MANAGEMENT’S DISCUSSION AND ANALYSIS

For the three months ended March 31, 2022

(Expressed in Canadian Dollars, unless otherwise stated)

May 16, 2022

| | |

Skylight Health Group Inc. Management Discussion and Analysis For the three months ended March 31, 2022 |

Introduction

The following management’s discussion and analysis (“MD&A”) of the financial condition and results of the operations of Skylight Health Group Inc. (the “Company”, “SHG”, “we”, “us”, “our”) constitutes management’s review of the factors that affected the Company’s financial and operating performance for the three months ended March 31, 2022. This MD&A was written to comply with the requirements of National Instrument 51-102 – Continuous Disclosure Obligations.

This discussion should be read in conjunction with the unaudited condensed interim consolidated financial statements of the Company for the three months ended March 31, 2022, together with the notes thereto, and the accounting policies as described in Note 3 to the consolidated financial statements (“consolidated financial statements”) for the fiscal years ended December 31, 2021 and 2020. Results are reported in Canadian dollars, unless otherwise noted.

The Company’s consolidated financial statements are prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”). Information contained herein is presented as at May 16, 2022, unless otherwise indicated.

The MD&A makes references to certain non-IFRS measures, including certain industry metrics. These metrics and measures are not recognized measures under IFRS, do not have meanings prescribed under IFRS and are as a result unlikely to be comparable to similar measures presented by other companies. These measures are provided as information complimentary to those IFRS measures by providing a further understanding of our operating results from the perspective of management. As such, these measures should not be considered in isolation or in lieu of review of our financial information reported under IFRS. This MD&A uses non-IFRS measures including “EBITDA”, “adjusted EBITDA”, “realized revenue”, “realized gross profit” and “realized adjusted EBITDA”. EBITDA and adjusted EBITDA are commonly used operating measures in the industry but may be calculated differently compared to other companies in the industry. “Realized revenue”, “realized gross profit” and “realized adjusted EBITDA” incorporate the results of continuing and discontinued operations. These non-IFRS measures, including the industry measures, are used to provide investors with supplementary measures of our operating performance that may not otherwise be apparent when relying solely on IFRS metrics.

On March 11, 2020, the World Health Organization declared the ongoing COVID-19 outbreak as a global health emergency. This resulted in governments worldwide enacting emergency measures to combat the spread of the virus, including the closure of certain non-essential businesses.

During the three months ended March 31, 2022, the pandemic did not have a material impact on the Company’s operations. While medical clinics had generally been deemed an essential business, the Company was able to switch to virtual appointments thereby reducing the impact on operations and enabled the Company to achieve savings in clinical operating expenses. As of March 31, 2022, the Company did not observe any impairment of its assets or a significant change in the fair value of assets due to the COVID-19 pandemic. The Company has taken steps to minimize the potential impact of the pandemic including safety measures with respect to personal protective equipment, the reduction in travel and the implementation of a virtual office including regular video conference meetings and participation in virtual Company events, trade shows, customer meetings and other virtual events.

Due to the rapid developments and uncertainty surrounding COVID-19, it is not possible to predict the impact that COVID-19 will have on the Company’s business, financial position and operating results in the future. In addition, it is possible that estimates in the Company’s consolidated financial statements will change in the near term as a result of COVID-19 and the effect of any such changes could be material, which could result in, among other things, impairment of long-lived assets including intangibles and goodwill. The Company is closely monitoring the impact of the pandemic on all aspects of its business.

Further information about the Company and its operations can be obtained from the offices of the Company or on SEDAR at www.sedar.com.

| | |

Skylight Health Group Inc. Management Discussion and Analysis For the three months ended March 31, 2022 |

Company Overview

Skylight Health Group Inc. (“SHG” or the “Company”), is a healthcare services and technology company, working to positively impact patient health outcomes. The Company operates a US multi-state primary care health network comprised of clinics providing a range of services from primary care, sub-specialty, allied health, and laboratory/diagnostic testing. The Company is focused on helping small and independent practices shift from a traditional fee-for-service (FFS) only model to include value-based care (VBC) through our proprietary technology, unique data analytics and our robust operations infrastructure. In a FFS model, payors (commercial and government insurers) reimburse on an encounter-based approach which puts a focus on volume of patients per day rather than creating positive patient outcomes. In a VBC model, providers are rewarded for keeping patients healthy and lowering unnecessary health costs instead of volume of services. VBC will lead to improved patient outcomes, reduced cost of delivery and drive stronger financial performance from existing practices

As of March 31, 2022, the balance sheet had a cash balance of $4.2 million. The Company has continued to position itself to see organic and acquisition-based growth in the coming quarters as it remains focused on shifting its clinical operations to include a VBC model. As of May 7, 2022, the Company has entered fully capitated Medicare Advantage risk contracts in Florida with more than 2,400 lives. Concurrently, the Company secured a $25.5 million (US$ 20.0 million) debt facility with FLC Credit Partners (“FLC”), a New York based lender, of which the Company has drawn-down $12.7 million (US$ 10.0 million), with $12.8 million (US$ 10.0 million) remaining.

The Company was founded in 2014, by founders with extensive experience in clinical practice management in Canada and the US, as owners, operators, and consultants to outpatient medical centers across a variety of specialties from primary care, urgent-care, sub-specialty, and allied health & wellness. SHG is founded on a model designed to drive towards helping small and independent practices adopt value-based capabilities and take on varying levels of risk. SHG positions itself as the disruptor to legacy health networks. Providing an opportunity to consolidate with SHG while maintaining patient treatment quality, accessibility and affordability and preserving the way healthcare should be delivered. SHG also positions itself to partner with health plans as they aim to provide more comprehensive care services to patients across varying risk groups and capitation models to lower the cost of downstream costs.

SHG practices offer both in-clinic and virtual care services through telemedicine and remote patient monitoring. As part of developing the infrastructure for improved access within its practices, the Company expects to expand valued-based health service offerings to patients based on quality improvement plans aimed at population and patient health management.

Finally, SHG has a disciplined operating model that allows the Company to deliver desired results in a time-efficient and cost-effective manner to its clients and to run a fiscally responsible business.

Segmentation

The Company’s current revenue is generated predominantly through its medical services segment. In 2020, the Company expanded significantly into insurable services which is where it expects to see its strongest growth in future periods. The Company has reported both insurable and uninsured services in a single consolidated medical services operating segment and contract and research division in the United States. The Company also derives a small segment of revenue from projects in its technology & data analytics division (Software and Corporate segment).

Key Highlights

The following are the major highlights of SHG’s operating results for the three months ended March 31, 2022 compared to the three months ended March 31, 2021. The financial information related to Canna Care Docs, MedEval Clinic LLC (“MedEval”), Rae of Sunshine Health Services (“ROSH”) and New Jersey Alternative

| | |

Skylight Health Group Inc (formerly CB2 Insights Inc) Management Discussion and Analysis For the three months ended March 31, 2022 |

Medicine LLC ("NJAM") (“Legacy Business”) is reported in the prior period as discontinued operations due to the divestiture of this business line in December 2021.

Disclaimer for Financial Highlights: Certain prior period financial information on the condensed interim consolidated statements of loss and comprehensive loss, and condensed interim consolidated statements of cash flows have been updated to present the Legacy Business as discontinued operations and has therefore been excluded from continuing operations for all periods presented in this MD&A. This MD&A reflects only the results of continuing operations, unless otherwise noted.

Financial Highlights

•During the three months ended March 31, 2022, revenues were $7.7 million, compared to $2.2 million for the three months ended March 31, 2021 (excluding revenue from discontinued operations of $2.8 million), an increase of $5.5 million. This increase was primarily due to additional revenue being contributed by the clinics acquired during the fiscal year ended December 31, 2021. Realized revenues for the three months ended March 31, 2022 were $7.7 million, compared to $5.0 million for the three months ended March 31, 2021.

