DECEMBER 14TH, 2021 Acquisition Expands U.S. Presence & Accelerates Fast-Growing Online Sports Betting Business Exhibit 99.2

SAFE HARBOR STATEMENT This presentation and the accompanying oral presentation includes forward-looking statements within the meaning of Section 27A of the Securities Act, Section 21E of the Exchange Act, and the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995 that relate to our current expectations and views of future events. All statements other than statements of historical facts contained in this presentation, including statements regarding whether the transaction is accretive to our fiscal 2022 earnings, whether the usbettingreport.com website can drive more revenue than before acquisition, our future results of operations and financial position, industry dynamics, business strategy and plans and our objectives for future operations, are forward-looking statements. These statements represent our opinions, expectations, beliefs, intentions, estimates or strategies regarding the future, which may not be realized. In some cases, you can identify forward-looking statements by terms such as “believe,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “expect,” “predict,” “potential,” “could,” “will,” “would,” “ongoing,” “future” or the negative of these terms or other similar expressions that are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Forward-looking statements are based largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives and financial needs. These forward-looking statements involve known and unknown risks, uncertainties, contingencies, changes in circumstances that are difficult to predict and other important factors that may cause our actual results, performance or achievements to be materially and/or significantly different from any future results, performance or achievements expressed or implied by the forward-looking statement. Such risks include our ability to manage expansion into the U.S. markets and other markets; compete in our industry; our expectations regarding our financial performance, including our revenue, costs, EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin and Free Cash Flow; the sufficiency of our cash, cash equivalents, and investments to meet our liquidity needs; mitigate and address unanticipated performance problems on our websites, or platforms; attract, retain, and maintain good relations with our customers; anticipate market needs or develop new or enhanced offerings and services to meet those needs; stay in compliance with laws and regulations, including tax laws, that currently apply or may become applicable to our business both in the U.S. and internationally and our expectations regarding various laws and restrictions that relate to our business; anticipate the effects of existing and developing laws and regulations, including with respect to taxation, and privacy and data protection that relate to our business; obtain and maintain licenses or approvals with gambling authorities in the U.S.; effectively manage our growth and maintain our corporate culture; identify, recruit, and retain skilled personnel, including key members of senior management; our ability to successfully identify, manage, consummate and integrate any existing and potential acquisitions; our ability to maintain, protect, and enhance our intellectual property; our intended use of the net proceeds from this offering; our ability to manage the increased expenses associated and compliance demands with being a public company; our ability to maintain our foreign private issuer status; and other important risk factors discussed under the caption “Risk Factors” in Gambling.com Group’s prospectus pursuant to Rule 424(b) filed with the US Securities and Exchange Commission (“SEC”) on July 23, 2021. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this presentation may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. We caution you therefore against relying on these forward-looking statements, and we qualify all of our forward-looking statements by these cautionary statements. The forward-looking statements included in this presentation are made only as of the date hereof. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected in the forward-looking statements will be achieved or occur. Moreover, neither we nor our advisors nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. Neither we nor our advisors undertake any obligation to revise, supplement or update any forward-looking statements for any reason after the date of this presentation to conform these statements to actual results or to changes in our expectations, even if new information becomes available in the future, except as may be required by law. You should read this presentation with the understanding that our actual future results, levels of activity, performance and events and circumstances may be materially different from what we expect. Unless otherwise indicated, information contained in this presentation concerning our industry, competitive position and the markets in which we operate is based on information from independent industry and research organizations, other third-party sources and management estimates. Management estimates are derived from publicly available information released by independent industry analysts and other third-party sources, as well as data from our internal research, and are based on assumptions made by us upon reviewing such data, and our experience in, and knowledge of, such industry and markets, which we believe to be reasonable. In addition, projections, assumptions and estimates of the future performance of the industry in which we operate and our future performance are necessarily subject to uncertainty and risk due to a variety of factors, including those described above. These and other factors could cause results to differ materially from those expressed in the estimates made by independent parties and by us. Industry publications, research, surveys and studies generally state that the information they contain has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements in this presentation. The trademarks included herein are the property of the owners thereof and are used for reference purposes only. Non-IFRS Financial Measures Management uses several financial measures, both IFRS and non-IFRS financial measures, in analyzing and assessing the overall performance of the business and for making operational decisions. EBITDA is a non-IFRS financial measure defined as earnings excluding net finance costs, income tax charge, depreciation, and amortization. Adjusted EBITDA is a non-IFRS financial measure defined as EBITDA adjusted to exclude the effect of non-recurring items, significant non-cash items, share-based payment expense and other items that our board of directors believes do not reflect the underlying performance of the business. Adjusted EBITDA Margin is a non-IFRS measure defined as Adjusted EBITDA as a percentage of revenue. We believe EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin are useful to our management as a measure of comparative operating performance from period to period as they remove the effect of items not directly resulting from our core operations including effects that are generated by differences in capital structure, depreciation, tax effects and non-recurring events. While we use EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin as tools to enhance our understanding of certain aspects of our financial performance, we do not believe that EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin are substitutes for, or superior to, the information provided by IFRS results. As such, the presentation of EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin is not intended to be considered in isolation or as a substitute for any measure prepared in accordance with IFRS. The primary limitations associated with the use of EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin as compared to IFRS results are that EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin as we define them may not be comparable to similarly titled measures used by other companies in our industry and that EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin may exclude financial information that some investors may consider important in evaluating our performance. Free Cash Flow Free Cash Flow is a non-IFRS financial measure defined as cash flow from operating activities less capital expenditures, or CAPEX. We believe Free Cash Flow is useful to our management as a measure of financial performance as it measures our ability to generate additional cash from our operations. While we use Free Cash Flow as a tool to enhance our understanding of certain aspects of our financial performance, we do not believe that Free Cash Flow is a substitute for, or superior to, the information provided by IFRS metrics. As such, the presentation of Free Cash Flow is not intended to be considered in isolation or as a substitute for any measure prepared in accordance with IFRS. The primary limitation associated with the use of Free Cash Flow as compared to IFRS metrics is that Free Cash Flow does not represent residual cash flows available for discretionary expenditures due to the fact that the measure does not deduct the payments required for debt service and other obligations or payments made for business acquisitions. Free Cash Flow as we define it also may not be comparable to similarly titled measures used by other companies in the online gambling affiliate industry. Adjusted figures represent non-IFRS information. See the tables at the end of this presentation for an explanation of the adjustments and reconciliations to the comparable numbers. Page 2

