be in compliance with the continued listing requirements of the Nasdaq Capital Market and will receive a deficiency notice and the Company’s securities that are listed on Nasdaq may be subject to delisting and (ii) the Company will not be able to file a registration statement with the SEC until such time as the 2021 20-F is filed (and will not be able to utilize a Form F-3 for at least one year) which will limit our ability to conduct financings in the U.S.

Operational Risks

The Company will be affected by a number of operational risks and the Company may not be adequately insured for certain risks, including: labour disputes; catastrophic accidents; fires; blockades or other acts of social activism; changes in the regulatory environment; impact of non-compliance with laws and regulations; natural phenomena, such as inclement weather conditions, floods, earthquakes and ground movements. There is no assurance that the foregoing risks and hazards will not result in personal injury or death, environmental damage, adverse impacts on the Company's operation, costs, monetary losses, potential legal liability and adverse governmental action, any of which could have an adverse impact on the Company's future cash flows, earnings and financial condition. Also, the Company may be subject to or affected by liability or sustain loss for certain risks and hazards against which the Company cannot insure or which the Company may elect not to insure because of the cost. This lack of insurance coverage could have an adverse impact on the Company's future cash flows, earnings, results of operations and financial condition. Additional operational risks are outlined below.

The Company is dependent on its relationships with the Skylight Health PCs

The Company is dependent on its relationships with the “Skylight Health PCs”, which are affiliated professional entities that the Company does not own, to provide healthcare services, and the Company’s business would be harmed if those relationships were disrupted or if the arrangements with the Skylight Health PCs become subject to legal challenges.

A prohibition on the corporate practice of medicine by statute, regulation, board of medicine or attorney general guidance, or case law, exists in certain of the U.S. states in which we operate. These laws generally prohibit the

practice of medicine by lay persons or entities and are intended to prevent unlicensed persons or entities from interfering with or inappropriately influencing providers’ professional judgment. Due to the prevalence of the corporate practice of medicine doctrine, including in certain of the states where the Company conducts its business, it does not own the Skylight Health PCs and contracts for healthcare provider services for its members through administrative services agreements (“ASAs”) with such entities. As a result, the Company’s ability to receive cash fees from the Skylight Health PCs is limited to the fair market value of the services provided under the ASAs. To the extent the Company’s ability to receive cash fees from the Skylight Health PCs is limited, the Company’s ability to use that cash for growth, debt service or other uses at the Skylight Health PC may be impaired and, as a result, the Company’s results of operations and financial condition may be adversely affected.

The Company’s ability to perform medical and digital health services in a particular U.S. state is directly dependent upon the applicable laws governing the practice of medicine, healthcare delivery and fee splitting in such locations, which are subject to changing political, regulatory, and other influences. The extent to which a U.S. state considers particular actions or relationships to constitute the practice of medicine is subject to change and to evolving interpretations by medical boards and state attorneys general, among others, each of which has broad discretion. There is a risk that U.S. state authorities in some jurisdictions may find that the Company’s contractual relationships with the Skylight Health PCs, which govern the provision of medical and digital health services and the payment of administrative and operations support fees, violate laws prohibiting the corporate practice of medicine and fee splitting. The extent to which each state may consider particular actions or contractual relationships to constitute improper influence of professional judgment varies across the states and is subject to change and to evolving interpretations by state boards of medicine and state attorneys general, among others. Accordingly, the Company must monitor its compliance with laws in every jurisdiction in which it operates on an ongoing basis, and the Company cannot provide assurance that its activities and arrangements, if challenged, will be found to be in compliance with the law. Additionally, it is possible that the laws and rules governing the practice of medicine, including the provision of digital health services, and fee splitting in one or more jurisdictions may change in a manner adverse to the Company’s business. While the ASAs prohibit the Company from controlling, influencing or otherwise interfering with the practice of medicine at each Skylight Health PC, and provide that physicians retain exclusive control and responsibility for all aspects of the practice of medicine and the delivery of medical services, there can be no assurance that the Company’s contractual arrangements and activities with the Skylight Health PCs will be free from scrutiny from U.S. state authorities, and the Company cannot guarantee that subsequent interpretation of the corporate practice of medicine and fee splitting laws will not circumscribe the Company’s business operations. State corporate practice of medicine doctrines also often impose penalties on physicians themselves for aiding the corporate practice of medicine, which could discourage providers from participating in the Company’s network of physicians. If a successful legal challenge or an adverse change in relevant laws were to occur, and the Company was unable to adapt its business model accordingly, the Company’s operations in affected jurisdictions would be disrupted, which could harm its business.

Financial Projections May Prove Materially Inaccurate or Incorrect

The Company’s financial estimates, projections and other forward-looking information accompanying this document were prepared by the Company without the benefit of reliable historical industry information or other information customarily used in preparing such estimates, projections and other forward-looking statements. Such forward-looking information is based on assumptions of future events that may or may not occur, which assumptions may not be disclosed in such documents. Investors should inquire of the Company and become familiar with the assumptions underlying any estimates, projections or other forward-looking statements. Projections are inherently subject to varying degrees of uncertainty and their achievability depends on the timing and probability of a complex series of future events.

