Q2 2021 Founder/CEO Letter To Shareholders

Dear Shareholder,

Last quarter, in advance of going public, I wrote my first shareholders letter where I shared our Q1 performance as well as introduced Taboola, our vision, our market, and our ability to drive predictable and profitable growth in a $60B+ open web market. Before we get into our Q2 update, I want to remind those who may be newer to Taboola, on what we do and what drives our success.

Taboola powers recommendations for the open web, helping people discover things they may like. You’ve seen us before, if you’ve visited sites you love like CNBC, NBCNews, the Independent in the UK, or Sankei in Japan - you would discover what to read next, powered by Taboola.

The open web, as many of you know, is the term for all the websites and publishers out there that aren’t Facebook, Amazon, Google, Apple or the like. The open web is really important, even essential, because it’s free and diverse and doesn’t belong to any one giant company. It belongs to everyone. Think about every website you love — every game, app on a mobile device or connected TV that lives outside of the walled gardens. That’s where Taboola fits.

Taboola has established long-term partnerships with some of the top publishers and digital properties in the world. Recommending something that a user may like at just the right time and just the right place is a significant challenge. We have a proprietary deep learning recommendations engine that is able to infer what a user might be interested in based on context (not 3rd party cookie reliant) and knowledge of what other users have liked in similar circumstances. Through our publisher partners, we reach 500M people a day, driving revenue, and we invest $100M a year in R&D to provide our partners with the platform and technology they need to drive revenue, engagement and audience. The strength of our platform has also attracted more than 13,000 advertisers who work directly with Taboola to reach consumers in a brand-safe environment.

Our success has provided us significant scale, and this is a market where scale matters a lot - the bigger you get, the more data you gain, your yield gets better - and the more network effect benefits you get and the more profitable growth you realize. This allows us to invest more in our core and outside of our core, and capture more opportunity in these multi-billion market areas.

I am so happy to update you all again on our business and the tremendous progress we’ve made. Q2 2021 has been the most eventful quarter since I started Taboola.

We are now a public company, trading under ‘TBLA’ on Nasdaq.

We are honored to have the support of, and to be working for, so many new investors, large and small - we are at the beginning of our public journey. We are focused on winning in the market, executing on our strategy and delivering on our commitments --- now for the benefit of not just ourselves but for our new public investors who chose Taboola, and believe what we believe.

We recently announced our agreement to acquire Connexity for $800M, allowing us to bring e-Commerce to the open web as another strong growth engine.

Connexity is already one of the largest e-Commerce media platforms on the open web -- over a million monthly transaction events supported by direct relationships with over 1,600 merchants, such as Walmart, Wayfair, Skechers, Macy’s, eBay and Otto. Connexity reaches more than 100 million unique shoppers per month, via relationships with premium publishers including Condé Nast, DotDash, Hearst, Vox Media, Meredith, and News Corp Australia.

Connexity is a B2B company, serving merchants as advertisers on one side - and enabling publishers as partners on the other. 90% of their revenue comes from merchants they have direct relationships with (most of it is paid through CPC, and some is paid through CPA), and they don’t rely on 3rd-party cookies. This is incredible - I love that their business, which is very aligned with Taboola’s strategy, is about working directly with both advertisers and publishers, serving high quality advertising experiences that do not depend on cookies.

With publishers - Connexity’s offering helps bring product recommendations to sites we all love, in a familiar format, as well as enabling clients to launch their own “shopping sections”. Imagine scrolling on a fashion website, clicking on the image of an incredible looking shoe and being able to click ‘buy’. Or scrolling through recipes on the Food Network, and discovering groceries you might like to buy. We imagine helping news publishers make each section of their site part of the larger e-Commerce ecosystem. These new capabilities will provide merchants, and publishers, large and small, more opportunities to scale outside of the walled gardens, making the open web thrive.