AGENDA Gambling.com Group Overview 04 What is RotoWire? 06 RotoWire’s Three Revenue Streams 07 RotoWire + Gambling.com Group 08 Revenue Stream: Advertising 09 Revenue Stream: Subscriptions 10 Revenue Stream: B2B Media Services 11 Deal Structure & Terms 13 14 Other Corporate Activity 15 Purchase of USBettingReport.com 16 Domain Portfolio Expansion 17 Q&A 18 Appendix Page 3 RotoWire Team 12

OVERVIEW GLOBAL Affiliate Marketing Powerhouse 15 Years in Business 30+ WEBSITES Focused on Sports Betting & iGaming 150+ Full-time Personnel* 14 MARKETS U.K., Ireland, the U.S., Canada and more PREMIUM Online Gambling Brands Page 4 *As of quarter ending September 30, 2021 HIGH-GROWTH AND HIGH-MARGIN Proven History of Superior, Organic Growth

200+ ONLINE gambling operators as clients Page 5

WHAT IS ROTOWIRE? THE ORIGINAL AUTHORITY IN FANTASY SPORTS Recognized by fantasy sports players all over the U.S. as a key source for player and team news as well as professional stats and tools 17 MILLION UNIQUES Unique web visitors to RotoWire.com in last 12 months 32 FULL TIME STAFF Plus 150+ external contributors 70+ MEDIA PARTNERS Syndicating content to millions more U.S. sports fans Page 6 10 MILLION SEARCH REFERRALS IN 2021 RotoWire’s expansive coverage of U.S. sports and high authority have driven 10 million referrals from search engines to RotoWire.com so far in 2021.