There is no assurance that the assumptions upon which these projections are based will be realized. Actual results may differ materially from projected results for a number of reasons including increases in operating expenses, changes or shifts in regulatory rules, undiscovered and unanticipated adverse industry and economic conditions, and unanticipated competition. Accordingly, investors should not rely on any projections to indicate the actual results the Company and its subsidiaries might achieve.

Difficulty to Forecast

The Company must rely largely on its own market research to forecast sales as detailed forecasts are not generally obtainable from other sources at this early stage of the Company’s business. A failure in the demand for its services to materialize as a result of competition, technological change or other factors could have a material adverse effect on the business, results of operations, and financial condition of the Company.

Competition General

There is potential that the Company will face intense competition from other companies, some of which can be expected to have longer operating histories and more financial resources and marketing experience than the Company. Increased competition by larger and better financed competitors could materially and adversely affect the business, financial condition, and results of operations of the Company. To remain competitive, the Company will require a continued high level of investment in research and development, marketing, sales, and client support.

Competition Healthcare Information Systems

The healthcare information systems market is highly competitive on a local, national and international level. The Company believes that the primary competitive factors in this market are:

•quality service and support;

•price;

•product features, functionality and ease of use;

•ability to comply with new and changing regulations;

•ongoing product enhancements; and

•reputation and stability of the vendor.

For example, the current electronic medical record market in Canada is currently dominated by Telus Health and the Company will face substantial competition from Telus Health and other established competitors, which have greater financial, technical, and marketing resources than it does. Its competitors could use their greater resources to modify their product offerings to incorporate platform functionality among doctors, patients, pharmacies and licensed producers in a comparable manner to the Company. The Company's competitors also have a larger installed base of users, longer operating histories and greater name recognition than the Company will.

There can be no assurance that the Company will successfully differentiate its current and proposed products from the products of its competitors, or that the marketplace will consider the products of the Company to be superior to competing products.

Competition Health Care Clinics

The industry is intensely competitive, and the Company competes with other companies that may have greater financial resources and facilities. Numerous other businesses are expected to compete in the clinic space and provide additional patient services. An increase in competition for patient evaluations and education may decrease prices and result in lower profits to the Company.

Management of Growth

The Company may be subject to growth-related risks including capacity constraints and pressure on its internal systems and controls. The ability of the Company to manage growth effectively will require it to continue to implement and improve its operational and financial systems and to expand, train, and manage its employee base. The inability of the Company to deal with this growth may have a material adverse effect on the Company’s business, financial condition, results of operations and prospects.

Reliance on Management

The success of the Company is dependent upon the ability, expertise, judgment, discretion, and good faith of its management. While employment agreements are customarily used as a primary method of retaining the services of key employees, these agreements cannot assure the continued services of such employees. Any loss of the services of such individuals could have a material adverse effect on the Company’s business, operating results, or financial condition.

Dependence on suppliers and skilled labour

The ability of the Company to compete and grow will be dependent on it having access, at a reasonable cost and in a timely manner, to skilled labour, equipment, parts and components. No assurances can be given that the Company will be successful in maintaining its required supply of skilled labour, equipment, parts and components.

Risks Related to Software and Product Development

The Company continues to develop software and products. Inherent risks include:

•Lack of experience and commitment of team

The project manager is the leader and the most responsible person. An inexperienced manager can jeopardize the completion of a project.

•Unrealistic deadlines

Software projects may fail when deadlines are not properly set. Project initialization, completion date and time must be realistic.

•Improper budget

Cost estimation of a project is very crucial in terms of project success and failure. Low cost with high expectations of large projects may cause project failure.

•Lack of resources

Software and hardware resources may not be adequate. Lack of resources in terms of manpower is also a critical risk factor of software failure.

•Personnel hiring

The Company and Company will be subject to extensive hiring requirements across all of its business lines as well as a need to release underperforming employees in order to perform and grow at the rate it intends. Staffing requirements may not be properly attained or assigned for/to specific tasks or company needs.

•Understanding problems of customers

Many customers are not technical in terms of software terminologies and may not understand the developer’s point of view. Developers may interpret information differently from what is provided by the clients.

•Inappropriate design

Software designers have a major role in the success or failure of the project if a design is inappropriate for the project.

•Market demand obsolete

Market demand may become obsolete while a project is still in progress.

Risks Related to the Company

Risk of Safeguarding Against Security & Privacy Breaches

A security or privacy breach could:

•expose the Company and Company to additional liability and to potentially costly litigation;

•increase expenses relating to the resolution of these breaches;

•deter potential customers from using our services; and

•decrease market acceptance of electronic commerce transactions.

