Confidential Draft No. 4 as confidentially submitted to the United States Securities and Exchange

Commission pursuant to Section 106(a) of the Jumpstart Our Business Startups Act of 2012 on August 14,

2023 and is not being filed publicly under the Securities Act of 1933, as amended.

Registration No. 333-______________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CONFIDENTIAL SUBMISSION

FORM S-1

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

Elevai Labs, Inc.

(Exact name of registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s Name into English)

| Delaware | 5912 | 85-1399981 | ||

| (State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer | ||

| incorporation or organization) | Classification Code Number) | Identification Number) |

120 Newport Center Drive, Ste. 250

Newport Beach, CA 92660

866-794-4940

(Address, including zip code, and telephone number, including area code, of principal executive offices)

Dr. Jordan R. Plews

Chief Executive Officer

120 Newport Center Drive, Ste. 250

Newport Beach, CA 92660

866-794-4940

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

William Rosenstadt, Esq. Mengyi “Jason” Ye, Esq. | Ying Li, Esq. Guillaume de Sampigny, Esq. Hunter Taubman Fischer & Li LLC New York, NY 10022

|

Approximate date of commencement of proposed sale to public: From time to time after the effective date of this registration statement.

If any securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | |||

| Non-accelerated filer ☒ | Smaller reporting company ☒ | |||

| Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and it is not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION DATED AUGUST 14, 2023 |

[●] Shares of Common Stock

Elevai Labs, Inc.

This is a firm commitment initial public offering of $[●] of shares of common stock par value US$0.0001 (“Common Stock”) per share of Elevai Labs, Inc. (the “Company”, “Elevai”, “we”, “us”, “our”), a Delaware corporation, which amount we have assumed to be equal to [●] shares of Common Stock using the midpoint of the price range on the cover page of this prospectus. We anticipate that the initial public offering price of our shares of Common Stock will be between $[●] and $[●] per share.

There is currently no public market for our Common Stock. We have applied to have our shares of our common stock listed on the Nasdaq Capital Market under the symbol “ELAB”, and this offering will not close unless such application has been approved. We cannot guarantee that we will be successful in listing on Nasdaq; however, we will not complete this offering unless we are so listed.

We are an “emerging growth company” under the federal securities laws and have elected to comply with certain reduced public company reporting requirements. See “Prospectus Summary-Implications of Being an Emerging Growth Company.”

Investing in our shares involves a high degree of risk. You should carefully consider the matters described under the caption “Risk Factors” beginning on page 15.

We are a “smaller reporting company” as defined under federal securities laws and, as such, have elected to comply with certain reduced public company disclosure requirements in this prospectus and future filings.

Upon the completion of this offering, our outstanding shares will consist of [●] shares of Common Stock, which includes [●] shares of our common stock issuable upon the conversion of all outstanding shares of our convertible preferred stock simultaneously with the completion of this offering (as described below), and assuming the underwriters do not exercise their over-allotment option to purchase additional shares of Common Stock, or [●] shares of Common Stock, assuming the over-allotment option is exercised in full.

Neither the United States Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Public offering price | $ | $ | ||||||

| Underwriter discounts(1) | $ | $ | ||||||

| Proceeds to us, before expenses(2) | $ | $ | ||||||

| (1) | The underwriter, Univest Securities, LLC, will receive compensation in addition to the discounts. The registration statement, of which this prospectus is a part, also registers for sale [●] warrants to purchase shares of Common Stock to be issued to the underwriter (based on the assumed offering price of $[●] per share, the midpoint of the range set forth on the cover page of this prospectus, assuming no exercise of the underwriter’s over-allotment option). We have agreed to issue the warrants to the underwriter as a portion of the underwriting compensation payable to the underwriter in connection with this offering. See “Underwriting” for a description of compensation payable to the underwriter. |

| (2) | The total estimated expenses related to this offering are set forth in the section entitled “Expenses Relating to this Offering.” |

We have granted a 45-day option to the underwriter to purchase up to additional [●] shares of Common Stock, representing 15% of the shares of Common Stock offered at the initial public offering, to cover over-allotments, if any.

The underwriter expects to deliver the shares of Common Stock on or about [●], 2023.

Univest Securities, LLC

The date of this prospectus is [●], 2023

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus, any amendment or supplement to this prospectus or any free writing prospectus prepared by or on our behalf. Neither we nor the underwriter have authorized any other person to provide you with different or additional information. Neither we nor the underwriter take responsibility for, nor can we assure you as to the reliability of, any other information that others may provide. The underwriter is not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. The information contained in this prospectus is accurate only as of the date of this prospectus or such other date stated in this prospectus, and our business, financial condition, results of operations and/or prospects may have changed since those dates.

Except as otherwise set forth in this prospectus, neither we nor the underwriter have taken any action to permit a public offering of these securities outside the United States or to permit the possession or distribution of this prospectus outside the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions relating to the offering of these securities and the distribution of this prospectus outside the United States.

Unless the context otherwise requires, in this prospectus, the term(s) “we”, “us”, “our”, “Company”, “our company”, “our business” and “Elevai” refer to Elevai Labs, Inc. and, unless the context requires otherwise, its subsidiaries.

i

This prospectus contains forward-looking statements. All statements other than statements of historical facts contained in this prospectus, including, without limitation, statements regarding our future results of operations and financial position, business strategy, transformation, strategic priorities and future progress, are forward-looking statements. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “project,” “believe,” “estimate” or “predict” “or the negative of these terms or other similar expressions. The forward-looking statements in this prospectus are only predictions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations. These forward-looking statements speak only as of the date of this prospectus and are subject to a number of important factors that could cause actual results to differ materially from those in the forward-looking statements, including the factors described in the sections entitled “Risk Factors” and in our periodic filings with the SEC. Because forward-looking statements are inherently subject to risks and uncertainties, you should not rely on these forward-looking statements as predictions of future events. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise.

ii

This summary highlights selected information appearing elsewhere in this prospectus. Because it is a summary, it may not contain all of the information that may be important to you. To understand this offering fully, you should read this entire prospectus carefully, including the information set forth under the heading “Risk Factors” and our financial statements.

Prospectus Conventions

Except where the context otherwise requires and for purposes of this prospectus only, references to:

| ● | “Exchange Act” are to the United States Securities Exchange Act of 1934, as amended; |

| ● | “FY2021”, “FY2022” are to fiscal year ended December 31, 2021, and December 31, 2022, respectively; |

| ● | “cGMP” are to current good manufacturing practices. |

| ● | “CM” are to conditioned media. |

| ● | “Common Stock” are to our Common Stock with a par value of $0.001 per share |

| ● | “hUMSCs” are to human umbilical mesenchymal stem cells. |

| ● | “KOL” are to key opinion leader. |

| ● | “SEC” or “Securities and Exchange Commission” are to United States Securities and Exchange Commission; |

| ● | “Securities Act” are to the U.S. Securities Act of 1933, as amended; and |

| ● | “Elevai”, “ELEVAI”, “our business”, “our Company”, “Company”, “we”, “us”, “our” and “Group” are to Elevai Labs, Inc., a Delaware corporation and, unless the context requires otherwise, its subsidiaries. |