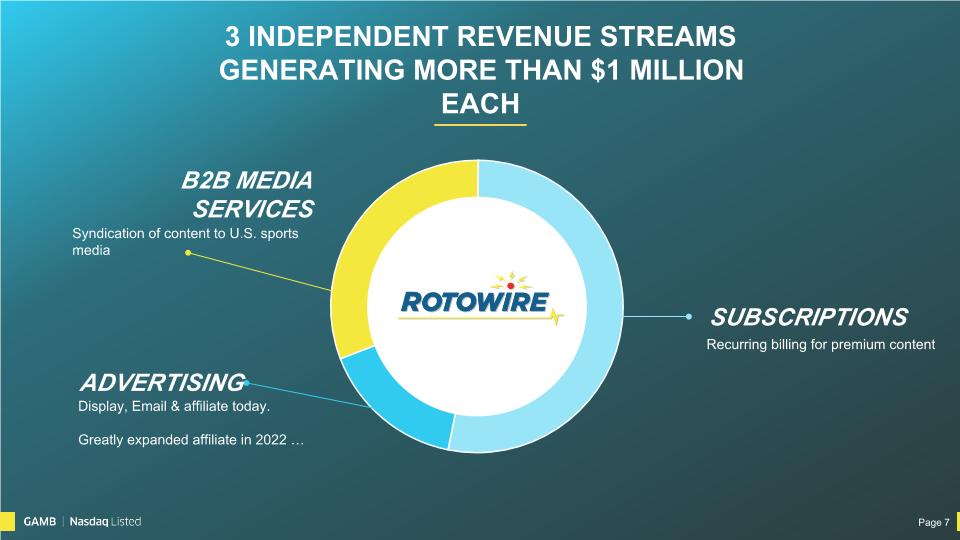

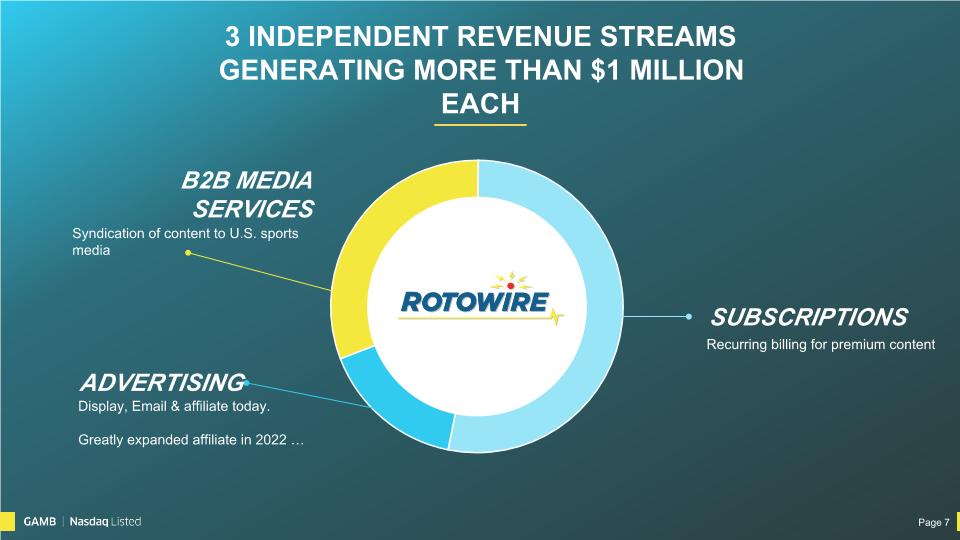

3 INDEPENDENT REVENUE STREAMS GENERATING MORE THAN $1 MILLION EACH B2B MEDIA SERVICES SUBSCRIPTIONS ADVERTISING Page 7 Recurring billing for premium content Display, Email & affiliate today. Greatly expanded affiliate in 2022 … Syndication of content to U.S. sports media