As a provider of software technology, the Company and Company are at risk of exposure to a security or privacy breach of its system which could lead to potentially costly litigation, deter potential customers from using its services, or bring about additional liability of the Company and Company. The Company and Company cannot assure that the use of applications designed for data security and integrity will address changing technologies or the security and privacy concerns of existing and potential customers. Although the Company and Company require that agreements with service providers who have access to sensitive data include confidentiality obligations that restrict these parties from using or disclosing any data except as necessary to perform their services under the applicable agreements, there can be no assurance that these contractual measures will prevent the unauthorized disclosure of sensitive data. If the Company and Company are unable to protect the security and privacy of our electronic transactions and data, our business will be materially adversely affected.

Risks Inherent in the Health Clinic Industry

Changes in operating costs (including costs for maintenance, insurance), inability to obtain permits required to conduct clinical business operations, changes in health care laws and governmental regulations, and various other factors may significantly impact the ability of the Company to generate revenues. Certain significant expenditures, including legal fees, borrowing costs, maintenance costs, insurance costs and related charges must be made to operate the Company’s clinic operation, regardless of whether the Company is generating revenue.

Material Impact of PIPEDA/HIPPA Legislation on the Company and Company’s Business

Regulations under PIPEDA/HIPAA governing the confidentiality and integrity of protected health information are complex and are evolving rapidly. As these regulations mature and become better defined, the Company and Company anticipates that they will continue to directly impact our business. Achieving compliance with these regulations could be costly and distract management’s attention from its operations. Any failure on the Company and Company’s part to comply with current or future regulations could subject it to significant legal and financial liability, including civil and criminal penalties. In addition, development of related federal and state regulations and policies regarding the confidentiality of health information or other matters could positively or negatively affect our business.

The Company and Company’s investments in the United States and Canada are subject to applicable anti-money laundering laws and regulations.

The Company and Company is subject to a variety of laws and regulations domestically and in the United States that involve money laundering, financial recordkeeping and proceeds of crime, including the Currency and Foreign Transactions Reporting Act of 1970 (commonly known as the Bank Secrecy Act), as amended by Title III of the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001 (USA PATRIOT Act), the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (Canada), as amended and the rules and regulations thereunder, the Criminal Code (Canada)

and any related or similar rules, regulations or guidelines, issued, administered or enforced by governmental authorities in the United States and Canada.

In February 2014, the Financial Crimes Enforcement Network (“FCEN”) of the Treasury Department issued a memorandum (the “FCEN Memo”) providing instructions to banks seeking to provide services to alternative therapies-related businesses. The FCEN Memo states that in some circumstances, it is permissible for banks to provide services to these businesses without risking prosecution for violation of federal money laundering laws. It refers to supplementary guidance that Deputy Attorney General Cole issued to federal prosecutors relating to the prosecution of money laundering offenses predicated on cannabis-related violations of the CSA. It is unclear at this time whether the current administration will follow the guidelines of the FCEN Memo.

In the event that any of the Company and Company’s operations, or any proceeds thereof, any dividends or distributions therefrom, or any profits or revenues accruing from such operations in the United States were found to be in violation of money laundering legislation or otherwise, such transactions may be viewed as proceeds of crime under one or more of the statutes noted above or any other applicable legislation. This could restrict or otherwise jeopardize the ability of the Company and Company to declare or pay dividends, effect other distributions or subsequently repatriate such funds back to Canada. Furthermore, while the Company and Company has no current intention to declare or pay dividends on its Common Shares in the foreseeable future, in the event that a determination was made that the Company and Company’s proceeds from operations (or any future operations or investments in the United States) could reasonably be shown to constitute proceeds of crime, the Company may decide or be required to suspend declaring or paying dividends without advance notice and for an indefinite period of time.

In certain circumstances, the Company’s reputation could be damaged

Damage to the Company’s reputation can be the result of the actual or perceived occurrence of any number of events, and could include any negative publicity, whether true or not. The increased usage of social media and other web-based tools used to generate, publish and discuss user-generated content and to connect with other users has made it increasingly easier for individuals and groups to communicate and share opinions and views regarding the Company and its activities whether true or not. Although the Company believes that it operates in a manner that is respectful to all stakeholders and that it takes care in protecting its image and reputation, the Company will not ultimately have direct control over how it is perceived by others. Reputation loss may result in decreased investor confidence, increased challenges in developing and maintaining community relations and an impediment to the Company’s overall ability to advance its projects, thereby having material adverse impact on financial performance, financial condition, cash flows and growth prospects.

Scrutiny of Company’s Investments in the United States

The Company’s existing investments in the United States, and any future investments, may become the subject of heightened scrutiny by regulators, stock exchanges and other authorities in Canada. As a result, The Company may be subject to significant direct or indirect interaction with public officials. There can be no assurance that this heightened scrutiny will not in turn lead to the imposition of certain restrictions on the Resulting Issue’s ability to invest in the United States or any other jurisdiction, in addition to those described herein.

Currency Fluctuations