Prospectus Definitions of Commonly Used Terms

For additional context of commonly used terms within this prospectus the following definitions are applicable when used herein:

| ● | “Conditioned Media” refers to the media or solution within which cells have been grown and have released various types of molecules such as growth factors, cytokines, and extracellular vesicles. This media can then be collected and used to study the effects of these molecules on other cells or tissues; | |

| ● | “Comedogenicity” refers to the potential of a substance or ingredient to clog pores and contribute to the formation of comedones (blackheads and whiteheads), which are a characteristic feature of acne. Comedogenic substances are more likely to cause acne or exacerbate existing acne-prone skin. In the context of skincare and cosmetic products, non-comedogenic formulations are preferred for individuals with acne-prone skin to reduce the likelihood of pore-clogging and acne development; | |

| ● | “Extracellular Vesicles” (EVs) are small membrane-bound particles released by cells into the extracellular environment. These vesicles play a crucial role in cell-to-cell communication by carrying proteins, lipids, and genetic material like ribonucleic acid (RNA) and deoxyribonucleic acid (DNA) from one cell to another; |

1

| ● | “Exosomes” refers to small membrane-bound vesicles that are released by cells that are involved in intercellular communication. They contain various types of biomolecules such as proteins, lipids, and nucleic acids, which can be transferred between cells and may modulate and support these natural cellular processes; | |

| ● | “hUMSC” stands for human umbilical cord-derived mesenchymal stem cells. hUMSC are adult stem cells that can differentiate into various cell types. hUMSCs can be isolated from the Wharton’s Jelly of the umbilical cord, and have shown therapeutic potential in various diseases such as osteoarthritis, myocardial infarction, and neurodegenerative diseases; | |

| ● | “Hyperpigmentation” is characterized by the appearance of the darkening of the skin due to the increased production of melanin, the pigment that gives skin its color. It can be caused by various factors such as exposure to sunlight, hormonal changes, and skin injuries. Hyperpigmentation may be treated with various topical agents such as hydroquinone, retinoids, and corticosteroids, as well as with cosmetic procedures such as chemical peels and laser therapy; | |

| ● | “Mesenchymal stem cells” (MSCs) are a type of multipotent adult stem cell that can differentiate into various cell types, including bone, cartilage, muscle, and fat cells. MSCs are found in various tissues, such as bone marrow, adipose tissue, and umbilical cord blood. They play a critical role in tissue repair and regeneration, as well as modulating immune responses; | |

| ● | “Modulation” refers to the regulation or adjustment of biological processes at various levels, including genes, proteins, cells, and physiological systems; | |

| ● | “Tumorigenic” describes the ability of a substance, cell, or process to induce the formation of tumors or cancerous growths. Tumorigenic substances or agents may cause genetic mutations, disrupt normal cell function, or promote uncontrolled cell growth, ultimately leading to the development of tumors; and | |

| ● | “White label” refers to a product that is manufactured by one company but sold under another company’s brand name. |

We have made rounding adjustments to some of the figures included in this prospectus. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that preceded them.

Unless the context indicates otherwise, all information in this prospectus assumes no exercise by the underwriters of their over-allotment option.

We obtained certain industry, market and competitive position data in this prospectus from our own internal estimates, surveys and research and from publicly available information, including private agency, industry and general publications and research, surveys and studies conducted by third parties, including the sources cited in “Business – Market, Industry and Other Research-Based Data”. None of these industry sources or governmental agencies are affiliated with us, and the information contained in this report has not been reviewed or endorsed by any of them. While we have not independently verified the data and information contained therein and such data and information may have been collected using third-party methodologies, we believe that the data and information, including projections based on a number of assumptions, from these third-party publications and reports used in this prospectus is reliable. However, the industries in which we operate may not grow at the rate projected by market data, or at all. Industry publications, research, surveys, studies, and forecasts generally state that the information they contain has been obtained from sources believed to be reliable but that the accuracy and completeness of such information is not guaranteed. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements in this prospectus. These forecasts and forward-looking information are subject to uncertainty and risk due to a variety of factors, including those described under “Risk Factors”. These and other factors could cause results to differ materially from those expressed in the forecasts or estimates from independent third parties and us.

2

The Company

We are a physician-dispensed skincare company with a focus on modernizing aesthetic skincare. We conduct research and development to advance innovative and science-driven topical skincare that complements the medical aesthetics industry. Upon our founding in 2020, we initiated our research and development phase for our current product formulations. Since 2022, we have principally employed a business-to-business model in which we produce and commercialize a new generation of topical skincare products that contain our proprietary stem cell-derived Elevai ExosomesTM designed to enhance the appearance of skin.

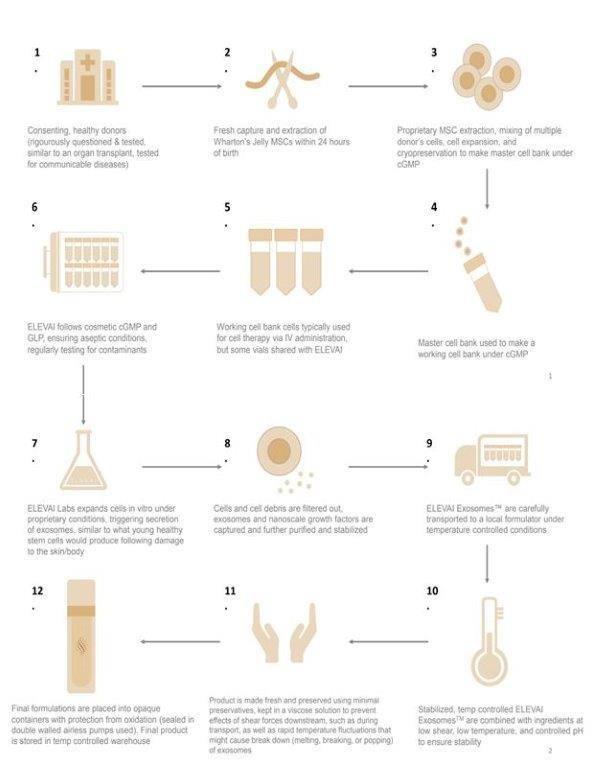

Our exosome manufacturing process from source to skin is known as ‘Precision Regenerative Exosome Technology™’ or ‘PREx™’. PREx™ utilizes advanced patent-pending stem cell processing technology as part of our cohesive production process involving carefully controlled stem cell culture to produce stem cell derived factors that are featured in our topical exosome products. Specifically, as referenced herein “exosomes” are small membrane-bound vesicles that are released by cells that are involved in intercellular communication. They contain various types of biomolecules such as proteins, lipids, and nucleic acids, which can be transferred between cells and may modulate and support these natural cellular processes.

Our proprietary PREx™ biotechnology process yields exosome lots from human umbilical cord-derived mesenchymal stem cells (“hUMSC”) for our specialty physician-dispensed skincare products. hUMSC are adult stem cells that can differentiate into various cell types. hUMSCs can be isolated from the Wharton’s Jelly portion of the umbilical cord and have shown therapeutic potential in various diseases such as osteoarthritis, myocardial infarction, and neurodegenerative diseases. Our products are comprised of topical cosmetic solutions to enhance the appearance of skin. Our products are not drug products or considered regenerative medicine, nor have any of our products received FDA approval. Our cosmetic products are not intended to prevent, treat or cure diseases or medical conditions. Moreover, our cosmetic products are not intended to be injected or delivered intravenously. Instead, our exosome-infused skincare products are topically applied to the skin to aid in the reduction of the appearance of a range of the most common cosmetic skin conditions, including the appearance of skin firmness, oxidative stress, photodamage, hyperpigmentation, and texture of soft tissue deficits, such as reducing the appearance of fine lines and wrinkles.