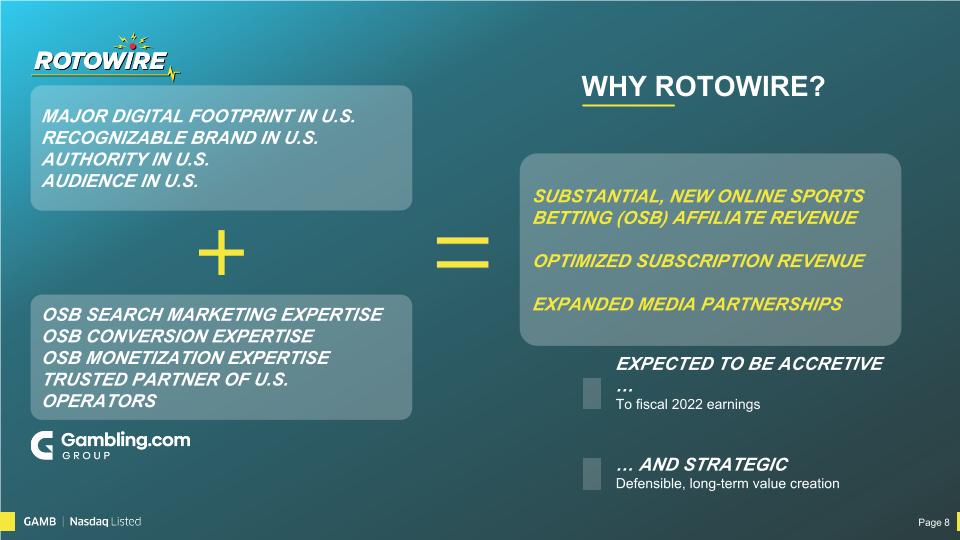

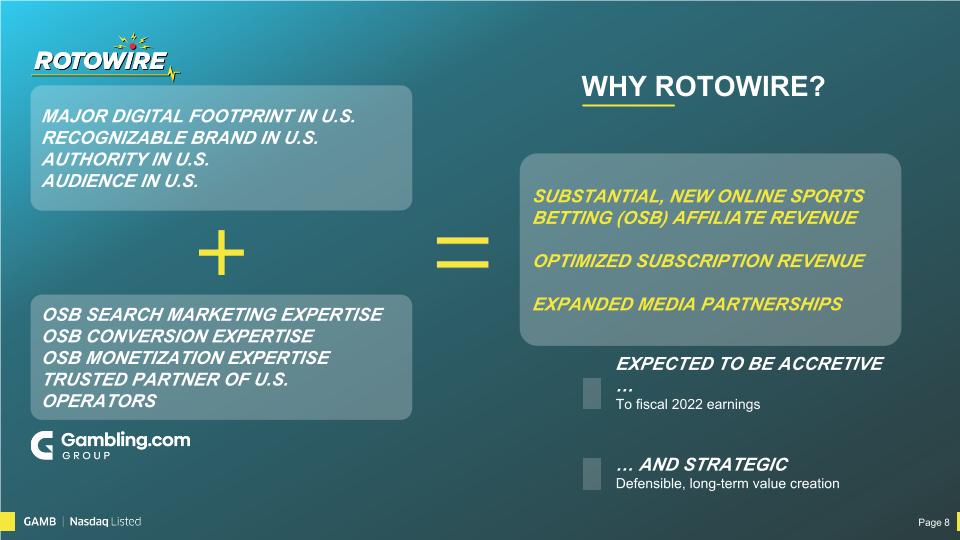

WHY ROTOWIRE? MAJOR DIGITAL FOOTPRINT IN U.S. RECOGNIZABLE BRAND IN U.S. AUTHORITY IN U.S. AUDIENCE IN U.S. OSB SEARCH MARKETING EXPERTISE OSB CONVERSION EXPERTISE OSB MONETIZATION EXPERTISE TRUSTED PARTNER OF U.S. OPERATORS SUBSTANTIAL, NEW ONLINE SPORTS BETTING (OSB) AFFILIATE REVENUE OPTIMIZED SUBSCRIPTION REVENUE EXPANDED MEDIA PARTNERSHIPS EXPECTED TO BE ACCRETIVE … To fiscal 2022 earnings … AND STRATEGIC Defensible, long-term value creation Page 8