•Gross profit was $3.4 million for the three months ended March 31, 2022, compared to $1.2 million for the three months ended March 31, 2021 (excluding gross profit from discontinued operations of $2.2 million). Gross margin was 44% for the three months ended March 31, 2022, compared to 55% for the three months ended March 31, 2021 (discontinued operations gross margin was 77% for the three months ended March 31, 2021). The margins in Q1 2022 were lower due to the primary care clinics acquisitions made during 2021 which have lower gross profit margins. The Company began acquiring primary care clinics in Q4 2020 and further acquired five primary care clinics in fiscal year 2021. Lower visit counts also contributed to a lower gross profit margin vs Q1 2021. In the near term, the Company is working towards improving the gross margins by renegotiating payor contracts, optimization of utilization rates of existing providers across the practices, while long term improvements will be achieved as the Company transitions to higher value-based care models which will yield a higher gross margin. Realized gross profit for the three months ended March 31, 2022 was $3.4 million, compared to $3.4 million for the the three months ended March 31, 2021.

•Operating expenses were $11.0 million for the three months ended March 31, 2022, compared to $4.9 million for the three months ended March 31, 2021, an increase of 123%. The increase was a result of a growth in operating expenses such as staffing and rent from primary care related clinical acquisitions made to date. Loss from continuing operations was $7.6 million for the three months ended March 31, 2022, compared to $3.7 million for the three months ended March 31, 2021. The increase is mainly attributed to the cost of integration in systems, resources and operations as well as increased office and administration costs tied towards practice acquisition growth and professional fees. Increased depreciation and amortization related to acquisitions also contributed, with $1.4 million in the three months ended March 31, 2022, compared to $0.5 million for the three months ended March 31, 2021.

•Adjusted EBITDA for the three months ended March 31, 2022 was a loss of $6.7 million compared to a loss of $1.9 million during the three months ended March 31, 2021. This decrease aligns to the increase in integration costs that the Company now believes it has largely realized. Going forward, the Company has already seen a significant reduction in these expenses resulting in expected EBITDA improvement from this period. Realized adjusted EBITDA for the three months ended March 31, 2022 was a loss of $6.7 million compared to a loss of $0.8 million during the three months ended March 31, 2021.

•The Company incurred negative cash-flow from continuing operations for the three months ended March 31, 2022 of $6.5 million compared to negative cash flow from continuing operations of $2.8 million for the three months ended March 31, 2021 primarily due to higher salaries and wages, marketing and business development costs, integration expenses and professional fees to support future growth. Moving forward, the Company has made significant improvements to its cash-flow from operations and corporate investments reducing the cash spend expected during the period from existing operations.

| | |

Skylight Health Group Inc (formerly CB2 Insights Inc) Management Discussion and Analysis For the three months ended March 31, 2022 |

Operating Highlights

•On April 5, 2022, the Company announced a joint venture (“JV”) partnership with Collaborative Health Systems (“CHS”), a population health management services organization and wholly owned subsidiary of Centene Corporation (NYSE: CNC), to integrate essential value-based care (“VBC”) services into Skylight Health’s growing enterprise of primary care practices. The primary goal of the partnership is to establish the core necessities of a VBC program, which includes joint efforts in payor contracting, taking on risk within Medicare Advantage, and population health improvement, including data and analytics supporting care coordination and quality improvement programs. Denver, Colorado Springs, Harrisburg, and Jacksonville will be the initial markets to participate.

•On April 29, 2022, the Company provided an update on the status of the Company’s research program; Skylight Health Research. In April 2021, Skylight Health Research announced its partnership with ClinEdge to launch formal clinical research studies into its practices and since inception Skylight Health Research has been awarded ten clinical studies and has completed two to-date. Total revenue earned through clinical studies in 2021 of $0.3 million has already been surpassed in 2022, and is expected to quadruple by the end of this year.

•On May 5, 2022, the Company completed the deal to acquire NeighborMD (“NMD”) with an effective control date of May 2, 2022. Total consideration for NMD was $10.2 million (US$ 8.0 million) paid in cash at closing.

•On May 5, 2022, the Company closed on a debt facility of $25.5 million (US$ 20.0 million) with FLC, a New York based lender. The terms of the facility allowed for the Company to draw down $12.7 million (US$ 10.0 million) to fund the NMD acquisition including working capital and the remainder to fund future acquisitions, as approved by the lender. The term of the facility is 3 years, with an annual coupon of the secured overnight financing rate plus 11% paid in cash. The principal will be amortized quarterly and subject to certain cash sweep triggers and a final balloon payment. Cash payments including interest will begin in July 2022. The Company may, at its discretion, pay back the lender in part or in full at any time during the term, without premium or penalty. FLC has received additional consideration of 4.5 million warrants priced at $1.17. The expiry date will be May 5, 2025, with respect to that percentage of the warrants that is equal to the percentage of the amount of principal amount of the debt line facility outstanding on May 5, 2023, compared to the amount outstanding on May 5, 2022, and the expiry date will be May 5, 2023, for the remaining warrants. Half (50%) of the warrants will be held in escrow and released in proportion to the pro rata percentage of the amount of any future draw downs.

Overall Performance and Outlook

Performance

Q1 2022 was an extension of efforts from 2021 and 2020 from both a healthy and robust market for raising equity and opportunities for acquisition. As previously communicated in the last earnings call, integration of systems, resources and technology continued through to the end of Q1 2022. Costs and time associated with these integrations have now largely been realized, and the Company has already begun efforts to remove any related expenses. The Company expects that synergies and efficiencies from a more robust unified platform will allow for further savings. Since the start of this reporting period, the Company estimates that it will expect to realize over $10 million in annualized cost savings with more synergies over the next quarter. This will lead to a reduced cash burn as the Company continues to work towards a pathway to profitability.

Revenue was down 18% from the previous quarter and increased 255% compared to the three months ended March 31, 2021. The reduction in revenue can be attributed to two primary reasons, the implementation of a new electronic medical record system (“EMR”) and secondly, the reduction in urgent care visits as COVID-10 cases reduced within the markets.

| | |

Skylight Health Group Inc (formerly CB2 Insights Inc) Management Discussion and Analysis For the three months ended March 31, 2022 |

The launch of Athena Health, the EMR chosen to be rolled out nationally, will lead to significant improvements in the operations and management of practices across multiple markets. As with any new software used at the point of care, training and new users will lead to reduced patient volume. This reduction is only temporary and since the launch in February and March, patient volume in the primary care space has already returned back to expected levels. The reduction in volume due to lower number of patients seeking care due to COVID-19 testing and affiliated symptoms is resultant of an improved health climate. This is a trend that affects all healthcare organizations across the country. Since the reduction in these office visits, the Company has begun to see an increase in primary care visits where patients looking to avoid unnecessary exposure are now returning for standard care treatments. The Company expects that this trend normalizes in the coming quarter, the need for primary care will continue to increase. The Company is well positioned to meet this demand of patients and see continued growth.

Over the last 6 months, the Company was able to to build a foundation to successfully integrate the practices that were acquired will lead to positive growth in the coming quarters and years. This foundation now presents a platform upon which patient growth, and transition to value can be established upon.

To expand on its journey to value, the Company has made two major subsequent announcements. The first was the completion and launch of a JV with CHS, a wholly owned subsidiary of Centene Corporation, a top national healthcare payor in the US. CHS along with Skylight, through the JV, will begin value based care contracting, and execution against these contracts. The strength that CHS brings in addition to its many years successfully managing and winning savings in the Medicare and Medicare Advantage space, will be its infrastructure and resources to support Skylight's journey. Skylight brings to the relationship, a partner committed to value based care, and a platform to rapidly grow the number of practices and patient panels to support these efforts. Together, the JV will mean significant growth opportunities as value based care contracts can transform revenues and EBITDA contribution with its improved economic structure.