Market, Industry and Other Research-Based Data

We currently distribute our cosmetics products through two distinct channels, including a business-to-business sales channel where we sell our products directly within the United States and through our distribution sales channel where we sell our products directly to distributors with international or regional reach under exclusive and non-exclusive territorial agreements. We have employed a combination of both distribution channels via distribution agreements and directed business-to-business channels to optimize our sales reach and strategy.

The term ‘physician-dispensed’ refers to a sales channel where cosmetics products are exclusively sold in physician clinics or medically directed businesses by licensed medical professionals or that have a medical professional on staff, such as medical spas. Our products are only available through a medically-directed business and are geared towards nourishing, protecting and supporting healthy looking skin. Such cosmetics products are highly sought after by consumers making them one of the fastest growing segments of the personal care market.1 Consumers turn to cosmetics to enhance the appearance of dull or aging skin and to brighten the skin by lessening the appearance of a myriad of aesthetics concerns such as unwanted pigmentation, acne, melasma and rosacea. They view these products as alternatives to medications and may try cosmetics products before using medicinal products. Physicians also value well designed topical skincare products formulated and manufactured with our biotechnology for their complementary aesthetic effects in conjunction with medications to improve skin appearance and to enhance the benefits of in-office procedures.

Our business-to-business model channel within the physician-dispensed cosmetics skincare market utilizes both online sales, and our trained direct sales force comprised of employed, and independently contracted aesthetic account managers. This business-to-business sales channel is distinct from our leverage of non-exclusive distribution agreements third-party distributors or resellers, who in turn sell our products to end customers. Under distribution agreements our relationship between the seller and the buyer is more indirect, because our distributors serve as an intermediaries, however we believe scaling our product lines through larger distribution sales channels will lead to faster brand expansion, recognition and market reach.

The skincare segment within the physician-dispensed market is projected to grow by a 9.9% CAGR to reach $12.8 billion by 2027 with the US physician-dispensed cosmetics market valued at $5.9 billion in 2020 alone.2 Outside the United States, the physician-dispensed skincare market varies by country due to cultural differences and regulatory requirements. Cultural desires for skin with lighter and more of an even pigmentation have created large and growing aesthetic skincare demands throughout Asia, particularly in Japan, China, Korea, and India. European and certain South American countries, such as Brazil, also present large skincare markets due to the complementary growth in cosmetic procedures and willingness on the part of their consumers to spend discretionary income on aesthetic enhancements. The global physician-dispensed cosmeceuticals market size was valued at $16.52 billion in 2020 and is projected to reach $35.33 billion by 2028, growing at a CAGR of 9.8% from 2021 to 2028.3

| 1 | U.S. Beauty & Personal Care 2023-2026 | Statista. |

| 2 | Physician-dispensed Cosmeceuticals – Global Market Trajectory & Analytics | Research & Markets |

| 3 | Physician-dispensed Cosmeceuticals Market Size, Share & Forecast | Verified Market Research |

3

Current Products and Products in Development

Our products rely on Elevai ExosomesTM that are derived from, ethically sourced and thoroughly tested, human umbilical mesenchymal stem cells (“hUMSCs”) originating from umbilical cord tissue. We purchase our hUMSCs from third parties that source umbilical tissue from consenting donors and are manufactured under current Good Manufacturing Practices (“cGMP”) conditions. We infuse our product lines with exosomes derived from these hUMSCs which are replete with growth factors. Our cosmetic topical products do not contain any living cells but do include our Elevai ExosomesTM. Our products and their safety are regulated by the FDA, however our products and all cosmetics generally do not require FDA approval before being sold. Nonetheless, the FDA may pursue enforcement action against products on the market that are not in compliance with applicable laws. See “Regulations” for more information.

We have integrated the use of stem cell exosomes into our initial product line: our Elevai Post Treatment E-Series™. The E-Series™ is comprised of two post-skincare procedure care products that target the face and neck, and upper chest regions. Our products include Empower™, and Enfinity™ serums, which are sold exclusively through our business-to-business model channel and via our distribution agreements channel.

Empower™ is our after-treatment topical product that supports the appearance of healthy skin and promotes an even toned complexion. Empower™ serum is a concentrated serum, designed specifically for application post ablative procedures and treatments such as such as energy device treatments, mid-depth chemical peels, micro needling, or injectables. Enfinity™ is our continuing care product that we recommend for daily use. Our Enfinity™ daily serum is a stable serum for at-home daily use that contains a blend of Elevai ExosomesTM combined with complementary stem cell growth factors. This daily product contains complimentary skincare ingredients available to support the appearance of healthy skin including Elevai ExosomesTM, vitamin C, hyaluronic acid, and copper peptides. Our exosome-based products, Enfinity™ are designed to remain shelf stable, are subject to minimal degradation over time when used and stored as directed, and do not require freezing or reconstitution prior to each use.

We further believe that our products have the potential to be used in a number of applications and other procedures beyond their current use. For example, we are in the early stages of evaluating the adjunctive use of our exosomes in the promotion of healthy hair growth cycles and noticeable improvement to hair appearance, fullness and thickness.

Competition

The market for medical aesthetic skincare products is highly competitive, and we expect the intensity of competition to increase in the future. Our principal competitors are large, well-established companies in the fields of pharmaceuticals, cosmetics, medical devices and health care.

Our largest direct competitors in the physician-dispensed cosmetic skincare market, inclusive of both distribution and business-to-business market channels for our medical aesthetics cosmetics products include SkinCeuticals, a division of L’Oréal S.A., Skinbetter Science LLC, a division of L’Oréal S.A., SkinMedica, Inc., a division of Allergan, Inc., ZO Skin Health, 51% owned by BlackStone, PCA Skin, EltaMD, each a division of Colgate-Palmolive, Dermalogica, Murad, each a division of Unilever, and Alastin Skincare, a division of Galderma.

Our competitors strictly in the business-to-business channels for medical aesthetics skincare products include The Beauty Company (Nasdaq:SKIN), Waldencast (Nasdaq:WALD), Inmode (Nasdaq: INMD, Evolus (Nasdaq: EOLS), Revance (Nasdaq: RVNC), and Cynosure.