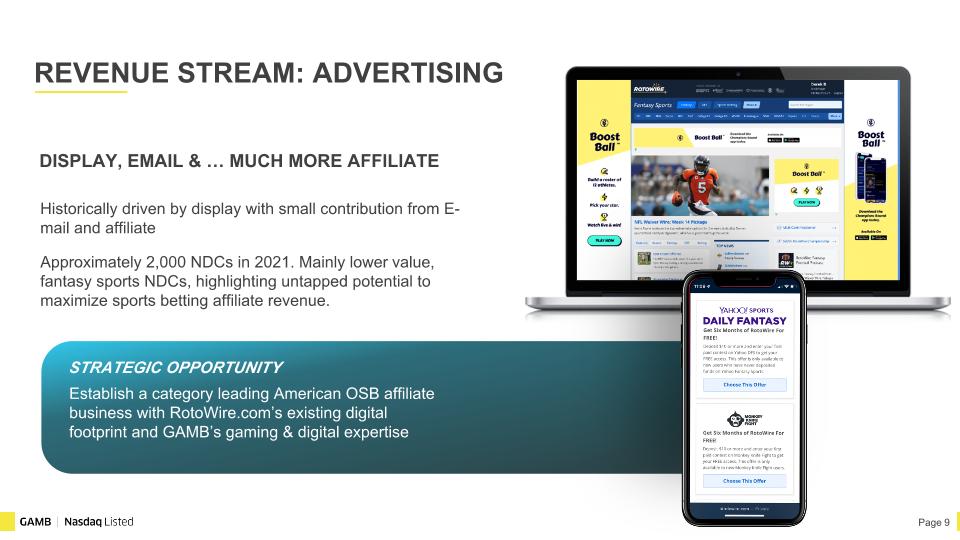

REVENUE STREAM: ADVERTISING Historically driven by display with small contribution from E-mail and affiliate Approximately 2,000 NDCs in 2021. Mainly lower value, fantasy sports NDCs, highlighting untapped potential to maximize sports betting affiliate revenue. DISPLAY, EMAIL & … MUCH MORE AFFILIATE STRATEGIC OPPORTUNITY Establish a category leading American OSB affiliate business with RotoWire.com’s existing digital footprint and GAMB’s gaming & digital expertise Page 9

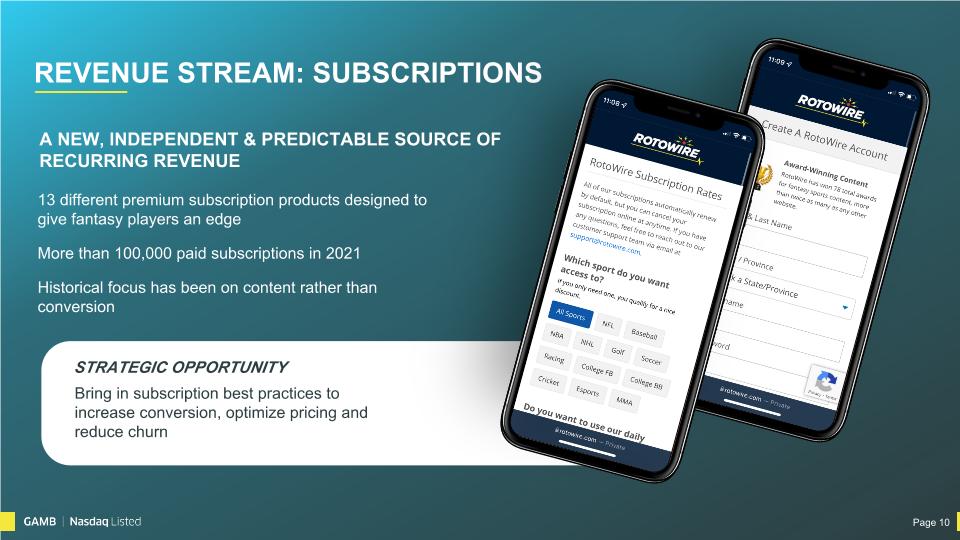

REVENUE STREAM: SUBSCRIPTIONS 13 different premium subscription products designed to give fantasy players an edge More than 100,000 paid subscriptions in 2021 Historical focus has been on content rather than conversion STRATEGIC OPPORTUNITY Bring in subscription best practices to increase conversion, optimize pricing and reduce churn A NEW, INDEPENDENT & PREDICTABLE SOURCE OF RECURRING REVENUE Page 10