Secondly, the Company recently completed the acquisition of NMD, a primary care group in Florida that has over 2,400 Medicare Advantage ("MA”) lives at full risk through its 9 owned practices and an affiliate network. Contracted currently with Humana and CarePlus, NMD enables Skylight to accelerate its journey to value by establishing itself as a full risk player in the MA category in one of the fastest growing Medicare markets in the Country. Skylight is now able to leverage these contracts to support the expansion of programs to its Jacksonville market, and leverage these skills and expertise to bring VBC to its other markets. With the NMD team, Skylight also welcomes over 5 years of experience in managing risk successfully and adding to its core capabilities. Under these contracts, Skylight will be able to recognize a fully capitated revenue model of between US $10-$12K per member per year as compared to the US $200-$400 per member per year in fee-for-service revenue. This transformative acquisition, will bring significant growth to the top-line but also organic growth as the Company expands these plans to its other markets. Additionally, the capabilities through NMD and with the JV, allow Skylight to be well positioned to introduce other MA risk plans in these markets, thereby opportunities to further grow its patient panel.

The Company’s research division continues to see growth and future opportunities. Having already surpassed 2021 revenue in the first 5 months of 2022, the Company is seeing growth from both revenue and adoption of the program with its sponsors. The unique ability for an organization such as big pharma or biotech to leverage patient access and clinical support through one organization, enables Skylight to be a differentiator in the market and attract ongoing study proposals. As the Company is now already engaged in 10 active studies across 5 of its practices, it expects to increase the number of research sites and studies ongoing. The costs for running the research department are largely already realized within the practices. This maximizes the margin contribution from research and the Company expects this to support future growth of EBITDA and cash-flow.

| | |

Skylight Health Group Inc (formerly CB2 Insights Inc) Management Discussion and Analysis For the three months ended March 31, 2022 |

Outlook

2022 Financial Performance Outlook:

Over the past 18 months, the Company has seen growth in annualized revenue from $13 million to over $70 million on a proforma basis today. As the Company continues to focus on integration and leveraging the revenue and cost synergies between its assets, it is also focused on a pathway to profitability. Based on performance today, the practices remain profitable from an operating model and where corporate and administrative expenses related to the public market listings and integrations have been the primary contributors to a negative EBITDA. Like with all integration efforts, the Company has seen a major cost reduction over the past few months and projects on a proforma basis, to be 40-50% lower than this reported quarter. With further synergies in the pipeline and improvements to revenues organically through MA contracting and other efforts, the Company expects to continue working towards a pathway to profitability.

The Company closed the quarter with $4.2 million in cash and a new debt facility which has 12.8 million (US$ 10.0 million) remaining to be drawn down. The Company remains committed to focusing on a positive bottom line, while minimizing the need for external capital. With the acquisition of NMD, and its JV with CHS, it expects to be able to begin recognizing revenue synergies in 2022 as it begins to onboard new MA members within its existing practices. This will allow the Company to focus on growing the revenues organically, improving contribution to the bottom line.

Market Outlook:

The need for improved primary care practice models in the US has never been greater than it is today. The Company believes its model for shifting fee-for-service primary care practices to a value-based care reimbursement model will close the gap in today’s widening shortage of primary care physicians. With the growing demand for accessible and affordable medical services in the US, the Company believes the following external factors will be significant contributors for growth of services. The Company believes it is well positioned to meet this growing opportunity.

•Growing perceived distrust and lack of personalized care delivered by larger legacy health networks are paving the way for disruption in the healthcare services sector where quality of care, accessibility and affordability will help create a new model for healthcare delivery.

•The rising cost in healthcare driven by higher acuity hospital services and lack of comprehensive patient care at the primary practice level, is leading national payors and governments to change reimbursement models to VBC which prioritizes quality over volume and holds physicians accountable.

•VBC not only has the opportunity to improve quality of care and lower cost of care management but can also be significantly more financially rewarding for primary care practices willing to share in risk.

•With over 56% of outpatient medical care operated by smaller groups of localized practitioners, and a growing demand for administrative needs to deliver care, the high cost of investment to support a VBC model is prohibitive and a barrier.

•The impact of the pandemic to independent primary care practices, rising levels of chronic care management and an aging population further amplifies the push for consolidation and support to enable primary care providers to shift to a more profitable and sustainable VBC model.

•Continued fragmentation of the primary care services market is leading to more opportunities to acquire disparate primary care clinics at attractive valuations. The Company is developing a robust national platform that not only generates overall efficiencies, but is aimed at integrating technology, access, and capabilities to transform current Fee for Service (“FFS”) practices to VBC. The conversion will lead to improved patient health outcomes, improved physician and patient satisfaction scoring, access, and better financial performance through strengthened contracts with payors.

•The Company presents an attractive exit opportunity for independent physician providers who find it challenging to move into value-based care programs but have an active and robust patient base that can benefit from these programs. Skylight offers these practices, alignment, resources, technology, continuity, focus on patient care and the opportunity for growth within its managed care contracts.

•The Company is seeing a strong shift back to primary care from urgent care visits over the last 12-24 months which were largely driven by an increased volume of COVID-19 testing and symptoms. This

| | |

Skylight Health Group Inc (formerly CB2 Insights Inc) Management Discussion and Analysis For the three months ended March 31, 2022 |

shift is being witnessed industry wide and the Company believes that while urgent care benefited due to this, the reduction in cases overall has led to more patients seeking primary care alternatives moving forward. This positions the Company well to provide a long-term home for patients looking for quality and primary care focused operations.

In addition to driving higher margins through improved patient outcomes, the Company believes it is well positioned for future growth through:

Acquisition of Primary Care Practice Groups

•The primary care sector in the US continues to remain highly fragmented with the majority of consolidation done by regional and localized healthcare networks. Historically proven to be misaligned with primary care providers, health systems can be seen using practices as feeders to higher acuity service, and traditional private equity consolidators can see these practices as a platform for future sale. There is a growing demand for primary care providers to remain independent, while partnering with the right group to bring scale and capabilities to support a VBC model.

•The Company has already acted on this opportunity with recent acquisitions. The Company has a robust pipeline of targeted deal flow that remains price disciplined, often acquiring these practices for considerably less than what they would be worth once they make the shift to taking on VBC health plans.

•The Company believes that contingent on an active market, proper access to capital and demand from physicians and payors, that it will remain highly acquisitive as part of its three-pronged growth plan.

Developing a Single System of Operation and Clinical Leadership

•Through a national management platform, the Company is focused on developing efficiencies and operational scale through its network of acquired practices. Nearly 40% of physician practices today seeking to drive towards VBC are partnered with a Management Services Organization (MSO).

•Many providers are not only seeking partnership but acquisition where they can still participate in small levels of ownership and reduce the burden of practice administration.

•SHG, unlike a traditional MSO, acquires practices but brings with it the same infrastructure and support systems that practices can see in a MSO partnership. Through this capability, the Company is focused on driving clinical efficiencies that can lead to improved operations workflows, provider, patient and staff satisfaction and overall clinical profitability growth.

•SHG brings strong clinical leadership through its clinic, value & performance management teams that work with each provider and practice to educate, deliver and succeed on quality improvement plans for better patient health outcomes and an aligned cost of care practice.

Conversion from Fee-for-Service to Value-Based-Care

•The move to VBC continues to accelerate largely driven by payors and government. The shift enables a focus on quality over volume where the primary care provider services to be incented to provide a more comprehensive level of care for patients. This in turn creates improved quality outcomes for the patient improving the management of chronic care illnesses, prevention of future issues and management of downstream costs.