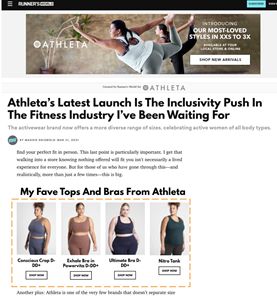

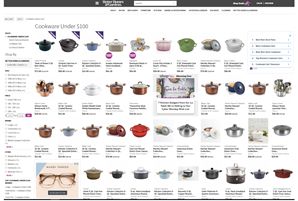

Connexity on publishers, and the user’s experience looks like this:

Connexity native product listing seamlessly embedded in publisher's editorial content (Hearst’s Runner’s World)

Connexity powering the shopping section of a publisher (Meredith’s Better Home & Gardens)

Connexity has successfully built a way to enable advertisers to extend their reach beyond their publisher partners. Similar to “Facebook Audience Network (‘FAN’)”, but powered by Connexity and in the e-Commerce Category. For example, a merchant working with Connexity, (see above) might be recommended on Meredith or Hearst, but might also be surfaced on Bing, Yahoo, Google, or even Instagram where influencers create content. This makes up approximately ~25% of the Connexity business, and it provides a great opportunity for Connexity and its merchants to find users wherever they may be.

I’m really excited about this acquisition. The market is excited. I've received many messages from our publisher community expressing their interest in expanding their work with us to launch shopping areas on their site(s), and bring e-Commerce to their editorial pages.

We beat our Q2 guidance by all measures, we’re raising our guidance for the full year 2021 and increasing expectations for 2022

As a reminder, when we released Q1 earnings, we raised our guidance for Q2 as well as for the full year, saying we will grow faster. Instead of our original projection to grow 17% for the year, our new and higher guidance was that we’ll grow ex-TAC Gross Profit 19% - 22% in 2021 versus 2020.

Today, we’re sharing that we beat our revised higher Q2 guidance, delivering strong growth year-over-year across all our financial metrics, and we’re raising our guidance for the full year 2021.

In Q2, revenue was up 23%, ex-TAC gross profit up 18% and Adjusted EBITDA up 17% versus last year, same quarter. About 40% of this growth comes from new business, and 60% comes growth in our yield. We are winning new business, seeing good demand for our new Agency/Brand offering and maintaining strong yield overall. At the same time, due to continued accelerated digitization from Covid-19, consumers are looking to interact and buy more online, where Taboola has a meaningful scale, reaching 500M+ daily active users.

Raising guidance for Q3 and the rest of 2021

Following this momentum, and a strong Q1 - we are increasing our stand alone expectations for Q3, and updating our full year guidance. We are now projecting that we will grow ex-TAC gross profit by 22 - 23% for the full year of 2021 versus 2020, which is an increase from our previous guidance of 19 - 22%. Note that our guidance does not incorporate our pending acquisition of Connexity which is expected to close in the third quarter.

Higher 2022 growth on a bigger base

Joined with Connexity, we expect in 2022 to grow ex-TAC gross profit over 30% on a reported, non-pro forma basis1. We previously told you that we expected the Taboola stand-alone ex-TAC gross profit to grow 16% in 2022. With the completion of the Connexity acquisition, we’re raising our expectations for next year, projecting that we will grow ex-TAC gross profit faster at 17%+ on a pro forma basis, despite the much larger base. We expect to close the acquisition by the end of the third quarter of this year.

We are laser focused on continuing to deliver predictable, and consistent profitable growth over the long run and we are proud of our track record of performance, which is built on a solid business foundation:

| ● | We have won the trust of incredible publishers who work with us exclusively (and typically) for 3-5 years |

| ● | 90% of our advertisers work with us directly, allowing our AI technology, called SmartBid to optimize the bids on their behalf |

| ● | We use contextual signals to deliver relevant recommendations and don't rely on 3rd-party cookies |

| ● | We have scale, and in our industry, scale matters - driving our flywheel, our yield and our competitive advantage higher. |

1Reported growth expectation assumes that the Connexity acquisition closes at the end of Q3 2021

Business Highlights

We are winning in the market and we are seeing great results.