4

Operational and Competitive Strengths

We face competition from both traditional cosmetics brands, such as retail-focused products, as well as other high-end cosmetics brands in the physician-dispensed cosmetics space. We believe the primary competitive factors in our favor is our Elevai ExosomesTM though our company exhibits the following additional operational and competitive strengths:

Our Next Generation Technology and Early Results:

Elevai ExosomesTM remain our key ingredient and main competitive strength, which is produced under proprietary and cGMP-compliant conditions in our state-of-the-art laboratory. We have a proprietary process to stimulate our ethically sourced cGMP grade hUMSCs to produce stem-cell derived exosomes. This process is designed to ensure that our customers consistently receive a stable, and potent product using strict standard operating procedures under laboratory controlled in-vitro culture conditions. Thereafter, we work closely with our formulation partners so that each batch of product is mixed according to our strict specifications. We believe we are one of the few in the physician-dispensed aesthetics industry to incorporate next generation biotechnology into its product lines. We believe that many of our competitors market products that contain inferior synthetic exosomes, exosomes from inferior sources, or ingredients that can be purchased anywhere. We are conducting ongoing sponsored validation studies involving individuals with noticeable skin pigmentation and redness to determine if there is an improvement in the appearance of skin pigmentation and redness issues when our topical products containing our Elevai ExosomesTM are applied daily. Subjects in one of our validation studies were analyzed by an advanced imaging and analysis device called “VISIA” to determine what percentage of those subjects’ facial skin showed evidence of a change in detected levels of hyper pigmentation after twice-daily application of our Enfinity™ daily serum over the course of approximately 12 weeks. After twelve weeks of twice daily topical application of our Enfinity™ daily serum, follow up VISIA scans showed a six to twenty percent reduction in the area of facial skin recorded with hyper pigmentation as compared to their initial VISIA scans. There we found that after multiple-week application of our products, those hyper pigmented regions appeared less dark, less pronounced or noticeable, and the skin appeared to display a more balanced skin tone and texture. This early positive assessment is based on our comparing quantified values of image data that are taken at multiple time points throughout the validation study in order make our well quantified comparison of skin quality at the timepoints recorded. There, the imaging data showed the intensity of the remaining hyperpigmentation on those subjects’ facial skin was visibly reduced as compared to initial VISIA scans. However, we note that we continue to determine if we can better quantify this reduction in pigmentation intensity as further evidence of performance is analyzed over the course of our validation studies. At this early stage, the continued success of positive results of our products is highly subjective to consumers and we have yet to complete formal clinical validation studies with a large cohort to demonstrate support for the performance claims of our products, such as their ability to aesthetically improve the skin. Furthermore, any statements contained herein regarding our topical cosmetic and exosome-containing serums have not been reviewed or approved by the FDA. Similarly, the United States FDA has relatively limited experience regulating cosmetics derived from stem cells, and as of the date of this prospectus, there are no FDA approved medical products utilizing exosomes.

Our Product Quality, Ongoing Research and Seamless Production Process:

Many of our early-stage competitors employ contract manufacturers and labs to handle all portions their production. Our California-based laboratory and production facility helps us protect our trade secrets by keeping our core processes for exosome production in-house and eliminates our need to rely on contractors that may use damaged products of inferior quality, or dangerous/unstable ingredients solely for the purpose of manufacturing our Elevai ExosomesTM. Our streamlined commercialization process is quality controlled from stem cell acquisition, through exosome production, to specifying our standards to our contractors for formulation and bottling, ensuring continuity across the process to limit damage to our product’s exosomes and actives. Additionally, our aesthetic account managers and senior-level staff are highly supportive of our physician clients who rely on the quality of our product literature and educational material. This literature allows our physician clients to provide the best information to their clients whose experience may be ultimately enhanced by choosing to use our product lines post-procedure.

Although we are an early-stage company, we have integrated the production of our Elevai ExosomesTM with our general production process. We do not outsource any aspect of our exosome production process or license any core technology. We also have the capability to commercialize a variety of products derived from stem cells containing innovative encapsulated stem cell produced factors and quickly introduce new competitive products and existing product enhancements. This capability is harnessed by our ability to produce unique ingredient in our own lab like Elevai ExosomesTM. These natural stem cell factors are a core ingredient, and an ingredient that we believe few others can commercialize or approximate. We maintain the ability and know-how to modulate the way the stem cells are cultured in our laboratory space. Through modulation, we are able to produce different versions of our stem cell exosomes, and tailor them for different purposes, such as potentially supporting and promoting a healthy hair growth cycle. As we continue to grow our production outputs, we expect to multiply our modalities and deliver newly and more narrowly tailored versions of exosomes to the market in the form of our cosmetic products.

Although our ultimate goal is to achieve vertical integration, our current focus is on promoting the manufacture of our top-quality products and reducing our costs to produce next-generation cosmetics for the physician-dispensed cosmetic skincare market at favorable price points while generating healthy margins. We believe our products will remain attractive to most consumers by pricing them at rates that are competitive with existing and emerging post-care and aesthetics cosmetics companies while remaining below a pricing tier reserved for more top-end direct-to-consumer products like those from La Mer Technology, Inc. Similarly, we believe that our pricing strategy is competitive with other competing physician dispensed skincare brands that do not contain exosomes. We believe this price point is still attainable for consumers in the physician-dispensed cosmetic skincare market even though our products employ the integration of topical exosomes that is in a similar class as existing skincare products, but through a newer manufacturing process which we believe allows our brand to market better quality and more purified extracellular vesicles in our products. Thus, we chose to favorably price ourselves at the top of the range that we believe the physician-dispensed cosmetic skincare market will positively respond to.

5

Our Products Ease of Use, Quality Ingredients, and Post-Procedure Benefits:

We believe our products often complement the experience- and improve the results-of most physician in-office or medical spa aesthetic face and body treatments that include laser treatment, microneedling and ablative surgical procedures. We designed our products to provide benefits without any blood draw or needling. Our products may also ease uneven looking or puffy skin texture associated with the post-procedure healing process by including ingredients that assist in soothing and supporting the skin for the appearance of a more even skin tone.

To attain customer satisfaction with our products after aesthetic face and body treatments, we carefully select high-quality active ingredients to aid in the healing process. These includes hydrating hyaluronic acid and ceramides, to support skin health for any skin type. Alongside our Elevai ExosomesTM, our products are packed with bioavailable forms of vitamin C, and skin-restoring copper peptides. Our products are integrated into post-procedure or treatment protocols and have achieved positive results under third-party dermal safety evaluations. Each of our products underwent clinical dermal safety evaluations and there was no skin reactivity observed at any time over the multi-week study.

We culture our hUMSCs under carefully controlled conditions in our lab without the use of animal components or byproducts, such as Fetal Bovine Serum (“FBS”). Aside from our moral compass, there are many reasons to avoid animal components in our production process in particular. While this includes safety to avoid animal borne viruses, there is more consistency and predictability for high quality exosomes when culturing hUMSCs. Although there is much variability in any animal-derived component, they remain the primary way that most scientists around the world grow cells in laboratories. We aim to ensure that our products do not contain any parabens, phthalates, or animal byproducts, and we never test on animals.

We believe the application of our topical products can reduce redness, brighten skin, improve wrinkles and skin texture to promote healthy looking skin and the appearance of rejuvenation. Depending on consumer needs, our skin products are designed to either be directly applied topically after an aesthetics or ablative procedure or applied daily. At this preliminary stage, the continued success of the early positive results of our products is highly subjective to consumers and we have yet to complete clinical validation studies to demonstrate support for any performance claims of our products, such as their ability to aesthetically improve the skin. Furthermore, any statements contained herein regarding our topical cosmetic and exosome-containing serums have not been reviewed or approved by the FDA.