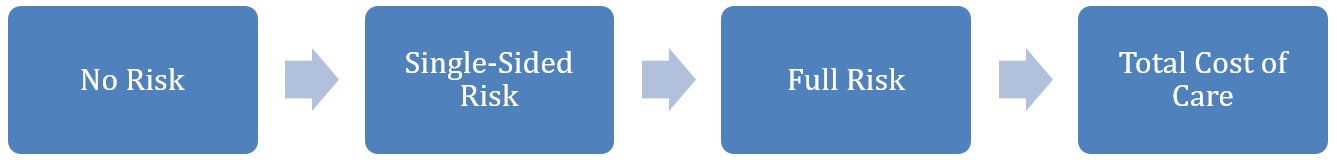

•The shift to value can take an evolutionary process where providers begin by stepping into managed care contracts offering shared savings, capitated care coordination, and/or a fixed per member per month (PMPM) capitated model. The shift to value goes from:

| | |

Skylight Health Group Inc (formerly CB2 Insights Inc) Management Discussion and Analysis For the three months ended March 31, 2022 |

•In the value-based model, the provider begins developing the tools and strategies to manage care and cost which can continue to drive them towards more risk sharing with payors and improving on the financial performance of contracts.

•As the provider continues to build the infrastructure to manage patient care and cost of care, the shift to total cost of care generates the greatest economic growth with the caveat that the provider is now responsible for the full healthcare dollar of that patient.

•SHG is committed to working with practices early in the conversion process, most of which are currently dominant FFS. FFS practices still represent the majority of practices in the US today.

•Data aggregation, actionable insights, and clinical leadership, combined with improved access, population health management strategies and services for patients will enable these practices to begin the shift to single sided risk, then full risk and ultimately to manage the total cost of care.

•The move to VBC can lead to significantly improved patient economics for the practice that will further enhance, incent, and improve the quality of care for patients.

•The Company is pleased to announce that in this journey, it has now begun participating in Total Cost of Care.

Medicare Advantage Total Cost of Care and its consideration for future growth

With the acquisition of NMD, the Company has now entered total cost of care or full risk contracts for MA in the state of Florida, which was originally planned for 2025. An important consideration for growth and margin recognition will be further explained in the Q2 MD&A segmentation of revenue. A full capitated risk contract reimburses the Company a fixed per member per month fee that is aligned with the condition(s) of a patient population within the group. This aggregation of conditions, known as a risk score, determines the capitated amount. The capitated fee Skylight can expect is an average of US $10,000 - US $12,000, per member per year.

The gross margin or contribution to Skylight is based on the benchmark minus the medical costs attributed to the patient during a given term. Gross margins in full risk models will generally be much lower than in a fee for service model as it is expected to be net of all medical expenses. However, the dollar value realized can be substantially higher. By accurately coding for risk score, and managing patient expenses, the contribution to a practice can be improved, maximizing the EBITDA contribution post clinical expenses. Prior to the acquisition, NMD has continued to operate in a surplus and Skylight expects this will continue to be the case post acquisition. Further, through the JV, the Company expects to further improve on the KPI's to increase contribution from the current plans.

Discussion of Operations

For the three months ended March 31, 2022, the Company has two reportable operating segments related to its software/research business and corporate, and medical services businesses, which also align with the two countries in which it operates, Canada and the United States.

Operating results

The following is selected financial data derived from the unaudited condensed interim consolidated financial statements of the Company for the three months ended March 31, 2022 and 2021:

| | |

Skylight Health Group Inc (formerly CB2 Insights Inc) Management Discussion and Analysis For the three months ended March 31, 2022 |

| | | | | | | | |

| (in 000’s of dollars) | Three months ended March 31, |

| 2022 | 2021 |

| Revenue | 7,713 | | 2,174 | |

| Cost of sales | 4,285 | | 974 | |

| Gross profit | 3,428 | | 1,200 | |

| Operating expenses | | |

| Salaries and wages | 5,467 | | 1,513 | |

| Office and administration | 2,167 | | 379 | |

| Marketing and business development | 428 | | 854 | |

| Professional fees | 1,046 | | 624 | |

| Rent | 165 | | 1 | |

| Share-based compensation | 353 | | 1,049 | |

| Depreciation and amortization | 1,383 | | 516 | |

| Total operating expenses | 11,009 | | 4,936 | |

| Loss from continuing operations | (7,581) | | (3,736) | |

| Non-operating expenses | 722 | | (482) | |

| Net loss from continuing operations | (8,303) | | (3,254) | |

| Net income from discontinued operations | — | | 857 | |

| Net loss | (8,303) | | (2,397) | |

| Net loss from continuing operations attributable to Shareholders of the Company | (8,267) | | (3,254) | |

| Net loss attributable to Shareholders of the Company | (8,267) | | (2,397) | |

| Net loss per share from continuing operations | (0.21) | | (0.09) | |

| Net loss per share | (0.21) | | (0.07) | |

Revenue

The Company’s revenue for the three months ended March 31, 2022 and 2021 was $7.7 million and $2.2 million, respectively (excluding revenue from discontinued operations of $2.8 million for the three months ended March 31, 2021) - growth of 255% from Q1 2021. Revenue for the three months ended March 31, 2022 consisted of clinic revenue amounting to $7.5 million (three months ended March 31, 2021: $2.1 million, excluding $2.8 million of clinic revenue from discontinued operations) and contract research revenue and software amounting to $0.2 million (three months ended March 31, 2021: $0.1 million).

Revenue compared to Q1 2021 increased significantly due to additional revenue being contributed by the clinics acquired during the fiscal year ended December 31, 2021.

Cost of sales

Cost of sales during the three months ended March 31, 2022 and 2021 was $4.3 million and $1.0 million, respectively (excluding cost of sales from discontinued operations of $0.6 million for the three months ended March 31, 2021). The increase in cost of sales is due to new acquisitions during the fiscal year ended December 31, 2021 and grew at a similar rate as the growth rate in revenues. Cost of sales pertains directly to the US clinical operations and mainly comprises service fees paid to doctors and nurse practitioners.

The gross profit margin was 44% in Q1 2022 compared to 55% in Q1 2021 (excluding gross margin from discontinued operations of 77% for the three months ended March 31, 2021). The margins in Q1 2022 were lower due to the primary care clinics acquisitions made during 2021 which have lower gross profit margins. The Company began acquiring primary care clinics in Q4 2020 and further acquired five primary care clinics in fiscal year 2021. Lower visit counts also contributed to a lower gross profit margin vs Q1 2021.

| | |

Skylight Health Group Inc (formerly CB2 Insights Inc) Management Discussion and Analysis For the three months ended March 31, 2022 |

Operating expenses

Operating expenses during the three months ended March 31, 2022 and 2021 were $11.0 million and $4.9 million, respectively (excluding operating expenses from discontinued operations of $1.3 million for the three months ended March 31, 2021). Operating expenses for the US and Canadian operations during the three months ended March 31, 2022 were $8.7 million and $2.3 million, respectively (three months ended March 31, 2021: $2.2 million and $2.8 million, respectively).

The increase in operating expenses during the three months ended March 31, 2022 to $11.0 million was mainly in relation to acquisitions of new clinics, listing on the TSX-V and Nasdaq, the recruitment of key leadership, management and operational hires, the employee stock option plan and building a national Skylight brand.

The Company is committed to streamlining operating expenses realized through efficiencies in technology and economies of scale including those realized from the new acquisitions. As a result, comparing Q1 2022 to Q1 2021, total operating expenses increased by 123%, lower than the increase of 255% of revenue of the business (excluding discontinued operations).