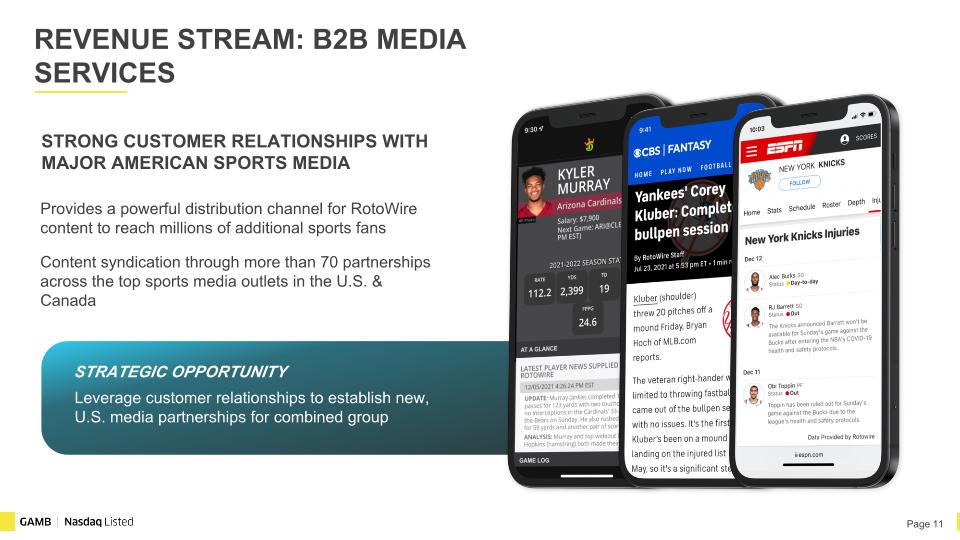

REVENUE STREAM: B2B MEDIA SERVICES Provides a powerful distribution channel for RotoWire content to reach millions of additional sports fans Content syndication through more than 70 partnerships across the top sports media outlets in the U.S. & Canada STRONG CUSTOMER RELATIONSHIPS WITH MAJOR AMERICAN SPORTS MEDIA STRATEGIC OPPORTUNITY Leverage customer relationships to establish new, U.S. media partnerships for combined group Page 11

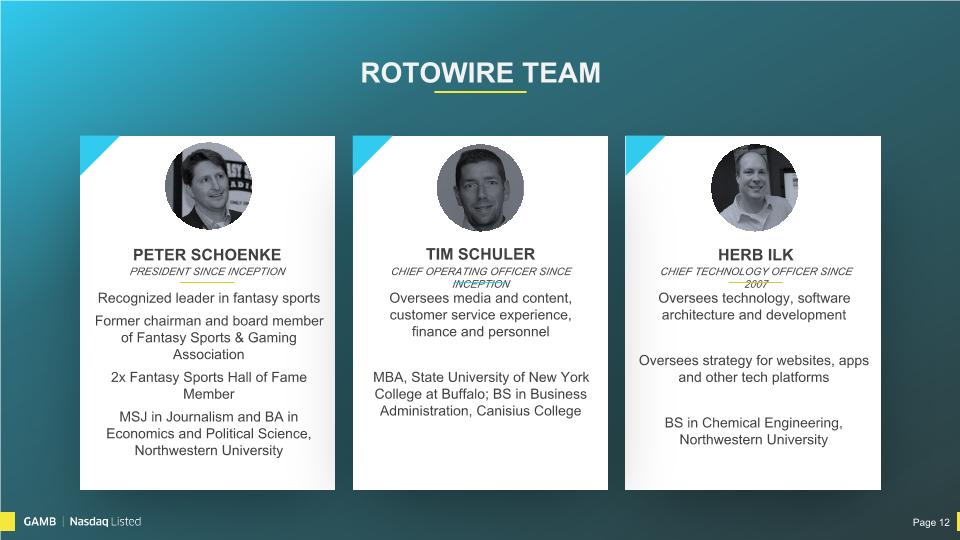

ROTOWIRE TEAM PETER SCHOENKE PRESIDENT SINCE INCEPTION CHIEF OPERATING OFFICER SINCE INCEPTION TIM SCHULER HERB ILK CHIEF TECHNOLOGY OFFICER SINCE 2007 Recognized leader in fantasy sports Former chairman and board member of Fantasy Sports & Gaming Association 2x Fantasy Sports Hall of Fame Member MSJ in Journalism and BA in Economics and Political Science, Northwestern University Oversees media and content, customer service experience, finance and personnel MBA, State University of New York College at Buffalo; BS in Business Administration, Canisius College Oversees technology, software architecture and development Oversees strategy for websites, apps and other tech platforms BS in Chemical Engineering, Northwestern University Page 12

