LETTER TO SHAREHOLDERS OF TWIN RIDGE CAPITAL ACQUISITION CORP.

Twin Ridge Capital Acquisition Corp.

999 Vanderbilt Beach Road, Suite 200

Naples, Florida 34108

PROXY STATEMENT FOR EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS OF

TWIN RIDGE CAPITAL ACQUISITION CORP.

AND

PROSPECTUS FOR 42,165,275 ORDINARY SHARES AND 12,210,742 PUBLIC WARRANTS, IN EACH CASE, OF

CARBON REVOLUTION PUBLIC LIMITED COMPANY

To the Shareholders of Twin Ridge Capital Acquisition Corp.:

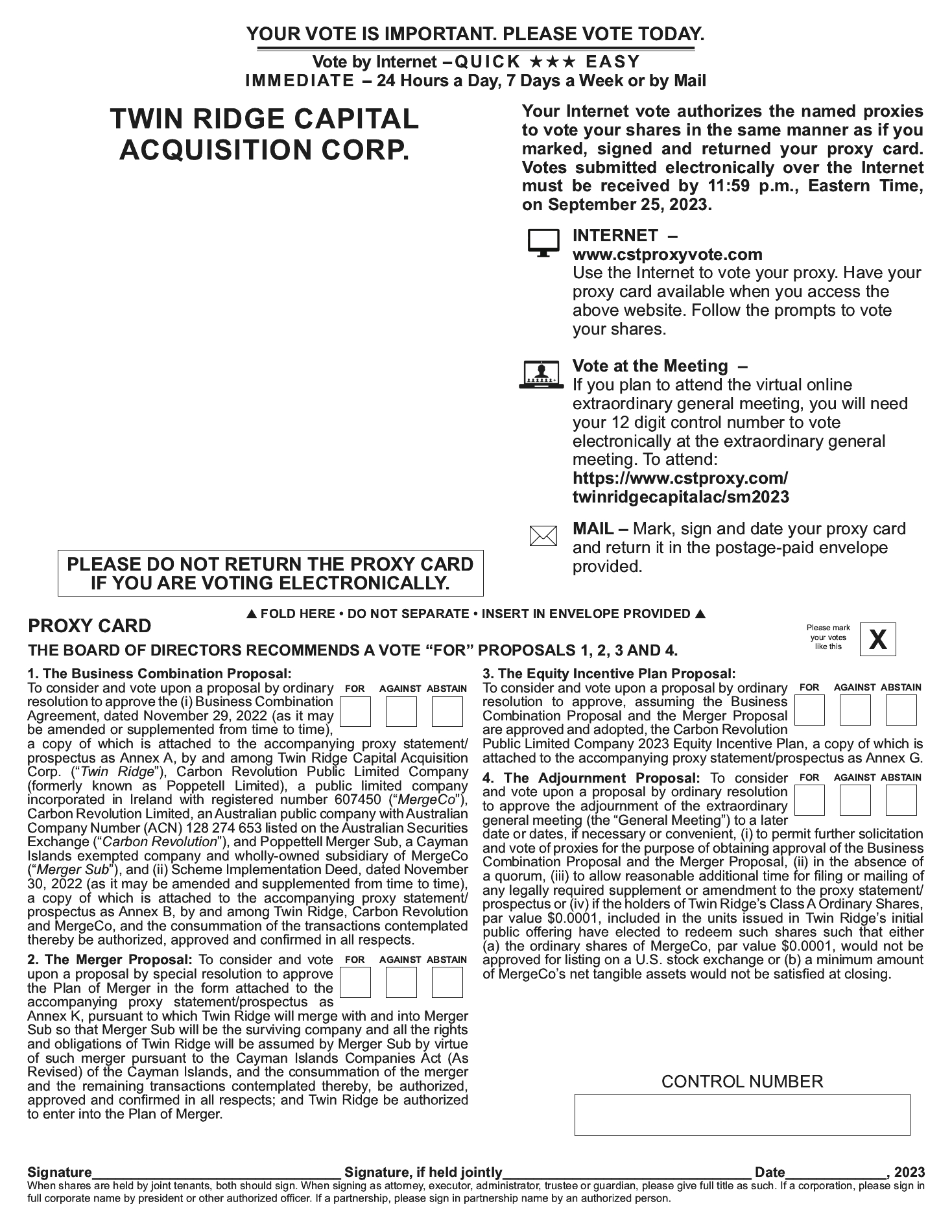

You are cordially invited to attend the extraordinary general meeting in lieu of the annual general meeting (the “General Meeting”) of Twin Ridge Capital Acquisition Corp., a Cayman Islands exempted company (“Twin Ridge”), on September 26, 2023 at 11:30 a.m., Eastern Time, at the offices of Kirkland & Ellis LLP located at 601 Lexington Avenue, 50th Floor, New York, New York 10022, and via a live webcast at https://www.cstproxy.com/twinridgecapitalac/sm2023, or at such other time, on such other date and at such other place to which the meeting may be adjourned, for the purpose of voting on Twin Ridge’s proposed Business Combination (as defined below) with Carbon Revolution Limited, an Australian public company with Australian Company Number (ACN) 128 274 653 listed on the Australian Securities Exchange (“Carbon Revolution”) and the other matters described in the accompanying proxy statement/prospectus.