Established Partnerships with Major Industry Players and Our Local Community:

Our position as an early mover in utilizing topical exosome skincare technology in the physician-dispensed markets has attracted various industry leaders to become our non-exclusive or exclusive partners, creating an extensive network for us to leverage. We believe the expertise and market coverage of both our exclusive and non-exclusive distribution agreements with channel partners broaden our executional capability, reduce our execution risk, and provide immediate market access to increase the speed at which our products can reach the market. These partnerships solidify our position as a smaller company with substantial technological expertise. Additionally, our exclusive and non-exclusive distribution partnerships have allowed our products to enter Asian and Canadian international markets via our third-party distributors, in a capital efficient manner. In addition to our white-label distribution agreement, we may plan to pursue strategic co-development opportunities and arrangements that further enhance our product pipeline to create effective synergies to supplement our product offerings in the physician-dispensed market. Our current collaboration with many high-volume distributors provides valuable knowledge that we believe will enhance our early mover advantage.

On April 1, 2023, the Mitacs-Accelerate Grants Program via the Office of Commercialization and Industry Engagement (OCIE) Dalhousie University in Nova Scotia, Canada awarded our team $90,000 Canadian Dollars under a two-year research grant in relation to a project entitled “Multiomic characterization of stem cell derived extracellular vesicles for supporting the skin.” Under this project, we will engage an intern from Dalhousie University’s Department of Process Engineering & Applied Science under the tutelage of Dr. Stansislav Sokolenko who is responsible for completing a report about the project that is reviewed by their faculty supervisor and presented to our team. The primary aim of this research project, called “ELV3000”, is to establish new and novel techniques for characterizing the bioactive ‘payload’ of our Elevai ExosomesTM in order to provide us with a greater understanding of how specific exosome contents may be attributable to positive skincare outcomes. The secondary aim of the research project will be to further optimize our Elevai Exosomes™ production process to eventually improve our products through the eventual ability to exert greater control over exosome payloads. This detailed characterization will be conducted using a combination of traditional and advanced techniques and will build on other work currently being performed by us and our contract research partners.

Additionally, we partner with local California universities through a federally funded program called “CareerCONNECTED” Federal Work Study (“CCFWS”) to maintain roots in the surrounding area. The CareerCONNECTED program provides low-income students an opportunity to learn real world skills they would not traditionally receive in an academic setting. 60% of the interns’ pay is federally funded and we pay the other 40% of their salary. We benefit immensely from these interns and believe it is mutually beneficial to our growth to work with eager, academic minded individuals that can help us with our more time intensive tasks that slow down our general operations. This in turn helps our lab team reduce production time to make our exosome enriched media. Along with the interns assisting the lab team, we in turn teach them essential lab skills that will benefit them going forward in their science careers. We believe the program gives us an advantage in training future scientists to our specifications and potentially selecting future employees from the intern pool that are already received high quality training that can meet our lab specifications. Any future opportunity to hire our trained interns reduces the time and the opportunity costs that we would normally incur with training a newly hired, full time lab tech.

6

We continue to grow through allying with channel partners, local universities, and strategic investors globally and expect these relationships will enhance our credibility, relationship with the surrounding community, generate better leads, and future conversion of customers. These investments will ultimately enable us to be more agile in achieving our goals in the shortest time and leverage further investment into our technological strengths alongside our partners’ connections and relationships.

Our Well Recognized and Award-winning Team and Brand:

We produce our Elevai ExosomesTM using a proprietary process called Precision Regenerative Exosome Technology, or PREx™, which has been developed and perfected by Jordan R. Plews, PhD. Dr. Plews is a published biochemical engineer with expertise in molecular biology and stem cells, which we believe will enable our ability to scale our concepts as we develop other novel product lines. We believe we can efficiently bridge the knowledge-gap between engineering and processing because of our research and aptitude in both fields. Using both vocations, improves our ability to isolate re-agents and stem-cell material to identify novel proof of concepts on a biochemical and molecular level while efficiently harnessing processes to produce and market those concepts at scale.

Our second founder, Dr. Hatem Abou-Sayed (known professionally as “Tim Sayed MD”), is a double board-certified plastic surgeon with nearly two decades of experience in the medical aesthetics market. Dr. Sayed was instrumental in positioning us as an exosome focused aesthetic skincare brand and forming the foundational engagements with our hUMSC suppliers to build on the established scientific background and legacy of our suppliers. In that capacity he helped to develop the application of our cosmetics products to complement device-based medical aesthetic procedures.

Under both founders’ guidance, we have made a number of strategic hires to assemble our management heads who in turn have recruited an experienced sales and marketing team. Together, our team has a demonstrated its ability to identify new business opportunities and to develop our business by growing our global distribution networks. Similarly, we are privileged to include a number of strategic advisors and consultants as members of our team including James R. Headley, NorthStrive Companies Inc., Kevin Green, and Crystal Muilenburg.

To that end, our brand has received a number of awards and accreditations, and we have been featured in exposés in recognition of our products and innovation. Those awards and recognitions include the People’s Choice Award after presenting at the Octane Aesthetics Tech Summit annual event, as part of the small business accelerator called the LaunchPad SBDC (Small Business Development Center). Additionally, we have been featured in the Aesthetic Guide Magazine, New Beauty Magazine, Grazia Magazine and MedEsthetics Magazine, among others.

Strategy

We believe we have the potential to be one of the most disruptive brands in the physician-dispensed cosmetics skincare market. We are in the early stages of new product development and have significant room to grow by attracting more consumers to the brand, making our current products more widely available and offering more innovative products to our consumers. We expect the United States to be the largest source of our growth over the next few years and see ample opportunity to expand in select international markets. We also believe we have an opportunity to improve our margins through greater operating leverage and efficiency once we begin distributing our product more widely.

Our Technology and Research:

We believe we are one of the first to adapt stem cell technology from cGMP grade hUMSCs to produce purified extracellular vesicles, also referred to as exosomes into topical skincare products to capture market share in the high growth physician-dispensed cosmetics skincare market. This strategy is not only based on our understanding of consumers’ interest in the appearance of a quicker post-procedure recovery, but our research into what the physician-dispensed cosmetics skincare market is currently lacking and our belief in our products’ ability—based on early imaging data leveraging quantitative analysis and visual assessments of photographic progress photos. Our imaging study data is gathered utilizing an advanced imaging and analysis device made by Canfield Scientific, called “VISIA”. This complexion analysis system captures high-quality, standardized images that are monitored following a medical aesthetic procedure at regular intervals to assess redness, discomfort, tone, texture, wrinkles, and other measures of skin appearance.

Since 2020, we have invested in the creation of a commercial process that began in 2022 which leverages the use of hUMSCs to produce extracellular vesicles, or exosomes in our products because not only do these factors have the ability to enhance the appearance of the skin, but they can do so without the tumorigenic or ethical concerns associated with the use of embryonic stem cells or induced pluripotent stem cells.24 Because we recognized the potential of utilizing hUMSCs for the skin, it was natural for us to utilize them as the basis for formulating our products. This is founded on our belief that our products can improve the appearance of skin prone to appearing temporarily red and puffy that is normally experienced by consumers while attending to their aesthetics needs in physicians’ offices or medical spas.

| 24 | Gao, F., et al., Mesenchymal stem cells and immunomodulation: current status and future prospects. Cell Death Dis, 2016. 7: p. e2062. |

7

A Visionary and Experienced Management Team:

We have made significant investments in our business over the past three years by building our own exosome manufacturing lab, hiring top talent to help us build functional and streamlined capabilities in our commercialization process. Our management team comes from leading international skincare companies, with world-class research, marketing, and e-commerce experience to implement growth strategies and drive operational improvements.