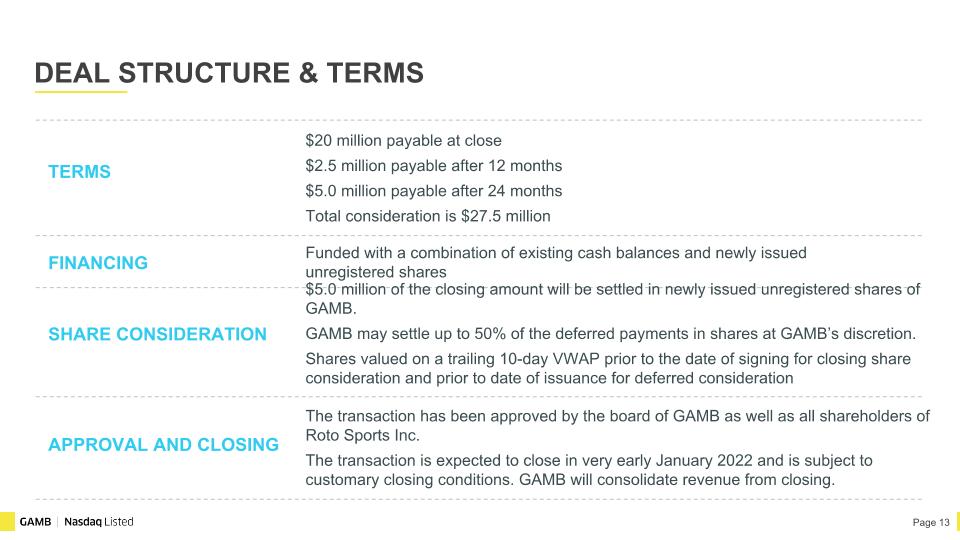

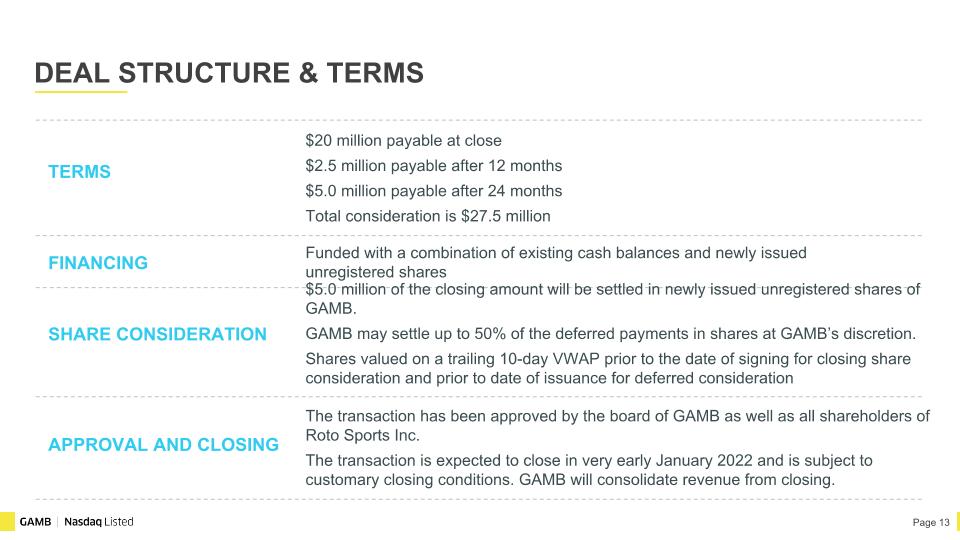

DEAL STRUCTURE & TERMS TERMS $20 million payable at close $2.5 million payable after 12 months $5.0 million payable after 24 months Total consideration is $27.5 million FINANCING Funded with a combination of existing cash balances and newly issued unregistered shares SHARE CONSIDERATION $5.0 million of the closing amount will be settled in newly issued unregistered shares of GAMB. GAMB may settle up to 50% of the deferred payments in shares at GAMB’s discretion. Shares valued on a trailing 10-day VWAP prior to the date of signing for closing share consideration and prior to date of issuance for deferred consideration APPROVAL AND CLOSING The transaction has been approved by the board of GAMB as well as all shareholders of Roto Sports Inc. The transaction is expected to close in very early January 2022 and is subject to customary closing conditions. GAMB will consolidate revenue from closing. Page 13