Net Loss

Net loss from continuing operations during the three months ended March 31, 2022 and 2021 was $8.3 million and $3.3 million, respectively (net income from discontinued operations was $0.9 million for the three months ended March 31, 2021). Net loss in the three months ended March 31, 2022 was primarily due to higher marketing and business development in order to build a national Skylight brand, professional fees related to acquisitions and listing on the TSX-V and Nasdaq, office and administration, depreciation and amortization and salaries and wages relating to the recruitment of key leadership, management and operational hires.

Quarterly Results

The following selected financial data from the last eight fiscal quarters has been prepared in accordance with IFRS and should be read in conjunction with the Company’s unaudited condensed interim consolidated financial statements for each of the periods considered below and the consolidated financial statements for the years ended December 31, 2021 and 2020.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in 000’s of dollars) | 2022 | 2021 | 2020 |

| Q1 | Q4 | Q3 | Q2 | Q1 | Q4 | Q3 | Q2 |

| Revenue | 7,713 | | 9,409 | | 8,697 | | 6,877 | | 2,174 | | 391 | | 48 | | 169 | |

| Cost of sales | 4,285 | | 4,082 | | 3,948 | | 3,067 | | 974 | | 283 | | 35 | | 53 | |

| Gross profit | 3,428 | | 5,327 | | 4,749 | | 3,810 | | 1,200 | | 108 | | 13 | | 116 | |

| Operating expenses | | | | | | | | |

| Salaries and wages | 5,467 | | 5,435 | | 4,596 | | 3,832 | | 1,513 | | 1,651 | | 365 | | 306 | |

| Office and administration | 2,167 | | 2,596 | | 2,331 | | 1,515 | | 379 | | 177 | | 201 | | 191 | |

| Marketing and business development | 428 | | 267 | | 305 | | 612 | | 854 | | 202 | | 43 | | 16 | |

| Professional fees | 1,046 | | 1,169 | | 1,081 | | 1,375 | | 624 | | 425 | | 44 | | 261 | |

| Rent | 165 | | 151 | | 155 | | 84 | | 1 | | 12 | | 2 | | 11 | |

| Share-based compensation | 353 | | 437 | | 204 | | 361 | | 1,049 | | 3,812 | | 217 | | 124 | |

| Depreciation and amortisation | 1,383 | | 1,520 | | 1,446 | | 1,136 | | 516 | | 213 | | 299 | | 302 | |

| Impairment loss | — | | 1,408 | | — | | — | | — | | — | | — | | — | |

| Total operating expenses | 11,009 | | 12,983 | | 10,118 | | 8,915 | | 4,936 | | 6,492 | | 1,171 | | 1,211 | |

| Loss from continuing operations | (7,581) | | (7,656) | | (5,369) | | (5,105) | | (3,736) | | (6,384) | | (1,158) | | (1,095) | |

The Company’s revenue for the three months ended March 31, 2022 and 2021 was $7.7 million and $2.2 million, respectively - a year over year growth of $5.5 million (excluding revenue from discontinued operations of $2.8 million during the three months ended March 31, 2021). The acquisition of clinics during the year ended December 31, 2021 significantly contributed to the increase of revenue. Revenue for the three months ended March 31, 2022 consisted of clinic revenue amounting to $7.5 million (three months ended March 31, 2021:

| | |

Skylight Health Group Inc (formerly CB2 Insights Inc) Management Discussion and Analysis For the three months ended March 31, 2022 |

$2.1 million), contract research solutions fees amounting to $0.2 million (three months ended March 31, 2021: $0.1 million) and software licensing fees amounting to $54.0 thousand (three months ended March 31, 2021: $6.0 thousand).

Cost of sales during the three months ended March 31, 2022 and 2021 totaled $4.3 million and $1.0 million, respectively (excluding cost of sales from discontinued operations of $0.6 million for the three months ended March 31, 2021). The increase is due to new acquisitions during the year ended December 31, 2021 as the Company completed five acquisitions.

Non-IFRS Measures

The MD&A makes references to certain non-IFRS measures, including certain industry metrics. These metrics and measures are not recognized measures under IFRS, do not have meanings prescribed under IFRS and are as a result unlikely to be comparable to similar measures presented by other companies. These measures are provided as information complimentary to those IFRS measures by providing a further understanding of our operating results from the perspective of management. As such, these measures should not be considered in isolation or in lieu of review of our financial information reported under IFRS.

Adjusted EBITDA

Adjusted EBITDA for the three months ended March 31, 2022 was a loss of $6.7 million compared to an adjusted EBITDA loss of $1.9 million for the three months ended March 31, 2021. The decrease was mainly due to salaries and wages related to the recruitment of key leadership, management and operational hires, increased office and administration costs and increased professional fees (legal, accounting and consulting). See below for reconciliation of adjusted EBITDA to loss from continuing operations:

| | | | | | | | |

| (in 000’s of dollars) | Three months ended |

| March 31, 2022 | March 31, 2021 |

| Loss from continuing operations | (7,581) | | (3,736) | |

| Depreciation, amortization from continuing operations (Note 1) | 1,383 | | 516 | |

| Interest (Note 1) | 2 | | — | |

| EBITDA | (6,196) | | (3,220) | |

| Share based compensation (Note 2) | 353 | | 1,049 | |

| Capitalization of software development cost (Note 3) | — | | (144) | |

| Capitalization of lease payments (Note 3) | (704) | | (316) | |

| Other income (non-cash) (Note 3) | (260) | | — | |

| Acquisition costs (Note 4) | — | | 33 | |

| Nasdaq and TSX-V listing cost (Note 5) | — | | 28 | |

| Severance (Note 5) | 109 | | — | |

| Corporate marketing cost (Note 6) | 25 | | 693 | |

| Adjusted EBITDA | (6,673) | | (1,877) | |

Note 1

Depreciation, amortization, and interest are items which are typically excluded to arrive at EBITDA. To calculate EBITDA, the Company adjusts all material items which do not reflect operational performance of the business.

Note 2

Share-based compensation is a non-cash item which is typically excluded to arrive at adjusted EBITDA..

Note 3

Capitalization has been included as an expense in the calculation of adjusted EBITDA because these expenses either relate to payroll or the Company’s leased properties and are not part of the condensed interim consolidated statements of loss and comprehensive loss. The Company believes that these are operational expenses and should be adjusted to arrive at adjusted EBITDA. Other income related to cancellation of leases are also adjusted in arriving at adjusted EBITDA.

Note 4

Acquisition costs in relation to Rocky Mountain have been included as an adjustment to EBITDA given the size and magnitude of Rocky Mountain versus the other acquisitions which the Company has completed.

| | |

Skylight Health Group Inc (formerly CB2 Insights Inc) Management Discussion and Analysis For the three months ended March 31, 2022 |

Note 5

Nasdaq and TSX-V listing and severance costs have been added back in the adjusted EBITDA calculation given they are not an operational recurring expense for the Company and therefore adjusted to calculate adjusted EBITDA.

Note 6

Certain corporate marketing costs have been added back in the adjusted EBITDA calculation as they are expenses the the Company incurred as it rebranded and built a national brand and therefore adjusted to calculate adjusted EBITDA.