I speak frequently about how Taboola is growing across 3 multi-billion dollar areas:

| ● | Growing our core business - this is our foundation, a business with a moat built on fourteen years of technology and algorithm innovation, direct publisher and advertiser partnerships, no reliance on 3rd-party cookies, interacting with 500M people a day and remaining focused on data and execution. Our core business provides us the scale, capabilities and permission to pursue our Anything and Anywhere growth initiatives. |

| ● | ‘Recommend Anything’, a way for us to diversify what we recommend. |

| - | Winning premium demand on premium new placements - We’re seeing terrific growth with premium demand such as video and native branding on premium new placements such as middle of the article pages, homepages and section fronts. We already power both editorial and paid recommendations for many of the largest publishers in the world, which gives us the advantage of being able to win in bundles, e.g., bottom of article and middle of the page recommendations: 1 + 1 = 3. |

| - | e-Commerce - Acquiring Connexity helps us supercharge our strategy of recommend anything and focus on bringing product and e-Commerce recommendations to the open web. More on Connexity below. |

| ● | ‘Recommend Anywhere’, where we’re continuing our expansion to recommend wherever people might be. Over time we will consider becoming the recommendation engine on devices like Connected TV, in the meantime, we’re already making good progress integrating our recommendations on device manufacturers |

| | - | Taboola News (our Apple News-like product) has continued to scale with two major deals. A long-term partnership with Sliide, a leading mobile platform that drives engagement and monetization for mobile carriers, OEMs and publishers, powering billions of user interactions. Samsung Brasil also selected Taboola News as their partner to integrate relevant content from Taboola’s premium publishers on mobile phones and other user touch points. |

More on Taboola and Connexity as part of “Recommend Anything” strategy

With this acquisition, we are executing on our plan to expand into e-Commerce as part of our “Recommend Anything” strategy. Connexity expands our market opportunity. In the US alone their estimated TAM is $35B for the e-Commerce media market. We believe that the future of the open web is e-Commerce, bringing merchants together with trusted publishers, connecting customers with products they might like - powered by Taboola. By combining our organizations, cultures, massive data, reach to 500M daily active users, and direct access to publishers, advertisers and merchants — we are making a huge step towards our vision.

We’ve seen great companies in Asia like WeChat and Alibaba massively succeed in e-Commerce. Mark Zuckerberg recently announced Instagram Shopping and Facebook Shops, and I’m convinced we can bring the power of commerce to every site, or app on the free internet. Imagine reading an article about a Star Wars LEGO set and instead of having to start a search to buy the set, products like LEGO’s Millennium Falcon, Yoda or R2-D2 are surfaced, alongside content, for users to consider buying.

Taboola will now be powering millions of e-commerce recommendations to millions of people across the open web every day. We can’t wait to bring this value to our publishers and these new channels to our advertisers. The synergies are very clear --

| ● | Driving yield growth by bringing Connexity Merchants to Taboola’s existing relationships with publishers / 500M active users |

| ● | Upselling existing Connexity publisher products, such as shop sections and commerce content, to Taboola’s ~9,000 publishers |

| ● | Building new, powerful and innovative products based on combined tech and data |

| ● | Bringing Connexity global by leveraging Taboola’s worldwide presence |

| ● | Creating a super data set to drive yield growth to both Connexity and Taboola’s partners |

Together with Connexity, we can achieve our shared dream. We’ll be at the forefront of powering recommendations for the open web, enabling merchants to leverage Taboola’s massive scale to reach their clients outside of the walled gardens.

Amazon has millions of merchants, but merchants mainly have Amazon. That changes once we acquire Connexity.

Our People

We are hiring quickly across all departments, and that is important for us given our fast, predictable, and profitable growth expectations. I’m proud to say that we have consistently been voted a top company to work for in Israel (where we house our R&D Center). Globally,

| - | 320 people applied to work at Taboola every day in Q2 |

| - | We finished Q1 with 1383 employees and Q2 with 1442 |

DEI

Building an inclusive and diverse workplace isn’t just the right thing to do as a society, we believe that multiple voices and perspectives can drive better results. Our culture is about transparency and collaboration, and with more diversity, we believe we can execute even better. As we look into Q3 and the rest of 2021, our DEI projects are front of the line.

| - | We have allocated $1.5M for DEI activities for 2021, with $500K already implemented in Q1’s RecommendHer campaign, which provided free advertising for women-owned businesses. |

| - | In June, Taboola Pride, our Employee Resource Group for the LGBTQ community at Taboola held a private, virtual event with over 10% of our employees attending the session. |

We’ve announced to our employees that we want to take a meaningful decision when it comes to women and people of color in leadership at Taboola. Our goal from now through 2025 is:

| - | 25% of our Sr. leadership team (VP and above) will be women |

| - | 45% of all future promotions and hires into leadership will be women or people of color |

Our global goal is gender diversity, and we’re going to focus on underrepresented minority groups in each of the regions we operate in.