Brand and Product Expansion:

We plan to continue to grow our young brand’s reputation. We plan to continue to expand our brand by attending events, presenting at scientific and medical aesthetic and cosmetic skincare conferences, and conducting clinical validation studies to further validate the aesthetic results of our products. We believe what differentiates us from many traditional cosmetics companies is our lean, but aggressive ability to make fast market-driven decisions and execute with quality control standards. We believe we have a major speed-to-market advantage over many other companies because of our size and aptitude in bioprocessing. Similarly, we are highly responsive to market-trends alongside physician and aesthetics consumer needs alike. We will continue to leverage our executional excellence as we combine our aptitude in stem cell research and bioprocessing while seeking to become the preferred partner of our key customers. Additionally, we have a robust product pipeline that we believe is likely to address the many evolving needs of customers, physicians, and clinicians in the aesthetic and cosmetics market ultimately increasing our branding and the number of customers we serve. Should any of our pipeline products over perform, especially those product lines that may focus on aesthetic needs other than skin appearance it may be advantageous for our branding to spin off those product lines and further focus on our core market: skin improvement and appearance.

Channel Expansion, Production Capacity, and International Growth:

While our current focus is on the physician-dispensed market, we intend to expand into other sales channels including e-commerce by growing the information available on our website and making our products available for purchase through our medical-spa, physician and physician group partners’ websites. We believe being featured on a variety of partner websites will strengthen our brand and provide a unique direct-to-consumer e-commerce model via our business-to-business relationships where our e-commerce partners receive a share of product purchase revenue. Ultimately, our business-to-business model will strengthen our relationships with our physician partners, while an eventual e-commerce model broadens our market exposure and drive traffic and conversion to our other social media profiles. Additionally, we expect our current and prospective exclusive and non-exclusive distribution agreements to penetrate global markets and pique consumer interest not typically within our current reach. We believe both our products and white-label products can drive new market demand for our brand in those international markets that our distribution partners sell our products in.

We intend to expand the production capacity of our products and to develop new pipeline products in response to a number of potential growth factors, including: our organic growth, the development of research and development of pipeline products, and the expected increase in our product popularity, expansions of our distributor networks and channels through exclusive and non-exclusive international distributional agreements, and other potential strategic partnerships with industry leaders. Moreover, in addition to and as a result of the foregoing growth factors we expect an increase in orders for our products and a continuous rise in sales volume in the future based on our market research and estimates. To keep pace with this rise in sales volume, we anticipate the need to expand our production capacity by the end of quarter one of 2024. This expansion will enable us to meet our projected demand and we anticipate doubling our production capacity would cost between $1,500,000 and $2,000,000. This additional capital would cover our expenses relating to expanded capacity, including increased rent, additional lab equipment, and an increase to our overall headcount. We expect a production capacity expansion will lower manufacturing costs through economies of scale and improve overall cost-efficiency and profit margins. Ultimately, we can provide our products at a competitive price, especially to cost-sensitive physicians or medical spa owners, and consumers in the skincare aesthetics market, who may be relatively new to the concept of medical aesthetics cosmetic skincare.

We expect to expand our product offerings in response to this estimated growth, which are subject to additional costs. To expand a single pipeline product, we currently estimate capital requirements of approximately $250,000 for equipment to support the initial development of that product. We further estimate an additional $100,000 worth of funds to arrange for the testing protocol, clinical validations and to fully launch any product at scale. We estimate the operational framework to prepare for the launch of a pipeline product such as a topical haircare product, would take six to twelve months of development work with an additional four to six months to fully scale such product before an official product launch. We estimate that this pipeline development and scaling effort would not likely begin until the end of quarter one of 2024 and conclude until quarter two of 2025. This estimate depends on whether we may need to expand our operations and development work of any new pipeline product, which is dependent on the results of the development work, continued research and initial rounds of validation testing.

8

Currently, we directly distribute our products directly and indirectly. We distribute directly in the United States through both our business-to-business sales channel and indirectly through our sales distribution channel via licensing and manufacturing agreements with third-party distributors. Under our distribution agreements, third party distributors include our products in their suite of domestic and international sales. Under this sales distribution channel, we sell our products to a distributor, who resells our products to the physician practice customers after placing their order in a designated territory that is either exclusive or non-exclusive to that distributor. We have broadened our sales channel to include our cosmetic product offerings at medical spa locations. In March 2023, we engaged in negotiations with a privately held aesthetics and dermatology company that operates thirteen medical spa locations throughout the United States, many of which are housed inside boutique and upscale hotels. In March 2023, we entered negotiations to provide our cosmetic products to the spa operator. In May 2023, we began supplying a number of that company’s medical spa locations that provide ablative services with our complementary cosmetic products. We aim to supply products to three of these medical spa locations by July 2023 to their customers who receive micro-needling, and laser treatments. Our principal goal is to expand our relationship with the medical spa company in order to provide our cosmetic product to all thirteen locations by May 2024. To that end, we plan to negotiate additional agreements with the remaining locations throughout 2023.

To bolster our regional sales, we entered into a non-exclusive authorized distribution agreement in August 2022 with Refine USA, LLC (“Refine”), one of the preeminent manufacturers and distributors of innovative aesthetic medical device technologies and clinical grade skincare. Under the agreement, Refine may purchase unlimited quantities of our topical cosmetics subject to minimum order size limits and distribute them throughout the United States to their network of consumers and physicians. As we continue to enhance our own United States sales channels, we are focused on bringing on third-party distributors in key large international markets, such as Canada, Europe, Brazil, Southeast Asia and the Middle East. We also plan to drive the distribution of our products through strategic relationships in specific countries, such as Japan. To continue growing in the physician-dispensed market, we intend to onboard more direct sales representatives that can reach geographic markets we currently do not have a presence in and partner with cosmetic device companies to co-market and sell our products. To this end, in January 2022, we signed a white label non-exclusive authorized global distribution agreement with premier aesthetic device company DermapenWorld Inc. (“DermaPenWorld”), which expanded the reach of our branding and serum integration. Under a ‘white label’ agreement our products or ingredients may be combined with another company’s ingredients or products and sold under that company’s brand name. Essentially, under these arrangements we provide products or ingredients that can be customized with branding and packaging to match the branding of the company that will be selling the product directly. Pursuant to that white label agreement, we provide a shared distributor wholesale quantities of our serums that are formulated together with DermapenWorld’s and products which are marketed globally subject to previously agreed upon key performance indicators. In addition, between February and May 2023, we entered three exclusive distribution agreements with three separate distributors in Canada, Kuwait, and Vietnam whereby those distributors are permitted to promote, market, sell and distribute our products within their designated countries. Under these exclusive distribution agreements, we granted each a nonexclusive, nontransferable, royalty free license to use our branded products and marketing literature. Because we are entering new markets under each contract, we also arranged for each distributor to assist us in obtaining any required registrations, licenses and other applicable governmental approvals necessary to import, sell and distribute our products at our expense. On June 26, 2023, pursuant to the terms of our white label non-exclusive authorized global distribution agreement with DermaPenWorld, we sent a termination letter to DermaPenWorld providing notice that we will not renew the distribution agreement upon its expiration. The termination notice is effective as of the end of business on January 16, 2024.