On November 29, 2022, Twin Ridge, Carbon Revolution Public Limited Company (formerly known as Poppetell Limited), a public limited company incorporated in Ireland with registered number 607450 (“MergeCo”), Carbon Revolution and Poppettell Merger Sub, a Cayman Islands exempted company and wholly-owned subsidiary of MergeCo (“Merger Sub”), entered into a Business Combination Agreement (as it may be amended or supplemented from time to time, the “Business Combination Agreement”), pursuant to which, among other things, Twin Ridge will be merged with and into Merger Sub, with Merger Sub surviving as a wholly-owned subsidiary of MergeCo (the “Merger”), with shareholders of Twin Ridge receiving ordinary shares of MergeCo, par value $0.0001 (the “MergeCo Ordinary Shares”), in exchange for their existing Twin Ridge Ordinary Shares (as defined below) and existing Twin Ridge warrant holders having their warrants automatically exchanged by assumption by MergeCo of the obligations under such warrants, including to become exercisable in respect of MergeCo Ordinary Shares instead of Twin Ridge Ordinary Shares, subject to, among other things, the approval of Twin Ridge’s shareholders. On November 30, 2022, Twin Ridge, Carbon Revolution and MergeCo entered into a Scheme Implementation Deed (as it may be amended or supplemented from time to time, the “Scheme Implementation Deed”). Under the Scheme Implementation Deed, Carbon Revolution has agreed to propose a scheme of arrangement under Part 5.1 of the Corporations Act 2001 (Cth) (the “Scheme”) and a capital reduction under Part 2J.1 of the Corporations Act 2001 (Cth) which, if implemented, will result in all shares of Carbon Revolution being cancelled in return for consideration, with Carbon Revolution issuing a share to MergeCo (resulting in Carbon Revolution becoming a wholly-owned subsidiary of MergeCo) and MergeCo issuing shares to the shareholders of Carbon Revolution, subject to approval from Carbon Revolution’s shareholders, approval of the Federal Court of Australia and the satisfaction of various other conditions (a full list of the conditions is set out in the Scheme Implementation Deed). A copy of the Business Combination Agreement is attached to this proxy statement/prospectus as Annex A and the Scheme Implementation Deed is attached to this proxy statement/prospectus as Annex B. See the section entitled “Shareholder Proposal 1 – The Business Combination Proposal”.

At the General Meeting, Twin Ridge’s shareholders will be asked to consider and approve the Business Combination Agreement, the Scheme Implementation Deed and the consummation of the transactions contemplated thereby (the “Business Combination”), and approve the other proposals described in the accompanying proxy statement/prospectus.

Concurrently with the execution of the Business Combination Agreement and the Scheme Implementation Deed, Twin Ridge Capital Sponsor LLC, a Delaware limited liability company (the “Sponsor”), Alison Burns, Paul Henrys, Gary Pilnick, Dale Morrison, Sanjay K. Morey, William P. Russell, Jr., Twin Ridge Capital Sponsor Subsidiary Holdings LLC, a Delaware limited liability company (“TRCA Subsidiary” and together with Alison Burns, Paul Henrys, Gary Pilnick, Dale Morrison, Sanjay K. Morey, William P. Russell, Jr. and the Sponsor, the “TRCA Parties”), Twin Ridge, Carbon Revolution and MergeCo entered into a Sponsor Side Letter (the “Sponsor Side Letter”), pursuant to which the TRCA Parties have agreed to take, or not take, certain actions during the period between the execution of the Sponsor Side Letter and the consummation of the Merger, including, (i) to vote any Twin Ridge Ordinary Shares owned by such TRCA Party (all such shares, the “Covered Shares”), in favor of the Merger and the Scheme and other related proposals at the shareholders meeting of Twin Ridge, and any other special meeting of Twin Ridge’s shareholders called for the purpose of soliciting shareholder approval in connection with the consummation of the Merger and the Scheme, (ii) to waive the anti-dilution rights or similar protections with respect to the Twin Ridge Class B ordinary shares, par value $0.0001 per share (the “Twin Ridge Class B Ordinary Shares”), owned by such party as set forth in Twin Ridge’s governing documents, or otherwise, and (iii) not to redeem any Covered Shares owned by such TRCA Party. On March 31, 2023, William Toler executed a joinder to the Sponsor Side Letter.

Pursuant to the Sponsor Side Letter, Sponsor has also agreed that, immediately prior to the consummation of the Merger, and conditioned upon the consummation of the Merger, 327,203 of the 5,267,203 Twin Ridge Class B Ordinary Shares beneficially owned by Sponsor shall be automatically forfeited and surrendered to Twin Ridge for no additional consideration. A copy of the Sponsor Side Letter is attached to this proxy statement/prospectus as Annex F.

Twin Ridge’s units, Class A ordinary shares, par value $0.0001 (the “Twin Ridge Class A Ordinary Shares”) and, together with the Twin Ridge Class B Ordinary Shares, the “Twin Ridge Ordinary Shares”), and warrants are currently listed on the New York Stock Exchange under the symbols “TRCA.U”, “TRCA” and “TRCA WS”, respectively. On September 1, 2023, the closing price of the Twin Ridge Class A Ordinary Shares was $10.73, the closing price of the Twin Ridge warrants was $0.0406 and the closing price of the Twin Ridge units was $10.76. MergeCo intends to apply to list its ordinary shares and warrants on a U.S. stock exchange under the symbols “CREV” and “CREVW”, respectively, upon the closing of the Business Combination.

See “

Risk Factors” beginning on page

47 of the accompanying proxy statement/prospectus for a discussion of information that should be considered in connection with an investment in MergeCo’s securities.

Information about the General Meeting, the Business Combination, the Merger and other related business to be considered by the Twin Ridge shareholders at the General Meeting is included in the accompanying proxy statement/prospectus.