Realized revenue, realized gross profit and realized adjusted EBITDA

Realized revenue, realized gross profit and realized adjusted EBITDA incorporate the results of continuing and discontinued operations. See below for reconciliation of revenue to realized revenue, gross profit to realized gross profit and adjusted EBITDA to realized adjusted EBITDA:

| | | | | | | | |

| (in 000’s of dollars) | Three months ended |

| March 31, 2022 | March 31, 2021 |

| $ | $ |

| Revenue | 7,713 | | 2,174 | |

| Revenue from discontinued operations | — | | 2,816 | |

| Realized revenue | 7,713 | | 4,990 | |

| | | | | | | | |

| (in 000’s of dollars) | Three months ended |

| March 31, 2022 | March 31, 2021 |

| $ | $ |

| Gross profit | 3,428 | | 1,200 | |

| Gross profit from discontinued operations | — | | 2,170 | |

| Realized gross profit | 3,428 | | 3,370 | |

| | | | | | | | |

| (in 000’s of dollars) | Three months ended |

| March 31, 2022 | March 31, 2021 |

| $ | $ |

| Adjusted EBITDA | (6,673) | | (1,877) | |

| Net income before gain on disposal from discontinued operations | — | | 857 | |

| Interest on lease liabilities from discontinued operations | — | | 26 | |

| Depreciation, amortization from discontinued operations | — | | 235 | |

| Realized adjusted EBITDA | (6,673) | | (759) | |

Financial Position

Significant Assets

| | | | | | | | |

| (in 000’s of dollars) | As at |

| March 31, 2022 | December 31, 2021 |

| $ | $ |

| Cash | 4,204 | | 11,653 | |

| Trade and other receivables | 6,623 | | 6,901 | |

| Intangible assets | 13,988 | | 14,873 | |

| Goodwill | 8,637 | | 8,739 | |

| Right of use assets | 14,962 | | 15,695 | |

Significant decrease in cash is due to cash flows used by operations together with cash used in financing activities.

| | |

Skylight Health Group Inc (formerly CB2 Insights Inc) Management Discussion and Analysis For the three months ended March 31, 2022 |

Contractual Obligations

The Company’s contractual obligations primarily consisted of three areas: i) Accounts payable and accrued liabilities of $6.0 million as at March 31, 2022 which are expected to be paid in the next 12 months; ii) Purchase consideration payable of $3.1 million from the Company’s clinic acquisitions completed during year ended December 31, 2021; and iii) Lease liabilities of $15.1 million ($1.1 million current and $13.9 million non-current) primarily as a result of the clinic acquisitions completed.

Outstanding share information

As at May 16, 2022, the date of the MD&A, the Company had the following number of common shares, preferred shares, deferred share units, warrants and options:

| | | | | |

| # |

| Common shares | 39,504,010 | |

| Preferred shares | 275,000 | |

| Deferred share units | 93,518 | |

| Warrants | 8,077,787 | |

| Options | 2,277,582 | |

Liquidity and Capital Resources

| | | | | | | | |

| (in 000’s of dollars) | Three months ended |

| March 31, 2022 | March 31, 2021 |

| $ | $ |

| Cash used in operating activities of continuing operations | (6,538) | | (2,795) | |

| Cash used in investing activities of continuing operations | 312 | | (1,375) | |

| Cash provided by financing activities of continuing operations | (1,161) | | 1,095 | |

The Company’s cash balance at March 31, 2022 totalled $4.2 million, a $7.4 million or 64% decrease from $11.7 million at December 31, 2021. For the three months ended March 31, 2022, cash used in operating activities of continuing operations totalled $6.5 million, compared to $2.8 million for the three months ended March 31, 2021, with the increase mainly reflecting the net loss from continuing operations. Cash provided by operating activities of discontinued operations for the three months ended March 31, 2021 was $1.1 million.

The Company’s cash provided by investing activities of continuing operations for the three months ended March 31, 2022 was $0.3 million (March 31, 2021: cash used in investing activities of $1.4 million). The increase was primarily due to the purchase consideration paid related to the acquisitions in 2021 of new clinics, purchase of furniture and equipment and software development. Cash used in investing activities of discontinued operations for the three months ended March 31, 2021 was $38.0 thousand.

The Company’s cash used in financing activities of continuing operations for the three months ended March 31, 2022 was $1.2 million (cash provided by financing activities for the three months ended March 31, 2021: $1.1 million). The Company’s financing activities of continuing operations in the three months ended March 31, 2022 primarily consisted of principal payment of lease liabilities of $0.3 million, interest on lease liabilities of $0.4 million, principal payment on loan of $0.3 million and dividends paid on preferred shares of $0.2 million. During the three months ended March 31, 2021, cash provided by financing activities of continuing operations comprised primarily of $1.2 million from the exercise of warrants. Cash used in financing activities of discontinued operations for the three months ended March 31, 2021 was $0.1 million.

As at March 31, 2022, the Company had a working capital surplus of $3.1 million (December 31, 2021: $9.8 million) and a cash balance of $4.2 million (December 31, 2021: $11.7 million). The working capital position has reduced primarily cash used in operating activities from continuing operations.

| | |

Skylight Health Group Inc (formerly CB2 Insights Inc) Management Discussion and Analysis For the three months ended March 31, 2022 |

Going concern

The condensed interim consolidated financial statements of the Company for the three months ended March 31, 2022 have been prepared on a going concern basis in accordance with IFRS. The going concern basis of presentation assumes that the Company will continue in operation for the foreseeable future and be able to realize its assets and discharge its liabilities and commitments in the normal course of business. The Company is subject to numerous risk factors that may impact its ability as a going concern, such as, but not limited to, governmental regulations, currency fluctuations, operational risks and extended and unforeseen issues resulting from the current COVID-19 pandemic.

As of the balance sheet date, the Company had an accumulated deficit of $44.9 million and negative cash flow from operations of continuing operations of $6.5 million for the three months ended March 31, 2022. The Company has positive working capital as of the balance sheet date of $3.1 million and a cash balance of $4.2 million. The Company has raised debt and equity financing through 2017 to 2021 in order to pursue acquisitions and platform development resulting in growth in its customer base. The Company expects that the investments it has made over this period will result in increased revenue and operating cash flow; however, the Company anticipates further investment and will require additional debt and/or equity financing in order to continue to develop its business. Subsequent to quarter end, the Company closed a debt facility to fund an acquisition that historically produced negative cash flow from operations. As per the terms of the debt agreement, the Company has to maintain a minimum cash amount of US$ 2.3 million and in case of a breach, the Company has 20 working days to remedy before triggering an event of default. The Company is forecasting they may not meet the minimum cash requirement unless additional funds are secured.

Although the Company has been successful in raising funds to date, there can be no assurance that adequate or sufficient funding will be available in the future or available under terms acceptable to the Company, or that the Company will be able to generate sufficient returns from operations. The ability of the Company to continue as a going concern through the end of July 2022 and to realize the carrying value of its assets and discharge its liabilities and commitments when due is dependent on the Company generating positive cash flows and additional financing before the end of July 2022 sufficient to fund its cash flow needs. The Company is not currently eligible to raise funds using a registration statement in the United States. These circumstances indicate the existence of a material uncertainty that may raise substantial doubt on the ability of the Company to meet its obligations as they come due, and accordingly the appropriateness of the use of the accounting principles applicable to a going concern.

The condensed interim consolidated financial statements do not reflect adjustments that would be necessary if the going concern assumption were not appropriate. If the going concern basis were not appropriate for the condensed interim consolidated financial statements, then adjustments would be necessary in the carrying value of the assets and liabilities, the reported revenue and expenses and the classifications used in the condensed interim consolidated statement of financial position. Such differences in amounts could be material.

The assessment of material uncertainties related to events and circumstances that may raise substantial doubt on the Company’s ability to continue as a going concern involves significant judgment. In making this assessment, management considers all relevant information, as described above.

Off-Balance Sheet Arrangements

The Company does not have any off-balance sheet arrangements as of March 31, 2022.