Financial Performance

Turning to our Q2 financials, we once again had strong results across our key business metrics and that performance gives us the confidence to raise our guidance for Q3 and full year. Here are the highlights:

(dollars in millions) | Q2 2021 | Year over Year Growth | Previous Guidance (as of 5/17/21) |

| | | | |

Revenues | $329 | 22.9% | $315 to $320 |

Gross Profit | $100 | 19.2% | $88 to $95 |

ex-TAC Gross Profit* | $117 | 18.2% | $108 to $113 |

Net Loss1 | $(61) | NM | not a guidance measure |

Adjusted EBITDA* | $41 | 17.0% | $34 to $36 |

1For the 2021 periods, a substantial majority is Share-based compensation expenses related to going public.

Within revenue, there was a balanced contribution with new business contributing 37.4% and existing business contributing 62.6% of the growth. Gains in yield fuel our business and enabled both investment and an adjusted EBITDA margin of 34.9%. Our continued profitable growth reflects the strength of our business model that includes:

| ● | long term and exclusive publisher partnerships (contracts) with guaranteed supply |

| ● | direct relationships with advertisers, strongly tilted to performance advertisers that are uniquely resilient |

| ● | a contextual, non-cookie dependent recommendations engine |

| ● | Our scale, and in our industry, scale matters - driving competitive advantage. |

All of these elements feed our yield improvement flywheel that results in greater publisher and advertiser success as well as higher growth and better margins.

Our Q2 performance gives us confidence to raise our Q3 expectations and full year guidance. Our guidance does not incorporate Connexity’s business pending the close of the acquisition. The table below includes our current guidance for full year 2021 compared to our previous guidance:

Full Year 2021 (dollars in millions) | | Increased Guidance (as of 8/10/21) | | Year over Year Growth | Previous Guidance (as of 5/17/21) |

Revenues | | $1,316 to $1,323 | | ~11% | $1,298 to $1,308 |

Gross Profit | | | | 22% to 24% | $374 to $386 |

ex-TAC Gross Profit | | $468 to $472 | | 22% to 23% | $456 to $466 |

Adjusted EBITDA | | $150 to $153 | | 41% to 44% | $140 to $150 |

For a complete look at our updated full year and Q3 guidance and Q2 results, please see our Q2 2021 earnings press release, which was furnished to the SEC and also posted on Taboola’s website today at https://investors.taboola.com.

* * *

And while we are focused on quarterly growth, our vision far surpasses quarter by quarter goals. We have a big vision for the next decade and it includes powering e-Commerce recommendations across the open web.

I’m looking forward to our first earnings call, where I will do my best to answer any questions you may have.

Kind regards,

-- Adam Singolda

Founder and CEO

*About Non-GAAP Financial Information

This press release includes ex-TAC Gross Profit, Adjusted EBITDA, Ratio of Adjusted EBITDA to ex-TAC Gross Profit and Free Cash Flow, which are non-GAAP financial measures. These non-GAAP financial measures are not measures of financial performance in accordance with GAAP and may exclude items that are significant in understanding and assessing the Company’s financial results. Therefore, these measures should not be considered in isolation or as an alternative to revenues, gross profit, net income, cash flows from operations or other measures of profitability, liquidity or performance under GAAP. You should be aware that the Company’s presentation of these measures may not be comparable to similarly-titled measures used by other companies.

The Company believes non-GAAP financial measures provide useful information to management and investors regarding future financial and business trends relating to the Company. The Company believes that the use of these measures provides an additional tool for investors to use in evaluating operating results and trends and in comparing the Company’s financial measures with other similar companies, many of which present similar non-GAAP financial measures to investors. Non-GAAP financial measures are subject to inherent limitations because they reflect the exercise of judgments by management about which items are excluded or included in calculating them. Please refer to the appendix at the end of this press release for reconciliations to the most directly comparable measures in accordance with GAAP.

Note Regarding Forward-Looking Statements

Certain statements in this press release are forward-looking statements. Forward-looking statements generally relate to future events including future financial or operating performance of Taboola.com Ltd. (the “Company”). For example, the expected timing and completion of the pending acquisition of Connexity and guidance for the third quarter of and Full Year 2021, are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expect”, “intend”, “will”, “estimate”, “anticipate”, “believe”, “predict”, “potential” or “continue”, or the negatives of these terms or variations of them or similar terminology. Such forward-looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward looking statements.