Once commercially viable, as our manufacturing process becomes more vertically integrated, we may expand our business model to provide mesenchymal stem cells (MSCs) to companies needing MSCs, large-scale stem cell culturing, or those companies developing MSC-derived products. This expanded role would position the company as a contract manufacturer and distributor of MSCs because we may become a dependable and well-regarded source of exosomes enriched cosmetic products which have been designed for topical application to assist in the recovery after the delivery of medical aesthetic services. Nonetheless, we aim to remain focused on developing and marketing topical products that are enhanced by unique stem cell derived additives and possibly expand from there into other high-science aesthetic skincare applications, given our biochemical engineering and bioprocessing prowess and ability to manufacture laboratory-based skincare additives ourselves. Thus, any expansion into our role as a manufacturer and distributor of MSCs would only come to fruition if funding and bandwidth were such that we felt we met all our aesthetic market goals and had remaining capacity, or we identified an overwhelming interest and opportunity to benefit from such a paradigm shift. In expanding under this strategic channel, we would likely partner, license, or outsource any non-aesthetics-based business so as not to complicate or defocus our Elevai product brand.

Research and Development

Our research and development efforts are focused on improving and enhancing our existing products as well as developing new products. We undertake research and development on new product formulations and execute studies on existing products and future products that demonstrate what we believe to be the high-quality design of our formulas and the powerful performance of our products.

While we currently primarily focus on bringing physician-dispensed cosmetic aesthetics products to market and supporting the skin, we are in the process of researching and developing applications for hair, both on the face and head, and have ongoing research into additional, customized applications. Currently, many companies and competitors alike talk about exosomes as though they are one single ingredient with the innate ability to do many different jobs. However, research shows that certain exosomes released by certain cells are directly correlated with the cells they originate from and those particular exosomes’ capabilities and contents vary based on the cell type used and the way those cells have been treated or cultured.5 Thus, this research shows the contents of exosomes vary widely depending on the cell type used to generate them, their culture conditions, their processing and storage conditions, and how they are applied or used. Knowing this, we use highly-trained professionals to isolate and culture our hUMSCs and the resulting secreted exosomes are produced using strict protocols.

After formulation, all pipeline products are tested for integrity, safety, and performance. Prior to launch, our pipeline products undergo several safety tests, including, but not limited to, human repeat insult patch tests, used to help predict the likelihood of induced allergic contact dermatitis, comedogenicity tests, to prevent the product clogging pores, and cumulative irritation tests, to evaluate the skin irritation potential and safety of individual ingredients or cosmetic compounds. Our products and their ingredients are also tested at multiple steps in the process to avoid any microbial contamination.

| 5 | Kugeratski, Fernanda G., and Raghu Kalluri. “Exosomes as mediators of immune regulation and immunotherapy in cancer.” The FEBS journal 288.1 (2021): 10-35; Lobb, Richard J., et al. “Oncogenic transformation of lung cells results in distinct exosome protein profile similar to the cell of origin.” Proteomics 17.23-24 (2017): 1600432; Camussi, Giovanni, et al. “Exosome/microvesicle-mediated epigenetic reprogramming of cells.” American journal of cancer research 1.1 (2011): 98. |

9

We currently work with Radyus Research to utilize a number of advanced analytical techniques that we believe will help us improve our current processes and keep our brand at the forefront of exosome product production. To analyze our exosomes, we and Raydus Research leverage NanoSight, a nanoparticle tracking analysis instrument so we may evaluate the proteomic characteristics (or characterization of the protein makeup) of our exosomes. Through this thorough process we access the make-up of our finalized exosomes while balancing the efficiency of different adjustments to our cell-culturing production process.

We are also in the early stages of evaluating the adjunctive and topical use of our exosomes on promoting healthy hair growth cycle and hair fullness through the use of pipeline serums, shampoos, and conditioners. We hope and expect our studies to show if topically applied, our hUMSC’s exosomes will have a positive impact as it relates to noticeably reducing the appearance of hair shedding. We anticipate this effect will be primarily through hydrating and nourishing the scalp and topically applying nutrients to the scalp.

Manufacturing

We have exclusively developed our manufacturing process through our management team’s experience in formulating robust skin care products, which we believe provides us with a competitive edge. Success in manufacturing our exosomes requires refined processes that are reliable, scalable, and economical. In our lab, we grow our ethically sourced stem cells and trigger them such that they produce exosomes under our proprietary method.

As of the date of this prospectus, we own or have an agreement in principle for the right to purchase the related manufacturing processes, methods, and formulations. Moreover, we also oversee our leased laboratory space in California which operate under Good Laboratory Practices (“GLP”) and adhere to Good Manufacturing Practices (“GMP”) for the production of our cosmetic products. Moreover, our products are formulated by a third-party in an FDA inspected facility that adheres to GMP guidelines because GMP guidelines promote the manufacture of our products at the highest recommended safety and quality standards for cosmetic products.

Our facility contains multiple cell and tissue culture suites containing biosafety cabinets and cell culture incubators. Not only does our facility provide a significant amount of cold storage and processing space that permit large-scale culture of hUMSCs and the ability to mass produce of stem cell-derived exosomes but allows us to perform cryo-preservation, cryo-storage, various forms of microscopy and cell analysis. Some additional key features of our facility include 24/7 security, advanced climate control, increased cold storage, additional cell culture and R&D suites to perform supplemental in-house research.

Intellectual Property

We have developed a comprehensive portfolio of intellectual property, consisting of patent applications, trademarks, domain names, know-how and trade secrets. As of the date of this prospectus, we have 15 registered trademarks inclusive of 12 global trademarks and 3 United States trademarks, and 18 trademark applications pending, 2 registered domain names, 3 non-provisional patent applications filed, 1 provisional patent application and 3 International Patent Corporation Treaty (“PCT”) applications filed.

Our Precision Regenerative Exosome Technology™, or PREx™, process is used to produce Elevai Exosomes™ and the exact process remains a trade secret. We have strategically decided to not pursue a patent around the process.

We believe our intellectual property adequately protects our products and technology and may prevent others from commercializing products or methods substantially similar to ours.

Corporate History and Structure

Elevai Labs, Inc. was incorporated in Delaware in June 2020 under the original name Reactive Medical Labs Inc. In June 2021, we entered into a stock transfer agreement with Reactive Medical Inc., a Canadian company, whereby we purchased substantially all of the assets and liabilities of Reactive Medical Inc. Under the stock transfer agreement, we acquired 100% of the issued and outstanding common shares of Reactive Medical Inc. Immediately before the stock transfer agreement BWL Investments Ltd., a British Columbia Canada corporation owned 100% of the issued and outstanding common shares of Reactive Medical Inc. In consideration of 100% of the issued and outstanding common shares of Reactive Medical Inc., we issued 100 shares of our Common Stock to BWL Investments Ltd. Upon completion of the stock transfer agreement, Reactive Medical Inc. became our wholly owned subsidiary. In September 2022, Reactive Medical Inc. changed its name to Elevai Research Inc. Our principal executive offices are located at 120 Newport Center Dr. #250, Newport Beach, CA 92660. As of the date of this prospectus, we are qualified to do business as a foreign corporation in the state of California. Our telephone number is 866-794-4940. Our website address is https://elevailabs.com. Information contained on our website or connected thereto does not constitute part of, and is not incorporated by reference into, this prospectus or the registration statement of which it forms a part.