Related Party Transactions

Key management personnel are those persons having authority and responsibility for planning, directing and controlling the activities of the Company, directly or indirectly. Key management personnel include the Company’s Chief Executive Officer ("CEO"), President, Chief Financial Officer ("CFO"), Chief Medical Officer, Chief Operating Officer, Chief Corporate Officer and members of the Company’s Board of Directors.

| | |

Skylight Health Group Inc (formerly CB2 Insights Inc) Management Discussion and Analysis For the three months ended March 31, 2022 |

The amounts disclosed in the table below are the amounts recognized as an expense during the reporting period.

| | | | | | | | |

| (in 000’s of dollars) | Three months ended |

| March 31, 2022 | March 31, 2021 |

| $ | $ |

| Salary and short-term employee benefits | 504 | | 223 | |

| Share based compensation | 296 | | 122 | |

| Directors’ fees | 115 | | 77 | |

| 915 | | 422 | |

New accounting standards issued but not yet effective

Amendments to IAS 1 - Presentation of financial statements (“IAS 1”)

In January 2020, the IASB issued Classification of Liabilities as Current or Non-current (Amendments to IAS 1). The amendments aim to promote consistency in applying the requirements by helping companies determine whether debt and other liabilities with an uncertain settlement date should be classified as current (due or potentially due to be settled within one year) or non-current. The amendments include clarifying the classification requirements for debt a Company might settle by converting it into equity. The amendments are effective for annual reporting periods beginning on or after January 1, 2023, with earlier application permitted. The Company is currently evaluating the impact of this amendment.

Use of estimates and judgments

The preparation of the condensed interim consolidated financial statements requires management to make judgments, estimates and assumptions that affect the application of accounting policies and the reported amounts of assets and liabilities at the date of the condensed interim consolidated financial statements and reporting amounts of revenues and expenses during the reporting period. Estimates and assumptions are continually evaluated and are based on management’s experience and other factors, including expectations of future events that are believed to be reasonable under the circumstances. However, actual outcomes may differ materially from these estimates.

The estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are generally recognized in the period in which the estimates are revised.

Our significant judgments, estimates and assumptions are disclosed in note 3 of the consolidated financial statements for the year ended December 31, 2021.

Disclosure Controls and Procedures and Internal Controls Over Financial Reporting

Management concluded that internal control over financial reporting (ICFR) was ineffective as of the end of the period covered by this report as a result of an unremediated material weakness in our internal control over financial reporting related to revenue recognition for certain contracts in recently acquired medical clinics. The material weakness identified in our internal control over financial reporting was identified in Q4 2021 and is described more fully in the Disclosure Controls and Procedures and Internal Controls Over Financial Reporting section of our MD&A for the years ended December 31, 2021 and 2020.

In response to the identification of this material weakness discussed above, we took immediate action to remediate it, and, to that end, new and improved revenue controls were designed and implemented in Q1 2022. Management will continue to remediate the design of these new controls and monitor and evaluate their operating effectiveness during the first half of 2022, in preparation for testing these controls. The weakness will

| | |

Skylight Health Group Inc (formerly CB2 Insights Inc) Management Discussion and Analysis For the three months ended March 31, 2022 |

not be considered fully remediated until the applicable controls operate for a sufficient period of time and management has concluded, through testing, that these controls are operating effectively.

Management has concluded that the weakness did not result in any misstatements or adjustments in the Company's condensed interim consolidated financial statements for the three months ended March 31, 2022.

There have been no significant changes to the Company’s ICFR for the three months ended March 31, 2022, which have materially affected, or are reasonably likely to materially affect the Company’s ICFR.

Limitation on scope of design

The Company has limited the scope of its disclosure controls and procedures and internal control over financial reporting evaluation to exclude acquisitions in the last 12 months, as permitted by securities regulators. The table below presents certain summary financial information included in the Company’s consolidated financial statements amounts related to these acquisitions excluded from our evaluation:

| | | | | |

| Selected financial information from the condensed interim consolidated statements of loss and comprehensive loss | Three months ended March 31, 2022 |

| (in 000’s of dollars) | $ |

| Revenue | 5,458 | |

| Net income | (2,334) | |

| |

| Selected financial information from the condensed interim consolidated statements of financial position | As at March 31, 2022 |

| (in 000’s of dollars) | $ |

| Current assets | 3,717 | |

| Non-current assets | 25,661 | |

| Current liabilities | 6,097 | |

| Non-current liabilities | 9,770 | |

Risk Factors

The following section describes specific and general risks that could affect the Company. These risks and uncertainties are not the only ones the Company is facing. Additional risks and uncertainties not presently known to the Company, or that it currently deems immaterial, may also impair its operations. If any such risks actually occur, the business, financial condition, liquidity, and results of the Company’s operations could be materially adversely affected. The risk factors described below should be carefully considered by readers.

Limited Operating History

The Company, while incorporated in November 2014, began carrying on business in 2017 and has only very recently begun to generate revenue. The Company is therefore subject to many of the risks common to early-stage enterprises, including under-capitalization, cash shortages, limitations with respect to personnel, financial, and other resources, and lack of revenues. There is no assurance that the Company will be successful in achieving a return on shareholders’ investment and likelihood of success must be considered in light of the early stage of operations.

Going Concern

The Company has historically not generated positive cash flow from operations. The Company is devoting significant resources to its business, however there can be no assurance that it will generate positive cash flow from operations in the future. The Company may continue to incur negative consolidated operating cash flow and losses. For the three months ended March 31, 2022, the Company had negative cash flows from continuing operations of $6.5 million and reported a net loss of $8.3 million. To the extent that the Company has negative cash flow in future periods, the Company may need to obtain additional financing to fund such negative cash

| | |

Skylight Health Group Inc (formerly CB2 Insights Inc) Management Discussion and Analysis For the three months ended March 31, 2022 |

flow. Subsequent to quarter end, the Company closed a debt facility to fund an acquisition that historically produced negative cash flow from operations. The debt will result in ongoing cash servicing requirements. See note 18 in the unaudited condensed interim consolidated financial statements of the Company for the three months ended March 31, 2022 for further details.

Risks Associated with Acquisitions

As part of the Company's overall business strategy, the Company may pursue strategic acquisitions designed to expand its operations in both existing and new jurisdictions. Future acquisitions may expose it to potential risks, including risks associated with: (a) the integration of new operations, services and personnel; (b) unforeseen or hidden liabilities; the diversion of resources from the Company's existing business and technology; (d) potential inability to generate sufficient revenue to offset new costs; (e) the expenses of acquisitions; or (f) the potential loss of or harm to relationships with both employees and existing users resulting from its integration of new businesses. In addition, any proposed acquisitions may be subject to regulatory approval.

The Company is dependent on its relationships with the Skylight Health PCs

The Company is dependent on its relationships with the “Skylight Health PCs”, which are affiliated professional entities that the Company does not own, to provide healthcare services, and the Company’s business would be harmed if those relationships were disrupted or if the arrangements with the Skylight Health PCs become subject to legal challenges.

A prohibition on the corporate practice of medicine by statute, regulation, board of medicine, attorney general guidance, or case law, exists in certain of the U.S. states in which the Company operates. These laws generally prohibit the practice of medicine by lay persons or entities and are intended to prevent unlicensed persons or entities from interfering with or inappropriately influencing providers’ professional judgment. Due to the prevalence of the corporate practice of medicine doctrine, including in certain of the states where the Company conducts its business, it does not own the Skylight Health PCs and contracts for healthcare provider services for its members through administrative services agreements (“ASAs”) with such entities and controls these entities through succession agreements with the providers. As a result, the Company’s ability to receive cash fees from the Skylight Health PCs is limited to the fair market value of the services provided under the ASAs. To the extent the Company’s ability to receive cash fees from the Skylight Health PCs is limited, the Company’s ability to use that cash for growth, debt service or other uses at the Skylight Health PC may be impaired and, as a result, the Company’s results of operations and financial condition may be adversely affected.