These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by the Company and its management, are inherently uncertain. Uncertainties and risk factors that could affect the Company’s future performance and cause results to differ from the forward-looking statements in this presentation include, but are not limited to: the ability to recognize the anticipated benefits of the recent transaction between the Company and ION Acquisitions Corp. 1 Ltd. (the “Business Combination”), which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably, maintain relationships with customers and retain its management and key employees; costs related to the Business Combination; changes in applicable laws or regulations; the Company’s estimates of expenses and profitability and underlying assumptions with respect to shareholder redemptions and purchase price and other adjustments; ability to attract new digital properties and advertisers; ability to meet minimum guarantee requirements in contracts with digital properties; intense competition in the digital advertising space, including with competitors who have significantly more resources; ability to grow and scale the Company’s ad and content platform through new relationships with advertisers and digital properties; ability to secure high quality content from digital properties; ability to maintain relationships with current advertiser and digital property partners; ability to make continued investments in the Company’s AI-powered technology platform; the need to attract, train and retain highly-skilled technical workforce; changes in the regulation of, or market practice with respect to, “third party cookies” and its impact on digital advertising; continued engagement by users who interact with the Company’s platform on various digital properties; the impact of the ongoing COVID-19 pandemic; reliance on a limited number of partners for a significant portion of the Company’s revenue; changes in laws and regulations related to privacy, data protection, advertising regulation, competition and other areas related to digital advertising; ability to enforce, protect and maintain intellectual property rights; and risks related to the fact that we are incorporated in Israel and governed by Israeli law; and other risks and uncertainties set forth in the section entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in the Company’s registration statement on Form F-4 relating to the Business Combination filed on April 30, 2021, and in subsequent filings with the Securities and Exchange Commission (“SEC”), including the final prospectus/proxy statement relating to the Business Combination.

Nothing in this press release should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on these forward-looking statements, which speak only as of the date they were made. The Company undertakes no duty to update these forward-looking statements except as may be required by law.

APPENDIX: Non-GAAP Reconciliation

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES FOR Q2 2021

(Unaudited)

The following table provides a reconciliation of Revenues to ex-TAC Gross Profit.

| | Three Months Ended June 30, | | | Six Months Ended June 30, | |

| | 2021 | | | 2020 | | | 2021 | | | 2020 | |

| | | (unaudited) | | | (unaudited) | |

| | (dollars in thousands) | | | (dollars in thousands) | |

Revenues | | $ | 329,072 | | | $ | 267,668 | | | $ | 632,022 | | | $ | 547,014 | |

| Traffic acquisition cost | | | 212,202 | | | | 168,783 | | | | 409,238 | | | | 379,161 | |

| Other cost of revenues | | | 16,625 | | | | 14,781 | | | | 33,040 | | | | 30,973 | |

Gross Profit | | $ | 100,245 | | | $ | 84,104 | | | $ | 189,744 | | | $ | 136,880 | |

| Add back: Other cost of revenues | | | 16,625 | | | | 14,781 | | | | 33,040 | | | | 30,973 | |

ex-TAC Gross Profit | | $ | 116,870 | | | $ | 98,885 | | | $ | 222,784 | | | $ | 167,853 | |

The following table provides a reconciliation of Net income (loss) to Adjusted EBITDA.

| | Three Months Ended June 30, | | | Six Months Ended June 30, | |

| | 2021 | | | 2020 | | | 2021 | | | 2020 | |

| | | (unaudited) | | | (unaudited) | |

| | (dollars in thousands) | | | (dollars in thousands) | |

Net income (loss) | | $ | (61,416 | ) | | $ | 12,905 | | | $ | (42,829 | ) | | $ | (10,948 | ) |

Adjusted to exclude the following: | | | | | | | | | | | | | | | | |

Financial expenses, net | | | 85 | | | | 654 | | | | 883 | | | | 206 | |

Tax expenses | | | 7,922 | | | | 4,665 | | | | 10,159 | | | | 9,128 | |

Depreciation and amortization | | | 8,646 | | | | 9,076 | | | | 16,890 | | | | 18,827 | |

Share-based compensation expenses(1) | | | 78,523 | | | | 2,223 | | | | 83,654 | | | | 4,493 | |

M&A costs(2) | | | 7,042 | | | | 5,342 | | | | 5,588 | | | | 11,439 | |

Adjusted EBITDA | | $ | 40,802 | | | $ | 34,865 | | | $ | 74,345 | | | $ | 33,145 | |

1For the 2021 periods, a substantial majority is Share-based compensation expenses related to going public.