10

Elevai has one wholly owned subsidiary, Elevai Research Inc. (FKA Reactive Medical Inc.).

The following diagram sets forth the structure of the Company as of the date of this prospectus an after giving effect to the offering based on a proposed number of [●] shares of Common Stock being offered (assuming no exercise of the over-allotment option by the underwriters) and the automatic conversion of our preferred stock simultaneous with this offering:

Implications of Being an Emerging Growth Company

As a company with less than $1.235 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of specified reduced reporting and other burdens that are otherwise applicable generally to public companies. These provisions include:

| - | a requirement to have only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations disclosure; |

| - | an exemption from the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended, or the Sarbanes-Oxley Act, in the assessment of our internal control over financial reporting; |

| - | reduced disclosure about our executive compensation arrangements in our periodic reports, proxy statements and registration statements; and |

| - | exemptions from the requirements of holding non-binding advisory votes on executive compensation and golden parachute arrangements. |

We will remain an emerging growth company until the earlier of (1) the last day of the fiscal year (a) following the fifth anniversary of the completion of this offering, (b) in which we have total annual revenues of at least $1.235 billion or (c) in which we are deemed to be a large accelerated filer, which means the market value of our Common Stock that is held by non-affiliates exceeds $700.0 million as of the prior December 31, and (2) the date on which we have issued more than $1.235 billion in non-convertible debt during the prior three-year period. We may choose to take advantage of some but not all of these reduced burdens. We have taken advantage of the requirement to have only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations disclosure in this prospectus and we may choose to take advantage of other reduced reporting burdens in future filings. Accordingly, the information contained herein and the information that we provide to our stockholders may differ from the information you might get from other public companies.

Summary Risk Factors

An investment in our shares involves a high degree of risk. If any of the factors below or in the section entitled “Risk Factors” or contained elsewhere in this prospectus occurs, our business, financial condition, liquidity, results of operations and prospects could be materially and adversely affected. These risks are discussed more fully in the section titled “Risk Factors.”

Risks Related to Our Business, Our Brand, Our Products and Our Industry

Risks and uncertainties related to our business include, but are not limited to, the following:

| ● | Our revenues and financial results depend significantly on sales of our Elevai Post Treatment E-Series™. If we are unable to manufacture or sell our Elevai Post Treatment E-Series™, in sufficient quantities and in a timely manner or maintain client acceptance of our Elevai Post Treatment E-Series™, our business will be materially and adversely impacted (see page 15 of this prospectus); |

| ● | Our marketed products and our products under development could be rendered obsolete by technological or other medical advances (see page 17 of this prospectus); |

| ● | We have a limited operating history at our current scale, which may make it difficult to evaluate our business and future prospects (see page 24 of this prospectus); |

| ● | Restrictions on the use of human stem cells, and the ethical, legal and social implications of that research, could prevent us from developing or gaining acceptance for commercially viable products in these areas (see page 29 of this prospectus); |

11

| ● | Our products may be expensive to manufacture, and they may not be profitable if we are unable to control the costs to manufacture them (see page 29 of this prospectus); |

| ● | Our business is based on novel technologies that are inherently expensive, risky and may not be understood by or accepted in the cosmetics marketplace, which could adversely affect our future value (see page 29 of this prospectus); and |

Risks Related to Our Financial Condition

In addition to the risks described above, we are subject to general risks and uncertainties relating our financial condition, including, but not limited to, the following:

| ● | As described in the report of our auditors for the six months ended June 30, 2023, and the years ended December 31, 2021, and 2022 and the notes to our consolidated financial statements, there is substantial doubt about our ability to continue as a going concern, and if we are unable to continue, you may lose your entire investment (see page 30 of this prospectus); |

| ● | We have a history of net losses, and we may not be able to achieve or maintain profitability in the future (see page 30 of this prospectus); |

Risks Related to Our Dependence on Third Parties

Risks and uncertainties related to our dependence on third parties include, but are not limited to, the following:

| ● | We depend on our collaborators to help us develop and test our proposed products, and our ability to develop and commercialize products may be impaired or delayed if collaborations are unsuccessful (see page 32 of this prospectus); |

| ● | If we, or our third-party manufacturers or formulators fail to comply with environmental, health and safety laws and regulations, we could become subject to fines or penalties or incur costs that could have a material adverse effect on the success of its business (see page 37 of this prospectus). |

Risks Related to Our Products Legal and Regulatory Risks

Risks and uncertainties related to our legal and regulatory risks include, but are not limited to, the following:

| ● | A recall or suspension of sale of our products, or the discovery of serious safety issues with our products or the incorrect application of such products by medical professionals to which we sell such products, could have a significant negative impact on us (see page 37-38 of this prospectus); |

| ● | Restrictive and extensive government regulation could slow or hinder our production of cosmetics containing a stem-cell byproduct and we may be unsuccessful in our efforts to comply with applicable federal, state and international laws and regulations, which could result in government enforcement actions (see page 40 of this prospectus); |

Risks Related to this Offering and Our Common Stock

In addition to the risks described above, we are subject to general risks and uncertainties relating to this offering, including, but not limited to, the following:

| ● | The price of our Common Stock could be subject to rapid and substantial volatility (see page 43-44 of this prospectus); |

| ● | Our Common Stock has not been publicly traded, and we expect that the price of our Common Stock will fluctuate substantially (see page 44 of this prospectus); |

| ● | We have broad discretion in the use of the net proceeds from this offering and may not use them effectively (see page 44 of this prospectus); |

| ● | You will suffer immediate and substantial dilution (see page 45 of this prospectus); |

| ● | There may not be an active, liquid trading market for our Common Stock (see page 47 of this prospectus); |

| ● | Shares eligible for future sale may adversely affect the market price of our Common Stock, as the future sale of a substantial amount of outstanding Common Stock in the public marketplace could reduce the price of our Common Stock (see page 47 of this prospectus); |

12

Offering Summary

Shares Offered:

| $[●] shares of Common Stock (excluding the underwriter’s over-allotment option), which we have assumed to be [●] shares using the midpoint of the price range on the cover page of this prospectus. | |

| Assumed Public Offering Price: | $[●] per share, the midpoint of the price range on the cover page of this prospectus. | |

| Over-Allotment: | We have granted the underwriter a 45-day option (commencing from the date of this prospectus) to purchase up to an additional fifteen percent of the shares sold in the initial closing of this offering at the public offering price to cover over-allotments, if any. We have assumed this option will be for [●] shares of Common Stock using the midpoint of the price range on the cover page of this prospectus. | |

| Shares Outstanding After the Offering: | [●] shares of Common Stock (or [●] shares of Common Stock if the underwriter exercises the over-allotment option in full). | |

| Lock-up: | We, our directors, executive officers and stockholders holding 5% or more of the issued and outstanding shares of Common Stock, will enter into a lock-up agreement with the Underwriters not to sell, transfer or dispose of any shares of Common Stock for a period of six months from the date of this prospectus. See “Shares Eligible for Future Sale” and “Underwriting.” | |