The Company’s ability to perform medical and digital health services in a particular U.S. state is directly dependent upon the applicable laws governing the practice of medicine, healthcare delivery and fee splitting in such locations, which are subject to changing political, regulatory, and other influences. The extent to which a U.S. state considers particular actions or relationships to constitute the practice of medicine is subject to change and to evolving interpretations by medical boards and state attorneys general, among others, each of which has broad discretion. There is a risk that U.S. state authorities in some jurisdictions may find that the Company’s contractual relationships with the Skylight Health PCs, which govern the provision of medical and digital health services and the payment of administrative and operations support fees, violate laws prohibiting the corporate practice of medicine and fee splitting. The extent to which each state may consider particular actions or contractual relationships to constitute improper influence of professional judgment varies across the states and is subject to change and to evolving interpretations by state boards of medicine and state attorneys general, among others. Accordingly, the Company must monitor its compliance with laws in every jurisdiction in which it operates on an ongoing basis, and the Company cannot provide assurance that its activities and arrangements, if challenged, will be found to be in compliance with the law. Additionally, it is possible that the laws and rules governing the practice of medicine, including the provision of digital health services, and fee splitting in one or more jurisdictions may change in a manner adverse to the Company’s business. While the ASAs prohibit the Company from controlling, influencing or otherwise interfering with the practice of medicine at each Skylight Health PC, and provide that physicians retain exclusive control and responsibility for all aspects of the practice of medicine and the delivery of medical services, there can be no assurance that the Company’s contractual arrangements and activities with the Skylight Health PCs will be free from scrutiny from U.S. state authorities, and the Company cannot guarantee that subsequent interpretation of the corporate practice of medicine and fee

| | |

Skylight Health Group Inc (formerly CB2 Insights Inc) Management Discussion and Analysis For the three months ended March 31, 2022 |

splitting laws will not circumscribe the Company’s business operations. State corporate practice of medicine doctrines also often impose penalties on physicians themselves for aiding the corporate practice of medicine, which could discourage providers from participating in the Company’s network of physicians. If a successful legal challenge or an adverse change in relevant laws were to occur, and the Company was unable to adapt its business model accordingly, the Company’s operations in affected jurisdictions would be disrupted, which could harm its business.

Operational Risks

The Company will be affected by a number of operational risks and the Company may not be adequately insured for certain risks, including: labour disputes; catastrophic accidents; fires; blockades or other acts of social activism; changes in the regulatory environment; impact of non- compliance with laws and regulations; natural phenomena, such as inclement weather conditions, floods, earthquakes and ground movements. There is no assurance that the foregoing risks and hazards will not result in personal injury or death, environmental damage, adverse impacts on the Company's operation, costs, monetary losses, potential legal liability, and adverse governmental action, any of which could have an adverse impact on the Company's future cash flows, earnings, and financial condition. Also, the Company may be subject to or affected by liability or sustain loss for certain risks and hazards against which the Company cannot insure or which the Company may elect not to insure because of the cost. This lack of insurance coverage could have an adverse impact on the Company's future cash flows, earnings, results of operations and financial condition.

Financial Projections May Prove Materially Inaccurate or Incorrect

The Company’s financial estimates, projections and other forward-looking information accompanying this document were prepared by the Company without the benefit of reliable historical industry information or other information customarily used in preparing such estimates, projections and other forward-looking statements. Such forward-looking information is based on assumptions of future events that may or may not occur, which assumptions may not be disclosed in such documents. Investors should inquire of the Company and become familiar with the assumptions underlying any estimates, projections or other forward-looking statements. Projections are inherently subject to varying degrees of uncertainty and their achievability depends on the timing and probability of a complex series of future events.

There is no assurance that the assumptions upon which these projections are based will be realized. Actual results may differ materially from projected results for a number of reasons including increases in operating expenses, changes or shifts in regulatory rules, undiscovered and unanticipated adverse industry and economic conditions, and unanticipated competition. Accordingly, investors should not rely on any projections to indicate the actual results the Company and its subsidiaries might achieve.

Difficulty to Forecast

The Company must rely largely on its own market research to forecast sales as detailed forecasts are not generally obtainable from other sources at this early stage of the Company’s business. A failure in the demand for its services to materialize as a result of competition, technological change or other factors could have a material adverse effect on the business, results of operations, and financial condition of the Company.

Public Health Crises such as the COVID-19 Pandemic and other Uninsurable Risks

Events in the financial markets have demonstrated that businesses and industries throughout the world are very tightly connected to each other. General global economic conditions seemingly unrelated to the Company or to the medical health services sector, including, without limitation, interest rates, general levels of economic activity, fluctuations in the market prices of securities, participation by other investors in the financial markets, economic uncertainty, national and international political circumstances, natural disasters, or other events outside of the Company’s control may affect the activities of the Company directly or indirectly. The Company’s business, operations and financial condition could also be materially adversely affected by the outbreak of epidemics or pandemics or other health crises. For example, in late December 2019, a novel coronavirus (“COVID-19”) originated, subsequently spread worldwide and on March 11, 2020, the World Health

| | |

Skylight Health Group Inc (formerly CB2 Insights Inc) Management Discussion and Analysis For the three months ended March 31, 2022 |

Organization declared it was a pandemic. The risks of public health crises such as the COVID-19 pandemic to the Company’s business include without limitation, the ability to raise funds, employee health, workforce productivity, increased insurance premiums, limitations on travel, the availability of industry experts and personnel, disruption of the Company’s supply chains and other factors that will depend on future developments beyond the Company’s control. In particular, the continued spread of the coronavirus globally, prolonged restrictive measures put in place in order to control an outbreak of COVID-19 or other adverse public health developments could materially and adversely impact the Company’s business in the United States. There can be no assurance that the Company’s personnel will not ultimately see its workforce productivity reduced or that the Company will not incur increased medical costs or insurance premiums as a result of these health risks. In addition, the coronavirus pandemic or the fear thereof could adversely affect global economies and financial markets resulting in volatility or an economic downturn that could have an adverse effect on the demand for the Company’s service offerings and future prospects. Epidemics such as COVID-19 could have a material adverse impact on capital markets and the Company’s ability to raise sufficient funds to finance the ongoing development of its material business. All of these factors could have a material and adverse effect on the Company’s business, financial condition, and results of operations. The extent to which COVID-19 impacts the Company’s business, including its operations and the market for its securities, will depend on future developments, which are highly uncertain and cannot be predicted at this time, and include the duration, severity and scope of the outbreak and the actions taken to contain or treat the coronavirus outbreak. It is not always possible to fully insure against such risks, and the Company may decide not to insure such risks as a result of high premiums or other reasons. Should such liabilities arise, they could reduce or eliminate any future profitability and result in increasing costs and a decline in the value of the Common Shares of the Company. Even after the COVID-19 pandemic is over, the Company may continue to experience material adverse effects to its business, financial condition, and prospects as a result of the continued disruption in the global economy and any resulting recession, the effects of which may persist beyond that time. The COVID-19 pandemic may also have the effect of heightening other risks and uncertainties disclosed herein. To date, the COVID-19 crisis has not materially impacted the Company’s operations, financial condition, cash flows and financial performance. In response to the outbreak, the Company has instituted operational and monitoring protocols to ensure the health and safety of its employees and stakeholders, which follow the advice of local governments and health authorities where it operates. The Company has adopted a work from home policy where possible. The Company continues to operate effectively whilst working remotely. The Company will continue to monitor developments of the pandemic and continuously assess the pandemic’s potential further impact on the Company’s operations and business.

Economic Environment

The Company’s operations could be affected by the economic context should the unemployment level, interest rates or inflation reach levels that influence consumer trends and consequently, impact the Company’s sales and profitability. As well, general demand for banking services and alternative banking or financial services cannot be predicted and future prospects of such areas might be different from those predicted by the Company’s management.

Global Economic Risk

Global economic conditions could have an adverse effect on the Company's business, financial condition, or results of operations. Adverse changes in general economic or political conditions in the United States or any of the states within the United States or any jurisdiction in which the Company operates or intends to operate could adversely affect the Company's business, financial condition, or results of operations.

Forward Looking Information