2 For 2020 periods, represents costs associated with the proposed strategic transaction with Outbrain Inc.which we elected not to consummate, and for 2021 periods, relates to the acquisition of ION Acquisition Corp. 1 Ltd. and going public.

We calculate Ratio of Net income (loss) to Gross profit as Net income (loss) divided by Gross profit. We calculate Ratio of Adjusted EBITDA to ex-TAC Gross Profit, a non-GAAP measure, as Adjusted EBITDA divided by ex-TAC Gross Profit. We believe that the Ratio of Adjusted EBITDA to ex-TAC Gross Profit is useful because TAC is what we must pay digital properties to obtain the right to place advertising on their websites, and we believe focusing on ex-TAC Gross Profit better reflects the profitability of our business. The following table reconciles Ratio of Net income (loss) to Gross Profit and Ratio of Adjusted EBITDA to ex-TAC Gross Profit for the period shown.

| | Three Months Ended June 30, | | | Six Months Ended June 30, | |

| | 2021 | | | 2020 | | | 2021 | | | 2020 | |

| | | (unaudited) | | | (unaudited) | |

| | (dollars in thousands) | | | (dollars in thousands) | |

Gross profit | | $ | 100,245 | | | $ | 84,104 | | | $ | 189,744 | | | $ | 136,880 | |

Net income (loss) | | $ | (61,416 | ) | | $ | 12,905 | | | $ | (42,829 | ) | | $ | (10,948 | ) |

Ratio of Net income (loss) to Gross profit | | | (61.3 | )% | | | 15.3 | % | | | (22.6 | )% | | | (8.0 | )% |

| | | | | | | | | | | | | | | | | |

ex-TAC Gross Profit | | $ | 116,870 | | | $ | 98,885 | | | $ | 222,784 | | | $ | 167,853 | |

Adjusted EBITDA | | $ | 40,802 | | | $ | 34,865 | | | $ | 74,345 | | | $ | 33,145 | |

Ratio of Adjusted EBITDA Margin to ex-TAC Gross Profit | | | 34.9 | % | | | 35.3 | % | | | 33.4 | % | | | 19.7 | % |

The following table provides a reconciliation of Net cash provided by operating activities to Free Cash Flow.

| | | Three Months Ended June 30, | | | Six Months Ended June 30, | |

| | | 2021 | | | 2020 | | | 2021 | | | 2020 | |

| | | (unaudited) | | | (unaudited) | |

| | | (dollars in thousands) | | | (dollars in thousands) | |

| Net cash provided by operating activities | | $ | 23,083 | | | $ | 36,834 | | | $ | 13,980 | | | $ | 47,842 | |

| Purchases of property and equipment, including capitalized platform costs | | | (16,138 | ) | | | (3,657 | ) | | | (21,675 | ) | | | (10,634 | ) |

| Free Cash Flow | | $ | 6,945 | | | $ | 33,177 | | | $ | (7,695 | ) | | $ | 37,208 | |

APPENDIX: Non-GAAP Reconciliation

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES FOR Q3 2021 and FULL YEAR 2021 GUIDANCE

(Unaudited)

The following table provides a reconciliation of Gross Profit to ex-TAC Gross Profit.

| | Q3 2021 | | | FY 2021 | |

| | | (unaudited) | |

| | (dollars in millions) | |

Revenues | | $ | 325 - $328 | | | $ | 1,316 - $1,323 | |

| Traffic acquisition cost | | $ | (210 - $211 | ) | | $ | (848 - $851 | ) |

| Other cost of revenues | | $ | (19 - $20 | ) | | $ | (75 - $77 | ) |

Gross Profit | | $ | 95 - $98 | | | $ | 390 - $396 | |

| Add back: Other cost of revenues | | $ | 19 - $20 | | | $ | 75 - $77 | |

ex-TAC Gross Profit | | $ | 115 - $117 | | | $ | 468 - $472 | |