OTHER GAMBLING.COM GROUP ACTIVITY AND UPDATES Page 14

PURCHASE OF USBettingReport.com (USBR) is a national U.S. sports betting affiliate site we acquired in November. Under-optimized from an SEO standpoint and under-monetized from a conversion rate and deal standpoint. Acquisition adds a high-quality site to our network in a very capital efficient way. Page 15 DEPLOYING THE PLAYBOOK ON USBETTINGREPORT.COM We believe the website can drive substantially more revenue than before we acquired it through continued development, search improvements, deal enhancement and conversion rate optimization – all of our specialties.

DOMAIN PORTFOLIO EXPANSION We have assembled a best-in-class domain portfolio with premium domain assets ready to go for all 50 states. All of which are .com and include bet plus the state name. Gambling.com Group sets the bar on domain quality in the online gambling industry. Page 16 BetOhio.com BetNY.com BetGeorgia.com BetCarolina.com BetCalifornia.com NewYorkBets.com BetTexas.com BetPennsylvania.com BetMassachusetts.com BetCA.com BetVirginia.com BetMichigan.com BetMaryland.com BetArizona.com BetWisconsin.com BetMissouri.com BetFL.com BetConnecticut.com and many more… U.S. BET “STATE” DOMAINS OTHER PORTFOLIO HIGHLIGHTS Scores.com

Q & A Page 17

APPENDIX Page 18

APPENDIX A GROWTH OF THE U.S. ONLINE GAMBLING MARKET Online Casino and Sports Betting Live* 5 STATES Online Sports Betting Live 13 STATES Online Sports Betting Legal But Not Yet Live 4 STATES Recent Bill Introduced But Not Yet Passed 26 STATES No Recent Bill Introduced 3 STATES GAMBLING.COM GROUP EXPECTS THE U.S. WILL ULTIMATELY BE THE WORLD’S LARGEST ONLINE GAMBLING MARKET Page 19 * Connecticut live with online casino only

APPENDIX B GROWTH OF THE U.S. ONLINE GAMBLING MARKET U.S. Online Gambling Market Size at 100% Legalization: The U.S. online gambling market is estimated to have the potential to grow to ~$69 billion if 100% of U.S. states were to legalize(1) iGaming is estimated to drive $43 billion of U.S. online gambling GGR while online sports betting is estimated to drive $26 billion (1) U.S. Online Gambling Market Size at Maturity: The U.S. online gambling market is estimated to grow to ~$30 billion by 2025 Assuming 65% of the U.S. population has access to legal OSB and 30% has access to legal iGaming, a $17 billion online sports betting market and a $13 billion iGaming market are implied U.S. Online Gambling Operator Marketing Spend: We estimate that online gambling operators will spend approximately 45% of their revenue on marketing (3) U.S. Online Gambling Affiliate Capture: We estimate that approximately 29% of operator marketing spend will be spent on affiliate channels (4) Gambling.com will compete for a potential ~$4 billion spend by B2C operators across the U.S. 44% of States Have Already Legalized Online Sports Betting or iGaming ~$69 Billion Estimated U.S. Online Gambling Market Size at 100% Legalization ~$30 Billion Estimated U.S. Online Gambling Market Size in 2025 ~$13.5 Billion Estimated U.S. Online Gambling Operator Marketing Spend ~$4 Billion Estimated U.S. Affiliate Market Size Page 20 1) If all states in the United States were to legalize online casino and online sports betting. Based on applying the estimated 2023 New Jersey iGaming gross revenue per adult and online sports betting gross revenue per adult to the size of the estimated 2030 U.S. adult population 2) Based on historical marketing spend of DraftKings, Rush Street Interactive, and Golden Nugget Online Gaming per public company filings. 3) Based on February 2019 research report by Pareto Securities