“Securities Act” means the Securities Act of 1933.

“Service Provider” means, as of any relevant time, any director, officer, employee, independent contractor or consultant of the Company or any of its Subsidiaries.

“Sponsor” means LSP Sponsor EBAC B.V. a Dutch limited liability company.

“Sponsor Incentive Shares” has the meaning specified in Section 2.02(c).

“Sponsor Nominee” has the meaning specified in Section 9.08.

“Sponsor Support Agreement” has the meaning specified in the Recitals hereto.

“Staleness Date” has the meaning specified in Section 7.03(d).

“Stock Exchange” means the Nasdaq Stock Market.

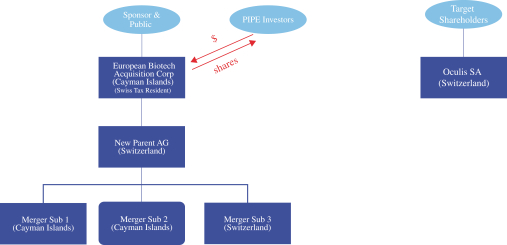

“Subscription Agreements” has the meaning specified in the Recitals hereto.

“Subsidiary” means, with respect to a Person, a corporation or other entity of which (i) more than fifty percent (50%) of the voting power of the equity securities or equity interests is owned, directly or indirectly, by such Person or (ii) such Person otherwise directs the management policies or corporate direction whether by equity ownership, contract or otherwise.

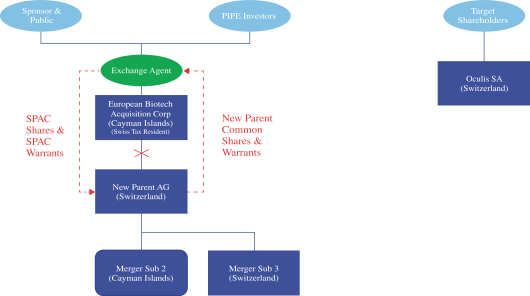

“Surviving EBAC Shares” has the meaning specified in the Recitals hereto.

“Surviving EBAC Warrants” has the meaning specified in the Recitals hereto.

“Swiss Code of Obligations” means the Swiss Federal Act on the Amendment of the Swiss Civil Code of 30 March 1911.

“Tax Grant” means any Tax exemption, Tax holiday, reduced Tax rate or other Tax benefit granted by a Governmental Authority with respect to the Company or any of its Subsidiaries that is not generally available without specific application therefor.

“Tax Return” means any return, declaration, report, statement, information statement or other document filed or required to be filed with any Governmental Authority with respect to Taxes, including any claims for refunds of Taxes, any information returns and any schedules, attachments, amendments or supplements of any of the foregoing.

“Tax Sharing Agreement” means any agreement or arrangement (including any provision of a Contract) pursuant to which a Person is or may be obligated to indemnify another Person for, or otherwise pay, any Tax of or imposed on any Person, or indemnify, or pay over to, another Person any amount determined by reference to actual or deemed Tax benefits, Tax assets, or Tax savings.

“Taxes” means any and all U.S. federal, state, and local and non-U.S. taxes, including all income, gross receipts, license, payroll, recapture, net worth, employment, excise, severance, stamp, occupation, premium, windfall profits, environmental, customs duties, capital stock, ad valorem, value added, ad valorem, inventory, franchise, profits, withholding, social security (or similar), unemployment, disability, real property, personal property, sales, use, transfer, registration, alternative or add-on minimum, estimated, and other taxes and all governmental charges, duties, fees, levies, and other similar charges in the nature of a tax, including any interest, penalty, or addition thereto.

A-21